122 Inflation Essay Topic Ideas & Examples

🏆 best inflation topic ideas & essay examples, 👍 good essay topics on inflation, ⭐ simple & easy inflation essay titles, 💡 interesting topics to write about inflation.

- Problem of China’s Inflation With the increase in oil prices, energy costs have increased, and this has resulted into an increase in the prices of products manufactured in the industries. In 2009 the government made a policy to increase […]

- Inflation and Deflation and Their Outcomes That is the money in the hands of the consumers is more causing an increase in the aggregate demand. On the other side, the lender of the money loses some value of the money given […] We will write a custom essay specifically for you by our professional experts 808 writers online Learn More

- Increasing Inflation Impact on Individuals In simpler terms, inflation is the rise in the cost of living due to an exaggerated increase in commodity prices. This is because the rate of savings will be lower than the inflation resulting in […]

- The Relationship Between Money Supply and Inflation It is evidenced that changing the money supply through the central banks leads to a control of the inflationary situations in the same economy.

- Inflation in the United Kingdom According to the Bank of England, inflation occurs when the demand exceeds the ability by the economy’s capacity to produce goods and services.

- Inflation and High-Interest Rates When a company borrows in a country with higher interest rates, the risk of inflation and currency depreciation grows, but the debt of this company is the same.

- Inflation Effect on Japan’s and Mexico’s Economies Thus, the study aimed to establish the influence of inflation and FDI on the GDP of a developed country, developing country, and the world.

- The Price Deviations and Inflation Rates As seen from the table, the price deviations and inflation rates vary significantly depending on the item, season, and any global events that affect the economy.

- The Economic Disparity and Inflation It is essential to emphasize that the economic consequences of the pandemic are severe and are due in the main to inflation.

- US Economy: Navigating Debt, Inflation, and Recession Risks Today, the US is the world’s largest debtor and also the largest economy, market, and investor. Household debt can become a severe problem for the economy if exceeds their dead and accumulated wealth.

- Unemployment Rate: Impact on GDP and Inflation In such a way, the scenario shows it is vital to preserve the balance and avoid decisions focusing on only one aspect of the economy.

- The Inflation Dynamics in the Canadian Context According to the report, the economy only functions well when inflation is stable and predictable and is in an unhealthy state otherwise.inflation has been stable in the country over the last 25 years because of […]

- “Expected and Realized Inflation…” by Binder & Kamdar At the same time, the key focus of adaptive expectations is on the past rates of realized inflation and the factors that caused it.

- Inflation at the International Monetary Fund Anchoring inflation expectations, which is a condition in which inflation is regarded near the Central Bank target and typically matches what consumers anticipate, is one of the other possible measures. The pandemic appears to be […]

- How the Federal Reserve Controls Inflation According to the author of the article, the crisis became the impetus for developing new strategies for controlling the level of inflation.

- Inflation: Types and Negative Effects The mentioned type of inflation can stimulate the economy and increase demand for jobs, but at the same time, it raises the prices and is usually more expensive than cost-push inflation.

- Fiscal Policy and Inflation in Canada According to the report, in order to protect the country from the long-lasting consequences of the COVID-19 pandemic and the recently emerged effects of the Russian-Ukraine war, Canadian policy-makers implemented fiscal policies, but their efficacy […]

- Walmart Has Been Negatively Impacted by Inflation The employment issues caused by the pandemic and increased prices for goods handling forced the company to consider the option of automation for business processes.

- “Inflation Hits the Fastest Pace Since 1981, at 8.5% Through March” by Koeze Further on, the predictions reveal that the inflation rate is expected to stabilize due to a decrease in the price of used cars and apparel.

- Inflation Rates and the Value of the Dollar Projected Social Security benefits at the retirement age of 65 years are 48,580 The current age is 25 years Retirement age is 65 years =40 years The annual inflation rate is at 3% Utilizing the […]

- Inflation’s Impact on Fixed Income By taking a diversified approach to fixed income investing, investors can better manage the risks associated with interest rates as well as inflation and increase the yield in their bond portfolios.

- How Economic Crises Affect Inflation Beliefs A feature of the article is the study by the authors of the consequences of inflationary crises and comparison with pre-existing crises to calculate the level of the crisis as a whole.

- Inflation: What Is It and Inflation in the USA Inflation is an increase in the general price level of goods, works, and services of the country’s population and businesses or an extended period. This kind of inflation is considered the best because it occurs […]

- Inflation Crisis in China for Financial Managers As a financial manager running my company, the rise in prices of commodities will decrease the purchasing power of the foreign currency used by investors and potential customers across the globe.

- Unemployment and Inflation Relation However, the level of unemployment and its prevailing types can differ significantly depending on the state of the economies of countries and the policies they use to combat unemployment.

- Unanticipated and Participated Inflation The first inflation outcome refers to income recipients hurt by inflation as there is a forcible price level increase that does not coincide with their income increase proportionally.

- Interest Rate and Inflation Impact on Exchange Rate The second observation point to be made pertains to the differences in the exchange rate of NZDUSD among the two viable.

- Inflation and Deflation Effects on the US and Saudi Stock Markets Inflation is traditionally defined as a consistent rise in the price rates within a specific industry or in the entire economy of the state, which is triggered by a rapid increase in demand: “Inflation is […]

- Treasury Inflation-Protected Security Refers This ensures that the real rate of interest is determined beforehand, and it adjusts automatically to the increase in the inflation rate.

- Significance of Inflation to Corporate Finance The argument goes on that with elevated inflation rates, there is always a chance to cut down on interest rates as compared to instances when the inflation rates are low and interest rates need to […]

- UAE and GCC Economic Analysis: Inflation and Unemployment This is explained by the fact that UAE is less dependent on oil trade, hence, the inflation and unemployment rate in the UAE is lower in comparison with the countries of GCC.

- Government Spending Stimulation in the Fight Against Inflation The equilibrium point is a point where the value of is money adjusted thereby creating an equilibrium in the quantity of money supplied and that of the quantity of money demanded.

- How the Inflation Gauge Was Faulty in the Past In other words, the goal of the CPI, when prices change, is to measure the percentage change if the spending by the consumers to be as well off as they were before.

- Inflation in the US Business Industry Inflation can be measured in the following ways; Monetary inflation; caused by increase in the increase in the amount of money in circulation in an economy.

- How Should Monetary Authorities React to Higher Inflation Therefore, the best alternative for monetary authorities to react to higher inflation is to reduce its regulatory influence in private enterprises and banks and limit the amount of money supply in the country. Therefore, the […]

- Gasoline Prices, Rates of Unemployment, Inflation, and Economic Growth The data which has been queried from the database are related to gasoline prices in California, the unemployment rate in the US, the inflation rate in the US, and Real GDP.

- Federal Reserve System: Inflation The article ‘Inflation and the Federal Reserve’ by Richard Cook; this source can be used to describe the central threat of inflation and identify the principal steps to be developed by central banks, government, and […]

- The US and the Philippines: Unemployment and Inflation In cyclical terms, this rising inflation is actually the product and not the cause of these record-high oil prices and the idea that the U.S.had failed to think of the above-discussed alternatives to the energy […]

- Interest Rate and Inflation in Netherlands As interest rate rises, demand for debt falls as cost of capital will increase and growth rate declined. As, more funds is shifting to Market B, central bank may raise the bank rate to stabilise […]

- Monetary Policy in an Economy: Inflation Inflation can be defined as a persistent rise in the general level of prices or alternatively, a persistent fall in the value of money.

- Dollarization the Main Tool to Reduce Inflation In general, wouldollarization’ means the substitution of hard currency for the domestic currency as the medium of exchange, and above all as the store of value, in a large part of the domestic economy, so […]

- Inflation Targeting in Emerging Countries Inflation Targeting is the public announcement of numerical targets for inflation for the year. Some emerging market countries that engage in inflation targeting have gone too far in the limitation of exchange rate flexibility, with […]

- Future Inflation and Growth Figures The increase in real GDP in the first half of 2007 was the same as that in the second half of 2006: at an annual rate of 2.25%.

- “Inflation Rise Hits US Consumers” BBC Article The main focus of the article’s concern is the inflation rise that US economics experiences now and the impact it has on US consumer spending.

- Inflation Dynamics: Mistakes in the Forecaster’s Behavior In this case, the authors of the article pay attention to the evaluation of the Phillips curve and understanding its advantages and drawbacks.

- Saudi Arabia and Inflation: Past, Present, Future What is the role of the Saudi Central Bank about inflation? What is the historical inflation trend in Saudi?

- Inflation Expectations: Households and Forecasters The New Keynesian formula that the authors of the paper were trying to create, in its turn was supposed to provide justification for the lack of forecast efficacy in determining the changes in inflation rates, […]

- Inflation Targeting in Emerging Economies Debates supporting the concept of inflation targeting are premised on the idea that recession remains as a greater challenge relative to the state of high inflation. The basis of inflation targeting is always to monitor […]

- The Federal Reserve and the Inflation Problem Louis in 2005, it was noted that the economic hero of the inflationary decades was the then chairman of the Fed, Paul Volcker.

- Economics and the Great Inflation in US and Japan In the 1990s and the early years of the 21st century, the federal reserve policy makers opted to adopt the mop-up-after strategy-policy of letting the bubbles burst and then mopping up there after.

- Inflation Tradeoffs and the Phillips Curve In the findings, Lucas concluded that the there is a direct relationship and variance in the tradeoff between full employment and inflation rate at a particular level of input in the countries studied.

- Inflation and Unemployment in the United States In the 21st century, there are so many issues in the economy of the United States. This is increasing the demand for skilled workers by the day as opposed to the unskilled.

- Unemployment and Inflation Issues In most cases, if one is suffering structural unemployment, it is as a result of improvement in a certain area, or a change in the way things are done.

- Fluctuations in Inflation and Employment Debate surrounded what is termed the multiplier effect: are they higher for tax cuts or government spending, the differences in multiplier effect from different tax cuts, Incentive impact from tax cuts.

- Inflation in the 1970s In such a case, the reduced injections into the circular flow of the economy trim down the demand, which reduces inflation, and the general growth of the economy reduces significantly.

- Inflation Causes: Structuralism and Monetarism One of the features of this kind of inflation is a rapid rise in the price level with the currency loosing its value.

- The Effects of Inflation Targeting In theory inflation targeting is straightforward: the impending rate of inflation is predicted by the central bank, later on it is juxtaposed with the target rates which the government considers as appropriate for the economy […]

- The Euro Zone’s Rising Inflation and Unemployment Rate However, the euro zone found itself in a predicament from late 2009 after the economic downturns that faced some countries in the euro zone.

- Inflation Tax – Printing More Money to Cover the War Expenses The subsequent encroachment of inflation diminishes the value of money hence even if people had more money, the value of their cash was meaningless, a phenomenon similar to tax collection, which reduces the total amount […]

- Economic Condition of Singapore: Inflation Hits 5.2% in March Some of the effects of high inflation rate that has been felt in the economy are the increase of the housing prices, and cost of fuel increased by approximately 5%, thereby increasing the cost of […]

- Inflation Is Here to Stay, as Prices Will Always Go Up Monetary policy refers to the actions pursued by the central bank of a country to regulate the amount of money supply in the economy.

- Effect of a Permanent Increase in Oil Price on Inflation and Output During the same year, the alterations in the price of oil were activated by a change in the supply of the same commodity in the market place.

- Consumer Price Index: Measuring Inflation In this case, the volumes of money being circulated exceeds the supply of goods and services in the same market thus leading to an upward adjustment of prices in order to absorb the extra monies […]

- The Cause of China’s Inflation The supply is affected by the increase of prices of food in the global market, whereby, the Chinese government finds it difficult to satisfy the food demand of the increasing population of the Chinese population.

- China’s Economic Growth and Inflation On the road to becoming the second largest economy, China has experienced growth rates of about 10% in the last 30 years making it to top the list of the fastest growing economies.

- Evaluate Government Policies to Reduce the Rate of Inflation The rate of inflation is the adjustment in the index of price in a single year to a new one expressed in percentages.

- The Current Impact of Inflation and Unemployment on Germany’s Political/Economic System It is notable to recognize the fact that the rate of savings in the nation is quite high causing a dip in the rate of inflation.

- Inflation in Saudi Arabia This paper, using the quarterly data from 1980 to 2010, examines the causes behind the inflation in Saudi, its effects, and the effectiveness of the counter-strategies and policies the Saudi government has put in place […]

- Inflation Rates in Sweden The recession of the early 1990s was largely responsible for the drop in inflation rates. As per the theoretical model of money supply and inflation, increases in money supply will lead to inflationary pressures.

- China Currency Policy and Inflation The sphere of inflation in China relates to the consumer price index which has recorded a rising orientation in the near past.

- Current News of Economics: The Global Inflation Inflation has affected the total demand for goods and services in the economy, thus exceeding the supply. This means that you would have to pay more for the same amount of goods and services you […]

- Analysis of Unemployment and Inflation in the United States This was at the height of the recession that continues to grapple the country with major negative implications in the economy.

- GDP, Unemployment, Inflation, and Economic Growth

- Absolute and Relative Anti-Inflation Reputation: Evidence From the Bond Markets

- World Inflation and Monetary Accommodation in Eight Countries

- Can Demography Improve Inflation Forecasts? The Case of Sweden

- Accounting for Post-Crisis Inflation and Employment: A Retro Analysis

- Unravelling India’s Inflation and Policy Puzzles

- Inflation and Financial Market Performance: What Have We Learned in the Past Ten Years?

- Administered Inflation and Business Pricing: Another Look

- The Historical Relationship Between Inflation and Political Rebellion: What It Might Teach Us About Neoliberalism

- America’s Only Peacetime Inflation: The 1970s

- Sectoral Inflation and the Phillips Curve: What Has Changed Since the Great Recession?

- Analyzing the Relationship Between Inflation Rate and Per Capita GDP Growth

- Banks, Lies, and Bricks: The Determinants of Home Value Inflation in Spain During the Housing Boom

- Capacity Utilization and Unemployment Rates: Are They Complements or Substitutes?

- Fast vs. Gradual Policies to Control Inflation

- Bond Market Inflation Expectations in Industrial Countries: Historical Comparisons

- Inflation and Monetary Velocity in Latin America

- What Drives the Relationship Between Inflation and Price Dispersion: Market Power vs. Price Rigidity

- How Much Did Speculation Contribute to the Recent Food Price Inflation?

- MAPI: Model for Analysis and Projection of Inflation in France

- Budget Deficit, Inflation, and Debt Sustainability: Evidence From Turkey

- Monetarism: Printing Money to Curb Inflation

- Capacity Constraints, Inflation, and the Transmission Mechanism: Forward-Looking vs. Myopic Policy Rules

- When Did Inflation Expectations in the Euro Area De-Anchor?

- Capturing the Link Between M3 Growth and Inflation in the Euro Zone

- Implementing Monetary Cooperation Through Inflation Targeting

- German Great Inflation: Summary & Analysis

- The Maastricht Inflation Criterion: On the Effect of the European Union Expansion

- What Unemployment Rates Tell Us About the Future Inflation

- Applying Foreign Exchange Interventions as an Additional Instrument Under Inflation Targeting: The Case of Ukraine

- China’s Economic Slowdown and International Inflation Dynamics

- The Impact of Inflation Targeting on the Real Economy of Developing and Emerging Countries

- Effects of Inflation on Business: The Good and the Bad

- U.S. Inflation Dynamics: What Drives Them Over Different Frequencies

- Structural Inflation and the 1994 ‘Monetary’ Crisis in China

- Macroeconomic Aggregate Model for Analysis of Inflation and Stabilization of the Russian Economy

- Cyclical vs. Acyclical Inflation: A Deeper Dive

- The Inflation-Output Nexus: Empirical Evidence From India, Brazil, and South Africa

- Forecasting Inflation Using Constant Gain Least Squares

- Stopping Hyperinflation: Lessons From the German Inflation Experience of the 1920s

- Modeling and Forecasting Inflation in Japan

- Globalization and Inflation Dynamics: The Impact of Increased Competition

- The Relationship Between Inflation and Economic Growth: A Multi-Country Empirical Analysis

- How Does Monetary Policy Influence Inflation and Employment?

- Assessing the Gap Between Observed and Perceived Inflation in the Euro Area

- Unanticipated Inflation, Devaluation, and Output in Latin America

- Inflation and Economic Growth Nexus in BRICS: Evidence From ARDL Bound Testing Approach

- Bootstrapping Covariate Unit Root Tests: An Application to Inflation Rates

- Fiscal Dominance and Inflation Targeting: Lessons From Brazil

- Inflation and the Gig Economy: E-Tailing and Self-Employment Rise in Disrupting the Phillips Curve

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, February 25). 122 Inflation Essay Topic Ideas & Examples. https://ivypanda.com/essays/topic/inflation-essay-topics/

"122 Inflation Essay Topic Ideas & Examples." IvyPanda , 25 Feb. 2024, ivypanda.com/essays/topic/inflation-essay-topics/.

IvyPanda . (2024) '122 Inflation Essay Topic Ideas & Examples'. 25 February.

IvyPanda . 2024. "122 Inflation Essay Topic Ideas & Examples." February 25, 2024. https://ivypanda.com/essays/topic/inflation-essay-topics/.

1. IvyPanda . "122 Inflation Essay Topic Ideas & Examples." February 25, 2024. https://ivypanda.com/essays/topic/inflation-essay-topics/.

Bibliography

IvyPanda . "122 Inflation Essay Topic Ideas & Examples." February 25, 2024. https://ivypanda.com/essays/topic/inflation-essay-topics/.

- Economic Topics

- Financial Crisis Paper Topics

- National Debt Research Topics

- Banking Research Ideas

- Money Research Ideas

- Forecasting Questions

- Macroeconomics Topics

- Budget Ideas

- Accountancy Titles

- Cash Flow Paper Topics

- Monopolistic Competition Essay Titles

- Private Equity Research Ideas

- Auditing Paper Topics

- Economic Crisis Essay Titles

- Intangible Assets Essay Topics

Presentations made painless

- Get Premium

100 Inflation Essay Topic Ideas & Examples

Inside This Article

Inflation is a key economic indicator that affects the purchasing power of consumers and the overall health of an economy. As such, it is a popular topic for essays and research papers in economics, finance, and related fields. If you are looking for inspiration for your next inflation essay, look no further. Here are 100 inflation essay topic ideas and examples to help you get started:

- The causes and effects of inflation

- The relationship between inflation and unemployment

- The impact of inflation on interest rates

- The role of the Federal Reserve in controlling inflation

- The differences between demand-pull and cost-push inflation

- The effects of hyperinflation on a country's economy

- The impact of inflation on fixed income earners

- The relationship between inflation and the stock market

- The effects of inflation on real estate prices

- The impact of inflation on international trade

- The role of inflation expectations in shaping economic behavior

- The effects of inflation on poverty and income inequality

- The impact of inflation on retirement savings

- The relationship between inflation and economic growth

- The effects of inflation on consumer spending

- The role of inflation in shaping monetary policy decisions

- The impact of inflation on business investment

- The effects of inflation on government finances

- The relationship between inflation and currency exchange rates

- The impact of inflation on the cost of living

- The effects of inflation on social welfare programs

- The role of inflation in causing economic recessions

- The impact of inflation on international competitiveness

- The effects of inflation on the environment

- The relationship between inflation and financial stability

- The role of inflation in shaping government policy decisions

- The impact of inflation on entrepreneurship and innovation

- The effects of inflation on consumer confidence

- The relationship between inflation and technological advancement

- The impact of inflation on the healthcare industry

- The effects of inflation on the education sector

- The role of inflation in shaping consumer behavior

- The impact of inflation on the agricultural sector

- The relationship between inflation and social mobility

- The effects of inflation on urban development

- The role of inflation in shaping labor market dynamics

- The impact of inflation on small businesses

- The effects of inflation on the tourism industry

- The relationship between inflation and government regulations

- The impact of inflation on infrastructure development

- The role of inflation in shaping energy policy

- The effects of inflation on the manufacturing sector

- The relationship between inflation and the digital economy

- The impact of inflation on the gig economy

- The effects of inflation on the sharing economy

- The role of inflation in shaping consumer preferences

- The impact of inflation on the automotive industry

- The relationship between inflation and the housing market

- The effects of inflation on the retail sector

- The impact of inflation on the hospitality industry

- The role of inflation in shaping supply chain dynamics

- The effects of inflation on the fashion industry

- The relationship between inflation and the art market

- The impact of inflation on the entertainment industry

- The effects of inflation on the music industry

- The role of inflation in shaping the sports industry

- The relationship between inflation and the gaming industry

- The impact of inflation on the film industry

- The effects of inflation on the publishing industry

- The role of inflation in shaping the food and beverage industry

- The impact of inflation on the beauty and personal care industry

- The effects of inflation on the health and wellness industry

- The relationship between inflation and the pharmaceutical industry

- The impact of inflation on the technology industry

- The effects of inflation on the telecommunications industry

- The role of inflation in shaping the media industry

- The relationship between inflation and the advertising industry

- The impact of inflation on the e-commerce industry

- The effects of inflation on the transportation industry

- The role of inflation in shaping the logistics industry

- The impact of inflation on the energy industry

- The effects of inflation on the renewable energy industry

- The relationship between inflation and the oil and gas industry

- The impact of inflation on the mining industry

- The effects of inflation on the construction industry

- The role of inflation in shaping the real estate industry

- The relationship between inflation and the property market

- The impact of inflation on the architecture and design industry

- The effects of inflation on the engineering industry

- The role of inflation in shaping the manufacturing industry

- The effects of inflation on the aerospace industry

- The relationship between inflation and the defense industry

- The impact of inflation on the security industry

- The effects of inflation on the law enforcement industry

- The role of inflation in shaping the healthcare industry

- The impact of inflation on the medical devices industry

- The effects of inflation on the biotechnology industry

- The role of inflation in shaping the life sciences industry

- The impact of inflation on the education industry

- The effects of inflation on the e-learning industry

- The relationship between inflation and the edtech industry

- The impact of inflation on the publishing industry

- The effects of inflation on the media and entertainment industry

- The role of inflation in shaping the sports and recreation industry

- The relationship between inflation and the leisure and travel industry

- The impact of inflation on the tourism and hospitality industry

- The effects of inflation on the food and beverage industry

- The role of inflation in shaping the retail and consumer goods industry

These are just a few examples of the many possible topics you could explore in an inflation essay. Whether you are interested in the macroeconomic implications of inflation or its effects on specific industries, there is no shortage of interesting and important questions to investigate. So pick a topic that interests you, do some research, and start writing!

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

114 Inflation Essay Topics

🏆 best essay topics on inflation, ✍️ inflation essay topics for college, 👍 good inflation research topics & essay examples, 🎓 most interesting inflation research titles, ❓ essay questions on inflation.

- The Inflation Impact on Society

- The Mechanisms of Inflation

- A Political Cartoon About Canada’s Inflation by MacKay

- Inflation: Causes, Problems, Impacts on Economy

- Malaysia’s Inflation

- Income Inflation: Absorption Costing vs. Variable

- Nominal Anchor: Monetary Targeting and Inflation

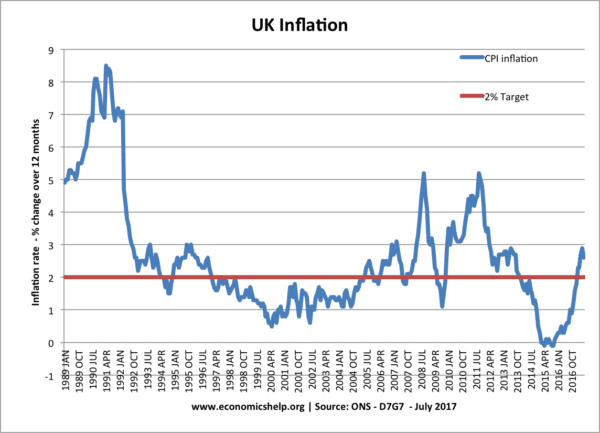

- Inflation in the UK The Bank of England raised its interest rates in response to the inflation increase and forecast inflation to reach a value just above two percent in two years.

- Measuring Inflation: Article Analysis Fluctuating in a seemingly unpredictable way, inflation rates are shaped by a range of factors, one of which is the change in the cost of living.

- The United States Inflation Rate Inflation is expressed primarily in the depreciation of money, which depreciates in relation to gold, commodities, and foreign currencies.

- Measuring Inflation: Consumer Price Index The article examines the consumer price index as the main instrument for measuring inflation in the United States, analyzes its advantages and disadvantages.

- The Ethical Repercussions Inflation Has Had on Businesses This paper analyzes the ethical repercussions inflation has had on businesses and the impacts that inflation has had on consumers and other businesses.

- How Raising Interest Rates Helps Fight Inflation and High Prices There is a mutual relationship between business and government where the government regulates the environment in which business operates.

- Exploration of Price Increase and Inflation Over the Years The paper discusses how inflation affected prices in 2021 and previous periods of inflation. It helps scientists understand how important inflation is.

- The Impact of Taxation and Inflation in the U.S. Carl Szabo’s article “Democrats want you to keep paying more” from the RealClear Policy website discusses how the current government makes Americans pay more.

- Real vs. Inflationary Growth: What’s the Difference? Real growth and inflation are associated with the Gross Domestic Product (GDP). GDP is the total market worth of a nation’s products and services during a specific period.

- The Unemployment and Inflation Causes in Australia The change in the Australian 2021 indicator of unemployment is the representation of cyclical unemployment since it lasted less than a year.

- Grades Inflation and Educational Services Quality In the modern education system, the quality of educational services has become the most relevant topic. The rating system aims to improve the differentia of academic performance.

- Inflation, Oil Prices, and How the President May Influence Them Inflation and oil prices are actual modern themes, as they are directly connected with the incomes and wealth of most people.

- How to Cure Inflation: Summary Inflation leads to increased prices. Although wages grow, the taxes increase. In the end, people do not have more money to spend on goods.

- Inflation and Increase in Money Supply Even though the increase in the money supply might stimulate the economy, it is a dangerous strategy, and the Federal Reserve has to act with caution.

- Inflation and Consumer Price Indexes The paper provides an example of a country that has implemented hyperinflation and explains the impact of this economic policy on the economy.

- The US Federal Reserve on Employment and Inflation The paper analyzes the statement of Federal Reserve, how it affects the economy, why the general public criticizes it, and what the future looks like if strategic changes are made.

- Federal Reserve System, Inflation, and Wage-Price Spiral An important indicator that can cause a policy shift toward a more stringent monetary policy would be the wage-price spiral.

- Inflation and Control Policies in the United Kingdom Inflation is a highly contentious issue. This is due to its economic implications. Inflation has the potential of crippling a country’s economy.

- The Problem of Inflation: Crucial Aspects Of primary importance is the recognition that inflation is not an unnatural or harmful mechanism for a country’s economy.

- Inflation and Unemployment in Bavaria Considering the normal state of the economy and the existing level of employment close to full, the President of Bavaria is not recommended to pursue an expansionary fiscal policy.

- Inflation in the Real Estate Industry This paper will cover the real estate industry in the US, as it might be affected by the increased inflation rates, as the demand for housing is not increasing as quickly.

- Balance of Payments, Inflation and Exchange Rate Balance of payments, inflation, and the exchange rate are the main driving forces of the UK economy, as well as in other countries.

- Inflation in India and China The growth of the Asian economies, more specifically China and India have allowed the examination of inflation in both countries.

- Zimbabwe Inflation Now Over 1 Million Percent In Zimbabwe, the national-average real wages are raised well above their historical trends, but faster inflation has reduced real wages back to trend levels.

- China Faces Inflation Pressure Inflation is essentially the rise in general price of goods and services over a period of time in economics. It is more commonly referred to as price inflation in now.

- Inflation in the United Kingdom’s Economy Global Positioning System is a system comprised of satellites capable of broadcasting certain signals used primarily for navigation in both the private and the military sectors.

- Mugabenomics as a Cause of Inflation in Zimbabwe The paper outlines the primary challenges of Zimbabwe economic system and provides a consistent account of inefficient economic strategies that disrupt the country’s well-being.

- Today’s Inflation and the Great Inflation of the 1970s

- Accelerating Inflation and the Distribution of Household Savings Incentives

- Perceived Inflation and Reality: Understanding the Difference

- Alternative Instruments for Hedging Inflation Risk in the Banking Industry

- Making Sense of Consumers’ Inflation Perceptions and Expectations

- Evaluating Inflation Targeting Based on the Distribution of Inflation and Inflation Volatility

- Global Inflation Dynamics: Regularities and Forecasts

- Contract Duration, Inflation Uncertainty, and the Welfare Effects of Inflation

- Advanced Economy Inflation: The Role of Global Factors

- Central Banks’ Inflation Forecasts: The Problem of Conditioning on Fixed Short-Term Interest Rates

- Who Is Suffering the Most From Rising Inflation?

- Conflict Inflation: Estimating the Contributions to Wage Inflation in Australia During the 1990s

- Adaptive Models and Heavy Tails With an Application to Inflation Forecasting

- The Main Strategies to Deal With Inflation in Business

- Does Inflation Harm Economic Growth?

- High Inflation and the Nominal Anchors of an Open Economy

- Euro Area Inflation: Aggregation Bias and Convergence

- Adopting Inflation Targeting: Practical Issues for Emerging Market Countries

- Causality Nexus Between Economic Growth, Inflation, and Innovation

- Analyzing Inflation: Monetary and Real Theories

- Deflating Inflation Expectations: The Implications of Inflation’s Simple Dynamics

- Forecasting Inflation: The Relevance of Higher Moments

- Inflation and Financial Market Performance: What Have We Learned in the Last Ten Years

- Commodity Prices and Inflation in the Middle East, North Africa, and Central Asia

- Analyzing the Connection Between Inflation and Unemployment

- Administered Prices, Inflation, and the Business Cycle

- Core Inflation and Inflation Targeting in a Developing Economy

- Baffling Inflation: Cost-push Inflation Theories in the Late 1950s United States

- America’s Historical Experience With Low Inflation

- Right Balance Between Growth and Inflation

- Admissible Monetary Aggregates and UK Inflation Targeting

- Estimating the Optimal Inflation Target From Trends in Relative Prices

- Causality Between Inflation and Inflation Uncertainty in South Africa

- Analyzing Factors Affecting U.S. Food Price Inflation

- Forecasting Inflation Using Economic Indicators: The Case of France

- Central Bank Independence and Inflation: Good News and Bad News

- Deflation and Inflation Trends in Japan

- Anticipated Inflation and Interest Rates in an Open Economy

- Financial Conditions and Density Forecasts for US Output and Inflation

- Arch and Structural Breaks in United States Inflation

- Has U.S. Inflation Really Become Harder to Forecast?

- Challenges for Adopting Inflation Targeting Regime in Egypt

- Demographic Transition and Inflation in Emerging Economies

- High Inflation: Resource Misallocations and Growth Effects

- Australian Wage and Price Inflation: 1971-1994

- Consumer Attitudes and the Epidemiology of Inflation Expectations

- Food Inflation and the Consumption Patterns of U.S. Households

- Inflation and Asset Returns in a Monetary Economy

- Discovering the Link Between Inflation Rates and Inflation Uncertainty

- Inflation and Deflationary Biases in Inflation Expectations

- What Are the Reasons for High and Persistent Inflation in the Country?

- How Does Inflation Affect Savings and Investment?

- How Is Inflation Used as a Measure of Economic Performance?

- What Is the Monetarist View of Inflation?

- Does Inflation Lead to a Rapid Increase in Unemployment?

- Whom Does Inflation Hurt the Most?

- What Measures of Inflation Are Used Today?

- Why Does Increased Interest Rate Not Increase Inflation?

- Why Does an Increase in the “Cost of Money” Not Mean an Increase in Inflation?

- What Methods Are Used to Control Inflation?

- What Happens to the Equilibrium Interest Rate When Inflation Is Expected to Decrease?

- Why Are Economists Concerned About Inflation?

- How Can Government Policies Be Used to Reduce Inflation in a Country?

- What Is Natural Rate of Inflation?

- How Can Cost-Push and Demand-Pull Inflation Be Caused by a Fall in the Exchange Rate?

- What Is the Condition of Low and Stable Inflation Called?

- How Does Inflation Affect Cash Flows?

- In Which Decade Was the Highest Rate of Inflation in the United States?

- Does Inflation Always Benefit Debtors and Hurt Creditors?

- Can the Introduction of a New Banknote Cause Inflation?

- How Does the Government Directly and Indirectly Create Inflation?

- What Are the Macroeconomic Effects of Inflation?

- How Does Unexpected Inflation Affect Creditors, Debtors, and Savers?

- Can Inflation Occur With Non-fiat Money?

- What Is the Effect of Inflation on Our Financial Assets?

- Why Does Inflation Harmful to the Economy?

- Could Inflation Be a Problem for Some Low- And Middle-Income Countries?

- What Does the Phillips Curve Show During Inflation?

- How Can an Inflation Tax Explain the Creation of Inflation by a Central Bank?

- What Type of Inflation Will Cause Stagflation?

Cite this post

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2023, May 7). 114 Inflation Essay Topics. https://studycorgi.com/ideas/inflation-essay-topics/

"114 Inflation Essay Topics." StudyCorgi , 7 May 2023, studycorgi.com/ideas/inflation-essay-topics/.

StudyCorgi . (2023) '114 Inflation Essay Topics'. 7 May.

1. StudyCorgi . "114 Inflation Essay Topics." May 7, 2023. https://studycorgi.com/ideas/inflation-essay-topics/.

Bibliography

StudyCorgi . "114 Inflation Essay Topics." May 7, 2023. https://studycorgi.com/ideas/inflation-essay-topics/.

StudyCorgi . 2023. "114 Inflation Essay Topics." May 7, 2023. https://studycorgi.com/ideas/inflation-essay-topics/.

These essay examples and topics on Inflation were carefully selected by the StudyCorgi editorial team. They meet our highest standards in terms of grammar, punctuation, style, and fact accuracy. Please ensure you properly reference the materials if you’re using them to write your assignment.

This essay topic collection was updated on January 8, 2024 .

Home — Essay Samples — Economics — Political Economy — Inflation

Essays on Inflation

Inflation essay topics and outline examples, essay title 1: understanding inflation: causes, effects, and economic policy responses.

Thesis Statement: This essay provides a comprehensive analysis of inflation, exploring its root causes, the economic and societal effects it generates, and the various policy measures employed by governments and central banks to manage and mitigate inflationary pressures.

- Introduction

- Defining Inflation: Concept and Measurement

- Causes of Inflation: Demand-Pull, Cost-Push, and Monetary Factors

- Effects of Inflation on Individuals, Businesses, and the Economy

- Inflationary Policies: Central Bank Actions and Government Interventions

- Case Studies: Historical Inflationary Periods and Their Consequences

- Challenges in Inflation Management: Balancing Growth and Price Stability

Essay Title 2: Inflation and Its Impact on Consumer Purchasing Power: A Closer Look at the Cost of Living

Thesis Statement: This essay focuses on the effects of inflation on consumer purchasing power, analyzing how rising prices affect the cost of living, household budgets, and the strategies individuals employ to cope with inflation-induced challenges.

- Inflation's Impact on Prices: Understanding the Cost of Living Index

- Consumer Behavior and Inflation: Adjustments in Spending Patterns

- Income Inequality and Inflation: Examining Disparities in Financial Resilience

- Financial Planning Strategies: Savings, Investments, and Inflation Hedges

- Government Interventions: Indexation, Wage Controls, and Social Programs

- The Global Perspective: Inflation in Different Economies and Regions

Essay Title 3: Hyperinflation and Economic Crises: Case Studies and Lessons from History

Thesis Statement: This essay explores hyperinflation as an extreme form of inflation, examines historical case studies of hyperinflationary crises, and draws lessons on the devastating economic and social consequences that result from unchecked inflationary pressures.

- Defining Hyperinflation: Thresholds and Characteristics

- Case Study 1: Weimar Republic (Germany) and the Hyperinflation of 1923

- Case Study 2: Zimbabwe's Hyperinflationary Collapse in the Late 2000s

- Impact on Society: Currency Devaluation, Poverty, and Social Unrest

- Responses and Recovery: Stabilizing Currencies and Rebuilding Economies

- Preventative Measures: Policies to Avoid Hyperinflationary Crises

Inflation Reduction Act in The Frame of Macroeconomic Challenges

The oscillating tides of the american economy, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

Analyzing The Inflation Reduction Act

Report on inflation and its causes, the rise of inflation rate in the us, iflation and its causes, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Methods to Control Inflation

The grade inflation, inflation: a deceitful solution to debt, how to control inflation in pakistan, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

Main Factors of Inflation in Singapore

Effects of inflation on commercial banks’ lending: a case of kenya commercial bank limited, food inflation in the republic of india, the issue of unemployment and inflation in colombia, the theory and policy of macroeconomics on inflation rate, socio-economic conditions in 'what is poverty' by jo goodwin parker, non-accelerating inflation rate of unemployment (nairu), targeting zero inflation and increase of government spending as a way of curbing recession, howa spiraling inflation has impacted the venezuelan economy, how venezuela has been affected by inflation, effects of inflation on kenya commercial banks lending, exploring theories of inflation in economics, about fuel prices: factors, impacts, and solutions, exploring the implications of the inflation reduction act, the impact of inflation reduction act on the international economic stage, relevant topics.

- Unemployment

- Penny Debate

- Supply and Demand

- American Dream

- Real Estate

- Minimum Wage

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Essay on Inflation: Types, Causes and Effects

Essay on Inflation!

Essay on the Meaning of Inflation:

Inflation and unemployment are the two most talked-about words in the contemporary society. These two are the big problems that plague all the economies. Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously.

Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. Hence the difficulty of defining ‘inflation’ .

Inflation may be defined as ‘a sustained upward trend in the general level of prices’ and not the price of only one or two goods. G. Ackley defined inflation as ‘a persistent and appreciable rise in the general level or average of prices’ . In other words, inflation is a state of rising price level, but not rise in the price level. It is not high prices but rising prices that constitute inflation.

ADVERTISEMENTS:

It is an increase in the overall price level. A small rise in prices or a sudden rise in prices is not inflation since these may reflect the short term workings of the market. It is to be pointed out here that inflation is a state of disequilibrium when there occurs a sustained rise in price level.

It is inflation if the prices of most goods go up. However, it is difficult to detect whether there is an upward trend in prices and whether this trend is sustained. That is why inflation is difficult to define in an unambiguous sense.

Let’s measure inflation rate. Suppose, in December 2007, the consumer price index was 193.6 and, in December 2008 it was 223.8. Thus the inflation rate during the last one year was 223.8 – 193.6/193.6 × 100 = 15.6%.

As inflation is a state of rising prices, deflation may be defined as a state of falling prices but not fall in prices. Deflation is, thus, the opposite of inflation, i.e., rise in the value or purchasing power of money. Disinflation is a slowing down of the rate of inflation.

Essay on the Types of Inflation :

As the nature of inflation is not uniform in an economy for all the time, it is wise to distinguish between different types of inflation. Such analysis is useful to study the distributional and other effects of inflation as well as to recommend anti-inflationary policies.

Inflation may be caused by a variety of factors. Its intensity or pace may be different at different times. It may also be classified in accordance with the reactions of the government toward inflation.

Thus, one may observe different types of inflation in the contemporary society:

(a) According to Causes:

i. Currency Inflation:

This type of inflation is caused by the printing of currency notes.

ii. Credit Inflation:

Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

iii. Deficit-Induced Inflation:

The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may be called deficit-induced inflation.

iv. Demand-Pull Inflation:

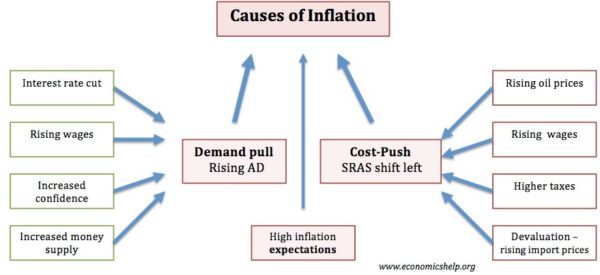

An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply.

If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods” .

Note that, in this region, price level begins to rise. Ultimately, the economy reaches full employment situation, i.e., Range 3, where output does not rise but price level is pulled upward. This is demand-pull inflation. The essence of this type of inflation is “too much spending chasing too few goods.”

v. Cost-Push Inflation:

Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to increase in the price of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not market-determined. Higher wage means higher cost of production.

Prices of commodities are thereby increased. A wage-price spiral comes into operation. But, at the same time, firms are to be blamed also for the price rise since they simply raise prices to expand their profit margins. Thus we have two important variants of CPI: wage-push inflation and profit-push inflation. Anyway, CPI stems from the leftward shift of the aggregate supply curve.

The price level thus determined is OP 1 . As aggregate demand curve shifts to AD 2 , price level rises to OP 2 . Thus, an increase in aggregate demand at the full employment stage leads to an increase in price level only, rather than the level of output. However, how much price level will rise following an increase in aggregate demand depends on the slope of the AS curve.

Causes of Demand-Pull Inflation :

DPI originates in the monetary sector. Monetarists’ argument that “only money matters” is based on the assumption that at or near full employment, excessive money supply will increase aggregate demand and will thus cause inflation.

An increase in nominal money supply shifts aggregate demand curve rightward. This enables people to hold excess cash balances. Spending of excess cash balances by them causes price level to rise. Price level will continue to rise until aggregate demand equals aggregate supply.

Keynesians argue that inflation originates in the non-monetary sector or the real sector. Aggregate demand may rise if there is an increase in consumption expenditure following a tax cut. There may be an autonomous increase in business investment or government expenditure. Governmental expenditure is inflationary if the needed money is procured by the government by printing additional money.

In brief, an increase in aggregate demand i.e., increase in (C + I + G + X – M) causes price level to rise. However, aggregate demand may rise following an increase in money supply generated by the printing of additional money (classical argument) which drives prices upward. Thus, money plays a vital role. That is why Milton Friedman believes that inflation is always and everywhere a monetary phenomenon.

There are other reasons that may push aggregate demand and, hence, price level upwards. For instance, growth of population stimulates aggregate demand. Higher export earnings increase the purchasing power of the exporting countries.

Additional purchasing power means additional aggregate demand. Purchasing power and, hence, aggregate demand, may also go up if government repays public debt. Again, there is a tendency on the part of the holders of black money to spend on conspicuous consumption goods. Such tendency fuels inflationary fire. Thus, DPI is caused by a variety of factors.

Cost-Push Inflation Theory :

In addition to aggregate demand, aggregate supply also generates inflationary process. As inflation is caused by a leftward shift of the aggregate supply, we call it CPI. CPI is usually associated with the non-monetary factors. CPI arises due to the increase in cost of production. Cost of production may rise due to a rise in the cost of raw materials or increase in wages.

Such increases in costs are passed on to consumers by firms by raising the prices of the products. Rising wages lead to rising costs. Rising costs lead to rising prices. And rising prices, again, prompt trade unions to demand higher wages. Thus, an inflationary wage-price spiral starts.

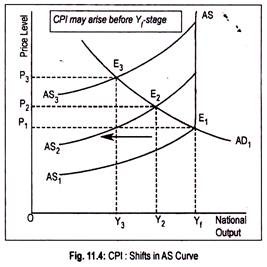

This causes aggregate supply curve to shift leftward. This can be demonstrated graphically (Fig. 11.4) where AS 1 is the initial aggregate supply curve. Below the full employment stage this AS curve is positive sloping and at full employment stage it becomes perfectly inelastic. Intersection point (E 1 ) of AD 1 and AS 1 curves determines the price level.

Now, there is a leftward shift of aggregate supply curve to AS 2 . With no change in aggregate demand, this causes price level to rise to OP 2 and output to fall to OY 2 .

With the reduction in output, employment in the economy declines or unemployment rises. Further shift in the AS curve to AS 2 results in higher price level (OP 3 ) and a lower volume of aggregate output (OY 3 ). Thus, CPI may arise even below the full employment (Y f ) stage.

Causes of CPI :

It is the cost factors that pull the prices upward. One of the important causes of price rise is the rise in price of raw materials. For instance, by an administrative order the government may hike the price of petrol or diesel or freight rate. Firms buy these inputs now at a higher price. This leads to an upward pressure on cost of production.

Not only this, CPI is often imported from outside the economy. Increase in the price of petrol by OPEC compels the government to increase the price of petrol and diesel. These two important raw materials are needed by every sector, especially the transport sector. As a result, transport costs go up resulting in higher general price level.

Again, CPI may be induced by wage-push inflation or profit-push inflation. Trade unions demand higher money wages as a compensation against inflationary price rise. If increase in money wages exceeds labour productivity, aggregate supply will shift upward and leftward. Firms often exercise power by pushing up prices independently of consumer demand to expand their profit margins.

Fiscal policy changes, such as an increase in tax rates leads to an upward pressure in cost of production. For instance, an overall increase in excise tax of mass consumption goods is definitely inflationary. That is why government is then accused of causing inflation.

Finally, production setbacks may result in decreases in output. Natural disaster, exhaustion of natural resources, work stoppages, electric power cuts, etc., may cause aggregate output to decline.

In the midst of this output reduction, artificial scarcity of any goods by traders and hoarders just simply ignite the situation.

Inefficiency, corruption, mismanagement of the economy may also be the other reasons. Thus, inflation is caused by the interplay of various factors. A particular factor cannot be held responsible for inflationary price rise.

Essay on the Effects of Inflation :

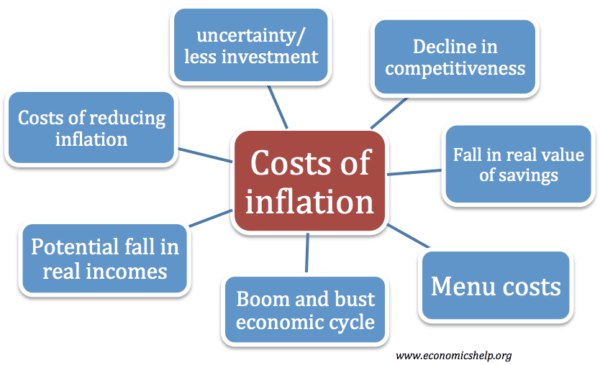

People’s desires are inconsistent. When they act as buyers they want prices of goods and services to remain stable but as sellers they expect the prices of goods and services should go up. Such a happy outcome may arise for some individuals; “but, when this happens, others will be getting the worst of both worlds.” Since inflation reduces purchasing power it is bad.

The old people are in the habit of recalling the days when the price of say, meat per kilogram cost just 10 rupees. Today it is Rs. 250 per kilogram. This is true for all other commodities. When they enjoyed a better living standard. Imagine today, how worse we are! But meanwhile, wages and salaries of people have risen to a great height, compared to the ‘good old days’. This goes unusually untold.

When price level goes up, there is both a gainer and a loser. To evaluate the consequence of inflation, one must identify the nature of inflation which may be anticipated and unanticipated. If inflation is anticipated, people can adjust with the new situation and costs of inflation to the society will be smaller.

In reality, people cannot predict accurately future events or people often make mistakes in predicting the course of inflation. In other words, inflation may be unanticipated when people fail to adjust completely. This creates various problems.

One can study the effects of unanticipated inflation under two broad headings:

(i) Effect on distribution of income and wealth

(ii) Effect on economic growth.

(a) Effects of Inflation on Income and Wealth Distribution :

During inflation, usually people experience rise in incomes. But some people gain during inflation at the expense of others. Some individuals gain because their money incomes rise more rapidly than the prices and some lose because prices rise more rapidly than their incomes during inflation. Thus, it redistributes income and wealth.

Though no conclusive evidence can be cited, it can be asserted that following categories of people are affected by inflation differently:

i. Creditors and Debtors:

Borrowers gain and lenders lose during inflation because debts are fixed in rupee terms. When debts are repaid their real value declines by the price level increase and, hence, creditors lose. An individual may be interested in buying a house by taking a loan of Rs. 7 lakh from an institution for 7 years.

The borrower now welcomes inflation since he will have to pay less in real terms than when it was borrowed. Lender, in the process, loses since the rate of interest payable remains unaltered as per agreement. Because of inflation, the borrower is given ‘dear’ rupees, but pays back ‘cheap’ rupees.

However, if in an inflation-ridden economy creditors chronically loose, it is wise not to advance loans or to shut down business. Never does it happen. Rather, the loan- giving institution makes adequate safeguard against the erosion of real value.

ii. Bond and Debenture-Holders:

In an economy, there are some people who live on interest income—they suffer most.

Bondholders earn fixed interest income:

These people suffer a reduction in real income when prices rise. In other words, the value of one’s savings decline if the interest rate falls short of inflation rate. Similarly, beneficiaries from life insurance programmes are also hit badly by inflation since real value of savings deteriorate.

iii. Investors:

People who put their money in shares during inflation are expected to gain since the possibility of earning business profit brightens. Higher profit induces owners of firms to distribute profit among investors or shareholders.

iv. Salaried People and Wage-Earners:

Anyone earning a fixed income is damaged by inflation. Sometimes, unionized worker succeeds in raising wage rates of white-collar workers as a compensation against price rise. But wage rate changes with a long time lag. In other words, wage rate increases always lag behind price increases.

Naturally, inflation results in a reduction in real purchasing power of fixed income earners. On the other hand, people earning flexible incomes may gain during inflation. The nominal incomes of such people outstrip the general price rise. As a result, real incomes of this income group increase.

v. Profit-Earners, Speculators and Black Marketeers:

It is argued that profit-earners gain from inflation. Profit tends to rise during inflation. Seeing inflation, businessmen raise the prices of their products. This results in a bigger profit. Profit margin, however, may not be high when the rate of inflation climbs to a high level.

However, speculators dealing in business in essential commodities usually stand to gain by inflation. Black marketeers are also benefited by inflation.

Thus, there occurs a redistribution of income and wealth. It is said that rich becomes richer and poor becomes poorer during inflation. However, no such hard and fast generalizations can be made. It is clear that someone wins and someone loses from inflation.

These effects of inflation may persist if inflation is unanticipated. However, the redistributive burdens of inflation on income and wealth are most likely to be minimal if inflation is anticipated by the people.

With anticipated inflation, people can build up their strategies to cope with inflation. If the annual rate of inflation in an economy is anticipated correctly people will try to protect them against losses resulting from inflation.

Workers will demand 10 p.c. wage increase if inflation is expected to rise by 10 p.c. Similarly, a percentage of inflation premium will be demanded by creditors from debtors. Business firms will also fix prices of their products in accordance with the anticipated price rise. Now if the entire society “learns to live with inflation” , the redistributive effect of inflation will be minimal.

However, it is difficult to anticipate properly every episode of inflation. Further, even if it is anticipated it cannot be perfect. In addition, adjustment with the new expected inflationary conditions may not be possible for all categories of people. Thus, adverse redistributive effects are likely to occur.

Finally, anticipated inflation may also be costly to the society. If people’s expectation regarding future price rise become stronger they will hold less liquid money. Mere holding of cash balances during inflation is unwise since its real value declines. That is why people use their money balances in buying real estate, gold, jewellery, etc.

Such investment is referred to as unproductive investment. Thus, during inflation of anticipated variety, there occurs a diversion of resources from priority to non-priority or unproductive sectors.

b. Effect on Production and Economic Growth :

Inflation may or may not result in higher output. Below the full employment stage, inflation has a favourable effect on production. In general, profit is a rising function of the price level. An inflationary situation gives an incentive to businessmen to raise prices of their products so as to earn higher doses of profit.

Rising price and rising profit encourage firms to make larger investments. As a result, the multiplier effect of investment will come into operation resulting in higher national output. However, such a favourable effect of inflation will be temporary if wages and production costs rise very rapidly.

Further, inflationary situation may be associated with the fall in output, particularly if inflation is of the cost-push variety. Thus, there is no strict relationship between prices and output. An increase in aggregate demand will increase both prices and output, but a supply shock will raise prices and lower output.

Inflation may also lower down further production levels. It is commonly assumed that if inflationary tendencies nurtured by experienced inflation persist in future, people will now save less and consume more. Rising saving propensities will result in lower further outputs.

One may also argue that inflation creates an air of uncertainty in the minds of business community, particularly when the rate of inflation fluctuates. In the midst of rising inflationary trend, firms cannot accurately estimate their costs and revenues. Under the circumstance, business firms may be deterred in investing. This will adversely affect the growth performance of the economy.

However, slight dose of inflation is necessary for economic growth. Mild inflation has an encouraging effect on national output. But it is difficult to make the price rise of a creeping variety. High rate of inflation acts as a disincentive to long run economic growth. The way the hyperinflation affects economic growth is summed up here.

We know that hyperinflation discourages savings. A fall in savings means a lower rate of capital formation. A low rate of capital formation hinders economic growth. Further, during excessive price rise, there occurs an increase in unproductive investment in real estate, gold, jewellery, etc.

Above all, speculative businesses flourish during inflation resulting in artificial scarcities and, hence, further rise in prices. Again, following hyperinflation, export earnings decline resulting in a wide imbalance in the balance of payments account.

Often, galloping inflation results in a ‘flight’ of capital to foreign countries since people lose confidence and faith over the monetary arrangements of the country, thereby resulting in a scarcity of resources. Finally, real value of tax revenue also declines under the impact of hyperinflation. Government then experiences a shortfall in investible resources.

Thus, economists and policy makers are unanimous regarding the dangers of high price rise. But the consequence of hyperinflation is disastrous. In the past, some of the world economies (e.g., Germany after the First World War (1914-1918), Latin American countries in the 1980s) had been greatly ravaged by hyperinflation.

The German Inflation of 1920s was also Catastrophic:

During 1922, the German price level went up 5,470 per cent, in 1923, the situation worsened; the German price level rose 1,300,000,000 times. By October of 1923, the postage of the lightest letter sent from Germany to the United States was 200,000 marks.

Butter cost 1.5 million marks per pound, meat 2 million marks, a loaf of bread 200,000 marks, and an egg 60,000 marks Prices increased so rapidly that waiters changed the prices on the menu several times during the course of a lunch!! Sometimes, customers had to pay double the price listed on the menu when they observed it first!!!

During October 2008, Zimbabwe, under the President-ship of Robert G. Mugabe, experienced 231,000,000 p.c. (2.31 million p.c.) as against 1.2 million p.c. price rise in September 2008—a record after 1923. It is an unbelievable rate. In May 2008, the cost of price of a toilet paper itself and not the costs of the roll of the toilet paper came to 417 Zimbabwean dollars.

Anyway, people are harassed ultimately by the high rate of inflation. That is why it is said that ‘inflation is our public enemy number one’. Rising inflation rate is a sign of failure on the part of the government.

Related Articles:

- Essay on the Causes of Inflation (473 Words)

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

- Demand Pull Inflation and Cost Push Inflation | Money

- Essay on Inflation: Meaning, Measurement and Causes

What is inflation?

Inflation refers to a broad rise in the prices of goods and services across the economy over time, eroding purchasing power for both consumers and businesses. In other words, your dollar (or whatever currency you use for purchases) will not go as far today as it did yesterday. To understand the effects of inflation, take a commonly consumed item and compare its price from one period with another. For example, in 1970, the average cup of coffee cost 25 cents; by 2019, it had climbed to $1.59. So for $5, you would have been able to buy about three cups of coffee in 2019, versus 20 cups in 1970. That’s inflation, and it isn’t limited to price spikes for any single item or service; it refers to increases in prices across a sector, such as retail or automotive—and, ultimately, a country’s economy.

Get to know and directly engage with senior McKinsey experts on inflation.

Ondrej Burkacky is a senior partner in McKinsey’s Munich office, Axel Karlsson is a senior partner in the Stockholm office, Fernando Perez is a senior partner in the Miami office, Emily Reasor is a senior partner in the Denver office, and Daniel Swan is a senior partner in the Stamford office.

In a healthy economy, annual inflation is typically in the range of two percentage points, which is what economists consider a signal of pricing stability. And there can be positive effects of inflation when it’s within range: for instance, it can stimulate spending, and thus spur demand and productivity, when the economy is slowing down and needs a boost. Conversely, when inflation begins to surpass wage growth, it can be a warning sign of a struggling economy.

Inflation affects consumers most directly, but businesses can also feel the impact. Here’s a quick explanation of the differences in how inflation affects consumers and companies:

- Households, or consumers, lose purchasing power when the prices of items they buy, such as food, utilities, and gasoline, increase.

- Companies lose purchasing power, and risk seeing their margins decline , when prices increase for inputs used in production, such as raw materials like coal and crude oil , intermediate products such as flour and steel, and finished machinery. In response, companies typically raise the prices of their products or services to offset inflation, meaning consumers absorb these price increases. For many companies, the trick is to strike a balance between raising prices to make up for input cost increases while simultaneously ensuring that they don’t rise so much that it suppresses demand, which is touched on later in this article.

How is inflation measured?

Statistical agencies measure inflation by first determining the current value of a “basket” of various goods and services consumed by households, referred to as a price index. To calculate the rate of inflation, or percentage change, over time, agencies compare the value of the index over one period to another, such as month to month, which gives a monthly rate of inflation, or year to year, which gives an annual rate of inflation.

For example, in the United States, that country’s Bureau of Labor Statistics publishes its Consumer Price Index (CPI), which measures the cost of items that urban consumers buy out of pocket. The CPI is broken down by regions and is reported for the country as a whole. The Personal Consumption Expenditures (PCE) price index —published by the US government’s Bureau of Economic Analysis—takes into account a broader range of consumers’ expenditures, including healthcare. It is also weighted by data acquired through business surveys.

Introducing McKinsey Explainers : Direct answers to complex questions

What are the main causes of inflation.

There are two primary types, or causes, of inflation:

- Demand-pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. For example, when demand for new cars recovered more quickly than anticipated from its sharp dip at the beginning of the COVID-19 pandemic, an intervening shortage in the supply of semiconductors made it hard for the automotive industry to keep up with this renewed demand. The subsequent shortage of new vehicles resulted in a spike in prices for new and used cars.

- Cost-push inflation occurs when the rising price of input goods and services increases the price of final goods and services. For example, commodity prices spiked sharply during the pandemic as a result of radical shifts in demand, buying patterns, cost to serve, and perceived value across sectors and value chains. To offset inflation and minimize impact on financial performance, industrial companies were forced to consider price increases that would be passed on to their end consumers.

Learn more about McKinsey's Pricing practice.

How does inflation today differ from historical inflation?

In January 2022, inflation in the United States accelerated to 7.5 percent, its highest level since February 1982, as a result of soaring energy costs , labor mismatches , and supply disruptions . But inflation is not a new phenomenon; countries have weathered inflation throughout history.

A common comparison to the current inflationary period is with that of the post–World War II era , when price controls, supply problems, and extraordinary demand fueled double-digit inflation gains—peaking at 20 percent in 1947—before subsiding at the end of the decade, according to the US Bureau of Labor Statistics. Consumption patterns today have been similarly distorted, and supply chains have been disrupted by the pandemic.

The period from the mid-1960s through the early 1980s, sometimes called “The Great Inflation,” saw some of the highest rates of inflation, with a peak of 14.8 percent in 1980. To combat this inflation, the Federal Reserve raised interest rates to nearly 20 percent. Some economists attribute this episode partially to monetary policy mistakes rather than to other purported causes, such as high oil prices. The Great Inflation signaled the need for public trust in the Federal Reserve’s ability to lessen inflationary pressures.

How does inflation affect pricing?

When inflation occurs, companies typically pay more for input materials . One way for companies to offset losses and maintain gross margins is by raising prices for consumers, but if price increases are not executed thoughtfully, companies can damage customer relationships, depress sales, and hurt margins. An exposure matrix that assesses which categories are exposed to market forces, and whether the market is inflating or deflating, can help companies make more informed decisions.

Done the right way, recovering the cost of inflation for a given product can strengthen relationships and overall margins. There are five steps companies can take to ADAPT (Adjust, Develop, Accelerate, Plan, and Track) to inflation:

- Adjust discounting and promotions and revisit other aspects of sales unrelated to the base price, such as lengthened production schedules or surcharges and delivery fees for rush or low-volume orders.

- Develop the art and science of price change . Don’t make across-the-board price changes; rather, tailor pricing actions to account for inflation exposure, customer willingness to pay, and product attributes.

- Accelerate decision making tenfold . Establish an “inflation council” that includes dedicated cross-functional, inflation-focused decision makers who can act nimbly and quickly on customer feedback.

- Plan options beyond pricing to reduce costs . Use “value engineering” to reimagine your portfolio and provide cost-reducing alternatives to price increases.

- Track execution relentlessly . Create a central supporting team to address revenue leakage and to manage performance rigorously.

Beyond pricing, a variety of commercial and technical levers can help companies deal with price increases in an inflationary market , but other sectors may require a more tailored response to pricing. In the chemicals industry, for instance, category managers contending with soaring prices of commodities can make the following five moves to save their companies money:

- Gain a full understanding of supply–market dynamics and outlook . Understand and track the elements that trigger price increases and rescind these increases once those drivers are no longer applicable.

- Ensure that suppliers can clearly articulate the impact that price increases in the market have on suppliers’ prices . In times of upward price pressure, sellers often overstate the share of raw materials in input costs, taking the opportunity to inflate their margins. Using cleansheet methodology to identify and challenge these situations is important.

- View unavoidable price increases as temporary surcharges, not the new future state . This mechanism, partly psychological in nature, is very effective in dealing with the stickiness of price increases because it shifts the burden of proof to the supplier.

- Prioritize cross-functional initiatives . When prices are high, the impact of yield improvements, waste reduction, or substitutions can be amplified. If any are available, now is the time to make them a priority.

- Work with sales to pass on price increases . Category managers work closely with finance and commercial teams to shed light on pure market effects and their impact on the prices of goods sold, while ensuring that the right arguments are advanced to pass market-price increases to customers.

Learn more about our Financial Services , Advanced Electronics , Operations , and Growth, Marketing & Sales practices.

What is the difference between inflation and deflation?