- [email protected]

- 0094212227519

- Introduction

- Heads of the Department

- Graduate Profile

- Structure of the Programme

- Calendar of Dates

- Lecture Schedule

- Dissertation Guidelines

- Internship Guideline

- Academic Counsellors

- Students Achievements

- Undergraduate Dissertations

- CPA Australia

- Memorandum of Understanding

Prof.T.Velnampy’s Publications:

- Pratheepkanth, P., Velnampy, T. , Balaputhiran, S., (2017). Capital Budgeting and Firm Performance in a Developed Country’s Firms Juxtaposed with Equivalent Firms in an Emerging Country. Management Decision (Forthcoming).

- Sooriyakumaran, L., and Velnampy. T , (2016). Impairment of assets and market value of share : A study of listed manufacturing companies in Sri Lanka. International Journal of Accounting and Business Finance 2(2), 35-45.

- Vaikunthavasan, S., Velnampy, T., Rajumesh, S., (2016). Challenges and opportunities associated with development of small and medium enterprises in Jaffna district. Journal of Business Studies 3(1), 63 – 80.

- Velnampy, T ., and Achchuthan, S. (2016). Green consumerism in Sri Lankan Perspective: An Application and Extension of Theory of Planned Behavior. Advances in Management and Applied Economics , 6 (5), 39- 66.

- Achchuthan, S., & Velnampy, T . (2016). A Quest for Green Consumerism In Sri Lankan Context: An Application Of Comprehensive Model Asian Journal of Empirical Research. , 6 (3), 59-76.

- Velnampy, T ., & Achchuthan, S. (2016). Integrated Model for Understanding and Enhancing Green Purchase Behavioral Intention: Directions for Future Research. Journal of Sociological Research , 7 (1). 105- 122.

- Subramaniam,V.A and Velnampy.T .(2016), Association Between Demographic Factors and Investment Decisions of few Selected State Sector Employees in Jaffna District, Sri Lanka, International Journal of Research in Management , 3(6), 80 – 92.

- Anandasayanan S and Velnampy T (2016), Dividend Policy and Corporate Profitability Econometric Analysis of Listed Manufacturing Firms in Sri Lanka, International Journal of Commerce and Management Research , 2(1), 53-58

- Shivany,S, Velnanpy,T (2015),Grounded Theory as a methodology for exploring Marketing Strategies for a special Context, International Research Journal of Social Science and Management , 4(11),115-126

- Shivany, S., Velnampy, T & Kajendra, K. (2015). The case of Women (Micro) marketers in Northern Province, Sri Lanka . Journal of Business Studies 4 (01), 12-23.

- Ramesh,S, Velnampy,T & Nimalathasan,B.,S (2015) Stock Market Response to Stock Split and Political Information in Sri Lankan Stock Market: An Event Study Application. Global Journal of Business and Management Research,3(3),14-21 .

- Sentheeswary.S & Velnampy.T (2015), Board Structure and Firm Performance: A Study of listed Commercial Banks in Sri Lanka, International Journal of Accounting and Business Finance , Faculty of Mgt Studies & Commerce, University of Jaffna,1(1), 15-24.

- Shivany,S, Velnanpy,T & Kajendra,K (2015), Literature Survey on Post war Marketing Strategies for the conflict affected areas of Sri Lanka, Annamalai International Journal of business Studies and Research .

- Velnampy.T & Sivesan.S (2015), Customer Value Creation Trough Customer Relationship Marketing, International Journal of Accounting and Business Finance , Faculty of Mgt Studies & Commerce, University of Jaffna,Special Issue, 85-102.

- Velnampy, T .,and Anojan, V. (2014). Financial Performance Of State And Private Sector Commercial Banks: A Comparative Study During War And Post War Scenarios Of Sri Lanka: European Journal Of Business and Innovation Research (EJBIR).2(1)

- Velnampy,T , Nimalthasan,p & Kalaiarasi, K., (2014).Dividend Policy and Firm Performance: Evidence from the Manufacturing Companies Listed on the Colombo Stock Exchange, Global Journal of Management and Business Research: A Administration and Management ,14(6).

- Velnampy, T . & Niresh, A (2014). Firm Size and Profitability: A Study of Listed Manufacturing Firms in Sri Lanka: International Journal of Business and Management; 4 (9), 57-64.

- M.B.M Ismail, T Velnampy (2014) Ranking Entrepreneurial Characteristics in South Eastern Region of Sri Lanka (SERSL): A Factor Scorer Method, SMART Journal of Business Management Studies , 10(1), 1-8.

- Velnampy, T .,and Anojan, V. (2014). Capital Structure, Liquidity Position and Their Impact on Profitability: A Study of Listed Telecommunication Firms in Colombo Stock Exchange (CSE), Sri Lanka. Research Journal of Finance and Accounting, 5(9), 131-139.

- Velnampy, T . Achchuthan, S. and Kajananthan, R. (2014). Foreign Direct Investment and Economic Growth:Evidence from Sri Lanka, International Journal of Business and Management; 1 (9), 140- 148

- Velnampy, T ., Sivathaasan, N., Tharanika, R., & Sinthuja, M. (2014). Board Leadership Structure, Audit Committee and Audit Quality: Evidence from Manufacturing Companies in Sri Lanka. International Journal of Business and Management, 9(4), p76.

- Velnampy, T . and Rajendran, K. (2014). Liquidity, Solvency and Profitability Analysis Using Cash Flow Ratios and Traditional Ratios: The Telecommunication Sector in Sri Lanka.

- Velnampy, T., and Pratheep Kanth .P,(2014). Corporate Governance Practices: A Study of Sri Lanka, European Journal of Applied Social Sciences Research (EJASSR),2(2).

- Velnampy, T . Achchuthan, S. and Kajananthan, R. (2014). Foreign Direct Investment, Economic Growth and Unemployment: Evidence from Sri Lanka , Annamali Business Review, 4 (1), 74-78.

- Velnampy, T ., & Nimalthasan, P. (2013). Corporate Governance Practices, Capital Structure And Their Impact On Firm Performance: A Study On Sri Lankan Listed Manufacturing Companies. Research Journal of Finance and Accounting, 4(18), 69-79.

- Velnampy, T . (2013). Corporate Governance and Firm Performance: A Study of Sri Lankan Manufacturing Companies. Journal of Economics and Sustainable Development,4(3): 228-235.

- Velnampy, T . and Achchuthan, S. (2013). Fiscal Deficit and Economic Growth: A Study on Sri Lankan Economic Perspective. Developing Country Studies, 3(3): 166-174.

- Ismail, M. B. M.and Velnampy, T . (2013). Determinants of Employee Satisfaction (ES) in Public Health Service Organizations (PHSO) in Eastern Province of Sri Lanka: A Pilot Study. European Journal of Business and Management, 5(21): 62-70.

- Velnampy, T . and Achchuthan, S. (2013). Export, Import and Economic Growth: Evidence from Sri Lanka. Journal of Economics and Sustainable Development,4.9: 147-155.

- Ismail, M. B. M.and Velnampy, T . (2013). Determinants of Corporate Performance (CP) in Public Health Service Organizations (PHSO) in Eastern Province of Sri Lanka: A Use of Balanced Score Card (BSC). Industrial Engineering Letters, 3(8): 1-9.

- Sivathaasan, N.and Velnampy, T . (2013). Use of electronic information resources and academic Performance of university teachers: A case study. European Journal of Business and Management, 5(14): 46-52.

- Ismail, M. B. M. and Velnampy, T . (2013). Impact of Income on Information Technology (IT) in South Eastern Region of Sri Lanka (SERSL): Non-Parametric Tests. Global Journal of Business and Management Research, 1(1): 33-37.

- Velnampy, T . and Ajanthan,A.(2013).Efficiency and financial sustainability of microfinance institutions:A study of Jaffna District. ACADEMICIA: An International Multidisciplinary Research Journal, 3(7): 206-224.

- Velnampy, T . and Nimalthasan, P. (2013). Corporate Governance Practices, Capital Structure And Their Impact On Firm Performance: A Study On Sri Lankan Listed Manufacturing Companies, Research Journal of Finance and Accounting, 4(18): 69-79.

- Velnampy, T .and Achchuthan, S. (2013). Economic Growth Structure: Sectoral Perspective, Opinion: International Journal of Management , 3 (1): 32-40.

- Ismail, M. B. M.and Velnampy, T . (2013). Determinants of Patient Satisfaction (PS) in Public Health Service Organizations (PHSO) In Eastern Province of Sri Lanka, 13, 2(18).

- Velnampy, T . and Rajendran, K. (2013). Cash Position and Profitability of Telecommunication Sector in Sri Lanka. Greener Journal of Social Sciences, 3(6) : 324-333.

- Velnamby, T . and Sivesan, S. (2013). Factor Analysis of Service Quality in University Libraries in Sri Lanka–An Application of SERVQUAL Model. Industrial Engineering Letters, 3(5): 40-49.

- Velnampy, T .and Aravinthan S. (2013). Occupational Stress and Organizational Commitment in Private Banks: A Sri Lankan Experience. European Journal of Business and Management, 5(7): 254- 267.

- Velnampy.T ,and Ismail, M. B. M. (2013), A Case Study Approach To Human Resource Planning – HRP- In Weaving Industry Of Maruthamunai Researchers World, Journal of Arts, Science & Commerce Vol.– III, Issue –1, Jan 2012.

- Ismail, M. B. M., & Velnampy, T . (2013). Marketing Mix of Product Life Cycle (MMPLC) and Business Performance (BP) for Sarong of Royal Handloom Weaving Factory (RHWF), European Journal of Commerce and Management Research (EJCMR),2(8), 168-174.

- Ismail, M. B. M & Velnampy, T . (2013). Determinants of Technological and Socio-cultural Environment of Mobile Phone Outlets. M-Infiniti: Journal of Management, 6(2) pp.87-91.

- Pirashanthini S, Tharmila K & Velnampy T (2013). Working capital approaches and firm’s profitability of manufacturing companies in Sri Lanka. Comprehensive Research Journal of Management and Business Studies (CRJMBS) Vol. 1(2) pp. 024 – 030

- Ismail, M. B. M & Velnampy, T . (2013). Impact of Income on Information Technology (IT) in South Eastern Region of Sri Lanka (SERSL): Non- Parametric Tests, Global Journal of Business and Management Research,1(1), 33-37.

- Sooriyakumaran, L. and Velnampy, T . (2013). Disclosures and Impacts of Impairment of Non-Current Assets in the Financial Statements: A Study on Listed Manufacturing Companies in Colombo Stock Exchange (CSE) in Sri Lanka. Merit Research Journal of Accounting, Auditing, Economics and Finance, 1(6) : 122-133.

- Velnampy, T . and Pratheepkanth,P. (2013). Corporate Governance and Firm Performance. European Journal of Commerce and Management Research (EJCMR) , 2(6):123-127.

- Ismail, M. B. M., & Velnampy, T .(2013), Application of Attribute Quality Control Chart (AQCC) in Brick Industry Clusters (BIC). European Journal of Commerce and Management Research (EJCMR),2(9),197-203.

- Velnampy, T . (2013). Recent Business Failures in Jaffna District. Sri Lanka: Problems and Suggestions, Eternal Baker, Bank of Ceylon, Pensioner Association, Jaffna, 2(1), 46-50.

- Velnampy.T and Sivesan.S. (2012), Impact of Customer Relationship Marketing on Customer Value Creation in Mobile Service Providers:A Sri Lankan Experience, Education and General Studies Vol.1, Iss.1,pp.15-21.

- Velnampy.T and Sivesan.S. (2012), Customer Relationship Marketing and Customer Satisfaction: A Study on Mobile Service Providing Companies in Srilanka, Global Journal of Management and Business Research 12 (18),1-7

- Velnampy, T ., & Sivesan, S. (2012). Determinants of Customer Relationship Marketing of Mobile Services Providers in Sri Lanka:-An application of Exploratory Factor Analysis. Industrial Engineering Letters , 2 (6), 10-15.

- Velnampy, T ., & Sivesan, S. (2012). Determinants of Employees’ Job Satisfaction: A Study of Banking Industries in Sri Lanka. Global Journal of Management and Business Research , 12 (22).

- Velnampy, T . & Niresh, A (2012) .The relationship between capital structure & Profitability: Global Journal of Management and Business Research, 12 (13), 68-74.

- Ismail, M, Velnampy, T , Mustafa, A (2012). Sri Lankan Tourism (SLT): A Forecast of Foreign Tourists (FFT), Global Journal of Management and Business Research, Volume 12(9), 3

- Velnampy, T ,and Pratheepkanth, P.,(2012), Portfolio structure & Performance-A study on Selected Financial Organization in Sri Lanka, Opinion: International Journal of Business Management, Vol.2, No.2, pp.16-22.

- Velnampy.T and Sivesan.S. (2012), Determinants of Key factors on customer value in Sri Lankan mobile service industries, SMART International Journal of Management, 8(2),11-17.

- Velnampy.T , and Pratheepkanth.P.(2011),Earnings per share and Share price in Milanka Companies in Colombo Stock Exchange (CSE), Sri Lanka, African Journal of Accounting, Auditing and Finance, Switzerland I(2).

- Velnampy.T . (2011), Value added, productivity and performance of few selected companies in Sri Lanka, Indian Journal of Commerce and Management, International Journal, India, Vol. II Issue 06.

- Velnampy.T .and Nimalathasan.B.(2010),Firm Size and Probability: A Comparative Study of Bank of Ceylon and Commercial Bank of Ceylon, Global Journal of Management and Business Research, USA Vol No II.

- Velnampy.T , and Prahalathan.B. (2009), Staff Productivity, Cost of Average Net Portfolio and Portfolio Yield: Special Reference to Rural Banks in Jaffna District”, Journal of Science and Management, Vavuniya Campus of the University of Jaffna, Vol.1, October.

- Velnampy, T ., & Nimalathasan, B.(2009),Factors Contributing Towards Banking Performance: A Comparative Study of State and Private Sector Banks in North and Eastern Provinces of Sri Lanka” Mentor, Journal of Business Studies, Faculty of Management Studies and Commerce, Eastern University of Sri Lanka, Vol.1, 2009

- Velnampy.T . (2009), Do the Personal Characteristics have an Association with Job Satisfaction? An Empirical Study of Sri Lankan Organizations”, Journal of Management Rajarata University of SriLanka, Mihintale.Vol.1.

- Velnampy.T . (2009), Job Satisfaction and Employee Motivation: An Empirical Study of Sri Lankan Organisations” Mentor, Journal of Business Studies,Faculty of Management Studies and Commerce, Eastern University of SriLanka, Vol.1.

- Velnampy.T . (2009), Ma;tpy; ,yf;fpa kPsha;tpd; tfpgq;F (Role of Literature Survey in Research, Kamuthi: Journal of Education, Management and Planning, Vol.1.

- Velnampy.T , and Nimalathasan.B.(2008), An association between organizational growth and profitability:A Study of Commercial bank of Ceylon Ltd in Sri Lanka” Economic and administrative Sciences series, University of Bucharest’s publishing house, Annalele of the University of Bucharest, Rome,2(46-57).

- Velnampy.T , and Kamalaruban.K.(2008), Evaluation of Factors Influencing Effective Procurement Management System of Public Sector Organisations”, Journal of Business Studies, Centre for Business Research, South East University, Dhaka Vol.IV, No.2.

- Velnampy.T .(2008),Job Attitudes and Employees Performance of Public Sector Organisations in Jaffna District, Sri Lanka”, GITAM Journal of Management, A Quarterly Publication of College of Management Studies, An Autonomous & NAAC Accredited ‘A’ Grade Institution, Visakhapatnam, India, Vol.6, No.2.

- Velnampy.T . (2007), Leadership Styles, Performance, and Job Attitudes”, Journal of Annamalai Business Review, Annamalai University, India, Vol.1, Issue 2.

- Velnampy, T ., and Nimalathasan, B. (2007). Organizational Growth and Profitability: A Case study Analysis of Bank of Ceylon, Journal of Business Studies, III.

- Velnampy.T .(2007), Marketing Strategies for Bankers, Journal of Catalysts, Bank of Ceylon,1(1 & 2),24 -26 & 34-38.

- Velnampy, T ., and Nimalathasan, B.(2007), Determinants of Key Performance Indicators (KPIS) of Private Sector Banks in Sri Lanka: An Application of Exploratory Factor Analysis” GITAM Journal of Management, A Quarterly Publication of College of Management Studies, An Autonomous & NAAC Accredited ‘A’ Grade Institution, Visakhapatnam, India, January –March 2012.

- Velnampy.T .(2007), Factors Influencing Motivation: An Empirical Study of Few Selected Sri Lankan Organisations”, Kelaniya Journal of Human Resource Management, Department of Human Resource Management, University of Kelaniya, Sri Lanka, Vol.2, No.1, January.

- Velnampy.T . (2006), Performance and its Impact on Organizational Commitment: A Comparative Study of State and Private Sector Banks in Sri Lanka” Journal of Management, Faculty of Management and Commerce, South Eastern University of Sri Lanka, Vol.IV, No.1.

- Velnampy.T .(2006), A Study on Investment Appraisal and Profitability”, Journal of Business Studies, Faculty of Management Studies and Commerce, University of Jaffna, Sri Lanka, Vol.II.

- Velnampy.T . (2006), An Empirical Study on Application of Altman Original Bankruptcy Fore-Casting Model in Sri Lankan Companies”, M- Infiniti, Journal of Management, Sai Ram Institute of Management, Sai Ram Engineering College, India, Vol 1, issue 1.

- Velnampy, T . (2006), A Study on Incentives and work motivation of public sector organizations in Sri Lanka. Journal of Annamalai Business Review, Annamalai University, India, Vol.1, Issue 1.

- Thevarajah.K and Velnampy.T . (2005), A Study of Work Motivation in Some Sri Lankan Organizations,Mentor: The Journal of Business Studies; Faculty of Management Studies and Commerce, Eastern University of Sri Lanka, Vol 1.

- Velnampy.T .and Sivalingam.T. (2005), Intellectual Property Rights (IPRs) on Auto Component Manufacturing Industries”, Journal of Business Studies, University of Jaffna, Sri Lanka, Vol .I.

- Sivalingam.T and Velnampy, T . (2004), Policy Draft to Eradicate Child Labour: Action Plan”, Third Concept-An International Journal of Ideas, New Delhi, Vol.17, No.203, January, 2004.

Prof.B.Nimalathasan’s Publications

- Nimalathasan, B. (2008). A Relationship between Owner-Managers Characteristics and Business performance, Lex et Scientia International Journal, XV(1): 61-68. [Indexed in EBSCO-CEEAS, CEEOL, RePEc, DOAJ, PROOUEST, ULRICH, DRJI and Google Scholar]

- Nimalathasan, B. (2009). The Incidence of Strategic Planning in Small Business, Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXI(3),11-17. [Indexed in Econ Lit, EBSCO and DOAJ]

- Nimalathasan,B .(2009).An Investigation of Financial Soundness of Listed Manufacturing Companies in Sri Lanka: An Application of Altman Model. Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXI(4),19-25. [ Indexed in Econ Lit, EBSCO and DOAJ]

- Nimalathasan, B.,& Uddin,S.M. (2009). Determinants of Key Favourable Environment for Intrapreneurship Development: An Empirical Study on Some Selected Enterprises in Chittagong, Bangladesh. Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXI(2),29-35. [ Indexed in Econ Lit, EBSCO and DOAJ]

- Nimalathasan, B. (2009). An Association between Market Orientation and Business Performance: The Case of Small Medium Enterprises in Sri Lanka. Manager, University of Bucharest, 10, 122-130. [Indexed EBSCO-CEEAS,CEEOL,RePEc,DOAJ, INDEX COPERNICUS, PROQUEST, ULRICH, DRJI, Google Scholar]

- Zahargier, S.M., & Nimalathasan,B.( 2009). Factors affecting Employees’ Performance in Ready-Made Garments (RMGs) Sector in Chittagong, Bangladesh. Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXIII (1),9-15. [ Indexed in Econ Lit, EBSCO and DOAJ]

- Absar, N.M.N., Azim, T.M., Nimalathasan,B ., & Sadia, A.(2010). Impact of Human Resource Practices on Job Satisfaction: A Study of Selected Industrial Enterprises in Bangladesh. Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXII (2), 31-42. [ Indexed in Econ Lit, EBSCO and DOAJ]

- Subramaniyam, A., & Nimalathasan, B .(2010). Industrial Relation System: Lessons for Bangladesh and Sri Lanka from Japanese Perspectives. Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXII (1), 52-60. [Indexed in Econ Lit, EBSCO and DOAJ]

- Absar, N.M.N., Nimalathasan, B., & Jilani, M.M.A.K.(2010). Impact of HR Practices on Organizational Performance in Bangladesh. IJIBIT, 3(2),15-19. [ Indexed in EBSCO and Cabell’s Management Directory, USA]

- Absar, N.M.N.,Sikder, H.Z., Nimalathasan, B., & Bhuiyan, M.M.(2010). Employee Compensation Practices in Industrial Enterprises of Bangladesh: A Public-Private Comparison Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXII (IV), 52-60.

- [ Indexed in Econ Lit, EBSCO and DOAJ]

- Nimalathasan,B.( 2010). Working Capital Management and Its Impact on Profitability: A Study of Selected Listed Manufacturing Companies in Sri Lanka, Manager, University of Bucharest, 12,76-82.

- [Indexed EBSCO-CEEAS,CEEOL,RePEc,DOAJ, INDEX COPERNICUS, PROQUEST, ULRICH, DRJI, Google Scholar]

- Nimalathasan,B ., & Valeriu,B.(2010). Capital Structure and Its Impact on Profitability: A Study of Listed Manufacturing Companies in Sri Lanka. Young Economics Journal (RTE),7-12.

- [Indexed in RePEc]

- Nimalathasan,B ., & Valeriu,B.(2010). Association between Critical, Creative Thinking and Problem Solving in Accounting Researches: An Overview, Young Economics Journal (RTE),7-12. [Indexed in RePEc]

- Nimalathasan,B.,& Valeriu,B.(2010). Job Satisfaction and Employees’ Work Performance: A Case Study of People’s Bank in Jaffna Peninsula, Sri Lanka, Management & Marketing, Universitatea Din Craiova,VIII(1), 43-47.

- [Indexed in EBSCO, CEEOL, RePEc]

- Absar, N.M.N., & Nimalathasan,B .(2010). Quality of Work Life Practices of Academic Professional in Bangladesh: A Factor Analytical Approach. International Journal of Commerce and Management,1(7), 6-11.

- [Indexed in EBSCO, PROQUEST, ULRICH, Open J.gate and others]

- Subramaniyam, A., & Nimalathasan, B.( 2010).Value Added Reporting: A Case Study of Abans Listed Manufacturing Company Limited in Sri Lanka. The Annals of the “STEFAN CEL MARE”, University of SUCEAVA, Fascicie of the Faculty of Economics and Public Administration,10(1),142-147.

- [ Indexed in EBSCO ]

- Kumar Gandhi,R., & Nimalathasan,B.( 2011).Liquidity Analysis of State Bank of India. Manager, 14,227-237.

- [Indexed in EBSCO ]

- Ather, S.M., & Nimalathasan, B .(2011). Industrial Relations in China: Lessons for Bangladesh. SONA Global Management Review, 5(3), 54-61.

- [Indexed in EBSCO and Ulrich International Directory]

- Zahargier,S.M. & Nimalathasan,B .(2011). Factors affecting Employees’ Performance in Ready-Made Garments (RMGs) Sector in Chittagong, Bangladesh. Petroleum-Gas University of Ploiesti Bulletin, Economic Science Series, LXIII (I), 9-15.

- Nimalathasan, B. (2011). Capital Structure Patterns: A Study of Companies Listed on The Colombo Stock Exchange in Sri Lanka. International Journal of Research in Computer Application and Management, 1(2), 16-19.

- Absar,N., Nimalathasan,B. & Monowar,M(2012). HRM – Market Performance Relationship: Evidence from Bangladeshi Organizations. South Asian Journal of Global Business Research. 1(2):238-255.

- [ Indexed in British Library, EBSCO and Summon]

- Nimalathasan,B., & Taher, M.D.(2012). Situation Analysis of Trade Unions and Industrial Relations in Bangladesh: A Country Profile, Manager,16.

- [Indexed in EBSCO-CEEAS, CEEOL, RePEc, DOAJ, PROQUEST, ULRICH, DRJI and Google Scholar]

- Nimalathasan,B.( 2012). Psychological Characteristics and Its Impact on Firm Performance: A Case Study of Small and Medium Entrepreneurs in Sri Lanka. International Journal of Multidisciplinary Management Studies.12 (12), 36-51.

- [Indexed in PROQUEST, ULRICH, Open J.gate and others]

- Nimalathasan,B., Balaputhiran,S & Priya,K. (2012). Evaluating the Financial Soundness of Selected Commercial Banks in Sri Lanka: An Application of Bankometer Model. International Journal of Research in Commerce and Management, 3 (11), 12-14

- Achchuthan,S & Nimalathasan,B ( 2012). Level of Entrepreneurial Intention of Management Undergraduates in the University of Jaffna, Sri Lanka: Scholars and Undergraduates Perspective. South Asian Academic Research Journals, 2 (10), 24-42.

- [ Indexed in PROQUEST, ULRICH, Open J.gate and others]

- Nimalathasan,B & KumarGandhi,R.(2012). Mutual Fund Financial Performance Analysis: A Comparative Study on Equity Diversified schemes and Equity Mid-Cap Schemes. EXCEL, International Journal of Multidisciplinary Management Studies.2 (3),91-106.

- Alok Kumar, P. and Nimalathasan,B.( 2012).Value Added: A Measure of Corporate Performance. Knowledge Hub, 1(7): 64-74

- [Indexed in Cabell’s]

- Arulvel, K.K; Balaputhiran,S, and Nimalathasan, B.( 2012). Financial Diagnosis: A Case Study of Lanka Aluminium Industries Plc in Sri Lanka. International Journal of Research in Commerce and Management,, 2(11),10-13.

- Anojan,V., Arulalan,N.& Nimalathasan,B.( 2013). Working Capital Management and Its Impact on Profitability: A Study of Selected Listed Beverage, Food and Tobacco Companies in Colombo Stock Exchange, Sri Lanka. The International Journal of Business Management, 1(6):15-20.

- [Indexed in DRJI, Open J-Gate and others]

- Priya,K., & Nimalathasan,B. ( 2013). Board Characteristics and Capital Structure: A Case Study of Selected Hotels & Restaurants in Sri Lanka. International Journal of Management and Social Sciences.2 (12):21-33.

- [Indexed in GIF, ASJR, Aol. and Google Scholar]

- Anojan,V., & Nimalathasan,B.( 2013). Factors Influencing in Career choice of Second Year Undergraduate Students: A Case Study of Faculty of Management Studies & Commerce, University of Jaffna, Sri Lanka. International Journal of Social Science & Interdisciplinary Research,2(11),16-25.

- [Indexed in Cabell’s and others]

- Ajanthan,A., Balaputhiran,S. & Nimalathasan,B (2013). Corporate Governance and Banking Performance: A Comparative Study between Private and State Banking Sector in Sri Lanka. European Journal of Business and Management 08/2013; 5(20):92-100.

- [Indexed in EBSCO, ULRICH, EZB and others]

- Elangkumaran.P & Nimalathasan. B .(2013).Leverage and its Impact on Earnings and Share Price A Special Reference to listed Companies of Colombo Stock Exchange (CSE) in Sri Lanka. International Journal of Technological Exploration and Learning (IJTEL) 2(4):166-171.

- [Indexed in DOAJ, DRJI, Issuu, Science Central.com and others]

- Priya,K. & Nimalathasan,B .(2013). Liquidity Management and Profitability: A Case Study of Listed Manufacturing Companies in Sri Lanka. International Journal of Technological Exploration and Learning (IJTEL), 2(4):161-165

- [ Indexed in DOAJ, DRJI, Issuu, Science Central.com and others]

- Nimalathasan, B & Achchuthan,B.(2013). Personal Demographic Factors and Its Influence on Entrepreneurial Intention: A Case in Sri Lanka. IJTEL,2(3),109-112.

- Priya,K. & Nimalathasan,B.( 2013). Value Added and Financial Performance: A Case Study of Listed Manufacturing Companies in Sri Lanka. SAARJ Journal on Banking & Insurance Research, 64-75.

- [Indexed in EBSCO, DOAJ, PROQUEST, ULRICH, DRJI and Google Scholar]

- Nimalathasan,B. & Priya,K.(2013). Evaluating Financial Performance using Cash flow ratios: A Case study of listed manufacturing company in Sri Lanka. International Journal of Management and Technology,3(2),7-10.

- Nimalathasan, B. (2007). Women in Management. Bankers Journal, XXV (01):3-5

- Nimalathasan, B. (2007). Application of Service Marketing Mix in Banking: A Special Reference to Bank of Ceylon of Jaffna, CATALYST of Welfare Society of Bank of Ceylon, Jaffna, 1(2): 17-19.

- Nimalathasan, B . (2007). Customer Satisfaction. The Insurance World, 04: 34-35.

- Velnampy, T., & Nimalathasan, B. (2007). Impact of organizational Growth on Profitability: A Study of Bank of Ceylon, Sri Lanka. Annamalai Business Review, 2(1): 1-9.

- Nimalathasan, B.( 2008). A Comparative Study of Financial Performance of Banking Sector in Bangladesh: An Application of CAMELS Rating System. Analele, Economics and Administrative Series, of the University of Bucharest Romania, VII: 4-52.

- Nimalathasan,B.( 2008).A Relationship between Owner-Manager’s Environmental Awareness and Small Business Performance. Manager, University of Bucharest, 7, 83-88..

- Velnampy,T.,& Nimalathasan, B.( 2008). An Association between Organizational Growth and Profitability in Commercial Bank of Ceylon Ltd in Sri Lanka. Analele Economics and Administrative Series, of the University of Bucharest, II, 43-52.

- Nimalathasan,B .(2008). Characteristics of Entrepreneurs: A Comparative Study of Small Scale Entrepreneurs of Sri Lankan and Bangladesh. Lex et Scientia, International Journal, XV, 350-358.

- Nimalathasan,B.( 2008). Marketing Audit: A Theoretical Overview. CATALYST of Welfare Society of Bank of Ceylon, Jaffna, 02(02), 15-18.

- Nimalathasan,B.( 2008). Ethics is banking: Some Theoretical Aspects. CATALYST of Welfare Society of Bank of Ceylon, Jaffna, 02(02), 31-34.

- Taher, M.A., Nimalathasan,B., & Kamrul,A. (2009) Intrapreneurship: The new Competitive Approach. Maneggiare, 4,21-30.

- Ather, S.M., & Nimalathasan, B. (2009). Factor Analysis: Nature, Mechanism & Uses in Social and Management Researches. Journal of ICMAB of Bangladesh, XXXVII (2),12-16.

- Nimalathasan, B.( 2009). Determinants of Key Performance Indicators (KPIs) of Private Sector Banks in Sri Lanka: An Application of Exploratory Factor Analysis. The Annals of the STEFAN CELMARE,9(2/10), 9-17.

- Nimalathasan, B. (2009). Entrepreneurial Characteristics and Gender wise Variations in Sri Lanka: A Discriminant Analysis, Journal of IPM Meerut, 10(1), 67-77.

- Nimalathasan, B (2009). Social Responsibility of Business: A Case Study of Grameen Phone in Bangladesh. Analele of University Bucharest, Economic and Administrative Sciences, 227-237.

- Nimalathasan,B.,( 2009). Profitability of Listed Pharmeutical Companies in Bangladesh: An Inter & Intra comparison Ambee & Ibn Sina companies Ltd. Analele of University Bucharest, Economic and Administrative Sciences, 139-148.

- Nimalathasan,B., & Taher, M.A.(2009).Entrepreneurship Development Potentiality in Bangladesh – A Lessons for Sri Lanka, Annamalai Business Review, 3(2),21-31.

- Subramaniyam,A.,& Nimalathasan,B.( 2009).Measurement of Operational Performance through Ratio Analysis: A Case Study of Selected Listed Manufacturing Companies in Sri Lanka. Journal of IPM Meerut, 10(2), 59-70.

- Nimalathasan, B., & Alexandru, N.(2010). Factors Contributing Towards Banking Performance: A Comparative Study of State and Private Sector Banks in North and Eastern Provinces of Sri Lanka. Metalurgia International, XV(5),93-97.

- Velnampy, T., & Nimalathasan, B. (2010). Firm Size on Profitability: A Comparative Study of Bank of Ceylon and Commercial Bank of Ceylon Ltd in Sri Lanka. Global Journal of Management and Business Research for Publication (GJMBR),10(2),96-103.

- Nimalathasan,B., & Taher, M.A.(2010). Entrepreneurship Development through Business Education in Sri Lanka: A Country Profile. Sankhya International Journal of Management and Technology, 1(2), 17-22.

- Nimalathasan,B. (2010). Empowering Women Through Entrepreneurship Development in Emerging Economies Analele Universitath Bucuresti, IV,63-70.

- Absar, N.M.N., & Nimalathasan, B .(2010). HR Practices of Industrial Enterprises in Bangladesh: An Approach to Factor Analysis. The Bangladesh Accountant Journal of the Institute of Chartered Accountants of Bangladesh,67(38), 79-84.

- Nimalathasan,B.( 2010).Working Capital Management Practices: A Case Study of Listed Manufacturing Companies in Sri Lanka. India, Journal of IPM. 11(1), 65-74.

- Kumar Gandhi, R.,Taher, M.A.,& Nimalathasan,B.( 2010). Retail Management Attitudes towards and their impact on Internee’s Performance: A Study of Selected Retail Enterprises in Bangladesh. SRM Management Digest, 8,107-115.

- Kumar Gandhi,R.., Gobiraj,V., & Nimalathasan.B.( 2010). Determinants of Customer Loyalty in Leading Supermarket in United Kingdom: An Exploratory Study. SRM Management Digest, 8,95-106.

- Absar, N.M.N.,Azim,T.M., & Nimalathasan,B.( 2010). Research on HRM Practices in Bangladesh: A Review of Literature and Directions for Future Studies. Indian Journal of International Business and Finance, 1(1 &2), 71-82.

- Nimalathasan,B.( 2010). Exploring Core Competencies of Readymade Garments (RMGs) Manufacturers in Bangladesh: An Application of Exploratory Factor Analysis. Ekonomika,56(1),47-53.

- Md.Abu Taher & Nimalathasan,B.( 2010). Industrial Relations in Sri Lanka: Lessons for Bangladesh. Annamalai Business Review, 4(2): 43-51.

- Kumar Gandhi,R & Nimalathasan,B (2011). Role of Associated Departments (COIR BOARD and TANSIDCO towards Entrepreneurial Development in India: A Case Study Approach, 12(2),22-27.

- Taher, A & Nimalathasan,B.( 2012). Association between Emotional Intelligence (EI) and Conflict Management Styles (CMS) in RMGs, Bangladesh: An Exploratory Study. Journal of Applied Management Research , 1(1), 5-19.

- Nimalathasan, B & Pratheepkanth, P(2012). Systematic Risk Management and Profitability: A Case Study of Listed Financial Institutions in Sri Lanka. Global Journal of Management and Business Research for Publication (GJMBR), 12(142).

- Nimalathasan,B (2012). Assessing Small and Medium Enterprises’ (SMEs) Performance through Financial and Non- Financial Indicators in Sri Lanka. Vignana Jyothi Institute of Management.4 (1),1-14.

- Priya,K., & Nimalathasan,B. (2013). Dividend Policy Ratios and Firm Performance: A case study of Selected Hotels & Restaurants in Sri Lanka. Global Journal of Commerce & Management Perspective,2(6),16-22.

- Nishanthini,A & Nimalathasan, B.( 2013). Determinants of Profitability: A Case Study of Listed Manufacturing Companies in Sri Lanka. Merit Research Journal of Art, Social Science and Humanities. 05,001-006.

- Pirashanthini,S., & Nimalathasan,B.( 2013). Capital Structure and Firm Value: An Empirical Study of Listed Manufacturing firms in Sri Lanka. Merit Research Journal of Art, Social Science and Humanities.86-91

- Vijitha,P.& Nimalathasan,B.( 2014). Value relevance of accounting information and shareprice: A study of listed manufacturing companies in Sri Lanka. Merit Research Journal of Business and Management, 2(1). 001-006.

- Nishanthini A.& Nimalathasan B . (2014). Market Efficiency and Its Impact on Share Price: A Study of Listed Manufacturing Companies in Sri Lanka. Asia Pacific Journal of Research,1(XX), 111-120.

- Priya,K., Nimalathasan,B & Pratheepan,T(2015). Impact of Capital Structure on The Firm Value: Case Study of Listed Manufacturing Companies in Sri Lanka, SCHOLARS WORLD-IRMJCR, III (I),47-53.

- Ramesh,S.,T Velnampy, T & Nimalathasan,B.( 2015). Stock Market Response to Stock Split And Political Information In Sri Lankan Stock Market: An Event Study Application, Global Journal of Business And Management Research,3(3),14-21

- Taher, M.A., & Nimalathasan, B.( 2009). Inventory Management: A Case Study of Listed Chemical and Pharmaceutical Companies in Sri Lanka. Proceedings of the 3rd International Conference on Impact of Economic Crisis in Global Business Scenario, Sri Sai Ram Institute of Management Studies,14-20.

- Taher,M.A.,& Nimalathasan,B.( 2009).DeterminantsofEntrepreneurialCharacteristics in Small and Medium Entrepreneurs of Sri Lanka: An Application of Exploratory Factor Analysis. Proceedings of the 3rd International Conference on Impact of Economic Crisis in Global Business Scenario, Sri Sai Ram Institute of Management Studies, India, 139-146.

- Nimalathasan, B., & Ather, S.M.(2010). QWL and Job satisfaction of Academic Professionals in Private Universities in Bangladesh. Proceedings of the Annual Research Conference (ARC), on 15th December,2010 University of Jaffna, Sri Lanka.661-671.

- Nimalathasan, B.( 2011). Job Satisfaction of Academic Professionals: A Comparative Study between the Public and the Private Universities in Bangladesh. Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future, Annamalai University, Chiddamparam, India.14-16.

- Balaputhiran,S.,& Nimalathasan, B. (2011). Working Capital Management Performance (WCM): A Comparative Study between Listed Manufacturing and Chemical & Pharmaceuticals Companies in Colombo Stock Exchange Ltd, Sri Lanka. Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future, Annamalai University, Chiddamparam, India.150-155.

- Ramesh, S., & Nimalathasan, B. (2011). Capital Budgeting Practices: A Study of Listed Manufacturing Companies in Sri Lanka. Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future on 28th & 30th of July, 2011 conducted by Department of Business Administration, Annamalai University, Chiddamparam, India,6-10.

- Arulvel,K.K.,Balaputhiran,S., Ramesh,S., & Nimalathasan,B.( 2011). Market Efficiency or Not. Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future on 28th & 30th of July, 2011 conducted by Department of Business Administration, Annamalai University, Chiddamparam, India,35-39.

- Ramesh,S & Nimalathasan, B .(2011). Bonus Issues Announcement and Its Impact on Share Price in Colombo Stock Exchange, Sri Lanka. Proceedings of the International Conference on Business Management (ICBM) University of Sri Jayewardenepura,33-38.

- Nimalathasan, B.( 2011). Variations of Quality of Work Life of Academic Professionals in Bangladesh: A Discriminant Analysis. Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future, Sri Sai Ram Institute of Management Studies, Tamparam, India,629-637.

- Ramesh,S & Nimalathasan, B.( 2011). Political Incidents of Sri Lanka and Their impact on the Share Prices: A Study of Listed Companies in Colombo Stock Exchange (CSE) between the Periods of 2005-2008. Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future, Sri Sai Ram Institute of Management Studies, Tamparam, India,528-541.

- Gobiraj,V., & Nimalathasan.B.( 2011). Customer Satisfaction and Customer Loyalty: A Case Study of Retail Super Markets in United Kingdom (UK). Proceedings of the International Conference on Leading beyond the Horizon: Engaging Future, Sri Sai Ram Institute of Management Studies, Tamparam, India,164-173. 1

- Pushpanathan,A., Ramesh,S& Nimalathasan,B (2012). The Different Leadership Styles and their impact On Profitability: A Case Study of Women Entrepreneurs in Northern District. A Proceedings of the International Research Conference of Management and Finance, University of Colombo,80-89.

- Achchuthan,S. & Nimalathasan,B.( 2012). Relationship between Entrepreneurial Motivation and Entrepreneurial Intention: A Case Study of Management Undergraduates of the University of Jaffna, Sri Lanka. A Proceeding 09 th International Conference on Business Management,University of Sri Jeyawardenapura, 42-50.

- Pushpanathan, A., Nimalathasan, B . & Ramesh,S.(2012). A Study of Organizational Performance of Women Entrepreneurs In Northern District. A Proceeding of 09 th International Conference on Business Management,University of Sri Jeyawardenapura, 259-270.

- Achchuthan,S. & Nimalathasan,B .(2012). Entrepreneurial Motivation and Self Employment Intention: A Case Study of Management Undergraduates of the University of Jaffna, Sri Lanka. A Proceeding of the International Conference on Business and Information University of Kelaniya, 77-90.

- Anojan,V. & Nimalathasan,B.( 2014). A Comparative Study of Financial Performance of State and Private Sector Commercial Banks in Sri Lanka: An Application of CAMEL Rating System. Proceedings of the International Conference on Contemporary Management (ICCM), University of Jaffa, 23-32.

- Muraleetharan,P., Velnampy,T & Nimalathasan,B (2017). Impact of CSR on Profitability: A study Manufacturing Companies in Sri Lanka. Proceedings of the 04 th International Conference on Contemporary Management, 44-53.

- Ramesh,S & Nimalathasan,B (2017). Political Events of Sri Lanka and Their Impact on Market Efficiency and Stock Prices: A Case in Colombo Stock Exchange (CSE) Between The Periods of 2005-2014.

- Velnampy, T. and Nimalathasan,B .(2007). Balance Score Card and Organizational Performance: A Comparative study of State and Private sector banks in North and Eastern Provinces of Sri Lanka. Proceedings of the International Research Conference on Knowledge for Growth and Development, Faculty of Management and Finance, University of Colombo, Sri Lanka,34.

- Velnampy,T.,& Nimalathasan, B.( 2008). A Relationship between Firm Size and Profitability: A Comparative Study of Bank of Ceylon and Commercial Bank of Ceylon Ltd. Proceedings of the 15th Annual Sessions of the Jaffna Science Association (JSA), Jaffna, Sri Lanka.15(1),74.

- Nimalathasan,B .,&Nanthagpoan,Y.(2008).EnvironmentalFriendlyEntrepreneurial Marketing Strategy as Sustainable Competitive Advantage: A New Paradigm in Marketing. Proceedings of the Vavuniya Campus Annual Research Session (VCARS) of Vavuniya Campus of the University of Jaffna. Sri Lanka,36.

- Nimalathasan, B., Taher, M.A., & Nanthagopan, Y. (2008). Critical Success Factors of Readymade Manufacturing Garments Entrepreneurs in Bangladesh. Proceedings of the Vavuniya Campus Annual Research Session (VCARS) of Vavuniya Campus of the University of Jaffna. Sri Lanka,32.

- Nimalathasan, B.( 2009) Corporate Social Responsibility Practices: Some Evidence from Bangladesh. Proceedings of ANVESH Nirma Conference for Doctoral Students conducted by Institute of Management, Nirma University of Science and Technology, Ahmadabad, India,14.

- Nimalathasan,B.( 2009). Job satisfaction of Private Sector Bank’s Executives in Bank’s Executives in Bangladesh: A Factor Analysis. Proceedings of ANVESH Nirma Conference for Doctoral Students, Institute of Management, Nirma University of Science and Technology, Ahmadabad, India,12.

- Nimalathasan, B., & Ather, S.M.(2010). Bond Market Development: A Factor Analytical Approach. Proceedings of the Vavuniya Campus Annual Research Session (VCARS) of the Vavuniya Campus of the University of Jaffna. Sri Lanka,5.

- Nimalathasan, B., & Ather, S.M.(2010). Quality of Work life (QWL) and Job Satisfaction: A Comparative Study between Public and Private Universities in Bangladesh. Proceedings of the Annual Research Session (ARS), Eastern University of Sri Lanka, 39.

- Rathika,S., & Nimalathasan,B.( 2012). Cash Conversion Cycle (CCC) and Profitability: A Case Study of Selected Listed Manufacturing Companies in Sri Lanka. Proceedings of the Abstract Jaffna University International Conference (JUICE-2012),50.

- Rathirani,Y. & Nimalathasan,B .(2012). Learner Support Services and Performance of the Students: A Case Study on Bachelor of Business Management (Online) Degree Programme, University of Jaffna, Sri Lanka,52.

Mr.K.K.Arulvel’s Publications:

- Arulvel, K.K, Balaputhiran,S, Ramesh,S, and Nimalathasan, B .(2011), Market Efficiency or Not: A study of Emerging Market of Colombo Stock Exchange(CSE) in Sri Lanka, Proceeding of International Conference of Annamalai University, India

- Arulvel, K.K, Balaputhiran,S, and Nimalathasan, B .(2012). Financial Diagnosis: A Case Study of Lanka Aluminium Industries Plc in Sri Lanka. International Journal of Research of Commerce and Management, 2(11): 10-13.

- Arulvel K.K and Balaputhiran S . (2013). FINANCIAL POSITION OF BANKING SECTOR: A COMPARATIVE STUDY BETWEEN STATE AND PRIVATE SECTOR BANKS IN SRI LANKA. An International Multidisciplinary Research Journal , 3 (2), 212-221, ISSN:2249-7137.

- Tharmila K. and Arulvel K. K . (October, 2013). THE IMPACT OF THE CAPITAL STRUCTURE AND FINANCIAL PERFORMANCE: A STUDY OF THE LISTED COMPANIES TRADED IN COLOMBO STOCK EXCHANGE. Merit Research Journal of Accounting, Auditing, Economics and Finance, Vol. 1(5) pp. 106-117.

- Arulvel,K.K. (2016). Stock Market Behavior to the Release of Financial Statements: A Study of Selected Listed Manufacturing Firms in Sri Lanka, International Journal of Advanced Research in Computer Science and Software Engineering, Volume 6, Issue 5, ISSN: 2277 128X

- Arulvel,K.K. (2016). Effects of Board Structure on Firm Performance: A Comparison between Consumer Discretionary and Material Industries in Sri Lanka , International Journal of Emerging Research in Management & Technology, Volume 5, Issue 5, ISSN: 2278 9359

Mr.A.Ajanthan’s Publications:

- Ajanthan, A. (2013). The relationship between dividend payout and firm profitability: A study of listed hotels and restaurant companies in Sri Lanka. International Journal of Scientific and Research Publications , 3 (6), 1-6.

- Ajanthan, A. (2013). Corporate governance and dividend policy: A study of listed hotels and restaurant companies in Sri Lanka. International Journal of Management, IT and Engineering , 3 (12), 98.

- Ajanthan, A. (2013). A Nexus between Liquidity & Profitability: A Study of Trading Companies in Sri Lanka. European Journal of Business and Management , 5(7), 221-237.

- Ajanthan, A. (2013). Determinants of Capital Structure: Evidence from Hotel and Restaurant Companies in Sri Lanka (June 12, 2013). International Journal of Scientific and Research Publications , Volume 3, Issue 6, June 2013.

- Ajanthan, A. (2013). Impact of Corporate Governance Practices on Firm Capital Structure and Profitability: A Study of Selected Hotels and Restaurant Companies in Sri Lanka. Research Journal of Finance and Accounting , Vol. 4, No. 10, 2013.

- Ajanthan, A., Balaputhiran,S & B. Nimalathashan.(2013). Corporate Governance and Banking Performance: a Comparative Study between Private and State Banking Sector in Sri Lanka.” European Journal of Business and Management, 5 (20),92-100.

- Alagathurai, A. (2013). Working Capital Management (WCM) and Corporate Profitability (CP): A Study of Selected Listed Companies in Sri Lanka. International Journal of Business & Management , Vol. 1, No. 2.

- Velnampy, T., & Ajanthan, A. (2014). Efficiency and financial sustainability of micro finance institutions: A study of Jaffna district. Asian Journal of Multidimensional Research (AJMR) , 3 (2), 103-121.

- Arulvel, K., & Ajanthan, A. (2013). Capital structure and financial performance: A study of listed trading companies in Sri Lanka. ACADEMICIA: An International Multidisciplinary Research Journal , 3 (6), 1-13.

- Achchuthan, S., & Alagathurai, A. (2017). A Quest for Seeking Microcredit among Youth: Evidence from an Emerging Nation in South Asian Region. Advances in Management & Applied Economics, Vol. 7, No. 2, 159-180.

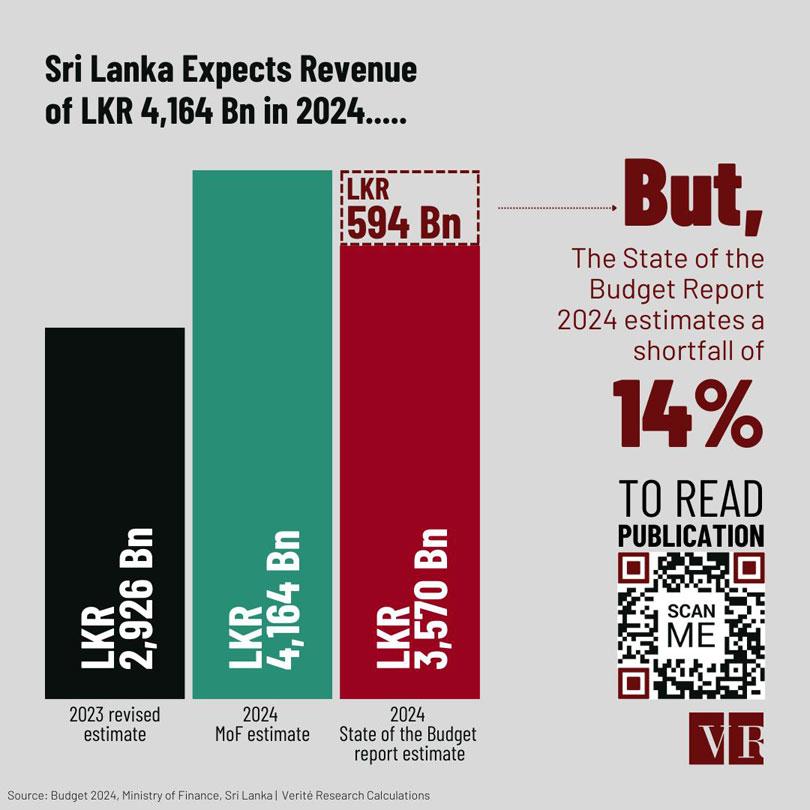

Annual Flagship report published on PublicFinance.lk by Verité Research assesses the assumptions made in the 2024 budget estimates.

With the new income taxes imposed, check out how much you would be paying in different tax structures!

These datasets provide statistics on key public finance issues including debt, expenditure, revenue, and financing. The data is available to download in multiple formats including Excel.

An up-to-date selection of the most significant official reports relating to public finance in Sri Lanka. These include appropriation acts, public accounts, fiscal reviews, and action plans.

A comprehensive collection of public finance related legislation, regulations, and circulars.

Verité Research Insights provide analysis and infographics on the most pertinent issues relating to public finance in Sri Lanka.

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Corporate Finance Practices in Sri Lanka

- Author & abstract

- 2 Citations

- Related works & more

Corrections

- Lingesiya Kengatharan

Suggested Citation

Download full text from publisher.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

- Who we work with

- Where we are

- Right to Information Act

- Member Home Page

- General FAQ

- Resources for My Practice

- Online Library

- My Guide to Regulations

- Useful Links

- Member Services

- Member Societies

- Overseas Chapters

- Student Home Page

- Why Become a Chartered Accountant ?

- Student Login

- Student Registration

- Examination

- Practical Training

- Multimedia English Language Centre (MELC)

- IT Training Courses

- CA Students’ Society

- Scholarship Schemes

- Training and Job Opportunities

- Technical Home Page

- Accounting Standards

- Auditing Standards

- Sustainability Disclosure Standards

- Audit Pronouncements

- SMP Capacity Building

- Audit Quality Assurance

- Integrated Reporting

- Publications

- Technical Updates

- Faculty Home Page

- Information Technology

- Audit Faculty

- Financial Reporting Faculty

- Multimedia English Language Centre

- Certified Business Accountant Faculty

- Business School

- SAB Campus Home Page

2022 Research Symposium - Topics

2022 Research Symposium - Guidelines

The Institute of Chartered Accountants of Sri Lanka (CA Sri Lanka), was established in the country to help develop the accounting profession. The Institute’s prime responsibility is to work towards upholding standards in the public interest and excellence in education & professional development. In order to fulfil this important objective, CA Sri Lanka has ventured in to research activities with the aim of further enhancing the accounting profession.

The research initiatives will focus on the following areas;

- Corporate Governance

- Sustainability Reporting and/or Integrated Reporting

- Enterprise Risk Management

- Stakeholder Expectation of an Audit

- Forensic Accounting

- Implementation of IFRS

In order to serve this purpose, CA Sri Lanka has nominated an independent committee and the main objectives of the research committee will be;

1. To perform the following activities in order to reap the quality of the research outcome.

- Identify the relevant areas for possible research activities in connection with the accounting and auditing profession.

- Identify and agree on the scope with the researcher.

- Guide the researcher to complete the research on the agreed scope and the time line.

- Conduct regular reviews of research findings and provide feedback based on the outcome.

- Promote and publicize research findings in a timely manner.

2. Attract more research activities which can create value to the profession as a whole.

Secured Payment Options

- The Research Center for Management Studies and Commerce

The Research Centre for Management Studies and Commerce is dedicated to foster management related research work at the Faculty of Management Studies and Commerce. It facilitates to conduct research on academic and national issues related to management, enables the Faculty to forge links with the industry, promotes postgraduate and post-doctoral level research, and encourage visiting scholars to collaborate in research pursuits with the Faculty. It is anticipated that these, in turn, will contribute towards the economic development of the country.

Mission of the Centre

The mission of the Centre is to be a prime center for management research; knowledge creation and dissemination.

Objectives of the Center

- To promote and facilitate the development of new research initiatives including sub-research centers and to enhance the broad based and collaborative research efforts through single or multi-disciplinary fields.

- To establish strong links between FMSC and the industry in terms of research and consultancy work, including the government, private and the SME sector.

Activities of the center

The Center implements the activities approved by the Faculty Research Committee. The activities to be carried out by the Centre include;

- Co-ordinate research and related activities of the research clusters identified in the Faculty.

- Promote research among the academic staff of the Faculty.

- Facilitate the researchers in publishing their research, attending conferences and other research related activities.

- Develop links between the Faculty and the industry, public sector, private sector and SME sector in related areas of research and consultancy.

- Promote collaborations with local and international universities and research institutes.

- Facilitate and conduct research conferences.

- Conduct training programs to enhance the research skills of the staff.

- Promote a collaborative environment for management related research between the academic staff and postgraduate students working together on common interests.

- Attract leading researchers/ scholars to work in the Faculty for extended periods (postdoctoral/ sabbatical).

Research Clusters

The Centre has established twelve research clusters (listed in Table below) to promote research culture among the academic staff. Each cluster covers the broader area in management discipline. By undertaking rigorous research initiative, the clusters are expected to solve practical issues in industries as well as contribute to theoretical development in the management discipline.

Services Offered by the Centre

The Centre provides following services to conduct research on academic and national issues:

- Maintaining research-related resource pool

- Facilitating the meetings for research groups

- Conducting workshops / discussion sessions on important aspects

- Linking researchers with appropriate resource persons to obtain support

- Guiding the development of research proposals other documents

- Sharing information/knowledge relevant to research projects

- Facilitating to publish working paper series on ongoing research projects

Completed Research Projects

Ongoing research projects

Dr. K.P. Lalith Chandralal, B. Com (Special)(USJP), M.Sc. in Management (USJP), PhD (UNE), is a senior lecturer attached to the Department of Marketing Management (DMM), University of Sri Jayewardenepura. He has engaged in both academic and industrial research and immensely contributed to the enhancement of the knowledge in Marketing and Management disciplines. He has disseminated such knowledge through publications and teaching during the last two decades. His research interests are mainly on experience marketing, destination image, sustainable tourism and memorable tourism experiences.

Dr. Vilani Sachitra is a senior lecturer attached to the Department of Commerce, Faculty of Management Studies and Commerce, University of Sri Jayewardenepura, Sri Lanka. Her research interests are mainly on international competitiveness, agribusiness and capability approach. Currently, she has published twenty eight indexed journal articles, twenty five conference papers, two text books and book chapter. Follow her on [email protected]

Research Assistant

Mr. B.T.K. Chathuranga Research Assistant Email: [email protected]

For more information, please contact:

Dr. K. P. Lalith Chandralal Director Email: [email protected] ., [email protected]

Dr. Vilani Sachitra Secretary Email: [email protected] , [email protected]

Faculty Research Center, Faculty of Management Studies and Commerce, University of Sri Jayewardenepura, Nugegoda, Sri Lanka. Phone: (94) 11-2758000 (Ext- 3029), Intercom: 3029 Fax: (94) 11-2803653

Working Paper Series Guidelines

News & Events

Workshop on Network Analysis for Research: Data Visualization and Exploration using Gephi

- Vision, Mission and Values

- Department Heads

- Unit/Centre Coordinators

- Administrative Officers

- Administration

- Dean’s Office

- Finance Unit

- Supplies Unit

- Technical Officer’s Unit

- Extension Programme Unit

- Postgraduate Center for Business Studies

- Academic Calender

- Plagiarism Policy

- Awards, Scholarships and Medals

- Departments

- Business Administration

- Business Economics

- Decision Sciences

- Entrepreneurship

- Estate Management and Valuation

- Human Resource Management

- Information Technology

- Marketing Management

- Public Administration

- Business Communication Unit

- Legal Studies Unit

- Information Technology Resource Centre (ITRC)

- The Research Center for Management Studies and Commerce (RCMSC)

- Staff Development Centre

- Student Support Centre

- The Centre for Spirituality in Sustainable Business Management

- PhD and M.Phil Programmes

- PhD Program in Management

- M. Phil in Business Economics

- M. Phil in Business

- Master Programmes

- MBA / MPM / MSc in Management

- M.Sc. in Applied Finance

- M.Sc. in Real Estate Management & Valuation

- M.Sc. in Public Policy and Management

- Master of Entrepreneurship

- Master of Public Management

- Master of Professional Accounting

- Master of Business Economics

- Internal Undegraduate Programmes

- B.Sc. Honours in Accounting

- B.Sc. Honours in Business Administration

- B.Sc. Honours in Business Administration (Business Economics)

- B. Com. Honours

- B. Sc. Honours in Operations and Technology Management

- B.Sc. Honours in Entrepreneurship

- B.Sc. Honours in Estate Management and Valuation

- B.Sc. Honours in Finance

- B.Sc. Honours in Human Resource Management

- B.Sc. Honours in Business Information Systems

- B.Sc. Honours in Marketing Management

- B.Sc. Honours in Management (Public)

- External Undergraduate Programmes

- B.Sc. Business Studies (GENERAL)

- B.Sc. Public Administration (GENERAL)

- B.Com (GENERAL)

- Postgraduate Diploma Programmes

- Postgraduate Diploma in Applied Finance

- Advanced Diploma Programmes

- Advanced Diploma in Entrepreneurial Business Management

- Advanced Diploma in Computer Based Accounting

- Diploma Programmes

- Diploma in Marketing Management

- Diploma in Public Management

- Diploma in Entrepreneurial Business Management

- Certificate Programmes

- Certificate course in Data Analysis

- Certificate in Entrepreneurial Business Management

- Conferences

- International Conference on Business Management

- International Conference on Real Estate Management and Valuation

- Journal of Business Research and Insights (JBRI)

- Sri Lankan Journal of Business Economics (SLJBE)

- Asian Journal of Marketing Management (AJMM)

- Asian Finance Review (AFR)

- Journal of Real Estate Studies (JRES)

- Undergraduate Research Symposiums

- Research Centres

- Ethics Review Committee

- Industry and Partnerships

- Partnerships with students

- Expertise for industry

- Professional Development

- Memorandum of Understandings

- Industry Liaison Office

- International Affairs

- Undergraduate Studies

- Postgraduate Studies

- Collaboration with the National/International Institutes

- FMSC Alumni

- Department Alumni Associations

- Support Students

- Support Community

Rating Action Commentary

Fitch Affirms Hemas Holdings at 'AAA(lka)'; Outlook Stable

Fri 26 Apr, 2024 - 5:32 AM ET

Fitch Ratings - Colombo/Singapore - 26 Apr 2024: Fitch Ratings has affirmed Sri Lanka-based consumer and healthcare company Hemas Holdings PLC's National Long-Term Rating at 'AAA(lka)' with a Stable Outlook.

The rating reflects the defensive nature of Hemas' operating cash flow stemming from its pharmaceutical distribution and manufacturing, as well as consumer businesses, which account for around 90% of the group's EBIT. The Stable Outlook is supported by Fitch expectations that Hemas will maintain an exceptionally strong balance sheet. EBITDA net leverage is likely to remain below 1.0x over the next few years, despite the company's inorganic growth aspirations.

Key Rating Drivers

Steady Operating Performance : Fitch forecasts Hemas' revenue to rise steadily in the next few years with an EBITDA margin around 10%-11%. We expect a gradual recovery in sales volumes of consumer products against a benign macroeconomic backdrop, counterbalanced by challenges in pharmaceutical distribution due to the government's regulated pricing. Fitch expects Sri Lanka's GDP to expand by 3.3% in 2024, on easing inflation from recent highs which will improve consumers' purchasing power.

Revenue rose by 10% yoy in 9MFY24 (financial year ends March) on an increase in sales volumes in domestic consumer businesses and pharmaceutical distribution, compensating for lower prices. Still, volumes sold significantly lagged levels before the economic crisis, and we expect only a gradual recovery in volumes over the medium term, as selling prices are likely to remain high as costs such as electricity are likely to stay high. The hospitals segment also performed well with higher admittance and surgeries and procedures due to increase demand for private healthcare.

Leading Domestic Market Position : We expect Hemas to sustain its leading share in pharmaceutical import and distribution in the country, having improved its market leadership in the past two years from weakened competition. An extensive local network and strong relationships with global principals supports the distribution business. Hemas is also in pharmaceutical manufacturing, and hospitals, which are seeing higher demand arising from an ageing population, increasing non-communicable diseases and rising health insurance penetration.

Hemas is the second-largest player in the domestic home and personal care (HPC) market and the leader in stationery products. Hemas has maintained market share by launching new brands and introducing various packaging sizes, catering to customers' reduced purchasing power. We believe demand for stationery products will remain strong, despite weak consumer spending, as households will prioritise educational needs. Similarly, we believe the fundamental necessity of HPC products will ensure their resilience amid the soft operating environment.

Geographic Concentration : We forecast Hemas' EBITDA outside of Sri Lanka to remain negligible in the next two years amid challenges in its HPC business in Bangladesh and slow progress in other markets. We believe that increasing Hemas' competitiveness in Bangladesh is likely to come from continuous investments in product innovation and its distribution network, which require upfront investment and will take time. Hemas also plans to penetrate other markets in South Asia and the Middle East.

Low Leverage Despite Higher Capex : Fitch expects Hemas' EBITDA net leverage to stay below 1.0x over FY25-FY26 amid a working-capital normalisation, despite a significant increase in capex. We forecast Hemas' annual capex to increase to LKR6 billion-7 billion on core business expansion, up from the LKR1.5 billion-2 billion in the past, although we believe it has flexibility to stagger the outflows. Hemas is also looking to increase its footprint in the healthcare segment via acquisitions, although its sound balance sheet should act as a buffer against any material weakening in its financial profile.

Interest Coverage to Recover : We expect Hemas' EBITDA interest coverage to increase to around 4.7x in FY25, from 2.9x in FY23, above our negative sensitivity of 2.3x, due to falling domestic interest rates amid a more benign inflationary environment than the last two years. The average-weighted prime lending rate decreased to around 11% by end-March 2024 on easing inflation, after the rate rose to 27% in December 2022. This supports strong interest coverage over the medium term.

Derivation Summary

Hemas is rated at the same level as Lion Brewery (Ceylon) PLC (AAA(lka)/Stable), whose rating reflects market leadership in the local beer industry, helped by high entry barriers, and a strong EBITDA margin. We expect Hemas to maintain the same level of leverage as Lion in the medium term.

Hemas' rating is at the same level as that of leading conglomerate Melstacorp PLC (AAA(lka)/Stable), whose rating reflects a larger operating scale and a dominant market position in spirits, accounting for about a 70% share of the domestic alcoholic-beverage market. This supports Melstacorp's high EBITDA margin and strong free cash flow. However, we expect Hemas to maintain a stronger balance sheet with lower leverage due to its more conservative approach to investments.

Domestic mobile market leader Dialog Axiata PLC (AAA(lka)/Stable) has a stronger business profile with its market-leading position, larger operating scale and the ability to generate a wider operating EBITDA margin and pass on higher taxes to consumers. Hemas' operations are constrained by regulatory pressure from price controls on part of its pharmaceutical business and a more limited ability to pass on cost escalation to customers in the consumer sector over a short period. Hemas' stronger financial profile compensates for these differences, resulting in both companies being rated the same.

Hemas is rated one notch above local conglomerate Sunshine Holdings PLC (AA+(lka)/Stable), reflecting Hemas' larger operating scale and stronger market position in similar businesses. We expect both companies to maintain similar financial risk profiles in the medium term.

Hemas' credit considerations lead to a higher rating than for large domestic banks, non-bank financial institutions and insurance companies, which are more exposed to sovereign stress due to their large holdings of sovereign-issued securities for regulatory reasons. The large financial institutions also have a broader exposure to the various economic sectors.

Key Assumptions

Fitch's Key Assumptions Within the Rating Case for the Issuer:

- Revenue growth of 7% yoy in FY25 amid a soft economic environment. Demand to continue to recover, with revenue growth averaging high-single digits;

- EBITDA margin to settle at about 11.0% from FY25 amid moderating costs and a demand recovery;

- Capex to average LKR6.0 billion-7.0 billion a year over FY25-FY26, with most of it spent on expansion within its core businesses;

- Dividend payout to average LKR1.6 billion-1.7 billion a year over FY25-FY27.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to positive rating action/upgrade:

- There is no scope for an upgrade, as the company is already at the highest rating on our Sri Lankan National Rating scale.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

- Group EBITDA net leverage rising above 4.5x on a sustained basis;

- Group EBITDA interest cover falling below 2.3x on a sustained basis.

Liquidity and Debt Structure

Strong Liquidity : Hemas had LKR13.9 billion of unrestricted cash at end-2023, compared with LKR16 billion of debt maturing in the next 12 months. About LKR14.5 billion of its near-term maturities consist of short-term working capital lines, which we expect banks to roll over as they are backed by around LKR27 billion of net working capital assets and a steady cash conversion cycle of around 110 days. We also expect the company's working capital balances to continue to decrease on the resumption of supplier credit, leading to lower short-term debt as its operations normalise.

Hemas had unused but uncommitted credit lines of about LKR41 billion at end-2023, which also support liquidity in the normal course of business. We believe Hemas will retain strong access to banks, given its stable cash flow generation from defensive industries, compared to most other rated corporates.

Issuer Profile

Hemas is a Sri Lanka-based diversified company in the healthcare, HPC, stationery manufacturing and transportation service sectors.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

VIEW ADDITIONAL RATING DETAILS

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

APPLICABLE CRITERIA

- National Scale Rating Criteria (pub. 22 Dec 2020)

- Corporate Rating Criteria (pub. 03 Nov 2023) (including rating assumption sensitivity)

- Sector Navigators – Addendum to the Corporate Rating Criteria (pub. 03 Nov 2023)

APPLICABLE MODELS

Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s).

- Corporate Monitoring & Forecasting Model (COMFORT Model), v8.1.0 ( 1 )

ADDITIONAL DISCLOSURES

- Solicitation Status

- Endorsement Policy

- Potential Conflicts Resulting from Revenue Concentrations

ENDORSEMENT STATUS

Tuesday, 22 Jan 2019 --> Last Updated : 2024-04-27 21:03:00

Group News Sites

Sunday Times

Tamil Mirror

Middleast Lankadeepa

Life Online

Home delivery

Advertise with us

Mobile Apps

Sun, 28 Apr 2024 Today's Paper

Sri Lanka to miss budget revenue target for 33rd year running in 2024: Verité Research

21 April 2024 12:55 pm - 8 - {{hitsCtrl.values.hits}}

The State of the Budget Report is compiled annually by Verité Research and published on PublicFinance.lk, Sri Lanka’s premier platform for economic insights.

"The report provides a robust analysis and objective assessment of the fiscal, financial and economic estimates in Sri Lanka’s annual budget. It mirrors the scope of a budget report that is expected to be published by the Parliamentary Committee on Public Finance (COPF), with the same aim, of helping improve informed engagement with the budget, both in public and in parliament.

The State of the Budget Report by Verité Research has consistently been more accurate on budget outcomes than projections of the government, which are approved by Parliament. It thereby forms an important additional input for professional economic analysis and decision making in Sri Lanka.

Over-estimated tax revenue by Sri Lanka has not met a revenue to GDP target set in a budget since 1991. Most recently, the Parliamentary Committee on Ways and Means reported that tax revenue fell 13% short of the budgeted target in 2023.

For 2024, the government is expecting a revenue of LKR 4,164 billion, a 42% increase from its revised projections for 2023. However, the State of the Budget Report projects a 14% shortfall, with revenue of only LKR 3,570 billion.

In the report, 61% of the projected shortfall is attributed to over-estimation of revenue from the Value Added Tax (VAT). The remaining 39% is attributed to the over-estimation of revenue from corporate income tax, personal income tax, Social Security Contribution Levy (SSCL) and Customs import duty.

In Interest-to-revenue ratio Sri Lanka has the highest interest-cost-to-revenue ratio in the world and reducing this ratio is critical for macroeconomic stability and sustainability. The budget for 2024 expects to lower this ratio to 64%. However, the revenue projections in the State of the Budget Report, together with the government calculation of interest costs, suggests this ratio will exceed 70%, as it has in the last few years.

Comments - 8

Wake Up You Bunch of Fools Sunday, 21 April 2024 03:04 PM

Minister of Finance is in dreamland that all’s well and can start importing vehicles. Stupidity at its best from a freak who doesn’t understand the gravity of the situation. People are feedup and need urgent relief.

Reply 0 0 0 0 -->

Anil Fernando Sunday, 21 April 2024 03:17 PM

Not big news if it is 33 years.

Gabriella Sunday, 21 April 2024 04:00 PM

Yes, but Sri Lanka is batting well. I am sure she will make a hundred plus.

Reply : 0 0 -->

As usual workers and farmers to sacrifice Sunday, 21 April 2024 08:57 PM

Even in this difficult situation, our greedy community has not changed. Car importers want their business, MPs want luxury new cars, unions and politicians are not ready to concede even an inch of their demand. Then, who will sacrifice? Is it the same old story of workers, both public and private and farmers?

Kevin Monday, 22 April 2024 03:28 AM

Over estimation of state revenues for the past 33 years! That is an endemic problem that will not go away. IMF was impressed with these rosy numbers. The 17th time SL failed an IMF program half way through. More election sweeteners please!

Bandu Monday, 22 April 2024 08:55 AM

Finance minister is clueless on finance. They will steal money from retirement funds to pay for the deficit. Like it happened year ago, with local debt restructuring. Sad for retirees...

Governors Club Monday, 22 April 2024 10:08 AM

And the economic advisors of the ivory tower raise their salaries by 80% including the treasury secretary. Thats how they fight inflationary spirals

P Kunchithapathan Monday, 22 April 2024 02:52 PM

State Minister of Finance is deliberately trying ti hide figures to enable the culprits to allow the imports of vehicles. What is the mighty hurry to import vehicles without taking measures to stregnthen public transport infrastructure. This is utterly a betrayal. The State of the Budget Report by Verité Research has consistently been more accurate on budget outcomes than projections of the government, which are approved by Parliament. Ministers and the government officials are trying to mislead the public to please the cabinet and the president.

Add comment Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Name - Reply Comment

RECOMMENDED

‘Spike in blast fishing’ poses renewed threats to Sri Lanka’s marine ecosystems

UDA owned land in Thalawathugoda; UDA Minister Prasanna Ranatunga under the spotlight for forceful occupation of reserved land

Loss-making SMIB faces political pressure in recovering loans

Baltimore Bridge Collapse: MV Dali, SL authorities anchored in mystery?

US authorities are currently reviewing the manifest of every cargo aboard MV

Has Sri Lanka become a potential hub for the illegal wildlife trade?

On March 26, a couple arriving from Thailand was arrested with 88 live animal

Spotlight on Moragahakanda Development Project Moragolla villagers lose livelihoods and down to one meal a day

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Ambitious Sri Lankan jobseekers ‘trafficked into Ukraine war zones’

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

Most Viewed in News

Sri lanka weighs open skies amidst plans for national carrier privatization.

Not AirAsia bidding to acquire SriLankan: Capital A CEO clarifies

Gota fires back at Cardinal, rebuts allegations

Ranil Wickremesinghe caravan moves on despite barking dogs

Sri Lankan among NASA’s new crew for next simulated Mars journey

Businessman claims Rs.50 Mn from Gota, Mahinda, Basil

MIRROR CRICKET

Sahan Arachchige to lead Sri Lanka ‘A’

26 Apr 2024 - 0 - 205

Is Chamari Athapaththu Sri Lanka’s greatest cricketer ever?

24 Apr 2024 - 15 - 2197

Athapaththu back atop ICC Women’s ODI Batting Rankings

23 Apr 2024 - 1 - 951

Chamari Athapaththu sets big goal for T20 World Cup

19 Apr 2024 - 6 - 1324

TODAY'S HEADLINES

Sri lanka to establish new energy sector regulator.

27 Apr 2024

Cabinet nod to transfer China-built Mattala airport’s management to Indian, Russian joint venture

Sajith never attends dinners hosted by ranil wickremesinghe, one soldier dead, nine injured in road crash.

26 Apr 2024

Dates confirmed for 78th Bradby Shield

SLAS appoints independent committee for investigation

25 Apr 2024

Pakistan lose key players for last two T20Is against New Zealand

- The Star ePaper

- Subscriptions

- Manage Profile

- Change Password

- Manage Logins

- Manage Subscription

- Transaction History

- Manage Billing Info

- Manage For You

- Manage Bookmarks

- Package & Pricing

AirAsia Consulting in early talks for SAL acquisition

- Corporate News

Wednesday, 24 Apr 2024

Related News

Russia's Yandex reports Q1 revenue rise as market awaits spin-off news

Microlink wins contract worth rm56mil, worldwide, masdar ink mou.

“Currently, it is in the pre-qualification stage, and no purchase bid or cash was involved,” AirAsia Consulting CEO Subashini Silvadas said.

KUALA LUMPUR: AirAsia Consulting is planning further engagement with the International Finance Corp (IFC) which is mandated to advise the Sri Lanka government on the divestiture of SriLankan Airlines Ltd (SAL).