What is “Assignment” of a Bad Faith Claim?

When an insurance company fails to settle a claim within its insured’s policy limits (despite a reasonable likelihood that a verdict will exceed those policy limits), the insurance company may be exposed to a claim for bad faith.

Under the law, an insurance company has a duty to give fair consideration to the rights of its insured when considering a settlement offer.

Let’s say an insurance company fails to consider its policyholder’s rights in deciding whether to accept a reasonable settlement offer. As a result, the policyholder’s assets are exposed to a judgment in excess of their insurance protection. In this situation, the policyholder may have a bad faith claim against the insurance company.

For example, a driver of a vehicle who is insured with a policy limit of $100,000 causes an accident that results in over $300,000 in damages to the other driver. The injured driver wants to settle the case for the $100,000 limit, but the at-fault driver’s insurance company refuses to accept the offer without a reasonable basis for doing so.

The case then proceeds to trial and results in a verdict far exceeding the amount of the coverage available, jeopardizing the policyholder’s personal assets. In that situation, the policyholder is personally on the hook for $200,000 when their insurance company should have ensured they paid nothing out of pocket.

If there is a reasonable likelihood of an excess verdict, like when the injured claimant’s medical bills exceed the policy limit, and the insurer still fails to settle the claim, the insurance company has breached its duty of good faith to its policyholder.

In this situation, the policyholder has the right to bring a cause of action against the insurer, not the injured driver, for the amount of the excess verdict. The policyholder had a contractual relationship with the insurer, and the policyholder is obligated to compensate the injured victim. Technically, it is the insured who was wronged through their relationship with the insurer. Thus, the bad faith claim belongs to the insured.

How does the injured victim get compensated?

Only a small minority of states allow the injured third-party to bring a bad faith action directly against the insurance company. However, in many jurisdictions, including Illinois, the policyholder can transfer, or “assign,” their right to pursue the bad faith claim against the insurer to the injured victim.

Often, the policyholder will trade their rights to prosecute the bad faith claim, in exchange for an agreement not to execute the judgment against the policyholder’s assets. Essentially, they trade their case against the insurance company for relief from the judgment. The assignment of a bad faith claim can be accomplished by a voluntary agreement or may be compelled by an order of the court.

What happens when an insurance company refuses to defend its policyholder?

Sometimes, an insurance company may refuse to defend its insured in a third-party claim by an injured party. Insurers may claim that there is no coverage for an occurrence for whatever reason, and because there is no covered event, there is no duty to defend the insured.

Some courts find that, where an insurer improperly refuses to represent its insured, the insured may settle the claim on their own, directly with the injured claimant, and then seek reimbursement from the insurance company. [i]

This is often true, even if the policy precludes settlements made without the insurance company’s consent. [ii] Often where this is the rule, an insured can agree to have a judgment entered against them for a certain amount, and then assign the bad faith claim connected to that judgment to the injured victim.

In summary, even though a third-party claimant will most likely be unable to pursue a claim for bad faith directly against the offending insurance company, compensation for the injured victim can often be awarded via assignment of the insured’s bad faith claim.

[i] See, e.g. Ansonia Assoc. Ltd. P’ship v. Pub. Serv. Mut. Ins. Co., 693 N.Y.S.2d 386, 389 (1998)

[ii] See Id.

Schedule Your Free Consultation Today

Recent blog posts, how to file an hpv vaccine lawsuit in the vicp, by katelyn pater | sep 19, 2022, tetanus shot side effects in adults: what you need to know, by katelyn pater | sep 6, 2022, arm sore after a meningitis vaccine you may have sirva, by katelyn pater | aug 10, 2022.

What Are the Elements of a Bad Faith Insurance Claim in Texas?

Insurance companies make money by collecting premiums, not by paying out on claims. Unfortunately, most insurers find any reason they can to deny a claim in an effort to avoid or delay payment of the claim. While insurers often seek to avoid or limit damages, they cannot use underhanded tactics to improperly deny or delay payment of a just claim. It is also illegal for insurers to use tactics including deception or coercion in efforts to induce a claimant into either accepting less than their claim is worth or dropping their claim entirely. When an insurance company uses inappropriate tactics to avoid paying what they owe, they may be guilty of insurance bad faith. Continue reading to learn about insurance bad faith, and if you have been subjected to bad faith conduct by an insurance company in Texas, call our Beaumont bad faith insurance lawyer for advice and representation.

Common Law Bad Faith

Texas law recognizes two different types of bad faith insurance claims: common law bad faith and statutory bad faith. “Common law” refers to causes of actions that have developed over centuries through court opinions, as opposed to causes of actions that are created by the legislative branch.

In Texas, an insured may bring a common law bad faith insurance claim against an insurance company that unreasonably denies or delays a claim, even though liability was reasonably clear. To bring this sort of bad faith claim, the plaintiff must prove that their coverage was unreasonably denied or delayed and that the insurance company should have known the claim was meritorious. It’s not enough for the plaintiff to successfully appeal a claim; rather, the insured must demonstrate that the insurer had good reason to know its liability to pay the claim was reasonably certain, that the insurer knew the claim should be granted and still chose to deny the claim or engage in other conduct to unreasonably deny the claim.

Statutory Bad Faith Insurance in Texas

Texas law also identifies specific conduct that may give rise to a bad faith claim. Chapter 541 of the Texas Insurance Code identifies “unfair methods of competition and unfair or deceptive acts or practices,” sometimes referred to as bad faith conduct. The law identifies a range of improper insurer conduct, including but not limited to:

- Misrepresenting the terms of a policy

- Misrepresentations intended to cause a policyholder to allow a policy to lapse ( e.g. , to miss premium payments) or otherwise forget or surrender the policy

- Making misleading or untrue statements in advertising an insurance policy

- Misrepresenting material facts in a claim

- Failing to reasonably explain why a claim was denied

- Denying a claim after failing to conduct a reasonable investigation

- Failing to render a decision within a reasonable period of time

- Refusing to reach a reasonable settlement

- Attempting to claim a full settlement has been reached when only a partial settlement has been reached

A wide range of conduct can fall within the “bad faith” umbrella. Acts or omissions that unduly burden the policyholder or attempt to coerce or deceive them into receiving less than they are due under the policy may be considered insurance bad faith. Between the statutory and common law bad faith causes of actions, bad faith conduct may include:

- Failing to communicate with a policyholder about a claim

- Continuing to request unnecessary documentation in order to delay adjudication or unduly burden and bully the claimant into giving up their claim

- Unjustifiably delaying decision-making or payment of claims

- Failing to acknowledge receipt of a claim

- Deliberately undervaluing claims

- Withholding information about a claim

- Using threatening or abusive tactics to discourage claims

Proving Bad Faith Insurance Claims

Proving insurance bad faith requires more than demonstrating that a claim was wrongfully denied or that benefits were delayed. A simple error is not enough. The plaintiff must show that the insurance company engaged in unreasonable or grossly negligent conduct which was a cause of recognized damages.

For example, if the company conducts an investigation, learns that the claim should be accepted, and then deliberately lies to the insured by saying the claim is not covered, the insurer would be liable for bad faith for the policy benefit as well as damage caused, including potentially attorneys fees. If the insurer barely conducts any investigation and just summarily denies the claim, it could be liable for engaging in bad faith conduct.

Call for Help With an Insurance Bad Faith Claim in Texas

If your insurance claim was wrongfully denied or if you’ve otherwise been subjected to bad faith conduct by an insurance company, contact the knowledgeable and accomplished Beaumont bad faith insurance lawyers at the Gilbert Adams Law Offices for a free consultation on your case at 409-835-3000 .

- Auto & 18 Wheeler Wrecks

- Personal Injury & Wrongful Death

- Construction Injuries, Fires & Burns

- Dangerous Products

- Premises Liability

- Dangerous Drugs

What Our Clients Are Saying

After a life altering accident, I placed my product liability/personal injury case in the hands of Gilbert Adams III. Mr. Adams is a sharp, resourceful attorney with an eagle’s eye for injustice. He pursued my case with ...

I was injured in a bad car wreck. Gilbert was my lawyer and did a really good job at getting a great settlement, which didn't take a long time. He always treat us with professionalism and respect. The other side wanted to no part of my...

I was in a car accident and was in need of a attorney. Gilbert Adams was the best thing that happened to me in my time of need. He was on top of everything and always kept me informed. He was dedicated till the end. I would never use anyone...

Ask The Attorney Video Segments

With the storm and flooding, I couldn't make it to my job.

Can a loan company sue me on a loan when I was told the loan was 'charged off'?

I accidentally ran a stop sign and caused a minor wreck.

Our family dog was run over and killed by a driver who was taken to jail for DUI.

My soon-to-be ex-wife has a daughter that I have raised since birth...

If you only have a copy of a person's will naming the executor and not the original...

What can be done when your ex-spouse is not following our divorce decree?

I owe a balance on my vet bill that I haven't been able to pay for a couple of year.

I have been served suit papers by my credit card co seeking entry of a default judgment.

© 2017 - 2024 Gilbert Adams Law Offices. All rights reserved. Custom WebShop™ law firm website design by NextClient.com.

Bad Faith Insurance in Texas: Know Your Rights

In Texas, insurance companies owe a wide range of duties to their policyholders aimed at ensuring claims are promptly adjusted and settled in a fair manner. An insurance company that breaches these duties can be liable to the policyholder for additional damages, penalties, and attorney’s fees beyond what is owed under the insurance policy.

The reason insurance companies are so closely regulated is the inherent advantage they have over their insureds who are depending on the coverage they paid for.

In Texas, there are two separate bodies of law that penalize insurance companies for acting in bad faith. The first is a common law implied covenant of good faith that requires an insurance company treat you honestly and fairly.

In addition, Chapter 541 of the Texas Insurance Code lays out in detail when an insurer engages in an unfair method of competition and unfair or deceptive acts or practices. Somewhat related is Chapter 542 of the Texas Insurance Code, which provides deadlines for an insurer to pay and settle claims.

If you believe your insurance company acted in bad faith, you should contact a Texas insurance attorney as soon as possible.

Proving a Bad Faith Claim in Texas

When proving a bad faith claim in Texas, it is important to understand that you have the burden of proof. This means that you, with the help of your lawyer, must demonstrate how the facts of your case meet the requirements of a bad faith claim.

There are two ways that you can prove your bad faith claim: either as a common law bad faith claim or a statutory bad faith claim.

Common-Law Bad Faith Claim

To prove a common law bad faith claim, you must show that your insurance company denied or delayed your claim even though liability was reasonably clear. The Texas Supreme Court recognized a common law claim for bad faith in 1983. English v. Fischer, 660 S.W.2d 521 (Tex. 1983).

Since then, the Texas Supreme Court has upheld the common law claim for bad faith despite the passage of statutes prohibiting insurers from engaging in certain actions that give rise to specific penalties.

Statutory Bad Faith Claim Under Chapter 541

There are several different causes of action you can bring against your insurance company under Chapter 541 of the Texas Insurance Code. These claims include:

- Misrepresentation of a material fact or policy provision;

- Failing to reach a settlement in good faith when liability is reasonably clear;

- Failing to reasonably explain why a claim was denied;

- Failing to affirm or deny coverage within a reasonable time; and

- Refusing to pay a claim without conducting a reasonable investigation.

Insurance companies, adjusters, and other personnel can be sued and held liable for bad faith insurance claim handling. There are numerous business practices that insurance companies may engage in that fall under the umbrella of bad faith. For example:

- Undervaluing claims

- Delaying adjustment of claims

- Delaying payment of claims

- Misrepresenting terms of the insurance policy

- Pressuring a policyholder not to hire an attorney

- Ignoring portions of the claim during investigation and adjustment

- Canceling or changing the terms of insurance after making a claim

- Failure to communicate with the policyholder

- Not providing reasons for the insurance company’s determinations

- Failing to assign qualified personnel to adjust and investigate your claim

- Request unnecessary information to delay the claim adjustment process

- Alleging the insured engaged in fraud or criminal behavior without reasonable justification

Bad faith normally requires you to prove that the insurance company didn’t just make an error, but that it engaged in intentional or grossly negligent conduct aimed at harming its insured. I often like to classify bad faith claims as either being obvious or not so obvious.

An example of an obvious bad faith claim is where the insurance company knowingly makes misrepresentations to a policyholder. For example, the insurance company denies your insurance claim after being told by its own experts that the claim is covered by your policy.

Another example of obvious bad faith may be an insurance company that misrepresents the terms of your insurance policy or changes the terms of the insurance policy without your knowledge.

Not so obvious bad faith often deals with the valuation of your claim. In many cases, an insurance company will estimate the value of your claim on the lower end. Although frustrating, this itself may not be bad faith.

You need to compare the insurance company’s investigation and reports to what you are claiming. If your dispute with the insurance company is over the value of specific items that you are claiming, there may not be bad faith if the insurance company can prove that its valuation was reasonable.

However, if the insurance company has ignored portions of your claim or estimated your damage in ways that are unreasonable, you may have a good claim for bad faith.

Damages for Bad Faith Conduct and Unfair Trade Practices

If you establish bad faith, the following damages can be recovered:

- Treble Damages, i.e. three times the amount the insurance company should have paid you. To get treble damages, courts tend to require that you prove the insurance company intentionally or knowingly acted in bad faith.

- Attorney’s fees, interest, and court costs.

- Interest on the delayed payments.

Don’t Forget About the Prompt Payment Statute

Chapter 542 of the Texas Insurance Code creates a number of requirements for insurers to respond to, investigate, and pay insurance claims. These requirements are separate and apart from the bad faith practices prohibited under Chapter 541. If an insurer violates this law, you are entitled to recover attorney’s fees and damages in the form of an annual 18% penalty.

To collect these damages, the law requires: (1) the policyholder had a claim under the policy; (2) the insurer is liable for the claim; and (3) the insurer failed to comply with a requirement of the statute.”

There are a number of specific requirements that you need to meet to collect attorney’s fees and damages for breach of the prompt payment requirements. For example, you need to notify the insurance company in writing of your claim or allegation of underpayment.

Once the insurer receives written notice, it has fifteen days to acknowledge the claim, begin an investigation, and request additional information from the policyholder.

Once the insurance company receives the information it has requested to evaluate the claim, it has 15 days to make a claim determination, but can extend that deadline to 45 days. The law also says that If the claim is accepted, the insurance company must pay within 5 business days of acceptance. If the claim is denied, the insurance company must provide reasons for the denial.

In short, insurance companies have a duty to promptly complete their investigations, make claim determinations, and pay claims. In most cases, the insurance company’s determination should be made within 60 days. Failure to comply with the technical requirements under the prompt payment law can entitle you to attorney’s fees and other penalties.

What Should You Do If You Believe Your Insurance Company Has Acted in Bad Faith?

If you believe your insurance company has acted in bad faith, you should contact a Texas insurance lawyer today. We at The BFH Law Group will determine the appropriate avenue to prove your bad faith claim. We will fight your insurance company and strive to get you the compensation you deserve. Contact us today to schedule your free consultation.

BFH Law Group Staff

We represent clients in a wide array of civil litigation matters including personal injury , maritime , insurance , and estate cases . Our attorneys collectively represented insurance companies for decades, handling maritime, trucking , property damage , and personal injury cases.

Guide for Causes of Action for Bad Faith Claims

Tex. Ins. Code § 542 and Common Law:

Under the Texas Unfair Claims Settlement Practices Act, an insurer cannot engage in unfair claim settlement practices which include “ . . . (4) not attempting in good faith to effect a prompt, fair, and equitable settlement of a claim submitted in which liability has become reasonably clear.”[1] Tex. Ins. Code § 541.151 creates a cause of action against those who engage in unfair or deceptive insurance practices.

C. Stowers Doctrine

In Texas, the duty of an insurer to accept reasonable settlement demand is known as the “Stowers duty”. The Stowers duty is the only common law tort duty that an insurer owes its insured when handling a third-party claim. Texas predicated the duty to settle on the control given to and exercised by the carrier under to the policy terms to control the litigation.[2] The elements for proving an insurer’s breach of a Stowers duty are as follows: (1)A claim against the insured is within the scope of coverage; (2) The demand is within policy limits; The terms of the demand are such that an ordinarily prudent insurer would accept it, considering the likelihood and degree of the insured’s potential exposure to an excess judgment.[3] The Fifth Circuit noted that the previous three elements must be met to activate a Stowers duty and that a demand must also offer to release fully the insured in exchange for a sum equal to or less than the policy limits.[4] In Texas, an insurer has no duty to initiate or make settlement offers absent a valid Stowers demand.[5] A Stowers claim is not a ‘bad faith’ claim.[6]

In assessing likelihood of liability and degree of exposure, the Garcia Court held that the terms of the demand must be such that an ordinary prudent insurer would accept it and that the assessment of reasonableness incudes as a key factor consideration of the likelihood and degree of the insured’s potential exposure to an excess judgment.[7] Factors in considering reasonableness include: (1) that the terms of the settlement were clear and undisputed;[8] (2)that the offer of settlement was written;[9] (3)that the offer of settlement was unconditional;[10] (4)whether all insureds are released;[11] and(5) that time limits to respond to the offer of settlement was provided.[12]

An error of judgment is not a failure to use ordinary care that dictates liability.[13] Only due care is required of the insurer, and the insurer does not become liable to an insured merely because a decision to reject an offer proves to be wrong.[14]

Although there have been many challenges to Stowers over the years, the Texas Supreme Court have affirmed the holding and only made two clarifications. In Tex. Farmers Inc. Co. v. Soriano, the Texas Supreme Court held that when an insurer is faced with multiple claimants under the same policy the adjuster must evaluate each demand independently and can settle one to the detriment of the others.[15] This creates a first come, first serve problem between plaintiffs. Also, in Trinity University Ins. Co. v. Bleeker, one must either resolve liens, or agree to resolve the liens out of the settlement proceeds and allow the insurance company to pay them direct from the proceeds, once proof of acceptance of some amount less than the policy limits is acquired by the Plaintiff and provided.[16]

[1] Tex. Ins. Code Ann. 542.003(4).

[2] G.A. Stowers Furniture Co v. Am. Indem. Co., 15 S.W.2d 544, 547 (Tex. Comm’n App. 1929, holding approved).

[3] Rocor Int'l, Inc. v. Nat’l Union Fire Ins. Co. of Pittsburgh, PA, 77 S.W. 3d 253, 261 (Tex. 2002).

[4] Am. Phys. Ins. Exch. V. Garcia, 876 S.W.2d 842, 848-49 (Tex. 1994).

[5] Garcia,876 S.W.2s at 849.

[6] Maryland Ins. Co. v. Head Indus. Coatings and Services, Inc., 938 S.W.2d 27,28 (Tex.1996); Garcia , 876 S.W.2d at 847; cf. Arnold v. National County Mut. Fire Ins. Co ., 725 S.W.2d 165, 167–68 (Tex.1987) (recognizing an insurer's duty to deal fairly and in good faith with its insured).

[8] Rocor,77 S.W.3d 253.

[9] Id.(noting that a formal settlement demand was not absolutely necessary to hold the insurer liable, although it is the better course as settlement terms must be clear and undisputed).

[10] Jones v. Highway Ins. Underwriters, 253 S.W.2d 1018, 1022 (Text. Civ. App. –Galveston 1952, writ ref’d n.r.e.).

[11] Trinity Universal Ins. Co. v. Bleeker, 966 S.W.2d 489 (Tex. 1998).

[12] Bramlett v. Medical Protective Co., 2013 U.S. Dist. LEXIS 31044 (N.D. Tex. Mar. 5,2013) (noting that “there may be cases in which an insurer has so little time to respond to a Stowers demand that no reasonable jury could find that it failed to act as a reasonably prudent insurer by rejecting the demand.”).

[13] Highway Ins. Underwriters v. Lufkin-Beaumont Motor Coaches, 215 S.W.2d 904, 928(Tex. Civ. App. – Beaumont 1948).

[15] 881S.W.2d 312 (Tex. 1994) (“When faced with a settlement demand arising out of multiple claims and inadequate proceeds, an insurer may enter into a reasonable settlement with one of the several claimants even though such settlement exhausts or diminishes the proceeds available to satisfy other claims.”).

[16] 996S.W.2d at 491.

Chartwell Law represents the interests of insurers and employers, as such, we continue to continue to monitor the legal landscape. If you have any questions about issues associated with right of action for bad faith claims, our attorneys are available to help. Please contact your Chartwell Law attorney.

Sign up for email notifications

Bad Faith Insurance In Texas: Know Your Rights

In Texas, insurance companies owe a wide range of duties to their policyholders aimed at ensuring claims are promptly adjusted and settled in a fair manner. An insurance company that breaches these duties can be liable to the policyholder for additional damages, penalties, and attorney’s fees beyond what is owed under the insurance policy. The reason insurance companies are so closely regulated is the inherent advantage they have over their insureds who are depending on the coverage they paid for.

In Texas, there are two separate bodies of law that penalize insurance companies for acting in bad faith. The first is a common law implied covenant of good faith that requires an insurance company treat you honestly and fairly. In addition, Chapter 541 of the Texas Insurance Code lays out in detail when an insurer engages in an unfair method of competition and unfair or deceptive acts or practices. Somewhat related is Chapter 542 of the Texas Insurance Code, which provides deadlines for an insurer to pay and settle claims.

If you believe your insurance company acted in bad faith, you should contact a Texas insurance attorney as soon as possible.

Proving a Bad Faith Claim in Texas

When proving a bad faith claim in Texas, it is important to understand that you have the burden of proof. This means that you, with the help of your lawyer, must demonstrate how the facts of your case meet the requirements of a bad faith claim.

There are two ways that you can prove your bad faith claim: either as a common law bad faith claim or a statutory bad faith claim.

Common Law Bad Faith Claim

To prove a common law bad faith claim, you must show that your insurance company denied or delayed your claim even though liability was reasonably clear. The Texas Supreme Court recognized a common law claim for bad faith in 1983. English v. Fischer, 660 S.W.2d 521 (Tex. 1983). Since then, the Texas Supreme Court has upheld the common law claim for bad faith despite the passage of statutes prohibiting insurers from engaging in certain actions that give rise to specific penalties.

Statutory Bad Faith Claim Under Chapter 541

There are several different causes of action you can bring against your insurance company under Chapter 541 of the Texas Insurance Code. These claims include:

- Misrepresentation of a material fact or policy provision;

- Failing to reach a settlement in good faith when liability is reasonably clear;

- Failing to reasonably explain why a claim was denied;

- Failing to affirm or deny coverage within a reasonable time; and

- Refusing to pay a claim without conducting a reasonable investigation.

Insurance companies, adjusters, and other personnel can be sued and held liable for bad faith insurance claim handling. There are numerous business practices that insurance companies may engage in that fall under the umbrella of bad faith. For example:

- Undervaluing claims

- Delaying adjustment of claims

- Delaying payment of claims

- Misrepresenting terms of the insurance policy

- Pressuring a policyholder not to hire an attorney

- Ignoring portions of the claim during investigation and adjustment

- Cancelling or changing the terms of insurance after making a claim

- Failure to communicate with the policyholder

- Not providing reasons for the insurance company’s determinations

- Failing to assign qualified personnel to adjust and investigate your claim

- Request unnecessary information to delay the claim adjustment process

- Alleging the insured engaged in fraud or criminal behavior without reasonable justification

Bad faith normally requires you to prove that the insurance company didn’t just make an error, but that it engaged in intentional or grossly negligent conduct aimed at harming its insured. I often like to classify bad faith claims as either being obvious or not so obvious. An example of an obvious bad faith claim is where the insurance company knowingly makes misrepresentations to a policyholder. For example, the insurance company denies your insurance claim after being told by its own experts that the claim is covered by your policy. Another example of obvious bad faith may be an insurance company that misrepresents the terms of your insurance policy or changes the terms of the insurance policy without your knowledge.

Not so obvious bad faith often deals with the valuation of your claim. In many cases, an insurance company will estimate the value of your claim on the lower end. Although frustrating, this itself may not be bad faith. You need to compare the insurance company’s investigation and reports to what you are claiming. If your dispute with the insurance company is over the value of specific items that you are claiming, there may not be bad faith if the insurance company can prove that its valuation was reasonable. However, if the insurance company has ignored portions of your claim or estimated your damage in ways that are unreasonable, you may have a good claim for bad faith.

Damages for Bad Faith Conduct and Unfair Trade Practices

If you establish bad faith, the following damages can be recovered:

- Treble Damages, i.e. three times the amount the insurance company should have paid you. To get treble damages, courts tend to require that you prove the insurance company intentionally or knowingly acted in bad faith.

- Attorney’s fees, interest, and court costs.

- Interest on the delayed payments.

Don’t Forget About the Prompt Payment Statute

Chapter 542 of the Texas Insurance Code creates a number of requirements for insurers to respond to, investigate, and pay insurance claims. These requirements are separate and apart from the bad faith practices prohibited under Chapter 541. If an insurer violates this law, you are entitled to recover attorney’s fees and damages in the form of an annual 18% penalty.

To collect these damages, the law requires: (1) the policyholder had a claim under the policy; (2) the insurer is liable for the claim; and (3) the insurer failed to comply with a requirement of the statute.” There are a number of a specific requirements that you need to meet to collect attorney’s fees and damages for breach of the prompt payment requirements. For example, you need to notify the insurance company in writing of your claim or allegation of underpayment. Once the insurer receives written notice, it has fifteen days to acknowledge the claim, begin an investigation, and request additional information from the policyholder.

Once the insurance company receives the information it has requested to evaluate the claim, it has 15 days to make a claim determination, but can extend that deadline to 45 days. The law also says that If the claim is accepted, the insurance company must pay within 5 business days of acceptance. If the claim is denied, the insurance company must provide reasons for the denial.

In short, insurance companies have a duty to promptly complete their investigations, make claim determinations, and pay claims. In most cases, the insurance company’s determination should be made within 60 days. Failure to comply with the technical requirements under the prompt payment law can entitle you to attorney’s fees and other penalties.

What Should You Do If You Believe Your Insurance Company Has Acted in Bad Faith?

If you believe your insurance company has acted in bad faith, you should contact a Texas insurance lawyer today. We at Johns Law Group will determine the appropriate avenue to prove your bad faith claim. We will fight your insurance company and strive to get you the compensation you deserve. Contact us today to schedule your free consultation.

Jeremiah Johns is a former insurance defense attorney who now represents plaintiffs in bad faith insurance, catastrophic injury cases, and commercial disputes. He has a unique perspective from his experience representing some of the nation’s largest insurance companies.

Jeremiah is licensed to practice law in Texas, Louisiana, Florida, and Georgia (though he is presently inactive in Georgia). He is also admitted to the 5th Circuit Court of Appeals. For his education, Jeremiah earned an LL.M. in Admiralty from Tulane University , a J.D., cum laude, from Syracuse University , and both a B.A. and B.S., magna cum laude, from Georgia State University .

- Contact Us for a Consultation Schedule your free consultation.

- Description

- Comments This field is for validation purposes and should be left unchanged.

- Skip to main content

- Skip to primary sidebar

- Find a Lawyer

- You've been hurt. Now what?

- Do I have a claim?

- Finding the best attorney to represent you

- Dealing with Insurance

- Laws by State

- Car accident

- Truck Accident

- Workplace injury

- Wrongful death

- Common work injuries

- Finding the best workers’ comp lawyers

- How workers’ comp benefits work

- Personal injury vs. workers’ compensation

- Spinal Cord/Column

- Brain Injury

- Occupational injuries

- Questions & Answers

- Tell Your Story

- Forms and Worksheets

- For Students

- Become a Partner

- Join lawyer directory

- Compare plans and features

- Guest blogging for attorneys

- Enjuris Excellence badge

Bad Faith Insurance Claims in Texas

About enjuris attorney editor.

Contributor: Enjuris Attorney Editor

How can I contribute?

What to do when your insurance company won’t pay up

Insurance companies have a duty to their clients that takes into account the inherent power struggle in the relationship.

In their relationship with the insured, the company has to investigate, negotiate and settle claims in good faith – this is because of the implied covenant of “ good faith and fair dealing ” that underlies every contract into which they enter.

This covenant says that the parties have to treat each other exactly as the title requires: fairly and with good faith. Insurance companies owe this common law duty as well as statutory duties found in chapters 541 and 542 of the Texas Insurance Code . Since the parties have a “special relationship,” there is a duty of care.

However, when an insurance company violates this covenant by acting in an unreasonable manner or with reckless disregard, those actions are called “bad faith.” Every jurisdiction, including Texas , allows insureds to bring claims for bad faith against their insurance company if they found their claim to be denied on an unreasonable basis.

Examples of bad faith actions

There are many types of bad faith that can arise; listed below are the most popular tactics that insurance companies use.

- Failing to communicate promptly with a client who has submitted a claim;

- Neglecting to properly investigate a claim;

- Denying a claim without offering a good reason;

- Delaying payment of a valid claim;

- Refusing requests for documentation (or making the insured sign multiple copies of the same documents in order to slow the process down);

- Forcing the insured to initiate litigation because of a low-ball settlement offer;

- Misrepresenting the law; or

- Attempting to force the insured into a lower settlement than coverage would warrant.

Proving bad faith

Bad faith is proven by specific facts and circumstances, and you have to establish that the insurance company’s actions indicated a clear disregard for the insured. This can be extremely difficult to prove, which may mean that you need to hire an attorney. If you haven’t hired one yet or don’t know where to start, consider speaking with an Enjuris Texas law firm partner !

Has something like this happened to you or someone you know? Tell your story below!

June 14, 2023

Resolving Bad Faith Insurance Claims in Texas

Consider the following scenario: You diligently protected yourself against potential dangers and losses by consistently paying your insurance payments for years. The unthinkable then occurs, necessitating the filing of an insurance claim. You anticipate that your insurance provider will act honestly and uphold their duty to offer the protection that you’ve purchased. Sadly, not all insurance providers fulfill their obligations. It’s critical to have competent legal counsel on your behalf when dealing with a bad-faith insurance dispute.

A Texas law firm called Callender Bowlin focuses on settling bad faith insurance claims and defending the liberties of policyholders. As you read on, we’ll discuss how crucial it is to work with a Callender Bowlin attorney to guide you through the difficulties of bad-faith insurance claims in Texas.

What is bad faith insurance?

Let’s first define what bad faith insurance is before getting into the intricacies of handling bad faith insurance claims.

The sorts of damages that can be sought as a result of this, as well as the legal definition of what is and is not considered is bad faith insurance , also called unfair claims practices, which differ by state. However, generally, an insurer could be accused of behaving in bad faith if they purposefully neglect to look into a claim, hide clauses in contracts, drag out settlement talks, and other similar acts.

The concept of “good faith” in policies, according to wherein both the policyholder and the insurance provider must act in accordance with the terms of the contract, is the basis for the concept of “bad faith.”

Understanding Bad Faith Insurance Claims in Texas

Every state, including Texas, has its own regulations and legislation controlling bad-faith insurance claims. In Texas, bad faith insurance claims are governed by particular statutes and legal precedents that specify the rights and redress that policyholders are entitled to.

Texas law permits policyholders to pursue damages for both the initial claim and any harm brought on by the insurance provider’s bad-faith actions. Financial losses, mental suffering, and in severe circumstances, punitive damages, are only a few examples of these damages.

Statutory Bad Faith Claim in Texas

Under Chapter 541 of the Texas Insurance Code , you have several various legal options for taking action against your insurance provider. These assertions comprise:

- Misrepresenting a crucial fact or a clause in a policy;

- Refusing to settle in good faith when liability is very obvious;

- Omitting to adequately explain the grounds for a claim denial;

- Failing to confirm or reject the coverage in a timely manner; and

- Refusing to settle a claim without making an extensive investigation.

Chapter 542 of the Texas Insurance Code also establishes several kinds of obligations for insurers in relation to how they must react to, look into, and pay insurance claims. These criteria are distinct from the bad-faith actions that are forbidden by Chapter 541. You have the right to receive attorney’s fees and damages in the amount of an annual 18% penalty if your insurer breaks the law.

In a nutshell, insurance firms have a responsibility to finish their investigations, decide whether to pay claims, and make payments quickly. The insurance firm’s decision should typically be rendered within 60 days. You may be eligible for attorney’s fees in addition to other penalties if you don’t follow the technical standards set forth in the prompt payment regulations.

Why Resolving Bad Faith Insurance Claims is Important

For policyholders, resolving insurance claims made in bad faith is crucial. When an insurance provider behaves deceitfully, it not only causes harm to the policyholder but also damages the industry’s reputation for honesty and integrity.

By making insurance providers answerable for their acts, we make it abundantly apparent that we will not put up with fraudulent business practices. Resolving claims made in bad faith helps policyholders regain trust in the insurance system by ensuring they get the settlement amount to which they are legally entitled.

The Role of a Lawyer in Resolving Bad Faith Insurance Claims

A thorough understanding of insurance law and the strategies used by insurance providers is necessary to successfully resolve bad faith insurance claims, which can prove to be a difficult and time-consuming procedure. At this point, it is essential to work with a bad faith insurance lawyer who has experience handling bad-faith insurance claims.

An experienced attorney at Callender Bowlin can help you manage the complexities of the legal system, negotiate with insurance providers on your behalf, and, if needed, defend your rights in court. They will represent your interests and put forth great effort to see that you are fairly and justly compensated for your losses.

Benefits of Hiring a Lawyer from Callender Bowlin

A Callender Bowlin attorney can help you resolve bad faith insurance claims in Texas and provide several important advantages. First and foremost, our attorneys are highly skilled and knowledgeable about the subtleties of bad-faith insurance claims. We have won several lawsuits against insurance providers and obtained beneficial results for those we represent.

Our attorneys also possess an in-depth understanding of Texas insurance legislation and the legal techniques required to contest bad-faith actions. You can benefit from our experience and improve your chances of having your claim successfully resolved by opting for a lawyer from Callender Bowlin.

How to Handle Insurance Claims Made in Bad Faith

Bad faith insurance claim resolution often entails several procedures, each requiring precise attention to detail and calculated judgment. Here are the main processes involved in dealing with bad faith insurance claims, whereas the exact process may change depending on the particulars of your case:

Gathering Evidence

To resolve a bad faith insurance claim, all pertinent evidence must first be gathered. Reviewing your insurance contract, recording your losses, and gathering all correspondence and communications with the insurance provider are all part of this process. When trying to make a compelling argument against the insurance provider’s bad faith actions, the evidence you acquire will be of utmost importance.

Negotiating with Insurance Companies

Your attorney will negotiate with the insurer after obtaining evidence. They will explain your case while emphasizing the insurance company’s bad-faith actions and arguing for just recompense. For clients to obtain a good settlement, skilled attorneys from Callender Bowlin specialize in negotiation strategies and know how to strike back against the insurers.

Filing a Lawsuit

The next step is to sue the insurance provider if negotiations don’t result in an appropriate settlement. Your attorney will prepare the required legal paperwork, describing the claim and providing evidence of bad faith. The act of bringing a lawsuit shows your determination and desire to fight for your legal entitlements as a policyholder.

Mediation and Settlement

Prior to going to trial, mediation may be necessary in some circumstances. In mediation, the policyholder and the insurer negotiate with the assistance of a neutral third party. Before resorting to court, it is hoped that a mutually win-win settlement can be reached.

Going to Trial

The dispute may go to trial if mediation fails to result in a fair settlement. Before a judge and jury, your attorney will present your case, claiming that the insurer behaved in bad faith and that you should receive the compensation that you are due. Even though facing trial can be a drawn-out and complicated procedure, you can be assured of your ability to pursue justice with the help of a Callender Bowlin attorney.

Frequently Asked Questions

How long does it take in texas to settle an insurance claim involving bad faith.

The length of a bad faith insurance claim can change depending on several variables, such as how complicated the situation is and how amenable the insurer is to negotiations. The time it takes to resolve can vary from months to a couple of years. Your attorney from Callender Bowlin will put forth a lot of effort to hasten the procedure and make sure your claim is settled as quickly as viable.

What losses am I eligible to pursue in a bad-faith insurance claim?

You may file a bad faith insurance claim to recover the initial claim amount, any financial losses brought on by the insurer’s bad faith actions, emotional suffering, and in extreme circumstances, punitive damages. Your attorney will evaluate the particulars of your situation and choose which damages to pursue.

What steps should I take to resolve a bad faith insurance claim?

Contact a Callender Bowlin attorney to begin addressing a bad faith insurance claim. We will examine the viability of your claim, assist you through the legal process, and uphold your legal entitlements. Take action right away to get the justice you deserve. Don’t wait.

Obtain Your Bad Faith Insurance Lawyer From CB Trial

For clients who have been wrongfully treated by their insurance providers, Texas law on bad faith insurance claims is crucial. You acquire a dependable ally who will battle tenaciously to make insurers liable for their acts when you hire a lawyer from Callender Bowlin.

Houston (HQ)

(713) 300-8700

- Insurance Disputes

- Bad Faith Insurance Claims

- Property Damage Claims

- First Party Insurance Claims

- Hail Damage Claims

- Fire Damage Claims

- Tornado Damage Claims

- Water Damage Claims

- Hurricane Damage Claims

- Business Interruption Claims

(303) 505-8700

- Personal Injury

- Auto Accidents

- Truck Accidents

- Pedestrian Accidents

- Slip and Fall

- Wrongful Death

- Wind Damage Claims

Albuquerque

(844) 966-3473

- Car Accidents

Phone: 713-547-5460

1700 Post Oak Blvd

2 BLVD Place Suite 610

Houston, TX 77056

Call Us At : 713-547-5460

What is a Bad-Faith Insurance Claim in Texas?

The Texas Legal Definition of Bad Faith

“Bad faith” means that the insurer failed to live up to the obligations of the contract it signed with the policyholder. Texas provides two legal pathways to hold an insurer accountable for bad faith. The first, known as common-law bad faith, requires that the policyholder prove the insurer denied the claim even though its duty to reimburse was reasonably clear. Common-law bad faith requires a finding that the insurer’s conduct was “egregious.” The second legal pathway is known as statutory bad faith and is generally easier to prove. The claim is based on Chapters 541 and 542 of the Texas Insurance Act, which forbid insurance companies from committing any “unfair or deceptive acts or practices.” The conduct does not need to be egregious for a policyholder to win their case.

Unfair and deceptive acts and practices include misleading a policyholder about what a policy will cover, failing to respond to claim requests within a reasonable period, and denying or refusing to pay a claim without first conducting a reasonable investigation. Texas courts have ruled that insurers cannot conduct an investigation in bad faith to look for a pretext to deny the claim. Unfair practices include imposing unreasonable requirements on the policyholder, such as repeatedly requesting the same information as a stalling tactic. It may also include demands to see unnecessary documents such as federal income tax returns as a condition of settling the claim.

With 2022 predicted to be an unusually heavy hurricane season, property owners should review their policies now to ensure adequate protection. You don’t want to wait until Alex, Bonnie, Colin, Danielle, Earl, or Fiona (2022's designated storm names) are headed before you find out that your policy needs updating.

Should I Hire an Attorney?

If your insurance company has refused to pay a claim and you believe the denial was in bad faith, you’ll want to consult a law firm that specializes in insurance claims. Contact Manfred Sternberg & Associates through our website or call 713-547-5460.

Understanding Compensation in Texas Personal Injury Cases

Hiring a Motor Vehicle Accidents Attorney in Texas

Residential Real Estate Transactions in Texas

Tax Foreclosure vs. Mortgage Foreclosure: Part II

Why Hiring an Attorney is Essential for Smooth Business Mergers and Acquisitions.

Tax foreclosure vs. mortgage foreclosure: part i.

Supreme Court Strikes Down “Equity Theft”

How Long Does It Take to Get Surplus Funds After a Foreclosure Sale?

The Importance of Hiring a Business Litigation Attorney in Texas

Quiet Title vs. Trespass to Try Title in Texas: 2

Request a consultation.

Mr. Sternberg’s track record and experience of working with clients from the earliest stages of their cases allows him to bring a uniquely broad-based perspective to the matters he handles.

Homepage FCE Form

By submitting this form, you agree to be contacted by our law firm, either by phone, text or by email.

Practice Areas

Business Law

Civil Litigation

Uniform Enforcements of Foreign Judgments

Excess Proceeds

Real Estate Law

Personal Injury

Contact Information

Phone: 713-547-5460

201 St. Charles Avenue

Suite 2500 PMB # 8873

New Orleans, LA 70170

Disclaimer : The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute an attorney-client relationship.

© Copyright 2023 | All Rights Reserved | Manfred Sternberg & Associates | Powered By Convert It Marketing | Privacy Policy

Understanding Bad Faith Insurance Claims in Texas: An Essential Guide

- February 26, 2024

- Scott Friedson

Introduction

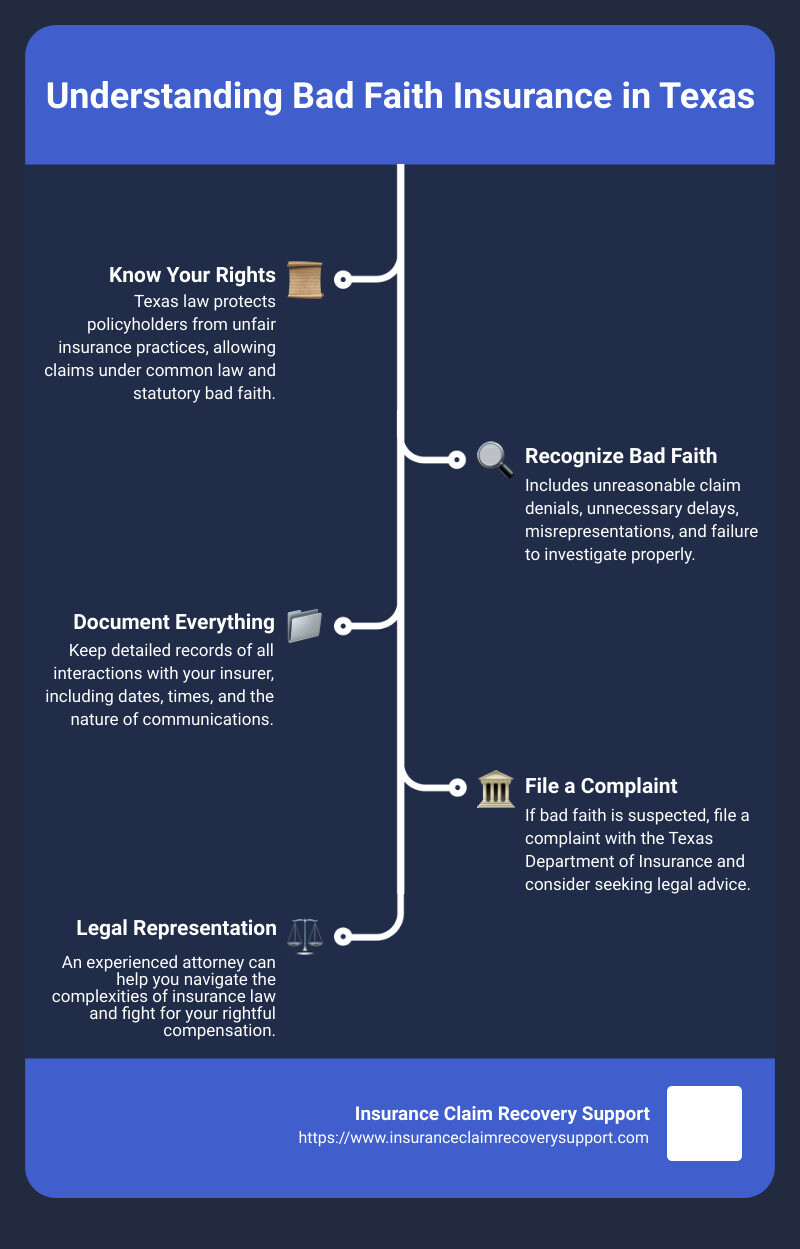

Bad Faith Insurance, Texas Law, Policyholders’ Rights

In Texas, the road to recovery after property damage can feel like a storm after the storm, especially when dealing with insurance companies. If you’re a commercial, multifamily, or apartment property owner who has faced property damage due to disasters like fires, hail, hurricanes, tornadoes, or floods, knowing about bad faith insurance claims is crucial.

Texas law offers protection to policyholders through both common law and statutory bad faith claims . These laws ensure that insurance companies handle your claim fairly and don’t use deceptive practices to deny, delay, or underpay. In simple terms, if an insurer acts in bad faith, you have the right to hold them accountable.

Under Texas law, bad faith insurance encompasses actions like unreasonable claim denial, unnecessary delays, misrepresentations, and failure to conduct a rightful investigation. Policyholders have the right to fight back against these unethical practices and seek fair settlements.

In short: – Texas law protects policyholders from bad faith insurance practices. – Common law and statutory claims enable policyholders to challenge unfair insurer conduct. – Policyholders’ rights include holding insurers accountable for unjust claim handling.

What is Bad Faith Insurance?

In Texas, when we talk about bad faith insurance , we’re looking at two main types: common law and statutory bad faith . It’s all about how insurance companies should treat you, the policyholder, and what happens when they don’t play fair. Let’s break it down in simple terms.

Common Law Bad Faith

Think of common law as the old-school rules of fairness that have been around for ages, based on court decisions. In Texas, if an insurance company unreasonably denies your claim or drags their feet in paying up, even when it’s pretty clear they should, that’s common law bad faith. It’s like if someone borrowed your lawnmower and then pretended they didn’t have it when you asked for it back. Not cool, right?

Statutory Bad Faith

On the flip side, statutory bad faith is more like the written rules of the game, laid out by Texas laws. The Texas Insurance Code is like the rulebook here. It lists specific no-nos for insurance companies, such as lying about what your policy covers, not investigating your claim properly, or taking forever to make a decision on your claim. Imagine playing a board game where someone keeps changing the rules to benefit themselves – that’s statutory bad faith.

Texas Insurance Code & Unfair Practices

The Texas Insurance Code is pretty clear about what’s considered unfair or deceptive. Some examples include: – Telling you something incorrect about your insurance policy. – Not being clear on why they denied your claim. – Dragging their feet on investigating your claim.

It’s all about making sure insurance companies treat you fairly and keep their promises. If they start playing games or bending the rules, they’re stepping into bad faith territory.

Why It Matters

Understanding bad faith insurance is crucial because it helps you stand up for your rights. If you’ve ever felt like your insurance company was giving you the runaround or not being straight with you, knowing about bad faith insurance gives you the power to challenge them. It’s like having a flashlight in a dark room – suddenly, you can see what’s going on, and you’re not just stumbling around hoping for the best.

Insurance companies have a duty to deal with you honestly and to not look for sneaky ways to avoid paying claims. When they forget this duty, bad faith laws remind them that playing fair isn’t just nice – it’s the law.

For more insights on avoiding unnecessary litigation with insurance claims, check out this source: Avoiding Unnecessary Litigation With a Public Adjuster .

Next, we’ll dive into how to spot these unfair practices in action. Stay tuned as we uncover the red flags that signal your insurance company might not be playing by the rules.

Elements of a Bad Faith Claim in Texas

In Texas, when you’re dealing with an insurance company, you might come across some practices that just don’t seem fair. This section breaks down the key elements that could indicate a bad faith insurance claim . Understanding these can help you spot when something’s not right and take action.

Unreasonable Denial

Sometimes, an insurance company might say “no” to your claim without a good reason. This is what we call an unreasonable denial . It’s like if someone borrowed your bike, promised to fix it if it broke but then refused to repair it when the chain fell off, claiming it wasn’t their responsibility. If the insurance company doesn’t have a solid reason for their denial, they might be acting in bad faith.

Delay Tactics

Ever feel like your insurance claim is stuck on an endless loop, waiting to be resolved? That’s because some insurers use delay tactics . It’s like waiting for a friend who keeps saying they’re “just around the corner” but never shows up. These tactics include asking for the same information over and over or taking too long to make a decision, all to wear you down into accepting less than you deserve or giving up entirely.

Misrepresentation

Misrepresentation involves the insurance company being a little too creative with the truth. Imagine if someone sold you a “waterproof” watch that stops working the first time you wash your hands. If your insurer isn’t being honest about your policy’s terms or the details of your claim, they’re not playing fair.

Failure to Investigate

An insurance company has a duty to look into your claim thoroughly. Failure to investigate is like a teacher giving you a grade without ever reading your assignment. If an insurer makes a decision about your claim without properly checking the facts, it’s a sign of bad faith.

Understanding these elements is crucial for anyone dealing with an insurance claim in Texas. If you spot any of these practices, it might be time to dig deeper and possibly seek legal advice. Being informed is your best defense against bad faith insurance claims.

For more insights on handling bad faith insurance claims and ensuring you’re treated fairly, visit Why Some Insurers Intentionally Delay, Deny & Underpay Claims .

Next, let’s explore how to identify these bad faith practices in your interactions with insurance companies. Recognizing the red flags early can save you a lot of time and stress.

How to Identify Bad Faith Practices

When dealing with insurance claims in Texas, knowing the signs of bad faith practices can make a huge difference. Let’s break down the key indicators that your insurance company might not be playing fair.

Lack of Communication

If your insurance company is suddenly hard to reach or stops updating you about your claim status, it’s a red flag. Reliable insurers keep their policyholders informed.

Unreasonable Demands

Being asked for the same documents multiple times or for information that seems irrelevant to your claim can be a tactic to discourage you. It’s not just frustrating; it could be a sign of bad faith.

Lowball Offers

When an offer from your insurance seems way too low compared to the damages you’ve suffered, it might be a lowball offer. Insurers hoping you’ll accept less than you deserve could be acting in bad faith.

Payment Delays

Delays can be a tactic to pressure you into settling for less. If your legitimate claim payment is being delayed without a good reason, be wary.

Denied Claims Without Explanation

A clear explanation is your right. If your claim is denied without a detailed reason why, your insurer may not be acting in good faith.

Any threats of increased premiums, policy cancellation, or other negative consequences for not accepting an offer or disputing a claim are major red flags.

Identifying these practices early can help you take the necessary steps to protect your rights. If you’re facing any of these issues, it might be time to seek legal guidance.

Steps to Take if You Suspect Bad Faith

If you’re up against what seems to be a bad faith insurance claim in Texas, it’s crucial to know the steps to safeguard your interests and push back against unfair practices. Here’s a simplified guide on what to do:

Document Everything

The cornerstone of standing up against bad faith practices is documentation. Every interaction with your insurance company should be recorded. This means saving emails, noting down phone calls (date, time, who you spoke with, and the gist of the conversation), and keeping a file of all correspondences. If things escalate, this documentation will be invaluable.

Internal Review

Before taking more formal steps, request an internal review of your claim. This means asking the insurance company to re-evaluate your case, preferably by someone different from the original adjuster. Sometimes, this can resolve the issue without needing to escalate further.

Texas Department of Insurance Complaint

If an internal review doesn’t yield fair results, your next step is to file a complaint with the Texas Department of Insurance (TDI). This state agency oversees insurance practices in Texas and can intervene on your behalf. Filing a complaint is relatively straightforward and can be done online. The TDI will investigate your claim and, if they find evidence of bad faith, can pressure the insurer to settle fairly.

Legal Representation

Finally, if all else fails, it’s time to seek legal representation. A lawyer specializing in bad faith insurance claims can offer you the expertise and leverage needed to fight back against the insurance company. They can guide you through filing a lawsuit, negotiating a settlement, and, if necessary, representing you in court. Insurance companies are more likely to take your claim seriously when you have legal representation.

It’s worth noting that hiring a lawyer doesn’t mean you’re immediately heading to court. Often, the mere presence of legal counsel can encourage an insurance company to settle fairly to avoid litigation.

For more detailed guidance on handling bad faith insurance claims in Texas, including insights on identifying such practices and understanding your rights, visit Insurance Claim Recovery Support .

Early identification and action are key to protecting your rights. If you suspect bad faith, don’t hesitate to take these steps to ensure you’re treated fairly and receive the compensation you’re entitled to.

Recoverable Damages in a Bad Faith Lawsuit

In Texas, if you’ve been the victim of a bad faith insurance claim, the law is on your side. Here’s what you can potentially recover in a lawsuit:

Policy Benefits : First and foremost, you’re entitled to the benefits your policy was supposed to pay out. If your claim was wrongfully denied or underpaid, the court could order the insurer to pay those original amounts.

Attorneys’ Fees : The thought of legal fees can be daunting, but Texas law allows you to recover the cost of hiring an attorney to fight your bad faith claim. This means you can seek justice without worrying about the financial burden.

Statutory Penalties : Texas law imposes penalties on insurers that act in bad faith. These penalties are in addition to what you’re owed under your policy and are meant to punish the insurer for their improper conduct.

Punitive Damages : In cases where the insurer’s actions are especially egregious, you might be awarded punitive damages. These are not tied to any specific loss you suffered but are meant to punish the insurer and deter similar conduct in the future.

Mental Suffering : Dealing with a bad faith insurance claim can take a toll on your mental health. The stress, anxiety, and uncertainty can be overwhelming. Texas law recognizes this and allows for recovery for mental anguish and suffering caused by the insurer’s actions.

If you find yourself facing a bad faith insurance claim in Texas, know that the law provides avenues to seek fairness and compensation. It’s important to document every interaction with your insurer, consult with legal professionals experienced in bad faith insurance claims, and take timely action to protect your rights. For more detailed guidance and support on navigating bad faith insurance claims in Texas, including insights on identifying such practices and understanding your rights, visit Insurance Claim Recovery Support .

Navigating a bad faith insurance claim can be complex, but understanding the types of damages you’re entitled to recover can empower you to take the necessary steps towards seeking justice. You don’t have to navigate this process alone. Professional help is available to guide you through each step and help you recover what you’re rightfully owed.

Dealing with insurance claims can undoubtedly be a daunting process, especially when you suspect that your insurer is not acting in your best interest. In Texas, the law provides policyholders with avenues to challenge insurers that act in bad faith. As we’ve explored the intricacies of bad faith insurance claims in Texas, it’s clear that knowledge, vigilance, and the right support are key to protecting your rights and ensuring fair treatment.

Insurance Claim Recovery Support LLC stands ready to assist policyholders who face challenges with their insurance companies. Our expertise in navigating the complex landscape of insurance claims, especially in the wake of Texas storms, positions us as a formidable ally in your corner. For support with your loss claims, visit our loss types service page .

Frequently Asked Questions about Bad Faith Insurance Claims in Texas

What is the bad faith standard in texas.

In Texas, the bad faith standard revolves around the insurer’s obligation to deal with policyholders fairly and in good faith. This means insurers must promptly and reasonably investigate, process, and pay valid claims. When an insurer unreasonably denies a claim or engages in deceptive practices, it may be liable for bad faith.

How Can an Insurer be Liable for Bad Faith?

An insurer can be liable for bad faith if it engages in practices such as unjustified denial of coverage, failure to conduct a proper investigation, delaying payment without reason, or offering significantly less than what a claim is worth. These actions can violate both common law and statutory provisions under the Texas Insurance Code.

Is it Difficult to Win a Bad Faith Claim?

Winning a bad faith claim in Texas can be challenging, but it is not impossible. Success often depends on the strength of the evidence showing that the insurer acted unreasonably or deceitfully. Documenting all communications with the insurer, gathering evidence of the claim’s validity, and seeking legal representation can significantly improve the chances of a favorable outcome.

If you’re facing difficulties with your insurance claim or suspect bad faith practices, you’re not alone. Insurance Claim Recovery Support LLC is here to help ensure you receive the compensation you’re entitled to. Our expertise in handling complex claims can provide you with the support and guidance needed to navigate these challenges effectively.

Social Media

Most popular.

Preventative Measures for Texas Wind Damage: A Homeowner’s Guide

The Top Traits of Highly Effective Claim Public Adjusters

Maximizing Your Claim: Tips for Filing After Hail Damage

The Complete Guide to Understanding Cosmetic Exclusions

News & articles, the latest news.

Learn how to protect your home from Texas wind damage with expert tips on roofing, windows, and emergency preparedness.

Discover the key traits of good claim public adjusters and how they can maximize your settlement. Learn to choose the right one for your needs.

Learn how to maximize your hail storm insurance claim with our step-by-step guide on filing, documentation, and repairs.

Get Access Now

7 ways for commercial policy-holders to maximize property damage insurance claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time. 15 years experience.

- Texas #1632488

- Florida #W797805

- Ohio #1289475

- Colorado #411678

- Georgia #2874635

- Kentucky #1014264

- North Carolina #15827727

- Nevada #3508775

- South Carolina #893766

- Oklahoma #100118599

- Pennsylvania #1043874

- Utah #915234

- NPN #15827727

Our Specialties

- Business Interuption

Contact Information

412 hazeltine drive lakeway, texas, 78734, us, call us : 512-904-9900 we are open from monday to friday 9.00 am - 5.00 pm, service locations austin | dallas-fort worth | san antonio | houston | lubbock | san angelo | amarillo | colorado | oklahoma | florida | and other areas.

- Privacy Policy

- Terms & Service

2024 © Copyright - Insurance Claim Recovery Support LLC | All Rights Reserved. | Sitemap

7 Ways Commercial Policyholders Maximize Property Damage Insurance Claims

- Name First Last

- Name This field is for validation purposes and should be left unchanged.

Step 1 of 12

What type of property do you own or manage.

- Multifamily

- Residential

What is the claim status?

Date of loss.

- Date * MM slash DD slash YYYY

Named Insured Policyholder and/or Business Entity

- Named Insured Policyholder and/or Business Entity *

Insurance Company

- Insurance Company *

Cause of Damage(s)

- Business Interruption / Loss of Use

- Earth Movement

- Flood/Water Damage

- Freeze/Pipe Burst/Water Damage

- Vandalism / Theft

Commercial Property Type

- Church / Synagogue

- Convention Center

- Hospitality

- Sports / Entertainment

Multi-family Property Type

- Condominium

- Home Owner Association

- Nursing Home

Residential Property Type

- Historical Property

- Condominium unit

Property Address

- Property Address * Street Address City State Alabama Alaska American Samoa Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah U.S. Virgin Islands Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific State Zip Code

Policyholder Information

- Name * First Last

Policy & Claim Documents Upload

- Policy, Statements of Value, Photos of Damages, Repair Bids, Estimates, Incurred Costs, Letters, Financial Statements, etc. Drop files here or Select files Accepted file types: pdf, jpg, png, gif, jpeg, xlsx, csv, xlsm, xlsb, webp, doc, txt, Max. file size: 400 MB. empty to support CSS :empty selector. -->

- Phone This field is for validation purposes and should be left unchanged.

Bad Faith Insurance Claims in Texas

You might have come across the phrase “bad faith insurance” without fully understanding its implications

Essentially, bad faith insurance refers to a situation in which an insured individual has a grievance against an insurance company due to its unlawful and inappropriate handling of claims.

Insurance companies are bound by a duty of good faith and fair dealing towards their clients, be they individuals or businesses.

If you suspect that an insurance company has not acted with fairness and good faith, you may be entitled to file a bad faith lawsuit against them on the grounds of common law bad faith and statutory violations in Texas.

Texas insurance companies have a duty to deal fairly and in good faith with parties during the claims process.

This includes ensuring that claims are adjusted promptly and settled equitably.

If an insurance company treated you improperly or unfairly, you have rights.

When an insurance company breaches its duties, it can be liable for damages, penalties, and attorney’s fees.

These damages and fees are in addition to what the insurance policy already owes the injured parties in bad faith insurance cases.

Texas Bad Faith Insurance Law

There are two ways to bring a bad faith claim. A person can file a common law insurance bad faith law claim or a statutory bad faith claim.

Common Law Bad Faith

Common law bad faith claims rely on an implied covenant of good faith, requiring that insurance companies treat their customers honestly and fairly.

A successful Texas common law bad faith insurance claim must establish that an insurance company unreasonably denied or delayed a claim’s payment.

The injured party must also prove that the insurer knew or should have known there was no reasonable basis for doing so.

Statutory Bad Faith

Statutory violations allow a person to hold an insurer liable for damages caused by unreasonable delays in responding to and paying claims and misrepresentations regarding the policy, the claim, or coverage.

Chapter 541 of the Texas Insurance Code provides examples of an insurer’s unfair or deceptive acts or practices.

Under Chapter 541, an injured party can bring several different causes of action against an insurance company.

These include:

- Misrepresentation of a material fact or policy provision;

- Failing to settle in good faith when liability is straightforward;

- Failing to explain why the company denied a claim reasonably;

- Failing to affirm or deny coverage within a reasonable time, and

- Refusing to pay claims without conducting a reasonable investigation.

Bad faith typically requires a person to prove that the insurance company’s actions were not the result of an error. The injured party also carries the burden of proof.

This means the person must demonstrate precisely how the case facts meet bad faith claim requirements.

Bad Faith Insurance Claims

An injured party can file a bad faith claim for almost any type of insurance, including auto and life.

Examples of bad faith behavior include:

- Failing to acknowledge a claim’s receipt;

- Canceling or changing insurance terms after an insured makes a claim;

- Misrepresenting insurance policy terms;

- Failing to conduct a prompt and thorough investigation;

- Ignoring portions of the claim during investigation and adjustment;

- Failing to assign qualified personnel to adjust and investigate claims;

- Unreasonably delaying claim adjustment;

- Delaying claim payments;

- Undervaluing claims;

- Failing to offer a prompt claim settlement;

- Pressuring a policyholder to forgo hiring an attorney;

- Failing to communicate with a policyholder;

- Requesting unnecessary information to delay the claim adjustment process;

- Alleging the insured engaged in fraud or criminal behavior without justification;

- Making payments without explaining what payments are for;

- Requiring physicians or claimants to submit numerous forms containing the same information and then using failure to submit as a reason for denial;

- Intentionally misrepresenting or misconstruing claim information;

- Withholding information about a claim, and

- Using threatening and abusive tactics to discourage claims.

Since words like unnecessary, reasonable, prompt, intentionally, and threatening can be subjective, it is always best to consult with an experienced attorney.

A skilled Houston insurance law attorney can review your facts and help you build a case against the insurance company.

Call Armstrong Lee & Baker LLP Today

At Armstrong Lee & Baker LLP , our bad faith insurance lawyers believe that the relationship between our firm and clients represents a sacred trust.

Our first and most important value is our commitment to our client’s best interests .

If you believe an insurance company acted in bad faith when dealing with you, contact us at 832-402-6637 and let us earn your confidence.

We offer free consultations and only charge a fee if you win.

Where You Can Find Our Houston, TX Office

Joshua Lee believes in aggressive, tough advocacy and a client-centered approach to every case. Joshua draws from a wide body of experiences and a robust understanding of the law. Joshua graduated from the New York University School of Law in New York City, which is considered among the best law schools in the world.

Rate this Post

Frequently asked questions, what will it cost for a consultation.

Absolutely nothing. At Armstrong Lee & Baker LLP, our attorneys work on a contingency fee basis. This means that you owe us nothing unless we win your case, whether that’s in the form of a settlement or a judgment. We offer a free consultation to anyone who thinks they might have a personal injury case.

How quickly should I speak to a personal injury attorney after an accident?

We suggest speaking with an attorney as soon as possible after your injury. Something to keep in mind is that all personal injury cases need evidence, and that evidence often degrades over time. As a result, many jurisdictions have a strict statute of limitations (or time limit) for filing a claim. In Texas, most victims have only two years from the date of injury to file, so it is important to start building your case immediately.

What does a non-subscriber work injury mean?

In the state of Texas, employers have the option of filing for workers’ compensation insurance. This policy covers them in case an employee suffers an injury on the job. However, some employers choose to be non-subscribers, which means they opt out of this coverage and lose certain legal protections. This means that if an injured employee sues them after a work injury, they may end up paying more damages. In addition, they may be liable for pain and suffering, punitive damages, and medical benefits. Learn more about non-subscriber injuries here .

How would I find out more about what companies are considered “non-subscribers” under Texas work injury laws?

The Texas Department of Insurance (TDI) keeps track of employers that report their non-subscriber status. Currently, you can find a spreadsheet of every reported non-subscriber business in Texas under TDI’s workers’ compensation insurance coverage verification page. This includes the business address, business name, and filing dates. Learn more here .

My lawsuit is pending and taking a bit of time—how do I pay my bills until a verdict or settlement is reached?