Best 10 BCG Matrix Examples for Students

Discover more helpful information.

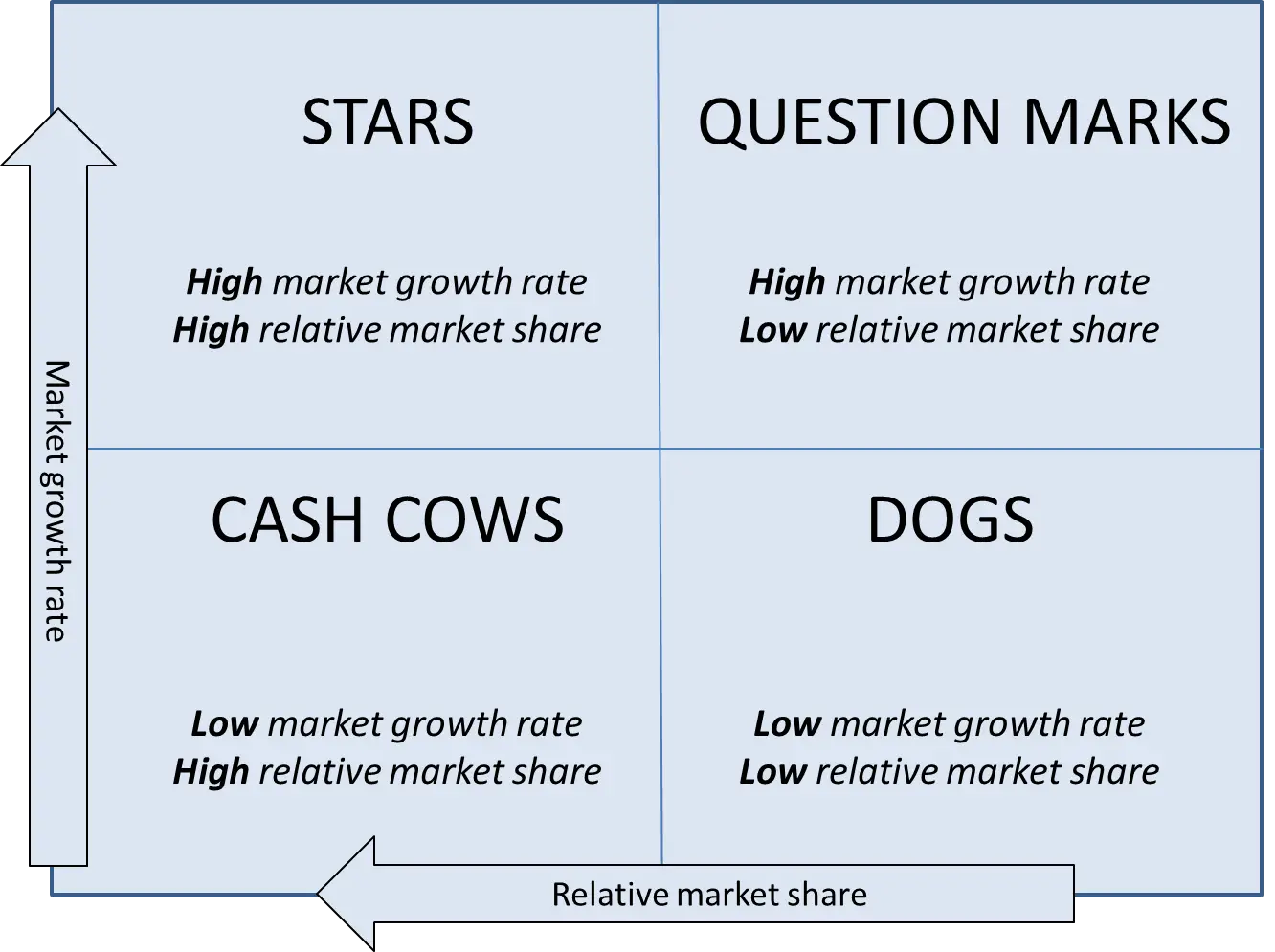

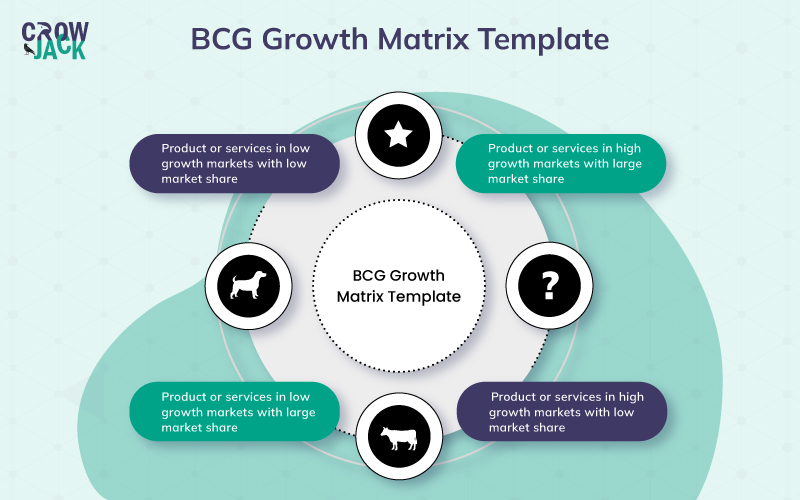

BCG Matrix is an apparatus utilized to incorporate methodology to break down specialty units or product offerings dependent on two factors: relative piece of the overall industry and the market development rate. By joining these two factors into a matrix, an organization can plot their specialty units as needs are and figure out where to dispense extra (financial) assets, where to money out, and where to strip.

The primary reason for the BCG Matrix is accordingly to settle on speculation choices on a corporate level. Contingent upon how well the unit and the business are doing, four different classification names can be credited to every group:

- Question Marks

This article covers every classification and how to utilize the BCG Matrix appropriately.

10 Examples of BCG Matrix (of famous companies)

The BCG Model depends on items as opposed to administrations, be that as it may, it applies to both. You could utilize this if checking on a scope of items, particularly before growing new ones. Here are the example list:

1. BCG Matrix of Coca-Cola

A world-driving ready-to-drink refreshment company, Coca-Cola Company has more than 500 soda pop brands, from Fuse Tea to Oasis to Lilt to Powerade. Yet, none of them is anyplace near the coke brand in terms of mindfulness, income, and benefit.

Stage 1. Choose the Product/Firm/Brand

We pick the firm Coca-Cola for investigation. Also, you need to identify the market, as the picked market is beverages, diet cokes, and mineral water.

Stage 2. Calculate Relative Market Share & Find out the Market Growth Rate

By and tremendous Growth rate in Coke is that it is no: in more than 200 countries.

Stage 3. Draw the Circles on a Matrix

2. BCG Matrix of Samsung

Stage 1. choose the product/firm/brand.

We pick the firm Samsung for investigation.

The picked market is the consumer electronics industry which incorporates smartphones, computers, tablets, etc.

Stage 3. Calculate Relative Market Share

By and tremendous Growth rate in Samsung home appliances by making 60% of the sales.

Stage 4. Draw the circles on a matrix

3. BCG Matrix of L'Oréal

We pick the firm L'Oréal for investigation.

Stage 2. Identify Market

The picked market is the Cosmetics Industry, which essentially incorporates Skincare, Makeup, Haircare, Hair shading, and Fragrances.

Stage 4. Find out the Market Growth rate

By and tremendous Growth rate in Cosmetics Industry (starting at 2018) = 4.8%

Stage 5. Draw the circles on a matrix

Note: Just follow the above pattern with every example and BCG matrix you will be making for your class.

4. BCG Matrix of PepsiCo

5. BCG Matrix of Apple

6. BCG Matrix of Nestle

7. BCG Matrix of Unilever

8. BCG Matrix of McDonalds

9. BCG Matrix of KFC

10. BCG Matrix of Amazon

What is BCG Matrix?

The Boston Consulting Group's item portfolio matrix ( BCG matrix ), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business to consider development openings by inspecting its arrangement of items to choose where to contribute to suspend or create things. It's otherwise called the Growth/Share Matrix. The Matrix is separated into four quadrants dependent on an investigation of market development and the relative peace of the overall industry.

It depends on the mix of market development and the overall industry comparative with the following best contender.

High Growth, High Market Share

Star units are pioneers in the classification. Items situated in this quadrant are appealing as they are located in a hearty class, and these items are exceptionally serious in the classification.

2. Question Marks

High Growth, Low Market Share

Like the name proposes, the future capability of these items is dubious. Since the development rate is high here, with the correct systems and ventures, they can become Cash cows and, at last, Stars if they have a flat piece of the overall industry so that off-base ventures can downsize them to Dogs significantly after loads of speculation.

3. Cash Cows

Low Growth, High Market Share

In the long run, if you are working for quite a while working in the business, advertising development may decay, and incomes deteriorate. At this stage, your Stars are probably going to change into Cash Cows. Since they despise everything that has a substantial relative piece of the overall industry in a deteriorating (developed) market, benefits and cash streams are relied upon to be high. As a result of the lower development rate, ventures required ought to likewise below. Along these lines, cash cows ordinarily produce cash in an overabundance of the measure of money expected to keep up the business. This 'overabundance cash' should be 'drained' from the Cash Cow for interests in different specialty units (Stars and Question Marks). Cash Cows eventually carry parity and security to a portfolio.

Low Growth, Low Market Share

Dogs hold a flat piece of the overall industry contrasted with contenders. Neither do they create cash, nor do they require huge cash. As a rule, the resources are not worth putting into because they create low or negative cash returns and may need enormous entireties of money to help. Because of the flat piece of the pie, these items face cost inconveniences.

How to Make a BCG Matrix Diagram?

So far, we realize products are ordered in four sorts. Presently we will see on what premise and how that order is done. We will comprehend the five procedures of improving a BCG matrix by making one for L'Oréal in the areas to follow.

Stage 1. Choose the Product

BCG matrix can be utilized to operate Business Units, separate brands, products, or firms as a unit itself. The decision of the group impacts the entire investigation. Along these lines, characterizing the unit is essential.

Stage 2. Define the Market

A mistakenly characterized market can prompt a weak characterization of products. For instance, if we investigate Daimler's Mercedes-Benz vehicle brand in the traveler vehicle market, it would wind up as a dog (it holds under 20% relative market share). However, it would be a cash cow in the extravagant vehicle market. Characterizing the market is a significant pre-imperative for a better understanding of the portfolio position.

Stage 3. Calculate the Relative Market Share

Market share is the level of the entire market taken into account by your company, estimated either in income terms or unit volume terms.

We utilize Relative Market Share in a BCG matrix, contrasting our product deals and the main adversary's sales for a similar product.

Relative Market Share = Product's business this year/Leading opponent's business this year

For instance, if your rival's market share in the vehicle business was 25% and your association's image market share was 10% around the same time, your relative market share would be just 0.4. The relative market share is given on the x-axis.

Stage 4. Find out the Market Development Rate

The business development rate can be effortlessly found through free online sources. It can likewise be determined by deciding the healthy income development of the leading firms. The market development rate is estimated in rate terms.

Market development rate was typically given side-effects (business this year – Product's business a year ago)/Product's business a year ago.

Markets with high development are ones where the total market share accessible is growing, so there are a lot of chances for all organizations to bring in cash.

Stage 5. Draw the Circles on a Matrix

Having determined the above measures, you have to plot the brands on the Matrix simply on EdrawMind desktop version. It has the premade templates for BCG. All you have to do is put up the data just like we did with every example.

The x-axis shows the relative market share, and the they-pivot shows the business development rate. You can plan a hover for every unit/brand/product, the size of which ought to relate to the extent of income created by it in a perfect world.

Taken these variables together, you can attract the perfect way to follow the BCG Matrix, from start-up to market pioneer. Question Marks and Stars should be financed with ventures produced with Cash Cows. What's more, Dogs should be stripped or exchanged to let loose cash with minimal potential and use it somewhere else. At long last, you will require a reasonable arrangement of Question Marks, Stars, and Cash Cows to guarantee positive cash streams later on.

[2023] Story Summary Examples

7 Types of Organizational Charts (With Examples)

Sunburst Chart: Explained with Examples & Templates

Story Outline Examples

To-Do List Mind Map Template

Subscribe for Free Business and Finance Resources

What is the bcg matrix explaining its components and quadrants.

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year.

Understanding BCG Matrix

Strategic analysis is crucial in the world of finance, helping professionals make informed decisions to drive growth and maximize returns.

One such tool that has stood the test of time is the BCG Matrix . Developed by the Boston Consulting Group , this matrix offers a systematic approach to analyzing a company's portfolio of products or business units.

In this article, we will delve into the intricacies of the BCG Matrix, explore its components and quadrants, and discuss how it can be applied to make strategic decisions in the finance industry.

What is the BCG Matrix?

The BCG Matrix, also known as the Growth-Share Matrix, is a visual representation of a company's portfolio of products or business units . It was developed by the Boston Consulting Group in the 1970s and is widely used across industries to assess the strategic position of different offerings.

By plotting products or units on a matrix based on their market growth rate and relative market share, the BCG Matrix provides valuable insights into the potential and profitability of each element in the portfolio .

Components of the BCG Matrix

Market Growth Rate

The market growth rate refers to the rate at which a particular market is growing . It is an important factor to consider when analyzing a company's portfolio because high-growth markets tend to offer greater opportunities for expansion and profitability. By assessing the market growth rate, finance professionals can identify industries or sectors with significant growth potential and allocate resources accordingly.

Relative Market Share

Relative market share is a measure of a company's market share compared to its competitors in a specific market . It provides insights into a company's competitive position and its ability to capture a significant portion of the market. A high relative market share indicates a strong market presence, which can lead to economies of scale, pricing power, and competitive advantages.

Quadrants of the BCG Matrix

The BCG Matrix divides the portfolio into four quadrants, each representing a different strategic outlook. Let's explore each quadrant:

Stars represent products or business units with a high market growth rate and a high relative market share . These are the growth drivers of a company's portfolio. Stars require substantial investment to sustain their growth trajectory and capture the market's potential. While they generate revenue, they also consume resources to fuel their expansion. Companies should develop strategies to support and maximize the potential of stars, as they can become future cash cows.

For example Tesla's electric vehicles (EVs) in the early 2010s. With a high market growth rate and a dominant market share in the electric vehicle industry, Tesla was considered a star. The company invested heavily in expanding its manufacturing capacity and charging infrastructure to capitalize on the growing demand for EVs.

Cash cows are products or business units with a low market growth rate but a high relative market share . These offerings have reached maturity and generate significant cash flow for the company. Cash cows typically have established customer bases and enjoy economies of scale, resulting in healthy profit margins. Finance professionals should focus on sustaining and extracting value from cash cows to fund other areas of the business .

Example Microsoft's Office Suite. Although the market growth rate for office productivity software is relatively low, Microsoft's Office Suite dominates the market with a high relative market share. This product line generates substantial revenue and profit, which supports the company's investments in other emerging areas, such as cloud computing.

Question Marks (Problem Children)

Question marks, also known as problem children or wildcards, are products or business units with a high market growth rate but a low relative market share . They require careful analysis and strategic decision-making due to the uncertainty surrounding their potential. Question marks may either become stars or fail to gain market traction. Companies need to assess the viability and potential of question marks and allocate resources accordingly.

Example: Uber's food delivery service, Uber Eats, during its early years. With the rapid growth of the food delivery market, Uber Eats had a high market growth rate. However, it faced intense competition from established players like DoorDash. Uber had to strategically invest in marketing and partnerships to gain market share and compete effectively.

Dogs represent products or business units with both a low market growth rate and a low relative market share . These offerings have limited potential and may not generate substantial returns. Companies should evaluate dogs to determine if they can be revitalized or if divestment is a more appropriate course of action.

Example: BlackBerry's smartphones in the mid-2010s. With declining market share and a lack of innovation compared to competitors like Apple and Samsung, BlackBerry's smartphones became dogs in the market. The company eventually shifted its focus to software and services.

Analyzing and Applying the BCG Matrix

To conduct a BCG Matrix analysis, finance professionals should follow these steps:

Gather relevant data and information, such as market growth rates and market shares .

Plot the products or business units on the matrix based on their market growth rate and relative market share.

Interpreting the results and making strategic decisions involves:

Identifying resource allocation priorities based on the quadrant placement.

Developing growth strategies for stars and question marks.

Considering divestment or restructuring options for dogs.

Maximizing the potential and profitability of cash cows.

By applying the BCG Matrix, finance professionals can make informed decisions that optimize resource allocation, drive growth, and enhance overall portfolio performance.

Limitations and Considerations

While the BCG Matrix is a valuable tool, it has some limitations:

The matrix focuses solely on two dimensions (market growth rate and relative market share), neglecting other factors such as competitive dynamics, industry trends, and external factors.

The matrix assumes that a high market share leads to profitability, which may not always hold true.

Industries with different characteristics may require modifications to the matrix for accurate analysis.

Finance professionals should complement the BCG Matrix with other analytical tools and consider the specific context of their industry and market to gain a comprehensive understanding of their portfolio.

Case Study: Application of the BCG Matrix

Let's consider a hypothetical case study to illustrate the application of the BCG Matrix.

Company X operates in the technology industry and has a diverse portfolio of products. After conducting a BCG Matrix analysis, the company identifies the following:

Product A: High market growth rate, high relative market share (star)

Product B : Low market growth rate, high relative market share (cash cow)

Product C: High market growth rate, low relative market share (question mark)

Product D: Low market growth rate, low relative market share (dog)

Based on this analysis, Company X develops strategies to further invest in Product A to maintain its growth trajectory, sustain Product B to continue generating cash flow, evaluate potential opportunities for Product C, and consider divestment or restructuring options for Product D.

The BCG Matrix is a powerful tool for strategic analysis in finance. By analyzing a company's portfolio based on market growth rate and relative market share, finance professionals can make data-driven decisions to allocate resources effectively, identify growth opportunities, and maximize profitability.

The BCG Matrix provides a structured framework for evaluating products or business units and helps finance professionals navigate the complexities of portfolio management.

- Business 101

Recent Posts

Maslow's Hierarchy of Needs: A Tool for Effective Business Management

Figurative Language: A Useful Tool for Business Professionals

What is Strategic Planning and Why is it Important in Business?

Commentaires

- What is the market penetration strategy?

- How to use BCG Matrix for strategic planning

- Recapitulation of Strategic planning models

Table of Content

- What is the BCG Matrix?

- Importance of BCG Matrix

- Application of BCG Matrix

- Example of application of BCG Matrix

Introduction to BCG Matrix

Boston Consulting Group’s Growth and Market Share Matrix is one of the important strategic planning tools that can be used by the organization to provide a graphic representation of the products and services of the organization and to decide what the organization should own, sell and invest in. This Matrix is mainly used by the management team of the company to assess the current state of the product and service offering of the company. This is also known as the Growth/ Share Matrix as this Matrix has the four-quadrant based on analysis of the market growth and market share. In this Matrix the product or service offering of the company are plotted in four different categories which include "Dogs," "Cash Cows," "Stars," And “Question Marks.

The need for the BCG Matrix

The BCG Matrix is used to assess the current state of the product lines and service offerings of the organization. By using this model, the organization can also determine the product lines that the organization should keep, sell and invest in. The use of this strategic planning model can also help the organization to better allocate the resources across its business units. This model is mainly used by large-scale organizations that have diversified product portfolios and need to assess the market share and growth prospects of different product lines. In addition, the BCG Matrix also provides a view on the available opportunities for the current product portfolio by understanding which business should the company invest in, which business needs harvesting, which business needs to be completely shut down, and which business needs divesting.

How to apply the BCG Matrix?

Before moving on to the real example of BCG Matrix, let us discuss How to use the BCG Matrix for strategic planning?

To use the BCG Matrix, the organization first needs to review the portfolio of the products, services, and strategic business units of the organization. Then, the organization needs to prepare the BCG Matrix template and consider the four different quadrants covered in the BCG Matrix. The four different quadrants include "Dogs," "Cash Cows," "Stars," And “Question Marks.

- The “Stars” category depicts the products or brands that have fantastic opportunities and can generate higher ROI due to higher market share, growth market, and cash generation capacity. The strategy that can be adopted by the organization for this category of products is to hold these products and invest in the marketing of these products to ensure higher market share and growth.

- The “Question marks” category includes the products that can attain higher growth but currently, the market of such products is uncertain – whether it will grow or decline. Also, the cash used in this category is high due to higher market growth, lower market share, etc. The key strategy available to the organization, in this case, is to build in the manner that helps to transform the new entry products into the higher market share products.

- The “Cash Cows” category includes products that are well-established and consistently produce cash through a higher market share in the low growth markets.

- The last category includes the “Dogs” category which includes the products that have little or no value as these products have low market growth as well as low market share. These products do not generate higher cash and thus, do not require higher investment. Thus, the key strategy that can be adopted for these products is to divest the product altogether or improve the product demand through innovation and rebranding.

After considering all the four quadrants, the organization needs to list and allocate its products on the basis of the market growth, market share, and cash generation or usage factor. After proper allocation of the products, the organization can then determine the strategies that can be adopted by considering the products that need investment and that need to be diversified.

BCG Matrix real example

Coca-Cola is an American MNC that has a product portfolio of more than 3500 beverages under 500 brands. For better understanding, let's prepare the Coca Cola BCG Matrix and see which products of Coca-Cola fall under which quadrant.

The Cash Cows include a product that is not in the growth industry but delivers a higher market share. Coke has been in the market for years and has achieved a leading position in the market in terms of the carbonated soft drink segment. Coke is also a major revenue-generating product for the company.

The Stars include the products and business units that attain a higher market share in the high-growth industry. The Kinley and Dasani water of Coca-Cola falls in this category as bottled water is becoming an ever-evolving and demanding product in the international market. Coca-Cola has the opportunity to hold Dasani and Kinley water bottles and invest in the marketing and advertising of these products to ensure higher market share and growth.

Question Mark

The products in the Question Mark category have a smaller market share even in the expanding market. Can you guess any product of Coca that is in the expanding industry but has a smaller market share? Some of these products are Minute Maid, Diet Coke, Smartwater, Sparkling water, Honest Tea, etc. There is huge potential for these products in the market due to rising health consciousness among the customers which suggests that Coca-Cola should either exit these products or invest in advertising, product quality improvement, and other features to ensure higher customer attractiveness.

Dogs category includes products that have lower growth potential and do not have a higher market share. Can you think of any Coca-Cola product or brand that is in this category? Maybe not. Have you heard about Zico Coconut Water? Coca-Cola can discontinue this product as this is the least profit-generating product for the company with a very low market share.

Hence, the use of the BCG Matrix provides insight into the current state of the organization's products in the industry which then helps the organization to engage in strategic planning and determine which products the organization should hold, divest, invest or sell.

A thorough examination of McKinsey 7s Model

In-depth analysis of usance of ge-mckinsey matrix.

Mastering the BCG Matrix: Practical Examples and Usage Guide

- Ossian Muscad

- July 18, 2023

- No Comments

Last Updated on July 18, 2023 by Ossian Muscad

The BCG Matrix is a tool businesses use to analyze their product portfolios and assess the relative performance of each offering. This matrix helps organizations identify which products are growing quickly, which are stable and mature, and which should be divested or have resources reallocated. It also provides insight into how different products interact within an organization’s portfolio. This article will discuss the basics of the BCG Matrix, provide practical examples of its usage, and offer advice on how you can use it to improve your decision-making processes.

What is the BCG Matrix?

The BCG Matrix, short for Boston Consulting Group Matrix, is a valuable tool employed in strategic management. It aids organizations in scrutinizing their diverse product offerings. This matrix segregates a company’s products or services into four distinct categories: Stars, Cash Cows, Question Marks, and Dogs. Each category signifies a different degree of market share and potential for growth.

The BCG Matrix serves as a guide for businesses to make informed decisions about their product portfolio. With its help, they can strategically allocate resources, determine investment priorities, and decide which products should receive more investment or be divested. However, it’s crucial to note that the BCG Matrix is one instrument among many in the toolbox of strategic analysis and should be used in conjunction with other tools for a comprehensive evaluation.

Brief History of the BCG Matrix

The BCG Matrix was developed in the 1970s by Bruce Henderson, the founder of the Boston Consulting Group. He designed this matrix as a comprehensive portfolio planning tool to assist companies in evaluating their product lines, enabling them to make informed decisions on which products to invest further in and which to divest from. The concept is built around four quadrants, categorizing a company’s Strategic Business Units (SBUs).

Henderson’s model operates on the premise that an increase in market share will result in increased cash generation. Simultaneously, it suggests that a product being established in a burgeoning market will necessitate continual investment for producing goods/services and expanding capacity, which would invariably be a significant cash consumer.

Advantages of Using the BCG Matrix

Utilizing the BCG Matrix offers numerous benefits, such as the following:

- Its concept is straightforward and comprehensible, making it easily accessible to different levels of management.

- This tool facilitates effective evaluation of existing opportunities and strategy formulation to maximize their potential.

- It guides companies in determining the optimal allocation of cash resources, aiming to enhance future growth and profitability.

- The matrix presents a structured framework for resource distribution across various products while providing a snapshot comparison of the product portfolio, enabling quick and easy assessments.

- The BCG Matrix also promotes strategic thinking by pushing companies to assess their products in the broader market context, encouraging a proactive approach to product management and future planning.

Limitations of the BCG Matrix

While the BCG Matrix is a beneficial tool, it has certain limitations that you need to consider. That way, you can thoroughly assess if it’s your right strategy. These limitations include the following:

- The model primarily uses two dimensions: relative market share and market growth rate. These factors don’t necessarily guarantee profitability, attractiveness, or success.

- It overlooks the potential synergy between different brands or product lines.

- The model assumes that businesses with lower market shares are less profitable, which is not always the case.

- Achieving a high market share can be costly and doesn’t necessarily translate into increased profits.

- ‘Dogs,’ or low market share products, can sometimes offer unique competitive advantages for businesses.

- The matrix doesn’t account for emerging competitors with swiftly growing market shares, potentially skewing strategic decisions.

Comparing BCG Matrix with the Ansoff Growth Matrix

The BCG Matrix and the Ansoff Growth Matrix are widely used strategic planning instruments businesses employ to examine their product portfolio and pinpoint growth prospects. However, they vary in their methodologies and focal points.

The BCG Matrix assesses the current product portfolio of a company by considering two key factors: the rate of market growth and the market share. The products are categorized into four groups: Stars, Cash Cows, Question Marks, and Dogs. This matrix aids businesses in making decisions regarding resource allocation and investment, focusing on growth potential and profitability.

Conversely, the Ansoff Growth Matrix scrutinizes a company’s growth opportunities by considering products and markets. The matrix organizes growth strategies into four quadrants: Market Penetration, Market Development, Product Development, and Diversification.

The Ansoff Growth Matrix equips businesses to identify potential growth avenues and make strategic decisions about product innovation and market expansion.

The Four Quadrants of The BCG Matrix

The Boston Consulting Group (BCG) Matrix is a strategic management tool that classifies a firm’s products or services into four categories, each represented by a quadrant. These quadrants are defined by market growth rate and relative market share.

Products in the Stars quadrant have a high market share in high-growth markets. They are the leaders in the business and often need continued investment to sustain their growth. If successful, Stars can eventually become Cash Cows as the market’s growth rate declines.

These products have a high market share in a low-growth industry or market. They generate more cash than what is necessary to maintain their market share. Because of their strong position and low growth needs, they are often seen as the company’s foundation and are desirable for generating strong cash flows and profits.

Question Marks

Also known as “problem children,” these products have a low market share in high-growth markets. They require significant resources to increase their market share. If this cannot be accomplished, they should be sold off. Deciding whether to invest in or divest from these products can be challenging for management.

Dogs are products with a low market share in low-growth markets. They neither generate substantial cash nor require massive amounts of cash. Often, these products are cash traps because of the money tied up in them, and companies usually opt to divest these products or businesses.

Each quadrant has different strategic implications and requires different resource allocations and management strategies.

BCG Positions Through Product Life Cycle

The BCG Matrix can be effectively utilized to analyze the lifecycle of each Product in your portfolio. The life cycle of a product comprises four stages: introduction, growth, maturity, and decline. By pinpointing where each Product resides in its lifecycle, you can ascertain its relevant position on the BCG Matrix.

During growth, products are generally classified as “Question Marks” in the BCG matrix. These products, having a low market share in a high-growth market, necessitate substantial investment for growth and market share capture, but they hold the potential to evolve into “Stars.”

As products mature and amass market share, they transition into the “Star” category of the BCG matrix. Boasting a high market share in a high-growth market, these products contribute significantly to the business’s revenue and profit.

With time, “Stars” may morph into “Cash Cows.” Products in this position have a high market share in a slow-growth market. They generate substantial cash flow for the business but require less investment compared to “Question Marks” or “Stars.”

Eventually, products may end their lifecycle and shift into the “Dog” quadrant of the BCG Matrix. These products, with a low market share in a low-growth market, may yield limited revenue and profits and often require significant investments to maintain or enhance their market position.

How To Make A BCG Matrix?

Creating and utilizing a BCG matrix is relatively simple. You must gather information about each product or service in your portfolio: relative market share and growth rate. Plot each Product on the matrix according to its market share and growth rate; the higher the market share, the further right it should be placed, while faster-growing markets should be placed higher up. With that said, follow the steps outlined below to create a compelling and successful BCG Matrix:

Step 1: Determine the Strategic Business Unit (Product-Market Fit)

The first step in creating a BCG matrix is to identify the specific business unit, Product, or brand you want to analyze. This selection is critical as it sets the foundation for the entire analysis process.

Step 2: Define the Market

Defining the market accurately is crucial to understand your portfolio’s positioning correctly. An incorrect market definition could lead to misclassification of products. For instance, Mercedes-Benz would be a ‘Dog’ in the overall passenger vehicle market due to its less than 20% market share, but it becomes a ‘Cash Cow’ in the luxury car segment.

Step 3: Calculate the Relative Market Share

Market share, measured by revenue or unit volume, reflects how much of the total market a company serves. The BCG matrix uses relative market share, comparing a product’s sales to its leading competitor’s. You can compute it as follows:

Relative Market Share = Your Product’s sales this year / Leading competitor’s sales this year

For instance, if your competitor has a market share of 25% and you have a 10% market share, your relative market share would be 0.4.

Step 4: Determine the Market Growth Rate

Using online resources or analyzing leading companies’ average revenue growth can help gauge an industry’s growth rate, commonly expressed as a percentage. Here’s the calculation:

Market Growth Rate = (Product’s sales this year – Product’s sales last year) / Product’s sales last year.

High-growth markets offer a larger pool of potential customers, providing ample opportunities for companies to generate revenue.

Step 5: Plot and Position the Circles on the Matrix

Once you’ve determined the market share and growth rate for each Product or business unit, plot these as circles on a two-by-two grid of the BCG matrix, with market share on the x-axis and growth rate on the y-axis. The size of each circle should correspond to the product or business unit’s market share: a larger market share means a larger circle. It is possible to draw this visualization using software tools or draw manually.

Sample BCG Matrix

Understanding how the BCG Matrix works requires looking at an example. That’s why we will take the example of Apple Inc., a well-known technology company with a diverse product portfolio. Here’s how some of their products might be categorized in the BCG Matrix:

- Stars: The iPhone could be considered a Star. It dominates a rapidly growing market with a large market share. Despite the competitive smartphone industry, the iPhone continues to be a leader due to its innovative features and strong brand loyalty.

- Cash Cows: The MacBook is a Cash Cow. It has a high market share in a relatively low-growth market. MacBooks are popular and generate substantial revenue, but the overall laptop market isn’t growing as fast as the smartphone market.

- Question Marks: Apple Watch might be considered a Question Mark. It has a lower market share in a high-growth market. Wearable tech is rapidly growing, but Apple Watch faces stiff competition from other tech giants.

- Dogs: The iPod is a Dog. It holds a small portion of the market in a market with minimal growth.. With the advent of smartphones that can store and play music, the demand for standalone music players like iPods has significantly declined.

Remember, the BCG Matrix is a simplified representation and may not fully capture the complexities of the market or business strategy. Also, the classification of products into different categories can change over time with changes in market dynamics.

Create and Utilize the BCG Matrix Using a Low-code Platform

As businesses grow and evolve, so does their product portfolio. Manual analysis of a business’s product portfolio is tedious and time-consuming. A low-code platform like DATAMYTE can help automate this process with its drag-and-drop interface to quickly create applications that can analyze your product portfolio in real-time using the BCG matrix. With DATAMYTE, you have all the tools you need to quickly create a BCG Matrix application and understand the positioning of your products in the market.

DATAMYTE is a quality management platform with low-code capabilities. The DataMyte Digital Clipboard , in particular, is a low-code workflow automation software that features a checklist and smart form builder. This tool lets you create a comprehensive BCG matrix checklist for your product portfolio, providing an automated way to measure and analyze market share and growth rate.

To create a checklist or form template using DATAMYTE, follow these steps:

- Log in to the DATAMYTE software and navigate to the ‘Checklist’ module.

- Click “Create Checklist.”

- Add a title to your checklist; select the category where it belongs.

- Start adding items to the checklist by clicking “Add Item.”

- Define the description of each item, what type of answer it requires, and other relevant specifications (e.g., reference documents, acceptance criteria, limits).

- Assign a team member responsible for conducting the inspection using the checklist.

- Add signature fields for approvals (e.g., supervisors, quality assurance personnel).

- Save the checklist—you can now access it anywhere, and it will be available for use on any device.

DATAMYTE also lets you conduct layered process audits, a high-frequency evaluation of critical process steps, focusing on areas with the highest failure risk or non-compliance. Conducting LPA with DATAMYTE lets you effectively identify and correct potential defects before they become major quality issues.

With DATAMYTE, you have an all-in-one solution for creating and implementing the BCG Matrix. It provides an insightful way to evaluate product portfolios and develop strategies for growth. Book a demo to learn how DATAMYTE can help you optimize your product portfolio with the BCG Matrix.

The BCG Matrix is a powerful tool businesses use to evaluate their product portfolios and identify areas for potential growth. It provides an insightful way to assess the relative market position of each Product and develop strategies for success. With the help of a low-code platform like DATAMYTE, businesses have all the tools they need to create and implement the BCG Matrix quickly. Start today!

Related Articles:

- The Importance of a Risk Avoidance Strategy in Today’s Business Landscape

- Cultivating Success: Steps to Building a Continuous Improvement Culture in Your Organization

- Implementation

- Case-Studies

- White Papers

- Knowledge Base

Experts in the Connected Factory

- 1-800-455-4359

- (763) 553-0455 ext. 1

- [email protected]

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Online only.

What Is a BCG Matrix?

Table of Contents

Business models are based on providing products or services that are profitable now, but a good business strategy also asks, “What about the future?” Created by the Boston Consulting Group, the BCG matrix – also known as the Boston matrix or growth-share matrix – provides a strategy for analyzing products according to growth and relative market share. The BCG model has been used since 1968 to help companies gain insights on what products best help them capitalize on market share growth opportunities and give them a competitive advantage.

More than 50 years after its inception, the BCG matrix model remains a valuable tool for helping companies understand their potential.

What is a BCG matrix?

A BCG matrix is a model used to analyze a business’s products to aid with long-term strategic planning. The matrix helps companies identify new growth opportunities and decide how they should invest for the future.

Most companies offer a wide variety of products, but some deliver greater returns than others. The BCG matrix gives the business a framework for evaluating the success of each product to help the company determine which ones they should invest more money into and which they should eliminate altogether. It can also help companies identify a new product to introduce to the market.

The matrix is divided into four quadrants based on market growth and relative market share. Each of these quadrants is discussed in more depth later in this article.

Anytime you’re considering making a pivot in your business, it’s helpful to also perform a SWOT analysis . This can help you understand the potential consequences of a major business decision.

What are the benefits of a BCG matrix?

The BCG matrix is a simple framework that all companies can use to evaluate their products. Anyone can look at the matrix and grasp which of the business’s products are performing the best. In addition to giving a bird’s-eye view of how products are performing, the matrix helps identify what factors make each product successful or unsuccessful. It also lets you see how your products stack up against one another.

The BCG matrix is also a useful tool for uncovering new opportunities in your market and eliminating poorly performing products, which can save your company a lot of money in the long run.

What are the limitations of a BCG matrix?

One limitation of using the BCG matrix is it doesn’t account for any factors beyond market share and growth. This means it won’t give you the complete picture as to why your products are succeeding or failing. While the BCG matrix is a great starting point, it’s not enough on its own to guide the future of a company. In many cases, it won’t provide enough information for handling complex business problems.

The BCG matrix isn’t a predictive analytics tool and won’t help you account for new products that could disrupt the market in the future.

How do you create a BCG matrix?

Now that you understand what a BCG matrix is and some of its pros and cons, let’s look at how you can set up your own matrix. To analyze your company, you’ll need data on your products or services’ relative market share and growth rate.

When examining market growth, you need to objectively analyze your competition and think in terms of growth over the next three years. ( Porter’s Five Forces is one useful framework for this type of analysis.) If your market is extremely fragmented, however, you can use absolute market share instead. Next, you can either draw a BCG matrix or find a BCG matrix template program online. Several are free, while others are available for subscription or offered as part of another charting program.

Credit: DeiMosz/Shutterstock

In this four-quadrant BCG matrix template, market share is shown on the horizontal line (low left, high right) and growth rate is found along the vertical line (low bottom, high top). The four quadrants are designated Stars (upper left), Question Marks (upper right), Cash Cows (lower left) and Dogs (lower right).

Place each of your products in the appropriate box based on where they rank in market share and growth. Where you set the dividing line between each quadrant depends in part on how your company compares to the competition. Here is a breakdown of each BCG matrix quadrant.

Stars quadrant

The business units or products with the best market share and generating the most cash are considered Stars. Monopolies and first-to-market products are frequently termed Stars too. However, because of their high growth rate, Stars consume large amounts of cash. This generally results in the same amount of money coming in that is going out. Stars can eventually become Cash Cows if they sustain their success until a time when a high-growth market slows down. A key tenet of a BCG strategy for growth is to invest in Stars.

Cash Cows quadrant

A Cash Cow is a market leader that generates more cash than it consumes. Cash Cows are business units or products with a high market share but low growth prospects. Cash Cows provide the cash required to turn a Question Mark into a market leader, cover the administrative costs of the company, fund research and development, service the corporate debt, and pay dividends to shareholders. Companies are advised to invest in cash cows to maintain the current level of productivity or to “milk” the gains passively.

Dogs quadrant

Dogs, sometimes also referred to as Pets, are units or products with a low market share and low growth rates. They frequently break even, neither earning nor consuming much cash. Dogs are generally considered cash traps because businesses have money tied up in them, even though they bring back almost nothing in return. These business units are prime candidates for divestiture.

Question Marks quadrant

These parts of a business have high growth prospects but a low market share. They consume a lot of cash but bring little in return. Question Marks lose a company money. However, since these business units are growing rapidly, they have the potential to turn into Stars in a high-growth market. Companies are advised to invest in Question Marks if the products have potential for growth, or to sell if they do not.

How do you use the BCG matrix to strategize?

Once you know where each product stands, you can evaluate them objectively and strategize the future of your business. The BCG matrix helps you identify which products you should prioritize and which need to be cut altogether.

Here are four ways to use the BCG matrix to strategize for your business:

- If your goal is to focus on innovation, increase your investment in Stars and Question Marks. For example, you may be able to push a Question Mark into a Star and, later, a Cash Cow, by investing more in it.

- If you can’t invest more into a product, keep it in the same quadrant and leave it alone. One of the advantages of a Cash Cow is that it’s a well-established product that takes less effort to maintain.

- Reduce your investment and take out the maximum cash flow from a product, which increases its overall profitability. This strategy is best used for Cash Cows.

- Divest the amount of money invested in a product and apply it elsewhere. This strategy is best for Dogs.

Since consumer preferences are constantly changing, it’s impossible to predict the long-term growth of any product. That’s why you should regularly revise and update your BCG matrix as market conditions change. For instance, a product that was a Question Mark could quickly turn into a Dog, so you should be ready to walk away if the stakes get too high.

At the end of the day, the goal isn’t to succeed in any one area – it’s to create a diversified portfolio. You need products in every quadrant of your BCG matrix to keep a healthy cash flow and offer products that can secure your company’s future.

What is the role of cash flow in the BCG matrix?

Understanding cash flow is key to making the most of the BCG matrix. In 1968, BCG founder Bruce Henderson noted that four rules should guide your approach to product cash flow strategies :

- Margins and cash generated are a function of market share. High margins and high market share go together.

- To grow, you need to invest in your assets. The added cash required to hold shares is a function of growth rates.

- High market share must be earned or bought . Buying market share requires an additional increment or investment.

- No product market can grow indefinitely. You need to get your payoff from growth when the growth slows – you lose your opportunity if you hesitate. The payoff is cash that cannot be reinvested in that product.

That last point is more important now than ever. The market moves more quickly now than it did 50 years ago, and BCG has since published recommended revisions on how to analyze and act on the matrix information. Maintaining a healthy supply of Question Marks readies you to act on the next trend. Cash Cows, conversely, need to be milked efficiently because they may fall out of favor – and profitability – more quickly. [Learn why profit margins are important for your business.]

What is a real-life BCG matrix example?

To ensure you understand a BCG analysis, it can be worthwhile to look at a real-life BCG matrix example. A famous BCG matrix example is that of The Coca-Cola Company, which owns many more drink lines than just its titular brand.

In the Coca-Cola BCG matrix example, Diet Coke and Minute Maid are Question Marks, as these products attract a modest audience, but still have room to grow. Its bottled water brands Kinley and Dasani are Stars since they dominate the market in, respectively, Europe and the U.S., and show no signs of slowing growth. Its titular drink is a Cash Cow since it experiences low growth and a high market share. However, Coca-Cola is also a Dog because legislation against soft drinks – not to mention public sentiment turning against them – has decreased soda sales.

The Coca-Cola company’s real-life BCG matrix example provides an important takeaway: Sometimes a product can fall into more than one quadrant.

One of the best ways to improve your sales is through sentiment analysis . Sentiment analysis can help you determine how consumers feel about your brand and products. You can also do a PEST analysis to consider political, economic, social and technological factors.

What are alternative matrix models?

While a great tool, the BCG matrix isn’t for every business. Some companies find they don’t have products in each quadrant, nor do they have a steady movement of products among the quadrants as their product life cycle progresses.

Some consultants advocate using the GE/McKinsey matrix instead, which measures products according to business unit strength and industry attractiveness rather than market share, the complexity of which may be outside an individual company’s control. Comparing the two models can reveal hidden insights that fuel increased growth for your company.

Jamie Johnson, Max Freedman and Katherine Arline contributed to the writing and reporting in this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

The Only Course You'll Need To Understand Marketing Like Never Before

How to Get Started with Marketing and Design Your Career in 5 Steps

BCG Matrix of Nestle [Detailed] Nestlé is a common house-hold brand for us since years. Think fast and tell me what all Nestlé products you love! I bet NesCafe, Maggi or chocolates like Kit-Kat made it to your favourite list. Now, have you ever wondered, that do firms also treat its products differently? How do they decide which brands to keep? Where to add new products? When to produce more goods? If yes, then this article is definitely curated for you. Give it a read and see how firms solve these critical questions.

Nestle is one of the world’s leading FMCG company. Most likely, dream company for most of the B-school students too. It has its presence in about 187 countries. Think how many market-segments and strategies it would be catering to! In order to understand their strategies, we have to get to know how BCG matrix of Nestle works.

To serve its immensely heterogenous customers, they maintain a broad brand portfolio, with numerous products under it. And, yet is successfully leading in most of the markets worldwide.

Boston Consulting group’s product portfolio matrix is designed to help with long term strategic planning, to help a business consider growth opportunities. This is done by reviewing its portfolio of products to decide where to invest, to discontinue or develop products.

So, let’s not wait anymore, and start digging!

What is BCG matrix?

BCG matrix isn’t a new phenomenon. And, in the changing digital landscape, we can slurp a lot of information from it. In fact, we can also apply it for developing better marketing strategies.

We will begin with understanding what are the quadrants of this matrix, how to interpret it, and many more things!

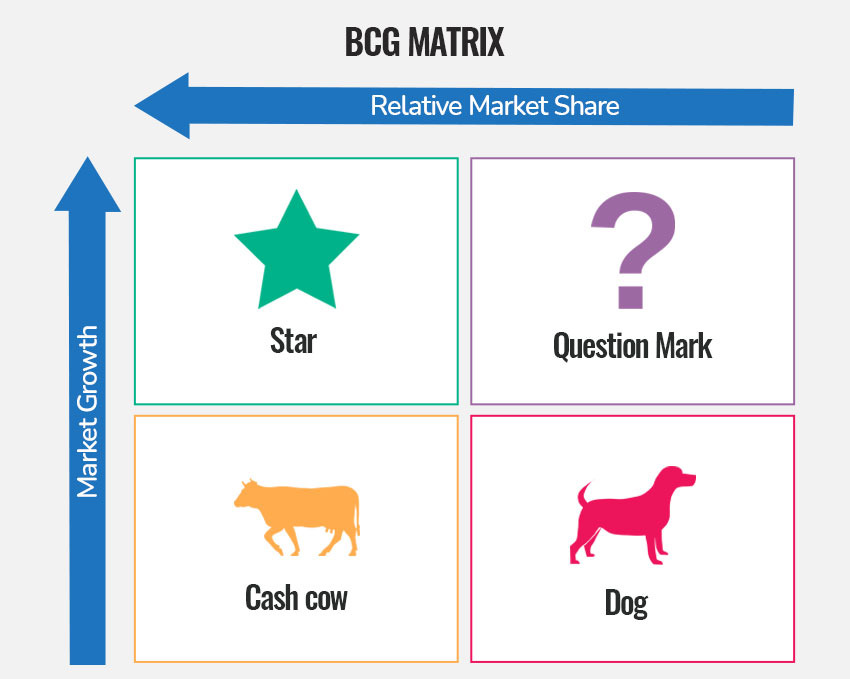

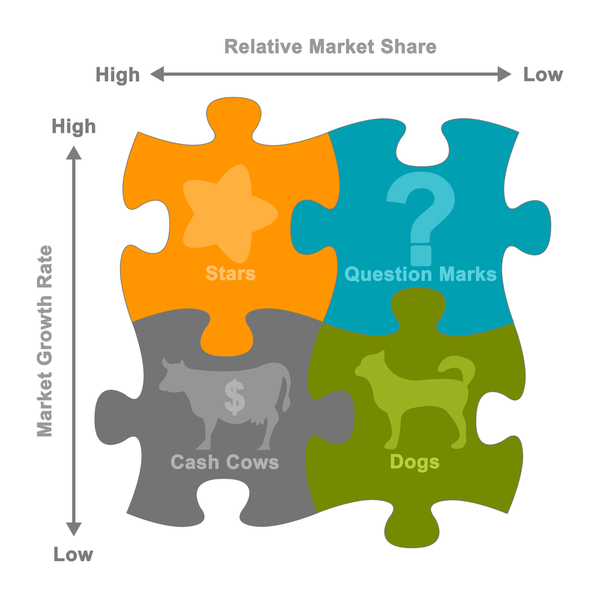

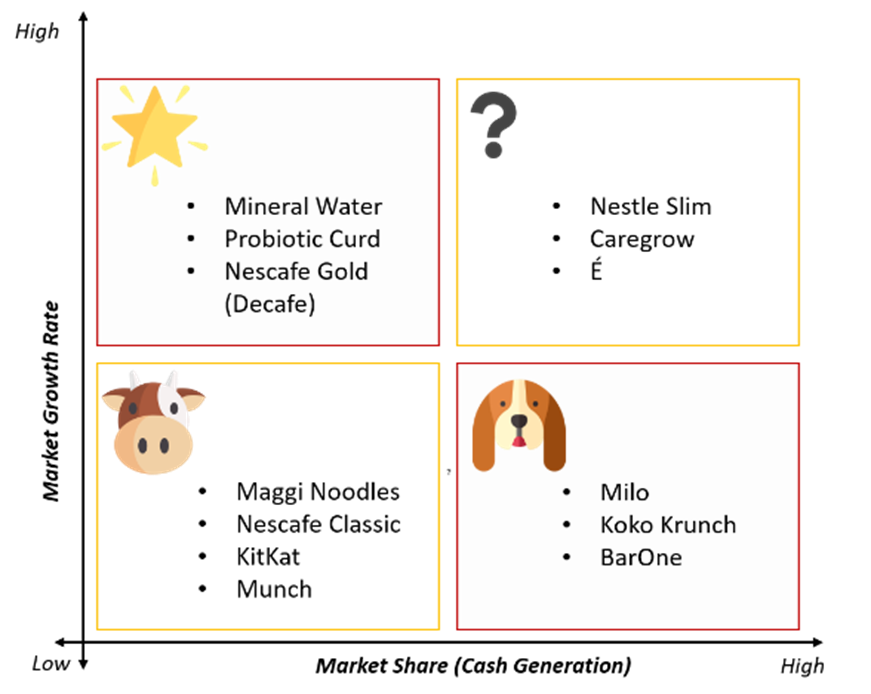

So, the Matrix is divided into 4 quadrants based on an analysis of market growth and relative market share, as shown in the diagram below.

Source: superheuristics.com

This matrix is, put simply, a portfolio management framework that helps companies decide how to prioritize their different businesses. It is a table, split into four quadrants, each with its own unique symbol that represents a certain degree of profitability. Quadrants being- question marks, stars, pets (often represented by a dog), and cash cows.

Now, let’s understand these quadrants better.

Each of the four quadrants represents a specific combination of relative market share, and growth:

Low Growth, High Share: Firms should milk these “cash cows” for cash to reinvest.

High Growth, High Share: Firms must invest in these “stars” as they have high future potential.

High Growth, Low Share: Firms should invest in or discard these “question marks,” depending on their chances of becoming stars.

Low Share, Low Growth: Firms should liquidate, divest, or reposition these “pets.”

Okay, so imagine that you have your matrix. Is your problem solved? No more critical decisions? The answer is “no”. Your task as an MBA is to interpret what the BCG matrix of Nestle shows you.

For instance, “pets” might look like the least attractive product. Will you discard it? Or push it to become cash cow or star later?

Also Read: The BCG Matrix – What is it and how to use it

Next, we should now start our analysis of BCG matrix of Nestle, India

Marketing Concepts Mastery Course

Learn the essential marketing concepts. Create the best outcomes from MBA without depending on placements!

Understand BCG Matrix, SWOT Analysis, Ansoff Matrix and many other important marketing frameworks just like an expert MBA professional would. Solidify your concepts by building a personal brand in marketing.

BCG Matrix of Nestle India

Here I am taking the case of Nestle, India specifically. Because, I aim at making it easily relatable for you. Now its time to check out the BCG Matrix of Nestlé and what products of the company fall under what Quadrant.

For Nestle, there are some products those have been undoubtedly the Cash Cows. They are- Nestle’s Maggi Noodles, NesCafe and its popular chocolates like KitKat, Munch.

With a market share of 80-85 %, Maggi Noodles holds a pseudo-monopoly in the market and have a high customer loyalty.

These products need very less investment. In fact, they are already available at every nook and cranny. And loved my most of us!

Stars

In the case of Nestle, Nestle’s Mineral Water and Nestle’s Nescafe Coffee (like Nescafe Latte) fall in the Star quadrant of the BCG Matrix of Nestle.

With the growing number of health-conscious customers, these products have the potential to produce greater ROI later. Even though, it might take heavy investment to make Nestle-brand visible in that market, they may turn to cash-cows pretty soon!

Source: nestlepurelife.com

Question Mark

Now this is an interesting bunch of products!

Nestle Everyday, Nestlé slim and Nestlé Milk maid are some of the milk and milk-based products from the house of Nestlé. And they come under Question Mark category.

This domain needs a higher investment, because its in the phase of development. And it is a high-risk decision to invest in them too. Like for example, “É by Nescafé” ! Nestle aims to revolutionize coffee-making with this new smart coffee maker.

Source: enescafe.in

Products under this category are not expected to bring in any significant capital. So future investment is seen as a wastage by firms, it could be invested in a Question mark or Star category instead.

I believe Nestle Milo and Koko Crunch can be put in this category. They did not have any significant grasp in the market.

Source: Nestle.com

Its time to dig deeper. Let’s see how Nestle “milked” their Cash-Cow Maggi!!

Maggi- Milking the Cash cow!

Source: nestle.in

Do you know how has Nestle uses this as an opportunity?

Let me tell you some sad facts first. Nielsen points out that 85% of all consumer packaged goods (CPG) product launches flop.

Yet, Nestle never steps back from launching new products. And what’s a better way to do that than launching under the safety-net of “Maggi” brand?

Firstly, new variants of existing product lines have more chances of surviving out. Secondly, if gaining popularity then same distribution channels can be used, without extra efforts. And thirdly, analysts have noticed that Nestle doesn’t even feel the need to advertise them.

And lastly, as consumer already love Maggi’s brand, they hardly spend time for purchase decisions.

Now, the next segment is to know what strategy to follow, based on the growth-share matrix??

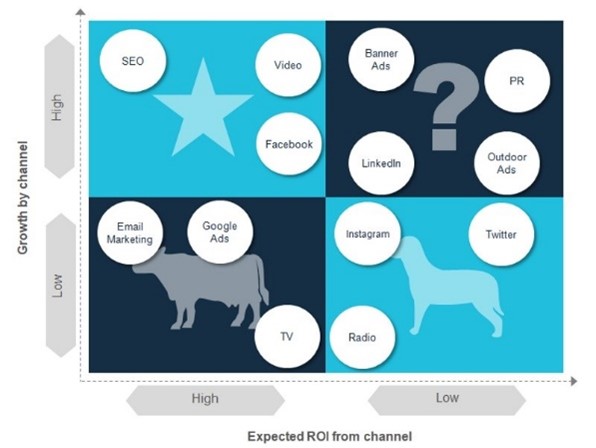

What Next to do with the Growth-Share Matrix?

We can use this matrix to decide on multiple fronts. Starting from resource allocation to utilization of marketing channels or platforms.

It can help grow a company’s expected ROI per channel. Now, it may vary for different B2B and B2C businesses and even across industry sectors.

For instance, high growth and high returns, investing in organic search (SEO) may be a good choice. At the other end of the scale, we have not witnessed companies growing exponentially and achieving high ROI as a result of Twitter alone.

Source: yewbiz.com

You can apply different strategy according to the quadrant you are in. The above image summaries a generic trend followed in the industry.

For understanding how the resource allocation is decided by firms do read our article on BCG matrix of ITC .

It tells you about how the matrix can help you to understand which resource allocation-strategy to use for which category. The strategies that are used by marketers are- Build, Hold, Harvest and Divest.

Case Analysis Blueprint Course

Use marketing frameworks like these to solve business case studies with ease

Frameworks like the BCG framework are extremely crucial to analyze the most complex case studies. Get to know how to analyze a marketing case study comprehensively in just 5 slides. Which means that the next time you need to analyze a case, you know exactly how to ace the case

We learnt why companies need a BCG matrix and what it is. Why it's such an essential tool for marketers.

We created The BCG Matrix of Nestle, keeping its broad product portfolio in mind. We identified the Matrix's various components, namely- Star, Cash Cow, Question Mark and Dog.

Next, we analysed how Nestle “milked” a cash cow- Maggi. Since Maggi is a well-know brand, hopefully this article provided a lucid clarity on how Nestle benefits from it.

And then we can see how can the matrix be used in order to decide where to invest and what platform to use, according to the quadrant.

Hope this article helped you!

You May Also Like

Segmentation and Targeting Success story at BMW In 2001, BMW came up with a video marketing campaign that was not targetted at any of its customer segments. It was targeted at another segment, not the customers of BMW. Find out who did BMW really target?

The Ansoff Matrix – identify your next growth strategy When you are seeking business growth, should you create new products or venture into a new market. Or, do both? The Ansoff Matrix helps you take that decision for your business growth

What is Transnational Strategy in International Business? Why are most of the offerings at a McDonald's in India are different from a McDonald's at Singapore and even more different from a McDonald's in China. And yet, why everything about their food, their ambiance and their promise to you feels exactly the same? These are some characteristics of a Transnational Strategy on display. Read on to know more about what is Transnational Strategy and how can a brand adopt it.

Yes Bank Transformation – BookMyShow Case Study (2018) With only a few days left for the finally submission of the Yes Bank case study, I bring to you key insights for the BookMyShow case study.

Price Adaptation Strategies – How to Modify Your Pricing Models What are Price Adaptation Strategies? What are the various approaches to Pricing? Learn about Price Adaptation Strategies in Marketing with Examples and be ready with all Pricing Concepts engraved in your mind for when you end up with a job as a Marketer.

Why do prices end in 99? Almost everyday at different places, you would have seen that prices of different things end in 99 or 9. We all have seen those prices and some of us even understand why would a shop owner price something like that. But, in this article, I will share with you the science and logic behind why do prices end in 99. I will also share with you the history of where and how it started. Read on.

About the Author: Surabhi Bhuyan

- Calculators

- Swot Analysis

- Pestle Analysis

- Five Forces Analysis

- Organizational Structure

- Copywriting

- Research Topics

- Student Resources

Services We Provide

Resources We Provide

Login / Register

- How to Apply BCG Matrix as a Powerful Strategic Planning Tool?

The contemporary corporate world as we see is getting enormously competitive with each passing day. Besides, businesses are trying their best to compensate for the losses incurred by the unfortunate COVID-19 crisis that has gripped the world for more than two years now. Having said that, businesses are revamping their strategies and approaches to edge past their competitors.

This is where strategic planning and strategic management come into the picture. Each business has its unique vision and mission statements that it pursues in an uncompromising manner. Further, the vision and mission of a company inspire strategic long-term goals that are planned, executed, and measured with great efficiency. Needless to say, it takes a lot of research, analysis, and brainstorming to craft strategic plans that can add value to an organization.

Table of Contents

- Introduction

BCG Matrix Definition

- Application of BCG Matrix

- McDonald’s BCG Matrix

- Toyota BCG Matrix

- Reckitt and Benckiser BCG Matrix

For that, business leaders use effective strategic planning tools and models like PESTLE Analysis, SWOT Analysis, VRIO Analysis, and other models subject to the purpose of strategic analysis. Furthermore, organizations rely on an effective change management process to optimize their strategic plans by bringing positive changes.

If we look at it from the perspective of assessing the competitive positioning of a company’s products and services, the BCG Growth Matrix is an excellent analysis model applied by businesses to gauge the success of their product lines.

In this thoughtful article, we delve deep into the various layers of the BCG Growth Matrix to understand the importance of the model and also effective application of it. The subsequent sections present an elaborative description of all aspects linked to the BCG Matrix.

The BCG growth share matrix was proposed by the Boston Consulting Group in 1970 as a strategic planning model to visualize the success of a company’s products or services. To elaborate, the matrix uses graphical representations of products and services to help the top management identify which products perform the best and the ones that are underperforming. Consequently, the company can undertake effective planning in terms of backing products with greater investments, discontinuing the loss-making products, or altering the product portfolio. The BCG Matrix template is illustrated below.

To elucidate, the graphical representation of products and services in the BCG Matrix plots market share on the horizontal axis and the rate of growth on the vertical axis respectively. The matrix classifies products and services into the following four classifications also known as the 4 squares in the BCG Matrix Template.

- Question Marks

Given below is an elucidation of each of these classes of products or services.

“Stars” Category

The products in the “Stars” category are the best performing products in terms of revenue generation, profitability, market share, and market growth. These products offer very high returns on investment and create great opportunities to explore new markets and scale in emerging economies. These can also be seen as the best-performing assets of a business.

Market Share: High

Market Growth Rate: High

Significance in strategic planning: With respect to strategic planning aligned with a company’s vision, the star products are of great significance. In fact, they closely follow the 80-20 Rule as more than 80 percent of revenue generation comes from these 20 percent products in the entire product line of a business. Having said that, companies should plan to add value to these products, invest more funds in these products and promote them with the most effective marketing strategies. With these products, companies can penetrate new markets in a worthwhile manner and offer higher profitability.

“Question Marks” Category

The next category includes products or services that have the potential to attain an impressive market share but in the current scenario, the market for these products has considerable uncertainties. To explain, there is a lack of certainty creating doubts about whether the market will decline in the future or scale. Besides, these products also utilize a large amount of a company’s cash as the market share is low and market growth is high. It may also be the case that these products might be using the largest share of the company’s resources and expertise.

Market Share: Low

Significance in strategic planning: From the viewpoint of strategic planning, the performance of products in this quadrant needs to be tracked in a continuous manner with well-defined key performance indicators. The company should evaluate the products closely to decide if the products needed to be continued. Besides, the company needs to plan effective strategies to reduce costs going into these products and to transform them into products offering unique propositions.

“Cash Cows” Category

The third category in the BCG Matrix includes “Cash Cows” which are basically the products that generate consistent cash flow for a business. To elaborate, these are the products that have a large market share and are well-established in consumer perception. With these products, companies can sustain their cash flows and evaluate growth in a convenient way as their growth patterns are highly predictable.

Market Growth Rate: Low

Significance in strategic planning: Business leaders and strategic analysts need to find ways in which they can take advantage of the presence of these products in mature markets and hence, convert them into star products.

“Dogs” Category

Products in this category have low penetration in the market and the market growth is low as well. To elaborate, these products can lead to cash traps for companies as they draw high investments but have little to no growth adding to potential losses.

Significance in strategic planning: In terms of strategic planning, identifying products in the “dogs” category will help companies to decide on discontinuation of products and disinvestment to get out of the cash traps.

Going further, let us now comprehend how the BCG Growth Matrix can be applied in a stepwise manner. The ensuing section provides details of an effective application of the model.

Stepwise Application of BCG Growth Matrix

Organizational leaders and analysts can apply the BCG Matrix by following the steps cited below for optimized strategic planning and execution.

Defining the market

The first and foremost step while applying the BCG Matrix is to clearly define the market in which the products or services are being analyzed. Defining the market clearly will further establish the context of the analysis. Here, it is imperative to note that defining the market incorrectly will have drastic consequences in terms of the classification of products as per the above-mentioned criteria. To explain, the implications will be largely different when Apple iPhones are evaluated in the premium smartphone market and when the same is assessed in the budget-friendly smartphone market. This example clearly illustrates that defining the market in a wrongful manner can lead to misleading results.

Evaluate market share

As mentioned above, the graphical representation illustrated in the BCG Matrix plots relative market share on the horizontal axis. Hence, the next step in applying the BCG Matrix is to evaluate the relative market share.

To find relative market shares for plotting the BCG Matrix, you can apply the following formula.

Relative Market Share: Brand’s market share/ Market share of the largest competitor in the industry

Evaluate market growth rate

The next step is to evaluate market growth as the vertical axis of the BCG matrix plots market growth. For finding the projections and current positions in terms of market growth, various factual reports are available on the internet that can be used to scan relevant data. What is highly important is to rely on credible sources of data and information.

Having evaluated the relative market share and the market growth rate, the next step is to plot units on the BCG Matrix with a market share on the vertical axis and market growth on the horizontal axis.

As you can see, it is quite simple to use the BCG Matrix for effective strategic planning with respect to an organization’s goals and SMART Objectives. Next, to get further clarity on the application of the matrix, let us apply this model to some real organizations to evaluate BCG Matrix examples.

BCG Matrix Examples With Application To Real Companies

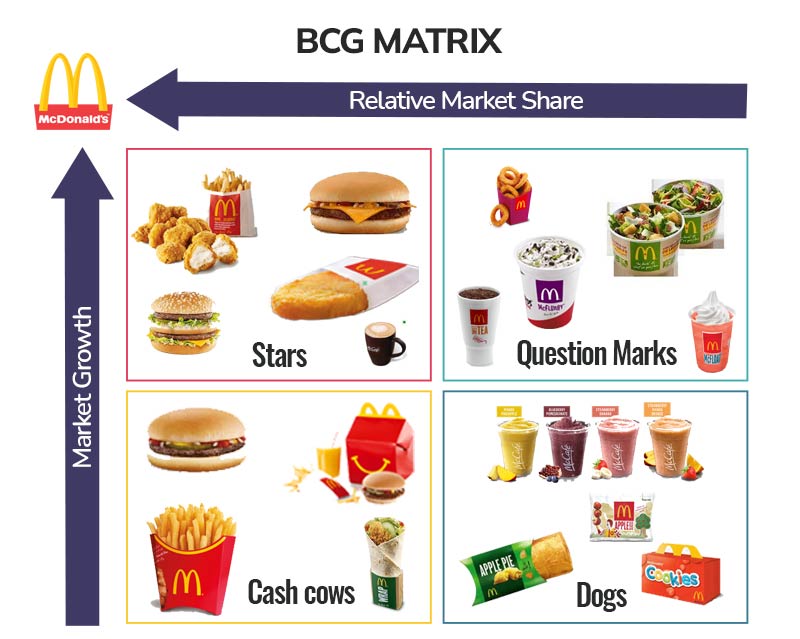

Bcg growth matrix of mcdonald’s.

McDonald’s as we know is one of the leading quick-service restaurant brands with a massive global presence. The BCG Matrix of McDonald’s (in the Australian Market) will assess the product offerings of the company as per market share and market growth. The segmentation of McDonald’s products into the four quadrants of the BCG Matrix is illustrated below.

Defined Market: Australia

McDonald’s Star Products

The star products are those that have a large market share amid incremental market growth. For McDonald’s Australia, its star products as per Dailymail include Cheeseburgers, Golden Hash Brownies, Big Mac Beef Burger, McNuggets, and McCafe Cappuccino.

McDonald’s Question Mark Products

These are the products that have a low market share. For McDonald’s Australia, the category of “question market products” includes onion rings, green salads, McFlurry, desserts, and teas.

McDonald’s Cash Cows

These are the products with relatively lesser market share in comparison to star products but these products generate regular cash flow. For McDonald’s Australia, the cash cows include french fries, beef burgers, happy meals, and wraps.

McDonald’s Dogs

Apple pie, apple slices, frozen cold drinks, and cookies fall in the Dogs category for McDonald’s Australia. McDonald’s should look to discontinue these products as the market growth is very low and the market share is also next to negligible.

An illustration of McDonald’s Australia BCG Matrix is presented below

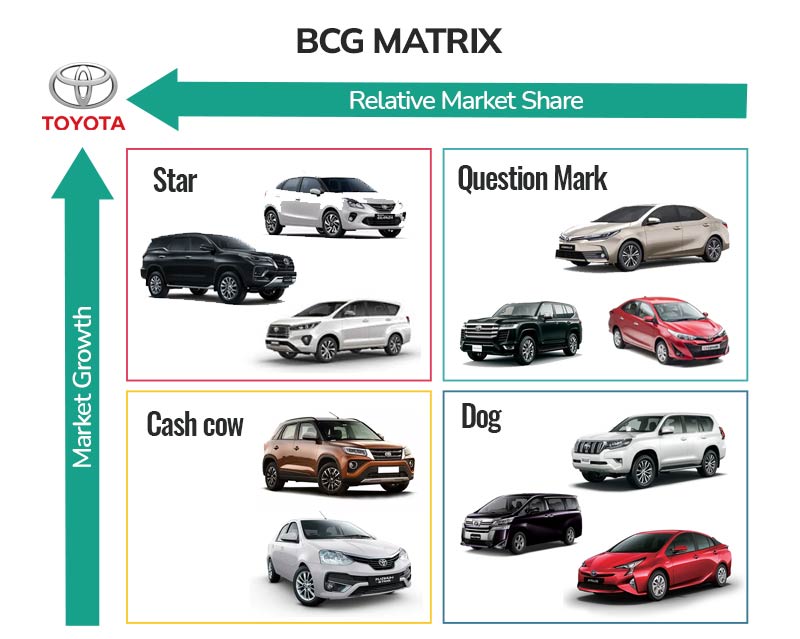

BCG Growth Matrix of Toyota

Toyota is a globally successful Japanese automotive manufacturer that has a dominant presence in different parts of the world. In fact, with a brand value worth $ 59.5 billion, Toyota tops the list of the world’s most valuable automotive brands . Given below are the BCG matrix quadrant divisions of Toyota with respect to the Indian Market.

Defined Market: India

Toyota’s Star Products

With respect to the Indian market, Toyota’s star products that have a high market share include Innova Crysta, Glanza, and Fortuner primarily as per Statista. These products are offering a high ROI to the company in the Indian market and helping the brand gain competitive advantages.

Toyota’s Question Mark Products

In this category, for Toyota, the cars with an uncertain future for their segments include Yaris, Corolla, and Land Cruiser. Potentially, these are great cars with luxury features but there are large uncertainties that prevail.

Toyota’s Cash Cows

Toyota Etios and Urban Cruiser are the cash cows for Toyota in the Indian market and if these cars are optimized in terms of features, safety, and other specifications, they do have the potential to emerge as cash cows in the middle-income segment that forms the largest section of car consumers in India.

Toyota’s Dogs

With respect to the Indian automotive market, Toyota Prius, Toyota Prado, and Toyota Vellfire are the cars that Toyota should look to discontinue in India.

An illustration of Toyota’s BCG Matrix with respect to the Indian market is presented below

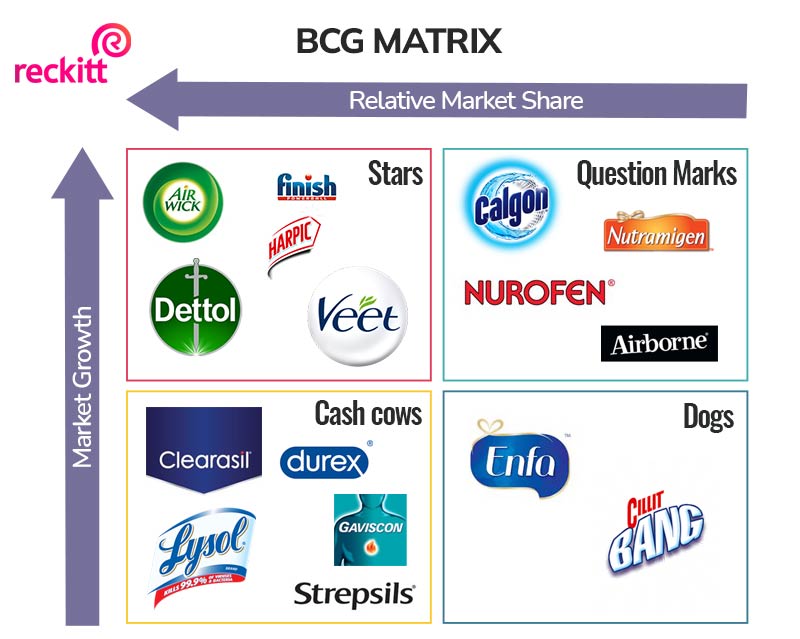

BCG Growth Matrix of Reckitt Benckiser’s Brands

Reckitt and Benckiser is a British consumer goods company with its operations spread all across the globe. Further, Reckitt and Benckiser Group has various brands under its conglomerate. The BCG matrix illustrated below sheds light on the classification of the group’s brands in the European market.

Defined Market: European Market

Reckitt and Benckiser’s Star Brands

These are the brands that offer the highest returns to the company in terms of cash flow and market penetration. For the company, its star brands include Finish, Airwick, Dettol, Veet, and Harpic. As per insights from Reuters , Finish, Veet, Airwick and Harpic generate around 70 percent sales for the company.

Reckitt and Benckiser’s Question Mark Brands

For Reckitt and Benckiser, the brands that have a rather uncertain future include Airborne, Nurofen, Calgon, and Nutramigen.

Reckitt and Benckiser’s Cash Cows

Brands inclusive of Vanish, Durex, Strepsils, Clearasil, Lysol, Gaviscon, and are the cash cows for Reckitt and Benckiser. These products have fixed cash flow patterns and generate regular revenue for the brand being essential products.

Reckitt and Benckiser’s Dogs

The brands that the company should possibly look to discontinue include Enfa and Cillit Bang.

An Illustration of Reckitt and Benckiser’s Brands BCG Matrix Is Given Below

To conclude, the BCG Growth matrix is a highly influential strategic planning tool that helps companies understand which products in the product line are aligned with the strategic vision of the company. Having said that, companies can plan to boost investments in the outperforming products, improve the performance of products with considerable market share and disinvest in products of brands that are liabilities for the company.

What are the limitations of the BCG Matrix?