Multinationality and Performance Literature: A Critical Review and Future Research Agenda

- Research Article

- Published: 22 June 2016

- Volume 57 , pages 311–347, ( 2017 )

Cite this article

- Quyen T. K. Nguyen 1

2655 Accesses

52 Citations

Explore all metrics

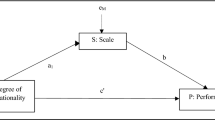

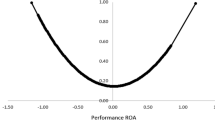

The literature on the relationship between the degree of multinationality (M) and performance (P) in the context of multinational enterprises (MNEs) has attracted a large volume of research in the past 50 years. Yet, the theoretical foundations and the empirical conclusions concerning the nature of M–P relationship vary greatly, thus call for a critical review and assessment. We examine 135 articles in 39 leading scholarly journals and classic books published during the period 1960–2015. We use an inductive approach and a qualitative content analysis methodology for our comprehensive and critical review of the literature. We incorporate international business, finance, and accounting perspectives in our analysis. We review the conceptualization and measurement of M, P, the findings on M–P relationships, methodologies, and geographic focus. We identify six key inconsistencies in the existing research, which cause ambiguity in the relevant findings. We make eight recommendations for future research to address these inconsistencies. Thus, our study contributes to the central debate in this research field.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Economies of Scale: The Rationale Behind the Multinationality-Performance Enigma

Stefan Eckert, Max Koppe, … Constantin Scharf

Turning the Tables: The Relationship Between Performance and Multinationality

Alice Schmuck, Katarina Lagerström & James Sallis

Multinationality and Performance: A Context-Specific Analysis for German Firms

Marcus Dittfeld

Aggarwal, R., Berrill, J., Hutson, E., & Kearney, C. (2011). What is a multinational corporation? Classifying the degree of firm-level multinationality. International Business Review, 20 (5), 557–577.

Article Google Scholar

Aggarwal, R., & Kyaw, N. A. (2008). Internal capital networks as a source of MNC competitive advantage: Evidence from foreign subsidiary capital structure decisions. Research in International Business and Finance, 22 (3), 409–439.

Allen, L., & Pantzalis, C. (1996). Valuation of the operating flexibility of multinational corporations. Journal of International Business Studies, 27 (4), 633–653.

Al-Obaidan, A. M., & Scully, G. W. (1995). The theory and measurement of the net benefits of multinationality: The case of international petroleum industry. Applied Economics, 27 (2), 231–238.

Annavarjula, M. G., & Beldona, S. (2000). Multinationality–performance relationship: A review and reconceptualization. The International Journal of Organizational Analysis, 8 (1), 48–67.

Annavarjula, M. G., Beldona, S., & Sadrieh, F. (2005). Corporate performance implications of multinationality: The role of firm-specific moderators. Journal of Transnational Management, 10 (4), 5–27.

Aulakh, P. S., & Mudambi, R. (2005). Financial resource flows in multinational enterprises: The role of external capital markets. Management International Review, 45 (3), 307–325.

Google Scholar

Bae, S. C., & Jain, V. (2003). The effects of R&D and international expansion on the performance of US industrial firms. Corporate Finance Review, 8 (1), 28–39.

Bae, S. C., Park, B., & Wang, X. (2008). Multinationality, R&D intensity, and firm performance: Evidence from US manufacturing firms. Multinational Business Review, 16 (1), 53–77.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17 (1), 99–120.

Baum, J. A., & Shipilov, V. (2006). Ecological approaches to organizations. In S. R. Clegg, C. Hardy, T. Lawrence, & W. Nord (Eds.), Handbook of organization studies (pp. 55–110). Thousand Oaks: Sage.

Chapter Google Scholar

Bausch, A., & Krist, M. (2007). The effect of context-related moderators on the internationalization-performance relationship: evidence from meta-analysis. Management International Review, 47 (3), 319–347.

Benvigvati, A. M. (1987). Domestic profit advantages of multinational firms. Journal of Business, 60 (3), 449–461.

Birkinshaw, J. M. (1996). How multinational subsidiary mandates are gained and lost. Journal of International Business Studies, 27 (3), 467–496.

Birkinshaw, J. M. (1997). Entrepreneurship in multinational corporations: The characteristics of subsidiary initiatives. Strategic Management Journal, 18 (3), 207–229.

Birkinshaw, J. M. (1999). The determinants and consequences of subsidiary initiative in multinational corporations. Entrepreneurship Theory and Practice, 24 (1), 9–36.

Birkinshaw, J. M. (2000). Entrepreneurship in the global firm . London: Sage.

Birkinshaw, J. M., & Hood, N. (1998). Multinational subsidiary evolution: Capability and charter change in foreign owned subsidiary companies. Academy of Management Review, 23 (4), 773–795.

Boddewyn, J. J. (1988). Political aspects of MNE theory. Journal of International Business Studies, 19 (3), 341–363.

Bowe, M., Filatotchev, I., & Marshall, A. (2010). Integrating contemporary finance and international business research. International Business Review, 19 (5), 435–445.

Bowen, H. P. (2007). The empirics of multinationality and performance. In A.M. Rugman (Ed.), Research in global strategic management ( vol. 13 ) : regional aspects of multinationality and performance (pp. 113–142). Oxford: Emerald.

Brock, D. M., & Yaffe, T. (2008). International diversification and performance: The mediating role of implementation. International Business Review, 17 (5), 600–615.

Brown, J. R., Martinsson, G., & Petersen, B. C. (2013). Law, stock markets, and innovation. Journal of Finance, 68 (4), 1517–1549.

Buckley, P., & Casson, M. (1976). The future of multinational enterprise . Basingstoke: Macmillan.

Book Google Scholar

Buehner, R. (1987). Assessing international diversification of West German corporations. Strategic Management Journal, 8 (1), 25–37.

Cantwell, J., & Mudambi, R. (2005). MNE competence-creating subsidiaries. Strategic Management Journal , 26 (12), 1109–1128.

Capar, N., & Kotabe, M. (2003). The relationship between international diversification and performance in service firms. Journal of International Business Studies, 34 (4), 345–355.

Cardinal, L. B., Miller, C. C., & Palich, L. E. (2011). Breaking the cycle of iteration: Forensic failures of international diversification and firm performance research. Global Strategy Journal, 1 (1–2), 175–186.

Casson, M. (1999). The organization and evolution of the multinational enterprise: An information cost approach. Management International Review, 39 (1), 77–121.

Caves, R. E. (1996). Multinational enterprises and economic analysis (2nd ed.). Cambridge: Cambridge University Press.

Chandler, A. (1962). Strategy and structure: Chapters in the history of the American Industrial Enterprise . Cambridge: MIT Press.

Chang, S. C., & Wang, C. F. (2007). The effect of product diversification strategies on the relationship between international diversification and firm performance. Journal of World Business, 42 (1), 969–979.

Chiang, Y. C., & Yu, T. H. (2005). The relationship between multinationality and the performance of Taiwan firms. Journal of American Academy of Business, 6 (1), 130–134.

Christophe, S. E. (1997). Hysteresis and the value of the US multinational corporation. Journal of Business, 70 (3), 435–462.

Christophe, S. E., & Lee, H. (2005). What matters about internationalization: A market-based assessment. Journal of Business Research, 58 (5), 636–643.

Click, R., & Harrison, P. (2002). Does multinationality matter? Evidence of value destruction in US multinational corporations. Paper presented at the Academy of International Business annual meeting, Puerto Rico.

Collins, J. M. (1990). A market performance comparison of U.S. firms active in domestic, developed and developing countries. Journal of International Business Studies, 21 (2), 271–287.

Contractor, F.J. (2007). The evolutionary or multi-stage theory of internationalization and its relationship to the regionalization for a company. In A.M. Rugman (Ed.), Research in global strategic management ( vol. 13 ) : Regional aspects of multinationality and performance (pp. 11–29). Oxford: Emerald.

Contractor, F. J. (2012). Why do multinational firms exist? A theory note about the effect of multinational expansion on performance and recent methodological critiques. Global Strategy Journal, 2 (4), 318–331.

Contractor, F. J., Kumar, V., & Kundu, S. K. (2007). Nature of the relationship between international expansion and performance: The case of emerging market firms. Journal of World Business, 42 (4), 401–417.

Contractor, F. J., Kundu, S. K., & Hsu, C. C. (2003). A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies, 34 (1), 5–18.

Daniels, J. D., & Bracker, J. (1989). Profit performance: Do foreign operations make a difference? Management International Review, 29 (1), 46–56.

Dastidar, P. (2009). International corporate diversification and firm performance: Does firm self-selection matter? Journal of International Business Studies, 40 (1), 71–85.

de Jong, G., & van Houten, J. (2014). The impact of MNE cultural diversity on the internationalization performance relationship: Theory and evidence from European multinational enterprises. International Business Review, 23 (1), 313–326.

Delios, A., & Beamish, P. W. (1999). Geographic scope, product diversification and the corporate performance of Japanese firms. Strategic Management Journal, 20 (8), 711–727.

Denis, D., Denis, D., & Yost, K. (2002). Global diversification industrial diversification and firm value. Journal of Finance, 57 (5), 1951–1979.

Desai, M. A., Foley, C. F., & Hines, J. J. R. (2004). A multinational perspective on capital structure choice and internal capital markets. Journal of Finance, 59 (6), 2451–2487.

Dess, G., Gupta, A., Hennart, J. F., & Hill, C. (1995). Conducting and integrating strategy research at the international, corporate and business levels: Issues and directions. Journal of Management, 21 (3), 357–393.

Doukas, J. A., & Kan, O. B. (2006). Does global diversification destroy firm value? Journal of International Business Studies, 37 (3), 352–371.

Drury, C. (2009). Management accounting for business (4th ed.). Australia: Cengage Learning.

Dunning, J. H. (1985). The United Kingdom. In J. H. Dunning (Ed.), Multinational enterprises, economic structure and international competitiveness . Chichester: John Wiley.

Duriau, V. J., Reger, R., & Pfarrer, M. D. (2007). A content analysis of the content analysis literature in organization studies: Research themes, data sources, and methodological refinements. Organizational Research Methods, 10 (5), 5–34.

Eckert, S., Dittfeld, M., Muche, T., & Raessler, S. (2010). Does multinationality lead to value enhancement? An empirical examination of publicly listed corporations from Germany. International Business Review, 19 (6), 562–574.

Eden, L., & Miller, S. (2001). Opening the black box: Multinationals and the costs of doing business abroad. Academy of management best paper proceedings.

Elango, B. (2000). An exploratory study into the linkages between corporate resources and the extent and form of internationalization of US firms. American Business Review, 18 (2), 12–26.

Elango, B., & Sethi, S. P. (2007). An exploration of the relationship between country of origin (COE) and the internationalization-performance paradigm. Management International Review, 47 (3), 369–392.

Errunza, V. R., & Senbet, L. W. (1981). The effects of international operations on the market value of the firm: Theory and evidence. Journal of Finance, 36 (2), 401–417.

Ferraris, S. P., Sen, N., & Nguyen, T. A. T. (2010). Firm value and the diversification choice: International evidence from global and industrial diversification. Applied Economics Letters, 17 (11), 1027–1031.

Fisch, J. H., & Zschoche, M. (2011a). The effects of liabilities of foreignness, economies of scale, and multinationality on firm performance: An information cost view. Schmalenbach Business Review, 3 (11), 51–68.

Fisch, J. H., & Zschoche, M. (2011b). Do firms benefit from multinationality through production shifting? Journal of International Management, 17 (2), 143–149.

Gande, A., Schenzler, C., & Senbet, L. W. (2009). Valuation effects of global diversification. Journal of International Business Studies, 40 (9), 1515–1532.

Gao, G. Y., Pan, Y., Lu, J., & Tao, Z. (2008). Performance of multinational subsidiaries: Influences of cumulative experience. Management International Review, 48 (6), 749–768.

Gedajlovic, E. R., & Shapiro, D. M. (1998). Management and ownership effects: Evidence from five countries. Strategic Management Journal, 19 (6), 533–553.

Geringer, M. J., Beamish, P. W., & da Costa, R. C. (1989). Diversification strategy and internationalization: Implications for MNE performance. Strategic Management Journal, 10 (2), 109–119.

Geringer, J. M., Tallman, S., & Olsen, D. M. (2000). Product and international diversification among Japanese multinational firms. Strategic Management Journal, 21 (1), 51–80.

Gestrin, M., Knight, R., & Rugman, A. M. (1998). The Templeton global performance index. The Oxford executive research briefings . Templeton: Templeton College.

Glaum, M., & Oesterle, M-J. (2007). Forty years of research on internationalization and firm performance: More questions than answers? Management International Review , 47 (3), 307–317.

Goerzen, A., & Beamish, P. W. (2003). Geographic scope and multinational enterprise performance. Strategic Management Journal, 24 (13), 1289–1306.

Gomes, L., & Ramaswany, K. (1999). An empirical examination of the form of the relationship between multinationality and performance. Journal of International Business Studies, 30 (1), 173–188.

Gomez-Meija, L. R., & Palich, L. E. (1997). Cultural diversity and the performance of multinational firms. Journal of International Business Studies, 28 (2), 309–334.

Goossens, E., & Doom, J. (2013). Biggest solar collapse in China imperils $1.28 billiony. Bloomberg.

Grant, R. M. (1987). Multinationality and performance among British manufacturing companies. Journal of International Business Studies, 18 (3), 79–89.

Grant, R. M., Jammine, A. P., & Thomas, H. (1988). Diversity, diversification and profitability among British manufacturing firms, 1972–1984. Academy of Management Journal, 31 (4), 771–801.

Henderson, A. D. (1999). Firm strategy and age dependence: A contingent view of the liabilities of newness, adolescence, and obsolescence. Administrative Science Quarterly, 44 (2), 281–314.

Hennart, J. F. (1982). A theory of multinational enterprise . Ann Arbor: University of Michigan Press.

Hennart, J. F. (2007). The theoretical rationale for a multinationality-performance relationship. Management International Review, 47 (3), 423–452.

Hennart, J. F. (2011). A theoretical assessment of the empirical literature on the impact of multinationality on performance. Global Strategy Journal, 1 (1–2), 135–151.

Hitt, M. A., Bierman, L., Uhlenbruck, K., & Simizu, K. (2006a). The importance of resources in the internationalization of professional service firms: The good, the bad, and the ugly. Academy of Management Journal, 49 (6), 1137–1157.

Hitt, M. A., Hoskisson, R. E., & Kim, H. (1997). International diversification: Effects on innovation and firm performance in product-diversified firms. Academy of Management Journal, 40 (4), 767–798.

Hitt, M. A., Tihanyi, L., Miller, T., & Connelly, B. (2006b). International diversification: Antecedents, outcomes, and moderators. Journal of Management, 32 (6), 831–867.

Hofstede, G. (1983). The cultural relativity of organizational practices and theories. Journal of International Business Studies, 14 (2), 75–89.

Horst, T. (1972). Firm and industry determinants of the decision to invest abroad: An empirical study. The Review of Economics and Statistics, 54 (3), 258–266.

Hughes, J. S., Logue, D. E., & Sweeney, R. J. (1975). Corporate international diversification and market assigned measures of risk and diversification. Journal of Financial and Quantitative Analysis, 10 (4), 627–637.

Hult, G. T. M. (2011). Commentaries: A strategic focus on multinationality and firm performance. Global Strategy Journal, 1 (1–2), 171–174.

Hult, G. T. M., Ketchen, D. J., Griffith, D. A., Chabowski, B. R., Hamman, M. K., Dykes, B. J., et al. (2008). An assessment of the measurement of performance in international business research. Journal of International Business Studies, 39 (6), 1060–1080.

Hutzschenreuter, T., Voll, J. C., & Verbeke, A. (2011). The impact of added cultural distance and cultural diversity on international expansion patterns: A Penrosean perspective. Journal of Management Studies, 48 (2), 305–329.

Hymer, S. H. (1960). Ph.D Thesis, MIT. The international operations of national firms: A study of direct foreign investment (Subsequently published by Cambridge: MIT Press under the same title in 1976) .

IFRS8-Operating Segments. (2015). http://www.ifrs.org/IFRSs/Documents/IFRS8en.pdf . Accessed 14 March 2015.

IAS38-Intangible Assets. (2015). http://www.ifrs.org/IFRSs/IFRS-technical-summaries/…/IAS38-English.pdf . Accessed 14 March 2015.

Johanson, J., & Vahlne, J.-E. (1977). The internationalization process of the firm: A model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8 (1), 23–32.

Jormanainen, I., & Koveshnikov, A. (2012). International activities of emerging market firms: A critical assessment of research in top international management journals. Management International Review, 52 (5), 691–725.

Jung, Y. (1991). Multinationality and profitability. Journal of Business Research, 23 (2), 179–187.

Kim, S. S. (2009). A study on the relationship between multinationality and performance among Korean firms. Journal of Korea Trade, 14 (1), 67–90.

Kim, H., Hoskisson, R. E., & Wan, W. P. (2004). Power dependence, diversification strategy, and performance in keiretsu member firms. Strategic Management Journal, 25 (7), 613–636.

Kim, W. C., Hwang, P., & Burgers, W. P. (1989). Global diversification strategy and corporate profit performance. Strategic Management Journal, 10 (1), 45–57.

Kim, W. C., Hwang, P., & Burgers, W. P. (1993). Multinationals’ diversification and risk-return trade-off. Strategic Management Journal, 14 (4), 275–286.

Kim, W. S., & Lyn, E. O. (1986). Excess market value, the multinational corporation, and Tobin q-ratio. Journal of International Business Studies, 17 (1), 119–125.

Kim, Y. S., & Mathur, I. (2008). The impact of geographic diversification on firm performance. International Review of Financial Analysis, 17 (4), 747–766.

Kim, C. W., & Mauborgne, R. A. (1993). Making global strategies work. Sloan Management Review, 34 (3), 11–27.

Kirca, A. H., Hult, T. M., Deligonul, S. Z., Perry, M. Z., & Cavusgil, S. T. (2012a). A multilevel examination of the drivers of firm multinationality: A meta analysis. Journal of Management, 38 (2), 502–530.

Kirca, A. H., Hult, T. M., Roth, K., Cavusgil, S. T., Perry, M. Z., Akdeniz, M. B., et al. (2011). Firm specific assets, multinationality, and financial performance: A meta-analytic review and theoretical integration. Academy of Management Journal, 54 (1), 47–72.

Kirca, A. H., Roth, K., Hult, T. M., & Cavusgil, S. T. (2012b). The role of context in the multinationality–performance relationship: A meta-analytic review. Global Strategy Journal, 2 (2), 108–121.

Kobrin, S. J. (1991). An empirical analysis of the determinants of global integration. Strategic Management Journal, 12 (S1), 17–31.

Kogut, B., & Singh, H. (1988). The effect of country culture on the choice of entry mode. Journal of International Business Studies, 19 (3), 411–423.

Kotabe, M., Srinivasan, S. S., & Aulakh, P. S. (2002). Multinationality and firm performance: The moderating role of R&D and marketing capabilities. Journal of International Business Studies, 33 (1), 79–97.

Kumar, M. S. (1984). Growth, acquisition and investment: An analysis of the growth of industrial firms and their overseas activities . Cambridge and New York: Cambridge University Press.

Lee, J., Hall, E. H., & Rutherford, M. W, Jr. (2003). A comparative study of US and Korean firms: Changes in diversification and performance. International Journal of Commerce and Management, 13 (1), 11–41.

Lee, S., Kim, M., & Davidson, W. N, I. I. I. (2015). Value relevance of multinationality: Evidence from Korean firms. Journal of International Financial Management & Accounting, 26 (2), 111–149.

Li, L. (2005). Is regional strategy more effective than global strategy in the US service industries? Management International Review, 45 (S1), 37–57.

Li, L. (2007). Multinationality and performance: A synthetic review and research agenda. International Journal of Management Reviews, 9 (2), 117–139.

Li, L., & Qian, G. (2005). Dimensions of international diversification: the joint effects on firm performance. Journal of Global Marketing, 18 (3/4), 7–35.

Lu, J. W., & Beamish, P. (2004). International diversification and firm performance: the S-curve hypothesis. Academy of Management Journal, 47 (4), 598–609.

Marthur, I., Singh, M., & Gleason, K. C. (2001). The evidence from Canadian firms on multinational diversification and performance. The Quarterly Review of Economics and Finance, 41 (4), 561–578.

Martin, J. D., & Petty, J. W. (2000). Value based management . Harvard: Harvard Business School Press.

Matysiak, L., & Bausch, A. (2012). Antecedents of MNE performance: Blinded by the obvious in 35 years of literature. Multinational Business Review, 20 (2), 178–211.

McDonald, F., Warhurst, S., & Allen, M. (2008). Autonomy, embeddedness and the performance of foreign owned subsidiaries. Multinational Business Review, 16 (3), 73–92.

Michel, A., & Shaked, I. (1986). Multinational corporations versus domestic corporations: Financial performance and characteristics. Journal of International Business Studies, 18 (3), 89–100.

Morales, A., & Martin, C. 2013. Suntech defaults on $541 million bond: A first for China. Bloomberg.

Morck, R., & Yeung, B. (1991). Why investors value multinationality? The Journal of Business, 64 (2), 165–187.

Morck, R., & Yeung, B. (2009). Metrics for international business research. In A. M. Rugman (Ed.), The Oxford handbook of international business (2nd ed., pp. 798–815). Oxford: Oxford University Press.

Mudambi, R. (1999). MNE internal capital markets and subsidiary strategic independence. International Business Review, 8 (2), 197–211.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13 (2), 187–222.

Nguyen, Q. T. K. (2011). The empirical literature on multinational enterprises, subsidiaries and performance. Multinational Business Review, 19 (1), 47–64.

Nguyen, Q. T. K. (2014). The regional strategies of British multinational subsidiaries in South East Asia. British Journal of Management, 25 (S1), 60–76.

Nguyen, Q. T. K. (2015a). The subsidiaries of multinational enterprises operate regionally, not globally. Multinational Business Review, 23 (4), 328–354.

Nguyen, Q.T.K. (2015). The determinants of reinvested earnings of multinational subsidiaries in emerging economies. In Tueselmann, H., Buzdugan, S., Cao, Q., Freund, D., & Golesorkhi, S. (Eds.), Impact of international business: Challenges and solutions for policy and practice (pp. 43–61). London: Palgrave Macmillan.

Nguyen, Q. T. K., & Rugman, A. M. (2015a). Multinational subsidiary sales and performance in South East Asia. International Business Review, 24 (1), 115–123.

Nguyen, Q. T. K., & Rugman, A. M. (2015b). Internal equity financing and the performance of multinational subsidiaries in emerging economies. Journal of International Business Studies, 46 (4), 468–490.

Oesterle, M.-J., & Richta, H. N. (2013). Internationalisation and firm performance: state of empirical research efforts and need for improved approaches. European Journal of International Management, 7 (2), 204–224.

Oesterle, M. J., & Wolf, J. (2011). Fifty years of management international review and IB/IM research: An inventory and some suggestions for the field’s development. Management International Review, 51 (6), 735–754.

Oh, C. H., & Contractor, F. (2014). A regional perspective on multinational expansion strategies: Reconsidering the three-stage paradigm. British Journal of Management, 25 (S1), 42–59.

Oh, C. H., & Rugman, A. M. (2014). The dynamics of regional and global multinationals, 1999–2008. Multinational Business Review, 22 (2), 108–117.

Palich, L., Cardinal, L., & Miller, C. (2000). Curvilinearity in the diversification-performance linkage: An examination of over three decades of research. Strategic Management Journal, 21 (2), 155–174.

Pantzalis, C. (2001). Does location matter? An empirical analysis of geographic scope and MNC market valuation. Journal of International Business Studies, 32 (1), 133–155.

Pattnaik, C., & Elango, B. (2009). The impact of firm resources on the internationalization and performance relationship: A study of Indian manufacturing firms. Multinational Business Review, 17 (2), 69–87.

Porter, M. E. (1990). The competitive advantage of nations . New York: Free Press.

Powell, K. S. (2013). From M–P to MA-P: Multinationality alignment and performance. Journal of International Business Studies, 45 (2), 211–226.

Qian, G. (1997). Assessing product-market diversification of U.S. firms. Management International Review, 37 (2), 127–149.

Qian, G. (1998). Determinants of profit performance for the largest US firms 1981–1992. Multinational Business Review, 6 (2), 44–51.

Qian, G. (2002). Multinationality, product diversification, and profitability of US emerging and medium-sized enterprises. Journal of Business Venturing, 17 (6), 611–634.

Qian, G., & Li, J. (2002). Multinationality, global market diversification and profitability among the largest US firms. Journal of Business Research, 55 (4), 325–335.

Qian, G., Li, L., Li, J., & Qian, Z. (2008). Regional diversification and firm performance. Journal of International Business Studies, 39 (2), 197–214.

Qian, G., Li, L., & Rugman, A. M. (2013). Liability of country foreignness and liability of regional foreignness: Their effects on geographic diversification and firm performance. Journal of International Business Studies, 44 (6), 635–647.

Ramaswamy, K. (1992). Multinationality and performance: A synthesis and redirection. Advances in International Competitive Management, 7 , 241–267.

Ramaswamy, K. (1995). Multinationality, configuration, and performance: A study of MNEs in the US drug and pharmaceutical industry. Journal of International Management, 1 (2), 231–253.

Ramaswamy, K., Kroeck, K. G., & Renforth, W. (1996). Measuring the degree of internationalization of a firm: A comment. Journal of International Business Studies, 27 (1), 167–177.

Ramirez-Aleson, M., & Espitia-Escuer, M. A. (2001). The effect of international diversification on performance. Management International Review, 41 (3), 291–315.

Reeb, D. M., Kwok, C. C., & Baek, Y. H. (1998). Systematic risk of the multinational corporation. Journal of International Business Studies, 29 (2), 263–279.

Riahi-Belkaoui, A. (1998). The effects of the degree of internationalization on firm performance. International Business Review, 7 (3), 315–321.

Ross, S. A. (1973). The economic theory of agency: The principal’s problem. American Economic Review, 63 (2), 134–139.

Roth, K., & Morrison, A. J. (1992). Implementing global strategy: Characteristics of global subsidiary mandates. Journal of International Business Strategy, 23 (4), 715–735.

Rugman, A. M. (1976). Risk reduction by international diversification. Journal of International Business Studies, 7 (2), 75–80.

Rugman, A. M. (1980). Internalization theory and corporate international finance. California Management Review, 23 (2), 73–79.

Rugman, A. M. (1981). Inside the multinationals: the economics of internal markets . New York: Columbia University Press.

Rugman, A. M. (1983). The comparative performance of U.S. and European multinational enterprises, 1970–1979. Management International Review, 23 (2), 4–14.

Rugman, A. M. (2000). The end of globalization . London: Random House.

Rugman, A. M. (2005). The regional multinationals: MNEs and “global” strategic management . Cambridge: Cambridge University Press.

Rugman, A. M. (Ed.). (2007). Research in global strategic management (vol. 13): Regional aspects of multinationality and performance . Oxford: Elsevier.

Rugman, A. M., & Collinson, S. (2012). International business (6th ed.). Harlow: Pearson.

Rugman, A. M., Lecraw, D. L., & Booth, L. D. (1985). International business: firm and environment . New York: McGraw-Hill.

Rugman, A. M., & Nguyen, Q. T. K. (2014). Modern international business theory and emerging economy multinational companies. In A. Cuervo-Cazurra & R. Ramamurti (Eds.), Understanding multinationals from emerging markets (pp. 53–80). Cambridge: Cambridge University Press.

Rugman, A.M., Nguyen, Q.T.K., & Wei, Z. (2016). Rethinking the literature on the performance of Chinese multinational enterprises. Management and Organization Review (Forthcoming) .

Rugman, A. M., & Oh, C. H. (2010). Does the regional nature of multinationals affect the multinationality and performance relationship? International Business Review, 19 (5), 479–488.

Rugman, A. M., & Oh, C. H. (2011). Methodological issues in the measurement of multinationality of U.S. firms. Multinational Business Review, 19 (3), 202–212.

Rugman, A. M., & Oh, C. H. (2013). Why the home region matters: Location and regional multinationals. British Journal of Management, 24 (4), 463–479.

Rugman, A. M., & Sukpanich, N. (2006). Firm specific advantages, intra-regional sales and performance of multinational enterprises. The International Trade Journal, 20 (3), 355–382.

Rugman, A. M., & Verbeke, A. (1992). A note on the transnational solution and the transaction cost theory of multinational strategic management. Journal of International Business Studies, 23 (4), 761–772.

Rugman, A. M., & Verbeke, A. (2001). Subsidiary–specific advantages in multinational enterprises. Strategic Management Journal, 22 (3), 237–250.

Rugman, A. M., & Verbeke, A. (2004). A perspective on regional and global strategies of multinational enterprises. Journal of International Business Studies, 35 (1), 3–18.

Rugman, A. M., & Verbeke, A. (2008). Internalization theory and its impact on the field of international business. In J. J. Boddewyn (Ed.), Research on global strategic management (Vol. 14, pp. 155–174)., International business scholarship: AIB fellows on the first 50 years and beyond Bradford: Emerald Group.

Rugman, A. M., Verbeke, A., & Nguyen, Q. T. K. (2011). Fifty years of international business and beyond. Management International Review, 51 (6), 755–786.

Rugman, A. M., Yip, G., & Jayaratnet, S. (2008). A note on return on foreign assets and foreign presence for UK multinationals. British Journal of Management, 19 (2), 162–170.

Ruigrok, W., Amann, W., & Wagner, H. (2007). The internationalization-performance relationship at Swiss firms: A test of the S-shape and extreme degrees of internationalization. Management International Review, 47 (3), 349–368.

Ruigrok, W., & Wagner, H. (2003). Internationalization and performance: An organizational learning perspective. Management International Review, 43 (1), 63–83.

Ryan, N. (2011). Economic value added versus profit-based measures of performance. ACCA website http://www.acca.co.uk/pubs/ . Accessed 10 November 2014.

Sambharya, R. B. (1995). The combined effect of international diversification and product diversification strategies on the performance of US-based multinational corporations. Management International Review, 35 (3), 197–213.

Seal, W., Garrison, G. H., & Norren, E. W. (2011). Management Accounting . Berkshire: McGraw-Hill Education.

Severn, A. K., & Laurence, M. M. (1974). Direct investment, research intensity, and profitability. Journal of Financial and Quantitative Analysis, 9 (2), 181–190.

Shaked, I. (1986). Are multinational corporations safer? Journal of International Business Studies (Spring), 17 (1), 83–106.

Shiller, R. J. (2000). Irrational exuberance . Princeton: Princeton University Press.

Siddharthan, N. S., & Lall, S. (1982). Recent growth of the largest U.S. multinationals. Oxford Bulletin of Economics and Statistics, 44 (1), 1–13.

Stewart, G.B. III (1991). The quest for value . HarperCollins.

Stopford, J. M., & Wells, L. T, Jr. (1972). Managing the multinational enterprise: Organization of the firm and ownership of the subsidiaries . London: Basic Books.

Suddaby, R., & Greenwood, R. (2005). Rhetorical strategies of legitimacy. Administrative Science Quarterly, 50 (1), 35–67.

Sui-Lee, W. (2013). UPDATE 2-Solar pain hits China as Suntech unit nears insolvency. Reuters.

Sullivan, D. (1994a). Measuring the degree of internationalization of a firm. Journal of International Business Studies, 25 (2), 325–342.

Sullivan, D. (1994b). The “threshold of internationalization”: Replication, extension, and reinterpretation. Management International Review, 34 (2), 165–186.

Tallman, S., Geringer, J. M., & Olsen, D. M. (2004). Contextual moderating effects and the relationship of firm-specific resources, strategy, structure and performance among Japanese multinational enterprises. Management International Review, 44 (1), 107–128.

Tallman, S., & Li, J. (1996). Effects of international diversity and product diversity on the performance of multinational firms. Academy of Management Journal, 39 (1), 179–196.

Teece, D., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18 (8), 537–556.

Thomas, D. E. (2006). International diversification and firm performance in Mexican firms: A curvilinear relationship. Journal of Business Research, 59 (4), 501–507.

Thomas, D. E., & Eden, L. (2004). What is the shape of the multinationality–performance relationship? Multinational Business Review, 12 (1), 89–110.

Tongli, L., Ping, E. J., & Chiu, W. K. C. (2005). International diversification and performance: Evidence from Singapore. Asia Pacific Journal of Management, 22 (1), 65–88.

Tushman, M., & Romanelli, E. (1985). Organizational evolution: A metamorphis of convergence and reorientation. In Cummings, L., Staw, B. (Eds.), Research in organizational behavior (pp. 171–222). Greenwich: JAI Press.

UNCTAD. (2013). World investment report . Geneva: United Nations Conference on Trade and Development (UNCTAD).

US GAPP. (2015). Financial Accounting Standard Board, FASB131— Disclosures about segments of an enterprise and related information. http://www.fasb.org/summary/stsum131.shtml . Accessed 14 March 2015.

Venkatraman, N., & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches. Academy of Management Review, 11 (4), 801–814.

Verbeke, A. (2013). International business strategy (2nd ed.). Cambridge: Cambridge University Press.

Verbeke, A., & Brugman, P. (2009). Triple testing the quality of multinationality-performance research: An internalization theory perspective. International Business Review, 18 (3), 265–275.

Verbeke, A., & Forootan, Z. M. (2012). How good are multinationality performance (M–P) empirical studies? Global Strategy Journal, 2 (4), 332–344.

Verbeke, A., Li, L., & Goerzen, A. (2009). Toward more effective research on the multinationality–performance relationship. Management International Review, 49 (2), 1–13.

Vernon, R. (1971). Sovereignty at bay . London: Longman Group.

Wang, C.-F., Chen, L-Y., & Chang, S.-C. (2011). International diversification and the market value of new product introduction. Journal of International Management , 17 (4), 333–347.

Wan, C. C. (1998). International diversification, industrial diversification, and firm performance of Hong Kong MNCs. Asia Pacific Journal of Management, 15 (2), 205–217.

Welch, C., Piekkari, R., Plakoyiannaki, E., & Paavilainen-Maentymaeki, E. (2011). Theorizing from case studies: Towards a pluralist future for international business research. Journal of International Business Studies, 42 (5), 740–762.

Wernerfelt, B. (1984). The resource-based view of the firm. Strategic Management Journal, 5 (2), 171–180.

Whited, T. M. (2001). Is it inefficient investment that causes the diversification discounts? Journal of Finance, 56 (5), 1667–1691.

Wiersema, M. F., & Bowen, H. P. (2011). The relationship between international diversification and firm performance: Why it remains a puzzle. Global Strategy Journal, 1 (1–2), 157–170.

Yang, Y., & Driffield, N. (2012). Multinationality-performance relationship: A meta-analysis. Management International Review, 52 (1), 23–47.

Yang, Y., Martins, P. S., & Driffield, N. (2013). Multinational performance and the geography of FDI: Evidence from 46 countries. Management International Review, 53 (6), 763–794.

Yin, R. K. (2003). Case study research: Design and methods . Thousand Oaks: Sage.

Yoshihara, H. (1985). Multinational growth of Japanese manufacturing enterprises in the post war era. The proceedings of the Fuji international conference on business history . Tokyo: Tokyo University Press.

Zaheer, S. (1995). Overcoming the liability of foreignness. Academy of Management Journal, 38 (2), 341–363.

Zahra, S. A., Ireland, R. D., & Hitt, M. A. (2000). International expansion by new venture firms: International diversity, mode of market entry, technological learning and performance. Academy of Management Journal, 43 (5), 925–950.

Download references

Acknowledgments

We are very grateful to Professor Joachim Wolf for his helpful guidance. We really appreciate constructive feedback and comments from two anonymous reviewers. In particular, we would like to thank the reviewer 1 for her helpful suggestions, which significantly improved this paper.

Author information

Authors and affiliations.

Henley Business School, University of Reading, Reading, England, UK

Quyen T. K. Nguyen

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Quyen T. K. Nguyen .

Rights and permissions

Reprints and permissions

About this article

Nguyen, Q.T.K. Multinationality and Performance Literature: A Critical Review and Future Research Agenda. Manag Int Rev 57 , 311–347 (2017). https://doi.org/10.1007/s11575-016-0290-y

Download citation

Received : 19 March 2015

Revised : 22 January 2016

Accepted : 10 May 2016

Published : 22 June 2016

Issue Date : June 2017

DOI : https://doi.org/10.1007/s11575-016-0290-y

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Multinationality (M)

- Performance (P)

- M–P relationships

- Internalization theory

- FSAs/CSAs framework

- Accounting perspectives (IAS38, IFRS8 and FASB131)

- Find a journal

- Publish with us

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

- We're Hiring!

- Help Center

Multinational Companies

- Most Cited Papers

- Most Downloaded Papers

- Newest Papers

- Save to Library

- Last »

- Multicultural Team Follow Following

- Diversity Management Follow Following

- Cultural Diversity Follow Following

- Use Case Follow Following

- Multiculturalism Follow Following

- Asia Pacific Follow Following

- Personnel Follow Following

- Classical Conditioning Follow Following

- Exploratory Study Follow Following

- Distributed System Follow Following

Enter the email address you signed up with and we'll email you a reset link.

- Academia.edu Publishing

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Share full article

There’s an Explosion of Plastic Waste. Big Companies Say ‘We’ve Got This.’

Big brands like Procter & Gamble and Nestlé say a new generation of plants will help them meet environmental goals, but the technology is struggling to deliver.

Recycled polypropylene pellets at a PureCycle Technologies plant in Ironton, Ohio. Credit... Maddie McGarvey for The New York Times

Supported by

By Hiroko Tabuchi

- Published April 5, 2024 Updated April 8, 2024

By 2025, Nestle promises not to use any plastic in its products that isn’t recyclable. By that same year, L’Oreal says all of its packaging will be “refillable, reusable, recyclable or compostable.”

And by 2030, Procter & Gamble pledges that it will halve its use of virgin plastic resin made from petroleum.

To get there, these companies and others are promoting a new generation of recycling plants, called “advanced” or “chemical” recycling, that promise to recycle many more products than can be recycled today.

So far, advanced recycling is struggling to deliver on its promise. Nevertheless, the new technology is being hailed by the plastics industry as a solution to an exploding global waste problem.

The traditional approach to recycling is to simply grind up and melt plastic waste. The new, advanced-recycling operators say they can break down the plastic much further, into more basic molecular building blocks, and transform it into new plastic.

PureCycle Technologies, a company that features prominently in Nestlé, L’Oréal, and Procter & Gamble’s plastics commitments, runs one such facility, a $500 million plant in Ironton, Ohio. The plant was originally to start operating in 2020 , with the capacity to process as much as 182 tons of discarded polypropylene, a hard-to-recycle plastic used widely in single-use cups, yogurt tubs, coffee pods and clothing fibers, every day.

But PureCycle’s recent months have instead been filled with setbacks: technical issues at the plant, shareholder lawsuits, questions over the technology and a startling report from contrarian investors who make money when a stock price falls. They said that they had flown a drone over the facility that showed that the plant was far from being able to make much new plastic.

PureCycle, based in Orlando, Fla., said it remained on track. “We’re ramping up production,” its chief executive, Dustin Olson, said during a recent tour of the plant, a constellation of pipes, storage tanks and cooling towers in Ironton, near the Ohio River. “We believe in this technology. We’ve seen it work,” he said. “We’re making leaps and bounds.”

Nestlé, Procter & Gamble and L’Oréal have also expressed confidence in PureCycle. L’Oréal said PureCycle was one of many partners developing a range of recycling technologies. P.&G. said it hoped to use the recycled plastic for “numerous packaging applications as they scale up production.” Nestlé didn’t respond to requests for comment, but has said it is collaborating with PureCycle on “groundbreaking recycling technologies.”

PureCycle’s woes are emblematic of broad trouble faced by a new generation of recycling plants that have struggled to keep up with the growing tide of global plastic production, which scientists say could almost quadruple by midcentury .

A chemical-recycling facility in Tigard, Ore., a joint venture between Agilyx and Americas Styrenics, is in the process of shutting down after millions of dollars in losses. A plant in Ashley, Ind., that had aimed to recycle 100,000 tons of plastic a year by 2021 had processed only 2,000 tons in total as of late 2023, after fires, oil spills and worker safety complaints.

At the same time, many of the new generation of recycling facilities are turning plastic into fuel, something the Environmental Protection Agency doesn’t consider to be recycling, though industry groups say some of that fuel can be turned into new plastic .

Overall, the advanced recycling plants are struggling to make a dent in the roughly 36 million tons of plastic Americans discard each year, which is more than any other country. Even if the 10 remaining chemical-recycling plants in America were to operate at full capacity, they would together process some 456,000 tons of plastic waste, according to a recent tally by Beyond Plastics , a nonprofit group that advocates stricter controls on plastics production. That’s perhaps enough to raise the plastic recycling rate — which has languished below 10 percent for decades — by a single percentage point.

For households, that has meant that much of the plastic they put out for recycling doesn’t get recycled at all, but ends up in landfills. Figuring out which plastics are recyclable and which aren’t has turned into, essentially, a guessing game . That confusion has led to a stream of non-recyclable trash contaminating the recycling process, gumming up the system.

“The industry is trying to say they have a solution,” said Terrence J. Collins, a professor of chemistry and sustainability science at Carnegie Mellon University. “It’s a non-solution.”

‘Molecular washing machine’

It was a long-awaited day last June at PureCycle’s Ironton facility: The company had just produced its first batch of what it describes as “ultra-pure” recycled polypropylene pellets.

That milestone came several years late and with more than $350 million in cost overruns. Still, the company appeared to have finally made it. “Nobody else can do this,” Jeff Kramer, the plant manager, told a local news crew .

PureCycle had done it by licensing a game-changing method — developed by Procter & Gamble researchers in the mid-2010s, but unproven at scale — that uses solvent to dissolve and purify the plastic to make it new again. “It’s like a molecular washing machine,” Mr. Olson said.

There’s a reason Procter & Gamble, Nestlé and L’Oréal, some of the world’s biggest users of plastic, are excited about the technology. Many of their products are made from polypropylene, a plastic that they transform into a plethora of products using dyes and fillers. P.&G. has said it uses more polypropylene than any other plastic, more than a half-million tons a year.

But those additives make recycling polypropylene more difficult.

The E.P.A. estimates that 2.7 percent of polypropylene packaging is reprocessed. But PureCycle was promising to take any polypropylene — disposable beer cups, car bumpers, even campaign signs — and remove the colors, odors, and contaminants to transform it into new plastic.

Soon after the June milestone, trouble hit.

On Sept. 13, PureCycle disclosed that its plant had suffered a power failure the previous month that had halted operations and caused a vital seal to fail. That meant the company would be unable to meet key milestones, it told lenders.

Then in November, Bleecker Street Research — a New York-based short-seller, an investment strategy that involves betting that a company’s stock price will fall — published a report asserting that the white pellets that had rolled off PureCycle’s line in June weren’t recycled from plastic waste. The short-sellers instead claimed that the company had simply run virgin polypropylene through the system as part of a demonstration run.

Mr. Olson said PureCycle hadn’t used consumer waste in the June 2023 run, but it hadn’t used virgin plastic, either. Instead it had used scrap known as “post industrial,” which is what’s left over from the manufacturing process and would otherwise go to a landfill, he said.

Bleecker Street also said it had flown heat-sensing drones over the facility and said it found few signs of commercial-scale activity. The firm also raised questions about the solvent PureCycle was using to break down the plastic, calling it “a nightmare concoction” that was difficult to manage.

PureCycle is now being sued by other investors who accuse the company of making false statements and misleading investors about its setbacks.

Mr. Olson declined to describe the solvent. Regulatory filings reviewed by The New York Times indicate that it is butane, a highly flammable gas, stored under pressure. The company’s filing described the risks of explosion, citing a “worst case scenario” that could cause second-degree burns a half-mile away, and said that to mitigate the risk the plant was equipped with sprinklers, gas detectors and alarms.

Chasing the ‘circular economy’

It isn’t unusual, of course, for any new technology or facility to experience hiccups. The plastics industry says these projects, once they get going, will bring the world closer to a “circular” economy, where things are reused again and again.

Plastics-industry lobbying groups are promoting chemical recycling. At a hearing in New York late last year, industry lobbyists pointed to the promise of advanced recycling in opposing a packaging-reduction bill that would eventually mandate a 50 percent reduction in plastic packaging. And at negotiations for a global plastics treaty , lobby groups are urging nations to consider expanding chemical recycling instead of taking steps like restricting plastic production or banning plastic bags.

A spokeswoman for the American Chemistry Council, which represents plastics makers as well as oil and gas companies that produce the building blocks of plastic, said that chemical recycling potentially “complements mechanical recycling, taking the harder-to-recycle plastics that mechanical often cannot.”

Environmental groups say the companies are using a timeworn strategy of promoting recycling as a way to justify selling more plastic, even though the new recycling technology isn’t ready for prime time. Meanwhile, they say, plastic waste chokes rivers and streams, piles up in landfills or is exported .

“These large consumer brand companies, they’re out over their skis,” said Judith Enck, the president of Beyond Plastics and a former regional E.P.A. administrator. “Look behind the curtain, and these facilities aren’t operating at scale, and they aren’t environmentally sustainable,” she said.

The better solution, she said, would be, “We need to make less plastic.”

Touring the plant

Mr. Olson recently strolled through a cavernous warehouse at PureCycle’s Ironton site, built at a former Dow Chemical plant. Since January, he said, PureCycle has been processing mainly consumer plastic waste and has produced about 1.3 million pounds of recycled polypropylene, or about 1 percent of its annual production target.

“This is a bag that would hold dog food,” he said, pointing to a bale of woven plastic bags. “And these are fruit carts that you’d see in street markets. We can recycle all of that, which is pretty cool.”

The plant was dealing with a faulty valve discovered the day before, so no pellets were rolling off the line. Mr. Olson pulled out a cellphone to show a photo of a valve with a dark line ringing its interior. “It’s not supposed to look like that,” he said.

The company later sent video of Mr. Olson next to white pellets once again streaming out of its production line.

PureCycle says every kilogram of polypropylene it recycles emits about 1.54 kilograms of planet-warming carbon dioxide. That’s on par with a commonly used industry measure of emissions for virgin polypropylene. PureCycle said that it was improving on that measure.

Nestlé, L’Oréal and Procter & Gamble continue to say they’re optimistic about the technology. In November, Nestlé said it had invested in a British company that would more easily separate out polypropylene from other plastic waste.

It was “just one of the many steps we are taking on our journey to ensure our packaging doesn’t end up as waste,” the company said.

Hiroko Tabuchi covers the intersection of business and climate for The Times. She has been a journalist for more than 20 years in Tokyo and New York. More about Hiroko Tabuchi

Learn More About Climate Change

Have questions about climate change? Our F.A.Q. will tackle your climate questions, big and small .

“Buying Time,” a new series from The New York Times, looks at the risky ways humans are starting to manipulate nature to fight climate change.

Big brands like Procter & Gamble and Nestlé say a new generation of recycling plants will help them meet environmental goals, but the technology is struggling to deliver .

The Italian energy giant Eni sees future profits from collecting carbon dioxide and pumping it into natural gas fields that have been exhausted.

New satellite-based research reveals how land along the East Coast is slumping into the ocean, compounding the danger from global sea level rise . A major culprit: the overpumping of groundwater.

Did you know the ♻ symbol doesn’t mean something is actually recyclable ? Read on about how we got here, and what can be done.

Advertisement

COMMENTS

Multinational Corporations - A Study. Dr V. Basil Hans. [email protected]. Kavitha B. [email protected]. ABSTRACT. The present study is about MNCs with refer ence to developing counties ...

Qatar Airways, which was founded in 1993 with two aircraft, has a similar story. Qatar Airways expanded rapidly to become a five-star-rated airline and was voted the world's number-one airline in 2015 (Skytrax, 2016).These examples are strong evidence of how some firms from emerging economies can develop unique capabilities and assets to establish a global network and adapt to the ...

The nascent research agenda described in this paper provides a vocabulary to describe and analyze the current processes of politicization, collaboration and contestation that occur at the business-government-society interface. ... Brammer, S. J., Pavelin, S., & Porter, L. A. 2009. Corporate charitable giving, multinational companies and ...

Research conducted in the MNC; the organization is in the background. Research conducted about the MNC as a complex multiunit, multilocational and multilingual organization; the MNC becomes part of the study itself. Role of the MNC as an organization form: The MNC is not considered significantly different from other types of organizations.

1. Introduction. More than 100,000 companies have established business operations abroad with more than 900,000 subsidiaries (Jaworek & Kuzel, Citation 2015).Timely data on the full scope of multinational enterprise (MNE) is unavailable because it is too difficult to trace all foreign direct investment (FDI) projects, international mergers and acquisitions, and changing ownership.

The impact of globalization on multinational enterprises was examined from the years. 1980 to 2020. A scoping literature review was conducted for a total of 141 articles. Qualitative, quantitative ...

Multinational companies Paper type Research paper 1. Introduction Corporate social responsibility (CSR) has acquired great relevance in the academic world and in firm management in recent years (Barrena et al., 2016; Madorran and Garcia, 2016). Defined as organizations' commitment to contribute to sustainable economic development,

Executing management control across borders is crucial for multinational companies (MNCs). Various management control mechanisms serve to align foreign subsidiaries with corporate goals. Management control at MNCs has been subject of numerous studies in the past 25 years, thus highlighting the relevance of the topic. To provide a comprehensive overview of the research field, a systematic ...

This paper argues for, and contributes to, a stronger integration of research on finance and international business/global strategy. We perform bibliometric analysis of journal publications between 2010 and 2016 and show that papers published in the two domains relate to very different underlying literatures which, so far, have had a limited ...

This paper investigates the impact of international collaboration and its characteristics on the quality of the innovation of multinational enterprises (MNEs) in emerging markets. ... on innovation quality in emerging economies is scarce. Third, the unique project-level dataset from the examined company allows us to minimize the identification ...

The impact of globalization on multinational enterprises was examined from the years 1980 to 2020. A scoping literature review was conducted for a total of 141 articles. Qualitative, quantitative, and mixed typologies were categorized and conclusions were drawn regarding the influence and performance (i.e., positive or negative effects) of globalization. Developed countries show more saturated ...

A growing body of economics literature shows that multinational corporations (MNCs) shift their profits to tax havens. We contribute to this evidence by comparing a range of available data sets focusing on US MNCs, including country-by-country reporting data, a full sample of which has been released in December 2019 for the first time. With each of the data sets, we analyse the effective tax ...

In the introductory article to a special issue on multinational corporations (MNCs) and employment practices, the authors highlight the key features of an international survey research project. Research teams carried out parallel surveys in four countries: Canada, Ireland, Spain, and the United Kingdom.

While there is a large body of academic debate surrounding human resource management issues in multinational corporations (MNCs), industrial relations (IR) issues often fail to receive the same degree of attention. This paper attempts to move the debate forward by critically reviewing some of the key debates surrounding IR in an international context. First, some key themes surrounding the ...

1 INTRODUCTION. A key challenge within the field of international human resource management (HRM) is the greater integration of multinational firms and how this gives rise to the globalisation of norms that affect work (Schotter et al., 2021).Work is becoming more globalised and increasingly governed by international structures.

I. Introduction. Over the past thirty years, the conceptualization of global strategies by Multinational Corporation has developed dramatically (Adler, 1997: Bartlett, & Ghoshal 1998), and the implication of these global strategic models for international human resource processes and practices has no less dramatic (Black et al., 1999).

This paper looks at the changing role of the EU-27-based multinational companies in the global economy as compared with the main regions of the world. It makes conclusions reflecting on the framework conditions of various global development scenarios defined in the framework an international research project of the Seventh Framework Programme of

The literature on the relationship between the degree of multinationality (M) and performance (P) in the context of multinational enterprises (MNEs) has attracted a large volume of research in the past 50 years. Yet, the theoretical foundations and the empirical conclusions concerning the nature of M-P relationship vary greatly, thus call for a critical review and assessment. We examine 135 ...

Local companies selling some kinds of portable electronics, groceries, and fifth generation (5G) infrastructure have gained 20 to 40 percentage points of market share over the past decade. The R&D spending of China's largest public companies grew three times as quickly as that of non-Chinese Fortune 500 companies between 2017 and 2021.

Increasingly, multinational companies, faced with cost issues and rising staff immobility, are substituting or complementing traditional expatriate assignments with other types of international assignments. These so-called non-standard international assignments include: short-term, commuter, rotational, contractual and virtual assignments.

Meanwhile, the theoretical blank of advertising research in this narrow research field is filled, and the approaches and methods to reduce the influence of cultural differences on cross-cultural advertising communication are proposed. Finally, we put forward advertising marketing suggestions on China's market for other multinational enterprises.

Maddie McGarvey for The New York Times. By 2025, Nestle promises not to use any plastic in its products that isn't recyclable. By that same year, L'Oreal says all of its packaging will be ...

Supported by the Swedish Research Council (grant numbers, 2015-00760 and 2021-02128), the Swedish Cancer Society (grant numbers, CAN 2015/437 and 22 2061 Pj), the Nordic Cancer Union (grant ...