Home » Career Guidance » Crafting Fresher Resume for Bank Job: Format, Samples, Tips

Crafting Fresher Resume for Bank Job: Format, Samples, Tips

Quick Summary

- The fresher resume format includes personal details, summary, education, projects, internships and certifications.

- Understanding job requirements, choosing the right format, highlighting skills, and customising for each application are the main steps to creating a banking resume.

- The tips for writing a fresher resume are to make it concise, easy to read and to tailor it according to the job specifications.

Table of Contents

In today’s competitive job market, a job opening receives around 250 resumes. Creating a great resume is important if you want to get a job at a bank. In the competitive banking industry, this will make you more marketable. Your resume to show off your abilities, qualifications, and potential to possible bosses. You need a resume that sells you if you’re starting in banking and want to make a good first impression. It’s a fantastic way to sell yourself as an applicant with unique skills and experience. Your fresher resume for a bank job can get you the job you want. But only if you have the right mix of experience and education and pay attention to the details.

Imagine a situation where someone finished college and studied finance. A banking position is what they’re after. Their resume must show off their school accomplishments. It should also mention any internships or part-time jobs. This blog will tell you the writing tips to write a good resume as a fresher. We provide you with samples too.

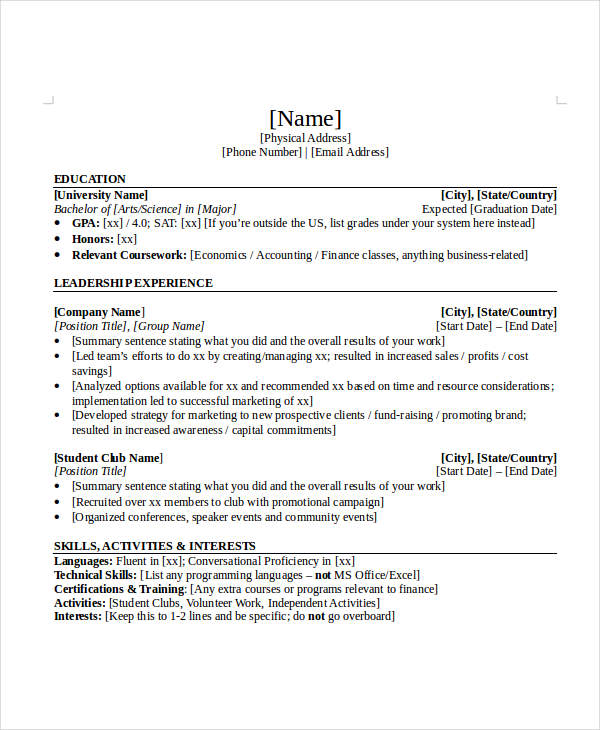

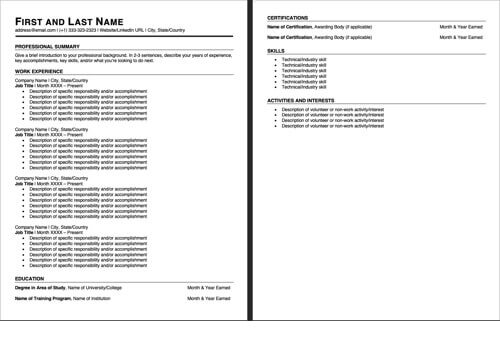

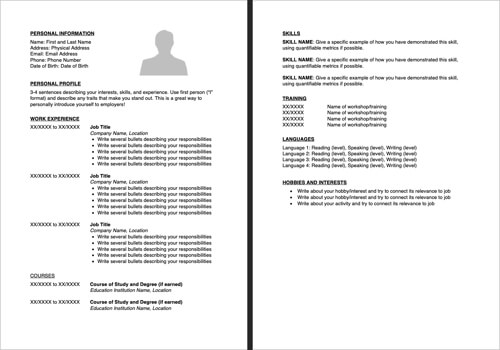

Fresher Resume for Bank Job Format

A well-organized and professional resume can set you apart from other applicants. They are also recent college grads seeking entry-level banking positions. Your resume is like a first impression for employers. It shows off your qualifications, skills, and potential to be a valuable asset in banking. If you want to make a good resume as a beginner, use a format that is made for people like you. This format will help you show off your good grades and skills. These are important for the job, and any internships or projects you have done. Here’s a way to make your resume format for a bank job fresher look better and more up-to-date:

Tips For Fresher Resume For Bank Job

- Limit your resume to one or two pages at most to show that you can be concise and focused.

- Make your resume easy to read and scan by using bullet points.

- Tailor your resume to the specific banking job you’re applying for. It emphasizes relevant skills and experiences.

- Proofread your resume. Correct all grammatical errors.

Remember, this is a suggested format. You can customize it based on your specific background. And also the requirements of the banking job you are targeting.

Steps to Create a Fresher Resume for Bank Job

It is necessary to engage in careful planning and pay close attention to detail. This is a must when developing a banking sector resume for a bank job fresher. Create an impressive banking resume format. It should highlight your qualifications, follow these steps to do it:

1. Understand the Job Requirements:

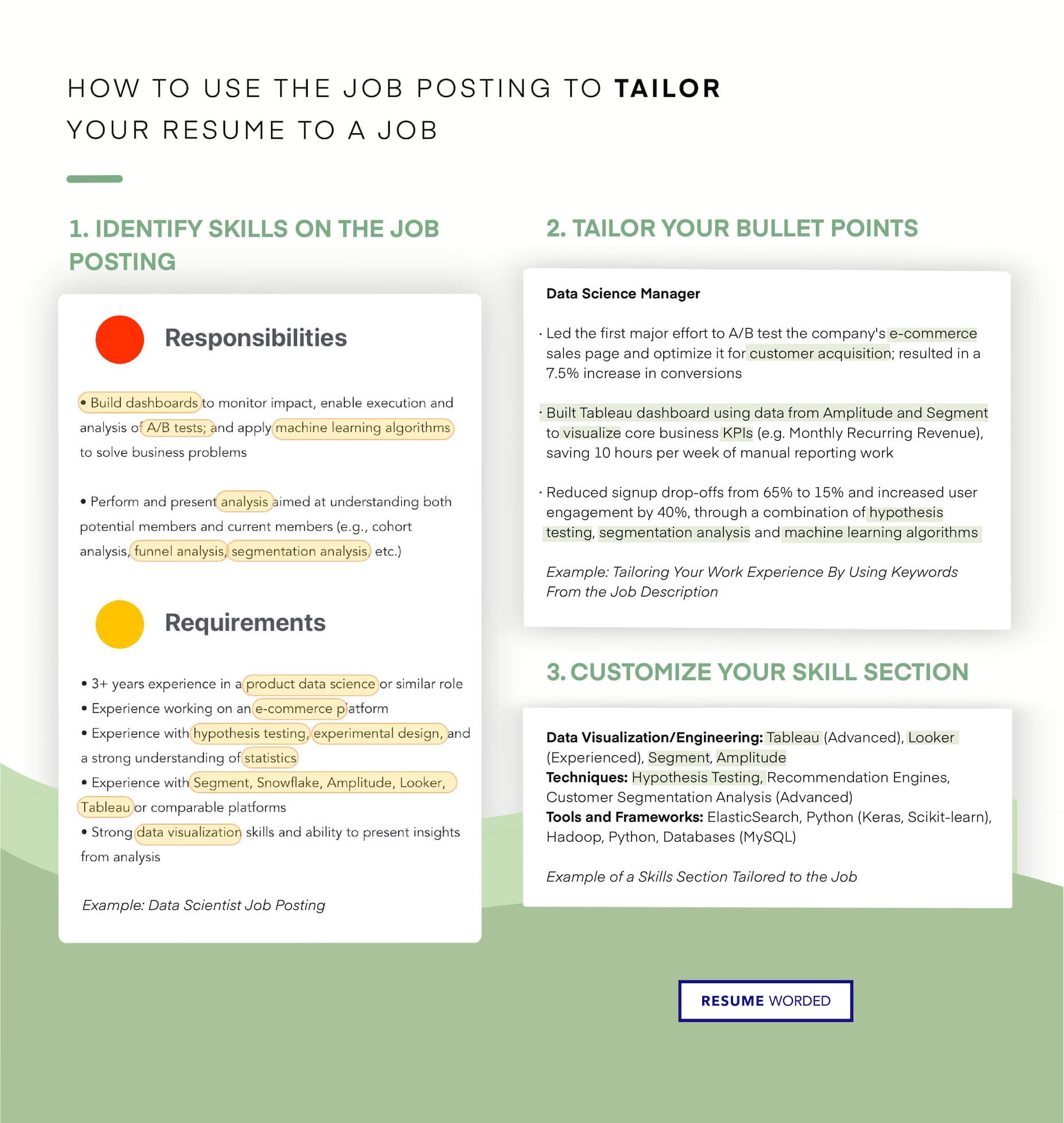

- Review the job description. Understand all the necessary skills and qualifications.

- Identify keywords and specific requirements mentioned in the job posting.

2. Choose the Right Resume Format:

- Opt for a clean and professional resume format. Follow the reverse-chronological format, which will highlight your most recent experiences first.

- If you need more work experience, consider a combination resume format. It emphasizes your skills and achievements.

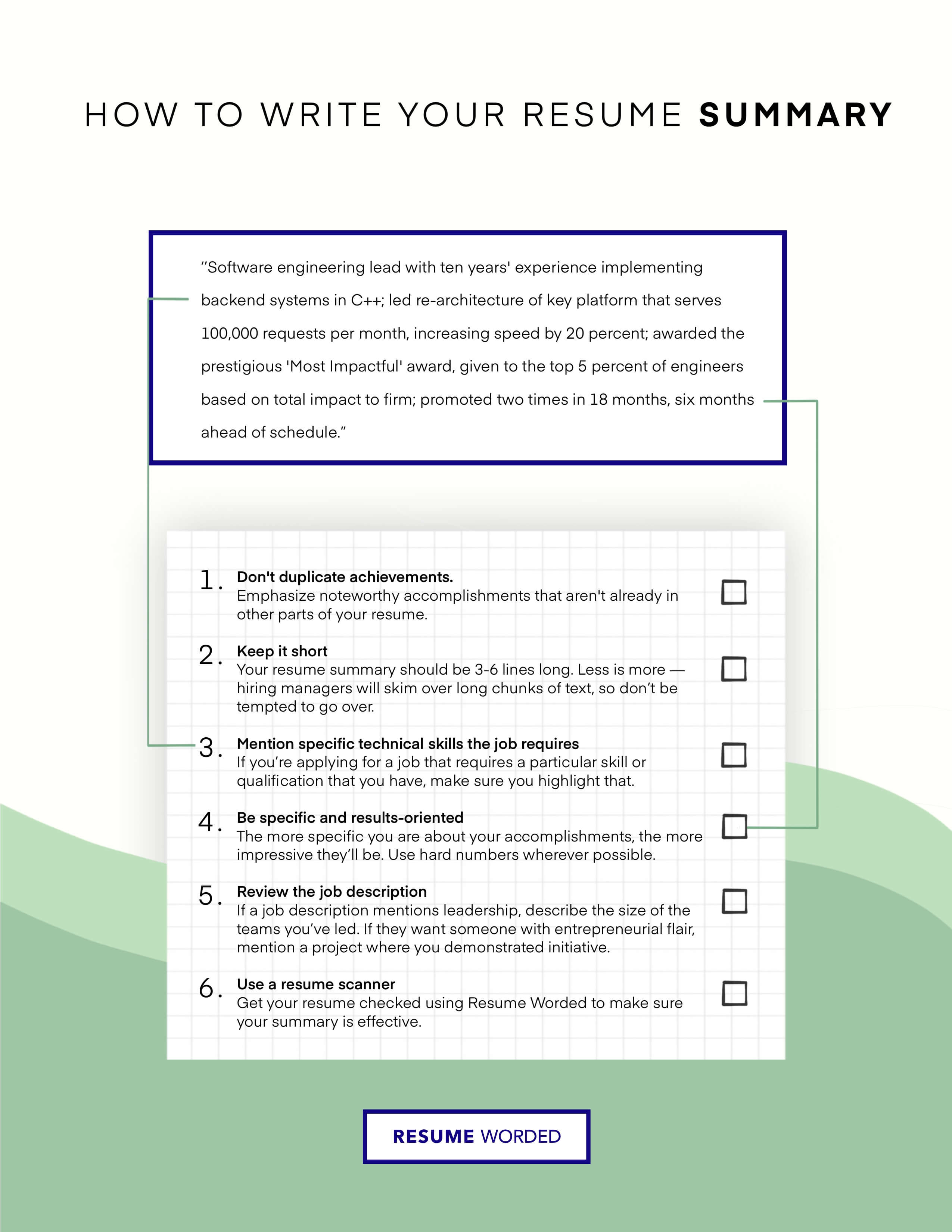

3. Include a Powerful Aim or Summary Statement:

- Begin your resume with a strong goal or profile summary statement. It should state your career goals and highlight your relevant skills and achievements.

- Tailor your statement to align with the specific banking job you’re applying for.

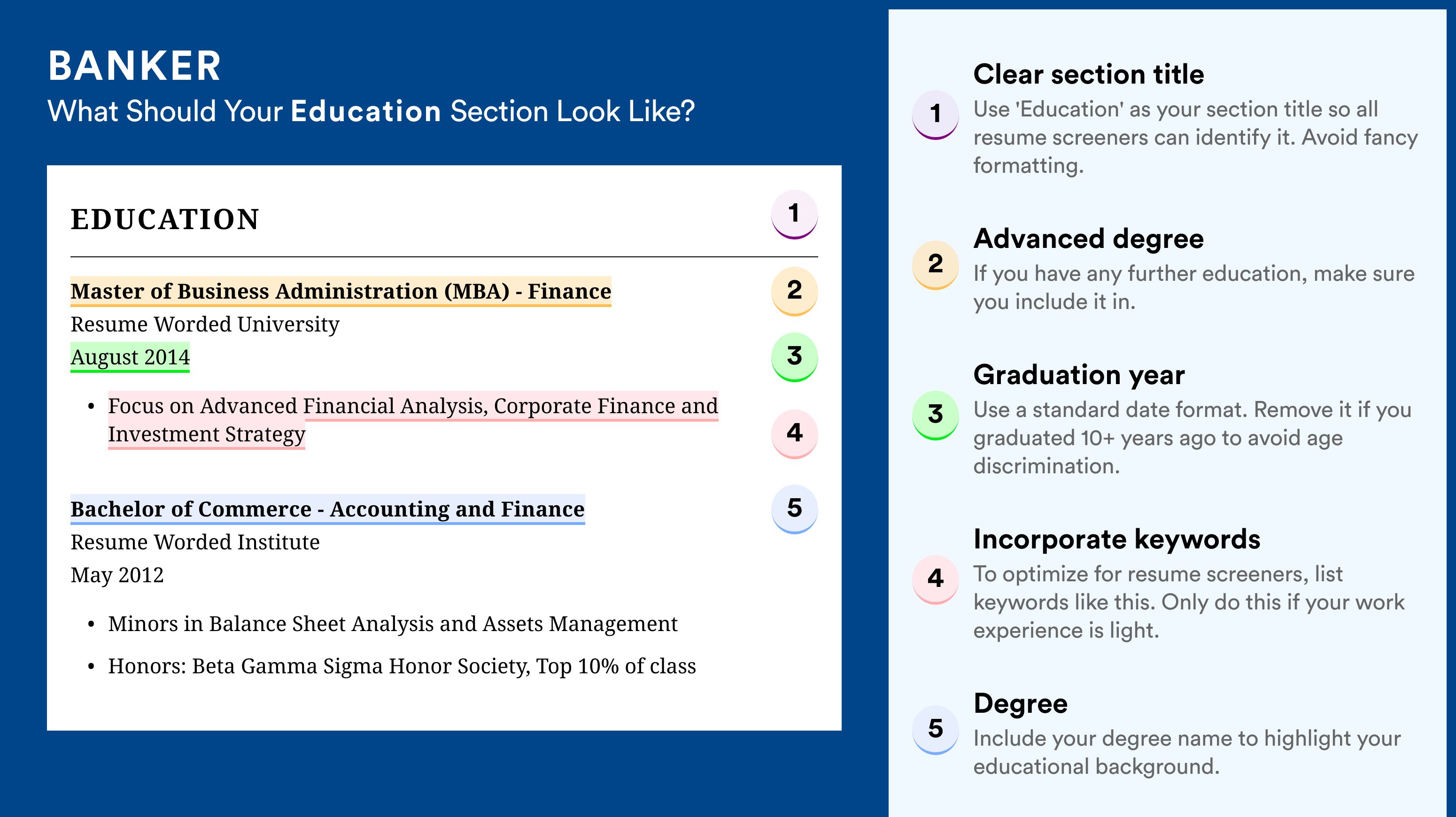

4. Highlight your Education:

- List your educational qualifications, starting with your most recent degree or program.

- Include the name of the institution, the degree obtained, and your major or specialization. Also, include any relevant academic achievements or honors.

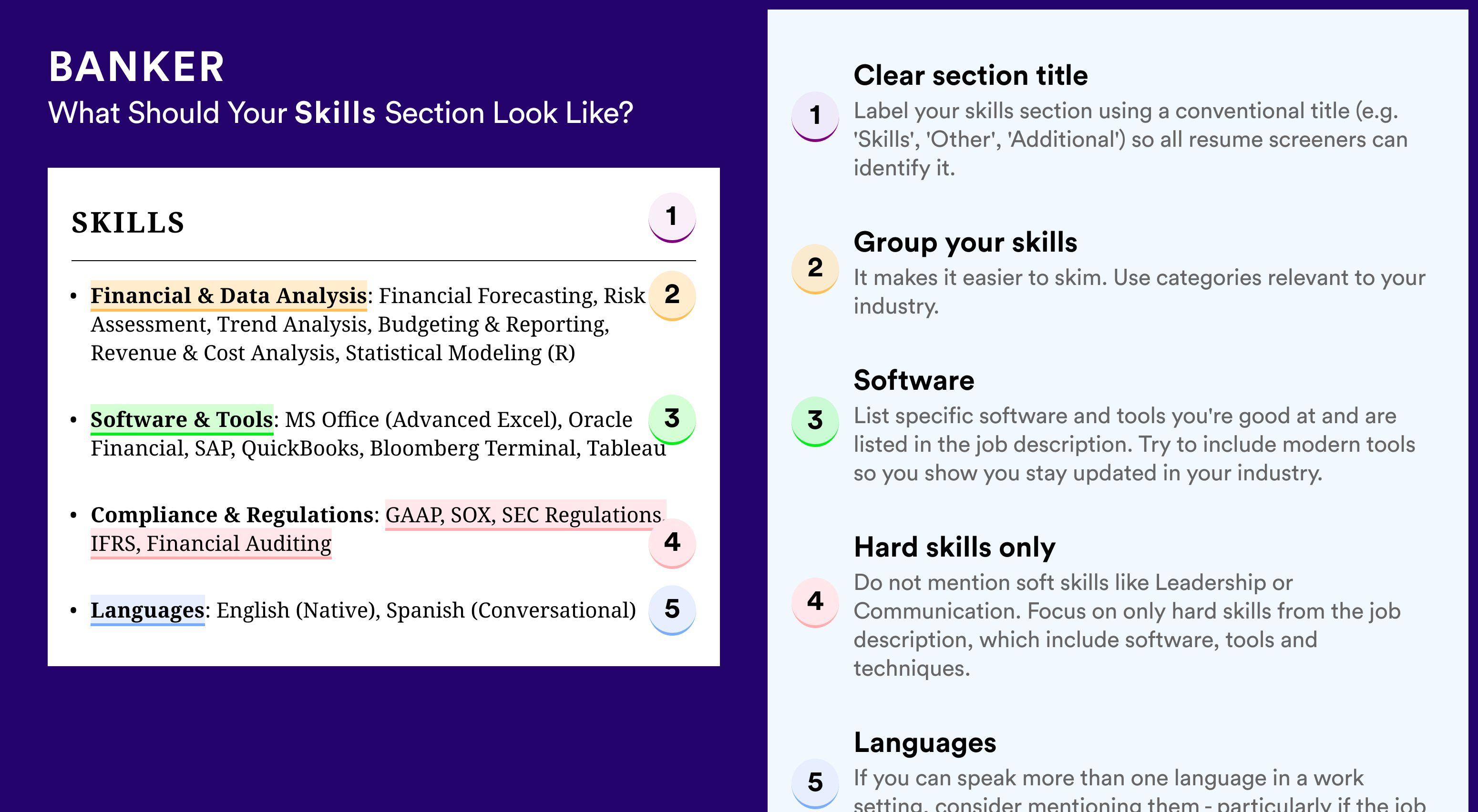

5. Showcase your Skills:

- Create a dedicated section highlighting your key skills relevant to the banking industry.

- In your resume, include both hard and soft skills.

6. Emphasize Internships, Projects, and Relevant Experience:

- If you have completed any internships or projects, highlight them.

- Describe your roles and responsibilities. Showcase the skills and knowledge gained during these experiences.

- If you have limited work experience, focus on different skills. This can also include volunteer work, or extracurricular activities demonstrating your abilities.

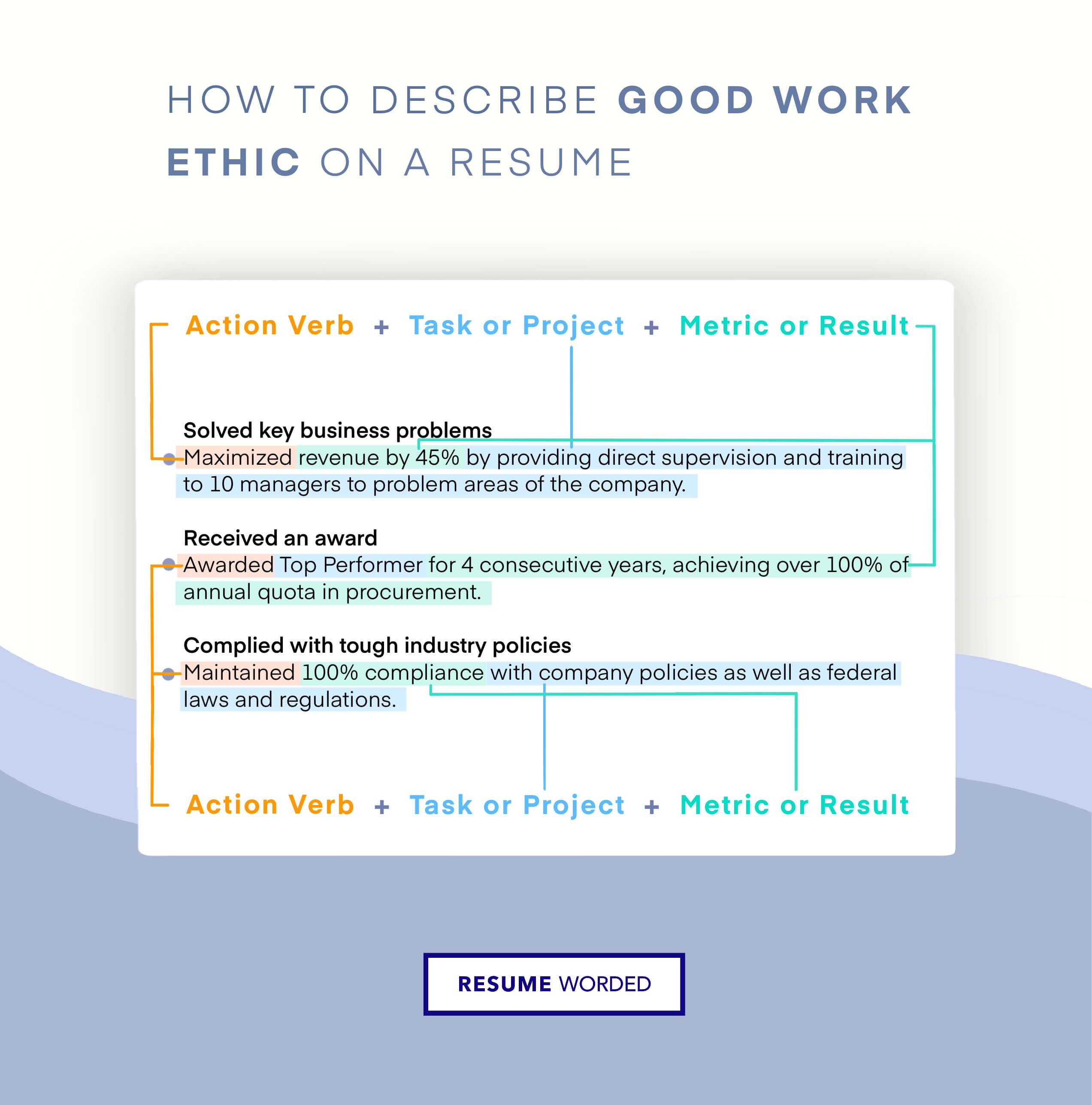

7. Quantify Achievements:

- Always try to put a number on your accomplishments to show off your skills more.

- For example, mention the size of the budgets you managed. You can also mention the percentage of sales achieved in a particular project.

8. Tailor your Resume for Each Application:

- Customize your resume for each banking job application. It can be done by incorporating relevant keywords and addressing specific job requirements.

- Highlight experiences and skills that align with the position you’re applying for.

9. Proofread and Edit:

- Check for typos and grammatical errors by reading over your resume.

- Ensure the formatting is consistent and easy to read.

- Seek feedback from mentors, professors, or career advisors. It is to improve the quality of your resume.

Remember, a fresher resume for bank job is your main opportunity. You should make a positive impression on potential employers. By following these steps you can showcase your qualifications. Also, you can increase your chances of securing a rewarding banking job.

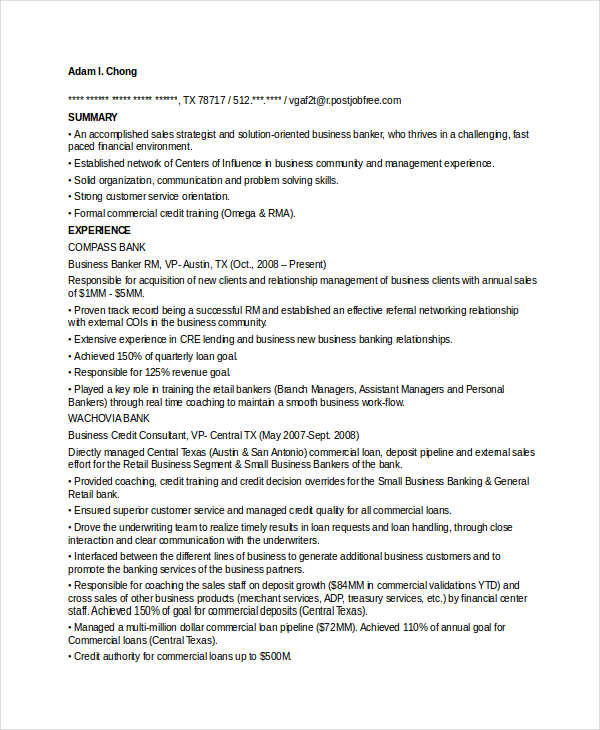

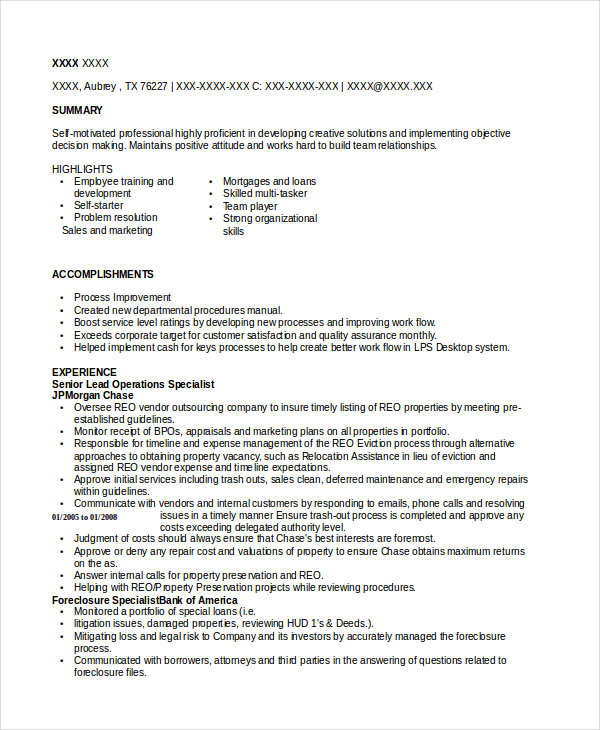

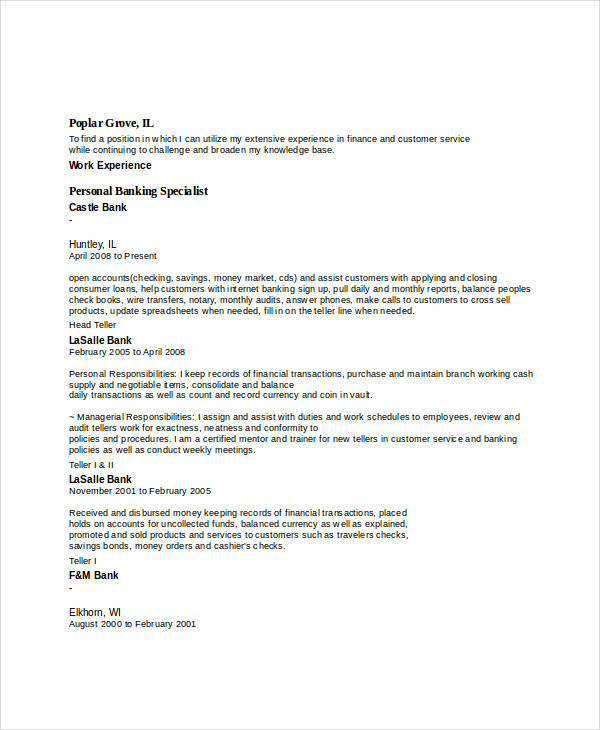

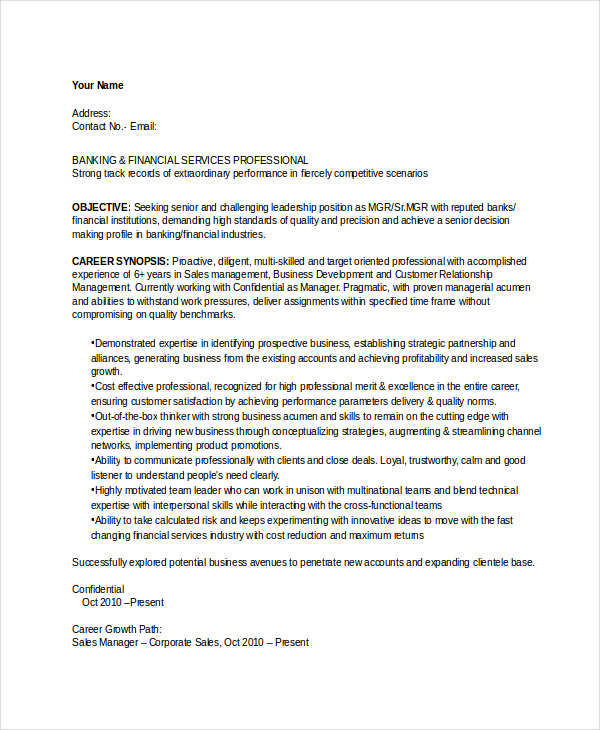

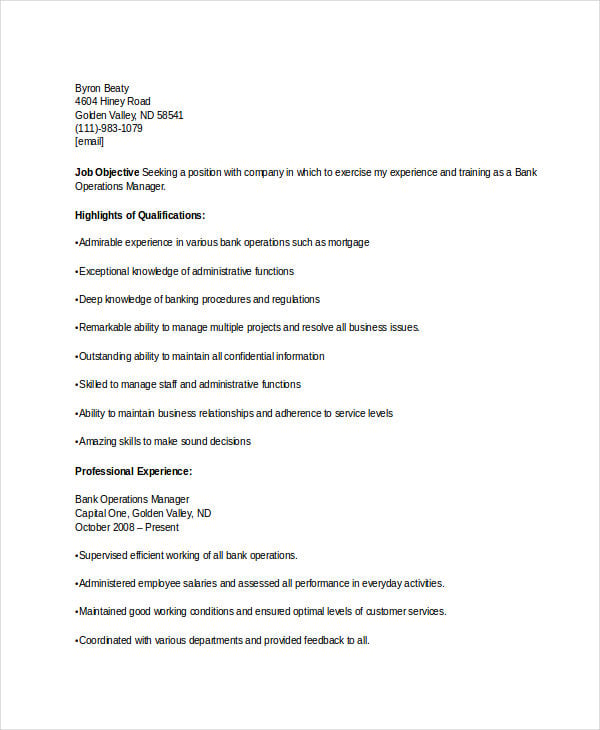

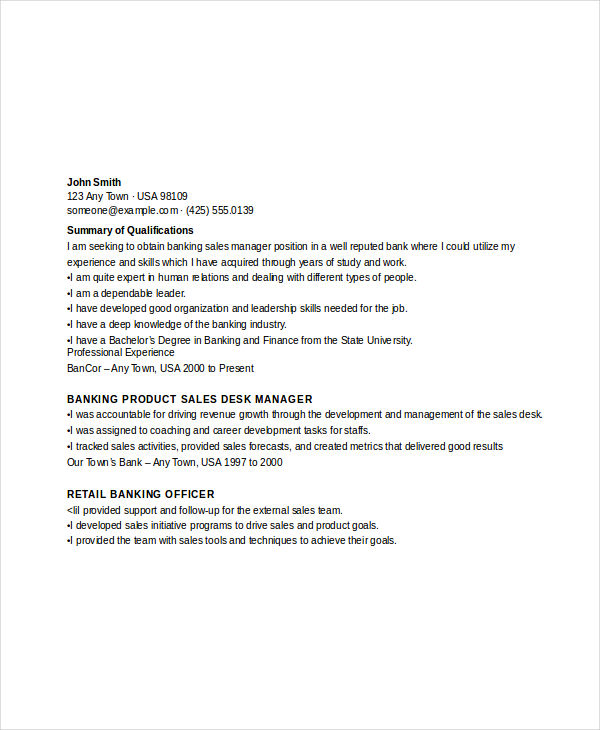

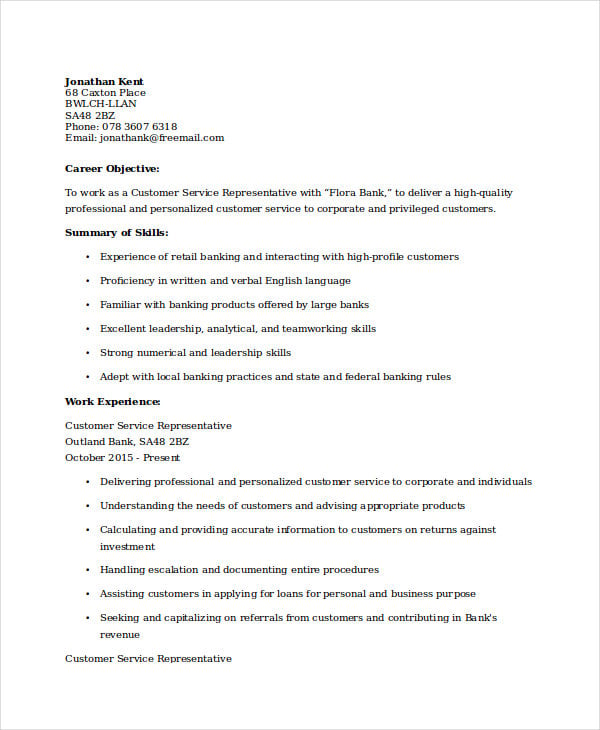

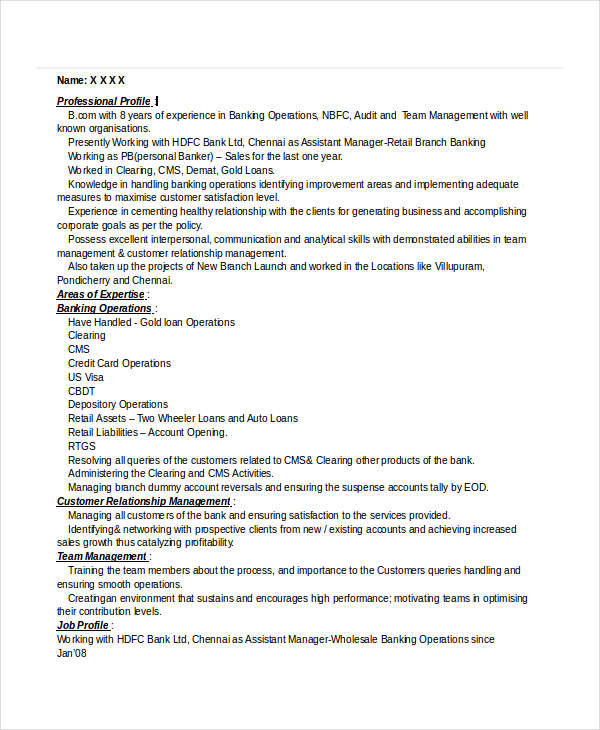

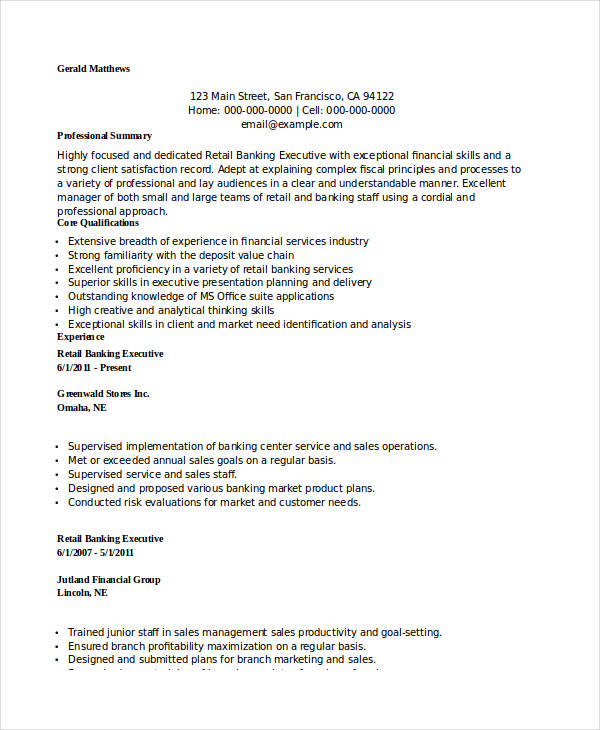

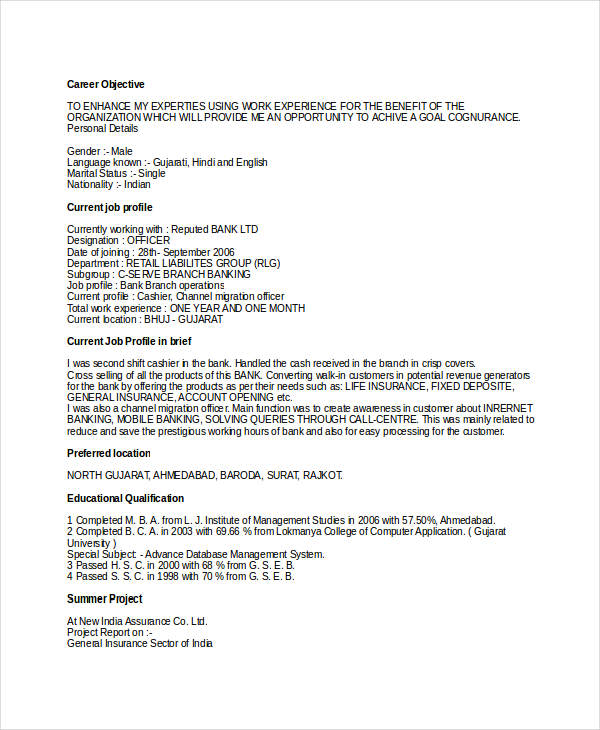

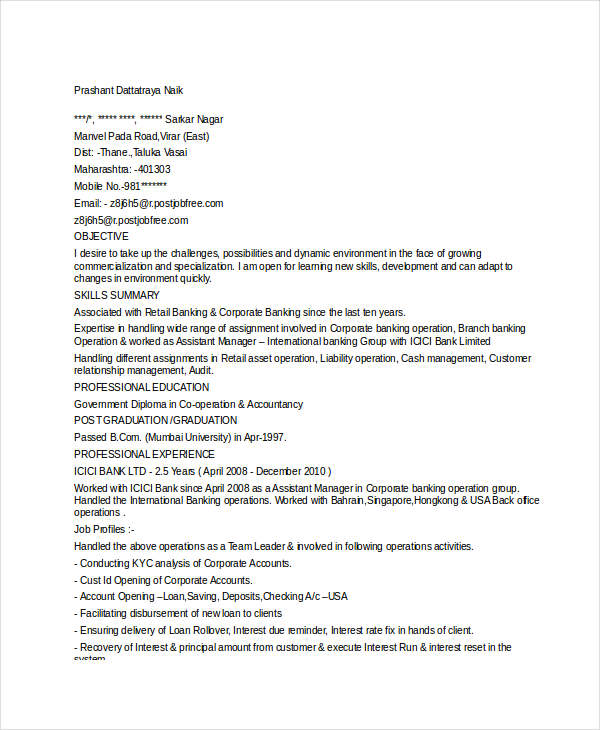

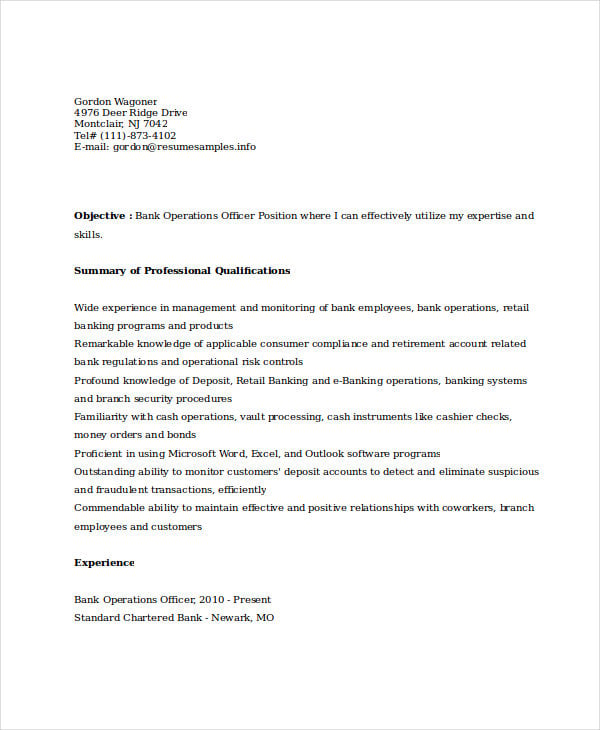

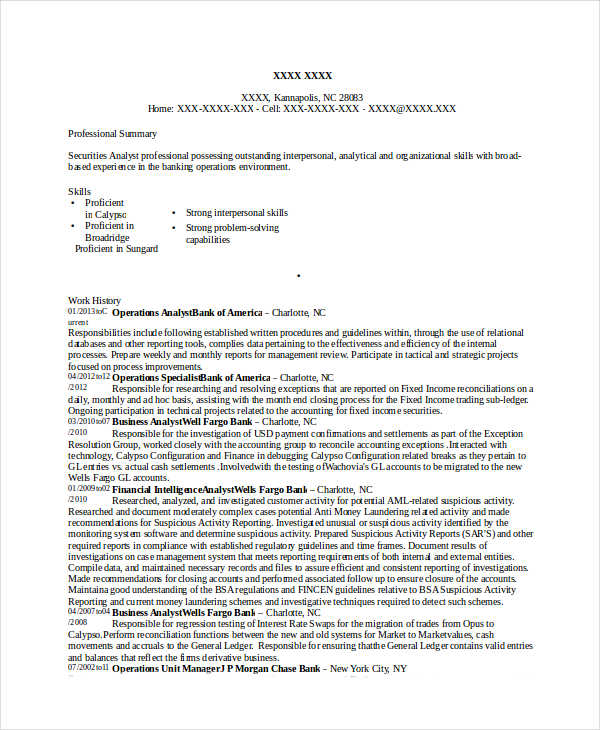

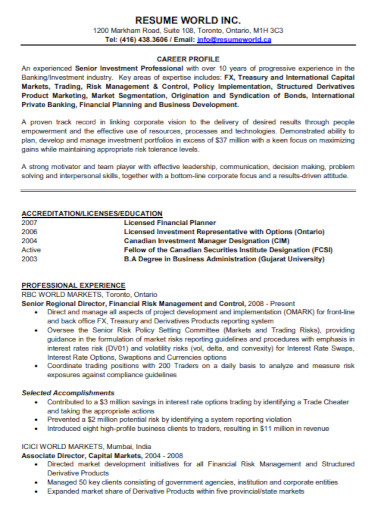

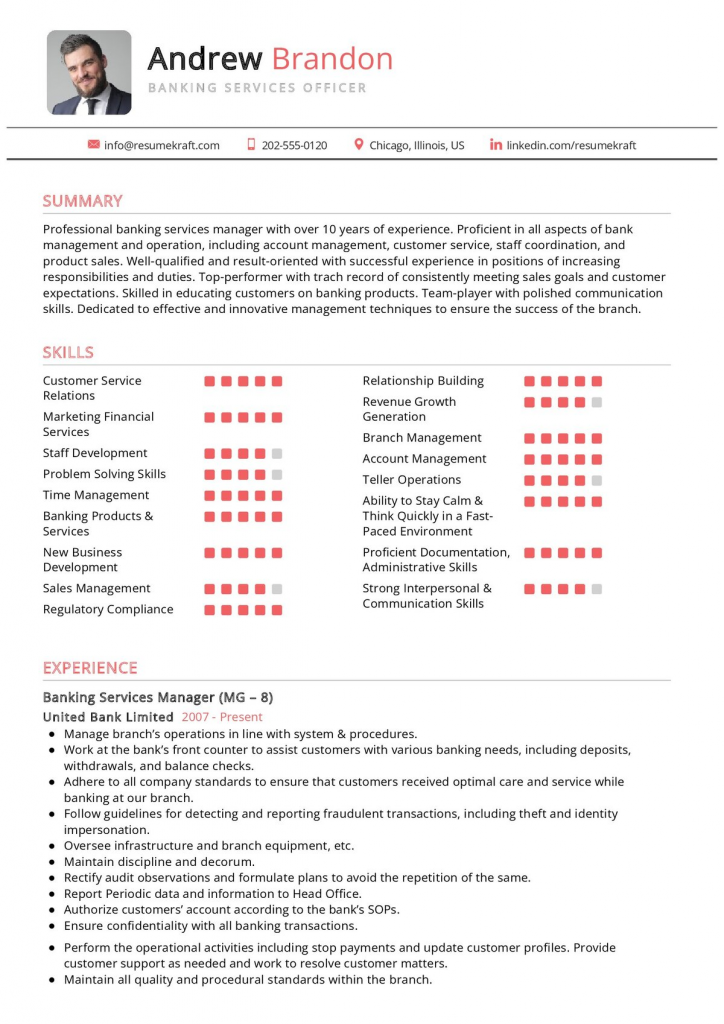

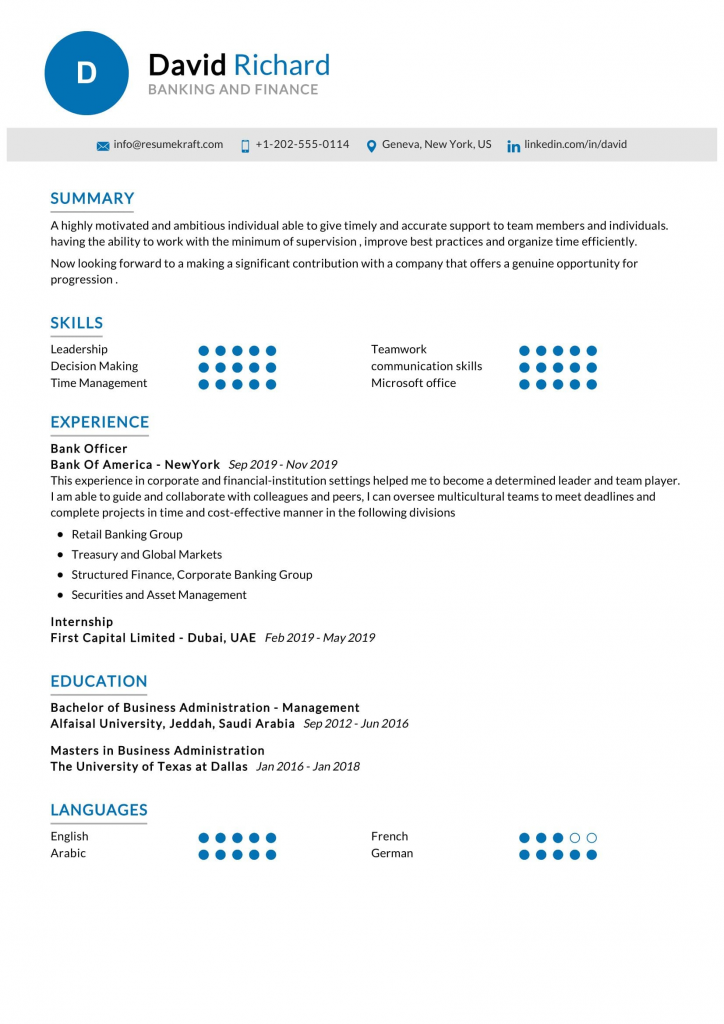

Sample Fresher Resume for Bank Job

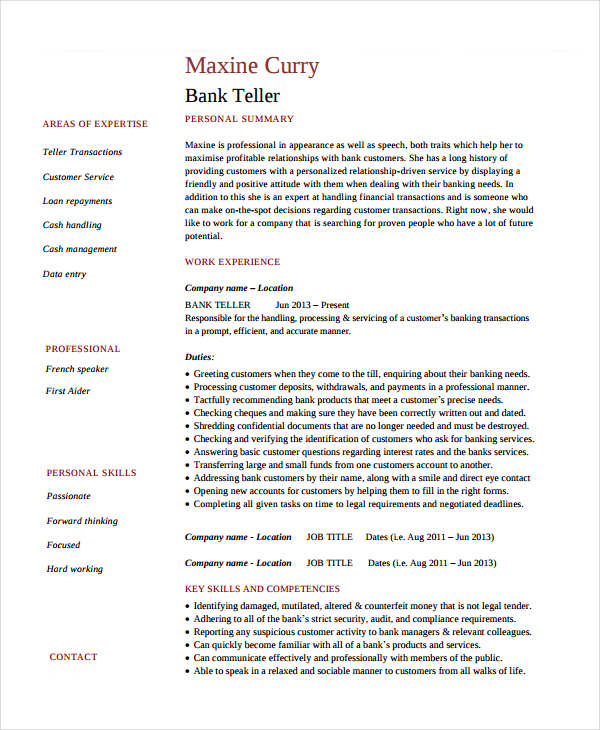

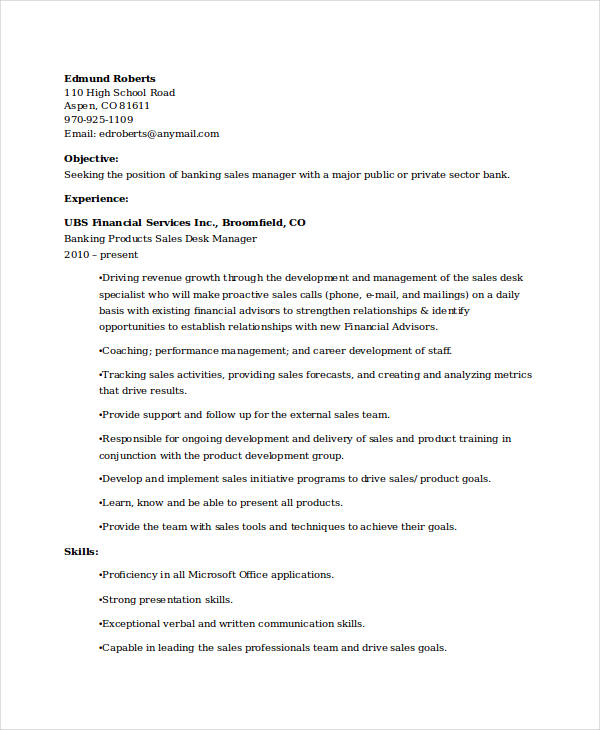

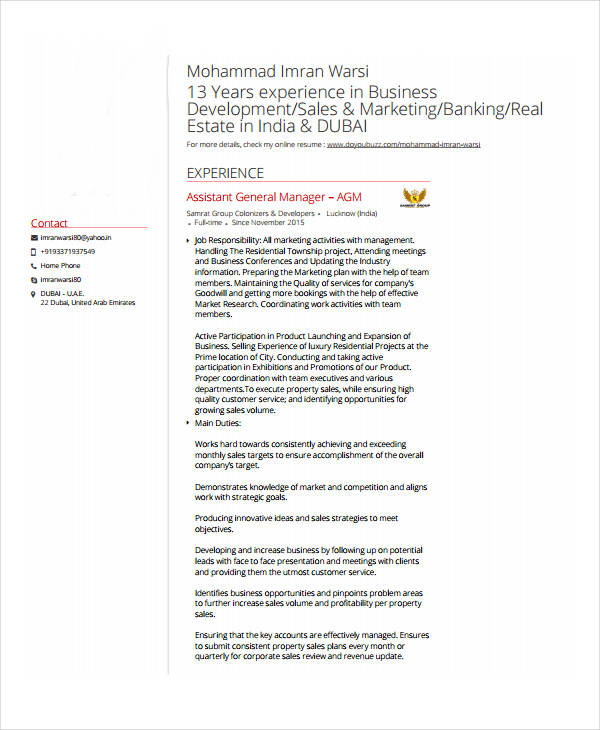

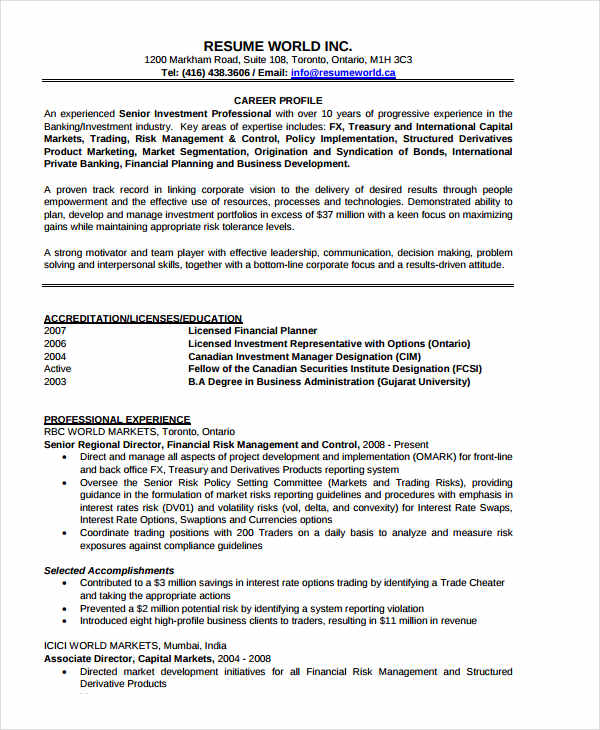

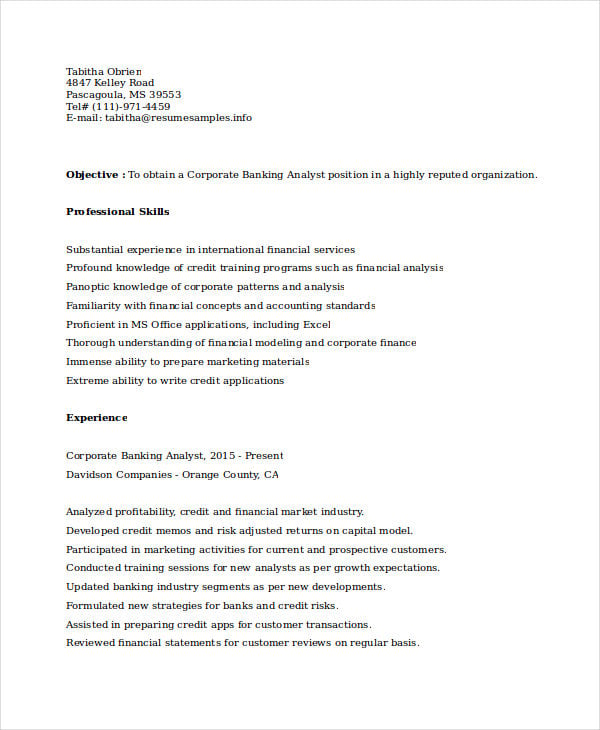

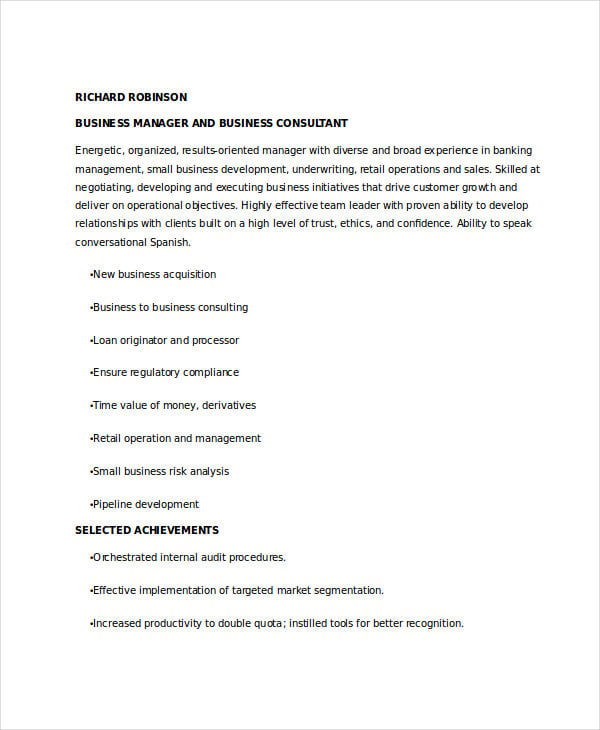

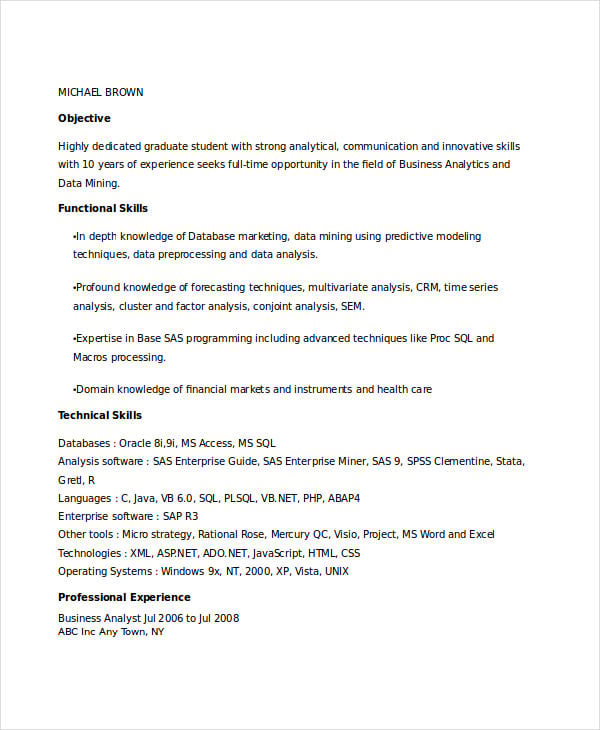

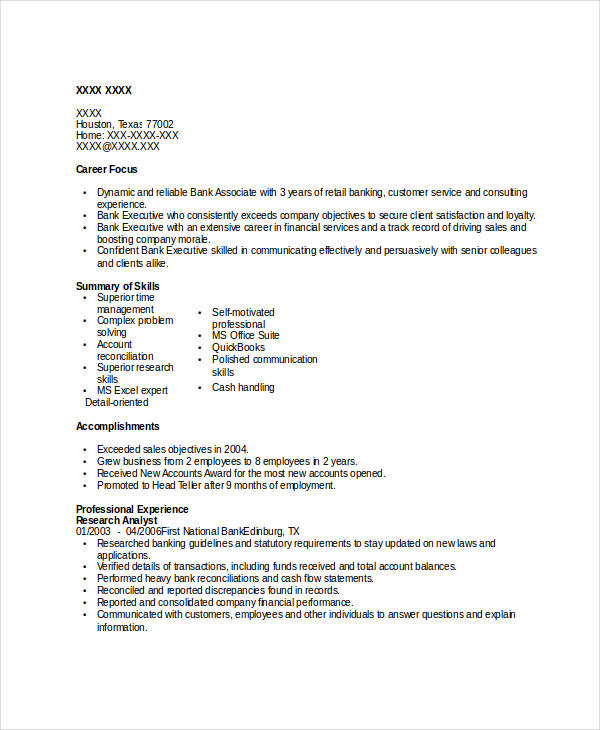

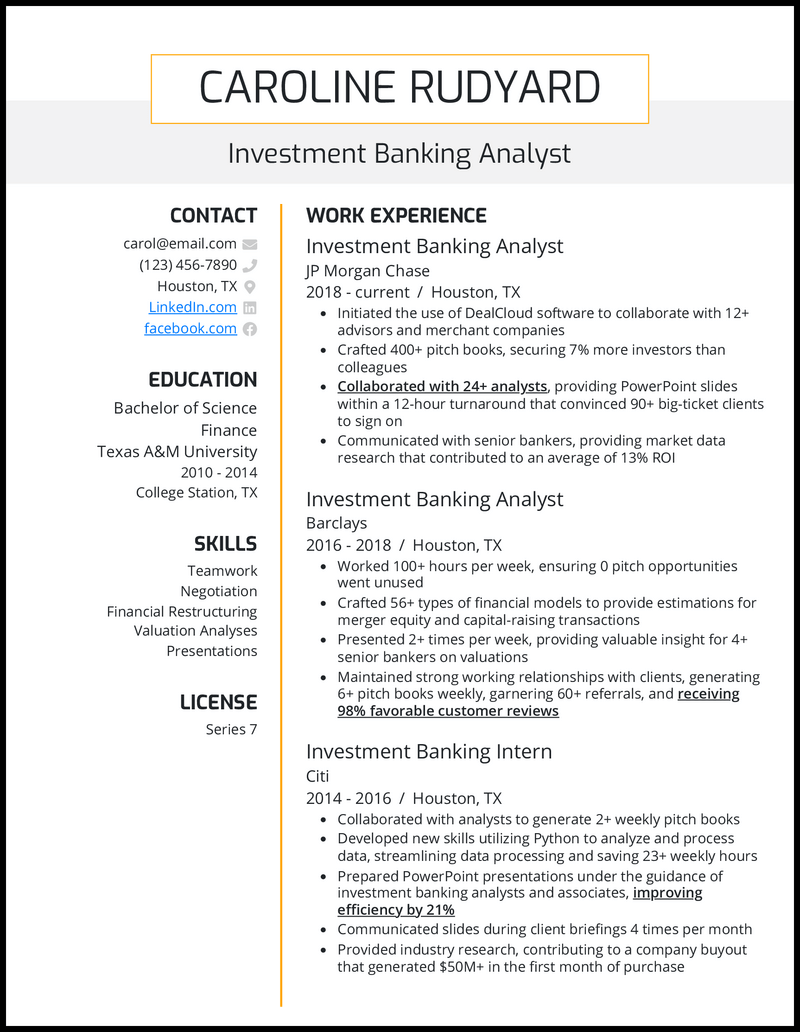

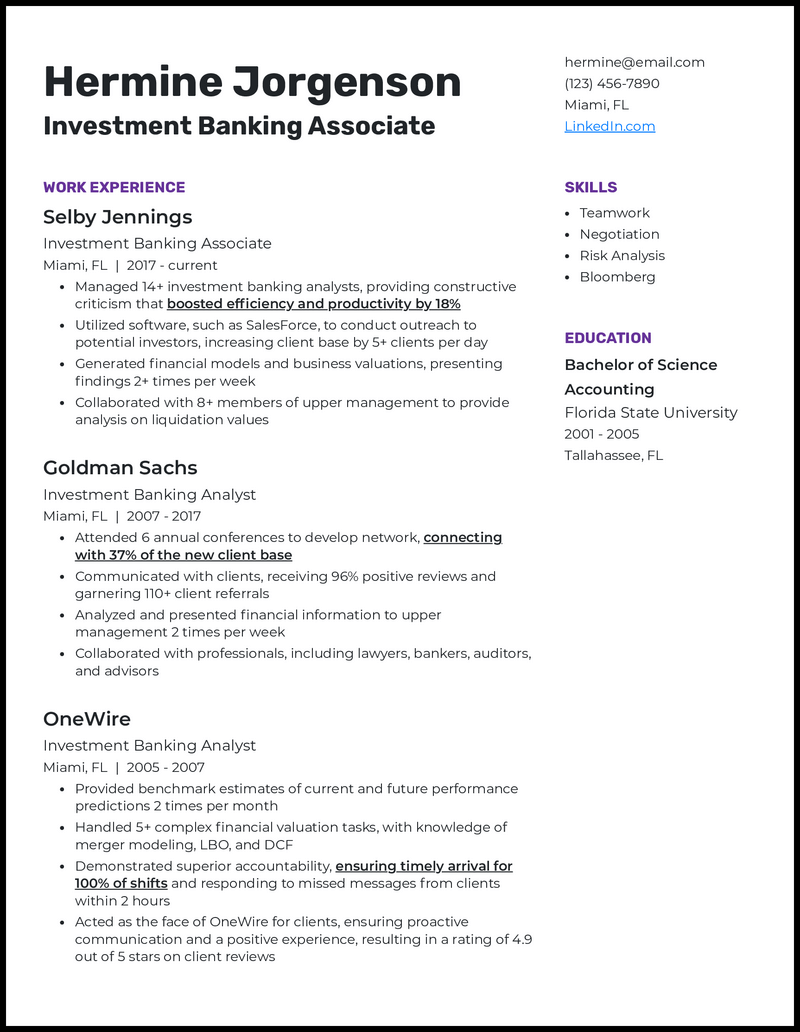

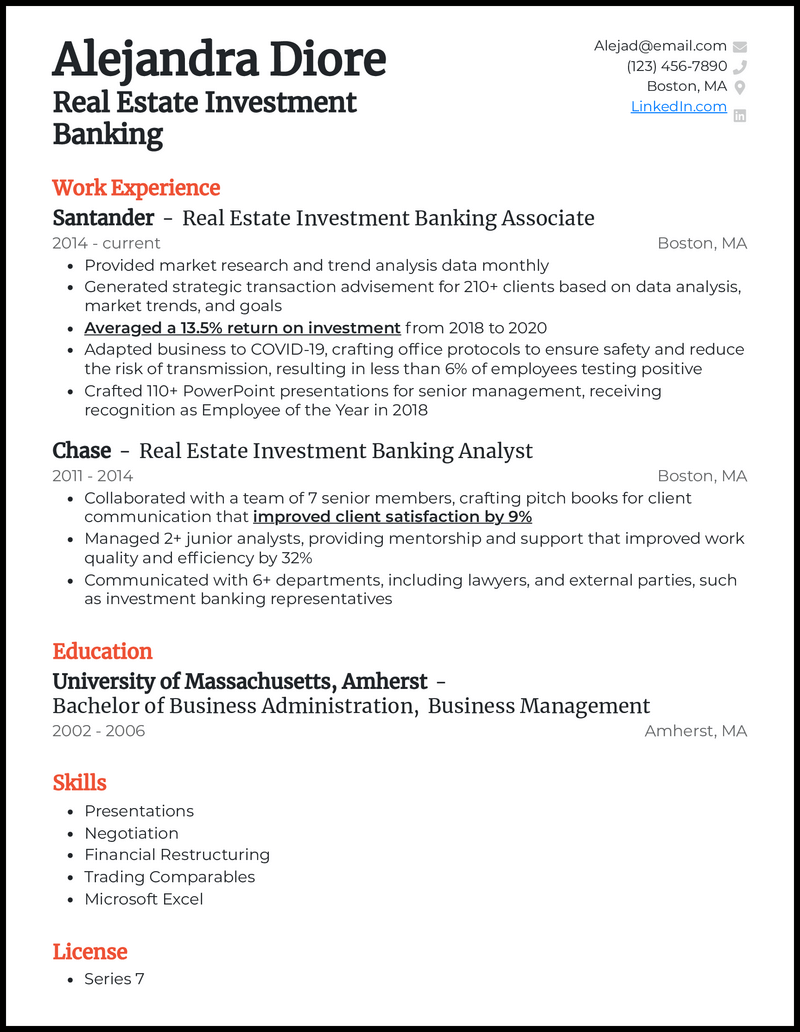

Here are a few sample resumes for bank jobs that you can use for reference that you can use it whenever you create a CV for a bank job fresher.

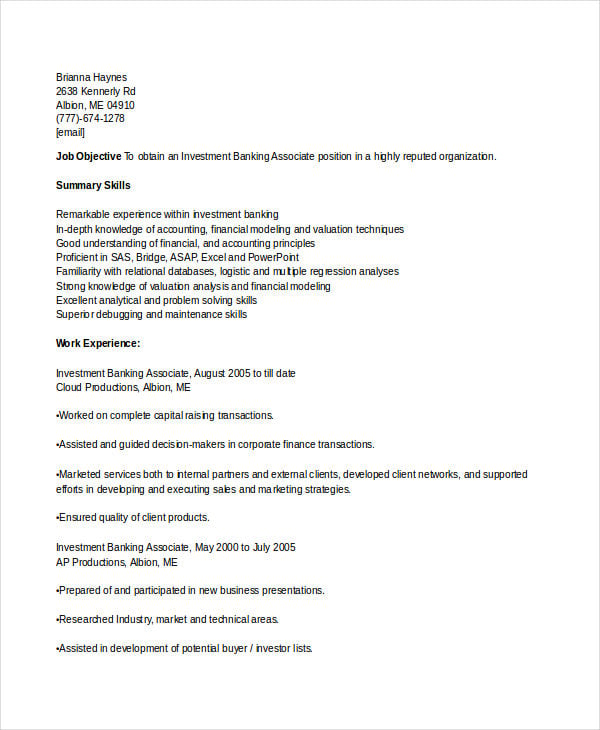

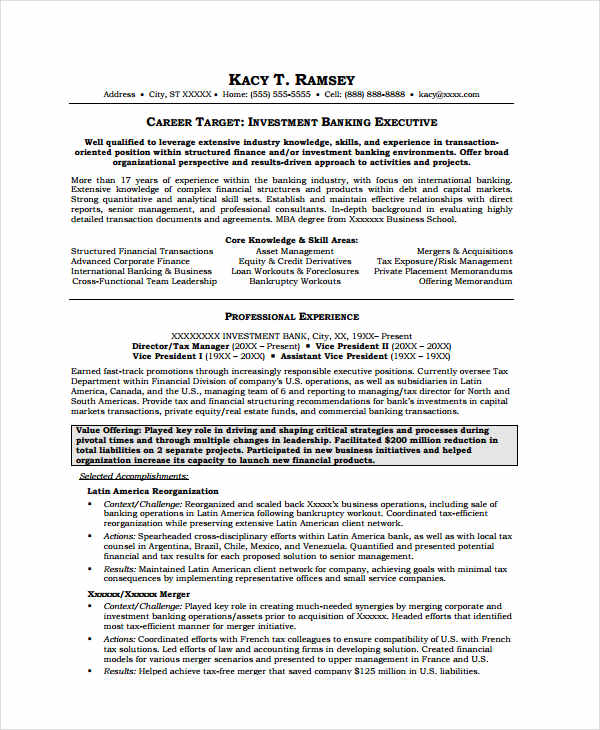

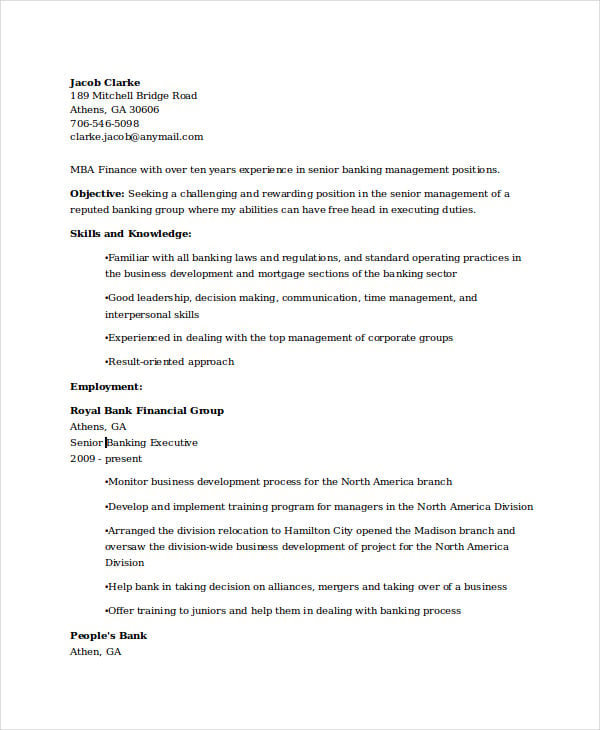

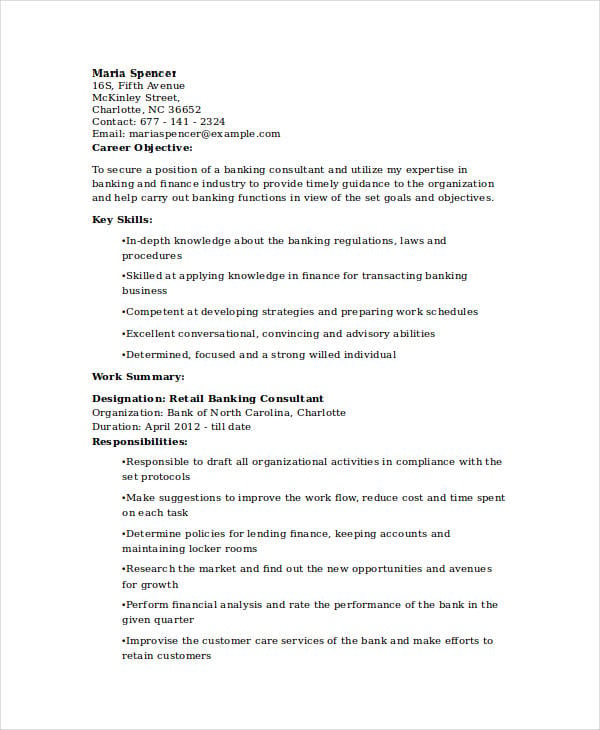

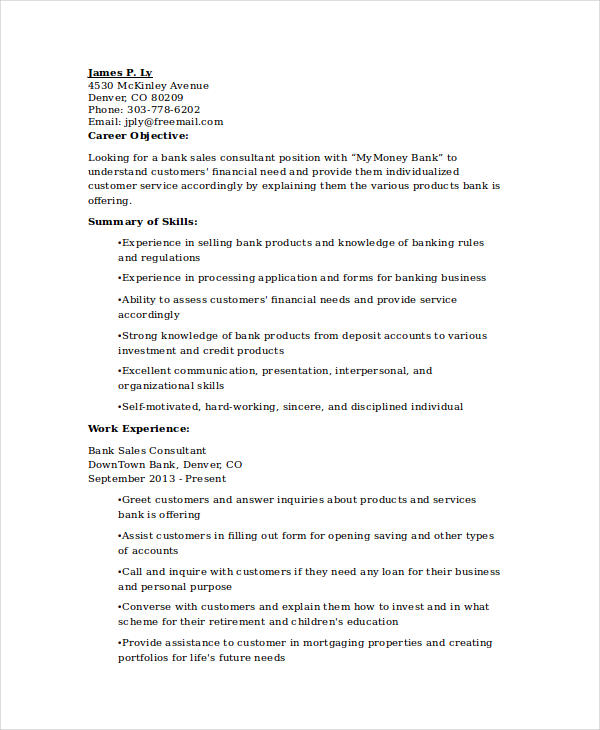

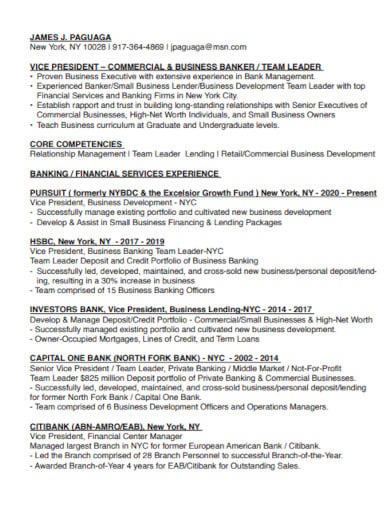

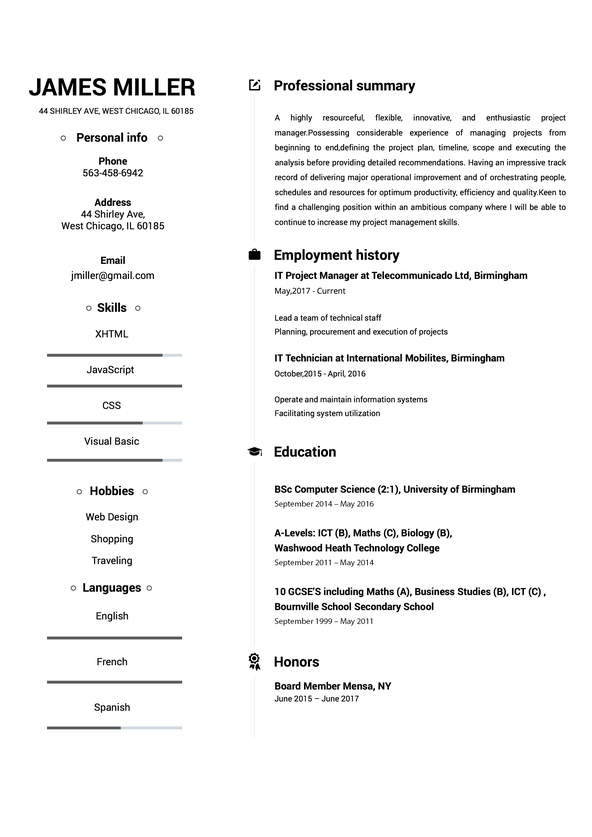

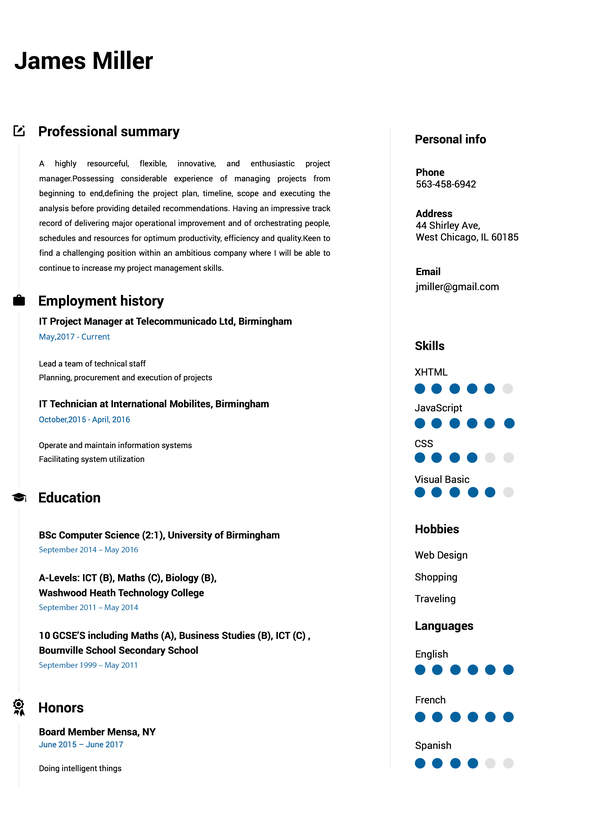

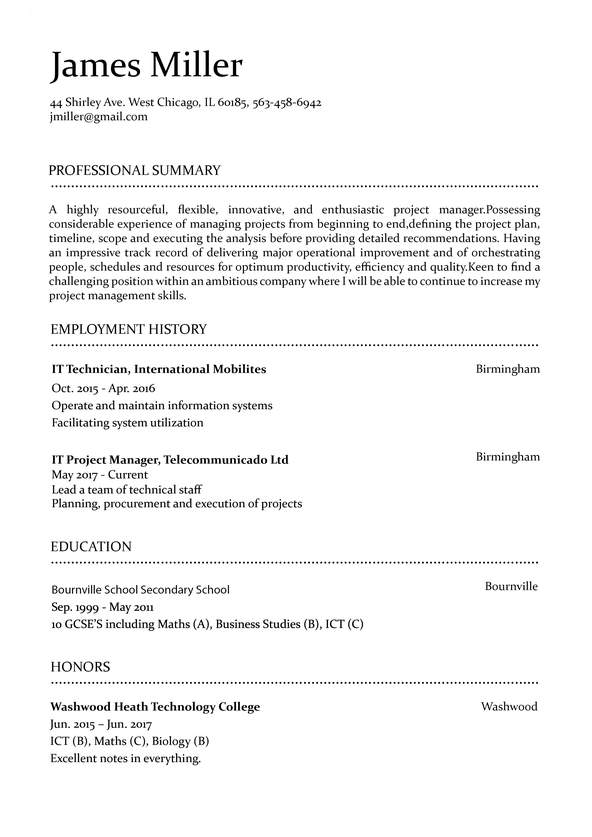

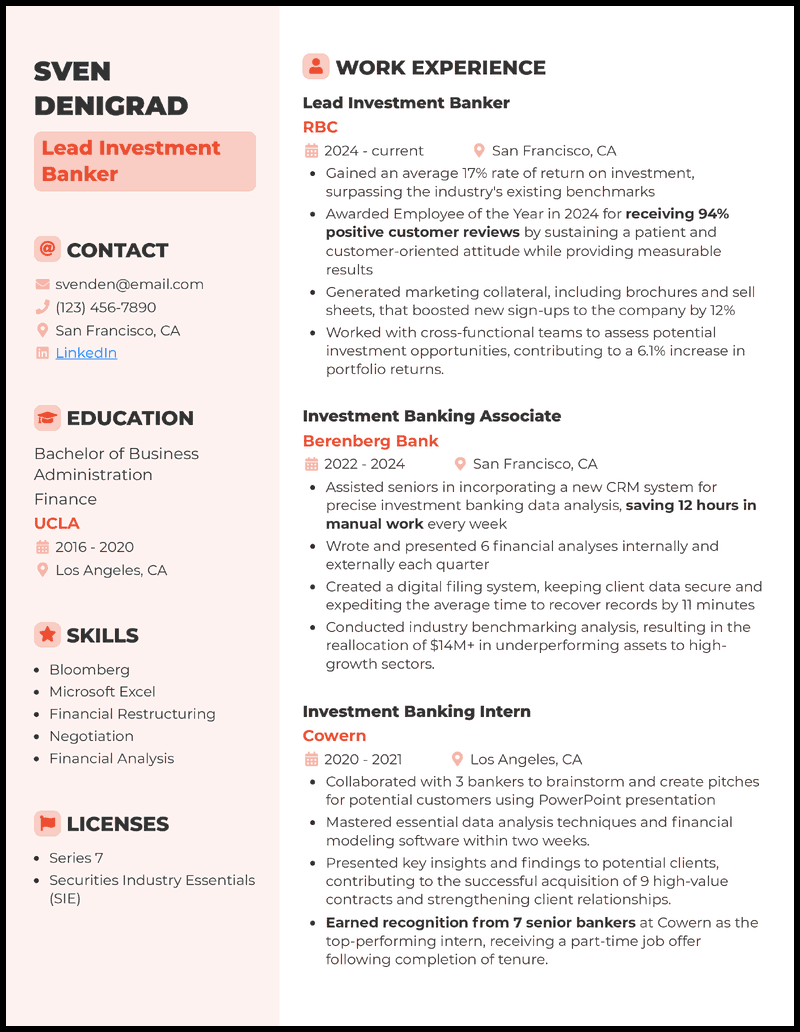

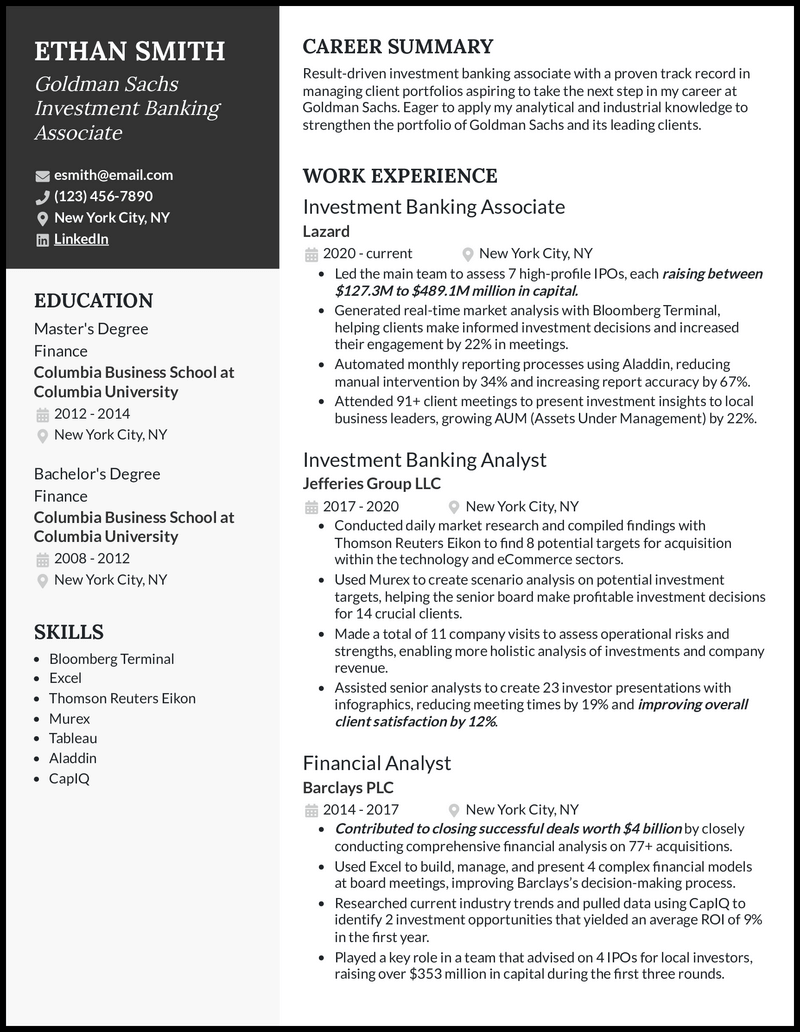

Sample Fresher Resume for Bank Associate

Key takeaways for your resume for bank job.

Crafting an impressive, fresher resume for a bank job is crucial. It helps to secure a promising career in the banking industry. This article provided valuable insights and guidelines to help you create a standout resume. By following the steps outlined in this article, you can develop a structured resume. Understanding the job requirements and including a powerful goal is essential. Remember to proofread and edit your resume summary for bank job freshers. Ensure it is error-free and formatted. Seeking feedback from mentors or career advisors can provide valuable insights for improvement. By following these guidelines, you can unlock opportunities in the banking industry. You can also position yourself as a competitive candidate. Your well-crafted, banking resume sample for fresh graduates will be a powerful tool. It will help you in securing your dream bank job. It will also help you in starting a successful career in the financial sector.

Evaluate numerous career choices to choose the right career path for yourself. Dive into our guide on Career Advice .

Frequently Asked Questions ( FAQ’s )

1. Highlight your educational qualifications, focusing on relevant coursework or projects. 2. Emphasize transferable skills gained from internships, part-time jobs, or volunteer work. 3. Showcase any relevant certifications or training programs. 4. Highlight your passion for the banking industry and your willingness to learn.

1. The reverse-chronological format is used for freshers. 2. It emphasizes your most recent experiences first, showcasing your growth and development. 3. A functional resume format can highlight skills and achievements.

1. The reverse-chronological format is accepted in the banking industry. 2. It presents your work experience in reverse order. 3. This allows recruiters to track your career progression.

Become an Online Expert

To read more related articles, click here.

Got a question on this topic?

Related Articles

- Privacy Policy

- Chegg Study

- Learn a language

- Writing Support

- Expert Hiring and Payment Dashboard

- पैसे कैसे कमाए? Earn Online

- Career Guidance

- General Knowledge

- Web Stories

Chegg India does not ask for money to offer any opportunity with the company. We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities.

- Chegg Inc. Compliance

© 2024 Chegg Inc. All rights reserved.

Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

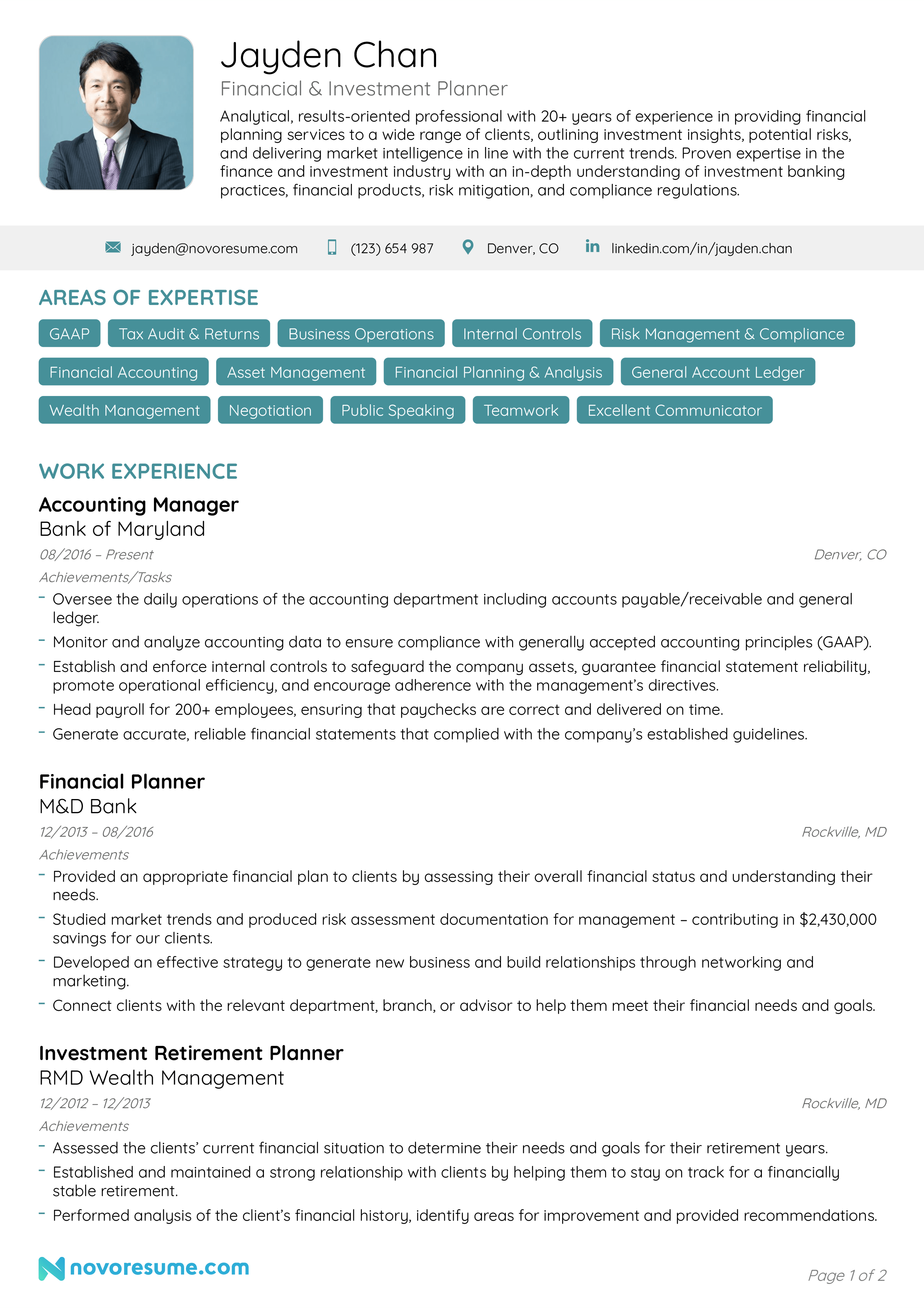

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

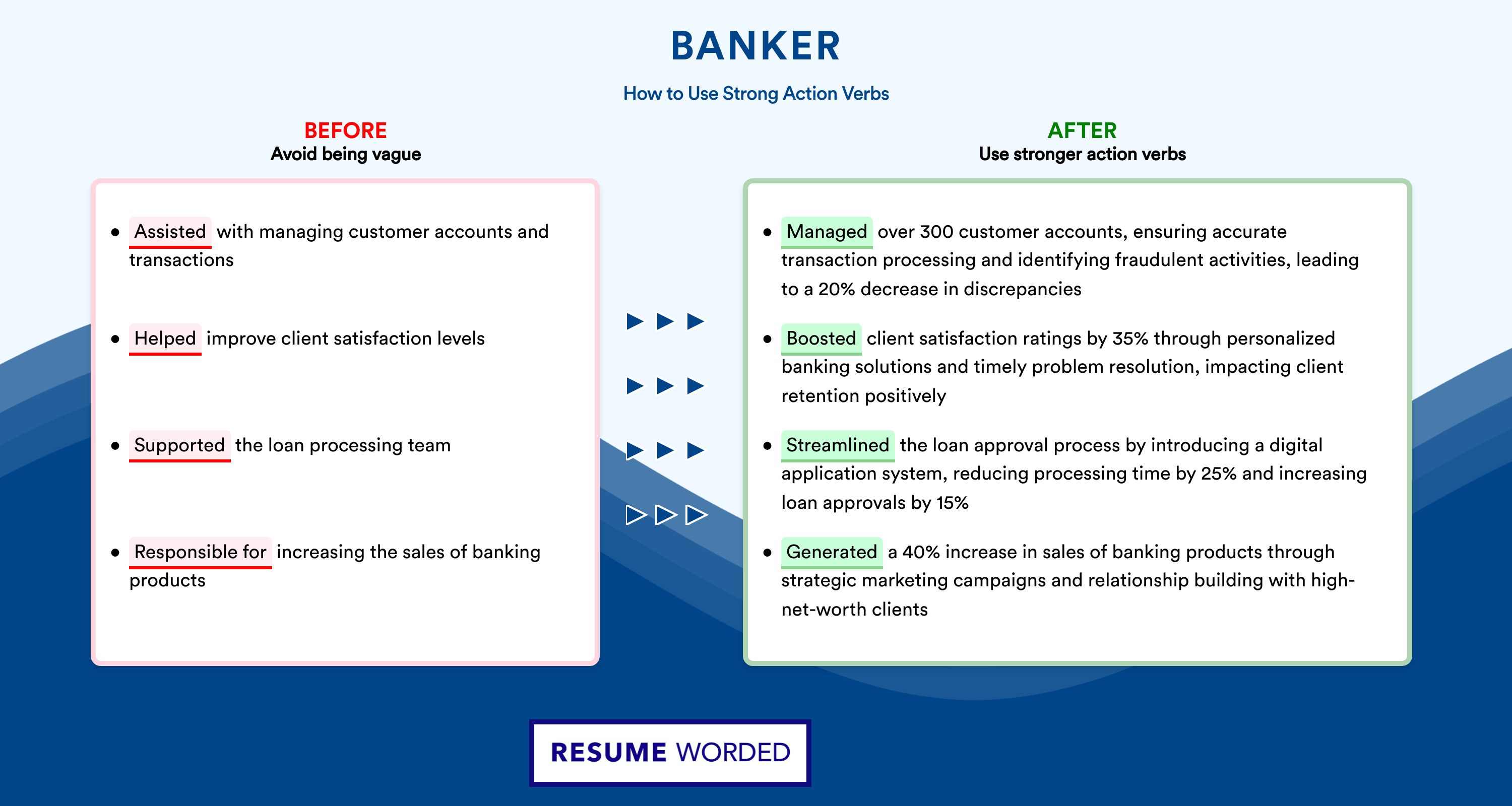

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Investment Banking Resume Guide & Examples

Banker Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Commercial Banker

- Personal Banker

Get advice on each section of your resume:

Jump to a resource:

- Banker Resume Tips

Banker Resume Template

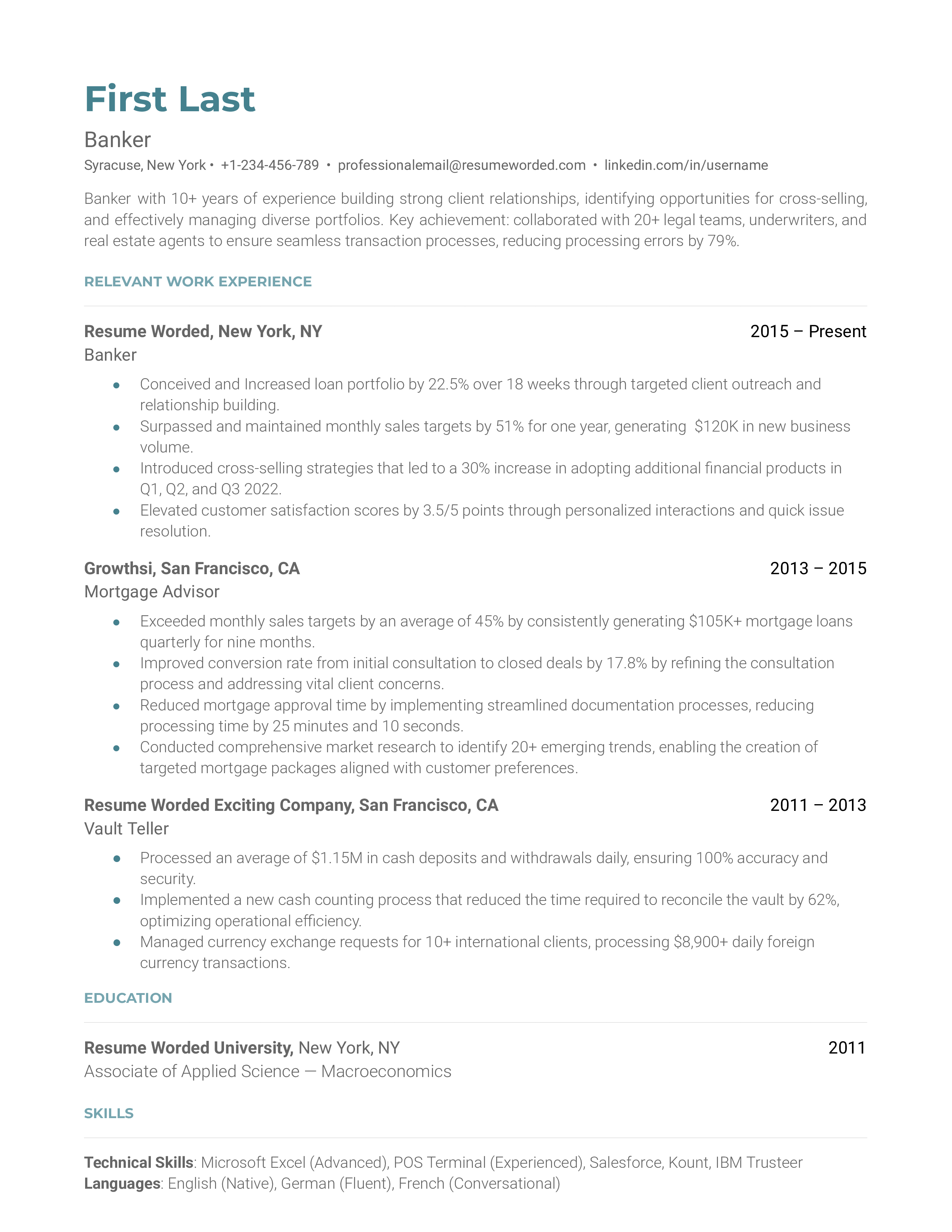

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., banker resume sample.

The banking industry is all about trust, relationship management, and understanding complex financial systems. A strong resume for a Banker role should reflect your ability to handle these tasks. Recently, the industry has been leaning heavily on technological innovation with online banking and digital transactions becoming standard. Also, sustainability and ethical banking practices are gaining traction. So, while it's essential to demonstrate your fundamental banking knowledge and financial acumen, showcasing your proficiency in the latest banking technologies and awareness of ethical banking practices could give you an added advantage. When crafting your resume, bear in mind that bankers are detail-oriented and value effective communication. Therefore, your resume needs to be impeccably neat, clear, and concise. It needs to quickly communicate your qualifications, experience, and skills relevant to the banking world.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your banker resume in 2024, showcase technical skills and digital proficiency.

Banking is no longer just about traditional financial services; it's rapidly going digital. Mention any experience or familiarity with banking software, online transaction systems, or fintech innovations. This shows you’re not just adaptable, but also forward-thinking.

Highlight understanding of ethical banking norms

As the industry shifts towards ethical banking practices and sustainable investing, it’s crucial to demonstrate your knowledge in this area. If you’ve been involved in any projects or initiatives related to ethical banking, sustainable finance, or corporate social responsibility (CSR), make sure it's there on your resume.

As a banker, your role is about more than just crunching numbers; you're expected to provide financial guidance, build relationships with clients, and work effectively in a highly regulated environment. Digital banking continues to grow so it's critical to understand latest technological trends and how they fit within the banking industry. By being mindful of these factors, you can tailor your resume to reflect the skills and experience that make you stand out in the evolving banking landscape. In crafting an effective banker resume, remember to emphasize your financial acumen and your customer service expertise. Don't just list out your duties; instead, quantify your achievements. It's a competitive field, so giving concrete evidence of your successes will definitely make your application more compelling.

Demonstrate knowledge of banking regulations

In your resume, you should clearly state your understanding and application of banking regulations. Mention specific regulatory projects you've managed or contributed to. This shows that you can navigate the complexities of banking law, a crucial skill for any banker.

Showcase your digital literacy

In light of the digital banking trend, demonstrating that you’re tech-savvy is a plus. List any software, tools or technologies you’ve used or learned that are relevant to banking. If you’ve been part of a project involving digital banking or fintech, make sure to include this in your list of accomplishments.

Commercial Banker Resume Sample

Personal banker resume sample.

We spoke with hiring managers at top banks like JPMorgan Chase, Bank of America, and Wells Fargo to understand what they look for in a banker's resume. The following tips will help you create a strong resume that stands out from other applicants and gets you interviews.

Highlight your banking experience and skills

Recruiters want to see that you have relevant experience and skills for the banking role you are applying for. Emphasize your banking experience and skills in your resume, such as:

- 5+ years of experience in retail banking, managing customer accounts and transactions

- Expertise in financial analysis, risk assessment, and lending products

- Strong knowledge of banking regulations and compliance requirements

Quantify your achievements wherever possible to show the impact you made. Instead of generic statements, use specific examples like:

- Managed customer accounts

- Skilled in financial analysis

- Managed 200+ customer accounts with $10M+ in assets, consistently meeting sales targets

- Conducted financial analysis for 50+ commercial lending deals, averaging $5M per deal

Tailor your resume to the specific banking role

Banking is a broad field with many different roles, such as retail banking, commercial banking, investment banking, and risk management. Tailor your resume to the specific role you are applying for. Here are some examples:

- For a retail banking role, focus on your experience with customer service, sales, and account management.

- For a commercial banking role, highlight your experience with business lending, financial analysis, and relationship management.

- For an investment banking role, emphasize your experience with financial modeling, deal execution, and client presentations.

Customizing your resume shows the recruiter that you understand the role and have the relevant skills and experience.

Use industry-specific keywords

Many banks use applicant tracking systems (ATS) to screen resumes for relevant keywords before a recruiter even looks at them. Include banking-specific keywords in your resume to increase your chances of passing the ATS screening. Some examples:

- Risk assessment

- Financial analysis

- Lending products

- Regulatory compliance

- Customer relationship management

Sprinkle these keywords throughout your resume in the relevant sections, such as your professional summary, skills, and work experience. However, avoid keyword stuffing or using keywords that do not apply to your actual experience.

Show your career progression

Recruiters want to see that you have progressed in your banking career and taken on increasing responsibilities. Show your career progression by listing your work experience in reverse-chronological order, with your most recent and relevant experience first.

For each job, include your title, the company name, dates of employment, and a few bullet points highlighting your key responsibilities and achievements. Use action verbs to describe what you did and the results you achieved. Here's an example:

Commercial Banking Relationship Manager, ABC Bank, 2018-2022 Managed a portfolio of 50+ mid-sized business clients with $100M+ in total loans Conducted financial analysis and risk assessment for new loan applications, resulting in a 20% increase in loan volume Developed and implemented a new client onboarding process, reducing onboarding time by 30%

Include relevant education and certifications

In addition to work experience, recruiters also look for relevant education and certifications on a banker's resume. Include your degree(s), major(s), and any relevant coursework or projects. Here are some examples:

- Bachelor of Science in Finance, XYZ University, 2015

- Coursework: Financial Accounting, Corporate Finance, Investment Analysis

- Capstone project: Developed a financial model for a $50M real estate investment

Also include any relevant banking certifications you have earned, such as:

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

These certifications show your expertise and commitment to the banking profession.

Demonstrate your soft skills

In addition to technical skills, banks also look for candidates with strong soft skills, such as communication, teamwork, and leadership. Demonstrate your soft skills by including examples in your work experience bullet points. Here are some examples:

- Collaborated with a cross-functional team of 10+ bankers, credit analysts, and underwriters to structure and close a $25M syndicated loan deal

- Presented quarterly portfolio performance reports to senior management, highlighting key risks and opportunities

- Mentored and trained 5 junior bankers on financial analysis and credit underwriting, resulting in a 50% reduction in errors

You can also include a separate skills section on your resume to highlight your key soft skills, such as:

- Relationship building

- Problem-solving

- Attention to detail

Writing Your Banker Resume: Section By Section

summary.

A resume summary for a banker is an optional section that provides a brief overview of your professional experience, skills, and career goals. While a summary is not required, it can be a useful tool to provide context for your resume and highlight your most relevant qualifications. However, it's important to avoid using an objective statement, as these are outdated and focus on what you want rather than what you can offer the employer.

When writing your banker resume summary, focus on your key strengths, accomplishments, and the value you can bring to the role. Tailor your summary to the specific position you're applying for and the financial institution's needs. Keep it concise, no more than a few sentences or a short paragraph.

To learn how to write an effective resume summary for your Banker resume, or figure out if you need one, please read Banker Resume Summary Examples , or Banker Resume Objective Examples .

1. Highlight your banking expertise and specializations

In your resume summary, showcase your specific areas of expertise within the banking industry. This helps employers quickly understand your focus and how you can contribute to their organization. Consider the following examples:

- Experienced banker with a proven track record of success.

- Skilled professional with experience in various banking roles.

Instead, be more specific and highlight your key areas of specialization:

- Commercial banker with 5+ years of experience in loan origination and portfolio management.

- Investment banker specializing in mergers and acquisitions for technology startups.

By focusing on your specific expertise, you demonstrate your value to potential employers and help them envision how you can contribute to their team.

2. Emphasize your achievements and impact

When crafting your banker resume summary, focus on your achievements and the impact you've made in your previous roles. Quantify your results whenever possible to provide concrete evidence of your success.

Experienced relationship manager with strong communication and interpersonal skills. Proven ability to build and maintain client relationships.

While this summary mentions relevant skills, it lacks specific achievements and impact. Instead, consider a summary that highlights quantifiable results:

Accomplished relationship manager with a track record of growing client portfolio by 30% and increasing revenue by $5M+ annually. Skilled in developing strategic partnerships and providing exceptional client service to high-net-worth individuals.

By emphasizing your achievements and impact, you demonstrate your value to potential employers and set yourself apart from other candidates.

Experience

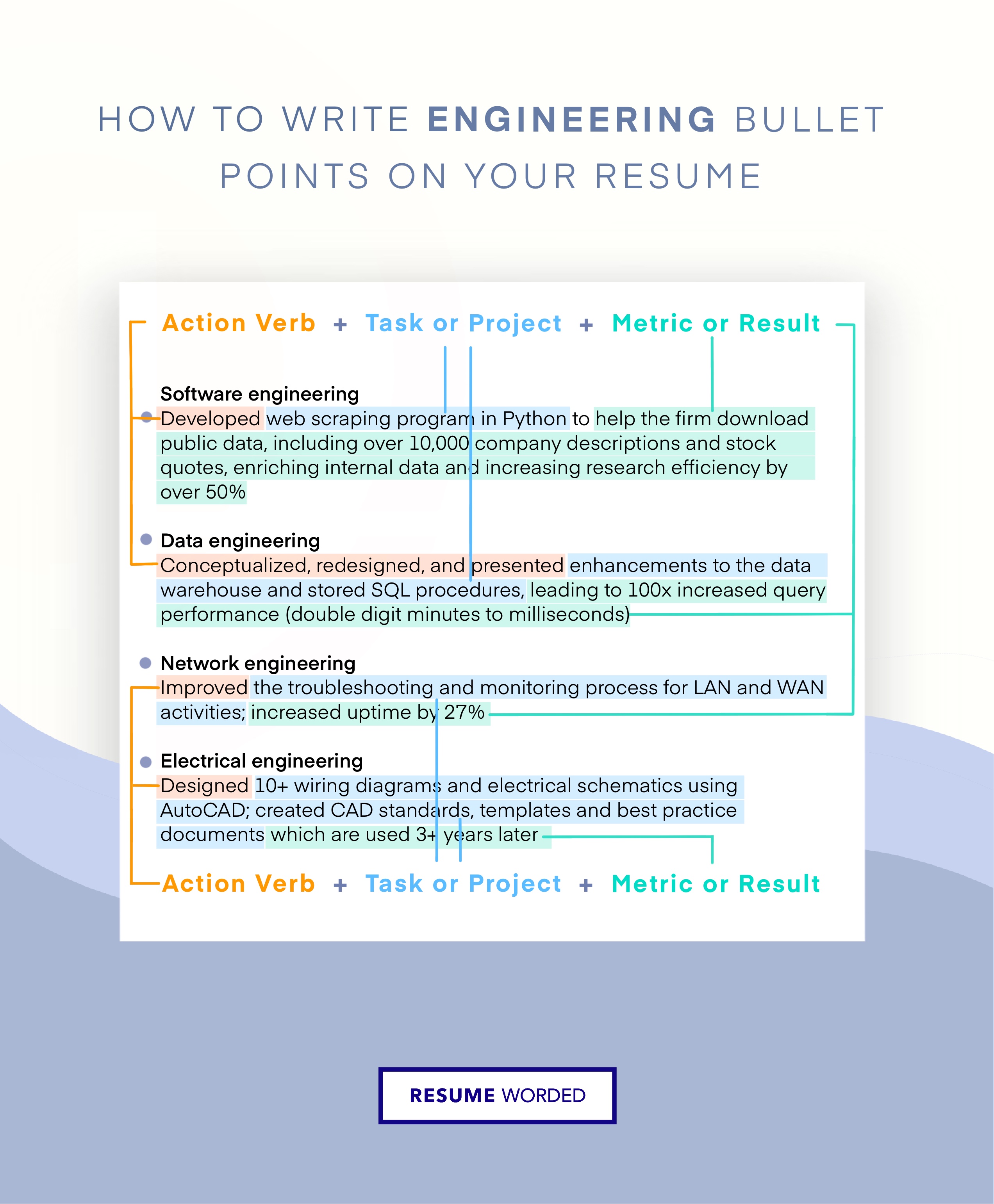

The work experience section is the heart of your resume. It's where you demonstrate your qualifications and show the hiring manager how you've applied your skills to produce results. When writing your work experience section, aim to create a compelling narrative that paints a clear picture of your career trajectory and accomplishments.

1. Highlight banking experience and skills

When describing your work experience, focus on the aspects of your roles that are most relevant to banking. This could include:

- Managing client accounts and portfolios

- Conducting financial analysis and risk assessments

- Developing investment strategies and providing financial advice

- Collaborating with cross-functional teams to deliver banking solutions

By emphasizing your banking-specific experience and skills, you demonstrate your qualifications for the role and make it easier for the hiring manager to visualize you in the position.

2. Use strong banking action verbs

When describing your achievements, use strong action verbs that resonate with the banking industry. Compare the following examples:

- Responsible for managing client portfolios

- Worked on financial analysis and risk assessment

Instead, use powerful verbs that convey your impact:

- Spearheaded the management of a $50M client portfolio, implementing strategies that generated a 15% return on investment

- Conducted in-depth financial analysis and risk assessments, identifying potential threats and opportunities for clients

Action verbs like "spearheaded," "implemented," "generated," "conducted," and "identified" create a stronger impression of your contributions and leadership.

After writing your work experience section, use our Score My Resume tool to get instant feedback on the strength of your resume based on criteria hiring managers care about, including your use of action verbs.

3. Quantify your banking accomplishments

Whenever possible, use metrics to quantify your achievements and provide context for your contributions. Numbers help hiring managers understand the scope and impact of your work. For example:

Managed a portfolio of 50+ high-net-worth clients, overseeing $250M in assets and achieving an average annual return of 12%

If you don't have access to specific metrics, you can still provide context by using numbers or percentages, such as:

- Collaborated with a team of 15 bankers to develop and implement a new risk assessment framework

- Streamlined the account opening process, reducing average processing time by 30%

4. Demonstrate career growth in banking

Showcase your career progression within the banking industry by highlighting promotions, increased responsibilities, and key projects. This demonstrates your ability to learn, grow, and take on new challenges. For example:

Promoted to Senior Financial Analyst after consistently exceeding performance targets and demonstrating strong leadership skills. In this role, led a team of five analysts in developing and implementing a new investment strategy that increased client portfolio returns by an average of 10%.

By showcasing your career growth, you signal to hiring managers that you have the potential to continue advancing and making valuable contributions to their organization.

Education

Your education section is a key part of your resume as a banker. It shows hiring managers that you have the necessary knowledge and qualifications for the role. In this section, we'll cover what to include and how to format your education section to make it stand out.

1. List your degrees in reverse chronological order

Start with your most recent degree first, and work backwards. This is the standard format for resumes in the banking industry.

For each degree, include:

- Name of the degree (e.g. Bachelor of Science in Finance)

- Name of the university

- Graduation year

- GPA (if above 3.5)

Here's an example of how to format your degrees:

- Master of Business Administration (MBA), XYZ University, 2020

- Bachelor of Science in Finance, ABC University, 2016

2. Highlight relevant coursework for entry-level bankers

If you are a recent graduate or have limited work experience, you can strengthen your education section by listing relevant coursework. This shows hiring managers that you have specific knowledge that applies to the banking role.

However, avoid listing every course you've taken. Instead, choose 3-5 courses that are most relevant to the job description.

Here's an example:

Bachelor of Science in Finance, DEF University, 2022 Relevant Coursework: Financial Modeling, Investment Banking, Corporate Finance, Financial Accounting

3. Keep it concise for experienced bankers

If you are a senior-level banker with many years of experience, your education section should be brief. Hiring managers will be more interested in your professional accomplishments than your degrees from many years ago.

Here's an example of what not to do:

- Master of Business Administration, XYZ University, 1995-1997

- Bachelor of Arts in Economics, ABC College, 1991-1995

- Online Course in Advanced Excel for Finance, 2005

Instead, keep it short and sweet:

- MBA, XYZ University

- B.A. Economics, ABC College

Skills

The skills section of your banker resume is a critical component that showcases your abilities and qualifications to potential employers. It's important to highlight the most relevant and valuable skills that align with the job requirements and demonstrate your expertise in the banking industry. In this section, we'll provide you with tips and examples to help you craft a compelling skills section that will catch the attention of hiring managers and increase your chances of landing an interview.

1. Prioritize banking-specific skills

When listing your skills, focus on those that are directly related to the banking industry and the specific job you're applying for. Highlight your expertise in areas such as financial analysis, risk management, loan processing, and customer service.

Here's an example of a well-structured skills section for a banker resume:

Financial Analysis : Financial modeling, financial statement analysis, credit analysis, budgeting and forecasting Risk Management : Risk assessment, fraud detection, compliance, anti-money laundering (AML) Loan Processing : Loan origination, underwriting, documentation, closing Customer Service : Relationship building, problem-solving, communication, sales

To ensure your skills section is tailored to the job, review the job description carefully and incorporate the key skills and qualifications mentioned. Using our Targeted Resume tool can help you identify the most important skills to include based on the specific job posting.

2. Avoid generic or outdated skills

When crafting your skills section, steer clear of listing generic or outdated skills that don't add value to your resume. For example, instead of simply stating "computer skills," be specific and mention the relevant software or tools you're proficient in, such as financial analysis software or customer relationship management (CRM) systems.

Computer skills Microsoft Office Communication Teamwork

Instead, showcase your skills in a more targeted and impactful way:

Financial Software : Bloomberg Terminal, Thomson Reuters Eikon, Morningstar CRM Systems : Salesforce, Oracle CRM, Microsoft Dynamics Data Analysis : Excel (Advanced), SQL, Tableau

Keep in mind that hiring managers often use Applicant Tracking Systems (ATS) to filter resumes based on the presence of specific skills and keywords. By including relevant and up-to-date skills, you increase your chances of passing the ATS screening and reaching the next stage of the hiring process.

3. Quantify your skills with proficiency levels

To provide hiring managers with a clear understanding of your skill levels, consider including proficiency indicators next to each skill. This can be done using terms like "Expert," "Advanced," "Intermediate," or "Beginner," or by using a visual scale, such as stars or bars.

Here's an example of how you can incorporate proficiency levels into your skills section:

Financial Analysis (Expert) Risk Management (Advanced) Loan Processing (Intermediate) Customer Service (Expert)

By quantifying your skills, you provide hiring managers with a quick and easy way to assess your capabilities and determine if you're a good fit for the role.

To ensure your skills section is effective and impactful, consider using our Score My Resume tool, which provides instant expert feedback on your resume, including an assessment of your skills section. The tool checks your resume against 30+ key criteria that hiring managers look for and offers suggestions for improvement.

Skills For Banker Resumes

Here are examples of popular skills from Banker job descriptions that you can include on your resume.

- DCF Valuation

- Financial Analysis

- Capital Markets

- Python (Programming Language)

- Due Diligence

- S&P Capital IQ

- Financial Modeling

Skills Word Cloud For Banker Resumes

This word cloud highlights the important keywords that appear on Banker job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, investment banking.

- C-Level and Executive Resume Guide

- Accounts Payable Resume Guide

- Collections Specialist Resume Guide

- Bookkeeper Resume Guide

- Financial Advisor Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Investment Banking Resume Guide & Examples for 2022

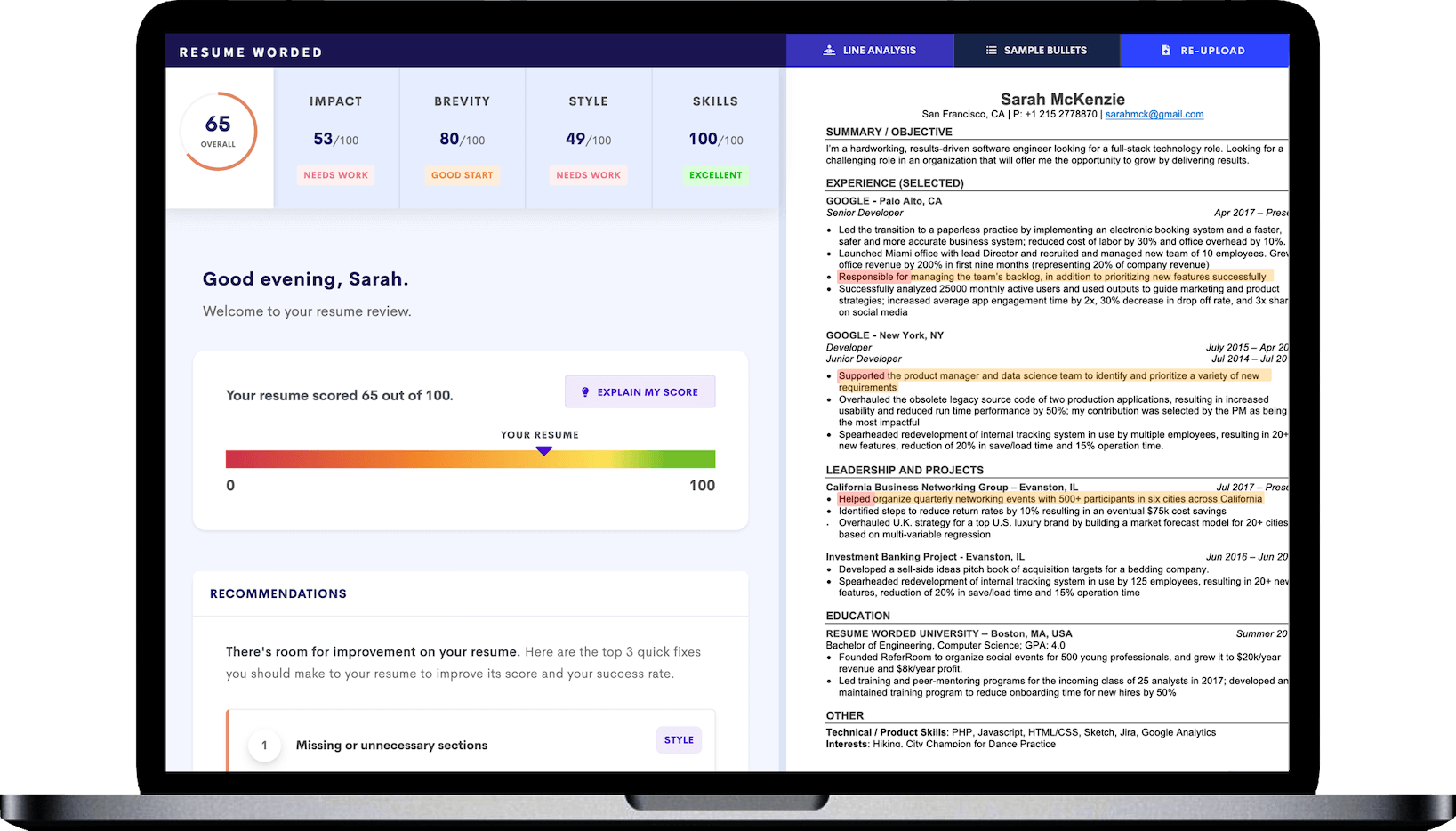

Improve your Banker resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Banker resumes in your industry.

• Fix all your resume's mistakes.

• Find the Banker skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Banker Resumes

- Template #1: Banker

- Template #2: Banker

- Template #3: Banker

- Template #4: Commercial Banker

- Template #5: Personal Banker

- Skills for Banker Resumes

- Free Banker Resume Review

- Other Finance Resumes

- Banker Interview Guide

- Banker Sample Cover Letters

- Alternative Careers to a Investment Banking Specialist

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 8 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 8 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

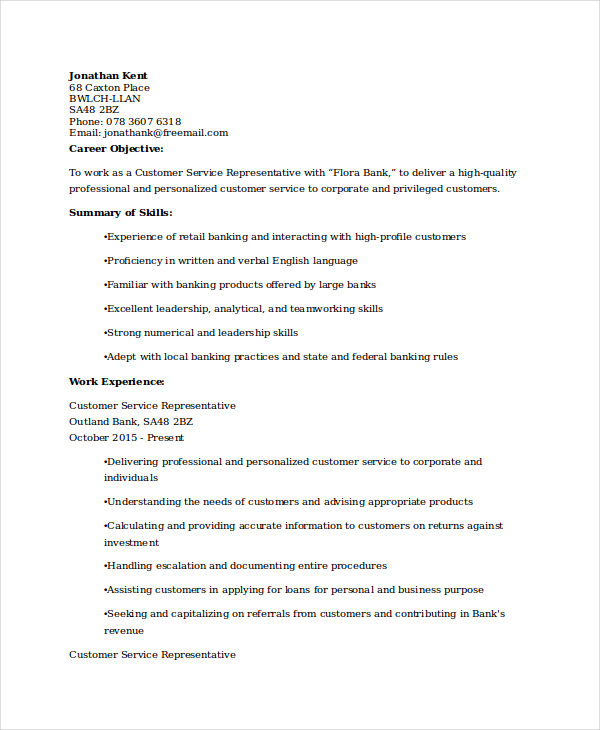

Download Sample Resumes for Banking Freshers in PDf and MS Word Format

Have you ever gotten stuck trying to write a resume that adequately highlights your experience and skills? Or have you struggled finding the right words to capture the attention of a hiring manager? A well written resume can be your ticket to your dream job and make the difference between getting noticed or ignored by the hiring manager – yet, resume writing is not something that is taught in school. Writing a successful resume is not easy. It takes time, effort and dedication, and it is difficult to find reliable information on what to include and what can be left out. The lack of information available is in part due to the difficulty of providing one guideline fit for everybody. Each person is unique and brings his or her own skill sets to the table, meaning that each resume needs to be unique as well. A good CV format for fresher must be written in proper format.

What information should a Banking CV include

What are the most important aspects of CV that you look for?

45% Previous related work experience 35% Qualifications & skills 25% Easy to read 16% Accomplishments 14% Spelling & grammar 9% Education (these were not just graduate recruiters or this score would be much higher!) 9% Intangibles: individuality/desire to succeed 3% Clear objective 2% Keywords added 1% Contact information 1% Personal experiences 1% Computer skills

A comparison between a good and abd Banking resume format

Writing a Banking resume is much like writing a paper for school. Every detail contributes – positively or negatively – to your final "grade." Like teachers, hiring managers look for a cohesive story; a persuasive argument; a neat, well organized appearance; and of course, perfect spelling and grammar.

The difference is that teachers read the entire paper (at least we hope) before assigning a grade. Hiring managers will probably decide within 10-30 seconds whether your resume is worth their time. If they spot an error or see nothing noteworthy during that brief scan, your resume may never get a full reading.

Read following great tips and instructions before creating your reusme

1. Check for Your Email Address for Banking Resume

BAD Email Address Example

[email protected] [email protected] [email protected]

GOOD Email Address Example

Try to use your real name in your email address:

[email protected] [email protected] [email protected]

Suggestion : Create a new email address specifically for your job search.

Check Your Objective for Banking Resume

" Writing an effective objective statement is tough. To make it easier, we have listed 50 objective statements from actual job seekers. You can see what works, and what doesn't. A hiring manager will often read dozens, if not hundreds of resumes at a time "

Bad Resume Objective Example

"To work for a company with a warm environment and great pay."

"To utilize my skills and experience working for an aggressive company, but more important, a well-balanced company."

" A challenging creative opportunity where I can apply my skills in a dynamic organization with plenty of room for advancement."

Good Resume Objective Example

" I am currently looking for a full time position in an environment that offers a greater challenge, increased benefits for my family, and the opportunity to help the company advance efficiently and productively "

" To apply the knowledge acquired through a bachelor's degree in Marketing and Communications and two summer internships at a public relations agency to an entry-level position on the marketing or PR team of a major financial institution. "

"My goal is to become associated with a company where I can utilize my skills and gain further experience while enhancing the company's productivity and reputation."

What Should You Avoid?

job interview Many job seekers use the resume objective for the wrong reasons. Instead of focusing on what they can offer to their potential employer, they use the resume objective simply as a means to get the job.

Typically, bad resume objectives are too general and lack focus on details, thus creating a bad impression to hiring managers. However, writing a non-customized objective that does not match the position you're applying for can considerably decrease your chances to be considered for the job.

Summary of Your Qualifications for Banking Career

BAD Summary

SUMMARY OF QUALIFICATIONS A loan and credit underwriter, experienced at analizing loan applications and working with customers in commerical and retail loan transactions.

GOOD Summary

SUMMARY OF QUALIFICATIONS Accomplished loan and credit underwriter with nine years' experience in commercial and retail banking and a proven record of profitable lending transactions. Adept at combining in-depth knowledge of industry practices and legal requirements with analytical expertise, strategic negotiation, and skillful relationship building to secure new and repeat business. Earned top underwriter or runner-up status in Northeast region for past four years.

Finally use following tips and idea's to wrap your Banking resume with useful informations

Contact Information: Name, Address, Phone Number (be sure to use one that you can answer during business hours), and email address.

Professional Summary as Banking : Defines your career objectives, highlights your experiences, skills and training. This summary will tell them what you can do for their organization. Great to include if you are switching careers or would be coming in on an entry level. Keep this sentence targeted, powerful and precise. Usually only a sentence or two in length.

Work Experiences for Banking Jobs: Only extend this area back 10-15 years maximum. Unless of course, you are moving from a company you have been with for 20 years. In that case, you will want to use the proper dates. If you are someone who has had six jobs in 15 years, keep it within the 10-year frame. Be sure to start with the most recent job title. Exclude unpaid experiences and volunteer work from this section. Remember you want to sell yourself to the reader, so consider that when deciding if a job is relevant to the job you are pursuing.

Education for Banking Freshers: There are different strategies for this section based on your level of schooling, work experience, and how long you have been out of school. If you have been out of school for fewer than 5 years, you will want to place education before work experiences. If you are more than 5 years from your school experience, you will want to place education after work experience. Areas to include if they highlight your success are: GPA, Honors programs, Clubs, Athletics, Relevant Course Work, and extracurricular activities. Your highest level of completed schooling should be listed first. If you have a Bachelor's degree, there is no need to include your high school information.

Achievements: Include this area if you have relevant highlights to show you are an excellent choice for the position. Highlights can include: Promotions, Certifications, Awards, Licensing

All Formats

- Graphic Design

51+ Banking Resume Samples

On this list, you will find 48+ banking resume samples that will help you increase your chances of landing a job at the bank.

Banking Resume Format Word

- Illustrator

Banking CV Format in Word Free Download

- Google Docs

Resume Template Bundle

ATS Resume Template Bundle

Resume for Bank Job Fresher in Word Format

CV for Bank Job PDF

Resume for Bank Job Fresher PDF

- Apple Pages

Resume Format for Bank Job in Word File Download

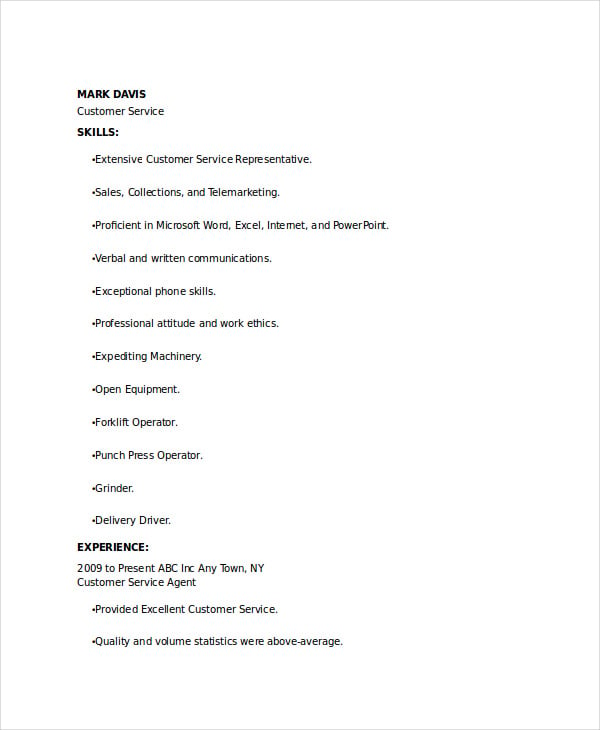

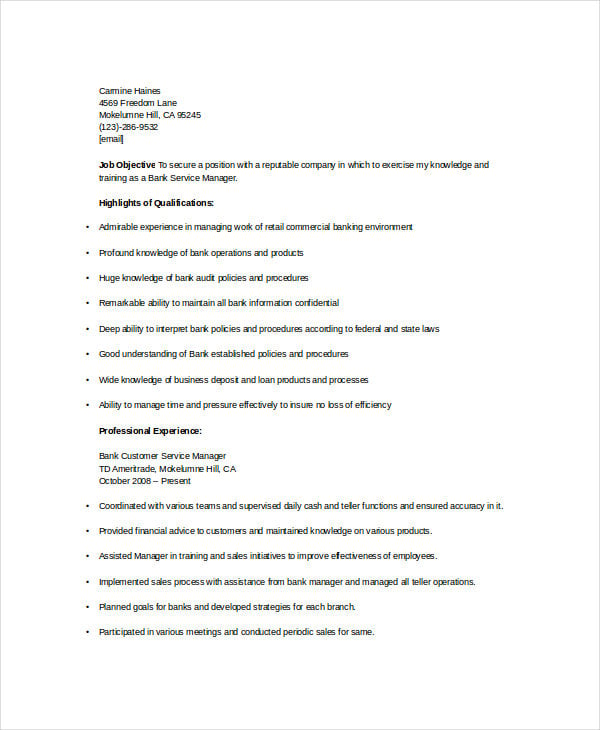

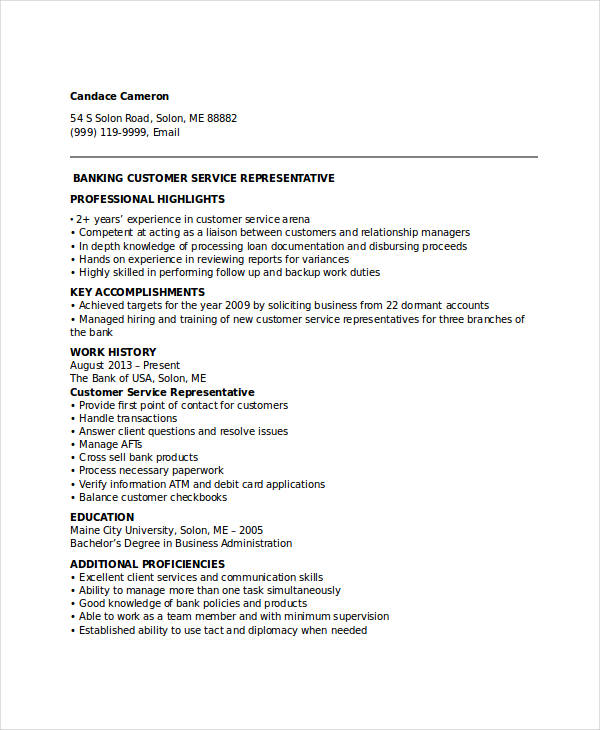

Banking Customer Service Resumes

Retail banking customer service resume.

Banking Customer Service Officer Resume

Banking Customer Service Manager Resume

Banking Customer Service Representative Resume

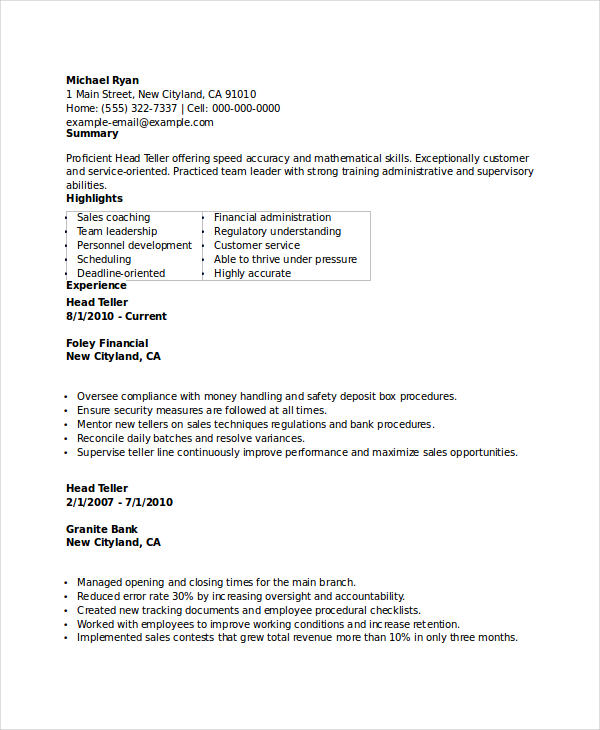

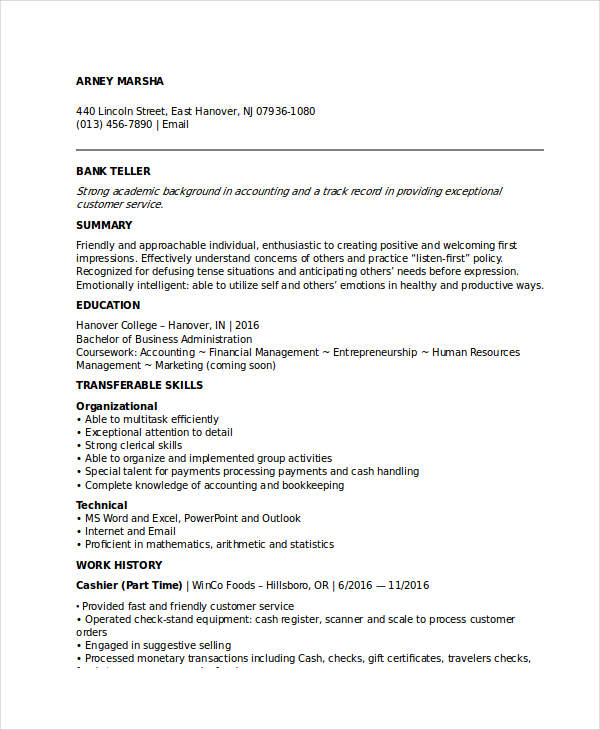

Banking Teller Resumes

Banking head teller resume.

Banking Bank Teller Job Resume

Free Retail Banking Teller Resume Sample

Banking Sales Resumes

Free banking sales manager with experience resume.

Free Retail Personal Banker Sales Resume

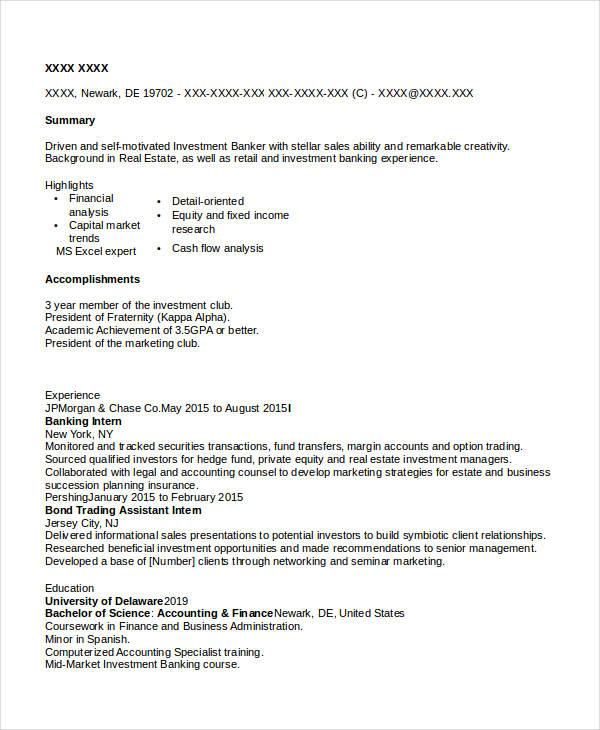

Investment Banking Resumes

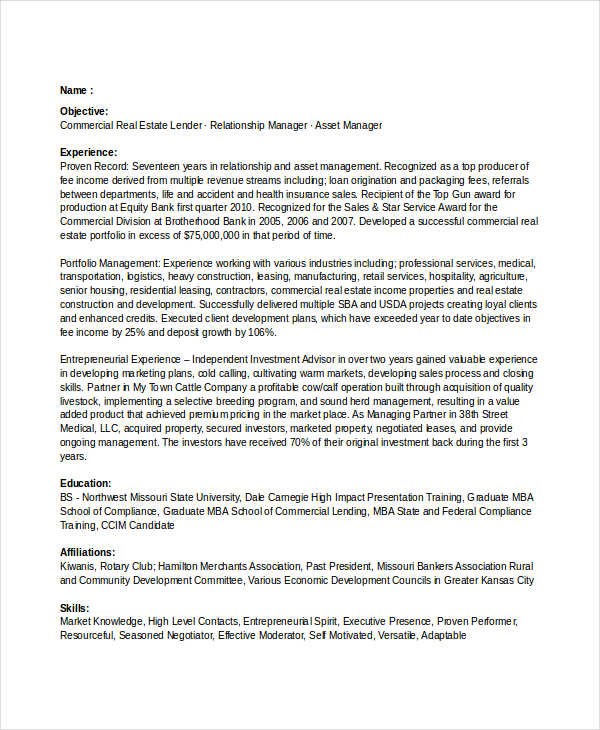

Free investment banking relationship manager resume.

Free Investment Banking Associate Resume

Commercial Banking Resumes

Free commercial real estate banking resume.

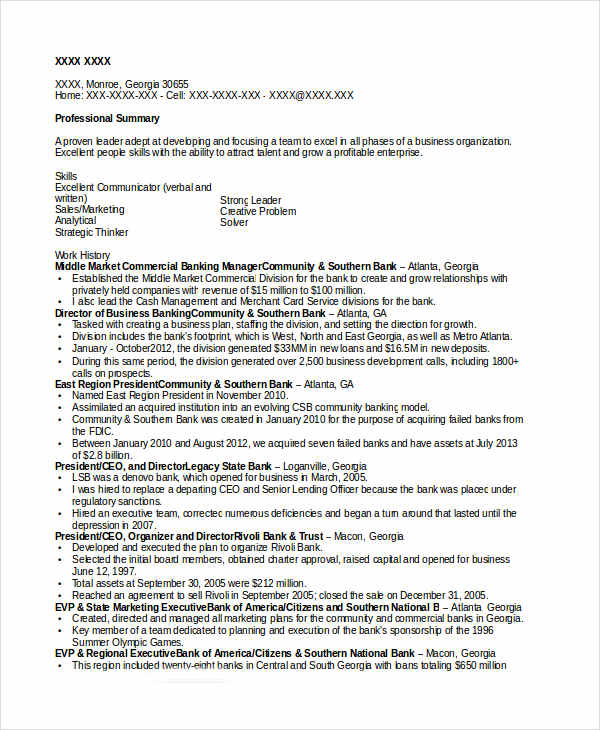

Commercial Banking Manager Sample Resume

Commercial Banking Resume Sample Template

Uses for These Bank Resumes

- Banking Customer Service Resumes. Tailored specifically for the customer service aspect in banking.

- Banking Teller Resumes. Entry-level, career-shifters and even experienced bankers should use this concise, well-organized template.

- Banking Sales Resumes. If you want to apply your sales knowledge in selling bank services to customers form, this resume is perfect for you.

- Investment Banking Resumes. If your life’s purpose is to watch other people grow, then download this template and apply it to your nearest bank now.

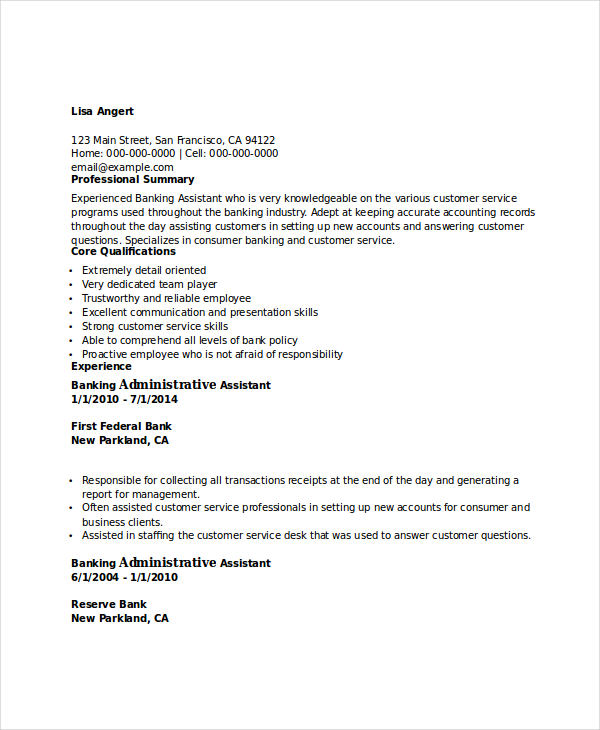

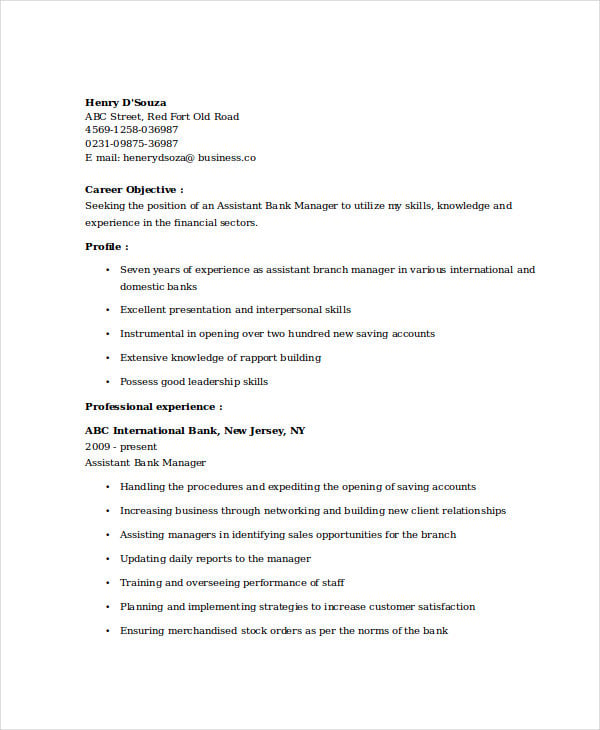

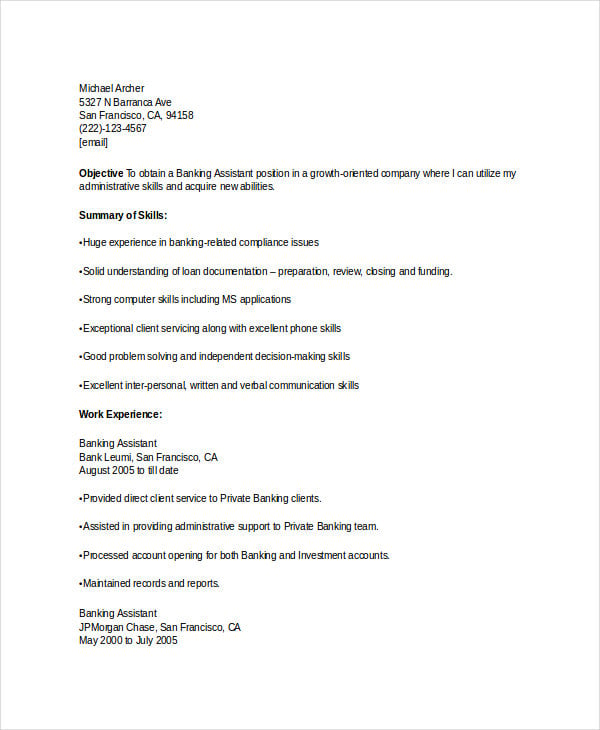

Banking Assistant Resumes

Banking administrative assistant resume.

Banking Assistant Manager Resume

Financial / Finance Banking Assistant Resume with Summary

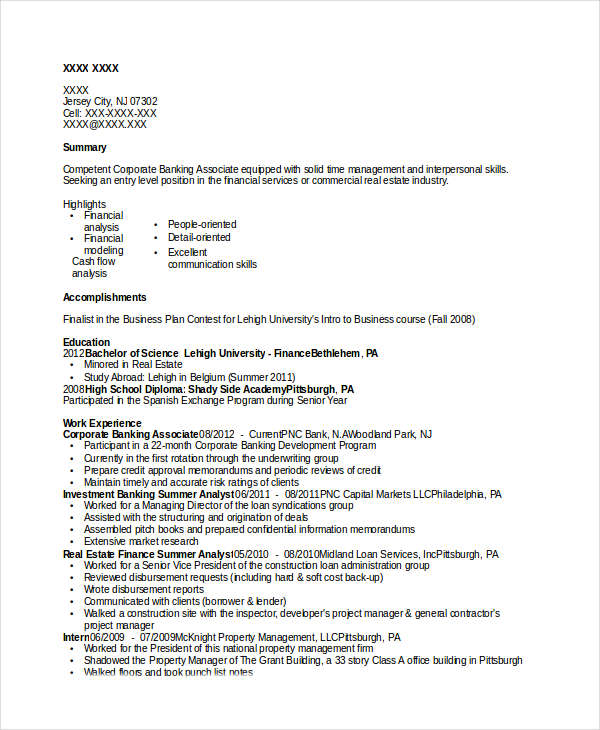

Corporate Banking Resumes

Corporate banking associate resume.

Corporate Banking Analyst Resume Template

Corporate Banking Manager Sample Resume

Banking Analyst Resumes

Banking business analyst sample resume.

Retails Banking Resume Sample Template

Banking Specialist Resumes

Business banking specialist resume.

Banking Operations Specialist Resume

Personal Banking Specialist Sample Resume

Banking Executive Resumes

Banking sales executive resume.

Investment Banking Executive Resume

Senior Banking Executive Sample Resume

How to Properly Write a Banking Resume

- Remember to write the basics of any resume. Make sure to include your name, address, contact number, and more. This helps the bank keep information about you that they may need for future references. Also, banks aren’t going to accept applicants who forget to write their names on the modern resume or applicants they can’t even contact back because they don’t have any information as to how to contact them.

- Make sure to include any information you think may be relevant. It’ll be important for you to include every information that you think can help you with the job—special recommendations from other companies, awards in school, previous job experiences, etc. This helps the company get to know a little bit better about your background and job skills.

Banking Consultant Resumes

Retail banking consultant resume.

Banking Sales Consultant Resume

Banking Manager Resumes

Banking project accountant manager resume.

Banking Operations Manager Resume

Banking Retired Sales Manager Resume

Entry Level Banking Resumes

Entry level investment banking resume.

Entry Level Brunch Banking Job Resume

Sample Entry Level Banking Resume

Retail Banking Resumes

Retail banking experience resume.

Free Retail Banking Manager Sample Resume

Free Retail Banking Executive Resume

Free Retail Banking Officer Resume

Banking Operations Resumes

Free retail banking operations resume.

Free Banking Operations Executive Resume

Free Banking Operations Analyst Resume

Fresh Graduate Banking Operations Officer Resume

Money Exchanger Banking Resume

Free Vice President Banking Resume

Why You Should Use These Bank Resumes

More in resume, professional cv template, bank accountant resume, professional banking resume, business banking relationship manager resume, community bank president resume, branch bank manager resume, assistant banker resume, banking resume for freshers, banking resume for experienced, professional resume template.

- 12+ HR Fresher Resume Templates

- 21+ Fresher Resume Templates

- 21+ Nurse Resume Templates – PDF, DOC

- 39+ Accountant Resumes in Doc

- 19+ Doctor Resume Templates – PDF, DOC

- 7+ Fresher Accountant Resumes

- 36+ Resume Format – Word, PDF

- 47+ Engineering Resume Templates in Word

- 13+ Computer Science Resume Examples

- 28+ Fresher Resume Templates in Word

- 10+ IT Fresher Resumes

- 48+ Resume Formats in PDF

- 50+ Best Resume Templates to Download

- 3+ Recruitment Consultant CV Templates in PDF

- 12+ Logistics Resume Templates in PDF | MS Word | Apple Pages

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

- ResumeBuild

5 Amazing banking Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, banking: resume samples & writing guide, ursula upton, employment history.

- Provide customer service and assist customers with their banking needs

- Process customer transactions, including deposits, withdrawals, and loan payments

- Handle incoming and outgoing payments

- Identify customer needs and recommend appropriate financial services

- Assist with branch operations and administrative tasks

- Ensure compliance with banking regulations and procedures

- Monitor and report suspicious activity

Do you already have a resume? Use our PDF converter and edit your resume.

Bernie Benson

Professional summary.

- Participate in training and development courses

- Answer customer inquiries and resolve customer complaints

- Open new accounts and help customers with account maintenance

- Assist in the development of marketing strategies

- Cross-sell bank products and services

- Balance cash drawers at the end of the day

Yolie Nelson

- Perform customer verifications and credit checks

- Maintain accurate records of customer accounts

Stanley Gray

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

banking Job Descriptions; Explained

If you're applying for an banking position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers. When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

- here we processing NEW LOAN SETUP (the begining stage of mortgage)

- Providing process information, daily work updates and delivers the loans with clients.· Handling the Preparing higher escalation calls.· Take Responsibility of enter floor.· Meet in daily service level and Answering level.· Meet the Difficulties of customer queries.

- we have worked with CENLAR bank with follow screens

- ADD1,ADD2,BOR1,PCR,MERS,HZD,FLD,SSN…etc

banking/liv clerk

- Oversee cashiers and conduct cash-ups

- Investigate and report shortages and surpluses

- Manage branch float and and ensure cashier floats are readily available

- Work within strict audit requirements

- Compile daily banking pack and submit to Admin Manager

- Coordinate training for new cashiers and Banking back up

- Recruit new cashiers. Interview and selection process

- Investigating and process invoices parked by Receiving department

- Liaison with suppliers for credits or incorrect prices

banking Job Skills

For an banking position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few. Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Analysis

- Database Management

- Project Management

- Quality Assurance

- Troubleshooting

- Computer Literacy

- Technical Writing

- Financial Management

- Visualization

- Business Acumen

- Process Improvement

- Risk Management

- Software Development

- Data Mining

- Cloud Computing

- Programming

- Mobile Development

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently. Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Adaptability

- Organization

- Public Speaking

- Negotiation

- Conflict Resolution

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Strategic Thinking

- Emotional Intelligence

- Flexibility

- Reliability

- Professionalism

- Customer Service

- Presentation

- Written Communication

- Social Media

- Supervisory

- Documentation

- Relationship Management.

How to Improve Your banking Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Charles Carter

Provide your contact information and address year gaps, always explain any gaps in your work history to your advantage..

- Employers want to know what you've accomplished, so make sure to explain any gaps using a professional summary.

- Adding extra details and context to explain why you have a gap in your work history shows employers you are a good fit for the position.

How to Optimize Your banking Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

- Perform custmer verifications an credit checks.

- Balence cash drawerss at teh end of teh day.

- Maintane inaccurat records of customer accounts.

- Perform custmer verifications, and credit checkes.

- Handel incommin and outgoin paymants.

- Anser customer inquires n' resolve customer compliants.

Include Job Descriptions and Avoid Bad Grammar

Avoid sending a wrong first impression by proofreading your resume..

- Spelling and typos are the most common mistakes recruiters see in resumes and by simply avoiding them you can move ahead on the hiring process.

- Before submitting your resume, double check to avoid typos.

banking Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an banking position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

To the respected PNC Bank Hiring Team

I am writing to express my interest in the Senior Banking role at PNC Bank. As a Banking with 5 years of experience, I am confident that I possess the necessary skills and qualifications to excel in this position.

As someone who has faced challenges in various areas of my life and has overcome them, I am confident in my ability to adapt and thrive in any environment. I have developed a reputation for being a collaborative team player and an effective problem solver, which has been instrumental in my career's success. With my experience and passion for the Banking field, I am excited to apply my skills to this role and contribute to your organization's growth and success.

Thank you for considering my application for the Senior Banking position. With my skills and the amazing team at this organization, I am assured that I can contribute to your organization's success and make a meaningful impact. Looking forward to a future where we can work together.

Showcase your most significant accomplishments and qualifications with this cover letter. Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Contemporary

Professional

Looking to explore other career options within the Banking field?

Check out our other resume of resume examples.

- Banking Resume

- Loan Processor Resume

- Personal Banker Resume

- Treasury Analyst Resume

- Loan Officer Resume

- Bank Teller Resume

- Banker Resume

FIND EVERYTHING YOU NEED HERE.

IF YOU HAVE QUESTIONS, WE HAVE ANSWERS.

4 Ways a Career Test Can Jump-Start Your Future (and Help Your Resume)

If you’re looking for a fresh path or a new passion, a career test could help you find it. You can take these tests online, in the comfort of your...

Avoid These 3 Resume Mistakes at All Costs

Your resume is your first impression for a prospective employer. The way you present yourself in that little document can make or break you – it can clinch you an...

Resume Design Tips and Tricks

Creating a resume that stands out from the rest doesn’t have to be rocket science. With just a few tips and tricks, you can make your professional resume a shining...

Build your Resume in 15 minutes

- Sample Resumes

FREE 11+ Banking Resume Samples in MS Word | PSD | AI | Publisher | Pages | Indesign

After researching possible banking careers and knowing which type of job interests you most, it’s the perfect time to put that knowledge to good use. Prior to landing an interview, you need to create an appealing sample resume . Take some time to contemplate what you would like to say to your potential employers about yourself. But what if you’re struggling on how you will express yourself, especially your skills and achievements to them? Don’t worry! We’re here to help you jumpstart your journey in your banking career. Just check our templates below and carefully read this article as we share valuable steps that can help you in this matter.

Banking Resume

Free 11+ banking resume samples, 1. banking cv format in word free download, 2. banking resume format word, 3. resume for bank job fresher in word format, 4. banking cv format in word, 5. resume format for bank job in word file download, how do i write a cv for banking, 6. banking resume template free download, 7. free cv template for banking job, 8. bank resume format pdf, 9. bank resume format pdf download, 10. bank job cv format pdf, 11. resume format for bank job, what is the key skill for bank job, 12. banking resume sample, what is a banking resume, how to create a banking resume, 1. focus on clarity and brevity, 2. feature your accomplishments and contributions, 3. be honest at all times, 4. proofread and revise your resume, what skills are required for banking jobs, what should i put on my resume for banking, what is bank resume, how do i write a bank resume, what do banks look for in a resume, what are the best jobs in banking.

Size: A4 & US

Writing a compelling CV (Curriculum Vitae) for a banking position is essential to make a strong impression on potential employers. Here’s a guide on how to structure and write an effective banking CV:

- Contact Information: Include your full name, phone number, email address, and LinkedIn profile (if applicable). Ensure this information is accurate and up-to-date.

- Personal Statement: Write a concise personal statement or objective that highlights your career goals, skills, and what you bring to a banking role.

- Professional Summary: Provide a brief summary of your banking experience, key skills, and achievements. Tailor this section to showcase your suitability for the specific banking position you’re applying for.

- Skills: Create a dedicated section for key skills relevant to the banking industry. Include both technical skills (e.g., financial analysis, risk management) and soft skills (e.g., communication, teamwork).

- Job title and dates of employment.

- Name of the company or financial institution.

- Key responsibilities and achievements.

- Quantify your achievements whenever possible (e.g., “Managed a portfolio of X clients”).

- Education: Include your educational background, starting with the most recent degree. Mention the institution, degree earned, graduation date, and any relevant honors or awards.