- Centers for Economic Education

- Certified Educator

- Partners and Donors

- Staff & Board of Directors

- Privacy Policy

- Free Workshops

- Professional Development & Certification

- Economic Decision-Making

- Mini-Economy Classroom Start-up Experience

- Performance Assessments

- Reading Makes Cents

- State Standards & Resources

- Stock Market Game™

- Virginia Economic Educator Awards

- Remote Learning Lessons

- Virginia Reads One Book

- Virginia Personal Finance Teacher Fellowship Program

- Life After High School School Resources

- Economics & Personal Finance Course

- Free Personal Finance & Economic Ed Teacher Resources

- Governor’s Challenge

- Register For SMG

- Classroom Resources

- Scholarships

- Stock Market Game Winners

- Frequently Asked Questions

Personal Finance Case Study

Regardless of whether you are able to participate in the Governor’s Challenge, we hope you will review the issues raised in the case study and consider using them in the classroom as group presentations and breakouts. Doing so will provide a good opportunity to apply many of the personal finance concepts and knowledge for your students. Below are examples of Case Studies. They also provide a good opportunity to exercise financial knowledge.

Click to download our Case Study Teacher Guidelines

Click to download the 2021 Governor’s Challenge Case Study

Click here to download the 2021 Governor’s Challenge Rubric

Click to download the 2021 Governor’s Challenge Financial Statements

Example 1 Personal Finance Case Study Example 1 Case Study Financial Statements Example 1 Rubric for Judging

Example 2 Personal Finance Case Study Example 2 Case Study Financial Statements Example 2 Rubric for Judging

2017 Governor’s Challenge Personal Finance Case Study

2016 Governor’s Challenge Personal Finance Case Study

2015 Governor’s Challenge Personal Finance Case Study

Yes, I'd like to help!

Sign up for educator emails.

Get resources for your K-12 classroom from the Virginia Council on Economic Education.

- Name * First Last

- School Name

- School Division School Division Not Teaching Independent Administrator Homeschool Private School Other Accomack County Albemarle County Alexandria Alleghany County Amelia County Amherst County Appomattox County Arlington County Augusta County Bath County Bedford County Bland County Botetourt County Bristol Brunswick County Buchanan County Buckingham County Buena Vista Campbell County Caroline County Carroll County Charles City County Charlotte County Charlottesville Chesapeake Chesterfield County Clarke County Colonial Beach Colonial Heights Covington Craig County Culpeper County Cumberland County Danville Dickenson County Dinwiddie County Essex County Fairfax County Falls Church Fauquier County Floyd County Fluvanna County Franklin City Franklin County Frederick County Fredericksburg Galax Giles County Gloucester County Goochland County Grayson County Greene County Greensville County Halifax County Hampton Hanover County Harrisonburg Henrico County Henry County Highland County Hopewell Isle of Wight County King and Queen County King George County King William County Lancaster County Lee County Lexington Loudoun County Louisa County Lunenburg County Lynchburg Madison County Manassas Manassas Park Martinsville Mathews County Mecklenburg County Middlesex County Montgomery County Nelson County New Kent County Newport News Norfolk Northampton County Northumberland County Norton Nottoway County Orange County Page County Patrick County Petersburg Pittsylvania County Poquoson Portsmouth Powhatan County Prince Edward County Prince George County Prince William County Pulaski County Radford Rappahannock County Richmond City Richmond County Roanoke City Roanoke County Rockbridge County Rockingham County Russell County Salem Scott County Shenandoah County Smyth County Southampton County Spotsylvania County Stafford County Staunton Suffolk Surry County Sussex County Tazewell County Virginia Beach Warren County Washington County Waynesboro West Point Westmoreland County Williamsburg-James City County Winchester Wise County Wythe County York County

- Middle School

- High School

- Email This field is for validation purposes and should be left unchanged.

- Browse All Articles

- Newsletter Sign-Up

PersonalFinance →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

The National Personal Finance Challenge

The competition to make you financially savvy.

The National Personal Finance Challenge (NPFC) is a nationwide competition that offers high school students the opportunity to build and demonstrate their knowledge in the concepts of earning income, spending, saving, investing, managing credit, and managing risk.

In the first round of the NPFC, student teams compete in a fun online 30-question challenge. High-scoring student teams are invited to their state finals. State champions proceed to the National competition, where teams use their knowledge to create a financial plan for a fictitious family scenario. The top 16 teams in the National Finals will advance to compete for the national championship title in a Quiz Bowl.

The 2024 National Personal Finance Challenge finals will be hosted in Cleveland, Ohio on May 19-20, 2024.

While in Cleveland ALL EXPENSES are covered including food, hotel, and events (transportation to/from state of origin excluded). The top four teams win cash prizes at our exciting in-person National Finals in Cleveland.

With over 15,000 students participating annually, our vision is to expand to 50,000 annual participants by 2025 from all over the country. We continue our efforts to make the program accessible to a diverse set of participants; trying to reach students from all corners of the nation. Currently, over 40% of our participants are from diverse backgrounds, reflecting our commitment to inclusivity and diversity.

All finalist team members receive cash prizes:

1st place $2,000 | 2nd place $1,000 | 3rd place $500 | 4th place $250

Investing in student teams and their futures.

The Council for Economic Education offers free resources for teachers and NPFC team coaches to ensure that the kids in their communities develop a solid understanding of the six core knowledge areas of personal finance. The online NPFC Toolkit includes engaging lessons, activities, instructive videos, quizzes and family scenario case studies to ensure that students are equipped not only to compete in the NPFC—but also to take control of their financial futures.

Students will learn about:

Earning Income

How it’s generated and how factors such as taxes, interest rates, and inflation impact income.

Buying goods and services by examining personal budgets, expenses, and income.

Analyzing compound interest and financial institutions and services.

Managing Credit

Credit reports, credit scores, and decision-making through consumer credit.

Various investment instruments, including stocks, bonds, and mutual funds. Students will also understand the concepts of risk and return and time horizon.

Managing Risk

Different types of insurance and vigilance against common scams and identity theft.

The competition to make you financially savvy

Financial Literacy Leads to Financial Opportunity

Many kids in high school are already earning and spending, and some may be thinking about saving and growing their personal wealth. Working with students in their teen years is vital for building financial competency and fluency while they begin to apply what they learn in the real world.

More than developing generations of educated consumers, CEE is dedicated to preparing teens to make educated decisions that impact their lives.

#Financechallenge

This program is generously funded by

This program is co-hosted by

Dollars and sense: The case for teaching personal finance

Americans aren’t good at managing their money — and there are signs that the problem is getting worse.

Already saddled with record levels of student debt, young adults today, for example, are even more unlikely to monitor their credit card debt and bank balances. Some people trick themselves into thinking that store refunds or anything less than $5 amount to free money . And too many people pay for online subscriptions they don’t use.

Thanks to the pioneering work of Stanford economist Annamaria Lusardi , numerous studies show how little people know about money. For two decades, Lusardi has been tracking financial literacy rates using three basic questions that she helped design and are now used as a standard measure around the world.

Her latest analysis of how Americans responded to those three questions in 2021 underscores their lack of financial know-how.

Only 53.1 percent of respondents demonstrated an understanding of how inflation works as prices on everything from cereal and cars were spiking. About two-thirds (69.4 percent) knew how to do a simple interest-rate calculation, but only 41.5 percent understood how, when it comes to investment risks, mutual funds are generally safer investments than a single company’s stock.

In all, just 28.5 percent of survey participants answered all three questions correctly, while the rest either got them wrong, or indicated they didn’t know.

The results are especially troubling as methods of managing money have evolved, says Lusardi, a globally recognized expert on personal finance who joined Stanford in September as a senior fellow at the Stanford Institute for Economic Policy Research (SIEPR) and director of the new Initiative for Financial Decision-Making. Workers now shoulder more of their retirement planning; consumers quickly and easily move money using their mobile phones; and investors make increasingly complex decisions.

“The world is changing really fast and we just expect people to have the skills to make financial decisions that have critical lifelong impacts,” says Lusardi, who is also a professor of finance (by courtesy) at the Graduate School of Business (GSB).

High rates of financial illiteracy are also problematic, she says, given today’s heightened economic uncertainty and growing wealth inequality. Respondents who were young, less educated, female, or not employed scored the lowest. Black Americans and Hispanics were also among the least financially literate.

A global pattern of illiteracy

Financial illiteracy, it turns out, is pervasive around the world, according to a newly published global analysis in the Journal of Financial Literacy and Wellbeing . Whether they are in a Nordic country with strong education systems, like Finland, or in a Latin American country, like Peru, which experienced inflation in 1990 upwards of 10,000 percent, most people don’t understand how money works, says Lusardi. And just like in the United States, the least knowledgeable tend to be women, racial minorities, the least-educated, and the unemployed.

Lusardi’s latest U.S. analysis — co-authored with Jialu Streeter , the executive director and a senior research scholar at SIEPR — is part of a special edition of the journal that includes analyses of 16 countries. Each study in the issue is based on the results of the “Big Three” questions that Lusardi and her longtime collaborator, economist Olivia Mitchell of The Wharton School at the University of Pennsylvania, crafted 20 years ago.

In 2011, Lusardi oversaw and contributed to a similar series of country comparisons — which yielded similar results and appeared in the Journal of Pension Economics & Finance .

“Financial illiteracy has been and continues to be a global phenomenon,” says Lusardi, who is one of the founders and inaugural editors of the Journal of Financial Literacy and Wellbeing , published by Cambridge University Press .

Why the ABCs of money matters

Beyond measuring and analyzing financial literacy rates, Lusardi’s extensive research has found how people who understand basic financial concepts are better at managing money. They save more for retirement, make smarter investment decisions, and manage their debts more effectively. Lusardi’s latest study shows that people who are financially literate are more likely to have money on hand to weather at least the early stages of an economic shock like a pandemic.

Lusardi has also shown that people think they know more about personal finance than they actually do, which she says makes them even more vulnerable to poor decision-making.

Stanford’s commitment to improving financial literacy is a key reason Lusardi says she joined The Farm. In addition to the Initiative for Financial Decision-Making — a collaboration between SIEPR, the GSB, and the Department of Economics in the School of Humanities and Sciences — Lusardi continues to serve as academic director of the Global Financial Literacy Excellence Center , which she founded in 2011. Prior to Stanford, Lusardi was the University Professor of Economics and Accountancy at The George Washington University.

The Big Three as global standard

In Lusardi, Stanford gains a leader in establishing financial literacy as a specialty within the field of economics.

Lusardi’s contributions to the field began in 2004, when The University of Michigan’s closely watched Health and Retirement Study added the so-called Big Three to a module dedicated to financial literacy and retirement planning. Then, in 2009, the financial education arm of the Financial Industry Regulatory Authority, which helps provide oversight of registered securities brokers and brokerage firms, began incorporating the same measures in its triennial survey of roughly 25,000 Americans.

Since then, other organizations, including central banks around the world, have integrated the Big Three into their respective assessments of household finances.

The underlying datasets in these surveys differ, but the results have uniformly shown that most people don’t understand how money, or financial systems broadly, functions, Lusardi says. In the U.S., this remained the case even after the Great Recession of 2008 and 2009 — the most severe economic downturn since the Great Depression — buffeted household finances.

“The continuous surprise is just how low financial literacy is in the United States and around the world,” says Lusardi, whose policy work includes advising the U.S. Treasury, the Organisation for Economic Co-operation and Development, and chairing the Italian Financial Education Committee in charge of designing a national strategy for financial literacy.

Solutions in education

To Lusardi, the answer to financial illiteracy lies in providing people with a basic education on the ABCs of personal finance.

“Developing personal finance skills is as important as learning how to read and write,” says Lusardi, who has been teaching financial literacy to undergraduate and graduate students for more than a decade. In fact, her move to Stanford is rooted in her experience working with SIEPR’s Michael Boskin and John Shoven to organize the first annual Teaching Personal Finance Conference in 2022.

“I’m not talking about expecting people to become Warren Buffet,” she says. “I’m talking about teaching people, especially the young, how to make savvy financial decisions. For first-generation or low-income students, it often means talking about topics they seldom discuss with their parents.”

Even as personal finance education has become somewhat of a cottage industry, results are mixed at best. Instructors, Lusardi says, often lack training and students tend to forget what they learn. In a 2014 journal publication , Lusardi and Mitchell noted that lack of sufficient funding or teacher training in financial education are still an issue; in a follow-up paper published this past fall, however, they said there’s reason for optimism.

More than half of U.S. states, for example, have added personal finance instruction as a high school graduation requirement. Universities, including Stanford, are now offering personal finance courses. Employers, too, are recognizing that financial anxiety hurts employee productivity and are sponsoring personal finance lessons in the workplace.

“Financial literacy education is really accelerating,” Lusardi says. “We’re finally seeing things turn around and, to me, that’s a very positive result.”

This story was updated on Feb. 15, 2024 with the new official name of Stanford's Initiative for Financial Decision-Making.

More News Topics

Daniel ho, muriel niederle elected to the american academy of arts and sciences.

- Awards & Appointments

- Innovation and Technology

We’re paying off medical debt wrong

- Media Mention

25 Years After Columbine, America Spends Billions to Prevent Shootings That Keep Happening

Day 7 of the 24 Hour Personal Finance Course: Save Me! Case Study

The 90 minute class at Eastside last week focused on the Save Me! case study .

Observations:

- Synopsis: Two friends have very different savings habits. The saver (Samuel) is dissatisfied for a number of reasons and the non-saver (Juan Carlos) is surprised to discover that he now needs to save $4,000 for each year of college

- Students spent first 45 minutes reading the case, answering the questions in the case and manipulating the savings variables (hours worked, pay per hour and savings rate) in the Google sheet.

We then worked through the case with the following progression:

- One student opened the discussion by summarizing the situation, the main characters and the problem that needed to be solved.

- Figure out the net cost for the schools that he is interested in. This will require asking his parents for their income. By doing this, he will have a better sense of how much he will need to save for college and can set a SMART goal.

- Work fewer hours to 1) improve his academic grades and 2) have a social life.

- Everyone was in agreement that he would give the money to his parents for the car repair since it was critical for their parents. Wish I had asked if Samuel should ask them to pay him back.

- Students did a good job of developing questions that Samuel should ask Juan Carlos to help in developing a savings goal.

- Good opportunity to discuss the tradeoff between hours worked at a part-time job and academic performance. Research suggests 20 hours is about the max that students should consider, while others may put that figure at 10 hours, especially when starting college.

- They quickly discovered the relationship between hours worked and saving. The higher percentage he saved, the fewer hours Juan Carlos would need to work to hit his goal.

- While students are unlikely to owe income taxes (unless they earn over $6,300 in 2015), Social Security and Medicare will be withheld from their pay.

- Discussed the tradeoffs between taking an unpaid internship which might further one’s career vs. a paid job that wasn’t necessarily exposing a student to a career interest of theirs.

- Discussed how a student might get paid more if they stayed at the same summer job for a number of years.

- Wish I had discussed how they should think about investing their savings. Should they invest in the stock market with the money they have saved for college? Good opportunity to discuss the 5 year rule (if you need money within five years, you don’t want to invest in the stock market).

- The answers varied as some students thought Juan Carlos could save a high percentage of his income while others weren’t so confident that he could hold down a job, let alone save a high percentage of his pay.

- We also discussed other alternative strategies, including taking out student loans and not working. Students didn’t think that was such a good idea as many saw the intrinsic value of the work itself in developing Juan Carlos’ skills.

- I closed by asking students if they had savings goals. Only a few hands went up. I then dug a little deeper to understand why they didn’t have goals. The principal reason being that most students were so focused on their academics that they didn’t have time for work and therefore having a savings goals didn’t make sense for them. With aid award letters fast approaching, I encouraged them to use the same template to develop their savings goals. Each dollar saved is a dollar they don’t need to borrow!

About the Author

Tim ranzetta.

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Behavioral Economics

Consumer Skills

Current Events

Curriculum Announcements

ELL Resources

FinCap Friday

Interactive

Paying for College

Press Releases

Podcasts in the Classroom

Professional Development

Question of the Day

So Expensive Series

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS

Question of the Day: How long does the average user spend on TikTok a day?

Top 5 Sub Plan Activities

Question of the Day [Women's History Month]: Match these CEOs with the S&P 500 companies they lead

Useful Personal Finance Movies and Documentaries with Worksheets

Tax Unit Updated for the Current Tax Filing Year

Awarded one of the Top Personal Finance Blogs

Awarded one of the Best Advocacy Blogs and Websites

Sending form...

One more thing.

Before your subscription to our newsletter is active, you need to confirm your email address by clicking the link in the email we just sent you. It may take a couple minutes to arrive, and we suggest checking your spam folders just in case!

Great! Success message here

New to NGPF?

Save time, increase student engagement, and help your students build life-changing financial skills with NGPF's free curriculum and PD.

Start with a FREE Teacher Account to unlock NGPF's teachers-only materials!

Become an ngpf pro in 4 easy steps:.

1. Sign up for your Teacher Account

2. Explore a unit page

3. Join NGPF Academy

4. Become an NGPF Pro!

Teacher Account Log In

Not a member? Sign Up

Forgot Password?

Thank you for registering for an NGPF Teacher Account!

Your new account will provide you with access to NGPF Assessments and Answer Keys. It may take up to 1 business day for your Teacher Account to be activated; we will notify you once the process is complete.

Thanks for joining our community!

The NGPF Team

Want a daily question of the day?

Subscribe to our blog and have one delivered to your inbox each morning, create a free teacher account.

Complete the form below to access exclusive resources for teachers. Our team will review your account and send you a follow up email within 24 hours.

Your Information

School lookup, add your school information.

To speed up your verification process, please submit proof of status to gain access to answer keys & assessments.

Acceptable information includes:

- a picture of you (think selfie!) holding your teacher/employee badge

- screenshots of your online learning portal or grade book

- screenshots to a staff directory page that lists your e-mail address

- any other means that can prove you are not a student attempting to gain access to the answer keys and assessments.

Acceptable file types: .png, .jpg, .pdf.

Create a Username & Password

Once you submit this form, our team will review your account and send you a follow up email within 24 hours. We may need additional information to verify your teacher status before you have full access to NGPF.

Already a member? Log In

Welcome to NGPF!

Take the quiz to quickly find the best resources for you!

ANSWER KEY ACCESS

Personal Finance Challenge

The Personal Finance Challenge (PFC) invites teachers to engage their students in an academic competition showcasing student’s knowledge of personal finance. This is a fun and competitive way to engage students more fully in their learning while assessing how well they are meeting financial literacy standards.

The competition is open to all middle and high school students who have taken an economics or economics-related course in school. There is no fee to participate.

Student teams of 3 or 4 take a 30-question test during a 2-week online testing period. The top-scoring teams from the online testing round of each division will compete in an exciting, fast-paced, online Quiz Bowl.

The 2024 Economics Challenge has concluded. Congratulations to the winning teams!

Review the rules for the 2024 Personal Finance Challenge.

Review past State Final questions.

This is a qualifying event for the National Personal Finance Challenge. The high school team with the highest combined Personal Finance Case Study presentation score and Personal Finance Challenge online test score will advance to the National High School Personal Finance Challenge.

Prizes for Personal Finance Quiz Bowl Winning Team:

High School 1st place: $500

Middle School 1st place: $500

2024 Winners

Middle School Division

First Place Team: Desert Money Management School: Orange Grove Middle School Teacher: Dawn Willman

Second Place Team: The Veblen Vibes School: BASIS Mesa Teacher: Greg Thorson

High School Division

First Place Team: ACPHS – S School: Arizona College Prep High School Teacher: Anju Sutaria

Second Place Team: Team 3 School: Hamilton High School Teacher: Grant Lapinski

Get in Touch

Contact ACEE for more information.

Sign Up for the ACEE Newsletter

" * " indicates required fields

16421 N. Tatum Blvd., Suite 123, Phoenix, Arizona 85032 Tel: (480)-368-8020 | EIN: 86-0896574

- International Center for Finance

- ICF Case Studies

Finance Case Studies

Featured finance case studies:.

Canary Wharf: Financing and Placemaking

Fondaco dei Tedeschi: A New Luxury Shopping Destination for Venice

Nathan Cummings Foundation: Mission-Driven Investing

The Decline of Malls

Expand the sections below to read more about each case study:, nathan cummings foundation, ellie campion, dwayne edwards, brad wayman, anna williams, william goetzmann, and jean rosenthal.

Asset Management, Investor/Finance, Leadership & Teamwork, Social Enterprise, Sourcing/Managing Funds

The Nathan Cummings Foundation Investment Committee and Board of Trustees had studied the decision to go “all in” on a mission-related investment approach. The Board voted 100% to support this new direction and new goals for financial investments, but many questions remained. How could NCF operationalize and integrate this new strategy? What changes would it need to make to support the investment strategies' long-term success? How could NCF measure and track its progress and success with this new strategy?

William Goetzmann, Jean Rosenthal, Jaan Elias, Edoardo Pasinato, Lukas Cejnar, Ellie Campion

Business History, Competitor/Strategy, Customer/Marketing, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The renovation of the Fondaco dei Tedeschi in Venice represented a grand experiment. Should an ancient building in the midst of a world heritage site be transformed into a modern mall for luxury goods? How best to achieve the transformation and make it economically sustainable? Would tourists walk to the mall? And would they buy or just look? What could each stakeholder learn from their experiences with the Fondaco dei Tedeschi?

Gardner Denver

James quinn, adam blumenthal, and jaan elias.

Asset Management, Employee/HR, Investor/Finance, Leadership & Teamwork

As KKR, a private equity firm, prepared to take Gardner-Denver, one of its portfolio companies, public in mid-2017, a discussion arose on the Gardner-Denver board about the implications of granting approximately $110 million in equity to its global employee base as part of its innovative "broad-based employee ownership program." Was the generous equity package that Pete Stavros proposed be allotted to 6,100 employees the wisest move and the right timing for Gardner Denver and its new shareholders?

Home Health Care

Jean rosenthal, jaan elias, adam blumenthal, and jeremy kogler.

Asset Management, Competitor/Strategy, Healthcare, Investor/Finance

Blue Wolf Capital Partners was making major investments in the home health care sector. The private equity fund had purchased two U.S. regional companies in the space. The plan was to merge the two organizations, creating opportunities for shared expertise and synergies in reducing management costs. Two years later, the management team was considering adding a third company. Projected revenues for the combined organization would top $1 billion annually. What was the likelihood that this opportunity would succeed?

Suwanee Lumber Company

Jaan elias, adam blumenthal, james shovlin, and heather e. tookes.

Asset Management, Investor/Finance, Sustainability

In 2016, Blue Wolf, a private equity firm headquartered in New York City, confronted a number of options when it came to its lumber business. They could put their holdings in the Suwanee Lumber Company (SLC), a sawmill they had purchased in 2013, up for sale. Or they could continue to hold onto SLC and run it as a standalone business. Or they could double down on the lumber business by buying an idle mill in Arkansas to run along with SLC.

Alternative Meat Industry: How Should Beyond Meat be Valued?

Nikki springer, leon van wyk, jacob thomas, k. geert rouwenhorst and jaan elias.

Competitor/Strategy, Customer/Marketing, Investor/Finance, Sourcing/Managing Funds, Sustainability

In 2009, when experienced entrepreneur Ethan Brown decided to build a better veggie burger, he set his sights on an exceptional goal – create a plant-based McDonald’s equally beloved by the American appetite. To do this, he knew he needed to transform the idea of plant-based meat alternatives from the sleepy few veggie burger options in the grocer’s freezer case into a fundamentally different product. Would further investments in research and development help give Beyond Meat an edge? Would Americans continue to embrace meat alternatives, or would the initial fanfare subside below investor expectations?

Hertz Global Holdings (A): Uses of Debt and Equity

Jean rosenthal, geert rouwenhorst, jacob thomas, allen xu.

Asset Management, Financial Regulation, Sourcing/Managing Funds

By 2019, Hertz CEO Kathyrn Marinello and CFO Jamere Jackson had managed to streamline the venerable car rental firm's operations. Their next steps were to consider ways to fine-tune Hertz's capital structure. Would it make sense for Marinello and Jackson to lead Hertz to issue more equity to re-balance the structure? One possibility was a stock rights offering, but an established company issuing equity was not generally well-received by investors. How well would the market respond to an attempt by Hertz management to increase shareholder equity?

Twining-Hadley Incorporated

Jaan elias, k geert rouwenhorst, jacob thomas.

Employee/HR, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

Jessica Austin has been asked to compute THI's Weighted Average Cost of Capital, a key measure for making investments and deciding executive compensation. What should she consider in making her calculation?

Shake Shack IPO

Vero bourg-meyer, jaan elias, jake thomas and geert rouwenhorst.

Competitor/Strategy, Innovation & Design, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds, Sustainability

Shake Shack's long lines of devoted fans made investors salivate when the company went public in 2015 and shares soared above expectations. Was the enthusiasm justified? Could the company maintain its edge in the long run?

Strategy for Norway's Pension Fund Global

Jean rosenthal, william n. goetzmann, olav sorenson, andrew ang, and jaan elias.

Asset Management, Investor/Finance, Sourcing/Managing Funds

Norway's Pension Fund Global was the largest sovereign wealth fund in the world. With questions in 2014 on policies, ethical investment, and other concerns, what was the appropriate investment strategy for the Fund?

Factor Investing for Retirement

Jean rosenthal, jaan elias and william goetzmann.

Asset Management, Investor/Finance

Should this investor look for a portfolio of factor funds to meet his goals for his 401(k) Retirement Plan?

Bank of Ireland

Jean w. rosenthal, eamonn walsh, matt spiegel, will goetzmann, david bach, damien p. mcloughlin, fernando fernandez, gayle allard, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork, Macroeconomics, State & Society

In August 2011, Wilbur Ross, an American investor specializing in distressed and bankrupt companies, purchased 35% of the stock of Bank of Ireland. Even for Ross, investing in an Irish bank seemed risky. Observers wondered if the investment made sense.

Commonfund ESG

Jaan elias, sarah friedman hersh, maggie chau, logan ashcraft, and pamela jao.

Asset Management, Investor/Finance, Metrics & Data, Social Enterprise

ESG (Environmental Social and Governance) investing had become an increasingly hot topic in the financial community. Could Commonfund offer its endowment clients some investment vehicle that would satisfy ESG concerns while producing sufficient returns?

Glory, Glory Man United!

Charles euvhner, jacob thomas, k. geert rouwenhorst, and jaan elias.

Competitor/Strategy, Employee/HR, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds

Manchester United might be the greatest English sports dynasty of all time. But valuation poses unique challenges. How much should a team's success on the pitch count toward its net worth?

Walmart de México: Investing in Renewable Energy

Jean rosenthal, k. geert rouwenhorst, isabel studer, jaan elias, and juan carlos rivera.

Investor/Finance, Operations, State & Society, Sustainability

Walmart de México y Centroamérica contracted for power from EVM's wind farm, saving energy costs and improving sustainability. What should the company's next steps be to advance its goals?

Voltaire, Casanova, and 18th-Century Lotteries

Jean rosenthal and william n. goetzmann.

Business History, State & Society

Gambling has been a part of human activity since earliest recorded history, and governments have often attempted to turn that impulse to benefit the state. The development of lotteries in the 18th century helped to develop the study of probabilities and enabled the financial success of some of the leading figures of that era.

Alexander Hamilton and the Origin of American Finance

Andrea nagy smith, william goetzmann, and jeffrey levick.

Business History, Financial Regulation, Investor/Finance

Alexander Hamilton is said to have invented the future. At a time when the young United States of America was disorganized and bankrupt, Hamilton could see that the nation would become a powerful economy.

Kmart Bankruptcy

Jean rosenthal, heather tookes, henry s. miller, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance

Less than 18 months after Kmart entered Chapter 11, the company emerged and its stocked soared. Why had the chain entered Chapter 11 in the first place and how had the bankruptcy process allowed the company to right itself?

Oil, ETFs, and Speculation

So alex roelof, k. geert rouwenhorst, and jaan elias.

Since the markets' origins, traders sought standardized wares to increase market liquidity. In the 1960s and later, they sought assets uncorrelated to traditional bonds and equities. By late 2004, commodity-based exchange-traded securities emerged.

Newhall Ranch Land Parcel

Acquired by a partnership of two closely intertwined homebuilders, Newhall Ranch was the last major tract of undeveloped land in Los Angeles County in 2003.

Brandeis and the Rose Museum

Arts Management, Asset Management, Investor/Finance, Social Enterprise, Sourcing/Managing Funds

The question of the role museums should play in university life became urgent for Brandeis in early 2009. Standard portfolios of investments had just taken a beating. Given that environment, should Brandeis sell art in order to save its other programs?

Taking EOP Private

Allison mitkowski, william goetzmann, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork

With 594 properties nationwide, EOP was the nation’s largest office landlord. Despite EOP's dominance of the REIT market, analysts had historically undervalued EOP. However, Blackstone saw something in EOP that the analysts didn’t, and in November, Blackstone offered to buy EOP for $48.50 per share. What did Blackstone and Vornado see that the market didn’t?

Subprime Lending Crisis

Jaan elias and william n. goetzmann.

Asset Management, Financial Regulation, Investor/Finance, State & Society

To understand the collapse of the subprime mortgage market, we look at a failing Mortgage Backed Security (MBS) and then drill down to look at a single loan that has gone bad.

William N. Goetzmann, Jean Rosenthal, and Jaan Elias

Asset Management, Business History, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The financial engineering of London's Canary Wharf was as impressive as the structural engineering. However, Brexit and the rise of fintech represented new challenges. Would financial firms leave the U.K.? Would fintech firms seek new kinds of space? How should the Canary Wharf Group respond?

The Future of Malls: Was Decline Inevitable?

Jean rosenthal, anna williams, brandon colon, robert park, william goetzmann, jessica helfand .

Business History, Customer/Marketing, Innovation & Design, Investor/Finance

Shopping malls became the "Main Street" of US suburbs beginning in the mid-20th century. But will they persist into the 21st?

Hirtle Callaghan & Co

James quinn, jaan elias, and adam blumenthal.

Asset Management, Investor/Finance, Leadership & Teamwork

In August 2019, Stephen Vaccaro, Yale MBA ‘03, became the director of private equity at Hirtle, Callaghan & Co., LLC (HC), a leading investment management firm associated with pioneering the outsourced chief investment office (OCIO) model for college endowments, foundations, and wealthy families. Vaccaro was tasked with spearheading efforts to grow HC’s private equity (PE) market value from $1 billion to a new target of roughly $3 billion in order to contribute to the effort of generating higher long-term returns for clients. Would investment committees overseeing endowments typically in the 10s or 100s of millions embrace this shift, and, more pointedly, was this the best move for client portfolios?

The Federal Reserve Response to 9-11

Jean rosenthal, william b. english, jaan elias.

Financial Regulation, Investor/Finance, Leadership & Teamwork, State & Society

The attacks on New York City and the Pentagon in Washington, DC, on September 11, 2001, shocked the nation and the world. The attacks crippled the nerve center of the U.S. financial system. Information flow among banks, traders in multiple markets, and regulators was interrupted. Under Roger Ferguson's leadership, the Federal Reserve made a series of decisions designed to provide confidence and increase liquidity in a severely damaged financial system. In hindsight, were these the best approaches? Were there other options that could have taken place?

Suwanee Lumber Company (B)

In early 2018, Blue Wolf Capital Management received an offer to sell both its mill in Arkansas (Caddo) and its mill in Florida (Suwanee) to Conifex, an upstart Canadian lumber company. Blue Wolf hadn’t planned to put both mills up for sale yet, but was the deal too good to pass up? Blue Wolf had invested nearly $36.5 million into rehabilitating the Suwanee and Caddo mills. However, neither was fully operational yet. Did the offer price fairly value the prospects of the mills? How should Blue Wolf consider the Conifex stock? Should Blue Wolf conduct a more extensive sales process rather than settle for this somewhat unexpected offer?

Occidental Petroleum's Acquisition of Anadarko

Jaan elias, piyush kabra, jacob thomas, k. geert rouwenhorst.

Asset Management, Competitor/Strategy, Investor/Finance, Sourcing/Managing Funds

In May of 2019, Vicki Hollub, the CEO of Occidental Petroleum (Oxy), pulled off a blockbuster. Bidding against Chevron, one of the world's largest oil firms, she had managed to buy Anadarko, another oil company that was roughly the size of Oxy. Hollub believed that the combination of the two firms brought the possibility for billions of dollars in synergies, more than offsetting the cost of the acquisition. Had Hollub hurt shareholder value with Oxy's ambitious deal, or had she bolstered a mid-size oil firm and made it a major player in the petroleum industry? Why didn't investors see the tremendous synergies in which Hollub fervently believed?

Hertz Global Holdings (B): Uses of Debt and Equity 2020

In 2019, Hertz held a successful rights offering and restructured some of its debt. CEO Kathyrn Marinello and CFO Jamere Jackson were moving the company toward what seemed to be sustainable profitability, having implemented major structural and financial reforms. Analysts predicted a rosy future. Travel, particularly corporate travel, was increasing as the economy grew. With all the creativity that the company had shown in its financial arrangements, did it have any options remaining, even while under the court-led reorganization?

Prodigy Finance

Vero bourg-meyer, javier gimeno, jaan elias, florian ederer.

Competitor/Strategy, Investor/Finance, Social Enterprise, State & Society, Sustainability

Having pioneered a successful financing model for student loans, Prodigy also was considering other financial services that could make use of the company’s risk model. What new products could Prodigy offer to support its student borrowers? What strategy should guide the company’s new product development? Or should the company stick to the educational loans it pioneered and knew best?

tronc: Valuing the Future of Newspapers

Jean rosenthal, heather e. tookes, and jaan elias.

Business History, Competitor/Strategy, Investor/Finance, Leadership & Teamwork

Gannet offered Tribune Publishing an all-cash buyout offer. Tribune then made a strategic pivot: new stock listing, new name "tronc," and a goal of posting 1,000 videos/day. Should the Tribune board take the buyout opportunity? What was the right price?

Role of Hedge Funds in Institutional Portfolios: Florida Retirement System

Jaan elias, william goetzmann and lloyd baskin.

Asset Management, Financial Regulation, Investor/Finance, Metrics & Data, State & Society

The Florida Retirement System, one of the country’s largest state pensions, had been slow to embrace hedge funds, but by 2015, they had 7% of their assets in the category. How should they manage their program?

Social Security 1935

Jean rosenthal, william n. goetzmann, and jaan elias.

Business History, Financial Regulation, Innovation & Design, Investor/Finance, State & Society

Frances Perkins, Franklin Roosevelt's Secretary of Labor, shaped the Social Security Act of 1935, changing America’s pension landscape. What might she have done differently?

Ant Financial: Flourishing Farmer Loans at MYbank

Jingyue xu, jean rosenthal, k. sudhir, hua song, xia zhang, yuanfang song, xiaoxi liu, and jaan elias.

Competitor/Strategy, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Leadership & Teamwork, Operations, State & Society

In 2015 Ant Financial's MYbank (an offshoot of Jack Ma’s Alibaba company) created the Flourishing Farmer Loan program, an all-internet banking service for China's rural areas. Could MYbank use financial technology to create a program with competitive costs and risk management?

Low-Carbon Investing: Commonfund & GPSU

Jaan elias, william goetzmann, and k. geert rouwenhorst.

Asset Management, Ethics & Religion, Investor/Finance, Social Enterprise, State & Society, Sustainability

In August of 2014, the movement to divest fossil fuel investments from endowment portfolios was sweeping campuses across the United States, including Gifford Pinchot State University (GPSU). How should GPSU and its investment partner Commonfund react?

360 State Street: Real Options

Andrea nagy smith and mathew spiegel.

Asset Management, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

360 State Street proved successful, but what could Bruce Becker construct on the 6,000-square-foot vacant lot at the southwest corner of the project? Under what set of circumstances and at what time would it be most advantageous to proceed? Or should he build anything at all?

Centerbridge

Jean rosenthal and olav sorensen.

When Jeffrey Aronson and Mark Gallogly founded Centerbridge, they hoped to grow the firm, but not to a point that it would lose its culture. Having added an office in London, could the firm add more locations and maintain its collegial character?

George Hudson and the 1840s Railway Mania

Andrea nagy smith, james chanos, and james spellman.

Business History, Financial Regulation, Investor/Finance, Metrics & Data

Railways were one of the original disruptive technologies: they transformed England from an island of slow, agricultural villages into a fast, urban, industrialized nation. George Hudson was the central figure in the mania for railroad shares in England. After the share value crashed, some analysts blamed Hudson, others pointed to irrational investors and still others maintained the crash was due to macroeconomic factors.

Demosthenes and Athenian Finance

Andrea nagy smith and william goetzmann.

Business History, Financial Regulation, Law & Contracts

Demosthenes' Oration 35, "Against Lacritus," contains the only surviving maritime loan contract from the fourth century B.C., proving that the ancient Greeks had devised a commercial code to link the economic lives of people from all over the Greek world. Athenians and non-Athenians alike came to the port of Piraeus to trade freely.

South Sea Bubble

Frank newman and william goetzmann.

Business History, Financial Regulation

The story of the South Sea Company and its seemingly absurd stock price levels always enters into conversations about modern valuation bubbles. Because of its modern application, discerning what was at the root of the world's first stock market crash merits considerable attention. What about the South Sea Company and the political, economic and social context in which it operated led to its stunning collapse?

Jean W. Rosenthal, Jaan Elias, William N. Goetzmann, Stanley Garstka, and Jacob Thomas

Asset Management, Healthcare, Investor/Finance, Sourcing/Managing Funds, State & Society

A centerpiece of the 2007 contract negotiations between the UAW and GM - and later with Chrysler and Ford - was establishing a Voluntary Employee Beneficiary Association (VEBA) to provide for retiree healthcare costs. The implications were substantial.

Northern Pulp: A Private Equity Firm Resurrects a Troubled Paper Company

Heather tookes, peter schott, francesco bova, jaan elias and andrea nagy smith.

Investor/Finance, Macroeconomics, State & Society, Sustainability

In 2008, the lumber industry was in a severe recession, yet Blue Wolf Capital Management was considering investment in a paper mill in Nova Scotia. How should they proceed?

Lahey Clinic: North Shore Expansion

Jaan elias, andrea r. nagy, jessica p. strauss, and william n. goetzmann.

Asset Management, Financial Regulation, Healthcare, Investor/Finance

In early 2007 the Lahey Clinic in Massachusetts believed that expansion of its North Shore facility was not only a smart strategy but also a business necessity. The two years of turmoil in the Massachusetts health care market prompted observers to question Lahey's 2007 decisions. Did the expansion strategy still make sense?

Carry Trade ETF

K. geert rouwenhorst, jean w. rosenthal, and jaan elias.

Innovation & Design, Investor/Finance, Macroeconomics, Sourcing/Managing Funds

In 2006 Deutsche Bank (DB) brought a new product to market – an exchange traded fund (ETF) based on the carry trade, a strategy of buying and selling currency futures. The offering received the William F. Sharpe Indexing Achievement Award for “Most Innovative Index Fund or ETF” at the 2006 Sharpe Awards. These awards are presented annually by IndexUniverse.com and Information Management Network for innovative advances in the indexing industry. The carry trade ETF shared the award with another DB/PowerShares offering, a Commodity Index Tracking Fund. Jim Wiandt, publisher of IndexUniverse.com, said, "These innovators are shaping the course of the index industry, creating new tools and providing new insights for the benefit of all investors." What was it that made this financial innovation successful?

William Goetzmann and Jaan Elias

Asset Management, Business History

Hawara is the site of the massive pyramid of Amenemhat III, a XII Dynasty [Middle Kingdom, 1204 – 1604 B.C.E.] pharaoh. The Hawara Labyrinth and Pyramid Complex present a wealth of information about the Middle Kingdom. Among its treasures are papyri covering property rights and transfers of ownership.

- Work & Careers

- Life & Arts

- Currently reading: Business school teaching case study: can green hydrogen’s potential be realised?

- Business school teaching case study: how electric vehicles pose tricky trade dilemmas

- Business school teaching case study: is private equity responsible for child labour violations?

Business school teaching case study: can green hydrogen’s potential be realised?

- Business school teaching case study: can green hydrogen’s potential be realised? on x (opens in a new window)

- Business school teaching case study: can green hydrogen’s potential be realised? on facebook (opens in a new window)

- Business school teaching case study: can green hydrogen’s potential be realised? on linkedin (opens in a new window)

- Business school teaching case study: can green hydrogen’s potential be realised? on whatsapp (opens in a new window)

Jennifer Howard-Grenville and Ujjwal Pandey

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

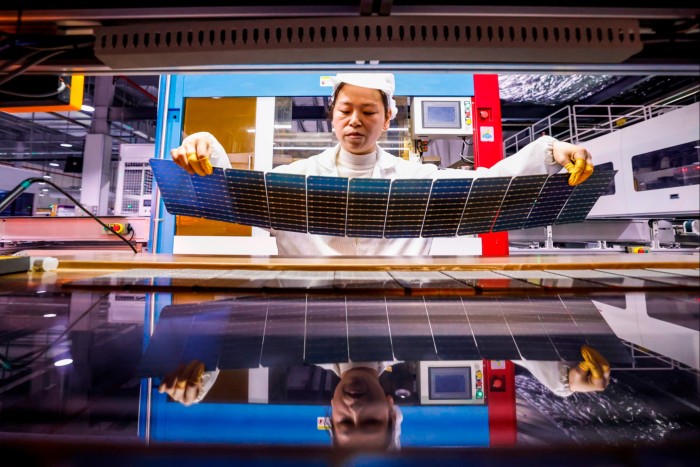

Hydrogen is often hyped as the “Swiss army knife” of the energy transition because of its potential versatility in decarbonising fossil fuel-intensive energy production and industries. Making use of that versatility, however, will require hydrogen producers and distributors to cut costs, manage technology risks, and obtain support from policymakers.

To cut carbon dioxide emissions, hydrogen production must shift from its current reliance on fossil fuels. The most common method yields “grey hydrogen”, made from natural gas but without emissions capture. “Blue hydrogen,” which is also made from natural gas but with the associated carbon emissions captured and stored, is favourable.

But “green hydrogen” uses renewable energy sources, including wind and solar, to split water into hydrogen and oxygen via electrolysis. And, because there are no carbon emissions during production or combustion, green hydrogen can help to decarbonise energy generation as well as industry sectors — such as steel, chemicals and transport — that rely heavily on fossil fuels.

Ultimately, though, the promise of green hydrogen will hinge on how businesses and policymakers weigh several questions, trade-offs, and potential long-term consequences. We know from previous innovations that progress can be far from straightforward.

Wind power, for example, is a mature renewable energy technology and a key enabler in green hydrogen production, but it suffers vulnerabilities on several fronts. Even Denmark’s Ørsted — the world’s largest developer of offshore wind power and a beacon for renewable energy — recently said it was struggling to deliver new offshore wind projects profitably in the UK.

Generally, the challenge arises from interdependencies between macroeconomic conditions — such as energy costs and interest rates — and business decision-making around investments. In the case of Ørsted, it said the escalating costs of turbines, labour, and financing have exceeded the inflation-linked fixed price for electricity set by regulators.

Business leaders will also need to steer through uncertainties — such as market demand, technological risks, regulatory ambiguity, and investment risks — as they seek to incorporate green hydrogen.

Test yourself

This is the third in a series of monthly business school-style teaching case studies devoted to responsible-business dilemmas faced by organisations. Read the piece and FT articles suggested at the end before considering the questions raised.

About the authors: Jennifer Howard-Grenville is Diageo professor of organisation studies at Cambridge Judge Business School; Ujjwal Pandey is an MBA candidate at Cambridge Judge and a former consultant at McKinsey.

The series forms part of a wide-ranging collection of FT ‘instant teaching case studies ’ that explore business challenges.

Two factors could help business leaders gain more clarity.

The first factor will be where, and how quickly, costs fall and enable the necessary increase to large-scale production. For instance, the cost of the electrolysers needed to split water into hydrogen and oxygen remains high because levels of production are too low. These costs and slow progress in expanding the availability and affordability of renewable energy sources have made green hydrogen much more expensive than grey hydrogen, so far — currently, two to three times the cost.

The FT’s Lex column calculated last year that a net zero energy system would create global demand for hydrogen of 500mn tonnes, annually, by 2050 — which would require an investment of $20tn. However, only $29bn had been committed by potential investors, Lex noted, despite some 1,000 new projects being announced globally and estimated to require total investment of $320bn.

Solar power faced similar challenges a decade ago. Thanks to low-cost manufacturing in China and supportive government policies, the sector has grown and is, within a very few years , expected to surpass gas-fired power plant installed capacity, globally. Green hydrogen requires a similar concerted effort. With the right policies and technological improvements, the cost of green hydrogen could fall below the cost of grey hydrogen in the next decade, enabling widespread adoption of the former.

Countries around the world are introducing new and varied incentives to address this gap between the expected demand and supply of green hydrogen. In Canada, for instance, Belgium’s Tree Energy Solutions plans to build a $4bn plant in Quebec, to produce synthetic natural gas from green hydrogen and captured carbon, attracted partly by a C$17.7bn ($12.8bn) tax credit and the availability of hydropower.

Such moves sound like good news for champions of green hydrogen, but companies still need to manage the short-term risks from potential policy and energy price swings. The US Inflation Reduction Act, which offers tax credits of up to $3 per kilogramme for producing low-carbon hydrogen, has already brought in limits , and may not survive a change of government.

Against such a backdrop, how should companies such as Hystar — a Norwegian maker of electrolysers already looking to expand capacity from 50 megawatts to 4 gigawatts a year in Europe — decide where and when to open a North American production facility?

The second factor that will shape hydrogen’s future is how and where it is adopted across different industries. Will it be central to the energy sector, where it can be used to produce synthetic fuels, or to help store the energy generated by intermittent renewables, such as wind and solar? Or will it find its best use in hard-to-abate sectors — so-called because cutting their fossil fuel use, and their CO₂ emissions, is difficult — such as aviation and steelmaking?

Steel producers are already seeking to pivot to hydrogen, both as an energy source and to replace the use of coal in reducing iron ore. In a bold development in Sweden, H2 Green Steel says it plans to decarbonise by incorporating hydrogen in both these ways, targeting 2.5mn tonnes of green steel production annually .

Meanwhile, the global aviation industry is exploring the use of hydrogen to replace petroleum-based aviation fuels and in fuel cell technologies that transform hydrogen into electricity. In January 2023, for instance, Anglo-US start-up ZeroAvia conducted a successful test flight of a hydrogen fuel cell-powered aircraft.

The path to widespread adoption, and the transformation required for hydrogen’s range of potential applications, will rely heavily on who invests, where and how. Backers have to be willing to pay a higher initial price to secure and build a green hydrogen supply in the early phases of their investment.

It will also depend on how other technologies evolve. No industry is looking only to green hydrogen to achieve their decarbonisation aims. Other, more mature technologies — such as battery storage for renewable energy — may instead dominate, leaving green hydrogen to fulfil niche applications that can bear high costs.

As with any transition, there will be unintended consequences. Natural resources (sun, wind, hydropower) and other assets (storage, distribution, shipping) that support the green hydrogen economy are unevenly distributed around the globe. There will be new exporters — countries with abundant renewables in the form of sun, wind or hydropower, such as Australia or some African countries — and new importers, such as Germany, with existing industry that relies on hydrogen but has relatively low levels of renewable energy sourced domestically.

How will the associated social and environmental costs be borne, and how will the economic and development benefits be shared? Tackling climate change through decarbonisation is urgent and essential, but there are also trade-offs and long-term consequences to the choices made today.

Questions for discussion

Lex in depth: the staggering cost of a green hydrogen economy

How Germany’s steelmakers plan to go green

Hydrogen-electric aircraft start-up secures UK Infrastructure Bank backing

Aviation start-ups test potential of green hydrogen

Consider these questions:

Are the trajectories for cost/scale-up of other renewable energy technologies (eg solar, wind) applicable to green hydrogen? Are there features of the current economic, policy, and business landscape that point to certain directions for green hydrogen’s development and application?

Take the perspective of someone from a key industry that is part of, or will be affected by, the development of green hydrogen. How should you think about the technology and business opportunities and risks in the near term, and longer term? How might you retain flexibility while still participating in these key shifts?

Solving one problem often creates or obscures new ones. For example, many technologies that decarbonise (such as electric vehicles) have other impacts (such as heavy reliance on certain minerals and materials). How should those participating in the emerging green hydrogen economy anticipate, and address, potential environmental and social impacts? Can we learn from energy transitions of the past?

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here .

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Promoted Content

Explore the series.

Follow the topics in this article

- Carbon footprint Add to myFT

- Climate change Add to myFT

- Renewable energy Add to myFT

- Environment Add to myFT

- Business school Add to myFT

International Edition

IMAGES

VIDEO

COMMENTS

NGPF Case Studies. Case Studies present personal finance issues in the context of real-life situations with all their ambiguities. Students will explore decision-making, develop communication skills, and make choices when there is no "right" answer. To help get you started, NGPF has created support guides to walk you through how to complete ...

Doing so will provide a good opportunity to apply many of the personal finance concepts and knowledge for your students. Below are examples of Case Studies. They also provide a good opportunity to exercise financial knowledge. Click to download our Case Study Teacher Guidelines. Click to download the 2021 Governor's Challenge Case Study.

256 Case Study 12: Susan Wood Questions 1. Susan has told you that Maude wants to divest herself of her interest in EastWood. Because this could affect Susan's financial planning, she has asked you what various ways Maude could transfer her interest in the business to Susan and Glen while satisfying her need for income and greater liquidity.

A released Personal Finance Challenge case study is a great culminating project to use in your classroom at the end of the school year. Group students into teams of four, give them Monday-Wednesday to prepare and then have the presentations on Thursday & Friday in your classroom. You can be the judge or invite other teachers, administration, or ...

Introduction Personal Finance We live in an age where -nancial decisions are more and more challenging. I Student debt to pay for expensive college and grad school I Mortgages to pay for expensive housing I Retirement saving to -nance longer retirement with less traditional pension income I Complex -nancial products and insurance contracts. The aim of this workshop is to introduce you to ...

Research was conducted by Harvard Business School professors Bo Becker, Daniel Bergstresser, and Guhan Subramanian. Key concepts include: Firms that would have been most affected by the proxy access rule, based on institutional ownership, lost value on October 4, 2010, following the news of the rule's delay.

The National Personal Finance Challenge (NPFC) is a nationwide competition that offers high school students the opportunity to build and demonstrate their knowledge in the concepts of earning income, spending, saving, investing, managing credit, and managing risk. In the first round of the NPFC, student teams compete in a fun online 30-question ...

The Best Practices in Action. 1. Ask learners what they want to learn about personal finance topics and financial decisions. When teaching his personal finance units, Eli tries to schedule local business people (immigrant business owners in particular) to present on topics that are of high interest to his learners.

More than half of U.S. states, for example, have added personal finance instruction as a high school graduation requirement. Universities, including Stanford, are now offering personal finance courses. Employers, too, are recognizing that financial anxiety hurts employee productivity and are sponsoring personal finance lessons in the workplace.

Case Study - Blog. Mar 06, 2016. Paying for College. Day 7 of the 24 Hour Personal Finance Course: Save Me! Case Study. The 90 minute class at Eastside last week focused on the Save Me! case study. Observations: Synopsis: Two friends have very different savings habits. The saver (Samuel) is dissatisfied for a number of reasons and the non-saver ...

Review the rules for the 2024 Personal Finance Challenge.. Review past State Final questions.. This is a qualifying event for the National Personal Finance Challenge. The high school team with the highest combined Personal Finance Case Study presentation score and Personal Finance Challenge online test score will advance to the National High School Personal Finance Challenge.

Sample case analysis personal finance fina200 case sample covering chapters student name: student id: please note instructions below your name and student id ... Case study 1 FINA 200; Preview text. PERSONAL FINANCE - FINA Case 1: Sample ... Tables can be found at the end of the Case to help respond to tax and Time Value of Money questions. You ...

Find step-by-step solutions and answers to Personal Finance - 9781260013993, as well as thousands of textbooks so you can move forward with confidence. hello quizlet. Home. Study tools. Subjects. Create. Generate. Log in. Sign up. Social Science. Economics. Finance; Personal Finance. ... Financial Planning Case - Questions. Page 524: Continuing ...

Chapter 19: At Quizlet, we're giving you the tools you need to take on any subject without having to carry around solutions manuals or printing out PDFs! Now, with expert-verified solutions from Personal Finance 14th Edition, you'll learn how to solve your toughest homework problems. Our resource for Personal Finance includes answers to ...

Personal Finance work budgeting case study summary national standards for personal finance education description: in this case study, students learn the basics ... All of Sharon's friends know who to turn to if they have money questions. Sharon attributes her financial savvy to the summer jobs she has held over the past four years.

This study investigates the perspectives and impact that personal finance education had on participants in Western Pennsylvania. The researchers begin with a literature review of personal finance courses in the United States (U.S.). The U.S. housing market collapse is also discussed as a key component of the financial crisis that is often overlooked and can be partly attributed to the lack of ...

Tutorial case studies -personal financial planning; Theory questions and answers- personal financial planning; COMM Banks- Lecture questions-MCQs (3)-s; Related documents. Introduction OF Financial Management; Discussion Assignment unit 5; Tutorial questions -Bonds valuation; Coversheet - DYFGV;

The Department of Human Development and Family Studies focuses on the interactions among individuals, families, and their resources and environments throughout their lifespans. It consists of three majors: Child, Adult, and Family Services (preparing students to work for agencies serving children, youth, adults, and families); Family Finance ...

The inability of traditional financial systems to serve millennials has increased the adoption of fin-tech platforms who, compared to the traditional counterparts, ensure ease of access and carrying out financial transactions and finance management. Millennials want services that are immediate, reliable and offer a wide range of convenience.

Bank of Ireland. Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork, Macroeconomics, State & Society. In August 2011, Wilbur Ross, an American investor specializing in distressed and bankrupt companies, purchased 35% of the stock of Bank of Ireland. Even for Ross, investing in an Irish bank seemed risky.

Study with Quizlet and memorize flashcards containing terms like Identify five reasons for the likely continued growth in the membership of credit unions. (5 marks), Analyse the possible effects of external influences on somebody in the retirement life stage of the personal life cycle. (5 marks), Describe why there has been a decline in the use of cheques to make payments. (5 marks) and more.

surveyed to know the factors that determine the Personal Finance Management. The study concludes that income, saving, educational level, lifestyle and residing status are the factors that determines the Personal Finance Management of Indian Working Professionals. Keywords: Personal Financial Management, Indian Working Professionals, Retirement

Saks Incorporated Case Questions 1. What was the current fiscal situation for Saks in 2009? -Because of the financial crisis, Saks was deteriorating in their net income and profits, and their debt doubled. Their share price went from $20 in the start of 2008 to $1.55 in March of 2009. 2.

This is the third in a series of monthly business school-style teaching case studies devoted to responsible-business dilemmas faced by organisations. Read the piece and FT articles suggested at ...

MBA 853F Case Raleigh Multifamily Development Consider the Raleigh Development project described on the RE Development slide deck (Notes 5). Suppose the current site owner agrees to a sale in which your team's price for the land would be $19M (the owner would get a bit less because of various transaction costs). Your development team "ties up" the land by signing a purchase agreement with the ...