Insurance Sector in India, Objective, Reforms, Regulators

Insurance sector in India provides financial protection through a wide range of insurance products & services. Read all about Insurance Sector in India, Objective, Regulators, Reforms for UPSC exam.

Table of Contents

Insurance Sector in India

The Insurance Sector in India is a vital part of the country’s financial industry, offering a diverse range of insurance products and services to mitigate risks and provide financial protection. It is regulated by the Insurance Regulatory and Development Authority of India (IRDAI) to ensure fairness and stability.

India’s insurance sector has grown significantly, covering life, health, motor, and property insurance, among others. Life insurance, particularly, is prominent and caters to long-term savings and protection needs. Other major insurance Public Sector Undertakings (PSUs) in India include New India Assurance Company Limited, Oriental Insurance Company Limited, National Insurance Company Limited, and United India Insurance Company Limited.

Public and private insurers operate in India, with private companies gaining market share through innovation and customer-centric approaches alongside traditional public sector companies like LIC. Regulatory reforms have enhanced transparency, customer protection, and competition, while digital platforms have improved accessibility and streamlined claims processes.

The insurance sector contributes to economic development by channelling funds into infrastructure projects and other investments, and it provides crucial financial security during uncertain times for individuals and families.

Read about: Government Schemes

Growth of Insurance Sector in India

The evolution of the Insurance Sector in India can be traced back to the early 19th century when British colonial rulers introduced insurance practices in the country. Here is a precise timeline of the key milestones in the history of the insurance sector in India:

These milestones reflect the progressive development of the insurance sector in India, from its early beginnings as a colonial institution to a diverse market with a mix of public and private players, catering to the evolving needs of the Indian population.

Read about: Planning Commission

Regulator of Insurance Sector in India

The Insurance Regulatory and Development Authority of India (IRDAI) is the regulatory body responsible for overseeing and regulating the insurance sector in India. Here is a precise description of the IRDAI, including its formation, the committee that recommended its establishment, and its significant achievements over the years:

Formation and Reason for Formation

The IRDAI was formed in 1999 following the recommendations of the Malhotra Committee, which was established in 1993 to examine and propose reforms for the Indian insurance sector. The committee emphasized the need for an autonomous and independent regulatory authority to protect the interests of policyholders, ensure fair practices, promote competition, and foster the growth of the insurance industry sustainably.

Read about: List of Beti Bachao Beti Padhao Scheme

Reforms in Insurance Sector in India

Several reforms have been undertaken in the Indian insurance sector to promote growth, enhance transparency, and improve customer protection. Here are some key reforms along with the years they were implemented:

Read about: Important Schemes of Indian Government

Insurance Sector in India UPSC

The Insurance Sector in India holds importance for UPSC aspirants due to its relevance to the UPSC Syllabus . Understanding the sector is crucial for topics such as Indian Economy and General Studies (GS) Paper-III. UPSC Online Coaching and UPSC Mock Test focused on the insurance sector aid aspirants in preparation. The sector’s role in mobilizing funds, supporting infrastructure projects, and providing financial stability highlights its significance in the national economy.

Read about: Five Year Plans of India

Sharing is caring!

Insurance Sector in India FAQs

What is insurance sector in india.

The insurance sector in India refers to the industry that provides various insurance products and services to individuals and businesses for risk mitigation and financial protection.

How big is insurance industry in India?

The insurance industry in India is substantial, with a total market size of billions of dollars.

Is insurance sector growing in India?

Yes, the insurance sector in India is growing steadily, witnessing an increase in the number of players, policies, and market penetration in recent years.

Why insurance is called an industry?

Insurance is called an industry because it involves multiple companies operating in a competitive market, offering a range of insurance products and services to customers.

What is insurance sector called?

The insurance sector is commonly referred to as the insurance industry.

Who controls insurance sector?

The Insurance Regulatory and Development Authority of India (IRDAI) controls and regulates the insurance sector in India

I, Sakshi Gupta, am a content writer to empower students aiming for UPSC, PSC, and other competitive exams. My objective is to provide clear, concise, and informative content that caters to your exam preparation needs. I strive to make my content not only informative but also engaging, keeping you motivated throughout your journey!

Leave a comment

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- UPSC Online Coaching

- UPSC Exam 2024

- UPSC Syllabus 2024

- UPSC Prelims Syllabus 2024

- UPSC Mains Syllabus 2024

- UPSC Exam Pattern 2024

- UPSC Age Limit 2024

- UPSC Calendar 2024

- UPSC Syllabus in Hindi

- UPSC Full Form

Recent Posts

- UPPSC Exam 2024

- UPPSC Calendar

- UPPSC Syllabus 2024

- UPPSC Exam Pattern 2024

- UPPSC Application Form 2024

- UPPSC Eligibility Criteria 2024

- UPPSC Admit card 2024

- UPPSC Salary And Posts

- UPPSC Cut Off

- UPPSC Previous Year Paper

BPSC Exam 2024

- BPSC 70th Notification

- BPSC 69th Exam Analysis

- BPSC Admit Card

- BPSC Syllabus

- BPSC Exam Pattern

- BPSC Cut Off

- BPSC Question Papers

IB ACIO Exam

- IB ACIO Salary

- IB ACIO Syllabus

CSIR SO ASO Exam

- CSIR SO ASO Exam 2024

- CSIR SO ASO Result 2024

- CSIR SO ASO Exam Date

- CSIR SO ASO Question Paper

- CSIR SO ASO Answer key 2024

- CSIR SO ASO Exam Date 2024

- CSIR SO ASO Syllabus 2024

Study Material Categories

- Daily The Hindu Analysis

- Daily Practice Quiz for Prelims

- Daily Answer Writing

- Daily Current Affairs

- Indian Polity

- Environment and Ecology

- Art and Culture

- General Knowledge

- Biographies

IMPORTANT EXAMS

- Terms & Conditions

- Return & Refund Policy

- Privacy Policy

- Screen Reader

- Skip to main content

- Text Size A

- Language: English

Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

India Organic Biofach 2022

Gulfood dubai 2023, indian insurance industry overview & market development analysis, the indian insurance market is expected to reach us$ 200 billion by 2027 and the country is the ninth-largest life insurance market globally., advantage india, robust demand.

* As per the Insurance Regulatory and Development Authority of India (IRDAI), India will be the sixth-largest insurance market within a decade, leapfrogging Germany, Canada, Italy and South Korea.

* The regulatory developments would furthermore contribute to the growth.

* The recent pandemic has emphasized the importance of healthcare on the economy, and health insurance would play a critical role in the effort to strengthen the healthcare ecosystem.

Attractive Opportunities

* Insurance market in India is expected reach US$ 222 billion by 2026.

* Robotic Process Automation (RPA) and AI will occupy center stage in insurance, driven by newer data channels, better data processing capabilities and advancements in AI algorithms.

* Bots will become mainstream in both the front and back-office to automate policy servicing and claims management for faster and more personalized customer service.

Policy support

* The government’s flagship initiative for crop insurance, Pradhan Mantri Fasal Bima Yojana (PMFBY), has led to significant growth in the premium income for crop insurance.

* Ayushman Bharat (Pradhan Mantri Jan Arogya Yojana) (AB PMJAY) aims at providing a health cover of 5 lakh per family per year for secondary and tertiary care hospitalization.

* Insurance cover for 44.6 crore persons under PM Suraksha Bima and PM Jeevan Jyoti Yojana was provided during the FY23.

Increasing Investments

* As announced in November 2023, Zurich Insurance Group is set to acquire a majority stake in Kotak General Insurance, marking the first major foreign investment in India's insurance sector in eight years.

* The IPO of LIC of India was the largest IPO ever in India and the sixth biggest IPO globally in 2022.

Insurance Industry Report

Introduction.

India’s Insurance industry is one of the premium sectors experiencing upward growth. This upward growth of the insurance industry can be attributed to growing incomes and increasing awareness in the industry. India is the fifth largest life insurance market in the world's emerging insurance markets, growing at a rate of 32-34% each year. In recent years the industry has been experiencing fierce competition among its peers which has led to new and innovative products within the industry. Foreign Direct Investment (FDI) in the industry under the automatic method is allowed up to 26% and licensing of the industry is monitored by the insurance regulator the Insurance Regulatory and Development Authority of India (IRDAI).

The insurance industry of India has 57 insurance companies - 24 are in the life insurance business, while 34 are non-life insurers. Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company. There are six public sector insurers in the non-life insurance segment. In addition to these, there is a sole national re-insurer, namely General Insurance Corporation of India (GIC Re). Other stakeholders in the Indian Insurance market include agents (individual and corporate), brokers, surveyors and third-party administrators servicing health insurance claims.

The insurance industry has undergone numerous transformations in terms of new developments, modified regulations, proposals for amendments and growth in 2022. These developments have opened new avenues of growth for the industry while ensuring that insurers stay relevant with changing times and the latest digital disruptions.

The Insurance Regulatory and Development Authority India (IRDA) is vigilant and progressive and is determined to achieve its mission of ‘Insurance for all by 2047’, with aggressive plans to address the industry’s challenges.

The growth of the insurance market is being supported by important government initiatives, strong democratic factors, conducive regulatory environment, increased partnerships, product innovations, and vibrant distribution channels.

Insurance Industry was largely dominated by offline channels like corporate agents, offline brokers or banks. Today, rapid digitization, product innovation and progressive regulation policies have made it possible for consumers to buy insurance through multiple distribution channels with the click of a button. The instability of the covid-19 pandemic highlighted the necessity for consumers to invest in products that would increase financial security, one of them being life insurance.

Market Size

The insurance industry in India has witnessed an impressive growth rate over the last two decades driven by the greater private sector participation and an improvement in distribution capabilities, along with substantial improvements in operational efficiencies.

In FY24 (until September 2023), non-life players’ saw a premium income increase by 14.86% year-over-year to Rs. 1,43,802 crore (US$ 17.29 billion) due to strong demand for health and motor policies.

The Indian non-life insurance industry logged 14.86% growth during the first half of FY24 as compared to 15.30% growth for the same period the previous year. The business growth for the first half of FY24 was driven by health (especially the group segment), motor, and crop insurance.

In April-November 2023, life insurers’ new business premiums grew to Rs. 211,690.65 crore (US$ 25.38 billion), according to Life Insurance Council data.

The premium in the month of March 2023 for the private life insurance industry grew at a healthy pace of 35% on a year-on-year basis and 20% for FY23.

Life insurance firms collected 18% more premiums in FY23 compared to the year before. Life insurers collected Rs. 3.71 lakh crore (US$ 44.85 billion) as the first-year premium in FY23 as against Rs. 3.14 lakh crore (US$ 37.96 billion) in FY22, shows the latest IRDAI data.

Mr. Debashish Panda, Chairman, IRDAI informed that the insurance industry of India has become a Rs. 59 crore (US$ 7.1 million) industry as of February 2023.

Driven by a pick-up in health and motor insurance segments, the non-life insurance industry has grown by 16.4% in FY23 compared to 11.1% in the previous year.

Among the private players, SBI Life, HDFC Life and ICICI Prudential Life led the industry in premium collection. SBI Life collected Rs. 29,587 crore (US$ 3.57 billion) premium in FY23 while HDFC Life and ICICI Prudential Life received Rs. 28,876 crore (US$ 3.48 billion) and Rs. 16,921 crore (US$ 2.04 billion), respectively.

As expected, the state-run insurance behemoth LIC alone contributed over 60% to the total new business premium collection. The insurer received close to Rs. 2.31 lakh crore (US$ 27.93 billion) as premium in FY23 compared to Rs. 1.99 lakh crore (US$ 24.06 billion) in FY22.

Among the private players, SBI Life, HDFC Life and ICICI Prudential Life led the industry in premium collection. SBI Life collected Rs. 29,600 crore (US$ 3.58 billion) premium in FY 2023 while HDFC Life and ICICI Prudential Life received Rs. 28,900 crore (US$ 3.49 billion) and Rs. 17,000 crore (US$ 2.05 billion), respectively.

According to the latest data released by the insurance regulator – the Insurance Regulatory and Development Authority of India - LIC improved its market share by 67.72% as of October, a gain of 447 basis points (bps). At the end of 2021-22, private players had a 36.75% share of the life insurance market, while LIC had 63.25%.

With nearly 62.58% of the new business market share in FY23, Life Insurance Corporation of India, the only public sector life insurer in the country, continued to be the market leader.

In FY23, non-life insurers (comprising general insurers, standalone health insurers and specialized insurers) recorded a 16.4% growth in gross direct premiums.

In India, gross premiums written off by non-life insurers reached US$ 10.95 billion in FY24* and US$ 31 billion in FY23.

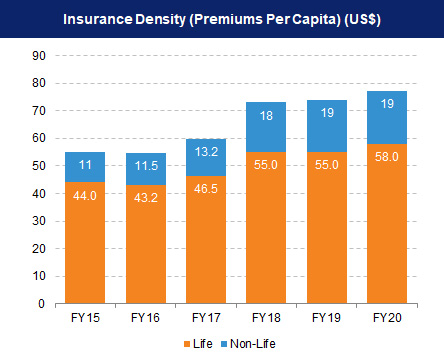

The life insurance industry was expected to increase at a CAGR of 5.3% between 2019 and 2023. India’s insurance penetration was pegged at 4.2% in FY21, with life insurance penetration at 3.2% and non-life insurance penetration at 1.0%. In terms of insurance density, India’s overall density stood at US$ 78 in FY21.

Premiums from India’s life insurance industry is expected to reach Rs. 24 lakh crore (US$ 317.98 billion) by FY31.

Between April 2021-March 2022, gross premiums written off by non-life insurers reached Rs. 220,772.07 crore (US$ 28.14 billion), an increase of 11.1% over the same period in FY21. In May 2022, the total premium earned by the non-life insurance segment stood at Rs. 36,680.73 crore (US$ 4.61 billion), a 24.15% increase compared to the previous year’s period. The market share of private sector companies in the general and health insurance market increased from 48.03% in FY20 to 49.31% in FY21 to 62.5% in FY23. Six standalone private sector health insurance companies registered a jump of 66.6% in their gross premium at Rs 1,406.64 crore (US$ 191.84 million) in May 2021, as against Rs. 844.13 crore (US$ 115.12 million) earlier.

According to S&P Global Market Intelligence data, India is the second-largest insurance technology market in Asia-Pacific, accounting for 35% of the US$ 3.66 billion insurtech-focused venture investments made in the country.

Investments and Recent Developments

The following are some of the major investments and developments in the Indian insurance sector.

- As announced in November 2023, Zurich Insurance Group is set to acquire a majority stake in Kotak General Insurance, marking the first major foreign investment in India's insurance sector in eight years.

- As announced in June 2023, Go Digit Life Insurance, in which both HDFC Bank and Axis Bank have bought stakes, plans to invest Rs. 500-600 crore (US$ 60.3-72.4 million) in the initial 18 months to start out as the country's 26th life insurer.

- As informed in September 2023, the UK and India have agreed to launch a partnership to boost cross-market investment by the insurance and pension sectors.

- In August 2023, Tata AIA launched a ULIP plan with benefits of critical illness cover- Tata AIA Pro Fit.

- With the introduction of new private sector companies, the insurance sector in India gained momentum in the year 2000.

- India allowed private companies in insurance sector in 2000, setting a limit on FDI to 26%, which was increased to 49% in 2014 and further increased to 74% in the Union Budget (Feb’21).

- The market share of private sector companies in the non-life insurance market rose from 15% in FY04 to 49.3% in FY21.

- Private insurers like HDFC, ICICI and SBI have been some tough competitors for providing life as well as non-life products to the insurance sector in India.

- The IPO of Life Insurance Corporation (LIC) of India was the largest IPO ever in India and the sixth biggest IPO globally of 2022. As of November 2022, listing of LIC accounted for more than a third of resources mobilised in the primary equity market until November 2022.

- Insurance market in India is expected reach US$ 222 billion by 2026.

- Robotic Process Automation (RPA) and AI will occupy center stage in insurance, driven by newer data channels, better data processing capabilities and advancements in AI algorithms.

- Bots will become mainstream in both the front and back-office to automate policy servicing and claims management for faster and more personalized customer service.

- Insurers can now launch new health insurance products without IRDAI’s nod. Earlier the flexibility was given for group insurance products but now retail products have also come under the new norms.

- The insurance industry is expected to use this opportunity for introduction of customized and innovative products, expansion of the choices available to the policyholders in order to address the dynamic needs of the market, which will further help in enhancing the insurance penetration in India.

- Bajaj Allianz Life Insurance, a private life insurer, has entered into a strategic partnership with City Union Bank, one of the oldest private sector banks in India. This partnership will help the private life insurer offer a wide array of life insurance solutions to the bank’s existing and future customers, across their 727 branches.

- In October 2022, Policybazaar's PBPartners launches its mobile app to facilitate the ease of insurance business for its advisors digitize their insurance business.

- Canara HSBC Life Insurance launched its‘Canara HSBC Life Insurance App’ on the 75th Independence Day of India. The app, available on android, iOS devices and web portal, offers access to policy details, the option to receive timely alerts, pay the premium, and track fund value among others.

- ICICI Lombard and Airtel Payments bank have entered into a partnership for providing cyber insurance in February 2022.

- Probus Insurance receives US$ 6.7 million in funding from a Swiss impact fund in December 2021.

- Companies are trying to leverage strategic partnership to offer various services as follows:

- In November 2021, ICICI Lombard collaborated with Vega to provide a personal accident insurance cover with every online Vega helmet purchase to increase road safety awareness among customers.

- In November 2021, ICICI Prudential Life Insurance partnered with NPCI Bharat BillPay, a subsidiary of National Payments Corporation of India (NPCI), to offer ClickPay feature to its customers.

- In November 2021, the Competition Commission of India (CCI) approved HDFC Life Insurance’s acquisition of 100% shareholding in Exide Life Insurance. The move is expected to strengthen HDFC Life’s position in South India.

- In November 2021, Willis Towers Watson acquired the remaining 51% shares in WTW India, taking the company’s holding in WTW India to 100%.

- In November 2021, Acko, a digital insurance start-up, raised US$ 255 million in funds, taking the company’s valuation to ~US$ 1.1 billion.

- In September 2021, ZestMoney raised US$ 50 million to enter new business opportunities in the insurance sector.

- In August 2021, PhonePe announced that it has received preliminary approval from IRDAI to act as a broker for life and general insurance products. As a result, the company can now offer insurance advice to its 300+ million users.

- In FY21, LIC achieved a record first-year premium income of Rs. 56,406 crore (US$ 7.75 billion) under individual assurance business with a 10.11% growth over last year.

- In FY23, non-life insurers (comprising general insurers, standalone health insurers and specialized insurers) recorded a 16.4% growth in gross direct premiums. In India, gross premiums written off by non-life insurers reached US$ 31 billion in FY23 and US$ 17.29 billion in FY24 (until September 2023), from US$ 28.14 billion in FY22, driven by strong growth from general insurance companies.

- In August 2021, ICICI Prudential Life Insurance tied up with the National Payments Corporation of India (NPCI) to provide a unified payments interface autopay.

Government Initiatives

The Government of India has taken number of initiatives to boost the insurance industry. Some of them are as follows:

- The Union Budget 2023-24 has proposed to limit the income tax exemption on the proceeds of high value life insurance policies. Mooted as part of an emphasis on better targeting of tax concessions and exemptions, the proposal means that income from life insurance policies with an aggregate premium up to Rs. 5 lakh (US$ 6,075) will be exempt from taxation.

- The government’s flagship initiative for crop insurance, Pradhan Mantri Fasal Bima Yojana (PMFBY), has led to significant growth in the premium income for crop insurance.

- Ayushman Bharat (Pradhan Mantri Jan Arogya Yojana) (AB PMJAY) aims at providing a health cover of Rs. 5 lakh (US$ 6,075) per family per year for secondary and tertiary care hospitalization.

- Insurance cover for 44.6 crore persons under PM Suraksha Bima and PM Jeevan Jyoti Yojana was provided during FY23.

- In 2022, the Indian government plans to sell a 7% stake in LIC for Rs. 50,000 crore (US$ 6.62 billion). This is the largest initial public offering (IPO) in India.

- In November 2021, the Indian government signed an agreement with the World Bank for a US$ 40 million project to advance the qualities of health services in Meghalaya, including the state’s health insurance programme.

- In September 2021, the Union Cabinet approved an investment of Rs. 6,000 crore (US$ 804.71 million) into entities, offering export insurance cover to facilitate additional exports worth Rs. 5.6 lakh crore (US$ 75.11 billion) over the next five years.

- In August 2021, the Parliament passed the General Insurance Business (Nationalisation) Amendment Bill. The bill aims to allow privatisation of state-run general insurance companies.

- Union Budget 2021 increased FDI limit in insurance from 49% to 74%. India's Insurance Regulatory and Development Authority (IRDAI) has announced the issuance, through Digilocker, of digital insurance policies by insurance firms.

- Under the Union Budget 2021, Finance Minister Ms. Nirmala Sitharaman announced that the initial public offering (IPO) of LIC will be implemented in FY22, as part of the consolidation in the banking and insurance sector. Though no formal market valuation has been undertaken, LIC’s IPO has the potential to raise Rs. 1 lakh crore (US$ 13.62 billion).

- In June 2021, the government extended a Rs. 50 lakh (US$ 66.85 thousand) insurance coverage scheme for healthcare workers across India until the next one year.

- In February 2021, the Finance Ministry announced to infuse Rs. 3,000 crore (US$ 413.13 million) into state-owned general insurance companies to improve the overall financial health of companies.

- Under Union Budget 2021, fund of Rs. 16,000 crore (US$ 2.20 billion) has been allocated for crop insurance scheme.

The future looks promising for the life insurance industry with several changes in the regulatory framework which will lead to further changes in the way the industry conducts its business and engages with its customers. Life insurance industry in the country is expected to increase by 14-15% annually for the next three to five years. The scope of IoT in Indian insurance market continues to go beyond telematics and customer risk assessment. Currently, there are 110+ InsurTech start-ups operating in India. These startups are expected to provide a major boost to the industry and help increase India’s insurance penetration which plays a crucial role in the overall development of the country. In the past, the Indian government has played a crucial role in increasing the scope of the insurance sector through various policies and schemes. This trend will continue in the further through schemes like the Pradhan Mantri Fasal Bima Yojana (PMFBY) providing crop insurance and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) providing life insurance coverage to the youth at an affordable price. Schemes like these coupled with India’s demographic factors such as a growing middle class, young insurable population and growing awareness of the need for protection and retirement planning will support the growth of the Indian insurance sector.

Note: Conversion rate used for November 2023 is Rs. 1 = US$ 0.012,

*- New Business Premium Value is until November 2023, Renewable Premium Value in India is until March 2022 (FY21)

References: Media Reports, Press Releases, Press Information Bureau, Union Budget 2021-22, Insurance Regulatory and Development Authority of India (IRDA), Crisil, Union Budget 2023-24, Economic Survey 2022-23

Related News

Life Insurance Corporation of India (LIC) has been acknowledged as the foremost insurance brand, showcasing a stable brand value of US$ 9.8 billion.

Secretary of Department of Financial Services, Dr. Vivek Joshi reported that in the last nine years, the insurance sector has seen substantial foreign direct investment (FDI) totalling close to US$ 6.5 billion (Rs. 54,000 crore), propelled by the government's gradual easing of regulations concerning overseas capital inflow.

India's insurance sector is set to lead G20 growth with a projected 7.1% premium increase, fuelled by life and non-life segments, despite macroeconomic challenges.

Life insurers, led by LIC's robust performance, saw a 43.76% YoY surge in new business premiums in December 2023.

Life Insurance Corporation (LIC) intends to launch 3-4 products for FY24 and targeting double-digit growth in coming years, according to Mr. Siddhartha Mohanty, Chairman of LIC.

Insurance India

Industry Contacts

- General Insurance Corporation of India

- Life Insurance Corporation of India

- India - Insurance Regulatory and Development Authority (IRDA)

- Insurance Institute of India

- United India Insurance Company Ltd

Insurance Companies in India

Ibef campaigns.

APEDA India Pavilion Gulfood February 20th-26th, 2022 | World Trade Centre,...

Ibef Organic Indian Pavilion BIOFACH2022 July 26th-29th, 2022 | Nuremberg, ...

Promoting Indigenous Start-ups: Case Study of Investor Interest in Small-town Start-ups

As urban markets become saturated, investors are turning their gaze towards the untapped potential of small-town innovation, driven by a desire to fos...

India's White Revolution

The "White Revolution" in India refers to the successful implementation of Operation Flood, a dairy development program launched on January ...

The Growth of Ayurveda in India

Ayurveda, an ancient health system originating from India, has a longstanding history. It revolves around using plants and herbs to maintain health an...

India's Solar Power Revolution

India is leading the renewable energy revolution, with a strategic emphasis...

Empowering MSMEs: Fintech Solutions for Small Businesses in India

Micro, small, and medium enterprises (MSMEs) are the backbone of the Indian...

Unlocking India's Digital SME Credit Gap and Economic Potential

The Indian economy thrives on the contributions of the Micro, Small, and Me...

Not a member

ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: Insurance Sector In India

Essay details and download:.

- Subject area(s): Finance essays

- Reading time: 10 minutes

- Price: Free download

- Published: 9 June 2012*

- File format: Text

- Words: 2,619 (approx)

- Number of pages: 11 (approx)

Text preview of this essay:

This page of the essay has 2,619 words. Download the full version above.

Insurance Sector In India

The insurance sector in India has come to a position of very high potential and competitiveness in the market. Indians, have always seen life insurance as a tax saving device, are now suddenly turning to the private sector that are providing them new products and variety for their choice. The evidence of the enlargement of the market can be seen in various other parameters as well. It was also recognized that India has a vast potential that is waiting to be taped and this could be achieved when sufficient competition is generated and it is exposed to the development. Last decade experience of the public and private sector together opening in the insurance market plays a significant role in shaping the economy and at the same time strengthens the risk taking ability. It also has a great social significance. The Insurance sector has obviously started growing at a rapid place after the sector was opened up. The credit for enlarging the market should however goes to the private sector as they came up with an aggressive market strategy to establish their presence. The public sector has in its turn, redrawn its priorities, revamped their marketing strategy, and together the public and private sectors have enlarged the market. All these efforts have brought life insurance closer to the customer as made it more relevant. The insurance companies are increasingly tapping the semi-urban and rural areas to take across the message of protection of life through insurance cover. Looking back in the previous decade, one can be reasonable of the period of the strides made by the insurance industry. Recognition of the benefits of foreign participation to the Indian economy and consumers is at the heart of the Indian Finance Ministry and IRDA’s support for a proposal now before the Indian Parliament to increase the foreign investment limit in the insurance sector from 26 per cent to 49 per cent. This increase will allow insurance companies to absorb new capital, which will facilitate industry expansion, the deployment of technical competencies, and the inflow of the latest products and services. Purpose of study: Main purpose of the study is to assess the socio-economic status of respondents and to examine the impact of status on insurance purchasing capacity. It empirically analyzes and assesses the relationship between income and investment in insurance policy. Its attempt to know about respondent’s basic reason behind insurance motive and to know day to day changes about insurance industry and what is the convenient source for getting insurance policies. The study also pointed out the private companies have huge task to play in creating awareness and credibility. The perceived benefits of buying a life policy range from security of income bulk return in future, daughter’s marriage, children’s education and good return on savings, in that order, the study adds. Review of Literature: There are various studies related to Insurance Sector in India and abroad. It was found that the numerous numbers of literatures is available on insurance industry and its various aspects. Few relevant reviews are discussed here under: Palli M. (2004), founds that in present scenario while boundaries between various financial products are innovating, people are looking not just at products, but at integrated financial solutions that can offer stability of returns along with total protection with flexible options, benefits unbundled and customized to suit their diverse need. Vijaykumar A. (2007), found that the need of the nation and its people has finally prevailed and privatization of insurance is now a reality towards further liberalization of the Indian economy. The success of the insurance industry will primarily depend upon meeting the rising expectations of the consumers who will be the king in the liberalized insurance market in future. Palande et al (2007), found that the present indications are that all economic actors are now in a mood to face the situation and have started preparing themselves for the challenges. The indications are that there is a bright future for the insurance industry in India. Sabera (2007), Indicated that the Government of India liberalized the insurance sector in March 2000, which lifted the entry restrictions for private insurance players, allowing foreign players to enter into the market and start their operations in India. The entry of private players helps in spreading and keeping the operation in the Indian insurance sector which in turn results in restructuring and revitalizing of public sector companies. Rao, C.S. (2007), reported that Insurance is a vital economic activity and there is an excellent scope for its growth in the emerging markets. The opening up of the insurance sector has raised high hopes among people both in India and abroad. The recent dettarification in the non-life domain has provided a great deal of operational freedom to the players. Arora & Mehta(2010), shown that Insurance companies will have to take initiative in educating people about the benefits of taking insurance and also they should come with more innovative and flexible plans so that the people are encouraged to take policies. If people aware of the insurance policy, they should understand the reality of why they are insured and should try to understand its essence. Selvakumar& Priyan (2010), found that insurance companies are increasingly taping the semi-urban and rural areas to take across the message of protection of life through insurance cover. Higher level of protection implies that customers are more conscious of the need for risk mitigation, grater security, and about the future of their dependents. Insurance sector has been evolving and improving its underwriting and risk management abilities.

After an intense review of literature (as above) and going through various available recording data, it can be safely asserted that- 1. Private players need to completely gear up to face the competition. Such competition will bring more benefits to the untapped customers in kinds of products and product range according to their needs. 2. By mobilizing significant long-term funds by contractual savings products, and investing them in diversified bonds and stocks, insurers help encourage the growth of debt and equity markets. 3. With India’s increased global market, Institutional investors, insurer pressure equity markets to adopt stronger corporate governance, rules and regulation quantify the greater transparency. Research Methodology: In this study evaluative research methodology has been applied. Primary Data were collected via paper questionnaires from existing customers of the insurance industry. The study is based on 255 random samples (policy-holders as respondents) which are collected from major cities of Utter-Pradesh with the help of questionnaire, group discussion and personal interview. For data analysis MS-Office (Execel-2007) has been used. Analysis and Results: Present study is based on respondents’ feedback and suggestions. Variables like income group, purpose of investments, medium of updating about insurance plans and convenient source for getting insurance policies, etc has been taken for the analysis which is shown in tables and figures. Investment Purpose: Investment in Insurance policy fulfilled so many purposes at a time. It may be financial compensation, family safety, tax rebate, risk cover and returns. Analysis done between Investment purpose and different income Ranges of the respondents. Purpose of investment of the respondents in insurance policies shown in below table-1. Table 1: Investment Purpose (N=255) Income Range ( In INR) Tax rebate Secure Retirement Financial Compensation Family Safety Risk cover Maximum Return Other Less than 50000 2 (1.80) 9 (17.65) 4 (17.39) 22 (16.92) 9 (13.43) 9 (14.75) 0 50000- 100000 3 (2.70) 12 (23.53) 3 (13.04) 21 (16.15) 8 (11.94) 10 (16.39) 0 100000-300000 59 (53.15) 13 (11.71) 7 (30.43) 49 (37.69) 34 (50.75) 20 (32.79) 1 (33.33) 300000-500000 35 (31.53) 14 (27.45) 7 (30.43) 30 (23.08) 11 (16.42) 13 (21.31) 2 (66.67) More than 500000 12 (10.81) 3 (5.88) 2 (8.70) 8 (6.15) 5 (7.46) 9 (14.75) 0 Source: Surveyed data Note: Data in parentheses is showing the percentage of actual data. Table 1 shows maximum respondents invests their money with the motive of tax rebate that is 53% and they falls in 100000-300000 Income Range. In the Income Range of 300000-500000 maximum 27% respondents getting insurance policy for securing their retirement. The maximum equally respondents with the motive of financial compensation that is 30% falls in 100000-300000 and 300000-500000 Income Range respectively. In the Income range of 100000-300000 maximum 38%, 51%, 33% and 33% respondents getting Insurance Policy for the motive of family safety, risk cover, maximum return and other purposes respectively. It shows maximum people getting insurance for tax rebate and family safety, so insurance companies should focus more innovative products as like child plan and pension plans etc. Medium of Updating about Insurance Plans: In the era of information many information providing agencies running throughout the world and everyone free to get information to various sources. Insurance Industry is not an exception of it. In this present study analysis has been done by taking Income Range as base and Medium of Information agency about insurance plans for the respondents. It shows in figure 1. Figure 1: Medium of Updating about Insurance Plans

Source: Surveyed data

Figure 1 depicts in every income range of respondents getting maximum information through Insurance advisor. News channel and newspaper also play an important role for getting information regarding insurance policy. After the increasing informative agency even today insurance agent is dominate all the information sources regarding insurance policy changes. Convenient Source for getting Insurance Plans: In present competitive scenario of the Insurance Industry 23 Life Insurance companies providing their services throughout the country. They provide their services through various distribution channels like Bank, Broker, and Insurance Agent etc. In study attempt to find out what is the most convenient source for getting insurance policy/product for customers. This analysis takes two variables Income group and various insurance policy provider agencies. It shows table 2. Table -2: Convenient Source for getting Insurance Plans (N=255) Income Range ( In INR) Insurance Agent Bank Financial Institutions Brokers Direct Insurance Company Other Less than 50000 21 (13.38) 12 (20.69) 4 (26.67) 0 4 (7.02) 0 50000-100000 21 (13.38) 11 (18.97) 2 (13.33) 2 (3.51) 14 (24.56) 0 100000-300000 67 (42.68) 25 (43.10) 4 (26.67) 1 (16.67) 21 (36.84) 0 300000-500000 36 (22.93) 8 (13.79) 5 (33.33) 1 (16.67) 11 (19.30) 1 (100) More than 500000 12 (7.64) 2 (3.45) 0 2 (33.33) 7 (12.28) 0 Source: Surveyed data Note: Data in parentheses is showing the percentage of actual data. Table-2 shows 43% respondent belongs to 100000-300000 Income Range. They prefer convenient source for getting insurance policy to Insurance Agent and bank both. In 300000-500000 Income Range maximum 33% respondents prefer to financial institutions for getting insurance and 33% respondents prefer to Broker for getting insurance they belongs from more than 500000 income range. In the Income Range 100000-300000 maximum 37% respondents prefer direct insurance company for getting their insurance need and 100% respondent who belongs from 300000-500000 income range prefer other sources for getting insurance products. It can be seen in figure 2. Figure 2: Convenient Source for getting Insurance Plans

Source: Surveyed data. Figure 2 depicts maximum customer prefer insurance agent as a most convenient sources for getting insurance policy products and bank get second preference regarding same. A very few customer wants to take insurance policy from financial institutions and brokers. After the involvement of various distribution channel in this field insurance agent is dominated factor for convent source for distributing insurance product. Thus insurance agents still remain the main source through which insurance products are sold. Findings: Socio-Economic Remarks: It was found that in post-liberalized-era, government service men of 26-45 age group population are more aware of buying insurance policy for several purposes. A major segment of age group below 25 years and more than 55 years, are not able to buy insurance plan. They cannot identify suitable products according to their need. Mostly urban educated graduates or post graduate people purchase maximum risk cover plans by insurance companies, as compared to others degree holders. Less number of the Intermediates passed respondents is under insurance covers because they are not able to get suitable products. The 4-6 family size is having maximum insurance policies as compared to other family sizes in the study area. Income Group Observations: Meddle income group population, who belongs to Rs. 100,000-300,000 income range buying more insurance products as compared to other income groups in the study area. High income group respondents prefer other alternatives of investments and savings other than insurance plans. Purpose of Investment: Although Insurance companies are fulfilling so many purposes of investments & savings at a time, but maximum respondents buy insurance policies for tax rebate and family safety. It was found that respondents investing or buying around are 10-20% of their annual income. Very few respondents want to invest more than 20% of their annual income in insurance plans. Mode of Insurance Awareness:Although there are a lot of modes of communications which are available for getting information, but the study found that the in Insurance industry, insurance agents are more appropriate medium for information transfer and any guidance or change in insurance products. A very few respondents are getting information through websites and modern mode of communications. News papers are also play an important role for updating knowledge about insurance products. During the study it was found, although there are so many insurance distribution channels have grown like banks, financial institutions, corporate agents etc. but even then insurance agents are dominating in case of selling and distribution of insurance products. Reason for Insurance: This globalised economy affected the Indians values and family system. So that more nuclear families believed on insurance sector for covering their risk and future plans. After the privatization of insurance markets so many flexible and diversified insurance plans came into existence and they are attracting the young age public for insurance and saving purposes. Product distribution channel in Insurance Industry are deepening and they are reaching up to every segment of the customers and Bancassurance also playing important role in this regard. Conclusion: In earlier days, customers could only buy limited prepackaged products pushed by agents chasing quick sales. Life insurance has today become a mainstay of any market economy since it offers plenty of scope for garnering large sums of money for long periods of time. In present customers have access to more and better products that suit their specific needs and a new breed of insurance advisors has taken birth. These agent advisors build enduring relationships with their clients and help them better understand the value of life insurance and sell customized solutions in a needs-based manner. This higher quality of sales interaction has been among the key benefits of privatization. A well-regulated life insurance industry which moves with the times by offering its customers tailor-made products to satisfy their financial needs is, therefore, essential if we desire to progress towards a worry-free future. That’s why now is the time to discover the powerful advantages of Customer Relationship Management for the insurance industry. This comprehensive, fully integrated solution provides everything to build a cutting-edge, customer-centric, and highly profitable organization. References 1. Singh, Harnam and Madhurima Lall ‘Marketing of Insurance Services in India: A Case Study of Life Insurance in U.P., Bookwell Delhi Publishers, Cases in Entreprenurship, 2013. 2. Kumari, Vaswati, "India Insurers Seek Perfect Partners." National Underwriters, March 5, 2001, 38-39. 3. Mitra, Sumit and Nayak, Shilpa. "Coming to Life." India Today, May 7, 2001. 4. Patel, Freny. "Centre wants GIC to merge unviable outfits before recast." Business Standard, April 13, 2001. 5. Roy, Abhijit. "Pension fund business in India." The Hindu, July 16, 1997, p. 25. 6. Roy, Samit. "Insurance Sector: India." Industry Sector Analysis, National Trade and Development Board, US Department of State, Washington, DC, December 1999. 7. Sinha, Tapen. Pension Reform in Latin America and Its Implications for International Policymakers. Boston, USA, Huebner Series Volume No. 23, Kluwer Academic Publishers, 2000. 8. Palli M.,(2004) ‘Asymmetric Issue of Indian Insurance Industry’ GITAM ‘ Excel Series New Deal in Insurance, pg 115-140. 9. Vijaykumar A.,(2007) ‘Globalization of Indian Insurance sector-issues and challenges’ 10. Palande, P.S & Shah R.S. and Lunawat, M.L.(2007), Insurance in India changing policies and emerging opportunities, Response Books, Sage publications ltd.pp244-298(3). 11. Sabera (2007), ‘Journal of Insurance Chronicle’, Vol.VII, Issue-I, Jan.2007, Page No.37. 12. Chellasamy P.& Sumathi N. (2007), Role of the Insurance Regulatory and Development Authority (IRDA), Edited book – Insurance Sector reforms in India: Challenge and Opportunities pp.141-149. 13. Palande, P.S & Shah R.S. and Lunawat, M.L.(2007), Insurance in India changing policies and emerging opportunities, Response Books, Sage publications ltd.pp299-447(3). 14. Rao, C.S. (2007), ‘The Regulatory Challenges Ahead’ Journal of Insurance Chronicle, Vol.VII, issue-X, Oct.2007. 15. Arora Poonam& Mehta Pratik, ‘Rudiments of Insurance’ ,( January-June 2010) The Journal pg.69-76 vol.XXXV 16. Selvkumar M. & Priyan Vimal J. (2010), ‘Indian Life Insurance Industry: Prospect for Private Sector’, The Journal ,Vol. XXXIV (1) pg 52-57.

...(download the rest of the essay above)

About this essay:

If you use part of this page in your own work, you need to provide a citation, as follows:

Essay Sauce, Insurance Sector In India . Available from:<https://www.essaysauce.com/finance-essays/insurance-sector-india/> [Accessed 25-04-24].

These Finance essays have been submitted to us by students in order to help you with your studies.

* This essay may have been previously published on Essay.uk.com at an earlier date.

Essay Categories:

- Accounting essays

- Architecture essays

- Business essays

- Computer science essays

- Criminology essays

- Economics essays

- Education essays

- Engineering essays

- English language essays

- Environmental studies essays

- Essay examples

- Finance essays

- Geography essays

- Health essays

- History essays

- Hospitality and tourism essays

- Human rights essays

- Information technology essays

- International relations

- Leadership essays

- Linguistics essays

- Literature essays

- Management essays

- Marketing essays

- Mathematics essays

- Media essays

- Medicine essays

- Military essays

- Miscellaneous essays

- Music Essays

- Nursing essays

- Philosophy essays

- Photography and arts essays

- Politics essays

- Project management essays

- Psychology essays

- Religious studies and theology essays

- Sample essays

- Science essays

- Social work essays

- Sociology essays

- Sports essays

- Types of essay

- Zoology essays

- Overview of the Insurance Industry in India

- Team India Blogs

Introduction

The insurance industry is critical for any country’s economic development. A well-developed insurance sector boosts risk-taking in the economy, as it provides some security in the event of an unforeseen, loss-causing incident. It also provides much-needed support to family members in the case of loss of life or health. Since the assets under management of insurance companies represent long-term capital, they also act as a pool in which to invest in long-term projects such as infrastructure development. The insurance industry in India has also grown along with the country’s economy. Several insurance companies in the country are expanding their operations, across both the public and private sector.

The history of India’s insurance industry reflects the history of India’s economy. Insurance companies in India were nationalised during pre-liberalisation. This was done to protect the interests of policyholders. Two state-owned insurance companies were thus created: the Life Insurance Corporation in 1956, and the General Insurance Corporation in 1972 for the non-life insurance business. Post liberalization, the industry was opened up. The Insurance Regulatory and Development Authority of India (IRDAI) was created in 1999 to regulate the insurance industry in India. Thus, the insurance sector was opened to private players. This allowed foreign players to collaborate with Indian entities to enter the sector. The number of insurance companies in India has increased quickly and continuously, and this has led to a vibrant insurance sector- with more variety and affordability for the consumer.

Present scenario

There are currently 57 insurance companies in India, of which 46 are from the private sector. There are 24 life insurance and 33 non-life insurance companies in India. The major names in the sector are:

Life insurance:

Life Insurance Corporation (LIC) HDFC Standard Life SBI Life Insurance ICICI Prudential Life Insurance

Non-life insurance:

New India Assurance United India Assurance National Insurance Company ICICI Lombard Oriental Insurance Company Bajaj Allianz

The market share of private sector players has increased over the years. In the non-life insurance sector, private companies had a market share of 54.68 % in FY 19 (as of Jan ‘19). In the life insurance sector, private companies had a market share of 33.74 % in FY 19 (as of Jan ‘19).

Market size

The overall market for insurance is expected to be $ 280 bn by 2020. Gross premiums in India reached $ 94.48 bn in FY 18. Of this number, the split between life insurance and non-life insurance was as follows: Life insurance: $ 71.1 bn Non-life insurance: $ 23.38 bn

Recent developments in the sector:

The last few years have seen a lot of activity in the sector. This is a testament to the vibrancy of the industry in India. Here are a few examples from different categories of deals/ developments:

Strategic deals: HDFC ERGO General Insurance Co. is in talks to acquire Apollo Munich Health Insurance (Reported valuation: $ 370 mn)

Financial investors: A consortium of private equity firms- Westbridge Capital and Madison Capital, as well as billionaire investor Rakesh Jhunjhunwala, are in discussions to acquire over 90% stake in Star Health and Allied Insurance. (Estimated deal size: $ 1 bn)

Initiatives by non-sector players: Indian e-commerce giant Flipkart has tied up with Bajaj Allianz General Insurance to provide customised insurance products for mobile phones sold on Flipkart.

New product offerings: HDFC ERGO launched a new product called E@Secure: a cyber insurance policy to protect individuals and families from cyber-attacks.

Future outlook and Growth drivers:

The insurance industry in India is expected to register healthy, consistent growth based on the following drivers: 1. Low insurance penetration in India: 3.69% (2017), compared to 6.3% globally (2016) 2. Government programs to increase insurance cover: Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Ayushman Bharat etc 3. Strong growth in the automotive industry is expected to boost motor insurance 4. Increasing interest in buying insurance; rising internet usage has contributed to this increasing interest 5. Innovative products like Unit Linked Insurance Plans (ULIPs) have contributed to the growth of insurance cover. 6. New distribution channels such as bancassurance, online distribution and NBFCs are contributing to the growth in insurance cover

Government initiatives / policies

1. Foreign Direct Investment (FDI) limit for the insurance sector increased from 26% to 49%. 2. Life insurance companies operational for 10+ years are now allowed to go public by IRDA 3. Government plans to divest a significant stake in PSU general insurance companies in order to execute the steep disinvestment target 4. Several flagship schemes have been launched by the government to boost the insurance sector.

Flagship schemes:

• Pradhan Mantri Jan Suraksha Bima Yojana: This scheme focuses on providing affordable insurance to people below the poverty line, in rural areas • Pradhan Mantri Jeevan Jyoti Bima Yojana: This initiative provides life insurance for people employed in the unorganised sector • Atal Pension Yojana: This guarantees pension Coverage to all citizens in the unorganised sector who join the National Pension System (NPS) • Ayushman Bharat Yojana: Each beneficiary family will receive medical insurance cover of INR 5 lakh, which they can use to get treatment at public or private hospitals.

Handpicked Blogs

We are India's national investment facilitation agency.

For further queries on this subject, please get in touch with us @Invest India. Raise your query

We have updated our terms and conditions and privacy policy Click "Continue" to accept and continue with ET BFSI

We use cookies to ensure best experience for you

We use cookies and other tracking technologies to improve your browsing experience on our site, show personalize content and targeted ads, analyze site traffic, and understand where our audience is coming from. You can also read our privacy policy , We use cookies to ensure the best experience for you on our website.

By choosing I accept, or by continuing being on the website, you consent to our use of Cookies and Terms & Conditions .

- Leaders Speak

- Brand Solutions

- Insurance in India – Current trends and what’s ahead

But beyond the numbers, the last two years of the pandemic have fundamentally transformed the sector and accelerated the pace of change – from the perspective of insurers, the healthcare ecosystem, consumers, and the regulator. This can have a long-lasting positive impact on healthy business growth, increased insurance penetration, product and process innovation, and, most importantly, customer experience.

- Vishal Bhave ,

- Published On Aug 13, 2022 at 08:00 AM IST

- By Vishal Bhave ,

- Updated On Aug 13, 2022 at 08:00 AM IST

All Comments

By commenting, you agree to the Prohibited Content Policy

Find this Comment Offensive?

- Foul Language

- Inciting hatred against a certain community

- Out of Context / Spam

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis., download etbfsi app.

- Get Realtime updates

- Save your favourite articles

- mobile apps

- life insurance

- motor insurance

- health insurance

- general insurance

Health insurance sector in India: an analysis of its performance

Vilakshan - XIMB Journal of Management

ISSN : 0973-1954

Article publication date: 30 November 2020

Issue publication date: 16 December 2020

Health insurance is one of the major contributors of growth of general insurance industry in India. It alone accounts for around 29% of total general insurance premium income earned in India. The growth of this sector is important from the perspective of overall growth of general insurance Industry. At the same time, problems in this sector are also many which are affecting its performance.

Design/methodology/approach

The paper provides an understanding on performance of health insurance sector in India. This study attempts to find out how much claims and commission and management expenses it has to incur to earn certain amount of premium. Methodology used for the study is regression analysis to establish relationship between dependent variable (Profit/Loss) and independent variable (Health Insurance Premium earned).

Findings of the study indicate that there is significant relationship between earned premium and underwriting loss. There has been increase of premium earnings which instead of increasing profit for the sector in fact has increased underwriting loss over the years. The earnings of the sector is growing at compounded annual growth rate of 27% still it is unable to earn underwriting profit.

Originality/value

This study is self-driven based on secondary data obtained from insurance regulatory and development authority site.

- Health insurance premium

- Management expenses

- Insurance regulatory and development authority

- Underwriting loss

- Compound annual growth rate

Dutta, M.M. (2020), "Health insurance sector in India: an analysis of its performance", Vilakshan - XIMB Journal of Management , Vol. 17 No. 1/2, pp. 97-109. https://doi.org/10.1108/XJM-07-2020-0021

Emerald Publishing Limited

Copyright © 2020, Madan Mohan Dutta.

Published in Vilakshan - XIMB Journal of Management . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence maybe seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

1.1 meaning of insurance.

Insurance is a contract between two parties where by one party agrees to undertake the risk of the other in exchange for consideration known as premium and promises to indemnify the party on happening of an uncertain event. The great advantage of insurance is that it spreads the risk of a few people over a large group of people exposed to risk of similar type.

Insurance has been identified as a sunrise sector by the financial planners of India. The insurance industry has lot of potential to grow, penetrate and service the masses of India. Insurance is all about protection. An insured needs two types of protection life and non-life. General insurance industry deals with non-life protection of the insured of which health insurance is a part.

1.2 Meaning of health insurance

Health insurance is a part of general insurance which contributes about 29% of premium amongst all other sectors of general insurance. But problems in this sector are many which is the driving force behind this study. This study will help the insurance companies to understand their performance and the quantum of losses that this sector is making over the years.

A plan that covers or shares the expenses associated with health care can be described as health insurance. These plans fall into commercial health insurance, which is provided by government, private and stand-alone health insurance companies.

Health insurance in India typically pays for only inpatient hospitalization and for treatment at hospitals in India. Outpatient services are not payable under health policies in India. The first health policy in India was Mediclaim Policy. In 2000, the Government of India liberalized insurance and allowed private players into the insurance sector. The advent of private insurers in India saw the introduction of many innovative products like family floater plans, critical illness plans, hospital cash and top-up policies.

Health insurance in India is an emerging insurance sector after life and automobile insurance sector. Rise in middle class, higher hospitalization cost, expensive health care, digitization and increase in awareness level are some important drivers for the growth of health insurance market in India.

Lifestyle diseases are on the rise. A sedentary lifestyle has pervaded our being. There is lower physical labour today than earlier and there is no reason why this would not be the trend going forward. The implication is the advent of lifestyle chronic diseases such as cardiac problems and diabetes.

In the context of the Indian health insurance industry, one could look at it both ways. Mired by low penetration and negative consumer perception about its utility are affecting the prospect of this industry. The flipside though is that we have hardly scratched the surface of the opportunity that lies in the future. It is as if the glass is half full. Much remains to be conquered and even more remains to be accomplished.

Health insurance companies needs to be optimistic and have courage to bring in innovation in the areas of product, services and distribution system. Bring it to the fold as the safety net that smartly covers and craft a health insurance plan befitting the need of the customers.

1.3 Background of health insurance sector in India

India’s tryst with health insurance programme goes back to the late 1940s and early 1950s when the civil servants (Central Government Health Scheme) and formal sector workers (Employees’ State Insurance Scheme) were enrolled into a contributory but heavily subsidized health insurance programmes. As a consequence of liberalization of the economy since the early 1990s, the government opened up private sector (including health insurance) in 1999. This development threw open the possibility for higher income groups to access quality care from private tertiary care facilities. However, India in the past five years (since 2007) has witnessed a plethora of new initiatives, both by the central government and a host of state governments also entering the bandwagon of health insurance. One of the reasons for initiating such programs may be traced to the commitment of the governments in India to scale up public spending in health care.

1.4 The need for health insurance in India

1.4.1 lifestyles have changed..

Indians today suffer from high levels of stress. Long hours at work, little exercise, disregard for a healthy balanced diet and a consequent dependence on junk food have weakened our immune systems and put us at an increased risk of contracting illnesses.

1.4.2 Rare non-communicable diseases are now common.

Obesity, high blood pressure, strokes and heart attacks, which were earlier considered rare, now affect an increasing number of urban Indians.

1.4.3 Medical care is unbelievably expensive.

Medical breakthroughs have resulted in cures for dreaded diseases. These cures however are available only to a select few. This is because of high operating and treatment expenses.

1.4.4 Indirect costs add to the financial burden.

Indirect sources of expense like travel, boarding and lodging, and even temporary loss of income account for as much as 35% of the overall cost of treatment. These facts are overlooked when planning for medical expenses.

1.4.5 Incomplete financial planning.

Most of us have insured our home, vehicle, child’s education and even our retirement years. Ironically however we have not insured our health. We ignore the fact that illnesses strike without warning and seriously impact our finances and eat into our savings in the absence of a good health insurance or medical insurance plan.

1.5 Classification of health insurance plans in India

Health insurance plans in India today can be broadly classified into the following categories:

1.5.1 Hospitalization.

Hospitalization plans are indemnity plans that pay cost of hospitalization and medical costs of the insured subject to the sum insured. There is another type of hospitalization policy called a top-up policy . Top-up policies have a high deductible typically set a level of existing cover.

1.5.2 Family floater health insurance.

Family health insurance plan covers entire family in one health insurance plan. It works under assumption that not all member of a family will suffer from illness in one time.

1.5.3 Pre-existing disease cover plans.

It offers covers against disease that policyholder had before buying health policy. Pre-existing disease cover plans offers cover against pre-existing disease, e.g. diabetes, kidney failure and many more. After waiting for two to four years, it gives covers to the insured.

1.5.4 Senior citizen health insurance.

This type of health insurance plan is for older people in the family. It provides covers and protection from health issues during old age.

1.5.5 Maternity Health insurance.

Maternity health insurance ensures coverage for maternity and other additional expenses.

1.5.6 Hospital daily cash benefit plans.

Daily cash benefits are a defined benefit policy that pays a defined sum of money for every day of hospitalization.

1.5.7 Critical illness plans.

These are benefit-based policies which pay a lump sum amount on certain critical illnesses, e.g. heart attack, cancer and stroke.

1.5.8 Disease-specific special plans.

Some companies offer specially designed disease-specific plans such as Dengue Care and Corona Kavach policy.

1.6 Strength, weakness, opportunity and threat analysis of health insurance sector (SWOT analysis)

The strengths, weaknesses, opportunities and threats (SWOT) is a study undertaken to identify internal strengths and weaknesses as well as external opportunities and threats of the health insurance sector.

1.6.1 Strengths.

The growth trend of the health insurance sector is likely to be high due to rise in per capita income and emerging middle-income group in India. New products are being launched in this sector by different insurance companies which will help to satisfy customers need. Customers will be hugely benefited when cash less facility will be provided to all across the country by all the insurance companies.

1.6.2 Weaknesses.

The financial condition of this sector is weak due to low investment in this sector. The public sector insurance companies are still dominating this industry due to their greater infrastructure facilities. This sector is prone to high claim ratio and many false claims are also made.

1.6.3 Opportunities.

The possibility of future growth of this sector is high, as penetration in the rural sector is low. The improvement of technology and the use of internet facility are helping this sector to grow in magnitude and move towards environment-friendly paperless regime.

1.6.4 Threats.

The biggest threat of this sector lies in the change in the government regulations. The profitability of this sector is affected due to increasing expenses and claims. The economic slowdown and recession in the economy can affect growth of this sector adversely. The increasing losses and need for insurance might reach a point of no return where insurance companies may be compelled to decline an insurance policy.

1.7 Political economic socio cultural and technological analysis of health insurance sector (PEST analysis)

This analysis describes a framework of macro-environmental factors used as strategic tool for understanding business position, growth potential and direction for operations.

1.7.1 Political factors.

Service tax on premium on insurance policies is being increased by the government for past few years during budget. Government monopoly in this sector came to an end after insurance companies were opened up for private participation in the year 2000. Foreign players were allowed to enter into joint venture with their Indian counterpart with 26% holding and which was further increased to 49% in the year 2015.

1.7.2 Economic factors.

The gross savings of people in India have increased significantly thereby encouraging people to buy insurance policy to cover their risks. Insurance companies are fast becoming prominent players in the security market. As these companies have huge disposable income which they are investing in the security market.

1.7.3 Socio-cultural factors.

Increase in insurance knowledge is helping people to increase their awareness about the risk to be covered through insurance. Change in lifestyle is leading to increase in risk thereby giving an opportunity to insurance companies to innovate newer products. Societal benefit is derived by transfer of risk through insurance due to improved socio-cultural environment.

1.7.4 Technological factors.

Insurance companies deals in large database and maintaining it by the application of latest technology is huge gain for this sector. Technological advancement has helped insurance companies to sale their products through their electronic portals. This has made their task of providing service to the customers easier and faster.

2. Review of literature

After opening up of the insurance industry health insurance sector has become significant both from economic and social point of view and researchers have explored and probed these aspects.

Ellis et al. (2000) reviewed a variety of health insurance systems in India. It was revealed that there is a need for a competitive environment which can only happen with the opening up of the insurance sector. Aubu (2014) conducted a comparative study on public and private companies towards marketing of health insurance policies. Study revealed that private sector services evoked better response than that of public sector because of new strategies and technologies adopted by them. Nair (2019) has made a comparative study of the satisfaction level of health insurance claimants of public and private sector general insurance companies. It was revealed that majority of the respondents had claim of reimbursement nature through third party administrator. Satisfaction with respect to settlement of claim was found relatively higher for public sector than private sector. Devadasan et al. (2004) studied community health insurance to be an important intermediate step in the evolution of an equitable health financing mechanism in Europe and Japan. It was concluded that community health insurance programmes in India offer valuable lessons for its policy makers. Kumar (2009) examined the role of insurance in financing health care in India. It was found that insurance can be an important means of mobilizing resources, providing risk protection and health insurance facilities. But for this to happen, it will require systemic reforms of this sector from the end of the Government of India. Dror et al. (2006) studied about willingness among rural and poor persons in India to pay for their health insurance. Study revealed that insured persons were more willing to pay for their insurance than the uninsured persons. Jayaprakash (2007) examined to understand the hurdles preventing the people to purchase health insurance policies in the country and methods to reduce claims ratio in this sector. Yadav and Sudhakar (2017) studied personal factors influencing purchase decision of health insurance policies in India. It was found that factors such as awareness, tax benefit, financial security and risk coverage has significant influence on purchase decision of health insurance policy holders. Thomas (2017) examined health insurance in India from the perspective of consumer insights. It was found that consumers consider various aspects before choosing a health insurer like presence of a good hospital network, policy coverage and firm with wide product choice and responsive employees. Savita (2014) studied the reason for the decline of membership of micro health insurance in Karnataka. Major reason for this decline was lack of money, lack of clarity on the scheme and intra house-hold factors. However designing the scheme according to the need of the customer is the main challenge of the micro insurance sector. Shah (2017) analysed health insurance sector post liberalization in India. It was found that significant relationship exists between premiums collected and claims paid and demographic variables impacted policy holding status of the respondents. Binny and Gupta (2017) examined opportunities and challenges of health insurance in India. These opportunities are facilitating market players to expand their business and competitiveness in the market. But there are some structural problems faced by the companies such as high claim ratio and changing need of the customers which entails companies to innovate products for the satisfaction of the customers. Chatterjee et al. (2018) have studied health insurance sector in India. The premise of this paper was to study the current situation of the health-care insurance industry in India. It was observed that India is focusing more on short-term care of its citizens and must move from short-term to long-term care. Gambhir et al. (2019) studied out-patient coverage of private sector insurance in India. It was revealed that the share of the private health insurance companies has increased considerably, despite of the fact that health insurance is not a good deal. Chauhan (2019) examined medical underwriting and rating modalities in health insurance sector. It was revealed that while underwriting a health policy one has to keep in mind the various aspects of insured including lifestyle, occupation, health condition and habits. There have been substantial studies on health insurance done in India and abroad. But there has not been any work on performance of health insurance sector based on underwriting profit or loss.

3. Research gap

After extensive review of literature it is understood that there has not been substantial study on the performance of health insurance sector taking underwriting profit or loss into consideration. In spite of high rate of growth of earned premium, this sector is unable to make underwriting profit. This is mainly because growth of premium is more than compensated by claims incurred and commission and other expenses paid. Thereby leading to growth of underwriting loss over the years across the different insurance companies covered under both public and private sector. This unique feature of negative performance of this sector has not been studied so far in India.

4. Objectives

review health insurance scenario in India; and

study the performance of health insurance sector in India with respect to underwriting profit or loss by the application of regression analysis.

5. Research methodology

The study is based on secondary data sourced from the annual reports of Insurance Regulatory Development Authority (IRDA), various journals, research articles and websites. An attempt has been made to evaluate the performance of the health insurance sector in India. Appropriate research tools have been used as per the need and type of the study. The information so collected has been classified, tabulated and analysed as per the objectives of the study.

The data is based on a time period of 12 years ranging from 2006–2007 to 2018–2019.

Secondary data analysis has been done using regression of the form: Y = a + b X

The research has used SPSS statistics software package for carrying out regression and for the various graphs Microsoft Excel software has been used.

5.1 The problem statement

It is taken to be a general assumption that whenever the premium increases the profit also increases. This determines that profits are actually dependent on the premium income. Hence, whenever the premium tends to increase, the profit made also supposed to increase.

The aim of the study is to find out whether the underwriting profit of the health insurance sector is increasing or there is an underwriting loss.