Solutions only available in England, Wales and Northern Ireland

Assignment of Debt UK – Everything You Need To Know

Get confidential debt help for your situation.

- Expert debt help to find the right solution for you

- We give you full support

- Together we can manage your debt

Get started

Struggling with debt? we can help you look at the available solutions.

If you have debts of over £5,000, and you're struggling to repay them, get in touch today!

In the complex financial landscape of the United Kingdom, understanding the nuances of ‘Assignment of Debt’ is essential for both creditors and debtors. This concept, often encountered but not always fully understood, involves the transfer of a debt obligation from the original creditor (the assignor) to a third party (the assignee).

This article aims to demystify the intricacies of debt assignment, explaining its types, legal implications, and impact on individuals’ financial standings.

Whether it’s about navigating through the differences between legal and equitable assignments, understanding the role of deeds, or grasping how such transactions affect your credit report and legal rights, this guide provides a comprehensive overview, ensuring that you are well informed about this critical aspect of financial management in the UK.

Table of Contents

What Does ‘Assignment of Debt’ Mean?

Assignment of Debt: a term that might sound complex, but it’s really quite straightforward. Let’s dive into what this means for you.

Simply put, your original creditor, known as the assignor, transfers your debt to another party, the assignee. This could change who you deal with regarding your debt. The assignee can now take legal steps to recover the debt from you. Thus, this might include court action.

How Debt Assignments Work

When a creditor offers credit to a borrower, they do so believing that the money they lend, along with the interest, is repaid on time. So, the lender waits to recover the money owed according to the timeframe stated in the contract.

In some situations, the lender might decide that they want to sell the debt to a third party because they no longer want to assume responsibility for servicing the loan. In this case, the debtor should be sent a Notice of Assignment (NOA). This should state that someone else is now responsible for collecting the outstanding debt. This is called a debt assignment.

It’s mandatory to inform the debtor when the debt is assigned to a third party so that they are aware of who they should pay the debt to. The payments won’t be accepted if the debtor ends up sending payments to the old creditor after they’re assigned. This might result in the debtor unintentionally defaulting.

Also, once the debtor receives this notice, it’s best that they verify that the new creditor has recorded the correct monthly payment and total balance. In some situations, the new assignee might even decide to make changes to the original terms of the loan. In this case, the creditor should notify the debtor without delay and give them sufficient time to respond.

Need more help to deal with your Debt issue?

There are a number of alternative debt solutions available in the UK that you could use to write off some of your priority debts. But keep in mind that choosing the right solution will aid you in writing off some of your debt, while choosing the wrong one will worsen your debt situation.

Are you struggling with unaffordable debt?

- Affordable repayments

- Reduce Pressure from people you owe

- One simple monthly payment

Legal Assignment vs Equitable Assignment

A legal assignment is when another company takes over the following from a creditor:

- Benefit of a debt

- The right to enforce the debt

This indicates that they have the right to seek court action over the loan.

However, when it comes to equitable assignment, it only transfers the benefit of the loan to a third party. In this case, there is no right to seek court action over the loan. Thus, in a situation where the assignee wants to take the debtor to court, they only have the right to work with the original creditor after the original creditor decides to take the debtor to court.

So, simply said, they don’t have the power to initiate court action themselves. Also, note that in order for the assignment to be effective, the debtor must be notified regarding the assignment. The debtor is obligated to make the payment to the assignee only after they get the notice.

Assignment vs Novation

When it comes to the assignment, the party that assigns will continue performing the obligation associated with the loan. However, the assignee is now entitled to the loan benefits.

For example, assume that you assign a debt, that a debtor owes to you, to another organisation. In this situation, you have some rights and obligations over the loan. But particularly the right to pursue legal action in court.

Meanwhile, when it comes to novation, it consists of a full transfer of both rights and obligations. For example, as per the previous scenario, the creditor would give the assignee company full power when it comes to both the obligations and the rights associated with the loan.

Assignment vs Selling

As mentioned before, the assignment of debt means that the right of an individual to collect a debt has been transferred legally from the assignor (original creditor) to the assignee (third party). Then, the debtors are informed regarding the assignment. They should then make the payments to the assignee.

However, keep in mind that the conditions and terms of the contract do not change.

When it comes to selling debt, this is where a lender sells their loan to another, usually for a lesser amount than what it’s worth. The buyer (most of the time a debt collection company) tries to collect the whole amount from the debtor.

Does an Assignment Need to be a Deed?

When delving into the law of assignment, a crucial question often pops up: is a formal deed essential to make the transfer of debt legitimate? The answer isn’t as straightforward as you might think. Let’s unpack this:

Often, a less formal agreement can do the job. However, in some cases, particularly when the original loan agreement was a deed, a deed for the assignment becomes necessary.

Understanding the importance of deeds in this context is key. If your original loan agreement was signed as a deed, the assignment might also need to be a deed. This adds a layer of formality and legal binding. A deed indicates a more serious commitment, making everyone involved fully aware of the transfer’s details.

Knowing your rights in these situations is non-negotiable:

- Whether it’s through a deed or an agreement, you’re entitled to be informed about the assignment. This ensures the process is fair and transparent.

- This notification is more than just a formality; it validates the transfer and helps you understand the change in your debt obligations.

- The use of a deed or agreement provides legal clarity. This helps in understanding your position in the new arrangement.

- In such situations, seeking legal or financial advice can be a wise move.

In the complex world of debt assignments, whether a deed is necessary depends on various factors. Understanding the role of deeds and your rights is essential in navigating these financial waters.

Benefits of Assignment of Debt

There are multiple reasons why a creditor might decide to assign the debt to another person. One of the main reasons for this is to improve liquidity or to reduce the risk. In some cases, the lender might also be wanting some capital urgently. Also, they might have accumulated a large amount of high-risk loans and be wary that most of them could default.

In such situations, lenders may be willing to assign them to another person swiftly, even for a very small amount. They are open to doing this as long as it will help to improve their financial outlook and appease worried investors.

In other cases, the creditor might decide the debt is too old to spend resources trying to collect it. They might even assume that since it’s old, it’s not worth assigning it to a third party to pick up the collection activity. In such an instance, a company will decide not to assign their debt to a third party.

Criticisms of Assignment of Debt

Even though the assignment of debt may seem like a good option for lenders, it also has a fair bit of criticism.

Over the past, debt buyers have been known to use various unethical practices in order to get paid. This includes constantly harassing debtors and issuing threats. In some situations, they have also been accused of chasing debts that have already been paid.

Additional Advice and Guidance

If you’re struggling with debt, note that there are many debt solutions available in the UK that you can consider taking up. Some of these include:

- Individual Voluntary Arrangement (IVA)

- Debt Management Plan (DMP)

- Debt Relief Orders (DRO)

However, note that while the right debt solutions will help to write off debt, choosing the wrong one might worsen your situation. So, we recommend you reach out to a debt charity for advice before you make the decision. Some debt charities you can reach out to include:

- National Debtline

- Citizens Advice

Alternatively, feel free to fill out our online form , and our MoneyAdvisor team will guide you.

- It refers to the transfer of a debtor’s obligation from the original creditor (assignor) to a third party (assignee).

- Legal Assignment: Transfers both the right to collect the debt and the right to enforce it legally, including court action.

- Equitable Assignment: Only the benefits of the loan are transferred, not the legal right to enforce it.

- Assignment maintains the original terms of the loan with a new creditor, whereas novation transfers all rights and obligations to a new party.

- In assignment, the right to collect the debt is transferred, while selling involves a financial transaction where the lender sells the loan, often at a lower price.

- Generally, a deed is not required for debt assignment, but it may be necessary when the original loan agreement is signed as a deed.

- Assignment of debt will be reflected in the credit report, including any updates on the loan terms and the new lender’s name.

- A formal notice is required, especially in legal assignments, to inform the borrower about the transfer of their debt.

- Once a notice is issued, the new creditor assumes the rights and obligations of the debt and may engage in various debt collection methods.

- Common reasons include avoiding the hassle of debt collection, lacking resources for legal action, or efficiency in debt collection through a third party like a collection agency.

- Under UK law, most debts have a limitation period of six years (twelve for mortgage loans), after which they might be written off if there’s no contact from the creditor.

Under UK law, the limitation period for most debts is six years. For mortgage loans, it extends to twelve years. If your creditor hasn’t contacted you within these time frames, you may have legal grounds to have the debt written off. This includes personal loans, credit cards, payday loans, and others.

The new lender takes on both the obligations and rights of the mortgage loan. Though rare, borrowers can also assign their mortgage to someone else. These assignments are recorded with the county recorder’s office for legal purposes.

Your credit report will reflect the change in lender and any new loan terms. You’ll see the new lender’s name instead of the old one. If you default under the new lender, they will report this to Credit Reference Agencies.

Under the Property Act 1925, it’s a formal notification to the borrower that their debt has been acquired by a new company. This notice is required in cases of legal assignment.

The new creditor assumes the benefits and obligations of the debt. They may hire a collection agency or use other methods to recover the debt, often avoiding court action to minimise costs.

Assigning debt is often done to avoid the trouble of collecting it. Some may lack the resources to take legal action against debtors. If a third party, like a debt collection agency, can handle repayment collection more efficiently, it’s a preferred choice.

Could you write off some debt?

We offer free advice. May not be suitable in all circumstances. Fees apply. Your credit rating may be affected.

Related Post

‘firstclear ltd ‘on Bank Statement – Who Are they?

Average Credit Score by Age in UK

Non Recourse Loan – Everything You Need To Know

How to Get Out of Debt – Find Out Now

Start reducing your debt repayments and regain control..., struggling with your debt you don’t need to do it alone. click here.

Feel free to visit our Complaints Policy and Privacy Policy

DEBT SOLUTIONS

- Debt Management Plan

- Debt Consolidation

- Debt Arrangement Scheme (DAS)

- Sequestration

- 0800 056 6820 (Free Phone)

- Crescent House, Lever Street, Bolton, BL3 6NN

Feel free to visit our Complaints Policy and Privacy Policy Customer Charter

Money Advisor and Moneyadvisor.co.uk are trading styles of Debt Correct; Debt Correct are authorised and regulated by the Financial Conduct Authority FRN: 663034 and can be found on the FCA register. Debt Correct is also licensed by the Information Commissioners Office (ICO). Licence No: ZA277704. Our registered office is 6 Hind Hill St, Heywood, OL10 1JZ.

Debt solutions such as IVA, Debt Management, DRO and Bankruptcy will have a negative impact on your credit rating. As part of our free service, we’ll look at your financial situation, explain the available options, and then recommend a debt solution which could be suitable for you. Depending on the solution, fees may be involved, which would be fully explained, and details provided in writing.

Should we determine an IVA is the most appropriate solution for you, we will pass your case to The Insolvency Group. Tracey Howarth (IP No: 16410), Mike Reeves (IP No: 7882) and Donald Harper (IP No: 9296) are licensed as insolvency practitioners in the UK with the Insolvency Practitioners Association.

*As an example, debt write-off of 85% has been achieved by 14.32% of our customers on approved IVAs in the last 12 months. (Dated 07/11/2023)

Learn about how I can check my credit score UK .

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

- Debt Arrangement Scheme

- Debt Consolidation

- Debt Management Plan

- Debt Relief Orders

- Individual Voluntary Arrangement

- Debt Collectors

- Types of debt

- Home Improvement Loans

- Lifetime Mortgages

- Council & Police Fines

- Private Parking Fines

- Convicted Driver Insurance

- Divorce help

- Customer Stories

- Help with debt

- Personal Finance

- Customer Stories Back

- About Us Back

- Contact Us Back

Assignment of Debt UK – All You Need to Know

Scott Nelson

Managing Director

MoneyNerd’s founder, Scott Nelson, has a decade of financial industry experience, including 6 years in FCA regulated loan and credit card companies. Troubled by a lack of conscience in the industry, he founded MoneyNerd to give genuine advice to those in debt and struggling financially.

Janine Marsh

Financial Expert

Janine Marsh is an award-winning presenter and a valuable member of the MoneyNerd team. With a wealth of experience as a financial expert, she's been featured on BBC Radio 4, BBC Local Radio, and BBC Five Live, and is a regular on Co-op Radio.

Total amount of debt?

For free & impartial money advice you can visit MoneyHelper . We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper . We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debt that has been passed to a third party? Don’t worry, you’ve found the right place to learn about it. Every month, over 170,000 people visit our website seeking advice on debt problems.

This article will help you understand:

- What ‘Assignment of Debt’ means

- The difference between Legal and Equitable Assignment

- How to tell if you can write off some of your debt

- The meaning of ‘Absolute Assignments’ and ‘Assignment of Receivables’

- How to seek help with problem debt

Our team understands your worry because some of us have been in the same situation. With our experience, we’re here to help you learn about ‘Assignment of Debt’ in the UK and what you can do about it.

There are several debt solutions in the UK, choosing the right one for you could write off some of your unaffordable debt , but the wrong one may be expensive and drawn out.

Answer below to get started.

How much debt do you have?

This isn’t a full fact find. MoneyNerd doesn’t give advice. We work with The Debt Advice Service who provide information about your options.

What Does ‘Assignment of Debt’ Mean?

Simply put, assignment of debt means that your original creditor (assignor) has decided to assign your debt to a third party, usually called the “assignee”.

The assignee now has the right to proceed with court action , if they deem it necessary, to recover money from you .

There are two commonly known types, as you’ll find out in the next few sections.

Legal Assignment vs Equitable Assignment

Legal assignment means that another company takes over both the benefit of a debt from a creditor as well as the right to enforce it , namely, the right to pursue court action over the loan.

In contrast, equitable assignment only transfers the benefit of a loan to a third party, but not the right to pursue court action over the loan.

So, if the assignee wants to take the debtor to court, they may only actively collaborate with the original creditor once the original creditor decides to take the borrower to court. So, they do not hold the power to initiate court action themselves.

Remember, for the assignment to be effective, the debtor must be given notice of the assignment . Only once they have received notice is the debtor obligated to make payment to the assignee.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Monthly debt repayments

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Assignment vs Novation

For assignments, the party that assigns still keeps performing the obligations associated with the loan, but the assignee is now entitled to the benefits of the loan.

To put this in perspective, let’s say you assign an amount a debtor owes you to another organisation. In this frame of reference, you still hold some rights and obligations over the loan, most notably the right to pursue legal action in court.

On the other hand, novation entails a full transfer of both rights and obligations .

For instance, in our original scenario, this would mean that a creditor gives the assignee company full power over both the rights and obligations associated with the loan.

Assignment vs Selling

As discussed, assignment of debt means the right to collect a debt has been legally transferred from the original creditor (assignor) to a third party (assignee).

The debtor is notified of this assignment, and they must then make payments to the assignee. However, the original contract’s terms and conditions remain unchanged.

As for the selling of debt , this typically refers to a financial transaction where a lender sells its loans to a third party , often for a fraction of the original amount.

The buyer (often a debt collection agency ) then attempts to collect the full amount from the debtor.

Does an Assignment Need to be a Deed?

No, it doesn’t need to be a deed .

Even if it is just an agreement, that is usually fine. Deeds were utilised commonly quite a while ago, and today’s court operations hardly require a deed as part of most assignments.

As for exceptions, there are a few cases where assignments might need to be deeds . For instance, when the original loan contract was signed as a deed , you do need a deed to assign it or to novate it.

Otherwise, a deed is not usually needed as assignments have three parties by default, and it is highly unlikely that any of them tampered with the agreement, since all of them have separate interests.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Frequently Asked Questions About Debt Assignment

How long before debt is written off in the uk.

Under UK law, the limitation period is six years , after which debt collectors won’t likely hound you for payment. For mortgage loans, however, this period is twelve years.

So, if your creditor has not contacted you for six years (or twelve years if you owe a mortgage loan ), you can take the matter to court and attempt to have your loan written off.

This includes payday loans, personal loans, credit cards, and some other types of loans.

What happens when a mortgage is assigned?

When a mortgage is assigned, the new lender takes on the obligations and rights of the mortgage loan.

In specific situations, even borrowers may assign their mortgage to another party, but this happens far less frequently than creditor assignments.

Lastly, when mortgage assignments happen, they are recorded with the county recorder’s office, which is the office responsible for storing and maintaining records of titles that affect deeds.

How does it affect my credit report?

When it comes to the specifics, your credit report will be updated to reflect the new company and the new terms of the loan , if any.

For one, you will see a new name on your credit record in place of an old one. The name of your previous company will be replaced, and the new company’s name will be entered.

Also, when you’ve started making repayments and default on a payment, your new creditors will inform the Credit Reference Agencies of this circumstance.

All in all, it entails an update of information on your credit report.

You can check your credit score on Equifax or Experian .

What is a notice of assignment?

Under the Property Act 1925, this is a notice that is used to formally inform a borrower that another company has bought or acquired their debts from their original creditor .

Creditors are required to formally inform borrowers through a notice if it’s a legal assignment.

What happens after a notice is issued?

Once a notice is issued, the due process for legal assignments dictates that the benefits and obligations of the lender are transferred to the company that purchases the debt.

After this, the usual debt collection procedures ensue , with the new creditor having the choice of hiring a collection agency, adopting in-house collection procedures, or other means.

Their aim likely is to recover the amount from you and avoid court action as much as possible since it can end up costing them a pretty penny as well.

Why do people assign their debt?

People may assign their debts when they don’t want to go through the trouble of collecting them themselves.

Another reason is they don’t have the resources to pursue court action against a debtor themselves or both. Debt collection can be quite a hassle at times.

In general, if a third party, such as a debt collection agency, can do the job of repayment collection more efficiently than a creditor can themselves, it’s probably a good idea to let them do it.

Is there something missing? We’re all ears and eager to improve. Send us a message and let us know how we can make our article more useful for you.

You can email us directly at [email protected] to share your feedback.

What is an Assignment of Debt?

By Sej Lamba

Updated on 26 February 2024 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

When Could an Assignment of Debt Happen?

Key issues on assignment of debt, drafting the correct documentation, giving notice, key takeaways.

Debts are increasingly common in today’s financial climate, and unfortunately, many people struggle to repay what they owe. Debts owed can be sold to third parties and a lot of companies in the UK purchase debts. However, this can be complicated as specific legal formalities apply when assigning debts. This article will explain some of the critical issues around the assignment of debt.

Debt collection can be a complex process. There are various reasons as to why debt is assigned. For example, a company owed debt may want to avoid putting in time and effort to chase it or want to take legal action to recover it.

To picture a scenario, imagine this:

- Joe Bloggs gets a brand-new shiny credit card. Joe purchases lots of nice things for his family with the credit card. Usually, he can keep up with payments as he keeps track of them and earns enough to pay them back;

- suddenly, Joe has an injury and cannot work anymore. He has to give up his job and now can’t afford to pay the credit card company back;

- Joe ignores various letters chasing the debt and hopes the problem will disappear. Ultimately, after months, the credit card company gives up and sells Joe’s debt to a debt collection agency.

So, in summary – after the debt sale, Joe now owes money to a different company.

In practice, debt assignments can be complex, and the parties must follow the relevant legal rules and draft the correct documentation.

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee).

In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third-party debt collection business.

This process can be complex. There have been several legal cases in the courts where this process has given rise to disputes.

There are two different types of assignment of debt – a legal assignment of debt and an equitable assignment of debt.

In simple terms:

- a legal assignment of debt will transfer the right for enforcement of the debt; and

- an equitable assignment of debt will transfer only the benefit of the debt without the right to enforce it.

Let us explore each type below.

Legal Assignment of Debt

If the assignment complies with specific legal requirements under the Law of Property Act 1925, it will be a ‘legal assignment’. This means that the assignee will be the new owner of the debt.

A legal assignment requires various formalities to be effective. For example, it must:

- be in writing and signed by the assignor;

- the debtor must be given written notice of the assignment;

- be absolute with no conditions attached to it;

- relate to the whole of the debt and not just part of it; and

- not be a charge.

After the transfer of the debt, the assignor can sue the debtor in its own name.

Equitable Assignment of Debt

It is also possible to have an equitable debt transfer – the requirements for this are much less strict. For example, this can be done informally by the assignor informing the assignee that the rights are transferred to them.

Download this free Commercial Contracts Checklist to ensure your contracts will meet your business’ needs.

For an equitable assignment, giving notice is not essential, but still always highly advisable.

Where an equitable assignment is made, the assignee won’t have the right to pursue court action for the debt. In this case, the assignee will have to join forces with the assignor to sue for the debt to sue for the debt.

The debtor should receive notice of any debt transfer so they know to whom the money is owed. Following notice, the new debt owner can pursue the debt owed.

A legal assignment is the best option for an assignee of debt – this will give them full rights to enforce the debt.

Assignments of debts can be very complex. For a legal assignment of debt, you need to follow various formalities. Otherwise, it may be unenforceable and lead to disputes. If you need help executing a debt assignment correctly, you should seek legal advice from an experienced lawyer.

If you need help with an assignment of debt, LegalVision’s experienced business lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 0808 196 8584 or visit our membership page .

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Capital raising essentials for startups, understanding your business’ new employment law obligations, contact us now.

Fill out the form and we will contact you within one business day

Related articles

3 Key Considerations to Manage Contract Risks

3 Business Benefits of Working With a Specialist Commercial Contracts Lawyer

What Are the Risks of a Verbal Contract With Your Customers?

3 Points Your Business Should Consider to Minimise Risk Before Signing a New Contract

We’re an award-winning law firm

2023 Economic Innovator of the Year Finalist - The Spectator

2023 Law Company of the Year Finalist - The Lawyer Awards

2023 Future of Legal Services Innovation - Legal Innovation Awards

2021 Fastest Growing Law Firm in APAC - Financial Times

English law assignments of part of a debt: Practical considerations

United Kingdom | Publication | December 2019

Enforcing partially assigned debts against the debtor

The increase of supply chain finance has driven an increased interest in parties considering the sale and purchase of parts of debts (as opposed to purchasing debts in their entirety).

While under English law part of a debt can be assigned, there is a general requirement that the relevant assignee joins the assignor to any proceedings against the debtor, which potentially impedes the assignee’s ability to enforce against the debtor efficiently.

This note considers whether this requirement may be dispensed with in certain circumstances.

Can you assign part of a debt?

Under English law, the beneficial ownership of part of a debt can be assigned, although the legal ownership cannot. 1 This means that an assignment of part of a debt will take effect as an equitable assignment instead of a legal assignment.

Joining the assignor to proceedings against the debtor

While both equitable and legal assignments are capable of removing the assigned asset from the insolvency estate of the assignor, failure to obtain a legal assignment and relying solely on an equitable assignment may require the assignee to join the relevant assignor as a party to any enforcement action against the debtor.

An assignee of part of a debt will want to be able to sue a debtor in its own name and, if it is required to join the assignor to proceedings against the debtor, this could add additional costs and delays if the assignor was unwilling to cooperate. 2

Kapoor v National Westminster Bank plc

English courts have, in recent years, been pragmatic in allowing an assignee of part of a debt to sue the debtor in its own name without the cooperation of the assignor.

In Charnesh Kapoor v National Westminster Bank plc, Kian Seng Tan 3 the court held that an equitable assignee of part of a debt is entitled in its own right and name to bring proceedings for the assigned debt. The equitable assignee will usually be required to join the assignor to the proceedings in order to ensure that the debtor is not exposed to double recovery, but the requirement is a procedural one that can be dispensed with by the court.

The reason for the requirement that an equitable assignee joins the assignor to proceedings against the debtor is not that the assignee has no right which it can assert independently, but that the debtor ought to be protected from the possibility of any further claim by the assignor who should therefore be bound by the judgment.

Application of Kapoor

It is a common feature of supply chain finance transactions that the assigned debt (or part of the debt) is supported by an independent payment undertaking. Such independent payment undertaking makes it clear that the debtor cannot raise defences and that it is required to pay the relevant debt (or part of a debt) without set-off or counterclaim. In respect of an assignee of part of an independent payment undertaking which is not disputed and has itself been equitably assigned to the assignee, we believe that there are good grounds that an English court would accept that the assignee is allowed to pursue an action directly against the debtor without needing the assignor to be joined, as this is likely to be a matter of procedure only, not substance.

This analysis is limited to English law and does not consider the laws of any other jurisdiction.

Notwithstanding the helpful clarifications summarised in Kapoor, as many receivables financing transactions involve a number of cross-border elements, assignees should continue to consider the effect of the laws (and, potentially court procedures) of any other relevant jurisdictions on the assignment of part of a debt even where the sale of such partial debt is completed under English law.

Legal title cannot be assigned in respect of part of a debt. A partial assignment would not satisfy the requirements for a legal assignment of section 136 of the Law of Property Act 1925.

If an assignor does not consent to being joined as a plaintiff in proceedings against the debtor it would be necessary to join the assignor as a co-defendant. However, where an assignor has gone into administration or liquidation, there may be a statutory prohibition on joining such assignor as a co-defendant (without the leave of the court or in certain circumstances the consent of the administrator).

[2011] EWCA Civ 1083

- Financial institutions

Recent publications

Publication

Singapore: Competition law fact sheet

Overview of the main provisions of the Competition Act, and discussion of the enforcement regime and recent enforcement trends.

Global | April 15, 2024

Recent interest rate increases could trigger unexpected arbitrage liabilities for bond issuers

For many years, investment yields were so low that the arbitrage rules applicable to tax-exempt bonds were for the most part more theoretical than practical.

United States | April 12, 2024

Preparing for change: How businesses can thrive under the EU's AI Act

On February 2, 2024, the Belgian Presidency of the Council of the European Union confirmed that the Committee of Permanent Representatives had signed the Artificial Intelligence (AI) Regulation, referred to as the AI Act. Approval by the EU Parliament followed on 13 March 2024, and the AI Act is likely to appear in the EU’s Official Journal around May 2024. The AI Act aims to establish a stringent legal framework governing the development, marketing, and utilisation of artificial intelligence within the region, thereby marking a significant advancement in the regulation of this burgeoning domain.

Global | April 12, 2024

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023

- Canada (English)

- Canada (Français)

- United States

- Deutschland (Deutsch)

- Germany (English)

- The Netherlands

- Türkiye

- United Kingdom

- South Africa

- Hong Kong SAR

- Marshall Islands

- Nordic region

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt , and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt. In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/148985994-5bfc2b8c46e0fb0083c07ba8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Assignment of debts - take care with cross-referencing

- Using your device

In the recent High Court decision in Nicoll -v- Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the validity of an assignment of debts and the notice requirements is considered.

The High Court in this case considered whether a notice of assignment in relation to a debt, which mentioned an unverifiable date of assignment, was still valid and enforceable against the debtor.

The debt in question originally arose between the debtor and the Co-operative Bank (Bank) and was evidenced in various facility letters between September 2010 and May 2013. A sum of over £10 million was advanced by the Bank to the debtor, and security was taken by the Bank in the form of charges over certain property. The overall balance was repayable by May 2015, but the debtor defaulted on the payment terms.

On 29 July 2016, the Bank assigned (or purported to assign) its debt and security to Promontoria. Both the Bank and Promontoria provided joint notice of the assignment in a single document to the debtor on 2 August 2016, with wording that the debt had been assigned ‘on and with effect from 29 July 2016’. There was no express reference to the date of the assignment or the assignment effective date, but rather this was defined by reference to the completion date in a related but unreferenced loan sale deed, so a more complicated analysis of a series of documents was required to reach the actual date of the assignment.

Promontoria proceeded to pursue the debtor for the debt by serving a statutory demand, dated 27 January 2017, and referred to the deed of assignment within its contents for payment of the outstanding debt.

The debtor’s attempt to have the statutory demand set aside was dismissed at the initial hearing, but the debtor received leave to appeal to the High Court on one issue. The debtor sought to challenge the effectiveness of the assignment of the debt based on an inability to work out from the notice of assignment whether the completion date for assignment had actually occurred. The debtor argued that:

- the case of WF Harrison -v- Burke [1956] 1 W.L.R. 419 is authority that a notice of assignment that gets the date of assignment wrong is invalid and, as a result, the assignment is not good against any debtor; and

- the date of assignment stated in the notice given to him was unverifiable, and therefore potentially wrong, rendering the notice invalid

The High Court agreed that the documentation disclosed by Promontoria to the debtor after the notice of assignment was insufficient to verify the date on which assignment had occurred, due to cross-referencing to other documents and there being conditions for completion. However, the High Court distinguished this case from WF Harrison -v- Burke case as the joint notice of assignment did not specify the date of the deed of assignment. It specified the date on which the assignment took effect, which is different. In WF Harrison -v- Burke , the notice of the assignment (given by the assignee only) specified the date of the assignment document (as opposed to the assignment itself) and got it wrong. In the present case, the notice of assignment was from both Promontoria and the Bank, i.e. assignor and assignee and made clear that the parties considered the assignment to be complete. In the circumstances, the debtor was not entitled to challenge Promontoria’s title to the debt.

The High Court accepted that while Promontoria had not produced evidence which in terms showed what the effective date of the assignment was, the joint notice clearly showed that both the Bank and Promontoria agreed and accepted that the assignment had taken place, and was sufficient evidence for the present purposes to be valid. The judge said: ‘The question is not whether Promontoria have provided a chain of proof through the wording of the documents. If that were the question then Promontoria would fail. The question is whether Promontoria has demonstrated that there is a completed assignment. I consider that it has. The crucial matter is the notice of assignment, against the background of the assignment document. The assignment documentation demonstrates a clear intention to assign even if the documents do not match up as they ought to. The notice of assignment provides clear evidence that the assignment has taken place.’ Accordingly, the High Court concluded that there was no arguable case that the assignment’s effective date had not occurred and considered that the assignment had been sufficiently demonstrated to be effective as against the debtor.

The High Court clearly held that a notice of assignment of a debt given to a debtor was valid, even though the assignment effective date, referred to in the notice, could not be verified by the debtor. The judgment provides strong support for the proposition that it is not open to debtors to seek to find alleged defects in any assignment, as long as they have been properly notified of the assignment and most importantly that the assignor and assignee both agree that the assignment is valid. This is a welcome decision for all creditors.

Dispute resolution

Related insights, hill dickinson welcomes new partner to growing commercial litigation team in london.

26 March 2024

We're delighted to welcome commercial disputes partner Sarah Emerson to our London Dispute Resolution team.

Is an arbitration tribunal’s decision on illegality in conflict with public policy?

08 February 2024

Under the Arbitration Ordinance (Cap. 609) of Hong Kong (“AO”), unless the relevant arbitration agreement expressly provides for application of the opt-in provisions in sections 5-7 of Schedule 2...

The Mainland Judgments in Civil and Commercial Matters (Reciprocal Enforcement) Ordinance came into effect on 29 January 2024

31 January 2024

The newly-implemented and much-anticipated Mainland Judgments in Civil and Commercial Matters (Reciprocal Enforcement) Ordinance (Cap. 645) ('Ordinance') is one of the cornerstones of the mutual legal

Fair trials, proving your case and uncontroverted expert evidence

18 December 2023

This was a relatively low-value personal injury claim which would not in normal circumstances have gone as far as the Supreme Court. However, it raised a point of general importance, with regard to th

High Court decision highlights the importance of keeping clients updated in respect of costs

20 November 2023

Earlier this year, the High Court heard a professional negligence claim against law firm Reynolds Porter Chamberlain LLP (RPC) brought by one of its former clients, Ms Forster. The case was Forster...

Focus on Cybersecurity: Claims against unknown hackers

Next in our series of articles looking at cyber issues we consider recent developments around hacking and ransomware. Ransomware cyberattacks (typically involving use of malicious software designed...

We can help you resolve business disputes through negotiation, mediation, arbitration or litigation. Our aim is to achieve resolution quickly and efficiently and to minimise the impact of a dispute on your day-to-day operations.

Where possible, we try to settle disputes without recourse to legal proceedings. However, when this is unavoidable, our very experienced and tenacious team will vigorously pursue a strategy set to achieve a successful outcome for you.

Clients in manufacturing, service industries, retail plcs, owner-managed businesses, accountants and other professionals rely on our clear, pragmatic advice, expert technical analysis and sound understanding of their business problems and commercial objectives.

Debt counselling

We're here to help you get back in charge of your finances. You can get debt advice online , at any time of day, if that's right for you.

Our team of debt experts help 650,000 people a year across the UK to overcome their debt problems, and get their lives back on track. Here's how we can help you.

Three steps to help you gain control

1. make the decision to get debt help.

Struggling with debt isn’t something to be ashamed of - and we won’t judge you. The important thing is to get our free debt help quickly.

2. Call us or use our online advice tool

Use our online debt tool to tell us about your financial situation. It's convenient and confidential - or give our experts a call.

3. Talk to our expert advisors for free

We know about debt so you can be sure we'll provide you with impartial advice and the practical solution that suits you.

Get free debt help now

Use our online debt help tool to get advice now. A session takes around 20 minutes to complete.

Asking for help can be hard.

Are debts causing you stress? Do you feel you never have the time?

Whatever the barrier, let’s deal with it together.

We’re here to help you

It's important to find the best debt solution for you. That's why your first step should always be to use our online debt advice tool or call our helpline.

Once we understand more about your debt problem we can suggest a plan of action tailored to you.

With 25 years' experience of providing debt advice , we offer a range of services and solutions to suit every situation. You can see some of them on this page.

Help us learn more about your circumstances and we can advise on the debt solution that’s right for you.

Sarah on Feefo says:

"really helpful and understanding without being patronising.".

"They’re there to explain the facts but never advise what you should do. You take control of your life. A life line for many!"

With a StepChange Debt Charity DMP we can help you repay your debts by making one affordable payment each month. A DMP is flexible, so the amount you pay can change depending on your circumstances. This solution is available across the UK.

Key DMP facts:

- Our DMPs are completely free. Every penny you send us goes towards paying off your debts

- In our experience, in most cases your creditors will stop interest and charges

- We've helped people repay millions of pounds of debt on DMPs since 1993

Find out more about getting a DMP as well as the potential risks involved.

An IVA is a legally-binding agreement which can help you pay back a reduced amount to settle your debts, usually over five or six years. At the end of this time your remaining debt is written off. This solution is available in England, Wales and Northern Ireland.

Key IVA facts:

- You make one affordable payment to us each month and we send this to your creditors

- Our IVA fees are included in your monthly payment

- Your creditors can no longer contact you

Find out more about our IVAs and how the various risks may affect you.

A DRO might be right for you if you owe less than £20,000, have a low income and very few assets. If we advise that a DRO is the best solution for you, we can help you apply. This solution is available in England, Wales and Northern Ireland.

Key DRO facts:

- You don't pay anything towards your debts for 12 months, after which your debts will be written off

- You pay a one-off fee to the Insolvency Service

- We can help and support you through the application process

Find out more about a DRO and the risks you must take into account.

Bankruptcy is a way of managing serious debt, particularly if you are unable to pay back the money you owe in a reasonable amount of time. This solution is available in England, Wales and Northern Ireland. Find out about bankruptcy in Scotland .

Key bankruptcy facts:

- Bankruptcy gives you a fresh start. All of your unsecured debts are written off

- You pay a one-off bankruptcy fee to the county court

- Bankruptcy will normally last for 12 months and will appear on your credit file for 6 years

Find out more about bankruptcy and the risks you'll need to consider first.

If you are a homeowner aged 55 or over, you could consider using equity release to unlock money from your home while you still live there. Equity release could allow you to release a tax-free cash lump sum for any purpose e.g. debt consolidation, home improvements or to supplement your income. This solution is available across the UK.

How StepChange Financial Solutions can help:

- Free, impartial advice via salaried advisers. No sales targets, bonuses or commission

- Qualified equity release advisors with in-depth knowledge and experience

- Telephone-based advice so no intrusive home visits

Find out more about equity release and the pros and cons of this particular solution.

Whether you're buying your first home, re-mortgaging for a better deal, or using your equity to manage debt or to support your retirement plans, StepChange Financial Solutions offers access to free mortgage and equity release advice you can trust. This solution is available across the UK.

Find out more about mortgage advice .

Solutions available in Scotland only

Under the DAS you can set up a debt payment programme (DPP) to help you repay your debts over a realistic amount of time.

Key DPP facts:

- Your interest and charges are frozen and your creditors can’t take any further action while your DPP is in place

- You make one affordable payment each week or month

- We’ll set up and manage your DPP completely free of charge

Find out more about a DPP under the Debt Arrangement Scheme (DAS) and the various risks involved.

MAP bankruptcy is a way of writing off debts you can’t afford to pay.

Key MAP facts:

- To qualify you must owe between £1,500 and £17,000

- To apply for MAP you need to pay a fee of £90

- MAP will be logged on your credit file for 6 years

Find out more about minimal assets process (MAP) bankruptcy as well as the various pros and cons to be aware of.

Sequestration allows you to write off debt that would otherwise take many years to clear.

Key sequestration facts:

- You must owe more than £1,500 to qualify for sequestration

- You must be living in Scotland or have lived in Scotland within the past year

- The fee for sequestration costs £200

Find out more about sequestration and any potential risks to keep in mind.

A protected trust deed is a legally binding arrangement where you make reduced payments over the course of 4 years.

Key trust deed facts:

- A trust deed will stop court action if diligence hasn't already started

- You may have to sell any valuable assets (apart from one car worth less than £3,000)

- A trust deed will be logged on your credit file for six years

Find out more about trust deeds and the risks to take into account.

Other ways we can help you

- Debt advice

With 25 years' experience, you can trust that you're getting expert help so that you can deal with your debts.

- Making a budget

- What your creditors can do

- Debt problems

- Payday loan debt

- Money advice

Practical tips about how to make your money go further, from creating a budget to saving on household bills.

- Benefits checker

- Utility switching

- Our MoneyAware debt blog

Client support

If you're already a StepChange Debt Charity client, we're here when you need us.

- Read our clients section

- Manage your DMP online

- Return to online

- Frequently asked questions

- Debt information

Debt happens. We deal with it.

We have helped millions of people since 1993.

Find out how.

- Read our clients' stories

- Read our reviews

- How we can adapt our service to support you

"StepChange - What A Relief"

"Would recommend StepChange to anyone who is struggling with debt. Their advisers are empathic and will bend over backwards to find the right solution for you."

Amanda, Feefo Review

- Practical Law

New: Deed of assignment

Practical law uk legal update 1-202-1081 (approx. 3 pages).

- The assignor is assigning the whole of the property demised by the lease.

- The property is not subject to any underlease(s).

- Where the assignee is paying a premium to the assignor or the assignor is paying a reverse premium to the assignee.

- Where the assignee gives an express indemnity covenant in respect of the rent and other obligations under the lease and/or in relation to matters contained in title documents affecting the property.

- Where the lease is being held over under the Landlord and Tenant Act 1954 and also where the assignor has commenced renewal proceedings.

- Where one party is paying, or making a contribution to, the legal (and surveyors') costs of the other.

- Considers in greater detail the various general issues affecting assignments of unregistered leases.

- Provides guidance on the legal, and drafting and negotiating, issues raised by each clause.

New Standard document and Drafting note

- Deed of assignment .

- Deed of assignment: drafting note .

- Landlord and Tenant

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

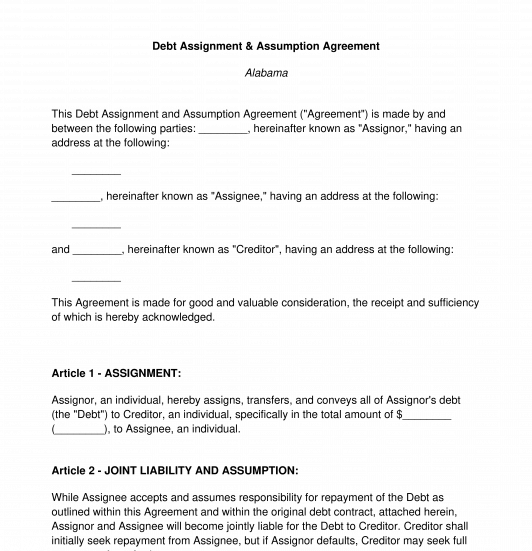

Debt Assignment and Assumption Agreement

Rating: 4.7 - 23 votes

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt Agreement, Debt Assignment Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

UK debt chief warns scale of borrowing leaves challenge for successor

- Medium Text

- Outgoing UK DMO boss Stheeman warns of 'risks' and 'challenges'

- UK to sell 265 billion pounds of debt in 2024/25

- Next debt agency CEO to be known 'in not too distant future'

DEBT RISING IN MANY RICH NATIONS

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by David Milliken and Dhara Ranasinghe; Editing by Andrew Cawthorne

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

Iran says any action against its interests will get a severe response

Iran will respond to any action against its interests, President Ebrahim Raisi said on Tuesday, according to the Iranian Student News Agency, a day after Israel warned it will respond to Tehran's weekend drone and missile attack.

UCL Faculty of Laws

Legal Aspects of International Finance (LAWS0254)

This module focuses on the major international debt finance transactions entered into by investment banks, corporate borrowers and, increasingly, multi strategy private equity funds and other alternate private credit providers, often referred to as “the ‘shadow banking’ sector”, who play an active role in the critically important international debt capital markets developed in London, New York and Tokyo and, more recently, in Hong Kong, Singapore and Frankfurt. It is designed to provide an in depth understanding of the legal structures used in these transactions and the legal and regulatory issues that arise. The international debt finance transactions focused upon include: Bi-lateral and Syndicated Loans (including ‘investment grade’ and ‘leveraged’ loans) entered into in the Primary and Secondary Loan Markets; Loan Transfers; Investment Grade Corporate Bond Issues; Securitisation Transactions; Project Finance Transactions; and the role of the lawyer in such transactions, including the giving of legal opinions.

The module convenor is an internationally recognised authority in international debt finance who has both practiced in the area, as a partner and global practice leader at one of the world’s largest international law firms, and taught the subject matter covered by the module to academics and practitioners for many years. He has been consistently recognised as a top tier lawyer by the leading legal directories, including Chambers (UK and international) who also included him in their inaugural Chambers 100, which ranked the top 100 business lawyers in the UK, where he was listed as one of the top five capital markets lawyers. He has worked on many landmark and ground breaking international finance transactions in numerous jurisdictions Teaching on this module is international in outlook and focusses on current market practice whilst at the same time providing high levels of academic rigor and critical analysis. Teaching will be based on market standard documentation currently used in the international debt finance markets and those who study this module will become very familiar with the content and legal issues arising from the use of such documents.

Module Syllabus

Overview of the International Debt Capital Markets and current developments in the market

Since no prior knowledge of international finance law or the international debt capital markets is assumed, teaching commences with an overview of the form and contractual structure of debt instruments typically used to raise finance in the international debt finance markets, including the funding mechanisms used in those markets. The causes and potential implications of the relatively recent Global Credit Crisis and how the raising of the international debt finance has been affected by that crisis will also be examined as will the debate in respect of the recent LIBOR crisis (interest rate setting) and the replacement of that benchmark. We will also consider the significance of the changing nature of the lenders in the international finance markets, in particular, the increasing prominence of the “shadow banking sector” including debt funds established by multi strategy private equity platforms. Current developments, for example, the increasing importance of ESG (Environmental, Sustainability and Governance) in international debt finance will also be covered.

International term loan agreements

The form and content of international (cross-border) term and revolving loan agreements including an analysis of the standard (Loan Market Association) form agreements typically used in the London based international finance markets in respect of both ‘Investment Grade’ and ‘Leveraged’ loans. We will focus, in particular, on the commercial objectives and legal effect of the key clauses included in such agreements including Conditions Precedent; Interest Rate and drawdown mechanics; Representations and Warranties; Covenants; and Events of Default.

Syndicated loan agreements (primary loan market transactions)

The form and content of international syndicated loan agreements (multi-bank loans) and an analysis of the roles, obligations and potential liabilities of the various parties thereto including: the Arranger/Lead Manager; Agent Banks; Security Trustees; and Syndicate Lenders.

Loan transfers (secondary loan market transactions)

How (and why) are loans regularly transferred in the secondary loan market? Additional considerations that arise in the context of non-performing loans (NPL’s); the methods of transfer typically used in the market: novation, assignment, sub-participation (risk and funded), proceeds assignment and transfers by way of trust. We will also consider the commercial and regulatory drivers for loan transfers; why liquidity in this market is important and how loan transfers are structured and documented.

Project finance

This component will focus on the documentation typically used in project finance transactions and the risks (legal and commercial) such documentation is intended to address. Typical project financing structures will also be examined as will the roles of the various parties in such transactions.

Securitisation and structured finance

This component will focus on classic “true sale” securitisation transactions including the commercial background and regulatory drivers that underpin the securitisation market. The structure of securitisation transactions will be examined in detail as will the role, rights and responsibilities of the various parties including: originators of securitisation transactions; ‘SPV’ styled issuers; arrangers; investors in securitised bonds; liquidity and credit enhancement providers, and third party service providers. We will also examine the documentation typically entered into to give effect to such transactions. The impact of the recent Global Credit Crisis and the Covid pandemic on securitisation transactions will be examined in detail, as will recent regulatory developments aimed at addressing some of the perceived weaknesses in the market. We will also examine the role of the international credit rating agencies.

International bond issues

This component will examine the process of raising international debt finance via the issue of international bonds; the parties to such issues and the fundamental terms typically incorporated. The legal nature of international bonds will also be examined as will the manner in which they are traded. The role and duties of the bond trustee will also be examined in detail.

Legal opinions

The role of the lawyer in international finance transactions; the form and content of legal opinions commonly delivered in international finance transactions and the potential liabilities for lawyers delivering such opinions.

Recommended Materials

McKnight, Paterson and Zakrzewski on ‘The Law of International Finance’ (2nd ed.) (2017), Oxford University Press.

Module reading lists and other module materials, including standard form documentation typically used in the international finance markets will be provided via online module pages, once students have made their module selections upon enrolment.

Preliminery Reading

The following book provides a good introduction to the subject:

Colin Paul & Gerald Montagu, Banking and Capital Markets Companion (Sixth Edition 2014), Bloomsbury

Key Information

Find out more.

- Life at Laws

- Student Support

- Careers Support

- UCL Laws Open Days

- Register your interest

Please read the FAQs for graduate applicants and graduate offer holders . If you still need to contact UCL Admissions, you can submit an enquiry via the Admissions Contact Form on the page.

You can also contact the LLM admissions team, particularly for queries relating to scholarships:

Email: [email protected] Tel: +44 (0)20 3108 8430

Unfortunately, the UCL Laws Graduate Office does not accept drop-in visitors.

Summer School

Our Summer School programme, open to current students and graduates, provides opportunities to delve deep into learning about key legal concepts.

Explore our courses

IMAGES

VIDEO

COMMENTS

A legal assignment is when another company takes over the following from a creditor: Benefit of a debt. The right to enforce the debt. This indicates that they have the right to seek court action over the loan. However, when it comes to equitable assignment, it only transfers the benefit of the loan to a third party.

Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice ...

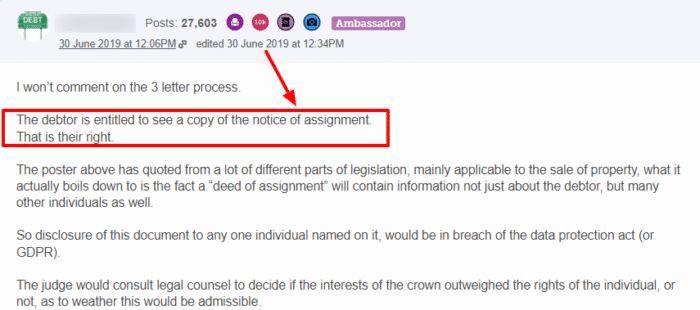

A deed of assignment of debt is used to transfer or sell the right to recover a debt. Without a deed of assignment of debt, the two companies are not able to do this - you need a written transfer document. Source: MSE Forum. Once the transfer document, or deed of assignment of debt, has been signed by the assignee (the party transferring the ...

In this post, we're analysing the ASSIGNMENT OF DEBT and ASSIGNED DEBT as a whole. It's very simple to understand when you... Skip to content. Call free for debt help: 0800 404 5050. Help with debt. Debt Solutions. Bankruptcy; ... Assignment of Debt UK - All You Need to Know. By Scott .