How to Write a Marketing Research Objective

We all know the old adage: is marketing is an art or a science?

At Seer, we think it’s both. But not necessarily both at the same time. We believe the better question is: which comes first in marketing, art or science?

And if you ask us that question, we’d tell you it’s a science first.

"The science of marketing is all about using data and insights to drive your strategy. The art of marketing is how you express that strategy."

Now that we know we are starting with science, what does that mean exactly?

Well, remember when you were in school and you had to come up with your own science research experiment? Remember what came first? The objective. Why? Because without an objective, you don’t have a testable proposition. And without a testable proposition, you don’t have direction. And we all know that when research doesn’t have a direction, it typically doesn’t garner any groundbreaking takeaways.

So, what does your high school science experiment have to do with marketing research?

Similar to the traditional objective, a great marketing research plan starts with a strong objective. One that is focused, measurable, and effective. Without a clear objective, your marketing research will not be as successful.

What is a Marketing Research Objective?

[TIP] By definition, a "Research Objective" is a statement of purpose that outlines a specific result to achieve within a dedicated time frame and available resources.

Applying this logic to marketing, a marketing research objective is a statement that outlines what you want to know about your customer. Clearly defining your objective at the beginning stages will help you avoid conflicting expectations or wasted collecting irrelevant data.

How Do You Create a Marketing Research Objective?

Start at the end. I know it sounds counterintuitive, but if you start with the desired outcome, you will be able to create a more focused objective. What’s the one thing you want to be able to take away from this research? What do you plan to do with the information? What does success look like? Use this objective as your compass while you navigate your research and analysis.

Typically, it’s easiest to do this in the form of a question. Here are a few examples.

- Example 1: Which features in Product X are most important to our Enterprise customers?

This question will give you a list of features, in order of importance, for your Enterprise customer.

- Example 2: What are the different search triggers amongst our four customer segments?

This question will result in a list of common factors that result in users searching for Service Y.

When you start seeing all the data points, behaviors, and survey responses - curiosity can set in.

An abundance of data can pull you in multiple directions because each finding is interesting in its own right. That’s when your objective comes in. Know the end result you are working toward and stay on that path.

Creating a Research Objective

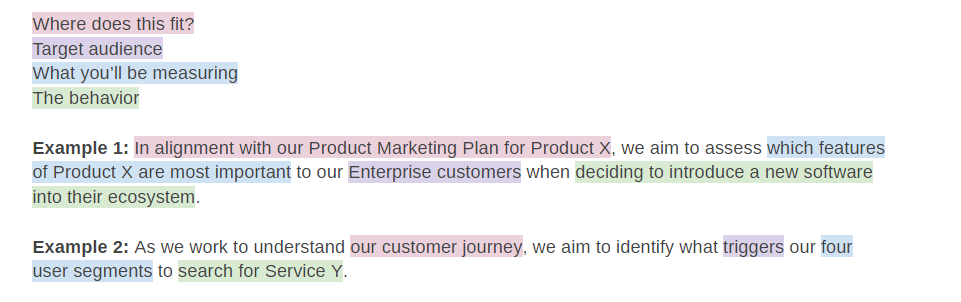

Once you’ve got your desired outcome, you’ll want to create your objective. A few things to consider as you create your statement:

- Where does this fit into your marketing strategy? Where does this objective fit into your larger marketing strategy? Not only is this helpful when dispersing information internally or getting buy-in, it keeps the research team focused on the higher business objectives attached to this research. Is this part of your company’s focus on brand awareness? A new product launch? An analysis of competitors? These are all very different things.

- Include your target audience. Typically, it’s difficult to understand everything with every user segment so pick which segment you plan to analyze. Is it your Enterprise customers? Customers living in a specific region? A certain demographic segment? Including this in your objective will be a helpful gut check when choosing participants.

- What will you measure? You don’t need to list out all of the data points you plan to measure, but there should be some measurable element in your objective. Is it sentiment? Are you looking for frequencies? What about behavioral trends? Including this in your objective will ensure you pick the most appropriate research methodology to acquire that measurable element.

- A behavior. What is the behavior or action that we are going to be researching? Is navigating your website? Is it purchasing a product? Is it clicking on an ad?

Let’s look at some examples:

Common Marketing Research Objective Pitfalls

While creating an objective may seem relatively straightforward, it can be easy to get wrong. Let’s go over some of the common pitfalls.

Objective is Too Broad

Now, if you follow the outline above, this shouldn’t be an issue because it forces you to get granular with your objective.

- Specific: As part of our rebranding, we are conducting a sentiment analysis with our recurring customers

- Broad: As part of our rebranding, we will ask customers how they feel about it

We want to avoid broad objectives because they can allow curiosity to get the best of us and a once seemingly clear research project can get muddied.

More Than One Objective

Every research project should have one objective and one objective only. Again, while this may seem easy enough to manage, you’d be surprised just how easy it is to sneak those secondary and tertiary objectives into your statement.

- One objective: We aim to understand what questions our customers have when considering purchasing a car

- Two objectives: We aim to understand what questions our customers have when searching for and considering a car

You see, the questions customers may have when searching for a car could be completely different than the questions they have when considering purchasing a car.

Making Assumptions

Avoid making your objective into a hypothesis with absolute statements and assumptions. Your objective should be more of a question than a prediction. That comes later.

- Objective: Uncover the purchase journey of our target demographic

- Assumption: Uncover what part search plays in the purchase journey of our target demographic

This looks unsuspecting, but in reality, we're already assuming that search plays a role in our audience's journey. That could sway the focus of the research.

Once you’ve created your objective, let it (and only it) drive the beginning stages of your marketing research.

Write it on a post-it and stick it on your desk, write it on the whiteboard at every meeting you have, keep it top of mind as you continue your research. It will serve as a compass and help you avoid being led astray by interesting data, curious colleagues, and conflicting agendas.

More Tips for Understanding Your Audience

Check back on the Seer blog for the next installment from our Audience team. Sign up for our newsletter to read the latest blogs on audience, SEO, PPC, and more.

We love helping marketers like you.

Sign up for our newsletter to receive updates and more:

Related Posts

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Starting the research process

- Research Objectives | Definition & Examples

Research Objectives | Definition & Examples

Published on July 12, 2022 by Eoghan Ryan . Revised on November 20, 2023.

Research objectives describe what your research is trying to achieve and explain why you are pursuing it. They summarize the approach and purpose of your project and help to focus your research.

Your objectives should appear in the introduction of your research paper , at the end of your problem statement . They should:

- Establish the scope and depth of your project

- Contribute to your research design

- Indicate how your project will contribute to existing knowledge

Table of contents

What is a research objective, why are research objectives important, how to write research aims and objectives, smart research objectives, other interesting articles, frequently asked questions about research objectives.

Research objectives describe what your research project intends to accomplish. They should guide every step of the research process , including how you collect data , build your argument , and develop your conclusions .

Your research objectives may evolve slightly as your research progresses, but they should always line up with the research carried out and the actual content of your paper.

Research aims

A distinction is often made between research objectives and research aims.

A research aim typically refers to a broad statement indicating the general purpose of your research project. It should appear at the end of your problem statement, before your research objectives.

Your research objectives are more specific than your research aim and indicate the particular focus and approach of your project. Though you will only have one research aim, you will likely have several research objectives.

Prevent plagiarism. Run a free check.

Research objectives are important because they:

- Establish the scope and depth of your project: This helps you avoid unnecessary research. It also means that your research methods and conclusions can easily be evaluated .

- Contribute to your research design: When you know what your objectives are, you have a clearer idea of what methods are most appropriate for your research.

- Indicate how your project will contribute to extant research: They allow you to display your knowledge of up-to-date research, employ or build on current research methods, and attempt to contribute to recent debates.

Once you’ve established a research problem you want to address, you need to decide how you will address it. This is where your research aim and objectives come in.

Step 1: Decide on a general aim

Your research aim should reflect your research problem and should be relatively broad.

Step 2: Decide on specific objectives

Break down your aim into a limited number of steps that will help you resolve your research problem. What specific aspects of the problem do you want to examine or understand?

Step 3: Formulate your aims and objectives

Once you’ve established your research aim and objectives, you need to explain them clearly and concisely to the reader.

You’ll lay out your aims and objectives at the end of your problem statement, which appears in your introduction. Frame them as clear declarative statements, and use appropriate verbs to accurately characterize the work that you will carry out.

The acronym “SMART” is commonly used in relation to research objectives. It states that your objectives should be:

- Specific: Make sure your objectives aren’t overly vague. Your research needs to be clearly defined in order to get useful results.

- Measurable: Know how you’ll measure whether your objectives have been achieved.

- Achievable: Your objectives may be challenging, but they should be feasible. Make sure that relevant groundwork has been done on your topic or that relevant primary or secondary sources exist. Also ensure that you have access to relevant research facilities (labs, library resources , research databases , etc.).

- Relevant: Make sure that they directly address the research problem you want to work on and that they contribute to the current state of research in your field.

- Time-based: Set clear deadlines for objectives to ensure that the project stays on track.

If you want to know more about the research process , methodology , research bias , or statistics , make sure to check out some of our other articles with explanations and examples.

Methodology

- Sampling methods

- Simple random sampling

- Stratified sampling

- Cluster sampling

- Likert scales

- Reproducibility

Statistics

- Null hypothesis

- Statistical power

- Probability distribution

- Effect size

- Poisson distribution

Research bias

- Optimism bias

- Cognitive bias

- Implicit bias

- Hawthorne effect

- Anchoring bias

- Explicit bias

Research objectives describe what you intend your research project to accomplish.

They summarize the approach and purpose of the project and help to focus your research.

Your objectives should appear in the introduction of your research paper , at the end of your problem statement .

Your research objectives indicate how you’ll try to address your research problem and should be specific:

Once you’ve decided on your research objectives , you need to explain them in your paper, at the end of your problem statement .

Keep your research objectives clear and concise, and use appropriate verbs to accurately convey the work that you will carry out for each one.

I will compare …

A research aim is a broad statement indicating the general purpose of your research project. It should appear in your introduction at the end of your problem statement , before your research objectives.

Research objectives are more specific than your research aim. They indicate the specific ways you’ll address the overarching aim.

Scope of research is determined at the beginning of your research process , prior to the data collection stage. Sometimes called “scope of study,” your scope delineates what will and will not be covered in your project. It helps you focus your work and your time, ensuring that you’ll be able to achieve your goals and outcomes.

Defining a scope can be very useful in any research project, from a research proposal to a thesis or dissertation . A scope is needed for all types of research: quantitative , qualitative , and mixed methods .

To define your scope of research, consider the following:

- Budget constraints or any specifics of grant funding

- Your proposed timeline and duration

- Specifics about your population of study, your proposed sample size , and the research methodology you’ll pursue

- Any inclusion and exclusion criteria

- Any anticipated control , extraneous , or confounding variables that could bias your research if not accounted for properly.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Ryan, E. (2023, November 20). Research Objectives | Definition & Examples. Scribbr. Retrieved March 25, 2024, from https://www.scribbr.com/research-process/research-objectives/

Is this article helpful?

Eoghan Ryan

Other students also liked, writing strong research questions | criteria & examples, how to write a problem statement | guide & examples, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home QuestionPro Marketing

How to Set Marketing Research Goals and Objectives

Marketing research goals.

Begin with the END

Instead of setting your goals and objectives from where you are NOW, imagine yourself ALREADY having achieved your goal – then work backwards and document HOW YOU GOT THERE.

The reason for this is very simple. If you set your goal based on where you are now – there is a good chance that you will get caught up in fixing a problem that is actually irrelevant in getting your business to where you want it to be.

Set your goals and objectives based on your vision for where you want your company to BE and not where it is NOW.

An Example:

If the vision and mission of your business is to help your customers be successful in their business — then imagine your customers being successful and then imagine in what ways you are helping them do that. This may include things you are currently doing — or NOT. And this is the key to creating marketing research goals and objectives that will help you measure the potential market opportunity, the target audience for your products and how they buy.

(I know that this sounds a little way out. But if you’re wondering how some of the successful businesses you see out there got that way — this is IT)

Take Clate Mask and Scott Martineau from InfusionSoft as an example. InfusionSoft is an email marketing intelligence software that automates your sales and marketing process. It’s a high-end software and it isn’t cheap. Clate and Scott found out that their customers really didn’t know how to put marketing messages together — and hence, the software didn’t appear to be “working.”

They quickly realized that if their customers knew what to put INTO the software – the customers would make more than enough money to pay the fee for the software and also refer the software to their friends and colleagues. As a result, they set a goal to have their entire client base double their sales within a 12 month period.

Having set this goal and objective — they were not only fired up and inspired about what was possible for their business. But their customers bought into the very same goal. Suddenly finding out what their customers needed or wanted that would help them grow and prosper was easy.

And what do you think happened to their response rates? Of course, every time they asked their customers what they wanted — these customers were eager to tell them.

So How is this Relevant to YOU?

If you’ve not been successful collecting feedback from your community or if the research you’ve done hasn’t delivered on results — you might want to look at the goals and objectives that you’ve set.

Are these goals and objectives more focused on solving a problem you have today? If so, that problem might be relevant to YOU but not your customer.

Use Social Media Chatter to Help You Find a Meaningful Goal

Enough of the heady stuff. Let’s get to the meat of how you can set these kinds of goals and objectives.

If you don’t already, set up several social media communication channels that include the following:

- Facebook Fan Page

- LinkedIn Company Profile

- LinkedIn Industry Group

- Twitter Account

The next thing you want to do is start posting articles on your blog that focus on your vision and how you are helping you customers be successful. Get active on industry community sites and spaces, ask questions, answer questions and participate. Then, TELL your customers, suppliers, industry experts to participate as well.

If you keep participating and reminding your audience to visit these sites – you will see conversations, get data and start forming relevant, success based goals and objectives.

Trying this backwards strategy of setting goals and objectives might identify new and exciting opportunities for your business.

Reader Interactions

[…] QuestionPro Blog Insights and sneak peeks into QuestionPro.com Skip to content HomeFree Online TrainingFree Webinar Schedule ← How to Set Marketing Research Goals and Objectives […]

[…] How to Set Marketing Research Goals and Objectives (questionpro.com) […]

MORE LIKE THIS

Resident Experience: What It Is and How to Improve It

Mar 27, 2024

11 Best Employee Onboarding and Training Software in 2024

Top 11 Team Engagement Software in 2024

8 Leading Brand Health Tracker to Track Your Brand Reputation

Mar 26, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![how to make objectives market research → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

![how to make objectives market research SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

20+ Tools & Resources for Conducting Market Research

What's a Competitive Analysis & How Do You Conduct One?

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![how to make objectives market research How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![how to make objectives market research 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![how to make objectives market research 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Media Center

- E-Books & White Papers

- Knowledge Center

A Basic Guide to Defining Your Market Research Goals

by Caitlin Stewart , on May 29, 2014

1. Define the problem or opportunity and state your objectives

When creating a new goal, it is important to recognize any current problems in a company. You should also work to see whether a problem can be molded into an opportunity. Basic marketing research courses explain that a management problem is any type of issue that needs managerial action in order to resolve the issue. However, a marketing research problem is defined as a statement specifying the type of information needed by the decision maker to help solve the management problem and how that information can be obtained efficiently and effectively. To solve the market research problem, a research team can develop a marketing research objective, which is a goal defining the specific information needed to solve the marketing research problem.

Before you begin a project , make sure you clearly define your objectives and the outcomes you expect from the research that will be conducted. Having a clear and definitive goal is helpful because setting too many goals can dilute a project and increase the chance of having the research fail. By having reasonable goals, you can refer back to them during the project to distinguish whether the research is still keeping the original goals in mind.

2. Develop the research design to meet your objectives

The purpose of a well-developed research design is to confirm theories, measure brand loyalty, describe the population, build a customer profile, or to gain specific information. Based on what you are interested in, deciding whether a descriptive or causal study is needed to meet research objectives is key when starting your project.

Consider all potential issues that could arise during research so you and your research team can be prepared and aware if they occur. For example, if information being gathered is irrelevant to the company’s newly developed objectives, both time and money will be wasted on continuing with that specific research. If this ever occurs, reorganize and consider working with research specialists to help in making sure that the data you are observing is targeted at your specific needs.

3. Collect information relevant to your objectives

Once information and data is needed, sometimes the easiest step is to start looking at secondary data first. Utilizing data sets and examining organized marketing research reports have the potential to clarify your issues or even provide a solution to your research objectives. Secondary data can even alert researchers to other problems and is usually less expensive and faster to gather than primary data.

Once you review or purchase all your secondary data, your researchers can determine whether any further research through surveys or focus groups is necessary. Conducting that research and developing solutions from the information gathered will be required in drawing new conclusions.

4. Create a final report

Create a final report by analyzing all data and organizing it into a useful format for your company’s marketing team. Sorting through conclusions to relate potential solutions to your goals and objectives is central in ensuring your company can make use of the new information both effectively and beneficially.

5. Follow up

Once all findings are organized, you need to choose whether the information gathered is going to be put into use. You should use this stage to identify the areas where marketing techniques can be improved for future research projects. But once all is finished, evaluating whether the information gathered was able to help create solutions and meet your goals is vital. Upper management will need to determine whether the information gathered was a.) worth the cost, and b.) beneficial in meeting the outlined goals.

By knowing what your overall goals and objectives are before you begin a new project, you will help your company and yourself in making sure the research stays on task.

Interested in learning more about using business intelligence to achieve your research goals? Download our free white paper on How to Use Market Research to Launch Your Business.

Thanks for reading!

Caitlin Stewart Marketing Intern, MarketResearch.com

About This Blog

Our goal is to help you better understand your customer, market, and competition in order to help drive your business growth.

Popular Posts

- A CEO’s Perspective on Harnessing AI for Market Research Excellence

- How to Use Market Research for Onboarding and Training Employees

- 10 Global Industries That Will Boom in the Next 5 Years

- Primary Data vs. Secondary Data: Market Research Methods

- 10 Booming Industries in the U.S. to Watch in 202 4 and Beyond

Recent Posts

Posts by topic.

- Industry Insights (814)

- Market Research Strategy (271)

- Food & Beverage (133)

- Healthcare (124)

- The Freedonia Group (120)

- How To's (107)

- Market Research Provider (88)

- Manufacturing & Construction (79)

- Packaged Facts (76)

- Pharmaceuticals (75)

- Telecommunications & Wireless (70)

- Heavy Industry (69)

- Marketing (58)

- Retail (56)

- Profound (55)

- Transportation & Shipping (54)

- Software & Enterprise Computing (53)

- House & Home (50)

- Materials & Chemicals (46)

- Consumer Electronics (45)

- Medical Devices (44)

- Energy & Resources (41)

- Public Sector (40)

- Demographics (37)

- Biotechnology (36)

- Business Services & Administration (36)

- Education (36)

- Custom Market Research (35)

- Diagnostics (34)

- Academic (33)

- E-commerce & IT Outsourcing (32)

- Travel & Leisure (32)

- Financial Services (29)

- Computer Hardware & Networking (26)

- Simba Information (24)

- Kalorama Information (21)

- Knowledge Centers (19)

- Apparel (18)

- Cosmetics & Personal Care (17)

- Social Media (16)

- Advertising (14)

- Big Data (14)

- Market Research Subscription (14)

- Holiday (11)

- Emerging Markets (8)

- Associations (1)

- Religion (1)

MarketResearch.com 6116 Executive Blvd Suite 550 Rockville, MD 20852 800.298.5699 (U.S.) +1.240.747.3093 (International) [email protected]

From Our Blog

Subscribe to blog, connect with us.

.png)

A Comprehensive Guide on How to Perform Market Research

Navigating the intricate world of business often hinges on understanding markets, consumers, and competitors. This understanding is directly rooted in effective market research. While many acknowledge its significance, the detailed process of conducting comprehensive market research can be a challenge for some.

This guide aims to clarify the steps and strategies involved, ensuring businesses can gather insights that are both meaningful and actionable. Dive in to discover the nuances and best practices on how to perform market research, setting the foundation for informed decision-making and strategic planning.

Understanding How to Do Market Research

Embarking on the journey of market research can be both exciting and rewarding, as it equips enterprises with market data needed to make strategic decisions. Follow these seven essential market research steps that will steer towards valuable insights.

1. Define Objectives

Before diving into market research, it's crucial to define the research objective. This foundational step forms the groundwork for an effective market research process.

- Start Broad, then Narrow Down : Begin by identifying the overarching goal, such as understanding customer preferences. From there, refine the objective to be more specific, like identifying preferences among a particular demographic or region.

- Align with Business Goals : Ensure that the research objectives are in sync with the company's broader goals. If the aim is market expansion, the research might focus on potential markets or competitor landscapes in new regions.

- Collaborate : Engage multiple departments or stakeholders in the objective-setting process. Different perspectives can offer a more holistic view of what the research should achieve.

- Stay Flexible : While it's essential to have clear objectives, it's equally important to remain adaptable. As the research progresses, new questions or areas of interest might emerge. Being open to refining objectives can lead to unexpected and valuable insights.

2. Choose the Right Market Research Method

Once objectives are crystal clear, the next pivotal step is selecting the appropriate research method. This choice can significantly influence the quality and relevance of the insights gathered.

Different methods offer varying levels of detail. While some provide a broad overview of the market, others delve deep into specific aspects or demographics. The chosen method also often dictates the time, money, and manpower required. Making an informed choice ensures optimal resource utilization without compromising on the quality of insights.

Exploring common research methods:

- Surveys : Ideal for gathering quantitative data, surveys can reach a wide audience and provide insights on general market trends, preferences, or behaviors.

- Interviews : Offering a qualitative perspective, one-on-one interviews can uncover deeper motivations, challenges, or sentiments of the target audience.

- Focus Groups : These are discussions with a small group of participants, providing a mix of qualitative insights and allowing for dynamic interactions and feedback on specific topics or products.

- Observational Research : By studying consumers in their natural environment, businesses can gain unfiltered insights into behaviors, usage patterns, and more.

- Experimental Research : This method tests hypotheses in controlled settings, allowing businesses to understand cause-and-effect relationships, such as the impact of a price change on sales.

3. Determine Target Market Research Audience

Identifying the specific target market research audience allows tailoring research efforts, ensuring relevant and representative data. This step ensures that the data collected is not just accurate but also relevant to the business's goals.

Steps to identify the right audience:

- Segmentation : Divide the broader market into smaller segments based on criteria like demographics, buying behavior, geographic location, or psychographics.

- Prioritization : Not all segments might be equally relevant. Assess which segments align most closely with the business objectives and prioritize them for research.

- Sampling : Instead of surveying an entire segment, a representative sample can be chosen. This sample should be large enough to be statistically significant but manageable in terms of research resources.

- Validation : Ensure that the chosen audience truly represents the desired market segment. This might involve preliminary surveys or checks to confirm their relevance.

Tips for determining the right audience:

- Stay Updated : Market dynamics change, and so do audience behaviors and preferences. Regularly update audience definitions to stay relevant.

- Avoid Biases : Ensure that the selection process is unbiased. Over-relying on certain criteria or overlooking others can skew results.

- Engage Stakeholders : Collaborate with sales, customer service, or other departments that interact directly with customers. Their insights can be invaluable in defining the right audience.

4. Collect Market Research Data

The data collection phase is where the groundwork laid in the previous steps comes to fruition. It's the process of gathering information from the defined audience using the chosen research method. The quality and accuracy of the data collected during this phase will directly influence the insights and conclusions drawn.

Best practices for data collection:

- Ensure Consistency : Whether it's the wording of survey questions or the setting of focus groups, maintaining consistency ensures data reliability across the board.

- Prioritize Data Quality : It's better to have smaller, high-quality data than vast amounts of unreliable information. Implement checks and balances to maintain data integrity.

- Stay Ethical : Always seek consent from participants, maintain their privacy, and be transparent about how the data will be used.

- Test and Refine : Before rolling out on a larger scale, test the data collection methods on a smaller group to identify and rectify potential issues.

5. Analyze the Market Research Data

After the meticulous process of data collection, the next step is analysis. This phase transforms raw data into meaningful insights, providing a clearer understanding of the market landscape, consumer behaviors, and potential opportunities or challenges.

Key data analysis techniques:

- Statistical Analysis : Using tools and software, data can be subjected to various statistical tests to identify significant patterns or trends.

- Qualitative Analysis : For data from interviews or focus groups, thematic analysis can be employed to identify recurring themes or sentiments.

- Comparative Analysis : By comparing current data with past data sets or benchmarking against industry standards, businesses can gauge their performance and position in the market.

- Predictive Analysis : Leveraging historical data and statistical algorithms, businesses can forecast future trends or behaviors.

- Visual Data Analysis : Tools that create graphs, charts, and heat maps can help in visualizing complex data sets, making patterns more discernible.

6. Interpret the Results

With data analysis complete, the next crucial step of market research is interpretation. This phase involves making sense of the analyzed data, drawing conclusions, and understanding the implications for the business. It's where the numbers and patterns are translated into strategic insights that can guide decision-making.

Steps for effective interpretation:

- Relate to Objectives : Revisit the initial research objectives and assess how the results address them. This ensures the interpretation remains aligned with the research's purpose.

- Consider External Factors : Understand external market dynamics, economic factors, or industry trends that might influence the results. This provides a holistic view of the findings.

- Draw Conclusions : Based on the data and its analysis, draw clear conclusions. These should be concise, actionable, and directly related to the research objectives.

- Recommend Actions : Based on the conclusions, suggest actionable steps the business can take. This turns the research into a strategic tool for growth.

7. Present the Findings

After the rigorous processes of data collection, analysis, and interpretation, it's time to communicate the insights. Presenting the findings is about packaging the market research results in a manner that's clear, compelling, and actionable for stakeholders, ensuring that the research's value is fully realized.

Key elements of an effective presentation:

- Executive Summary : Start with a concise overview of the research objectives, methods, and key findings. This provides a snapshot for those who might not delve into the details.

- Visual Aids : Utilize charts, graphs, and infographics to represent data visually . This makes complex data sets more digestible and highlights key patterns or trends.

- Detailed Findings : Delve into the specifics of the results, ensuring that stakeholders have access to both the broad strokes and the finer details.

- Recommendations : Based on the interpreted results, outline actionable recommendations for the business. This turns insights into clear next steps.

- Q&A Session : Allow stakeholders to ask questions or seek clarifications. This ensures a thorough understanding and can also provide additional perspectives.

Prompts to Build Reports in Minutes

Unlock ChatGPT's potential in building marketing reports and dashboards with this comprehensive guide. 5 steps to build your next market research report.

Example of Market Research

Imagine launching a new product and wanting to understand the market's response. Market research becomes the guiding compass, gauging customer interest through methods like surveys and focus groups.

Gauging Customer Interest

Market research becomes your trusted ally in deciphering the minds and hearts of your target customers. Through surveys, focus groups, and feedback mechanisms , you gain valuable insights into what sparks their interest and captures their attention. Unveiling the features, benefits, and packaging that resonate most with consumers allows you to tailor your product offerings to meet their desires precisely.

Identifying Competitors

Market research identifies competitors, their market size, and what sets the product apart. In the fiercely competitive business landscape, knowing who your competitors are and what sets you apart is essential. Armed with this knowledge, your enterprise can carve out a distinct niche and craft a unique value proposition that resonates with your audience.

Determining Optimal Pricing Strategies

Pricing is crucial. Market research guides towards the optimal balance between profitability and customer perception. By assessing consumer willingness to pay and comparing prices of similar products in the market, you can strategically position your offering to attract and retain loyal customers.

Analyzing Consumer Behavior Market Research Data

Data becomes the goldmine of knowledge, and market research is the expert prospector that digs deep to unearth valuable insights. By analyzing consumer behavior data, your enterprise gains a deep understanding of customer preferences, shopping habits, and pain points. This treasure trove of information empowers you to refine your marketing approach, create compelling messaging, and deliver personalized experiences that resonate with your audience on a profound level.

Allocating Resources Effectively

Launching a new product demands efficient resource allocation. Market research guides to invest where they yield the highest returns. By identifying the most promising market segments and channels, you can optimize your marketing efforts, ensuring your message reaches the right audience at the right time.

Aligning Business Strategies With Actual Market Desires

The journey of conducting market research is like navigating through uncharted waters. By defining clear objectives, choosing the right methods, determining the target audience, collecting and analyzing data, interpreting the results, and presenting the findings in a clear and concise manner, an enterprise positions itself to unlock valuable insights. These insights empower strategic decisions, driving growth and success in the fiercely competitive market landscape. It's all about understanding market demand research, competitor landscape, customer preferences, and more, and using this knowledge to steer the enterprise in the right direction.

Frequently Asked Questions

What are the essential steps for effective market research.

To succeed in market research, follow these steps. First, define clear goals and insightful research questions. Then, choose suitable research methods aligned with objectives. Identify the specific audience for relevant data. Collect reliable data systematically using tools like surveys. Analyze the data to uncover meaningful trends. Interpret results for strategic decisions. Finally, present findings in a concise report.

How can market research benefit new product launches?

Market research helps new product launches by understanding customer interest. It identifies competitors and pricing strategies. Analyzing consumer behavior data guides better decision-making. Market research optimizes marketing efforts for higher returns.

How does market research refine business marketing approaches?

Market research refines marketing by providing insights, identifying effective strategies, and keeping up with trends. It assesses marketing success, leading to improvements.

What are the primary benefits of using market research in decision-making?

Market research reduces uncertainty, identifies opportunities, minimizes risks, boosts competitiveness, and enhances customer satisfaction.

500+ data sources under one roof to drive business growth. 👇

Analytics that detect nuances for better decision-making

Unshackling Marketing Insights With Advanced UTM Practices

Improvado Labs: experience the latest marketing analytics technology

%20(1).png)

Im provado - A Marketing Analytics Platform

Improvado automates the annoying parts of data management. No more manual anything. Just automate.

From the blog

San Diego | Headquarters

3919 30th St, San Diego, CA 92104

San Francisco

2800 Leavenworth St, Suite 250, San Francisco, CA 94133

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

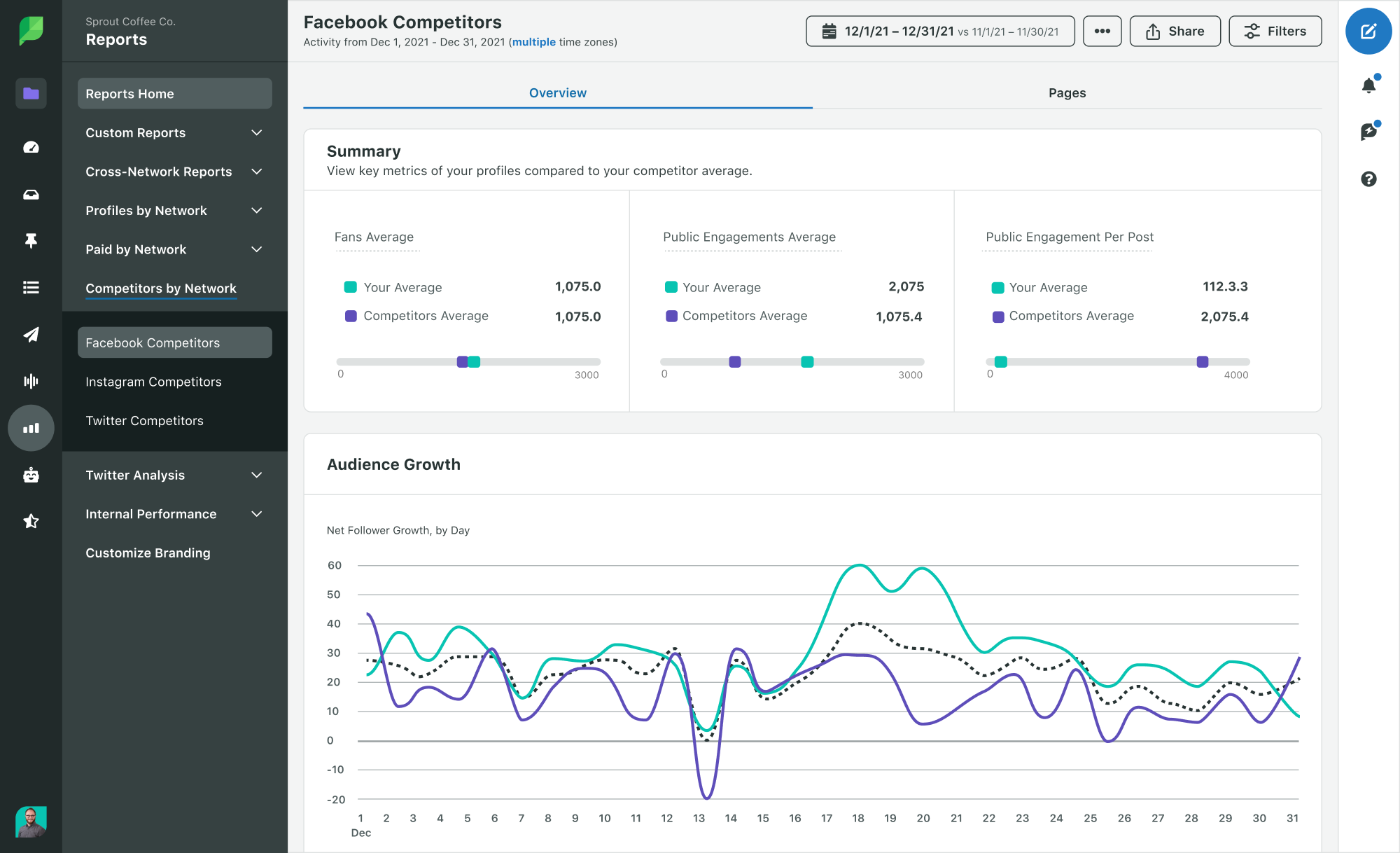

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Leveling Up

- Marketing Disciplines

The 43 best marketing resources we recommend in 2024

Executing a successful demand generation strategy [with examples]

How customer relationship marketing on social media drives revenue

- Other Platforms

SMS marketing 101: What is SMS Marketing (+ examples)

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

BRAND NEW Two-Day LIVE Summit with 20+ Ecommerce Trailblazers.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.