Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regards to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Finish Your Business Plan Today!

How to write a business plan for an accounting firm.

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, or the amount of revenue earned.

- Your legal business structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the accounting industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the accounting industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your accounting business plan:

- How big is the accounting industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your accounting business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your accounting business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, organizations, government entities, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of accounting business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r accounting firms.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes CPAs, other accounting service providers, or bookkeeping firms. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of accounting business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide options for multiple customer segments?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a accounting business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f accounting company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide auditing services, tax accounting, bookkeeping, or risk accounting services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your accounting company. Document where your company is situated and mention how the site will impact your success. For example, is your accounting business located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your accounting marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your accounting business, including answering calls, scheduling meetings with clients, billing and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your accounting business to a new city.

Management Team

To demonstrate your accounting business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing accounting businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an accounting business or bookkeeping firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer discounts for referrals ? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your accounting business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a accounting business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of your most prominent clients. Summary Writing a business plan for your accounting business is a worthwhile endeavor. If you follow the accounting business plan example above, by the time you are done, you will truly be an expert. You will understand the accounting industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful accounting business.

Accounting Business Plan Template FAQs

What is the easiest way to complete my accounting business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your accounting business plan.

How Do You Start an Accounting Business?

Starting an accounting business is easy with these 14 steps:

- Choose the Name for Your Accounting Business

- Create Your Accounting Business Plan

- Choose the Legal Structure for Your Accounting Business

- Secure Startup Funding for Your Accounting Business (If Needed)

- Secure a Location for Your Business

- Register Your Accounting Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Accounting Business

- Buy or Lease the Right Accounting Business Equipment

- Develop Your Accounting Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Accounting Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Accounting business plan?

OR, Let Us Develop Your Plan For You Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan writer can create your business plan for you. Other Helpful Business Plan Articles & Templates

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. His expertise, reputation, and loyal clientbase will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the clientbase that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

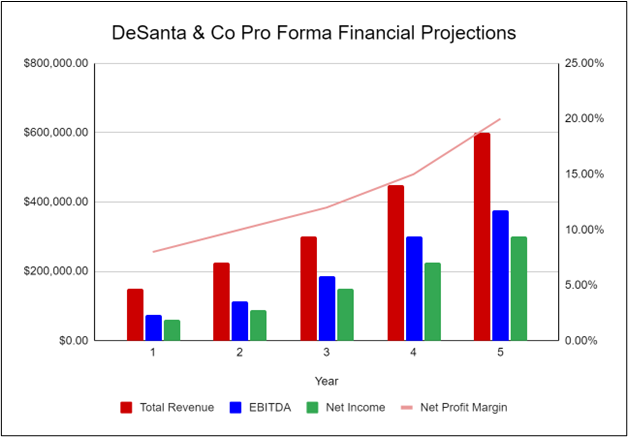

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. After working for several accounting firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his clientbase and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, accounting business plan faqs, what is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

Accounting Firm Business Plan

After getting started with upmetrics , you can copy this sample business plan into your business plan and modify the required information and download your accounting firm business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

Download a sample accounting firm business plan

Need help writing your business plan from scratch? Here you go; download our free accounting firm business plan pdf to start.

It’s a modern business plan template specifically designed for your accounting firm business. Use the example business plan as a guide for writing your own.

Related Posts

Bookkeeping Business Plan

Counseling Private Practice Business Plan

Presenting your Business Plan

Top Business Planning Tools

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Search Search Please fill out this field.

Understanding the Legal Requirements

Acquiring bookkeeping skills, creating a business plan for your bookkeeping business, marketing strategies for your bookkeeping business, managing finances in your bookkeeping business, acquiring clients for your bookkeeping business, is bookkeeping a profitable business, can you start your own bookkeeping business, how much should i charge my bookkeeping clients, the bottom line.

- Small Business

- How to Start a Business

How to Start Your Own Bookkeeping Business: Essential Tips

Understanding the legal requirements

:max_bytes(150000):strip_icc():format(webp)/20171019_172018-5a12f5cdbeba3300373b7964-3d8c34a5e28d41cdb3c4e2df355329f4.jpg)

Starting a bookkeeping business is something you might be interested in if you naturally love numbers and want to break free of the traditional nine-to-five. It’s possible to offer bookkeeping services to clients in person or remotely, which may be ideal if you would prefer a work-at-home job.

Before starting a bookkeeping business, you’ll first need to know the basics of operating legally. It’s also helpful to understand how to market your services and manage the financial side of running a business.

Key Takeaways

- A degree in accounting is not required to start a bookkeeping business, though a certification in bookkeeping can be helpful to have.

- You’ll need to choose a business structure, and register your business with the proper state authorities if required by law where you live.

- If you plan to hire employees, you may need to obtain workers’ compensation insurance in compliance with state law.

- Developing a solid marketing plan can help you build your brand and attract clients to your business.

The legal requirements for starting a bookkeeping business are similar to any other type of business. Some of the most important things you’ll need include:

- Selecting a business structure (i.e., sole proprietorship, limited liability company, etc.)

- Choosing a name for the business

- Registering your business with the proper state agencies

- Obtaining a federal Employer Identification Number (EIN) and state identification numbers, if necessary

- Applying for any necessary licenses or permits

- Opening a business bank account

- Getting business insurance , including liability coverage and/or home-based business insurance

The exact requirements for starting a small business will depend on the state in which you live. You may need to contact your secretary of state or department of revenue for more information on what paperwork you may need to complete to legally establish your bookkeeping business.

There may be additional steps required if you plan to hire employees for your business. For instance, you may need to obtain workers’ compensation insurance. The requirements for workers’ compensation vary by state. For instance, California requires workers’ compensation for all employers, regardless of the number of employees. In Alabama, on the other hand, businesses are not required to purchase workers’ compensation insurance if they have fewer than five employees.

Some states may impose steep penalties against businesses that fail to obtain workers’ compensation insurance.

Starting a bookkeeping business requires an understanding of accounting and bookkeeping practices. You may need to first complete a training program before you can launch.

For example, you might pursue any of the following:

- Bookkeeping certification

- Tax certification

- Accounting software certification

Unlike the requirements to become an accountant, the training required to become a bookkeeper is less strenuous. It’s possible to find and complete an online training program from home.

As you compare online bookkeeping courses , consider the range of topics covered, the course format, and the cost. Whether it makes sense to obtain just one bookkeeping certification or additional tax and accounting software certificates can depend on your niche and the types of services you plan to offer.

While a degree in accounting may be helpful for starting a bookkeeping business, it’s not an absolute requirement.

A business plan is a detailed overview of how you plan to launch and grow your business. There are several key elements that are typically included in a comprehensive business plan. Here’s what yours might look like as you draft a plan for your bookkeeping business.

- Executive summary : The executive summary should offer a brief overview of what your business is about, your mission, and how you’ll be successful. Your mission statement can also include information about your employees (if you plan to hire any) and your plans for growth.

- Company description : Your company description is an opportunity to provide additional details about your business, including who you plan to serve and what problems you’ll solve for your clients.

- Market analysis : Market analysis allows you to look at your competitors and identify their strengths and weaknesses. Completing this section can help you better understand what makes your bookkeeping business unique.

- Organization and management : This section should describe how your business is legally structured and who’s responsible for running it. If you’re operating as a one-person business, this part of your plan will likely be brief.

- Services : In the services section, you can expand on what types of services you plan to offer as a bookkeeper and who you expect your customers to be.

- Marketing : How you market your bookkeeping business can depend on your niche or target audience and what resources you have to invest in advertising. You’ll use this section to sketch out your marketing plans for attracting clients to your business.

- Financial projections : This section is where you’ll outline how much revenue and profit you expect to make from the business.

Having a business plan to start a bookkeeping business isn’t a requirement, but creating one can help you get some clarity on what your goals are and how you plan to proceed with growing the business. Even if you’re just planning to offer bookkeeping services remotely as a sole proprietor , it can still be helpful to flesh out the exact steps you’ll need to take to succeed.

A business plan may be required if you plan to apply for business financing from banks or investors.

When you start any new business, you can’t expect customers or clients to magically find you. Instead, you’ll have to invest some time (and perhaps, money) in marketing your business.

If you’re specifically interested in working as a bookkeeper remotely, establishing a website and social media profiles may be a starting point for your marketing plan. Both can make it easier for potential clients to find you in online searches. You can also leverage social media to build your brand and increase your visibility.

Aside from a website and social media, there are some other options you might consider for marketing your services. They can include:

- Using LinkedIn to build out your professional network and establish credibility

- Joining a local meetup group of bookkeepers in your area

- Joining a professional business association in your area

- Participating in local small business events

- Seeking out opportunities to be a guest on podcasts in the finance niche

- Offering a seminar or workshop, either online or in person

When planning your marketing strategy , it’s important to think about the message you want to send to prospective clients. That message should be consistent across all of the channels you use to market your business, whether that includes YouTube, Facebook, TikTok, or another platform.

It’s also important to consider who your message is targeting. Your marketing content should speak to the needs and pain points of the types of customers you’re most interested in attracting to your business.

Keeping track of cash flow is essential for running any business. As you prepare to start your bookkeeping business, it’s important to keep track of your expenses, which may include:

- Website hosting

- Accounting software

- Customer relationship management (CRM) software

- Cloud storage fees

- Home office supplies (if you’ll be working remotely)

- Registration fees

- Fees for certification or training

- Marketing costs

Once your business gets under way, you can make a monthly budget to track your cash inflows and outflows. You’ll also need to give some thought to how you plan to invoice your clients for your services. That includes choosing when to send invoices , how quickly you expect them to be paid, and which payment methods you'll accept.

Running a business also means paying taxes on your earnings. That includes income tax and estimated quarterly taxes . Generally, you’re required to make estimated quarterly tax payments to the Internal Revenue Service (IRS) if:

- You expect to owe at least $1,000 in tax for the year, after subtracting withholding and refundable credits.

- You expect your withholding and refundable credits to be the smaller of 90% of the tax shown on your current year’s return or 100% of the tax shown on your prior year’s return.

If your state imposes an income tax, you’ll also be responsible for making estimated tax payments to your state agency.

Opening a business bank account can make it easier to keep track of what funds go in and out. You can open a business bank account at a traditional bank, credit union, or online bank. You’ll need to provide your personal information, along with your business details, in order to open an account. Comparing fees, features, and accessibility can help you choose the best business bank account for your needs.

You might also consider applying for a business credit card to help cover expenses until you start making money. You can apply for a business credit card using your personal credit score and income ; business credit is not a requirement. If you’re considering a business credit card , you might want to look for one that offers a generous rewards program and/or charges no annual fee.

Once you’ve covered all the legal aspects of starting your business, it’s time to start finding your first clients. There are a few ways you can go about doing this. These include:

- Looking for remote bookkeeping opportunities on freelance job boards

- Establishing profiles on sites like Fiverr or Upwork, which connect companies with freelance workers

- Reaching out to local businesses to ask if they need bookkeeping services

- Running ads on social media

- Joining local small business directories

- Offering a free consultation to local businesses

- Asking friends, family, or other business owners for referrals

Once you start getting your first clients, it’s important to focus on customer satisfaction. Clients who are happy with your services are more likely to stay loyal and continue to hire you. They also may be willing to refer you to people they know who might need a good bookkeeper.

Bookkeeping has the potential to be a profitable business if you’re able to maintain a solid roster of clients who are willing to pay competitive rates for your services. A typically remote bookkeeper’s salary is just over $55,000 a year, but it’s possible to make much more than that, depending on your clientele and the rates you charge.

It’s possible to start a bookkeeping business from scratch, even if you don’t have a professional or educational background in accounting or bookkeeping. Having a degree or certification in either area could be an advantage, but it’s possible to acquire the skills you need to become a bookkeeper online. Likewise, you don’t need to have experience running a business, but that could also prove helpful.

The amount you should charge your bookkeeping clients can depend on a number of factors, including how much experience you have, which certifications you hold, the types of services you offer, and the types of individuals or businesses you work with. Someone who’s new to the profession, for example, may start their rates at $20 an hour, while someone with several years of experience may charge $35 an hour or more. Researching average bookkeeper salaries for your area can give you an idea of what your competitors may charge.

Starting a bookkeeping business can be a great opportunity to take control of your career. Before diving in, however, it’s important to understand what’s involved to get your new business up and running. The more prepared you are before launching, the greater your chances of succeeding as an expert bookkeeper.

U.S. Small Business Administration. “ Launch Your Business .”

Insureon. “ State Laws for Workers’ Compensation .”

U.S. Small Business Administration. “ Write Your Business Plan .”

Internal Revenue Service. “ Estimated Tax .”

Glassdoor. “ Remote Bookkeeper Salaries .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-11255773532-a93b827339e146b28c0aa3084a98e115.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Creating your business plan

It’s time to get things down on paper. Your business plan is vital to reality checking all those ideas you have.

What to do on day zero

If you already know what you want to be called, lock down the name and register the URL. Now take some time to see what’s working for other bookkeepers. Find the ones in your area and check out their websites – plus their LinkedIn and Facebook profiles – to see what makes them tick. How do they speak to the market? What services do they offer? How much do they charge? Use this research to help start the plan for your bookkeeping business.

But what if I already know the plan?

It’s great if you already know how you’re going to get started, but it’s still important to write everything down. For one thing, you’ll want to record all your golden ideas before they’re forgotten. Plus the writing process will help you interrogate those ideas.

Putting them on a timeline, costing them out, and fitting them around each other might reveal a thing or two. Perhaps some assumptions will need to be rethought, or some ideas will have to be skipped in favor of others. It’s a great way to organize your thinking.

Start with a working one-pager

The key to a business plan is to start out simple, and build on it as you go. Begin with a few headings and bullet points that map out your vision, goals, milestones and predictions.

Don’t let it get out of hand or bog you down. That’s not what a business plan is for. It’s supposed to help you get started. So set yourself a target of producing a one page plan to start.

Choose your words carefully

Decide how you’re going to talk about your business, and which words you’ll use. It’ll be helpful in settling on a value proposition and relating to clients. You can use your chosen terms in your elevator pitch, on your website, in blurbs about your business – and in your business plan.

Sections for a one-page business plan

1. Value proposition: Explain why clients will be better off with you.

2. The problem you’re solving: Describe the status quo and say why it’s not ideal.

3. Target market and competition: Profile the clients you want, and the bookkeeping solutions they use now.

4. Sales and marketing: Show how you’ll reach your target market, and what you’ll say to them.

5. Budget and sales: Work out your costs and predict how much you can earn over the first couple of years.

6. Milestones: Identify all the things that need to happen and map them against a timeline.

7. The team: Identify the people that will be involved (including consultants) and outline their roles.

8. Funding: Show how you’ll bankroll the business, especially as you wait for fees to start rolling in.

9. Contingency plan: What will you do if your cash flow isn’t what you budgeted?

You may eventually draw up a longer business plan, or you may stick with a short one. It depends on your working style, and the level of risk you’re taking on. Your plan will probably be more detailed if you’re taking on a lot of debt.

You can download a copy of our one-page or multi-page business plan template .

Staying alive

Once you’ve got your plan nailed down, remember you really don’t. You should treat your plan as a living document and keep tweaking it as things evolve. That’s another reason why it’s good to have a short plan, which you’re much more likely to update as you go. Try to be agile and open to change.

The discipline of maintaining your business plan will help you:

- discover and solve problems – putting things in black and white will show up holes in your thinking.

- get feedback from others – you can share your plan to get feedback from trusted advisors.

- go for more finance – an up-to-date business plan (and budget) means you’re always ready to apply for loans.

- guide growth – regular focus on the big picture will help you make strategic decisions rather than instinctive ones.

Have a succession plan

You will also need a succession plan. What will happen when you step away from the business? Will you sell it? Who to? A family member, a staff member, or someone on the open market?

A good succession plan will make sure the business can survive and thrive without you. That it will perform for its clients and its new owners. And it should give you the flexibility to step away from the business at short notice, if required or desired.

Learn more in our guide to succession planning.

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Starting a bookkeeping business

Work through the big decisions around accreditation, services to offer, fees to charge, and how to find clients.

You’ll need some training and certification to become a professional bookkeeper. Find out where this is available.

With a foundation of knowledge, skills and experience, take the next steps in setting up as a bookkeeper.

You need to nail down what services you’ll offer, who to, and how. Don’t promise more than you’re able to deliver.

Designing your bookkeeping business around a specific type of client or your strengths can be a successful way to go.

How do you walk the line between profitable for you and affordable for your clients? And help clients budget?

You might deliver an awesome service at a great price, but what if no one knows? Let’s look at marketing your services.

Download the bookkeeping business guide

A guide to help you work through the big decisions around starting a bookkeeping business. Fill out the form to receive the guide as a PDF.

Privacy notice .

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

Business development

- Billing management software

- Court management software

- Legal calendaring solutions

Practice management & growth

- Project & knowledge management

- Workflow automation software

Corporate & business organization

- Business practice & procedure

Legal forms

- Legal form-building software

Legal data & document management

- Data management

- Data-driven insights

- Document management

- Document storage & retrieval

Drafting software, service & guidance

- Contract services

- Drafting software

- Electronic evidence

Financial management

- Outside counsel spend

Law firm marketing

- Attracting & retaining clients

- Custom legal marketing services

Legal research & guidance

- Anywhere access to reference books

- Due diligence

- Legal research technology

Trial readiness, process & case guidance

- Case management software

- Matter management

Recommended Products

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

Fast track case onboarding and practice with confidence. Tap into a team of experts who create and maintain timely, reliable, and accurate resources so you can jumpstart your work.

A business management tool for legal professionals that automates workflow. Simplify project management, increase profits, and improve client satisfaction.

- All products

Tax & Accounting

Audit & accounting.

- Accounting & financial management

- Audit workflow

- Engagement compilation & review

- Guidance & standards

- Internal audit & controls

- Quality control

Data & document management

- Certificate management

- Data management & mining

- Document storage & organization

Estate planning

- Estate planning & taxation

- Wealth management

Financial planning & analysis

- Financial reporting

Payroll, compensation, pension & benefits

- Payroll & workforce management services

- Healthcare plans

- Billing management

- Client management

- Cost management

- Practice management

- Workflow management

Professional development & education

- Product training & education

- Professional development

Tax planning & preparation

- Financial close

- Income tax compliance

- Tax automation

- Tax compliance

- Tax planning

- Tax preparation

- Sales & use tax

- Transfer pricing

- Fixed asset depreciation

Tax research & guidance

- Federal tax

- State & local tax

- International tax

- Tax laws & regulations

- Partnership taxation

- Research powered by AI

- Specialized industry taxation

- Credits & incentives

- Uncertain tax positions

A powerful tax and accounting research tool. Get more accurate and efficient results with the power of AI, cognitive computing, and machine learning.

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

Automate workpaper preparation and eliminate data entry

Trade & Supply

Customs & duties management.

- Customs law compliance & administration

Global trade compliance & management

- Global export compliance & management

- Global trade analysis

- Denied party screening

Product & service classification

- Harmonized Tariff System classification

Supply chain & procurement technology

- Foreign-trade zone (FTZ) management

- Supply chain compliance

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Risk & compliance management.

- Regulatory compliance management

Fraud prevention, detection & investigations

- Fraud prevention technology

Risk management & investigations

- Investigation technology

- Document retrieval & due diligence services

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Who we serve.

- Broadcasters

- Governments

- Marketers & Advertisers

- Professionals

- Sports Media

- Corporate Communications

- Health & Pharma

- Machine Learning & AI

Content Types

- All Content Types

- Human Interest

- Business & Finance

- Entertainment & Lifestyle

- Reuters Community

- Reuters Plus - Content Studio

- Advertising Solutions

- Sponsorship

- Verification Services

- Action Images

- Reuters Connect

- World News Express

- Reuters Pictures Platform

- API & Feeds

- Reuters.com Platform

Media Solutions

- User Generated Content

- Reuters Ready

- Ready-to-Publish

- Case studies

- Reuters Partners

- Standards & values

- Leadership team

- Reuters Best

- Webinars & online events

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

- Reuters Media Center

- Jurisdiction

- Practice area

- View all legal

- Organization

- View all tax

Featured Products

- Blacks Law Dictionary

- Thomson Reuters ProView

- Recently updated products

- New products

Shop our latest titles

ProView Quickfinder favorite libraries

- Visit legal store

- Visit tax store

APIs by industry

- Risk & Fraud APIs

- Tax & Accounting APIs

- Trade & Supply APIs

Use case library

- Legal API use cases

- Risk & Fraud API use cases

- Tax & Accounting API use cases

- Trade & Supply API use cases

Related sites

United states support.

- Account help & support

- Communities

- Product help & support

- Product training

International support

- Legal UK, Ireland & Europe support

New releases

- Westlaw Precision

- 1040 Quickfinder Handbook

Join a TR community

- ONESOURCE community login

- Checkpoint community login

- CS community login

- TR Community

Free trials & demos

- Westlaw Edge

- Practical Law

- Checkpoint Edge

- Onvio Firm Management

How to start an accounting firm: Your checklist for successfully starting a firm

So, you're thinking of starting an accounting firm.

That's great. No doubt you have plenty of questions about how to set up a new firm and get off to a great start.

Thomson Reuters spoke with some of our industry experts to get answers to the big questions you may have.

Here's what they told us.

Useful links

- Tax preparation software

- Accounting software

- Tax and accounting research

- Practice management software

- See all solutions

Starting your own accounting business sounds like a lot of work. Why would I want to start an accounting firm?

Starting an accounting firm is like starting any small business – it requires a lot of work. However, industry and consulting firms list accounting firms as one of the single most profitable small businesses a person can start right now.

Here are a few questions to consider when starting a firm:

- Do you want to be a cog in the machine or own a firm? Frankly, there isn’t a wrong answer to this question, but rather a preference. However, going out on your own comes with one significant benefit: you’re getting the profit from the firm, not just your wages. You go from employee to owner.

- What’s my business purpose? While perhaps a bit esoteric, defining your business’s purpose is crucial. Why am I doing this? What’s my goal behind this? It’s not just a philosophical exercise. Knowing why you’re starting a firm can help you define your target market, whether it’s helping small businesses, real estate, or another service area.

- Do you want to be nimble and cutting edge? Small firms tend to be much more agile and have a greater ability to do new things. From adopting new technology to discovering and implementing new software or other efficiency creating tools, running your own firm lets you make the decisions about what makes your business unique—and profitable.

- Should you start a legal entity? For some, a sole proprietorship won’t require incorporation – especially if the work is centered around less complex tasks such as basic tax preparation. However, there are certain liability protections by becoming an LLC, including limiting risk for your business. Assets become owned by your business and are distinguished from personal assets. When a business is not incorporated, it becomes harder to draw that line and the entire enterprise becomes at risk.

What are the requirements to open an accounting firm? What do I need?

Starting an accounting firm is no different from starting any other small business. And while there are accounting-specific requirements, it’s important to remember that you’re starting a business first.

Start by figuring out your purpose, goal, and market. This will influence many other decisions, including the function of the services you provide, whether you want a physical or virtual location, your target demographic, and the location of your business.

Once you’ve selected a location and determined your goals, it’s time to consider the nuts and bolts of owning a business.

You’ll need to:

- Obtain Employer Identification Number (EIN) and Tax ID number

- Investigate employment laws

- Determine startup costs

- Develop a pricing structure for services

- Decide on the legal structure of your business (S-Corp, L-Corp, LLC, Partnership, LLP )

- Look at business insurance

- Create a business bank account

- Develop internal policies and rules

- Hire employees

Additionally, you’ll have to think about the day-to-day needs of running a business, including managing risk, basic administrative tasks, and general questions of how and where you will meet clients.

Will I need to get a new EIN from the federal government ?

In most cases, owning and running an accounting firm necessitates an Employer Identification Number (EIN). However, the IRS website provides an in-depth explanation of who is required to have an EIN and when. A good rule of thumb is: if you plan on hiring employees – or plan to in the future – you’ll probably need an EIN.

That said, even if you don’t think you need one – or the website says it isn’t a requirement– most businesses are probably better off acquiring an EIN.

Luckily, the online process is fast, easy, and free.

If I’m not a Certified Public Accountant, do I need a CPA to open an accounting firm ?

It depends.

While all CPAs are accountants, not all accountants are CPAs. There are differences between the two, including education, experience, and certain opportunities. However, the answer goes back to the question, “What services do you want to offer?”

An accounting firm can do almost everything a CPA firm can do with one exception – audits and assurance services. So, if that is a part of your goals or your target market, then it’s probably wise to think about the steps needed to become a CPA.

However, if you are looking to focus on the multitude of other services accounting firms provide, it’s likely not a necessary credential to start. And while there are certain state-by-state exceptions about what can and cannot be undertaken by a CPA, they are not a requirement for starting an accounting firm.

However, if you want to call yourself a “CPA firm” – you will need a CPA.

Can accountants work from home ?

One of the benefits of starting an accounting firm is flexibility. So, the simple answer to the question is, yes—many accountants can and do work from a home office.

All the regulations that apply to a physical location also apply to virtual or home offices. So not having a physical office does not put an accounting firm at a disadvantage.

In fact, working from home is even easier with modern technology and software solutions that help bring vital aspects of your daily workflow into one dedicated (and usually online) space. For instance, Thomson Reuters makes its CS Professional Suite of tax and accounting software available as hosted online solutions and designed its Onvio products to run entirely in the cloud.

It’s important to note: an accounting firm must have a dedicated EFIN (Electronic Filing Identification Number) for every separate location where they perform work. So, if you have a physical location and do work in a home office, you’ll need to investigate whether you’ll need a separate EFIN for home office.

The answer largely depends on how much – and the extent of the work – you do from home. Check with the IRS for further guidance.

If I’d prefer a home-based accounting business, what should I know about starting an accounting firm from home ?

Luckily, accounting firms don’t need a physical space to operate successfully. And like the traditional brick and mortar approach, having a home-based or virtual business brings both opportunities and challenges that are unique to that approach. When considering a home-based business, it’s important to think about the unique challenges and opportunities involved.

These include:

- Shared work locations. There are many co-working locations across the country, many of which include both space for professionals to perform their tasks, as well as providing a professional, on-demand space to meet with clients. While there is usually a monthly fee to use these spaces, the benefits they provide are often worth the cost (and are significantly cheaper than leasing or purchasing office space).

- Low costs. New businesses often struggle with overhead. As you build your client list, keeping costs low is a priority. Not only does it allow you to see a profit early, but it also allows you to adjust your service menu to attract clients with lower-than-normal prices.

- Liability issues. If you choose to meet clients in your home, liability and zoning can be an issue. If a client gets hurt inside your home office, or falls outside of it, it’s important to know the laws surrounding liability.

- Zoning laws. Most cities and counties have zoning regulations. Make sure you investigate and comply with any laws to ensure your home-based business isn’t operating illegally.

- Turn limitations into unique opportunities. While not having a physical space can be challenging at times, it can also be an advantage. Consider visiting clients onsite. Not only does it solve space concerns, it communicates a message to the client—you offer a higher level of service.

What are the key services offered by accounting firm s?

In many ways, this question can be answered by once again looking at your goals and target market. What are the key services needed by that population? How can you serve them better? Still, while many services will be dictated by the specifics of your clients and their business, there are a few standards most accounting firms offer, including:

- Assurance services

- Bookkeeping

While these are typically the core offerings – and the ones that will provide consistent business in most accounting firms – it’s also important to investigate emerging and buzz-worthy services that are attracting bigger and more progressive accounting businesses.

From consulting and advising to outsourced CFO services (serving as the embedded strategic financial decision-maker for a client), taking a cue from the bigger firms – and anticipating what trends might trickle down to smaller and independent businesses – can increase the clients you serve and put you steps ahead of your competition.

What should I know about running an accounting firm ?

Starting a business is filled with new and challenging decisions. However, once the business is up and running, it’s common to be unprepared for typical day-to-day operations. Anticipating (and planning for) these concerns helps make sure you’re working as efficiently as possible.

Common questions and concerns include:

- Talent acquisition and development. Frankly, finding and keeping staff is a significant challenge, which is why hiring always leads industry surveys about common needs and concerns. Even if you aren’t ready to hire a team, it’s wise to start developing a strategy early.

- Going beyond the seasonal business . Every year it gets harder and harder to operate a seasonal accounting business, especially if you’re looking to offer a variety of services. Unless you’re doing just cookie-cutter tax prep – and you avoid complex returns – you won’t be able to operate on a seasonal basis. That said, prioritizing the season and maximizing your efficiency (and your profits) during the heavy times is critical to finding success.

- Keep on top of regulatory changes. Keeping up with major regulatory changes can be a challenge – especially if you add staff. Finding a solution that helps minimize the burden and risk that otherwise exists will help stave off the constant onslaught of new information.

- Rethink the traditional role of the accounting firm. Traditional accounting firms used to meet with clients just once a year to do their tax return. More progressive firms are moving to a year-round schedule, which not only allows them to expand services for current and future clients but implies a partnership relationship that goes beyond the “one touchpoint” per year model.

How much should an accountant charge per hour? Or should accountants charge a fixed fee ?

This, in many ways, is an unanswerable question because the only reliable advice that can be given is, “It depends.” Every context is different and is swayed by factors such as competition, location, service offerings, and level of expertise.

However, even though there isn’t a standard fee, most accounting firms are moving away from an hourly fee structure and choosing to institute to a fixed fee model that allows for better value for clients, a more manageable business plan, and eventually an increase in earnings.

Again, every context is unique, and there are certain situations when an hourly fee structure is best. These include:

- When you’re gathering information to develop a fee structure

- Gauging profitability in a newer firm and trying to determine the hours you need to work and remain profitable

- Early in your career when you need more time to complete basic tasks

Outside of those circumstances, a fixed fee is recommended and preferred. As your skill and expertise grow, so will your abilities to complete tasks quickly. With an hourly fee, this means having to take on more clients to maintain (and hopefully increase) your profits.

A fixed fee structure is about value. The expertise and skill you bring to service are of more importance than just an hour of work for clients. Pricing your abilities based on knowledge is not only good for your business but is ultimately valuable for your clients as well.

How should I price accounting and bookkeeping services ?

While there is still a debate surrounding hourly versus fixed fees in some aspects of the business, accounting and bookkeeping is not one of them.

Accounting and bookkeeping services (as well as other service lines, such as simple tax preparations) are almost universally charged as a fixed fee, and there is a market expectation for that pricing structure.

When determining a fee structure, many accountants call other firms and ask for quotes. They use the average of those quotes to determine a fair and competitive price for their services.

Another resource is local and national affiliations and associations. Many of the larger ones (such as the National Association of Tax Preparers) will distribute recommended price structures and other useful information.

How much should a CPA charge for taxes?

While you do not have to be a CPA to prepare or file taxes, the training and expertise it requires to gain that credential matters. Simply put, you’re a CPA, and you deserve a premium for your services.

When trying to structure fees, it’s important to set a minimum job value. By setting a minimum job value at, say, $500, you won’t get mired in lower-level work that you likely don’t want to take on. Plus, that work can take up time and pull you away from more valuable work that you’d rather be doing.

Knowing what you want to charge and identifying the value you bring to your clients is critical. You are providing a service to your clients, but you’re also giving them a value based on your credentials and experience. So, it’s up to you to set the standards and have them choose between lower costs (them doing it their self) versus the value of having a CPA prepare your taxes.

That said, there’s a balance.

Many CPAs make a practice of “writing down” certain services because they know their hourly rate for larger projects can quickly become untenable for a client. Not only is this seen as a discount by the client, but it also allows you to create a fixed-fee structure for your services and show the clients the savings and value they receive.

If they need more staff, what do accounting firms look for when hiring?

When hiring, accounting firms are like many businesses and are looking for a combination of credentials, experience, and the ability to perform the necessary tasks. However, in an increasingly competitive hiring market, many firms are beginning to look at soft skills as valuable for new hires.