Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

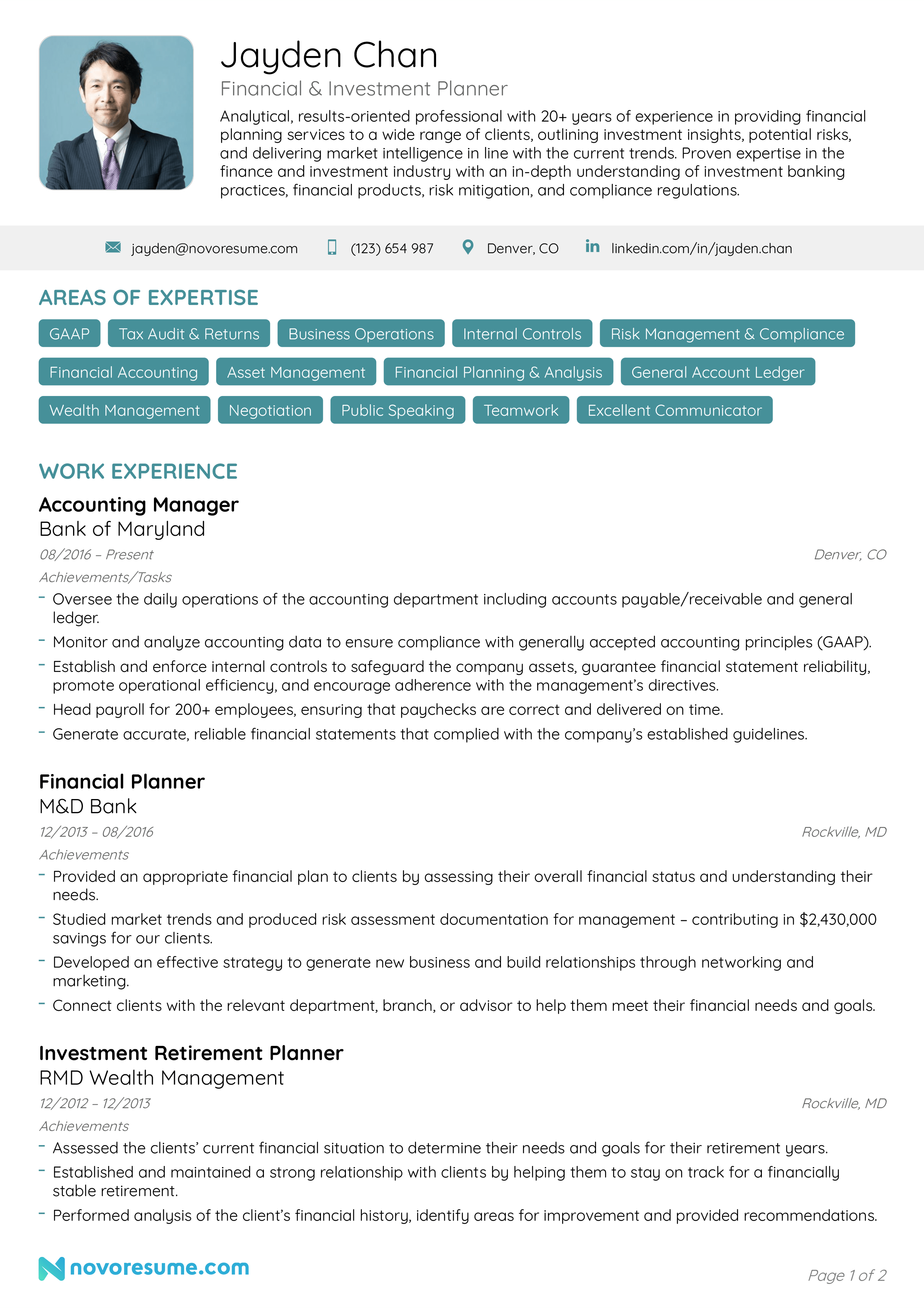

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

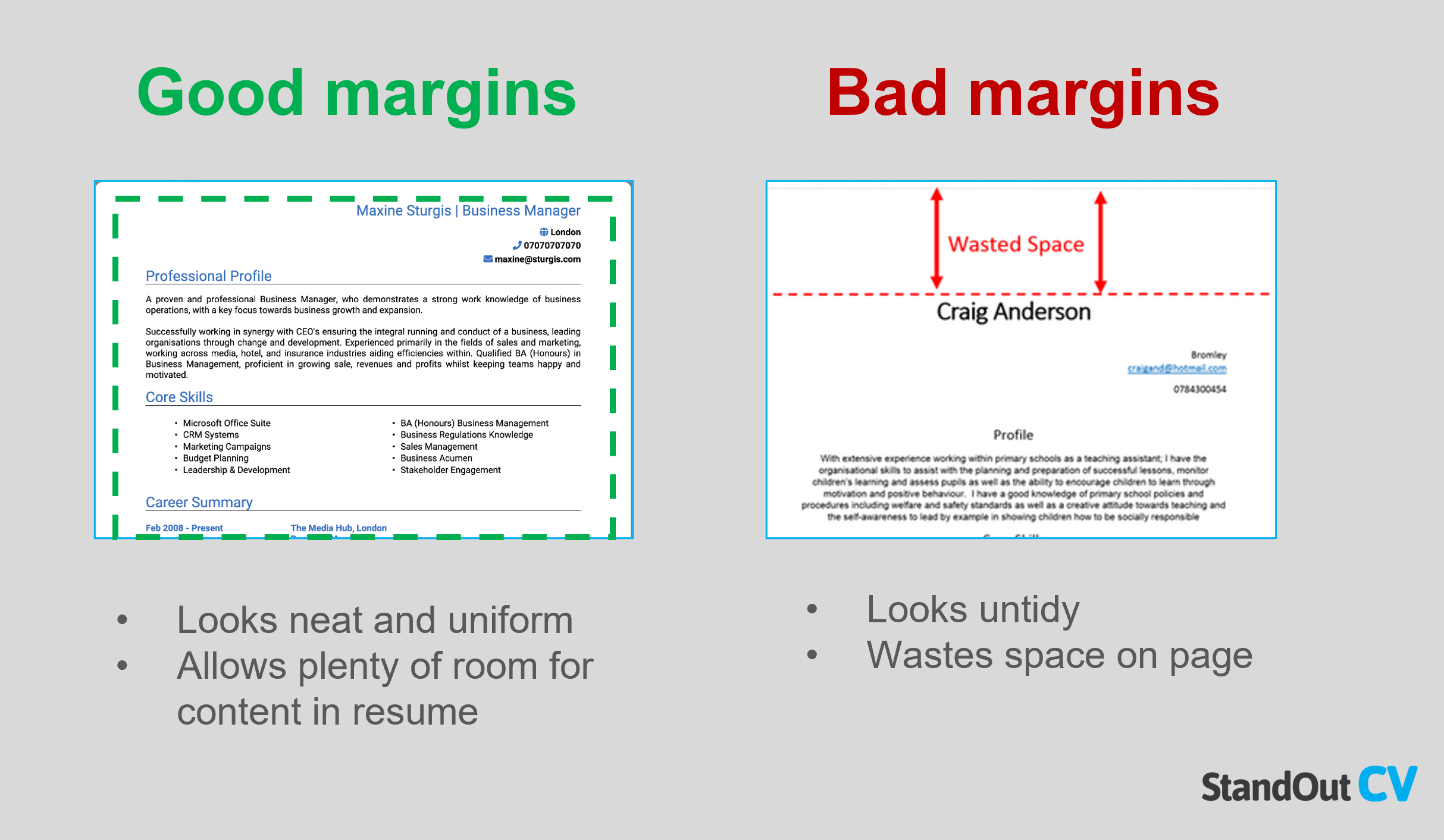

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

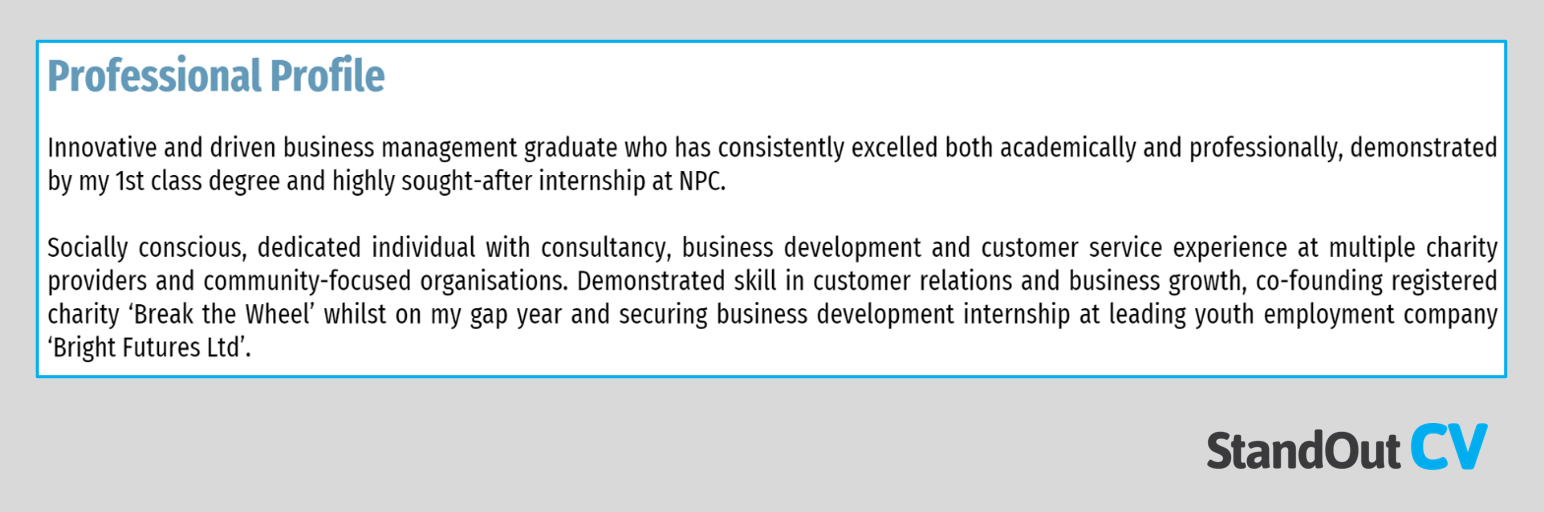

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

- Career Blog

Banking Resume Writing Tips and Examples for 2024

A banking resume is a document that summarizes a candidate’s qualifications and experiences related to the field of banking, including knowledge of financial services, banking operations, and customer service skills. It highlights the individual’s professional achievements, education, work experience, and relevant skills with the aim of persuading the hiring manager to invite the candidate for an interview.

Why is it important to have a well-written resume?

A well-written banking resume can significantly increase the candidate’s chances of being invited to an interview. For one, it signals the candidate’s competence, attention to detail, and professionalism, which are important traits in banking jobs. A poorly written resume, on the other hand, can reflect negatively on the candidate and end up overlooked by the recruiter or hiring manager.

How to format a banking resume?

The format of a banking resume should be targeted and relevant to the specific job being applied for. It should be concise and structured, making it easy for the recruiter or hiring manager to skim and quickly identify key information. A banking resume should start with a summary statement – a brief overview of the candidate’s career objectives and highlight their most relevant experiences and qualifications.

The chronological format is the most common approach for banking resumes. In this format, the candidate should list their professional experiences in reverse chronological order, starting with the most recent experience first. The candidate must include relevant experiences, accomplishments, and specific tasks performed when describing their work experience.

In addition to work experience, a banking resume should include a relevant education section, highlighting relevant coursework, and academic achievements. The candidate can choose to include additional sections such as certifications, relevant skills, and volunteer work.

A well-drafted banking resume positions the candidate to stand out from the competition, increase their chances of being selected for an interview, and ultimately secure their dream banking job.

Decoding the Job Description

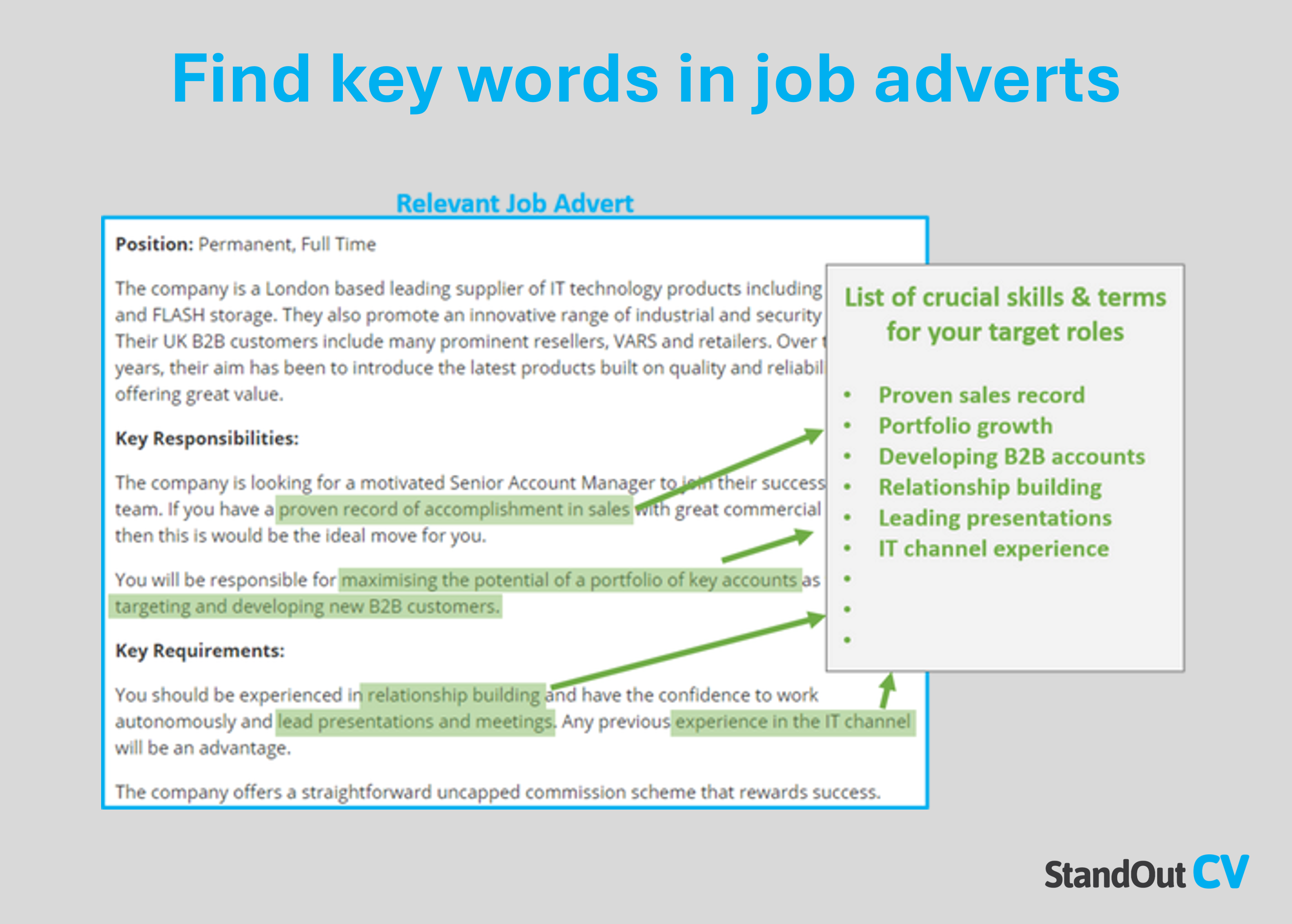

When it comes to writing a successful banking resume, it’s essential to understand the job description and tailor your resume accordingly.

A. What to look for in a job posting?

Before you start crafting your resume, carefully analyze the job posting. Pay particular attention to:

- Required qualifications: Determine what specific skills, education, and experience are essential for the role.

- Key responsibilities: Identify the primary duties and responsibilities of the job. What duties will you be performing daily, weekly, and monthly?

- Company culture: Understand the company’s values, goals, and mission. Does your experience and passion align with their culture?

B. How to tailor your resume based on a job description?

Once you have analyzed the job posting, tailor your resume to emphasize your relevant experience and qualifications.

- Use job-specific keywords: Incorporate keywords from the job posting into your resume’s summary, skills, and experience sections.

- Highlight relevant achievements: Identify and showcase specific accomplishments that relate to the job’s requirements, using measurable results and data where possible.

- Emphasize transferrable skills: If you lack specific qualifications or experience, highlight transferable skills and relevant job experiences that demonstrate your ability to learn and adapt quickly.

C. Understanding the role of a banking professional.

To craft a successful banking resume, it’s crucial to understand the role of a banking professional.

Bankers are responsible for managing financial transactions and the overall financial health of individuals, businesses, and organizations. They handle day-to-day transactions such as deposits, withdrawals, and wire transfers, and may also offer investment advice, loans, and lines of credit.

Key skills for a banking professional include attention to detail, financial analysis, customer service, risk management, and regulatory compliance.

When writing your banking resume, emphasize your knowledge of financial products and services, experience handling financial transactions, and any certifications or licenses relevant to the industry.

Carefully analyzing job postings, tailoring your resume accordingly, and understanding the role of a banking professional are key to crafting a successful banking resume.

Essential Banking Resume Sections

When writing a banking resume, there are certain essential sections that you should include to make a good impression on potential employers. Here are the main sections that you should include:

A. Personal Information

The personal information section should include your full name, email address, phone number, and mailing address. You can also include your LinkedIn profile or other relevant social media profiles.

B. Objective or Summary Statement

The objective or summary statement is a brief statement that highlights your career goals and key skills. This section should be tailored to the specifics of the job you are applying for.

C. Education

The education section should include the name of the institution, the degree or certification earned, the date of graduation, and any relevant coursework or honors.

D. Professional Experience

The professional experience section should include your work history dating back to your most recent job. Include the job title, employer name, dates of employment, and bulleted details of your responsibilities and achievements during your time in each role.

The skills section should include your technical and soft skills relevant to the banking industry. Examples of technical skills in banking include financial analysis, risk management, and credit analysis. Soft skills might include strong communication or leadership abilities.

F. Certifications and Licenses

The certifications and licenses section should include any relevant professional certifications, such as the Chartered Financial Analyst (CFA) designation.

G. Awards and Achievements

The awards and achievements section should highlight any formal awards or recognition you have received for your work in banking or related fields.

H. Extracurricular Activities or Volunteering

The extracurricular activities or volunteering section is a great way to show that you are well-rounded and have interests outside of work. This section can include any relevant activities, such as volunteering at a local bank or financial literacy organization.

I. Hobbies and Interests

The hobbies and interests section isn’t always necessary, but it can help give potential employers a sense of your personality and interests. This section should be brief and only include relevant information that might set you apart from other candidates.

By including these essential sections in your banking resume, you can make a great first impression and increase your chances of landing an interview. Be sure to tailor your resume to the specifics of each job posting and highlight how your skills and experience make you a great fit for the position.

Crafting an Effective Personal Information Section

When it comes to writing a banking resume, the personal information section is an essential part. It is the first thing that recruiters see, and it is what can make or break their interest in your application. In this section, you need to provide specific details about yourself that are relevant to the banking job you are applying for. In this article, we will be discussing five important elements of a personal information section.

A. Contact Information

Contact information is perhaps the most crucial part of the personal information section. Without this information, recruiters cannot contact you if they are interested in your application. It is vital to make sure that all information provided is accurate, so double-check your contact details before submitting your resume.

The contact information should include your full name, current address, phone number, and email address. Make sure that you use a professional email address, and avoid using nicknames or any other informal language.

B. Professional Headline

A professional headline is a brief statement that summarizes your skills and experience. It should be placed right after your name and contact information. The headline should be catchy, short, and impactful. Consider using phrases like “Experienced Banking Professional” or “Financial Analyst with 10 Years of Experience.” The headline should make a statement about your expertise and experience in banking.

C. LinkedIn Profile

LinkedIn is a professional social media platform that allows you to showcase your skills, experience, and career aspirations. Having a LinkedIn profile is essential for any job seeker, including those in banking. Recruiters often use LinkedIn to find potential candidates, so it is crucial to include a link to your LinkedIn profile in the personal information section.

Your LinkedIn profile should be complete with a professional profile picture, a summary of your skills and experience, and recommendations from previous employers. Make sure that your LinkedIn profile aligns with the skills and experience mentioned in your resume.

Your address may not seem like an essential part of your personal information section, but it can be useful for recruiters. For example, if you are applying for a job in a specific location, having an address in that area can increase your chances of getting the job. Therefore, it is recommended to include your current address in your resume.

E. Photo or No Photo?

When it comes to adding a photo to your resume, there are different opinions on this matter. Some recruiters prefer resumes with a photo, while others believe that it is not necessary. Ultimately, the decision to include a photo in your resume is up to you.

If you decide to include a photo in your resume, make sure that it is a professional headshot. Avoid using casual photos or selfies. A professional photo will help to create a positive first impression and will make your application more memorable.

Writing an Engaging Objective or Summary Statement

When it comes to writing a strong banking resume, an engaging objective or summary statement can make all the difference. But before you start crafting this section of your resume, it’s important to understand the difference between an objective statement and a summary statement.

A. What’s the difference between an objective and a summary statement?

An objective statement is a brief statement that highlights your career goals and the type of position you are seeking. It should be specific and relevant to the job you are applying for. On the other hand, a summary statement provides a brief overview of your skills, strengths, and previous experience. It should be tailored to the specific job you are applying for, highlighting what you can bring to the table and what sets you apart from other candidates.

B. How to write an objective or summary statement that stands out?

When it comes to writing an objective or summary statement that stands out, there are a few key things to keep in mind. First, it’s important to make it clear what you can offer the employer. This means highlighting your unique skills, strengths, and experience that make you a good fit for the job. It’s also important to use specific, measurable language that shows the impact you have made in previous roles.

Another important factor is tailoring your objective or summary statement to the specific job you are applying for. This means doing your research on the company and the position to understand what they are looking for in a candidate. Use the language and keywords they use in the job description to make your statement more relevant and compelling.

Finally, make sure your objective or summary statement is concise and impactful. It should be no more than two to three sentences, and should highlight the most important information about you and your qualifications without including unnecessary details.

C. Dos and Don’ts of writing an effective statement.

To ensure that your objective or summary statement is effective, there are a few dos and don’ts to keep in mind.

- Use specific, measurable language that shows your impact in previous roles.

- Tailor your statement to the specific job and company you are applying to.

- Keep it concise and impactful, focusing on the most important information about you and your qualifications.

- Use keywords and language from the job description to make your statement more relevant.

- Include unnecessary details or information that is not directly relevant to the job.

- Use vague language or cliches that don’t add value to your statement.

- Be too generic or broad in your statement, making it unclear what you are looking for in a position.

By following these tips and guidelines, you can create an objective or summary statement that stands out to potential employers and helps you land your next banking job.

Highlighting Your Education Background

Your educational background is an important aspect of your banking resume. It showcases your academic achievements and demonstrates your qualifications for the job. Here are some tips on how to effectively highlight your education background.

A. How to display your educational qualifications?

When it comes to displaying your educational qualifications, there are a few things you should keep in mind. First, make sure to list your degrees in chronological order, starting with the most recent. Second, be sure to include the institution name, the degree earned, and the date of graduation. Third, consider including any academic honors or awards you received.

It is also important to tailor your education section to the specific job you are applying for. For example, if you are applying for a position in investment banking, highlighting relevant coursework such as finance or accounting would be beneficial.

B. What to include in the education section?

When it comes to what to include in the education section of your banking resume, there are several key pieces of information to consider. These include:

- Institution name

- Degree earned (e.g. Bachelor of Science, Master of Business Administration)

- Field of study

- Date of graduation

- Academic honors or awards (optional)

Additionally, if you have any certifications or licenses relevant to the banking industry, you may want to include those in a separate section or as part of your education background.

C. Should you include your GPA?

Whether or not to include your GPA depends on several factors. If you have a high GPA, you may want to include it to demonstrate your academic excellence. However, if your GPA is lower, you may want to leave it off. It is also important to consider the requirements of the job posting – if the employer specifically requests a GPA, be sure to include it.

Effectively highlighting your education background is an important aspect of creating a strong banking resume. Be sure to list your degrees in chronological order, include relevant coursework, and consider including academic honors or awards. When it comes to including your GPA, carefully consider whether or not it is relevant to the position and job requirements.

Showcasing Your Professional Experiences

When it comes to writing a banking resume, showcasing your professional experiences is essential. This section is where you highlight your work history and demonstrate your proficiency in the field. To write an engaging work experience section, you need to follow the tips listed below.

A. How to Write an Engaging Work Experience Section?

To make your work experience section more engaging, you need to focus on your accomplishments instead of just listing your job responsibilities. Start each bullet point with an action verb and quantify your achievements wherever possible.

For example, instead of saying “Responsible for customer service,” say “Provided exceptional customer service resulting in a 95% satisfaction rate.”

Another tip is to tailor your work experience section to the job you’re applying for. Highlight the skills and experiences that are relevant to the position.

B. Choosing the Right Action Verbs

Action verbs are powerful because they help demonstrate the impact of your work. Some examples of action verbs you can use in your work experience section include:

- Implemented

- Coordinated

Avoid using passive language and focus on using action verbs that show initiative and leadership.

C. What to Include in the Job Description?

When writing your job descriptions, make sure to include specific details about your role and responsibilities. Highlight your achievements and the impact they had on your team or company. The job description should also include:

- Company name

- Employment dates

- Job responsibilities

- Achievements

- Skills utilized

- Projects worked on

Quantify as many of your achievements as possible, and use data to show the impact of your work.

D. Formatting Your Work Experience Section

Formatting your work experience section is crucial for readability and professionalism. Use reverse chronological order, starting with your most recent position, and work your way backward. Use bullet points to break up your job responsibilities and achievements. Also, make sure you separate each job with clear headings, including the company name, job title, and employment dates.

When it comes to showcasing your professional experiences, the key is to focus on demonstrating your achievements and tailoring your descriptions to the job you’re applying for. Use powerful action verbs, quantify your accomplishments, and format your work experience section for maximum readability.

Highlighting Your Skills and Qualifications

Hiring managers want to know what you bring to the table in terms of skills and qualifications. To ensure that you are considered for the job, you need to highlight both your technical and soft skills.

A. Technical skills vs. soft skills

Technical skills refer to job-specific knowledge or abilities, such as proficiency in specific software, programming languages, or financial models. Having strong technical skills is essential in the banking industry, where employees are expected to be fully trained and knowledgeable on the latest financial products and services.

In contrast, soft skills are non-technical abilities that are equally important in banking. These may include communication, leadership, teamwork, problem-solving, and time management. Soft skills are necessary for building relationships with clients, resolving conflicts, and working effectively with colleagues.

B. Identifying your transferable skills

As you update your banking resume, it’s important to identify both your technical and soft skills. But, keep in mind that you may have transferable skills, too. Transferable skills are those you can apply across different roles or industries. These might include research, project management, or problem-solving skills, which can be valuable assets in a variety of professions.

Make a list of all the skills you have, whether technical or soft, and consider what skills may be transferable. After you complete this exercise, you may find you have a broader range of skills than you first realized.

C. How to match your skills with job requirements?

When looking at job postings, you’ll notice that most have a list of desired qualifications or skills. To land the job, you’ll need to make sure your skills align with what the employer is seeking.

The first step is to read the job description carefully and take note of the required qualifications. Some employers may prioritize specific technical skills, while others may focus on soft skills or transferable skills. Highlight these qualifications on your resume to show the recruiter that you have what it takes to be successful in the role.

It’s also important to include specific examples of how you have applied your skills in the past. Provide quantifiable results that demonstrate your successes and achievements. Doing so will help you stand out from other applicants and show that you have the necessary experience to excel in the role.

Highlighting your skills and qualifications is crucial to the success of your banking resume. Be sure to include both technical and soft skills, consider transferable skills, and align your skills with the job requirements. By doing so, you’ll increase your chances of landing the job of your dreams.

Listing Your Certificates and Licenses

If you have obtained relevant certificates or licenses, it is vital to include them in your banking resume. Employers in the banking industry look for candidates who have the necessary certifications and licenses needed to perform specific roles. Here are tips for displaying your certificates and licenses accurately:

A. How to display your certifications and licenses?

- Separate Section: Certificates and licenses should have a dedicated section in your resume. This section should come after your education and work experience and before other additional skills.

- Use Bold: Use boldface for the certificate or license name, with the issuing organization in normal font beside it. For example, Certified Financial Planner (CFP) , CFP Board.

- Mention Date and Expiry: Mention when you received the certificate and when it will expire.

- Add Descriptions: You may add descriptions or additional information about the certification or license if it is relevant to the job you are applying for.

B. What to include and exclude?

Here’s what you should include and exclude when mentioning your certificates and licenses in your banking resume:

- Relevancy: Only include certifications and licenses that are relevant to the job you are applying for. For example, if you are applying for a position in investment banking, then the Chartered Financial Analyst (CFA) certification would be highly relevant.

- Credentials that have formal recognition: Include only those certifications and licenses that are recognized by professional bodies or institutions. For example, ACLS (Advanced Cardiac Life Support) is a certification recognized by the American Heart Association.

- Recent Certifications: Include only the most recent certifications and licenses. Employers usually prioritize recent certifications over older ones.

- Expired Certificates: If a certificate or license has expired, exclude it from your resume. It’s best to renew the certification before mentioning it in your resume.

- Irrelevant Certifications: Certifications and licenses that are unrelated to banking or the job you are applying for should be excluded from your resume.

- Incomplete Certifications: If you have started a certification or license program and have not completed it, exclude it from your resume.

Displaying your certificates and licenses accurately and concisely is essential in banking resumes. Only mention relevant, recognized, and up-to-date certifications and licenses in your resume to improve your chances of landing your desired job in banking.

Showcasing Your Awards and Achievements

A. how to highlight your awards and achievements.

Highlighting your awards and achievements is an important aspect of a strong banking resume. Not only does it show your competency and dedication to your job, but it also sets you apart from other applicants. Here are some tips to effectively highlight your awards and achievements:

Use bullet points: Using bullet points is an effective way to make your accomplishments stand out. It also makes it easier for the recruiter to read and absorb the information.

Focus on the most recent and relevant awards: When listing your awards and achievements, it’s important to focus on the most recent and relevant ones. This will showcase your current skillset and expertise, and give the recruiter an idea of how you can contribute to their organization.

Use metrics and numbers: Use metrics and numbers to quantify your achievements. This will show the recruiter the actual impact you have made in your previous roles. For example, instead of saying “Increased customer satisfaction”, you can say “Increased customer satisfaction by 25% in 6 months”.

Provide context: Provide context for each award or achievement. This will help the recruiter understand the situation and the impact you made. For example, instead of saying “Received Employee of the Month Award”, you can say “Received Employee of the Month Award for exceptional performance in driving sales and exceeding targets for 3 consecutive months”.

B. Mistakes to avoid while listing your accomplishments.

While listing your accomplishments is crucial to make your resume stand out, there are some mistakes you should avoid:

Listing irrelevant awards: Listing irrelevant awards can distract the recruiter from the important ones. Make sure to focus on the most recent and relevant ones.

Using vague language: Using vague language such as “Improved customer satisfaction” or “Increased revenue” without providing any context or metrics doesn’t give the recruiter a clear understanding of your accomplishments. Make sure to use specific metrics and provide context for each award or achievement.

Including personal achievements: While personal achievements such as winning a sports tournament or participating in a charity event are admirable, they don’t belong on a professional resume. Include only professional achievements that pertain to the job you’re applying for.

Listing duties as accomplishments: Listing duties such as “Processed customer transactions” or “Managed customer complaints” as accomplishments doesn’t show any additional value or impact you made. Make sure to list only achievements that show your competency and dedication to your job.

C. Why highlight your achievements in a resume?

Highlighting your achievements in a resume is important for several reasons:

Differentiates you from other applicants: Listing your accomplishments sets you apart from other applicants who only list their job duties. It shows that you’re competent and dedicated to your job.

Shows your skills and expertise: Listing your accomplishments shows the skills and expertise you have, and gives the recruiter an idea of how you can contribute to their organization.

Including Your Extracurricular Activities or Volunteering

As a banking professional, you may have a wealth of knowledge in the industry, but employers are not just looking for a technical expert. They also want to know that you are a well-rounded individual who can contribute to the community. That’s where extracurricular activities and volunteering experience come in.

A. How to portray your community service and volunteering experience?

When it comes to including your extracurricular activities and volunteering experience in your resume, it’s essential to stay focused on the skills relevant to the banking industry. Here’s how to do it:

Focus on transferable skills : Your community service and volunteering experience can demonstrate your abilities to manage people, organize events, or fundraise. Consider how these skills can apply to the banking industry and highlight them in your resume.

Quantify your achievements : Show your impact by including measurable results in your resume. For example, if you organized a fundraising event, mention how much money you raised and the number of participants you attracted.

Include only relevant experiences : While it’s important to mention your extracurricular activities and volunteering experience, remember to only include those that are relevant to the job you are applying for. For instance, if your volunteering experience involves working with children, it may not be relevant to a banking position.

B. The importance of including your extrac

Including your extracurricular activities and volunteering experience in your banking resume can make you stand out from other candidates. Here are some reasons why:

Shows your personality : Your extracurricular activities can provide a glimpse of who you are beyond your technical skills. It shows that you have interests and passions outside of work, which can make you a more well-rounded employee.

Demonstrates transferable skills : As mentioned earlier, your community service and volunteering experience can demonstrate transferable skills that are relevant to the banking industry, such as communication, leadership, and teamwork.

Illustrates your commitment : Volunteering and participating in extracurricular activities require time and effort, which shows that you are committed and responsible. This trait is particularly important in the banking industry, where accuracy and attention to detail are critical.

Including your extracurricular activities and volunteering experience in your banking resume can help showcase your abilities beyond the technical skills required for the job. Make sure to focus on transferable skills, quantify your achievements, and only include relevant experiences. Doing so can make you stand out from other candidates and demonstrate your commitment to the community and the banking industry.

Related Articles

- 110 Expert Resume Tips for Landing More Interviews

- Student Counselor Job Description: A Complete Guide

- Interview Follow-Up: How to Do It Right

- Preparing for an Online Job Interview: Tips and Strategies

- Pharmacy Technician Resume: Sample and Writing Tips

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

- Search Search Please fill out this field.

- Career Planning

- Finding a Job

How To Write a Personal Statement for Job Searching

Madeleine Burry writes about careers and job searching for The Balance. She covers topics around career changes, job searching, and returning from maternity leave, and has been writing for The Balance since 2014.

:max_bytes(150000):strip_icc():format(webp)/madeleine-burry-2d077a7f67724d798a60c50d3568b533.jpg)

Different Types of Personal Statements

What you should include, tips for writing a job search personal statement, examples of personal statements.

Kiyoshi Hijiki / Getty Images

What's a personal statement, and why do you need one when you're job searching? A job search personal statement is a place to share why you're interested in a position and why you're a good match.

In your statement, you can get a bit personal—use the space to share details and insights about yourself, and forge a connection with potential employers. Here are some tips on how to write a successful personal statement that will further your job search.

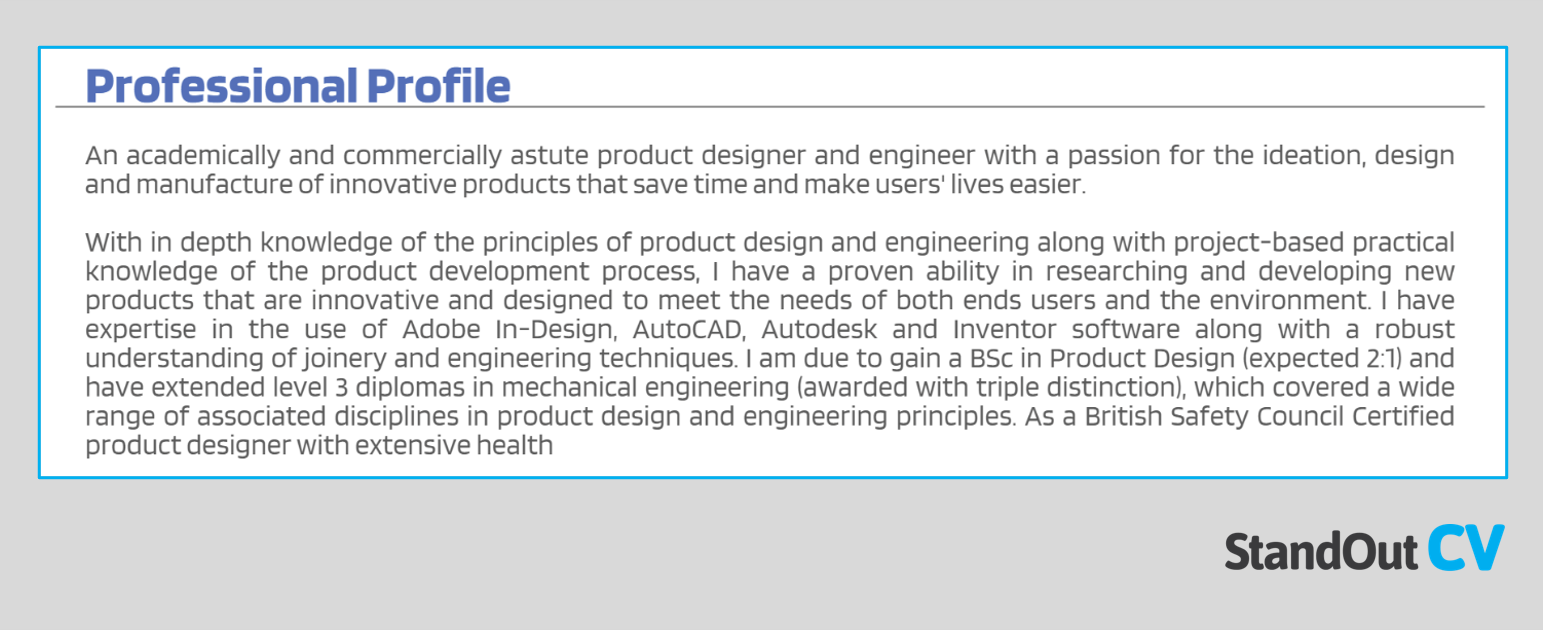

A personal statement may be included in your curriculum vitae or CV. Much like an in-person elevator speech or the summary section within a resume, a CV personal statement highlights your objectives and abilities. Since a CV may stretch over several pages, this allows you to showcase must-see details from within the document. You'll want to write just a few sentences for a personal statement in a CV.

Or, you may need to write a personal statement as part of a job application. This helps hiring managers to separate out candidates applying for every job in a category (e.g., putting in applications for any "production manager" position) from more engaged candidates, who are interested in the company.

Write something that matches the application's requested word count; if one isn't provided, aim for 250 to 500 words. Regardless of where it appears, your goal in a personal statement is the same: try to connect your background and goals with the job at hand.

In your personal statement, you want to make a connection between yourself and the position. Think of this as a three-part process:

- Share Some Details About Yourself: Who are you? You may say things like "Highly seasoned production manager" or "Recent graduate with honors."

- Highlight Your Most Relevant Experience and Talents and Share What You'd Bring to the Company: Think: "Strong, speedy writer capable of crafting ad copy that engages and enchants." or "In my years as a project manager, I've never let a detail slip; I've won internal awards for the best team player. My projects release on time and match requested specifications."

- Provide a Bit of Information About Your Career Goals: For instance, "Looking for a staff writer position" or "Eager for placement in a mid-sized firm as an audit supervisor" or "Seeking a position as a production assistant to further develop my skills in television and put my time management abilities to the test."

While it's called a personal statement, avoid over-sharing. Only include information that's relevant to the job at hand. That is if you're applying for a position as an accountant, no need to mention your goal of becoming a staff writer at a magazine.

Remember, the main goal of your personal statement is for it to further your job search.

Your personal statement should always be personalized—it's a mistake to reuse the same personal statement for every job you apply for. You don't need to write the personal statement from scratch each time—just make tweaks so it reflects the needs of the company and the qualities requested in the job description.

Here are more tips for writing a successful job search personal statement:

- Know Your Audience: Target your personal statement to a specific job position and company. Spend a bit of time researching the company to get a sense of what they're looking for in a candidate. Decode the job description so you understand the company's needs in a candidate. Take notes on where your qualifications are a good match for the position.

- Make Some Lists: What have you done that employers should know about? Make a list of your accomplishments (and keep in mind that while splashy awards are important, so too is reorganizing a chaotic system that gives everyone hives to make it user-friendly). Brainstorm a list of your talents as well as your soft, communication, and general skills.

- Go Long on Your First Draft—Then Cut It Down: Hopefully, your time spent thinking about the company's needs and what you have to offer has given you plenty of fodder to get started writing your personal statement. At this point, don't worry about length; write as much you want. Then, go back and edit—aim for a few sentences for a CV and around 250 to 500 words in an application. Cut unnecessary words and clichés that don't add meaning. Instead, use action verbs . While it's fine to write in the first person, avoid overusing the word "I." Try to vary the composition of sentences.

- Make It Targeted: You have lots of skills and interests and work experience. What you want to emphasize in one position is not necessarily what you want to highlight in another. If you are qualified as both a writer and an editor, choose which talent to call out in your personal statement—and make it the one that's most relevant to the job you want.

Here are some examples of personal statements to use as inspiration:

- I'm a seasoned accountant with CPA and CMA certification and more than 10 years of experience working in large firms. Oversaw audits and a department of ten. My positive attitude and detail-oriented spirit help ensure that month-end financial wrap-ups go smoothly and without any inaccuracies or fire drills. Looking for a leadership role in my next position.

- Recent college graduate with freelance writing experience at major print magazines as well as online outlets and the college newspaper. A strong writer who always meets deadlines, and matches the company tone and voice. In search of a staff writer position and eager to learn the magazine trade from the ground up.

- I'm an award-winning designer in children's clothes looking to make the transition to adult athletic year. At Company X, I developed a new line for toddlers and traveled to Asia to oversee production. I'm a fast learner and am eager for a new challenge in the growing field of athleisure.

CV personal statement examples

If you want to secure job interview, you need a strong personal statement at the top of your CV.

Your CV personal statement is a short paragraph which sits at the very top of your CV – and it’s aim is to summarise the benefits of hiring you and encourage employers to read your CV in full.

In this guide I have included 17 CV personal statement examples from a range of professions and experience levels, plus a detailed guide of how to write your own personal statement that will get you noticed by employers

CV templates

17 CV personal statement examples

To start this guide, I have included 10 examples of good personal statements, to give you an idea of how a personal statement should look , and what should be included.

Note: personal statements are generally used by junior candidates – if you are experienced, check out our CV profile examples instead.

Graduate CV personal statement (no experience)

Although this graduate has no paid work experience, they compensate for it by showcasing all of the skills and knowledge the have gained during their studies, and demonstrating how they apply their knowledge in academic and personal projects.

When you have little or no experience, it’s important to draw out transferable workplace skills from your studies and extracurricular work, to showcase them to employers.

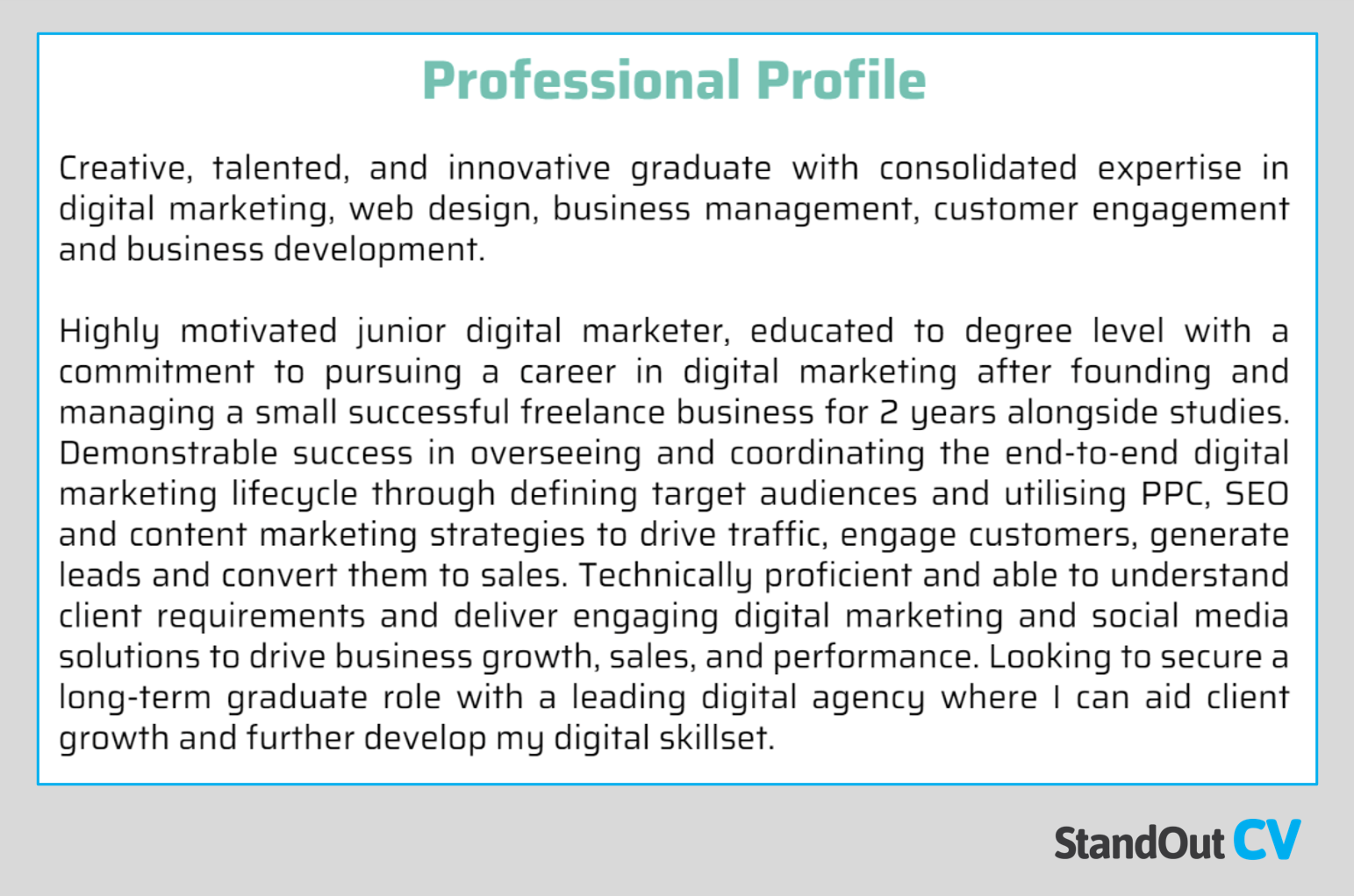

Graduate CV personal statement (part time freelance experience)

This candidate has graduated with a degree in biochemistry but actually wants to start a career in digital marketing after providing some digital freelance services to fund their studies.

In this case, they haven’t made much mention of their studies because they aren’t relevant to the digital marketing agencies they are applying to. Instead they have focused their personal statement around their freelance work and passion for the digital field – although they still mention the fact they are degree educated to prove their academic success.

School leaver CV personal statement (no experience)

This candidate is 16 years old and has no work experience whatsoever, but they compensate for this by detailing their academic achievements that relate to the roles they are applying for (maths and literacy are important requirements in finance and accountancy roles).

They also add some info on their extracurricular activities and school work-placements, to strengthen this student CV further.

Top tips for writing a CV personal statement

- Thoroughly research the jobs and companies you are planning to apply for to identify the type of candidate they are looking for – try to reflect that in your personal statement

- Don’t be afraid to brag a little – include some of your most impressive achievements from education, work or personal life

- Focus on describing the benefits an employer will get from hiring you. Will you help them to get more customers? Improve their workplace? Save them time and money?

- If you have no work experience, demonstrate transferable workplace skills from your education, projects, or even hobbies

School leaver CV personal statement (part time experience)

Although this person has only just left school, they have also undertaken some part-time work in a call centre alongside their studies.

To make the most of this experience, they have combined their academic achievements with their workplace exposure in this personal statement.

By highlighting their GCSE results, summer programme involvement, work experience and expressing their ambitions to progress within sales, this candidate really makes an appealing case for hiring them.

College leaver CV personal statement (no experience)

This candidate has left college with good grades, but does not yet have any work experience.

To compensate for the lack of workplace exposure, they have made their A level results prominent and highlighted skills and experience which would benefit the employers they are targeting.

Any recruiter reading this profile can quickly understand that this candidate has great academic achievements, a passion for IT and finance and the ability to transfer their skills into an office environment.

College student CV personal statement (freelance experience)

As this student has picked up a small amount of freelance writing work during their studies, they have made sure to brag about it in their personal statement.

They give details on their relevant A level studies to show the skills they are learning, and boost this further by highlighting the fact that they have been applying these skills in a real-life work setting by providing freelance services.

They also include key action verbs that recruiters will be looking for , such as creative writing, working to deadlines, and producing copy.

Academic CV personal statement

Aside from junior candidates, the only other people who might use a personal statement, are academic professionals; as their CV’s tend to be more longer and detailed than other professions.

This candidate provides a high level overview of their field of study, length of experience, and the roles they have held within universities.

School leaver CV personal statement with and sports experience

Although this person has no work experience, they are still able to show employers the value of hiring them by selling their other achievements and explaining how they could benefit an organisation.

They expand on their sports club involvement to demonstrate their teamwork, leadership skills, communication and motivation, which are all important traits in the workplace, and will be looked upon favourably by recruiters and hiring managers.

They also draw upon their future plans to study business studies and take a part time job, to further prove their ambition and dedication.

History graduate CV personal statement

This history graduate proves their aptitude for both academic achievement and workplace aptitude by showcasing valuable skills from their degree and voluntary work.

They do this by breaking down the key requirements for each and showing how their skills could be beneficial for future employers, such as listening, communication, and crisis management.

They also describe how their ability to balance studies alongside voluntary work has not only boosted their knowledge and skills, but also given excellent time management and organisational skills – which are vital assets to any employer.

Law graduate CV personal statement

This legal graduate makes the most from their work university work placements by using it to bulk out the contents of their CV personal statement.

They include their degree to show they have the necessary qualifications for legal roles, which is crucial, but more importantly, they showcase how they applied their legal skills within a real-life work setting.

They give a brief overview of the types of legal professionals they have been working alongside and the type of work they have been carrying out – this is all it takes to get the attention of recruiters and show employers they have what it takes to fulfil roles in the legal sector.

Medical student CV personal statement

This medical student proves their fit for the role by showcasing the key skills they have gained from their studies and their work experience placements.

In just these few sentences, they are able to highlight the vast amount of experience they have across different disciplines in the industry, something which is particularly important in the medical sector.

As they have not graduated yet and are still studying, they have provided proof of their most recent grades. This can give the recruiter some indication as to the type of grade they could be graduating with in the near future.

Masters student CV personal statement

This masters student has started by specifying their area of study, in this case, accounting, and given details about the specific areas of finance they are most interested in. This can hint towards their career goals and passions.

They have then carefully listed some of the key areas of accounting and finance that they are proficient in. For example, business finance, advanced corporate finance and statistics.

They have also outlined some of the transferable skills needed for accounting roles that employers will be looking out for, such as communication, attention to detail and analytical skills.

Finance student CV personal statement

As this finance student has recently undertaken some relevant work experience, they’ve made sure to shout about this in their personal profile.

But more than this, they have included a list of some of the important finance skills they gained as a result of this work experience – for example, financial reporting, processing invoices and month-end reconciliations.

Plus, through power words and phrases such as ‘prevent loss’ and ‘ improve upon accuracy and efficiency’, they have also showcased how they can apply these skills in a workplace setting to benefit the potential employer.

Internship CV personal statement

This digital marketing professional has started their personal profile by outlining their most relevant qualifications and work experience, most notably their freelance role as a content manager.

They have also provided examples of some of the key marketing skills that potential employers might be looking for, including very detailed examples of the platforms and tools they are proficient in – for example, LinkedIn, Twitter and Pinterest.

They have then closed their statement by giving a detailed description of the type of role or opportunity they are looking for. In this case, an in-house position in a marketing company.

Graduate career changer personal statement

Switching careers as a graduate can be tough. Especially when it comes to writing a personal statement that will attract employers in your new chosen field.

This candidate is looking to move from history teaching into journalism, so they have created a statement which briefly mentions their current workplace, but mainly focuses on highlighting transferable skills which are relevant to journalism. They achieve this by discussing the writing skills they use in their current role, and mentioning their hobby of writing – including some publications they have been featured in for extra brownie points.

Business management graduate personal statement

This business management proves their ability to work within a junior business management position by swiftly highlighting their impressive degree (to ensure it is not missed) and summarising some of the real-life experience they have gained in management during their university placements and volunteering. They do not let their lack of paid work experience, stop them demonstrating their valuable skills.

PhD graduate

PhD graduate roles attract a lot of competition, so it’s important that your CV contains a personal statement that will quickly impress and attract recruiters.

This candidate provides a short-but-comprehensive overview of their academic achievements, whilst demonstrating their exceptional level of knowledge in research, languages and publication writing.

By highlighting a number of skills and abilities that are in high-demand in the academic workplace, this CV is very likely to get noticed and land interviews.

How to write a personal statement for your CV

Now that you’ve seen what a personal statement should look like and the type of content it should contain, follow this detailed guide to one for your own CV – and start racking those interviews up.

Guide contents

What is a CV personal statement?

Cv personal statement or cv profile, personal statement format, what to include in a cv personal statement.

- Personal statement mistakes

How to write persuasively

A personal statement is a short paragraph at the top of your CV which gives employers an overview of your education, skills and experience

It’s purpose is to capture the attention of busy recruiters and hiring managers when your CV is first opened – encouraging them to read the rest of it.

You achieve this by writing a tailored summary of yourself that explains your suitability for the roles you are applying for at a very high level, and matches your target job descriptions .

One question candidates often ask me is , “what is the difference between a personal statement and a CV profile?”

To be honest, they are almost the same – they are both introductory paragraphs that sit at the top of your CV… but there are 2 main differences

A personal statement tends to be used more by junior candidates (graduates, school leavers etc.) and is relatively long and detailed.

A CV profile tends to be favoured by more experienced candidates , and is shorter in length than a personal statement.

Note: If you are an experienced candidate, you may want to switch over to my CV profile writing guide , or example CV profiles page.

To ensure you grab recruiters’ attention with your personal statement, lay it out in the following way.

Positioning

You need to ensure that your personal statement sits at the very top of your CV, and all of it should be totally visible to readers, without the need to scroll down the page.

Do this by reducing the top page margin and minimising the space taken up by your contact details.

This will ensure that your whole personal statement can be seen, as soon as your CV is opened.

We have a Word CV template which can help you to get this right.

Size/length

Your personal statement needs to contain enough detail to provide an introduction to your skills and knowledge, but not so much detail that it bores readers.

To strike the right balance, anything between 8-15 lines of text is perfect – and sentences should be sharp and to-the-point.

As with the whole of your CV or resume , your personal statement should be written in a simple clean font at around size 10-12 to ensure that it can be read easily by all recruiters and employers.

Keep the text colour simple , ensuring that it contrasts the background (black on white is best) and break it into 2 or even 3 paragraphs for a pleasant reading experience.

It should also be written in a punchy persuasive tone, to help you sell yourself and increase your chances of landing interviews , I cover how to do this in detail further down the guide.

Quick tip: A poorly written CV will fail to impress recruiters and employers. Use our quick-and-easy CV Builder to create a winning CV in minutes with professional CV templates and pre-written content for every industry.

Once you have the style and format of your personal statement perfected, you need to fill it with compelling content that tells recruiters that your CV is worth reading.

Here’s what needs to go into your personal statement…

Before you start writing your personal statement, it’s crucial that you research your target roles to find out exactly what your new potential employers are looking for in a candidate.

Run a search for your target jobs on one of the major job websites , look through plenty of adverts and make a list of the candidate requirements that frequently appear.

This research will show you exactly what to include in your personal statement in order to impress the recruiters who will be reading it.

Education and qualifications are an important aspect of your personal statement, especially if you are a junior candidate.

You should highlight your highest and most relevant qualifications, whether that is a degree, A levels or GCSEs. You could potentially go into some more detail around modules, papers etc. if they are relevant to the roles you are applying for.

It’s important that you discuss the experience you have gained in your personal statement, to give readers an idea of the work you are comfortable undertaking.

This can of course be direct employed work experience, but it doesn’t have to be.

You can also include:

- School/college Uni work placements

- Voluntary work

- Personal projects

- Hobbies/interests

As with all aspects of your CV , the content should be tailored to match the requirements of your target roles.

Whilst discussing your experience, you should touch upon skills used, industries worked in, types of companies worked for, and people you have worked with.

Where possible, try to show the impact your actions have made. E.g . A customer service agent helps to make sales for their employer.

Any industry-specific knowledge you have that will be useful to your new potential employers should be made prominent within your personal statement.

For example

- Knowledge of financial regulations will be important for accountancy roles

- Knowledge of IT operating systems will be important for IT roles

- Knowledge of the national curriculum will be important for teachers

You should also include some information about the types of roles you are applying for, and why you are doing so. Try to show your interest and passion for the field you are hoping to enter, because employers want to hire people who have genuine motivation and drive in their work.

This is especially true if you don’t have much work experience, as you need something else to compensate for it.

CV personal statement mistakes

The things that you omit from your personal statement can be just as important as the things you include.

Try to keep the following out of your personal statement..

Irrelevant info

Any information that doesn’t fall into the requirements of your target roles can be cut out of your personal statement. For example, if you were a professional athlete 6 years ago, that’s great – but it won’t be relevant if you’re applying to advertising internships, so leave it out.

Generic clichés

If you are describing yourself as a “ dynamic team player with high levels of motivation and enthusiasm” you aren’t doing yourself any favours.

These cliché terms are vastly overused and don’t provide readers with any factual details about you – so keep them to a minimum.

Stick to solid facts like education, skills , experience, achievements and knowledge.

If you really want to ensure that your personal statement makes a big impact, you need to write in a persuasive manner.

So, how do you so this?

Well, you need to brag a little – but not too much

It’s about selling yourself and appearing confident, without overstepping the mark and appearing arrogant.

For example, instead of writing.

“Marketing graduate with an interest in entering the digital field”

Be creative and excite the reader by livening the sentence up like this,

“Marketing graduate with highest exam results in class and a passion for embarking on a long and successful career within digital”

The second sentence is a much more interesting, makes the candidate appear more confident, throws in some achievements, and shows off a wider range of writing skills.

Quick tip: A poorly written CV will fail to impress recruiters and employers. Use our quick-and-easy CV Builder to create a winning CV in minutes with professional templates and pre-written content for every industry.

Your own personal statement will be totally unique to yourself, but by using the above guidelines you will be able to create one which shows recruiters everything they need.

Remember to keep the length between 10-20 lines and only include the most relevant information for your target roles.

You can also check our school leaver CV example , our best CV templates , or our library of example CVs from all industries.

Good luck with the job hunt!

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Personal Banker Resume Examples

Your resume is your first impression to a potential employer. If you want to stand out from the crowd, you need to make sure that your resume stands out. A personal banker is a professional who is responsible for managing the money and finances of individuals, businesses, and organizations. As a personal banker, you must be able to effectively communicate with clients, understand financial products and services, and process and analyze financial data. You must also have a solid understanding of banking regulations and procedures. Writing a resume for a personal banker position requires a combination of technical skills, financial industry knowledge, and customer service. This guide provides tips and examples on how to create a standout personal banker resume that will help you get noticed.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Personal Banker

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

Experienced Personal Banker with 8 years of experience in providing excellent customer service. Expert in handling customer queries and providing appropriate solutions. Possess excellent communication and interpersonal skills. Adept at building positive relationships with customers and co- workers.

Core Skills :

- Financial Analysis

- Banking Operations

- Customer Service

- Risk Management

- Account Management

- Loan Processing

- Documentation

- Problem- Solving

Professional Experience : Personal Banker, Bank of America, Los Angeles, CA May 2014 – Present

- Provide clients with accurate information and educated them on current bank products.

- Perform daily operations of the banking activities such as deposits, withdrawals and transfers.

- Assist customers in opening various accounts including savings, checking, and certificate of deposits.

- Verify customer identity and ensure all documents are compliant with anti- money laundering laws.

- Respond to customer inquiries and resolve customer issues.

- Generate reports related to banking activities and update customer records.

Personal Banker, Chase Bank, Los Angeles, CA July 2012 – April 2014

- Responded to customer inquiries, assisted in opening accounts and provided information on banking products.

- Managed customer accounts and ensured accuracy in transactions.

- Maintained customer records and updated banking system.

- Provided customer service support in responding to customer complaints and queries.

- Assisted customers in processing loan applications and loan documents.

Education : Bachelor of Science in Finance, University of California, Los Angeles, CA Graduated in June 2012

Create My Resume

Build a professional resume in just minutes for free.

Personal Banker Resume Examples Resume with No Experience

Recent college graduate looking to join the banking industry as a Personal Banker. I am a highly motivated and hardworking individual with excellent customer service and communication skills. With a passion for finance and banking and a commitment to help others, I am confident that I will make a valuable addition to any team.

- Strong verbal and written communication skills

- Strong interpersonal and customer service skills

- Organizational and time management skills

- Proficient in Microsoft Office Suite

- Knowledge of banking regulations

- Analytical and problem- solving skills

Responsibilities :

- Provide excellent customer service

- Identify customer needs and provide tailored solutions

- Maintain customer records and accounts

- Process banking transactions including deposits and withdrawals

- Assist customers with loan and credit card applications

- Answer customer questions and resolve issues

- Cross- sell bank products and services

- Manage customer relationships and promote customer loyalty

Experience 0 Years

Level Junior

Education Bachelor’s

Personal Banker Resume Examples Resume with 2 Years of Experience

Highly motivated and organized Personal Banker with over two years of experience in the banking sector. Proven ability to foster strong client relationships and provide excellent customer service. Experienced in cash handling, loan processing and handling financial transactions. Knowledge of banking policies and procedures, as well as a strong understanding of financial products and services.

- Cash Handling

- Banking Policies

- Financial Transactions

- Financial Product Knowledge

- Assisted customers in opening and closing accounts while ensuring compliance with banking regulations.

- Processed and monitored customer transactions, providing good customer service.

- Advocated for customers in resolving disputes and negotiated solutions.

- Monitored customer accounts and provided timely payments to creditors.

- Worked with customers to open lines of credit and close loans.

- Provided product and service advice to customers, tailored to their needs.

- Identified customer needs and provided appropriate banking solutions.