How to write a research plan: Step-by-step guide

Last updated

30 January 2024

Reviewed by

Today’s businesses and institutions rely on data and analytics to inform their product and service decisions. These metrics influence how organizations stay competitive and inspire innovation. However, gathering data and insights requires carefully constructed research, and every research project needs a roadmap. This is where a research plan comes into play.

There’s general research planning; then there’s an official, well-executed research plan. Whatever data-driven research project you’re gearing up for, the research plan will be your framework for execution. The plan should also be detailed and thorough, with a diligent set of criteria to formulate your research efforts. Not including these key elements in your plan can be just as harmful as having no plan at all.

Read this step-by-step guide for writing a detailed research plan that can apply to any project, whether it’s scientific, educational, or business-related.

- What is a research plan?

A research plan is a documented overview of a project in its entirety, from end to end. It details the research efforts, participants, and methods needed, along with any anticipated results. It also outlines the project’s goals and mission, creating layers of steps to achieve those goals within a specified timeline.

Without a research plan, you and your team are flying blind, potentially wasting time and resources to pursue research without structured guidance.

The principal investigator, or PI, is responsible for facilitating the research oversight. They will create the research plan and inform team members and stakeholders of every detail relating to the project. The PI will also use the research plan to inform decision-making throughout the project.

- Why do you need a research plan?

Create a research plan before starting any official research to maximize every effort in pursuing and collecting the research data. Crucially, the plan will model the activities needed at each phase of the research project.

Like any roadmap, a research plan serves as a valuable tool providing direction for those involved in the project—both internally and externally. It will keep you and your immediate team organized and task-focused while also providing necessary definitions and timelines so you can execute your project initiatives with full understanding and transparency.

External stakeholders appreciate a working research plan because it’s a great communication tool, documenting progress and changing dynamics as they arise. Any participants of your planned research sessions will be informed about the purpose of your study, while the exercises will be based on the key messaging outlined in the official plan.

Here are some of the benefits of creating a research plan document for every project:

Project organization and structure

Well-informed participants

All stakeholders and teams align in support of the project

Clearly defined project definitions and purposes

Distractions are eliminated, prioritizing task focus

Timely management of individual task schedules and roles

Costly reworks are avoided

- What should a research plan include?

The different aspects of your research plan will depend on the nature of the project. However, most official research plan documents will include the core elements below. Each aims to define the problem statement, devising an official plan for seeking a solution.

Specific project goals and individual objectives

Ideal strategies or methods for reaching those goals

Required resources

Descriptions of the target audience, sample sizes, demographics, and scopes

Key performance indicators (KPIs)

Project background

Research and testing support

Preliminary studies and progress reporting mechanisms

Cost estimates and change order processes

Depending on the research project’s size and scope, your research plan could be brief—perhaps only a few pages of documented plans. Alternatively, it could be a fully comprehensive report. Either way, it’s an essential first step in dictating your project’s facilitation in the most efficient and effective way.

- How to write a research plan for your project

When you start writing your research plan, aim to be detailed about each step, requirement, and idea. The more time you spend curating your research plan, the more precise your research execution efforts will be.

Account for every potential scenario, and be sure to address each and every aspect of the research.

Consider following this flow to develop a great research plan for your project:

Define your project’s purpose

Start by defining your project’s purpose. Identify what your project aims to accomplish and what you are researching. Remember to use clear language.

Thinking about the project’s purpose will help you set realistic goals and inform how you divide tasks and assign responsibilities. These individual tasks will be your stepping stones to reach your overarching goal.

Additionally, you’ll want to identify the specific problem, the usability metrics needed, and the intended solutions.

Know the following three things about your project’s purpose before you outline anything else:

What you’re doing

Why you’re doing it

What you expect from it

Identify individual objectives

With your overarching project objectives in place, you can identify any individual goals or steps needed to reach those objectives. Break them down into phases or steps. You can work backward from the project goal and identify every process required to facilitate it.

Be mindful to identify each unique task so that you can assign responsibilities to various team members. At this point in your research plan development, you’ll also want to assign priority to those smaller, more manageable steps and phases that require more immediate or dedicated attention.

Select research methods

Research methods might include any of the following:

User interviews: this is a qualitative research method where researchers engage with participants in one-on-one or group conversations. The aim is to gather insights into their experiences, preferences, and opinions to uncover patterns, trends, and data.

Field studies: this approach allows for a contextual understanding of behaviors, interactions, and processes in real-world settings. It involves the researcher immersing themselves in the field, conducting observations, interviews, or experiments to gather in-depth insights.

Card sorting: participants categorize information by sorting content cards into groups based on their perceived similarities. You might use this process to gain insights into participants’ mental models and preferences when navigating or organizing information on websites, apps, or other systems.

Focus groups: use organized discussions among select groups of participants to provide relevant views and experiences about a particular topic.

Diary studies: ask participants to record their experiences, thoughts, and activities in a diary over a specified period. This method provides a deeper understanding of user experiences, uncovers patterns, and identifies areas for improvement.

Five-second testing: participants are shown a design, such as a web page or interface, for just five seconds. They then answer questions about their initial impressions and recall, allowing you to evaluate the design’s effectiveness.

Surveys: get feedback from participant groups with structured surveys. You can use online forms, telephone interviews, or paper questionnaires to reveal trends, patterns, and correlations.

Tree testing: tree testing involves researching web assets through the lens of findability and navigability. Participants are given a textual representation of the site’s hierarchy (the “tree”) and asked to locate specific information or complete tasks by selecting paths.

Usability testing: ask participants to interact with a product, website, or application to evaluate its ease of use. This method enables you to uncover areas for improvement in digital key feature functionality by observing participants using the product.

Live website testing: research and collect analytics that outlines the design, usability, and performance efficiencies of a website in real time.

There are no limits to the number of research methods you could use within your project. Just make sure your research methods help you determine the following:

What do you plan to do with the research findings?

What decisions will this research inform? How can your stakeholders leverage the research data and results?

Recruit participants and allocate tasks

Next, identify the participants needed to complete the research and the resources required to complete the tasks. Different people will be proficient at different tasks, and having a task allocation plan will allow everything to run smoothly.

Prepare a thorough project summary

Every well-designed research plan will feature a project summary. This official summary will guide your research alongside its communications or messaging. You’ll use the summary while recruiting participants and during stakeholder meetings. It can also be useful when conducting field studies.

Ensure this summary includes all the elements of your research project. Separate the steps into an easily explainable piece of text that includes the following:

An introduction: the message you’ll deliver to participants about the interview, pre-planned questioning, and testing tasks.

Interview questions: prepare questions you intend to ask participants as part of your research study, guiding the sessions from start to finish.

An exit message: draft messaging your teams will use to conclude testing or survey sessions. These should include the next steps and express gratitude for the participant’s time.

Create a realistic timeline

While your project might already have a deadline or a results timeline in place, you’ll need to consider the time needed to execute it effectively.

Realistically outline the time needed to properly execute each supporting phase of research and implementation. And, as you evaluate the necessary schedules, be sure to include additional time for achieving each milestone in case any changes or unexpected delays arise.

For this part of your research plan, you might find it helpful to create visuals to ensure your research team and stakeholders fully understand the information.

Determine how to present your results

A research plan must also describe how you intend to present your results. Depending on the nature of your project and its goals, you might dedicate one team member (the PI) or assume responsibility for communicating the findings yourself.

In this part of the research plan, you’ll articulate how you’ll share the results. Detail any materials you’ll use, such as:

Presentations and slides

A project report booklet

A project findings pamphlet

Documents with key takeaways and statistics

Graphic visuals to support your findings

- Format your research plan

As you create your research plan, you can enjoy a little creative freedom. A plan can assume many forms, so format it how you see fit. Determine the best layout based on your specific project, intended communications, and the preferences of your teams and stakeholders.

Find format inspiration among the following layouts:

Written outlines

Narrative storytelling

Visual mapping

Graphic timelines

Remember, the research plan format you choose will be subject to change and adaptation as your research and findings unfold. However, your final format should ideally outline questions, problems, opportunities, and expectations.

- Research plan example

Imagine you’ve been tasked with finding out how to get more customers to order takeout from an online food delivery platform. The goal is to improve satisfaction and retain existing customers. You set out to discover why more people aren’t ordering and what it is they do want to order or experience.

You identify the need for a research project that helps you understand what drives customer loyalty. But before you jump in and start calling past customers, you need to develop a research plan—the roadmap that provides focus, clarity, and realistic details to the project.

Here’s an example outline of a research plan you might put together:

Project title

Project members involved in the research plan

Purpose of the project (provide a summary of the research plan’s intent)

Objective 1 (provide a short description for each objective)

Objective 2

Objective 3

Proposed timeline

Audience (detail the group you want to research, such as customers or non-customers)

Budget (how much you think it might cost to do the research)

Risk factors/contingencies (any potential risk factors that may impact the project’s success)

Remember, your research plan doesn’t have to reinvent the wheel—it just needs to fit your project’s unique needs and aims.

Customizing a research plan template

Some companies offer research plan templates to help get you started. However, it may make more sense to develop your own customized plan template. Be sure to include the core elements of a great research plan with your template layout, including the following:

Introductions to participants and stakeholders

Background problems and needs statement

Significance, ethics, and purpose

Research methods, questions, and designs

Preliminary beliefs and expectations

Implications and intended outcomes

Realistic timelines for each phase

Conclusion and presentations

How many pages should a research plan be?

Generally, a research plan can vary in length between 500 to 1,500 words. This is roughly three pages of content. More substantial projects will be 2,000 to 3,500 words, taking up four to seven pages of planning documents.

What is the difference between a research plan and a research proposal?

A research plan is a roadmap to success for research teams. A research proposal, on the other hand, is a dissertation aimed at convincing or earning the support of others. Both are relevant in creating a guide to follow to complete a project goal.

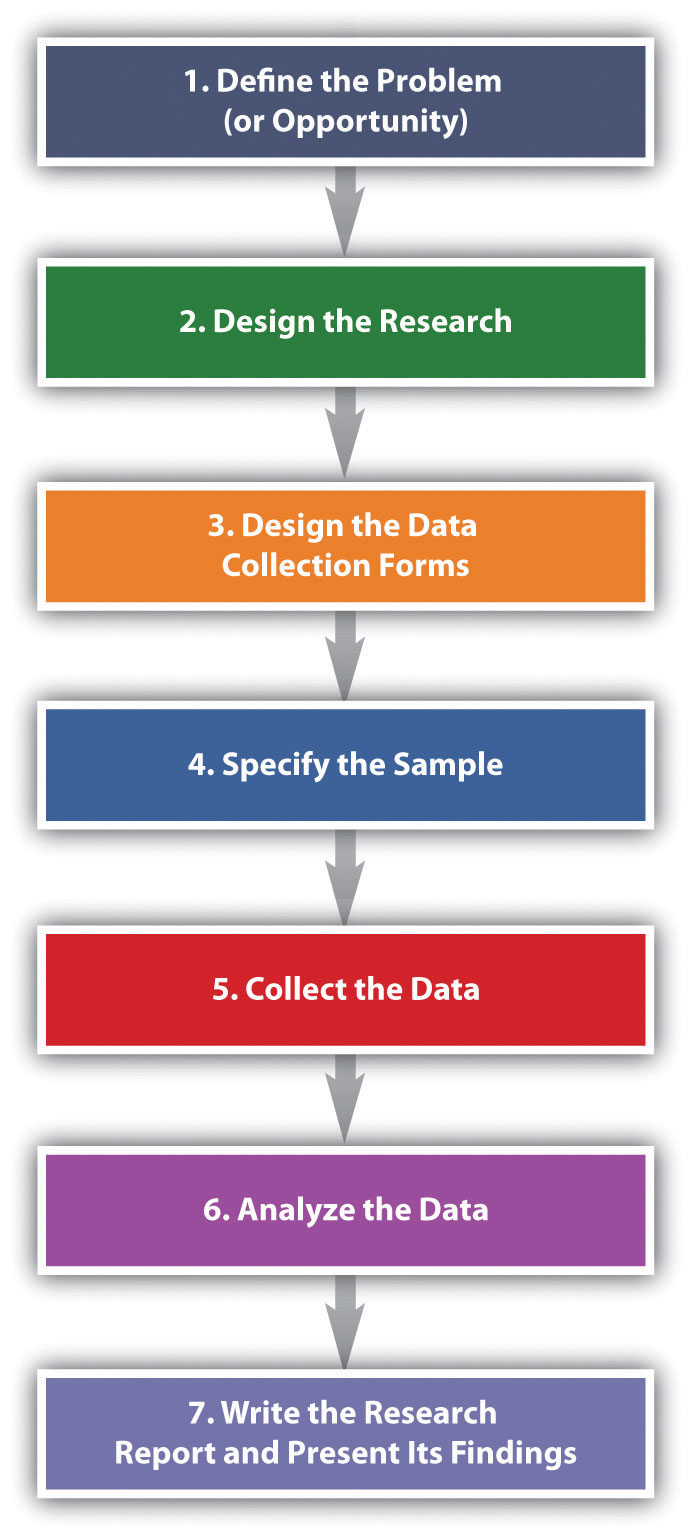

What are the seven steps to developing a research plan?

While each research project is different, it’s best to follow these seven general steps to create your research plan:

Defining the problem

Identifying goals

Choosing research methods

Recruiting participants

Preparing the brief or summary

Establishing task timelines

Defining how you will present the findings

Get started today

Go from raw data to valuable insights with a flexible research platform

Editor’s picks

Last updated: 21 December 2023

Last updated: 16 December 2023

Last updated: 6 October 2023

Last updated: 25 November 2023

Last updated: 12 May 2023

Last updated: 15 February 2024

Last updated: 11 March 2024

Last updated: 12 December 2023

Last updated: 18 May 2023

Last updated: 6 March 2024

Last updated: 10 April 2023

Last updated: 20 December 2023

Latest articles

Related topics, log in or sign up.

Get started for free

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Methodology

Research Design | Step-by-Step Guide with Examples

Published on 5 May 2022 by Shona McCombes . Revised on 20 March 2023.

A research design is a strategy for answering your research question using empirical data. Creating a research design means making decisions about:

- Your overall aims and approach

- The type of research design you’ll use

- Your sampling methods or criteria for selecting subjects

- Your data collection methods

- The procedures you’ll follow to collect data

- Your data analysis methods

A well-planned research design helps ensure that your methods match your research aims and that you use the right kind of analysis for your data.

Table of contents

Step 1: consider your aims and approach, step 2: choose a type of research design, step 3: identify your population and sampling method, step 4: choose your data collection methods, step 5: plan your data collection procedures, step 6: decide on your data analysis strategies, frequently asked questions.

- Introduction

Before you can start designing your research, you should already have a clear idea of the research question you want to investigate.

There are many different ways you could go about answering this question. Your research design choices should be driven by your aims and priorities – start by thinking carefully about what you want to achieve.

The first choice you need to make is whether you’ll take a qualitative or quantitative approach.

Qualitative research designs tend to be more flexible and inductive , allowing you to adjust your approach based on what you find throughout the research process.

Quantitative research designs tend to be more fixed and deductive , with variables and hypotheses clearly defined in advance of data collection.

It’s also possible to use a mixed methods design that integrates aspects of both approaches. By combining qualitative and quantitative insights, you can gain a more complete picture of the problem you’re studying and strengthen the credibility of your conclusions.

Practical and ethical considerations when designing research

As well as scientific considerations, you need to think practically when designing your research. If your research involves people or animals, you also need to consider research ethics .

- How much time do you have to collect data and write up the research?

- Will you be able to gain access to the data you need (e.g., by travelling to a specific location or contacting specific people)?

- Do you have the necessary research skills (e.g., statistical analysis or interview techniques)?

- Will you need ethical approval ?

At each stage of the research design process, make sure that your choices are practically feasible.

Prevent plagiarism, run a free check.

Within both qualitative and quantitative approaches, there are several types of research design to choose from. Each type provides a framework for the overall shape of your research.

Types of quantitative research designs

Quantitative designs can be split into four main types. Experimental and quasi-experimental designs allow you to test cause-and-effect relationships, while descriptive and correlational designs allow you to measure variables and describe relationships between them.

With descriptive and correlational designs, you can get a clear picture of characteristics, trends, and relationships as they exist in the real world. However, you can’t draw conclusions about cause and effect (because correlation doesn’t imply causation ).

Experiments are the strongest way to test cause-and-effect relationships without the risk of other variables influencing the results. However, their controlled conditions may not always reflect how things work in the real world. They’re often also more difficult and expensive to implement.

Types of qualitative research designs

Qualitative designs are less strictly defined. This approach is about gaining a rich, detailed understanding of a specific context or phenomenon, and you can often be more creative and flexible in designing your research.

The table below shows some common types of qualitative design. They often have similar approaches in terms of data collection, but focus on different aspects when analysing the data.

Your research design should clearly define who or what your research will focus on, and how you’ll go about choosing your participants or subjects.

In research, a population is the entire group that you want to draw conclusions about, while a sample is the smaller group of individuals you’ll actually collect data from.

Defining the population

A population can be made up of anything you want to study – plants, animals, organisations, texts, countries, etc. In the social sciences, it most often refers to a group of people.

For example, will you focus on people from a specific demographic, region, or background? Are you interested in people with a certain job or medical condition, or users of a particular product?

The more precisely you define your population, the easier it will be to gather a representative sample.

Sampling methods

Even with a narrowly defined population, it’s rarely possible to collect data from every individual. Instead, you’ll collect data from a sample.

To select a sample, there are two main approaches: probability sampling and non-probability sampling . The sampling method you use affects how confidently you can generalise your results to the population as a whole.

Probability sampling is the most statistically valid option, but it’s often difficult to achieve unless you’re dealing with a very small and accessible population.

For practical reasons, many studies use non-probability sampling, but it’s important to be aware of the limitations and carefully consider potential biases. You should always make an effort to gather a sample that’s as representative as possible of the population.

Case selection in qualitative research

In some types of qualitative designs, sampling may not be relevant.

For example, in an ethnography or a case study, your aim is to deeply understand a specific context, not to generalise to a population. Instead of sampling, you may simply aim to collect as much data as possible about the context you are studying.

In these types of design, you still have to carefully consider your choice of case or community. You should have a clear rationale for why this particular case is suitable for answering your research question.

For example, you might choose a case study that reveals an unusual or neglected aspect of your research problem, or you might choose several very similar or very different cases in order to compare them.

Data collection methods are ways of directly measuring variables and gathering information. They allow you to gain first-hand knowledge and original insights into your research problem.

You can choose just one data collection method, or use several methods in the same study.

Survey methods

Surveys allow you to collect data about opinions, behaviours, experiences, and characteristics by asking people directly. There are two main survey methods to choose from: questionnaires and interviews.

Observation methods

Observations allow you to collect data unobtrusively, observing characteristics, behaviours, or social interactions without relying on self-reporting.

Observations may be conducted in real time, taking notes as you observe, or you might make audiovisual recordings for later analysis. They can be qualitative or quantitative.

Other methods of data collection

There are many other ways you might collect data depending on your field and topic.

If you’re not sure which methods will work best for your research design, try reading some papers in your field to see what data collection methods they used.

Secondary data

If you don’t have the time or resources to collect data from the population you’re interested in, you can also choose to use secondary data that other researchers already collected – for example, datasets from government surveys or previous studies on your topic.

With this raw data, you can do your own analysis to answer new research questions that weren’t addressed by the original study.

Using secondary data can expand the scope of your research, as you may be able to access much larger and more varied samples than you could collect yourself.

However, it also means you don’t have any control over which variables to measure or how to measure them, so the conclusions you can draw may be limited.

As well as deciding on your methods, you need to plan exactly how you’ll use these methods to collect data that’s consistent, accurate, and unbiased.

Planning systematic procedures is especially important in quantitative research, where you need to precisely define your variables and ensure your measurements are reliable and valid.

Operationalisation

Some variables, like height or age, are easily measured. But often you’ll be dealing with more abstract concepts, like satisfaction, anxiety, or competence. Operationalisation means turning these fuzzy ideas into measurable indicators.

If you’re using observations , which events or actions will you count?

If you’re using surveys , which questions will you ask and what range of responses will be offered?

You may also choose to use or adapt existing materials designed to measure the concept you’re interested in – for example, questionnaires or inventories whose reliability and validity has already been established.

Reliability and validity

Reliability means your results can be consistently reproduced , while validity means that you’re actually measuring the concept you’re interested in.

For valid and reliable results, your measurement materials should be thoroughly researched and carefully designed. Plan your procedures to make sure you carry out the same steps in the same way for each participant.

If you’re developing a new questionnaire or other instrument to measure a specific concept, running a pilot study allows you to check its validity and reliability in advance.

Sampling procedures

As well as choosing an appropriate sampling method, you need a concrete plan for how you’ll actually contact and recruit your selected sample.

That means making decisions about things like:

- How many participants do you need for an adequate sample size?

- What inclusion and exclusion criteria will you use to identify eligible participants?

- How will you contact your sample – by mail, online, by phone, or in person?

If you’re using a probability sampling method, it’s important that everyone who is randomly selected actually participates in the study. How will you ensure a high response rate?

If you’re using a non-probability method, how will you avoid bias and ensure a representative sample?

Data management

It’s also important to create a data management plan for organising and storing your data.

Will you need to transcribe interviews or perform data entry for observations? You should anonymise and safeguard any sensitive data, and make sure it’s backed up regularly.

Keeping your data well organised will save time when it comes to analysing them. It can also help other researchers validate and add to your findings.

On their own, raw data can’t answer your research question. The last step of designing your research is planning how you’ll analyse the data.

Quantitative data analysis

In quantitative research, you’ll most likely use some form of statistical analysis . With statistics, you can summarise your sample data, make estimates, and test hypotheses.

Using descriptive statistics , you can summarise your sample data in terms of:

- The distribution of the data (e.g., the frequency of each score on a test)

- The central tendency of the data (e.g., the mean to describe the average score)

- The variability of the data (e.g., the standard deviation to describe how spread out the scores are)

The specific calculations you can do depend on the level of measurement of your variables.

Using inferential statistics , you can:

- Make estimates about the population based on your sample data.

- Test hypotheses about a relationship between variables.

Regression and correlation tests look for associations between two or more variables, while comparison tests (such as t tests and ANOVAs ) look for differences in the outcomes of different groups.

Your choice of statistical test depends on various aspects of your research design, including the types of variables you’re dealing with and the distribution of your data.

Qualitative data analysis

In qualitative research, your data will usually be very dense with information and ideas. Instead of summing it up in numbers, you’ll need to comb through the data in detail, interpret its meanings, identify patterns, and extract the parts that are most relevant to your research question.

Two of the most common approaches to doing this are thematic analysis and discourse analysis .

There are many other ways of analysing qualitative data depending on the aims of your research. To get a sense of potential approaches, try reading some qualitative research papers in your field.

A sample is a subset of individuals from a larger population. Sampling means selecting the group that you will actually collect data from in your research.

For example, if you are researching the opinions of students in your university, you could survey a sample of 100 students.

Statistical sampling allows you to test a hypothesis about the characteristics of a population. There are various sampling methods you can use to ensure that your sample is representative of the population as a whole.

Operationalisation means turning abstract conceptual ideas into measurable observations.

For example, the concept of social anxiety isn’t directly observable, but it can be operationally defined in terms of self-rating scores, behavioural avoidance of crowded places, or physical anxiety symptoms in social situations.

Before collecting data , it’s important to consider how you will operationalise the variables that you want to measure.

The research methods you use depend on the type of data you need to answer your research question .

- If you want to measure something or test a hypothesis , use quantitative methods . If you want to explore ideas, thoughts, and meanings, use qualitative methods .

- If you want to analyse a large amount of readily available data, use secondary data. If you want data specific to your purposes with control over how they are generated, collect primary data.

- If you want to establish cause-and-effect relationships between variables , use experimental methods. If you want to understand the characteristics of a research subject, use descriptive methods.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the ‘Cite this Scribbr article’ button to automatically add the citation to our free Reference Generator.

McCombes, S. (2023, March 20). Research Design | Step-by-Step Guide with Examples. Scribbr. Retrieved 22 April 2024, from https://www.scribbr.co.uk/research-methods/research-design/

Is this article helpful?

Shona McCombes

FLEET LIBRARY | Research Guides

Rhode island school of design, create a research plan: research plan.

- Research Plan

- Literature Review

- Ulrich's Global Serials Directory

- Related Guides

A research plan is a framework that shows how you intend to approach your topic. The plan can take many forms: a written outline, a narrative, a visual/concept map or timeline. It's a document that will change and develop as you conduct your research. Components of a research plan

1. Research conceptualization - introduces your research question

2. Research methodology - describes your approach to the research question

3. Literature review, critical evaluation and synthesis - systematic approach to locating,

reviewing and evaluating the work (text, exhibitions, critiques, etc) relating to your topic

4. Communication - geared toward an intended audience, shows evidence of your inquiry

Research conceptualization refers to the ability to identify specific research questions, problems or opportunities that are worthy of inquiry. Research conceptualization also includes the skills and discipline that go beyond the initial moment of conception, and which enable the researcher to formulate and develop an idea into something researchable ( Newbury 373).

Research methodology refers to the knowledge and skills required to select and apply appropriate methods to carry through the research project ( Newbury 374) .

Method describes a single mode of proceeding; methodology describes the overall process.

Method - a way of doing anything especially according to a defined and regular plan; a mode of procedure in any activity

Methodology - the study of the direction and implications of empirical research, or the sustainability of techniques employed in it; a method or body of methods used in a particular field of study or activity *Browse a list of research methodology books or this guide on Art & Design Research

Literature Review, critical evaluation & synthesis

A literature review is a systematic approach to locating, reviewing, and evaluating the published work and work in progress of scholars, researchers, and practitioners on a given topic.

Critical evaluation and synthesis is the ability to handle (or process) existing sources. It includes knowledge of the sources of literature and contextual research field within which the person is working ( Newbury 373).

Literature reviews are done for many reasons and situations. Here's a short list:

Sources to consult while conducting a literature review:

Online catalogs of local, regional, national, and special libraries

meta-catalogs such as worldcat , Art Discovery Group , europeana , world digital library or RIBA

subject-specific online article databases (such as the Avery Index, JSTOR, Project Muse)

digital institutional repositories such as Digital Commons @RISD ; see Registry of Open Access Repositories

Open Access Resources recommended by RISD Research LIbrarians

works cited in scholarly books and articles

print bibliographies

the internet-locate major nonprofit, research institutes, museum, university, and government websites

search google scholar to locate grey literature & referenced citations

trade and scholarly publishers

fellow scholars and peers

Communication

Communication refers to the ability to

- structure a coherent line of inquiry

- communicate your findings to your intended audience

- make skilled use of visual material to express ideas for presentations, writing, and the creation of exhibitions ( Newbury 374)

Research plan framework: Newbury, Darren. "Research Training in the Creative Arts and Design." The Routledge Companion to Research in the Arts . Ed. Michael Biggs and Henrik Karlsson. New York: Routledge, 2010. 368-87. Print.

About the author

Except where otherwise noted, this guide is subject to a Creative Commons Attribution license

source document

Routledge Companion to Research in the Arts

- Next: Literature Review >>

- Last Updated: Sep 20, 2023 5:05 PM

- URL: https://risd.libguides.com/researchplan

We use cookies to give you the best experience possible. By continuing we’ll assume you’re on board with our cookie policy

- A Research Guide

- Research Paper Guide

How to Write a Research Plan

- Research plan definition

- Purpose of a research plan

- Research plan structure

- Step-by-step writing guide

Tips for creating a research plan

- Research plan examples

Research plan: definition and significance

What is the purpose of a research plan.

- Bridging gaps in the existing knowledge related to their subject.

- Reinforcing established research about their subject.

- Introducing insights that contribute to subject understanding.

Research plan structure & template

Introduction.

- What is the existing knowledge about the subject?

- What gaps remain unanswered?

- How will your research enrich understanding, practice, and policy?

Literature review

Expected results.

- Express how your research can challenge established theories in your field.

- Highlight how your work lays the groundwork for future research endeavors.

- Emphasize how your work can potentially address real-world problems.

5 Steps to crafting an effective research plan

Step 1: define the project purpose, step 2: select the research method, step 3: manage the task and timeline, step 4: write a summary, step 5: plan the result presentation.

- Brainstorm Collaboratively: Initiate a collective brainstorming session with peers or experts. Outline the essential questions that warrant exploration and answers within your research.

- Prioritize and Feasibility: Evaluate the list of questions and prioritize those that are achievable and important. Focus on questions that can realistically be addressed.

- Define Key Terminology: Define technical terms pertinent to your research, fostering a shared understanding. Ensure that terms like “church” or “unreached people group” are well-defined to prevent ambiguity.

- Organize your approach: Once well-acquainted with your institution’s regulations, organize each aspect of your research by these guidelines. Allocate appropriate word counts for different sections and components of your research paper.

Research plan example

- Writing a Research Paper

- Research Paper Title

- Research Paper Sources

- Research Paper Problem Statement

- Research Paper Thesis Statement

- Hypothesis for a Research Paper

- Research Question

- Research Paper Outline

- Research Paper Summary

- Research Paper Prospectus

- Research Paper Proposal

- Research Paper Format

- Research Paper Styles

- AMA Style Research Paper

- MLA Style Research Paper

- Chicago Style Research Paper

- APA Style Research Paper

- Research Paper Structure

- Research Paper Cover Page

- Research Paper Abstract

- Research Paper Introduction

- Research Paper Body Paragraph

- Research Paper Literature Review

- Research Paper Background

- Research Paper Methods Section

- Research Paper Results Section

- Research Paper Discussion Section

- Research Paper Conclusion

- Research Paper Appendix

- Research Paper Bibliography

- APA Reference Page

- Annotated Bibliography

- Bibliography vs Works Cited vs References Page

- Research Paper Types

- What is Qualitative Research

Receive paper in 3 Hours!

- Choose the number of pages.

- Select your deadline.

- Complete your order.

Number of Pages

550 words (double spaced)

Deadline: 10 days left

By clicking "Log In", you agree to our terms of service and privacy policy . We'll occasionally send you account related and promo emails.

Sign Up for your FREE account

Get a 50% off

Study smarter with Chegg and save your time and money today!

Research Plan

Define how to conduct a research activity by writing the protocol before starting., applied for.

Stakeholders

also called

Research Protocol

related content

Hypothesis Generation

Interview Guide

Diary Study

The research plan is a document that clarifies how to approach the research, touching upon research goals, selected methodologies, types of participants and tools used, timeline and locations. This planning activity needs to be done upfront, before starting the actual research, and help maximizing the effort and modeling the activities in the best way possible, according to the specific research purpose. The plan becomes even more important when the research requires to travel in the field, or coordinate different teams in various locations.

Design the research and explain the approach to other team members or stakeholders.

remember to

Include debriefing sessions in the schedule in order to make the work effective and avoid team burnout.

Grow with us! Share your case studies

The collection is always evolving, following the development of our practice. If you have any interesting tools or example of application to share, please get in touch.

This website uses cookies to collect anonymized usage statistics so that we can improve the overall user experience. If you want to know more or change your preferences, read our Cookie Policy . By clicking Accept you are giving consent to the use of cookies.

No, thank you.

Preparing the Research Plan

Please visit the following pages to earn more about writing the Research Plan including the Specific Aims and Research Strategy:

Rigorous Study Design

Writing For Reviewers

Writing Specific Aims

Writing a Research Strategy

NIH may return the application if it doesn't meet all formatting requirements: Be sure to follow the rules for font, page limits, and more. Do not include information from one section in another section to evade page limits. If responding to an institute-specific program announcement (PA) (not a parent program announcement) or a request for applications (RFA), check the NIH Guide notice, which has additional information. Should it differ from the Notice of Funding Opportunity (NOFO), defer to the NIH Guide . The application must meet the initiative's objectives and special requirements. NINDS program staff will check the application, and if it is not responsive to the announcement, the application will be withdrawn and returned without a review. For detailed instructions please see the NIH's SF 424 (R&R) Application and Electronic Submission Information for the generic SF 424 Application Guide or in the NOFO.

comments Want to contact NINDS staff? Please visit our Find Your NINDS Program Officer page to learn more about contacting Program Officers, Grants Management Specialists, Scientific Review Officers, and Health Program Specialists.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

10.2 Steps in the Marketing Research Process

Learning objective.

- Describe the basic steps in the marketing research process and the purpose of each step.

The basic steps used to conduct marketing research are shown in Figure 10.6 “Steps in the Marketing Research Process” . Next, we discuss each step.

Figure 10.6 Steps in the Marketing Research Process

Step 1: Define the Problem (or Opportunity)

There’s a saying in marketing research that a problem half defined is a problem half solved. Defining the “problem” of the research sounds simple, doesn’t it? Suppose your product is tutoring other students in a subject you’re a whiz at. You have been tutoring for a while, and people have begun to realize you’re darned good at it. Then, suddenly, your business drops off. Or it explodes, and you can’t cope with the number of students you’re being asked help. If the business has exploded, should you try to expand your services? Perhaps you should subcontract with some other “whiz” students. You would send them students to be tutored, and they would give you a cut of their pay for each student you referred to them.

Both of these scenarios would be a problem for you, wouldn’t they? They are problems insofar as they cause you headaches. But are they really the problem? Or are they the symptoms of something bigger? For example, maybe your business has dropped off because your school is experiencing financial trouble and has lowered the number of scholarships given to incoming freshmen. Consequently, there are fewer total students on campus who need your services. Conversely, if you’re swamped with people who want you to tutor them, perhaps your school awarded more scholarships than usual, so there are a greater number of students who need your services. Alternately, perhaps you ran an ad in your school’s college newspaper, and that led to the influx of students wanting you to tutor them.

Businesses are in the same boat you are as a tutor. They take a look at symptoms and try to drill down to the potential causes. If you approach a marketing research company with either scenario—either too much or too little business—the firm will seek more information from you such as the following:

- In what semester(s) did your tutoring revenues fall (or rise)?

- In what subject areas did your tutoring revenues fall (or rise)?

- In what sales channels did revenues fall (or rise): Were there fewer (or more) referrals from professors or other students? Did the ad you ran result in fewer (or more) referrals this month than in the past months?

- Among what demographic groups did your revenues fall (or rise)—women or men, people with certain majors, or first-year, second-, third-, or fourth-year students?

The key is to look at all potential causes so as to narrow the parameters of the study to the information you actually need to make a good decision about how to fix your business if revenues have dropped or whether or not to expand it if your revenues have exploded.

The next task for the researcher is to put into writing the research objective. The research objective is the goal(s) the research is supposed to accomplish. The marketing research objective for your tutoring business might read as follows:

To survey college professors who teach 100- and 200-level math courses to determine why the number of students referred for tutoring dropped in the second semester.

This is admittedly a simple example designed to help you understand the basic concept. If you take a marketing research course, you will learn that research objectives get a lot more complicated than this. The following is an example:

“To gather information from a sample representative of the U.S. population among those who are ‘very likely’ to purchase an automobile within the next 6 months, which assesses preferences (measured on a 1–5 scale ranging from ‘very likely to buy’ to ‘not likely at all to buy’) for the model diesel at three different price levels. Such data would serve as input into a forecasting model that would forecast unit sales, by geographic regions of the country, for each combination of the model’s different prices and fuel configurations (Burns & Bush, 2010).”

Now do you understand why defining the problem is complicated and half the battle? Many a marketing research effort is doomed from the start because the problem was improperly defined. Coke’s ill-fated decision to change the formula of Coca-Cola in 1985 is a case in point: Pepsi had been creeping up on Coke in terms of market share over the years as well as running a successful promotional campaign called the “Pepsi Challenge,” in which consumers were encouraged to do a blind taste test to see if they agreed that Pepsi was better. Coke spent four years researching “the problem.” Indeed, people seemed to like the taste of Pepsi better in blind taste tests. Thus, the formula for Coke was changed. But the outcry among the public was so great that the new formula didn’t last long—a matter of months—before the old formula was reinstated. Some marketing experts believe Coke incorrectly defined the problem as “How can we beat Pepsi in taste tests?” instead of “How can we gain market share against Pepsi?” (Burns & Bush, 2010)

New Coke Is It! 1985

(click to see video)

This video documents the Coca-Cola Company’s ill-fated launch of New Coke in 1985.

1985 Pepsi Commercial—“They Changed My Coke”

This video shows how Pepsi tried to capitalize on the blunder.

Step 2: Design the Research

The next step in the marketing research process is to do a research design. The research design is your “plan of attack.” It outlines what data you are going to gather and from whom, how and when you will collect the data, and how you will analyze it once it’s been obtained. Let’s look at the data you’re going to gather first.

There are two basic types of data you can gather. The first is primary data. Primary data is information you collect yourself, using hands-on tools such as interviews or surveys, specifically for the research project you’re conducting. Secondary data is data that has already been collected by someone else, or data you have already collected for another purpose. Collecting primary data is more time consuming, work intensive, and expensive than collecting secondary data. Consequently, you should always try to collect secondary data first to solve your research problem, if you can. A great deal of research on a wide variety of topics already exists. If this research contains the answer to your question, there is no need for you to replicate it. Why reinvent the wheel?

Sources of Secondary Data

Your company’s internal records are a source of secondary data. So are any data you collect as part of your marketing intelligence gathering efforts. You can also purchase syndicated research. Syndicated research is primary data that marketing research firms collect on a regular basis and sell to other companies. J.D. Power & Associates is a provider of syndicated research. The company conducts independent, unbiased surveys of customer satisfaction, product quality, and buyer behavior for various industries. The company is best known for its research in the automobile sector. One of the best-known sellers of syndicated research is the Nielsen Company, which produces the Nielsen ratings. The Nielsen ratings measure the size of television, radio, and newspaper audiences in various markets. You have probably read or heard about TV shows that get the highest (Nielsen) ratings. (Arbitron does the same thing for radio ratings.) Nielsen, along with its main competitor, Information Resources, Inc. (IRI), also sells businesses scanner-based research . Scanner-based research is information collected by scanners at checkout stands in stores. Each week Nielsen and IRI collect information on the millions of purchases made at stores. The companies then compile the information and sell it to firms in various industries that subscribe to their services. The Nielsen Company has also recently teamed up with Facebook to collect marketing research information. Via Facebook, users will see surveys in some of the spaces in which they used to see online ads (Rappeport, Gelles, 2009).

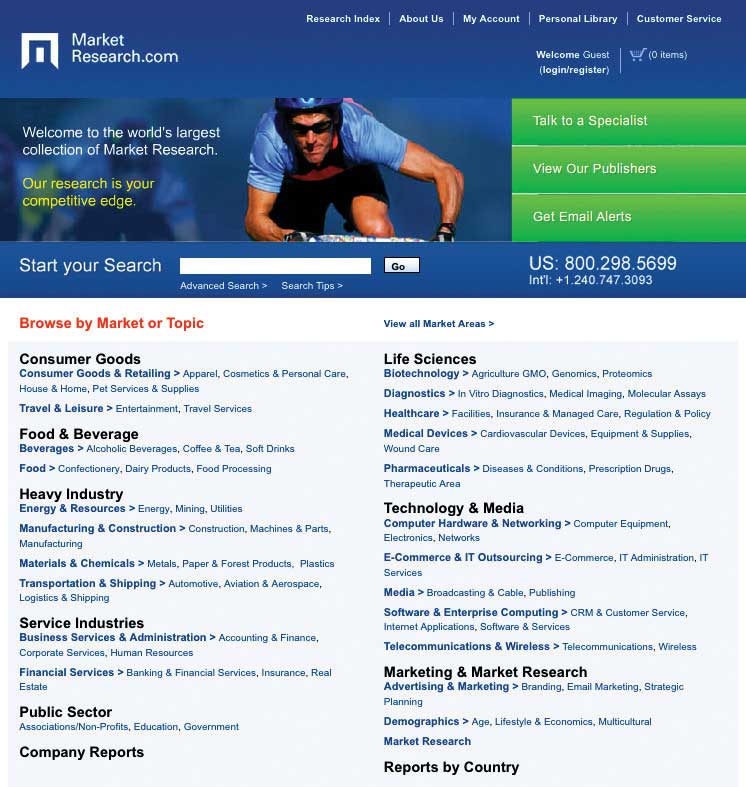

By contrast, MarketResearch.com is an example of a marketing research aggregator. A marketing research aggregator is a marketing research company that doesn’t conduct its own research and sell it. Instead, it buys research reports from other marketing research companies and then sells the reports in their entirety or in pieces to other firms. Check out MarketResearch.com’s Web site. As you will see there are a huge number of studies in every category imaginable that you can buy for relatively small amounts of money.

Figure 10.7

Market research aggregators buy research reports from other marketing research companies and then resell them in part or in whole to other companies so they don’t have to gather primary data.

Source: http://www.marketresearch.com .

Your local library is a good place to gather free secondary data. It has searchable databases as well as handbooks, dictionaries, and books, some of which you can access online. Government agencies also collect and report information on demographics, economic and employment data, health information, and balance-of-trade statistics, among a lot of other information. The U.S. Census Bureau collects census data every ten years to gather information about who lives where. Basic demographic information about sex, age, race, and types of housing in which people live in each U.S. state, metropolitan area, and rural area is gathered so that population shifts can be tracked for various purposes, including determining the number of legislators each state should have in the U.S. House of Representatives. For the U.S. government, this is primary data. For marketing managers it is an important source of secondary data.

The Survey Research Center at the University of Michigan also conducts periodic surveys and publishes information about trends in the United States. One research study the center continually conducts is called the “Changing Lives of American Families” ( http://www.isr.umich.edu/home/news/research-update/2007-01.pdf ). This is important research data for marketing managers monitoring consumer trends in the marketplace. The World Bank and the United Nations are two international organizations that collect a great deal of information. Their Web sites contain many free research studies and data related to global markets. Table 10.1 “Examples of Primary Data Sources versus Secondary Data Sources” shows some examples of primary versus secondary data sources.

Table 10.1 Examples of Primary Data Sources versus Secondary Data Sources

Gauging the Quality of Secondary Data

When you are gathering secondary information, it’s always good to be a little skeptical of it. Sometimes studies are commissioned to produce the result a client wants to hear—or wants the public to hear. For example, throughout the twentieth century, numerous studies found that smoking was good for people’s health. The problem was the studies were commissioned by the tobacco industry. Web research can also pose certain hazards. There are many biased sites that try to fool people that they are providing good data. Often the data is favorable to the products they are trying to sell. Beware of product reviews as well. Unscrupulous sellers sometimes get online and create bogus ratings for products. See below for questions you can ask to help gauge the credibility of secondary information.

Gauging the Credibility of Secondary Data: Questions to Ask

- Who gathered this information?

- For what purpose?

- What does the person or organization that gathered the information have to gain by doing so?

- Was the information gathered and reported in a systematic manner?

- Is the source of the information accepted as an authority by other experts in the field?

- Does the article provide objective evidence to support the position presented?

Types of Research Design

Now let’s look specifically at the types of research designs that are utilized. By understanding different types of research designs, a researcher can solve a client’s problems more quickly and efficiently without jumping through more hoops than necessary. Research designs fall into one of the following three categories:

- Exploratory research design

- Descriptive research design

- Causal research design (experiments)

An exploratory research design is useful when you are initially investigating a problem but you haven’t defined it well enough to do an in-depth study of it. Perhaps via your regular market intelligence, you have spotted what appears to be a new opportunity in the marketplace. You would then do exploratory research to investigate it further and “get your feet wet,” as the saying goes. Exploratory research is less structured than other types of research, and secondary data is often utilized.

One form of exploratory research is qualitative research. Qualitative research is any form of research that includes gathering data that is not quantitative, and often involves exploring questions such as why as much as what or how much . Different forms, such as depth interviews and focus group interviews, are common in marketing research.

The depth interview —engaging in detailed, one-on-one, question-and-answer sessions with potential buyers—is an exploratory research technique. However, unlike surveys, the people being interviewed aren’t asked a series of standard questions. Instead the interviewer is armed with some general topics and asks questions that are open ended, meaning that they allow the interviewee to elaborate. “How did you feel about the product after you purchased it?” is an example of a question that might be asked. A depth interview also allows a researcher to ask logical follow-up questions such as “Can you tell me what you mean when you say you felt uncomfortable using the service?” or “Can you give me some examples?” to help dig further and shed additional light on the research problem. Depth interviews can be conducted in person or over the phone. The interviewer either takes notes or records the interview.

Focus groups and case studies are often utilized for exploratory research as well. A focus group is a group of potential buyers who are brought together to discuss a marketing research topic with one another. A moderator is used to focus the discussion, the sessions are recorded, and the main points of consensus are later summarized by the market researcher. Textbook publishers often gather groups of professors at educational conferences to participate in focus groups. However, focus groups can also be conducted on the telephone, in online chat rooms, or both, using meeting software like WebEx. The basic steps of conducting a focus group are outlined below.

The Basic Steps of Conducting a Focus Group

- Establish the objectives of the focus group. What is its purpose?

- Identify the people who will participate in the focus group. What makes them qualified to participate? How many of them will you need and what they will be paid?

- Obtain contact information for the participants and send out invitations (usually e-mails are most efficient).

- Develop a list of questions.

- Choose a facilitator.

- Choose a location in which to hold the focus group and the method by which it will be recorded.

- Conduct the focus group. If the focus group is not conducted electronically, include name tags for the participants, pens and notepads, any materials the participants need to see, and refreshments. Record participants’ responses.

- Summarize the notes from the focus group and write a report for management.

A case study looks at how another company solved the problem that’s being researched. Sometimes multiple cases, or companies, are used in a study. Case studies nonetheless have a mixed reputation. Some researchers believe it’s hard to generalize, or apply, the results of a case study to other companies. Nonetheless, collecting information about companies that encountered the same problems your firm is facing can give you a certain amount of insight about what direction you should take. In fact, one way to begin a research project is to carefully study a successful product or service.

Two other types of qualitative data used for exploratory research are ethnographies and projective techniques. In an ethnography , researchers interview, observe, and often videotape people while they work, live, shop, and play. The Walt Disney Company has recently begun using ethnographers to uncover the likes and dislikes of boys aged six to fourteen, a financially attractive market segment for Disney, but one in which the company has been losing market share. The ethnographers visit the homes of boys, observe the things they have in their rooms to get a sense of their hobbies, and accompany them and their mothers when they shop to see where they go, what the boys are interested in, and what they ultimately buy. (The children get seventy-five dollars out of the deal, incidentally.) (Barnes, 2009)

Projective techniques are used to reveal information research respondents might not reveal by being asked directly. Asking a person to complete sentences such as the following is one technique:

People who buy Coach handbags __________.

(Will he or she reply with “are cool,” “are affluent,” or “are pretentious,” for example?)

KFC’s grilled chicken is ______.

Or the person might be asked to finish a story that presents a certain scenario. Word associations are also used to discern people’s underlying attitudes toward goods and services. Using a word-association technique, a market researcher asks a person to say or write the first word that comes to his or her mind in response to another word. If the initial word is “fast food,” what word does the person associate it with or respond with? Is it “McDonald’s”? If many people reply that way, and you’re conducting research for Burger King, that could indicate Burger King has a problem. However, if the research is being conducted for Wendy’s, which recently began running an advertising campaign to the effect that Wendy’s offerings are “better than fast food,” it could indicate that the campaign is working.

Completing cartoons is yet another type of projective technique. It’s similar to finishing a sentence or story, only with the pictures. People are asked to look at a cartoon such as the one shown in Figure 10.8 “Example of a Cartoon-Completion Projective Technique” . One of the characters in the picture will have made a statement, and the person is asked to fill in the empty cartoon “bubble” with how they think the second character will respond.

Figure 10.8 Example of a Cartoon-Completion Projective Technique

In some cases, your research might end with exploratory research. Perhaps you have discovered your organization lacks the resources needed to produce the product. In other cases, you might decide you need more in-depth, quantitative research such as descriptive research or causal research, which are discussed next. Most marketing research professionals advise using both types of research, if it’s feasible. On the one hand, the qualitative-type research used in exploratory research is often considered too “lightweight.” Remember earlier in the chapter when we discussed telephone answering machines and the hit TV sitcom Seinfeld ? Both product ideas were initially rejected by focus groups. On the other hand, relying solely on quantitative information often results in market research that lacks ideas.

The Stone Wheel—What One Focus Group Said

Watch the video to see a funny spoof on the usefulness—or lack of usefulness—of focus groups.

Descriptive Research

Anything that can be observed and counted falls into the category of descriptive research design. A study using a descriptive research design involves gathering hard numbers, often via surveys, to describe or measure a phenomenon so as to answer the questions of who , what , where , when , and how . “On a scale of 1–5, how satisfied were you with your service?” is a question that illustrates the information a descriptive research design is supposed to capture.

Physiological measurements also fall into the category of descriptive design. Physiological measurements measure people’s involuntary physical responses to marketing stimuli, such as an advertisement. Elsewhere, we explained that researchers have gone so far as to scan the brains of consumers to see what they really think about products versus what they say about them. Eye tracking is another cutting-edge type of physiological measurement. It involves recording the movements of a person’s eyes when they look at some sort of stimulus, such as a banner ad or a Web page. The Walt Disney Company has a research facility in Austin, Texas, that it uses to take physical measurements of viewers when they see Disney programs and advertisements. The facility measures three types of responses: people’s heart rates, skin changes, and eye movements (eye tracking) (Spangler, 2009).

Figure 10.9

A woman shows off her headgear for an eye-tracking study. The gear’s not exactly a fashion statement but . . .

lawrencegs – Google Glass – CC BY 2.0.

A strictly descriptive research design instrument—a survey, for example—can tell you how satisfied your customers are. It can’t, however, tell you why. Nor can an eye-tracking study tell you why people’s eyes tend to dwell on certain types of banner ads—only that they do. To answer “why” questions an exploratory research design or causal research design is needed (Wagner, 2007).

Causal Research

Causal research design examines cause-and-effect relationships. Using a causal research design allows researchers to answer “what if” types of questions. In other words, if a firm changes X (say, a product’s price, design, placement, or advertising), what will happen to Y (say, sales or customer loyalty)? To conduct causal research, the researcher designs an experiment that “controls,” or holds constant, all of a product’s marketing elements except one (or using advanced techniques of research, a few elements can be studied at the same time). The one variable is changed, and the effect is then measured. Sometimes the experiments are conducted in a laboratory using a simulated setting designed to replicate the conditions buyers would experience. Or the experiments may be conducted in a virtual computer setting.

You might think setting up an experiment in a virtual world such as the online game Second Life would be a viable way to conduct controlled marketing research. Some companies have tried to use Second Life for this purpose, but the results have been somewhat mixed as to whether or not it is a good medium for marketing research. The German marketing research firm Komjuniti was one of the first “real-world” companies to set up an “island” in Second Life upon which it could conduct marketing research. However, with so many other attractive fantasy islands in which to play, the company found it difficult to get Second Life residents, or players, to voluntarily visit the island and stay long enough so meaningful research could be conducted. (Plus, the “residents,” or players, in Second Life have been known to protest corporations invading their world. When the German firm Komjuniti created an island in Second Life to conduct marketing research, the residents showed up waving signs and threatening to boycott the island.) (Wagner, 2007)

Why is being able to control the setting so important? Let’s say you are an American flag manufacturer and you are working with Walmart to conduct an experiment to see where in its stores American flags should be placed so as to increase their sales. Then the terrorist attacks of 9/11 occur. In the days afterward, sales skyrocketed—people bought flags no matter where they were displayed. Obviously, the terrorist attacks in the United States would have skewed the experiment’s data.

An experiment conducted in a natural setting such as a store is referred to as a field experiment . Companies sometimes do field experiments either because it is more convenient or because they want to see if buyers will behave the same way in the “real world” as in a laboratory or on a computer. The place the experiment is conducted or the demographic group of people the experiment is administered to is considered the test market . Before a large company rolls out a product to the entire marketplace, it will often place the offering in a test market to see how well it will be received. For example, to compete with MillerCoors’ sixty-four-calorie beer MGD 64, Anheuser-Busch recently began testing its Select 55 beer in certain cities around the country (McWilliams, 2009).

Figure 10.10

Select 55 beer: Coming soon to a test market near you? (If you’re on a diet, you have to hope so!)

Martine – Le champagne – CC BY-NC 2.0.

Many companies use experiments to test all of their marketing communications. For example, the online discount retailer O.co (formerly called Overstock.com) carefully tests all of its marketing offers and tracks the results of each one. One study the company conducted combined twenty-six different variables related to offers e-mailed to several thousand customers. The study resulted in a decision to send a group of e-mails to different segments. The company then tracked the results of the sales generated to see if they were in line with the earlier experiment it had conducted that led it to make the offer.

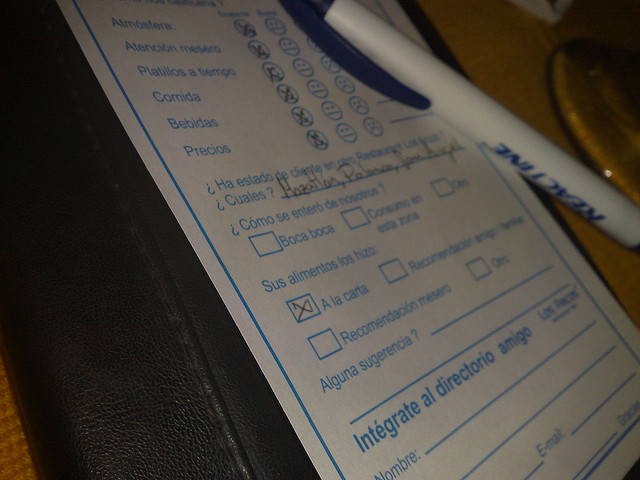

Step 3: Design the Data-Collection Forms

If the behavior of buyers is being formally observed, and a number of different researchers are conducting observations, the data obviously need to be recorded on a standardized data-collection form that’s either paper or electronic. Otherwise, the data collected will not be comparable. The items on the form could include a shopper’s sex; his or her approximate age; whether the person seemed hurried, moderately hurried, or unhurried; and whether or not he or she read the label on products, used coupons, and so forth.

The same is true when it comes to surveying people with questionnaires. Surveying people is one of the most commonly used techniques to collect quantitative data. Surveys are popular because they can be easily administered to large numbers of people fairly quickly. However, to produce the best results, the questionnaire for the survey needs to be carefully designed.

Questionnaire Design

Most questionnaires follow a similar format: They begin with an introduction describing what the study is for, followed by instructions for completing the questionnaire and, if necessary, returning it to the market researcher. The first few questions that appear on the questionnaire are usually basic, warm-up type of questions the respondent can readily answer, such as the respondent’s age, level of education, place of residence, and so forth. The warm-up questions are then followed by a logical progression of more detailed, in-depth questions that get to the heart of the question being researched. Lastly, the questionnaire wraps up with a statement that thanks the respondent for participating in the survey and information and explains when and how they will be paid for participating. To see some examples of questionnaires and how they are laid out, click on the following link: http://cas.uah.edu/wrenb/mkt343/Project/Sample%20Questionnaires.htm .

How the questions themselves are worded is extremely important. It’s human nature for respondents to want to provide the “correct” answers to the person administering the survey, so as to seem agreeable. Therefore, there is always a hazard that people will try to tell you what you want to hear on a survey. Consequently, care needs to be taken that the survey questions are written in an unbiased, neutral way. In other words, they shouldn’t lead a person taking the questionnaire to answer a question one way or another by virtue of the way you have worded it. The following is an example of a leading question.

Don’t you agree that teachers should be paid more ?

The questions also need to be clear and unambiguous. Consider the following question:

Which brand of toothpaste do you use ?

The question sounds clear enough, but is it really? What if the respondent recently switched brands? What if she uses Crest at home, but while away from home or traveling, she uses Colgate’s Wisp portable toothpaste-and-brush product? How will the respondent answer the question? Rewording the question as follows so it’s more specific will help make the question clearer:

Which brand of toothpaste have you used at home in the past six months? If you have used more than one brand, please list each of them 1 .

Sensitive questions have to be asked carefully. For example, asking a respondent, “Do you consider yourself a light, moderate, or heavy drinker?” can be tricky. Few people want to admit to being heavy drinkers. You can “soften” the question by including a range of answers, as the following example shows:

How many alcoholic beverages do you consume in a week ?

- __0–5 alcoholic beverages

- __5–10 alcoholic beverages

- __10–15 alcoholic beverages

Many people don’t like to answer questions about their income levels. Asking them to specify income ranges rather than divulge their actual incomes can help.

Other research question “don’ts” include using jargon and acronyms that could confuse people. “How often do you IM?” is an example. Also, don’t muddy the waters by asking two questions in the same question, something researchers refer to as a double-barreled question . “Do you think parents should spend more time with their children and/or their teachers?” is an example of a double-barreled question.

Open-ended questions , or questions that ask respondents to elaborate, can be included. However, they are harder to tabulate than closed-ended questions , or questions that limit a respondent’s answers. Multiple-choice and yes-and-no questions are examples of closed-ended questions.

Testing the Questionnaire

You have probably heard the phrase “garbage in, garbage out.” If the questions are bad, the information gathered will be bad, too. One way to make sure you don’t end up with garbage is to test the questionnaire before sending it out to find out if there are any problems with it. Is there enough space for people to elaborate on open-ended questions? Is the font readable? To test the questionnaire, marketing research professionals first administer it to a number of respondents face to face. This gives the respondents the chance to ask the researcher about questions or instructions that are unclear or don’t make sense to them. The researcher then administers the questionnaire to a small subset of respondents in the actual way the survey is going to be disseminated, whether it’s delivered via phone, in person, by mail, or online.

Getting people to participate and complete questionnaires can be difficult. If the questionnaire is too long or hard to read, many people won’t complete it. So, by all means, eliminate any questions that aren’t necessary. Of course, including some sort of monetary incentive for completing the survey can increase the number of completed questionnaires a market researcher will receive.

Step 4: Specify the Sample

Once you have created your questionnaire or other marketing study, how do you figure out who should participate in it? Obviously, you can’t survey or observe all potential buyers in the marketplace. Instead, you must choose a sample. A sample is a subset of potential buyers that are representative of your entire target market, or population being studied. Sometimes market researchers refer to the population as the universe to reflect the fact that it includes the entire target market, whether it consists of a million people, a hundred thousand, a few hundred, or a dozen. “All unmarried people over the age of eighteen who purchased Dirt Devil steam cleaners in the United States during 2011” is an example of a population that has been defined.

Obviously, the population has to be defined correctly. Otherwise, you will be studying the wrong group of people. Not defining the population correctly can result in flawed research, or sampling error. A sampling error is any type of marketing research mistake that results because a sample was utilized. One criticism of Internet surveys is that the people who take these surveys don’t really represent the overall population. On average, Internet survey takers tend to be more educated and tech savvy. Consequently, if they solely constitute your population, even if you screen them for certain criteria, the data you collect could end up being skewed.

The next step is to put together the sampling frame , which is the list from which the sample is drawn. The sampling frame can be put together using a directory, customer list, or membership roster (Wrenn et. al., 2007). Keep in mind that the sampling frame won’t perfectly match the population. Some people will be included on the list who shouldn’t be. Other people who should be included will be inadvertently omitted. It’s no different than if you were to conduct a survey of, say, 25 percent of your friends, using friends’ names you have in your cell phone. Most of your friends’ names are likely to be programmed into your phone, but not all of them. As a result, a certain degree of sampling error always occurs.

There are two main categories of samples in terms of how they are drawn: probability samples and nonprobability samples. A probability sample is one in which each would-be participant has a known and equal chance of being selected. The chance is known because the total number of people in the sampling frame is known. For example, if every other person from the sampling frame were chosen, each person would have a 50 percent chance of being selected.

A nonprobability sample is any type of sample that’s not drawn in a systematic way. So the chances of each would-be participant being selected can’t be known. A convenience sample is one type of nonprobability sample. It is a sample a researcher draws because it’s readily available and convenient to do so. Surveying people on the street as they pass by is an example of a convenience sample. The question is, are these people representative of the target market?

For example, suppose a grocery store needed to quickly conduct some research on shoppers to get ready for an upcoming promotion. Now suppose that the researcher assigned to the project showed up between the hours of 10 a.m. and 12 p.m. on a weekday and surveyed as many shoppers as possible. The problem is that the shoppers wouldn’t be representative of the store’s entire target market. What about commuters who stop at the store before and after work? Their views wouldn’t be represented. Neither would people who work the night shift or shop at odd hours. As a result, there would be a lot of room for sampling error in this study. For this reason, studies that use nonprobability samples aren’t considered as accurate as studies that use probability samples. Nonprobability samples are more often used in exploratory research.

Lastly, the size of the sample has an effect on the amount of sampling error. Larger samples generally produce more accurate results. The larger your sample is, the more data you will have, which will give you a more complete picture of what you’re studying. However, the more people surveyed or studied, the more costly the research becomes.

Statistics can be used to determine a sample’s optimal size. If you take a marketing research or statistics class, you will learn more about how to determine the optimal size.