- Open access

- Published: 07 February 2022

Cryptocurrency trading: a comprehensive survey

- Fan Fang 1 , 2 ,

- Carmine Ventre 1 ,

- Michail Basios 2 ,

- Leslie Kanthan 2 ,

- David Martinez-Rego 2 ,

- Fan Wu 2 &

- Lingbo Li ORCID: orcid.org/0000-0002-3073-1352 2

Financial Innovation volume 8 , Article number: 13 ( 2022 ) Cite this article

84k Accesses

149 Citations

19 Altmetric

Metrics details

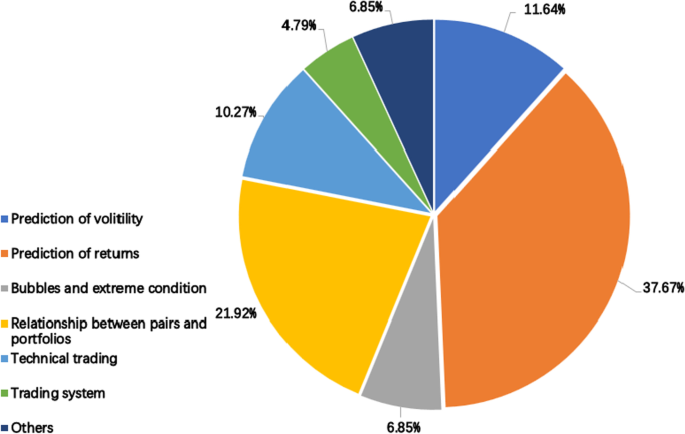

In recent years, the tendency of the number of financial institutions to include cryptocurrencies in their portfolios has accelerated. Cryptocurrencies are the first pure digital assets to be included by asset managers. Although they have some commonalities with more traditional assets, they have their own separate nature and their behaviour as an asset is still in the process of being understood. It is therefore important to summarise existing research papers and results on cryptocurrency trading, including available trading platforms, trading signals, trading strategy research and risk management. This paper provides a comprehensive survey of cryptocurrency trading research, by covering 146 research papers on various aspects of cryptocurrency trading ( e . g ., cryptocurrency trading systems, bubble and extreme condition, prediction of volatility and return, crypto-assets portfolio construction and crypto-assets, technical trading and others). This paper also analyses datasets, research trends and distribution among research objects (contents/properties) and technologies, concluding with some promising opportunities that remain open in cryptocurrency trading.

Introduction

Cryptocurrencies have experienced broad market acceptance and fast development despite their recent conception. Many hedge funds and asset managers have begun to include cryptocurrency-related assets into their portfolios and trading strategies. The academic community has similarly spent considerable efforts in researching cryptocurrency trading. This paper seeks to provide a comprehensive survey of the research on cryptocurrency trading, by which we mean any study aimed at facilitating and building strategies to trade cryptocurrencies.

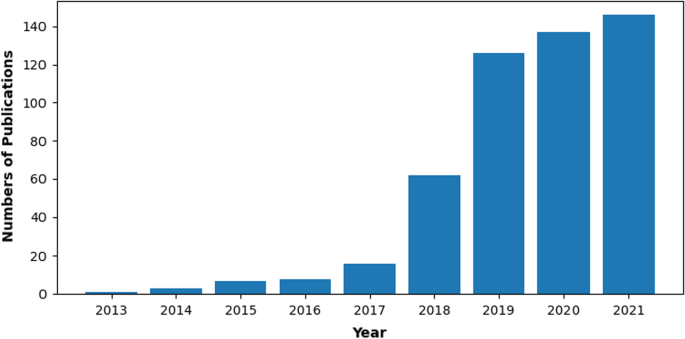

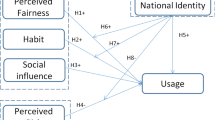

As an emerging market and research direction, cryptocurrencies and cryptocurrency trading have seen considerable progress and a notable upturn in interest and activity (Farell 2015 ). From Fig. 1 , we observe over 85% of papers have appeared since 2018, demonstrating the emergence of cryptocurrency trading as a new research area in financial trading. The sampling interval of this survey is from 2013 to June 2021.

The literature is organised according to six distinct aspects of cryptocurrency trading:

Cryptocurrency trading software systems (i.e., real-time trading systems, turtle trading systems, arbitrage trading systems);

Systematic trading including technical analysis, pairs trading and other systematic trading methods;

Emergent trading technologies including econometric methods, machine learning technology and other emergent trading methods;

Portfolio and cryptocurrency assets including research among cryptocurrency co-movements and crypto-asset portfolio research;

Market condition research including bubbles (Flood et al. 1986 ) or crash analysis and extreme conditions;

Other Miscellaneous cryptocurrency trading research.

In this survey we aim at compiling the most relevant research in these areas and extract a set of descriptive indicators that can give an idea of the level of maturity research in this area has achieved.

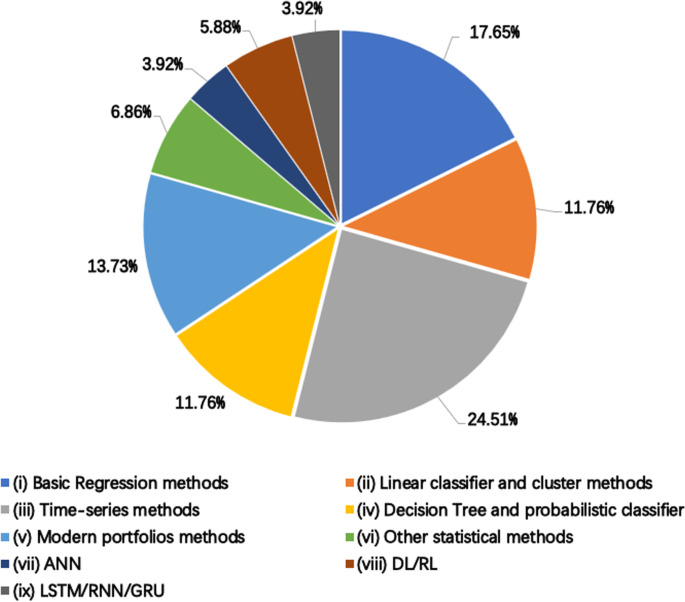

Cryptocurrency Trading Publications (cumulative) during 2013–2021(June 2021)

We also summarise research distribution (among research properties and categories/research technologies). The distribution among properties defines the classification of research objectives and content. The distribution among technologies defines the classification of methods or technological approaches to the study of cryptocurrency trading. Specifically, we subdivide research distribution among categories/technologies into statistical methods and machine learning technologies. Moreover, We identify datasets and opportunities (potential research directions) that have appeared in the cryptocurrency trading area. To ensure that our survey is self-contained, we aim to provide sufficient material to adequately guide financial trading researchers who are interested in cryptocurrency trading.

There has been related work that discussed or partially surveyed the literature related to cryptocurrency trading. Kyriazis ( 2019 ) investigated the efficiency and profitable trading opportunities in the cryptocurrency market. Ahamad et al. ( 2013 ) and Sharma et al. ( 2017 ) gave a brief survey on cryptocurrencies, merits of cryptocurrencies compared to fiat currencies and compared different cryptocurrencies that are proposed in the literature. Mukhopadhyay et al. ( 2016 ) gave a brief survey of cryptocurrency systems. Merediz-Solà and Bariviera ( 2019 ) performed a bibliometric analysis of bitcoin literature. The outcomes of this related work focused on specific area in cryptocurrency, including cryptocurrencies and cryptocurrency market introduction, cryptocurrency systems / platforms, bitcoin literature review, etc. To the best of our knowledge, no previous work has provided a comprehensive survey particularly focused on cryptocurrency trading.

In summary, the paper makes the following contributions:

Definition This paper defines cryptocurrency trading and categorises it into: cryptocurrency markets, cryptocurrency trading models, and cryptocurrency trading strategies. The core content of this survey is trading strategies for cryptocurrencies while we cover all aspects of it.

Multidisciplinary survey The paper provides a comprehensive survey of 146 cryptocurrency trading papers, across different academic disciplines such as finance and economics, artificial intelligence and computer science. Some papers may cover multiple aspects and will be surveyed for each category.

Analysis The paper analyses the research distribution, datasets and trends that characterise the cryptocurrency trading literature.

Horizons The paper identifies challenges, promising research directions in cryptocurrency trading, aimed to promote and facilitate further research.

Figure 2 depicts the paper structure, which is informed by the review schema adopted. More details about this can be found in " Paper collection and review schema " section.

Tree structure of the contents in this paper

Cryptocurrency trading

This section provides an introduction to cryptocurrency trading. We will discuss Blockchain , as the enabling technology, cryptocurrency markets and cryptocurrency trading strategies .

Blockchain technology introduction

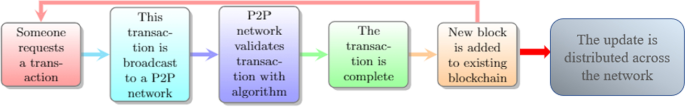

Blockchain is a digital ledger of economic transactions that can be used to record not just financial transactions, but any object with an intrinsic value (Tapscott and Tapscott 2016 ). In its simplest form, a Blockchain is a series of immutable data records with timestamps, which are managed by a cluster of machines that do not belong to any single entity. Each of these data block s is protected by cryptographic principle and bound to each other in a chain (cf. Fig. 3 for the workflow).

Cryptocurrencies like Bitcoin are conducted on a peer-to-peer network structure. Each peer has a complete history of all transactions, thus recording the balance of each account. For example, a transaction is a file that says “A pays X Bitcoins to B” that is signed by A using its private key. This is basic public-key cryptography, but also the building block on which cryptocurrencies are based. After being signed, the transaction is broadcast on the network. When a peer discovers a new transaction, it checks to make sure that the signature is valid (this is equivalent to using the signer’s public key, denoted as the algorithm in Fig. 3 ). If the verification is valid then the block is added to the chain; all other blocks added after it will “confirm” that transaction. For example, if a transaction is contained in block 502 and the length of the blockchain is 507 blocks, it means that the transaction has 5 confirmations (507–502) (Johar 2018 ).

Workflow of Blockchain transaction

From Blockchain to cryptocurrencies

Confirmation is a critical concept in cryptocurrencies; only miners can confirm transactions. Miners add blocks to the Blockchain; they retrieve transactions in the previous block and combine it with the hash of the preceding block to obtain its hash, and then store the derived hash into the current block. Miners in Blockchain accept transactions, mark them as legitimate and broadcast them across the network. After the miner confirms the transaction, each node must add it to its database. In layman terms, it has become part of the Blockchain and miners undertake this work to obtain cryptocurrency tokens, such as Bitcoin. In contrast to Blockchain, cryptocurrencies are related to the use of tokens based on distributed ledger technology. Any transaction involving purchase, sale, investment, etc. involves a Blockchain native token or sub-token. Blockchain is a platform that drives cryptocurrency and is a technology that acts as a distributed ledger for the network. The network creates a means of transaction and enables the transfer of value and information. Cryptocurrencies are the tokens used in these networks to send value and pay for these transactions. They can be thought of as tools on the Blockchain, and in some cases can also function as resources or utilities. In other instances, they are used to digitise the value of assets. In summary, cryptocurrencies are part of an ecosystem based on Blockchain technology.

Introduction of cryptocurrency market

What is cryptocurrency.

Cryptocurrency is a decentralised medium of exchange which uses cryptographic functions to conduct financial transactions (Doran 2014 ). Cryptocurrencies leverage the Blockchain technology to gain decentralisation, transparency, and immutability (Meunier 2018 ). In the above, we have discussed how Blockchain technology is implemented for cryptocurrencies.

In general, the security of cryptocurrencies is built on cryptography, neither by people nor on trust (Narayanan et al. 2016 ). For example, Bitcoin uses a method called “Elliptic Curve Cryptography” to ensure that transactions involving Bitcoin are secure (Wang et al. 2017 ). Elliptic curve cryptography is a type of public-key cryptography that relies on mathematics to ensure the security of transactions. When someone attempts to circumvent the aforesaid encryption scheme by brute force, it takes them one-tenth the age of the universe to find a value match when trying 250 billion possibilities every second (Grayblock 2018 ). Regarding its use as a currency, cryptocurrency has properties similar to fiat currencies. It has a controlled supply. Most cryptocurrencies limit the availability of their currency volumes. E.g. for Bitcoin, the supply will decrease over time and will reach its final quantity sometime around 2140. All cryptocurrencies control the supply of tokens through a timetable encoded in the Blockchain.

One of the most important features of cryptocurrencies is the exclusion of financial institution intermediaries (Harwick 2016 ). The absence of a “middleman” lowers transaction costs for traders. For comparison, if a bank’s database is hacked or damaged, the bank will rely entirely on its backup to recover any information that is lost or compromised. With cryptocurrencies, even if part of the network is compromised, the rest will continue to be able to verify transactions correctly. Cryptocurrencies also have the important feature of not being controlled by any central authority (Rose 2015 ): the decentralised nature of the Blockchain ensures cryptocurrencies are theoretically immune to government control and interference.

The pure digital asset is anything that exists in a digital format and carries with it the right to use it. Currently, digital assets include digital documents, motion picture and so on; the market for digital assets has in fact evolved since its inception in 2009, with the first digital asset “Bitcoin” (Kaal 2020 ). For this reason, we call the cryptocurrency the “first pure digital asset”.

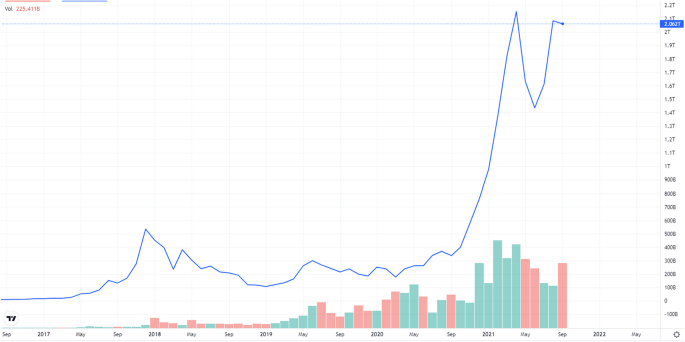

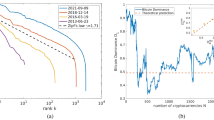

As of December 20, 2019, there exist 4950 cryptocurrencies and 20,325 cryptocurrency markets; the market cap is around 190 billion dollars (CoinMaketCap 2019 ). Figure 4 shows historical data on global market capitalisation and 24-h trading volume (TradingView 2021 ). The blue line is the total cryptocurrency market capitalization and green/red histogram is the total cryptocurrency market volume. The total market cap is calculated by aggregating the dollar market cap of all cryptocurrencies. From the figure, we can observe how cryptocurrencies experience exponential growth in 2017 and a large bubble burst in early 2018. In the wake of the pandemic, cryptocurrencies raised dramatically in value in 2020. In 2021, the market value of cryptocurrencies has been very volatile but consistently at historically high levels.

Total market capitalization and volume of cryptocurrency market, USD (TradingView 2021 )

There are three mainstream cryptocurrencies (Council 2021 ): Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Bitcoin was created in 2009 and garnered massive popularity. On October 31, 2008, an individual or group of individuals operating under the pseudonym Satoshi Nakamoto released the Bitcoin white paper and described it as: ”A pure peer-to-peer version of electronic cash that can be sent online for payment from one party to another without going through a counterparty, ie. a financial institution.” (Nakano et al. 2018 ) Launched by Vitalik Buterin in 2015, Ethereum is a special Blockchain with a special token called Ether (ETH symbol in exchanges). A very important feature of Ethereum is the ability to create new tokens on the Ethereum Blockchain. The Ethereum network went live on July 30, 2015, and pre-mined 72 million Ethereum. Litecoin is a peer-to-peer cryptocurrency created by Charlie Lee. It was created according to the Bitcoin protocol, but it uses a different hashing algorithm. Litecoin uses a memory-intensive proof-of-work algorithm, Scrypt.

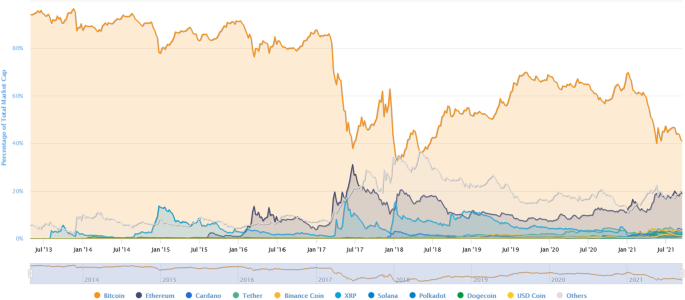

Figure 5 shows percentages of total cryptocurrency market capitalisation; Bitcoin and Ethereum account for the majority of the total market capitalisation (data collected on 14 September 2021).

Percentage of Total Market Capitalisation (Coinmarketcap 2020 )

Cryptocurrency exchanges

A cryptocurrency exchange or digital currency exchange (DCE) is a business that allows customers to trade cryptocurrencies. Cryptocurrency exchanges can be market makers, usually using the bid-ask spread as a commission for services, or as a matching platform, by simply charging fees. A cryptocurrency exchange or digital currency exchange (DCE) is a place that allows customers to trade cryptocurrencies. Cryptocurrency exchanges can be market makers (usually using the bid-ask spread as a commission for services) or a matching platform (simply charging fees).

Table 1 shows the top or classical cryptocurrency exchanges according to the rank list, by volume, compiled on “nomics” website (Nomics 2020 ). Chicago Mercantile Exchange (CME), Chicago Board Options Exchange (CBOE) as well as BAKKT (backed by New York Stock Exchange) are regulated cryptocurrency exchanges. Fiat currency data also comes from “nomics” website (Nomics 2020 ). Regulatory authority and supported currencies of listed exchanges are collected from official websites or blogs.

First we give a definition of cryptocurrency trading .

Definition 1

Cryptocurrency trading is the act of buying and selling of cryptocurrencies with the intention of making a profit.

The definition of cryptocurrency trading can be broken down into three aspects: object, operation mode and trading strategy. The object of cryptocurrency trading is the asset being traded, which is “cryptocurrency”. The operation mode of cryptocurrency trading depends on the means of transaction in the cryptocurrency market, which can be classified into “trading of cryptocurrency Contract for Differences (CFD)” (The contract between the two parties, often referred to as the “buyer” and “seller”, stipulates that the buyer will pay the seller the difference between themselves when the position closes (Authority 2019 )) and “buying and selling cryptocurrencies via an exchange”. A trading strategy in cryptocurrency trading, formulated by an investor, is an algorithm that defines a set of predefined rules to buy and sell on cryptocurrency markets.

Advantages of trading cryptocurrency

The benefits of cryptocurrency trading include:

Drastic fluctuations The volatility of cryptocurrencies are often likely to attract speculative interest and investors. The rapid fluctuations of intraday prices can provide traders with great money-earning opportunities, but it also includes more risk.

24-h market The cryptocurrency market is available 24 h a day, 7 days a week because it is a decentralised market. Unlike buying and selling stocks and commodities, the cryptocurrency market is not traded physically from a single location. Cryptocurrency transactions can take place between individuals, in different venues across the world.

Near anonymity Buying goods and services using cryptocurrencies is done online and does not require to make one’s own identity public. With increasing concerns over identity theft and privacy, cryptocurrencies can thus provide users with some advantages regarding privacy.

Different exchanges have specific Know-Your-Customer (KYC) measures for identifying users or customers (Adeyanju 2019 ). The KYC undertook in the exchanges allows financial institutions to reduce the financial risk while maximising the wallet owner’s anonymity.

Peer-to-peer transactions One of the biggest benefits of cryptocurrencies is that they do not involve financial institution intermediaries. As mentioned above, this can reduce transaction costs. Moreover, this feature might appeal to users who distrust traditional systems.

Over-the-counter (OTC) cryptocurrency markets offer, in this context, peer-to-peer transactions on the Blockchain. The most famous cryptocurrency OTC market is “LocalBitcoin (Localbtc 2020 )”.

Programmable “smart” capabilities Some cryptocurrencies can bring other benefits to holders, including limited ownership and voting rights. Cryptocurrencies may also include a partial ownership interest in physical assets such as artwork or real estate.

Disadvantages of trading cryptocurrency

The disadvantages of cryptocurrency trading include:

Scalability problem Before the massive expansion of the technology infrastructure, the number of transactions and the speed of transactions cannot compete with traditional currency trading. Scalability issues led to a multi-day trading backlog in March 2020, affecting traders looking to move cryptocurrencies from their personal wallets to exchanges (Forbes 2021 ).

Cybersecurity issues As a digital technology, cryptocurrencies are subject to cyber security breaches and can fall into the hands of hackers. Recently, over $600 million of ethereum and other cryptocurrencies were stolen in August 2021 in blockchain-based platform Poly Network (Forbes 2021 ). Mitigating this situation requires ongoing maintenance of the security infrastructure and the use of enhanced cyber security measures that go beyond those used in traditional banking (Kou et al. 2021 ).

Regulations Authorities around the world face challenging questions about the nature and regulation of cryptocurrency as some parts of the system and its associated risks are largely unknown. There are currently three types of regulatory systems used to control digital currencies, they include: closed system for the Chinese market, open and liberal for the Swiss market,and open and strict system for the US market (UKTN 2021 ). At the same time, we notice that some countries such as India is not at par in using the cryptocurrency. As Buffett said, “It doesn’t make sense. This thing is not regulated. It’s not under control. It’s not under the supervision of \([\ldots ]\) United States Federal Reserve or any other central bank (Forbes 2017 ).”

Cryptocurrency trading strategy

Cryptocurrency trading strategy is the main focus of this survey. There are many trading strategies, which can be broadly divided into two main categories: technical and fundamental. Technical and fundamental trading are two main trading analysis thoughts when it comes to analyzing the financial markets. Most traders use these two analysis methods or both (Oberlechner 2001 ). From a survey on stock prediction, we in fact know that 66% of the relevant research work was based on technical analysis; while 23% and 11% were based on fundamental analysis and general analysis, respectively (Nti et al. 2020 ). Cryptocurrency trading can draw on the experience of stock market trading in most scenarios. So we divide trading strategies into two main categories: technical and fundamental trading.

They are similar in the sense that they both rely on quantifiable information that can be backtested against historical data to verify their performance. In recent years, a third kind of trading strategy, which we call programmatic trading, has received increasing attention. Such a trading strategy is similar to a technical trading strategy because it uses trading activity information on the exchange to make buying or selling decisions. programmatic traders build trading strategies with quantitative data, which is mainly derived from price, volume, technical indicators or ratios to take advantage of inefficiencies in the market and are executed automatically by trading software. Cryptocurrency market is different from traditional markets as there are more arbitrage opportunities, higher fluctuation and transparency. Due to these characteristics, most traders and analysts prefer using programmatic trading in cryptocurrency markets.

Cryptocurrency trading software system

Software trading systems allow international transactions, process customer accounts and information, and accept and execute transaction orders (Calo and Johnson 2002 ). A cryptocurrency trading system is a set of principles and procedures that are pre-programmed to allow trade between cryptocurrencies and between fiat currencies and cryptocurrencies. Cryptocurrency trading systems are built to overcome price manipulation, cybercriminal activities and transaction delays (Bauriya et al. 2019 ). When developing a cryptocurrency trading system, we must consider the capital market, base asset, investment plan and strategies (Molina 2019 ). Strategies are the most important part of an effective cryptocurrency trading system and they will be introduced below. There exist several cryptocurrency trading systems that are available commercially, for example, Capfolio, 3Commas, CCXT, Freqtrade and Ctubio. From these cryptocurrency trading systems, investors can obtain professional trading strategy support, fairness and transparency from the professional third-party consulting companies and fast customer services.

Systematic trading

Systematic trading is a way to define trading goals, risk controls and rules. In general, systematic trading includes high frequency trading and slower investment types like systematic trend tracking. In this survey, we divide systematic cryptocurrency trading into technical analysis, pairs trading and others. Technical analysis in cryptocurrency trading is the act of using historical patterns of transaction data to assist a trader in assessing current and projecting future market conditions for the purpose of making profitable trades. Price and volume charts summarise all trading activity made by market participants in an exchange and affect their decisions. Some experiments showed that the use of specific technical trading rules allows generating excess returns, which is useful to cryptocurrency traders and investors in making optimal trading and investment decisions (Gerritsen et al. 2019 ). Pairs trading is a systematic trading strategy that considers two similar assets with slightly different spreads. If the spread widens, short the high cryptocurrencies and buy the low cryptocurrencies. When the spread narrows again to a certain equilibrium value, a profit is generated (Elliott et al. 2005 ). Papers shown in this section involve the analysis and comparison of technical indicators, pairs and informed trading, amongst other strategies.

Tools for building automated trading systems

Tools for building automated trading systems in cryptocurrency market are those emergent trading strategies for cryptocurrency. These include strategies that are based on econometrics and machine learning technologies.

Econometrics on cryptocurrency

Econometric methods apply a combination of statistical and economic theories to estimate economic variables and predict their values (Vogelvang 2005 ). Statistical models use mathematical equations to encode information extracted from the data (Kaufman 2013 ). In some cases, statistical modeling techniques can quickly provide sufficiently accurate models (Ben-Akiva et al. 2002 ). Other methods might be used, such as sentiment-based prediction and long-and-short-term volatility classification based prediction (Chang et al. 2015 ). The prediction of volatility can be used to judge the price fluctuation of cryptocurrencies, which is also valuable for the pricing of cryptocurrency-related derivatives (Kat and Heynen 1994 ).

When studying cryptocurrency trading using econometrics, researchers apply statistical models on time-series data like generalised autoregressive conditional heteroskedasticity (GARCH) and BEKK (named after Baba, Engle, Kraft and Kroner, 1995 (Engle and Kroner 1995 )) models to evaluate the fluctuation of cryptocurrencies (Caporin and McAleer 2012 ). A linear statistical model is a method to evaluate the linear relationship between prices and an explanatory variable (Neter et al. 1996 ). When there exists more than one explanatory variable, we can model the linear relationship between explanatory (independent) and response (dependent) variables with multiple linear models. The common linear statistical model used in the time-series analysis is the autoregressive moving average (ARMA) model (Choi 2012 ).

Machine learning technology

Machine learning is an efficient tool for developing Bitcoin and other cryptocurrency trading strategies (McNally et al. 2018 ) because it can infer data relationships that are often not directly observable by humans. From the most basic perspective, Machine Learning relies on the definition of two main components: input features and objective function. The definition of Input Features (data sources) is where knowledge of fundamental and technical analysis comes into play. We may divide the input into several groups of features, for example, those based on Economic indicators (such as, gross domestic product indicator, interest rates, etc.), Social indicators (Google Trends, Twitter, etc.), Technical indicators (price, volume, etc.) and other Seasonal indicators (time of day, day of the week, etc.). The objective function defines the fitness criteria one uses to judge if the Machine Learning model has learnt the task at hand. Typical predictive models try to anticipate numeric (e.g., price) or categorical (e.g., trend) unseen outcomes. The machine learning model is trained by using historic input data (sometimes called in-sample) to generalise patterns therein to unseen (out-of-sample) data to (approximately) achieve the goal defined by the objective function. Clearly, in the case of trading, the goal is to infer trading signals from market indicators which help to anticipate asset future returns.

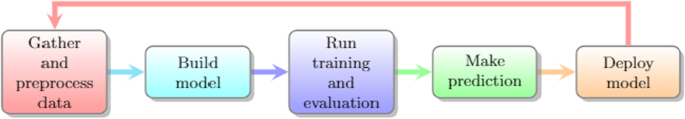

Generalisation error is a pervasive concern in the application of Machine Learning to real applications, and of utmost importance in Financial applications. We need to use statistical approaches, such as cross validation, to validate the model before we actually use it to make predictions. In machine learning, this is typically called “validation”. The process of using machine learning technology to predict cryptocurrency is shown in Fig. 6 .

Process of machine learning in predicting cryptocurrency

Depending on the formulation of the main learning loop, we can classify Machine Learning approaches into three categories: Supervised learning, Unsupervised learning and Reinforcement learning. We list a general comparison (IntelliPaat 2021 ) among these three machine learning methods in Table 2 . Supervised learning is used to derive a predictive function from labeled training data. Labeled training data means that each training instance includes inputs and expected outputs. Usually, these expected outputs are produced by a supervisor and represent the expected behaviour of the model. The most used labels in trading are derived from in sample future returns of assets. Unsupervised learning tries to infer structure from unlabeled training data and it can be used during exploratory data analysis to discover hidden patterns or to group data according to any pre-defined similarity metrics. Reinforcement learning utilises software agents trained to maximise a utility function, which defines their objective; this is flexible enough to allow agents to exchange short term returns for future ones. In the financial sector, some trading challenges can be expressed as a game in which an agent aims at maximising the return at the end of the period.

The use of machine learning in cryptocurrency trading research encompasses the connection between data sources’ understanding and machine learning model research. Further concrete examples are shown in a later section.

Portfolio research

Portfolio theory advocates diversification of investments to maximize returns for a given level of risk by allocating assets strategically. The celebrated mean-variance optimisation is a prominent example of this approach (Markowitz 1952 ). Generally, crypto asset denotes a digital asset (i.e., cryptocurrencies and derivatives). There are some common ways to build a diversified portfolio in crypto assets. The first method is to diversify across markets, which is to mix a wide variety of investments within a portfolio of the cryptocurrency market. The second method is to consider the industry sector, which is to avoid investing too much money in any one category. Diversified investment of portfolio in the cryptocurrency market includes portfolio across cryptocurrencies (Liu 2019 ) and portfolio across the global market including stocks and futures (Kajtazi and Moro 2019 ).

Market condition research

Market condition research appears especially important for cryptocurrencies. A financial bubble is a significant increase in the price of an asset without changes in its intrinsic value (Brunnermeier and Oehmke 2013 ; Kou et al. 2021 ). Many experts pinpoint a cryptocurrency bubble in 2017 when the prices of cryptocurrencies grew by 900 \(\%\) . In 2018, Bitcoin faced a collapse in its value. This significant fluctuation inspired researchers to study bubbles and extreme conditions in cryptocurrency trading. The cryptocurrency market has experienced a near continuous bull market since the fall of 2020, with the value of Bitcoin soaring from $10,645 on October 7, 2020 to an all-time high of $63,346 on April 15, 2021. This represents a gain of approximately +600% in just six months (Forbes 2021 ). Some experts believe that the extreme volatility of exchange rates means that cryptocurrency exposure should be kept at a low percentage of your portfolio. “I understand if you want to buy it because you believe the price will rise, but make sure it’s only a small part of your portfolio, maybe 1 or 2%!” says Thanos Papasavvas, founder of research group ABP Invest, who has a 20-year background in asset management (FT 2021 ). In any case, bubbles and crash analysis is an important researching area in cryptocurrency trading.

Paper collection and review schema

The section introduces the scope and approach of our paper collection, a basic analysis, and the structure of our survey.

Survey scope

We adopt a bottom-up approach to the research in cryptocurrency trading, starting from the systems up to risk management techniques. For the underlying trading system, the focus is on the optimisation of trading platforms structure and improvements of computer science technologies.

At a higher level, researchers focus on the design of models to predict return or volatility in cryptocurrency markets. These techniques become useful to the generation of trading signals. on the next level above predictive models, researchers discuss technical trading methods to trade in real cryptocurrency markets. Bubbles and extreme conditions are hot topics in cryptocurrency trading because, as discussed above, these markets have shown to be highly volatile (whilst volatility went down after crashes). Portfolio and cryptocurrency asset management are effective methods to control risk. We group these two areas in risk management research. Other papers included in this survey include topics like pricing rules, dynamic market analysis, regulatory implications, and so on. Table 3 shows the general scope of cryptocurrency trading included in this survey.

Since many trading strategies and methods in cryptocurrency trading are closely related to stock trading, some researchers migrate or use the research results for the latter to the former. When conducting this research, we only consider those papers whose research focuses on cryptocurrency markets or a comparison of trading in those and other financial markets.

Specifically, we apply the following criteria when collecting papers related to cryptocurrency trading:

The paper introduces or discusses the general idea of cryptocurrency trading or one of the related aspects of cryptocurrency trading.

The paper proposes an approach, study or framework that targets optimised efficiency or accuracy of cryptocurrency trading.

The paper compares different approaches or perspectives in trading cryptocurrency.

By “cryptocurrency trading” here, we mean one of the terms listed in Table 3 and discussed above.

Some researchers gave a brief survey of cryptocurrency (Ahamad et al. 2013 ; Sharma et al. 2017 ), cryptocurrency systems (Mukhopadhyay et al. 2016 ) and cryptocurrency trading opportunities (Kyriazis 2019 ). These surveys are rather limited in scope as compared to ours, which also includes a discussion on the latest papers in the area; we want to remark that this is a fast-moving research field.

Paper collection methodology

To collect the papers in different areas or platforms, we used keyword searches on Google Scholar and arXiv, two of the most popular scientific databases. We also choose other public repositories like SSRN but we find that almost all academic papers in these platforms can also be retrieved via Google Scholar; consequently, in our statistical analysis, we count those as Google Scholar hits. We choose arXiv as another source since it allows this survey to be contemporary with all the most recent findings in the area. The interested reader is warned that these papers have not undergone formal peer review. The keywords used for searching and collecting are listed below. [Crypto] means the cryptocurrency market, which is our research interest because methods might be different among different markets. We conducted 6 searches across the two repositories until July 1, 2021.

[Crypto] + Trading

[Crypto] + Trading system

[Crypto] + Prediction

[Crypto] + Trading strategy

[Crypto] + Risk Management

[Crypto] + Portfolio

To ensure high coverage, we adopted the so-called snowballing (Wohlin 2014 ) method on each paper found through these keywords. We checked papers added from snowballing methods that satisfy the criteria introduced above until we reached closure.

Collection results

Table 4 shows the details of the results from our paper collection. Keyword searches and snowballing resulted in 146 papers across the six research areas of interest in " Survey scope " section.

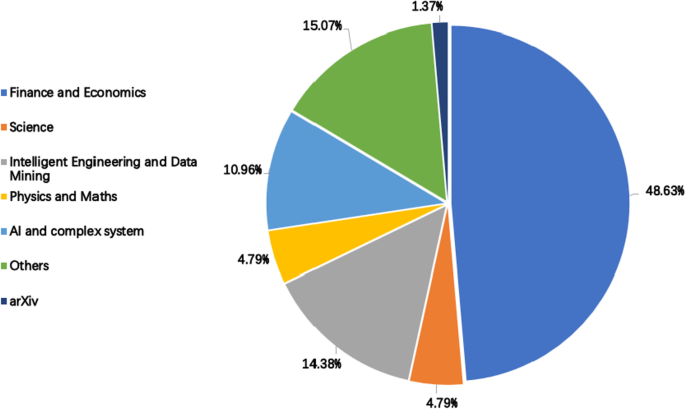

Figure 7 shows the distribution of papers published at different research sites. Among all the papers, 48.63% papers are published in Finance and Economics venues such as Journal of Financial Economics (JFE), Cambridge Centre for Alternative Finance (CCAF), Finance Research Letters, Centre for Economic Policy Research (CEPR), Finance Research Letters (FRL), Journal of Risk and Financial Management (JRFM) and some other high impact financial journals; 4.79% papers are published in Science venues such as Public Library Of Science one (PLOS one), Royal Society open science and SAGE; 14.38% papers are published in Intelligent Engineering and Data Mining venues such as Symposium Series on Computational Intelligence (SSCI), Intelligent Systems Conference (IntelliSys), Intelligent Data Engineering and Automated Learning (IDEAL) and International Conference on Data Mining (ICDM); 4.79% papers are published in Physics / Physicians venues (mostly in Physics venue) such as Physica A and Maths venue like Journal of Mathematics; 10.96% papers are published in AI and complex system venues such as Complexity and International Federation for Information Processing (IFIP); 15.07% papers are published in Others venues which contains independently published papers and dissertations; 1.37% papers are published on arXiv. The distribution of different venues shows that cryptocurrency trading is mostly published in Finance and Economics venues, but with a wide diversity otherwise.

Publication venue distribution

Survey organisation

We discuss the contributions of the collected papers and a statistical analysis of these papers in the remainder of the paper, according to Table 5 .

The papers in our collection are organised and presented from six angles. We introduce the work about several different cryptocurrency trading software systems in " Cryptocurrency trading software systems " section. " Systematic trading " section introduces systematic trading applied to cryptocurrency trading. In " Emergent trading technologies " section, we introduce some emergent trading technologies including econometrics on cryptocurrencies, machine learning technologies and other emergent trading technologies in the cryptocurrency market. Section 8 introduces research on cryptocurrency pairs and related factors and crypto-asset portfolios research. In " Bubbles and crash analysis " and " Extreme condition " sections we discuss cryptocurrency market condition research, including bubbles, crash analysis, and extreme conditions. " Others related to cryptocurrency trading " section introduces other research included in cryptocurrency trading not covered above.

We would like to emphasize that the six headings above focus on a particular aspect of cryptocurrency trading; we give a complete organisation of the papers collected under each heading. This implies that those papers covering more than one aspect will be discussed in different sections, once from each angle.

We analyse and compare the number of research papers on different cryptocurrency trading properties and technologies in " Summary analysis of literature review " section, where we also summarise the datasets and the timeline of research in cryptocurrency trading.

We build upon this review to conclude in " Opportunities in cryptocurrency trading " section with some opportunities for future research.

Cryptocurrency trading Software Systems

Trading infrastructure systems.

Following the development of computer science and cryptocurrency trading, many cryptocurrency trading systems/bots have been developed. Table 6 compares the cryptocurrency trading systems existing in the market. The table is sorted based on URL types (GitHub or Official website) and GitHub stars (if appropriate).

Capfolio is a proprietary payable cryptocurrency trading system which is a professional analysis platform and has an advanced backtesting engine (Capfolio 2020 ). It supports five different cryptocurrency exchanges.

3 Commas is a proprietary payable cryptocurrency trading system platform that can take profit and stop-loss orders at the same time (3commas 2020 ). Twelve different cryptocurrency exchanges are compatible with this system.

CCXT is a cryptocurrency trading system with a unified API out of the box and optional normalized data and supports many Bitcoin / Ether / Altcoin exchange markets and merchant APIs. Any trader or developer can create a trading strategy based on this data and access public transactions through the APIs (Ccxt 2020 ). The CCXT library is used to connect and trade with cryptocurrency exchanges and payment processing services worldwide. It provides quick access to market data for storage, analysis, visualisation, indicator development, algorithmic trading, strategy backtesting, automated code generation and related software engineering. It is designed for coders, skilled traders, data scientists and financial analysts to build trading algorithms. Current CCXT features include:

Support for many cryptocurrency exchanges;

Fully implemented public and private APIs;

Optional normalized data for cross-exchange analysis and arbitrage;

Out-of-the-box unified API, very easy to integrate.

Blackbird Bitcoin Arbitrage is a C++ trading system that automatically executes long / short arbitrage between Bitcoin exchanges. It can generate market-neutral strategies that do not transfer funds between exchanges (Blackbird 2020 ). The motivation behind Blackbird is to naturally profit from these temporary price differences between different exchanges while being market neutral. Unlike other Bitcoin arbitrage systems, Blackbird does not sell but actually short sells Bitcoin on the short exchange. This feature offers two important advantages. Firstly, the strategy is always market agnostic: fluctuations (rising or falling) in the Bitcoin market will not affect the strategy returns. This eliminates the huge risks of this strategy. Secondly, this strategy does not require transferring funds (USD or BTC) between Bitcoin exchanges. Buy and sell transactions are conducted in parallel on two different exchanges. There is no need to deal with transmission delays.

StockSharp is an open-source trading platform for trading at any market of the world including 48 cryptocurrency exchanges (Stocksharp 2020 ). It has a free C# library and free trading charting application. Manual or automatic trading (algorithmic trading robot, regular or HFT) can be run on this platform. StockSharp consists of five components that offer different features:

S#.Designer - Free universal algorithm strategy app, easy to create strategies;

S#.Data - free software that can automatically load and store market data;

S#.Terminal - free trading chart application (trading terminal);

S#.Shell - ready-made graphics framework that can be changed according to needs and has a fully open source in C#;

S#.API - a free C# library for programmers using Visual Studio. Any trading strategies can be created in S#.API.

Freqtrade is a free and open-source cryptocurrency trading robot system written in Python. It is designed to support all major exchanges and is controlled by telegram. It contains backtesting, mapping and money management tools, and strategy optimization through machine learning (Fretrade 2020 ). Freqtrade has the following features:

Persistence: Persistence is achieved through SQLite technology;

Strategy optimization through machine learning: Use machine learning to optimize your trading strategy parameters with real trading data;

Marginal Position Size: Calculates winning rate, risk-return ratio, optimal stop loss and adjusts position size, and then trades positions for each specific market;

Telegram management: use telegram to manage the robot.

Dry run: Run the robot without spending money;

CryptoSignal is a professional technical analysis cryptocurrency trading system (Cryptosignal 2020 ). Investors can track over 500 coins of Bittrex, Bitfinex, GDAX, Gemini and more. Automated technical analysis includes momentum, RSI, Ichimoku Cloud, MACD, etc. The system gives alerts including Email, Slack, Telegram, etc. CryptoSignal has two primary features. First of all, it offers modular code for easy implementation of trading strategies; Secondly, it is easy to install with Docker.

Ctubio is a C++ based low latency (high frequency) cryptocurrency trading system (Ctubio 2020 ). This trading system can place or cancel orders through supported cryptocurrency exchanges in less than a few milliseconds. Moreover, it provides a charting system that can visualise the trading account status including trades completed, target position for fiat currency, etc.

Catalyst is an analysis and visualization of the cryptocurrency trading system (Catalyst 2020 ). It makes trading strategies easy to express and backtest them on historical data (daily and minute resolution), providing analysis and insights into the performance of specific strategies. Catalyst allows users to share and organise data and build profitable, data-driven investment strategies. Catalyst not only supports the trading execution but also offers historical price data of all crypto assets (from minute to daily resolution). Catalyst also has backtesting and real-time trading capabilities, which enables users to seamlessly transit between the two different trading modes. Lastly, Catalyst integrates statistics and machine learning libraries (such as matplotlib, scipy, statsmodels and sklearn) to support the development, analysis and visualization of the latest trading systems.

Golang Crypto Trading Bot is a Go based cryptocurrency trading system (Golang 2020 ). Users can test the strategy in sandbox environment simulation. If simulation mode is enabled, a fake balance for each coin must be specified for each exchange.

Real-time cryptocurrency trading systems

Bauriya et al. ( 2019 ) developed a real-time Cryptocurrency Trading System. A real-time cryptocurrency trading system is composed of clients, servers and databases. Traders use a web-application to login to the server to buy/sell crypto assets. The server collects cryptocurrency market data by creating a script that uses the Coinmarket API. Finally, the database collects balances, trades and order book information from the server. The authors tested the system with an experiment that demonstrates user-friendly and secure experiences for traders in the cryptocurrency exchange platform.

Turtle trading system in Cryptocurrency market

The original Turtle Trading system is a trend following trading system developed in the 1970s. The idea is to generate buy and sell signals on stock for short-term and long-term breakouts and its cut-loss condition which is measured by Average true range (ATR) (Kamrat et al. 2018 ). The trading system will adjust the size of assets based on their volatility. Essentially, if a turtle accumulates a position in a highly volatile market, it will be offset by a low volatility position. Extended Turtle Trading system is improved with smaller time interval spans and introduces a new rule by using exponential moving average (EMA). Three EMA values are used to trigger the “buy” signal: 30EMA (Fast), 60EMA (Slow), 100EMA (Long). The author of Kamrat et al. ( 2018 ) performed backtesting and comparing both trading systems (Original Turtle and Extended Turtle) on 8 prominent cryptocurrencies. Through the experiment, Original Turtle Trading System achieved an 18.59% average net profit margin (percentage of net profit over total revenue) and 35.94% average profitability (percentage of winning trades over total numbers of trades) in 87 trades through nearly one year. Extended Turtle Trading System achieved 114.41% average net profit margin and 52.75% average profitability in 41 trades through the same time interval. This research showed how Extended Turtle Trading System compared can improve over Original Turtle Trading System in trading cryptocurrencies.

Arbitrage trading systems for cryptocurrencies

Christian (Păuna 2018 ) introduced arbitrage trading systems for cryptocurrencies. Arbitrage trading aims to spot the differences in price that can occur when there are discrepancies in the levels of supply and demand across multiple exchanges. As a result, a trader could realise a quick and low-risk profit by buying from one exchange and selling at a higher price on a different exchange. Arbitrage trading signals are caught by automated trading software. The technical differences between data sources impose a server process to be organised for each data source. Relational databases and SQL are reliable solution due to the large amounts of relational data. The author used the system to catch arbitrage opportunities on 25 May 2018 among 787 cryptocurrencies on 7 different exchanges. The research paper (Păuna 2018 ) listed the best ten trading signals made by this system from 186 available found signals. The results showed that the system caught the trading signal of “BTG-BTC” to get a profit of up to 495.44% when arbitraging to buy in Cryptopia exchange and sell in Binance exchange. Another three well-traded arbitrage signals (profit expectation around 20% mentioned by the author) were found on 25 May 2018. Arbitrage Trading Software System introduced in that paper presented general principles and implementation of arbitrage trading system in the cryptocurrency market.

Characteristics of three cryptocurrency trading systems

Real-time trading systems use real-time functions to collect data and generate trading algorithms. Turtle trading system and arbitrage trading system have shown a sharp contrast in their profit and risk behaviour. Using Turtle trading system in cryptocurrency markets got high returns with high risk. Arbitrage trading system is inferior in terms of revenue but also has a lower risk. One feature that turtle trading system and arbitrage trading system have in common is they performed well in capturing alpha.

Technical analysis

Many researchers have focused on technical indicators (patterns) analysis for trading on cryptocurrency markets. Examples of studies with this approach include “Turtle Soup pattern strategy” (TradingstrategyGuides 2019 ), “Nem (XEM) strategy” (TradingstrategyGuides 2019 ), “Amazing Gann Box strategy” (TradingstrategyGuides 2019 ), “Busted Double Top Pattern strategy” (TradingstrategyGuides 2019 ), and “Bottom Rotation Trading strategy” (TradingstrategyGuides 2019 ). Table 7 shows the comparison among these five classical technical trading strategies using technical indicators. “Turtle soup pattern strategy” (TradingstrategyGuides 2019 ) used a 2-day breakout of price in predicting price trends of cryptocurrencies. This strategy is a kind of chart trading pattern. “Nem (XEM) strategy” combined Rate of Change (ROC) indicator and Relative Strength Index (RSI) in predicting price trends (TradingstrategyGuides 2019 ). “Amazing Gann Box” predicted exact points of increase and decrease in Gann Box which are used to catch explosive trends of cryptocurrency price (TradingstrategyGuides 2019 ). Technical analysis tools such as candlestick and box charts with Fibonacci Retracement based on golden ratio are used in this technical analysis. Fibonacci Retracement uses horizontal lines to indicate where possible support and resistance levels are in the market. “Busted Double Top Pattern” used a Bearish reversal trading pattern which generates a sell signal to predict price trends (TradingstrategyGuides 2019 ). “Bottom Rotation Trading” is a technical analysis method that picks the bottom before the reversal happens. This strategy used a price chart pattern and box chart as technical analysis tools.

Ha and Moon ( 2018 ) investigated using genetic programming (GP) to find attractive technical patterns in the cryptocurrency market. Over 12 technical indicators including Moving Average (MA) and Stochastic oscillator were used in experiments; adjusted gain, match count, relative market pressure and diversity measures have been used to quantify the attractiveness of technical patterns. With extended experiments, the GP system is shown to find successfully attractive technical patterns, which are useful for portfolio optimization. Hudson and Urquhart ( 2019 ) applied almost 15,000 to technical trading rules (classified into MA rules, filter rules, support resistance rules, oscillator rules and channel breakout rules). This comprehensive study found that technical trading rules provide investors with significant predictive power and profitability. Corbet et al. ( 2019 ) analysed various technical trading rules in the form of the moving average-oscillator and trading range break-out strategies to generate higher returns in cryptocurrency markets. By using one-minute dollar-denominated Bitcoin close-price data, the backtest showed variable-length moving average (VMA) rule performs best considering it generates the most useful signals in high frequency trading.

Grobys et al. ( 2020 ) examined a simple moving average trading strategy using daily price data for the 11 most traded cryptocurrencies over the period 2016-2018. The results showed that, excluding Bitcoin, technical trading rules produced an annualised excess return of 8.76% after controlling for average market returns. The analysis also suggests that cryptocurrency markets are inefficient. Al-Yahyaee et al. ( 2020 ) examined multiple fractals, long memory processes and efficiency assumptions of major cryptocurrencies using Hurst exponents, time-rolling MF-DFA and quantile regression methods. The results showed that all markets provide evidence of long-term memory properties and multiple fractals. Furthermore, the inefficiency of cryptocurrency markets is time-varying. The researchers concluded that high liquidity with low volatility facilitates arbitrage opportunities for active traders.

Pairs trading

Pairs trading is a trading strategy that attempts to exploit the mean-reversion between the prices of certain securities. Miroslav (Fil 2019 ) investigated the applicability of standard pairs trading approaches on cryptocurrency data with the benchmarks of Gatev et al. ( 2006 ). The pairs trading strategy is constructed in two steps. Firstly, suitable pairs with a stable long-run relationship are identified. Secondly, the long-run equilibrium is calculated and pairs trading strategy is defined by the spread based on the values. The research also extended intra-day pairs trading using high frequency data. Overall, the model was able to achieve a 3% monthly profit in Miroslav’s experiments (Fil 2019 ). Broek (van den Broek and Sharif 2018 ) applied pairs trading based on cointegration in cryptocurrency trading and 31 pairs were found to be significantly cointegrated (within sector and cross-sector). By selecting four pairs and testing over a 60-day trading period, the pairs trading strategy got its profitability from arbitrage opportunities, which rejected the Efficient-market hypothesis (EMH) for the cryptocurrency market. Lintilhac and Tourin ( 2017 ) proposed an optimal dynamic pair trading strategy model for a portfolio of assets. The experiment used stochastic control techniques to calculate optimal portfolio weights and correlated the results with several other strategies commonly used by practitioners including static dual-threshold strategies. Li and Tourin ( 2016 ) proposed a pairwise trading model incorporating time-varying volatility with constant elasticity of variance type. The experiment calculated the best pair strategy by using a finite difference method and estimated parameters by generalised moment method.

Other systematic trading methods in cryptocurrency trading mainly include informed trading. Using USD / BTC exchange rate trading data, Feng et al. ( 2018 ) found evidence of informed trading in the Bitcoin market in those quantiles of the order sizes of buyer-initiated (seller-initiated) orders are abnormally high before large positive (negative) events, compared to the quantiles of seller-initiated (buyer-initiated) orders; this study adopts a new indicator inspired by the volume imbalance indicator (Easley et al. 2008 ). The evidence of informed trading in the Bitcoin market suggests that investors profit on their private information when they get information before it is widely available.

Emergent trading technologies

Copula-quantile causality analysis and Granger-causality analysis are methods to investigate causality in cryptocurrency trading analysis. Bouri et al. ( 2019 ) applied a copula-quantile causality approach on volatility in the cryptocurrency market. The approach of the experiment extended the Copula-Granger-causality in distribution (CGCD) method of Lee and Yang ( 2014 ) in 2014. The experiment constructed two tests of CGCD using copula functions. The parametric test employed six parametric copula functions to discover dependency density between variables. The performance matrix of these functions varies with independent copula density. Three distribution regions are the focus of this research: left tail (1%, 5%, 10% quantile), central region (40%, 60% quantile and median) and right tail (90%, 95%, 99% quantile). The study provided significant evidence of Granger causality from trading volume to the returns of seven large cryptocurrencies on both left and right tails. Bouri et al. ( 2020 ) examined the causal linkages among the volatility of leading cryptocurrencies via the frequency-domain test of Bodart and Candelon ( 2009 ) and distinguished between temporary and permanent causation. The results showed that permanent shocks are more important in explaining Granger causality whereas transient shocks dominate the causality of smaller cryptocurrencies in the long term. Badenhorst et al. ( 2019 ) attempted to reveal whether spot and derivative market volumes affect Bitcoin price volatility with the Granger-causality method and ARCH (1,1). The result shows spot trading volumes have a significant positive effect on price volatility while the relationship between cryptocurrency volatility and the derivative market is uncertain. Bouri et al. ( 2020 ) used a dynamic equicorrelation (DECO) model and reported evidence that the average earnings equilibrium correlation changes over time between the 12 leading cryptocurrencies. The results showed increased cryptocurrency market consolidation despite significant price declined in 2018. Furthermore, measurement of trading volume and uncertainty are key determinants of integration.

Several econometrics methods in time-series research, such as GARCH and BEKK, have been used in the literature on cryptocurrency trading. Conrad et al. ( 2018 ) used the GARCH-MIDAS model to extract long and short-term volatility components of the Bitcoin market. The technical details of this model decomposed the conditional variance into the low-frequency and high-frequency components. The results identified that S&P 500 realized volatility has a negative and highly significant effect on long-term Bitcoin volatility and S&P 500 volatility risk premium has a significantly positive effect on long-term Bitcoin volatility. Ardia et al. ( 2019 ) used the Markov Switching GARCH (MSGARCH) model to test the existence of institutional changes in the GARCH volatility dynamics of Bitcoin’s logarithmic returns. Moreover, a Bayesian method was used for estimating model parameters and calculating VaR prediction. The results showed that MSGARCH models clearly outperform single-regime GARCH for Value-at-Risk forecasting. Troster et al. ( 2019 ) performed general GARCH and GAS (Generalized Auto-regressive Score) analysis to model and predict Bitcoin’s returns and risks. The experiment found that the GAS model with heavy-tailed distribution can provide the best out-of-sample prediction and goodness-of-fit attributes for Bitcoin’s return and risk modeling. The results also illustrated the importance of modeling excess kurtosis for Bitcoin returns.

Charles and Darné ( 2019 ) studied four cryptocurrency markets including Bitcoin, Dash, Litecoin and Ripple. Results showed cryptocurrency returns are strongly characterised by the presence of jumps as well as structural breaks except the Dash market. Four GARCH-type models (i.e., GARCH, APARCH, IGARCH and FIGARCH) and three return types with structural breaks (original returns, jump-filtered returns, and jump-filtered returns) are considered. The research indicated the importance of jumps in cryptocurrency volatility and structural breakthroughs. Malladi and Dheeriya ( 2021 ) examined the time series analysis of Bitcoin and Ripple’s returns and volatility to examine the dependence of their prices in part on global equity indices, gold prices and fear indicators such as volatility indices and US economic policy uncertainty indices. Autoregressive-moving-average model with exogenous inputs model (ARMAX), GARCH, VAR and Granger causality tests are used in the experiments. The results showed that there is no causal relationship between global stock market and gold returns on bitcoin returns, but a causal relationship between ripple returns on bitcoin prices is found.

Some researchers focused on long memory methods for volatility in cryptocurrency markets. Long memory methods focused on long-range dependence and significant long-term correlations among fluctuations on markets. Chaim and Laurini ( 2019 ) estimated a multivariate stochastic volatility model with discontinuous jumps in cryptocurrency markets. The results showed that permanent volatility appears to be driven by major market developments and popular interest levels. Caporale et al. ( 2018 ) examined persistence in the cryptocurrency market by Rescaled range (R/S) analysis and fractional integration. The results of the study indicated that the market is persistent (there is a positive correlation between its past and future values) and that its level changes over time. Khuntia and Pattanayak ( 2018 ) applied the adaptive market hypothesis (AMH) in the predictability of Bitcoin evolving returns. The consistent test of (Domínguez and Lobato 2003 ), generalized spectral (GS) of (Escanciano and Velasco 2006 ) are applied in capturing time-varying linear and nonlinear dependence in bitcoin returns. The results verified Evolving Efficiency in Bitcoin price changes and evidence of dynamic efficiency in line with AMH’s claims. Gradojevic and Tsiakas ( 2021 ) examined volatility cascades across multiple trading ranges in the cryptocurrency market. Using a wavelet Hidden Markov Tree model, authors estimated the transition probability of propagating high or low volatility at one time scale (range) to high or low volatility at the next time scale. The results showed that the volatility cascade tends to be symmetrical when moving from long to short term. In contrast, when moving from short to long term, the volatility cascade is very asymmetric.

Nikolova et al. ( 2020 ) provided a new method to calculate the probability of volatility clusters, especially for cryptocurrencies (high volatility of their exchange rates). The authors used the FD4 method to calculate the Hurst index of a volatility series and describe explicit criteria for determining the existence of fixed size volatility clusters by calculation. The results showed that the volatility of cryptocurrencies changes more rapidly than that of traditional assets, and much more rapidly than that of Bitcoin/USD, Ethereum/USD, and Ripple/USD pairs. Ma et al. ( 2020 ) investigated whether a new Markov Regime Transformation Mixed Data Sampling (MRS-MIADS) model can improve the prediction accuracy of Bitcoin’s Realised Variance (RV). The results showed that the proposed new MRS-MIDAS model exhibits statistically significant improvements in predicting the RV of Bitcoin. At the same time, the occurrence of jumps significantly increases the persistence of high volatility and switches between high and low volatility.

Katsiampa et al. ( 2018 ) applied three pair-wise bivariate BEKK models to examine the conditional volatility dynamics along with interlinkages and conditional correlations between three pairs of cryptocurrencies in 2018. More specifically, the BEKK-MGARCH methodology also captured cross-market effects of shocks and volatility, which are also known as shock transmission effects and volatility spillover effects. The experiment found evidence of bi-directional shock transmission effects between Bitcoin and both Ether and Litcoin. In particular, bi-directional shock spillover effects are identified between three pairs (Bitcoin, Ether and Litcoin) and time-varying conditional correlations exist with positive correlations mostly prevailing. In 2019, Katsiampa ( 2019 ) further researched an asymmetric diagonal BEKK model to examine conditional variances of five cryptocurrencies that are significantly affected by both previous squared errors and past conditional volatility. The experiment tested the null hypothesis of the unit root against the stationarity hypothesis. Once stationarity is ensured, ARCH LM is tested for ARCH effects to examine the requirement of volatility modeling in return series. Moreover, volatility co-movements among cryptocurrency pairs are also tested by the multivariate GARCH model. The results confirmed the non-normality and heteroskedasticity of price returns in cryptocurrency markets. The finding also identified the effects of cryptocurrencies’ volatility dynamics due to major news.

Hultman ( 2018 ) set out to examine GARCH (1,1), bivariate-BEKK (1,1) and a standard stochastic model to forecast the volatility of Bitcoin. A rolling window approach is used in these experiments. Mean absolute error (MAE), Mean squared error (MSE) and Root-mean-square deviation (RMSE) are three loss criteria adopted to evaluate the degree of error between predicted and true values. The result shows the following rank of loss functions: GARCH (1,1) > bivariate-BEKK (1,1) > Standard stochastic for all the three different loss criteria; in other words, GARCH(1,1) appeared best in predicting the volatility of Bitcoin. Wavelet time-scale persistence analysis is also applied in the prediction and research of volatility in cryptocurrency markets (Omane-Adjepong et al. 2019 ). The results showed that information efficiency (efficiency) and volatility persistence in the cryptocurrency market are highly sensitive to time scales, measures of returns and volatility, and institutional changes. Omane-Adjepong et al. ( 2019 ) connected with similar research by Corbet et al. ( 2018 ) and showed that GARCH is quicker than BEKK to absorb new information regarding the data.

Zhang and Li ( 2020 ) examined how to price exceptional volatility in a cross-section of cryptocurrency returns. Using portfolio-level analysis and Fama-MacBeth regression analysis, the authors demonstrated that idiosyncratic volatility is positively correlated with expected returns on cryptocurrencies.

As we have previously stated, Machine learning technology constructs computer algorithms that automatically improve themselves by finding patterns in existing data without explicit instructions (Holmes et al. 1994 ). The rapid development of machine learning in recent years has promoted its application to cryptocurrency trading, especially in the prediction of cryptocurrency returns. Some ML algorithms solve both classification and regression problems from a methodological point of view. For clearer classification, we focus on the application of these ML algorithms in cryptocurrency trading. For example, Decision Tree (DT) can solve both classification and regression problems. But in cryptocurrency trading, researchers focus more on using DT in solving classification problems. Here we classify DT as “Classification Algorithms”.

Common machine learning technology in this survey

Several machine learning technologies are applied in cryptocurrency trading. We distinguish these by the objective set to the algorithm: classification, clustering, regression, reinforcement learning. We have separated a section specifically on deep learning due to its intrinsic variation of techniques and wide adoption.

Classification algorithms Classification in machine learning has the objective of categorising incoming objects into different categories as needed, where we can assign labels to each category (e.g., up and down). Naive Bayes (NB) (Rish et al. 2001 ), Support Vector Machine (SVM) (Wang 2005 ), K-Nearest Neighbours (KNN) (Wang 2005 ), Decision Tree (DT) (Friedl and Brodley 1997 ), Random Forest (RF) (Liaw and Wiener 2002 ) and Gradient Boosting (GB) (Friedman et al. 2001 ) algorithms habe been used in cryptocurrency trading based on papers we collected. NB is a probabilistic classifier based on Bayes’ theorem with strong (naive) conditional independence assumptions between features (Rish et al. 2001 ). SVM is a supervised learning model that aims at achieving high margin classifiers connecting to learning bounds theory (Zemmal et al. 2016 ). SVMs assign new examples to one category or another, making it a non-probabilistic binary linear classifier (Wang 2005 ), although some corrections can make a probabilistic interpretation of their output (Keerthi et al. 2001 ). KNN is a memory-based or lazy learning algorithm, where the function is only approximated locally, and all calculations are being postponed to inference time (Wang 2005 ). DT is a decision support tool algorithm that uses a tree-like decision graph or model to segment input patterns into regions to then assign an associated label to each region (Friedl and Brodley 1997 ; Fang et al. 2020 ). RF is an ensemble learning method. The algorithm operates by constructing a large number of decision trees during training and outputting the average consensus as predicted class in the case of classification or mean prediction value in the case of regression (Liaw and Wiener 2002 ). GB produces a prediction model in the form of an ensemble of weak prediction models (Friedman et al. 2001 ).

Clustering algorithms Clustering is a machine learning technique that involves grouping data points in a way that each group shows some regularity (Jianliang et al. 2009 ). K-Means is a vector quantization used for clustering analysis in data mining. K-means stores the k -centroids used to define the clusters; a point is considered to be in a particular cluster if it is closer to the cluster’s centroid than any other centroid (Wagstaff et al. 2001 ). K-Means is one of the most used clustering algorithms used in cryptocurrency trading according to the papers we collected. Clustering algorithms have been successfully applied in many financial applications, such as fraud detection, rejection inference and credit assessment. Automated detection clusters are critical as they help to understand sub-patterns of data that can be used to infer user behaviour and identify potential risks (Li et al. 2021 ; Kou et al. 2014 ).

Regression algorithms We have defined regression as any statistical technique that aims at estimating a continuous value (Kutner et al. 2005 ). Linear Regression (LR) and Scatterplot Smoothing are common techniques used in solving regression problems in cryptocurrency trading. LR is a linear method used to model the relationship between a scalar response (or dependent variable) and one or more explanatory variables (or independent variables) (Kutner et al. 2005 ). Scatterplot Smoothing is a technology to fit functions through scatter plots to best represent relationships between variables (Friedman and Tibshirani 1984 ).

Deep Learning algorithms Deep learning is a modern take on artificial neural networks (ANNs) (Zhang et al. 2019 ), made possible by the advances in computational power. An ANN is a computational system inspired by the natural neural networks that make up the animal’s brain. The system “learns” to perform tasks including the prediction by considering examples. Deep learning’s superior accuracy comes from high computational complexity cost. Deep learning algorithms are currently the basis for many modern artificial intelligence applications (Sze et al. 2017 ). Convolutional neural networks (CNNs) (Lawrence et al. 1997 ), Recurrent neural networks (RNNs) (Mikolov et al. 2011 ), Gated recurrent units (GRUs) (Chung et al. 2014 ), Multilayer perceptron (MLP) and Long short-term memory (LSTM) (Cheng et al. 2016 ) networks are the most common deep learning technologies used in cryptocurrency trading. A CNN is a specific type of neural network layer commonly used for supervised learning. CNNs have found their best success in image processing and natural language processing problems. An attempt to use CNNs in cryptocurrency can be shown in (Kalchbrenner et al. 2014 ). An RNN is a type of artificial neural network in which connections between nodes form a directed graph with possible loops. This structure of RNNs makes them suitable for processing time-series data (Mikolov et al. 2011 ) due to the introduction of memory in the recurrent connections. They face nevertheless for the vanishing gradients problem (Pascanu et al. 2013 ) and so different variations have been recently proposed. LSTM (Cheng et al. 2016 ) is a particular RNN architecture widely used. LSTMs have shown to be superior to nongated RNNs on financial time-series problems because they have the ability to selectively remember patterns for a long time. A GRU (Chung et al. 2014 ) is another gated version of the standard RNN which has been used in crypto trading (Dutta et al. 2020 ). Another deep learning technology used in cryptocurrency trading is Seq2seq, which is a specific implementation of the Encoder-Decoder architecture (Xu et al. 2017 ). Seq2seq was first aimed at solving natural language processing problems but has been also applied it in cryptocurrency trend predictions in Sriram et al. ( 2017 ).

Reinforcement learning algorithms Reinforcement learning (RL) is an area of machine learning leveraging the idea that software agents act in the environment to maximize a cumulative reward (Sutton and Barto 1998 ). Deep Q-Learning (DQN) (Gu et al. 2016 ) and Deep Boltzmann Machine (DBM) (Salakhutdinov and Hinton 2009 ) are common technologies used in cryptocurrency trading using RL. Deep Q learning uses neural networks to approximate Q-value functions. A state is given as input, and Q values for all possible actions are generated as outputs (Gu et al. 2016 ). DBM is a type of binary paired Markov random field (undirected probability graphical model) with multiple layers of hidden random variables (Salakhutdinov and Hinton 2009 ). It is a network of randomly coupled random binary units.

Research on machine learning models

In the development of machine learning trading signals, technical indicators have usually been used as input features. Nakano et al. ( 2018 ) explored Bitcoin intraday technical trading based on ANNs for return prediction. The experiment obtained medium frequency price and volume data (time interval of data is 15min) of Bitcoin from a cryptocurrency exchange. An ANN predicts the price trends (up and down) in the next period from the input data. Data is preprocessed to construct a training dataset that contains a matrix of technical patterns including EMA, Emerging Markets Small Cap (EMSD), relative strength index (RSI), etc. Their numerical experiments contain different research aspects including base ANN research, effects of different layers, effects of different activation functions, different outputs, different inputs and effects of additional technical indicators. The results have shown that the use of various technical indicators possibly prevents over-fitting in the classification of non-stationary financial time-series data, which enhances trading performance compared to the primitive technical trading strategy. (Buy-and-Hold is the benchmark strategy in this experiment.)

Some classification and regression machine learning models are applied in cryptocurrency trading by predicting price trends. Most researchers have focused on the comparison of different classification and regression machine learning methods. Sun et al. ( 2019 ) used random forests (RFs) with factors in Alpha01 (Kakushadze 2016 ) (capturing features from the history of the cryptocurrency market) to build a prediction model. The experiment collected data from API in cryptocurrency exchanges and selected 5-min frequency data for backtesting. The results showed that the performances are proportional to the amount of data (more data, more accurate) and the factors used in the RF model appear to have different importance. For example, “Alpha024” and “Alpha032” features appeared as the most important in the model adopted. (The alpha features come from paper “101 Formulaic Alphas” (Kakushadze 2016 ).) Vo and Yost-Bremm ( 2018 ) applied RFs in High-Frequency cryptocurrency Trading (HFT) and compared it with deep learning models. Minute-level data is collected when utilising a forward fill imputation method to replace the NULL value (i.e., a missing value). Different periods and RF trees are tested in the experiments. The authors also compared F-1 precision and recall metrics between RF and Deep Learning (DL). The results showed that RF is effective despite multicollinearity occurring in ML features, the lack of model identification also potentially leading to model identification issues; this research also attempted to create an HFT strategy for Bitcoin using RF.