- Insights & Analysis

- Nonprofit Jobs

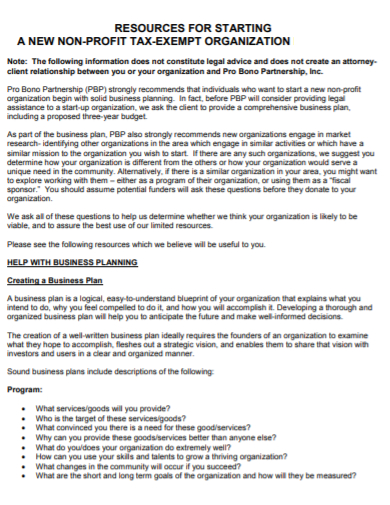

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

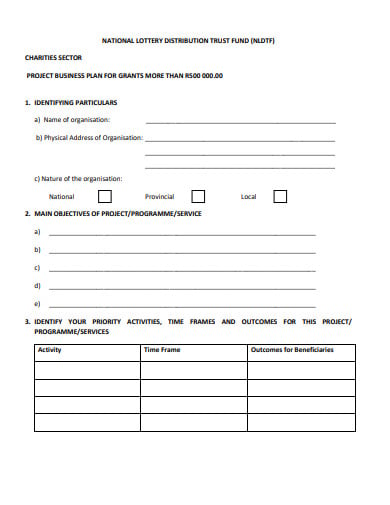

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

13 min. read

Updated October 27, 2023

Believe it or not, creating a business plan for a nonprofit organization is not that different from planning for a traditional business.

Nonprofits sometimes shy away from using the words “business planning,” preferring to use terms like “strategic plan” or “operating plan.” But, the fact is that preparing a plan for a for-profit business and a nonprofit organization are actually pretty similar processes. Both types of organizations need to create forecasts for revenue and plan how they’re going to spend the money they bring in. They also need to manage their cash and ensure that they can stay solvent to accomplish their goals.

In this guide, I’ll explain how to create a plan for your organization that will impress your board of directors, facilitate fundraising, and ensures that you deliver on your mission.

- Why does a nonprofit need a business plan?

Good business planning is about setting goals, getting everyone on the same page, tracking performance metrics, and improving over time. Even when your goal isn’t to increase profits, you still need to be able to run a fiscally healthy organization.

Business planning creates an opportunity to examine the heart of your mission , the financing you’ll need to bring that mission to fruition, and your plan to sustain your operations into the future.

Nonprofits are also responsible for meeting regularly with a board of directors and reporting on your organization’s finances is a critical part of that meeting. As part of your regular financial review with the board, you can compare your actual results to your financial forecast in your business plan. Are you meeting fundraising goals and keeping spending on track? Is the financial position of the organization where you wanted it to be?

In addition to internal use, a solid business plan can help you court major donors who will be interested in having a deeper understanding of how your organization works and your fiscal health and accountability. And you’ll definitely need a formal business plan if you intend to seek outside funding for capital expenses—it’s required by lenders.

Creating a business plan for your organization is a great way to get your management team or board to connect over your vision, goals, and trajectory. Even just going through the planning process with your colleagues will help you take a step back and get some high-level perspective .

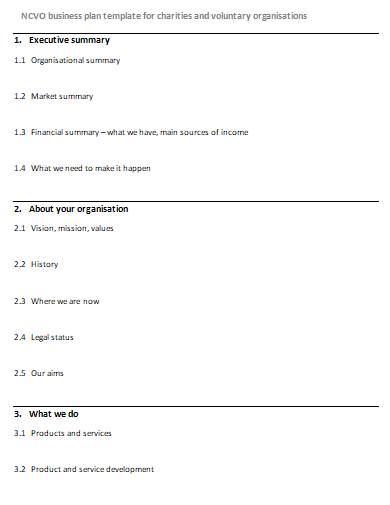

- A nonprofit business plan outline

Keep in mind that developing a business plan is an ongoing process. It isn’t about just writing a physical document that is static, but a continually evolving strategy and action plan as your organization progresses over time. It’s essential that you run regular plan review meetings to track your progress against your plan. For most nonprofits, this will coincide with regular reports and meetings with the board of directors.

A nonprofit business plan will include many of the same sections of a standard business plan outline . If you’d like to start simple, you can download our free business plan template as a Word document, and adjust it according to the nonprofit plan outline below.

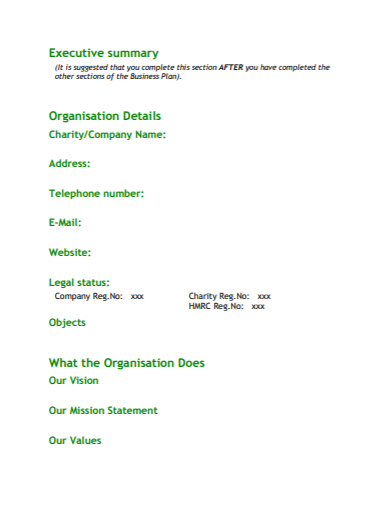

Executive summary

The executive summary of a nonprofit business plan is typically the first section of the plan to be read, but the last to be written. That’s because this section is a general overview of everything else in the business plan – the overall snapshot of what your vision is for the organization.

Write it as though you might share with a prospective donor, or someone unfamiliar with your organization: avoid internal jargon or acronyms, and write it so that someone who has never heard of you would understand what you’re doing.

Your executive summary should provide a very brief overview of your organization’s mission. It should describe who you serve, how you provide the services that you offer, and how you fundraise.

If you are putting together a plan to share with potential donors, you should include an overview of what you are asking for and how you intend to use the funds raised.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Opportunity

Start this section of your nonprofit plan by describing the problem that you are solving for your clients or your community at large. Then say how your organization solves the problem.

A great way to present your opportunity is with a positioning statement . Here’s a formula you can use to define your positioning:

For [target market description] who [target market need], [this product] [how it meets the need]. Unlike [key competition], it [most important distinguishing feature].

And here’s an example of a positioning statement using the formula:

For children, ages five to 12 (target market) who are struggling with reading (their need), Tutors Changing Lives (your organization or program name) helps them get up to grade-level reading through a once a week class (your solution).

Unlike the school district’s general after-school homework lab (your state-funded competition), our program specifically helps children learn to read within six months (how you’re different).

Your organization is special or you wouldn’t spend so much time devoted to it. Layout some of the nuts and bolts about what makes it great in this opening section of your business plan. Your nonprofit probably changes lives, changes your community, or maybe even changes the world. Explain how it does this.

This is where you really go into detail about the programs you’re offering. You’ll want to describe how many people you serve and how you serve them.

Target audience

In a for-profit business plan, this section would be used to define your target market . For nonprofit organizations, it’s basically the same thing but framed as who you’re serving with your organization. Who benefits from your services?

Not all organizations have clients that they serve directly, so you might exclude this section if that’s the case. For example, an environmental preservation organization might have a goal of acquiring land to preserve natural habitats. The organization isn’t directly serving individual groups of people and is instead trying to benefit the environment as a whole.

Similar organizations

Everyone has competition —nonprofits, too. You’re competing with other nonprofits for donor attention and support, and you’re competing with other organizations serving your target population. Even if your program is the only one in your area providing a specific service, you still have competition.

Think about what your prospective clients were doing about their problem (the one your organization is solving) before you came on this scene. If you’re running an after-school tutoring organization, you might be competing with after school sports programs for clients. Even though your organizations have fundamentally different missions.

For many nonprofit organizations, competing for funding is an important issue. You’ll want to use this section of your plan to explain who donors would choose your organization instead of similar organizations for their donations.

Future services and programs

If you’re running a regional nonprofit, do you want to be national in five years? If you’re currently serving children ages two to four, do you want to expand to ages five to 12? Use this section to talk about your long-term goals.

Just like a traditional business, you’ll benefit by laying out a long-term plan. Not only does it help guide your nonprofit, but it also provides a roadmap for the board as well as potential investors.

Promotion and outreach strategies

In a for-profit business plan, this section would be about marketing and sales strategies. For nonprofits, you’re going to talk about how you’re going to reach your target client population.

You’ll probably do some combination of:

- Advertising: print and direct mail, television, radio, and so on.

- Public relations: press releases, activities to promote brand awareness, and so on.

- Digital marketing: website, email, blog, social media, and so on.

Similar to the “target audience” section above, you may remove this section if you don’t promote your organization to clients and others who use your services.

Costs and fees

Instead of including a pricing section, a nonprofit business plan should include a costs or fees section.

Talk about how your program is funded, and whether the costs your clients pay are the same for everyone, or based on income level, or something else. If your clients pay less for your service than it costs to run the program, how will you make up the difference?

If you don’t charge for your services and programs, you can state that here or remove this section.

Fundraising sources

Fundraising is critical for most nonprofit organizations. This portion of your business plan will detail who your key fundraising sources are.

Similar to understanding who your target audience for your services is, you’ll also want to know who your target market is for fundraising. Who are your supporters? What kind of person donates to your organization? Creating a “donor persona” could be a useful exercise to help you reflect on this subject and streamline your fundraising approach.

You’ll also want to define different tiers of prospective donors and how you plan on connecting with them. You’re probably going to include information about your annual giving program (usually lower-tier donors) and your major gifts program (folks who give larger amounts).

If you’re a private school, for example, you might think of your main target market as alumni who graduated during a certain year, at a certain income level. If you’re building a bequest program to build your endowment, your target market might be a specific population with interest in your cause who is at retirement age.

Do some research. The key here is not to report your target donors as everyone in a 3,000-mile radius with a wallet. The more specific you can be about your prospective donors —their demographics, income level, and interests, the more targeted (and less costly) your outreach can be.

Fundraising activities

How will you reach your donors with your message? Use this section of your business plan to explain how you will market your organization to potential donors and generate revenue.

You might use a combination of direct mail, advertising, and fundraising events. Detail the key activities and programs that you’ll use to reach your donors and raise money.

Strategic alliances and partnerships

Use this section to talk about how you’ll work with other organizations. Maybe you need to use a room in the local public library to run your program for the first year. Maybe your organization provides mental health counselors in local schools, so you partner with your school district.

In some instances, you might also be relying on public health programs like Medicaid to fund your program costs. Mention all those strategic partnerships here, especially if your program would have trouble existing without the partnership.

Milestones and metrics

Without milestones and metrics for your nonprofit, it will be more difficult to execute on your mission. Milestones and metrics are guideposts along the way that are indicators that your program is working and that your organization is healthy.

They might include elements of your fundraising goals—like monthly or quarterly donation goals, or it might be more about your participation metrics. Since most nonprofits working with foundations for grants do complex reporting on some of these, don’t feel like you have to re-write every single goal and metric for your organization here. Think about your bigger goals, and if you need to, include more information in your business plan’s appendix.

If you’re revisiting your plan on a monthly basis, and we recommend that you do, the items here might speak directly to the questions you know your board will ask in your monthly trustee meeting. The point is to avoid surprises by having eyes on your organization’s performance. Having these goals, and being able to change course if you’re not meeting them, will help your organization avoid falling into a budget deficit.

Key assumptions and risks

Your nonprofit exists to serve a particular population or cause. Before you designed your key programs or services, you probably did some research to validate that there’s a need for what you’re offering.

But you probably are also taking some calculated risks. In this section, talk about the unknowns for your organization. If you name them, you can address them.

For example, if you think there’s a need for a children’s literacy program, maybe you surveyed teachers or parents in your area to verify the need. But because you haven’t launched the program yet, one of your unknowns might be whether the kids will actually show up.

Management team and company

Who is going to be involved and what are their duties? What do these individuals bring to the table?

Include both the management team of the day-to-day aspects of your nonprofit as well as board members and mention those who may overlap between the two roles. Highlight their qualifications: titles, degrees, relevant past accomplishments, and designated responsibilities should be included in this section. It adds a personal touch to mention team members who are especially qualified because they’re close to the cause or have special first-hand experience with or knowledge of the population you’re serving.

There are probably some amazing, dedicated people with stellar qualifications on your team—this is the place to feature them (and don’t forget to include yourself!).

Financial plan

The financial plan is essential to any organization that’s seeking funding, but also incredibly useful internally to keep track of what you’ve done so far financially and where you’d like to see the organization go in the future.

The financial section of your business plan should include a long-term budget and cash flow statement with a three to five-year forecast. This will allow you to see that the organization has its basic financial needs covered. Any nonprofit has its standard level of funding required to stay operational, so it’s essential to make sure your organization will consistently maintain at least that much in the coffers.

From that point, it’s all about future planning: If you exceed your fundraising goals, what will be done with the surplus? What will you do if you don’t meet your fundraising goals? Are you accounting for appropriate amounts going to payroll and administrative costs over time? Thinking through a forecast of your financial plan over the next several years will help ensure that your organization is sustainable.

Money management skills are just as important in a nonprofit as they are in a for-profit business. Knowing the financial details of your organization is incredibly important in a world where the public is ranking the credibility of charities based on what percentage of donations makes it to the programs and services. As a nonprofit, people are interested in the details of how money is being dispersed within organizations, with this information often being posted online on sites like Charity Navigator, so the public can make informed decisions about donating.

Potential contributors will do their research—so make sure you do too. No matter who your donors are, they will want to know they can trust your organization with their money. A robust financial plan is a solid foundation for reference that your nonprofit is on the right track.

- Business planning is ongoing

It’s important to remember that a business plan doesn’t have to be set in stone. It acts as a roadmap, something that you can come back to as a guide, then revise and edit to suit your purpose at a given time.

I recommend that you review your financial plan once a month to see if your organization is on track, and then revise your plan as necessary .

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

Related Articles

6 Min. Read

Differences Between Single-Use and Standing Plans Explained

14 Min. Read

How to Write a Five-Year Business Plan

11 Min. Read

Fundamentals of Lean Planning Explained

5 Min. Read

How to Write a Growth-Oriented Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

- Nonprofit & Community

Nonprofit Business Plan

2. Organization Overview

Depending on the organization’s details, you must add various organizational overview elements. Still, every organization should include some foundational elements like its name, purpose, operations, legal structure, location, and history.

Organization Description:

Provide all the basic information about your nonprofit in this section like

- Name & Type of Your Organization: Describe the name and type of your nonprofit organization. For instance, you may operate one of these types of nonprofit organizations:

- Educational organizations

- Charitable organizations

- Healthcare organizations

- Religious organizations

- Location of your nonprofit and why you selected that place.

Mission & Vision:

Organization history:.

If you’re an established nonprofit, you can provide information about your organization’s history, like when it was founded and how it evolved. If you can, add some personality and intriguing details, especially if you got any achievements or recognitions till now for your incredible community services.

Future goals:

It’s crucial to convey your aspirations and your vision. Mention your short-term and long-term goals with the nonprofit; they can be specific targets depending on your ultimate vision.

This section should provide an in-depth understanding of the nonprofit organization. Also, the business overview section should be engaging and precise.

3. Products, Programs, and Services

The products, programs, and services section of a nonprofit business plan should describe specific products, programs, and services that will offer to its beneficiaries. Your nonprofit may or may not have all products, programs, and services to offer.

So, write this section depending on your organization’s offerings:

In a nutshell, your products, programs, and services section should describe how your nonprofit meets needs and positively impacts the community. Use solid examples and numbers to back your claims.

Some additional tips for writing the market analysis section of your business plan:

- Use a variety of sources to gather data, including industry reports, market research studies, and surveys.

- Be specific and provide detailed information wherever possible.

- Include charts and graphs to help illustrate your key points.

- Keep your target audience in mind while writing the business plan

4. Market Analysis

Market analysis provides a clear understanding of the market your nonprofit will run along with the target market, competitors, and growth opportunities. Your market analysis should contain the following essential components:

Target Market:

Market size and growth potential:, competitive analysis:, market trends:.

- For example, It may be necessary for a nonprofit focused on environmental conservation to adapt its messaging to reflect the growing demand for sustainable products and practices.

Regulatory Environment:

Some additional tips for writing the market analysis section of your nonprofit business plan:

- Use various sources to gather data, including industry reports, market research studies, and surveys.

- Keep your target audience in mind while writing the business plan.

5. Sales And Marketing Strategies

Building awareness, promoting engagement, and generating revenue should be the focus of your business plan’s “Sales and marketing strategies” section. Here are some key elements to include in your sales & marketing plan:

Unique Value Proposition (UVP):

Marketing mix:, marketing channels:, fundraising strategies:.

- Identify fundraising strategies that align with the nonprofit’s mission, vision, and values.

Donor Retention:

In short, a nonprofit business plan’s sales and marketing strategies section should describe how your organization can reach, engage, and retain your target market and generate sustainable revenue.

Be specific, realistic, and data-driven in your approach, and be prepared to adjust your strategies based on feedback and results.

6. Operations Plan

When writing the operations plan section, it’s essential to consider the various aspects of your organization’s processes and procedures involved in operating a nonprofit. Here are the components to include in an operations plan:

Staffing & Training:

Operational process:.

- Your operations must also include details on monitoring and evaluating programs and their impact on the community.

Quality Control:

Facilities and equipment:, technology & information system:.

By including these key elements in your operations plan section, you can create a comprehensive plan that outlines how you will run your nonprofit organization.

7. Management Team

The management team section provides an overview of the nonprofit organization’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

- It should include the owners, senior management, other department managers, and people involved in the organizational operations, along with their education and professional background.

Organizational structure:

Compensation plan:.

Overall, the management team section of your business plan should mention key personnel involved in successfully running your organizational operations.

So, highlight your organization’s key personnel and demonstrate why you have the right team to execute your organization’s mission.

8. Financial Plan

When writing the financial plan section of a business plan, it’s important to provide a comprehensive overview of your financial projections and goals for the first few years of your organization.

Revenue Streams:

Fundraising goals:, financial ratios:, risk analysis:.

Remember to be realistic with your financial projections and provide supporting evidence for your estimates.

9. Appendix

Include any additional information supporting your plan’s main content when writing the appendix section. This may include financial statements, market research data, legal documents, and other relevant information.

- Include a table of contents for the appendix section to make it easy for readers to find specific information.

- Include financial statements such as income, balance sheets, and cash flow statements . These should be up-to-date and show your financial projections for at least the first three years of your business.

- Provide market research data, such as statistics on the industry’s size, consumer demographics, and trends in the industry.

- Include any legal documents such as permits, licenses, and contracts.

- Provide any additional documentation related to your business plans, such as marketing materials, product brochures, and operational procedures.

- Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your nonprofit organization should only include relevant and essential information supporting your plan’s main content.

Download a sample nonprofit organization business plan

Need help writing a business plan for your nonprofit? Here you go; download our free nonprofit organization business plan pdf to start.

It’s a modern business plan template specifically designed for your nonprofit organization. Use the example business plan as a guide for writing your own.

You may explore our other nonprofit and community business plan examples before you start writing

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Write your business plan with Upmetrics

A business plan app like Upmetrics is the best way to draft your business plan. This incredible tool comes with step-by-step instructions and 400+ customizable sample business plans to help you get started.

So, whether starting a nonprofit organization or planning to grow an existing one, Upmetrics is the tool you need to create a business plan.

Related Posts

Charity Business Plan

Community Center Business Plan

What are the Elements of an Operations Plan

How to Make an Appendix Section of Business Plan

400+ Free Business Plan Template

Youth Mentoring Program Business Plan

Frequently asked questions, why do you need a nonprofit business plan.

Business plans outline the organization’s goals, strategies, and tactics for achieving its mission. Nonprofit business plans serve as a roadmap for staff, lenders, and other shareholders, helping them make informed decisions, measure progress, and remain focused on the organization’s mission.

How to get funding for your nonprofit business?

Fundraising for a nonprofit can be challenging, but a few strategies and a strategic approach can help you achieve your goal.

Here are some of the most common ways to get funding for your nonprofit:

- Individual Donations: Individual donations are among key revenue streams for any nonprofit. It includes both one-time payments as well as recurring assistance.

- Grants: Many foundations and government agencies offer grants to nonprofit organizations that meet specific criteria.

- Corporate Sponsorships: A nonprofit can approach corporations that align with its values and mission to gain sponsorships for charity events, programs, or projects.

- Crowdfunding: The process of supporting a business or organization by getting many people to invest in your nonprofit organization, usually online.

Where to find business plan writers for your nonprofit business?

There are many business plan writers available, but no one knows your business and idea better than you, so we recommend you write your nonprofit business plan and outline your vision as you have in your mind.

What is the easiest way to write your nonprofit business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any nonprofit business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Charity Business Plan Template

What is a Charity Business Plan?

A charity business plan outlines the goals, projects, and initiatives of a non-profit organization or social enterprise. It serves as a roadmap for the organization's activities, and helps to ensure that the organization is working towards achieving its objectives in an effective and efficient manner. The charity business plan template provides a structure for outlining the organization's mission and goals, as well as the strategies, projects, and KPIs that can be used to achieve them.

What's included in this Charity Business Plan template?

- 3 focus areas

- 6 objectives

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Charity Business Plan template for?

The charity business plan template is designed for non-profit organizations and social enterprises that want to develop a business plan that outlines their mission, goals, and strategies. The template provides an organized and systematic way to create a business plan that takes into consideration the organization's resources, goals, and objectives. It is designed to help organizations create an effective and efficient business plan that can be used to track their progress and ensure that they are on the right path towards achieving their mission.

1. Define clear examples of your focus areas

Focus areas are the broad topics that the organization is focusing on. Examples of focus areas may include increasing outreach, improving efficiency, or increasing impact. Each focus area should have several objectives and projects that are related to that focus area.

2. Think about the objectives that could fall under that focus area

Objectives are the goals that the organization wants to achieve within a particular focus area. These objectives should be specific, measurable, and achievable. Examples of objectives may include reaching new donors, engaging existing donors, or automating data entry.

3. Set measurable targets (KPIs) to tackle the objective

KPIs, or key performance indicators, are measurable targets that are used to track progress towards an organization's objectives. Examples of KPIs may include increasing website visits, increasing email response rate, or decreasing time to process donations.

4. Implement related projects to achieve the KPIs

Projects are the actions that are taken to achieve the organization's objectives and KPIs. Examples of projects may include creating a digital marketing campaign, implementing email strategies, or automating data entry.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

Cascade Strategy Execution Platform provides a comprehensive suite of tools and resources to help organizations develop and implement a successful business plan. It offers features such as goal setting, project tracking, real-time reporting, and automated notifications, which can help organizations see faster results from their strategy.

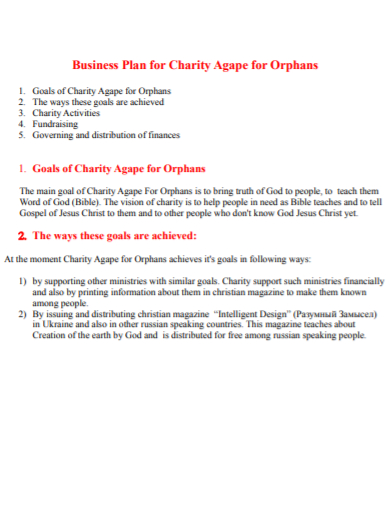

3 Sample Nonprofit Business Plans For Inspiration

Download our Ultimate Nonprofit Business Plan Template here

Below are sample plans to help guide you in writing a nonprofit business plan.

- Example #1 – Kids Are Our First Priority (KAOFP) – a Nonprofit Youth Organization based in Chicago, IL

- Example #2 – Church of the Sacred Heart – a Nonprofit Church based in St. Louis, MO

- Example #3 – Finally Home – a Nonprofit Homeless Shelter in Los Angeles, CA

Sample Nonprofit Business Plan #1 – Kids Are Our First Priority (KAOFP) – a Nonprofit Youth Organization based in Chicago, IL

Executive summary.

Kids Are Our First Priority (KAOFP) is a 501(c)3 nonprofit youth organization that seeks to provide opportunities for students who might otherwise not have access to the arts and humanities. We believe all students should have the opportunity to discover and develop their interests and talents, regardless of socioeconomic status or geographic location. We offer completely free after-school programming in music production, digital photography, creative writing, and leadership development to 12-18-year-olds at risk of dropping out of high school.

Our organization has been active for over five years and has run highly successful programs at two schools in the city of Chicago. We have been awarded an active grant from a local foundation for this coming year, but we will need to cover all costs on our own after that point. Nonprofit administrators have seen a lot of turnovers, leaving the organization without a sustainable plan for reaching its goals.

Organization Overview

The Kids Are Our First Priority (KAOFP) is a 501(c)3 nonprofit youth organization with a mission to provide opportunities for development and self-expression to students who might otherwise not have access. Audiences include at-risk, low-income students from elementary through high school in the Chicago area.

Our programs are built around creative learning with two goals: firstly, creating a space for learning and growth; secondly, encouraging students to share their work with the world.

KAOFP runs three different programs in partnership with closely related nonprofit organizations, providing after-school programming for elementary, middle, and high school-aged children. Programs take place twice a week at different schools around Chicago. While each program is unique in its goals and activities, all programs focus on creative development in the arts and humanities.

Products, Programs, and Services

The three programs offered by KAOFP are Leadership Development (LD), Creative Writing (CW), and Music Production (MP). Students learn in small groups led by skilled instructors. All activities are designed to encourage student engagement, creativity, expression, and community building. Instructors encourage students to share their work with the world through presentations on- and off-site.

Leadership Development (LD)

The Leadership Development program is designed to provide leadership opportunities for high school students who might not otherwise have access to these experiences. Students learn about facilitation, collaboration, communication, and organizational skills as they plan and run projects of their own design. The program’s goal is to provide a structured environment that encourages students to become more confident and comfortable being leaders in their schools, communities, and future careers.

Creative Writing (CW)

Students learn how to use writing creatively as a tool for expression, discovery, and communication. In small groups led by skilled instructors, students write poetry, short stories, and essays of their own design. They also learn about the publishing industry, read each others’ work, and share their writing with the community.

Music Production (MP)

Students learn how to use digital media as a tool for expression, discovery, and communication. In weekly sessions led by skilled instructors, students explore music production through computer software and recording equipment. Students produce their own music and write about their experiences in weekly journals. Industry professionals in the community often volunteer to lead special workshops and seminars.

Industry Analysis

The youth arts and humanities field is extremely competitive. There are many different types of nonprofit organizations doing similar work, but few credible providers with long-term commitments to their communities. KAOFP’s greatest strengths and competitive advantages are our stable and qualified staff, a strong foundation of funding and community support, and a diverse set of programs.

Our biggest competitors include national non-profits with large budgets for advertising and marketing as well as commercial programs that offer music lessons and creative writing courses which may be more cost-effective than our programs. We feel that by focusing on specific areas of creative expression, KAOFP can better serve its communities and differentiate itself from other nonprofit organizations effectively.

Customer Analysis

KAOFP serves elementary, middle, and high school-aged students with programs that include both after-school and summer programming.

Our focus is on low-income neighborhoods with a high population of at-risk youth. In these areas, KAOFP fills a void in the education system by providing opportunities for creative expression and leadership development to students who would not otherwise have access to these resources.

The demographics of our current students are as follows:

- 91% African-American/Black

- 6% Hispanic/Latino

- 5% Multiracial

- 3.9% Low Income

- 4.9% Not Identified

Our main target is low-income African American and Latino youth in Chicago Public Schools. We would like to expand our outreach to include other communities in need of creative enrichment opportunities.

Marketing Plan

KAOFP’s marketing program is designed to support student, parent, and staff recruitment by promoting the organization’s goals and programs. Our main target audience consists of parents seeking after-school enrichment opportunities for their children that emphasize creativity and the arts.

To reach this audience, we advertise in public schools as well as on social networking sites such as Facebook and Twitter. We intend to begin marketing online through a company-sponsored blog, which will feature regular updates about KAOFP events and activities. We also intend to use word of mouth as a form of marketing.

Strategic partnerships with local schools and community centers will provide us with additional exposure as well as additional resources to secure funding.

Operations Plan

KAOFP’s day-to-day operation is structured around its programs on Tuesdays from 4 pm to 8 pm.

Administrative offices are located in the same space as each program, allowing instructors to closely monitor their students and provide support as needed. The administrative offices serve the essential function of fundraising, communications, record-keeping, and volunteer coordination. KAOFP’s Board of Directors meets bi-monthly to provide further leadership, guidance, and oversight to our board members and volunteers.

Customer service is conducted by phone and email during our regular business hours of Monday – Friday 9 am to 12 pm. We are not open on weekends or holidays.

Management Team

KAOFP’s organizational structure includes a Board of Directors, an Executive Director, and Program Directors. The Board of Directors provides guidance and oversight to the organization, while the Executive Director manages day-to-day operations. The Program Directors oversee each of KAOFP’s programs.

KAOFP has a small but dedicated staff that is committed to our students and our mission. Our team has a wide range of experience in the arts, education, and nonprofit sector.

Executive Director

The Executive Director is responsible for the overall management of KAOFP. This includes supervising staff, developing and implementing programs, overseeing finances, and representing the organization to the public.

Our Executive Director, Susie Brown, has been with KAOFP since its inception in 2010. She has a B.A. in Fine Arts from the University of Illinois at Urbana-Champaign and an M.F.A. in Creative Writing from Columbia College Chicago. Susie is responsible for the overall management of KAOFP, including supervising staff, developing and implementing programs, overseeing finances, and representing the organization to the public.

Program Directors

Each of KAOFP’s programs is overseen by a Program Director. The Program Directors are responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Art Program Director

The Art Program Director, Rachel Smith, has a B.A. in Fine Arts from the University of Illinois at Urbana-Champaign. She is responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Music Program Director

The Music Program Director, John Jones, has a B.A. in Music Education from the University of Illinois at Urbana-Champaign. He is responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Theatre Program Director

The Theatre Program Director, Jane Doe, has a B.A. in Theatre Arts from the University of Illinois at Urbana-Champaign. She is responsible for developing and implementing the program curricula, recruiting and training program instructors, and evaluating student progress.

Board of Directors

KAOFP’s Board of Directors provides guidance and oversight to the organization. The Board consists of community leaders, educators, artists, and parents. Board members serve three-year terms and can be renewed for one additional term.

Financial Plan

KAOFP’s annual operating budget is approximately $60,000 per year, with an additional one-time cost of about $10,000 for the purchase of equipment and materials. The agency makes very efficient use of its resources by maintaining low overhead costs. Our biggest expense is instructor salaries, which are approximately 75% of total expenses.

Pro Forma Income Statement

Pro forma balance sheet, pro forma cash flow statement, nonprofit business plan example #2 – church of the sacred heart – a nonprofit church based in st. louis, mo.

The Church of Sacred Heart is a nonprofit organization located in St. Louis, Missouri that provides educational opportunities for low-income families. We provide the best quality of education for young children with tuition rates significantly lower than public schools. It has been voted Best Catholic Elementary School by the St Louis Post Dispatch for four years running, and it has maintained consistently high ratings of 4.5 out of 5 stars on Google Reviews since its opening in 1914.

The Church of Sacred Heart strives to build strong relationships with our community by making an impact locally but not forgetting that we operate on global principles. As such, our school commits 10% of its profits to charitable organizations throughout the world every year, while also conducting fundraisers throughout the year to keep tuition rates affordable.

We are currently transitioning from a safe, high-quality learning environment to an even more attractive facility with state-of-the-art technology and modern materials that will appeal to young students and their families. New facilities, such as additional classrooms and teachers’ lounges would allow us not only to accommodate new students but also attract current families by having more places within the school where they can spend time between classes.

By taking full advantage of available opportunities to invest in our teachers, students, and facilities, we will be able to achieve steady revenue growth at 4% per year until 20XX.

The Church of Sacred Heart provides a safe learning environment with an emphasis on strong academics and a nurturing environment that meets the needs of its young students and their families. Investing in new facilities will allow us to provide even better care for our children as we continue to grow as a school.

Mission Statement: “We will strive diligently to create a safe, respectful environment where students are encouraged and inspired to learn through faith.”

Vision Statement: “Sacred Heart believes education gives every child the opportunity to achieve their full potential.”

The Church of the Sacred Heart was built in 1914 and is located in the Old North St. Louis neighborhood, an area with a high concentration of poverty, crime, unemployment, and abandoned buildings.

The church houses the only Catholic school for low-income families in the north city; together they formed Sacred Heart’s educational center (SCE). SCE has strived to provide academic excellence to children from low-income families by providing a small, nurturing environment as well as high academic standards.

The facility is in need of renovations and new equipment to continue its mission.

The Church of the Sacred Heart is a small nonprofit organization that provides a variety of educational and community services.

The services provided by Sacred Heart represent a $5 billion industry, with nonprofit organizations accounting for $258.8 billion of that total.

The health care and social assistance sector is the largest among nonprofits, representing 32 percent of revenues, followed by educational services (18 percent), and human and other social service providers (16 percent).

The key customers for the Church of the Sacred Heart are families in need of affordable education. The number of students in the school has increased from 500 when it opened in 1914 to 1,100 at its peak during 20XX-20XX but has since declined due to various reasons.

The children at Sacred Heart are from low-income families and 91 percent qualify for free or reduced lunches. Most parents work or have a family member who works full-time, while others don’t work due to child care restraints. The number of children enrolled in Sacred Heart is stable at 1,075 students because there is a lack of affordable alternatives to Catholic education in the area.

SCE offers K-5th grade students a unique learning experience in small groups with individualized instruction.

Sacred Heart has an established brand and is well known for its high standards of academic excellence, which include a 100 percent graduation rate.

Sacred Heart attracts prospective students through promotional materials such as weekly bulletins, mailers to homes that are located in the area served, and local churches.

Parents and guardians of children enrolled in Sacred Heart are mainly referrals from current families, word-of-mouth, and parishioners who learn about the school by attending Mass at Sacred Heart.

The Church of Sacred Heart does not currently advertise; however, it is one of the few Catholic schools that serve low-income families in St. Louis, MO, and therefore uses word of mouth to attract new students to its school.

The Church of Sacred Heart has an established brand awareness within the target audience despite not having direct marketing plans or materials.

The operations section for the Church of the Sacred Heart consists of expanding its after-school program as well as revamping its facility to meet the growing demand for affordable educational services.

Sacred Heart is located in an area where more than one-third of children live below the poverty line, which helps Sacred Heart stand out among other schools that are more upscale. Expansion into after-school programs will allow it to capture a larger market share by providing additional services to its target audience.

In order to expand, Sacred Heart will have to hire additional personnel as well as invest in new equipment and supplies for both the school and the after-school program.

The Church of Sacred Heart’s financial plan includes a fundraising plan that would help renovate the building as well as acquire new equipment and supplies for the school.

According to the National Center for Education Statistics, Catholic elementary schools across all grade levels spend an average of $6,910 per pupil on operating expenses. A fundraising initiative would help Sacred Heart acquire additional revenue while expanding its services to low-income families in St Louis, MO.

Financial Overview

The Church of the Sacred Heart expects to generate revenues of about $1.2 million in fiscal year 20XX, representing a growth rate of 2 percent from its 20XX revenue level. For 20XX, the church expects revenues to decrease by 4 percent due to a decline in enrollment and the lack of new students. The Church of Sacred Heart has experienced steady revenue growth since its opening in 1914.

- Revenue stream 1: Tuition – 22%

- Revenue stream 2: Investment income – 1%

Despite being located in a poverty-stricken area, the Church of Sacred Heart has a stable revenue growth at 4 percent per year. Therefore, Sacred Heart should be able to attain its 20XX revenue goal of $1.2 million by investing in new facilities and increasing tuition fees for students enrolled in its after-school program.

Income Statement f or the fiscal year ending December 31, 20XX

Revenue: $1.2 million

Total Expenses: $910,000

Net Income Before Taxes: $302,000

Statement of Financial Position as of December 31, 20XX

Cash and Cash Equivalents: $25,000

Receivables: $335,000

Property and Equipment: $1.2 million

Intangible Assets: $0

Total Assets: $1.5 million

Balance Statement

The board of directors has approved the 20XX fiscal year budget for Sacred Heart Catholic Church, which is estimated at $1.3 million in revenues and $920,000 in expenditures.

Cash Flow Statement f or the Fiscal Year Ending December 31, 20XX

Operating Activities: Income Before Taxes -$302,000

Investing Activities: New equipment and supplies -$100,000

Financing Activities: Fundraising campaign $200,000

Net Change in Cash: $25,000

According to the 20XX fiscal year financial statements for Sacred Heart Catholic Church, it expects its investments to decrease by 4 percent and expects to generate $1.3 million in revenues. Its total assets are valued at $1.5 million, which consists of equipment and property worth approximately 1.2 million dollars.

The Church of Sacred Heart’s financial statements demonstrate its long-term potential for strong revenue growth due to its steady market share held with low-income families in St. Louis, MO.

Nonprofit Business Plan Example #3 – Finally Home – a Nonprofit Homeless Shelter in Los Angeles, CA

Finally Home is a nonprofit organization that aims to provide low-income single-parent families with affordable housing. The management team has a strong background in the social service industry and deep ties in the communities they plan to serve. In addition, Finally Home’s CEO has a background in real estate development, which will help the organization as they begin developing its operations.

Finally Home’s mission is to reinvent affordable housing for low-income single-parent families and make it more sustainable and accessible. They will accomplish this by buying homes from families and renting them out at an affordable price. Finally Home expects its model of affordable housing to become more sustainable and accessible than any other model currently available on the market today. Finally Home’s competitive advantage over similar organizations is that it will purchase land and buildings from which to build affordable housing. This gives them a greater amount of ownership over their communities and the properties in which the homes are located, as well as freedom when financing these projects.

Finally Home plans on accomplishing this by buying real estate in areas with high concentrations of low-income families who are ready to become homeowners. These homes will be used as affordable housing units until they are purchased by Finally Home’s target demographic, at which point the organizations will begin renting them out at a base rate of 30% of the family’s monthly household income.

Finally Home plans on financing its operations through both private donations and contributions from foundations, corporations, and government organizations.

Finally Home’s management team has strong backgrounds in the social service industry, with deep ties to families that will be prepared to take advantage of Finally Home’s affordable housing opportunities. The CEO of Finally Home also brings extensive real estate development experience to the organization, an asset that will be especially helpful as Finally Home begins its operations.

Finally Home is a nonprofit organization, incorporated in the State of California, whose mission is to help homeless families by providing them with housing and support services. The centerpiece of our program, which will be replicated nationwide if successful, is an apartment complex that offers supportive living for single parents and their children.

The apartments are fully furnished, and all utilities are paid.

All the single parents have jobs, but they don’t earn enough to pay market-rate rent while still paying for other necessities such as food and transportation.

The organization was founded in 20XX by Henry Cisneros, a former U.S. Secretary of Housing and Urban Development who served under President Bill Clinton. Cisneros is the chairman of Finally Home’s board of directors, which includes leaders with experience in banking, nonprofit management, and housing professions.

The core values are family unity, compassion for the poor, and respect for our clients. They are the values that guide our employees and volunteers at Finally Home from start to finish.

According to the United States Conference of Mayors’ Task Force on Hunger and Homelessness 20XX Report, “Hunger & Homelessness Survey: A Status Report on Hunger & Homelessness in America’s Cities,” almost half (48%) of all homeless people are members of families with children. Of this number, over one quarter (26%) are under the age of 18.

In 20XX, there were 9.5 million poor adults living in poverty in a family with children and no spouse present. The majority of these families (63%) have only one earner, while 44% have zero earners because the person is not old enough or does not work for other reasons.

The total number of people in poverty in 20XX was 46.5 million, the largest number since Census began publishing these statistics 52 years ago.

Finally Home’s goal is to help single parents escape this cycle of poverty through providing affordable housing and case management services to support them long term.

Unique Market Position

Finally Home creates unique value for its potential customers by creating housing where it does not yet exist.

By helping single parents escape poverty and become self-sufficient, Finally Home will drive demand among low-income families nationwide who are experiencing homelessness. The high level of need among this demographic is significant nationwide. However, there are no other organizations with the same market position as Finally Home.

Finally Home’s target customers are low-income families who are experiencing homelessness in the Los Angeles area. The organization will actively seek out these families through national networks of other social service providers to whom they refer their clients regularly.

Finally Home expects to have a waiting list of families that are interested in the program before they even open their doors.

This customer analysis is based on the assumption that these particular demographic groups are already active users of other social service programs, so referrals will be natural and easy for Finally Home.

Industry Capacity

This information is based on the assumption that these particular demographic groups are already active users of other social service programs, so referrals will be natural and easy for Finally Home.

There is a growing demand for low-income single-parent housing nationwide, yet there is no one organization currently providing these services on a national level like Finally Home.

Thus, Finally Home has a competitive advantage and market niche here because it will be the only nonprofit organization of its kind in the country.

Finally Home’s marketing strategies will focus on attracting potential customers through national networks of other social service providers. They will advertise to their referral sources using materials developed by the organization. Finally Home will also advertise its services online, targeting low-income families using Google AdWords.

Finally Home will be reinventing affordable housing to make it more accessible and sustainable for low-income single parents. In this new model, Finally Home will own the land and buildings on which its housing units are built, as well as the properties in which they are located.

When a family is ready to move into an affordable housing unit, Finally Home will buy the home they currently live in. This way, families can take advantage of homeownership services like property tax assistance and financial literacy courses that help them manage their newfound wealth.

Finally Home has already partnered with local real estate agents to identify properties for purchase. The organization expects this to result in homes that are at least 30% cheaper than market value.

Finally Home will finance its operational plan through the use of private contributions and donations from public and private foundations, as well as corporate sponsorships.

Finally Home’s management team consists of:

- Veronica Jones, CEO, and Founder

- Mark MacDonald, COO

- Scott Bader, CFO

Management Summary

The management team has a strong history of social service advocacy and deep ties in the communities they plan to serve. In addition, the organization’s CEO has a background in real estate development that will be helpful as Finally Home begins operations.

- Year 1: Operation startup costs to launch first five houses ($621,865)

- Year 2: Deliver on market offer and complete first capital raise ($4,753,000)

- Year 3: Deliver on market offer and complete $5 million capital raise ($7,950,000)

- Year 4+: Continue to grow market share with a national network of social services providers ($15,350,000).

This nonprofit business plan will serve as an effective road map for Finally Home in its efforts to create a new model for affordable housing.

Nonprofit Business Plan Example PDF

Download our non-profit business plan pdf here. This is a free nonprofit business plan example to help you get started on your own nonprofit plan.

How to Finish Your Nonprofit Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your nonprofit business plan?

With Growthink’s Ultimate Nonprofit Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Nonprofit Business Planning Articles

- Non-Profit Business Plan

- How to Write a Nonprofit Business Plan

- 10 Tips to Make Your Nonprofit’s Business Plan Stand Out

- How to Write a Mission Statement for Your Nonprofit Organization

- Strategic Planning for a Nonprofit Organization

- How to Write a Marketing Plan for Your Nonprofit Business

- 4 Top Funding Sources for a Nonprofit Organization

- What is a Nonprofit Organization?

- 20 Nonprofit Organization Ideas For Your Community

Business Plan Template for Charity Organizations

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

Charity organizations play a crucial role in making the world a better place. But to truly make an impact, they need a solid roadmap. That's where ClickUp's Business Plan Template for Charity Organizations comes in.

This template is specifically designed to help charity leaders and managers:

- Clearly define their organization's mission, goals, and strategies

- Secure funding and establish key partnerships by presenting a comprehensive plan

- Guide their day-to-day operations towards maximizing social impact

Whether you're a non-profit veteran or just starting out, this template will provide the structure and guidance you need to create a powerful business plan that sets your charity up for success. So let's get started and make a difference together!

Business Plan Template for Charity Organizations Benefits

A business plan template for charity organizations offers a range of benefits to help leaders and managers effectively navigate the complex world of fundraising and social impact. Some of the key benefits include:

- Streamlining the planning process by providing a structured framework to outline the organization's mission, vision, and goals

- Enhancing credibility and professionalism when presenting the organization to potential donors, partners, and stakeholders

- Guiding strategic decision-making by identifying key priorities, target demographics, and sustainable funding models

- Facilitating effective communication and alignment among team members, board members, and volunteers

- Increasing the likelihood of securing funding and partnerships by demonstrating a clear roadmap and measurable outcomes.

Main Elements of Charity Organizations Business Plan Template

ClickUp’s Business Plan Template for Charity Organizations is designed to help charity organization leaders and managers create a comprehensive and impactful business plan. Here are the main elements of this template:

- Custom Statuses: Keep track of the progress of each section of your business plan with statuses like Complete, In Progress, Needs Revision, and To Do.

- Custom Fields: Add important information to your business plan such as Reference, Approved, and Section, making it easy to organize and reference key details.

- Custom Views: Explore different perspectives of your business plan, including Topics, Status, Timeline, Business Plan, and Getting Started Guide, to easily navigate and focus on specific areas of your plan.

With ClickUp's Business Plan Template for Charity Organizations, you can streamline the process of creating a comprehensive and effective business plan to guide your organization's success in maximizing social impact.

How To Use Business Plan Template for Charity Organizations

If you're a charity organization looking to create a business plan, follow these six steps to make the most of the Business Plan Template in ClickUp:

1. Define your mission and vision

Start by clearly defining the mission and vision of your charity organization. What is the purpose of your organization? What impact do you hope to make in the world? This will serve as the foundation for your business plan and guide all of your future decisions.

Use a Doc in ClickUp to articulate your mission and vision statements.

2. Identify your target audience and beneficiaries

Next, identify the specific audience or beneficiaries that your charity organization aims to serve. Who are the individuals or communities that will benefit from your work? Understanding your target audience will help you tailor your programs and services to meet their needs.

Create tasks in ClickUp to list and categorize your target audience and beneficiaries.

3. Outline your programs and services

Now it's time to outline the specific programs and services that your charity organization will offer. What initiatives will you undertake to fulfill your mission? This could include fundraising events, community outreach programs, educational workshops, or any other activities that align with your goals.

Use custom fields in ClickUp to define and track your programs and services.

4. Develop a fundraising and financial strategy

Every charity organization needs a solid fundraising and financial strategy to support its operations. Determine the different fundraising methods you'll use, such as grants, donations, sponsorships, or partnerships. Additionally, create a budget and financial plan that outlines your expected income and expenses.

Utilize the Goals feature in ClickUp to set financial targets and track your progress.

5. Establish a marketing and communication plan

To raise awareness about your charity organization and attract supporters, you'll need a well-defined marketing and communication plan. Consider the various channels and strategies you'll use to reach your target audience, such as social media, email campaigns, press releases, or partnerships with influencers or media outlets.

Use the Calendar view in ClickUp to schedule and manage your marketing and communication activities.

6. Set goals, milestones, and measures of success

Finally, set specific goals, milestones, and measures of success for your charity organization. What do you hope to achieve in the short term and long term? Break down your goals into actionable steps and establish deadlines to keep yourself accountable.

Create Milestones in ClickUp to track your progress and celebrate your achievements.

By following these steps and utilizing the Business Plan Template in ClickUp, your charity organization will be well-equipped to create a comprehensive and effective business plan.

Get Started with ClickUp’s Business Plan Template for Charity Organizations

Charity organization leaders and managers can use the Business Plan Template for Charity Organizations in ClickUp to create a comprehensive plan that aligns with their mission and goals, and helps them secure funding and partnerships.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a powerful business plan:

- Use the Topics View to organize your plan into different sections, such as mission, goals, strategies, and financials

- The Status View will help you track the progress of each section, with statuses like Complete, In Progress, Needs Revision, and To Do

- The Timeline View will give you a visual representation of your plan's milestones and deadlines

- The Business Plan View will provide a comprehensive overview of your plan, allowing you to easily navigate and make updates

- The Getting Started Guide View will provide step-by-step instructions on how to use the template and create an effective business plan

- Utilize custom fields like Reference, Approved, and Section to add additional information and track key details

- Collaborate with team members to gather input, make revisions, and ensure everyone is aligned with the plan's objectives

- Monitor and analyze your plan's progress and performance to make informed decisions and drive social impact.

- Business Plan Template for Network Engineers

- Business Plan Template for Talent Acquisition

- Business Plan Template for Transportation Companies

- Business Plan Template for Voiceover Artists

- Business Plan Template for Sports Team

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

How to write a business plan for a small charity

Table of Contents

Description of charity

Explaining the audience, swot analysis, opportunities, financial projection, manage your finances for achieving objectives with countingup.

Typical businesses use a plan to secure funding by sharing it as a proposal to investors or forming part of an application to the bank for a loan. For a charity, though, there might be other uses to putting together a business plan . These may include the ability to set out a direction for your organisation or look for sizable donations, which may require you to share a plan.

This guide will make sure that you can get on with reaching your social objectives by showing you how to write a business plan for a charity. It includes:

For a social enterprise (charity), the business’ objectives are different from usual companies. Typical companies may aim to create wealth for the owner, for example. But, according to the UK Government , to be legally considered a charity, your organisation must have a charitable purpose. So the first thing to include in your business plan should be these aims.

If you can make it clear what the objectives of your business are, it provides a greater incentive for people to donate. It might also be helpful to explain why it’s the purpose you chose. With an objective, you should also describe how the organisation plans to help it. For example, if your charity aims to help blind people, they may look to fund guide dogs to be provided for them.

The other key element of your description of your charity should be how you plan to fund it. You may sell products, provide services or ask for donations. There may be other charities helping a similar cause, so you should also describe what makes you unique that will make people want to donate.

Charities rely on funding to fulfil their objectives. Without it, you may struggle to help those you would like to. As a result, running the organisation requires some business thinking. For example, identifying a target audience most likely to donate or pay for products/services shows that you are more likely to reach your goals.

To find your audience, you may have to carry out market research . Speak directly to those affected by the issue you aim to solve and those interested in helping your charity. You can gather information through surveys and interviews to find out as much as possible about your market. Another way to do this is by looking at similar charities’ focus and who they target.

It may be helpful for you to put together a customer profile (sometimes called customer avatar) to use your findings from your market research productively. By having a hypothetical person to think about, you can find insights for where you should be marketing to them and why they would donate.

A customer profile could include:

Putting these details together helps you describe how you plan to market your charity.

For more information on how to market your small business, see: How to Market Your Small Business Effectively: 9 Top Tips

It is essential to understand where the current position of your charity is to help you plan for the future. To think about all aspects of your business, you can do a SWOT analysis . This technique focuses on your strengths, weaknesses, opportunities and threats.

Your organisation’s strengths should provide the reasons that your charity is likely to achieve its goals. For example, you could mention the quotes and information of those who would benefit you in your marketing.

There are likely some weaknesses your charity may have. Identifying them lets you talk about how you will get over them. For example, if you lack experience in financial management, mention that you plan to use an app like Countingup to make it easier.

If you show that there are opportunities your organisation can take advantage of, it might give more confidence to someone willing to donate. For example, if a sports event is coming up later this year that relates to your cause, maybe you could partner with them.

Like any business, there may be potential threats to your charity. But by mentioning them, you can also say how you plan to avoid them. For example, if you sell donated things and you run out, mention your plans to make other things to sell.