Multiple Choice

Conservatism means that if there is uncertainty in a potential financial estimate, a company should err on the side of caution and report the most conservative amount. For the example, answers will vary. Sample answer: When I am budgeting for revenue in our household, I estimate what amount we will be paid, and I always round slightly down and with the expenses round up slightly so that there is a little leftover.

Assets = Liabilities + Equity; Revenues increase equity, while expenses decrease equity.

The general journal.

Decreasing cash decreases assets; decreasing accounts payable decreases liabilities. Assets (decrease) = Liabilities (decrease) + Equity (no change).

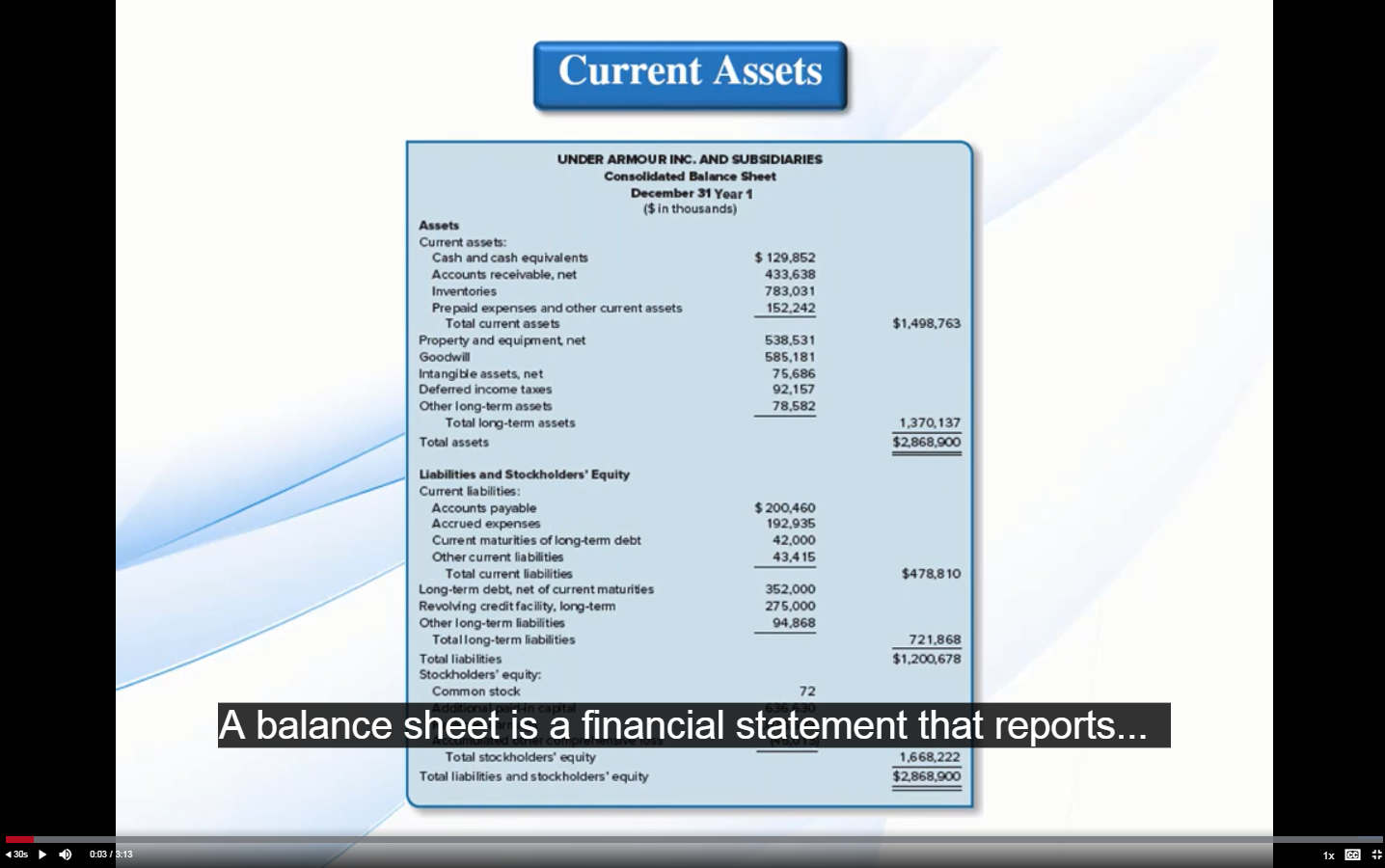

The combined total of liabilities and equity equals the total of assets because there is a claim against every asset that the company owns. Creditors have claims against some of the company’s assets, in the amount of the liabilities owed to them; owners (stockholders) have claims against all the rest of the company’s assets. Equity is the total of assets minus liabilities, which is sometimes referred to as net assets.

The total in accounts receivable will increase with a debit. We know this because accounts receivable is an asset account, and asset balances increase with debit entries.

A journal is a chronological listing of all of the recordable transactions that have occurred in a company.

Recognize means to make a journal entry.

It is a comprehensive listing for all accounts a company has and their balances.

T-accounts represent the changes made to the general ledger. They are used as an illustrative tool when planning or discussing the effects a particular transaction will have on the accounting records. T-accounts are used in academic and business situations, as they are easier to sketch out than general journals.

A prepaid account is an account that shows the balance of money we have paid in advance of an expense being incurred. Prepaid accounts are assets.

A T-account is a visual depiction of the activity in an account. Entries made on the left side of the T-account represent debits, while entries on the right side represent credits. The ending account balance is the total net combined debits and credits for that account.

Asset accounts, dividend accounts, and expense accounts are increased with a debit. (Also, contra-liability accounts, contra-equity accounts, and contra-revenue accounts are increased with a debit.)

Normal balance refers to the expected ending balance for an account, based on the way that the account balance increases (either debit or credit.)

The purpose of the trial balance is to recap the account balances, to ensure that debits equal credits. The trial balance is used to prepare the financial statements, in this order: Income Statement, Retained Earnings Statement, and Balance Sheet.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/chapter-3

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Select a product below:

- Connect Math Hosted by ALEKS C

- My Bookshelf (eBook Access) C

Sign in to Shop:

- Professional

- International

- Sign In

- There are currently no items in your shopping cart.

- News & Insights

- Diversity, Equity & Inclusion

- Social Responsibility

- About

- Get Support

Get Support

- My Account Details

Choose a content option below that suits your rigor, writing and teaching preferences.

The Spiceland-Thomas “Organized Learning Framework” presents material in a clear, concise, and balanced fashion through a widely praised conversational writing style.

Financial Accounting, 5th Edition By David Spiceland and Wayne Thomas and Don Herrmann ©2019

A highly respected and time-tested title that employs a rigorous, proven pedagogy widely used by a majority of top business programs.

Financial Accounting, 10th Edition By Robert Libby, Patricia Libby, and Frank Hodge ©2020

A decision maker’s approach that builds critical-thinking skills and drives conceptual foundations by delaying the use of terms like “debits” and “credits.”

Introductory Financial Accounting for Business, 1st Edition By Thomas Edmonds and Christopher Edmonds ©2019

A user’s approach that drives students to understand financial accounting’s overall impact on a business.

Fundamental Financial Accounting Concepts, 10th Edition By Thomas Edmonds, Christopher Edmonds, Frances McNair, and Philip Olds ©2019

A balanced approach with an engaging writing style, entrepreneurial focus, and data-driven pedagogy shown to improve Accounting Cycle understanding.

Fundamentals of Financial Accounting, 6th Edition By Fred Phillips, Robert Libby, and Patricia Libby ©2019

Fundamentals of Financial Accounting, Sixth Edition By Fred Phillips, Robert Libby, and Patricia Libby ©2019

A “building-block” approach with a visually engaging presentation and streamlined coverage, including real-world business examples and analytical decision-making tools.

Financial Accounting Fundamentals, 7th Edition By John Wild ©2019

A streamlined, visually enhanced edition that uses real business examples, analytical decision-making tools, and a highly engaging “building block approach.”

Financial Accounting: Information for Decisions, 9th Edition By John Wild ©2019

A selection of the Financial chapters from the popular Fundamental Accounting Principles title, taking a step-by-step approach to sole proprietorship examples to help build student confidence.

Principles of Financial Accounting (Chapters 1-17) 24th Edition By John Wild and Ken Shaw ©2019

Digital tools to help your students succeed in your Financial Accounting course

McGraw Hill Connect® for Financial Accounting provides the most comprehensive solution to the market. Each asset in Connect is designed to address pressing course challenges, like student engagement, student preparedness, and relevancy. No matter how your course is designed, we have a solution that’s got you covered.

Helping students get ready for your course

SMARTBOOK® – Smartbook makes study time as productive and efficient as possible. SmartBook identifies and closes knowledge gaps through a continually adapting reading experience that highlights portions of the content based on comprehension. Students have a visual representation of the areas in which they have demonstrated understanding, as well as areas in which they need to focus. The result? More confidence, better grades, and greater success.

Helping students prepare for lecture

CONCEPT OVERVIEW VIDEOS – Videos that teach each chapter’s core learning objectives and concepts through an engaging multimedia presentation. These learning tools bring the text content to life through video, audio, and checkpoint questions that are graded for accuracy – ensuring students complete and fully comprehend the material. Concept Overview Videos harness the full power of technology to truly engage and appeal to all learning styles. Concept Overview Videos are ideal in all class formats—online, face-to-face or hybrid.

Accounting Assignment Help » Financial Accounting Assignment Help » Connect Financial Accounting Chapter 3 Homework

Connect Financial Accounting Chapter 3 Homework

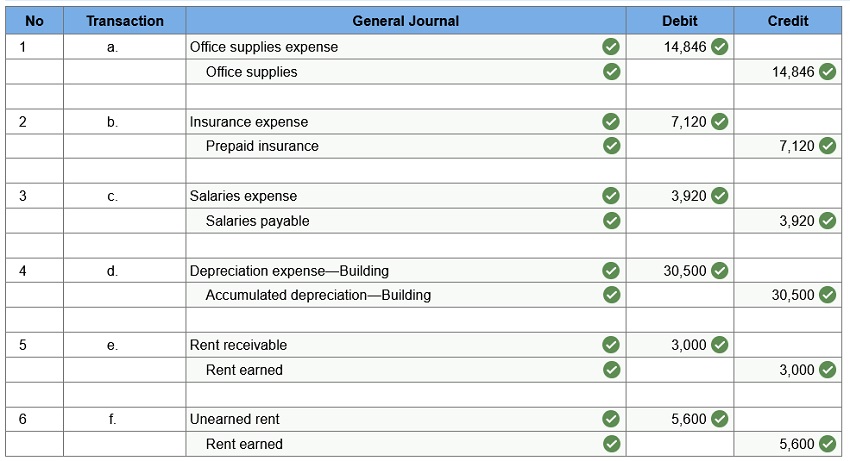

Q1. Arnez Company’s annual accounting period ends on December 31, 2019. The following information concerns the adjusting entries to be recorded as of that date.

a. The Office Supplies account started the year with a $4,000 balance. During 2019, the company purchased supplies for $13,400, which was added to the Office Supplies account. The inventory of supplies available at December 31, 2019, totaled $2,554.

b. An analysis of the company’s insurance policies provided the following facts.

The total premium for each policy was paid in full (for all months) at the purchase date, and the Prepaid Insurance account was debited for the full cost. (Year-end adjusting entries for Prepaid Insurance were properly recorded in all prior years.)

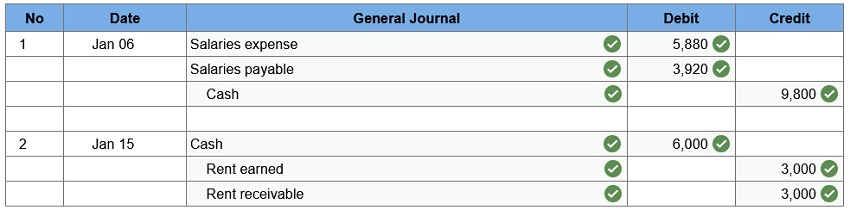

c. The company has 15 employees, who earn a total of $1,960 in salaries each working day. They are paid each Monday for their work in the five-day workweek ending on the previous Friday. Assume that December 31, 2019, is a Tuesday, and all 15 employees worked the first two days of that week. Because New Year’s Day is a paid holiday, they will be paid salaries for five full days on Monday, January 6, 2020.

d. The company purchased a building on January 1, 2019. It cost $960,000 and is expected to have a $45,000 salvage value at the end of its predicted 30-year life. Annual depreciation is $30,500.

e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,000 per month, starting on November 1, 2019. The rent was paid on time on November 1, and the amount received was credited to the Rent Earned account. However, the tenant has not paid the December rent. The company has worked out an agreement with the tenant, who has promised to pay both December and January rent in full on January 15. The tenant has agreed not to fall behind again.

f. On November 1, the company rented space to another tenant for $2,800 per month. The tenant paid five months’ rent in advance on that date. The payment was recorded with a credit to the Unearned Rent account. Assume no other adjusting entries are made during the year.

Use the information to prepare adjusting entries as of December 31, 2019.

Prepare journal entries to record the first subsequent cash transaction in 2020 for parts c and e .

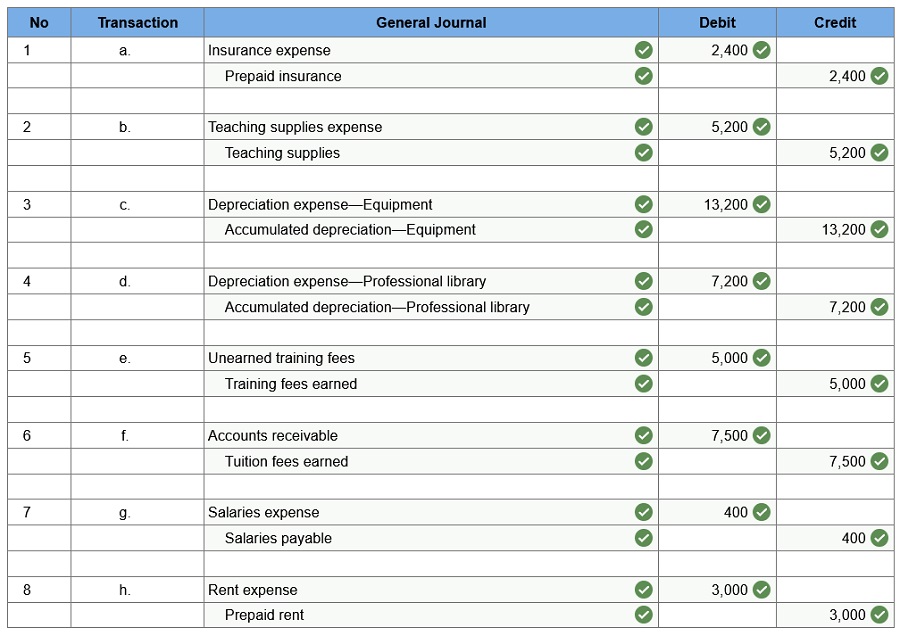

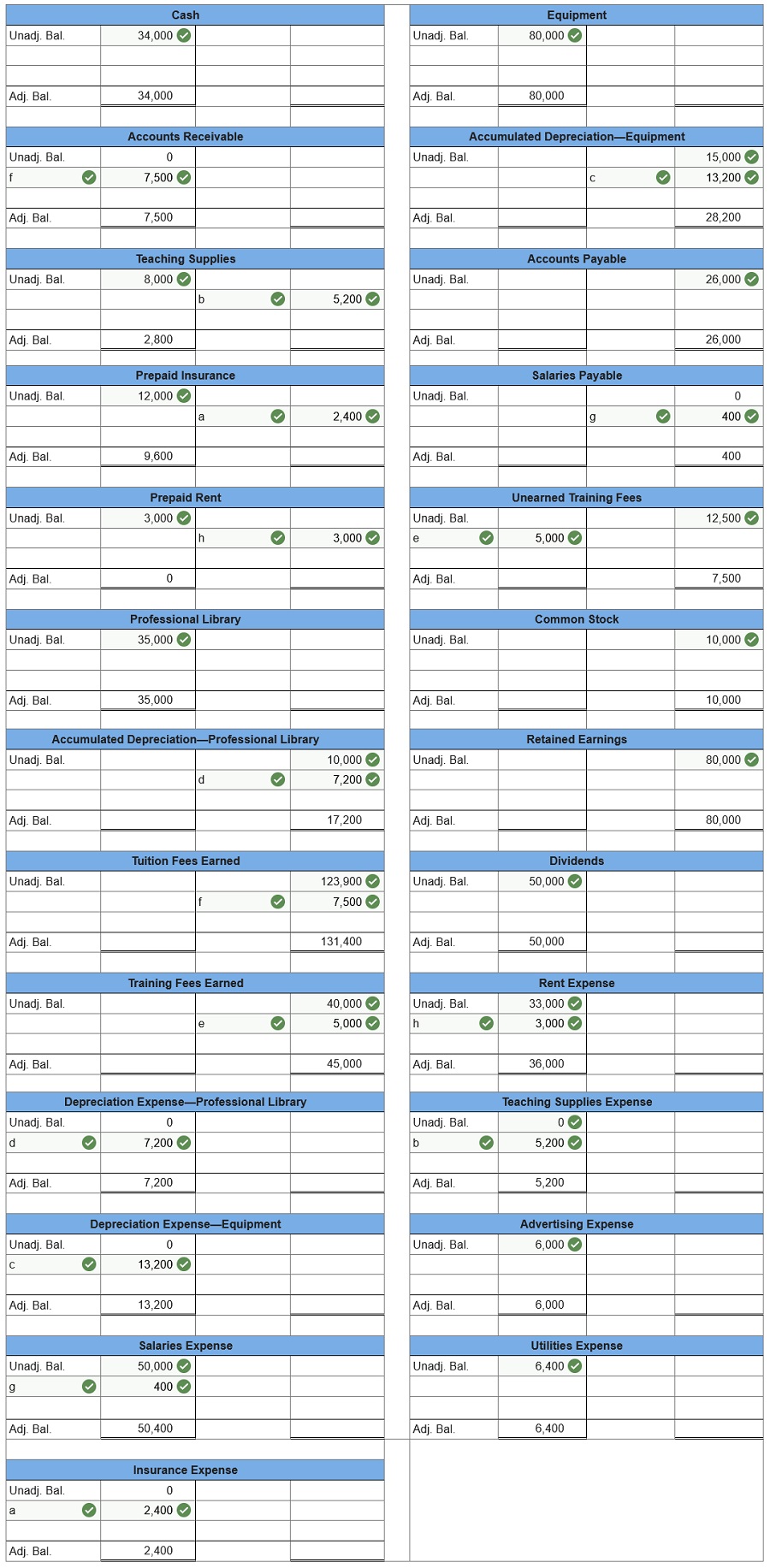

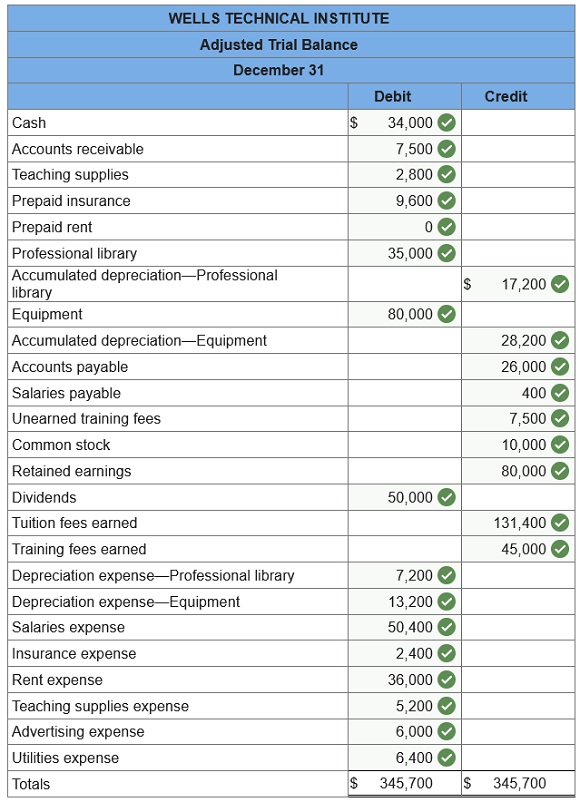

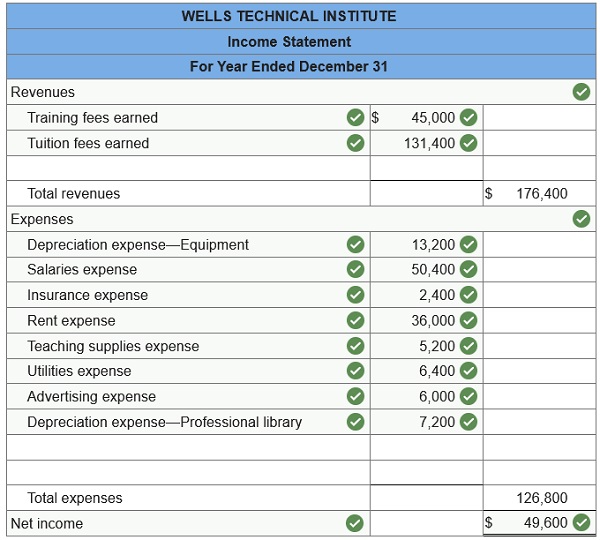

Q2. Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows along with descriptions of items a through h that require adjusting entries on December 31.

Additional Information Items

- An analysis of WTI’s insurance policies shows that $2,400 of coverage has expired.

- An inventory count shows that teaching supplies costing $2,800 are available at year-end.

- Annual depreciation on the equipment is $13,200.

- Annual depreciation on the professional library is $7,200.

- On September 1, WTI agreed to do five courses for a client for $2,500 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $12,500 cash in advance for all five courses on September 1, and WTI credited Unearned Training Fees.

- On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $7,500 of the tuition has been earned by WTI.

- WTI’s two employees are paid weekly. As of the end of the year, two days’ salaries have accrued at the rate of $100 per day for each employee.

- The balance in the Prepaid Rent account represents rent for December.

1 Prepare the necessary adjusting journal entries for items a through h . Assume that adjusting entries are made only at year-end.

2a Post the balance from the unadjusted trial balance and the adjusting entries in to the T-accounts.

2b Prepare an adjusted trial balance.

3a Prepare Wells Technical Institute’s income statement for the year.

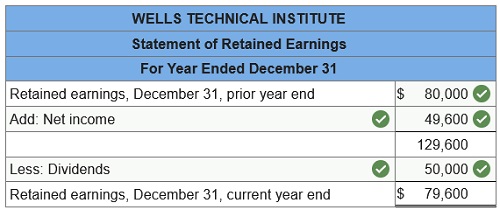

3b Prepare Wells Technical Institute’s statement of retained earnings for the year. The Retained Earnings account balance was $80,000 on December 31 of the prior year .

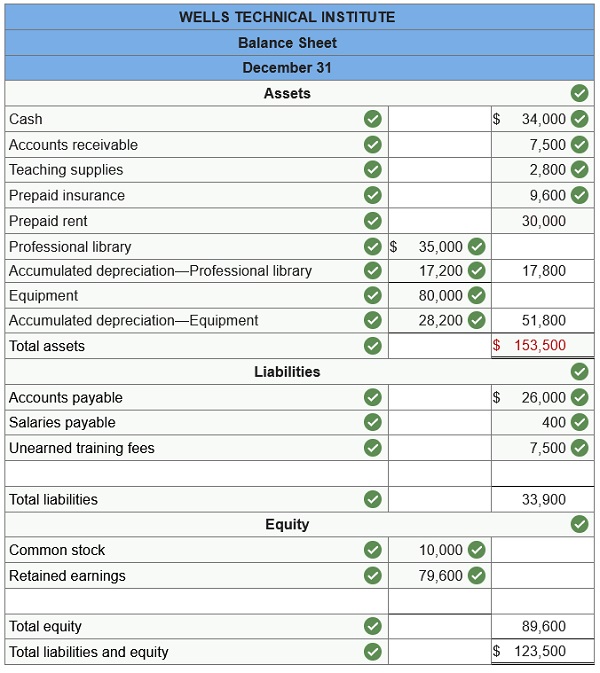

3c Prepare Wells Technical Institute’s balance sheet as of December 31.

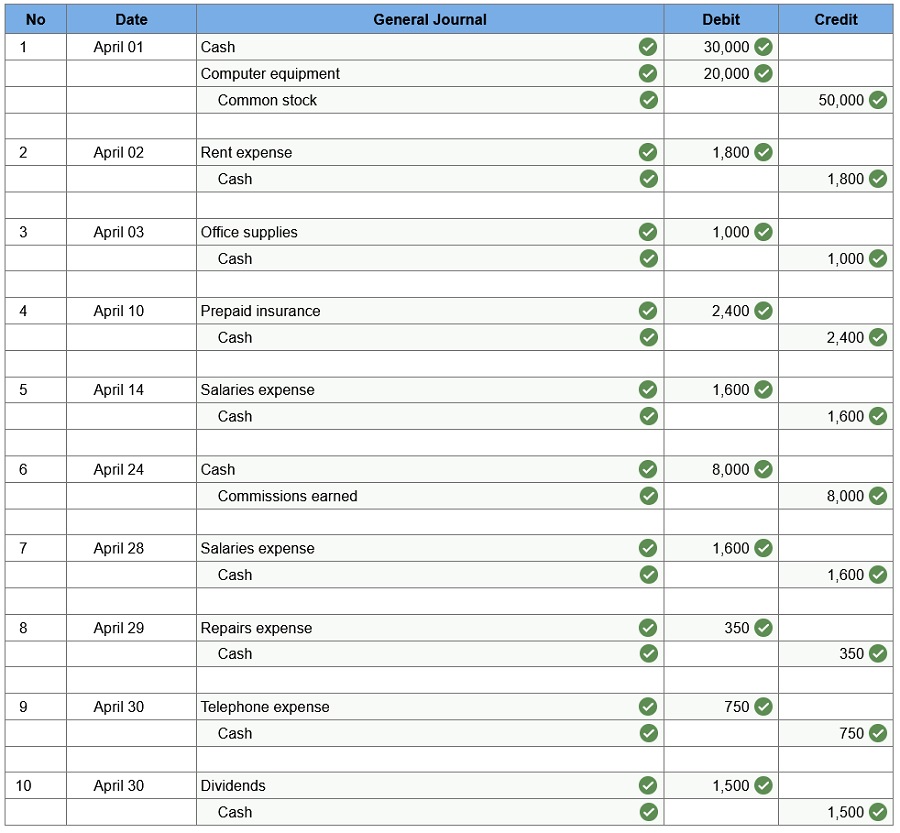

Q3. On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company’s first month.

The company’s chart of accounts follows.

Use the following information:

- Prepaid insurance of $133 has expired this month.

- At the end of the month, $600 of office supplies are still available.

- This month’s depreciation on the computer equipment is $500.

- Employees earned $420 of unpaid and unrecorded salaries as of month-end.

- The company earned $1,750 of commissions that are not yet billed at month-end.

Required: 1. & 2. Prepare journal entries to record the transactions for April and post them to the ledger accounts in Requirement 6b. The company records prepaid and unearned items in balance sheet accounts.

5c. Prepare the balance sheet at April 30. 6a. Prepare journal entries to close the temporary accounts and then post to Requirement 6b. 6b. Post the journal entries to the ledger. 7. Prepare a post-closing trial balance.

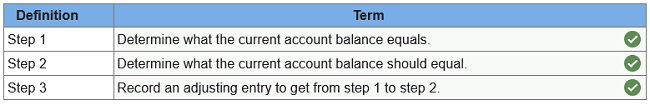

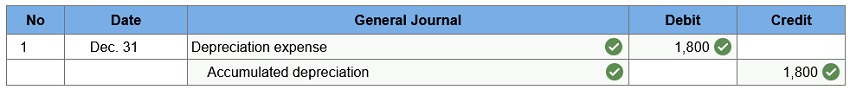

Q4. Place the steps in the three-step adjusting process in the correct order:

Q5. On January 1, the company purchased equipment that cost $10,000. The equipment is expected to be worth about (or has a salvage value of) $1,000 at the end of its useful life in five years. The company uses straight-line depreciation. It has not recorded any adjustments relating to this equipment during the current year. Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

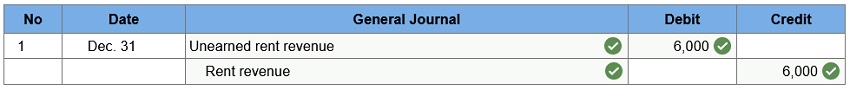

Q6. On November 1, the company rented space to another tenant. A check in the amount of $9,000, representing three months’ rent in advance, was received from the tenant on that date. The payment was recorded with a credit to the Unearned Rent Revenue account. Complete the necessary December 31 adjusting journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

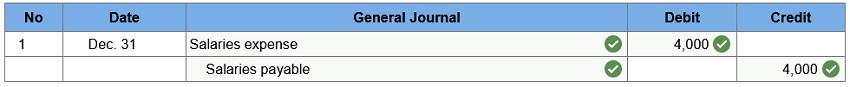

Q7. The company employs a single employee who works all five weekdays and is paid on the following Monday. The employee works the entire week ending on Friday, December 30. The employee earns $800 per day. Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

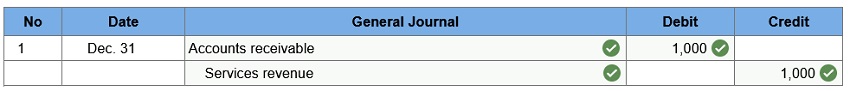

Q8. On Saturday, December 31, the company’s owner provided ten hours of service to a customer. The company bills $100 per hour for services provided on weekends. Payment has not yet been received. The owner did not stop in the office on Saturday; as such, on December 31, the services were unbilled and unrecorded. Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.

Q9. Before the adjusting entry for a deferral of an expense, the expenses will be _____ and the assets will be _____.

- Understated; overstated

- Overstated; understated

- Understated; understated

- Overstated; overstated

Q10. Assume that the Accumulated Depreciation account has an unadjusted normal balance of $120,000. The company’s list of adjusting entries includes one that debits Depreciation Expense and credits the Accumulated Depreciation account for $20,000. The adjusted balance in the Accumulated Depreciation account is a:

- credit balance of $140,000

- debit balance of $120,000

- credit balance of $120,000

- debit balance of $140,000

To get rest of the solutions, please connect with us via live chat or via WhatsApp at +44 7448-027841

IMAGES

VIDEO

COMMENTS

Step-by-step solution. Step 1 of 7. Adjusting entries: Adjusting entries refer to the entries passed prior to the issue of financial statements, to convert accounting records to the accrual basis of accounting. They are usually passed at the end of the accounting period. Step 2 of 7.

Now, with expert-verified solutions from Financial Accounting 3rd Edition, you'll learn how to solve your toughest homework problems. Our resource for Financial Accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. With Expert Solutions for thousands of practice ...

Now, with expert-verified solutions from Financial Accounting 6th Edition, you'll learn how to solve your toughest homework problems. Our resource for Financial Accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. With Expert Solutions for thousands of practice ...

Chapter 3 Operating Decisions and the Accounting System Q: 1,2,4,6,7,8,11; E: 2,3,4,6,7,10,11,18; P:1,2, ANSWERS TO QUESTIONS. A typical business operating cycle for a manufacturer would be as follows: inventory is purchased, cash is paid to suppliers, the product is manufactured and sold on credit, and the cash is collected from the customer.

5. The general journal. 7. Decreasing cash decreases assets; decreasing accounts payable decreases liabilities. Assets (decrease) = Liabilities (decrease) + Equity (no change). 9. The combined total of liabilities and equity equals the total of assets because there is a claim against every asset that the company owns.

Chapter 3 Homework Solutions (Part 1) Q3-9. ... A Critical Approach, 4th edition Page 3-E3-9. John Friedlan, Financial Accounting: A Critical Approach, 4th edition Page 3-Assets = Liabilities + Owners' Equity Cash Accounts Receivable. Inventory Automobile Loan Payable.

Now, with expert-verified solutions from Financial Accounting 13th Edition, you'll learn how to solve your toughest homework problems. Our resource for Financial Accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. With Expert Solutions for thousands of practice ...

Hw 3 - Homework 3 ; Azure - No rework; Related documents. AL4-310-F2020 - Homework for 310 ... 2020 Solutions Manual, Chapter 3 3-QUESTIONS. Q3-1. The five major steps in the accounting cycle are: ... 2020 3-4 Financial Accounting, 6th Edition. Q3-19. The cost principle and the matching concept support Dehning's handling of its catalog costs ...

Rules of accounting: Personal Account - Debit the receiver and credit the giver. Real Account - Debit the assets and credit the liabilities. Nominal Account - Debit all the expenses and losses and credit the incomes or profits. Step 2 of 6. Indicate the accounts that should be debited or credited for the transactions as follows: Step 3 of 6.

Course Hero-verified solutions and explanations. Chapter 1 Business Decisions and Financial Accounting. Chapter 2 The Balance Sheet. Chapter 3 The Income Statement. Chapter 4 Adjustments, Financial Statements, and Financial Results. Chapter 5 Fraud, Internal Control, and Cash. Chapter 6 Merchandising Operations and the Multistep Income Statement.

Now, with expert-verified solutions from Financial Accounting 4th Edition, you'll learn how to solve your toughest homework problems. Our resource for Financial Accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. With Expert Solutions for thousands of practice ...

View Homework Help - Ch 3 Homework Solutions.pdf from BUSI 3001 at Carleton College. Advance Financial Accounting Chapter 3 SOLUTIONS Problem 3-1 (a) Journal entry on Abduls books Cash and

Accounting 229 Chapter 3 Homework Solutions Processing Accounting Information intro accounting chapter hw solutions processing accounting information exercises. ... 3-4 FINANCIAL ACCOUNTING SOLUTIONS MANUAL LO 3,4,5 EXERCISE 3-12 DETERMINING AN ENDING ACCOUNT BALANCE Cash 2,000 1, 1, 250 3,650 1,

McGraw Hill Connect® for Financial Accounting provides the most comprehensive solution to the market. Each asset in Connect is designed to address pressing course challenges, like student engagement, student preparedness, and relevancy. No matter how your course is designed, we have a solution that's got you covered.

Now, with expert-verified solutions from Financial Accounting 11th Edition, you'll learn how to solve your toughest homework problems. Our resource for Financial Accounting includes answers to chapter exercises, as well as detailed information to walk you through the process step by step. With Expert Solutions for thousands of practice ...

Connect Financial Accounting Chapter 3 Homework. Q1. Arnez Company's annual accounting period ends on December 31, 2019. The following information concerns the adjusting entries to be recorded as of that date. a. The Office Supplies account started the year with a $4,000 balance. During 2019, the company purchased supplies for $13,400, which ...

Do whatever you want with a Financial accounting chapter 3 homework solutions. Financial accounting chapter 3 homework solutions. Financial accounting chapter 3 exercise solutions. Financial accountin: fill, sign, print and send online instantly. Securely download your document with other editable templates, any time, with PDFfiller.

Find step-by-step solutions and answers to Fundamental Accounting Principles - 9781264224883, as well as thousands of textbooks so you can move forward with confidence. ... Chapter 3:Adjusting Accounts for Financial Statements. Page 105: Multiple Choice Quiz. Page 106: Multiple Choice Quiz. Page 106: Quick Study. Page 107:

Study with Quizlet and memorize flashcards containing terms like On November 1, 2017, the account balances of Schilling Equipment Repair were as follows. No. Debits 101 Cash $ 2,380 112 Accounts Receivable 4,270 126 Supplies 1,790 153 Equipment 11,160 212 Salaries and Wages Payable 650 311 Common Stock 9,300 320 Retained Earnings 3,950 $19,600 No. Credits 154 Accumulated Depreciation ...