- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Restricted Access

Reason: Access restricted by the author. A copy can be requested for private research and study by contacting your institution's library service. This copy cannot be republished

Adapting strategic infrastructure planning: process interventions for sustainable development

Principal supervisor, additional supervisor 1, year of award, department, school or centre, degree type, campus location, usage metrics.

- St. Mary's University Institutional Repository

- Thesis and Dissertation

- Masters Program

- GENERAL MANAGEMENT

Items in DSpace are protected by copyright, with all rights reserved, unless otherwise indicated.

Retirement planning – a systematic review of literature and future research directions

- Published: 28 October 2023

Cite this article

- Kavita Karan Ingale ORCID: orcid.org/0000-0003-3570-4211 1 &

- Ratna Achuta Paluri 2

513 Accesses

Explore all metrics

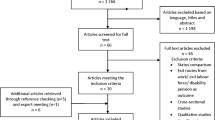

Rising life expectancy and an aging population across nations are leading to an increased need for long-term financial savings and a focus on the financial well-being of retired individuals amidst changing policy framework. This study is a systematic review based on a scientific way of producing high-quality evidence based on 191 articles from the Scopus and Web of Science databases. It adopts the Theory, Context, Characteristics, and Method (TCCM) framework to analyze literature. This study provides collective insights into financial decision-making for retirement savings and identifies constructs for operationalizing and measuring financial behavior for retirement planning. Further, it indicates the need for an interdisciplinary approach. Though cognitive areas were studied extensively, the non-cognitive areas received little attention. Qualitative research design is gaining prominence in research over other methods, with the sparse application of mixed methods design. The study’s TCCM framework explicates several areas for further research. Furthermore, it guides the practice and policy by integrating empirical evidence and concomitant findings. Coherent synthesis of the extant literature reconciles the highly fragmented field of retirement planning. No research reports prospective areas for further analysis based on the TCCM framework on retirement planning, which highlights the uniqueness of the study.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

A Research Proposal to Examine Psychological Factors Influence on Financial Planning for Retirement in China

Domains and determinants of retirement timing: A systematic review of longitudinal studies

Micky Scharn, Ranu Sewdas, … Allard J. van der Beek

Reinventing Retirement

Deanna L. Sharpe

Data Availability

The research data will be made available on request.

Acknowledgment.

Elderly population is defined as a population aged 65 years and over.

Defined benefit plan guarantees benefits to the employee, while defined contribution plan requires employees to decide on their own investment and bear the financial risks identified with it.

“The old-age dependency ratio is defined as the number of individuals aged 65 and over per 100 people of working age defined as those at ages 20 to 64”(OECD 2023 ).

Adams GA, Rau BL (2011) Putting off tomorrow to do what you want today: planning for Retirement. Am Psychol 66(3):180–192. https://doi.org/10.1037/a0022131

Article Google Scholar

Aegon Cfor, Longevity, Retirement ICR (2016) The Aegon Retirement Readiness Survey 2016. In The Aegon Retirement Readiness Survey 2016 . https://www.aegon.com/contentassets/c6a4b1cdded34f1b85a4f21d4c66e5d3/2016-aegon-retirement-readiness-report-india.pdf

Agarwalla SK, Barua SK, Jacob J, Varma JR (2015) Financial Literacy among Working Young in Urban India. World Development , 67 (2013), 101–109. https://doi.org/10.1016/j.worlddev.2014.10.004

Ajzen I (1991) The theory of Planned Behavior. Organ Behav Hum Decis Process 50:179–211. https://doi.org/10.47985/dcidj.475

Anderson A, Baker F, Robinson DT (2017) Precautionary savings, retirement planning, and misperceptions of financial literacy. J Financ Econ 126(2):383–398. https://doi.org/10.1016/j.jfineco.2017.07.008

Atkinson A, Messy FA (2011) Assessing financial literacy in 12 countries: an OECD/INFE international pilot exercise. J Pension Econ Finance 10(4):657–665. https://doi.org/10.1017/S1474747211000539`

Aydin AE, Akben Selcuk E (2019) An investigation of financial literacy, money ethics, and time preferences among college students: a structural equation model. Int J Bank Mark 37(3):880–900. https://doi.org/10.1108/IJBM-05-2018-0120

Bapat D (2020) Antecedents to responsible financial management behavior among young adults: the moderating role of financial risk tolerance. Int J Bank Mark 38(5):1177–1194. https://doi.org/10.1108/IJBM-10-2019-0356

Beckett A, Hewer P, Howcroft B (2000) An exposition of consumer behaviour in the financial services industry. Int J Bank Mark 18(1):15–26. https://doi.org/10.1108/02652320010315325

Białowolski P (2019) Economic sentiment as a driver for household financial behavior. J Behav Experimental Econ 80(August 2017):59–66. https://doi.org/10.1016/j.socec.2019.03.006

Binswanger J, Carman KG (2012) How real people make long-term decisions: the case of retirement preparation. J Economic Behav Organ 81(1):39–60. https://doi.org/10.1016/j.jebo.2011.08.010

Brounen D, Koedijk KG, Pownall RAJ (2016) Household financial planning and savings behavior. J Int Money Finance 69:95–107. https://doi.org/10.1016/j.jimonfin.2016.06.011

Brown R, Jones M (2015) Mapping and exploring the topography of contemporary financial accounting research. Br Acc Rev 47(3):237–261. https://doi.org/10.1016/j.bar.2014.08.006

Brown S, Gray D (2016) Household finances and well-being in Australia: an empirical analysis of comparison effects. J Econ Psychol 53:17–36. https://doi.org/10.1016/j.joep.2015.12.006

Brown S, Taylor K (2014) Household finances and the big five personality traits. J Econ Psychol 45:197–212. https://doi.org/10.1016/j.joep.2014.10.006

Brown S, Taylor K (2016) Early influences on saving behaviour: analysis of British panel data. J Bank Finance 62:1–14. https://doi.org/10.1016/j.jbankfin.2015.09.011

Brüggen EC, Post T, Schmitz K (2019) Interactivity in online pension planners enhances engagement with retirement planning – but not for everyone. J Serv Mark 33(4):488–501. https://doi.org/10.1108/JSM-02-2018-0082

Bruggen E, Post T, Katharina S (2019) Interactivity in online pension planners enhances engagement with retirement planning but not for everyone. J Serv Mark 33(4):488–501

Calcagno R, Monticone C (2015) Financial literacy and the demand for financial advice. J Bank Finance 50:363–380. https://doi.org/10.1016/j.jbankfin.2014.03.013

Campbell JY (2006) Household finance. J Finance 61(4):1553–1604. https://doi.org/10.1111/j.1540-6261.2006.00883.x

Choudhury K (2015) Service quality and customers’ behavioural intentions: class and mass banking and implications for the consumer and society. Asia Pac J Mark Logistics 27(5):735–757

Chowdhry N, Jung J, Dholakia U (2018) Association for consumer research. Adv Consum Res 42:42–46

Google Scholar

Clark GL, Knox-Hayes J, Strauss K (2009) Financial sophistication, salience, and the scale of deliberation in UK retirement planning. Environ Plann A 41(10):2496–2515. https://doi.org/10.1068/a41265

Clark R, Lusardi A, Mitchell OS (2017) Employee Financial Literacy and Retirement Plan Behavior: a case study. Econ Inq 55(1):248–259. https://doi.org/10.1111/ecin.12389

Collins JM, Urban C (2016) The role of information on Retirement Planning: evidence from a field study. Econ Inq 54(4):1860–1872. https://doi.org/10.1111/ecin.12349

Creswell J (2009) Research Design Qualitative Quantitative and Mixed Methods Approaches. In Sage Publishing: Vol. Third edit . https://doi.org/10.1002/tl.20234

Csorba L (2020) The determining factors of financial culture, financial literacy, and financial behavior. Public Finance Q 65:67–83. https://doi.org/10.35551/PFQ_2020_1_6

Davidoff T, Gerhard P, Post T (2017) Reverse mortgages: what homeowners (don’t) know and how it matters. J Economic Behav Organ 133:151–171. https://doi.org/10.1016/j.jebo.2016.11.007

Davis FD (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly: Management Information Systems 13(3):319–339. https://doi.org/10.2307/249008

Devlin J (2001) Consumer evaluation and competitive advantage in retail financial services - a research agenda. Eur J Mark 35(5/6):639–660

Dholakia U, Tam L, Yoon S, Wong N (2016) The ant and the grasshopper: understanding personal saving orientation of consumers. J Consum Res 43(1):134–155. https://doi.org/10.1093/jcr/ucw004

Dolls M, Doerrenberg P, Peichl A, Stichnoth H (2018) Do retirement savings increase in response to information about retirement and expected pensions? J Public Econ 158(July 2017):168–179. https://doi.org/10.1016/j.jpubeco.2017.12.014

Dragos SL, Dragos CM, Muresan GM (2020) From intention to the decision in purchasing life insurance and private pensions: different effects of knowledge and behavioural factors. J Behav Experimental Econ 87(March):101555. https://doi.org/10.1016/j.socec.2020.101555

Drever AI, Odders-white E, Kalish CW, Hoagland EM, Nelms EN, Drever AI, Odders-white E, Charles W, Else-quest NM, Hoagland EM, Nelms EN (2015) Foundations of Financial Weil-Being: Insights into the Role of Executive Function, Financial Socialization, and Experience-Based Learning in Childhood and Youth Source : The Journal of Consumer Affairs, Vol. 49, No. 1, Special Issue on Starting Ea. The Journal of Consumer Affairs , 49 (1)

Duflo E, Saez E (2002) Participation and investment decisions in a retirement plan: the influence of colleagues’ choices. J Public Econ 85(1):121–148. https://doi.org/10.1016/S0047-2727(01)00098-6

Duxbury D, Summers B, Hudson R, Keasey K (2013) How people evaluate defined contribution, annuity-based pension arrangements: a behavioral exploration. J Econ Psychol 34:256–269. https://doi.org/10.1016/j.joep.2012.10.008

Earl J, Bednall T, Muratore A (2015) A matter of time: why some people plan for retirement and others do not. Work Aging and Retirement 1(2):181–189. https://doi.org/10.1093/workar/wau005

Employees Benefits Research Institute (2020) EBRI Retirement Confidence Survey Report (Issue 202)

Engel JF, Kollat DT, Blackwell RD (1968) A model of consumer motivation and behavior. In: Research in consumer behavior. Holt, Rinehart and Winston, Inc., New York, pp 3–20

Erasmus A, Boshoff E, Rousseau G (2001) Consumer decision-making models within the discipline of consumer science: a critical approach. J Family Ecol Consumer Sci /Tydskrif Vir Gesinsekologie En Verbruikerswetenskappe 29(1):82–90. https://doi.org/10.4314/jfecs.v29i1.52799

Farrell L, Fry TRL, Risse L (2016) The significance of financial self-efficacy in explaining women’s personal finance behaviour. J Econ Psychol 54:85–99

Fernandes D, Lynch JG, Netemeyer RG (2014) Financial literacy, financial education, and downstream financial behaviors. Manage Sci 60(8):1861–1883. https://doi.org/10.1287/mnsc.2013.1849

Filbec G, Ricciardi V, Evensky H, Fan S, Holzhauer H, Spieler A (2017) Behavioral finance: a panel discussion. J Behav Experimental Finance 15:52–58. https://doi.org/10.1016/j.jbef.2015.07.003

Fishbein M (1979) A theory of reasoned action: some applications and implications. Nebraska Symposium on Motivation 27:65–116

Fisher PJ, Montalto CP (2010) Effect of saving motives and horizon on saving behaviors. J Econ Psychol 31(1):92–105. https://doi.org/10.1016/j.joep.2009.11.002

Flores SAM, Vieira KM (2014) Propensity toward indebtedness: an analysis using behavioral factors. J Behav Exp Finance 3:1–10

Foxall GR, Pallister JG (1998) Measuring purchase decision involvement for financial services: comparison of the Zaichkowsky and Mittal scales. Int J Bank Mark 16(5):180–194. https://doi.org/10.1108/02652329810228181

Friedman M (1957) Introduction to “A theory of the consumption function”. In: A theory of the consumption function. Princeton University Press, pp 1–6

Frydman C, Camerer CF (2016) The psychology and neuroscience of financial decision making. Trends Cogn Sci 20(9):661–675. https://doi.org/10.1016/j.tics.2016.07.003

Gardarsdóttir RB, Dittmar H (2012) The relationship of materialism to debt and financial well-being: the case of Iceland’s perceived prosperity. J Econ Psychol 33(3):471–481. https://doi.org/10.1016/j.joep.2011.12.008

Gathergood J (2012) Self-control, financial literacy and consumer over-indebtedness. J Econ Psychol 33(3):590–602

Gerhard P, Gladstone JJ, Hoffmann AOI (2018) Psychological characteristics and household savings behavior: the importance of accounting for latent heterogeneity. J Economic Behav Organ 148:66–82. https://doi.org/10.1016/j.jebo.2018.02.013

Gibbs PT (2009) Time, temporality, and

Goedde-Menke M, Lehmensiek-Starke M, Nolte S (2014) An empirical test of competing hypotheses for the annuity puzzle. J Econ Psychol 43:75–91

Gough O, Nurullah M (2009) Understanding what drives the purchase decision in pension and investment products. J Financial Serv Mark 14(2):152–172. https://doi.org/10.1057/fsm.2009.14

Griffin B, Loe D, Hesketh B (2012) Using Proactivity, Time Discounting, and the theory of Planned Behavior to identify predictors of Retirement Planning. Educ Gerontol 38(12):877–889. https://doi.org/10.1080/03601277.2012.660857

Gritten A (2011) New insights into consumer confidence in financial services. Int J Bank Mark 29(2):90–106. https://doi.org/10.1108/02652321111107602

Grohmann A (2018) Financial literacy and financial behavior: Evidence from the emerging Asian middle class. Pacific Basin Finance Journal , 48 (November 2017), 129–143. https://doi.org/10.1016/j.pacfin.2018.01.007

Grohmann A, Kouwenberg R, Menkhoff L (2015) Childhood roots of financial literacy. J Econ Psychol 51:114–133. https://doi.org/10.1016/j.joep.2015.09.002

Hair JF, Sarstedt M, Ringle CM, Mena JA (2012) An assessment of the use of partial least squares structural equation modeling in marketing research . 414–433. https://doi.org/10.1007/s11747-011-0261-6

Hanna SD, Kim KT, Chen SCC (2016) Retirement savings. In: Handbook of consumer finance research, pp 33–43

Harrison T, Waite K, White P (2006) Analysis by paralysis: the pension purchase decision process. Int J Bank Mark 24(1):5–23. https://doi.org/10.1108/02652320610642317

Hastings J, Mitchell O (2011) How financial literact and impatience shape retirement wealth and investment behaviors. Pengaruh Harga Diskon Dan Persepsi Produk Terhadap Nilai Belanja Serta Perilaku Pembelian Konsumen, NBER Working paper, 1–28

Hauff J, Carlander A, Amelie G, Tommy G, Holmen M (2016) Breaking the ice of low financial involvement: does narrative information format from a trusted sender increase savings in mutual funds? Int J Bank Mark 34(2):151–170

Hentzen JK, Hoffmann A, Dolan R, Pala E (2021) Artificial intelligence in customer-facing financial services: a systematic literature review and agenda for future research. Int J Bank Mark. https://doi.org/10.1108/IJBM-09-2021-0417

Hershey DA, Mowen JC (2000) Psychological determinants of financial preparedness for retirement. Gerontologist 40(6):687–697. https://doi.org/10.1093/geront/40.6.687

Hershey DA, Henkens K, Van Dalen HP (2007) Mapping the minds of retirement planners: a cross-cultural perspective. J Cross-Cult Psychol 38(3):361–382. https://doi.org/10.1177/0022022107300280

Hershey DA, Jacobs-Lawson JM, McArdle JJ, Hamagami F (2007b) Psychological foundations of financial planning for retirement. J Adult Dev 14(1–2):26–36. https://doi.org/10.1007/s10804-007-9028-1

Hershey DA, Jacobs-Lawson JM, McArdle JJ, Hamagami F (2008) Psychological foundations of financial planning for retirement. J Adult Dev 14(1–2):26–36. https://doi.org/10.1007/s10804-007-9028-1

Hershfield H, Goldstein D, Sharpe W, Fox J, Yeykelis L, Carstensen L, Bailenson J (2011) Increasing saving behavior through age-progressed renderings of the future self. J Mark Res 48:23–37

Hoffmann AOI, Broekhuizen TLJ (2009) Susceptibility to and impact of interpersonal influence in an investment context. J Acad Mark Sci 37:488–503

Hoffmann AOI, Broekhuizen TLJ (2010) Understanding investors’ decisions to purchase innovative products: drivers of adoption timing and range. Int J Res Mark 27(4):342–355. https://doi.org/10.1016/j.ijresmar.2010.08.002

Hoffmann AOI, Plotkina D (2020a) Positive framing when assessing the personal resources to manage one’s finances increases consumers’ retirement self-efficacy and improves retirement goal clarity. Psychol Mark 38(12):2286–2304. https://doi.org/10.1002/mar.21563

Hoffmann AOI, Plotkina D (2020b) Why and when does financial information affect retirement planning intentions and which consumers are more likely to act on them? Journal of Business Research , 117 (September 2019), 411–431. https://doi.org/10.1016/j.jbusres.2020.06.023

Hoffmann AOI, Plotkina D (2021) Let your past define your future. How recalling successful financial experiences can increase beliefs of self-efficacy in financial planning. J Consum Aff 55(3):847–871. https://doi.org/10.1111/joca.12378

Hoffmann AOI, Risse L (2020) Do good things come in pairs? How personality traits help explain individuals’ simultaneous pursuit of a healthy lifestyle and financially responsible behavior. J Consum Aff 54(3):1082–1120. https://doi.org/10.1111/joca.12317

Hsiao YJ, Tsai WC (2018) Financial literacy and participation in the derivatives markets. J Bank Finance 88:15–29

Huhmann BA, McQuitty S (2009) A model of consumer financial numeracy. Int J Bank Mark 27(4):270–293. https://doi.org/10.1108/02652320910968359

Huston SJ (2010) Measuring financial literacy. J Consum Aff 44(2):296–316. https://doi.org/10.1111/j.1745-6606.2010.01170.x

Ijevleva K, Arefjevs I (2014) Analysis of the Aggregate Financial Behaviour of customers using the Transtheoretical Model of Change. Procedia - Social and Behavioral Sciences 156(April):435–438. https://doi.org/10.1016/j.sbspro.2014.11.217

Ingale KK, Paluri RA (2020) Financial literacy and financial behavior: a bibliometric analysis. Rev Behav Finance. https://doi.org/10.1108/RBF-06-2020-0141

Jacobs-Lawson J, Hershey D (2005) Influence of future time perspective, financial knowledge, and financial risk tolerance on retirement savings behavior. Financial Serv Rev 14:331–344. https://doi.org/10.1088/1751-8113/44/8/085201

Jappelli T, Padula M (2013) Investment in financial literacy and saving decisions. J Bank Finance 37(8):2779–2792. https://doi.org/10.1016/j.jbankfin.2013.03.019

Kadoya Y, Rahim Khan MS (2020) Financial literacy in Japan: new evidence using financial knowledge, behavior, and attitude. Sustain (Switzerland) 12(9). https://doi.org/10.3390/su12093683

Kamil NSSN, Musa R, Sahak SZ (2014) Examining the Role of Financial Intelligence Quotient (FiQ) in explaining credit card usage behavior: a conceptual Framework. Procedia - Social and Behavioral Sciences 130:568–576. https://doi.org/10.1016/j.sbspro.2014.04.066

Kerry MJ (2018) Psychological antecedents of retirement planning: a systematic review. Front Psychol 9(OCT). https://doi.org/10.3389/fpsyg.2018.01870

Kerry MJ, Embretson SE (2018) An experimental evaluation of competing age predictions of future time perspective between workplace and retirement domains. Front Psychol 8(JAN):1–9. https://doi.org/10.3389/fpsyg.2017.02316

Kiliyanni AL, Sivaraman S (2016) The perception-reality gap in financial literacy: evidence from the most literate state in India. Int Rev Econ Educ 23:47–64. https://doi.org/10.1016/j.iree.2016.07.001

Kimiyaghalam F, Mansori S, Safari M, Yap S (2017) Parents’ influence on retirement planning in Malaysia. Family Consumer Sci Res J 45(3):315–325

Klapper L, Lusardi A, Panos GA (2013) Financial literacy and its consequences: evidence from Russia during the financial crisis. J Bank Finance 37(10):3904–3923

Koehler DJ, Langstaff J, Liu WQ (2015) A simulated financial savings task for studying consumption and retirement decision-making. J Econ Psychol 46:89–97. https://doi.org/10.1016/j.joep.2014.12.004

Kramer MM (2016) Financial literacy, confidence, and financial advice seeking. Journal of Economic Behavior and Organization , 131 (June 2015), 198–217. https://doi.org/10.1016/j.jebo.2016.08.016

Kumar S, Tomar S, Verma D (2019) Women’s financial planning for retirement: systematic literature review and future research agenda. Int J Bank Mark 37(1):120–141. https://doi.org/10.1108/IJBM-08-2017-0165

Kwon KN, Lee J (2009) The effects of reference point, knowledge, and risk propensity on the evaluation of financial products. J Bus Res 62(7):719–725. https://doi.org/10.1016/j.jbusres.2008.07.002

Landerretche OM, Martínez C (2013) Voluntary savings, financial behavior, and pension finance literacy: evidence from Chile. J Pension Econ Finance 12(3):251–297. https://doi.org/10.1017/S1474747212000340

Lee T (2017) (David). Clear, conspicuous, and improving: US corporate websites for critical financial literacy in retirement. International Journal of Bank Marketing , 35 (5), 761–780. https://doi.org/10.1108/IJBM-01-2016-0010

Liang C-J, Wang Wen‐Hung, Farquhar JD (2009) (2009). The influence of customer perceptions on financial performance in financial services. International Journal of Bank Marketing , 27 (2), 129–149

Liberman N, Trope Y (2003) Construal level theory of intertemporal judgment and decision. In: Loewenstein G, Read D, Baumeister R (eds) Time and decision: economic and psychological perspectives on intertemporal choice, pp 245–276

Lim KL, Soutar GN, Lee JA (2013) Factors affecting investment intentions: a consumer behaviour perspective. J Financ Serv Mark 18:301–315

Lin C, Hsiao YJ, Yeh CY (2017) Financial literacy, financial advisors, and information sources on demand for life insurance. Pac Basin Finance J 43(March):218–237. https://doi.org/10.1016/j.pacfin.2017.04.002

Lown JM (2011) Development and validation of a Financial Self-Efficacy Scale. J Financial Couns Plann 22(2):54–63

Lusardi A, Mitchell OS (2007) Baby Boomer retirement security: the roles of planning, financial literacy, and housing wealth. J Monet Econ 54(1):205–224. https://doi.org/10.1016/j.jmoneco.2006.12.001

Maloney M, McCarthy A (2017) Understanding pension communications at the organizational level: insights from bounded rationality theory & implications for HRM. Hum Resource Manage Rev 27(2):338–352. https://doi.org/10.1016/j.hrmr.2016.08.001

Marjanovic Z, Fiksenbaum L, Greenglass E (2018) Financial threat correlates with acute economic hardship and behavioral intentions that can improve one’s personal finances and health. J Behav Experimental Econ 77(April):151–157. https://doi.org/10.1016/j.socec.2018.09.012

Marques S, Mariano J, Lima ML, Abrams D (2018) Are you talking to the future me? The moderator role of future self-relevance on the effects of aging salience in retirement savings. J Appl Soc Psychol 48(7):360–368. https://doi.org/10.1111/jasp.12516

McKechnie S (1992) Consumer buying behaviour in financial services: an overview. Int J Bank Mark 10(5):5–39. https://doi.org/10.1108/02652329210016803

Milner T, Rosenstreich D (2013a) A review of consumer decision-making models and development of a new model for financial services. J Financial Serv Mark 18(2):106–120. https://doi.org/10.1057/fsm.2013.7

Milner T, Rosenstreich D (2013b) Insights into mature consumers of financial services. J Consumer Mark 30(3):248–257. https://doi.org/10.1108/07363761311328919

Mitchell OS, Mukherjee A (2017) Assessing the demand for micro pensions among India’s poor. J Econ Ageing 9:30–40. https://doi.org/10.1016/j.jeoa.2016.05.004

Mitchell O, Utkus S (2003) Lessons from Behavioral Finance for Retirement Plan Design (PRC WP 2003-6). http://prc.wharton.upenn.edu/prc/prc.html

Modigliani F, Brumberg RH (1954) Utility analysis and the consumption function: an interpretation of cross-section data. In: Kurihara KK (ed) Post-Keynesian economics. Rutgers University Press, New Brunswick, pp 388–436

Moher D, Liberati A, Tetzlaff J, Altman DG, Altman D, Antes G, Atkins D, Barbour V, Barrowman N, Berlin JA, Clark J, Clarke M, Cook D, D’Amico R, Deeks JJ, Devereaux PJ, Dickersin K, Egger M, Ernst E, …, Tugwell P (2009) Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS Med 6(7). https://doi.org/10.1371/journal.pmed.1000097

Monti M, Pelligra V, Martignon L, Berg N (2014) Retail investors and financial advisors: new evidence on trust and advice taking heuristics. J Bus Res 67(8):1749–1757. https://doi.org/10.1016/j.jbusres.2014.02.022

Mouna A, Anis J (2017) Financial literacy in Tunisia: its determinants and its implications on investment behavior. Res Int Bus Finance 39:568–577

Mullainathan S, Thaler R (2000) Massachusetts Institute of Technology Department of Economics Working Paper Series . September

Nga KH, Yeoh KK (2018) An exploratory model on retirement savings behaviour: a Malaysian study. Int J Bus Soc 19(3):637–659

OECD (2023) Old-age dependency ratio (indicator). https://doi.org/10.1787/e0255c98-en . Accessed 13 Oct 2023

Onwuegbuzie AJ, Collins KM (2007) A typology of mixed methods sampling designs in social science research. Qualitative Rep 12(2):474–498

Pallister JG, Wang HC, Foxall GR (2007) An application of the style/involvement model to financial services. Technovation 27(1–2):78–88. https://doi.org/10.1016/j.technovation.2005.10.001

Pan L, Pezzuti T, Lu W, Pechmann C (2019) Hyperopia and frugality: different motivational drivers and yet similar effects on consumer spending. J Bus Res 95(August 2018):347–356

Parise G, Peijnenburg K (2017) Understanding the Determinants of Financial Outcomes and Choices: The Role of Noncognitive Abilities. BIS Working Papers

Paul J, Rosado-Serrano A (2019) Gradual internationalization vs Born-Global/International new venture models: a review and research agenda. Int Mark Rev 36(6):830–858. https://doi.org/10.1108/IMR-10-2018-0280

Paul J, Criado AR (2020) The art of writing literature review: what do we know and what do we need to know? Int Bus Rev 29(4):101717. https://doi.org/10.1016/j.ibusrev.2020.101717

Paul J, Khatri P, Kaur Duggal H (2023) Frameworks for developing impactful systematic literature reviews and theory building: what, why and how? J Decis Syst 00(00):1–14. https://doi.org/10.1080/12460125.2023.2197700

Petkoska J, Earl JK (2009) Understanding the influence of demographic and psychological variables on Retirement Planning. Psychol Aging 24(1):245–251. https://doi.org/10.1037/a0014096

Piotrowska M (2019) The importance of personality characteristics and behavioral constraints for retirement saving. Econ Anal Policy 64:194–220

Plath DA, Stevenson TH (2005) Financial services consumption behavior across Hispanic American consumers. J Bus Res 58(8):1089–1099. https://doi.org/10.1016/j.jbusres.2004.03.003

Poterba JM (2015) Saver heterogeneity and the challenge of assessing retirement saving adequacy. Natl Tax J 68(2):377–388. https://doi.org/10.17310/ntj.2015.2.06

Potrich ACG, Vieira KM, Kirch G (2018) How well do women do when it comes to financial literacy? Proposition of an indicator and analysis of gender differences. J Behav Experimental Finance 17:28–41. https://doi.org/10.1016/j.jbef.2017.12.005

Rai D, Lin CW (2019) (Wilson). The influence of implicit self-theories on consumer financial decision making. Journal of Business Research , 95 (August 2018), 316–325. https://doi.org/10.1016/j.jbusres.2018.08.016

Ramalho TB, Forte D (2019) Financial literacy in Brazil – do knowledge and self-confidence relate with behavior? RAUSP Manage J 54(1):77–95. https://doi.org/10.1108/RAUSP-04-2018-0008

Rana J, Paul J (2017) Consumer behavior and purchase intention for organic food: a review and research agenda. J Retailing Consumer Serv 38(June):157–165. https://doi.org/10.1016/j.jretconser.2017.06.004

Ranyard R, McNair S, Nicolini G, Duxbury D (2020) An item response theory approach to constructing and evaluating brief and in-depth financial literacy scales. J Consum Aff 54(3):1121–1156. https://doi.org/10.1111/joca.12322

RBI Household Finance Committee (2017) Indian household finance. Reserve Bank of India, Mumbai

Ruefenacht M, Schlager T, Maas P, Puustinen P (2015) Drivers of long-term savings behavior from consumer’s perspective. Electron Libr 34(1):1–5

Scholz JK, Seshadri A, Khitatrakun S (2006) Are Americans saving “optimally” for retirement? J Polit Econ 114(4):607–643

Schuabb T, França LH, Amorim SM (2019) Retirement savings model tested with Brazilian private health care workers. Front Psychol 10(JULY):1–11. https://doi.org/10.3389/fpsyg.2019.01701

Schuhen M, Schurkmann S (2014) International Review of Economics Education. Int Rev Econ Educ 16:1–11

Segel-Karpas D, Werner P (2014) Perceived financial retirement preparedness and its correlates: a national study in Israel. Int J Aging Hum Dev 79(4):279–301. https://doi.org/10.1177/0091415015574177

Seth H, Talwar S, Bhatia A, Saxena A, Dhir A (2020) Consumer resistance and inertia of retail investors: Development of the resistance adoption inertia continuance (RAIC) framework. Journal of Retailing and Consumer Services , 55 (August 2019), 102071. https://doi.org/10.1016/j.jretconser.2020.102071

Sewell M (2008) Behavioural finance. Economist 389(8604):1–13. https://doi.org/10.1057/9780230280786_5

Shefrin HM, Thaler RH (1988) The behavioral life‐cycle hypothesis. Econ Inq 26(4):609–643

Shim S, Serido J, Tang C (2012) The ant and the grasshopper revisited: the present psychological benefits of saving and future oriented financial behavior. J Econ Psychol 33(1):155–165

Simon HA (1978) Information-processing theory of human problem solving. In: Handbook of learning and cognitive processes, vol 5, pp 271–295

Sivaramakrishnan S, Srivastava M, Rastogi A (2017) Attitudinal factors, financial literacy, and stock market participation. Int J Bank Mark 34(1):1–5

Snyder H (2019) Literature review as a research methodology: an overview and guidelines. J Bus Res 104(August):333–339. https://doi.org/10.1016/j.jbusres.2019.07.039

Stawski RS, Hershey DA, Jacobs-Lawson JM (2007) Goal clarity and financial planning activities as determinants of retirement savings contributions. Int J Aging Hum Dev 64(1):13–32. https://doi.org/10.2190/13GK-5H72-H324-16P2

Steinert JI, Zenker J, Filipiak U, Movsisyan A, Cluver LD, Shenderovich Y (2018) Do saving promotion interventions increase household savings, consumption, and investments in Sub-saharan Africa? A systematic review and meta-analysis. World Dev 104:238–256. https://doi.org/10.1016/j.worlddev.2017.11.018

Steinhart Y, Mazursky D (2010) Purchase availability and involvement antecedents among financial products. Int J Bank Mark 28(2):113–135. https://doi.org/10.1108/02652321011018314

Strömbäck C, Lind T, Skagerlund K, Västfjäll D, Tinghög G (2017) Does self-control predict financial behavior and financial well-being? J Behav Experimental Finance 14:30–38. https://doi.org/10.1016/j.jbef.2017.04.002

Strömbäck C, Skagerlund K, Västfjäll D, Tinghög G (2020) Subjective self-control but not objective measures of executive functions predict financial behavior and well-being. Journal of Behavioral and Experimental Finance , 27 . https://doi.org/10.1016/j.jbef.2020.100339

Tam L, Dholakia U (2014) Saving in cycles: how to get people to save more money. Psychol Sci 25(2):531–537. https://doi.org/10.1177/0956797613512129

Tang N, Baker A (2016) Self-esteem, financial knowledge and financial behavior. J Econ Psychol 54:164–176

Tate M, Evermann J, Gable G (2015) An integrated framework for theories of individual attitudes toward technology. Inform Manage 52(6):710–727. https://doi.org/10.1016/j.im.2015.06.005

Taylor MP, Jenkins SP, Sacker A (2011) Financial capability and psychological health. J Econ Psychol 32(5):710–723. https://doi.org/10.1016/j.joep.2011.05.006

Tennyson S, Yang HK (2014) The role of life experience in long-term care insurance decisions. Journal of Economic Psychology , 42 (2014), 175–188. https://doi.org/10.1016/j.joep.2014.04.002

Thaler BRH (1994) Psychology and savings policies. Am Econ Rev 84(2):175–179. http://www.jstor.org/stable/3132220

Thaler R (1980) Toward a positive theory of consumer choice. J Econ Behav Organ 1:39–60

Thaler RH (2005) Advances in behavioral finance. Adv Behav Finance 2:1–694. https://doi.org/10.2307/2329257

Thaler R, Shefrin H (1981) An economic theory of self-control. J Polit Econ 89(2):392–406

Tomar S, Kent Baker H, Kumar S, Hoffmann AOI (2021) Psychological determinants of retirement financial planning behavior. Journal of Business Research , 133 (November 2020), 432–449. https://doi.org/10.1016/j.jbusres.2021.05.007

Topa G, Moriano JA, Depolo M, Alcover CM, Morales JF (2009) Antecedents and consequences of retirement planning and decision-making: a meta-analysis and model. J Vocat Behav 75(1):38–55. https://doi.org/10.1016/j.jvb.2009.03.002

Topa G, Moriano JA, Depolo M, Alcover CM, Moreno A (2011) Retirement and wealth relationships: Meta-analysis and SEM. Res Aging 33(5):501–528. https://doi.org/10.1177/0164027511410549

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14(3):207–222. https://doi.org/10.1111/1467-8551.00375

Ülkümen G, Cheema A (2011) Framing goals to influence personal savings: the role of specificity and construal level. J Mark Res 48(6):958–969. https://doi.org/10.1509/jmr.09.0516

United Nations, Department of Economic and Social, Affairs PD (2020) (2019). World Population Ageing 2019. In United Nations . http://link.springer.com/chapter/10.1007/ 978-94-007-5204-7_6

Utkarsh, Pandey A, Ashta A, Spiegelman E, Sutan A (2020) Catch them young: impact of financial Socialization, financial literacy and attitude towards money on the financial well-being of young adults. Int J Consumer Stud 44(6):531–541. https://doi.org/10.1111/ijcs.12583

Valente TW, Paredes P, Poppe P (1998) Matching the message to the process: the relative ordering of knowledge, attitudes, and practices in behavior change research. Hum Commun Res 24(3):366–385

Van Rooij M, Teppa F (2014) Personal traits and individual choices: taking action in economic and non-economic decisions. J Econ Behav Organ 100:33–43

van Rooij M, Lusardi A, Alessie R (2011) Financial literacy and stock market participation. J Financ Econ 101(2):449–472. https://doi.org/10.1016/j.jfineco.2011.03.006

Van Rooij MCJ, Lusardi A, Alessie RJM (2011a) Financial literacy and retirement planning in the Netherlands. J Econ Psychol 32(4):593–608. https://doi.org/10.1016/j.joep.2011.02.004

van Schie RJG, Dellaert BGC, Donkers B (2015) Promoting later planned retirement: construal level intervention impact reverses with age. J Econ Psychol 50:124–131. https://doi.org/10.1016/j.joep.2015.06.010

Venkatesh V, Morris M, Davis G, Davis F (2003) Factors influencing the Use of M-Banking by academics: Case Study sms-based M-Banking. MIS Q 27(3):425–478

Vitt LA (2004) Consumers’ financial decisions and the psychology of values. J Financial Service Professionals 58(November):68–77. http://search.ebscohost.com/login.aspx?direct=true &db=bth&AN=14888952&site=ehost-live

Wang L, Lu W, Malhotra NK (2011) Demographics, attitude, personality, and credit card features correlate with credit card debt: a view from China. J Econ Psychol 32(1):179–193. https://doi.org/10.1016/j.joep.2010.11.006

World Economic Forum (2019) Investing in (and for) our future. Issue June. www.weforum.org

Xia T, Wang Z, Li K (2014) Financial literacy overconfidence and stock market participation. Soc Indic Res 119(3):1233–1245. https://doi.org/10.1007/s11205-013-0555-9

Xiao JJ, Chen C, Chen F (2014) Consumer financial capability and financial satisfaction. Soc Indic Res 118(1):415–432. https://doi.org/10.1007/s11205-013-0414-8

Yeung DY, Zhou X (2017) Planning for retirement: longitudinal effect on retirement resources and post-retirement well-being. Front Psychol 8:1300

Zhou R, Pham MT (2004) Promotion and prevention across mental accounts: when financial products dictate consumers’ investment goals. J Consum Res 31(1):125–135. https://doi.org/10.1086/383429

Download references

Acknowledgements

Authors would like to acknowledge the academicians and researchers who guided the search of the article and would like to thank the experts for the valuable inputs to refine the work.

There is no funding received for this research.

Author information

Authors and affiliations.

Symbiosis International (Deemed University), Pune, India

Kavita Karan Ingale

Symbiosis Institute of Operations Management, Symbiosis International (Deemed) University, Pune, India

Ratna Achuta Paluri

You can also search for this author in PubMed Google Scholar

Contributions

Both authors contributed to the conceptualization, research design, methodology, analysis of the data,writing of the manuscript and its revision.

Corresponding author

Correspondence to Kavita Karan Ingale .

Ethics declarations

Conflict of interest.

The authors declare that there is no conflict of interest.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Ingale, K.K., Paluri, R.A. Retirement planning – a systematic review of literature and future research directions. Manag Rev Q (2023). https://doi.org/10.1007/s11301-023-00377-x

Download citation

Received : 14 December 2022

Accepted : 04 October 2023

Published : 28 October 2023

DOI : https://doi.org/10.1007/s11301-023-00377-x

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Retirement planning

- Systematic literature review

- Financial behavior

- Household finance

- Long-term savings

- Pension plan

- Financial literacy

- TCCM framework

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO

COMMENTS

A strategic plan combines various organizational goals to accomplish a specific mission. In his seminal piece on public sector strategic planning, Bryson (2004) submits that public sector strategic planning in the United States is a "disciplined effort to produce fundamental decisions and actions that shape and guide what an organization is,

Strategic planning has been an integral part of organizations while its impact on organization performance has been debated for many years. There are mixed (positive and negative) results for ...

A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF DOCTOR OF PHILOSOPHY IN BUSINESS ADMINISTRATION, ... strategic planning is carried out, its extensiveness and inclusiveness, is a concern for organizations in the twenty first century. Possible mediating effect of strategy

comprehensiveness, size, c ompleteness, meaning, ra onality, goal formula on, observa on and analysis, processes, factors, systems, clarity, innova on, speci ca ons, abili es. and strategy. Most ...

Strategic planning is the latest step in the evolutionary process of finding better ways for an. organization to manage itself in times of turbulent environmental change (Wilkinson, 1985). Although strategic planning is generally applied in businesses it actually began in the. context of warfare.

Strategic planning (SP) is one of the more popular management approaches in contemporary organizations, and it is consistently ranked among the five most popular managerial approaches worldwide (Rigby and Bilodeau 2013; Wolf and Floyd 2017).Typically operationalized as an approach to strategy formulation, SP includes elements such as analysis of the organization's mandate, mission, and values ...

strategic planning requires transformation of mental models from rule-based to goal-based, which can be made possible by the effective intellectual preparation of strategy practitioners. Thereby, the research calls for increased attention on strategy practitioners and their actual practice in strategic planning processes.

This thesis deals with the strategic plan, which is described from the perspective of creation and related processes and procedures in the theoretical part. Work is devoted to the analysis of the content and form of the plan. From this perspective, addressing the status of the plans and their quality in selected cities of various sizes in the ...

I direct the first part of this chapter to the rationale for the 7-Step Strategic Planning Process. We bring together the findings of Chapter 3, which provided a rationale for planning and a scope for planning.These insights raise fundamental questions as to the purpose of strategic planning, which was the focus of Chapter 4.The questions and responses create a conceptual structure that ...

Strategic planning is a formalized planning process for shaping an organization's future (Moldof, 1993). Bartol and Martin (1991) describe strategic planning as the development of detailed action steps by top management to reach strategic goals. Bradley and Vrettas (1990) define strategic planning as a process used by leaders of an

Strategic planning can be defined as the process of using systematic criteria and rigorous investigation to formulate, implement and control strategy and formally document organizational expectations (Higgins and Vincze, 1993; Mintzberg, 1994; Pearce and Robinson, 1994). Strategic Planning is a process by which we can envision the future and ...

Strategic planning in universities is frequently positioned as vital for clarifying future directions, providing a coherent basis for decision-making, establishing priorities, and improving ... Collected Essays on Learning and Teaching, Vol. IX 208 argue that in spite of established formulas for c reating a strategic plan, the process is non ...

Keywords: Strategy, Strategic Planning, Strategic management, Leadership, Public Sector, Bahrain. Over more than three decades, there has been a sustained interest in strategic planning in the public sector to secure positive outcomes and long-term growth. ... Organization of the Thesis ...

The aim of this study is to identify the impact of strategic planning and continuous improvement on the effectiveness and efficiency of administrative decisions at Empowerment for Administrative ...

Overcoming Challenges and Pitfalls. Challenge of consensus over clarity. Challenge of who provides input versus who decides. Preparing a long, ambitious, 5 year plan that sits on a shelf. Finding a balance between process and a final product. Communicating and executing the plan. Lack of alignment between mission, action, and finances.

The results suggested that 33.3% of SMEs in the Cape metropole do not engage in strategic planning because decision-making is based on assumptions, intuitions and/or experience while 14.6% of SMEs indicated that planning is expensive. Additionally, 14.6% of SMEs also indicated that planning is time-consuming.

University of Toronto

Strategic planning is an organization‟s process of defining its strategy, or direction, and making decisions on allocating its resources to pursue this strategy including its capital and people (Adeleke et al, 2008). These plethora‟s of definitions are complementary in the sense they express and sometimes

The thesis eventually concludes with three sets tools that altogether comprise the integrated framework of effective strategic planning for the development of smart cities: (a) the Strategic ...

The first intervention aimed at improving planners' reflexivity with regard to the limits of traditional planning approaches and building capacity for alternative approaches. The second intervention focused on enabling the systemic diagnosis of impediments to sustainable infrastructure delivery as part of the strategic planning process.

Abstract: Strategic planning is a widely adopted management approach in contemporary organizations. Underlying its popularity is the assumption that it is a successful practice in public and private organizations that has positive consequences for organizational performance. Nonetheless, strategic planning has been criticized for being overly

It was recommended that In the process of designing Strategic Planning, participation of the concerned bodies enhances the pace of improving organizational performance and top-level management at different department in the insurance should involve employees to understand and share the organizational value which helps to create a team-spirit ...

Rising life expectancy and an aging population across nations are leading to an increased need for long-term financial savings and a focus on the financial well-being of retired individuals amidst changing policy framework. This study is a systematic review based on a scientific way of producing high-quality evidence based on 191 articles from the Scopus and Web of Science databases. It adopts ...

At the core of the strategic management process is the creation of goals, a mission statement, values and organisational objectives. Organisational goals, the mission statement, values and ...