- Business Templates

- Sample Notice

FREE 11+ Notice of Assignment Samples in PDF | MS Word

There are many ways of promoting awareness of something, and one of that is giving notice. Notices are used to make all sorts of announcements. The public is notified of new processes, operating schedules, and other changes through a public notice. At work, you’re required to give notice before going on leave or before resigning from your post by filling out an employee notice form . In business, it is essential to give notice if you granted someone the authority to do specific tasks on your behalf. That notice is called a notice of assignment, and that’s what we’re about to discuss below.

Notice Of Assignment

What is a notice of assignment, assignment vs. delegation: what should you use, 11+ notice of assignment samples, 1. notice of assignment sample, 2. basic notice of assignment template, 3. notice of assignment of real estate purchase contract, 4. standard notice of assignment sample, 5. notice to seller regarding assignment template, 6. notice of assignment in pdf, 7. notice of assignment form sample, how a notice of assignment works, step #1: contract review, step #2: transfer of rights, step #3: sending of official notification, step #4: execution of the assignment, 8. notice of assignment and discharge by performance, 9. receipt for notice of assignment template, 10. notice of pending assignment template, 11. notice of assignment of stakeholding money form in doc, 12. notice of assignment in doc.

A business partnership is common in different business industries. Most companies partner with another company to cover certain functions for them. So they assign their rights to another company that specializes in the specific task they want to be done. The company here is basically transferring rights to another company so that they can perform the assigned tasks. In legal terms, this process is called an assignment. A Notice of Assignment is provided after the Notice of Assignment Contract is signed. A Notice of Assignment is similar to a sale notice or a meeting notice whose purpose is to let a group of people know about something they are interested in or are involved in.

Some companies partner with factoring companies to succeed in their accounts receivable financing. The Notice of Assignment is an essential part of the partnership. It is also used as a notice of assignment of debt. Through this notice, debtors are notified that a new company has acquired or purchased their debt. It also serves as a payment notice informing the debtor of the new company who will be collecting their payment and other payment details.

The terms assignment and delegation may seem so similar that a lot of people use them interchangeably. It may be forgivable to let it be, but it’s just so wrong, especially when what is being referred to are legal terms. One thing that is common between assignment and delegation is the act or process of transferring. What they want to transfer is the main factor that makes them different.

In the assignment process, the assignor transfers their rights to another person. An assignment is specific and the rights assigned to an assignee is limited to what they’ve been tasked to do. Common examples are Assignment of Lease and Deed of Assignment . After the assignment is made, a Notice of Assignment is provided to notify the involved individuals. When delegating, you’re not transferring any rights but you are distributing your obligations to a different party. That just sounds like an easy way to rid yourself of your obligations. Well, as a consequence, the party delegating the obligation is held liable for anything that will happen, good or bad. Before deciding to assign or delegate, make sure that it’s allowed in your contract. Now that you know of their differences, you should be able to decide whether to assign or delegate.

You may browse through and download the samples provided below, and use them as reference or study materials.

Size: 415.1 KB

Size: 74.5 KB

Size: 8.0 KB

Size: 4.4 KB

Size: 145.3 KB

Size: 64.0 KB

Size: 123.4 KB

Understanding legal terms and processes can be complicated, especially if it’s your first encounter with such legal terms and processes. Unlike a notice memo that is simple and easy to understand, a Notice of Assignment is entirely on a different level. Here’s a simplified explanation that will help you understand how a Notice of Assignment works.

There are clauses in a contract that may prohibit you from assigning rights to another party. Reviewing your contract with another company or entity is like taking extra steps to ensure that you’ll not get yourself into a contract breach.

Two parties are involved in the transfer of rights. The assignor is the party transferring the rights, and the assignee is the party receiving the rights. This is a legal transaction, so a legal document such as a contract is signed by both parties to prove that they both agree on the terms and conditions of the transaction.

Those who are involved or affected by the transfer is notified of the changes through a Notice of Assignment. The notice lets the entities involved know that the assignee will be doing specific transactions, like collecting and receiving payments. Sending out the Notice of Assignment is an essential step if the transaction is related to building a partnership.

After the notices have been sent out, the assignment shall be carried out by the assignee as agreed in the contract. The assignee only has rights to do things that were specifically assigned to them.

Size: 247.7 KB

Size: 769.0 KB

Size: 354.7 KB

Size: 28.9 KB

Size: 10.6 KB

Companies and other entities can transfer their rights to process a specific transaction to another party through an assignment. The transafer is announced through a Notice of Assignment that is sent to both the companies involved and their customers.

Related Posts

10+ separation notice samples & templates, 13+ two weeks notice samples & templates, 6+ sample disagreement letter, formal resignation letter, 14+ student schedule samples, 14+ job resignation letter templates, 27+ contract termination letter examples & templates, 6+ sample air force letter of recommendation, 6+ audit quotations, 9+ sample resignation letter, 9+ literary essay example, 8+ letter of resignation example, 8+ how to make a company profile sample, 8+ sample class schedule, 12+ sample reference sheet templates, 16+ sample endorsement letter samples, 8+ sample employee notice form, 8+ sample resignation letters 2 week notice, 9+ separation notice templates.

Fuel savings are here! Learn more on our blog .

Learn how to set up your business for success this year on our blog .

+1 (410) 204 2084

What Is A Notice Of Assignment In The Trucking Industry?

To understand a notice of assignment, trucking company owners first have to be familiar with factoring—and to understand factoring, we’ll have to discuss the nuances of cash flow in the shipping industry.

Basically, the challenge for fleet owners (and owner-operators) is that their customers take forever to pay their invoices. You deliver a load and issue the invoice. The shipper may take 30 or 45 or 60 days—or more—to pay that invoice. Meanwhile, you’ve got fuel costs, payroll, insurance payments, and the thousand other financial obligations that keep your trucks on the road. You need that invoice paid now .

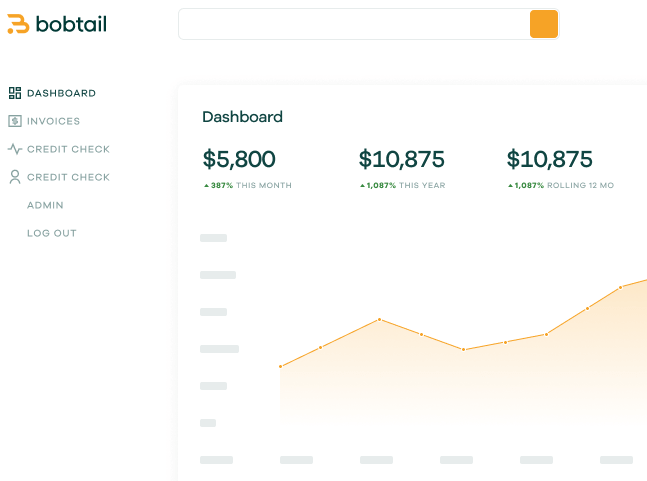

Factoring is the industry’s solution for quick payments to carriers. A factoring company steps in and pays your invoice today. Then that company collects from your customer, the shipper or broker who hired you to haul a given load. For their service, the factoring company keeps a low percentage of the total invoice value. (With Bobtail, the factoring fee ranges from 1.99% to 2.99%, depending on the volume of invoices you factor.)

Note that factoring is not a loan; the factoring company buys your invoices, so there’s no compounding interest or credit impact. Factoring beats loans as a cash-flow solution, hands down.

Struggling with slow payments from shippers and brokers? Keep cash flowing the simple way with Bobtail factoring.

With these preliminaries out of the way, we’re ready to answer the question that brought you here: What exactly is a notice of assignment in trucking?

Defining The Notice Of Assignment In Trucking

Factoring requires shippers and brokers to make changes in their billing systems. You’re no longer the collector on a factored invoice; the factoring company is. Accounts payable departments are busy places, and it’s easy for a shipper’s finance team to get confused when you do the work but another company collects the payment (after that company pays you, of course).

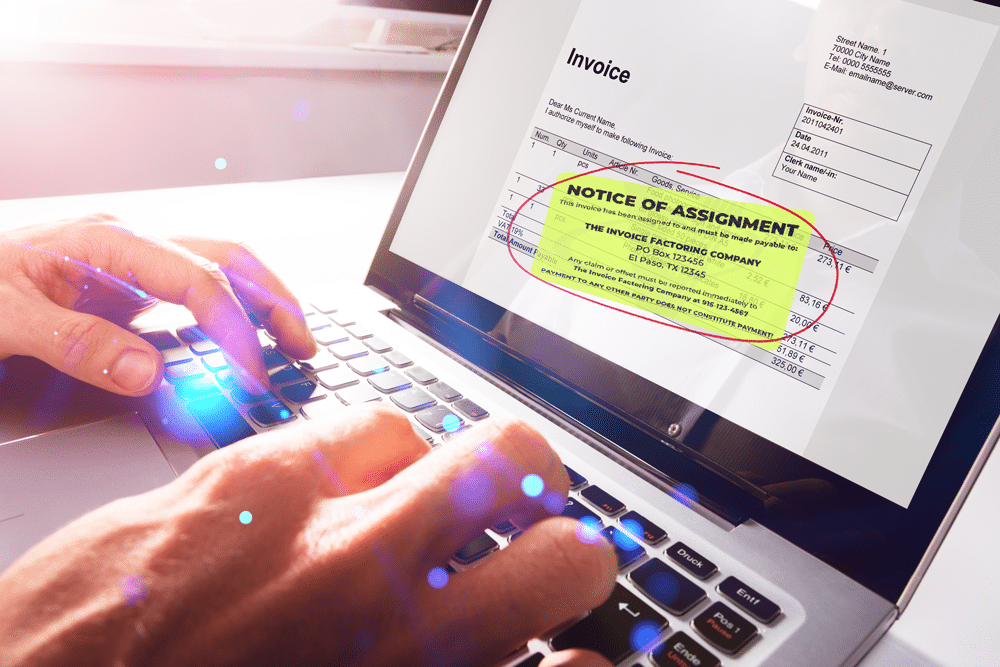

A notice of assignment clears up the billing relationship in a factoring agreement. A notice of assignment is a contractual document, supplied to both the carrier and the customer, that tells the customer to pay the factoring company, not the carrier.

The notice of assignment is an essential piece of paperwork, one of the documents you’ll have to keep on file as you establish a factoring relationship. You’ll have to sign the notice of assignment, and so will your customer. In short, this is a contractual agreement that carries legal consequences, and clarifies who exactly the shipper should pay for a delivered load.

Why is a notice of assignment important?

Consider the case of a trucking company that shifts to factoring after months or years of collecting directly from a shipper. That carrier’s payment details are already set up in the shipper’s accounting systems. Due to accidents or willful fraud, it’d be easy for the carrier to collect on an invoice twice—once from the factoring company and again from the customer.

In that scenario, the factoring company loses money, or at least becomes embroiled in a flurry of paperwork and legal challenges. So the notice of assignment is designed to protect the factoring company. But this document provides benefits for you, the carrier, and your customers, too.

How A Notice Of Assignment Benefits Shippers And Carriers

Who needs more paperwork? While it may seem like just another legal document, notices of assignment are actually helpful for all three parties involved in a factoring payment deal: the factoring company, sure, but also the carrier and the customer.

For shippers , the notice of assignment is a strong incentive to update payment details in their accounting systems. It delineates the nature of the financial agreement. It provides visibility and clarity that avoids conflict down the line. Most importantly, factoring companies require shippers to sign a notice of assignment—and factoring benefits customers, too. It keeps them from having to renegotiate payment terms, and gives them the full 30 or 60 days to pay, which allows them to optimize their own cash utilization.

Carriers also benefit from the clarity that comes with a notice of assignment. This document allows you to rest assured that the customer won’t accidentally pay you for a factored invoice, so you don’t have to spend all day trying to get the money into the right hands—or face collection threats of your own.

The binding agreement contained within a notice of assignment protects you from legal problems. It’s simply smart business to make sure everyone knows exactly who should get paid, and for what. Notices of assignment accomplish this goal—and, with Bobtail, the paperwork is simpler than you might think.

Simplifying Notices Of Assignment

Traditional factoring companies aren’t the most efficient financial operators in the world. They make you sign restrictive contracts. They might even tell you who you can work with, and who you can’t. They stack hidden fees on everything from set-up to ACH transfers to terminating the deal. And they make you fill out reams of paperwork before depositing a cent.

Bobtail is different every step of the way. We started this company to eliminate the inefficiencies in the factoring process, and that includes personalized assistance with handling notices of assignment.

When you sign up with Bobtail—a quick, online process involving a single application form—you’ll get a personal account manager who’s always ready to answer questions and solve problems. They’ll issue your notice of assignment and make sure your customers understand the document and why it’s necessary.

All you have to do is carry on carrying loads.

When you decide to factor an invoice, the process is even simpler. Just deliver the load, upload the invoice, attach a rate confirmation and a bill of lading, and get paid. It’s all done through Bobtail’s online system, so you can handle financing from the rig. We also provide a user-friendly digital dashboard that makes it easy to track every invoice at every step of the financing process. There’s simply no easier way to factor an invoice.

At Bobtail, we believe that you know what’s best for your business. That’s why we don’t make you sign a long-term contract; this is no-contract factoring. You pick which accounts to factor and which to collect from directly, and we don’t have volume requirements or exclusive financing deals.

We also don’t charge hidden fees. You just pay a flat factoring fee so there’s no confusion on exactly how much cash will hit your bank account—or when. Invoices are filled the same day you submit them, or the next day if the invoice arrives after 11 a.m. Eastern time.

Don’t be intimidated by a notice of assignment in trucking—or any other documents related to your factoring service. With Bobtail, our devoted customer service team makes sure everything runs smoothly, and we’re there to help every step of the way. Or, as one Trustpilot review puts it:

“They always answer the phone! The staff is very helpful and cordial. The three things I love are: Payments are on time, the website is easy to use, and great customer service!”

(Read more customer reviews on Trustpilot.)

Ready to improve cash flow without the headaches? Sign up to learn more today.

If you have questions about account set-up, notices of assignment, or anything else related to factoring, contact the Bobtail sales team at (410) 204-2084, or email us at [email protected].

Caroline Asiala is the Digital Marketing Manager at Bobtail. With a background rooted in advocating for migrant rights, Caroline leverages her expertise in content creation to support small trucking businesses, many of which are immigrant-owned and operated, with the information they need to make their businesses thrive.

Download our mobile app

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

Notice of Assignment Template

Document description.

This notice of assignment template has 1 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our notice of assignment template:

OBJECT: NOTICE OF ASSIGNMENT Dear [CONTACT NAME], You are hereby notified that on [DATE] we have assigned and transferred to [SPECIFY] the following [SPECIFY] existing between us: [DESCRIBE] Please direct any further correspondence (or payments, if applicable) to them at the following address: [ADDRESS] Please contact us should you have any questions. Thank you for your cooperation. [YOUR NAME] [YOUR TITLE] [YOUR PHONE NUMBER] [[email protected]] [YOUR COMPANY NAME] [YOUR COMPLETE ADDRESS] Tel: [YOUR PHONE NU

Related documents

3,000+ templates & tools to help you start, run & grow your business, all the templates you need to plan, start, organize, manage, finance & grow your business, in one place., templates and tools to manage every aspect of your business., 8 business management modules, in 1 place., document types included.

1.915-859-8900 Get a Free Quote

Factoring Notice of Assignment (NOA): Everything You Need to Know

A factoring notice of assignment (NOA) is usually required when you factor your invoices. Rest assured, NOAs are quite common in business and aren’t a cause for concern. However, it helps to understand what they are and how they work so that you can explain them to your customers as needed.

Assignment of Debt Explained

Companies transfer debt, along with all associated rights and obligations, to third parties all the time. One example of this occurs with collection companies. In these cases, the business, also referred to as the creditor, sells its uncollectable balances or assigns specific debts to the collection company. The collection company is then authorized to collect those specific balances on behalf of the creditor.

Assignment of debt may also come into play when businesses outsource their receivables and leverage certain types of funding, among other situations.

What Does Notice of Assignment Mean?

The customer, also referred to as the debtor, must be informed when a creditor assigns their debt to a third party. The document used in this process is referred to as a notice of assignment of debt.

What is a Notice of Assignment in Factoring?

When you leverage invoice factoring , you’re selling an unpaid B2B invoice to a factoring company at a discount. In exchange, you receive up to 98 percent of the invoice’s value right away and get the remaining sum minus a small factoring fee when your client pays. This means you’re not waiting 30, 60, or more days for payment. This cash flow acceleration helps businesses bridge cash flow gaps caused by slow-paying customers, seasonality, rapid growth, and more. Plus, the cash can be used for anything the business needs. This unique process means businesses can receive immediate funding without creating debt like other funding sources.

A notice of assignment is required in factoring because you’re assigning debt to a third party – the factoring company – and the customers involved need to know.

The Role of Notice of Assignment for Cash Flow

Invoice factoring stands out as a solution for businesses seeking to improve their cash flow. When a company decides to use invoice factoring, it enters into a factoring relationship, where accounts receivable and financial rights are handled differently than usual. This process involves the NOA, a pivotal document in factoring transactions. Essentially, NOA is a simple letter informing customers that the payment terms have changed and future payments should be made payable to the factoring company.

This notification ensures that there are no misdirected payments, which is a critical aspect when managing accounts payable and securing immediate cash. By using factoring, businesses can access working capital, which reduces the strain of slow-paying customers. It’s important for factoring clients to understand how factoring companies notify your customers and the implications of this process. The factoring contract typically outlines these details, ensuring that every party in a factoring transaction is aware of their responsibilities, especially regarding remittance addresses and payment information.

Factoring services offer an alternative to traditional lines of credit, providing businesses with high advances at low rates. This method is beneficial for companies that demand longer payment terms from their clients. By transferring the right to collect payments to the factoring company, the business can focus on its core operations while the finance company handles the receivables. Understanding the benefits of factoring and effectively communicating them to your customers may improve the factoring process and maintain healthy customer relationships, even when introducing new financial arrangements like invoice factoring.

The Importance of a Notice of Assignment in Factoring

Notice of Assignment in invoice factoring keeps your customers in the loop so they know who is collecting and why. It also lets them know where to send their payments. This streamlines the process and helps ensure there’s no confusion about where payments need to go.

Elements of a Factoring NOA Document

Each factoring company words its NOA a bit differently, but NOAs usually include:

- A statement that indicates the factoring company is now managing the invoice or invoices.

- A notice that payments should be made to the factoring company.

- Details on how payments can be made, including addresses, bank details, or payment portal information.

- What will occur if payments are sent to the business instead of the third party.

- A signature from someone at your business to show your customer that the NOA is authentic and a signature space for your customer to sign indicating that they’ve read and understand the document.

How Do Factoring Companies Notify Your Customers

A factoring notice of assignment is usually sent to customers by U.S. mail, though sometimes factoring companies use other delivery services or even digitize the NOA.

What Will Your Clients Think of You Factoring Your Invoices?

Sometimes, businesses that are new to invoice factoring have concerns about how customers will react to factoring or receiving an NOA. However, it’s usually not a cause for concern.

Although your factoring company isn’t an outsourcing company, it behaves quite similarly when collecting invoices. Nearly 40 percent of small businesses outsource at least one business process, Clutch reports. That means a significant portion of your customers already have some experience engaging with third parties. Furthermore, invoice factoring is growing in leaps and bounds and is expected to grow by eight percent in the coming years, per Grandview Research . Many of your customers already have experience with factoring or will very soon. Because most businesses have some exposure to factoring or will in the near future, it’s generally seen as an ordinary business practice – nothing more, nothing less.

However, even if factoring is entirely new to your customers, how they respond to your decision is often determined by how you present it. For instance, it accelerates payments without putting pressure on your customers to pay faster. It has benefits for them, too, and can help improve the relationship. This alone can actually help some businesses win bids or attract new customers. Explaining it to them this way can help soothe any concerns if customers come to you with questions.

How to Ensure Your Customer Relationships Are Protected

Most factoring companies will take good care of their customers because they are a reflection of you. Your repeat business helps ensure they’ll have repeat business. However, reviewing a factoring company’s testimonials and success stories is always a good idea to understand better how they operate before you sign up.

It’s also essential to work with a company like Viva that doesn’t send mass notifications to all its customers. We only notify those who are debtors on the invoices you’d like to factor to eliminate any confusion.

Lastly, it’s better to work with a company that provides you with 24/7 access to your account so you can see what’s paid and outstanding at a glance and can make decisions about orders using real-time data.

Request a Complimentary Invoice Factoring Quote

At Viva Capital, we always provide white glove care to the businesses we serve and their customers.As part of our service, we handle the Notice of Assignment with professionalism. Our collection experts make it easy for your customers to manage their bills and are happy to answer their questions. You’ll also have access to your personal Customer Account Portal so you can make informed decisions on the fly and always know what’s outstanding. To learn more or get started, request a complimentary invoice factoring quote .

- Recent Posts

- 10 Credit Crunch Business Strategies to Boost Your Resilience - March 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring - February 9, 2024

- Factoring Notice of Assignment (NOA): Everything You Need to Know - January 4, 2024

About Armando Armendariz

The Cost of Invoice Factoring: Is it Worth It?

Why Relying on Business Credit Cards is Dangerous

Comments are closed.

Request FREE Funding Estimate

Discover how we've helped businesses just like yours.

How Medlock Contractors has forged better relationships with their subcontractors with the help of Viva Capital Funding.

How R. Ramirez Express saves $5,000 per year in fuel costs with Viva Capital Funding.

How BelCon Logistics grew 1,000% in just 3.5 years with Viva Capital Funding.

How Top of the Line Healthcare Staffing boosted revenue 1,000% with Viva Capital Funding.

How Sun City Pallets boosted revenue 400% with Viva Capital Funding.

How DMI Industries Supplies grew and continued its global expansion plans with Viva Capital Funding.

How Cold Way Transportation boosted revenue 47% with Viva Capital Funding.

Industries we serve

- Transportation

- Manufacturing

- Service providers

- Construction

- Other Industries

Latest articles and insights

- Agile Business Transformation: Navigating Market Shifts for Long-Term Success April 8, 2024

- 10 Credit Crunch Business Strategies to Boost Your Resilience March 21, 2024

- What to Include in an Invoice to Get Paid Fast March 7, 2024

- Insurance for Business: Which Policies to Consider and Why February 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring February 9, 2024

(216) 292-5660

216.930.1983

Learn About Notice of Assignment for Invoice Factoring

In a factoring relationship, you agree to assign your selected receivables to the factoring company. By advancing your cash against your invoices, the factor has purchased the right to collect amounts due from your customers. The Notice of Assignment is a critical part of your factoring paperwork as it reflects the change in invoice ownership.

What is a Notice of Assignment?

The Notice of Assignment is a simple letter the factoring company sends to your customers whose invoices you are factoring. In writing, the notice informs your customers that the accounts receivable is assigned, and future payments should be made payable to the factoring company. The notice will also include a remittance address so your customer can change their payment information.

The Notice of Assignment legally explains to your customers that any payments they make to you instead of the factor will not satisfy their obligation. The factoring company may hold your customers liable for misdirected amounts. This may occur if your customers choose to ignore the notice or fail to update payment information.

Many factors will require your customers to sign and return a copy of the notice to acknowledge receipt. This is not always required, though. Instead, the Notice of Assignment may include language that considers your customer’s continued use of your services to constitute an agreement to the notice. In addition, the factor may only revoke a Notice of Assignment if they send a signed and notarized release notification to your customers. They will do so if you choose not to factor that account any longer or you end your factoring relationship. In either case, the account must have no outstanding balance.

What Programs Don’t Use a Notice of Assignment?

Financing programs that do not use a notice of assignment include non-notification factoring and sales ledger financing.

Non-notification factoring is similar to regular factoring, but with a few key differences. Instead of sending a conventional Notice of Assignment to customers, the factoring company informs them of a new payment address using the company’s regular letterhead. This allows the customer to still send payments to the new address without being aware that it belongs to the factor. To qualify for non-notification factoring, companies typically need to have monthly revenues of at least $300,000, a track record of over a year, reliable financial reports, and no serious financial difficulties.

Sales ledger financing operates like a line of credit based on outstanding receivables. Companies can access up to 90% of their outstanding receivables at any given time without the need to submit a factoring schedule of accounts for each transaction. Although the finance company still handles payments, the customer does not receive a Notice of Assignment. Instead, they receive a letter indicating a change in the payment address. Sales ledger financing offers greater flexibility compared to non-notification factoring, with daily rates allowing for better cost control. The qualification requirements for sales ledger financing usually include monthly revenues of at least $300,000, a track record of 1-2 years, reliable financial reports, good receivables management systems, and no serious financial difficulties.

Get Started Now

Secure the funds you need today. Complete the form or call.

Why do Factoring Companies Notify Your Customers?

The Notice of Assignment is a vital form of protection for a factoring company. It protects the factor in case the business owner (the factor’s client) receives the payment instead of the factoring company.

In a best-case scenario, the notice serves to inform every party in a factoring transaction of their rights and responsibilities. It also gives your customer the appropriate address to make account payments, allowing your factoring relationship to continue smoothly.

In a worst-case scenario, a factor can recover unpaid amounts from your customer should they continuously pay over notice or not pay at all. A Notice of Assignment is evidence in any legal proceeding — from a demand letter for payment to a full-fledged lawsuit — that asserts the factor’s standing and rights to payment.

What Will Your Customers Think?

Customers may have concerns or questions when they receive a letter regarding the use of invoice factoring. It’s understandable that they may be unsure or unfamiliar with this financing tool. As a business owner, it’s important to address these concerns and communicate with your customers effectively.

First and foremost, it’s essential to acknowledge that invoice factoring is a common practice utilized by many small and midsize companies to finance their operations and facilitate growth. Chances are, your customers are already aware of this financing method and how it works.

When discussing invoice factoring with your customers, emphasize the benefits it provides to them. By using factoring, you can offer them extended payment terms, such as 30- to 60-day terms, while still ensuring excellent service. This enables your customers to utilize their available cash resources more effectively. Without factoring, providing extended payment terms might be challenging, especially for businesses experiencing growth.

It’s crucial to assure your customers that little is changing in terms of the services and support your company provides. Reassure them that they will still have the same level of communication and engagement with you and your employees as before. Highlight that despite factoring being implemented, your commitment to their satisfaction remains unchanged.

Address the misconception that factoring indicates financial trouble within your company. Remind your customers that factoring is a versatile tool used to achieve various goals and objectives, just like other forms of financing such as loans or lines of credit. Factoring simply serves to smooth out your cash flow and support your business’s overall financial stability and growth.

Overall, open communication with your customers is key. Provide them with transparency and reassurance, explaining the benefits of factoring and emphasizing that it is a common and established financing practice. By effectively addressing their concerns, you can foster trust and maintain strong relationships with your valued customers.

Why a Notice of Assignment Matters To You

You will receive a copy of the Notice of Assignment that the factor sends to your customers. While the notice is to inform your customers, it also has an important implication for you as well.

As your factoring agreement explains, payments your company receives from your customers over notice are payable to the factoring company. Even in the smoothest transition, you may receive payments sent before receipt of the notice or released before your customers’ updated their payment system. There will likely be a provision explaining the procedure for sending misdirected payments to the factor in these cases. Misdirected payments are usually sent by overnight check or via bank transfer.

However, you may be responsible for additional penalties and fees if your customers continue to pay over notice, and you deposit those payments into your account. In addition, you may end up owing more, depending on fee structure, due to the extra time it takes for the factor to receive payment. Some factors include a misdirected payment fee in the factoring agreement that you will have to pay if you fail to return misdirected payments to the factor. Therefore, fees may be higher if you are responsible for the misdirection.

As with any legal document, be sure to be fully aware of the language used within the Notice of Assignment. Be mindful of your customers’ responsiveness to the notice. Take action immediately if you realize that any of your customers are not sending their payments on time. This transparency solidifies your factoring relationship, builds trust with your factor, and protects your interests.

What if the Payment is for an Invoice I Didn’t Factor?

When you assign your customers’ receivables to your factoring company, you agree to direct all payments to the factor, even for invoices that you did not factor. This eliminates complications for all parties and ensures that the factoring company receives every payment they should. Without an all-inclusive assignment, your customers would receive a notification every single time you factor an invoice. They would have to retain two addresses on file, increasing the likelihood of misdirected payments.

Your factoring company will have a straightforward procedure in place to address non-factored payments. This may include applying those payments to open invoices and sending you the difference or the total amount in a regularly scheduled reserve release. Stay prepared by asking your factor about their policies surrounding non-factored payments.

Factor Finders can help you find the right factoring company for your invoice factoring needs. Contact us to learn more about our factoring services for every industry and to get started today.

Don’t want to talk on the phone?

Get a free quote by filling out our online form .

Connect With Us

(216) 865-4922

Newsletter Sign-Up

Need fresh ideas on how to grow your small business? We've got you covered!

Quick Links

© 2024 Factor Finders, LLC All Rights Reserved.

Privacy Overview

Secure the funds you need today.

- Invoice Factoring

- Accounts Receivable Financing

- DIP Financing

- Working Capital Loans

- Asset Based Lending

- Bridge Loans

- Purchase Order Financing

- Inventory Financing

- M&A Financing

- Manufacturing

- Distribution

- Consumer Packaged Goods

- Service Companies

- Oil & Gas

- Transportation

- Application

- Case Studies

- DOWNLOADABLE RESOURCES

- Financial Calculators

- Financial Glossary

- Request A Quote

What is a Notice of Assignment?

In This Article

When you enter a factoring contract, you agree to sell your invoices, or accounts receivable, to a factoring company or third party that gives you a cash advance. This third party will then become your company’s collection department on these invoices. To notify your clients of this change of invoice ownership, the financial provider will send them a Notice of Assignment (NOA).

If you’re considering factoring your accounts receivable, you may be wondering what an NOA contains and what effects it may have on your customers and business. In this guide, we’ll cover the components of an NOA, how your factoring company sends them, and their role in the factoring process.

What is a NOA in Factoring?

A notice of assignment is a simple letter from a third party to your customers. It legally explains that a change of invoice ownership has occurred, informing your clients that a third party (bank, factoring company, financing company) will now manage and collect accounts receivable. The NOA will provide a remittance address so customers can update their payment information. The purpose of this communication is to notify your customers of a change in the collection process.

What Is a Notice of Assignment?

Understand how implementing a Notice of Assignment with Porter Capital’s factoring services can fast-track your receivables!

Discover Our Factoring Services

How Do Factoring Companies Notify Your Customers?

Factoring is more common than ever and clients range from NYC modeling agencies and namesake branded product line manufacturers, to small startup companies selling gourmet food items. No company is too large or too small to factor their invoices and many work with big box stores that demand longer payment terms to have products on their shelves. These 90 to 120 day payment terms can make factoring a necessity for smooth cash flow.

Your customers will receive the NOA as a letter in the mail to sign and return. Your business will also receive a copy of this letter. Ensure you fully understand the language used in the NOA and your responsibilities in the transition process. Sometimes business owners worry about their customers’ reactions to receiving an NOA. Invoice factoring is becoming an increasingly popular and acceptable means for financing businesses across many industries, so your customers may already be accustomed to the process. You can alert your clients about a coming NOA, proactively resolving any questions or concerns that may arise.

Why Is a NOA in Factoring Important?

When you enter a factoring contract, you agree to sell the intangible financial rights to your invoices and receive cash up front for those invoices. Because the rights are intangible, factoring companies need legal language that outlines ownership of the AR. Once the NOA is completed, a business receives the cash advance while the factor waits for invoice payments. The NOA is a critical part of the financial relationship and protects the financing provider in the event of misdirected payments. An NOA ensures all parties are aware of their responsibilities throughout the factoring process so everyone can enjoy the benefits.

Components of a NOA Document

The NOA document will contain a few vital pieces of information, including:

- Notification that accounts receivable have been assigned and is payable to a third party

- An updated payment address.

- An explanation of customer liability in the event of a misdirected payment.

Each component of the NOA ensures the factoring relationship runs smoothly by giving customers the information they need to make correct payments. It may also outline steps for your company to take if you receive a misdirected payment.

Contact Porter Capital for a Factoring Quote

When you need to improve your cash flow, consider invoice factoring with Porter Capital. With over 30 years in the business, we can offer you and your customers the reliable and trustworthy services you expect and deserve. We will help you find the best solutions for your specific business demands, enabling you to enjoy greater stability and flexibility.

Work with a trusted factoring company to expand your business, get ahead of the competition and increase customer satisfaction. Contact us online today to receive a quote for our factoring services.

Share This Article

Related posts.

2023 Deals of the Year – ABFJournal

What Is Staffing Factoring and Who Benefits From It?

How to Find Clients for Your Staffing Agency

13 February 2023

Notice of Assignment in Factoring in the U.S

When a business uses invoice factoring, they transfer ownership of its accounts receivable to a factoring company, which then has the responsibility to collect payment for those invoices.

Therefore, a document is issued to alert its customers of this. This is known as a notice of assignment.

Meaning of Notice of Assignment

A notice of assignment is a document that notifies clients that a factoring company has acquired ownership of their accounts receivable, or invoices, from the original business.

The notice's objective is to alert customers to the ownership change and specify who should receive payments.

Importance of Notice of Assignment

A notice of assignment is vital because it officially notifies customers that the ownership of an invoice has changed hands and that they should now direct payments to the factoring company.

The notice helps ensure that payments are sent to the appropriate parties , avoiding misunderstandings and potential conflicts and preventing uncertainty.

In the event of a disagreement, having a detailed and official notice of assignment can safeguard the legal interests of both the company and the factoring company.

Impact of Notice of Assignment on Businesses

The possible impacts faced by businesses by using a factoring company and sending their customers a notice of assignment are:

1. Enhanced customer relationships: By providing clear and official notification to customers of the change in ownership of invoices, a business can help maintain and strengthen its relationship with them.

2. Improved cash flow: By transferring ownership of invoices to a factoring company, a business can receive payment more quickly and improve its overall cash flow.

3. Increased operational efficiency: By using a factoring company to manage the collections process, a business can free up internal resources and focus on its core operations, leading to increased efficiency.

4. Reduced risk: By transferring the responsibility of collecting payment to a factoring company, a business can reduce its exposure to the risk of non-payment and bad debt.

However, before deciding to utilize factoring , it's crucial to consider any potential drawbacks, such as losing control over the collection process and the expense of the factoring service.

Factors Covered in a Notice of Assignment The main sections covered are:

- The company's accounts receivable have been transferred to a third-party financial institution, and payment should now be made to them

- The customer should now send payments to a new address, typically a secure payment processing location

- The customer will be responsible if they make a payment to the wrong address

Information in a Notice of Assignment

In a factoring notice of assignment, the following details are covered to notify the business’ customer about the transfer of ownership of accounts receivable:

- Particulars of the accounts receivable being assigned , including the amount and invoice numbers

- Details of the factor and the client/debtor

- Specifics of the assignment of the accounts receivable, including the effective date and any conditions of the assignment

- Instructions for the customer on how to direct future payments to the factor

- Any other relevant terms and conditions of the factoring agreement

What Happens When an Obligor Doesn’t Receive Notice of Agreement

A business that sells its accounts receivables (invoices) to a third-party factor must send a notice of agreement to its customers.

The purpose of the notice is to inform the customer that the factor has taken ownership of the invoice, and the payments should be made directly to the factor instead of the business.

If the customer does not receive the notice, they may continue to make the payments to the business, leading to confusion, delayed payments to the factor and potential disputes.

In some cases, the customer may have the right to demand a return of the payment made to the factor or stop payment if the notice of assignment was not correctly given.

How to Receive Notice of Agreement

A factoring notice of agreement is typically provided by the factoring company or third-party factor that has purchased the accounts receivable (invoices) from the business.

The notice is usually generated by the factor and given to the business to send to its customers.

The business may also be responsible for ensuring that the notice of assignment is delivered correctly to its customers.

Some factoring companies provide templates or sample notices that the business can use.

Requirements for a Notice of Assignment

To obtain a notice of assignment (NOA) from a factoring company, the following requirements are necessary:

- Monthly revenue of at least $300,000

- A stable financial track record of 1-2 years

- Accurate and trustworthy financial reports

- Effective management of accounts receivable

- No significant financial difficulties

1. Who Sends a Factoring Notice of Assignment? A factoring notice of assignment is typically sent by the business that has sold its accounts receivables or invoices to a third-party factor or factoring company.

The factor usually provides the notice of assignment, and the business may have to sign a factoring agreement with the factor to obtain the notice.

The notice informs the business’ customers that the factor has taken over the ownership of the invoices, and the payments should be made directly to the factoring company instead of the business.

2. How Much Does a Notice of Assignment Cost? The cost for issuing a notice of assignment in factor can differ based on various elements, such as the amount assigned, the state where the assignment is taking place and the particular provisions of the assignment agreement.

This cost may include legal fees, filing paperwork fees and other administrative expenses. It's crucial to examine the assignment agreement thoroughly to determine the precise cost and be aware of any additional fees that may be incurred.

3. How Long Does a Notice of Assignment Take? The duration of issuing a notice of assignment in factoring can differ based on particular circumstances. Usually, the process can take anywhere between a few days to weeks.

The length of the time may be influenced by factors such as the state in which the assignment is getting issued, the complexity of the assignment agreement and the accessibility of relevant parties.

Moreover, the time needed for the notice of assignment may be affected by any legal challenges or hindrances.

4. Does Notice of Assessment Mean You Owe Money? In the United States, a notice of assessment usually implies that you owe money to the government.

However, it is contingent on particular circumstances. The Internal Revenue Service (IRS) sends out the notice of assessment to inform taxpayers of any modification to their tax obligations.

If the notice displays an increase in the amount owed, it implies that the taxpayer has an outstanding balance with the IRS and should pay it promptly to prevent further interest and penalties.

On the other hand, if it shows a decrease in the amount owed, it showcases that the taxpayer has paid more taxes than required and may be eligible for a refund.

It is, therefore, always advisable to thoroughly examine the notice and to get help from a professional.

5. Is Notice of Agreement a Proof of Debt? A notice of agreement alone is not considered proof of a debt. The document merely outlines the terms and conditions agreed upon by the parties involved.

It is not enough evidence to confirm the presence of debt but rather serves as a record of the agreement between the parties.

To establish proof of debt, other financial documents such as receipts, invoices or other documentation may be necessary.

The specific requirements for proving a debt depend upon the type of debt and the laws of the jurisdiction where it is being established.

6. What is a Letter of Release? A letter of release from a factoring company is a declaration that a debt has been satisfied and is no longer the company's responsibility.

In factoring, a business sells its accounts receivable to a factoring company for a fee to receive cash quickly.

Upon receiving the payment on the accounts receivable by the business’ customer, the factoring company issues a letter of release, confirming that the debt has been fully paid off and the company is no longer obligated to it.

The letter serves as proof that the debt has been fully resolved. It can be used to clear the debt from the business's financial records.

The specifics of the letter of release, including the terms and conditions, will depend on the particular factoring agreement and the laws in the jurisdiction where it is formed and drafted.

Siddhi Parekh

Finance manager at drip capital.

Table of Content

- Information in a NOA

- What Happens When an Obligor Doesn’t Receive NOA

- How to Receive NOA

- Requirements for NOA

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

Notice of Assignment | Practical Law

Notice of Assignment

Practical law canada standard document 3-599-7067 (approx. 8 pages).

Notice of Assignment

This notice of assignment letter can be used by a party to a commercial contract to provide notice to the other party of its assignment of its rights or performance under the contract to a third party. This template includes practical guidance, drafting notes, and alternate and optional clauses. Counsel should review the underlying agreement. This template presumes that consent is not required for assignment and that the entire agreement is being assigned. The underlying agreement should also provide confirmation of the proper individual or department to whom the notice is sent. For a full listing of related assignment content, see Assignment in Commercial Transactions Resource Kit. For a full listing of related contract clauses, see General Commercial Contract Clause Resource Kit. For more information regarding the assignability of commercial contracts, see Commercial Contracts Assignment. If consent to an assignment is required, see Request for Consent to Assignment.

Factoring Investor | Learn Invoice Factoring Business

Sell Invoices, Broker Receivables, Find Factoring Companies, and Learn About The Factoring Business!

- Learn Invoice Factoring

- The Factoring Business Notice of Assignment – Never Fund Without It

Real life scenario explains why factoring companies require a Notice of Assignment to fund business invoices in this article from Oxygen Funding.

After gathering the required documents we moved forward with our proposal to fund the prospect. The prospect accepted our terms and we proceeded with funding our new client’s invoices. For the first month or so we were able to verify, fund and collect without any problems. Since the client’s business was growing, he was looking for us to increase his credit line so we could purchase more of his invoices.

It was in the second month of funding when our team noticed that several of his invoices with one of his customers were still outstanding. This development struck us as odd since this particular customer of our client was very strong and the invoices with his other customers were paying in a timely fashion.

We contacted our client to shed some light on the issue and he informed us that he was not aware of any issues with the customer. We followed up with the client’s customer, who surprisingly informed us that they had never changed the payment address to our office even though they signed our notice of assignment.

Why Factoring Companies Use a Notice of Assignment When Funding Invoices

A “Notice of Assignment” is generally a written instruction to the client’s customer that the client’s accounts receivable have been assigned and is payable to the factor. This is an extremely important document for factoring companies . This document protects the factoring company in the event a payment is accidentally sent to the client instead of the factor. Even if the client skips off with your money, this document ensures you are still owed the funds from the client’s customer. Hopefully, you will never have to enforce this notice but it imperative you have it as part of your requirements before funding.

As it turned out, the client received our checks and actually deposited the funds directly in his company’s account. Believe it or not, this happens quite often in the factoring business. Many times, the client’s accountant or bookkeeper will deposit everything that comes into their office without knowing which check is the property of the factoring company.

With this knowledge, we informed the client that all factored funds were the legal property of our company and needed to be returned to our company immediately. Our factoring agreement has a clause that specifically addresses misdirected payments. It basically imposes a huge penalty on the client if the funds are not returned to our office within a twenty four hour period once the client has been notified.

The client informed us he wouldn’t be able to return the funds to us for another week or so. He also stated that since it wasn’t his mistake he had every right to the money to take care of a few expenses and pay us later. We explained to him this was unacceptable since he was now paid twice on his invoices and informed him of the misdirected payment clause in his agreement. He brushed it off saying we would get our money in about a week or so. Finally, we informed him of the notice of assignment that he and his customer signed when we opened his account with our company. We also mentioned that his customer would be receiving a demand payment letter from our legal department explaining the situation and how they owed us the money for the invoices he deposited.

This was not the way we wanted the situation to play out, but unfortunately the client left us no other choice. Think about, if this legal document had reached his customer it would have portrayed him in a very negative light and severely damaged his relationship. Needless to say, we received our funds from the client (along with the penalty) the next day. We also ceased funding this client because we felt that when given the choice to do the right thing, he chose not to do so.

Always have a notice of assignment perfected with all customers you fund to ensure that any misdirected payments will be paid to you, the factoring company.

For more information, he can be reached at [email protected] or you can visit his company’s website at www.oxygenfunding.com

Two of the most read articles from Don include:

- Starting Your Own Factoring Business? It’s Your Call

- Getting In the Factoring Business – Part Two

Share this:

Don D'Ambrosio assists companies with cash flow needs through invoice factoring services. You can connect with Don online through the Oxygen Funding website , LinkedIn or Google+

Great article! This article also shows the importance of the client’s “character” and how significant it is to the factoring relatioship. Clients should always notify their factoring company if a check is received by accident. When they don’t, the factoring relationship is damaged and often terminated resulting in additional strain on the business’ cash flow.

Great read!

Hi, it’s really good article about the Factoring Companies Use a Notice of Assignment .You must have a lot of patience to research, plan and write this kind of solid information.

Most Popular Pages and Articles

- How To Sell Invoices With AR Funding

- Starting A Factoring Broker Business

- What Invoice Factor Is Best For Your Company?

- Accounts Receivable Factoring Examples

- How I Run My One Person Factoring Business

- Tips For Starting a Small Business Factoring Company

- Top 10 Accounts Receivable Factoring Questions

- Recourse and Non-recourse Factoring

- Five Strategies to Reduce Factoring Costs

- January 2019

- November 2018

- December 2017

- January 2017

- November 2016

- August 2016

- January 2016

- November 2015

- October 2015

- September 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

Return to top of page

Copyright © 2024 Factoring Investor . . . Privacy Policy . . . Contact Us

FoundLetters.com

Sample Notice-of Assignment Letter

From: [Your Name, & Address here]

[Recipient Name & address here]

[Date here]

Dear [name], You are hereby notified that on [date of Assignment], we allocated and shifted our interest in the matter mention below to [Assignee name].

This assignment involves –

– [Describe in brief what has been assigned] – You are requested to send any future notices, payments or queries regarding this matter to [Assignee name] at [address of Assignee].

[Your name]

Encl: [Enclosures List here]

Download Sample Notice-of Assignment Letter In Word Format

Top Sample Letters Terms:

- sample notice of assignment letter

- notice of assignment to developer

- sample notice of assignment to developer

- draft notice of assignment

- engineer assignment letter notification

- notice of assignment meaning

- notice of assignment trucking

No Related Letters.

Leave a Comment Cancel reply

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Bankers Factoring an Employee-Owned Accounts Receivable Factoring Company

July 25, 2023 By Chris Curtin

What is a Notice of Assignment in Factoring?

Why is a factoring notice of assignment (noa) important when selling your a/r.

Table of contents

What is a notice of assignment letter, what is included in the factor financing noa, how does factoring noa impact my customers, benefits of noa factoring:, factoring arrangement: assignment of accounts receivable, notice of assignment factoring, bankers factoring difference, what is a notice of assignment in factoring.

It is a letter that informs the business owner’s customers of your relationship with a factoring company. The notice of assignment letter is the first communication between the invoice factor company and the account debtor (your customer). The factoring contract spells out the change in invoice ownership.

The invoice factoring companies will send your customers, also known as debtors, a notice of assignment (NOA) letter. It will be sent immediately when you sell your unpaid receivables. The letter is also a standard document in factoring agreements. And accounts receivable (A/R) invoice factoring is a common financial product to accelerate the cash flows of small businesses.

Factoring invoices is a time-tested business funding solution to support operations and fund growth plans. Partnering with factoring companies allows your business to receive fast cash flow by selling invoices. Moreover, sending the NOA letter is a critical step to communicate your A/R has been assigned and is payable to the factoring company.

You can also read how factoring companies buy accounts receivable .

Complete Bankers Factoring online funding application to begin your debt-free funding process including Bad Debt Protection.

Contact Bankers Factoring to learn about the factoring NOA process and how we can provide consistent cash flow funding. We partner with you and your customers to provide an elite program for your business success.

A Notice of Assignment (NOA) is a letter that informs account debtors their creditor (our client) is factoring invoices under the Universal Commercial Code (UCC) . And invoice factoring is an agreement to assign your accounts receivable (A/R) to a factoring company. So the letter communicates that a third party (factoring company) is managing and collecting your A/R. An assignment letter notifies your customers or account debtors of the transfer in ownership.

The NOA letter is the first-time customers will learn that you are utilizing factor financing. But selling your unpaid invoices to a factoring company will not concern your customer. In addition, invoice funding is a popular financing vehicle to cover operating expenses and accelerate sales growth.

Keep reading, Factoring Company: What it is and Your Best Choice .

Factoring NOA letters are standard documents sent to customer (debtor) accounting departments. Assignment letters include language regarding the arrangement:

- NOA letter informs your customers that a factoring company is managing receivable invoices

- The notice includes language stating the factoring company has the right to payments

- Your business A/R has been assigned to a third party, and payment is transferred to them

- Updated information for making payments (remittance) to factor

- Notice of assignment letters include legal clauses related to the assignment

Assignment companies send NOA to establish their ownership and management position for your receivables. That’s because letting your customers know about the receivable assignment helps them make timely payments. Moreover, the factor provides specific remittance instructions to ensure an easy transaction for all parties involved.

Keep reading How Does a Factoring Company Work ?

Selling your receivables can cause stress about sending an NOA letter to your customer. However, invoice factoring demonstrates to your customers that you are serious about your operational performance by establishing financing lines. In fact, the US factoring market valued at $3.9 billion in 2022 shows how many companies use invoice services ( IBISWorld ).

- Streamlined accounting process between your debtor’s accounts payable team and the factoring company.

- Partnering with a factoring company demonstrates your plans to grow your company and shows you are serious about your finances.

- Invoice factoring companies enhance customer service relationships by providing highly skilled professionals to communicate with your customers.

If your company works with commercial customers that demand extended credit terms, a factoring facility can help your cash flow.

Keep reading How Factor Financing Impacts Customer Relations .

A/R factoring is a type of business funding that injects working capital into companies with slow-paying customers. However, factoring agreements are not debt-financing like business loans and do not dilute your equity position. To know more, keep reading How to Finance Your Business Without Giving Up Equity .

Assigning accounts receivable lets your account debtors know you have transferred ownership of A/R. By selling your unpaid invoices, you receive two cash installments.

The initial cash advance, the first installment, ranges from 80 to 93% of your total A/R purchase value. And the second and final installment, rebate, or discount releases the remaining balance, less our fee. Therefore, the assignment of accounts receivable removes cash flow obstacles by bypassing the lengthy receivable period.

Factoring your receivables is a great solution to overcome cash flow struggles. Additionally, factoring companies work closely with your customers allowing you to focus on your business. But with over 800 factoring companies in the US, finding a factoring company can be difficult. Bankers Factoring provides the best service with 20 years of experience. We make sure to communicate well with our customers while protecting our client’s interests.

Notice of assignment letters (NOA) can be scary for business owners unfamiliar with invoice factoring services. Most startups, small businesses, and companies extend credit terms requiring commercial funding. Offering net 30 to 120-day payment terms places cash flow problems for most entities.

Assignment letters should not turn you away from alternative financing. Your customers are familiar with NOA factoring and have other customers working with factoring companies.

Worrying about assignment letters only prevents your business from achieving its full potential. Bankers Factoring provides the best non-recourse factoring services and manages customer relations that enhance your business profile. Furthermore, we take on the credit risk from unpaid receivables while providing up to 93% cash advances. Accelerating your receivables cycle can unleash new sales growth and operational performance. Utilize free cash flow to improve profitability.

- Accounts Receivable Financing

- A/R Insurance through Factoring

- Bankers Factoring DIP Financing

- Best Payroll Funding Company

- Government Factoring

- Purchase Order Financing

- SAAS & Startup Factoring

- Small Business Invoice Factoring Company

- A/R Financing & Factoring Glossary

- Bankers Factoring Tax Lien Solutions

- Factoring Fees and Rates Explained

- How Does a Factoring Company Work?

- Invoice Factoring Blog

- Invoice Factoring FAQ

- Online 24-hour Factoring Reporting

- Quickbooks Factoring Journal Entries

Partner With Us

- Bank & Credit Union Partnerships

- Factoring Broker Program

- Bankers Factoring Careers

- Factoring Client Testimonials

- Industries that Use Factoring

Follow Bankers Factoring

- Bankers Factoring Company: Accounts Receivable Factoring Company

- Privacy Policy & Legal

- Bankers Factoring Sitemap

- Bankers Factoring Locations & Offices

- Contact Bankers Factoring

What Is a Factoring Notice of Assignment?

If you have already worked with a factoring company, then you have probably heard the term Notice of Assignment (NOA) before. There can be so much paperwork involved with the operation of a small business these days. It can be hard to keep up with the times and know what everything is.

For example, a notice of assignment (NOA) is actually a very common document utilized in the trucking industry. It’s ideal for companies using a factoring transaction service because a factoring fee will pay them on the load in advance.

From there, the factoring company will be responsible for collecting payment for the service from the customer. Today, we will be taking a deeper look into the Notice of Assignment to better understand the importance of NOAs and why we need them.

TAFS is More than Freight Factoring

How does an noa work.

Once a factoring company has paid the client for the load, it is important that the debtor knows that the money they owe is now due to another party. This official notification is delivered via a Notice of Assignment. It will be sent out to the debtor as a way of informing them that their payments must now be remitted to the factoring company instead of the carrier.

Why is an NOA Important?

An NOA is a legal document that acts as a way of notifying the debtor about who they need to pay. When a carrier works with a factoring company, the TAFs Factoring carrier will be paid in advance by the factoring company, so it is important that the debtor is informed of the presence of the third party that will now be managing that company’s accounts receivable (AR).

An NOA can also ensure that the debtor understands there’s a third party that will be collecting payments from them on behalf of the carrier. Notifying the debtor of this change will make it more likely to avoid payments being sent to the wrong party as well as conflicts and violations of the factoring client agreement.

What Is Covered in an NOA?

In a standard Notice of Assignment, you will find legal forms stating that the assignment of accounts receivable of the business has been assigned to a third-party provider. As such, payments are now payable directly to them.

The NOA will include an updated address of the third party so that the debtor knows where to send any future payments, as well as the third party’s phone number and a statement letting the customer know that he or she will be held liable in the event of a misdirected payment.

Will Factoring Affect My Work With My Client?

Working with a factoring company should not negatively impact any work that you do for your clients. The truth is that factoring is extremely common these days and in the larger picture, most business owners work with some form of a lender.

What you can do on a personal level to avoid any confusion or worry is to simply assure your customers that invoice factoring will not affect the service you are providing to them and they can continue to expect the same level of service and attention in working with you.

What Will Customers Think When They Receive an NOA?

Nowadays, a large percentage of companies use factoring or some sort of third-party financing option to help keep their operations flowing smoothly from one invoice payout to the next. This is often a display of good business management and dependability in the eyes of your clients. By taking control of your company’s finances, you’re letting them know that you are serious about your business and you plan to be around for years to come.

Is There a Financing Option That Will Not Send an NOA?

Select factoring companies may offer what is known as a non-notification factoring plan in which a conventional deed of assignment is not used. This plan is not often used because it leads to unnecessary confusion, which often results in payments being sent to the wrong party.

This happens because no matter what, the debtor is still required to mail the payment to the factoring company, but instead of an NOA being issued and making this clear, the company’s letterhead is included.

Example of an NOA

An NOA is often used in circumstances where a trucking company is utilizing a factoring company to manage their receivable financing for them. The Notice of Assignment is sent to the debtor with clear notification that the accounts receivable of the company they are doing business with are being managed by a third party.

It will properly advise the remittance address for their payments moving forward. With this official notice being received it is now up to the debtor to comply and update their system to make sure payments are processed to the correct party.

4 Things To Consider When Factoring

If you are going to use a factoring company here are some things you may want to consider regarding the NOA.

Responsibility

The responsibility lies with both the carrier and the factoring company. The factoring company will send NOAs to many debtors but it is hard for a factoring company to know every customer a carrier has or will work with. For this reason, the responsibility also falls on the carrier as well to notify all of their customers of the new payment conditions.

Requirements

The Notice of Assignment is required to be sent out so that the customer is fully aware of who they are legally obligated to pay. Without this notice, many payments would be sent to the incorrect party causing many issues that would deeply complicate the process.

If the trucking company accepts payment from the customer when it should have gone to the factoring company, the trucking company would be in violation of the contract and could be assessed additional fees or charged with fraud.

Being notified of a factoring company being used is not a bad thing. Utilizing a f actoring company allows the carrier the ability to maintain operations within the windows of payment terms on the loads which may not pay out for 30 days or 60 days. In some cases, it might even be 90 days.

Most factoring company contracts require carriers to submit every single invoice to minimize the likelihood of causing confusion. If the debtor has to change who they pay for different invoices, the odds are that errors will occur and payment will be sent to the wrong place. That is also why debtors don’t change who they pay after receiving an NOA unless they have an official release letter from the factoring company. This is a red flag for a carrier trying to commit fraud.

Receiving an NOA Is Actually a Good Thing

In conclusion, we now know that receiving an NOA will inform the recipient that the carrier they used is collecting money via a factoring company or other third-party business. As such, they will not be managing their accounts receivable. This means they are taking their business seriously and making moves to ensure their company will be around for years to come, and with the ability to grow and expand.

Sign up for a FreightWaves e-newsletter to stay informed of all news and trends impacting supply chain careers and operations.

More From Education

How to implement a fleet safety program, best team driving companies, 7 freight truck types & what they haul, does curb weight include fuel.

FreightWaves Ratings reference a list of approved sources for use of research to support editorial research and drafting. These include the Federal Motor Carrier Safety Administration , U.S Department of Transportation , Better Business Bureau® , International Fuel Tax Association, Inc , Federal Highway Administration , additional Federal, State, and Local government websites, internal data compiling, original research, and commentary from industry experts.

As one of the industry leaders, TAFS assists trucking companies to increase cash flow with some of the lowest factoring rates in the industry and a 1-hour advance option.

TAFS Freight Factoring

As one of the industry leaders, TAFS assists trucking companies to increase cash flow with some of the lowest factoring rates in the industry and 1-hour advance option.

Formal Notice of Assignment

Save, fill-In The Blanks, Print, Done!

Download Formal Notice of Assignment

Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (42.62 kB)

- Language: English

- We recommend downloading this file onto your computer.

- Legal Clarity : It provides legal documentation of the assignment, which is essential for establishing the validity and enforceability of the transfer of rights, interests, or obligations. This can be crucial in case of disputes or legal challenges.

- Notification : It formally notifies relevant parties, including third parties, creditors, and other stakeholders, about the change in ownership or obligations. This transparency helps prevent misunderstandings and potential conflicts.

- Contractual Compliance : In many cases, contracts and agreements require formal notice or consent for assignment. Failing to provide proper notice can lead to contract breaches and legal consequences. A Formal Notice of Assignment ensures compliance with contractual obligations.

- Protection of Interests : It protects the interests of both parties involved. The assignor can use it to demonstrate that they have transferred their rights or obligations, while the assignee can use it as evidence of their acquisition.

- Third-Party Recognition : For certain types of assignments, such as the assignment of accounts receivable or the transfer of real estate, third parties, including debtors or tenants, need to recognize the change. A Formal Notice of Assignment informs these parties of the new entity with whom they should interact.

- Prevention of Unauthorized Assignment : It helps prevent unauthorized or fraudulent assignments. By requiring a formal notice, it adds an additional layer of scrutiny, ensuring that assignments are legitimate and properly authorized.

- Record-Keeping : It serves as an important record in the documentation of business transactions and changes in ownership or rights. Proper record-keeping is essential for auditing, compliance, and future reference.

- Due Diligence : In mergers, acquisitions, or financial transactions, potential buyers or investors often review the history of assignments. A Formal Notice of Assignment provides a clear and traceable record of such changes.

- Liability and Responsibility : It clarifies the assignment's terms, conditions, and any associated responsibilities or limitations. This helps ensure that both the assignor and assignee understand their roles and obligations.

- Enforceability : In case the assignment needs to be enforced in court, having a well-documented Formal Notice of Assignment strengthens the legal standing of the parties involved.

DISCLAIMER Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

GDPR Compliance Templates

Related templates, sale and security agreement, property purchase and sale agreement.

- Purchase And Assumption