Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

- Help & FAQ

Qualitative research in finance

Research output : Contribution to journal › Article › peer-review

This paper provides an overview of qualitative research to encourage finance researchers to apply a more diverse approach to current research practices. Social science researchers recognize that research questions should determine what research paradigm is best for each study. Imagine the benefits to finance if we expand our empirical sources of data to include what people have to say, which then allows us to explore the complex reasoning behind these conversations. It is the intent of this paper to enhance our current research practices in finance through the use of qualitative methods and to view this approach as an invaluable supplement or prelude to existing practices.

- qualitative research

Access to Document

- 10.1177/0312896212469611

Other files and links

- Link to publication in Scopus

Fingerprint

- Qualitative Research Business & Economics 100%

- Finance Business & Economics 81%

- Research Paradigms Business & Economics 37%

- Qualitative Methods Business & Economics 36%

- Social Sciences Business & Economics 22%

T1 - Qualitative research in finance

AU - Kaczynski, Dan

AU - Salmona, Michelle

AU - Smith, Tom

PY - 2014/2

Y1 - 2014/2

N2 - This paper provides an overview of qualitative research to encourage finance researchers to apply a more diverse approach to current research practices. Social science researchers recognize that research questions should determine what research paradigm is best for each study. Imagine the benefits to finance if we expand our empirical sources of data to include what people have to say, which then allows us to explore the complex reasoning behind these conversations. It is the intent of this paper to enhance our current research practices in finance through the use of qualitative methods and to view this approach as an invaluable supplement or prelude to existing practices.

AB - This paper provides an overview of qualitative research to encourage finance researchers to apply a more diverse approach to current research practices. Social science researchers recognize that research questions should determine what research paradigm is best for each study. Imagine the benefits to finance if we expand our empirical sources of data to include what people have to say, which then allows us to explore the complex reasoning behind these conversations. It is the intent of this paper to enhance our current research practices in finance through the use of qualitative methods and to view this approach as an invaluable supplement or prelude to existing practices.

KW - finance

KW - qualitative research

UR - http://www.scopus.com/inward/record.url?scp=84893691329&partnerID=8YFLogxK

U2 - 10.1177/0312896212469611

DO - 10.1177/0312896212469611

M3 - Article

AN - SCOPUS:84893691329

SN - 0312-8962

JO - Australian Journal of Management

JF - Australian Journal of Management

Qualitative Research in Financial Markets

Asian Review of Accounting

ISSN : 1321-7348

Article publication date: 18 May 2010

(2010), "Qualitative Research in Financial Markets", Asian Review of Accounting , Vol. 18 No. 1. https://doi.org/10.1108/ara.2010.34118aaa.002

Emerald Group Publishing Limited

Copyright © 2010, Emerald Group Publishing Limited

Article Type: Conference announcement and Call for papers From: Asian Review of Accounting, Volume 18, Issue 1

Behavioural Perspectives on the Financial CrisisBehavioural Finance Working Group,Cass Business School, City University, London, 10-11 DecemberConference organisers: William Forbes, Paul Hamalainen, and Gulnur MuradogluKeynote speaker: Werner De Bondt, De Paul University, Chicago, USA

The unfolding financial crisis issues a dramatic challenge to the current practice of banking, insurance and investment management professionals and those who regulate them. The intensity of the crisis raises problems regarding the adequacy of prevailing orthodoxy regarding how markets operate and how their excesses might be controlled. Behavioural approaches to finance as an emergent complement to and critique of standard finance theory should have much to say about both the causes and the potential remedies for ``the state we are in''. This inaugural meeting of the Behavioural Workshop will seek contributions from areas which include, while not being limited to, the following issues:

The construction of mental frames and heuristics to guide risk management of structured finance products, securitised debt and other instruments.

The role of individual investors in the crisis, especially those obtaining "sub-prime'' mortgages.

The psychology and reactions of investors (professional and retail) to the engulfing crisis.

The way forward and behavioural perspectives on rebuilding a robust financial system.

Attempts to improve financial markets by enhancing "financial democracy'' through trading platforms for the most commonly feared risks, losing one's job or home, etc.

Reflecting behavioural perspectives in financial regulation and corporate governance reforms.

Professional investors, transparency and behavioural assumptions underlying market discipline.

The deadline for paper submissions is 18 September 2009 . The organisers will come back with a decision within three weeks after the deadline. To submit a paper for consideration please e-mail a PDF version of the paper to: [email protected]

Papers chosen for submission will be considered for publication for a special issue of Qualitative Research in Financial Markets .

There will be a separate PhD session to encourage the work of PhD students on Behavioural Finance. PhD students with full or near full papers are encouraged to apply.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Thesis Topics for Financial Management: A Comprehensive Guide

Welcome to the ultimate guide to thesis topics for financial management. Whether you’re a finance student seeking inspiration or a researcher delving into unexplored financial territories, this article will provide a comprehensive roadmap to help you navigate the complexities of financial management and identify captivating thesis topics that will leave a lasting impact.

Key Takeaways:

Financial management thesis topics can explore areas such as capital management, investment choices, employee salary plans, stock market intermediaries, and the impact of fintech.

Examine the relationship between valuation and financial decisions in strategic financial management.

Investigate financial management practices in government budgeting and healthcare organizations.

Explore personal financial management, financial literacy, and financial management challenges in project costs and finance.

Analyze principles for managing financial operation exposure.

Additional resources for finance thesis topic ideas can be found at 1233 Finance Dissertation Topics: Useful List To Inspire You and Finance Dissertation Topic Ideas .

Table of Contents

Thesis Topics for Financial Management

Navigating the dynamic and ever-evolving field of financial management requires a thorough understanding of its principles and practices. For those pursuing advanced degrees in finance, selecting a compelling and impactful thesis topic is crucial. This guide provides financial management students with a comprehensive roadmap for identifying, researching, and developing effective thesis topics that align with their academic and career aspirations.

Choosing a Thesis Topic

Identify Your Interests: Begin by reflecting on your academic pursuits, professional goals, and personal interests. Consider areas of financial management that pique your curiosity and align with your long-term objectives.

Conduct Preliminary Research: Explore various aspects of financial management through scholarly articles, textbooks, and industry reports. Identify emerging trends, unanswered questions, and gaps in the existing literature.

Consider Your Resources: Assess the availability of data, literature, and expert guidance related to your potential thesis topics. Ensure that you have the necessary resources to conduct a comprehensive and meaningful research project.

Consult with Faculty: Engage with professors, academic advisors, and industry professionals to gather insights and feedback on potential thesis topics. Their expertise can help you refine your ideas and ensure their relevance and feasibility.

Developing Your Thesis Topic

Narrow Your Focus: Once you have a general topic area, narrow it down to a specific and manageable research question. Your thesis topic should be specific enough to allow for in-depth analysis while remaining broad enough to provide meaningful insights.

Conduct a Literature Review: Review existing literature related to your thesis topic to identify knowledge gaps, inconsistencies, or unexplored perspectives. This will help you position your research within the broader academic context.

Formulate a Research Hypothesis: Develop a clear and testable hypothesis that outlines the relationship between the variables you intend to investigate. Your hypothesis should be specific, measurable, and falsifiable.

Design Your Research Methodology: Choose appropriate research methods and techniques to gather and analyze data. Consider quantitative methods (e.g., surveys, experiments), qualitative methods (e.g., interviews, case studies), or a combination of both.

Writing Your Thesis

Organize Your Content: Outline the structure of your thesis, including an introduction, literature review, methodology, results, discussion, and conclusion. Each section should flow logically from the previous one.

Present Your Findings: Clearly and concisely present your research findings, using tables, graphs, and other visual aids to enhance clarity and comprehension.

Analyze and Interpret Your Results: Discuss the implications of your findings and their relevance to the existing body of knowledge. Identify limitations and suggest areas for future research.

Draw Conclusions: Summarize your key findings and their significance. Provide a clear answer to your research question and highlight the contributions of your research to the field of financial management.

By following these steps and adhering to the principles of academic rigor and intellectual curiosity, you can develop a compelling and impactful thesis topic for financial management . Your research will not only contribute to the advancement of knowledge but also provide valuable insights for practitioners and policymakers, ultimately shaping the future of financial management.

For those working on their financial management thesis, explore our comprehensive list of thesis topics in financial management that will inspire your research and help you excel in your academic endeavors.

MBA students, looking for your next thesis topic? Check out our diverse selection of thesis topics for MBA students to find one that resonates with your interests and aspirations.

Conduct a thorough analysis of the financial landscape in Nepal with our thesis topics for finance in Nepal , providing insightful perspectives on this dynamic sector.

Delve into the dynamic world of finance with our thesis topics for finance , offering a wide range of subjects that will ignite your passion for this ever-evolving field.

Data Collection and Analysis: Methods and Approaches for Financial Management Research

Picture this: you’re standing before a financial puzzle. Data points are the pieces, and your goal is to assemble them into a meaningful picture. How do you proceed? It’s all about choosing the right methods for data collection and analysis —the foundation of any solid financial management research.

- Qualitative research: Uncover deeper insights by exploring non-numerical data and subjective experiences.

- Data collection methods: Interviews, focus groups, ethnography, document analysis, and observation are commonly used.

- Data analysis: Delve into thematic analysis, grounded theory, phenomenology, and discourse analysis for meaningful interpretation.

- Quantitative research: Harness the power of numerical data to test hypotheses and uncover trends.

- Data collection methods: Surveys, experiments, content analysis, and econometrics are popular choices.

- Data analysis: Statistical techniques, regression analysis, and modeling bring clarity to numerical data.

- Mixed methods: Blend qualitative and quantitative approaches for a comprehensive understanding.

- Data integration: Combine diverse data sources to paint a complete picture.

- Ethical considerations: Ensure research integrity, participant confidentiality, and data security.

- Data visualization: Transform complex data into digestible visuals and graphics.

Qualitative Research: Unveiling Subjective Perspectives

Qualitative research delves into non-numerical data , offering a rich understanding of subjective experiences , beliefs, and attitudes that shape financial behavior. Researchers use this method to explore topics like consumer preferences, market trends, and corporate decision-making.

Common Data Collection Methods:

- Interviews: Engage in one-on-one conversations to gather detailed insights and personal narratives.

- Focus Groups: Facilitate group discussions to generate a collective understanding of shared perspectives.

- Ethnography: Immerse yourself in a specific setting to observe and understand financial practices and behaviors.

- Document Analysis: Scrutinize financial documents, reports, and other written sources for valuable information.

- Observation: Directly observe financial activities and interactions to gather real-time data.

Data Analysis Techniques:

- Thematic Analysis: Identify and extract recurring themes and patterns from the collected data.

- Grounded Theory: Develop theories based on the data itself, rather than applying pre-existing frameworks.

- Phenomenology: Aim to understand the subjective experiences and perspectives of individuals related to financial phenomena.

- Discourse Analysis: Examine how language is used to construct and communicate financial meanings and practices.

Quantitative Research: Unraveling Numerical Patterns

Quantitative research investigates numerical data to test hypotheses , uncover trends, and establish relationships between variables. This method is often used to assess financial performance, analyze market data, and evaluate investment strategies.

- Surveys: Gather data from a large sample of respondents using standardized questionnaires.

- Experiments: Conduct controlled experiments to test the effects of specific variables on financial outcomes.

- Content Analysis: Analyze written or visual material to extract quantitative information.

- Econometrics: Apply statistical and mathematical models to financial data to identify patterns and relationships.

- Statistical Techniques: Employ statistical methods like correlation, regression, and analysis of variance to uncover patterns and relationships.

- Regression Analysis: Investigate the relationship between a dependent variable and one or more independent variables.

- Modeling: Develop mathematical or computer models to simulate financial systems and forecast outcomes.

Mixed Methods: Blending Qualitative and Quantitative Insights

Mixed methods research combines qualitative and quantitative approaches to gain a comprehensive understanding of a research topic. This approach allows researchers to explore both the subjective experiences and numerical patterns related to financial phenomena.

Key Benefits:

- Triangulation: Mixed methods provide multiple perspectives, enhancing the validity and reliability of research findings.

- Complementary Insights: Qualitative data can help interpret and explain quantitative findings, leading to a deeper understanding.

- Holistic View: Mixed methods offer a comprehensive understanding of complex financial issues.

Data Integration: Unifying Diverse Data Sources

Data integration involves combining data from multiple sources to create a comprehensive dataset. This process enhances the richness and depth of the analysis, allowing researchers to draw more informed conclusions.

Common Data Integration Techniques:

- Data Warehousing: Store data from various sources in a central repository for easy access and analysis.

- Data Mining: Extract valuable information and patterns from large datasets using statistical and machine learning techniques.

- Data Fusion: Combine data from different sources to create a more comprehensive and accurate representation of reality.

Ethical Considerations: Upholding Research Integrity

Ethical considerations are paramount in financial management research. Researchers must ensure the integrity of their research , confidentiality of participants , and security of data . This includes obtaining informed consent, protecting privacy, and adhering to institutional review board guidelines.

Data Visualization: Transforming Data into Insights

Data visualization transforms complex data into digestible visuals and graphics . This makes it easier for researchers and decision-makers to understand patterns, trends , and relationships in the data . Common data visualization techniques include charts, graphs, heat maps, and infographics.

- Qualitative and Quantitative Methods, Data Collection and Analysis

- Mixed Methods: A Guidebook for Researchers

Thesis Structure and Organization: Crafting a Coherent and Cohesive Thesis

Navigating the labyrinth of academic research can be daunting, especially when it comes to crafting a thesis that stands out. In the realm of financial management, a well-structured and organized thesis is the cornerstone of a successful research endeavor.

- Logical Flow: A thesis should have a clear structure that flows logically from one chapter to the next, guiding the reader through your research journey.

- Introduction: Begin by establishing the context and significance of your research topic, culminating in a concise thesis statement that encapsulates your central argument.

- Body Chapters: Dedicate separate chapters to distinct aspects of your research, ensuring each chapter delves deeper into a specific facet of your thesis statement.

- Conclusion: Summarize the key findings of your research, reinforcing the significance of your work and its implications for the field of financial management.

In the realm of financial management, meticulous Thesis Structure and Organization: Crafting a Coherent and Cohesive Thesis is quintessential for a compelling thesis. By adhering to these fundamental principles, you’ll elevate your research to new heights, crafting a thesis that resonates with readers and leaves a lasting impact on the field.

- Structuring Your Thesis

- Thesis Statements – The Writing Center

Writing and Presentation: Communicating Your Research Findings Effectively

In the realm of financial management, crafting a captivating thesis requires meticulous attention to detail, a keen eye for relevant topics, and the ability to effectively convey your findings to a diverse audience. The research journey is akin to embarking on an intellectual expedition, where you’ll navigate the financial landscape, uncover hidden gems of knowledge, and weave together a compelling narrative that captivates your readers.

- Embark on an intellectual journey to select captivating thesis topics in financial management.

- Delve into quantitative and qualitative research methods to uncover hidden gems of knowledge.

- Craft a compelling thesis narrative that resonates with your audience.

- Master the art of presenting your findings with clarity, confidence, and visual appeal.

- Engage your audience through active participation and thought-provoking discussions.

As you embark on this academic odyssey, let’s explore some strategies for selecting compelling thesis topics in financial management:

Embrace a Broader Perspective: Expand your horizons beyond traditional finance topics. Consider emerging trends, societal issues, and interdisciplinary approaches that intertwine finance with other fields, such as technology, sustainability, and behavioral economics.

Seek Inspiration from Real-World Challenges: Dive into the complexities of the financial world and identify pressing problems or opportunities that demand exploration. Examine financial crises, market anomalies, or corporate scandals, and investigate how financial management practices can mitigate risks and enhance performance.

Tap into Your Passions: Reflect on your personal interests and expertise in financial management. Choose a topic that ignites your intellectual curiosity and allows you to delve deeply into an area that truly fascinates you. Your passion for the subject matter will shine through in your research and captivate your audience.

Conduct Preliminary Research: Before committing to a specific topic, conduct preliminary research to assess its feasibility and relevance. Explore existing literature, consult with faculty advisors, and gather data to determine if your chosen topic offers sufficient depth and breadth for a comprehensive thesis.

Refine Your Topic: Once you’ve selected a promising topic, narrow it down to a specific and manageable scope. A well-defined thesis statement should clearly articulate your research question, objectives, and expected contributions to the field of financial management.

With your thesis topic meticulously chosen, it’s time to delve into the intricacies of quantitative and qualitative research methods, each offering unique tools to uncover the hidden gems of knowledge:

Quantitative Research: Harness the power of data and statistical analysis to uncover patterns, trends, and relationships within financial data. Leverage statistical software, econometric models, and forecasting techniques to extract meaningful insights and test hypotheses.

Qualitative Research: Explore the subjective dimensions of financial phenomena by conducting interviews, focus groups, and case studies. Delve into the perceptions, experiences, and behaviors of individuals and organizations to gain a deeper understanding of complex financial issues.

As you embark on your research journey, remember that the art of presenting your findings is just as crucial as the research itself. Master the skill of crafting a compelling thesis narrative, one that captivates your audience and leaves a lasting impression:

Organize Your Content: Structure your thesis logically and coherently. Introduce your topic, present your research findings, discuss their implications, and conclude with a concise summary. Each section should flow seamlessly into the next, building a cohesive narrative.

Clarity and Conciseness: Strive for clarity and conciseness in your writing. Avoid jargon and technical terms that may alienate your audience. Use simple language that effectively conveys your ideas. Eliminate unnecessary words and phrases to ensure your message is clear and compelling.

Visual Appeal: Incorporate visual aids, such as graphs, charts, and images, to enhance the impact of your findings. Visuals can simplify complex data, illustrate trends, and make your presentation more engaging and memorable.

Engage Your Audience: Encourage active participation and thought-provoking discussions. Pose questions, seek feedback, and invite your audience to share their perspectives. Create an interactive experience that stimulates critical thinking and fosters a deeper understanding of your research.

Remember, the success of your thesis presentation lies not only in the content itself but also in your ability to deliver it with confidence, clarity, and passion. Captivate your audience with your enthusiasm for the subject matter and your genuine desire to share your knowledge and insights.

As you embark on this academic odyssey, embrace the challenges and revel in the discoveries that await you. Your thesis is not merely an academic exercise; it’s an opportunity to make a meaningful contribution to the field of financial management and leave your mark on the world of finance.

Most Relevant URL Sources:

- Communicating Research Findings

- Writing and Presenting Research Findings

Q1: What is the goal of financial management thesis topics?

A1: Financial management thesis topics aim to explore and analyze various aspects of financial management practices, theories, and challenges in different contexts. The goal is to contribute to the body of knowledge in financial management and provide insights for decision-makers in businesses, organizations, and governments.

Q2: What are some common thesis topics in financial management?

A2: Common thesis topics in financial management include capital management and investment decisions, employee salary plans and tax strategies, the role of intermediaries in stock markets, comparative studies of traditional finance methods and the influence of Fintech, and the link between valuation and financial decisions.

Q3: What are the different types of data collection methods commonly used in thesis research in financial management?

A3: Thesis research in financial management often employs qualitative research methods to gather data. These methods include interviews, focus groups, ethnography, document analysis, and observation. These methods allow researchers to collect rich and detailed information about the subjective experiences, attitudes, and beliefs of individuals and groups related to financial phenomena.

Q4: How can thesis research in financial management contribute to the field?

A4: Thesis research in financial management can contribute to the field by providing deeper insights into financial phenomena, exploring new areas of inquiry, and generating novel theoretical and practical implications. The findings from thesis research can inform decision-making, improve financial practices, and address real-world challenges faced by businesses, organizations, and policymakers.

Q5: What are some important considerations for organizing and structuring a thesis in financial management?

A5: Organizing and structuring a thesis in financial management requires careful attention to the reader’s expectations, discipline requirements, and logical flow. A clear structure typically includes an introduction, body chapters, and a conclusion. The introduction provides background information and context, while the body chapters present the research findings in a logical order, addressing different aspects of the research question. The conclusion summarizes the main findings and restates the thesis statement.

Related Posts:

- The Future of Fintech Login: Secure & User-Friendly…

- Understanding VP Finance Salary: Insights from an…

- Student Loan Repayment and Salary Sacrifice:…

- Is Taking a Student Loan Halal in Islamic Finance:…

- MBA Finance Project Topics for the Future: Exploring…

- Strategies for Tackling Student Loan Repayment on a…

Recent Posts

Low-Risk, Low-Cost Investment Options for Beginners: A Guide to Smart Investing

Low-Cost Index Funds for Beginners: A Comprehensive Guide to Smart Investing

Cheap Ways to Start Investing Small Amounts: A Beginner’s Guide to Financial Empowerment

Best Investment Options with Little Risk for Beginners

Ways to Save on Medical Expenses

Techniques for Reducing Healthcare Costs: A Comprehensive Guide

Saving Money on Healthcare Costs: Strategies for Consumers and Businesses

Healthcare Savings Strategies for Financial Well-being

Long-Term Investment Strategy for Young Investors: A Guide to Financial Success

Investment Strategies for Millennials: A Comprehensive Guide to Financial Success

Privacy Policy

Fintech: A content analysis of the finance and information systems literature

- Research Paper

- Published: 03 April 2023

- Volume 33 , article number 2 , ( 2023 )

Cite this article

- Zack Jourdan 1 ,

- J. Ken. Corley 2 ,

- Randall Valentine 3 &

- Arthur M. Tran 3

6365 Accesses

8 Citations

3 Altmetric

Explore all metrics

The amount of research related to financial technologies (fintech) has grown rapidly since these modalities have been implemented. A review of this literature base will help identify the topics that have been explored and identify topics for further research. This research project collects, synthesizes, and analyzes both the research strategies (i.e., methodologies) and content (e.g., topics, focus, categories) of the literature, and then discusses an agenda for future research efforts. We searched for fintech research published in the last 20 years and analyzed 146 articles published in Finance and 70 articles published in Information Systems (IS) during this period in their respective A*, A, and B journals in the 2019 Australian Business Deans Council list. We found an increasing level of activity during the most recent 6-year period and a biased distribution of fintech articles focused on exploratory methodologies. We also found several research strategies that were either underrepresented or absent from the pool of fintech research and identified several subject areas that need further exploration. We also created four fintech topic categories to organize and classify this diverse research stream.

Similar content being viewed by others

A bibliographic overview of financial engineering in the emerging financial market

Jyoti Ranjan Jena, Saroj Kanta Biswal, … Rashmi Ranjan Panigrahi

Introduction

Innovation and Fintech

Avoid common mistakes on your manuscript.

With the continuous advancements in technology, the current interest in fintech in both academia and in practice is more prevalent than ever. Typically, a portmanteau for “financial technology”, fintech has been referenced for more than 40 years in more than 200 scholarly articles (Schueffel, 2016 ). Throughout the years, different definitions of fintech have been proposed for different contexts and across countries, while the origin of the term “fintech” remains to be a point of contention. Only until recently, Schueffel ( 2016 ) reconciles various existing definitions and defines fintech as “a new financial industry that applies technology to improve financial activities.” As a joint evolution of finance and technology, fintech encompasses cryptocurrencies, Internet banking, mobile payments, crowdfunding, peer-to-peer lending, Robo-Advisory, online identification, and many other important innovations (Lagna & Ravishankar, 2022 ). Nonetheless, fintech is still a relatively undiscovered academic field and expects its definition to continue to evolve. To date, no study has examined neither the methodologies employed nor the content thereof. The purpose of this study is to synthesize the methodologies and content of all fintech article from the past 20 year encompassing all journals on the Australian Business Deans list that have a rating of A*, A, and B. In doing so, we hope to find a synthesis of keywords and methodological advances that can be used in further exploration of fintech research.

Studies which systematically review the literature, such as Farooq and Jibran ( 2018 ), have been shown to be valuable contributions to understanding the scope, measurements, impact size, and determinants of a particular area to synthesize with the area’s future research agenda. In this paper, we performed a meta-analysis of research methods employed in the data stream of fintech research. In the literature stream, there has not been a comprehensive survey of the methodologies employed in fintech literature. In fact, there have been very few studies reviewing the methodologies employed in finance research in the past 15 years, with Kim and Ji ( 2015 ) and Adams et al. ( 2019 ) being the closest examples. Lagna and Ravishankar ( 2022 ) illustrated the growing interest that IS researchers have shown in the fintech research domain. Alt et al. ( 2018 ) called fintech a revolution that had evolved from offline, hierarchical, process-oriented organizations to digital, agile, customer-centric system and stated, “FinTech businesses are more IT companies than financial providers were before.”

The following sections of the paper will examine the current literature to determine what is known about the concept of fintech. The remainder of this paper is organized as follows: a description of the methodology for the analysis of the fintech research is presented. This is followed by the results. Finally, the research is summarized with a discussion of the limitations of this project and suggestions for future research.

- Literature review

One focus in the fintech literature is about how fintech companies provide new and improved financial services. As Thakor ( 1999 ) discusses, the development of information technology enables new financial firms to be highly specialized and provides products and services which are tailored to customer preferences. As new players in the financial market, fintech companies have the potential to reduce financial contracting frictions and increase consumer welfare (Philippon, 2015 ). For example, Fuster et al. ( 2019 ) find evidence that fintechs have improved the productivity of mortgage lending.

These additional values which fintechs may bring to the finance industry come from the fact that these firms are different from traditional financial institutions. Thakor ( 2020 ) discusses that fintech firms bare lower operating costs than traditional banks. For instance, Lending Club, a fintech firm, has operating costs as a percentage of outstanding loans at 2.70% compared to those of banks at almost 7%. According to Benoit et al. ( 2019 ), fintechs also have lower regulatory costs than banks. In the USA, even though peer-to-peer (P2P) lending is subject to the US Securities and Exchange Commission (SEC)’s regulation and state laws, these regulatory burdens are much lighter than that of banks.

Much of the recent fintech research is concerned with how fintechs impact traditional banks. Christensen ( 2016 ) provides the “disruptive theory” in which new entrants effectively compete with traditional players by providing accessible and cost-effective goods and services to customers. Boyd and De Nicolo ( 2005 ) posit that banks become more competitive by providing cheaper loans. In turn, borrowers have less incentive to risk shift which results in banks having less default risk. Similarly, Goetz ( 2018 ) finds that the increased competition forces banks to be more efficient by reducing over-lending and engaging in relationship lending. On the other hand, Bertsch et al. ( 2020 ) find that banks’ increased misconduct is related to the emergence of the US online lending market. Large banks can also choose to acquire fintech firms. For instance, in 2015, Capital One acquired Level Money to strengthen its capabilities in digital banking technologies (Li et al., 2017 ). Hornuf et al. ( 2021 ) find that many banks acknowledge the technical superiority of fintech start-ups and have incorporated these firms’ products and services into their own business models.

Thakor ( 2020 ) and other survey papers review the fintech literature’s research contents of what we currently know about fintech and the research directions that have been taken. On the other hand, this paper focuses on reviewing the research methodologies. Studies which systematically review the literature, such as Farooq and Jibran ( 2018 ), have been shown to be valuable contributions to understanding the scope, measurements, impact size, and determinants of a particular area in order to synthesize with the area’s future research agenda. There has not been a comprehensive survey of the methodologies employed in fintech literature. In fact, there have been very few studies reviewing the methodologies employed in finance research in the past 15 years, with Kim and Ji ( 2015 ) and Adams et al. ( 2019 ) being the closest examples.

For the purpose of reviewing the practice of significance testing, Kim and Ji ( 2015 ) survey recently published articles in four top-ranking finance journals. They find that finance researchers almost exclusively use the conventional significance levels (1%, 5%, and 10%) while paying little attention to the sample size, power of the test, and expected losses. The authors also suggest using more often the Bayesian method or revised standards for evidence (0.1% or 0.5%). Adams et al. ( 2019 ) review the articles published in the same four top-ranking finance journals from 1988 to 2017 in order to investigate whether outliers are treated appropriately in these studies. The authors document that each year, 30–70% of these articles use OLS. To encourage finance researchers to utilize other useful econometric methods, they propose a multivariate outlier identification strategy. As the authors explain, this technique can minimize frictions which hinder the adoption of these methods. Due to their purposes of addressing very specific problems, these two articles provide method surveys that are non-comprehensive. Table 1 summarizes the differences between this paper and the other surveys of fintech methods.

Methodology

The approach to the analysis of the fintech research is to first identify trends in the Finance and Information Systems (IS) literature because fintech is the intersection between financial services and information systems. Specifically, we wished to capture the trends pertaining to (1) the number and distribution of fintech articles published in the leading journals, (2) methodologies employed in fintech research, and (3) the research topics being published in this research. During the analysis of this literature, we attempted to identify gaps and needs in the research and therefore enumerate and discuss a research agenda which allows for the progression of research (Webster & Watson, 2002 ). Systematic literature reviews are a meta-analysis technique designed to collect, organize, analyze, and categorize existing knowledge and concepts in the research literature of a given category (Briner et al., 2009 ). In short, we hope to paint a representative landscape of the current fintech literature base to influence the direction of future research efforts in this important area of study.

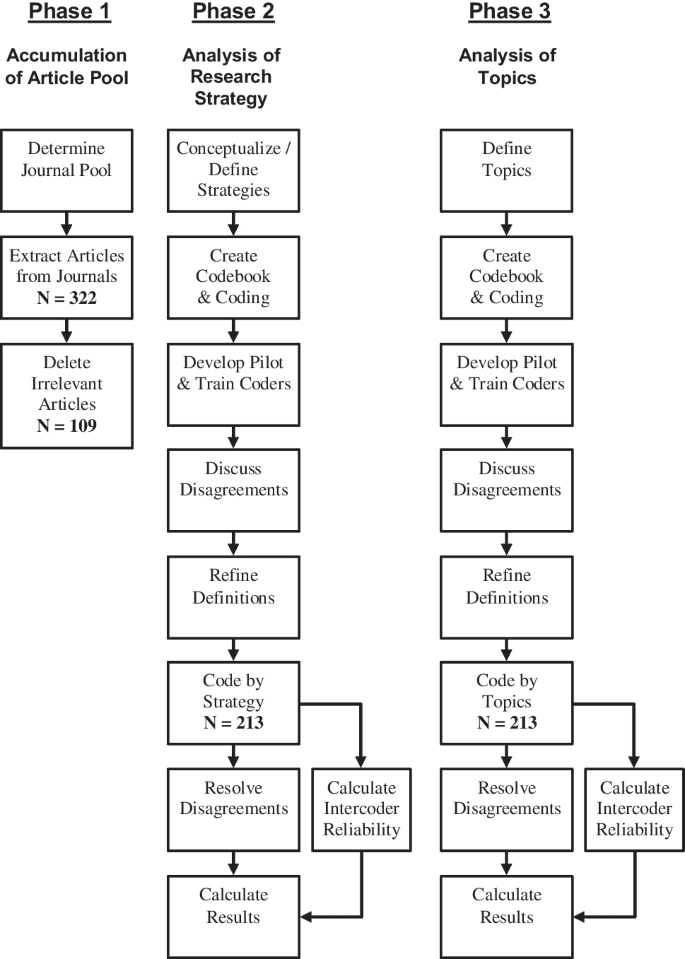

To examine the current state of research on fintech in the top Finance and IS journals, the authors conducted a literature review and analysis in three phases. Phase 1 accumulated a representative pool of articles. Phase 2 classified the articles by research method. Phase 3 classified the research by topic. Each of the three phases is discussed in the following paragraphs.

Phase 1: Accumulation of article pool

We used the Web of Science (WoS) citation database, Scopus citation database, and Google Scholar to search for research articles with a focus on fintech. The search parameters were constrained based on (a) a list of top ranked journals, (b) a specific time range, and (c) key search terms. Figure 1 illustrates steps in the content analysis process adapted from Neuendorf ( 2002 ) and successfully employed by several similar research studies in Internet marketing (Corley et al., 2013 ), Business Intelligence (Jourdan et al., 2008 ), and Enterprise Resource Planning systems (Cumbie et al., 2005 ).

Overview of literature analysis

First, the researchers chose to use the journals from the Australian Business Dean’s Council ABDC list (ABDC, 2019 ). Then, we filtered the ranking of journals to include only Finance (Code 1502) and collected the list of A* (see Table 2 ), A (see Table 3 ), and B (see Table 4 ) journals. Then, we filtered the ranking of journals to include only Information Systems (Code 0806) and collected the list of A* (see Table 5 ), A (see Table 6 ), and B (see Table 7 ) journals. Many of the Finance and IS journals in the sample contained no fintech articles and were deleted from the tables.

The search parameters were further constrained to a specific timeframe. As previously discussed, the term fintech was first coined by Citicorp in 1993 (Schueffel, 2016 ). The search parameters were further constrained based on the historical timeframe in which technologies capable of facilitating the Finance function were first introduced, and the years of publications for articles in our search sample were constrained to the years of 2002 through December of 2021.

The final constraint was based on the key search term “fintech.” In WoS, Scopus, and Google Scholar the search engine scanned for the term “fintech” and close variations of this term found in the title, abstract, and keywords of articles published in the top Finance journals between January of 2002 and December of 2021 when the search was executed. There was a considerable overlap in the pool of articles returned from the three search engines (WoS, SCOPUS, and Google Scholar). Of the 322 (227 Finance and 95 IS) total articles in the initial search, 83 articles (67 Finance and 16 IS) were removed because the articles’ publication year was 2022. This further shows the explosive growth of this research topic’s popularity as the search was conducted in late February of 2022. Once duplicate entries and non-research articles (book reviews, editorials, commentary, etc.) were removed, another 26 (17 Finance and 9 IS) articles were removed. As a result of this process, 216 (146 Finance and 70 IS) articles remained in the composite data pool for analysis. All 216 article files were collected in Adobe Acrobat PDF format and loaded into NVivo 11 to run a word frequency query of the content without numbers and extemporaneous words (i.e. “a,” “and,” “the,” etc.). Figure 2 shows the word cloud that resulted from this query.

Word cloud of fintech research created in NVivo

Phase 2: Classification by research strategy

Once the researchers identified the articles for the final data pool, each article was examined and categorized according to its research strategy. Due to the subjective nature of research strategy classification, content analysis methods were used for the categorization process (Neuendorf, 2017 ).

First, the research categories were adopted from Scandura and Williams ( 2000 ) (see Table 8 ), who extended the research strategies initially described by McGrath ( 1982 ). Specifically, nine categories of business research strategies were selected including: Formal theory/literature reviews, sample survey, laboratory experiment, experimental simulation, field study (primary data), field study (secondary data), field experiment, judgment task, and computer simulation.

Second, to guard against the threats to reliability (Neuendorf, 2017 ), we performed a pilot test on articles not included in the final data pool for this study. Researchers independently categorized the articles in the pilot test based on the best fit among the nine research strategies. After all articles in the pilot test were categorized, the researchers compared their analyses. In instances where the independent categorizations did not match, the researchers re-evaluated the article collaboratively by reviewing the research category definitions, discussing the disagreement thoroughly, and collaboratively assigning the article to a single category. This process allowed the researchers to develop a collaborative interpretation of the research category definitions. This pilot test served as a training session for accurately categorizing the articles for this study.

Each research strategy is defined by a specific design approach, and each is also associated with certain tradeoffs that researchers must make when designing a study. These tradeoffs are inherent flaws that limit the conclusions that can be drawn from a particular research strategy. These tradeoffs refer to three aspects of a study that can vary depending on the research strategy employed. These variable aspects include generalizability from the sample to the target population (external validity), precision in measurement and control of behavioral variables (internal and construct validity), and the issue of realism of context (Scandura & Williams, 2000 ).

Campbell and Cook ( 1976 ) stated that a study has generalizability when the study has external validity across times, settings, and individuals. Formal theory/literature reviews and sample surveys have a high degree of generalizability by establishing the relationship between two constructs and illustrating that this relationship has external validity. A research strategy that has low external validity, but high internal validity is a benefit of the laboratory experiment. In the laboratory experiment, where the degree of measurement precision is high, cause and effect relationships may be determined, but these relationships may not be generalizable for other times, settings, and populations. While the formal theory/literature reviews and sample surveys have a high degree of generalizability and the laboratory experiment has a high degree of precision of measurement, these strategies have low degree of contextual realism. The only two strategies that maximize degree of contextual realism are field studies that use either primary or secondary data because the data is collected in an organizational setting (Scandura & Williams, 2000 ). The other four strategies maximize neither generalizability, nor degree of precision in measurement, nor degree of contextual realism. This point illustrates the futility of using only one strategy when conducting fintech research. Because no single strategy can maximize all types of validity, it is best for researchers to use a variety of research strategies.

Two coders independently reviewed and classified each article according to research strategy. Only a few articles were reviewed at one sitting to minimize coder fatigue and thus protect intercoder reliability (Neuendorf, 2017 ). Upon completion of the classification process, agreements and disagreements were tabulated. The percent agreement was 87.5% ( N = 216). Then, intercoder reliability ( κ = 0.874) using Cohen’s Kappa (Cohen, 1960 ) and Krippendorf’s Alpha (Krippendorff, 2013 ) for each methodology ( α = 0.859) was calculated. Neuendorf ( 2017 ) suggests that a Cohen’s kappa greater than 0.800 is considered acceptable. Krippendorff ( 2013 ) stated that researchers could use reliability scores greater than 0.800. Therefore, the calculations for intercoder reliability were well within the acceptable ranges. We calculated the reliability measures prior to discussing disagreements as mandated by Weber ( 1990 ). If the original reviewers did not agree on how a particular article was coded, a third reviewer arbitrated the discussion of how the disputed article was to be coded. This process resolved the disputes in all cases.

Phase 3: Categorization by fintech research topic

Typically, the process of categorizing research articles by a specific research topic involves an iterative cycle of brainstorming and discussion sessions among the researchers. This iterative process helps to identify common themes within the data pool of articles. Through the collaborative discussions during this process researchers can synthesize a hierarchical structure within the literature of overarching research topics and more granular level subtopics. The outcome is a better understanding of the current state of a particular stream of research. This iterative process was modified for this specific study on the topic of fintech.

This process resulted in four research topics: Enhance, Impact, Innovate, and Research. The Enhance topic was research that investigates how traditional financial products and services are implemented and improved by using fintech. Examples include using fintech to improve the traditional activities of making personal consumer loans (Di Maggio & Yao, 2021 ; Gerrans et al., 2021 ), analyzing the creditworthiness of borrowers (Jagtiani & Lemieux, 2019 ), and enhancing customer experience in traditional wealth management (Kim et al., 2020 ). The Impact topic analyses fintech’s influence on industries, governments, and economies and includes the impact of technology on banking industry misconduct (Bertsch et al., 2020 ), fragility of financial institutions that use various technologies (Fung et al., 2020 ), how various technologies are affecting the insurance industry (Stoeckli et al., 2018 ), and the new regulatory models necessary from fintech (Jiang et al., 2021 ). The Innovate topic explores financial products and services that were created by or made possible by the implementation of fintech with financial products and services such as blockchain, initial coin offerings (ICOs), and cryptocurrencies (Zhao et al., 2021 ), digital tokens (Benedetti & Nikbakht, 2021 ), peer to peer lending (Fu, Huang, & Singh, 2021), mobile payments (Du, 2018), crowdfunding (Lin & Pursiainen, 2021 ), and the analysis of the new business models created by innovations in fintech (Gomber, Kauffman, Parker, & Weber, 2018). The Research topic illustrates the importance and impact of fintech on individuals and society up to and including research on fintech itself. Research that represents this topic include financial literacy (Philippas & Avdoulas, 2020 ), financial inclusion (Hua & Huang, 2021 ; Kanga et al., 2021 ; Senyo, Osabutey, & Kan, 2021), the use of fintech as a research tool (Bradbury et al., 2019 ), and research on the concept of fintech itself (Bollaert et al., 2021 ). The authors used these four topics to successfully categorize all 216 articles in the research sample.

To guard against the threats to reliability (Neuendorf, 2017 ), we once again performed a pilot test on articles not included in the final data pool for this study. Following the adoption of the four research topics, this second pilot study was used as a training session for categorizing articles by research topic. Researchers independently categorized the articles in the pilot test based on the best fit among the four research topics. After all articles in the pilot test were categorized, the researchers compared their analyses. In instances where the independent categorizations did not match, the researchers re-evaluated the article collaboratively by reviewing the research category definitions, discussing the disagreement thoroughly, and collaboratively assigning the article to a single category. This process allowed the researchers to develop a collaborative interpretation of the research topic definitions (see Table 9 ). Once we established the topic definitions, we independently placed each article in one fintech category. As before, we categorized only a few articles at a time to minimize coder fatigue and thus protect intercoder reliability (Neuendorf, 2017 ).

Upon completion of the classification process, agreements and disagreements were tabulated. The percent agreement was 86.1% ( N = 216). Then, intercoder reliability ( κ = 0.860) using Cohen’s Kappa (Cohen, 1960 ) and Krippendorf’s Alpha (Krippendorff, 2013 ) for each methodology ( α = 0.815) was calculated. Neuendorf ( 2017 ) suggests that a Cohen’s kappa greater than 0.800 is considered acceptable. Krippendorff ( 2013 ) stated that researchers could use reliability scores greater than 0.800. Therefore, the calculations for intercoder reliability were well within the acceptable ranges. We calculated the reliability measures prior to discussing disagreements as mandated by Weber ( 1990 ). If the original reviewers did not agree on how a particular article was coded, a third reviewer arbitrated the discussion of how the disputed article was to be coded. This process resolved the disputes in all cases.

To identify gaps and needs in the research (Webster & Watson, 2002 ), we hope to paint a representative landscape of the current fintech literature base. To examine the current state of this research, the authors conducted a literature review and analysis in three phases. Phase 1 accumulated a representative pool of fintech articles, and the articles were then analyzed with respect to year of publication, journal, and author. Phase 2 briefly discussed the research strategies set forth by Scandura and Williams ( 2000 ) and the results of the classification of the articles by those research strategies. Phase 3 involved the creation and use of four fintech topics, a short discussion of each topic, and the results of the classification of each article within the research topics. These results are discussed in the following paragraphs.

Results of Phase 1

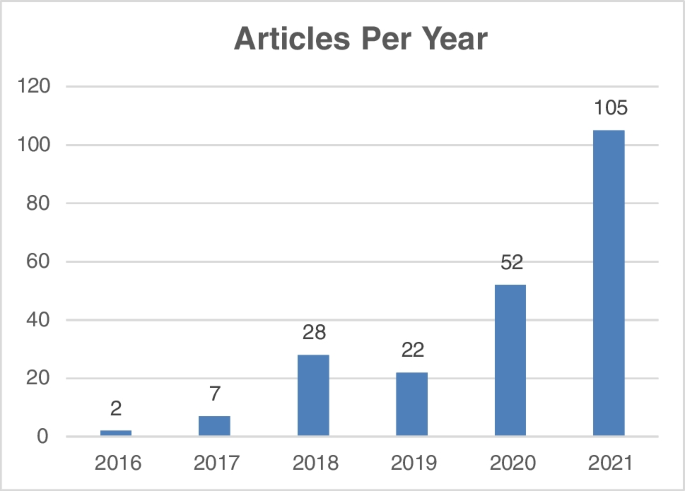

Using the described search criteria within the selected journals, we collected a total of 216 articles. For the complete list of Finance articles in our sample ( N = 146), see Appendix 1 . For the complete list of Information Systems articles in our sample ( N = 70), see Appendix 2 . In phase 1, we further analyzed the articles’ year of publication, journal, and author. Figure 3 shows the number of articles per year in our sample. Although no articles were collected prior to 2016, there is a dramatically increasing trend over the 6-year period of 2016 through 2021. From 2020 to 2021, the number of articles more than doubled, with N = 52 in 2020 and N = 105 in 2021. With fintech issues becoming ever more important to researchers and practitioners, this drastic increase comes as no surprise.

Number of fintech articles published per year

We analyzed the productivity of authors who published in this line of research by assigning scores based on each author’s share of each article. For projects with multiple authors, each co-author was given an equal share of the credit. An author who published an article alone was assigned a score of 1.0. For a two-author article, each author earned a score of 0.500, three authors shared 0.333, and so on. Authorship order was not calculated into this formula. We totaled the scores for each Finance author, then ranked the authors according to their totaled scores in descending order. The results of the top 43 fintech authors in Finance are displayed in Table 10 . This system rewards both quantity of research and ownership of research. The top ranked Finance researcher (Schwienbacher, A.) and the second ranked research (Selim, M.) both had a sole-author paper and co-authorship on another article in the Finance sample. All others who wrote a sole-author research article tied for third place. All of the remaining authors in this list co-authored more than one fintech research article published in Finance, so their scores are above 0.500.

Similarly, the scores for each Information Systems author were totaled, and the authors were sorted from highest to lowest scores. The results of the top 13 fintech authors in the Information Systems sample are displayed in Table 11 . This system rewards both quantity of research and ownership of research. The top ranked researcher (Gozman, D.) had co-authorship on many articles in the Information Systems sample. All the second-ranked authors had a sole author paper (score = 1.0). The remaining authors who had a score greater than 0.500 were also ranked in the sample. A score greater than 0.500 indicates having more than one co-authorship in the sample.

Results of Phase 2

The results of the categorization of the 216 articles according to the nine research strategies described by Scandura and Williams ( 2000 ) are summarized in Table 12 . Of the 216 articles, 104 articles (48.15%) were classified as Field Study—Secondary Data making this category the most used research strategy. With 62 articles (28.70%), Formal Theory/Literature Review was the second most prevalent research strategy. Following were Sample Survey with 23 articles (10.65%) and Field Study—Primary Data with 20 articles (9.26%). The remaining categories had three or fewer articles. These top four research strategies composed of 96.76% of the articles in the sample. No articles were classified as a Judgment Task nor a Field Experiment. These four strategies are exploratory in nature and indicate the beginnings of a body of research (Scandura & Williams, 2000 ). Further categorization and analysis of the articles with respect to fintech topic categories were conducted in the third phase of this research project.

Results of Phase 3

Table 13 shows the number of articles per fintech research topic category. These four categories provided a topic area classification for all the 216 articles in our research sample. Of the 216 articles, 38.43% were classified as “Research,” making it the most prevalent fintech topic category. This result is not surprising because the content analyzed was collected from research publishing outlets. Closely following were “Impact” and “Innovate” (21.76%) tying for second place. “Enhance” was the least popular with 18.06% of the articles. These four research strategies accounted for 100% of the articles in the sample. This illustration of the share of fintech research that is represented by each topic reveals the amount of attention fintech is receiving in Finance journals across a new, yet diverse, research stream.

Fintech research strategies versus topics

By plotting fintech research topics against research strategies (Table 14 ), many of the gaps in fintech research are exposed. In our minds, these gaps exist for two reasons. First, some of these research strategies are not prevalent in Finance and IS research. Because some top research journals do not accept papers that use non-traditional or qualitative research strategies, researchers tend to avoid unorthodox strategies. Second, some of these categories have not been studied because they represent a relatively new phenomenon, of which the research has not caught up with the business reality. The great news for researchers interested in fintech is that this domain should provide research opportunities for years to come.