Transforming enterprise risk management for value in the insurance industry

The value of enterprise risk management (ERM) in the insurance industry was given a decisive demonstration in the financial crisis. McKinsey research showed that the better their ERM systems, the better insurers performed financially in 2008 and 2009. 1 1. From compliance to value creation: The journey to effective enterprise risk management for insurers (PDF–456KB), February 2014. In the aftermath, much industry attention focused on creating or improving ERM systems, and the focus has been sustained under pressure from regulators, rating agencies, and investors. The starting point for the industry’s ERM efforts has been, perhaps naturally, a reactive stance, with systems designed to respond to incidents and ensure compliance with existing and forthcoming regulations. Yet a few insurers have been able to develop ERM frameworks that support strategic decisions and create real business value. Over time, they have reduced the volatility of their returns and improved capital performance—results of having enabled a more penetrating view of proposed risk taking across the enterprise and embedding the ERM function as an active partner in business decision making.

What are the elements of an effective ERM framework? How can insurers move from playing defense to using ERM systematically to advance business objectives? In a recent survey we conducted, leaders of a range of insurance companies revealed that they were thinking about such questions in a focused way. 2 2. Twenty-seven insurers representing approximately $3 trillion in assets were asked about systemic risk in the sector, the adequacy of industry regulation in accounting for risk, and the performance of their companies’ internal risk-management practices. Most agreed that the sector was largely free of systemic risk, but expressed a range of views on the current and evolving regulatory environment: see Luca Pancaldi, Uwe Stegemann, and Torban Swart, “The big questions for the insurance sector,” chapter 10 in The Economics, Regulation, and Systemic Risk of Insurance Markets , ed. Felix Hufeld, Ralph S. J. Koijen, and Christian Thimann (Oxford University Press, 2016). While expressing confidence in the strength of their companies’ risk capabilities, respondents identified key areas for improvement in risk transparency and insight (Exhibit 1). Smaller companies also indicated gaps in risk culture and performance transformation. Most of the surveyed chief financial and risk officers indicated that they are enhancing ERM amid a perceived climate of heightened risk—one defined by a more uncertain macroeconomic environment, persisting low interest rates, financial-market volatility, and rising geopolitical instability.

Attaining ERM excellence: A journey to value creation

Where do you stand the erm framework.

On the journey toward its integration into business strategy, the epitome of excellence in enterprise risk management (ERM), the risk function strengthens the interlinked areas of the framework. It is always good to know where you are going well before you get there. Optimally, the broad areas of ERM and their constituent elements are mutually reinforcing.

Risk transparency and insight

- Risk identification and taxonomy. A common vocabulary for different risks enables an enterprise-wide view of the risk profile, so that it can be shaped according to the business strategy. Risks are thereby defined and prioritized based on probability, impact, and preparedness.

- Risk reporting. Regulatory and company-specific reporting principles are selected for timeliness, clarity, comprehensiveness, and accuracy; the underlying data architecture and IT must support risk-data aggregation. Strong governance is essential.

- Risk IT and data analytics. With technical and business-leading analytics talent, new sources and types of data are captured to extract differentiating insights; machine learning is applied to improve existing models and enable the underwriting of new risks.

- Stress testing. Models are based on consistent scenarios and translation of economic drivers into key insurance risks. The approach is to assess risks in line with the business strategy, taking account of balance-sheet and capital implications.

Risk appetite and strategy

- Risk appetite. The risk appetite is defined by the business strategy. An understanding of whether you are the natural owner of given risks is developed on this basis; how much risk to take to pursue company goals is then cascaded down to the businesses.

- Risk strategy. The strategy comprises actions to transform the risk profile, selected based on priorities and including trade-offs with corresponding costs.

Risk decisions and processes

- Decisions. Risk is embedded in strategic and business decision making rather than used in a purely compliance-driven approach.

- Processes and operations. Core business processes and operations are designed and executed on a risk-informed basis.

Risk organization and governance

- Risk archetypes. The risk function’s mandate for enterprise risk management is clearly defined.

- Risk organization. Risk structures are designed across the entire organization with the support of top management.

- Risk-function profile. Responsibilities are clearly allocated between the risk-taking and controlling units.

Risk culture and performance transformation

- Risk culture. Diagnostic inquiries can be made periodically to ensure that the risk culture is sound across the entire organization.

- Risk norms. New risk norms should be embedded through corporate processes and governance.

- Risk skill building. A program should be in place to enhance risk skills for key roles as needed.

In thinking about the experience of leading institutions with enterprise risk management, McKinsey developed a framework to help capture best practices (see sidebar, “Where do you stand? The ERM framework”). The framework integrates the elements of risk management in a reinforcing cycle that supports the business strategy (Exhibit 2).

A best-practice risk function fosters a highly integrated, enterprise-wide risk culture across the organization, managing the risk profile to serve the business strategy. The path to ERM excellence involves a transformative journey, and most insurers are at its beginning stages (Exhibit 3). For the majority of companies, the risk focus is on compliance, a necessary starting point. They monitor risk, gauge risk levels against new regulations, and react appropriately to risk incidents. The ERM function at this stage is mainly backward looking, developing controls and aligning existing risks with current and forthcoming regulation. The risk function first establishes and then operates within risk-review guidelines and may have (and at times may exercise) formal veto power over business decisions.

Systematic ERM really only begins after compliance-focused capabilities have been adequately developed, including the setting of risk limits and policies and the adoption of accounting and statutory metrics. Most insurers are at this stage of development. They use their own risk and solvency assessment (ORSA), in line with US and EU regulations. This provides insurers with an internal process for assessing the effectiveness of risk-management capabilities and solvency under normal and stressed conditions. ORSA helps insurers evaluate all material risks that could affect their ability to meet policy-holder obligations, including market risks, credit and underwriting risks, liquidity risks, and operational risks.

At this stage, the ERM approach pushes the risk-management function to incorporate loss control and risk-return optimization into its role. In ongoing dialogue with other functions (such as finance) and the business, risk managers proactively identify potential issues and, where helpful, challenge common practices. The function develops an understanding of corporate strategy and the ability to model economic capital (risk capital) and conduct stress testing. The function then converts the models into strategic input for top management.

Would you like to learn more about our Risk Practice ?

In the ultimate stage of the journey, the risk function creates value by integrating ERM with corporate strategy. The function becomes a sought-after thought partner, enabling business management to weigh risk-return implications and potential risk trade-offs in strategic and operational decisions. To become a strategic thought partner, the ERM function must be able to create the comprehensive economic-capital models needed to drive business decisions and to link advanced risk analytics to key business processes.

Improving ERM: Where insurers say they are focusing

As Exhibit 1 displayed, our survey respondents mostly cited capabilities within risk transparency and insight as the objects of their planned ERM-improvement efforts.

Within this ERM area, respondents noted their intentions to improve stress testing, risk reporting, and—especially—data and analytics. One-quarter of respondents cited data governance and quality and another quarter cited automation and speed of data gathering as their initial improvement priorities. In the survey and follow-up discussions, respondents shared their perceptions that the industry needs generally to invest more in analytics, recognizing the transformative power of big data. Fast, automated access to accurate data is only a prerequisite for the strategic use of advanced analytics. The broad challenge is to generate value from the data. Advanced analytics enables better decision making in pursuit of strategic objectives and increased performance transparency to improve bottom-line financial results.

Most respondents indicated that they perform stress testing and consider results in decision making, but about half revealed that not all risks are taken into account in the process. In interviews and follow-up discussions, survey participants expressed their intention to improve stress testing by properly accounting for all risks in their stress tests and by deriving more useful insights from the results. Nearly half of respondents revealed that their risk-reporting process was only partly structured and had no predefined escalation mechanisms in place.

Risk culture

When asked about the level of accountability for risk-related matters in their organization, 38 percent of respondents declared that risks in daily business are not always considered with the support of both qualitative judgment and quantitative tools. This implies that a plurality of the industry is not achieving available levels of risk transparency that could improve business decisions.

With respect to frontline functions, participants indicated that risk is most engrained in people’s minds in the following areas: investment management (the first choice for 56 percent of participants) and corporate and commercial nonlife (22 percent). Room to improve frontline risk culture seems to exist in retail life and nonlife businesses.

Discussions and interviews with insurance leaders highlighted that some players are making significant investments in risk-culture programs, in particular launching dedicated actions to increase risk culture in retail businesses where third parties (that is, brokers and independent financial advisers) are often the main distribution channel.

Approaching ERM transformation

ERM transformations can be focused on selected priority areas or the overall ERM program. Experience has shown that successful transformations have key traits in common. Direct board and top-management sponsorship and participation is the first requirement. Second, a chief risk officer (CRO) should be elevated from the usual technical-advisory status to play a true leading role. As leader, the CRO should drive the initiatives and set the direction of the effort. In planning the transformation, the CRO-led team must take an integrated perspective, above all ensuring consistency across all core ERM elements. This is even more important than achieving excellence in any one area. The CRO should communicate the core messages of the transformation and ensure that they are cascaded to all levels of the organization. The CRO-led effort must also influence risk management throughout the organization, using such leverage as material incentives and role modeling optimal behavior.

A targeted intervention

In a targeted ERM intervention, particular elements—such as risk-appetite definitions, stress testing, or reporting, for example—are addressed as priority challenges. Such interventions are efficient when the overall ERM framework has been thoroughly evaluated and determined to be robust. They can also be helpful in addressing particular external constraints, such as regulatory findings or new rules (and rulings). Success depends on a well-defined starting point and clearly articulated set of priorities.

The targeted transformation begins with a diagnostic evaluation of the ERM framework. This will scan each segment and identify and prioritize improvement initiatives. The development of advanced capabilities can be an ideal choice for a targeted intervention. Machine learning, for example, allows companies truer visibility into their customers’ risk profiles. It improves existing models and helps companies avoid unseen risks while potentially allowing them to underwrite completely new risks. The future profitability of the sector depends on such differentiating insights from new sources and types of data. To obtain these insights, leading companies are investing in innovative capabilities such as advanced analytics and machine learning.

An overall ERM transformation

An overall transformation program will cut across all or most of the ERM framework’s segments and their constituent elements, and it could take up to two years to complete. Insurers undertake such transformations when a diagnostic evaluation reveals that the ERM framework requires general improvement; when the company is undergoing a strategic change of course, such as a modified risk appetite or a significant change in the business mix; or when the improvement areas indicated in the diagnostic require interventions that cut across the entire organization or involve cross-functional elements in the framework.

Unleashing the value of advanced analytics in insurance

An overall ERM transformation is shaped in three steps. First, an independent diagnosis of the current ERM status is undertaken, based on best-practice knowledge and insights, with peer-performance benchmarking. The results are discussed with top management and the board, in order to define the target ERM state and prioritize the needed array of initiatives. Finally, an integrated action program is built, with clearly defined milestones and deadlines, incorporating early experiences and making needed improvements and adjustments as the transformation progresses.

Exhibit 4 presents a brief outline of the results of an actual diagnostic evaluation of a large insurer’s ERM framework and proposed transformation program.

The evaluation is the beginning of the journey to build a new ERM foundation and to formalize risk strategy and processes. In each part of the framework, actions are identified and implemented to focus the transformation effort on a defined target ERM state. Actions are rolled out strategically, according to prioritized needs. In the example diagnostic, priority actions for transparency and insight would include a review of reporting and stress testing and the development and implementation of new governance and models. The approach to stress testing would be shaped by the insurer’s specific situation and needs. It would involve deep analysis on a consistent set of scenarios, a comprehensive assessment of implications, identification of tailored strategic actions and mitigating decisions, and deep dives on specific risk exposures (Exhibit 5).

As the transformation proceeds within each area of the ERM framework, and as gaps with the target end state are closed and connections across the risk function are strengthened, priorities can be reassessed and realigned in light of new insights and accomplishments.

With a broad consensus among insurers that the environment has become riskier and the regulatory atmosphere more complex, greater and more systematic attention is being afforded to the state of enterprise risk management. As improvement areas in the ERM framework are identified, leading insurers are taking this opportunity to move beyond plugging the gaps. Commanding new capabilities and techniques, they are defining a target state for ERM and cultivating an organization-wide risk culture that could become sources of real competitive value.

Christian Bongiovanni and Luca Pancaldi are partners in McKinsey’s Milan office, Uwe Stegemann is a senior partner in the Cologne office, and Giambattista Taglioni is a senior partner in the New York office.

The authors wish to thank Daniel Kaposztas for his contributions to this article.

Explore a career with us

Related articles.

Compliance in 2016: More than just following rules

People and talent management in risk and control functions

- Browse All Articles

- Newsletter Sign-Up

RiskManagement →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

The implication of business intelligence in risk management: a case study in agricultural insurance

- Original Article

- Open access

- Published: 22 May 2021

- Volume 3 , pages 155–166, ( 2021 )

Cite this article

You have full access to this open access article

- Mehran Amini 1 ,

- Sara Salimi 2 ,

- Farid Yousefinejad 3 ,

- Mohammad J. Tarokh 4 &

- Sayyed M. Haybatollahi 5

6743 Accesses

3 Citations

Explore all metrics

The increasing data scales in today’s business sectors coupled with the necessity of risk management raise the importance of business intelligence tools as an integrated solution for the insurance industry. These tools have mostly been used to achieve effective risk management. Although methods of risk management in the insurance industry have been proposed many years ago, the research effort has primarily been focused on predictive analyses. This study aimed to investigate the role of business intelligence as a solution to illustrate its potential in risk management particularly for decision-makers in agricultural insurance. We hypothesized that this would make a preferable decision in uncertain conditions. Sample data from the online transaction process system of Iran agricultural insurance fund were preprocessed in SQL server. Multidimensional online analytical processing architecture was analyzed using Targit business intelligence tool. Our results identified financial risks that lead to a framework of controlling risk based on business intelligence in the agricultural insurance fund.

Similar content being viewed by others

RETRACTED ARTICLE: A hybrid approach for risk analysis in e-business integrating big data analytics and artificial intelligence

Yu Zhang, L. Ramanathan & M. Maheswari

Research on the Application of Data Mining Algorithm in Financial Risk Control Model in the Process of Digital Economy Transformation

Overseas Risk Intelligence Monitoring Based on Computer Modeling

Avoid common mistakes on your manuscript.

1 Introduction

Risk management is an effective tool to tackle uncertainties in the probability of an event’s occurrence that challenges decision makings. Many factors associated with risk management including business intelligence (BI) have the potential to be used to reduce such uncertainties. This challenge in decision making, appears to increase together with the expansion of globalization. Easy-to-use technologies for saving data and widespread access to the internet allow researchers and organizations to collect more data (Zhu et al. 2019 ). Because the origin, content, and display methods of most of these data vary and because they relate to diverse settings, such as commercial and financial, the current literature lacks enough findings concerning how these data are modeled and how they contribute to a company’s decision making strategy. Although methods for managing the uncertainties (e.g., managing liquidity related risks) in insurance have been proposed for many years, the research efforts, thus far, have primarily been focused on predicting outcomes based on the given dataset as well as its variables. While business intelligence has always been regarded as the highest priority for investment, companies have complained about the overflow of information and lack of access to the relevant data (Howson 2013 ). Hence, relevant data from companies’ data servers can be analyzed in favor of cost reduction (e.g., time and resources) by different BI algorithms that can also lead to controlling financial risks (Ghosh et al. 2018 ; Chen 2017 ). By implementing the risk management processes, many organizations aim to increase the impact of risk management activities and to build up value for stakeholders (Williams and Heins 1989 ). The necessity of using BI raised from the fact that financial enterprises including insurance companies like any other financial enterprises have analyzable data that can be used to modify knowledge-based risk management. In this study, our research purpose besides an investigative case study and providing an implementable framework was how business intelligence approaches can be used to risk management process using real-world data. This study particularly focused on the implication of BI approaches in improving decision making in agricultural insurance. We, therefore, investigated whether agricultural insurance data pertain to online transactional processing (OLTP) system contain the following elements: complete data of insurers, their properties specifications, locations, amount of paid compensations, reasons of damages, and bank account of insurers in the agricultural bank. However, previous studies have addressed a variety of problems in using BI, from leveraging organizational agility (Cheng et al. 2020 ) to improve decision making in other sectors such as transportation, health, telecommunications, etc. (Ain et al. 2019 ). This study draws on BI approaches (e.g., observation, reporting, and prediction) with a focus on the phases of risk management (e.g., detection analysis and risk control) to demonstrate how BI can improve provided services, preferable managing of uncertainties coupled with improving decision quality based on existing data in the company.

2 Literature review

The term BI was first referred to “an automatic system to disseminate information to the various sections of any industrial, scientific or government organization” (Luhn 1958 ). In recent years, BI has been known as an intended process through which a company can investigate and train to extract information from vast stocks of data to detect an obtainable opportunity while minimizing the threats associated with uncertainty (Cheng et al. 2020 ). Previous studies have shown that the progress of computational intelligence occurs in various fields (Wu et al. 2014 ; Ain et al. 2019 ), in which a survey of the significant areas and perspectives are presented in this section.

2.1 Early warning systems

Various studies have addressed the importance of early warning systems (EWS) as a method to control risk. By testing EWS in practice, in her study, Krstevska ( 2012 ) referred to macroeconomic models with the features of Macedonia’s economy and they proved that EWS is an advantageous solution that can be conducted in BI tools to forecast the risk of a financial crisis. In another study, Flores ( 2009 ) addressed the early warning in insurance utilizing stochastic optimization to find an investment policy for the management of a fund from the perspective of a risk-averse government. Early warning is also discussed for conveying the mechanisms of financial and macroeconomic supervision that regional monetary units can be considered in the BI policies to cultivate existing surveillance tools for improving crisis detection and prevention. In particular, they illustrated that the RMU might be beneficial as a tool for macroeconomic consultation (Castell 2009 ). Some studies argued their method in industrial applications and described a method for identifying logistic risks for small-to-medium size companies (Xie et al. 2009 ). Fuzzy cognitive map (FCM) is a mixed methodology based on neural network and fuzzy logic, which both are in the querying algorithms of the BI. Liu et al. ( 2006 ) developed an intelligent early warning system using fuzzy logic based on an integrated set of software metrics from multiple perspectives to make sponsors, users, project managers and software developers aware of many potential risks as early as possible. It has the potential to improve software development and maintenance to a great extent. Han and Deng ( 2018 ) combined artificial neural networks, fuzzy optimization and time-series econometric models in one unified framework to form a hybrid intelligent early warning system for predicting economic crises. Wang et al. ( 2018 ) proposed a financial crisis early warning monitoring algorithm based on FCM, and evaluated the effect of the algorithm based on the relevant data of listed companies in China; the experimental outcomes showed that the technique is efficient, economical, and timely and can practically reflect the crisis state of financial data.

2.2 Risk-based decision making

Employing computational intelligence for decision-making based on risk in information systems as supporting systems of decision-making has been studied since 1970 (Keen 1978 ; Sprague 1982 ). Some studies have taken advantage of the business intelligence to provide another application for analyzing the loan risk in financial modeling of pulp and paper industry (Warenski 2012 ). Some researchers have specifically addressed the assessment of value and risk in IT investment; by taking the resource-based view of the company and the perspective of the feasible option, they found that IT investments and their timing influence organizational downside risk (Otim et al. 2012 ). Such investments involving a complex series of stakeholders require attention to organizational policies. Some have studied the role of political pluralism in the expansion of commercial banks, especially from the perspective of risk management in India (Olson 1996 ). Industrial decision-making does not merely include multi-stakeholders, but it also includes multi-criteria. Some researchers have provided a risk assessment technique of multiple criteria for analyzing risk in safety by integrating the accepted features of the common failure mode, effects, and criticality analysis technique in the BI tools with taking into account economic variables in terms of risk and to minimize the total safety costs by defining a specific index called total risk priority number (Wu et al. 2014 ). Lakemond et al. ( 2013 ) dealt with a model for considering risk in product development, which is capable of initial assessments of risk and other challenges. Some of the neural networks study applications to assess reliability to reduce the project failure risk. Another application showed the value of artificial neural network models in the projects of public-private partnerships. The application was also used in the banking industry which included employing artificial neural networks to analyze credit cards applications which allow banks to effectively control their risk after the post-2008 bubble (Yazici 2011 ). Some researchers combined neural networks with text mining software to address financial risk management in daily trading. Another application was to use the artificial neural network models, which is one of the main algorithms in BI tools to manage the financial risk of over 7000 small companies in Italy. The results showed that when the method is unconnectedly designed according to size, geographical area, and business sector, the method prediction accuracy is noticeably higher for the smallest sized companies and especially those which are operating in central Italy (Ciampi 2013 ).

2.3 Game-based risk analysis

The role of Nash in offering game theory and studying the competitive strategy is significant (Nash 1950 ). The focus of this field is mainly on industrial risk management. Some researchers studied a complete information game model which examines emerging multi-risks in a project management environment by designing an effective algorithm to deal with the allocation solution based on Nash equilibrium that can also be reflected in the BI based plans, and an experiment is presented to show the usefulness of the proposed game method. The proposed solution methods can be employed to support decision-making in project risk management (Zhao 2009 ). Some extended the game theory models to probabilistic risk analysis in counter-terrorism activities. They carried out a comparative analysis of probabilistic risk analysis methods such as Bayesian networks, decision trees, and game theory that are the main algorithms in BI tools to get insights into the significant differences in assumptions and results. They found that assessing the distribution of potential attacker decisions is a problematic judgment, especially considering the adaptation of the attacker to defender decisions. Intelligent opponent risk analysis is an extension of decision analysis and sequential game theory that can be taken to decompose such judgments (Merrick 2011 ). And some used this theory to model vertical distinction in online advertising and found that a higher revenue can result in lower service prices (Lin et al. 2012 ).

2.4 Credit risk decisions

The basic task of the financial industry in risk management is to study the probability of default. Some researchers offered a scoring model for the Czech banks by means of linear discriminatory analysis, the initial probability of default is calculated through a scoring model in US banks by using linear discriminant analysis. They showed that even though all banks are well organized, there is still a high chance that “a financial crisis” will arise (Gurny 2009 ). Some others utilized the Six Sigma DMAIC methodology to reduce financial risk (Chen et al. 2012 ). Still, some others showed how scorecards can be used to predict the risk management of credit value of large banks (Wu 2010 ). Caracota et al. ( 2010 ) offered a scoring model for (small- and medium-size) enterprises that applied for loans. Some others studied the effectiveness of credit scoring of public enterprises (sponsored by the state) and showed how credit bureau scoring resulted in support for different strategies of risk escape or preference for less risk and greedy investments risks (Poon 2009 ).

2.5 Data mining in enterprise risk management

Data mining has turned into a very popular concept in statistical and artificial intelligence tools as well as plays a pivotal role in the BI tools for the analysis of sets of big data. Among the various risk management related studies, some researchers have applied the data mining tools to the financial affairs of companies, including fraud detection management, credit risk estimation, and performance prediction of the company (Shiri et al. 2012 ). Some argued that data mining in internal fraud renders preferable results compared to a single-variant analysis (Jans et al. 2010 ). Holton ( 2009 ) employed data mining for occupational fraud in auditing which the main focus is on detecting motivational aspects such as employee disgruntlement. Their proposed model predicts whether emails contain disgruntled communications, providing extremely relevant information not otherwise likely to be revealed in a fraud audit. The model can be incorporated into fraud risk analysis systems to improve their ability to detect and deter fraud. In other industries, data mining is employed to better predict the electricity supply cut-off, especially when caused by a storm (Nateghi et al. 2011 ). Some other studied data mining to support risk management in the supply chain; the recognized papers’ insights, gaps and future directions could inspire new investigation procedures with a view to managing the risks in the globalized supply chain environment (Ghadge et al. 2012 ; Shojaei and Haeri 2019 ). Some other studies have been conducted to reduce occupational damage risk using data mining (Murayama et al. 2011 ; Zhu et al. 2019 ).

The aforementioned studies, therefore, support the adaptation and utilization of the BI systems and their capabilities in wider organizational settings including sequential case studies. Although companies have been unsuccessful to capture the advantages of BI systems to their full extent. They mainly are pursuing means to leverage value from the carried out systems (Visinescu et al. 2017 ). However, prior studies do not have any comprehensive solution that discusses the ways related to adoption and utilization of BI system in practical and sequential stages in financial settings such as agricultural insurance, we present a utilitarian and sequential exploratory case study with a limited dataset in the agricultural insurance coupled with a suggested framework, which not only is a universal and reusable abstraction but it also delivers specific functionality that facilitates the development of BI applications, products, and solutions.

3.1 Description of the Iran agricultural insurance system

Iran agricultural insurance fund is the only active insurance company in the agriculture section in Iran. It was established in 1984 by agricultural bank which is one of the governmental banks in Iran. The initial aim of setting up this fund was to support the farmers and ranchers whose products were damaged by pests, diseases, drought, frostbite, and other natural disasters. Cotton and beet were first insured in 1984 as the first agricultural products ever insured, and at the time being, more than 153 products and activities are under insurance. During 30 years its responsibilities had been expanded into some main responsibilities, such as, investigating in any research in terms of increasing and improving agricultural products, holding courses to educate farmers and ranchers, investing in developing the company’s IT sections to become an IT-based system, like updating data servers to collect all relevant datasets such as farmers’ data, their properties location and specifications, paid compensations in each year, etc. (Agricultural insurance fund 2020 ). The historical reports have showed that the capacity of insurance is as follows (which has not fully been materialized due to the voluntary nature of insurance and also a limitation in financial resources): farming products (85 %), garden products (89 %), birds (100 %), products of livestock, aquatics and natural resources (95 %). Some of the indices of agricultural insurance development within the last 10 years (the 10 years ending in the agricultural year 2011–2012, comparative performance) are as follows:

Insurance of farming products; from 2 million hectares to 5.8 million hectares (2.9 times)

Insurance of garden products; from 12,000 hectares to 510,000 hectares (42.5 times)

Livestock insurance; from 2 million animals to 14 million animals (7 times)

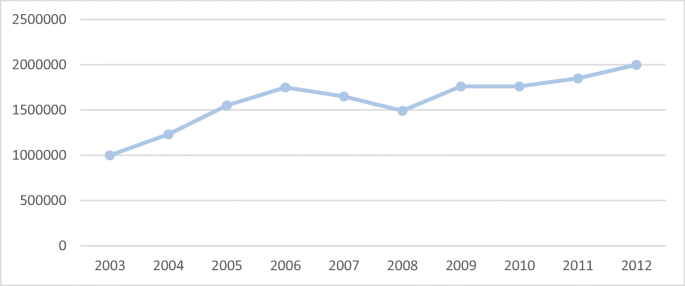

As it can be seen from Fig. 1 , the upward trend of agricultural insurance growth among signed contracts is significant. In Fig. 1 the ascending growth trend of insurers number within the last 10 years is shown, which amounts to more than 2 million at the end of the farming year 2011–2012:

Insurers’ number within 10 years (Agricultural insurance fund 2020 )

Table 1 shows the overall figures of premium (including government’s share and insured person’s share) and compensation paid during the 10 farming years 2002–2003 to 2012–2013 (by million Rials).

3.2 Dataset description

The sample dataset contained 7740 insured agricultural lands and 21 numerical and categorical variables of each land, which is taken by the informatics section of agricultural banks from the online transaction processing servers of the agricultural insurance fund in 2013–2014. It consisted of lands that were cultivated by insured landowners with wheat in the Kermanshah region which has 5 branches of agricultural bank: Kozaran district, Shahid Rajaie, Keshavari Blvd, Mahidasht and Kermanshah. The online transaction processing servers of the company are collecting data of contracts, financial transactions, and insurance appraisers’ reports in all Iran agricultural banks in an integrated data center.

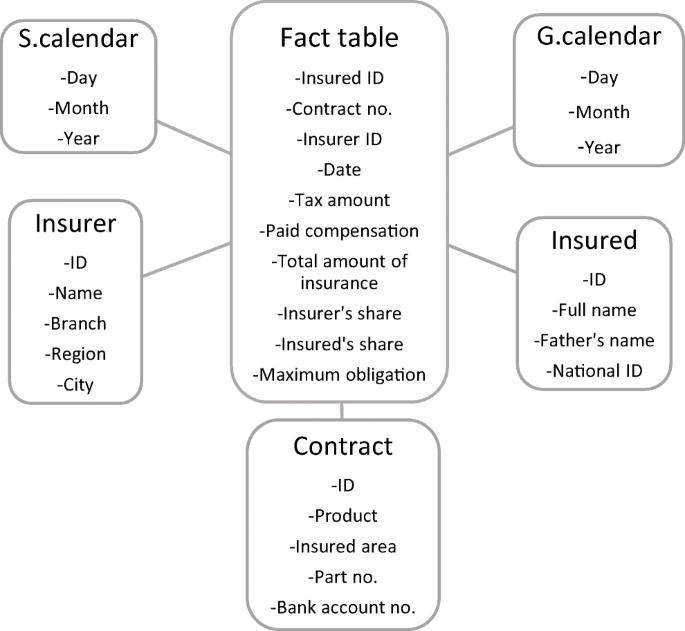

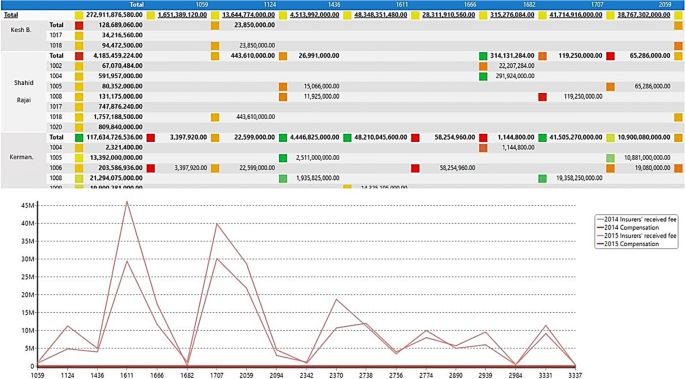

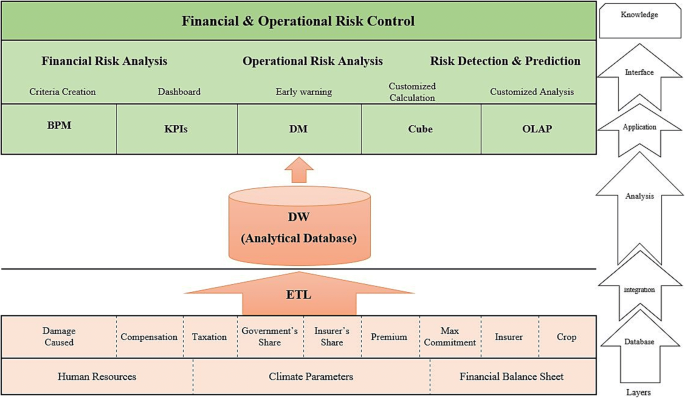

The dataset consisted of two types of data: measures and dimensions. (1) The measures were numerical variables, which were organized in a fact table and contained foreign keys of the logical relationships. These variables included: insured ID, contract number, date, tax amount, paid compensation, the total amount of insurance, insurer’s share, insured person’s share, maximum obligation. (2) The dimensions or the system’s key performance indicators (KPIs) were categorical variables and contained primary keys; in our case study dimensions contain five tables, Solar Hijri calendar, Gregorian calendar, insurer profile, the insured person or company profile, insurance contract specifications. These two types of data based on the created database on the fund’s online transactions processing servers shape the data cube scheme (Fig. 2 ). Financial risks in agricultural insurance are generally related to unexpected financial outcomes that can cause many issues such as liquidity risk. A suitable mechanism to manage uncertainty in agricultural insurance must have the ability to accurately detect all kinds of risks by modeling all data in the agricultural insurance online transaction processing (OLTP) servers without impeding the performance of the platform. Therefore, a mechanism of insured individuals clustering through schemed data cube was presented. Using the clustering mechanism, we grouped data points together based on a set of parameters such as their similarities and relations. Despite that insured individuals may have various possessions in different regions, the logical relationships among the tables still have a mechanism to identify the users who have partially similar features. By investigating the created data cube, which was a multidimensional array of all involved variables the financial risk management purposes of the research were asserted.

Data cube scheme and logical relationships

In various relative analytics, we had three primary factors: hindsight, insight, and foresight. At the foresight level, predictive analyses were used to predict the outcomes, by taking the advantage of various machine learning (ML) algorithms (McNellis 2019 ; Ereth and Eckerson 2018 ). BI tools based on collected data can predict the future state of the variables. Two pivotal predicting algorithms in BI are regression and classification, which both are categorized under the same umbrella of supervised ML. The regression algorithm allows evaluating the mapping function of the input variables as numerical or continuous output variables known as measures. The, classification algorithm, on the other hand, attempts to assess the mapping function of the input variables to discrete or categorical output variables known as dimensions. These algorithms can be conducted based on several architects, the main two ones are multidimensional online analytical processing (MOLAP) and relational online analytical processing ROLAP; in the present work, the chosen architecture is MOLAP because it has some merits over ROLAP, such as, better performance in real-time analysis and dealing with a bigger amount of data. Creating MOLAP architecture has various steps (Fig. 3 ). We used SQL server analysis service (SSAS) 2012 to create tables out of OLTP datasets contains 5 dimension tables and 1 fact table represents the measures, then raising an analysis services multidimensional and data mining project in Microsoft visual studio 2010 and connect to the created database in SSAS and transfer all data, next generating data source view from all added tables and data, this is followed by forming logical relationships between fact table (with foreign keys) and dimensional tables (with primary keys), then creating dimensions’ attributes and hierarchies which leads to building data cube based on fact table that contains measures. In the penultimate stage, making a connection string from Targit (business intelligence tool) to the Microsoft visual studio. Finally, the created data cube is available in the Targit environment to make customized queries, comparisons, dashboard system, prediction, etc.

Steps in various platforms to create MOLAP architecture

4.1 The applied MOLAP

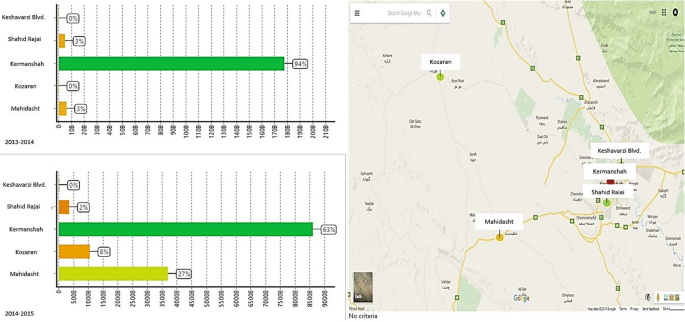

Risk management phases, in general, were as follows: risk detection, risk analysis and risk control. According to the results obtained from designing the dimensions and measures existing in the data cube and experts’ comments, some financial risks were identified, which are regarded as the function of financing decisions of the company (Bandaly et al. 2018 ). All the next indicated graphs belong to 2014–2015 were the BI predictions, which were processed by the sample 2012–2013 dataset. Figure 4 shows the analyses and behavior trend of total earning insured amount in each premium issuing branches in the given region (Kermanshah which has 5 branches: Keshavarzi Blvd., Shahid Rajai, Kermanshah, Kozaran, and Mahidasht) during the farming year of 2013–2014 and the predicted year of 2014–2015. In the 2013–2014 graph, axis x represents the amount of money earned by each branch for insuring the farmers’ lands. Graph 2014–2015 is a prediction of the same trend in the next year in which Mahidasht and Kozaran branches would have better financial performance. This foresight is achieved by learning algorithms such as a neural network in the BI software engine depending on the measures of the dataset such as land area, number of bank accounts, insured savings, and insurance fee. Based on these figures’ managers can take actions to prevent the causes of decreasing trends in Kermanshah, Shahid Rajai branches and empowering positive impacts on increasing trends in the other branches. As it can be seen (Fig. 4 ) Kermanshah had better performance although Kozaran and Mahidasht could earn much more insurance fees since they cover vaster farmlands. The reason behind the performance of the Kermanshah branch in comparison to other branches was behind the fact that the manager’s main focus was no longer on acquiring new customers but on retaining old ones. Managers in Keshavarzi Blvd. and Shahid Rajai branches by carrying the same policies in the next year they would run the risk of losing their positions.

Forecasting amount of received money for insurance fee

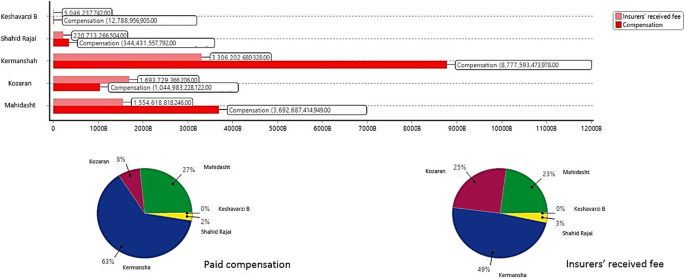

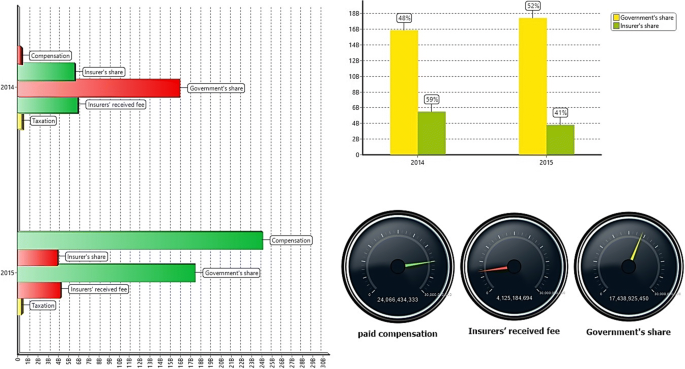

In another analysis in Fig. 5 , the predicted paid compensation amount in comparison with insurers’ received fee in different branches in the 2014–2015 farming year is shown. Due to the updating of new policies in terms of agricultural insuring tariffs in the share of government in 2014, all the districts except Kozaran would be faced with an increasing trend in the amount of paid compensation in the 2014–2015 farming year. This assessment and prediction are crucial at the beginning of each farming year and should be considered, because the budget of the fund is provided by the annual government budget, therefore the agriculture bank must send the estimated budget to the government for the upcoming farming year. Basically, each branch has its agricultural experts to advise farmers and after every report given by landowners they have to visit the reported land to evaluate the level of damage also farmers can take full advantage from their consultations, for example, the right form of ploughing or plowing a field which is one of the basic instructions of field management that can dramatically reduce the level of damage especially in the fields with a slope of higher than 20 degrees. Kozaran branch is the only branch with a higher insurance fee than the amount of total paid compensation. These figures demonstrate that they could use their experts to keep the level of damage low.

The paid compensation amount and insurers’ received fee prediction in 2014–2015 farming year

Through analysis indicated in Fig. 6 , the trend of the production of each land (x-axis is the name of lands with the lowest damage) compared with the paid compensation amount (y, axis) in the 2014–2015 farming year is predicted. These 19 lands would be the most profitable lands among 7740 lands in the agricultural insurance fund in the region of Kermanshah which paid compensation amount to them is the lowest one, therefore their owners’ performance in controlling relevant risks is noticeable. From the marketing point of view and saving financial resources, finding lands with low damage level is essential because by investigating the reasons behind it, experts in the ministry of agriculture can encourage other farmers to follow those models and solutions to reduce the damage, consequently, the paid compensation amount would be decreased as well. Besides general risk management mechanisms such as adopting cropping techniques pest management systems, fertilization, irrigation that are considered in most of the land there are two extra common techniques among these 19 fields which are the owners not only used resistant variables (this is a crucial factor in farming because many farmers are using their product in each year as the next year seed which this can cause reduce the next year’s product more than 5 % in each year) but also they employed crop rotation strategy which can naturally build up soil fertility, crop yield, reduce soil erosion. Through BI customized queries drill down into the data cube entities finding differences and the reasons for managers in each branch is applicable. Being aware of the reasons behind each damage can solve or reduce it for upcoming farming years.

Profitable insured lands

Based on the principles of financial risk management, the agricultural insurance fund financial analysis process includes four steps: collecting financial data, providing financial balance sheets, providing financial ratios and creating financial measures based on the fund’s strategies (Agricultural insurance fund 2020 ). As you can see in Fig. 7 , by employing business intelligence various algorithms the mentioned four steps financial processes are achievable through designing an analytical database and an appropriate data cube. Based on the financial records in the sample dataset of 2013–2014, the financial variables in 2014–2015 are predicted. High dependence on the government’s resources, high damage in products, and absence of participation on the part of the private sector, heightens the importance of management, financial risk analysis, and extraction of meaningful trends out of transactional data of the fund. The government’s share in the 2014–2015 farming year would be increased by 4 % as compared to 2013–2014. Upon the occurrence of minor damage in 2013–2014 (indicated by 2014 in Fig. 6 ), the amount of paid compensation would be increased by 24 times as compared to the previous year which can cause obvious liquidity risk. Since the outsourcing of financial risk is not possible for agricultural insurance fund in such farming years (e.g., with a high level of damage), the compensation should be paid through consultation with the government, which often is accompanied by payment deferment, absence of appropriate approaches for similar risky events for the following years. Failing in predicting financial outcomes would cause serious financial risks furthermore high dependence of agricultural insurance fund on the government budget can make fund fails in meeting its obligations unless the decision-makers could have an insight of the upcoming outcomes based on their existing data sets which are feasible by employing business intelligence approaches.

Predicted financial measures for 2014–2015 by analyzing 2013–2014 financial records

4.2 A framework of BI in relationship with risk management

As a foundation for developing applications whereby business intelligence developers can define a specific platform to prepare a groundwork for a data-driven company, frameworks have an undeniable role to play. For the sake of having a comprehensive framework, every database must be taken into account through which analyzing them the developers can achieve beneficial outputs and results for the next layer; the first layer of the framework (Fig. 8 ) is dedicated to all potential databases that could give the feeds for the customized queries in the interface layer, for example, the rate of rainfall in a particular area has unquestionable impacts on dry farming. In the integration layer, all valid datasets are extracted; data cleaning and cleansing, which aims to pass only proper data to the target is one of the actions in the transform step; in the last step of ETL through loading all created data marts are gathered to feed the data warehouse; data warehouse (DW) as the data provider of the BI algorithms is conducted by loading data marts in the analysis layer. In the application layers, all outputs of implementing BI based on multidimensional online analytical processing architecture are available, such as online analytical processing (OLAP), data cube, data management, key performance indicators monitoring, business process management. In the interface layer, all elements of our BI arsenal can be seen, which early warning system is the most important one that quite stands out and leads the whole framework to the knowledge layer with regard to controlling uncertainties and risk management.

The framework of BI system in agricultural insurance

5 Discussion

The scope of this paper focused on the implication of business intelligence as a solution to illustrate its potential in risk management particularly for decision-makers in agricultural insurance. Through multidimensional online analytical processing architect, we carried out series of predictions in terms of financial measures (numerical variables) for 2014–2015 farming year by analyzing a limited sample of financial and operational records consists of insured lands were cultivated with wheat in 2013–2014 in Kermanshah region and its 5 branches.

As risk analysis attempts at assessing an underlying true risk with quantified uncertainty limits (Goerlandt and Reniers 2018 ); indeed business intelligence solutions can determine how likely specific outcomes are if some aspects of the system are not precisely known. The presented BI system predicted the government’s share in the 2014–2015 farming year would be increased by 4 % compared to 2013–2014. Our results showed that upon the occurrence of minor damage in 2013–2014 (Fig. 6 ) the amount of paid compensation increased by 24 times compared to the previous year which can cause obvious liquidity risk. The relationship between a financial enterprise liquidity risk and its performance has been also shown by the previous studies (Pac et al. 2018 ). This is a vital analysis of the risk perspective since the outsourcing of financial risk is not possible for agricultural insurance fund in farming years with a high level of damage therefore, compensation should be paid through consultation with the government, which often is accompanied by payment deferment as well as the absence of appropriate approaches for similar risky events for the following years. Failing in predicting financial outcomes would cause serious financial risks; furthermore, high dependence of agricultural insurance fund on the government budget can make fund fails in meeting its obligations; hence, an implication of the aforementioned prescriptive analytic would be to allow agricultural insurance to use collected data from OLTP, contracts, climate parameters, etc., to predict future possible outcomes by employing proposed MOLAP architecture along with the customized framework suggested by the current study.

Furthermore, improved decision excellence is the pivotal expected upside of implementing BI systems. Specifically, common decision making methods in the Iran agricultural insurance fund as for: command, consult, vote, consensus (i.e., talk until reaching an agreement) can be replaced by BI algorithms to help agricultural insurance to become an insights-driven organization even when there is a paucity of relevant data. Take for instance, predicting 19 lands that would be the most profitable lands among 7740 records in the agricultural insurance fund in the given region is a good example of defining future strategies because their owners’ performance in controlling relevant risks is noticeable; therefore, by investigating the reasons behind it, experts in the ministry of agriculture can encourage other farmers to follow those models and solutions to reduce the damage, consequently, the paid compensation amount would be decreased as well.

This study had some limitations that need to be mentioned. Since we used real data from the online transactional processing of the fund, we couldn’t show all the possible results. The granted permission for receiving sample dataset was only for the 2013–2014 farming year, whereas at least 15 years of data is collected in the fund servers which can lead to more accurate results and a wide range of problems in terms of fraud detection, human resource management, etc., can be covered and analyzed. Furthermore, because of the insured persons, personals, insurance appraisers’ private privacy data, our ability to show the results was another important limitation.

6 Conclusions

To handle financial risk management numerous companies are struggling with becoming data-driven businesses. A financial enterprise like agricultural insurance is one of these enterprises that face financial risks through business intelligence analysis. Considering the nature of agriculture as an industry with unique conditions we can witness uncertainty in its sections and experts in these fields are dealing with the most uncertain factors therefore, altering the obsolete strategies in terms of being a data-driven company for agricultural insurance fund has to be categorized as a high priority goal. A practical contribution of this research was to demonstrate the benefits of business intelligence solutions regarding financial uncertainties. We showed employing business intelligence can dramatically decrease imprecise estimations caused countless uncertainties in agricultural insurance. In this experimental case study, we strove to illustrate the BI approaches to indicate three levels of analytics (e.g., hindsight, insight, foresight) which can lead to risk management’s stages (e.g., detection, analysis, control). The results of the analytical model of BI revealed four possible predictions to tackle financial risks. We also proposed a framework of BI system in agricultural insurance with the main focus on financial and operational risk management through which minor modifications can be employed in various financial enterprises.

Agricultural insurancefund (2020) Agricultural Insurance Fund, History and Responsibilities. In:Agriculture Bank Web Page. http://www.sbkiran.ir/about/tasks

Ain N, Vaia G, Delone WH (2019) Two decades of research on business intelligence system adoption, utilization and success – a systematic literature review. Decis Support Syst 125(April):113113. https://doi.org/10.1016/j.dss.2019.113113

Article Google Scholar

Bandaly D, Shanker L, Şatır A (2018) Integrated financial and operational risk management of foreign exchange risk, input commodity price risk and demand uncertainty. IFAC-PapersOnLine 51(11):957–962. https://doi.org/10.1016/j.ifacol.2018.08.484

Caracota RC, Dimitriu M, Dinu MR (2010) Building a scoring model for small and medium enterprises. Theoret Appl Econ 17(9):117–128

Google Scholar

Castell MRF, Dacuycuy LB (2009) Exploring the use of exchange market pressure and RMU deviation indicator for Early Warning System (EWS) in the ASEAN + 3 region. DLSU Bus Econ Rev 18(2):1–30

Chen CH (2017) Research on business intelligence with data mining applications. Int J Bus Econ Res 6(2):19. https://doi.org/10.11648/j.ijber.20170602.11

Chen YC, Chen SC, Huang MY, Tsai CL (2012) Application of six sigma DMAIC methodology to reduce financial risk: a study of credit card usage in Taiwan. Int J Manag 29:166–176

Cheng C, Zhong H, Cao L (2020) Facilitating speed of internationalization: the roles of business intelligence and organizational agility. J Bus Res 110(January):95–103. https://doi.org/10.1016/j.jbusres.2020.01.003

Ciampi F, Gordini N (2013) Small enterprise default prediction modeling through artificial neural networks: an empirical analysis of italian small enterprises. J Small Bus Manag 51(1):23–45

Ereth J, Eckerson W (2018) AI: The new BI. How algorithms are transforming business intelligence and analytics. Retrieved August, 1, 2019

Flores C (2009) Management of catastrophic risks considering the existence of early warning systems. Scand Actuar J 1:38–62

Article MathSciNet Google Scholar

Ghadge A, Dani S, Kalawsky R (2012) Supply chain risk management: present and future scope. Int J Logist Manag 23(3):313–339

Ghosh P, Som S, Sen S (2018) Business intelligence development by analysing customer sentiment.2018 7th International Conference on Reliability, Infocom Technologies and Optimization: Trends and Future Directions, ICRITO 2018, 287–90. https://doi.org/10.1109/ICRITO.2018.8748517

Goerlandt F, Reniers G (2018) Prediction in a risk analysis context: implications for selecting a risk perspective in practical applications. Saf Sci 101 (October 2017):344–51. https://doi.org/10.1016/j.ssci.2017.09.007

Gurny P, Tichy T (2009) Estimation of future PD of financial institutions on the basis of scoring model. In: 12th International Conference on Finance & Banking: Structural & Regional Impacts of Financial Crises, 215–228

Han Y, Deng Y (2018) A hybrid intelligent model for assessment of critical success factors in high-risk emergency system. J Ambient Intell Humaniz Comput 9(6):1933–1953. https://doi.org/10.1007/s12652-018-0882-4

Holton C (2009) Identifying disgruntled employee systems fraud risk through text mining: a simple solution for a multi-billion dollar problem. Decis Support Syst 46(4):853–864

Howson C (2013)Successful business intelligence: unlock the value of BI & big data, 2nd edn. McGraw-Hill Osborne Media, New York. https://doi.org/10.1036/9780071809191

Jans M, Lybaert N, Vanhoof K (2010) Internal fraud risk reduction: results of a data mining case study. Int J Account Inf Syst 11(1):17–41

Keen PGW, Scott Morton MS (1978) Decision support systems: an organizational perspective. Addison-Wesley, Reading

Krstevska A (2012) Early warning systems: testing in practice. IUP J Financ Risk Manag 9(2):7–22

Lakemond N, Magnusson T, Johansson G et al (2013) Assessing interface challenges in product development projects. Res Technol Manag 56(1):40–48

Lin M, Ke X, Whinston AB (2012) Vertical differentiation and a comparison of online advertising models. J Manag Inf Syst 29(1):195–236

Liu X, Kane G, Bambroo M (2006) An intelligent early warning system for software quality improvement and project management.J Syst Softw 79(11):1552–64. https://doi.org/10.1016/j.jss.2006.01.024

Luhn HP (1958) A business intelligence system. IBM J Res Dev 2(4):314–319. https://doi.org/10.1147/rd.24.0314

McNellis J (2019) You’re likely investing a lot in marketing analytics, but are you getting the right insights? Gartner. https://blogs.gartner.com/jason-mcnellis/2019/11/05/youre-likely-investing-lot-marketing-analytics-getting-right-insights/

Merrick J, Parnell GS (2011) A comparative analysis of PRA and intelligent adversary methods for counterterrorism risk management. Risk Anal 31(9):1488–1510

Murayama S, Okuhara K, Shibata J, Ishii H (2011) Data mining for hazard elimination through text information in accident report. Asia Pac Manag Rev 16(1):65–81

Nash J (1950) Equilibrium points in N-person games. Proc Natl Acad Sci 36(1):48–49

Nateghi R, Guikema SD, Quiring SM (2011) Comparison and validation of statistical methods for predicting power outage durations in the event of hurricanes. Risk Anal 31(12):1897–1906

Olson DL (1996) Decision aids for selection problems. Springer, New York

Otim S, Dow KE, Grover V, Wong JA (2012) The impact of information technology investments on downside risk of the firm: alternative measurement of the business value of IT. J Manag Inf Syst 29(1):159–194

Pac R, Finan B, Pol M, Yi-kai, Chen (2018) Bank liquidity risk and performance 21(1). https://doi.org/10.1142/S0219091518500078

Poon M (2009) From new deal institutions to capital markets: commercial risk scores and the making of subprime mortgage finance. Acc Organ Soc 34(5):654–674

Shiri MM, Amini MT, Raftar MB (2012) Data mining techniques and predicting corporate financial distress. Interdiscip J Contemp Res Bus 3(12):61–68

Shojaei P, Haeri SAS (2019) Development of supply chain risk management approaches for construction projects: a grounded theory approach. Comput Ind Eng 128:837–850. https://doi.org/10.1016/j.cie.2018.11.045

Sprague RHJ, Carlson ED (1982) Building effective decision support systems. Prentice-Hall, Englewood Cliffs

Visinescu LL, Jones MC, Sidorova A (2017) Improving decision quality: the role of business intelligence. J Comput Inf Syst 57(1):58–66. https://doi.org/10.1080/08874417.2016.1181494

Wang Q, Hui F, Wang X, Ding Q (2018) Research on early warning and monitoring algorithm of financial crisis based on fuzzy cognitive map. Clust Comput 7. https://doi.org/10.1007/s10586-018-2219-7

Warenski L (2012) Relative uncertainty in term loan projection models: what lenders could tell risk managers. J Exp Theor Artif Intell 24(4):501–511

Williams AC, Heins RM (1989) Risk management and insurance. McGraw-Hill, New York

Wu D, Olson DL (2010) Enterprise risk management: coping with model risk in a large bank. J Oper Res Soc 61(2):179–190

Wu D, Dash S-H, Chen (2014) Business intelligence in risk management: some recent progresses. Inf Sci 256:1–7. https://doi.org/10.1016/j.ins.2013.10.008

Xie K, Liu J, Peng H, Chen G, Chen Y (2009) Early-warning management of inner logistics risk in SMEs based on label-card system. Prod Plan Control 20(4):306–319

Yazici M (2011) Combination of discriminant analysis and artificial neural network in the analysis of credit card customers. Eur J Financ Bank Res 4(4):1–10

Zhao L, Jiang Y (2009) A game theoretic optimization model between project risk set and measurement. Int J Inf Technol Decis Mak 8(4):769–786

Zhu X, Jin X, Jia D, Sun N, Wang P (2019) Application of data mining in an intelligent early warning system for rock bursts. Processes 7(2). https://doi.org/10.3390/pr7020055

Download references

Acknowledgements

Authors would thank the “Research and Development” department of the Agricultural insurance fund of Iran for the collaboration by giving access to financial and operational data.

Open access funding provided by Széchenyi István University (SZE).

Author information

Authors and affiliations.

Department of Information Technology, Szechenyi Istvan University, Gyor, Hungary

Mehran Amini

Department of Management, Kurdistan University, Sanandaj, Iran

Sara Salimi

Department of Management, Islamic Azad University, Sanandaj, Iran

Farid Yousefinejad

Department of Industrial Engineering, K. N. Toosi University of Technology, Tehran, Iran

Mohammad J. Tarokh

School of psychology, University of Nottingham, Nottingham, UK

Sayyed M. Haybatollahi

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Mehran Amini .

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Amini, M., Salimi, S., Yousefinejad, F. et al. The implication of business intelligence in risk management: a case study in agricultural insurance. J. of Data, Inf. and Manag. 3 , 155–166 (2021). https://doi.org/10.1007/s42488-021-00050-6

Download citation

Received : 10 February 2020

Accepted : 11 May 2021

Published : 22 May 2021

Issue Date : June 2021

DOI : https://doi.org/10.1007/s42488-021-00050-6

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Business intelligence

- Risk management

- Risk analytics

- Agricultural insurance

- Find a journal

- Publish with us

- Track your research

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The Case for AI Insurance

- Ram Shankar Siva Kumar

- Frank Nagle

Existing plans might not cover the risks posed by these new technologies.

When organizations place machine learning systems at the center of their businesses, they introduce the risk of failures that could lead to a data breach, brand damage, property damage, business interruption, and in some cases, bodily harm. Even when companies are empowered to address AI failure modes, it is important to recognize that it is harder to be the defender than the attacker since the former needs to guard against all possible scenarios, while the latter only needs to find a single weakness to exploit. Enter AI insurance. The authors believe that businesses can expect stringent requirements when AI insurance is introduced to limit the insurance provider’s liability with rates cooling off as the AI insurance market matures. They offer a guide on preparing for the introduction of these insurance plans.

Most major companies, including Google , Amazon , Microsoft , Uber , and Tesla , have had their artificial intelligence (AI) and machine learning (ML) systems tricked, evaded, or unintentionally misled. Yet despite these high profile failures, most organizations’ leaders are largely unaware of their own risk when creating and using AI and ML technologies. This is not entirely the fault of the businesses. Technical tools to limit and remediate damage have not been built as quickly as ML technology itself, existing cyber insurance generally doesn’t fully cover ML systems, and legal remedies (e.g., copyright, liability, and anti-hacking laws) may not cover such situations. An emerging solution is AI/ML-specific insurance. But who will need it and exactly what it will cover are still open questions.

- RK Ram Shankar Siva Kumar is a data cowboy in Azure Security Data Science at Microsoft. He currently leads two efforts at Microsoft: using Machine Learning to secure systems via Azure Sentinel, a cloud intrusion detection system; as well as securing Machine learning systems via the Trustworthy AI group. Ram is also an affiliate at the Berkman Klein Center at Harvard University, and Technical Advisory Board Member at University of Washington.

- FN Frank Nagle is an assistant professor at Harvard Business School where he studies and teaches topics at the intersection of technology and strategy. Previously, he worked in the cybersecurity field for nearly a decade.

Partner Center

- Account details

- Follow topics

- Saved articles

- Newsletters

- Help Centre

- Subscriber rewards

You are currently accessing Risk.net via your Enterprise account.

If you already have an account please use the link below to sign in .

If you have any problems with your access or would like to request an individual access account please contact our customer service team.

Phone: 1+44 (0)870 240 8859

Email: [email protected]

You are currently accessing Risk.net via your institutional login.

If you have any problems with your access, contact our customer services team.

Phone: +44 20 7316 9685

Journal of Operational Risk

1744-6740 (print)

1755-2710 (online)

Editor-in-chief: Marcelo Cruz

Impact Factor: 0.645

First Published: March 2006

Extreme value theory for operational risk in insurance: a case study

Michal vyskočil and jiří koudelka.

- Tweet

- Save this article

- Send to

- Print this page

Need to know

- Standard formula may not always be conservative, prudent and sufficient

- Advanced model provides reasonable results in operational risk capital calculations

- Peak-over-threshold application under generalized extreme value distribution

- Capital requirement calculation is based on bootstrapping principle

This case study focuses on modeling the real, unique data set of 4245 operational risk claims of an anonymous Central and Eastern European insurance company from 2010 to 2018. We apply extreme value theory to build a more complex model, estimating losses from operational risk events using available historical claims. Low frequency, high-severity claims are identified using the extreme value theory peak-over-threshold method, and modeled via the generalized Pareto distribution, and compared with with Frechet, Weibull and Gumbel distributions. The compound lognormal distribution is used for high-frequency, low-severity claims. Using the bootstrapping principle, many one-year claims portfolio predictions are generated to calculate value-at-risk. The aim of this paper is to examine the sufficiency of the standard formula approach as defined in Solvency II in the case of a company with a specific risk profile. Based on the calculations for the real, unique data set we develop a new approach for estimating the solvency capital requirement for operational risk. Our findings show that the application of extreme value theory to internal data provides a more conservative capital requirement estimation than the standard formula calculation. Thus, the analyzed insurance company may be vulnerable to potential losses when the standard formula is applied.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email [email protected]

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

- About the editor

- Editorial board

- Call for papers

- Publish with us

- Reprints and permissions

Sorry, our subscription options are not loading right now

Please try again later. Get in touch with our customer services team if this issue persists.

New to Risk.net? View our subscription options

If you already have an account, please sign in here .

More papers in this issue

- Volume 16, Number 4 (December 2021)

- Thomas Kaiser

Browse journals

You need to sign in to use this feature. If you don’t have a Risk.net account, please register for a trial.

You are currently on corporate access.

To use this feature you will need an individual account. If you have one already please sign in.

Alternatively you can request an individual account here

Enterprise Risk Management Case Studies: Heroes and Zeros

By Andy Marker | April 7, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled more than 20 case studies of enterprise risk management programs that illustrate how companies can prevent significant losses yet take risks with more confidence.

Included on this page, you’ll find case studies and examples by industry , case studies of major risk scenarios (and company responses), and examples of ERM successes and failures .

Enterprise Risk Management Examples and Case Studies

With enterprise risk management (ERM) , companies assess potential risks that could derail strategic objectives and implement measures to minimize or avoid those risks. You can analyze examples (or case studies) of enterprise risk management to better understand the concept and how to properly execute it.

The collection of examples and case studies on this page illustrates common risk management scenarios by industry, principle, and degree of success. For a basic overview of enterprise risk management, including major types of risks, how to develop policies, and how to identify key risk indicators (KRIs), read “ Enterprise Risk Management 101: Programs, Frameworks, and Advice from Experts .”

Enterprise Risk Management Framework Examples

An enterprise risk management framework is a system by which you assess and mitigate potential risks. The framework varies by industry, but most include roles and responsibilities, a methodology for risk identification, a risk appetite statement, risk prioritization, mitigation strategies, and monitoring and reporting.

To learn more about enterprise risk management and find examples of different frameworks, read our “ Ultimate Guide to Enterprise Risk Management .”

Enterprise Risk Management Examples and Case Studies by Industry

Though every firm faces unique risks, those in the same industry often share similar risks. By understanding industry-wide common risks, you can create and implement response plans that offer your firm a competitive advantage.

Enterprise Risk Management Example in Banking

Toronto-headquartered TD Bank organizes its risk management around two pillars: a risk management framework and risk appetite statement. The enterprise risk framework defines the risks the bank faces and lays out risk management practices to identify, assess, and control risk. The risk appetite statement outlines the bank’s willingness to take on risk to achieve its growth objectives. Both pillars are overseen by the risk committee of the company’s board of directors.

Risk management frameworks were an important part of the International Organization for Standardization’s 31000 standard when it was first written in 2009 and have been updated since then. The standards provide universal guidelines for risk management programs.

Risk management frameworks also resulted from the efforts of the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The group was formed to fight corporate fraud and included risk management as a dimension.

Once TD completes the ERM framework, the bank moves onto the risk appetite statement.

The bank, which built a large U.S. presence through major acquisitions, determined that it will only take on risks that meet the following three criteria:

- The risk fits the company’s strategy, and TD can understand and manage those risks.

- The risk does not render the bank vulnerable to significant loss from a single risk.

- The risk does not expose the company to potential harm to its brand and reputation.

Some of the major risks the bank faces include strategic risk, credit risk, market risk, liquidity risk, operational risk, insurance risk, capital adequacy risk, regulator risk, and reputation risk. Managers detail these categories in a risk inventory.

The risk framework and appetite statement, which are tracked on a dashboard against metrics such as capital adequacy and credit risk, are reviewed annually.

TD uses a three lines of defense (3LOD) strategy, an approach widely favored by ERM experts, to guard against risk. The three lines are as follows:

- A business unit and corporate policies that create controls, as well as manage and monitor risk

- Standards and governance that provide oversight and review of risks and compliance with the risk appetite and framework

- Internal audits that provide independent checks and verification that risk-management procedures are effective

Enterprise Risk Management Example in Pharmaceuticals

Drug companies’ risks include threats around product quality and safety, regulatory action, and consumer trust. To avoid these risks, ERM experts emphasize the importance of making sure that strategic goals do not conflict.

For Britain’s GlaxoSmithKline, such a conflict led to a breakdown in risk management, among other issues. In the early 2000s, the company was striving to increase sales and profitability while also ensuring safe and effective medicines. One risk the company faced was a failure to meet current good manufacturing practices (CGMP) at its plant in Cidra, Puerto Rico.

CGMP includes implementing oversight and controls of manufacturing, as well as managing the risk and confirming the safety of raw materials and finished drug products. Noncompliance with CGMP can result in escalating consequences, ranging from warnings to recalls to criminal prosecution.