myCBSEguide

- Class 12 Economics Case...

Class 12 Economics Case Study Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

In this article, we will discuss how to download CBSE class 12 Economics Case Study Questions from the myCBSEguide App and our Student Dashboard for free. For the students appearing for class 12 board exams from the commerce/ humanities stream, Economics is a very lucrative and important subject. It is a very high-scoring subject that aids the students to increase their percentile and excel in academics.

The exam is divided into 2 parts:

- Macro Economics

- Indian Economics Development

12 Economics Case Study Questions

CBSE introduced case-based questions for class 12 in the year 2021-22 to enhance critical thinking in students. CBSE introduced a few changes in the question paper pattern to enhance and develop analytical and reasoning skills among students. Sanyam Bharadwaj, controller of examinations, CBSE quoted that the case-based questions would be based on real-life situations encountered by students.

The purpose was to drift from rote learning to competency and situation-based learning. He emphasized the fact that it was the need of the hour to move away from the old system and formulate new policies to enhance the critical reasoning skills of students. Introducing case study questions was a step toward achieving the goals of the National Education Policy (NEP) 2020.

What is a Case Study Question?

As part of these questions, the students would be provided with a comprehensive passage, based on which analytical questions will have to be solved by them. The students will have to read the given passage thoroughly before attempting the questions. In The current examination cycle (2021-22), case-based questions have a weightage of around 20%.

Types of Case Study Questions in Economics

CBSE plans to increase the weightage of such questions in the following years, so as to enhance the intellectual and analytical abilities of the students. Case-based questions are predominantly of 3 types namely:

- Inferential

Local questions

Local questions can be easily solved as the answers are there in the given passage itself.

Global Questions

For Global questions, the students will have to read the passage in depth, analyze it and then solve it.

Inferential questions

Inferential questions are the ones that would require the student to have complete knowledge of the topic and could be answered by application of the concepts. The answers to such questions are tricky and not visible in the given passage, though the passage would highlight the concept on which the questions would be asked by CBSE.

HOTS Questions in Class 12 Economics

Personally, the concept of case-based questions is not new since CBSE has always included questions based on Higher Order Thinking Skills (HOTs). Though now we will have an increased percentage of such questions in the question paper.

Advantages of Case-based Questions

Class 12 Economics has two books and CBSE can ask Case study questions from any of them. Students must prepare themselves for both the books. They must practice class 12 Economics case-based questions as much as possible.

Case study questions:

- Enhance the intellectual and analytical abilities of the students.

- Provide a complete and deeper understanding of the subject.

- Inculcate intellectual reasoning and scientific temperamental in students.

- Help students retain knowledge for a longer time.

- Would definitely help to discard the concept of memorizing insanely and cramming without a factual understanding of the content.

- The questions would help to terminate the existing system of education in India that promotes rote learning.

Sample case study questions (Economics) class 12

Here are some case study questions for CBSE class 12 Economics. If you wish to get more case study questions and other related study material, download the myCBSEguide App now. You can also access it through our Student Dashboard.

Case Study 1

Keeping in view the continuing hardships faced by banks in terms of social distancing of staff and consequent strains on reporting requirements, the Reserve Bank of India has extended the relaxation of the minimum daily maintenance of the CRR of 80% for up to September 25, 2020. Currently, CRR is 3% and SLR is 18.50%.

“As announced in the Statement of Development and Regulatory Policies of March 27, 2020, the minimum daily maintenance of CRR was reduced from 90% of the prescribed CRR to 80% effective the fortnight beginning March 28, 2020 till June 26, 2020, that has now been extended up to September 25, 2020,” said the RBI.

Q.1 The full forms of CRR and SLR are:

- Current Reserve Ratio and Statutory Legal Reserves

- Cash Reserve Ratio and Statutory Legal Reserves

- Current Required Ratio and Statutory Legal Reserves

- Cash Reserve Ratio and Statutory Liquidity Ratio (ans)

Q.2 What will be the value of the money multiplier?

- None of these

Q.3 SLR implies:

- a) Certain percentage of the total banks’ deposits has to be kept in the current account with RBI

- b) Certain percentage of net total demand and time deposits have to be kept by the bank themselves (ans)

- c) Certain percentage of net demand deposits has to be kept by the banks with RBI

- d) None of the above

Q.4 Decrease in CRR will lead to __.

- a) fall in aggregate demand in the economy

- b) rise in aggregate demand in the economy (ans)

- c) no change in aggregate demand in the economy

- d) fall in the general price level in the economy

Case Study 2

An important lesson that the COVID-19 pandemic has taught the policymakers in India is to provide greater impetus to sectors that make better allocation of resources and reduce income inequalities. COVID-19 has also taught a lesson that in crisis the population returns to rely on the farm sector. India has a large arable land, but the farm sector has its own structural problems. However, directly or indirectly, 50 percent of the households still depend on the farm sector. Greater support to MSMEs, higher public expenditure on health and education and making the labour force a formal employee in the economy are some of the milestones that the nation has to achieve.

One of the imminent reforms to be done in the country is labour reforms. Labour laws are outmoded in India, and some of these date back to the last century.

India’s complex labour laws have been blamed for keeping manufacturing businesses small and hindering job creation. Industry hires labour informally because of complex laws and that is responsible for low wages.

- Which types of structural problems are faced by the agricultural sector?

- “It is necessary to create employment in the formal sector rather than in the informal sector.’’ Defend or refute the given statement with valid argument.

- Hired labour comes in …………………. (Informal organisation / formal organisation)

- What do you mean by MSMEs?

Case Study 3

People spend to acquire information relating to the labour market and other markets like education and health. This information is necessary to make decisions w.r.t investment in human capital and its efficient utilization. Thus, expenditure incurred for acquiring information relating to the labour market and other markets is also a source of human capital formation.

Q1. Which of the following is the source of human capital formation in India?

- Acquiring information

- All of these (ans)

Q2. Education provides

- Private benefit

- Social benefit

- Both 1) and 2) (ans)

Q3. __ persons contribute more to the growth of an economy.

Q4. Training given by a company to its employees is generally__________

- Investment (ans)

- Social wastage

- Both 1) and 2)

Tips to Solve Case Study Questions in Economics

Let’s understand how you can solve case study questions in class 12 Economics. The two books are Macroeconomics and Indian Economic Development.

- Read the passage thoroughly

- Can follow a reversal pattern, especially macroeconomics questions, i.e. read questions first and then look for the answers in the passage.

- In case the question asked is about Indian Economic Development, read the passage very carefully as most of the answers would be hidden in the passage itself.

- Macro Economics questions will be more application-based and would test your conceptual clarity.

- Answer briefly and precisely.

Important Chapters – Economics Case Study Questions

Following are some of the very important topics that need to be prepared very thoroughly under CBSE class 12 Economics. We expect that CBSE will certainly ask case-based questions from these chapters.

- National income and its aggregates

- Government budget

- Current challenges faced by the Indian economy

“Stop waiting for tomorrow, Start now”

Test Generator

Create question paper PDF and online tests with your own name & logo in minutes.

Question Bank, Mock Tests, Exam Papers, NCERT Solutions, Sample Papers, Notes

Related Posts

- Competency Based Learning in CBSE Schools

- Class 11 Physical Education Case Study Questions

- Class 11 Sociology Case Study Questions

- Class 12 Applied Mathematics Case Study Questions

- Class 11 Applied Mathematics Case Study Questions

- Class 11 Mathematics Case Study Questions

- Class 11 Biology Case Study Questions

- Class 12 Physical Education Case Study Questions

3 thoughts on “Class 12 Economics Case Study Questions”

thanks for your information, dont forget to visit airlangga university website https://www.unair.ac.id/mahasiswa-unair-dan-y20-indonesia-diskusikan-isu-resesi-ekonomi/

thank you for Economics MCQs

https://mcqquestions.net/economics

Leave a Comment

Save my name, email, and website in this browser for the next time I comment.

- Book Solutions

- State Boards

CBSE Class 12 Economics Case study Questions & Answers For Chapter (Microeconomics & Macroeconomics)

Understudies can discover the chapter astute vital questions for course 12th Economics within the table underneath. These imperative questions incorporate questions that are regularly inquired in a long time. Moreover, arrangements are to give for these questions, with extraordinary accentuation on ease-of-study. Tap on the joins underneath to begin investigating.

Below we posted all the Case Study Questions & Answers for Class 12 Economics all Chapters –

CBSE Class 12 Case Study Question for Economics

Case study 01:.

(a) From the following data calculate the value of Domestic Income:

Ans:- Domestic Income (NDP@fc)

=(i)+(ii)+(iv)+(vii)+(viii)+(x)

=₹2000+₹800+₹460+₹940+₹300+₹200

=₹4,700 crore

(b) Distinguish between ‘Value of Output’ and ‘Value Added’.

Ans: Value of output is the estimated money value of all the goods and services, inclusive of change in stock and production for self-consumption. Whereas,

Value added is the excess of value of output over the value of intermediate consumption.

(a) Given the following data, find Net Value Added at Factor Cost by Sambhav (a farmer) producing Wheat:

Ans: Net Value Added at Factor Cost (NVA @ FC)

=(i)+(iii)+(iv)+(vi)-(v)

=₹6800+₹200+₹50+₹20-₹100

=₹6,970crore

(b) State any two components of ‘Net Factor Income from Abroad’.

Ans: Component of net factor income from abroad are:

(i) Net compensation of employees

(ii) Net income from property and entrepreneurship

(iii) Net retained earnings of resident companies abroad

(a) ‘Pesticides are chemical compounds designed to kill pests. Many pesticides can also pose health risks to people even if exposed to nominal quantities. ‘In the light of the above statement, suggest any two traditional methods for replacement of the chemical pesticides.

Ans: The traditional practices can help in controlling contamination without the use of chemical fertilizers, as follows:

(i) Neem trees and its by products are a natural pest-controller, which has been used since ages in India. Recently, the government promoted the sale Neem coated urea as a measure of natural pest control.

(ii) Large variety of birds should be allowed to dwell around the agricultural areas, they can clear large varieties of pests including insects

(b) ‘In recent times the Indian Economy has experienced the problem of Casualisation of the workforce. This problem has only been aggravated by the outbreak of COVID-19.’ Do you agree with the given statement? Discuss any two disadvantages of casualisation of the workforce in the light of the above statement.

Ans:- The given statement is quite appropriate with reference to the ‘casualisation of labour’ in India.

(i) For casual workers, the rights of the labour are not properly protected by labour laws. Particularly, during pandemic times, as demand for goods and services fell the casual workers were left jobless, without any compensation or support.

(ii) During the COVID-19 lockdown millions of casual workers lost their jobs, raising the question of their survival. Also, additional health expenditure added to their troubles.

Key questions for 12th review Biology are outlined agreeing to the CBSE NCERT program. All address sorts are accessible within the PDF, from one-word to one-line answers, brief reply sorts to five point long reply sorts. Hence, understudies can plan for exams and indeed clarify their concepts through them. On the off chance that they refer to these questions, it’ll get ready their minds to pick up a competitive advantage. Understudies will gotten to be commonplace with question patterns and the sorts of questions that will show up on exams.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

We have a strong team of experienced Teachers who are here to solve all your exam preparation doubts

Telangana scert class 9 physical science chapter 12 sound solution, cbse notes for class 10 science chapter 7 – control and coordination, comprehension class 2 worksheet, new learning composite mathematics class 5 s.k gupta anubhuti gangal commercial arithmetic (percentage, profit and loss) chapter 15a solution.

Sign in to your account

Username or Email Address

Remember Me

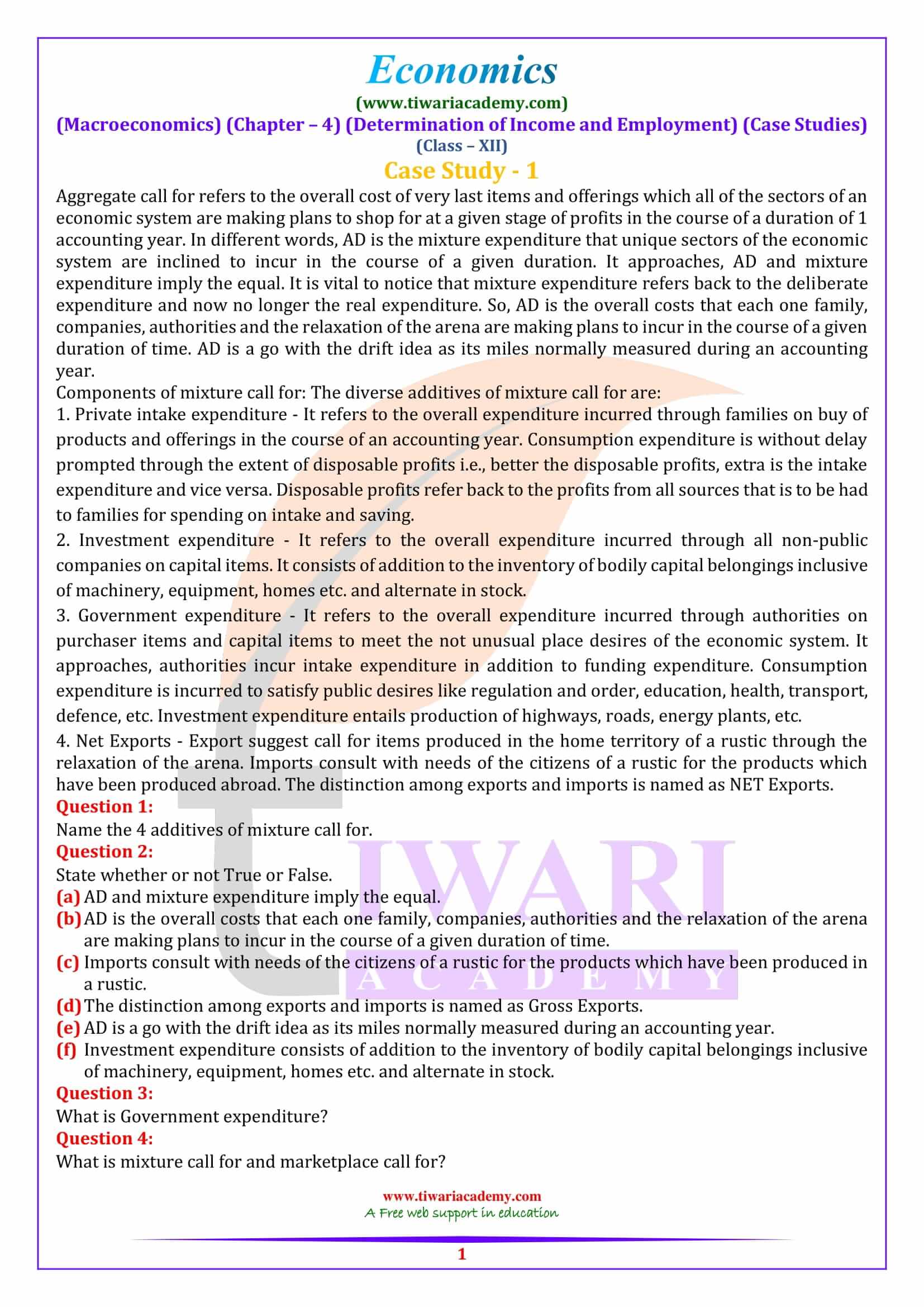

NCERT Solutions for Class 12 Macroeconomics Chapter 4 Case Study

NCERT Solutions for Class 12 Macroeconomics Chapter 4 Case Study Questions with answers in English Medium designed for session 2024-25. The Case Study MCQ of class 12 Economics chapter 4 Determination of Income and Employment are given here to understand Case Studies and to prepare the Case based questions.

Class 12 Macroeconomics Chapter 4 Case Studies Question Answers

- Class 12 Macroeconomics Chapter 4 Case Study

- Class 12 Macroeconomics Chapter 4 NCERT Solutions

- Class 12 Macroeconomics Chapter 4 MCQ Answers

- Class 12 Indian Eco & Macro Economics Solutions

- Class 12 NCERT Solutions in Hindi & English Medium

- Class 12 NCERT Books in Hindi & English Medium

Aggregate call for refers to the overall cost of very last items and offerings which all of the sectors of an economic system are making plans to shop for at a given stage of profits in the course of a duration of 1 accounting year. In different words, AD is the mixture expenditure that unique sectors of the economic system are inclined to incur in the course of a given duration. It approaches, AD and mixture expenditure imply the equal. It is vital to notice that mixture expenditure refers back to the deliberate expenditure and now no longer the real expenditure. So, AD is the overall costs that each one family, companies, authorities and the relaxation of the arena are making plans to incur in the course of a given duration of time. AD is a go with the drift idea as its miles normally measured during an accounting year.

Components of mixture call for: The diverse additives of mixture call for are:

- Private intake expenditure – It refers to the overall expenditure incurred through families on buy of products and offerings in the course of an accounting year. Consumption expenditure is without delay prompted through the extent of disposable profits i.e., better the disposable profits, extra is the intake expenditure and vice versa. Disposable profits refer back to the profits from all sources that is to be had to families for spending on intake and saving.

- Investment expenditure – It refers to the overall expenditure incurred through all non-public companies on capital items. It consists of addition to the inventory of bodily capital belongings inclusive of machinery, equipment, homes etc. and alternate in stock.

- Government expenditure – It refers to the overall expenditure incurred through authorities on purchaser items and capital items to meet the not unusual place desires of the economic system. It approaches, authorities incur intake expenditure in addition to funding expenditure. Consumption expenditure is incurred to satisfy public desires like regulation and order, education, health, transport, defence, etc. Investment expenditure entails production of highways, roads, energy plants, etc.

- Net Exports – Export suggest call for items produced in the home territory of a rustic through the relaxation of the arena. Imports consult with needs of the citizens of a rustic for the products which have been produced abroad. The distinction among exports and imports is named as NET Exports.

- Question 1: Name the 4 additives of mixture call for.

- Question 2: State whether or not True or False. (a) AD and mixture expenditure imply the equal. (b) AD is the overall costs that each one family, companies, authorities and the relaxation of the arena are making plans to incur in the course of a given duration of time. (c) Imports consult with needs of the citizens of a rustic for the products which have been produced in a rustic. (d) The distinction among exports and imports is named as Gross Exports. (e) AD is a go with the drift idea as its miles normally measured during an accounting year. (f) Investment expenditure consists of addition to the inventory of bodily capital belongings inclusive of machinery, equipment, homes etc. and alternate in stock.

- Question 3: What is Government expenditure?

- Question 4: What is mixture call for and marketplace call for?

- Question 5: Fill with inside the blanks: (a) AD and mixture expenditure imply the _________. (b) Consumption expenditure is incurred to satisfy _________ like regulation and order, education, health, transport, defence, etc. (c) ________ entails production of highways, roads, energy plants, etc. (d) AD is a _________ as its miles normally measured during an accounting year. (e) Export suggests call for items produced in the _________ territory of a rustic through the relaxation of the arena.

- Answer 1: Private intake expenditure, Investment expenditure, Government expenditure and Net exports.

- Answer 2: (a) True, (b) True, (c) False, (d) False, (e) True, (f) True

- Answer 3: Government expenditure refers to the overall expenditure incurred through authorities on purchaser items and capital items to meet the not unusual place desires of the economic system. It approaches, authorities incur intake expenditure in addition to funding expenditure.

- Answer 4: Aggregate call for is the overall call for all items and offerings inside the complete economic system. Whereas, marketplace call for is the overall call for one commodity within the marketplace.

- Answer 5: (a) equal, (b) public desires, (c) Investment expenditure, (d) go with the drift idea, (e) home.

Aggregate deliver refers to cash cost of very last items and offerings that each one the manufacturers are inclined to deliver in an economic system in a given duration of time. It has to be mentioned that AS refers handiest to deliberate manufacturing or preferred output in the course of a given time duration. Aggregate deliver is equals to country wide profits. When AS is expressed in bodily phrases, it refers to general output of products and offerings in an economic system. We recognise that cost of general output is shipped to elements of manufacturing within the shape of rent, wages, hobby and income. The sum general of those element earning at home and country wide stage is named as country wide profits. So, we will say that mixture deliver and country wide profits, are one and the equal thing.

The primary part of country wide profits is spent on intake of products and offerings and the stability is stored. It approaches, profits are both fed on or stored. Consumption expenditure refers to that part of profits that is spent on the acquisition of products and offerings on the given stage of profits. Consumption feature refers to purposeful courting among intake and country wide profits. It represents the willingness of families to buy items and offerings at a given stage of profits in the course of a given time duration. It additionally indicates the intake stage at unique degrees of profits in an economic system. It is a mental idea as its miles prompted through subjective elements like customer’s options and habits, etc.

- Question 1: What is mixture deliver?

- Question 2: What do you recognize through intake feature?

- Question 3: State whether or not True or False. (a) Aggregate deliver and country wide profits, are one and the equal thing. (b) The primary part of country wide profits is spent on intake of products and offerings and the stability is stored. (c) When AS is expressed in bodily phrases, it refers to general output of products and offerings in an economic system. (d) Aggregate deliver isn’t always equals to country wide profits. (e) The sum general of the element earning at home and country wide stage is named as country wide profits.

- Question 4: Fill with inside the blanks: (a) It is a mental idea as its miles prompted through _____________ elements like customer’s options and habits, etc. (b) When AS is expressed in bodily phrases, it refers to ______________ of products and offerings in an economic system. (c) Consumption feature refers to _______________ among intake and country wide profits. (d) It has to be mentioned that AS refers handiest to _______________ or preferred output in the course of a given time duration. (e) Aggregate deliver refers to ______________ of very last items and offerings that each one the manufacturers are inclined to deliver in an economic system in a given duration of time.

- Question 5: How can we calculate country wide profits?

- Answer 1: Aggregate deliver refers to cash cost of very last items and offerings that each one the manufacturers are inclined to deliver in an economic system in a given duration of time.

- Answer 2: Consumption feature refers to purposeful courting among intake and country wide profits. It represents the willingness of families to buy items and offerings at a given stage of profits in the course of a given time duration.

- Answer 3: (a) True, (b) True, (c) True, (d) False, (e) False

- Answer 4: (a) subjective, (b) general output, (c) purposeful courting, (d) deliberate manufacturing, (e) cash cost

- Answer 5: The cost of general output is shipped to elements of manufacturing inside the shape of rent, wages, hobby and income. The sum general of those element earning at home and country wide stage is named as country wide profits.

There are technical factors of propensity to devour: 1. Average propensity to devour (APC) 2. Marginal propensity to devour (MPC) Average propensity to devour refers back to the ratio of intake expenditure to the corresponding stage of profits. Some vital factors approximately APC are: As lengthy as intake is extra than country wide profits, APC is extra than 1. At the break-even factor intake is same to country wide profits, so APC is equals to 1. Beyond the break-even factor, intake is much less than country wide profits. APC Falls constantly with the growth in profits due to the fact the share of profits spent on intake continues on decreasing. APC may be 0 handiest while intake turns into 0. However, intake is in no way 0 at any stage of profits. Even at 0 stage of country wide profits, there’s self-sustaining intake. Marginal propensity to devour refers back to the ratio of alternate in intake expenditure to alternate in general profits. MPC explains what percentage of alternate in profits is spent on intake. Some vital factors approximately MPC: We recognise, incremental profits are both spent on intake or stored for destiny use. In everyday conditions cost of MPC varies among zero to 1.

MPC of negative is extra than that of wealthy due to the fact negative human beings spend an extra percent in their multiplied profits on intake as maximum in their simple desires continue to be unsatisfied. On the alternative hand, which human beings spend a smaller percentage as they already experience a better popular of living. MPC Falls with successive growth in profits due to the fact as an economic system turns into richer, it has the tendency to devour smaller percent of every increment to its profits.

- Question 1: When does APC turns into 0?

- Question 2: Why does MPC falls with successive growth in profits?

- Question 3: Fill with inside the blanks: (a) In everyday conditions cost of MPC varies among ____________. (b) APC Falls constantly with the ___________in profits due to the fact the share of profits spent on intake continues on decreasing. (c) Incremental profits are both spent on intake or _____________ for destiny use. (d) Average propensity to devour refers back to the ratio of ______________ to the corresponding stage of profits. (e) As lengthy as intake is extra than country wide profits, APC is ______________ than 1. (f) Marginal propensity to devour refers back to the _____________ in intake expenditure to alternate in general profits. (g) Even at 0 stage of country wide profits, there’s ______________ intake.

- Answer 1: APC may be 0 handiest while intake turns into 0. However, intake is in no way 0 at any stage of profits. Even at 0 stage of country wide profits, there’s self-sustaining intake.

- Answer 2: MPC Falls with successive growth in profits due to the fact as an economic system turns into richer, it has the tendency to devour smaller percent of every increment to its profits.

- Answer 3: (a) zero to 1, (b) growth, (c) stored, (d) intake expenditure, (e)extra, (f) ratio of alternate, (g) self-sustaining

Investment refers back to the expenditure incurred on advent of New Capital belongings. It consists of the expenditure incurred on belongings like machinery, building, equipment, uncooked material, etc. This caused growth inside the effective ability of an economic system. The funding expenditure is assessed below heads: Induced funding and self-sustaining funding. Induced funding refers back to the funding which relies upon at the income expectancy and is without delay prompted through profits stage. IT will increase with growth in profits and reduces with the lower in profits. Autonomous funding refers back to the funding which isn’t always suffering from modifications within the stage of profits and isn’t always caused totally through income motive. It isn’t always prompted through alternate in profits.

According to a well-known economist, the selection to spend money on a brand-new task relies upon elements: Marginal performance of funding and Rate of hobby. Marginal performance of funding – It refers back to the anticipated price of go back from an extra funding. It is decided through elements:

- Supply rate refers back to the price of manufacturing a brand-new asset of that kind. It is the rate at which the New Capital Asset may be furnished or replaced.

- Prospective yield refers to internet go back, anticipated from the Capital Asset over its lifetime.

- Rate of hobby – it refers to price of borrowing cash for financing the funding. There exists an inverse courting among ROI and the quantity of funding. At an excessive ROI, the funding spending could be much less and at a low ROI, the funding spending could be extra.

- Question 1: What is ROI?

- Question 2: State whether or not True or False. (a) Induced funding refers back to the funding which relies upon at the income expectancy and is without delay prompted through profits stage. (b) Prospective yield refers to gross go back, anticipated from the Capital Asset over its lifetime. (c) Marginal performance of funding refers back to the anticipated price of go back from an extra funding. (d) Autonomous funding isn’t always suffering from modifications within the stage of profits and isn’t always caused totally through income motive. (e) At an excessive ROI, the funding spending could be extra and at a low ROI, the funding spending could be much less.

- Question 3: Fill with inside the blanks: (a) Rate of hobby refers to price of _____________ cash for financing the funding. (b) The funding expenditure is assessed below heads: ____________ and self-sustaining funding. (c) Supply rate is the rate at which the new _____________ may be furnished or replaced. (d) ___________ funding isn’t always prompted through alternate in profits. (e) ___________ funding will increase with growth in profits and reduces with the lower in profits.

- Question 4: What is funding?

- Answer 1: Rate of Interest refers to price of borrowing cash for financing the funding. There exists an inverse courting among ROI and the quantity of funding. At an excessive ROI, the funding spending could be much less and at a low ROI, the funding spending could be extra.

- Answer 2: (a) True, (b) False, (c) True, (d) True, (e) False

- Answer 3: (a) borrowing, (b) Induced funding, (c) capital asset, (d) Autonomous, (e) Induced.

- Answer 4: Investment refers back to the expenditure incurred on advent of New Capital belongings. It consists of the expenditure incurred on belongings like machinery, building, equipment, uncooked material, etc. This caused growth within the effective ability of an economic system.

Ex-ante variable is the deliberate or anticipated cost of variable, whereas, ex-publish variable is the real or found out cost of the variable. Both those phrases are normally utilized in context of saving and funding. There are factors of saving and Investments: 1) Ex-ante saving and ex-ante funding 2) Ex-publish saving and ex-publish funding Ex-ante saving refers to quantity of financial savings, which families deliberate to keep at unique degrees of profits in the economic system. In different words, ex-ante saving are the deliberate financial savings of an economic system at unique degrees of profits. The quantity of ex-ante or deliberate saving is given through the saving feature. Ex-ante funding refers to quantity of funding which companies plans to make investments at unique degrees of profits within the economic system. The quantity of ex-ante or deliberate funding is decided through the relation among funding call for and price of hobby, i.e., through funding call for feature.

Ex-publish financial savings consult with the real or found out saving in an economic system in the course of a year. Ex-publish or real saving is the sum general of deliberate saving and unplanned saving. Ex-publish funding refers back to the found out or real funding in an economic system in the course of a year. Ex-publish or real funding is the sum general of deliberate funding and unplanned funding. Planned cost of the variables are their ex-ante measures, whereas, found out cost of the variables are their ex-publish measures. The importance of difference among Ex-ante and Ex-publish is that each one the variables inside the principle of profits dedication are ex-ante valuables, i.e., ex-ante variables shape the premise of principle of country wide profits dedication.

- Question 1: What is the difference among ‘ex-ante’ and ‘ex-publish’?

- Question 2: What is ex-publish saving?

- Question 3: Fill with inside the blanks: (a) Ex-publish or real funding is the ______________ of deliberate funding and unplanned funding. (b) Ex-ante saving refers to quantity of financial savings, which families deliberate to keep at unique _____________ with inside the economic system. (c) The quantity of ex-ante or deliberate funding is decided through the _____________ among funding call for and price of hobby. (d) The quantity of ex-ante or deliberate saving is given through the ______________. (e) __________ funding refers back to the found out or real funding in an economic system in the course of a year.

- Question 4: State whether or not True or False (a) Planned cost of the variables are their ex-ante measures, whereas, found out cost of the variables are their ex-publish measures. (b) There are factors of saving and Investments: 1) Ex-ante saving and ex-ante funding. 2) Ex-publish saving and ex-publish funding (c) The quantity of ex-publish saving is given through the saving feature. (d) Ex-publish or real saving is the sum general of deliberate saving and unplanned saving. (e) The quantity of ex-ante or deliberate funding isn’t always decided through the relation among funding call for and price of hobby. (f) Ex-ante variable is the deliberate or anticipated cost of variable, whereas, ex-publish variable is the real or found out cost of the variable.

- Answer 1: The importance of difference among Ex-ante and Ex-publish is that each one the variables with inside the principle of profits dedication are ex-ante valuables, i.e., ex-ante variables shape the premise of principle of country wide profits dedication.

- Answer 2: Ex-publish financial savings consult with the real or found out saving in an economic system in the course of a year. Ex-publish or real saving is the sum general of deliberate saving and unplanned saving.

- Answer 3: (a) sum general; (b)degrees of profits; (c)relation; (d) saving feature; (e)Ex-publish.

- Answer 4: (a) True; (b) True; (c)False; (d) True; (e) False; (f) True.

Copyright 2024 by Tiwari Academy | A step towards Free Education

- CBSE Class 12 Macro Economics Chapter 2 – National Income Accounting Class 12 Notes

National Income Accounting Class 12 Revision Notes

We will introduce the concept of national income accounting by providing national income accounting class 12 notes. We will be beginning by introducing some basic concepts of Macro Economics. Thus, we will illustrate some primary ideas we shall work with. Then, we will describe the circular flow of income across different sectors in a circular way. Moreover, we will study the three methods to calculate the national income. These will include gaining knowledge of namely product method, expenditure method and income method. Furthermore, we will describe the various sub-categories of national income.

Also, we will describe some of the Macro Economic identities. Moreover, we will define different price indices like GDP deflator, Consumer Price Index, Wholesale Price Indices. Also, we will discuss the problems associated when we take the GDP of a country as an indicator of the aggregate welfare of the people of the country.

Download Toppr app for Android and iOS or signup for free.

Sub-Topics Covered Under National Income Accounting :

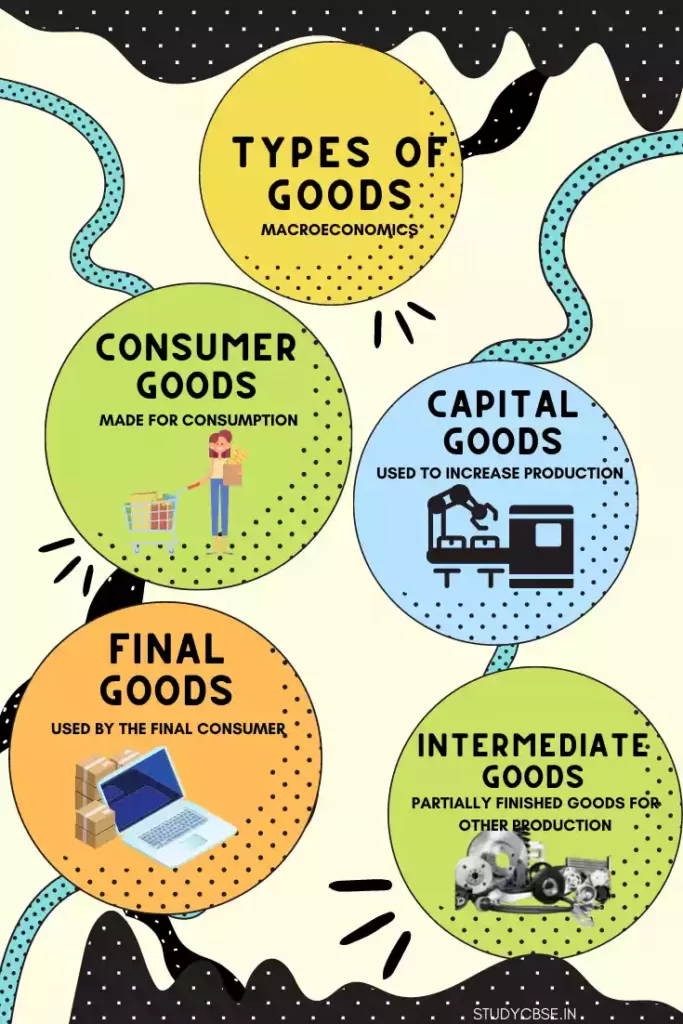

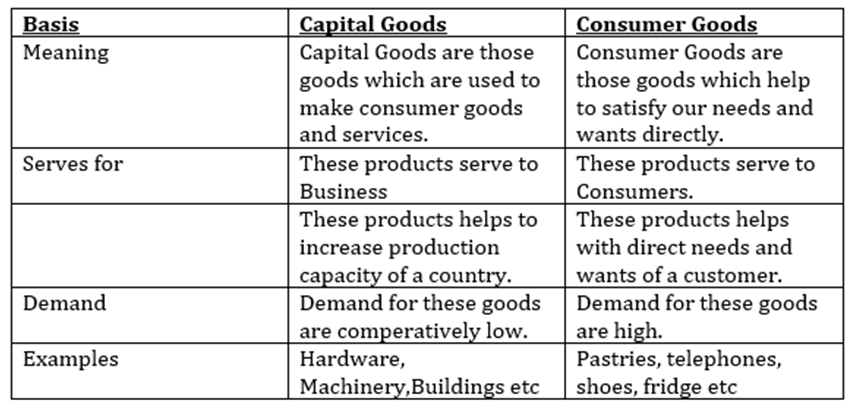

- Some Basic Concepts of Macroeconomics : Under this Subtopic, we will discuss the basic concepts in Macro Economics. We will get familiar with terms: final goods, capital goods, intermediate goods, etc.

- Circular Flow of Income and Methods of Calculating National Income : Here, we will describe the circular flow of income across different sectors. Also three ways to calculate the national income: product method, expenditure method, and income method.

- Expenditure Method and Income Method : Here, we will discuss the expenditure method and income Methods in detail.

- Some Macroeconomic Identities : Here, we will study about some macroeconomic identities such as Gross National Product (GNP), Net National Product (NNP), Personal Income (PI), etc., in detail.

- Goods, Prices, GDP and Welfare : Here we will learn to calculate Real GDP. Also, we will get to know as to how the GDP of a country be taken as an index of the welfare of the people of that country.

Customize your course in 30 seconds

Which class are you in.

CBSE Class 12 Macro Economics Revision Notes

- CBSE Class 12 Macro Economics Chapter 4 – Income Determination Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 3 – Money and Banking Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 6 – Open Economy Macroeconomics Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 5 – Government Budget and the Economy Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 1 – Introduction to Macro Economics Class 12 Notes

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

- Bihar Board

SRM University

Ap ssc results 2024, mp board result 2024.

- UP Board 10th Result 2024

- UP Board 12th Result 2024

- AP Board Result 2024

- JAC Board Result 2024

- Assam Board Result 2024

- Karnataka Board Result

- Shiv Khera Special

- Education News

- Web Stories

- Current Affairs

- नए भारत का नया उत्तर प्रदेश

- School & Boards

- College Admission

- Govt Jobs Alert & Prep

- GK & Aptitude

- CBSE Class 12

CBSE Class 12 Economics Important Case Study Based Questions for 2023 Board Exams

Cbse class 12 economics important case study based questions: class 12th economics exam is just a few hours away. get important case study questions to practice before cbse class 12 economics board examinations scheduled to be conducted on march 17, 2023. .

Important Case Study Based Questions for CBSE Class 12 Economics Board Exam 2023

Read the following case study paragraph carefully and answer the questions on the basis of the same..

Q1 The central bank of India i.e. Reserve Bank of India, is the apex institution that control the entire financial market. It's one of the major functions is to maintain the reserve of foreign

exchange. Also, it intervenes in the foreign exchange market to stabilise the excessive fluctuations in the foreign exchange rate.

In other words, it is the central bank's job to control a country's economy through monetary policy; if the economy is moving slowly or going backward, there are steps that central bank can take to boost the economy. These steps, whether they are asset purchases or printing more money, all Involve injecting more cash into the economy. The simple supply and demand economic projection occur and currency will devalue.

When the opposite occurs, and the economy is growing, the central bank will use various methods to keep that growth steady and in-line with other economic factors such as wages and prices.

Whatever the central bank does or in fact don't do, will affect the currency of that country.

Sometimes, it is within the central bank's interest to purposefully effect the value of a currency.

For example, if the economy is heavily reliant on exports and their currency value becomes too high, importers of that country's commodities will seek cheaper supply; hence directly effecting the economy.

1 Which of the following tools are used by the central bank to control the flow of money in domestic economy?

(a) Fiscal tools (b) Quantitative monetary tools

(c) Qualitative monetary tools (d) Both (b) and (c)

- a) Tighten the money supply in the economy

- b) Ease the money supply in the economy

- c) Allow commercial banks to work under less strict environment

- d) Both (b) and (c)

3 Which of the following steps should be taken by the central bank if there is an excessive rise in the foreign exchange rate?

(a) Supply foreign exchange from its stock

(b) Demand more of other foreign exchange

(c) Not intervene in the market as the exchange rate is determined by the market forces

(d) Help central government to stabilize the foreign exchange rate.

Answer:

1(d) Both (b) and (c)

2(a) Tighten the money supply in the economy

3(a) Supply foreign exchange from its stock

Q2 Changes in aggregate demand bring about changes in the level of output, employment, income, and price. These changes are generally cyclical in nature. These changes, more generally, follow a cycle of four different stages namely boom, recession, depression and recovery. The cyclical nature of economic activity is known as trade cycle or business cycle. Boom is a stage of economic activity characterized by rising prices, rising employment, rising purchasing power.

- During the time of ‘excess demand’, Govt. should .................. the public expenditure.

- a) Reduce b) increase c) unchanged d) none of these.

- Investment depends on: a) Supply b) income c) saving d) Both (a) and (c)

Answer: Income.

Q3 In the modern world, govt. aims at maximizing the welfare of the people and the country. It

requires various infrastructure and economic welfare activities. These activities require huge govt. spending through appropriate planning and policy. Budget provides a solution to all these concerns. Budget is prepared by the government at all levels.

Estimated expenditure and receipts are planned as per the objectives of the government. In India, budget is prepared by the parliament on such a day as the president may direct. The parliament approves the budget before it can be implemented. The receipts and expenditures as shown in the budget are only the estimated values for the upcoming fiscal year, and not the actual figure.

- a) Reallocation of resources.

- b) Re distribution of income

- c) Reducing expenditure

- d) Economic stability.

Answer: c) Reducing expenditure

Answer: False

Q4 India’s balance of payments position improved dramatically in 2013-14 particularly in the last three quarters. this moved in large part to measure taken by the government and the Reserve Bank of India (RBI) and eat some part to the overall macro-economic slowdown that fed into the external sector. current account deficit (CAD) declined sharply from a record high of U.S. dollar 88.2 billion (4.7% of GDP) in 2012 -1/3 to U.S. dollars 32.4 billion (1.7% of GDP) in 2013 -14. After staying at perilously unsustainable levels off well over 4.0 percentage of GDP in 2011 -12 and 2012 -13, the improvement in BOP position is a welcome relief, and there is need to sustain the position going forward. This is because even as CAD came down, net capital flows moderated sharply from U.S. dollars 92.0 billion in 2012 -13 do U.S. dollar 47.9 billion in 2013-14, that two after a special swap window of

The RBI under the nonresident Indian (NRI) scheme / overseas borrowings of banks alone yielded U.S. dollar 3 4.0 billion. This led to some increase in the level of external debt, but it has remained at the manageable levels. the large depreciation of the rupee during the course of the year, note with standing sizable accretion to reserve in 2013 – 14, could partly be attributed to frictional forces and partly to the role of expectations in the forex market. the rupiah has stabilized the recently, reflecting an overall sense of confidence in the forex market as in the other financial markets of a change for better economic

prospects there is a need to nurture and build upon this optimism through creation of an enabling environment for investment inflows so as to sustain the external position in an as yet uncertain global milieu. --------- The Hindu, archives

- a) credit, capital account

- b) debit, capital account

- c) credit, current account

- d) debit, current account

- a) current account

- b) revenue account

- c) capital account

- d) official reserves

- a) outward flow of foreign exchange

- b) inward flow of foreign exchange

- c) decrease in the level of external debt

- d) decrease in future claims

Answers: 1.b 2. c 3. b 4. d

Q5 The green revolution for the third agricultural revolution is the set of research technology

e-transfer initiatives earring between GNE E and the late 1960 that increased agricultural

production worldwide beginning most markedly in the late 1960 the initiative resulted in

the adoption of new technologies including high yield varieties of CSR rules of cells

especially does wheat and rice it was associated with chemical fertilizers agrochemicals

and controlled water supply and newer methods of cultivation including machine isolation

National bank for agriculture and rural development is and apex development finance

institution fully owned by government of India the bank has been entrusted with Martyrs

concerning policy planning and operations in the field of credit for agriculture and other

economic activities in rural areas in India.

1 Who among the following is known as the father of green revolution

(a) Dr. M S Swaminathan

(b) Dadabhai Naoroji

(c) Vikram Sarabhai

(d) all of these

2 Green revolution is also known as ..................

(a) Golden revolution

(b) milk revolution

(c) Wheat revolution

(d) None of this

3 Which of the following institutions were setup as the apex body in rural areas to support the small farmers in the adoption of modern farming methods?

4 Green revolution was the ............... set of agricultural reforms brought in India

Answer: 1 (a) 2 (c) 3 (d) 4(c)

- Narasimha Rao. This policy opened the door of the India Economy for the global exposure for the first time. In this New Economic Policy P. V. Narasimha Rao governmentreduced the import duties, opened reserved sector for the private players, devalued the Indian currency to increase the export. This is also known as the LPG Model of growth. New Economic Policy refers to economic liberalization or relaxation in the import tariffs, deregulation of markets or opening the markets for private and foreign players, and reduction of taxes to expand the economic wings of the country. Former Prime Minister Manmohan Singh is considered to be the father of New Economic Policy (NEP) of India. Manmohan Singh introduced the NEP on July 24,1991. Main Objectives of New Economic Policy – 1991, July 24 The main objectives behind the launching of the New Economic policy (NEP) in 1991 by the union Finance Minister Dr. Manmohan Singh are stated as follows:

The main objective was to plunge Indian Economy in to the arena of ‘Globalization and to give it a new thrust on market orientation. The NEP intended to bring down the rate of inflation.

1 New Economic Policy of India was launched in the year 1991 under the

- P. V. Narasimha Rao

- Atal Bihari Bajpayi

- Sharad Pawar

- None of these

2 .................................. is also known as the LPG Model of growth. ((choose

the correct alternative)) (New Economic Policy / New Education Policy)

Answer: New Economic Policy

3 State whether the given statement is true or false:

Former Prime Minister Manmohan Singh is considered to be the father of New Economic Policy (NEP) of India. ((choose the correct alternative))

True / False

Answer: True

Q7 Both forms of capital formation are the outcomes of conscious investment decisions. The decision regarding investment in physical capital is taken on the basis of one’s knowledge in this regard. The ownership of physical capital is the outcome of the conscious decision of the owner the physical capital formation is mainly an economic and technical process.

Human capital formation takes place in one’s life when she/he is unable to decide whether it would maximize her/his earnings. Children are given different types of school education and health care facilities by their parents and society. Moreover, the human capital formation at this stage is dependent upon the already formed human capital at the school level. Human capital formation is partly a social process and partly a conscious decision of the possessor of the human capital.

- a) Human capital is intangible whereas physical capital is tangible.

- b) Human capital can cope up with the changing technology whereas physical cannot.

- c) Human capital generates both personal and societal benefits whereas physical capital generates only personal benefit.

- d) Human capital gets obsolete with time whereas physical capital does not.

- In the context of the paragraph, it can be argued that human capital depreciates faster than the physical capital. The given statement is:

- c) Partially true

- d) can’t comment due to lack of proper estimation mechanism

- Machines and industrial tools are examples of _

- a) Physical capital

- b) Human capital

- c) Both physical and human capital

- d) Natural capital

- Investment in education by parents is the same as_______

- a) Investment in intermediate goods by companies

- b) Investment in CSR activity by companies

- c) Investment in capital goods by companies

- d) None of the above

Answer: – c) Investment in capital goods by companies

Q8 The central government will spend Rs. 9800 crores on livestock development over the next five years in a bid to leverage almost Rs. 55000 crore of outside investment into the Animal Husbandry Sector. It would do this by merging a slew of schemes of the Department of Animal Husbandry and Dairying into three main programmes, focused on indigenous cows and dairy development, livestock health and infrastructure development, an official statement said. The Cabinet Committee on Economic Affairs approved the implementation of the special livestock sector package by revising and realigning the various components of the existing schemes in order to boost growth and make animal husbandry more remunerative for the 10 crore farmers engaged in it.

1) Livestock production provides ------------- for the family without disrupting other food producing activities

(a)Increased stability in income

(b) food security

(c)transport and fuel

Answer: (d) all of these

2) The central bank undertakes to invest on livestock development in ----------- (horticulture/ animal husbandry) sector

Answer: animal husbandry

3) State one limitation of livestock sector in India

Answer: The livestock productivity is quite low as compared to other countries

Important resources for Class 12 Economics Board Exam 2023

Get here latest School , CBSE and Govt Jobs notification in English and Hindi for Sarkari Naukari and Sarkari Result . Download the Jagran Josh Sarkari Naukri App . Check Board Result 2024 for Class 10 and Class 12 like CBSE Board Result , UP Board Result , Bihar Board Result , MP Board Result , Rajasthan Board Result and Other States Boards.

- MP Board Class 5th, 8th Result 2024

- MP Board Result 2024 Class 5th, 8th

- MP Board 5th, 8th Result 2024

- RSKMP Result 2024

- rskmp.in Exam Result 2024

- Anna University Result 2024

- Manabadi 10th Public Exam Results 2024

- BSEAP AP SSC Results 2024

- AP SSC Results 2024 Manabadi by Jagran Josh

- AP SSC Topper List 2024

Latest Education News

Upcoming Government Jobs 2024 LIVE: Employment News April (20-26) 2024, Notifications, Admit Card, Exam Date, Result and much more

Current Affairs Quiz: 23 April 2024- Mount Erebus

CDS Answer Key 2024: Download Maths, GK, English, Paper SET A B C D PDF (Unofficial)

Optical Illusion Vision Test: Find the comb in the library in 7 seconds!

NEET UG 2024 City Intimation Slip Live Updates: NTA Release Date and Time for City Slip at neet.ntaonline.in, Check Admit Card Release Date

Current Affairs Hindi One Liners: 23 अप्रैल 2024- आईपीएल 2024

Anna University Result OUT at coe1.annauniv.edu: Download UG and PG Revaluation Marks

Anna University Result 2024 OUT at coe1.annauniv.edu: Direct Link to Download UG and PG Marksheet

JKSSB JA Admit Card 2024 Out For Junior Assistant Posts: Here's Download Link

UPSC CAPF 2024 Notification Tomorrow: Check AC Eligibility, Exam Date, Application Dates

JEE Advanced 2024: B Tech. Civil Engineering Cut-Offs For IITs, Check Other Participating Institutions Here

MP Board Class 5th, 8th Result 2024 LINK जारी: रोल नंबर से यहाँ देखें एमपी बोर्ड 5वीं और 8वीं के नतीजे सबसे तेज, rskmp.in से करें डाउनलोड

Current Affairs Quiz In Hindi: 23 अप्रैल 2024- माउंट एरेबस

Uttarakhand Board 10th, 12th Result 2024 Likely to Be Declared on April 30, Check Steps To Download, Other Details Here

T20 World Cup 2024: कौन-कौन से खिलाड़ी भारतीय स्क्वॉड के है प्रबल दावेदार?

MP Board Result 2024: क्या 25 अप्रैल को जारी होगा एमपी बोर्ड हाईस्कूल, इंटर के नतीजे? जानें क्या है लेटेस्ट अपडेट

Ratan Tata Receives Prestigious KISS Humanitarian Award

Test Your IQ: Can You Find The Missing Number In This Puzzle In 10 Seconds?

GLBians danced to the tunes of playback singer Sukhwinder Singh

TMC Recruitment 2024, Apply Online for 87 Medical and Non Medical Posts, Check Eligibility

National Income and Related Aggregates Class 12 Notes: A Comprehensive Guide

Master the concepts of Class 12 Macroeconomics Chapter 2 National Income and Related Aggregates (also known as National Income Accounting) with these class 12 notes, designed to provide a clear and concise understanding of the topic. Check out these comprehensive notes and study materials to help you ace your exams.

Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful. - Albert Schweitzer

Class 12 Economics: National Income Accounting Class 12 Notes

Final goods and intermediate goods.

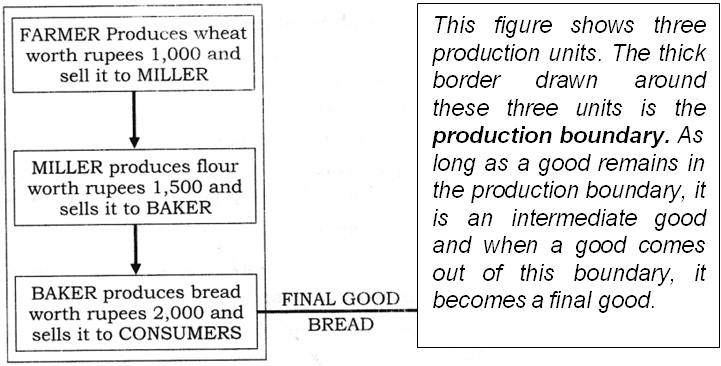

Final Goods

- Goods that are used either for final consumption by consumers or for investment by producers are known as final goods. These goods do not pass through the production process and are not used for resale. For example, bread, butter, biscuits, etc. used by the consumer

- It is not in the nature of the good but in the economic nature of its use that a good becomes a final good : Whether a good is a final good or an intermediate good depends on its use. For example, milk used by a sweet maker is an intermediate good but when it is used by the consumer it becomes a final good.

Types of Final Goods -

- Consumer goods can be durable (TV, Mobiles, etc.) and non-durable (bread, milk, etc.)

- Capital goods are durable.

- Investment is an addition to capital stock.

Intermediate Goods

- Intermediate goods are those goods that are meant either for reprocessing or for resale. Goods used in the production process during an accounting year are known as intermediate goods. Goods that are purchased for resale are also treated as intermediate goods. For example, Rice, wheat, sugar, etc. purchased by a retailer/wholesaler.

- Intermediate goods are not included in the calculation of national income. Only final goods are included in the calculation of national income because the value of intermediate goods is included in the value of final .goods. If it is included in national income it will lead to the problem of double counting .

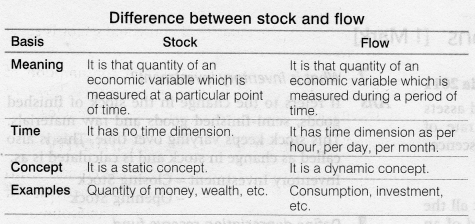

Stock and Flow

- A stock is a quantity that is measured at a point of time i.e. at 4 p.m., on 31st March, etc.

- It has no time dimension.

- Wealth, population, money supply, wealth, stock, inventory, etc. are stock concepts.

- A flow is a quantity that is measured over a period of time i.e. days, months, years, etc.

- It has a time dimension.

- National income, population growth, income, change in stock, value-added, change in inventory, etc. are flow concepts.

Gross Investment and Net Investment

- Part of our final output that comprises capital goods constitutes a gross investment of an economy.

- These may be machines, tools, and implements; buildings, office spaces, storehouses, or infrastructure like roads, bridges, airports, or jetties.

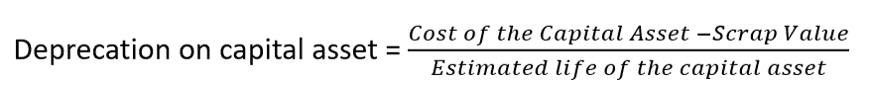

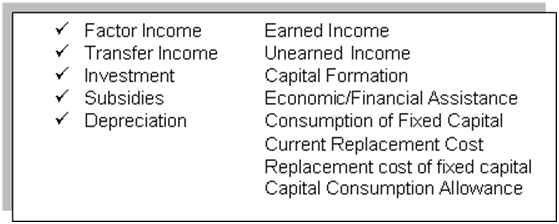

- A part of the capital goods produced this year goes for the replacement of existing capital goods and is not an addition to the stock of capital goods already existing and its value needs to be subtracted from gross investment for arriving at the measure for net investment. This part is called Depreciation.

- Depreciation is also known as 'Consumption of Fixed Capital'.

- Net Investment = Gross Investment - Depreciation

- Depreciation is thus an annual allowance for the wear and tear of a capital good.

- Depreciation is an accounting concept. No real expenditure may have actually been incurred each year yet depreciation is annually accounted for.

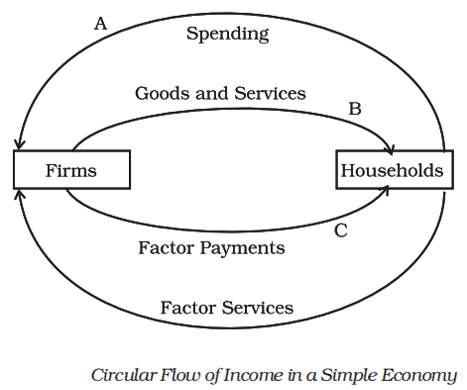

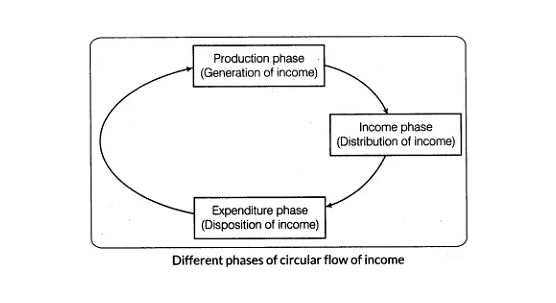

Circular Flow of Income

There may fundamentally be four kinds of contributions that can be made during the production of goods and services:

- the contribution made by human labor, remuneration for which is called wage

- the contribution made by capital, remuneration for which is called interest

- the contribution made by entrepreneurship, remuneration of which is profit

- the contribution made by fixed natural resources (called ‘land’), remuneration for which is called rent.

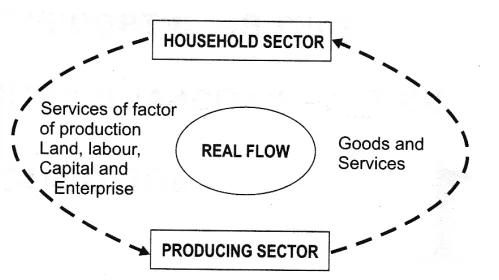

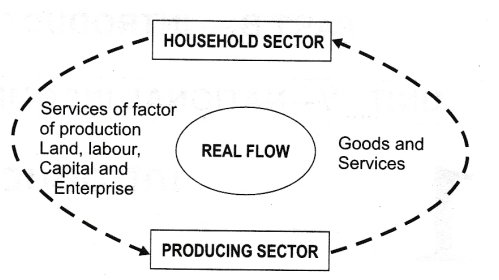

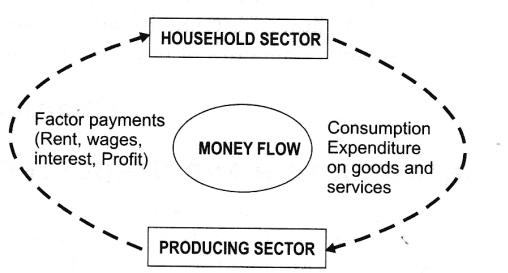

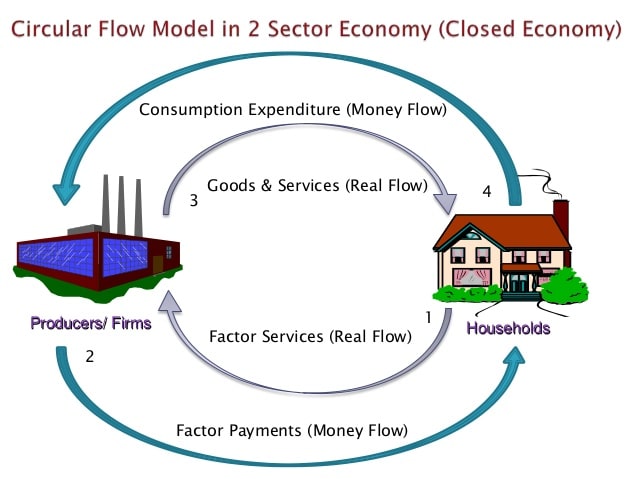

Circular flow of income in a two-sector economy

- Households are owners of factors of production, they provide factor services to the firms (producing units). Firms provide factor payments in exchange for their factor services. So, factor payments flow from firms (producing units) to households.

- Households purchase goods and services from firms (producing units) for which they make payments to them. So, consumption expenditure (spending on goods and services) flows from households to firms.

- The aggregate consumption by the households of the economy is equal to the aggregate expenditure on goods and services produced by the firms in the economy.

- The aggregate spending of the economy must be equal to the aggregate income earned by the factors of production (the flows are equal at A and C).

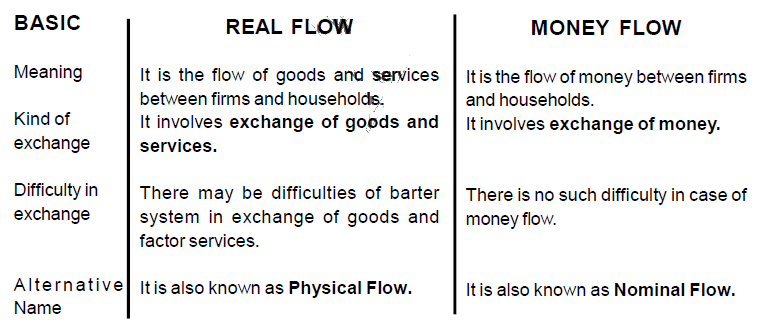

- Real Flow: Real flow is the flow of factor services and goods and services between households and firms.

- Nominal Flow: Nominal flow/Money flow is the flow of factor payments and payments for goods and services between households and firms.

Factor Cost and Market Price

Factor cost includes only the payment to factors of production, it does not include any tax. In order to arrive at the market prices, we have to add to the factor cost the total indirect taxes less total subsidies.

Market price - Indirect taxes (IT) + Subsidies = Factor Cost

Factor costs + Indirect taxes (I.T.) - Subsidies = Market price

⇒ Factor costs + Net Indirect tax (NIT) = Market price

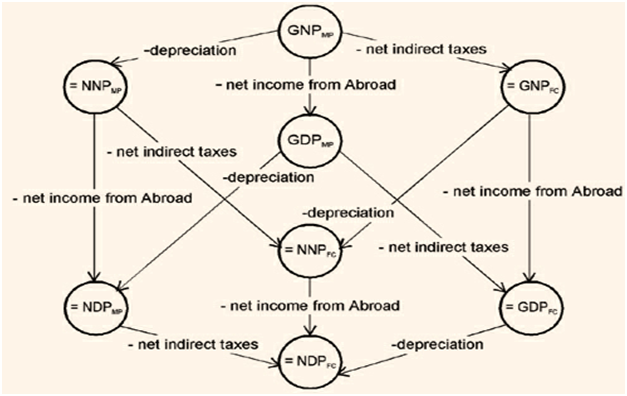

- GDP mp = GDP fc + I.T. - Subsidies

- GDP mp = GDP fc + net I.T.

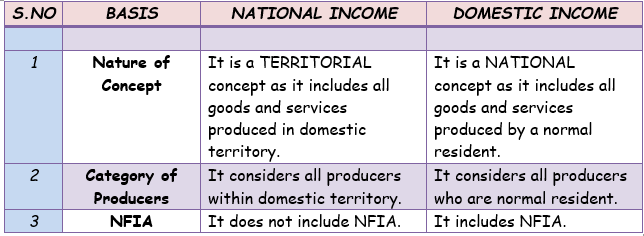

National Product and Domestic Product

Gross Domestic Product measures the aggregate production of final goods and services taking place within the domestic economy during a year. But the whole of it may not accrue to the citizens of the country. For example, a citizen of India working in Saudi Arabia may be earning her wage and it will be included in the Saudi Arabian GDP. But legally speaking, she is an Indian. Is there a way to take into account the earnings made by Indians abroad or by the factors of production owned by Indians? When we try to do this, in order to maintain symmetry, we must deduct the earnings of the foreigners who are working within our domestic economy, or the payments to the factors of production owned by the foreigners. For example, the profits earned by the Korean-owned Hyundai car factory will have to be subtracted from the GDP of India.

The macroeconomic variable which takes into account such additions and subtractions is known as Gross National Product (GNP).

GNP = GDP + Factor income earned by the domestic factors of production employed in the rest of the world – Factor income earned by the factors of production of the rest of the world employed in the domestic economy

Hence, GNP = GDP + Net factor income from abroad (NFIA)

- The national product includes the production activities of residents irrespective of whether performed within the economic territory or outside it.

- In comparison, the domestic product includes the production activity of the production units located in the economic territory irrespective of whether carried out by the residents or non-residents.

Gross and Net

Gross - depreciation (consumption of fixed capital) = Net

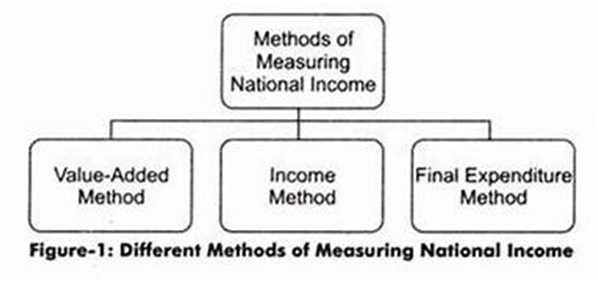

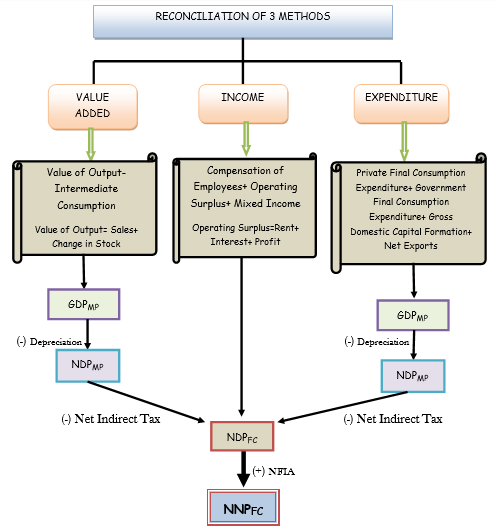

Methods of Calculating National Income

- The Product or Value Added Method Or Production Method

- Expenditure Method Or Final Expenditure Method

- Income Method or Income Distribution Method

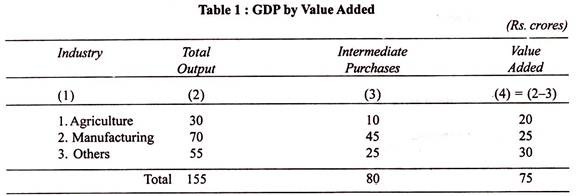

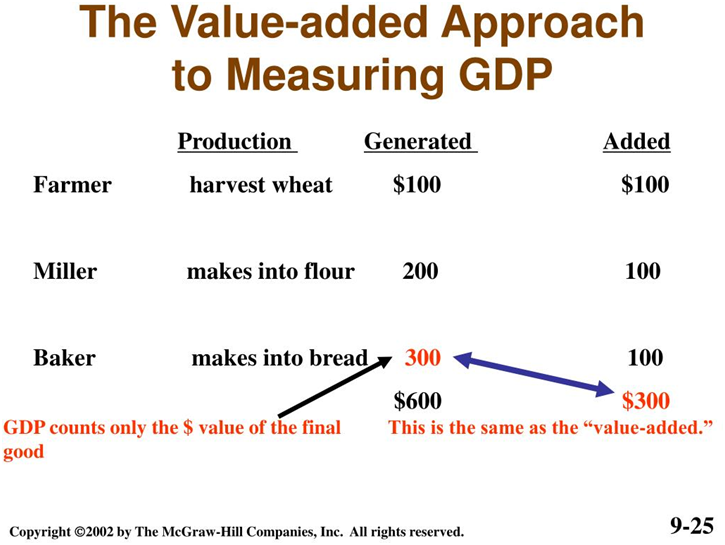

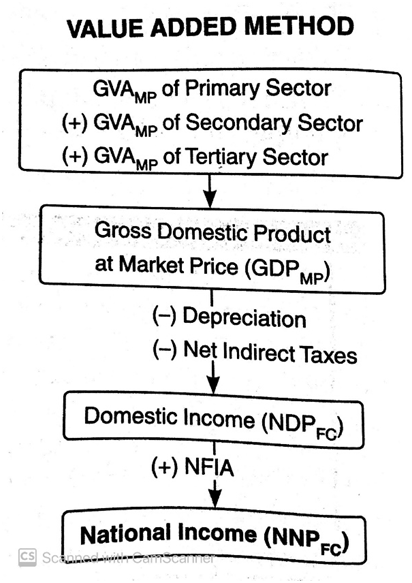

1. Value Added Method Or Production Method

It is now a matter of general practice to group all the production units of the economic territory into three broad groups: primary sector, secondary sector, and tertiary sectors.

Inventory : In economics, the stock of unsold finished goods, semi-finished goods, or raw materials which a firm carries from one year to the next is called inventory. It is a stock variable.

Change of inventories of a firm during a year ≡ production of the firm during the year – sale of the firm during the year. It is a flow variable.

Inventories are treated as capital. Addition to the stock of capital of a firm is known as an investment. Therefore, a change in the inventory of a firm is treated as an investment.

There can be three major categories of investment.

- First is the rise in the value of inventories of a firm over a year which is treated as investment expenditure undertaken by the firm.

- The second category of investment is fixed business investment , which is defined as the addition of the machinery, factory buildings, and equipment employed by the firms.

- The last category of investment is residential investment , which refers to the addition of housing facilities.

Changes in inventories may be planned or unplanned.

- In case of an unexpected fall in sales, the firm will have unsold stock of goods that it had not anticipated. Hence there will be an unplanned accumulation of inventories .

- In the opposite case where there is an unexpected rise in sales, there will be unplanned decumulation of inventories .

Also, Change of inventories = production of the firm – sale of the firm

⇒ Production of the firm = Change of inventories + Sale of the firm

∴ Equation (i) can also be written as

Net Value Added = Gross Value Added - Depreciation

If we sum the gross value added of all the firms of the economy in a year, we get a measure of the value of the aggregate amount of goods and services produced by the economy in a year. Such an estimate is called Gross Domestic Product (GDP) .

In the production method, we first find out Gross Value Added at Market Price (GVA mp ) in each sector and then take their sum to arrive at GDP mp .

Thus, GDP mp = Sum total of gross value added (GVA mp ) of all the firms in the economy.

2. Income Method

In this method, we first estimate factor payments by each sector. The sum of such factor payments equals Net Value Added at Factor Cost (NVA fc ) by that sector. Then we take sum total of NVA fc by all the sectors to arrive at NDP fc .

The components of NDP fc are:

- Compensation of employees

- Rent and royalty

i.e., (1) + (2) + (3) + (4) = NDP fc

Compensation of employees : It is the total remuneration in cash or in kind, payable by an enterprise to an employee in return for work done by the latter during the accounting period.

The main components of compensation of employees are :

- Social security contributions by employers.

Rent : It is the amount receivable by a landlord from a tenant for the use of land.

Royalty : It is the amount receivable by the landlord for granting the leasing rights of sub-soil assets.

Interest : It is the amount payable by a production unit to the owners of financial assets in the production unit. The production unit uses these assets for production and in turn makes interest payments, imputed or actual.

Profit : It is a residual factor payment by the production unit to the owners of the production unit.

The main source of data on factor payments is the accounts of production units. Since accounts of most production units are not available to the estimators, and also since the accounting practices differ, it is not possible for the estimators to clearly identify the components. Therefore, in cases where total factors payment is estimable but not its different components, an additional factor payment item called ‘mixed income’ is added. Since this problem arises mainly in the case of self-employed people like doctors, chartered accountants, consultants, etc, this factor payment is popularly called “ mixed income of the self-employed ”.

In case there is such an item then,

NDP fc = Compensation of employees + Rent and royalty + Interest + Profit + Mixed income (if any)

There is another term used in factor payments. It is ‘ operating surplus ’. It is defined as the sum of rent and royalty, interest, and profits.

Operating Surplus = Rent and royalty + Interest + Profit

∴ NDP fc = Compensation of employees + operating surplus + mixed income (if any)

Once we estimate NDP fc , we can find NNP fc , or national income, by adding NFIA.

NDP fc + NFIA = NNP fc .

3. Final Expenditure Method

In this method, we take the sum of final expenditures on consumption and investment. This sum equals GDPmp. These final expenditures are on the output produced within the economic territory of the country.

Its main components are: Private final consumption expenditure (PFCE) + Government final consumption expenditure (GFCE) + Gross domestic capital formation (GDCF) (Gross Investment) + Net exports (= export - imports) (X-M) = GDP mp

=GDP mp - Depreciation + NFIA -NIT

= National Income

- GDCF= Net domestic fixed capital formation + (Closing stock - Opening stock) + Consumption of fixed capital

- Closing stock - opening stock = Net change in stocks.

Precautions in making estimates of National Income:

A. value added (production) method:.

- Avoid Double Counting : Value added equals value of output less intermediate cost. There is a possibility that instead of counting ‘value added’ one may count the value of output. You can verify by taking some imaginary numerical example that counting only values of output will lead to counting the same output more than once. This will lead to an overestimation of national income. There are two alternative ways of avoiding double counting: (a) count only value-added and (b) count only the value of final products.

- Do not include the sale of second-hand goods : Sale of the used goods is not a production activity. The good should not be treated as fresh production and therefore doesn’t qualify for inclusion in national income. However, any brokerage or commission paid to facilitate the sale is a fresh production activity. It should be included in production but to the extent of brokerage or commission only.

- Self-consumed output must be included : Output produced but retained for self-consumption, rather than selling in the market, is output and must be included in estimates. Services of owner-occupied buildings, farmers consuming their own produce, etc. are some examples

B. Income Distribution Method:

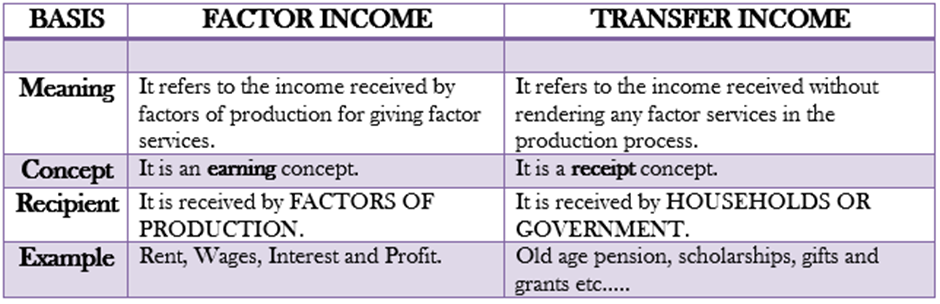

- Avoid transfers : National income includes only factor payments, i.e. payment for the services rendered to the production units by the owners of factors. Any payment for which no service is rendered is called a transfer, and not a production activity. Gifts, donations, charities, etc. are the main examples. Since transfers are not a production activity it must not be included in national income.

- Avoid capital gain: Capital gain refers to the income from the sale of second-hand goods and financial assets. Income from the sale of old cars, old houses, bonds, debentures, etc. are some examples. These transactions are not production transactions. So, any income arising to the owners of such things is not a factor income.

- Include income from the self-consumed output : When a house owner lives in that house, he does not pay any rent. But in fact, he pays rent to himself. Since rent is a payment for services rendered, even though rendered to the owner itself, it must be counted as a factor payment.

- Include free services provided by the owners of the production units : Owners work in their own units but do not charge salaries. Owners provide finance but do not charge any interest. Owners do production in their own buildings but do not charge rent. Although they do not charge, the services have been performed. The imputed (estimated) value of these must be included in national income.

C. Final Expenditure Method:

- Avoid intermediate expenditure : By definition, the method includes only final expenditures, i.e. expenditures on consumption and investment. Like in the value-added method, the inclusion of intermediate expenditures like that on raw materials, etc, will mean double counting.

- Do not include expenditure on second-hand goods and financial assets: Buying second-hand goods is not a fresh production activity. Buying financial assets is not a production activity because financial assets are neither goods nor services. Therefore they should not be included in estimates of national income.

- Include the self-use of own-produced final products : For example, a house owner using the house for himself. Although explicitly he does not incur any expenditure, implicitly he is making payment of rent to himself. Since the house is producing a service, the imputed value of this service must be included in national income.

- Avoid transfer expenditures : A transfer payment is a payment against which no services are rendered. Therefore no production takes place. Since no production takes place it has no place in national income. Charities, donations, gifts, scholarships, etc. are some examples.

National Product and Other Aggregates

First, let us note that out of NI (NNP fc ), which is earned by the firms and government enterprises, a part of the profit is not distributed among the factors of production. This is called Undistributed Profits (UP) . We have to deduct UP from NI to arrive at PI since UP does not accrue to households. Similarly, Corporate Tax , which is imposed on the earnings made by the firms, will also have to be deducted from the NI, since it does not accrue to the households. On the other hand, the households do receive interest payments from private firms or the government on past loans advanced by them. And households may have to pay interest to the firms and the government as well, in case they had borrowed money from either. So, we have to deduct the net interest paid by the households to the firms and government. The households receive transfer payments from the government and firms (pensions, scholarships, prizes, for example) which have to be added to calculate the Personal Income of the households.

However, even PI is not the income over which the households have a complete say. They have to pay taxes from PI. If we deduct the Personal Tax Payments (income tax, for example) and Non-tax Payments (such as fines) from PI, we obtain what is known as Personal Disposable Income.

Personal Disposable Income is the part of the aggregate income which belongs to the households. They may decide to consume a part of it and save the rest.

The idea behind National Disposable Income is that it gives an idea of what is the maximum amount of goods and services the domestic economy has at its disposal. Current transfers from the rest of the world include items such as gifts, aids, etc.

- The sum of net value added by all the production units in the domestic territory is net domestic product of factor cost (NDP fc ). All the income generated in a year is not received by consumer households. Income from property and entrepreneurship accruing to the departmental commercial enterprise of the government is retained by the government. Secondly, non-departmental enterprises of the government save a part of their profits for future expansion. This sum also is not available for distribution. It these two sums are deducted from NDP fc , we get income from domestic product or NDP fc accruing to the private sector.

- Income from domestic product accruing to the private sector = NDP fc – income from property and entrepreneurship accruing to the government administration department - savings of non-departmental enterprises.

- 'National debt interest’ is the interest paid by the government on loans taken to meet its administrative expenditure, a consumption expenditure. Since interest on loans taken to meet consumption expenditure is not a factor income it was not included in NDP fc . But since it is a disposable income it is added to NDP fc to arrive at disposable income of the private sector, called Private Income.

Remember this Formula Chart for solving Numerical Problems:

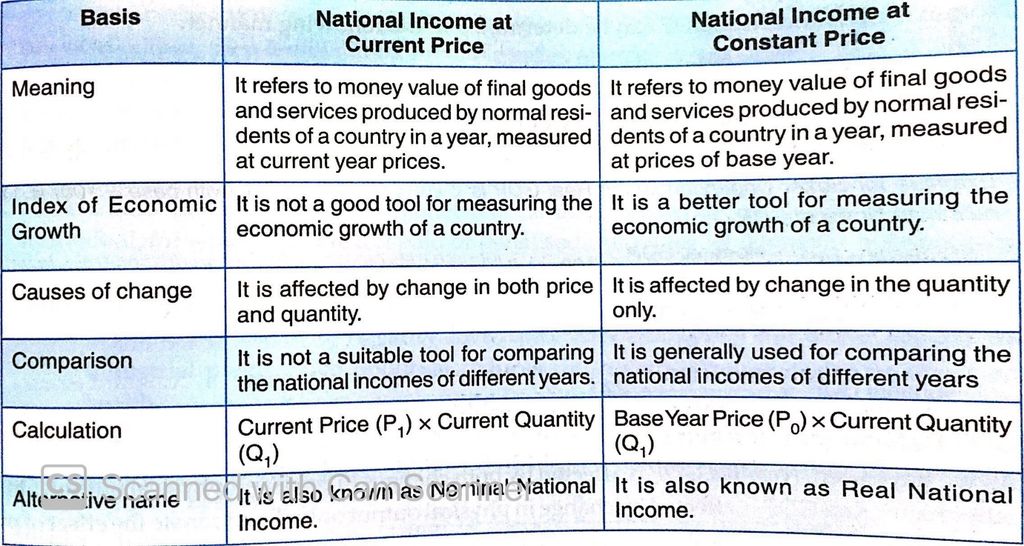

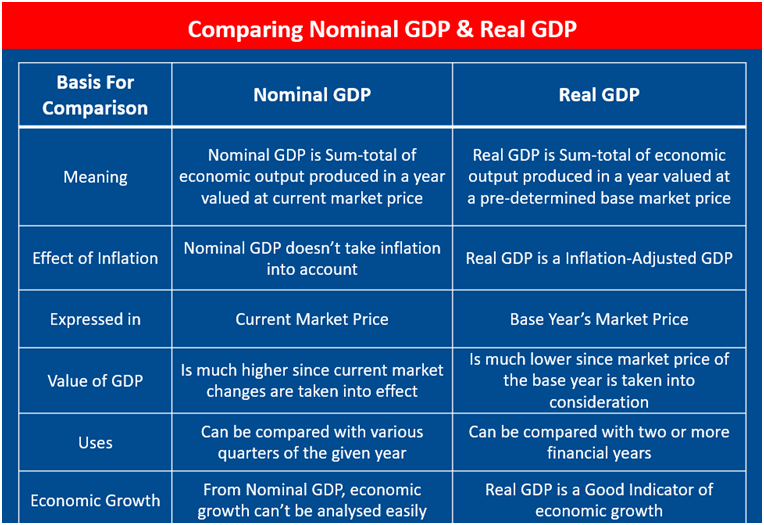

Basic national income aggregates, nominal and real gdp.

GDP Deflator : It is the ratio of nominal GDP to real GDP.

GDP Deflator = ( Nominal GDP / Real GDP x 100) %

Consumer Price Index (CPI) : We calculate the cost of purchase of a given basket of commodities in the base year. We also calculate the cost of purchase of the same basket in the current year. Then we express the latter as a percentage of the former. This gives us the Consumer Price Index of the current year vis-´a-vis the base year.

Wholesale Price Index (WPI) : It is worth noting that many commodities have two sets of prices. One is the retail price that the consumer actually pays. The other is the wholesale price, the price at which goods are traded in bulk. These two may differ in value because of the margin kept by traders. Goods that are traded in bulk (such as raw materials or semi-finished goods) are not purchased by ordinary consumers. Like CPI, the index for wholesale prices is called Wholesale Price Index (WPI). In countries like USA, it is referred to as Producer Price Index (PPI) .

GDP and Welfare

If a person has more income he or she can buy more goods and services and his or her material well-being improves. So it may seem reasonable to treat his or her income level as his or her level of well-being.

But there are at least three reasons why this may not be correct:

- Distribution of GDP – how uniform is it : If the GDP of the country is rising, the welfare may not rise as a consequence. This is because the rise in GDP may be concentrated in the hands of very few individuals or firms. For the rest, the income may in fact have fallen. In such a case the welfare of the entire country cannot be said to have increased.

- Non-monetary exchanges : Many activities in an economy are not evaluated in monetary terms. For example, the domestic services women perform at home are not paid for. In barter exchanges, goods (or services) are directly exchanged against each other. But since money is not being used here, these exchanges are not registered as part of economic activity. In developing countries, where many remote regions are underdeveloped, these kinds of exchanges do take place, but they are generally not counted in the GDPs of these countries. This is a case of underestimation of GDP. Hence, GDP calculated in a standard manner may not give us a clear indication of the productive activity and well-being of a country.

- Externalities : Externalities refer to the benefits (or harms) a firm or an individual causes to another for which they are not paid (or penalized). For example, let us suppose there is an oil refinery that refines crude petroleum and sells it in the market. The output of the refinery is the amount of oil it refines. We can estimate the value added by the refinery by deducting the value of intermediate goods used by the refinery (crude oil in this case) from the value of its output. The value added by the refinery will be counted as part of the GDP of the economy. But in carrying out the production the refinery may also be polluting the nearby river. This may cause harm to the people who use the water of the river. Hence their well-being will fall. Pollution may also kill fish or other organisms of the river on which fish survive. As a result, the fishermen of the river may be losing their livelihood. In this case, the GDP is not taking into account such negative externalities. Therefore, if we take GDP as a measure of the welfare of the economy we shall be overestimating the actual welfare. This was an example of a negative externality. There can be cases of positive externalities as well. In such cases, GDP will underestimate the actual welfare of the economy.

Frequently Asked Questions

What is National Income Accounting?

National Income Accounting is the process of measuring the total economic output of a country over a specific period of time. It is used to evaluate the economic performance of a country and to make comparisons between countries.

What are the components of National Income?

The components of National Income include compensation of employees, gross operating surplus, taxes on production and imports, and net property income from abroad.

What is Gross Domestic Product (GDP)?

Gross Domestic Product (GDP) is the total value of all goods and services produced within a country's borders in a specific period of time. It is one of the most widely used indicators of a country's economic performance.

What is Gross National Product (GNP)?