- Browse All Articles

- Newsletter Sign-Up

- 22 Apr 2024

- Research & Ideas

When Does Impact Investing Make the Biggest Impact?

More investors want to back businesses that contribute to social change, but are impact funds the only approach? Research by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin Roth challenges long-held assumptions about impact investing and reveals where such funds make the biggest difference.

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

- Cold Call Podcast

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 14 Mar 2023

What Does the Failure of Silicon Valley Bank Say About the State of Finance?

Silicon Valley Bank wasn't ready for the Fed's interest rate hikes, but that's only part of the story. Victoria Ivashina and Erik Stafford probe the complex factors that led to the second-biggest bank failure ever.

- 13 Mar 2023

What Would It Take to Unlock Microfinance's Full Potential?

Microfinance has been seen as a vehicle for economic mobility in developing countries, but the results have been mixed. Research by Natalia Rigol and Ben Roth probes how different lending approaches might serve entrepreneurs better.

- 16 Feb 2023

ESG Activists Met the Moment at ExxonMobil, But Did They Succeed?

Engine No. 1, a small hedge fund on a mission to confront climate change, managed to do the impossible: Get dissident members on ExxonMobil's board. But lasting social impact has proved more elusive. Case studies by Mark Kramer, Shawn Cole, and Vikram Gandhi look at the complexities of shareholder activism.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews.

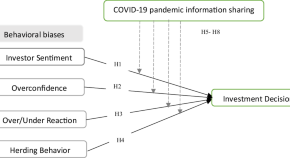

Viral decisions: unmasking the impact of COVID-19 info and behavioral quirks on investment choices

- Wasim ul Rehman

- Omur Saltik

- Suleyman Degirmen

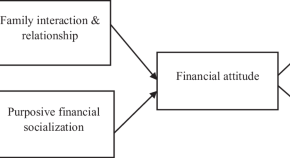

Parents’ financial socialization or socioeconomic characteristics: which has more influence on Gen-Z’s financial wellbeing?

- Khalid Abdul Ghafoor

- Muhammad Akhtar

Cyclical dynamics and co-movement of business, credit, and investment cycles: empirical evidence from India

- Ridhima Garg

The effects of heterogeneous CSR on corporate stock performance: evidence from COVID-19 pandemic in China

COVID-19, the Russia–Ukraine war and the connectedness between the U.S. and Chinese agricultural futures markets

- Yongmin Zhang

- Yingxue Zhao

The complex relationship between credit and liquidity risks: a linear and non-linear analysis for the banking sector

- Jihen Bouslimi

- Abdelaziz Hakimi

- Kais Tissaoui

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Financial analysis

- Finance and investing

- Corporate finance

Strategic Analysis for More Profitable Acquisitions

- Alfred Rappaport

- From the July 1979 Issue

What's Missing from Annual Reports

- Graham Kenny

- December 19, 2014

Why CEOs Should Share Their Long-Term Plans with Investors

- Christina Rehnberg

- George Serafeim

- Brian Tomlinson

- September 19, 2018

Pitfalls in Evaluating Risky Projects

- James E. Hodder

- Henry E. Riggs

- From the January 1985 Issue

How Much Cash Does Your Company Need?

- Richard Passov

- From the November 2003 Issue

Finance: What Managers Need to Know

- September 08, 2009

Valuation Matters

- Michael J. Mauboussin

- From the March 2002 Issue

When The Numbers Don't Add Up

- Jacqueline Murphy

- April 01, 2011

Get More Funding for Your R&D Initiatives

- Christoph Loch

- October 30, 2023

Today’s Options for Tomorrow’s Growth

- W. Carl Kester

- From the March 1984 Issue

What’s It Worth?: A General Manager’s Guide to Valuation

- Timothy A. Luehrman

- From the May–June 1997 Issue

How Much Should a Corporation Earn?

- John J. Scanlon

- From the January 1967 Issue

CEOs Don’t Care Enough About Capital Allocation

- José Antonio Marco-Izquierdo

- April 16, 2015

To Change Your Strategy, First Change How You Think

- Mark Bonchek

- Barry Libert

- May 17, 2017

Value Acceleration: Lessons from Private-Equity Masters

- Paul Rogers

- Thomas P. Holland

- From the June 2002 Issue

How Unicorns Grow

- Harvard Business Review

- From the January–February 2016 Issue

Are You Paying Too Much for That Acquisition?

- Robert G. Eccles

- Kersten L. Lanes

- Thomas C. Wilson

- From the July–August 1999 Issue

Salespeople, Stop Worrying About Being Liked

- March 22, 2019

Putting the Service-Profit Chain to Work

- James L. Heskett

- Thomas O. Jones

- Gary W. Loveman

- W. Earl Sasser, Jr.

- Leonard A. Schlesinger

- From the March–April 1994 Issue

Content Marketers Need to Act Like Publishers

- Greg Satell

- March 21, 2016

Assessing Earnings Quality: Nuware, Inc.

- October 13, 2004

Body Shop International PLC 2001: An Introduction to Financial Modeling (v. 1.2)

- Robert F. Bruner

- Robert M. Conroy

- Susan Shank

- John Vaccaro

- October 08, 2001

Anandam Manufacturing Company: Analysis of Financial Statements

- Vinay Goyal

- Subrata Kumar Mitra

- April 06, 2016

Airinit: Clearing the Accounting Air

- Shane Dikolli

- Gerry yemeng

- January 25, 2024

Environmental Impact-Driven Private Equity Decisions at Ambienta (B)

- Atalay Atasu

- Benjamin Kessler

- November 13, 2022

Gome: Going Public

- August 20, 2007

Financial Accounting Reading: Basic Accounting Concepts and Assumptions

- David F. Hawkins

- June 08, 2017

Amazon.com in the Year 2001: The Question of Going Concern

- Krishna G. Palepu

- Jeremy Cott

- June 20, 2001

Designing Executive Compensation at Kongsberg Automotive (A)

- Suraj Srinivasan

- Quinn Pitcher

- July 10, 2018

California Choppers

- Dan Thompson

- September 23, 2009

Incentive Contracts For Financial Consultants At Private Client Services Division

- Suneel C. Udpa

- November 01, 2012

Star River Electronics Ltd. (V. 1.2)

- Kenneth Eades

- March 21, 2002

Method for Valuing High-Risk, Long-Term Investments: The "Venture Capital Method"

- William A. Sahlman

- Daniel R. Scherlis

- July 24, 1987

Financial Accounting: A Self-Paced Learning Program

- Paul M. Healy

- Michael Sartor

- November 03, 2005

Forestry and Timberland: Impact Investment Analysis

- Jaclyn C. Foroughi

- Maureen McNichols

- February 27, 2022

General Foods Corp.: Project Duck Soup

- Robert R. Glauber

- Steven R. Fenster

- Laura Scher

- February 10, 1986

Bed Bath & Beyond

- Amy P. Hutton

- James Weber

- April 11, 1996

Shift Capital: Transforming the Kensington Neighborhood

- Bruce Usher

- December 18, 2018

Martin Smith: January 2002

- Josh Lerner

- November 26, 1997

Finance Reading: Risk and Return 1: Stock Returns and Diversification, Teaching Note

- April 11, 2017

Airinit: Clearing the Accounting Air, Teaching Note

Popular topics, partner center.

Finance and Investment

Finance specific articles, core business articles, other business articles, finance news from proquest databases.

- Help for these sources

- Analyst & Advisory Services

- Financial Statements & SEC

- Stock Prices

- Bonds & Interest Rates

- Mutual Funds

- Personal Finance

- Directories

- Encyclopedias & Handbooks

- Going Public

- Stock Markets

- Commodities

- Financial Regulations

- More from Lauinger Library

- Legal from GU Law

- Finance at Georgetown

- Using Bloomberg

- CFA Readings

Business Information Consultant (BIC)

Was this Finance guide helpful?

- Banking Information Source This link opens in a new window Includes information on the international and domestic operations of retail and commercial banks and credit unions. Covers over 400 publications, with 160 current full-text trade magazines, newspapers, and some scholarly publications. The American Banker full-text articles start with 1987, while other full-text articles started in 1990. Formerly Banking Literature Index from the American Bankers Association.

- Fed in Print This link opens in a new window Index to all Federal Reserve Board and Banks' publications with selected full text in more recent years.

- Wall Street Journal This link opens in a new window Eastern edition; New York. The Wall Street Journal is the financial newspaper of record. It offers in-depth coverage of national and international finance as well as first rate coverage of hard news. Updated daily.

- Financial Times Financial Times is published out of the UK and is considered a global financial newspaper. Choose ProQuest (ABI/Inform- Complete) access for ease of use.

- ABI/Inform Complete This link opens in a new window The most comprehensive ABI/INFORM™ database, this comprises ABI/INFORM Global, ABI/INFORM Trade and Industry, and ABI/INFORM Dateline. The database features thousands of full-text journals, dissertations, working papers, key business and economics periodicals such as the Economist, country-and industry-focused reports, and downloadable data. Its international coverage gives researchers a complete picture of companies and business trends around the world.

- Business Source Complete This link opens in a new window Full-text business publications and hundreds of scholarly, peer-reviewed journals covering all aspects of business. Coverage goes as far back as 1886. Additional full text, non-journal content includes financial data, case studies, investment research reports, market research reports, country reports, company profiles, SWOT analysis, books, videos, major reference works, book digests, and conference proceedings. more... less... Covers management, economics, finance, accounting, international business and more. Titles include Harvard Business Review, California Management Review, MIT Sloan Management Review and Administrative Science Quarterly .

- Company Dossier (LexisNexis) This link opens in a new window LexisNexis Company Dossier covers more than 35 million global companies, both public and private. Under Reference link, information comes from Hoover's, Disclosure, Datamonitor, Extel, Vickers, and SGA Executive Tracker. more... less... Includes company description and history; key financials; executive, structure, subsidiaries, auditor, and bank information news by region, topic and publication; patents, trademarks, and brands; and litigation.

- Factiva This link opens in a new window Limited to 5 concurrent users. Provides worldwide full-text coverage of local and regional newspapers, trade publications, business newswires, media transcripts, news photos, business-rich websites, investment analyst reports, market research reports, country and regional profiles, company profiles, and historical market data.

- Business Abstracts with Full Text This link opens in a new window Covers all aspects of contemporary business, including accounting, taxation, foreign trade, advertising, banking, public relations, government regulations, real estate, acquisitions and mergers, insurance, communications, management, marketing, entertainment, healthcare, hospitality, tourism, oil and computers.

- Emerald Intelligence + Fulltext This link opens in a new window This source has over 130 full-text journals published by MCB University Press. Subjects include: general management, human resources, information management, library & information services, marketing, property, engineering, quality, training & education, operations, production & economics. Most of the journals have an international perspective.

- NYU's Damodaran's Current Data " Welcome to my [Aswath Damodaran] data page. This page contains links to almost everything you ever wanted to know about the data that is available on my site (and more). I have broken the page down into five constituent parts to make it more naviagable." About data, data breakdown, current data , archived data, webcasts/tools more... less... About Data: I lay out the history/philosophy of my datasets, the timing of the data, the sources I use and some caveats/rules for data usage. Data Breakdown: I explain how I break the data down by variable, by industry, by region, by time and by company. Current Data: This is where the data resides, broken down into corporate finance, valuation and portfolio management sections. Archived Data: If you need the data from prior years, you will find it here, broken down into corporate finance, valuation and portfolio management sections. Webcasts/Tools: These are webcasts, tools (spreadsheets), blog posts and writings about data analysis."

- Next: Analyst & Advisory Services >>

- Last Updated: Apr 24, 2024 10:19 AM

- URL: https://guides.library.georgetown.edu/finance

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Finance and Financial Data

- Analyst Reports

- Earnings Call Transcripts

- Private Companies & Startups

- Stocks & Bonds

- Deals and M&A

- Commodities

- ESG / Sustainability

- Real Estate This link opens in a new window

- Finding Financial Data

- Top-Ranked Finance Journals

Ask a Librarian

You will be connected with a business specialist first, if available.

A Selection of Top-Ranked Finance Journals

- Accounting Review

- Financial Analysts Journal

- Journal of Banking & Finance

- Journal of Corporate Finance

- Journal of Finance

- Journal of Financial Economics

- Journal of Portfolio Management

- Quantitative Finance

- Review of Financial Studies

Search NYU's Electronic Journal Subscriptions by Title

- Search by E-Journal Title

Resources for Finding Finance Scholarship

- ABI/INFORM This link opens in a new window ABI/INFORM features full-text journals, dissertations, working papers, key business, and economics periodicals. Researchers can locate country- and industry-focused reports, and its international focus provides a picture of companies and business trends around the world.

- Business Source Complete This link opens in a new window Business Source Complete is a full text database of articles from popular, scholarly, and trade publications. Subjects covered include management, economics, finance, accounting, international business. Dates of coverage: 1886 to present.

- Google Scholar This link opens in a new window Google Scholar is a central search for scholarly literature. It covers disciplines and sources, peer-reviewed papers, theses, books, abstracts and articles, from academic publishers, professional societies, preprint repositories, universities and other scholarly organizations.

- << Previous: Finding Financial Data

- Next: FAQs >>

- Last Updated: Apr 17, 2024 9:56 AM

- URL: https://guides.nyu.edu/finance

- Accounting Firms

- People In Practice

- Business Recovery

- Company News

- Corporate Finance

- People In Business

- Making Tax Digital

- Regulatory Bodies

- Advertise With Us

- search search

- News keyboard_arrow_down

- Practice strategy

- Contracting

- Administration

- Corporate Tax

- Personal Tax

- Accounting Software

- Accounting Standards

- Business Regulation

- Corporate Governance

- Practice Regulation

- Top 50+50 Accountancy Firms 2023

- Financial Power List 2019

- Top 20 International Alliances and Associations 2019

- Top 20 International Networks 2019

Advertise With US

Information.

- Partner With Us at CFO Executive Dialogue

- Terms & Conditions

- Cookie Policy

- Privacy Policy

New AICPA & CIMA research shows deep divide among finance professionals about the future of finance

AICPA & CIMA released today their Re-defining finance for a sustainable world white paper, the latest iteration of their Future of Finance research programme.

Originally launched in 2019 with the Re-inventing finance for a digital world white paper, this extensive global research programme explores the future of the accounting and finance profession in the age of disruption and its broader ecosystem, defining essential skills, competencies, and knowledge needed to succeed in an ever-changing business world.

A clear divide has opened up between accounting and finance professionals who work as business partners and those who don’t. 60% of accounting and finance professionals surveyed say they identify as finance business partners, and 84% of those are extremely optimistic about the future of the profession.

“Advances in AI, lessons from the COVID pandemic, and dealing with economic uncertainty mean that learning to understand operations, finance strategy and being able to business partner are now must-haves in the repertoire of skills for modern accounting and finance teams,” says Andrew Harding, FCMA, CGMA, Chief Executive – Management Accounting at AICPA & CIMA, together as the Association of International Certified Professional Accountants.

“As the demand for data-driven decision-making and sustainable business models accelerate, the demand for strategic value creating finance teams is set to grow.”

Of the 40% who say they don’t identify as finance business partners, only 15% say they are optimistic about the future of the profession. There is also a split in attitudes to automation with 92% of accounting and finance professionals in non-business partnering roles fearing being automated out of existence compared to 67% of those in business partnering roles.

The Re-defining finance for a sustainable world white paper highlights that the accounting and finance is unequivocally changing, moving away from traditional rules-based approaches and towards a more inclusive, expansive, and value-creation mindset better suited for the challenges of today and tomorrow. Other key findings from the report include:

- Three out of five (61%) accounting and finance professionals say that ESG is becoming increasingly important to their organisation’s business model.

- Since 2018, perceptions of the value finance professionals add to business have risen; including cost efficiency (up 19%), analysis and insights (up 11%), reporting accuracy (up 9%), controllership and risk (up 7%), capital optimisation (up 7%), and partnering and decision support (up 6%).

Through their global Future of Finance programme, which first began before the pandemic, AICPA & CIMA also identified four key shifts redefining the future of the accounting and finance profession:

- A clear evolution of the scope of finance roles within finance teams to embrace ESG and sustainability.

- An acceleration in the adoption of technology to drive a shift from transactional processing by finance teams through automation.

- A growing focus on value-adding creation to transform business models for long-term success.

- A greater need for business partnering skills and the ability to use data and analytics combined with business acumen to improve strategic decision-making and drive business performance.

“The impact of technology developments and sustainability considerations upon business mean that our profession is evolving in new directions at pace. As trusted advisors, accounting and finance professionals at all levels will need to adapt to these changes, adopt multi-capital perspectives of value, and be prepared to partner beyond organisational boundaries,” says Rebecca McCaffry, FCMA, CGMA, Associate Technical Director at AICPA & CIMA, together as the Association of International Certified Professional Accountants.

“These are defining times for the profession, and our research will prove an invaluable resource for illuminating the way forward.”

The broadening of the accounting and finance’s team scope of responsibilities is increasingly driven by ESG, both through new regulations being implemented in this space and growing demand for sustainable business models.

Resources & Whitepapers

Ap the importance of ux in accounts payable: often overlooked, always essential, accounting software the power of customisation in accounting systems, accounting firms turn accounts payable into a value-engine, ap 8 key metrics to measure to optimise accounts payable efficiency.

While 61% of accounting and finance professionals believe that ESG is becoming more important to business models, the alignment between intent and practice remains elusive. AICPA & CIMA’s Re-defining finance for a sustainable world white paper found that only 48% of accounting and finance professionals are currently measuring the impact of sustainable initiatives and only 45% say that they are currently measuring the performance of these initiatives.

This continued expansion of their role is pushing accounting and finance teams to grow their business partnering skills, moving away from their traditional reporting and control roles to using both financial and nonfinancial data to influence resilient, longer-term decision-making. In fact, 62% of accounting and finance professionals highlighted that this remains an area which needs addressing, including enhancing their business acumen and leadership skills.

Subscribe to get your daily business insights

Get the latest analysis and reports delivered to your inbox daily.

Embracing user-friendly AP systems can turn the tide, streamlining workflows, enhancing compliance, and opening doors to early payment discounts. Download Now

Organisations can enhance their financial operations' efficiency, accuracy, and responsiveness by adopting platforms that offer them self-service customisability Download Now

In a world of instant results and automated workloads, the potential for AP to drive insights and transform results is… Download Now

Discover how AP dashboards can transform your business by enhancing efficiency and accuracy in tracking key metrics, as revealed by the latest insights from the Institute of Finance & Management. Download Now

Accountancy Age Rankings

35 under 35 accountancy age & aj chambers selection for 2024.

The numbers you crunch tell a story. Your expertis...

The importance of UX in accounts payable: Often overlooked, always essentia...

The importance of ux in accounts payable: often ov....

Embracing user-friendly AP systems can turn the tide, streamlining workflows, enhancing compliance, and opening doors to early payment discounts. Read...

The power of customisation in accounting systems

Organisations can enhance their financial operations' efficiency, accuracy, and responsiveness by adopting platforms that offer them self-service cust...

Turn Accounts Payable into a value-engine

In a world of instant results and automated workloads, the potential for AP to drive insights and transform results is enormous. But, if you’re still ...

8 Key metrics to measure to optimise accounts payable efficiency

8 key metrics to measure to optimise accounts paya....

Discover how AP dashboards can transform your business by enhancing efficiency and accuracy in tracking key metrics, as revealed by the latest insight...

Related Articles

The ingredients for building the ideal modern finance and accounting team, the ingredients for building the ideal modern fina....

New research reveals a clear recipe for constructing a high-impact finance unit in today’s rapidly evolving business climate. Global talent lead...

CIPFA Appoints Owen Mapley as new CEO

The Chartered Institute of Public Finance and Accountancy (CIPFA) has announced the appointment of Owen Mapley as its new Chief Executive Officer (CEO...

Diversity and inclusion critical to tackling financial talent shortage

Diversity and inclusion critical to tackling finan....

While diversity and inclusion (DE&I) strategies are nothing new, they have risen in importance amongst financial talent when it comes to choosing a pl...

People Moves Update: A series of mid-market appointments

People moves update: a series of mid-market appoin....

December highlighted a flurry of movements for the mid-market accounting firms Read More...

Balancing partnership and parentship

In November, Anne Dwyer, partner and head of audit in London at Kreston Reeves, sat down with Adam Munro, managing consultant at AJ Chambers, to expla...

IT literacy a “prerequisite” for accountants

A basic level of IT literacy combined with investment in training and personal development is essential for staff and new hires at accountancy firms t...

Q&A: caba CEO Cristian Holmes

Accountancy Age spoke with caba CEO, Dr Cristian Holmes, to discuss the importance of the organisation’s mental health services in helping accountants...

Sir Martin Sorrell: Reforms contradict policy

Former CEO of FTSE 100 company WPP concerned reforms may discourage listing in the UK Read More...

Subscribe to the latest news & insights

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

In the U.S. and around the world, inflation is high and getting higher

Two years ago, with millions of people out of work and central bankers and politicians striving to lift the U.S. economy out of a pandemic-induced recession , inflation seemed like an afterthought. A year later, with unemployment falling and the inflation rate rising, many of those same policymakers insisted that the price hikes were “transitory” – a consequence of snarled supply chains, labor shortages and other issues that would right themselves sooner rather than later.

Now, with the inflation rate higher than it’s been since the early 1980s, Biden administration officials acknowledge that they missed their call . According to the latest report from the Bureau of Labor Statistics, the annual inflation rate in May was 8.6%, its highest level since 1981, as measured by the consumer price index . Other inflation metrics also have shown significant increases over the past year or so, though not quite to the same extent as the CPI.

With inflation in the United States running at its highest levels in some four decades, Pew Research Center decided to compare the U.S. experience with those of other countries, especially its peers in the developed world. An earlier version of this post was published in November 2021.

The Center relied primarily on data from the Organization for Economic Cooperation and Development (OECD), most of whose 38 member states are highly developed democracies. The OECD collects a wide range of data about its members, facilitating cross-national comparisons. We chose to use quarterly inflation measures, both because they’re less volatile than monthly figures and because they were available for all but one OECD country (Costa Rica, which joined the OECD in May 2021). Quarterly inflation data also were available for seven non-OECD countries with sizable national economies, so we included them in the analysis as well.

For each country, we calculated year-over-year inflation rates going back to the first quarter of 2010 and ending in the first quarter of this year. We also calculated how much those rates had risen or fallen since the start of the COVID-19 pandemic in the first quarter of 2020.

To get a sense of longer-term inflation trends in the U.S., we analyzed two measures besides the commonly cited consumer price index: The Consumer Price Index Retroactive Series (R-CPI-U-RS) from the Bureau of Labor Statistics, and the Personal Consumption Expenditures Price Index from the Bureau of Economic Analysis.

Inflation in the United States was relatively low for so long that, for entire generations of Americans, rapid price hikes may have seemed like a relic of the distant past. Between the start of 1991 and the end of 2019, year-over-year inflation averaged about 2.3% a month, and exceeded 5.0% only four times. Today, Americans rate inflation as the nation’s top problem , and President Joe Biden has said addressing the problem is his top domestic priority .

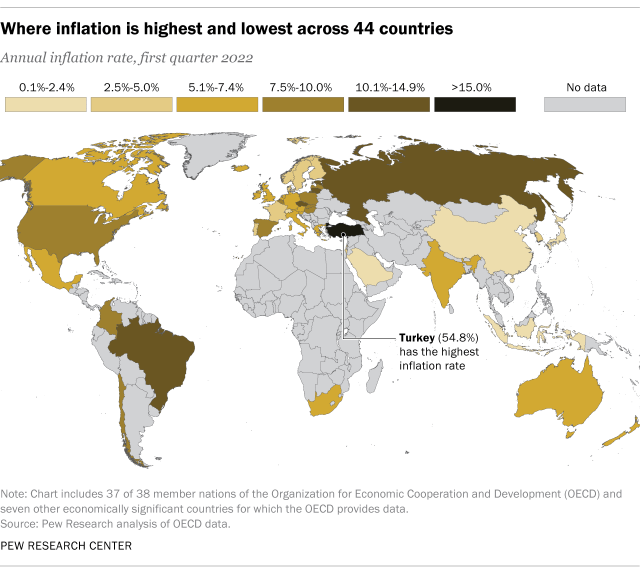

But the U.S. is hardly the only place where people are experiencing inflationary whiplash. A Pew Research Center analysis of data from 44 advanced economies finds that, in nearly all of them, consumer prices have risen substantially since pre-pandemic times.

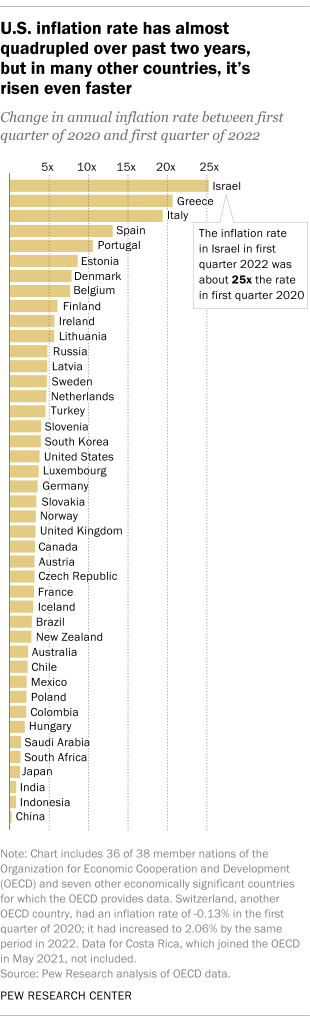

In 37 of these 44 nations, the average annual inflation rate in the first quarter of this year was at least twice what it was in the first quarter of 2020, as COVID-19 was beginning its deadly spread. In 16 countries, first-quarter inflation was more than four times the level of two years prior. (For this analysis, we used data from the Organization for Economic Cooperation and Development, a group of mostly highly developed, democratic countries. The data covers 37 of the 38 OECD member nations, plus seven other economically significant countries.)

Among the countries studied, Turkey had by far the highest inflation rate in the first quarter of 2022: an eye-opening 54.8%. Turkey has experienced high inflation for years, but it shot up in late 2021 as the government pursued unorthodox economic policies , such as cutting interest rates rather than raising them.

The country where inflation has grown fastest over the past two years is Israel. The annual inflation rate in Israel had been below 2.0% (and not infrequently negative) every quarter from the start of 2012 through mid-2021; in the first quarter of 2020, the rate was 0.13%. But after a relatively mild recession , Israel’s consumer price index began rising quickly: It averaged 3.36% in the first quarter of this year, more than 25 times the inflation rate in the same period in 2020.

Besides Israel, other countries with very large increases in inflation between 2020 and 2022 include Italy, which saw a nearly twentyfold increase in the first quarter of 2022 compared with two years earlier (from 0.29% to 5.67%); Switzerland, which went from ‑0.13% in the first quarter of 2020 to 2.06% in the same period of this year; and Greece, a country that knows something about economic turbulence . Following the Greek economy’s near-meltdown in the mid-2010s, the country experienced several years of low inflation – including more than one bout of deflation, the last starting during the first spring and summer of the pandemic. Since then, however, prices have rocketed upward: The annual inflation rate in Greece reached 7.44% in this year’s first quarter – nearly 21 times what it was two years earlier (0.36%).

Annual U.S. inflation in the first quarter of this year averaged just below 8.0% – the 13th-highest rate among the 44 countries examined. The first-quarter inflation rate in the U.S. was almost four times its level in 2020’s first quarter.

Regardless of the absolute level of inflation in each country, most show variations on the same basic pattern: relatively low levels before the COVID-19 pandemic struck in the first quarter of 2020; flat or falling rates for the rest of that year and into 2021, as many governments sharply curtailed most economic activity; and rising rates starting in mid- to late 2021, as the world struggled to get back to something approaching normal.

But there are exceptions to that general dip-and-surge pattern. In Russia, for instance, inflation rates rose steadily throughout the pandemic period before surging in the wake of its invasion of Ukraine . In Indonesia, inflation fell early in the pandemic and has remained at low levels. Japan has continued its years-long struggle with inflation rates that are too low . And in Saudi Arabia, the pattern was reversed: The inflation rate surged during the pandemic but then fell sharply in late 2021; it’s risen a bit since, but still is just 1.6%.

Inflation doesn’t appear to be done with the developed world just yet. An interim report from the OECD found that April’s inflation rate ran ahead of March’s figure in 32 of the group’s 38 member countries.

- COVID-19 & the Economy

- Economic Conditions

Drew DeSilver is a senior writer at Pew Research Center

Wealth Surged in the Pandemic, but Debt Endures for Poorer Black and Hispanic Families

Key facts about the wealth of immigrant households during the covid-19 pandemic, 10 facts about u.s. renters during the pandemic, after dropping in 2020, teen summer employment may be poised to continue its slow comeback, covid-19 pandemic pinches finances of america’s lower- and middle-income families, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

IMAGES

VIDEO

COMMENTS

by Kasandra Brabaw. One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency. 23 Mar 2023.

The Journal of Finance publishes leading research across all the major fields of financial research. It is the most widely cited academic journal on finance and one of the most widely cited journals in economics as well. Each issue of the journal reaches over 8,000 academics, finance professionals, libraries, government and financial ...

The Journal of Finance publishes leading research across all the major fields of financial research. It is the most widely cited academic journal on finance. Each issue of the journal reaches over 8,000 academics, finance professionals, libraries, government and financial institutions around the world. Published six times a year, the journal is the official publication of The American Finance ...

Explore the latest full-text research PDFs, articles, conference papers, preprints and more on FINANCE. Find methods information, sources, references or conduct a literature review on FINANCE

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial ...

Much of the financial literature focuses on the decisions of auditors and managers and the behavior of investors in negotiation decisions, leading to the publication of a large number of experimental studies in the 1960s and 1970s (Libby et al., 2002).Moreover, the instruments of the experimental method—the ability to observe directly, control, and manipulate variables—are adequate for the ...

The aim of the Journal of Banking and Finance is to provide an outlet for the increasing flow of scholarly research concerning financial …. View full aims & scope. $3240. Article publishing charge. for open access. 488 days. Submission to acceptance. 4 days. Acceptance to publication.

Accounting & Finance is essential reading for academics, graduate students, practitioners, and all those interested in research in accounting and finance. Our research addresses significant questions from a broad range of perspectives and using a broad range of research methods. Accounting & Finance publishes significant contributions to the ...

Related Topics: Business and society ... articles on finance that have appeared in HBR have enjoyed the influence of the 1962 article reprinted here as a "Classic." ... New research shows that ...

1. Introduction. This article presents a review of the fifty most influential publications in the Tier 1 Finance journals since their inception, a visualization of their conceptual interrelations, and an agenda for research in finance in the 21st century. The journals commonly classified as Tier 1 Finance journals are: the Journal of Finance ...

Financial analysis Magazine Article. Alfred Rappaport. Less than a decade after the frantic merger activity of the late 1960s, we are again in the midst of a major wave of corporate acquisitions ...

11 According to the survey of the European Central Bank ("Household sector report 2022 Q4", Citation 2023), the mean level of household financial investment in the euro area in 2022 reaches 2.5% in transactions as a percentage of outstanding financial assets.We recognize that in our survey the market participation share reported by participants is considerably higher than the official ...

In addition, "corporate" finance related terms and research on "governance" issues is highly featured in JOD, 4* and 2* journals - ranking in the top 5 keywords for these outlets - while it is far less common in the (positions 10 and 14, respectively). This is in line with the findings from Table 1 and Fig. 1, Fig. 2, Fig. 3, Fig. 4 ...

Finance Specific Articles. Includes information on the international and domestic operations of retail and commercial banks and credit unions. Covers over 400 publications, with 160 current full-text trade magazines, newspapers, and some scholarly publications. The American Banker full-text articles start with 1987, while other full-text ...

1.1. Financial behavior. According to Xiao (Citation 2008), financial behavior is defined as " … any human behavior that is relevant to money management."The most common financial behaviors noted in the literature are those related to the use of money, credit and savings (Hilgert et al., Citation 2003; Xiao et al., Citation 2006).This is why financial literacy is seen as a way to ...

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors. Evaluating the impact of financial literacy on individual financial planning effectiveness.

A Selection of Top-Ranked Finance Journals. Accounting Review. Financial Analysts Journal. Journal of Banking & Finance. Journal of Corporate Finance. Journal of Finance. Journal of Financial Economics. Journal of Portfolio Management. Quantitative Finance.

The finance-related SDG index helps countries understand the ways in which finance correlates to sustainable development and formulate national policies and long-term strategies to achieve the SDGs in the relevant context. ... Related research . People also read lists articles that other readers of this article have read.

AICPA & CIMA released today their Re-defining finance for a sustainable world white paper, the latest iteration of their Future of Finance research programme.. Originally launched in 2019 with the Re-inventing finance for a digital world white paper, this extensive global research programme explores the future of the accounting and finance profession in the age of disruption and its broader ...

The present research paper has drawn policy implications based on the findings: (1) financial managers need to accelerate the growth of financial technology with green financeand supervisors should boost fintech firms to energetically engage in several areas of green finance projects and environmental quality safeguarding enterprises that ...

Between the start of 1991 and the end of 2019, year-over-year inflation averaged about 2.3% a month, and exceeded 5.0% only four times. Today, Americans rate inflation as the nation's top problem, and President Joe Biden has said addressing the problem is his top domestic priority. But the U.S. is hardly the only place where people are ...

The Berkshire Hathaway ( BRK.A -0.34%) ( BRK.B -0.01%) chairman has been wildly successful with his investment philosophy. For years Berkshire made it very easy for investors to see its top ...