- Type 2 Diabetes

- Heart Disease

- Digestive Health

- Multiple Sclerosis

- Diet & Nutrition

- Supplements

- Health Insurance

- Public Health

- Patient Rights

- Caregivers & Loved Ones

- End of Life Concerns

- Health News

- Thyroid Test Analyzer

- Doctor Discussion Guides

- Hemoglobin A1c Test Analyzer

- Lipid Test Analyzer

- Complete Blood Count (CBC) Analyzer

- What to Buy

- Editorial Process

- Meet Our Medical Expert Board

Medicare Assignment: Everything You Need to Know

Medicare assignment.

- Providers Accepting Assignment

- Providers Who Do Not

- Billing Options

- Assignment of Benefits

- How to Choose

Frequently Asked Questions

Medicare assignment is an agreement between Medicare and medical providers (doctors, hospitals, medical equipment suppliers, etc.) in which the provider agrees to accept Medicare’s fee schedule as payment in full when Medicare patients are treated.

This article will explain how Medicare assignment works, and what you need to know in order to ensure that you won’t receive unexpected bills.

fizkes / Getty Images

There are 35 million Americans who have Original Medicare. Medicare is a federal program and most medical providers throughout the country accept assignment with Medicare. As a result, these enrollees have a lot more options for medical providers than most of the rest of the population.

They can see any provider who accepts assignment, anywhere in the country. They can be assured that they will only have to pay their expected Medicare cost-sharing (deductible and coinsurance, some or all of which may be paid by a Medigap plan , Medicaid, or supplemental coverage provided by an employer or former employer).

It’s important to note here that the rules are different for the 29 million Americans who have Medicare Advantage plans. These beneficiaries cannot simply use any medical provider who accepts Medicare assignment.

Instead, each Medicare Advantage plan has its own network of providers —much like the health insurance plans that many Americans are accustomed to obtaining from employers or purchasing in the exchange/marketplace .

A provider who accepts assignment with Medicare may or may not be in-network with some or all of the Medicare Advantage plans that offer coverage in a given area. Some Medicare Advantage plans— health maintenance organizations (HMOs) , in particular—will only cover an enrollee’s claims if they use providers who are in the plan's network.

Other Medicare Advantage plans— preferred provider organizations (PPOs) , in particular—will cover out-of-network care but the enrollee will pay more than they would have paid had they seen an in-network provider.

Original Medicare

The bottom line is that Medicare assignment only determines provider accessibility and costs for people who have Original Medicare. People with Medicare Advantage need to understand their own plan’s provider network and coverage rules.

When discussing Medicare assignment and access to providers in this article, keep in mind that it is referring to people who have Original Medicare.

How to Make Sure Your Provider Accepts Assignment

Most doctors, hospitals, and other medical providers in the United States do accept Medicare assignment.

Provider Participation Stats

According to the Centers for Medicare and Medicaid Services, 98% of providers participate in Medicare, which means they accept assignment.

You can ask the provider directly about their participation with Medicare. But Medicare also has a tool that you can use to find participating doctors, hospitals, home health care services, and other providers.

There’s a filter on that tool labeled “Medicare-approved payment.” If you turn on that filter, you will only see providers who accept Medicare assignment. Under each provider’s information, it will say “Charges the Medicare-approved amount (so you pay less out-of-pocket).”

What If Your Provider Doesn’t Accept Assignment?

If your medical provider or equipment supplier doesn’t accept assignment, it means they haven’t agreed to accept Medicare’s approved amounts as payment in full for all of the services.

These providers can still choose to accept assignment on a case-by-case basis. But because they haven’t agreed to accept Medicare assignment for all services, they are considered nonparticipating providers.

Note that "nonparticipating" does not mean that a provider has opted out of Medicare altogether. Medicare will still pay claims for services received from a nonparticipating provider (i.e., one who does not accept Medicare assignment), whereas Medicare does not cover any of the cost of services obtained from a provider who has officially opted out of Medicare.

If a Medicare beneficiary uses a provider who has opted out of Medicare, that person will pay the provider directly and Medicare will not be involved in any way.

Physicians Who Have Opted Out

Only about 1% of all non-pediatric physicians have opted out of Medicare.

For providers who have not opted out of Medicare but who also don’t accept assignment, Medicare will still pay nearly as much as it would have paid if you had used a provider who accepts assignment. Here’s how it works:

- Medicare will pay the provider 95% of the amount they would pay if the provider accepted assignment.

- The provider can charge the person receiving care more than the Medicare-approved amount, but only up to 15% more (some states limit this further). This extra amount, which the patient has to pay out-of-pocket, is known as the limiting charge . But the 15% cap does not apply to medical equipment suppliers; if they do not accept assignment with Medicare, there is no limit on how much they can charge the person receiving care. This is why it’s particularly important to make sure that the supplier accepts Medicare assignment if you need medical equipment.

- The nonparticipating provider may require the person receiving care to pay the entire bill up front and seek reimbursement from Medicare (using Form CMS 1490-S ). Alternatively, they may submit a claim to Medicare on behalf of the person receiving care (using Form CMS-1500 ).

- A nonparticipating provider can choose to accept assignment on a case-by-case basis. They can indicate this on Form CMS-1500 in box 27. The vast majority of nonparticipating providers who bill Medicare choose to accept assignment for the claim being billed.

- Nonparticipating providers do not have to bill your Medigap plan on your behalf.

Billing Options for Providers Who Accept Medicare

When a medical provider accepts assignment with Medicare, part of the agreement is that they will submit bills to Medicare on behalf of the person receiving care. So if you only see providers who accept assignment, you will never need to submit your own bills to Medicare for reimbursement.

If you have a Medigap plan that supplements your Original Medicare coverage, you should present the Medigap coverage information to the provider at the time of service. Medicare will forward the claim information to your Medigap insurer, reducing administrative work on your part.

Depending on the Medigap plan you have, the services that you receive, and the amount you’ve already spent in out-of-pocket costs, the Medigap plan may pay some or all of the out-of-pocket costs that you would otherwise have after Medicare pays its share.

(Note that if you have a type of Medigap plan called Medicare SELECT, you will have to stay within the plan’s network of providers in order to receive benefits. But this is not the case with other Medigap plans.)

After the claim is processed, you’ll be able to see details in your MyMedicare.gov account . Medicare will also send you a Medicare Summary Notice. This is Medicare’s version of an explanation of benefits (EOB) , which is sent out every three months.

If you have a Medigap plan, it should also send you an EOB or something similar, explaining the claim and whether the policy paid any part of it.

What Is Medicare Assignment of Benefits?

For Medicare beneficiaries, assignment of benefits means that the person receiving care agrees to allow a nonparticipating provider to bill Medicare directly (as opposed to having the person receiving care pay the bill up front and seek reimbursement from Medicare). Assignment of benefits is authorized by the person receiving care in Box 13 of Form CMS-1500 .

If the person receiving care refuses to assign benefits, Medicare can only reimburse the person receiving care instead of paying the nonparticipating provider directly.

Things to Consider Before Choosing a Provider

If you’re enrolled in Original Medicare, you have a wide range of options in terms of the providers you can use—far more than most other Americans. In most cases, your preferred doctor and other medical providers will accept assignment with Medicare, keeping your out-of-pocket costs lower than they would otherwise be, and reducing administrative hassle.

There may be circumstances, however, when the best option is a nonparticipating provider or even a provider who has opted out of Medicare altogether. If you choose one of these options, be sure you discuss the details with the provider before proceeding with the treatment.

You’ll want to understand how much is going to be billed and whether the provider will bill Medicare on your behalf if you agree to assign benefits (note that this is not possible if the provider has opted out of Medicare).

If you have supplemental coverage, you’ll also want to check with that plan to see whether it will still pick up some of the cost and, if so, how much you should expect to pay out of your own pocket.

A medical provider who accepts Medicare assignment is considered a participating provider. These providers have agreed to accept Medicare’s fee schedule as payment in full for services they provide to Medicare beneficiaries. Most doctors, hospitals, and other medical providers do accept Medicare assignment.

Nonparticipating providers are those who have not signed an agreement with Medicare to accept Medicare’s rates as payment in full. However, they can agree to accept assignment on a case-by-case basis, as long as they haven’t opted out of Medicare altogether. If they do not accept assignment, they can bill the patient up to 15% more than the Medicare-approved rate.

Providers who opt out of Medicare cannot bill Medicare and Medicare will not pay them or reimburse beneficiaries for their services. But there is no limit on how much they can bill for their services.

A Word From Verywell

It’s in your best interest to choose a provider who accepts Medicare assignment. This will keep your costs as low as possible, streamline the billing and claims process, and ensure that your Medigap plan picks up its share of the costs.

If you feel like you need help navigating the provider options or seeking care from a provider who doesn’t accept assignment, the Medicare State Health Insurance Assistance Program (SHIP) in your state may be able to help.

A doctor who does not accept Medicare assignment has not agreed to accept Medicare’s fee schedule as payment in full for their services. These doctors are considered nonparticipating with Medicare and can bill Medicare beneficiaries up to 15% more than the Medicare-approved amount.

They also have the option to accept assignment (i.e., accept Medicare’s rate as payment in full) on a case-by-case basis.

There are certain circumstances in which a provider is required by law to accept assignment. This includes situations in which the person receiving care has both Medicare and Medicaid. And it also applies to certain medical services, including lab tests, ambulance services, and drugs that are covered under Medicare Part B (as opposed to Part D).

In 2021, 98% of American physicians had participation agreements with Medicare, leaving only about 2% who did not accept assignment (either as a nonparticipating provider, or a provider who had opted out of Medicare altogether).

Accepting assignment is something that the medical provider does, whereas assignment of benefits is something that the patient (the Medicare beneficiary) does. To accept assignment means that the medical provider has agreed to accept Medicare’s approved fee as payment in full for services they provide.

Assignment of benefits means that the person receiving care agrees to allow a medical provider to bill Medicare directly, as opposed to having the person receiving care pay the provider and then seek reimbursement from Medicare.

Centers for Medicare and Medicaid Services. Medicare monthly enrollment .

Centers for Medicare and Medicaid Services. Annual Medicare participation announcement .

Centers for Medicare and Medicaid Services. Lower costs with assignment .

Centers for Medicare and Medicaid Services. Find providers who have opted out of Medicare .

Kaiser Family Foundation. How many physicians have opted-out of the Medicare program ?

Center for Medicare Advocacy. Durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS) updates .

Centers for Medicare and Medicaid Services. Check the status of a claim .

Centers for Medicare and Medicaid Services. Medicare claims processing manual. Chapter 26 - completing and processing form CMS-1500 data set .

Centers for Medicare and Medicaid Services. Ambulance fee schedule .

Centers for Medicare and Medicaid Services. Prescription drugs (outpatient) .

By Louise Norris Norris is a licensed health insurance agent, book author, and freelance writer. She graduated magna cum laude from Colorado State University.

AARP's Brain Health Resource Center offers tips, tools and explainers on brain health.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP — $12 FOR YOUR FIRST YEAR WHEN YOU SIGN UP FOR AUTOMATIC RENEWAL

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

AARP Hearing Center

Ways To Improve Your Hearing

Brain Health Resources

Tools and Explainers on Brain Health

A Retreat For Those Struggling

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Beach vacation ideas

Vacations for Sun and Fun

Plan Ahead for Tourist Taxes

AARP City Guide

Discover Seattle

25 Ways to Save on Your Vacation

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

TV for Grownups

Best Reality TV Shows for Grownups

Robert De Niro Reflects on His Life

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Navigate All Kinds of Connections

Life & Home

Couple Creates Their Forever Home

Store Medical Records on Your Phone?

Maximize the Life of Your Phone Battery

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

Your Ultimate Guide to Mulching

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Keep Your Car Running

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

What is Medicare assignment and how does it work?

Kimberly Lankford,

Because Medicare decides how much to pay providers for covered services, if the provider agrees to the Medicare-approved amount, even if it is less than they usually charge, they’re accepting assignment.

A doctor who accepts assignment agrees to charge you no more than the amount Medicare has approved for that service. By comparison, a doctor who participates in Medicare but doesn’t accept assignment can potentially charge you up to 15 percent more than the Medicare-approved amount.

That’s why it’s important to ask if a provider accepts assignment before you receive care, even if they accept Medicare patients. If a doctor doesn’t accept assignment, you will pay more for that physician’s services compared with one who does.

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

How much do I pay if my doctor accepts assignment?

If your doctor accepts assignment, you will usually pay 20 percent of the Medicare-approved amount for the service, called coinsurance, after you’ve paid the annual deductible. Because Medicare Part B covers doctor and outpatient services, your $240 deductible for Part B in 2024 applies before most coverage begins.

All providers who accept assignment must submit claims directly to Medicare, which pays 80 percent of the approved cost for the service and will bill you the remaining 20 percent. You can get some preventive services and screenings, such as mammograms and colonoscopies , without paying a deductible or coinsurance if the provider accepts assignment.

What if my doctor doesn’t accept assignment?

A doctor who takes Medicare but doesn’t accept assignment can still treat Medicare patients but won’t always accept the Medicare-approved amount as payment in full.

This means they can charge you up to a maximum of 15 percent more than Medicare pays for the service you receive, called “balance billing.” In this case, you’re responsible for the additional charge, plus the regular 20 percent coinsurance, as your share of the cost.

How to cover the extra cost? If you have a Medicare supplement policy , better known as Medigap, it may cover the extra 15 percent, called Medicare Part B excess charges.

All Medigap policies cover Part B’s 20 percent coinsurance in full or in part. The F and G policies cover the 15 percent excess charges from doctors who don’t accept assignment, but Plan F is no longer available to new enrollees, only those eligible for Medicare before Jan. 1, 2020, even if they haven’t enrolled in Medicare yet. However, anyone who is enrolled in original Medicare can apply for Plan G.

Remember that Medigap policies only cover excess charges for doctors who accept Medicare but don’t accept assignment, and they won’t cover costs for doctors who opt out of Medicare entirely.

Good to know. A few states limit the amount of excess fees a doctor can charge Medicare patients. For example, Massachusetts and Ohio prohibit balance billing, requiring doctors who accept Medicare to take the Medicare-approved amount. New York limits excess charges to 5 percent over the Medicare-approved amount for most services, rather than 15 percent.

AARP NEWSLETTERS

%{ newsLetterPromoText }%

%{ description }%

Privacy Policy

ARTICLE CONTINUES AFTER ADVERTISEMENT

How do I find doctors who accept assignment?

Before you start working with a new doctor, ask whether he or she accepts assignment. About 98 percent of providers billing Medicare are participating providers, which means they accept assignment on all Medicare claims, according to KFF.

You can get help finding doctors and other providers in your area who accept assignment by zip code using Medicare’s Physician Compare tool .

Those who accept assignment have this note under the name: “Charges the Medicare-approved amount (so you pay less out of pocket).” However, not all doctors who accept assignment are accepting new Medicare patients.

AARP® Vision Plans from VSP™

Exclusive vision insurance plans designed for members and their families

What does it mean if a doctor opts out of Medicare?

Doctors who opt out of Medicare can’t bill Medicare for services you receive. They also aren’t bound by Medicare’s limitations on charges.

In this case, you enter into a private contract with the provider and agree to pay the full bill. Be aware that neither Medicare nor your Medigap plan will reimburse you for these charges.

In 2023, only 1 percent of physicians who aren’t pediatricians opted out of the Medicare program, according to KFF. The percentage is larger for some specialties — 7.7 percent of psychiatrists and 4.2 percent of plastic and reconstructive surgeons have opted out of Medicare.

Keep in mind

These rules apply to original Medicare. Other factors determine costs if you choose to get coverage through a private Medicare Advantage plan . Most Medicare Advantage plans have provider networks, and they may charge more or not cover services from out-of-network providers.

Before choosing a Medicare Advantage plan, find out whether your chosen doctor or provider is covered and identify how much you’ll pay. You can use the Medicare Plan Finder to compare the Medicare Advantage plans and their out-of-pocket costs in your area.

Return to Medicare Q&A main page

Kimberly Lankford is a contributing writer who covers Medicare and personal finance. She wrote about insurance, Medicare, retirement and taxes for more than 20 years at Kiplinger’s Personal Finance and has written for The Washington Post and Boston Globe . She received the personal finance Best in Business award from the Society of American Business Editors and Writers and the New York State Society of CPAs’ excellence in financial journalism award for her guide to Medicare.

Discover AARP Members Only Access

Already a Member? Login

More on Medicare

How Do I Create a Personal Online Medicare Account?

You can do a lot when you decide to look electronically

I Got a Medicare Summary Notice in the Mail. What Is It?

This statement shows what was billed, paid in past 3 months

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices

Recommended for You

AARP Value & Member Benefits

Learn, earn and redeem points for rewards with our free loyalty program

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

The National Hearing Test

Members can take a free hearing test by phone

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

Medicare Interactive Medicare answers at your fingertips -->

Participating, non-participating, and opt-out providers, outpatient provider services.

You must be logged in to bookmark pages.

Email Address * Required

Password * Required

Lost your password?

If you have Original Medicare , your Part B costs once you have met your deductible can vary depending on the type of provider you see. For cost purposes, there are three types of provider, meaning three different relationships a provider can have with Medicare . A provider’s type determines how much you will pay for Part B -covered services.

- These providers are required to submit a bill (file a claim ) to Medicare for care you receive. Medicare will process the bill and pay your provider directly for your care. If your provider does not file a claim for your care, there are troubleshooting steps to help resolve the problem .

- If you see a participating provider , you are responsible for paying a 20% coinsurance for Medicare-covered services.

- Certain providers, such as clinical social workers and physician assistants, must always take assignment if they accept Medicare.

- Non-participating providers can charge up to 15% more than Medicare’s approved amount for the cost of services you receive (known as the limiting charge ). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare’s approved amount for covered services.

- Some states may restrict the limiting charge when you see non-participating providers. For example, New York State’s limiting charge is set at 5%, instead of 15%, for most services. For more information, contact your State Health Insurance Assistance Program (SHIP) .

- If you pay the full cost of your care up front, your provider should still submit a bill to Medicare. Afterward, you should receive from Medicare a Medicare Summary Notice (MSN) and reimbursement for 80% of the Medicare-approved amount .

- The limiting charge rules do not apply to durable medical equipment (DME) suppliers . Be sure to learn about the different rules that apply when receiving services from a DME supplier .

- Medicare will not pay for care you receive from an opt-out provider (except in emergencies). You are responsible for the entire cost of your care.

- The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you.

- Opt-out providers do not bill Medicare for services you receive.

- Many psychiatrists opt out of Medicare.

Providers who take assignment should submit a bill to a Medicare Administrative Contractor (MAC) within one calendar year of the date you received care. If your provider misses the filing deadline, they cannot bill Medicare for the care they provided to you. However, they can still charge you a 20% coinsurance and any applicable deductible amount.

Be sure to ask your provider if they are participating, non-participating, or opt-out. You can also check by using Medicare’s Physician Compare tool .

Update your browser to view this website correctly. Update my browser now

Medicare Assignment: Understanding How It Works

Medicare assignment is a term used to describe how a healthcare provider agrees to accept the Medicare-approved amount. Depending on how you get your Medicare coverage, it could be essential to understand what it means and how it can affect you.

What is Medicare assignment?

Medicare sets a fixed cost to pay for every benefit they cover. This amount is called Medicare assignment.

You have the largest healthcare provider network with over 800,000 providers nationwide on Original Medicare . You can see any doctor nationwide that accepts Medicare.

Understanding the differences between your cost and the difference between accepting Medicare and accepting Medicare assignment could be worth thousands of dollars.

Doctors that accept Medicare

Your healthcare provider can fall into one of three categories:

Medicare participating provider and Medicare assignment

Medicare participating providers not accepting medicare assignment, medicare non-participating provider.

More than 97% of healthcare providers nationwide accept Medicare. Because of this, you can see almost any provider throughout the United States without needing referrals.

Let’s discuss the three categories the healthcare providers fall into.

Participating providers are doctors or healthcare providers who accept assignment. This means they will never charge more than the Medicare-approved amount.

Some non-participating providers accept Medicare but not Medicare assignment. This means you can see them the same way a provider accepts assignment.

You need to understand that since they don’t take the assigned amount, they can charge up to 15% more than the Medicare-approved amount.

Since Medicare will only pay the Medicare-approved amount, you’ll be responsible for these charges. The 15% overcharge is called an excess charge. A few states don’t allow or limit the amount or services of the excess charges. Only about 5% of providers charge excess charges.

Opt-out providers don’t accept Original Medicare, and these healthcare providers are in the minority in the United States. If healthcare providers don’t accept Medicare, they won’t be paid by Medicare.

This means choosing to see a provider that doesn’t accept Medicare will leave you responsible for 100% of what they charge you. These providers may be in-network for a Medicare Advantage plan in some cases.

Avoiding excess charges

Excess charges could be large or small depending on the service and the Medicare-approved amount. Avoiding these is easy. The simplest way is to ask your provider if they accept assignment before service.

If they say yes, they don’t issue excess charges. Or, on Medicare.gov , a provider search tool will allow you to look up your healthcare provider and show if they accept Medicare assignment or not.

Medicare Supplement and Medicare assignment

Medigap plans are additional insurance that helps cover your Medicare cost-share . If you are on specific plans, they’ll pay any extra costs from healthcare providers that accept Medicare but not Medicare assigned amount. Most Medicare Supplement plans don’t cover the excess charges.

The top three Medicare Supplement plans cover excess charges if you use a provider that accepts Medicare but not Medicare assignment.

Medicare Advantage and Medicare assignment

Medicare assignment does not affect Medicare Advantage plans since Medicare Advantage is just another way to receive your Medicare benefits. Since your Medicare Advantage plan handles your healthcare benefits, they set the terms.

Most Medicare Advantage plans require you to use network providers. If you go out of the network, you may pay more. If you’re on an HMO, you’d be responsible for the entire charge of the provider not being in the network.

Do all doctors accept Medicare Supplement plans?

All doctors that accept Original Medicare accept Medicare Supplement plans. Some doctors don’t accept Medicare. In this case, those doctors won’t accept Medicare Supplements.

Where can I find doctors who accept Medicare assignment?

Medicare has a physician finder tool that will show if a healthcare provider participates in Medicare and accepts Medicare assignments. Most doctors nationwide do accept assignment and therefore don’t charge the Part B excess charges.

Why do some doctors not accept Medicare?

Some doctors are called concierge doctors. These doctors don’t accept any insurance and require cash payments.

What is a Medicare assignment?

Accepting Medicare assignment means that the healthcare provider has agreed only to charge the approved amount for procedures and services.

What does it mean if a doctor does not accept Medicare assignment?

The doctor can change more than the Medicare-approved amount for procedures and services. You could be responsible for up to a 15% excess charge.

How many doctors accept Medicare assignment?

About 97% of doctors agree to accept assignment nationwide.

Is accepting Medicare the same as accepting Medicare assignment?

No. If a doctor accepts Medicare and accepts Medicare assigned amount, they’ll take what Medicare approves as payment in full.

If they accept Medicare but not Medicare assignment, they can charge an excess charge of up to 15% above the Medicare-approved amount. You could be responsible for this excess charge.

What is the Medicare-approved amount?

The Medicare-approved amount is Medicare’s charge as the maximum for any given medical service or procedure. Medicare has set forth an approved amount for every covered item or service.

Can doctors balance bill patients?

Yes, if that doctor is a Medicare participating provider not accepting Medicare assigned amount. The provider may bill up to 15% more than the Medicare-approved amount.

What happens if a doctor does not accept Medicare?

Doctors that don’t accept Medicare will require you to pay their full cost when using their services. Since these providers are non-participating, Medicare will not pay or reimburse for any services rendered.

Get help avoiding Medicare Part B excess charges

Whether it’s Medicare assignment, or anything related to Medicare, we have licensed agents that specialize in this field standing by to assist.

Give us a call, or fill out our online request form . We are happy to help answer questions, review options, and guide you through the process.

Related Articles

- What are Medicare Part B Excess Charges?

- How to File a Medicare Reimbursement Claim?

- Medicare Defined Coinsurance: How it Works?

- Welcome to Medicare Visit

- Guide to the Medicare Program

CALL NOW (833) 972-1339

What Does It Mean for a Doctor to Accept Medicare Assignment?

Written by: Malini Ghoshal, RPh, MS

Reviewed by: Malinda Cannon, Licensed Insurance Agent

Key Takeaways

Doctors who accept Medicare assignment are paid agreed-upon rates for services.

It’s important to verify that your doctor accepts assignment before receiving services to avoid high out-of-pocket costs.

A doctor or clinician may be “non-participating” but can still agree to accept Medicare assignment for some services.

If you visit a doctor or clinician who has opted out (doesn’t accept Medicare), you may have to pay for your entire visit cost unless it’s a medical emergency.

Medigap Supplemental insurance (Medigap) plans won’t pay for service costs from doctors who don’t accept assignment.

One of the things that Original Medicare beneficiaries often enjoy about their coverage is that they can use it anywhere in the country. Unlike plans with provider networks, they can visit doctors either at home or on the road; both are covered the same.

But do all doctors accept Medicare patients?

Truth is, this wide-ranging coverage area only applies to doctors who accept Medicare assignment. Fortunately, most do. If you’re eligible for Medicare, it’s important to visit doctors and clinicians who accept Medicare assignment. This will help keep your out-of-pocket costs within your control. Doctors who agree to accept Medicare assignment sign an agreement that they’re willing to accept payment from Medicare for their services.

If you’re a current beneficiary or nearing enrollment, you may have other questions. Do all doctors accept Medicare Advantage plans? What about Medicare Supplement insurance (Medigap)? Read on to learn how to find doctors that accept Medicare assignment and how this keeps your healthcare costs down.

Find a local Medicare plan that fits your needs.

What Is Medicare Assignment of Benefits?

When you’re eligible for Medicare, you have the option to visit doctors and clinicians who accept assignment. This means they are Medicare-approved providers who agree to receive Medicare reimbursement rates for covered services. This helps save you money.

If you have Original Medicare (Part A and B), your doctor visits are covered by your Part B plan. Inpatient services such as hospital stays and some skilled nursing care are covered by Part A .

In order for a participating doctor (or facility) to bill Medicare and be reimbursed, you must authorize Medicare to reimburse your doctor directly for your covered services. This is called the Medicare assignment of benefits. You transfer your right to receive Medicare payment for a covered service to your doctor or other provider.

Note: If you have a Medicare Supplement insurance ( Medigap ) plan to pay for out-of-pocket costs, you may also need to sign a separate assignment of benefits form for Medigap reimbursement. More on Medigap below.

How Can I Find Doctors Near Me That Accept Medicare?

There are several ways to find doctors and other clinicians who accept Medicare assignment close to you.

First, let’s take a look at the different types of Medicare providers.

They include:

Participating providers: Medicare-participating doctors and providers sign a participation agreement stating they will accept Medicare reimbursement rates for their services.

Non-participating providers: Doctors or providers who are non-participating providers are eligible to accept Medicare assignment but haven’t signed a Medicare agreement. They may choose to accept assignment on a case-by-case basis. If you visit a non-participating provider, make sure to ask if they accept assignment for your particular service. Also get a copy of their fees. They will need to select “yes” on Centers for Medicare & Medicaid Services CMS Form 1500 to accept assignment for the service.

Opt-out providers: Some doctors and other providers choose not to accept Medicare. If they choose to opt out, the period is two years (based on Medicare guidelines). The opt-out automatically renews if the provider doesn’t request a change in their status. You would be responsible for paying all costs for services received from an opt-out provider. You cannot bill Medicare for reimbursement unless the service was an urgent or emergency medical need. According to a report from KFF , roughly 1% of non-pediatric physicians opted out of Medicare in 2023.

Visiting a doctor who doesn’t accept assignment may cost you more. These providers can charge you up to 15% more than the Medicare-approved rate for a given service. This 15% charge is called the limiting charge. Some states limit this extra charge to a certain percent. This may also be called the Part B excess charge.

Here are some tips for finding doctors and providers who accept Medicare assignment:

- The easiest way to find a doctor who accepts Medicare assignment is to contact their office and ask them directly.

- If you’re looking for a new doctor, you can use the Medicare search tool to find clinicians and doctors that accept Medicare assignment.

- You can also ask a state health insurance assistance program (SHIP) representative for help in locating a doctor that accepts Medicare assignment.

- Don’t assume that having a longstanding relationship with your doctor means nothing will ever change. Check in with them to make sure they still accept Medicare assignment and whether they’re planning to opt out.

Note: Your doctor can choose to become a non-participating provider or opt out of participating in Medicare. It’s important to verify they accept Medicare assignment before receiving any services.

My Medicare coverage doesn’t address all of my needs.

Do Doctors Who Accept Medicare Have to Accept Supplement Plans?

If your doctor accepts Medicare assignment and you have Original Medicare (Medicare Part A and Part B) with a Medicare Supplement (Medigap) plan, they will accept the supplemental insurance. Depending on your Medigap plan coverage , it may pay all or part of your out-of-pocket costs such as deductibles, copayments and coinsurance.

However, if you have a Medicare Advantage plan (Part C), you may have a network of covered doctors under the plan. If you visit an out-of-network doctor, you may need to pay all or part of the cost for your services.

Keep in mind that you can’t have a Medigap supplemental plan if you have a Medicare Advantage plan.

If you have questions or want to learn more about different Medicare plans like Original Medicare with Medigap versus Medicare Advantage, GoHealth has licensed insurance agents ready to help. They can shop your different options and offer impartial guidance where you need it.

Do Most Doctors Accept Medicare Advantage Plans?

Many doctors accept Medicare Advantage (Part C) plans, but these plans often use provider networks. These networks are groups of doctors and providers in an area that have agreed to treat an insurance company’s customers. If you have a Part C plan, you may be required to see in-network doctors with few exceptions. However, these types of plans are popular options for all-in-one coverage for your health needs. Plans must offer Part A and B coverage, plus a majority also include Part D , or prescription drug coverage. But whether a doctor accepts a Medicare Advantage plan may depend on where you live and the type of Medicare Advantage plan you have.

There are several types of Medicare Advantage plans including:

- Health Maintenance Organization (HMO): These plans have a network of covered providers, as well as a primary care physician to manage your care. If you visit a doctor outside your plan network, you may have to pay the full cost of your visit.

- Preferred Provider Organization (PPO): You’ll probably still have a primary care physician, but these are more flexible plans that allow you to go out of network in some cases. But you may have to pay more.

- Private Fee for Service (PFFS): You may be able to visit any doctor or provider with these plans, but your costs may be higher.

- Special Needs Plan (SNP): This type of plan is only for certain qualified individuals who either have a specific health condition ( C-SNP ) or who qualify for both Medicaid and Medicare insurance ( D-SNP ).

Ready for a new Medicare Advantage plan?

What Are Medicare Assignment Codes?

Medicare assignment codes help Medicare pay for covered services. If your doctor or other provider accepts assignment and is a participating provider, they will file for reimbursement for services with a CMS-1500 form and the code will be “assigned.”

But non-participating providers can select “not assigned.” This means they are not accepting Medicare-assigned rates for a given service. They can charge up to 15% over the full Medicare rate for the service.

If you go to a doctor or provider who accepts assignment, you don’t need to file your own claim. Your doctor’s office will directly file with Medicare. Always check to make sure your doctor accepts assignment to avoid excess charges from your visit.

Health Insurance Claim Form . CMS.gov.

Lower costs with assignment . Medicare.gov.

How Many Physicians Have Opted-Out of the Medicare Program? KFF.org.

Joining a plan . Medicare.gov.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Let's see if you're missing out on Medicare savings.

We just need a few details.

Related Articles

What Is Medicare IRMAA?

What Is an IRMAA in Medicare?

How to Report Medicare Fraud

Medicare Fraud Examples & How to Report Abuse

How to Change Your Address with Medicare

Reporting a Change of Address to Medicare

Can I Get Medicare if I’ve Never Worked?

Can You Get Medicare if You've Never Worked?

Why Are Some Medicare Advantage Plans Free?

Why Are Some Medicare Advantage Plans Free? $0 Premium Plans Explained

What Is Medicare Assignment?

Am I Enrolled in Medicare?

When and How Do I Enroll?

When and How Do I Enroll in Medicare?

Medicare Frequently Asked Questions

Let’s see if you qualify for Medicare savings today!

The independent source for health policy research, polling, and news.

Paying a Visit to the Doctor: Current Financial Protections for Medicare Patients When Receiving Physician Services

Cristina Boccuti Published: Nov 30, 2016

- Issue Brief

Under current law, Medicare has several financial protections in place that are designed to safeguard Medicare beneficiaries—seniors and people with permanent disabilities—from unexpected and confusing charges when they seek care from doctors and other practitioners. These protections include the participating provider program, limitations on balance billing, and conditions on private contracting. This issue brief describes these three protections, explains why they were enacted, and examines the implications of modifying them for beneficiaries, providers, and the Medicare program.

Main Findings

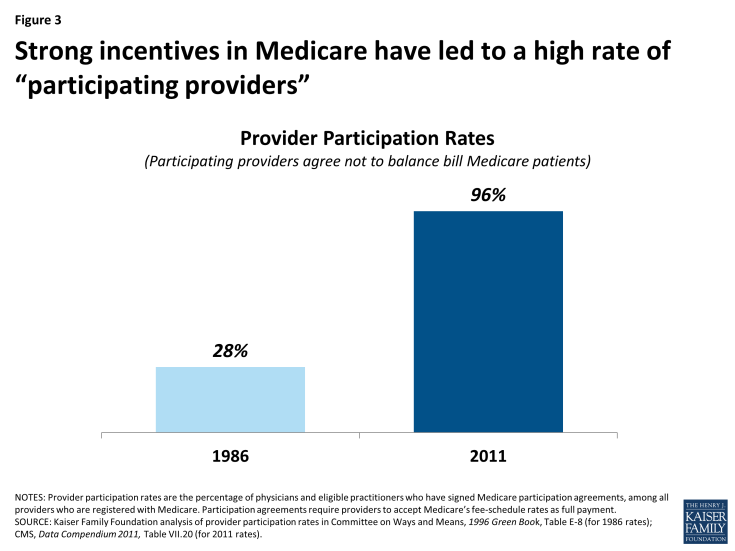

- The participating provider program was enacted in 1984 for two purposes: (1) to assist Medicare patients with identifying and choosing providers who charge Medicare-approved rates; and (2) to encourage providers to accept these rates. Given this program’s strong provider incentives, the number of participating providers grew rapidly across all states and today, the vast majority (96%) of eligible physicians and practitioners are “participating providers”—agreeing to charge Medicare’s standard fees when they see beneficiaries.

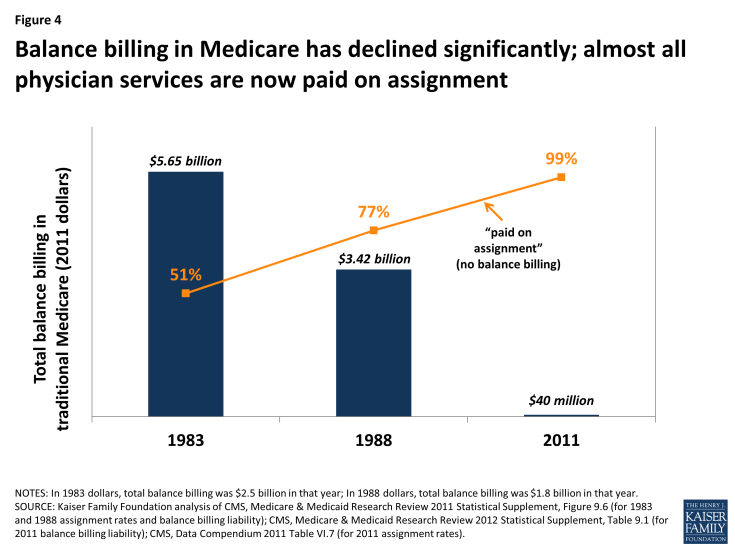

- The Congress instituted limitations on balance billing in 1989, in conjunction with implementation of the Medicare physician fee schedule. This financial protection limits the amount that “non-participating” providers may charge beneficiaries through balance billing—whereby beneficiaries are responsible for the portion of the provider’s charge that exceeds Medicare’s fee-schedule rate. Total out-of-pocket liability from balance billing has declined significantly over the past few decades dropping from $2.5 billion in 1983 ($5.65 billion in 2011 dollars) to $40 million in 2011.

- In 1997, the Congress codified several conditions for private contracting that apply to physicians and practitioners who “opt out” of Medicare and see beneficiaries only under individual private contracts. These restrictions were instituted to ensure that beneficiaries are aware of the financial ramifications of entering into these private contracts, and to safeguard patients and Medicare from fraud and abuse. In general, private contracting is relatively rare with only 1 percent of practicing physicians opting out of Medicare.

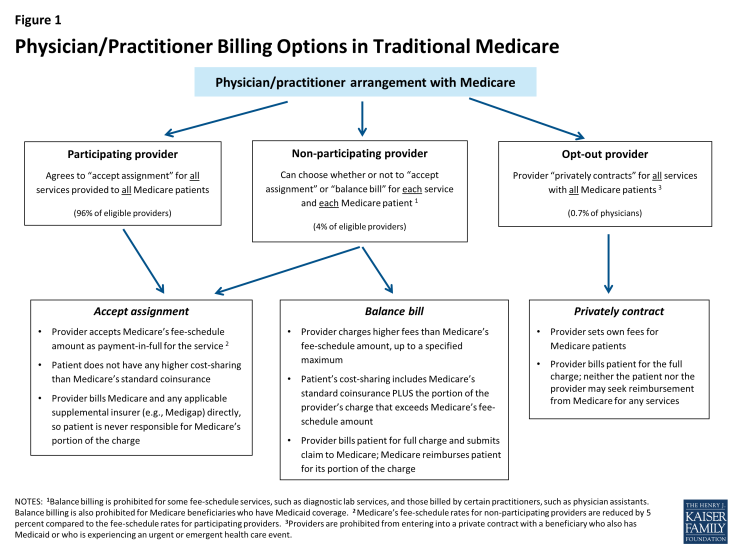

Background: Current Provider Options for Charging Medicare Patients

Under current law, physicians and practitioners have three options for how they will charge their patients in traditional Medicare. They may register with Medicare as (1) a participating provider, (2) a non-participating provider, or (3) an opt-out provider who privately contracts with each of his or her Medicare patients for payment (Figure 1). This issue brief describes these three options and then examines three current provisions in Medicare that provide financial protections for Medicare beneficiaries.

Participating providers: Physicians and practitioners who register with Medicare as participating providers agree to “accept assignment” for all of their Medicare patients. Accepting assignment entails two conditions: agreeing to accept Medicare’s fee-schedule amount as payment-in-full for a given service and collecting Medicare’s portion directly from Medicare, rather than the patient. Therefore, when Medicare patients see participating providers, they can be certain that these providers will not charge fees higher than Medicare’s published fee-schedule amount and that they will not face higher out-of-pocket liability than the maximum 20-percent coinsurance for most services. The vast majority (96%) of providers who provide Medicare-covered services are participating providers.

Non-participating providers: Non-participating providers do not agree to accept assignment for all of their Medicare patients; instead they may choose—on a service-by-service basis—to charge Medicare patients higher fees, up to a certain limit. When doing so, their Medicare patients are liable for higher cost sharing to cover the higher charges. This arrangement is called “balance billing” and means that the Medicare patient is financially responsible for the portion of the provider’s charge that is in excess of Medicare’s assigned rate, in addition to standard applicable coinsurance and deductibles for Medicare services. When non-participating providers do not accept assignment, they may not collect reimbursement from Medicare; rather, they bill the Medicare patient directly, typically up front at the time of service. Non-participating providers must submit claims to Medicare on behalf of their Medicare patients, but Medicare reimburses the patient, rather than the nonparticipating provider, for its portion of the covered charges. A small share (4%) of providers who provide Medicare-covered services are non-participating providers.

Opt-out providers, privately contracting: Physicians and practitioners who choose to enter into private contracts with their Medicare patients “opt-out” of the Medicare program entirely. These opt-out providers may charge Medicare patients any fee they choose. Medicare does not provide any reimbursement—either to the provider or the Medicare patient—for services provided by these providers under private contracts. Accordingly, Medicare patients are liable for the entire cost of any services they receive from physicians and practitioners who have opted out of Medicare. Several protections are in place to ensure that patients are clearly aware of their financial liabilities when seeing a provider under a private contract. An extremely small portion of physicians (less than 1% of physicians in clinical practice) have chosen to “opt-out” of the Medicare program, of whom 42 percent are psychiatrists.

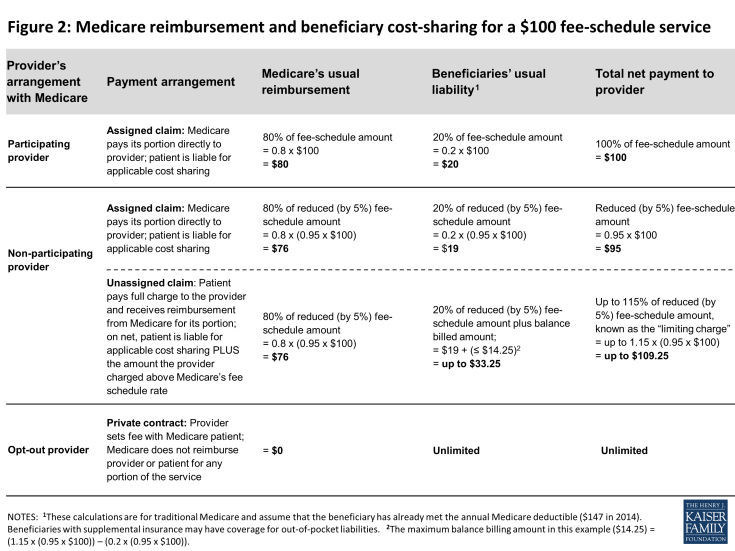

These provider options have direct implications on the charges and out-of-pocket liabilities that beneficiaries face when they receive physician services (Figure 2). They also play a major role in several financial protections in current law—namely, the physician participation program, limitations on balance billing, and conditions for private contracting—which help beneficiaries understand the financial implications of their provider choices and encourage providers to accept Medicare’s standard fees.

Figure 1: Physician/Practitioner Billing Options in Traditional Medicare

Figure 2: Medicare reimbursement and beneficiary cost-sharing for a $100 fee-schedule service

Medicare’s Participating Provider Program

Medicare’s participating provider program includes several incentives (both financial and nonfinancial) to encourage physicians and practitioners to “accept assignment” for all of their Medicare patients. When providers accept assignment, they agree to accept Medicare’s fee-schedule amount as payment-in-full for a given service and are allowed to bill Medicare directly for its portion of the reimbursement. Physicians and practitioners who agree to accept assignment on all services that they provide to Medicare patients are “participating providers” and are listed in Medicare provider directories. Beneficiaries who select a participating provider are assured that, after meeting the deductible, their coinsurance liability will not exceed 20 percent of the charge for the services they receive (Figure 2).

Congress established the participating provider program in the 1984 Deficit Reduction Act (DEFRA) to address two main concerns: confusion among beneficiaries about the fees they were being charged when they saw a doctor and escalating rates of balance billing from charges that exceeded Medicare’s established “usual, customary, and reasonable” rates for their area. 1 At that time, aside from Medicaid-eligible beneficiaries, Medicare had no limits on the amount that physicians and practitioners could balance bill for their services. Surveys conducted by the Physician Payment Review Commission (PPRC), a congressional advisory body and predecessor of the Medicare Payment Advisory Commission (MedPAC), revealed that prior to the participating provider program, beneficiaries often did not know from one physician to the next whether they would face extra out-of-pocket charges due to balance billing and how much those amounts might be. 2 By 1984, beneficiaries’ payment for balance billing reached 27 percent of total Medicare Part B out-of-pocket liability and was jeopardizing their access to affordable physician services. 3

The establishment of the participating provider program in Medicare instituted multiple incentives to encourage providers to accept assignment for all their patients and become participating providers. For example, Medicare payment rates for participating providers are 5 percent higher than the rates paid to non-participating providers. Also, participating providers may collect Medicare’s reimbursement amount directly from Medicare, in contrast to non-participating providers who may not collect payment from Medicare and typically bill their Medicare patients upfront for their charges. (Non-participating providers must submit claims to Medicare so that their patients are reimbursed for Medicare’s portion of their charges.) Participating providers also gain the benefit of having electronic access to Medicare beneficiaries’ supplemental insurance status, such as their Medigap coverage. This information makes it considerably easier for providers to file claims to collect beneficiary coinsurance amounts, as well as easing the paperwork burden on patients. Additionally, Medicare helps beneficiaries in traditional Medicare seek and select participating providers by listing them by name with their contact information on Medicare’s consumer-focused website (www.Medicare.gov).

Given the strong incentives of the participation program, combined with limits on balance billing (discussed in the next section), it is not surprising that the share of physicians and practitioners electing to be participating providers has risen to high levels across the country. Overall, the rate of providers with participation agreements has grown to 96 percent in 2011, up considerably from about 30 percent in 1986, two years after the start of the participating provider program (Figure 3). 4 As a result, across all states, most beneficiaries now encounter predictable expenses for Medicare-covered services, and are never responsible for Medicare’s portion of the fee (Appendix 1).

Figure 3: Strong incentives in Medicare have led to a high rate of “participating providers”

Medicare’s Balance Billing Limitations

Despite the incentives to become participating providers, a small share (4%) of physicians and practitioners who are registered with Medicare are non-participating providers. These providers can—on a service-by-service basis—charge patients in traditional Medicare higher fees than Medicare’s fee-schedule amount, up to a specified maximum. When charging higher fees, beneficiaries are responsible for the difference between Medicare’s approved amount and the providers’ total charge—essentially the balance of the bill remaining after accounting for Medicare’s reimbursement. This higher cost-sharing arrangement is called “balance billing” and means that the Medicare patient is financially liable for not only the applicable coinsurance and deductible, but also for any amount in which the provider’s charge exceeds Medicare’s assigned rate. Providers may not balance bill Medicare beneficiaries who also have Medicaid coverage. 5

When non-participating providers balance bill, they bill the beneficiary directly, typically for the full charge of the service—including Medicare’s share, applicable coinsurance and deductible, and any balance billed amount. Non-participating providers are then required to submit a claim to Medicare, so that Medicare can process the claim and reimburse the patient for Medicare’s share of the charge. Two Medigap insurance policies, which beneficiaries may purchase to supplement their Medicare coverage, include coverage for balance billing. 6 Balance billing is prohibited for Medicare-covered services in the Medicare Advantage program, except in the case of private fee-for-service plans.

In traditional Medicare, the maximum that non-participating providers may charge for a Medicare-covered service is 115 percent of the discounted fee-schedule amount. (Medicare’s fee-schedule rates for non-participating physicians are reduced by five percent.) Accordingly, non-participating providers may bill Medicare patients up to 9.25 percent more than participating providers (i.e., 1.15 x 0.95= 109.25). If the non-participating physician or practitioner balance bills the maximum amount permitted (not including any unmet deductible), total beneficiary liability for Medicare-covered services is about 33 percent of Medicare’s regular fee schedule amount (Figure 2).

Balance billing limitations were implemented in conjunction with the institution of Medicare’s physician fee-schedule in the Omnibus Budget Reconciliation Act of 1989. At the time, Medicare’s charge-based methodology for physician services gave rise to rapid spending growth and confusion among beneficiaries about what charges they would face for physician services. 7 Moreover, high cost-sharing liabilities weighed disproportionately on beneficiaries who were sickest and used the most physician services. Despite physician reports that they took patient incomes into account when determining whether to charge higher-than Medicare rates, PPRC research did not find a relationship between beneficiary income and the probability that claims would be assigned. 8

While the Congress constrained growth in provider fees through the implementation of the fee schedule, it also implemented maximum “limiting charges” to establish further certainty and predictability for patients on their expected costs for services. In trying to rein in Medicare fee-schedule payments, the Congress sought to protect beneficiaries from excess charges that providers could otherwise impose in response to restrictions on their fees. 9

The continued desire to protect beneficiary spending during the implementation of the new physician fee schedule gave rise to the question of whether Congress might consider imposing even greater restrictions on balance billing or even mandate assignment (prohibiting balance billing) for all claims. 10 Ultimately, the rationale in Congress for allowing limited balance billing was that it would provide for: (1) a “safety valve” for physicians who believed that the fee schedule did not adequately reflect the quality of services that they provided; (2) a means to correct any underpricing of resource costs in the fee schedule; and (3) necessary financial protections for beneficiaries, particularly in areas of the country where choice of physicians was limited. 11

As limits on balance billing were implemented and incentives for physicians and practitioners to take assignment took hold, beneficiary liability for balance billing declined dramatically. CMS data show that in 2011, total balance billing amounted to $40 million, down significantly from $2.5 billion in 1983, (which equals $5.6 billion in 2011 dollars) (Figure 4). Concurrently, the rate of assigned claims to total covered charges climbed from 51% in 1983 to 99% in 2011.

Figure 4: Balance billing in Medicare has declined significantly; almost all physician services are now paid on assignment

Private Contracting Conditions for Providers who Opt Out of Medicare

A very small share of providers (less than 1 percent of physicians) have elected to “opt out” of Medicare and contract privately with all of their Medicare patients, individually. 12 Their fees are not bound by Medicare’s physician fee schedule in any way, which means that these providers have no limits on the amounts they may charge beneficiaries for their services. Medicare does not reimburse either the provider or the patient for any services furnished by opt-out providers. Therefore, Medicare patients are financially responsible for the full charge of services provided by providers who have formally opted out of Medicare. 13

Serving as beneficiary protections, several important conditions exist for providers who elect to contract privately with Medicare patients. One condition is that prior to providing any service to Medicare patients, physicians and practitioners must inform their Medicare patients that they have opted out of Medicare and provide their Medicare patients with a written document stating that Medicare will not reimburse either the provider or the patient for any services furnished by opt-out providers. Their Medicare patients must sign this document to signify their understanding of it and their right to seek care from a physician or other practitioner who has not opted-out of Medicare.

Providers opt-out by submitting a signed affidavit to Medicare agreeing to applicable terms and affirming that their contracts with patients include all the necessary information. Physicians or practitioners who opt out of Medicare must privately contract with all of their Medicare patients, not just some. Once a physician or practitioner opts out of Medicare, this status lasts for a two-year period and is automatically renewed unless the physician or practitioner actively cancels it. 14 Providers may not enter into a private contract with a beneficiary who also has Medicaid benefits or who is experiencing an urgent or emergent health care event. 15

These conditions, which provide protections for both beneficiaries and the Medicare program, were included in the Balanced Budget Act of 1997 as part of the legislation that first codified physicians’ ability to privately contract with Medicare beneficiaries. Requiring opt-out providers to privately contract for all services they provide to Medicare patients (rather than being able to select by individual patients or services) was intended to prevent confusion among Medicare patients as to whether or not each visit would be covered under Medicare and how much they could expect to pay out-of-pocket. Similarly, requiring providers to opt out for a minimum period of time—two years—was intended to ensure that beneficiaries had consistent information to make knowledgeable choices when selecting their physicians. Both of these provisions also addressed Medicare’s duty to guard against fraudulent billing in an administratively feasibly manner. If, for example, physicians contracted with only some of their patients and/or services, Medicare would have to examine each contract for each submitted claim to discern which claims were eligible for Medicare reimbursement and which were not.

Previous Kaiser Family Foundation analysis shows that psychiatrists are disproportionately represented among the 0.7 percent of physicians (4,863) who have opted out of Medicare—comprising 42 percent of all physicians who have opted out (Figure 5). 16 Another 1,775 clinical professionals with non-physician doctorate degrees (i.e. oral surgeon dentists, podiatrists, and optometrists) also have opted-out of the Medicare program. 17 Dentists who are oral surgeons comprise the majority of this group (95%). Earlier research that examined opt-out providers through 2002 found similarly low numbers of providers opting out (2,839) as well as relatively higher opt-out rates among psychiatrists compared with other specialties. 18

Some physician organizations attribute physician decisions to opt out of Medicare to frustration with Medicare’s fees and regulations. 19 Others have noted a similar trend in physician refusal to work with any insurers—including commercial insurance plans—especially in prosperous communities. 20 In these cases, providers require patients to pay them directly out-of-pocket, leaving the patient to seek reimbursement, if any, from their insurer. For providers with patients who have the resources to make the payments, this billing method significantly reduces providers’ paperwork.

Concierge Practice Models

Some physicians are turning to concierge practice models (also called retainer-based care), in which they charge their patients annual membership fees and typically have smaller patient caseloads. Physicians in a concierge practice model do not necessarily need to opt-out of Medicare to see Medicare patients. However, if they do not opt-out of Medicare, these physicians are subject to Medicare’s balance billing rules, and therefore, cannot charge beneficiaries additional fees for services that are already covered by Medicare. 21 For example, the annual fee for a concierge practice may not be used for the yearly wellness visit covered by Medicare, but it could be applied to items such as a newsletter and high-end waiting room furniture. More controversy exists about concierge practices applying annual fees paid by Medicare beneficiaries to enhanced appointment access and extra time with patients. 22

While anecdotal reports suggest a significant migration of primary care physicians to concierge/retainer practices, particularly in areas around Washington D.C and other major east and west coast cities, reliable data on the number of these practices are lacking. In 2010, a report for MedPAC found listings for 756 concierge physicians, compared with 146 found by Government Accountability Office in 2005. 23 Other news articles have reported larger numbers (4,400 in 2012) according to the American Association of Private Physicians. 24

Implications of Proposals to Modify Incentives and Relax Certain Financial Protections—Pros and Cons

Proposals introduced by Rep. Tom Price, House Speaker Paul Ryan and others have sought to relax private contracting conditions either throughout the Medicare program or as a demonstration project that could be implemented by the Administration. For example, in 2015, two Bills introduced in the House with a companion Bill in the Senate 25 include provisions to allow physicians and practitioners to engage in private contracting on a beneficiary-by-beneficiary basis, instead of requiring providers to opt-out of Medicare entirely. These Bills would also allow beneficiaries to seek Medicare reimbursement for the portion of the privately contracted fee that equals Medicare’s fee schedule amount, but no out-of-pocket limits would apply to the remaining portion of the provider’s charge. Similar changes are also proposed as a demonstration in the 2016 House Republican Plan, “A Better Way, our Vision for a Confident America.” 26 An earlier House Bill also included a demonstration to allow non-participating providers to collect Medicare’s portion of their charge directly from Medicare. 27

Pros: Support for Relaxing restrictions and increasing physician autonomy

Proponents of such proposals, including the American Medical Association, support relaxing restrictions on balance billing and private contracting for a number of reasons—perhaps the foremost is that they would allow physicians to charge Medicare beneficiaries higher rates and thereby get relief from fees that they say have failed to keep pace with the rising costs of running their practices. 28 Proponents also assert that this ability could increase the overall number of providers willing to accept Medicare patients. This concern may be an issue in some geographic areas, though surveys and other data sources show that nationally, access to physicians among Medicare seniors is generally comparable to access among people age 55 to 64 with private insurance. 29

Physician groups also state that proposals to relax constraints on balance billing and private contracting would give providers a sense of greater autonomy in how they relate to both their patients and the Medicare program and would allow physicians to charge higher fees to some patients based on their assessment of their patients’ ability to pay. 30 Additionally, beneficiaries would be able to seek at least partial Medicare reimbursement for services they received under private contracts. Proposals that would allow non-participating providers to collect Medicare’s portion of their charge directly from Medicare would obviate the need to charge patients the full fee upfront. This circumstance could be helpful to those patients who do not want to wait for Medicare’s reimbursement, even if on net, they would incur higher out-of-pocket liability due to balance billing. Non-participating providers could also experience a more reliable payment from Medicare, compared with the challenges, in some cases, of collecting fees from Medicare patients for unassigned claims.

Cons: Concerns about Eroding Financial Protections

Other analysts have raised concerns about the effects of relaxing private contracting rules and balance billing restrictions. 31 To the extent that such changes lead to increases in the number of non-participating and/or opt-out providers, they could exacerbate problems that lower-income beneficiaries face when seeking care. Beneficiaries without the ability to pay higher rates (who are also likely to be disproportionately sicker) could find a reduced pool of physicians willing to accept them. Also, for rarer physician specialties and in some geographic areas, such as rural parts of the country, patients may have little choice among physicians. If the limits on balance billing and private contracting were relaxed, beneficiaries in these situations could face the types of problems that existed prior to the imposition of limits on balance billing—high out-of-pocket costs and greater confusion and uncertainty about possible charges. Additionally, concerns have been raised about the accuracy and appropriateness of providers determining which Medicare patients in their caseload can afford higher fees, and by how much.

While proposals that allow beneficiaries and non-participating physicians to seek reimbursement from Medicare may, in the short term, reduce out-of-pocket liability for beneficiaries, they could also decrease the incentives for physicians and practitioners to become participating providers. In the long run, if significantly more providers balance billed their Medicare patients or opted-out of Medicare, this shift could alternatively increase beneficiary out-of-pocket spending.

From the perspective of the Medicare’s program integrity, Medicare would have significant difficulty tracking fraud and abuse if physicians were able to contract selectively for services with some but not all beneficiaries. Medicare would have to examine every physician-patient contract, on a claim-by-claim basis, to determine which claims could be reimbursed directly to the physician and which would be the full responsibility of the patient. Additionally, Medicare would need to examine these physicians’ billing practices to ensure that beneficiaries were not being charged inappropriately.

Conclusions

Balance billing limits, with incentives for physicians to accept assignment, have proven effective in limiting beneficiaries’ out-of-pocket liability for physician services. Today, a small share of Medicare beneficiaries experience balance billing just as only small share of provider claims in Medicare are paid unassigned—very different from the years before balance billing limits were instituted. Moreover, only about 1 percent of physicians provide services to beneficiaries on a private contracting basis. As the Congress has been considering changes to the way in which Medicare pays for physician service in the context of SGR repeal, some proposals have briefly surfaced to relax constraints on balance billing and private contracting.

On the one hand, these proposals could increase physician autonomy and provider willingness to treat Medicare patients, particularly among those providers who charge higher fees. On the other hand, such proposals could result in higher out-of-pocket liability, particularly in the longer term, which could affect beneficiary access to care. Additionally, relaxing these protections could foster less predictability in the fees beneficiaries encounter when seeing physicians and practitioners. Patients most at risk for experiencing a greater financial burden would be those with modest incomes and greater health care needs. Beneficiaries in geographic areas with limited choices of physicians might also be at higher risk if a growing number of providers choose to balance bill or require private contracts with their Medicare patients. The key is to strike a balance between assuring that providers receive fair payments from Medicare while also preserving financial protections that help beneficiaries face more predictable and affordable costs when they seek care.

Technical support in preparation of this brief was provided by Health Policy Alternatives, Inc.

- Consumer Protection

- Cost Sharing

- Medicare's Future

- ISSUE BRIEF

Also of Interest

- Medicare Patients’ Access to Physicians: A Synthesis of the Evidence - Issue Brief

- Visualizing Health Policy: Physicians and Medicare

Trending: Medicare's Future

- KFF Health Tracking Poll February 2024: Voters on Two Key Health Care Issues: Affordability and ACA

- Health Care Costs Top the Public’s List of Financial Worries, and Those Who Are Struggling the Most Want to Hear Presidential Candidates Discuss Economic and Health Care Issues

- 10 Reasons Why Medicare Advantage Enrollment is Growing and Why It Matters

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

CMS Newsroom

Search cms.gov.

- Physician Fee Schedule

- Local Coverage Determination

- Medically Unlikely Edits

Provider Assignment

On this page:, provider nomination and the geographic assignment rule.

- Part A and Part B (A/B) and Home Health and Hospice (HH+H)

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS)

- Specialty Providers and Demonstrations

- Railroad Retirement Beneficiaries Entitled to Medicare

- Qualified Chains

- Out-of-Jurisdiction Providers (OJP)

Section 911(b) of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA), Public Law 108-173 , repealed the provider nomination provisions formerly found in Section 1816 of the Title XVIII of the Social Security Act and replaced it with the Geographic Assignment Rule. Generally, a provider or supplier will be assigned to the Medicare Administrative Contractor (MAC) that covers the state where the provider or supplier is located. The Center for Medicare & Medicaid Services’ (CMS) has defined the following approach for assigning providers, physicians, and suppliers to MACs.

return to top

Part A/Part B (A/B) and Home Health and Hospice (HH+H) Rule

All A/B and HH+H providers will be assigned to the MAC contracted by CMS to administer A/B and HH+H claims for the geographic locale in which the provider is physically located. Learn more about the current A/B MAC jurisdictions and HH+H areas and view the corresponding maps at Who are the MACs.

Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) Rule

Each DMEPOS supplier submits claims to the DME MAC contracted by CMS to administer DMEPOS claims for the geographic locale in which the beneficiary resides permanently. Learn more about the current DME MAC jurisdictions and view the corresponding map at Who are the MACs.

Specialty Providers and Demonstrations Rule

Specialty providers and providers involved with certain demonstrations will submit claims to a specific MAC designated by CMS. Learn more about a specific A/B MAC or DME MAC and view the corresponding maps at Who are the MACs .

Railroad Retirement Beneficiaries Entitled to Medicare Rule

Physicians and other suppliers (except for DMEPOS suppliers) will continue to enroll with and bill the contractor designated by the Railroad Retirement Board for Part B services furnished to their beneficiaries. Each DMEPOS supplier will submit claims to the DME MAC contracted by CMS to administer DMEPOS claims for the geographic locale in which the beneficiary resides permanently. Learn more about the current DME MAC jurisdictions and view the corresponding map at W ho are the MACs.

Qualified Chains Rule