Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Auditing and Consulting Business Plan

Start your own auditing and consulting business plan

Artemide Auditing & Consulting AG

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Artemide Auditing & Consulting AG (Artemide AC) is in the process of being formed as an ongoing sole proprietorship owned and operated by Sandor Artemide AC. The company is a spinoff of Daten Riffwald-Ennetmoos AG. Between the owners of Daten Riffwald-Ennetmoos and Artemide AC there will be 25% cross-participation. This plan is written as a guide for continuing and managing the business under the new company, and will also serve as the basis for marketing proposals. The two objectives of Artemide AC are to generate a profit and to grow at a challenging and manageable rate.

The mission of Artemide AC is to provide fast and reliable services in auditing and consulting to small and medium businesses (SMB), individuals, and other organizations.

The keys to success for Artemide AC are: visibility to generate new business leads, networking with other professionals, responsiveness, and quality.

The initial primary service offered will be auditing, although specialized fields will be considered in future growth.

The overall objective is to focus the activities towards the specialized services (analyses, investigations, startups, etc.) and to become a leader in this niche in the Luzern area. The company projects growth to be ~10% of sales in the next three years.

The most important keys to success for Artemide AC are developing visibility to generate new business leads, strong concentration on relationships with clients, and a high level of quality in our services.

The cooperation between Daten Riffwald-Ennetmoos and Artemide AC is flexible–with the objective to change rapidly if the market demands.

The sole proprietorship company “Sandor Artemide dipl. Wirtschaftsprüfer” was founded on 8 March 1996. In the first 10-month period, the company generated sales of $50,000.

Artemide AC is established in a separate office from Daten Riffwald-Ennetmoos AG, in Luzern. Secretary and telephone response is assumed by Daten Riffwald-Ennetmoos.

There are four major classes of competition in the actual fiduciary business in Switzerland. These include individual proprietors and small fiduciary and accounting offices and medium fiduciary offices with between 6 and 25 employees, these offices are available for general financial and tax consulting. There are also large auditing and consulting companies. These companies have several hundred employees. They tend to operate more in the lucrative consulting business. Banks, Assurances and other financial consultants are also new competitors in this field. Banks are now active in start-up consulting, corporate finance, mergers and acquisitions, and others.

Technology is, of course, very important to the success of Artemide AC. It is imperative that the company stay up-to-date on technological developments and it will be important to devote a reasonable portion of each year’s revenues toward upgrading the equipment and software used in normal operations.

Artemide AC will adopt a focused market strategy. Logical segmentation breaks the market down into the following: Individuals, Investors, Small Businesses, Medium Businesses, Large Businesses, and Authorities and Public Organizations. For our further development, we consider Individual persons and Investors plus Small and Medium Businesses to be crucial.

For our business, we do not have main competitors. We have a lot of widely-sized competitors in a vast market of services.This market environment gives ample opportunity for Artemide AC to create and expand a niche in the chosen market fields. Finally, worth noting is the growth trend for the general market, estimated between 5% and 10%, annually.

There are three different major opportunities (needs) in the fiduciary business over the next years:

- Bookkeeping and other services related to the operative financial management (payroll, cost-accounting, accounting for pension funds, etc.).

- Consulting and special mandates such as financial planning, business evaluation, merger and acquisition valuation, special audits, etc.

- Legal Auditing (incl. IAS and other standards) as an independent and responsible institution.

In addition, the company sees three primary market trends which seem to be most important in our business.

- Rapid growth in the complexity of business that requires rapid adaptation in the strategy and structures of companies.

- More litigation due to higher percentages of unsuccessful ventures.

- The growth of outsourced financial consulting.

All of this provides continuing opportunities for a dynamic company such as Artemide AC.

We believe our business is in a grand change. The competitors must be generalists and specialists at the same time. For small and medium fiduciary businesses, a focus of one primary segment of business is necessary. For example, if the “core” business is accounting, the other fiduciary businesses like tax, auditing, consulting must be reduced to a general level. In the core business, the company must be current with the services, while having the capacity to innovate (like new accounting services related to the Internet).

Artemide AC’s competitive edge is in the well-established reputation of Sandor Artemide who has been in the consulting business for over a decade, and the company’s ability to focus in this niche market.

The company’s sales strategy will be based on building long-term customer relationships, which will result in repeat sales. The company estimates that revenues will be approximately $232,000 by Year 3, yielding profits. The company will manage its assets and create profits with no debt financing. It does not anticipate any cash flow problems.

Sandor Artemide, the majority owner of Artemide AC, will assume strategic management functions. Brigitte Artemide will be in charge of market research and customer support. Since no major increases in personnel are expected in the next three years, Mr. Artemide will retain his managerial functions throughout these years.

1.1 Mission

Artemide AC’s mission is simple and straightforward:

- Purpose – Artemide AC exists to provide complete, reliable and high quality services to SMBs, individuals, lawyers, and authorities. Services must give solutions and results!

- Vision – By providing innovative services, Artemide AC generates a name in Luzern and the surrounding area.

1.2 Keys to Success

The keys to success for Artemide AC are:

- Developing visibility to generate new business leads.

- Relationships with clients (developing loyal, respectful, and intensive contact with both clients and potential clients).

- Marketing/strategy and networking with other professionals.

- Collaboration with Daten Riffwald-Ennetmoos AG for generally fiduciary services and IT services.

- Responsiveness to clients (fast response time for special problems).

- Quality (especially in reporting information).

- Excellence in fulfilling the promise.

- Openness: languages and willpower for creating interregional and international contacts.

1.3 Objectives

The objectives of this business plan are:

- To provide a written guide for managing this business; a strategic framework for developing a comprehensive tactical marketing philosophy.

- This plan is not intended to obtain financing, it is purely for internal improvements.

- The scope of this plan is to provide detailed monthly projections for the current plan year, as well as yearly summaries for the following two years.

The objectives of Artemide Auditing & Consulting are:

- The overall objective is to focus the activities towards the specialized services (analyses, investigations, startups, etc.) and to become a leader in this niche in the Luzern area.

- Cash flow – To generate sufficient cash flow to finance future growth and development, and to provide the resources needed to achieve the other objectives of the company and its owners.

- Growth – To expand the business at a rate that is both challenging and manageable, serving the market with innovation and adaptability. (Growth projected at 10% of sales in the next three years.)

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The goal will be to continue the activities on a larger personal and organizational basis, still with no debt financing.

- Artemide AC will assume operations of one of the Daten Riffwald-Ennetmoos AG’s divisions.

- Between the owners of Daten Riffwald-Ennetmoos and Artemide AC there will be a 25% cross-participation.

- The cooperation between Daten Riffwald-Ennetmoos and Artemide AC is flexible–with the objective to change rapidly if the market demands.

2.1 Company History

The sole proprietorship company “Sandor Artemide dipl. Wirtschaftsprüfer” was founded 8 March 1996. In the first 10-month period, the company generated sales of $50,000.

In the time of general recession, between 1996 and 2000, with a concentrated basis work, the owner created and assured his independent existence. The name Artemide was made known, and he has established a good professional reputation in Luzern.

Before starting his own business, Sandor Artemide acquired extensive professional experience as listed below:

- 5 years ATAG Graff & Altern in Geneva, Switzerland.

- 3 years Ziegfeld in Bern, Switzerland.

- 4 years KUGN in Bienne, Switzerland.

2.2 Company Ownership

Artemide Auditing & Consulting AG will be incorporated in the city of Luzern by Sandor Artemide, who will be the majority owner. Twenty-five percent of the company will be owned by Daten Riffwald-Ennetmoos AG, the parent company.

2.3 Company Locations and Facilities

Artemide AC is established in a separate office from Daten Riffwald-Ennetmoos AG, in Luzern. Secretary and telephone response is assumed by Daten Riffwald-Ennetmoos. In the same building, on the first level, is established ATO Geistesblitz (sale and consulting of SMB software sage-KHK).

The structure is well established and satisfies the needs of both Daten Riffwald-Ennetmoos and Artemide AC. Both companies intend to optimize the office location in the future.

Artemide AC will be the number one company in the Luzern area for specialized and investigative services in the modern business environment. Artemide AC also offers both classic, auditing, and general consulting services.

- Artemide AC will offer three main services – Auditing, Consulting, and Investigation.

- There appear to be four main classes of competition, as indicated under section 3.2.

- Fulfillment of services will be provided in the future by Sandor Artemide and other equally qualified professionals.

- It’s important to be current with the classic and special business software.

Detailed descriptions of these points are found in the sections below.

3.1 Service Description

Artemide Auditing & Consulting AG offers three main services:

- Consulting – Includes business planning, business evaluation, merger and acquisition, start-up planning, restructuring, and business-succession planning, etc.

- Investigation – Our auditing and business expertise provides us with the ability to perform analysis, specialized audits, and valuation of businesses in business disputes, fraud, or other cases of incertitude and disputes.

3.2 Competitive Comparison

There seems to be four major classes of competition in the actual fiduciary business in Switzerland:

- Individual proprietors and small fiduciary and accounting offices . The primary business of these competitors is accounting and tax compliance (for individuals and companies). This offices normally employ between 1 and 5 people. These offices deal in a large spectrum on a general level, but without specialization. These offices are often members of the STV.

- Medium fiduciary offices with between 6 and 25 or more employees. These offices are also dealing in a large and general spectrum. If there are several partners–with different formation and specialties–these offices are available for general financial and tax consulting. This offices are member of the STV or/and the TK.

- Large auditing and consulting companies . These companies have several hundred employees. They tend to operate more in the lucrative consulting business. Public companies are normally audited by these companies. Large companies are normally not interested in dealing with small and medium business. All large companies have an international network.

- Banks, Assurances and other Financial Consultants are new competitors. Financial services are “in.” Banks are active in start-up consulting, corporate finance, mergers and acquisitions, and others.

3.3 Fulfillment

The fulfillment of services was provided in the past by the owner himself. The ultimate delivery was the owner’s expertise and problem solving capability, coupled with an open mind and ease of communication. The end result is an established trust with complete customer confidence and satisfaction.

In the future, the clients must also accept the work of other qualified personnel–it is necessary to transfer and expand the established personal goodwill into company goodwill. This will only be possible with qualified and motivated employees.

3.4 Technology

Technology is, of course, very important to the success of Artemide Auditing & Cconsulting. It is imperative that the company stay up-to-date on the technological developments in the classic business software like MS-Office, etc. as well as in the special software and tools for auditing, financial planning, business planning, etc.

In addition, it will be important to devote a reasonable portion of each year’s revenues toward upgrading the equipment and software used by Artemide AC in its normal operations.

Market Analysis Summary how to do a market analysis for your business plan.">

Artemide Auditing & Consulting AG will adopt a focused market strategy.

- Logical segmentation breaks the market down into the following: Individuals, Investors, Small Businesses, Medium Businesses, Large Businesses, and Authorities and Public Organizations. Descriptions are provided below.

- The largest and most logical target markets for Artemide AC at the present are small and medium businesses. In a new “Financial Industry” Individuals and Investors become an important market segment.

- For our business, we do not have main competitors. We have a lot of widely-sized competitors in a vast market of services. This market environment gives ample opportunity for Artemide AC to create and expand a niche in the chosen market fields.

- Finally, worth noting is the growth trend for the general market, estimated between 5% and 10%, annually.

4.1 Market Segmentation

- Individual persons and Investors

- Small Businesses – Defined as businesses with 1 to 24 employees, this is the second largest and fastest growing segment in our region.

- Medium Businesses – 25 to 499 employees.

- Large Businesses – 500 or more employees.

- Authorities and Public Organizations

4.2 Target Market Segment Strategy

For our further development, we consider the following market segments to be very important:

- Individual persons and Investors.

- Small and Medium Businesses.

Artemide AC will focus its marketing strategy primarily on these market segments.

4.2.1 Market Needs

There are three different major opportunities (needs) in the fiduciary business over the next years:

- Consulting and special mandates.

- Financial-Planning

- Business-Planning

- Business-Evaluation

- Merger & Acquisition

- Startup-Planning

- Restructuring

- Business Succession-Planning

- Coaching in Financial-Managing

- Special Audits, Reviews

- Investigation, Forensic Services

We think that the need for consulting and other specialized fields has a strong growth potential.

4.2.2 Market Trends

Three primary market trends seem to be most important in our business:

- Trend 1- (most important) Rapid growth in complexity of business in an ever-changing market and competitive environment needs continuous and rapid adaptation in both strategy and structures of companies.

- Trend 2- (moderately important) In the future there will be a percentage of unsuccessful ventures resulting in more litigation, which, in turn, will emphasize the need for specialized audits, investigation, restructuring, etc.

- Trend 3- (least important) Predicted continued growth in consulting because companies will be unwilling to pay fixed costs of salaries, choosing instead to treat specialized financial knowledge and needs as variable costs from external sources.

Economically it is more expedient to acquire specialized services from a consulting firm that has its own specialized employees.

4.2.3 Market Growth

As noted in the previous section, several factors are predicted to continue well into the next decade, not the least of which we estimate the annual market growth rate between 5% and 10%.

4.3 Service Business Analysis

The fiduciary and consulting business for the local area is already well established, yet still allows ample opportunity for us. This is supported by the following points:

- Already in existence are a large number of firms – we think that most of the small and medium firms are operating in a limited spectrum of traditional fiduciary services (accounting and tax) and they do not have enough knowledge and/or time for entering the field of specialized services – so we have new participants like banks, assurances, lawyers, and others entering the market.

- Customers in the fiduciary business tend to be loyal, relying on the same consultant for future needs once a relationship has been established – this fact requires establishing a good and intensive personal relationship with client. This, in the large, “big 6,” firms, is often not realizable because of staff turn over and inaccessibility of personnel.

- The globalization of markets will increase the demands for expansion of new services related to our business.

We believe our business is in a in a period of grand change. The competitors must be generalists and specialists at the same time. For small and medium fiduciary businesses, a focus of one primary segment of business is necessary. For example, if the “core” business is accounting, the other fiduciary businesses like tax, auditing, consulting must be reduced to a general level. In the core business, the company must be current with the services, while having the capacity to innovate (like new accounting services related to the Internet).

For our business, we do not have main competitors: We have many competitors in diversified services. More important than the competitors, is the need to get established in the right market and to develop this market with a strong and flexible strategy.

4.3.1 Competition and Buying Patterns

Competition in the general field of business consulting in the Luzern area is quite intense. Although numerous established companies offer a variety of services to different customer segments, Artemide Auditing & Consulting AG considers competition in our focus market niche of small and medium businesses to be modest. Customers in this segment strongly rely on the consultant’s professional qualifications and the ability to come up with viable solutions in a time- and cost-effective manner.

Strategy and Implementation Summary

Artemide AC will offer auditing, consulting, and investigation services to small and medium businesses in the Luzern area. The company will focus on providing excellent customer service, and that will generate favorable client referrals and increase customer retention.

5.1 Competitive Edge

Artemide Auditing & Consulting’s competitive edge is in the well-established reputation of Sandor Artemide who has been in the consulting business for over a decade. Combining his professional expertise with the financial, marketing, and technical support of Daten Riffwald-Ennetmoos AG, the company is positioned to further entrench itself in the growing market of small and medium business consulting in the Luzern area.

5.2 Sales Strategy

The company’s sales strategy will be based on building long-term customer relationships, which will result in repeat sales. Customer service and ‘face time’ with clients will be aimed to maintain a high level of customer retention. The charts and table below outline the Sales Forecast for the next three years.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

Sandor Artemide, the majority owner of Artemide AC, will assume strategic management functions. Brigitte Artemide will be in charge of market research and customer support. No major increases in personnel are expected in the next three years.

6.1 Personnel Plan

The following table outlines the two-person management system of Artemide AC.

Financial Plan investor-ready personnel plan .">

The following sections include the annual estimates for the standard set of financial tables. Detailed monthly pro-forma tables are included in the appendix.

7.1 Important Assumptions

This information is presented in the table below.

7.2 Key Financial Indicators

The Benchmark chart below uses index values to compare past and future financial indicators. The bars show relative change, not absolute values.

7.3 Break-even Analysis

With our average monthly fixed costs, Artemide will surpass break even consistently throughout the next year of operations.

7.4 Projected Profit and Loss

The projected profit and loss information is presented in the table and charts below.

7.5 Projected Cash Flow

The projected cash flow and cash balance information is presented in the chart and table below.

7.6 Projected Balance Sheet

The projected balance sheet information is presented in the table below.

7.7 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8721.01 – Auditing services, are shown for comparison.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How To Write a Winning Accountant Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for accountant businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every accountant business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Accountant Business Plan?

An accountant business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Accountant Business Plan?

An accountant business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Accountant Business Plan

The following are the key components of a successful accountant business plan:

Executive Summary

The executive summary of an accountant business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your accountant company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your accountant business , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your accountant firm, mention this.

Industry Analysis

The industry or market analysis is an important component of an accountant business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the accountant industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an accountant business may include small business owners, individuals with complex financial situations, or other businesses that need accounting assistance.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or accountant services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your accountant business via word-of-mouth or referrals from satisfied customers.

Operations Plan

This part of your accountant business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an accountant business include reaching $X in sales. Other examples include adding new products or services, expanding to new markets, or opening new locations.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific accountant industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Accountant Business

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Accountant Business

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup accountant business.

Sample Cash Flow Statement for a Startup Accountant Business

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your accountant company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

The goal of any business plan is to provide a roadmap for the future. A winning accountant business plan does this by providing a detailed overview of your company, its operations, and its financials. If you are seeking funding, your business plan should also include an appendix with your full financial projections and supporting documentation.

Finish Your Accounting Firm Business Plan in 1 Day!

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. His expertise, reputation, and loyal clientbase will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the clientbase that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

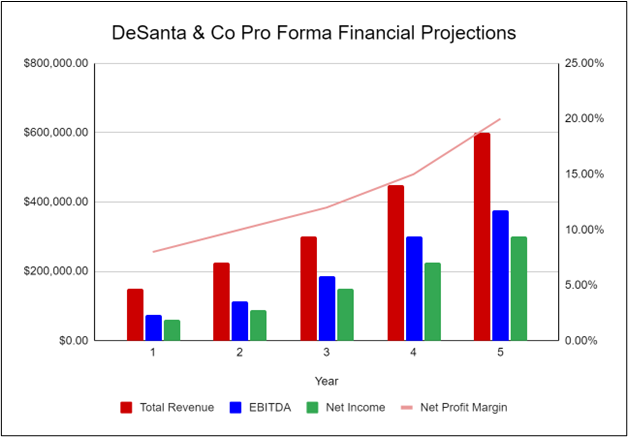

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. After working for several accounting firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his clientbase and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, accounting business plan faqs, what is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

Starting an Audit Firm? Here's Your Complete 12-Step Guide

By alex ryzhkov, resources on auditor.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

Introduction

Auditing is an important and growing field. The UK audit profession is estimated to be worth £7.4 billion annually and is continuing to grow. Launching an auditor business is a daunting task, however there are many steps to make the process easier. This blog post will outline the 12 step checklist for starting an auditor business. It’s important to follow each step closely and ensure that all the necessary details have been taken care of, in order to ensure a successful launch. Let’s begin!

Create A Business Plan

A business plan is a critical part of launching a successful auditor business. The business plan should include an overview of the business, a description of the services offered, a marketing strategy, a financial plan, and any other pertinent information. Here are some tips for creating a successful business plan:

- Research the industry to gain insight into the current market conditions and potential competition.

- Develop a clear mission statement for your business.

- Set realistic goals for the business and create an action plan for achieving them.

- Create a complete financial plan that includes start-up costs, projected profits, and sources of funding.

- Develop a marketing plan that outlines how the business will reach customers.

- Outline any legal requirements or permits necessary to operate the business.

- Analyze the potential risks and rewards of the business.

Creating a detailed business plan is an essential step in launching any business, and it is especially important when opening an auditor business. Taking the time to carefully craft the plan will help ensure the business has the best chance of succeeding.

Develop A Financial Model

Developing a financial model is a crucial step in launching a new auditing business. A financial model is a representation of the expected financial performance of the business. It is important to create a financial model that accurately reflects the realities of running a business.

When creating a financial model for a new auditing business, it is important to consider a few key factors. Here are some tips and tricks for developing a financial model for a new auditing business:

- Understand the market: It is important to understand the market for auditing services in your area. Research the current market conditions, potential competitors, and potential customers.

- Identify revenue sources: Identify the sources of revenue for your business. Will you be offering services to individual clients, businesses, or both?

- Understand costs: Accurately estimate all of the costs associated with running the business. Consider all costs, such as payroll, taxes, rent, insurance, marketing, and more.

- Forecasting: Create a forecast of the expected financial performance of the business. This should include both short-term and long-term projections.

- Business plan: Create a business plan to ensure that the financial model is in line with the overall goals of the business.

- Evaluate and adjust: Evaluate the financial model on a regular basis and make adjustments as needed.

Creating a financial model is a crucial step in launching a new auditing business. It is important to understand the market, identify revenue sources, understand costs, create a forecast, create a business plan, and evaluate and adjust the financial model on a regular basis.

$169.00 $99.00 Get Template

Explore Potential Sources Of Funding

Once you have created a business plan and developed a financial model, you will need to explore potential sources of funding in order to launch your auditor business. There are a variety of potential sources of funding, including traditional loans, private investors, crowdfunding, grants, and more. It is important to take the time to research the different options and decide which one is the best fit for your business.

Here is a checklist of sources of funding to consider:

- Traditional Loans – Traditional loans from banks, credit unions, or other financial institutions can provide much-needed capital for your business.

- Private Investors – Private investors, such as angel investors or venture capitalists, can provide capital in exchange for equity in your business.

- Crowdfunding – Crowdfunding platforms, such as Kickstarter or GoFundMe, allow you to raise money from a large group of people.

- Grants – Grants are typically offered by the government and are given to businesses that are working on specific projects or initiatives.

- Small Business Loans – Small business loans are typically offered by the Small Business Administration and are designed to help small businesses get the capital they need.

It is important to remember that each of these sources of funding has its own set of requirements and qualifications. It is important to do the research and find the one that is the best fit for your business. For example, grants typically require extensive paperwork and a very specific project to be eligible for funding.

Once you have identified the potential sources of funding, it is important to create a plan for applying for and securing the funding. This plan should include a timeline for applying for the funding and a strategy for how you will use the funds once they are secured.

Research Necessary Permits And Licenses

When starting an auditor business, it is important to research necessary permits and licenses. Depending on the location of the business, the requirements may vary. Generally, a business needs to be registered with the state and local authorities, and auditors may also need to be certified or licensed. Here are some tips and tricks for researching necessary permits and licenses for an auditor business:

- Understand the local regulations. Research the local regulations to understand what is required to set up an auditor business.

- Contact the local government. Reach out to the local government to understand the necessary steps and documents required to register the business.

- Check for certifications. Check if there are any certifications or licenses required for an auditor.

- Look for any additional permits. Research if there are any additional permits required for the business, such as a business license, health department permits, etc.

- Find out if there are any insurance requirements. Research if there are any insurance requirements for the auditor business, such as liability insurance.

- Understand the tax requirements. Research the tax requirements for the business, and register for the necessary tax ID.

It is important to research the necessary permits and licenses before starting an auditor business. By researching the local regulations and understanding the requirements, you can ensure that you are in compliance with the law and have all the necessary documents in place to start your business.

Develop a Legal Structure

When launching an auditor business, it is important to develop a legal structure that works for your business. There are several factors to consider when deciding on a legal structure, such as the type of business, tax implications, and personal liability.

When deciding on a legal structure for your business, it is important to consider the following:

- Type of business: Are you a sole proprietorship, limited liability company (LLC), partnership, or corporation?

- Tax implications: What type of taxes will you need to pay?

- Personal liability: What type of liability will you have as a business owner?

Once you have determined the legal structure of your business, you will need to register your business with the appropriate agencies. Depending on the type of business and the state in which you are operating, this could include registering with the Secretary of State, the Department of Revenue, or the Internal Revenue Service (IRS).

It is also important to consider the type of insurance you will need. This could include general liability insurance, professional liability insurance, or workers' compensation insurance. Depending on the type of business you are running and the state in which you are operating, you may be required to have certain types of insurance.

Finally, you will need to make sure your business complies with all applicable laws. This could include labor laws, environmental laws, and consumer protection laws. Make sure you research the applicable laws and regulations in your state and local area.

Form A Team

When it comes to launching a successful auditor business, it is essential to have a dedicated and experienced team. A business cannot run without the right team in place. Here are some tips and tricks to help you form the perfect team for your auditor business:

- Start by identifying the skills and experience needed for your team. Consider the roles your team will need to fill, such as accounting, legal, marketing, and operations.

- Create a job description for each role and use it to advertise the positions. Reach out to your network and other industry contacts to find candidates.

- Once you have identified potential candidates, conduct interviews to assess their skills and fit with the team. Ask questions that will help you get a better understanding of the candidate’s experience and qualifications.

- Assemble the team and provide them with the resources and support they need to succeed. This could include training materials, access to software, and any other tools they may need.

- Encourage open communication and collaboration among your team members. This will help them develop better working relationships and foster a productive and creative working environment.

Establish Brand And Position

As a business owner, your brand and position are critical pieces of your success. Establishing a brand and positioning your auditor business correctly will enable you to stand out from the competition and attract customers. Here are some tips and tricks for establishing a brand and position for your business:

- Start by researching your target audience and understanding their needs and wants. This will help you to create a unique brand and position that resonates with them.

- Create a brand identity that is memorable and easily recognizable. This includes a logo, slogan, and color palette that reflects the values, mission, and culture of your business.

- Develop a concise elevator pitch that concisely explains the services you offer and why you are the best choice for customers.

- Focus on creating a strong online presence for your business. This includes setting up a website, being active on social media, and leveraging SEO tactics.

- Seek feedback from your target audience on your brand and positioning to ensure it resonates with them.

Create A Marketing And Sales Strategy

Creating a marketing and sales strategy is a key step in launching your auditor business. Your marketing and sales strategy should outline the various tactics you will use to reach your target market and convert prospects into customers. Here are some tips and tricks to get started:

Identify Your Target Market

A key part of creating your marketing and sales strategy is to identify your target market. To do this, you will need to research your potential customers and their needs and wants. This will help you determine the best way to market and sell your services.

Develop a Unique Selling Proposition

Once you have identified your target market, you will need to develop a unique selling proposition (USP) for your auditor business. Your USP should clearly communicate why customers should choose your business over the competition. This will help you stand out in the marketplace.

Create a Marketing Plan

Once you have identified your target market and developed a USP, it’s time to create a detailed marketing plan. Your marketing plan should include a variety of tactics to reach your target market, such as content marketing, social media marketing, email marketing, and search engine optimization (SEO).

Develop a Sales Process

You will also need to develop a sales process for your auditor business. This should include the steps you will take to convert prospects into customers, such as cold-calling, emailing, networking, and creating presentations.

Track and Measure Results

Finally, you should track and measure the results of your marketing and sales efforts. This will help you determine which tactics are working and which ones need to be tweaked or abandoned. You should also track customer feedback to ensure that your services are meeting their needs.

Secure A Physical Space

Finding the right space for your auditor business is essential. Not only will you need enough space to accommodate your team and any other staff, but you also need to consider the type of environment that will be conducive to your business activities. To secure a physical space, consider the following:

- Determine the size and type of space you need. Consider the size of your team and any other equipment you may need to accommodate your operations.

- Conduct research to identify potential locations. Evaluate each location based on factors such as cost, access to transportation, and potential clientele.

- Negotiate the terms of your lease. This can include the length of the lease, amount of space, and any additional amenities.

- Secure any necessary permits and licenses. Depending on the type of business you’re operating, there may be certain permits and licenses that you need to secure in order to operate legally.

- Secure insurance coverage. This will provide you with financial protection in the event of any unexpected events or damages.

- Make any necessary renovations. This may include painting, installing fixtures, and installing furniture.

Once you’ve secured a physical space, you’ll be well on your way to launching your auditor business. Good luck!

Develop An Online Presence

In today’s digital world, having an online presence is essential for any business. As an auditor, it’s important to create an online presence that reflects your brand and its core values. Here are some tips and tricks to help you get started:

- Ensure your website is professional and reflects your brand. Include contact information, customer testimonials and reviews, and any information about the services you provide.

- Create social media accounts on platforms such as Facebook, Twitter, and LinkedIn. Use these accounts to promote your services, share updates, and engage with customers.

- Start a blog to share valuable content and provide customers with helpful resources.

- Create an email newsletter with updates about your business and new services.

- Advertise on digital platforms such as Google, Facebook, and Instagram.

By creating a comprehensive online presence, you’ll be able to reach more potential customers and establish a strong presence in the industry. Remember to keep your online presence updated and relevant to ensure success.

Implement Infrastructure And Systems

In order to ensure your auditor business is successful, you need to have the right infrastructure and systems in place. This will involve setting up the appropriate processes and tools to help manage your operations and customers.

Here are some key steps to help you get started:

- Develop a customer relationship management (CRM) system: A CRM system will help you to effectively manage your customer relationships, track customer data, and generate leads. It will also enable you to create customized customer experiences.

- Set up an accounting system: An accounting system will help you to track and manage your finances, such as invoices, payments, and expenses. It can also help you to generate financial reports and analyse your performance.

- Create a project management system: A project management system will help you to effectively manage projects and tasks, assign responsibilities, and track progress. This will help to ensure projects are completed on time and within budget.

- Establish a communication system: A communication system will enable you to communicate with customers, partners, and team members. This could include email, messaging services, or collaboration tools.

- Develop a customer service system: A customer service system will help you to manage customer inquiries and complaints. It can also provide helpful information to customers, such as FAQs and tutorials.

By implementing the right infrastructure and systems, you can ensure your auditor business is running smoothly and efficiently. This will help to ensure your business is successful and that your customers are satisfied.

Launch And Track New Business

Launching a new business can be both daunting and exciting. You have likely spent months, if not years, preparing for the day that your business opens its doors. When the time finally arrives, it is important to ensure that the launch is well-planned and executed. Here are some tips and tricks to help you launch and track your new business.

Know Your Goals

Before launching your business, take the time to define your goals and objectives. Consider what you would like to achieve in the short-term, mid-term and long-term. Once you have identified your goals, you can use them as a benchmark to measure the success of your business.

Have a Clear Plan

Before launching your business, it is essential to have a clear plan in place. This plan should include your objectives, strategies and tactics. It should also include an outline of how you will measure success and track progress. Having a plan in place will help ensure that your launch is successful and that your business is able to meet its goals.

Develop a Launch Timeline

Creating a timeline for your launch is key to ensuring that the process is successful. A launch timeline should include key milestones and actionable tasks, as well as timelines for each task. This timeline should be updated regularly to ensure that you are on track and that all tasks are completed on time.

Set Up Tracking and Monitoring

Once your launch is complete, it is important to set up a tracking and monitoring system. This system should track key metrics, such as sales, customer feedback and website traffic. This data can then be used to measure the success of your business and inform future decisions.

Promote Your Business

Promoting your business is essential for its success. Utilize all available channels, such as email, social media, and print media to promote your business. Additionally, consider hosting events or offering incentives to encourage customers to try out your business.

Stay Flexible

As you launch and track your business, it is important to remain flexible. While you should adhere to your plan and timeline, be prepared to make changes when needed. It is also important to remain open to feedback and suggestions from customers, as this can help you improve your business.

Launching an auditor business is a challenging but rewarding task. By following the 12-step checklist outlined in this blog post, you can be sure to prepare your business for a successful launch. It’s important to consult with a lawyer, accountant and business advisor throughout the process. With the right preparation and research you’re sure to make a great start to your auditing business.

Related Blogs

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- Writing Business Plan

- Buy a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

404 Not found

Sample Consulting Firm Business Plan

Writing a business plan is a crucial step in starting a consulting firm. Not only does it provide structure and guidance for the future, but it also helps to create funding opportunities and attract potential investors. For aspiring consulting firm business owners, having access to a sample consulting firm business plan can be especially helpful in providing direction and gaining insight into how to draft their own consulting firm business plan.

Download our Ultimate Consulting Firm Business Plan Template

Having a thorough business plan in place is critical for any successful consulting firm venture. It will serve as the foundation for your operations, setting out the goals and objectives that will help guide your decisions and actions. A well-written business plan can give you clarity on realistic financial projections and help you secure financing from lenders or investors. A consulting firm business plan example can be a great resource to draw upon when creating your own plan, making sure that all the key components are included in your document.

The consulting firm business plan sample below will give you an idea of what one should look like. It is not as comprehensive and successful in raising capital for your consulting firm as Growthink’s Ultimate Consulting Firm Business Plan Template , but it can help you write a consulting firm business plan of your own.

Consulting Firm Business Plan Example – InsightAdvantage Consultants

Table of contents, executive summary, company overview, industry analysis, customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan.

Welcome to InsightAdvantage Consultants, our new consulting firm rooted in the vibrant landscape of San Francisco, CA. Born out of a vision to fill the void for high-quality local consulting services, our mission is dedicated to offering unparalleled consulting solutions tailored to the unique needs of businesses in our community. Specializing in strategic planning, management consulting, and financial advisory, we craft personalized solutions that empower our clients to navigate their specific challenges and seize opportunities for growth. With our firm strategically located in San Francisco, we not only ensure our services are highly relevant and specialized for the local market but also contribute actively to the local business ecosystem, making us the go-to consulting firm in the area.

Our success at InsightAdvantage Consultants is driven by a blend of factors. The wealth of experience brought by our founder, who has a proven track record in the consulting industry, sets a solid foundation for our operations. Coupled with our commitment to superior consulting expertise, we stand out as a leader in the field. Our specialized understanding of the San Francisco market further cements our position as the preferred local consulting partner. Since our launch in January 2024, we’ve hit several key milestones, including establishing our brand identity, securing a prime location for our operations, and structuring our business as an S Corporation ready for growth. These accomplishments underscore our readiness and enthusiasm to empower local businesses towards success.

The Consulting Firm industry in the United States, currently valued at over $250 billion, exhibits a robust demand across various sectors, including healthcare, technology, and finance. With an expected annual growth rate of 3-4%, the industry is on a trajectory of steady expansion. A notable trend is the emergence of specialized niche consulting firms like InsightAdvantage Consultants, which cater to specific business needs with highly targeted expertise and solutions. This trend aligns with our focus on the San Francisco market, positioning us to leverage the increasing demand for specialized consulting services in the region.

InsightAdvantage Consultants targets a diverse customer base, starting with local residents to establish a strong community presence. We also focus on small to medium-sized enterprises (SMEs) and tech startups in San Francisco, offering them tailored consulting services to address their unique challenges. By providing strategies for growth, efficiency improvements, and competitive positioning, we aim to support the backbone of the local economy and the dynamic tech startup sector with agile, innovative solutions that drive sustainable success.

Our main competitors include Run Right Business Consulting, with their tailored services and deep local market understanding; Piedmont Avenue Consulting, specializing in marketing and branding strategies; and BookSoEasy, which combines business consulting with technological solutions. Despite the strengths of these firms, InsightAdvantage Consultants remains unmatched in our blend of industry experience, innovative strategies, and deep local market insights. Our diverse team of industry veterans and young innovators enables us to offer solutions that are both time-tested and infused with fresh, forward-thinking ideas. This unique combination, along with our strategic location in San Francisco, positions us as a leader in the consulting industry.

InsightAdvantage Consultants offers a comprehensive suite of services, including Strategic Planning, Management Consulting, and Financial Advisory, each designed to meet our clients’ diverse needs. Our pricing strategy is tailored to reflect the value and customization of our services, with prices varying based on scope and complexity. To promote our offerings, we employ a robust digital marketing strategy, leveraging social media, SEO, and email campaigns, complemented by content marketing to position us as thought leaders. Networking events, referral programs, and targeted advertising campaigns further amplify our visibility and attract a broad spectrum of clients.

Our operations at InsightAdvantage Consultants are centered around key processes such as client communication, market research, strategy development, project management, and quality assurance, to name a few. We are committed to continuous learning and professional development to stay ahead of industry trends. In the coming months, we aim to achieve several milestones, including securing initial client contracts, achieving operational efficiency, and building a strong local network. These efforts are all geared towards ensuring our firm’s success and sustainable growth.

At the helm of InsightAdvantage Consultants is Lucas Jackson, our President, who brings a wealth of experience and a proven track record from the consulting industry. His expertise in strategic planning, operational efficiency, and business development is invaluable to guiding our firm towards achieving its strategic goals. Lucas’s leadership and deep market understanding ensure we are well-equipped to navigate the industry landscape and achieve lasting success.

Welcome to InsightAdvantage Consultants, a new consulting firm based in the vibrant city of San Francisco, CA. As a local consulting firm, we stand out in a landscape that previously lacked high-quality local consulting services. Our mission is to bridge this gap and offer unparalleled consulting solutions that cater specifically to the needs of businesses in our community.

At InsightAdvantage Consultants, we specialize in a range of services designed to empower businesses to achieve their goals. Our offerings include strategic planning, which helps businesses chart a course for success in an ever-changing market. We also provide management consulting to streamline operations, enhance efficiency, and foster leadership within teams. Additionally, our financial advisory services are tailored to help businesses optimize their financial strategies for growth and stability. Each of these services is crafted with our clients’ success in mind, offering personalized solutions that address their unique challenges and opportunities.

Our firm is proudly based in San Francisco, CA, serving customers within this dynamic city. This strategic location not only allows us to be close to our clients but also to be an integral part of the local business ecosystem. By focusing on serving San Francisco businesses, we ensure that our services are highly relevant and tailored to the specific needs of companies operating in this unique market.