- Help & Terms of Use

Three essays on corporate governance and ESG investing

- School of Accounting and Finance - Business School

- Bristol Doctoral College

Student thesis : Doctoral Thesis › Doctor of Philosophy (PhD)

File : application/pdf, 2.31 MB

Type : Thesis

- Persistent link

- Help & FAQ

Essays in corporate finance and ESG

- Center Ph. D. Students

Research output : Thesis › Doctoral Thesis

Access to Document

- 10.26116/jbea-0x27

- Proefschrift Zhenshu Wu_digitaal Final published version, 2.35 MB

Fingerprint

- Corporate Finance Business & Economics 100%

- Carbon Business & Economics 69%

- Governance Business & Economics 61%

- Scandal Business & Economics 47%

- Corporate Cash Holdings Business & Economics 30%

- Market Crash Business & Economics 28%

- Increase in Risk Business & Economics 28%

- Stock Performance Business & Economics 26%

T1 - Essays in corporate finance and ESG

AU - Wu, Zhenshu

N1 - CentER Dissertaton Series Volume: 720

N2 - The three essays collected in this PhD thesis are on topics of corporate finance and environmental, social, and governance (ESG). The first essay examines the effect of state ownership on the relationship between ESG and stock performance. Taking the COVID-19 market crash as an exogenous shock, this study suggests that the benefit of ESG activities on stock returns is driven by non-state-owned enterprises. The second essay investigates the intra-industry effects of environmental and social (ES) scandals in China. It demonstrates that, although rivals experience a significant decline in stock prices during scandal announcements, rivals’ strong ES performance can mitigate the negative influence through channels of risk. The third essay studies how carbon risk affects corporate cash holding policies and documents a significant increase in high-carbon emitters’ cash holdings when carbon risk increases in China.

AB - The three essays collected in this PhD thesis are on topics of corporate finance and environmental, social, and governance (ESG). The first essay examines the effect of state ownership on the relationship between ESG and stock performance. Taking the COVID-19 market crash as an exogenous shock, this study suggests that the benefit of ESG activities on stock returns is driven by non-state-owned enterprises. The second essay investigates the intra-industry effects of environmental and social (ES) scandals in China. It demonstrates that, although rivals experience a significant decline in stock prices during scandal announcements, rivals’ strong ES performance can mitigate the negative influence through channels of risk. The third essay studies how carbon risk affects corporate cash holding policies and documents a significant increase in high-carbon emitters’ cash holdings when carbon risk increases in China.

U2 - 10.26116/jbea-0x27

DO - 10.26116/jbea-0x27

M3 - Doctoral Thesis

SN - 978 90 5668 722 9

T3 - CentER Dissertation Series

PB - CentER, Center for Economic Research

CY - Tilburg

- Browse All Articles

- Newsletter Sign-Up

CorporateGovernance →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

- My Shodhganga

- Receive email updates

- Edit Profile

Shodhganga : a reservoir of Indian theses @ INFLIBNET

- Shodhganga@INFLIBNET

- Indira Gandhi Institute of Development Research

Items in Shodhganga are licensed under Creative Commons Licence Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

Corporate Governance Research Paper Topics

This guide provides a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on choosing a relevant and feasible topic, and tips on how to write a successful corporate governance research paper. Corporate governance is a critical aspect of modern business that has a significant impact on the success of organizations. As a result, students who study corporate governance are often assigned to write research papers that explore various aspects of the topic. In addition, iResearchNet offers custom writing services that provide expert degree-holding writers, customized solutions, and timely delivery. By using this guide and iResearchNet’s writing services, students can ensure that their corporate governance research papers meet the highest academic standards.

Corporate Governance Research

Corporate governance is a critical aspect of modern business that encompasses the practices, processes, and systems by which organizations are directed, controlled, and managed. As a result, students who study corporate governance are often assigned to write research papers that explore various aspects of the topic, ranging from board structures and executive compensation to shareholder activism and stakeholder engagement.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code.

In this guide, we provide a comprehensive list of corporate governance research paper topics divided into 10 categories, expert advice on how to choose a relevant and feasible topic, and tips on how to write a successful corporate governance research paper. In addition, we offer custom writing services through iResearchNet that provide expert degree-holding writers, customized solutions, and timely delivery.

By using this guide and iResearchNet’s writing services, students can ensure that their corporate governance research papers are well-researched, well-written, and meet the highest academic standards.

100 Corporate Governance Research Paper Topics

Corporate governance is a broad and complex topic that encompasses a wide range of issues and challenges facing modern organizations. To help students choose a relevant and feasible corporate governance research paper topic, we have divided our comprehensive list of topics into 10 categories, each with 10 topics.

Board of Directors

- Board independence and effectiveness

- Board diversity and gender equality

- CEO duality and separation of roles

- Board composition and characteristics

- Board oversight and accountability

- Board nominations and elections

- Board leadership and culture

- Board committees and responsibilities

- Board evaluation and performance

- Board compensation and incentives

Executive Compensation

- Executive pay and performance

- Executive pay and firm performance

- Pay-for-performance and pay-for-skill

- CEO pay ratios and pay equity

- Stock options and equity-based compensation

- Executive severance and golden parachutes

- Executive perquisites and benefits

- Executive retirement and pensions

- Say-on-pay and shareholder activism

- Institutional investors and executive pay

Shareholder Activism

- Shareholder rights and activism

- Shareholder proposals and proxy access

- Shareholder engagement and communication

- Shareholder activism and corporate social responsibility

- Institutional investors and shareholder activism

- Hedge funds and shareholder activism

- Shareholder activism and executive compensation

- Shareholder activism and board independence

- Shareholder activism and corporate governance reforms

- Shareholder activism and CEO turnover

Stakeholder Engagement

- Stakeholder identification and analysis

- Stakeholder mapping and prioritization

- Stakeholder communication and dialogue

- Stakeholder participation and empowerment

- Stakeholder consultation and feedback

- Stakeholder engagement and corporate social responsibility

- Stakeholder engagement and sustainability reporting

- Stakeholder engagement and risk management

- Stakeholder engagement and corporate reputation

- Stakeholder engagement and value creation

Corporate Culture and Ethics

- Corporate values and ethics

- Ethical leadership and decision-making

- Corporate social responsibility and sustainability

- Business ethics and compliance

- Corporate citizenship and philanthropy

- Corporate culture and values alignment

- Corporate culture and employee behavior

- Corporate culture and organizational performance

- Corporate culture and innovation

- Corporate culture and risk management

Board-Shareholder Relations

- Board-shareholder communication and engagement

- Board-shareholder conflict resolution

- Board-shareholder cooperation and collaboration

- Board-shareholder activism and response

- Board-shareholder rights and responsibilities

- Board-shareholder agreements and charters

- Board-shareholder engagement and corporate social responsibility

- Board-shareholder relations and institutional investors

- Board-shareholder relations and minority shareholders

- Board-shareholder relations and corporate governance reforms

Regulatory and Legal Environment

- Corporate governance regulations and compliance

- Corporate governance laws and policies

- Corporate governance codes and standards

- Corporate governance enforcement and penalties

- Corporate governance and public policy

- Corporate governance and the role of regulators

- Corporate governance and antitrust laws

- Corporate governance and securities laws

- Corporate governance and data privacy laws

- Corporate governance and intellectual property laws

Risk Management and Disclosure

- Enterprise risk management and oversight

- Risk management and strategic planning

- Risk management and financial reporting

- Risk management and sustainability reporting

- Risk management and cybersecurity

- Risk management and climate change

- Risk management and supply chain management

- Risk management and crisis management

- Risk management and stakeholder engagement

- Risk management and disclosure requirements

International Corporate Governance

- Cross-border mergers and acquisitions and corporate governance

- Corporate governance and foreign direct investment

- Corporate governance and multinational corporations

- Corporate governance and global supply chains

- Corporate governance and global financial markets

- Corporate governance and emerging markets

- Corporate governance and corruption

- Corporate governance and cultural diversity

- Corporate governance and the United Nations Sustainable Development Goals

- Corporate governance and global challenges

Corporate Governance Reform

- Corporate governance failures and scandals

- Corporate governance reforms and their impact

- Corporate governance and shareholder activism

- Corporate governance and executive compensation reform

- Corporate governance and board independence reform

- Corporate governance and stakeholder engagement reform

- Corporate governance and diversity and inclusion reform

- Corporate governance and sustainability reform

- Corporate governance and regulatory reform

- Corporate governance and future trends

By organizing the corporate governance research paper topics into categories, students can easily identify areas of interest and develop research questions that align with their academic goals and interests. The categories cover a wide range of issues and challenges facing modern organizations, from board structures and executive compensation to stakeholder engagement and international corporate governance.

Choosing a Topic in Corporate Governance

Choosing a relevant and feasible corporate governance research paper topic is critical for success in academia. The following are expert tips on how to choose a corporate governance research paper topic:

- Consider your interests : Choose a topic that you are interested in and passionate about. Your enthusiasm for the topic will help you stay motivated throughout the research and writing process.

- Identify a research gap : Choose a topic that fills a research gap or addresses a new research question. This will help you contribute new knowledge to the field and make a meaningful contribution to academic scholarship.

- Consult with your instructor : Discuss potential topics with your instructor and seek feedback on your ideas. Your instructor can help you refine your research question and suggest relevant literature and sources.

- Conduct a literature review : Conduct a literature review to identify gaps and areas of interest within the field. This will help you develop research questions and identify key concepts and themes.

- Consider feasibility : Choose a topic that is feasible given the time and resources available to you. Be realistic about your research scope and the data sources that are available to you.

- Stay current : Choose a topic that is current and relevant to the field. This will help you stay up-to-date on the latest trends and developments in corporate governance.

- Identify a manageable scope : Choose a topic that has a manageable scope. Narrow down your research question to a specific aspect of corporate governance that can be explored in-depth within the scope of a research paper.

- Brainstorm potential topics : Brainstorm a list of potential topics based on your interests, literature review, and discussions with your instructor. Evaluate each topic based on its relevance, feasibility, and potential impact.

By following these expert tips, students can choose a relevant and feasible corporate governance research paper topic that aligns with their academic interests and goals. In the next section, we provide tips on how to write a successful corporate governance research paper.

How to Write a Corporate Governance Research Paper

Writing a successful corporate governance research paper requires careful planning and attention to detail. The following are expert tips on how to write a corporate governance research paper:

- Develop a clear research question : Develop a clear and concise research question that addresses a gap or new research question within the field of corporate governance. The research question should be specific and focused to ensure a manageable scope for the research paper.

- Conduct a literature review : Conduct a comprehensive literature review to identify key concepts and themes within the field of corporate governance. This will help you develop a theoretical framework and provide a foundation for your research paper.

- Select appropriate research methods : Select appropriate research methods that align with your research question and objectives. This may include qualitative, quantitative, or mixed-methods research approaches.

- Collect and analyze data : Collect and analyze data using appropriate research methods. This may include conducting interviews, surveys, or analyzing financial data. Ensure that your data collection and analysis is rigorous and aligns with the research question and objectives.

- Develop a clear and structured outline : Develop a clear and structured outline for your research paper. This will help you organize your thoughts and ideas and ensure a logical flow of information.

- Write a clear and concise introduction : Write a clear and concise introduction that provides background information and context for the research question. The introduction should also clearly state the research question and objectives.

- Develop a comprehensive literature review : Develop a comprehensive literature review that provides a theoretical framework for the research question. The literature review should be organized thematically and include key concepts and themes within the field of corporate governance.

- Analyze and interpret findings : Analyze and interpret the findings of the research. Ensure that your analysis and interpretation aligns with the research question and objectives.

- Develop a clear and concise conclusion : Develop a clear and concise conclusion that summarizes the key findings of the research and provides implications for practice and future research.

- Ensure proper formatting and citation : Ensure that your research paper is properly formatted and cited. Follow the guidelines of the citation style required by your instructor, such as APA, MLA, or Chicago.

By following these expert tips, students can write a successful corporate governance research paper that contributes new knowledge to the field and makes a meaningful contribution to academic scholarship. In the next section, we provide information on how students can benefit from the iResearchNet writing services for corporate governance research papers.

iResearchNet Writing Services for Corporate Governance Research Papers

At iResearchNet, we understand the importance of producing high-quality corporate governance research papers that meet the academic standards of students. Our team of expert degree-holding writers can help students produce well-written and well-researched corporate governance research papers that meet the requirements of their instructors. Our writing services include the following features:

- Expert degree-holding writers : Our writers are experts in corporate governance with advanced degrees in the field. They have the knowledge and expertise to produce high-quality research papers that meet the academic standards of students.

- Custom written works : We provide custom written works that are tailored to the specific needs and requirements of each student. Our writers work closely with students to ensure that their research papers meet their expectations and academic standards.

- In-depth research : Our writers conduct in-depth research to ensure that the research papers are well-supported with relevant and reliable sources.

- Custom formatting : Our writers are well-versed in various citation styles, including APA, MLA, Chicago/Turabian, and Harvard. We ensure that the research papers are properly formatted and cited according to the required citation style.

- Top quality, customized solutions : We are committed to providing top-quality and customized solutions that meet the unique needs and requirements of each student.

- Flexible pricing : We offer flexible pricing options to ensure that our writing services are affordable for students.

- Short deadlines : We can accommodate short deadlines of up to 3 hours for urgent assignments.

- Timely delivery : We ensure timely delivery of research papers to ensure that students have enough time to review and submit their assignments.

- 24/7 support : We provide 24/7 support to answer any questions or concerns that students may have about their research papers.

- Absolute Privacy : We prioritize the privacy and confidentiality of our clients. We ensure that all client information is kept confidential and secure.

- Easy order tracking : We provide easy order tracking to enable students to track the progress of their research papers.

- Money-back guarantee : We offer a money-back guarantee to ensure that students are satisfied with the quality of their research papers.

By using iResearchNet writing services, students can benefit from the expertise of our writers and produce high-quality corporate governance research papers that meet the academic standards of their instructors.

Order Your Custom Research Paper Today!

Writing a successful corporate governance research paper requires careful planning and attention to detail. By choosing a relevant and feasible research paper topic, conducting a comprehensive literature review, and following the tips outlined in this article, students can produce high-quality research papers that make meaningful contributions to the field of corporate governance. Additionally, iResearchNet writing services offer students a valuable resource for producing high-quality research papers that meet the academic standards of their instructors. With expert degree-holding writers, customized solutions, and a range of support features, iResearchNet can help students achieve academic success and excel in their studies. Contact us today to learn more about our writing services and how we can assist you in your corporate governance research paper writing needs.

ORDER HIGH QUALITY CUSTOM PAPER

- Dean's Message

- Our Divisions & Units

- Publications

- Program-based

- School-based

- Scholarships

- IDPO Courses Syllabi

- Quality Assurance

- Students Sharing

- Video Sharing

- Enrichment Programs

- Corporate & Professional Development

- AIS SA Program

- Student Wellness Consultation

- Wellness & Relaxation

- Impact Stories

- Research Facilities

- Newsletters

- Latest Events

- Visit Giving Alumni Events

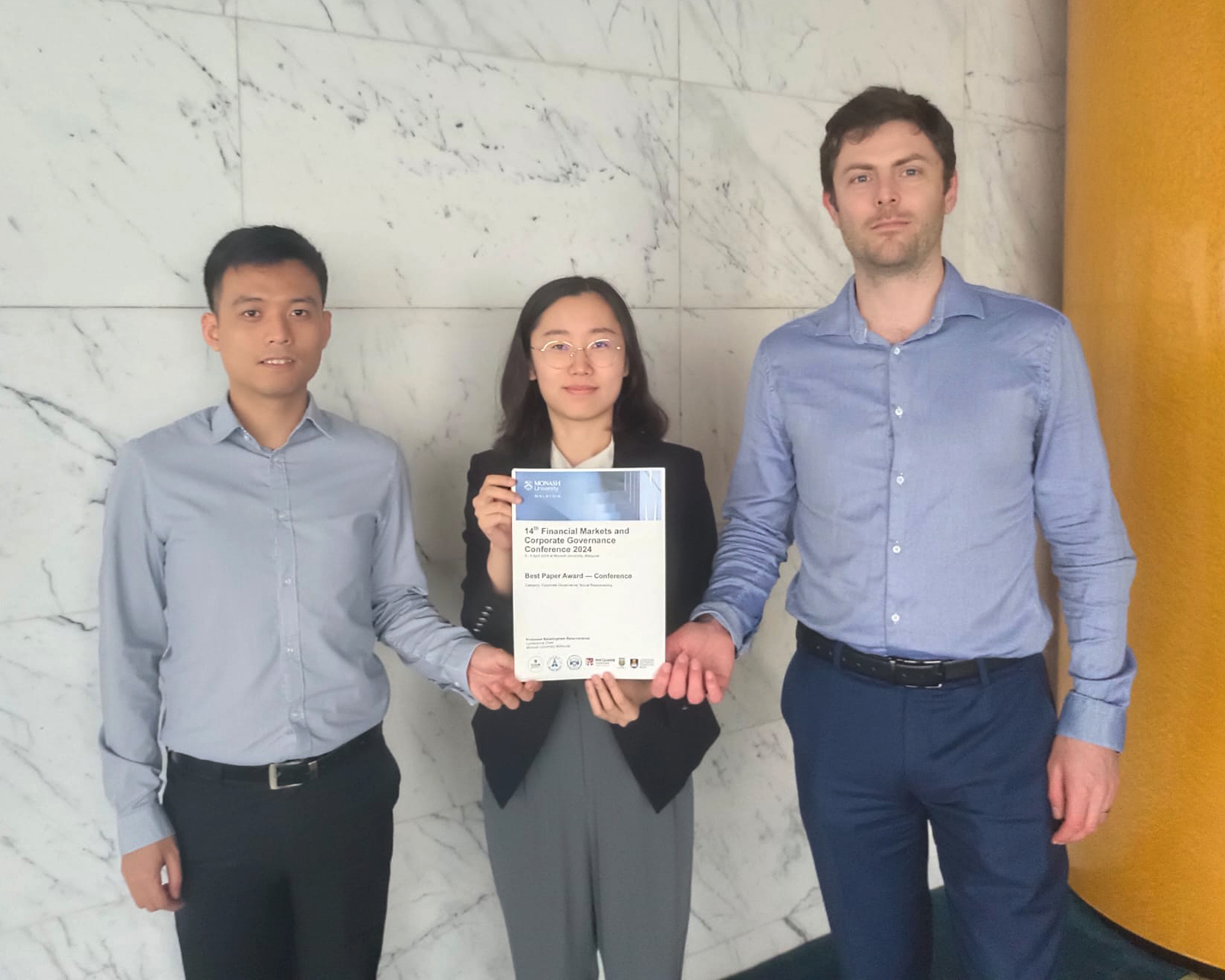

Prof. Keith CHAN (Assistant Professor, Division of Environment and Sustainability ) and Prof. Quentin MOREAU (Assistant Professor, Division of Environment and Sustainability ), together with their PhD student in Environmental Science, Policy and Management WANG Xiaoqing Nora, have received the Best Paper Award in the Corporate Governance/Social Responsibility category at the 14th Financial Markets and Corporate Governance Conference 2024 for their paper titled "Do responsible firms behave differently in difficult times?".

The paper examines whether firms maintain their sustainability efforts or prioritize shareholders during challenging periods. The team presents evidence that these firms tend to reduce dividends (paid to shareholders) and sustainability efforts more than others, and they identify predictors of responsible firms that prioritize shareholders over other stakeholders when experiencing financial losses.

The 14th Financial Markets and Corporate Governance Conference was hosted by Monash University Malaysia from April 2nd to 4th, 2024. The conference brought together esteemed academics, industry experts, and practitioners to discuss pressing topics shaping the financial landscape, including Sustainable Finance, Earnings Quality, FinTech, Governance, and post-pandemic challenges in Financial Markets.

Please join us in congratulating Prof. Keith, Prof. Quentin, and Nora!

Harvard, Yale Students Shout Divest at Unyielding Colleges (2)

By Janet Lorin, Eliyahu Kamisher and Katia Porzecanski

A cause celebre is ringing out across Harvard Yard, Columbia’s South Lawn, Yale’s Beinecke Plaza and UC Berkeley’s Sproul Plaza: Disclose and divest.

And university students say they won’t stop protesting against Israel until that demand is met.

“We’re willing to risk suspension, expulsion and arrest, and I think that that will put pressure,” said Malak Afaneh, a law student at University of California, Berkeley, and a protest organizer.

She and her fellow pro-Palestinian demonstrators want universities to cut their investments in everything tied to Israel and weapons that fuel the war in Gaza. That means funds run by BlackRock ...

Learn more about Bloomberg Law or Log In to keep reading:

Learn about bloomberg law.

AI-powered legal analytics, workflow tools and premium legal & business news.

Already a subscriber?

Log in to keep reading or access research tools.

- Kreyòl Ayisyen

Prepared Remarks of CFPB Director Rohit Chopra at Rutgers Law School Center for Corporate Law and Governance

It’s been a pleasure to be back in Philadelphia and Camden today. Thank you to the Rutgers Law School Center for Corporate Law and Governance for having me.

Today, I want to talk about the subprime-style lending powered by securitization that plagued the country twenty years ago. I am not talking about mortgages. I'm referring to another subprime machine that got less attention at the time, but is more front-and-center today: student loans.

First, I am going to explain a bit about student-loan securitization. Then, I want to tell you about a lawsuit the CFPB filed that was focused on a securitization trust, including a recent opinion issued in the Third Circuit Court of Appeals, which covers where we are sitting today. I'll close with some thoughts about how the CFPB and other law enforcement agencies are thinking about other corporate forms and their responsibilities under the law.

Student-Loan Securitization

Law students across the country are taking on enormous debt. According to one study, the average law student owes $160,000 in student loan debt, with nearly three-quarters of that debt coming from the cost of law school. 1 This is particularly challenging for those attending private and for-profit institutions. Indeed, the same study found Rutgers to be one of the more affordable top-tier law schools to attend.

Student debt now tops $1.6 trillion 2 , and many law students feel the anxiety of debt and how it may distort their career choices.

The size of the student loan market unsurprisingly has attracted investors over the years. One way loan originators can take advantage of interest from investors is through securitization.

Here’s how securitization works: while there are a couple of technical intermediate steps, the loan originator – the firm who actually lent consumers the money – sells the bundle of loans to a trust, which is just a separate legal entity set up for this purpose.

The trust turns the loans into bonds by issuing certificates to investors that promise to pay them some portion of the cash flows, the principal and interest, generated by the loans owned by the trust. Now, these securities can slice and dice the cash flows produced by the loans in all sorts of complex ways to provide the investor with more or less risk than the loans carry themselves. And to close the loop, the trust uses the money investors pay to purchase the loans from the originator.

At this point, the investors own bonds based on the loans, but the trust owns the loans themselves. The trust is in charge of collecting interest and servicing the loans, including by hiring third parties.

Turning loans into bonds – or securitization – enables banks and other loan originators to gain immediate liquidity. That is to say, after originating a loan and selling a loan to a trust, it now has money freed up to go make another loan. And, instead of keeping the risk on their own books, the originator can sell to a trust that then spreads the risk across a broader universe of willing investors. In theory, this should drive down borrowing costs for consumers – so long as there are willing buyers for the loans.

While slicing and dicing cash flows is an old concept, modern securitization, which started with mortgages, can trace its roots to right after the Second World War. A housing crunch followed the millions of servicemembers returning home once the war ended. One reason for the housing crunch was that banks did not have the liquidity to make and hold all the mortgages that the economy needed. Bankers eventually developed an investment vehicle that isolated defined mortgage pools, segmented the credit risk, and structured the cash flows from the underlying loans. 3 In other words, they developed securitized assets. Over time, the product class has moved beyond mortgages and even beyond lending products with fixed terms.

Securities backed by student loans have seen significant growth. In 2007, about half-a-trillion dollars of student loans were owned and securitized. At the end of last year, that figure stood at more than $1.7 trillion. 4

Securitization of student loans began in November 1992. One of the first types of student loans to be securitized were those issued through the Federal Family Education Loan (FFEL) Program. These loans were federally guaranteed but issued through private lenders. Securitizing student loans opened the door to similar problems seen in the mortgage market in the lead up to the Great Recession. Specifically, that lenders become incentivized to make as many loans as possible – i.e., make the loans, sell them off, and use the raised money to make more student loans.

These incentives and weak oversight by federal regulators led to a number of scandals, involving kickbacks from lenders to schools and financial aid offices. In 2008, Congress banned many of these practices. Congress also ended the FFEL program with the 2009-2010 school year, though many still owe on these loans.

Private student loans were also able to be securitized beginning in 1992. However, at the time, private student loans were not a significant portion of the market. While government-guaranteed loans were established expressly to support people’s ability to attend college, private student loans really came into existence to bridge the gap between what students received from the government and the actual cost of college. And private student loans generally offered worse terms. There was not a reason to take out private loans so long as college was affordable.

As the cost of college steadily increased, so too did the share of private student loans. While private student loans do come with some underwriting standards, we saw those standards fall along with mortgage standards in the lead-up to the 2008 crisis.

Specifically, in the lead-up to the crisis, some lenders bypassed school financial aid offices and marketed loans directly to students. As a result, in many cases, the school could not review the borrower’s financial need, compare it to the loan amount, or even verify that the borrower was enrolled. Many lenders also lowered the minimum credit score required to receive a private student loan so that they could originate and then sell off more loans. Many students did not understand the differences and features between federal and private loans. They ended up using riskier private loans before exhausting their safer federal options.

In a joint report with the U.S. Department of Education, the CFPB found students were yet another group of consumers that were hurt by the boom and bust of the financial crisis. Specifically, as private student loans were funded in large part by the asset-backed securities market, many lenders made money by originating and then selling private student loans with less regard for borrowers’ creditworthiness. In terms of overall outstanding student loan volumes, the private student loan market grew from less than $5 billion in 2001 to over $20 billion in 2008, and then rapidly contracted to less than $6 billion in 2011. 5

When Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which created the CFPB, it established a number of responsibilities for the CFPB in the student loan market.

That leads me into discussing the Third Circuit decision in CFPB v. National Collegiate Student Loan Trusts .

The CFPB’s Enforcement Action against the National Collegiate Student Loan Trusts

In September 2017, the CFPB took action against a group of 15 securitization trusts known as the National Collegiate Student Loan Trusts and their debt collection servicer, Transworld Systems, for unfair and deceptive practices in debt collection lawsuits against defaulted student loan borrowers.

In 2017, the Trusts owned more than 800,000 student loans. Between 2001 and 2007, the Trusts purchased and securitized the loans, and then sold notes secured by the loans to investors. Over time, some of the borrowers on those student loans fell behind on their payments and ultimately defaulted. In order to sue to collect on a debt, the person or company filing suit must be able to prove that the consumer owed the debt and that they own the loan that is being collected. But by the time Transworld Systems was filing collection lawsuits on the Trusts’ behalf, it lacked documents necessary to prove ownership and the statute of limitations, the deadline for a plaintiff to file a lawsuit, on many loans had expired.

The Trusts and Transworld Systems went forward with debt collection lawsuits anyway. In fact, over 2,000 collections lawsuits were filed on behalf of the Trusts. In these lawsuits, the Trusts did not have or could not find the documentation necessary to prove either that they owned the loans or that the targeted consumers owed the debts.

In some of these cases, the Trusts could not even produce evidence the consumer ever agreed to pay back the loan. Nonetheless, the Trusts filed suit against the consumers to collect the debts. Further, in many of the collections lawsuits, the Trusts filed false and misleading affidavits.

The CFPB sued the trusts for this conduct. We contend that it violates the Consumer Financial Protection Act. They argued that, as trusts, they were not covered persons under the Consumer Financial Protection Act. Their argument was that the CFPB could only sue the people who did the dirty work – the debt collectors and servicers – not the trusts who hired them to do it on the Trusts’ behalf.

The case made its way to the Third Circuit Court of Appeals. A decision against the CFPB could have been read to suggest the law does not cover the institutions actually calling the shots in many financial transactions. In securities markets, a negative decision would have had the potential to be especially dangerous, given the investment nature of securitization.

Decision by the United States Third Circuit Court of Appeals

The Third Circuit resolved that the Trusts are “covered persons” under the Consumer Financial Protection Act because they engage in offering or providing consumer financial products or services.

The Third Circuit cited the 15 trusts’ own intra-trust agreement, and made four key points. First, the Trusts acquired student loans in order to begin an enterprise or activity.

Second, the Trusts entered into agreements with third-party servicers. Those agreements acknowledged that the third parties were carrying out activities that would otherwise be the direct responsibility of the Trusts.

Third, without the third-party servicers, the Trusts could not fulfill their obligations of servicing student loans. The Trusts did not have any employees and made themselves dependent on third-party servicers to carry out servicing requirements.

Fourth, the lawsuits brought against borrowers were done to benefit the Trusts. “As such, the Trusts cannot claim that they did not ‘take part in’ collecting debts.” 6

In other words, the Trusts engaged in conduct making them a covered person, even though they did so by hiring other companies to act on their behalf. They wanted to collect debts, including through debt collection and lawsuits. The trusts entered into special servicing agreements with others in order to provide for the servicing, collection, and litigation of delinquent and defaulted loans.

The Trusts cannot use the fact that they hired someone else to do the job to avoid coverage under the Consumer Financial Protection Act. Accordingly, the Third Circuit Court of Appeals returned the case to the district court, in order for the Trusts to face accountability.

As the Court affirmed, people and entities can be considered covered persons under the Consumer Financial Protection Act, even if they do not directly perform certain activities themselves. Instead, if they arrange for others to carry out these activities on their behalf, they can still be held liable. Those who control and direct the activities are accountable, not just the third parties they hire.

It is important to ensure that owners and others have the right incentives not to hire people to break the law on their behalf.

This is particularly relevant for securitized trusts, because it means that the owners cannot sidestep their responsibilities under the law. It also means owners and others cannot evade accountability when they hire or contract with lawbreakers to work on their behalf.

1 . Average Law School Debt [2023]: Student Loan Statistics (educationdata.org)

2 . Household Debt and Credit Report - FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

3 . Asset Securitization (occ.treas.gov)

4 . FRED Economic Data (fred.stlouisfed.org)

5 . CFPB and U.S. Department of Education Joint Report Finds a Cycle of Boom and Bust in Private Student Loan Market (consumerfinance.gov)

6 . Consumer Financial Protection Bureau v. National Collegiate Master Student Loan Trust (uscourts.gov)

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. For more information, visit www.consumerfinance.gov .

advancing Oklahoma scholarship, research and institutional memory

- SHAREOK TM Home

- The University of Oklahoma

- OU - Dissertations

Essays in Corporate Governance

Collections

- OU - Dissertations [9327]

What is corporate governance? Essay

Importance of corporate governance, works cited.

Corporate governance refers to a system that enables us to control and direct organisations. The IUFC defines corporate governance as “the relationships among the management, Board of Directors, controlling shareholders, minority shareholders, and other shareholders” (IFC 1).

While the traditional definition of corporate governance recognizes the existence and significance of the terms “other stakeholders”, however, there is still a lot of debate on the kind of relationship between on the one hand, self-serving managers and on the other hand, disconnected owners (Applied Corporate Governance para. 2). Corporate governance consists of two key components:

- The long-term relationship between the management and owners of a firm and the incentives for managers, checks and balances, as well as communication between investors and the management;

- Transactional relationships that include issues of authority and disclosure.

What the above two elements appears to suggest is that business owners are suspicious of the activities of their managers, as explained by the need for checks and balances. In addition, both the management and investors share an adversarial relationship. Corporate governance consists of five components that are worth of consideration by both investors and the management.

They include the long-term strategic goals of an organisation, customers, the environment, employees, and regulatory/legal compliance (Applied Corporate Governance para. 5). As such, corporate governance can be thought of as a culture that is founded on strong business ethics.

Corporate governance enables managers of a firm to fulfill the long-term strategic goals of the shareholders. In the process of fulfilling such goals, there is need to also consider that the expectations of the various stakeholders of the organisation (Kirkpatrick 6).

Therefore, the past, present and future interests of employees at the firm need to be addressed. In addition, the management should endevour to enhance excellent relationships with both suppliers and customers. At the same time, the needs and interests of the local community should also be fulfilled.

Globalisation has seen organisations becoming more complex as most of them have increased in terms of size and scale of trade. As a result, most organisations have ended up with a very bureaucratic structure as they try to manage the emerging complexity (Applied Corporate Governance para. 5). This has led to an augmentation of the importance of internal regulation and corporate governance owing to the increased difficulty of regulating organisations externally.

Many organisations view corporate governance as an important undertaking when it comes to the issue of integrity. Shareholders and the general public would want to be associated with an organisation that is led by leaders with integrity (Kirkpatrick 9). In this respect, corporate governance acts as a vital tool for measuring, encouraging, and projecting integrity within the organisation.

Corporate governance in an organisation is also important in as far as the bonus culture is concerned. The recent financial crisis helped to reveal the system of remuneration and bonuses operated by many financial institutions. There is a widely held argument that this system of remuneration and bonuses encouraged irresponsible lending and excessive risk taking by financial institutions, thereby triggering the global financial crisis (Applied Corporate Governance para. 6).

Ideally, the existence of a better checks and balances system would have sounded warning bells before it was too late. A number of financial experts outside the financial systems who were privy to the dangerous levels of lending practiced by many financial institutions had tried to raise an alarm but in the absence of a sound system of corporate governance, it was hard to ascertain these allegations.

In this case, sound corporate governance practices would have helped to contain the situation. Indeed, weaknesses and failures in corporate governance arrangements played a key role in the financial crisis experienced by financial institutions. Good corporate governance offers the right incentives for both the management and the Board of Directors to pursue the goals that are in the best interest of shareholders and the organisations at large (Tricker and Tricker 27).

In addition, good corporate governance also facilitates effective monitoring, thereby making it easy to detect deviations from the accepted norm and practices. Consequently, remedial measures can be taken before it is too late.

Corporate governance results in better regulatory framework within the organisation. What this means is that corporate governance leads to sound management of the organisation (Applied Corporate Governance para. 7). In the same way, when governance within a corporation fails, the management is deemed to have failed as well. In the recent global financial crisis, many financial institutions were rewarding their CEOs with hefty pension and bonus packages, even as the government struggled to bail out failing firms.

This is a reflection of poor management because it does not make financial sense to award a CEO a hefty package to leave office while the organisation is in financial limbo. In the financial markets, good corporate governance requires the right balance between on the one hand, customer choice and innovation and on the other hand, implementing basic standards. This may require organisations to change their corporate culture but in the end, the ensuing rewards are worth the sacrifice.

Corporate governance is also important to an organisation when it comes to the issue of training the directors. Following the collapse of such organisations as WorldCom and Enron in the past decade, questions have been raised on the need to re-assess the qualifications of directors. In the past, there has never been any formal yardstick with which to assess the qualifications of the senior people who run an organisation (Applied Corporate Governance para. 8).

From a practical point of view, majority of the large and well run corporations seek for the most fitting qualifications from among their senior staff; however, an increasingly larger number of organisations are now offering selection services and training to non-executive directors.

The collapse of the above mentioned firms and a dozen others has seen more professionals reassessing the role of direction as a discipline or professionals that demands specific forms of training and development. In this case, corporate governance has played a crucial role in efforts to re-evaluate the qualifications of directors charged with the responsibility of overseeing the operations of organisations (Tricker and Tricker 33).

Some MBA courses now include corporate governance as part of their course content. Such a trend should be encouraged so that the true importance of corporate governance can get the recognition it deserves.

In summary, corporate governance refers to the system that ensures the control and management of organisations. It enshrines the components of the long-term relationship between the owners of an organisation and the management. A sound corporate governance system should take into account the interests of the firms, the shareholders, the employees, suppliers, and the local community as well.

Corporate governance is important to an organisation with regard to the issue of integrity because shareholders and the general public would want to be associated with an organisation that has integrity. Also, corporate governance helps to contain the bonus culture within organizations. It also leads to better regulatory framework, as well as in the training of directors.

Applied Corporate Governance. The importance of corporate governance . 2009. Web.

IFC. Corporate Governance . 2005. Web.

Kirkpatrick, Grant. The Corporate Governance Lessons from the Financial Crisis . 2009. Web.

Tricker, Robert and Tricker, Bob. Corporate Governance: Principles, Policies and Practices. Oxford, UK: Oxford University Press, 2009. Print.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, January 4). What is corporate governance? https://ivypanda.com/essays/what-is-corporate-governance/

"What is corporate governance?" IvyPanda , 4 Jan. 2024, ivypanda.com/essays/what-is-corporate-governance/.

IvyPanda . (2024) 'What is corporate governance'. 4 January.

IvyPanda . 2024. "What is corporate governance?" January 4, 2024. https://ivypanda.com/essays/what-is-corporate-governance/.

1. IvyPanda . "What is corporate governance?" January 4, 2024. https://ivypanda.com/essays/what-is-corporate-governance/.

Bibliography

IvyPanda . "What is corporate governance?" January 4, 2024. https://ivypanda.com/essays/what-is-corporate-governance/.

- Is Bonus Banking the Answer?

- Annual Bonus Schemes and Earnings Manipulation

- Sharpe BMW: Implementing the Bonus Payment Plan

- Bonus Banking: Case of UBS

- Coastal Medical Center's Pay-for-Performance Bonus

- Review of Sharpe’s BMW

- The Motherhood Penalty vs. the Fatherhood Bonus

- Internet Job Research: Accountants and Auditors

- Effective Incentives in Motivating Workers

- Ethical Behavior at Work and Employee Relations

- The Roles of an Internal Auditor in Corporate Governance

- Duties of Corporate people

- Twenty four hour garage

- Political Influence and Corporate Transparency in Indonesian Companies

- Corporate Governance and Organizational Structure

What is This Management?: Essays on Corporate Governance and Management Education

Dean Bill Pounds was for many MIT Sloan students their favorite, most memorable teacher. In this collection of short essays on management and corporate governance, he shares practical, down-to-earth wisdom and insight on topics rarely touched on in the typical MBA curriculum, gleaned from his decades of experience across a wide variety of boards.

CEOs, corporate directors, and anyone interested in how organizations function and perform in the mysterious realm beyond the executive suite will find these timeless ideas a thought-provoking and sometimes irreverent complement to more traditional academic and legal treatments of these important subjects.

Any author proceeds from sales will be given to the MIT Sloan Annual Fund.

IMAGES

VIDEO

COMMENTS

Abstract. This thesis consists of three essays, presented as chapters, on corporate governance. The first chapter examines the internal corporate governance channels that focus on CEO compensation structure and the board of directors. The following two chapters study corporate governance mechanisms from an external perspective.

Abstract. This thesis consists of three essays investigating the effect of internal and external corporate governance on corporate behaviours, as well as investigating the topic of Environmental, Social and Governance (ESG) finance. Chapter 2 seeks to understand the effectiveness of board of directors on firms' environmental performance—a ...

Corporate governance has been defined in various ways from "the system by which companies are directed and controlled" (Cadbury, ... In this essay, we highlight key changes in the corporate governance context over the past two decades and provide scholars a roadmap for future research. The newly transformed shareholder landscape and the ...

Corporate governance is a set of policies and rules used to direct and control a company's operations. It is essential for managing a firm and balancing the interests of the stakeholders, shareholders, executive directors, suppliers, and customers. Accountability, transparency, fairness, and responsibility form the corporate governance framework.

This dissertation is a collection of three essays that investigate the role and importance of corporate governance in public and private firms. Chapter 1, investigates the role of governance characteristics in determining the probability of a firm undergoing a going private transaction. Firms with greater board control are

The three essays collected in this PhD thesis are on topics of corporate finance and environmental, social, and governance (ESG). The first essay examines the effect of state ownership on the relationship between ESG and stock performance. Taking the COVID-19 market crash as an exogenous shock, this study suggests that the benefit of ESG ...

The primary theme of my work is the governance of corporate risk. I approach corporate risk governance from two perspectives: monitoring and incentives. There is a growing literature in finance and accounting that examines which corporate governance practices affect outcomes important to investors. Another stream of the corporate finance

Associate Professor Aiyesha Dey discusses how the case, "Scott Tucker: Race to the Top," examines the role of individual leaders in the corporate governance system, as well as their responsibility for creating a positive corporate culture that embodies ethics, self-restraint, and a commitment to serve. Open for comment; 0 Comments.

The Shodhganga@INFLIBNET Centre provides a platform for research students to deposit their Ph.D. theses and make it available to the entire scholarly community in open access. ... This thesis aims to contribute to the existing literature on corporate governance by presenting three essays on the relationship between governance mechanisms and ...

2.5 Hypotheses. Corporate governance includes a range of issues pertaining to the direction and management of firms. In general, strong corporate governance is both legally mandated and, in most firms, voluntarily pursued, thereby involving both management compliance and discretionary judgment.

100 Corporate Governance Research Paper Topics. Corporate governance is a broad and complex topic that encompasses a wide range of issues and challenges facing modern organizations. To help students choose a relevant and feasible corporate governance research paper topic, we have divided our comprehensive list of topics into 10 categories, each ...

Prof. Keith CHAN (Assistant Professor, Division of Environment and Sustainability) and Prof. Quentin MOREAU (Assistant Professor, Division of Environment and Sustainability), together with their PhD student in Environmental Science, Policy and Management WANG Xiaoqing Nora, have received the Best Paper Award in the Corporate Governance/Social Responsibility category at the 14th Financial ...

governance on rm investment and performance. We develop a measure of internal governance that captures the relative contribution of the CEO compared to non-CEO executives in rm value creation. Consistent with the theory, we nd that there is a hump-shaped relation between relative contributions and corporate investment measured

A cause celebre is ringing out across Harvard Yard, Columbia's South Lawn, Yale's Beinecke Plaza and UC Berkeley's Sproul Plaza: Disclose and divest. And university students say they won't stop protesting against Israel until that demand is met. "We're willing to risk suspension ...

Law students across the country are taking on enormous debt. According to one study, the average law student owes $160,000 in student loan debt, with nearly three-quarters of that debt coming from the cost of law school. 1 This is particularly challenging for those attending private and for-profit institutions. Indeed, the same study found ...

Metadata. This dissertation is a collection of three essays that investigate the role and importance of corporate governance in public and private firms. Chapter 1, investigates the role of governance characteristics in determining the probability of a firm undergoing a going private transaction. Firms with greater board control are more likely ...

Corporate Governance Networks and Financial Performance: I investigate the impact of two different corporate governance network connectedness measures on financial performance of firms.I consider both ownership connectedness, defined as the number of connections to other firms through common shareholders, and boardroom connectedness, that is the number of connections to other firms through ...

first one is the coefficient on the interaction term consisted of return and outside. board dummy (β3 in equation (1)), and the second one is the coefficient of the. interaction term consisted of return, outside board dummy, and outside CEO. dummy (β5 in equation (1)). The first thing we can see about these two.

Internal Governance, Investment and Security Design: This paper studies the role of internal governance in dynamic context of the firm using continuous-time dynamic contract model. The internal governance limits the amount of capital diversion, but the manager's decisions on effort and capital diversion are unobservable.

Primarily, the objective of this paper is to analyse the corporate governance implemented in the company. Herein, the company that will be given emphasis is a food retailing company. Overview of the Company. Kay (1995) stated that food retailing in Britain is dominated by six chains and that the oldest and largest is the company that will be ...

There are have been various definition s of corporate governance but for the purpose of this essay ,'Corporate governance refers to the way in which companies are governed, and to what purpose it is concerned with practices and procedures for trying to ensure that a company is run in such a way that it achieves its objectives this could be to maximize the wealth of its owners its ...

External Attributes of Corporate governance which consists of percentages of institutional shareholders and ownership of block shareholders and announcement of stock dividend is the capital ...

Corporate Governance in the market as it is an overall summary to compare the level of Corporate Governance and its impact on the market performance by comparing the corporate governance in developed and developing economies, size of the firm, ownership structure and the special case for the banking sector.

Corporate governance refers to a system that enables us to control and direct organisations. The IUFC defines corporate governance as "the relationships among the management, Board of Directors, controlling shareholders, minority shareholders, and other shareholders" (IFC 1). We will write a custom essay on your topic. 812 writers online.

Dean Bill Pounds was for many MIT Sloan students their favorite, most memorable teacher. In this collection of short essays on management and corporate governance, he shares practical, down-to-earth wisdom and insight on topics rarely touched on in the typical MBA curriculum, gleaned from his decades of experience across a wide variety of boards.

Corporate Governance Essay INTRODUCTION Definition Corporate governance is a mechanism to control and monitor corporate behaviour. It comprises of the system of rules, practices and processes by which a company is directed and controlled. Corporate governance essentially involves balancing the interests of a company's many stakeholders.