Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

- Manufacturing & Wholesale

Renewable Energy Business Plan

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Renewable Energy Business Plan?

Writing a renewable energy business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Products and services:.

Highlight the renewable energy services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

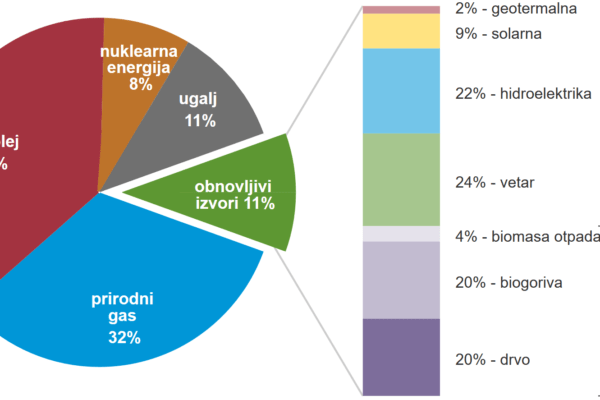

Describe what kind of renewable energy company you run and the name of it. You may specialize in one of the following renewable energy businesses:

- Solar energy business

- Wind energy business

- Biomass energy business

- Geothermal energy business

- Hydropower business

- Energy storage business

- Hydrogen fuel business

- Energy efficiency & consulting business

- Describe the legal structure of your renewable energy company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established renewable energy business, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your renewable energy business plan::

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your products & services:

Mention the renewable energy products & services your business will offer. This list may include:

- Solar panels

- Wind turbines

- Energy storage systems

- Monitoring systems

- Consultancy & feasibility studies

- System design & engineering

- Installation

- Project financing & funding

Quality measures:

This section should explain how you maintain quality standards and consistently provide the highest quality service.

Additional Services

In short, this section of your renewable energy plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your renewable energy business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your renewable energy business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & machinery:.

Include the list of equipment and machinery required for renewable energy, such as for solar energy; solar panels, inverters, racks or frames, solar tracking systems, solar charge controllers, etc are needed.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your renewable energy business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your renewable energy services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your renewable energy business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample renewable energy business plan will provide an idea for writing a successful renewable energy plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our renewable energy business plan pdf .

Related Posts

Recycling Business Plan

Solar Panel Business Plan

Write a Startup Business Plan

Free Sample Business Plans Example

Frequently asked questions, why do you need a renewable energy business plan.

A business plan is an essential tool for anyone looking to start or run a successful renewable energy business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your renewable energy company.

How to get funding for your renewable energy business?

There are several ways to get funding for your renewable energy business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your renewable energy business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your renewable energy business plan and outline your vision as you have in your mind.

What is the easiest way to write your renewable energy business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any renewable energy business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

How do I write a good market analysis in a renewable energy business plan?

Market analysis is one of the key components of your business plan that requires deep research and a thorough understanding of your industry. We can categorize the process of writing a good market analysis section into the following steps:

- Stating the objective of your market analysis—e.g., investor funding.

- Industry study—market size, growth potential, market trends, etc.

- Identifying target market—based on user behavior and demographics.

- Analyzing direct and indirect competitors.

- Calculating market share—understanding TAM, SAM, and SOM.

- Knowing regulations and restrictions

- Organizing data and writing the first draft.

Writing a marketing analysis section can be overwhelming, but using ChatGPT for market research can make things easier.

How detailed should the financial projections be in my renewable energy business plan?

The level of detail of the financial projections of your renewable energy business may vary considering various business aspects like direct and indirect competition, pricing, and operational efficiency. However, your financial projections must be comprehensive enough to demonstrate a complete view of your financial performance.

Generally, the statements included in a business plan offer financial projections for at least the first three or five years of business operations.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Search Search Please fill out this field.

- Career Advice

How to Become a Renewable Energy Entrepreneur

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

From photovoltaic solar panels to kinetic energy adapters that generate electricity from pedaling stationary bicycles, entrepreneurs are taking advantage of the green revolution by finding and marketing renewable energy solutions.

Since we use energy for almost everything, the recent trend towards greener, more sustainable technology is creating many opportunities for entrepreneurial-minded individuals.

But is this just a fad? Or are there viable business opportunities for the long term?

Key Takeaways

- Not every entrepreneur is an investor. Consider opportunities for green services.

- Focus on the industries you're most familiar with.

- Consider government financing sources.

Renewables Are Here to Stay

As the global population rises, the reality of finite resources is sinking in. Our energy requirements cannot depend on fossil fuels forever. Advances in technology have allowed us to tap into reserves that were inaccessible in the past, but that only delays the inevitable.

These concerns, along with the negative impacts of burning fossil fuels, have created an environmentally and socially conscious mindset among different sets of economic actors, including consumers, investors, corporations, and governments. Companies and investors looking for profits have taken advantage of consumer interest in cleaner energy alternatives and government-incentivized green business initiatives.

With all these factors driving the shift towards renewable energy, now is the time to start looking for opportunities to help solve the world’s energy problems and, perhaps, make money doing it.

Recognizing the Opportunity

There are innumerable opportunities for implementing an innovative renewable energy solution. However, the best place to start looking is in your own area of expertise. Think about the industries you’ve worked in and how renewable energy could benefit them.

Also, remember that becoming a renewable energy entrepreneur doesn’t mean you have to build your own wind farm or hydroelectric dam. Renewable energy is about more than just electricity generation. It is also about storage, conservation, and distribution.

Product or Service?

You also don’t need to invent a new product or technology. You can get involved in installation, repair and maintenance, or consulting.

Think broadly, and focus on your areas of expertise.

Finally, brainstorm with friends, family, and colleagues about things that people want or need.

Some people build a business around an idea and then try to sell that idea rather than building the business around something people already want to buy. Green consumers are no different.

Green Consumer Challenge

Despite all the hype about environmental sustainability, the evidence suggests that green consumers look for the same things most consumers want: individual benefit at a low cost.

Although the environmentally conscientious market, labeled LOHAS (Lifestyles of Health and Sustainability), is growing, the green market is still relatively niche. Marketing to everyone else means educating consumers on the advantages of renewable energy, including showing them how it can add value to their lives at a lower cost.

Beyond the LOHAS

Consumers are not the only group that one needs to consider when looking for the right opportunity. Think about how the product or service will affect or be affected by others, such as suppliers, the government, the competition, and financing organizations like banks.

All of these actors could have an impact on the success of your business, so it is helpful to think about the role they will play while you’re in the development stage .

Developing a Business Plan

In devising a business plan , it is helpful to determine if there are other businesses in other regions of the world that are already offering a similar product or service. Look at the fundamentals of those businesses and use them as models for developing your own plan.

The percentage of entrepreneurs who invest some personal savings in the early stages.

Regardless of how extensive you decide to make your business plan, you definitely need to do some initial market research and summarize a business concept. You will want to analyze costs, make revenue projections, and set out some key milestones for developing and launching your business.

Talk to Potential Customers

Remember to conduct interviews with potential customers in order to get a sense of the demand for your product or service and how best to introduce it to the market.

Also, contact suppliers to get price quotes on materials and services that you will need to manufacture your product or deliver your service.

Once you’ve completed your business plan, it is time to figure out how you are going to finance your business.

Financing Your Business

Every business succeeds or fails on the basis of its ability to sustain itself financially, but it could take some time before revenues are large enough to cover costs.

Although there are a number of financing options for new businesses and startups, the research shows that almost 90% of entrepreneurs invest some personal savings at the early stages of their business. And more than 74% said that personal savings were the primary source of initial financing. Using your own savings may also show other potential investors that you are serious about the future of your new venture.

The Options for Financing

Some entrepreneurs obtain financing from banks, venture capital , angel investors, or the government. The first two options may be harder to obtain in the early stages as they tend to demand to see an existing company with strong growth potential before forking over the money. Angel investors, those who offer new and fledgling businesses capital in exchange for equity, are also possible funding options, but tend to offer smaller amounts.

While it can take some time to receive approval and not all businesses are eligible, government funding could be a good way to go given the numerous incentives for cleaner, more sustainable technologies and services.

Visit the U.S. Department of Energy site for current energy efficiency and renewable energy funding opportunities and the National Renewable Energy Laboratory (NREL) site for renewable energy project financing information.

The Bottom Line

Once you’ve had an idea, made a plan, and figured out how to finance your business, you’re on your way to becoming a renewable energy entrepreneur.

But the work has just begun. Now you’re going to have to convince consumers to spend money on your product or service. This is not easy, but it can be rewarding, especially considering that you're sustaining not only your livelihood but that of people all over the world for generations to come. Renewable energy entrepreneurs may just save the planet yet.

RetailMeNot. " 4 in 5 Consumers Think Eco-Friendly Products Cost More 'Green .'"

Eric Koester. " Green Entrepreneur Handbook: The Guide to Building and Growing a Green Business ," Page 88. CRC Press, 2016.

:max_bytes(150000):strip_icc():format(webp)/119478243-5c2cdbbd46e0fb0001843ea9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Renewable Energy – Business Plan

Renewable energy. Preparing a Business Plan and a complete Project Proposal for your business idea is the most important step in starting your business. Our expert team of engineers and economists with their knowledge and experience will fully respond to your requests and ideas, in accordance with all the rules of project documentation, writing a business plan, macro and micro economic situation at the time of writing the project. This guarantees the ultimate outcome of your project application and business plan. We make all kinds of projects, business plans based on renewable energy sources (solar systems, wind generators, heat pumps, etc.) for the purpose of obtaining loans, subsidies and other investments. We optimize energy systems in accordance with your requirements, we make a “payback” (payback analysis) period for the designed system. We do SWOT and market analysis of your idea, product and system. We improve processes, increase energy efficiency in existing systems and production processes. We perform this according to the most famous models of excellence TQL, TQM, Kaizen, Sixsigma and their tools (SiPoc, Ishikawa, etc.).

Figure 2. Project proposal and Business Plan for all types of energy systems

The advantages of our business plans are in a modern, effective and chronological content, which consists of:

SUMMARY OF BUSINESS PLAN

- Business idea

- The potential of a business idea

- The key to success

- Necessary financial resources MISSION AND GOALS PRODUCTS AND SERVICES MARKET STRATEGY

- Market analysis

- Competition

- Market performance

- Marketing and sales OPERATION PLAN

- Location and office space

- Human Resources

- Legal aspects

- Credit policy MANAGEMENT

- Team management

- Organization FINANCE

- Financial indicators

Figure 3. Installed wind turbines in an urban settlement

In addition to business plans and projects, we also offer wind generators – turbines, solar panels that can be ordered from us with all the accompanying electrical and mechanical equipment such as: inverter – domestic and EU production, supporting and prefabricated structures, complete design documentation, installation of support systems construction, electrical installation and connection to the electricity grid.

Download the catalog of our wind turbines

Download the operating characteristics of our wind turbines

Tell us your needs and we will offer you the best solution.

Related Articles

Renewable energy

The Working principle

Profitability

How to succeed in the expanding global offshore wind market

Offshore wind —now widely recognized as a proven and reliable source of renewable energy—is likely to grow in the coming years. According to our research, global installed offshore wind capacity is expected to reach 630 gigawatts (GW) by 2050, up from 40 GW in 2020, and with upside potential of 1,000 GW in a 1.5° pathway scenario. 1 McKinsey Global Energy Perspectives proprietary model.

About the authors

Rapidly expanding government commitments and technological progress are contributing to the positive outlook in established markets and countries new to offshore wind. More companies are pursuing offshore wind projects, some of which may involve challenges and risks, including commercial requirements from authorities, difficult project economics, and the requirement to build or bolster capabilities.

This article describes the offshore wind opportunity, progress at the regional and country levels, and tailwinds that could support growth. It also discusses the challenges companies could face and how success in four areas can help them win auctions, execute projects, and support profitable growth.

Global support and technological progress fuel growth in offshore wind

All regions globally are expected to contribute to growth in offshore wind, which can help curb climate change (Exhibit 1). Europe is starting from the largest base (25 GW in 2020) and is expected to increase capacity by 7 percent annually to 190 GW in 2050 in the base case.

The Asia–Pacific region (APAC), which had 11 GW of installed offshore wind in 2020, is projected to strongly increase its capacity, surpassing Europe, the Middle East, and Africa (EMEA) by the mid-2030s and installing 410 GW by 2050 in the base case, including 240 GW in Mainland China. In Asia, Taiwan has positioned itself as the offshore wind pioneer, alongside Mainland China. Japan issued its third tender—the instrument most governments use to allocate offshore wind capacity—in December 2021. 2 Adnan Durakovic, “Japan launches third offshore wind auction,” OffshoreWIND.biz, December 10, 2021. Australia, South Korea, and Vietnam are also beginning to act on their ambitions.

Offshore wind in the Americas is still in its infancy, but the region is projected to build approximately 35 GW of capacity by 2050. 3 Global Energy Perspective 2021 , reference case, McKinsey, January 2021. In March 2021, US President Joe Biden issued an executive order calling for 30 GW of offshore wind capacity to be installed by 2030. Complementing the federal trend, states with access to marine areas suitable for offshore wind have set ambitious state-level targets. While much of this activity is taking place on the East Coast, areas in California, the Gulf of Mexico, Alaska, and Hawaii also are starting to recognize their offshore wind potential, including in floating technologies.

Meanwhile, many other countries are exploring offshore wind, including Azerbaijan, Brazil, Canada, Colombia, India, Oman, the Philippines, Sri Lanka, and Trinidad and Tobago. 4 “New program to accelerate expansion of offshore wind power in developing countries,” World Bank, March 6, 2019.

Technological progress is also boosting the outlook for offshore wind. Until recently, turbines have been installed onto bottom-fixed foundations that are grounded in waters with typical depths of up to 50 meters, requiring a relatively shallow continental shelf. Newer, floating foundations, however, can be installed irrespective of the terrain that lies below and may become viable for water depths of 1,000 meters and beyond 5 “Tetra offshore foundations for any water depth,” Stiesdal, accessed February 1, 2022. —an advancement that increases the viable sea area for offshore wind by a factor of five. 6 “Overview of floating offshore wind (text version),” National Renewable Energy Laboratory, Office of Energy Efficiency and Renewable Energy, US Department of Energy, February 26, 2020. France has already completed a tender for its first commercial floating project. Italy has identified more than 17 GW of offshore wind potential, 70 percent of which lies in deep waters requiring floating foundations. 7 Alessando Ferro, “L’ ‘impero’ dell’eolico off shore dell’Italia,” Il Giornale , January 2, 2022.

Additionally, excess offshore wind capacity can now serve as an alternative fuel source for hydrogen electrolysis, a versatile energy storage, transmission, and fuel technology that can be used to decarbonize many hard-to-abate industries and applications. Because electrolysis is so capital intensive to build, companies are eager to maximize utilization, an objective that offshore wind also supports due to its high capacity. In 2021, Denmark approved a project to construct an offshore hub with up to 10 GW of capacity in the form of an artificial island in the North Sea that, using on-site electrolyzers, can store electricity and produce green hydrogen. 8 “Denmark parliament approves giant artificial island off Copenhagen,” BBC News, June 4, 2021.

Finally, the power rating of wind turbines is growing significantly. Turbines with a capacity of more than 15 megawatts (MW) are expected to be available within five years. In comparison, the average turbine size installed in 2020 was around 8 MW. The leading three Western OEMs have announced that models in the range of 13–15 MW will be available for installation by 2024. 9 John Parnell, “Vestas launches world’s largest turbines as ‘big 3’ competition ramps up,” Greentech Media, February 12, 2021; “GE Renewable Energy’s Haliade-X prototype starts operating at 14 MW,” GE, October 5, 2021.

As a result of these advancements, the levelized cost of electricity (LCOE) for offshore wind is falling substantially, from around €150 per megawatt-hour (MWh) in 2015 to a projected less than €50 per MWh by around 2024. 10 Based on the auction price of the United Kingdom’s third contract-for-difference tender, which is expected to be commissioned around that time. In fact, 2021 has turned out to be a defining year for offshore wind. Established offshore wind veterans and oil majors, including BP, Equinor, Shell Energy, and TotalEnergies, have announced ambitious pipeline plans (Exhibit 2). This is advantageous because much of the capacity announced through 2030 had already been auctioned by the beginning of 2022.

Companies pursuing offshore wind can expect challenges

The industry’s growth prospects and the race to net-zero emissions are attracting more companies with adjacent capabilities. In addition to offshore wind veterans, utilities, oil majors, and other large capital project developers are entering the market.

Along with increasing competition, governments are strengthening commercial requirements that apply to companies bidding for offshore wind projects. Some governments use tenders to determine either the electricity price for a long-lasting offtake agreement 11 In project financing, an agreement to purchase all or a substantial part of the output or product produced by a project. or the seabed lease price. In some geographies, this has led to inflated seabed lease prices. Along the US Atlantic coast, for example, lease prices increased more than tenfold from 2017 to 2018. 12 $74 per acre at area North Carolina WEA OCS-A 0508 in 2017; $1,059 per acre at area Massachusetts WEA OCS-A 0521 in 2019. Companies are also trying to improve their competitive positions with low offtake pricing (Exhibit 3).

In several recent European tenders, zero-subsidy bids have won capacity. A recent tender in Denmark even required what could be interpreted as developers making payments to the government in the form of a bid that included full construction of both generation and transmission assets.

After being awarded capacity, some companies may face risks to their capital-project development costs. Offshore wind projects typically take several years to complete but are based on cost calculations made months in advance of the auction—and several years before the project is commissioned into service. In the meantime, raw-material prices fluctuate; for example, prices for steel, which makes up 70 to 80 percent of the total mass of each offshore wind turbine, were at all-time highs for most of 2021. 13 Grace Donnelly, “Record-high steel prices could hamper renewable rollout in near-term,” Emerging Tech Brew , March 28, 2022. Additionally, some construction equipment and wind turbine installation vessels (WTIVs) are scarce for the larger turbine sizes that are being deployed; globally, there are only about ten WTIVs that can accommodate ten-MW turbines.

Moreover, many offshore wind projects require extensive upgrades to port infrastructure and local supply chains, partly based on explicit government requirements that aim to create local jobs. In the face of this increasing variability and uncertainty, offshore wind participants need to build capabilities in several areas to effectively participate.

Strategies to support growth in offshore wind

Established producers and newcomers can overcome the challenges by committing to excellence along the offshore wind value chain by excelling in several foundational, high-value areas (Exhibit 4).

The goal of development is to open new markets, acquire strong sites, and succeed at auctions. Currently, local markets can be divided into two archetypes with respect to development. In some countries, such as the United States and the United Kingdom, sites are selected and leased by government entities, and then developed by companies to secure remuneration at official capacity tenders for those locations. In other countries, such as Denmark and the Netherlands, sites are centrally developed by government entities, and offshore wind bidders then compete in the tender process for one or several locations. In both archetypes, the starting point for success in offshore wind is a clear strategy. Excellence in development also demands bidding prowess and a smart approach to predevelopment, such as building connections with the local community.

Clear strategy: A clear offshore wind strategy starts with a company deciding which technologies to include in its portfolio. Solely focusing on offshore wind is a high-stakes, high-capital-expenditure undertaking that poses more clustered risk than a diversified portfolio that also includes, for example, solar photovoltaic (PV) and onshore wind.

Second, companies could consider which geographic markets to target for participation. Offshore wind markets vary widely, especially with respect to their regulatory and political environments and maturity. Viable target markets typically have regulatory environments supporting renewable energy and for offshore wind specifically. Most leaders of viable markets either have already established a market and regulatory framework or have made plans to do so. Notably, a broader portfolio comes with the upside of diversification but also with increased complexity.

Third, companies may want to understand their capabilities and limitations. For example, an experienced project developer such as an oil major may build on its extensive experience securing financing for and managing large-scale capital projects. A regulated utility may choose to build on its knowledge of local communities and institutions. Following a thorough capabilities assessment, participants can determine where and how to add capabilities (for example, develop them in-house, selectively hire, or partner with others).

Predevelopment including links to local communities: As offshore wind tender processes become more competitive, participants need to successfully manage a broad range of stakeholders. Some companies use innovative strategies to involve local communities in their offshore wind plans from the start. For example, the joint venture between Ørsted and Eversource solicited opinions from the local fishing community when scouting and monitoring sites off the coast of Rhode Island. The two companies also upgraded a fleet of local fishing boats to meet industry safety standards to minimize the risks of incidents at sea. 14 Adrijana Buljan, “Ørsted, Eversource team up with US fishermen,” Offshore WIND, May 20, 2021.

Additional complex decisions that need to be made before development may include whether and where to build a local manufacturing footprint for turbine assembly. This can be a critical differentiator for tender participants, given the economic impact on communities. Ultimately, organizations such as turbine OEMs and foundation manufacturers are responsible for building their respective manufacturing footprints, which means the offshore wind developer needs to work closely with these stakeholders and, often, to navigate and resolve competing interests.

Entering new offshore wind markets is challenging given the local knowledge required. Only a few experienced international players have managed to organically penetrate new markets around the world, although many partner with or acquire local utilities, companies, or projects to gain market entry (Exhibit 5). Notably, there could be large adjacent value pools forming for infrastructure players. For instance, in the United States, the Biden administration projects that multibillion-dollar investments in ports and vessels will be needed to meet the 2030 target. 15 “Fact sheet: Biden administration jumpstarts offshore wind energy projects to create jobs,” White House, March 29, 2021.

Implementing successful bidding: As new participants enter the market, companies could focus more time on planning and executing their bid process to improve their bid success. A thoughtful approach to auction excellence can help companies remain level-headed and focus on the critical elements of an auction.

First, participants need to establish a fact base about the auction. This involves scrutinizing the government’s core assessment criteria and auction rules. Collecting and analyzing previous auction results can provide meaningful insights into long-term price trends to inform bid development. Auction participants can also attempt to estimate ranges of bids from competitors for a given auction. Combining deep industry intelligence, competitive economics, and informed assumptions can help participants anticipate competitors’ likely auction behaviors. By using publicly available information, auction participants can approximate competitors’ walk-away prices, hurdle rates, and minimum required rate of return on a project.

As new participants enter the market, companies could focus more time on planning and executing their bid process to improve their bid success.

Second, after establishing a deep understanding of competitors, companies may want to determine their own valuation of the project, including a business case for capital expenditures, operating expenditures, and commercial risk. Best practices include defining the specific walk-away price for a given lease by solving backward from the expected offtake price and taking into account project risks along the value chain.

Multitechnology integration: As the offshore wind industry matures, governments and experienced companies are increasingly linking offshore wind projects to a specific use rather than simply feeding into the larger electricity grid. For example, integrating offshore wind with hydrogen electrolysis will become more commonplace; developers may benefit from investing in technology integration capabilities. Ørsted recently announced plans to connect one of the world’s largest electrolyzer projects to 2 GW of new offshore wind capacity in the North Sea. It plans to power the electrolysis process with electric power from offshore wind and thus enable the build-out of infrastructure required to sustainably produce steel, ammonia, ethylene, and other hydrogen-based chemicals and materials in Europe. 16 Stefan de Bruijn and Michael Korsgaard, “Ørsted to develop one of the world’s largest renewable hydrogen plants to be linked to industrial demand in the Netherlands and Belgium,” Ørsted, March 31, 2021.

Securing offshore wind capacity is the first step in a long journey. The next step is to effectively execute engineering, procurement, construction, and installation (EPCI) processes to achieve the cost targets that informed the successful auction strategy.

Fit-for-purpose operating model: Successful offshore wind projects require a well-structured organization and a detailed strategy for in-house versus outsourced activities. Key elements—including the organizational structure, staffing model, and governance—must be designed with the company’s core competencies and the specific opportunity in mind.

EPCI package structure: Participants can consider a number of offshore packaging archetypes. For example, in a full EPCI model, the developer contracts both supply and installation for each group of components (most importantly, turbine, wind-turbine-generator foundation, array cables, export cables, and offshore substations). In multicontracting, in contrast, the developer contracts out supply and installation separately for all components.

In mature markets, offshore wind veterans can often achieve cost advantages by using a multicontracting approach—procuring key components or packages directly from suppliers and handling installation separately (Exhibit 6). A multicontracting strategy, however, requires a complete understanding of the offshore wind value chain, good availability of supply and installation resources, and deep in-house project execution capabilities—which is why it is typically only available to experienced participants. Furthermore, not all local markets offer the supplier landscape required to contract out in packages using this strategy.

Procurement excellence: Material costs have been rising, mostly driven by an unprecedented surge in steel prices, making procurement excellence an essential skill for offshore wind developers. Overall, material cost fluctuations create uncertainty that can pose a significant risk to projects. To decrease fluctuations and lower EPCI costs overall, offshore wind developers can employ advanced procurement tools and strategies to ensure low cost and early technology access. These include rigorous spend analysis, clean sheeting—analyzing a product’s cost structure from top to bottom to optimize design and capture savings—and excellence in supplier negotiations.

Claims management excellence in construction: Excellence in construction in a number of key areas, including claims management, is crucial. Claims can amount to 10 to 20 percent of total contract cost. Best-in-class claims management can decrease penalties and build thriving, collaborative relationships with contractors. This includes having the right organizational structure and standardized processes in place for recording and processing claims; creating transparency to identify, analyze, and counteract the most common, high-value causes of claims; and changing the culture to anticipate and prevent claims—rather than simply respond to them—by collecting evidence on contractor behavior and carefully reviewing contract terms to eliminate clauses that previously led to claims. These practices can help limit the overall number of claims.

Operations and maintenance (O&M) excellence can be a major source of competitive advantage. Based on today’s installed capacity in Europe, our research suggests there would be a savings opportunity of more than €600 million per year if all participants adopted best-in-class O&M practices. Turbines to be installed in the future will have significantly more mature technology but also more complexity resulting from significantly larger blades, gearboxes, and generators, for example.

O&M costs are hard to predict and heavily based on assumptions such as the number of major component failures expected over a 20- to 30-year asset lifetime. Given the significant reduction in offshore wind capital expenditure over time and the longer lifetime of assets, achieving low O&M cost and reliable performance is crucial. As a starting point, companies may want to decide whether to have third parties (for example, OEMs or other O&M service providers) perform maintenance services or to perform O&M in-house.

In the case of third parties providing O&M services, rigorous performance measurement and consequence management in case of deviations from contractual obligations are key to ensure that risk and cost are adequately passed on to the service provider. If O&M is performed in-house, excellent execution based on lean principles and the use of digital technologies—for example, to enable predictive maintenance—can help bolster effectiveness.

While cost fluctuations are the norm in large offshore wind projects, government pricing mechanisms and long-term offtake agreements have historically ensured relatively stable revenues. However, going forward, the exposure of the industry to market prices (so-called merchant risk) and thus to revenue fluctuation is likely to increase significantly. More and more existing assets are leaving the subsidy phase, and new assets that are selling electricity at current wholesale prices are coming online “subsidy free.” At the same time, any additional volatility on the revenue side comes with a potentially significant impact on financing terms.

Managing merchant risk starts with defining a clear strategy: How much merchant exposure is a company comfortable with, and what share of revenues should be locked in? The question becomes even more challenging with power prices skyrocketing in some regions of the world and demand for green electricity likely continuing to surge.

For the portion of revenues that are locked in, companies may want to develop the right approach to identify and secure offtake. Options for corporate offtakers range from investing outright in a project to striking deals with a limited number of large offtakers to having a broader portfolio of offtakers. For production, the company will need to decide how much to hedge and over what period of time.

Ultimately, participants could consider developing the right operating model across the front-, middle-, and back-office systems underpinning their strategy. Options include maintaining full trading and structuring capabilities in-house and outsourcing most activity while retaining a small but highly capable team in-house to avoid excessive value leakage.

Looking ahead

By the end of this decade, thousands of turbines will likely be turning along the coasts of Asia, Europe, North America, and other regions. The offshore wind industry has the potential to create significant value for companies, communities, regions, and countries while making a major contribution to reliable, low-cost, and clean electricity. Companies that intend to capture their share of this value pool have considerable work to do to build excellence along the value chain. Sizable investments—in organizations, processes, technology, and people—will be required to master the challenges ahead and to effectively compete with other players.

Florian Kühn is a partner in McKinsey’s Oslo office, Friederike Liebach is a consultant in the Frankfurt office, Tim Matthey is a consultant in the Boston office, Andreas Schlosser is a partner in the Munich office, and Jakub Zivansky is an associate partner in the Prague office.

The authors wish to thank Peter Claus, Emil Hosius, Nadine Janecke, Boris Naar, Fridolin Pflugmann, Bogdan Rozhkov, Joscha Schabram, Thomas Schrade, Christian Staudt, Humayun Tai, Alexander Weiss, and Raffael Winter for their contributions to this article.

Explore a career with us

Related articles.

Net-zero power: Long-duration energy storage for a renewable grid

Japan offshore wind: The ideal moment to build a vibrant industry

Capturing the wind: Renewable-energy opportunities in Vietnam

Mobile Menu Overlay

The White House 1600 Pennsylvania Ave NW Washington, DC 20500

FACT SHEET: Biden Administration Jumpstarts Offshore Wind Energy Projects to Create Jobs

Interior, Energy, Commerce, and Transportation Departments Announce New Leasing, Funding, and Development Goals to Accelerate and Deploy Offshore Wind Energy and Jobs

Today, the White House convened leaders from across the Administration to announce a set of bold actions that will catalyze offshore wind energy, strengthen the domestic supply chain, and create good-paying, union jobs.

National Climate Advisor Gina McCarthy, Interior Secretary Deb Haaland, Energy Secretary Jennifer Granholm, Commerce Secretary Gina Raimondo, and Transportation Secretary Pete Buttigieg met today with state officials, industry executives, and labor leaders to announce new leasing, funding, and goals that employ President Biden’s whole-of-government approach, position America to lead a clean energy revolution, and create thousands of jobs across the country with the choice to join a union.

In his first week in office, President Biden issued an Executive Order that calls on our nation to build a new American infrastructure and clean energy economy that will create millions of new jobs. In particular, the President’s Order committed to expand opportunities for the offshore wind industry. The President recognizes that a thriving offshore wind industry will drive new jobs and economic opportunity up and down the Atlantic Coast, in the Gulf of Mexico, and in Pacific waters. The industry will also spawn new supply chains that stretch into America’s heartland, as illustrated by the 10,000 tons of domestic steel that workers in Alabama and West Virginia are supplying to a Texas shipyard where Dominion Energy is building the Nation’s first Jones Act compliant wind turbine installation vessel.

Federal leadership, in close coordination with states and in partnership with the private sector, unions and other key stakeholders, is needed to catalyze the deployment of offshore wind at scale.

Today, the Administration is taking coordinated steps to support rapid offshore wind deployment and job creation:

- Advance ambitious wind energy projects to create good-paying, union jobs

- Investing in American infrastructure to strengthen the domestic supply chain and deploy offshore wind energy

- Supporting critical research and development and data-sharing.

Advance Ambitious Wind Energy Projects to Create Good-Paying, Union Jobs

- Announcing a New Wind Energy Area. The Interior Department’s Bureau of Ocean Energy Management (BOEM) is announcing a new priority Wind Energy Area in the New York Bight—an area of shallow waters between Long Island and the New Jersey coast—which a recent study from Wood Mackenzie shows can support up to 25,000 development and construction jobs from 2022 to 2030, as well as an additional 7,000 jobs in communities supported by this development. The study indicates the New York Bight lease area also has the potential to support up to 4,000 operations and maintenance jobs annually, and approximately 2,000 community jobs, in the years following. This new Wind Energy Area is adjacent to the greater metropolitan Tri-State area— the largest metropolitan population center in the United States that is home to more than 20 million people and their energy needs. The next step is for BOEM to publish a Proposed Sale Notice, followed by a formal public comment period and a lease sale in late 2021 or early 2022.

- DOI action to unlock deployment potential: To position the domestic offshore wind industry to meet the 2030 target, DOI’s Bureau of Ocean Energy Management (BOEM) plans to advance new lease sales and complete review of at least 16 Construction and Operations Plans (COPs) by 2025, representing more than 19 GW of new clean energy for our nation.

- Massive supply chain benefits of deploying offshore wind energy at scale: Meeting the 2030 target will catalyze significant supply chain benefits, including new port upgrade investments totaling more than $500 million; one to two new U.S. factories for each major windfarm component including wind turbine nacelles, blades, towers, foundations, and subsea cables; additional cumulative demand of more than 7 million tons of steel—equivalent to 4 years of output for a typical U.S. steel mill; and the construction of 4 to 6 specialized turbine installation vessels in U.S. shipyards, each representing an investment between $250 and $500 million.

- 2050 implications of meeting the 2030 goal: Achieving this target also will unlock a pathway to 110 GW by 2050, generating 77,000 offshore wind jobs and more than 57,000 additional jobs in communities supported by offshore wind activity – all while creating further economic opportunity and ensuring future generations have access to clean air and abundant renewable power.

- Advancing critical permitting milestones for the Ocean Wind Offshore Wind Project. BOEM is announcing a Notice of Intent (NOI) to prepare an Environmental Impact Statement (EIS) for Ocean Wind, putting it in line to become America’s third commercial scale offshore wind project. Ocean Wind has proposed an offshore wind project with a total capacity of 1,100 megawatts (MW) — enough to power 500,000 homes across New Jersey. BOEM previously announced environmental reviews for Vineyard Wind (MA) and South Fork (RI), and anticipates initiating the environmental reviews for up to ten additional projects later this year.

Investing in American Infrastructure to Strengthen the Domestic Supply Chain and Deploy Offshore Wind Energy

- Investing in Port Infrastructure to Support Offshore Wind. The U.S. Department of Transportation’s (DOT) Maritime Administration today is announcing a Notice of Funding Opportunity for port authorities and other applicants to apply for $230 million for port and intermodal infrastructure-related projects through the Port Infrastructure Development Program. Port Infrastructure Development Grants support projects that strengthen and modernize port infrastructure, and can support shore-side wind energy projects, such as storage areas, laydown areas, and docking of wind energy vessels to load and move items to offshore wind farms. In addition to supporting our nation’s long-term economic vitality, DOT’s review process will consider how proposed projects can most effectively address climate change and environmental justice imperatives.

- Access to $3 billion in Debt Capital to Support Offshore Wind Industry through DOE Loan Programs Office. DOE’s Loan Programs Office (LPO) released a fact sheet to facilitate access for the offshore wind industry for $3 billion in funding through LPO’s Title XVII Innovative Energy Loan Guarantee Program. The fact sheet signals that LPO is open for business and ready to partner with offshore wind and offshore transmission developers, suppliers, and other financing partners to scale the U.S. offshore industry and support well-paying jobs. To date, LPO has provided $1.6 billion in support of projects totaling about 1,000 MW of onshore wind.

Supporting Critical Research and Development and Data-Sharing

- Announcing offshore wind R&D funding through the National Offshore Wind R&D Consortium. The National Offshore Wind Research and Development Consortium (NOWRDC), created by the DOE and the New York State Energy Research and Development Authority (NYSERDA), is announcing the award of $8 million to 15 offshore wind research and development projects that were selected through a competitive process. The new projects will focus on offshore support structure innovation, supply chain development, electrical systems innovation, and mitigation of use conflicts that will help reduce barriers and costs for offshore wind deployment. The NOWRDC was established in 2018 with a $20.5 million DOE investment, matching funds from NYSERDA, and with follow-on contributions from state agencies in Maryland, Virginia, Massachusetts, and Maine—all resulting in a total investment of around $47 million.

- Partnering with Industry on Data-Sharing. The Department of Commerce’s National Oceanic and Atmospheric Administration (NOAA) is signing a Memorandum of Agreement with Ørsted, an offshore wind development company, to share physical and biological data in Ørsted-leased waters subject to U.S. jurisdiction. This agreement is the first of its kind between an offshore wind developer and NOAA, and paves the way for future data-sharing agreements that NOAA expects to enter into with other developers. NOAA anticipates that Ørsted’s and other companies’ data will fill gaps in ocean science areas—particularly in ocean mapping and observing—in service of NOAA’s mission to advance climate adaptation and mitigation, weather-readiness, healthy oceans, and resilient coastal communities and economies.

- Studying Offshore Wind Impacts. NOAA’s Northeast Sea Grant programs, in partnership with DOE, DOC, and NOAA’s Northeast Fisheries Science Center, is releasing a request for research proposals to support more than $1 million in grant funding to improve understanding of offshore renewable energy for the benefit of a diversity of stakeholders, including fishing and coastal communities. Grant funding will support objective community-based research in the Northeast to further understanding of the effects of offshore renewable energy on the ocean and local communities and economies as well as opportunities to optimize ocean co-use.

At today’s convening, leaders from across the Administration shared their commitment to work closely with one another and with key stakeholders to deliver the economic potential presented by offshore wind energy resources.

- National Climate Advisor Gina McCarthy: “President Biden has declared very clearly that when he thinks of climate, he thinks of people and jobs—good-paying, union jobs. That’s because President Biden believes we have an enormous opportunity in front of us to not only address the threats of climate change, but use it as a chance to create millions of good-paying, union jobs that will fuel America’s economic recovery, rebuild the middle class, and make sure we bounce back from the crises we face. Nowhere is the scale of that opportunity clearer than for offshore wind. This commitment to a new, untapped industry will create pathways to the middle class for people from all backgrounds and communities.”

- Secretary of Interior Deb Haaland: “For generations, we’ve put off the transition to clean energy and now we’re facing a climate crisis. It’s a crisis that doesn’t discriminate – every community is facing more extreme weather and the costs associated with that. But not every community has the resources to rebuild, or even get up and relocate when a climate event happens in their backyards. The climate crisis disproportionately impacts communities of color and low-income families. As our country faces the interlocking challenges of a global pandemic, economic downturn, racial injustice, and the climate crisis – we have to transition to a brighter future for everyone.”

- Secretary of Energy Jennifer Granholm: “This offshore wind goal is proof of our commitment to using American ingenuity and might to invest in our nation, advance our own energy security, and combat the climate crisis,” said Secretary of Energy Jennifer M. Granholm. “DOE is going to marshal every resource we have to get as many American companies, using as many sheets of American steel, employing as many American workers as possible in offshore wind energy—driving economic growth from coast to coast.”

- Secretary of Commerce Gina Raimondo: “The Commerce Department is committed to innovative partnerships that advance the best science and data to ensure the development of offshore wind is transparent and inclusive of all stakeholders,” said Secretary Raimondo. “We look forward to engaging the public and private sectors to invest in clean energy solutions, like offshore wind, that will contribute to our whole-of-government approach to combat the climate crisis and create high-paying, high-skilled American jobs.”

- Secretary of Transportation Pete Buttigieg: “Tackling the climate crisis is vital to our nation’s future,” said U.S. Secretary of Transportation Pete Buttigieg. “The Biden-Harris Administration is taking actions that show how creating jobs and addressing climate change can and must go hand in hand. Today’s announcement makes a critical investment in our nation’s ports, which in turn builds up the resilience and sustainability of America’s economy.”

Stay Connected

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden.

It should be noted that there is no special software required to use these templates. All business plans come in Microsoft Word and Microsoft Excel format. Each business plan features:

- Excecutive Summary

- Company and Financing Summary

- Products and Services Overview

- Strategic Analysis with current research!

- Marketing Plan

- Personnel Plan

- 3 Year Advanced Financial Plan

- Expanded Financial Plan with Monthly Financials

- Loan Amortization and ROI Tools

- FREE PowerPoint Presentation for Banks, Investors, or Grant Companies!

1.0 Executive Summary

The purpose of this business plan is to raise $5,000,000 for the development of an alternative energy business that produces electricity from wind turbines while showcasing the expected financials and operations over the next three years. The Wind Farm, Inc. (“the Company”) is a New York based corporation that will sell electricity into the power grid from the power produced from its wind turbines. The Company was founded by John Doe.

1.1 Products and Services

As the prices of traditional fuels has skyrocketed (oil, natural gas, and coal), the demand among consumers for ecologically friendly and economically viable alternatives has increased. As of mid 2008, the prices of crude oil and its related energy products has almost doubled. As such, companies like Wind Farm, Inc. have recognized a tremendous opportunity to develop facilities that produce electricity from renewable and infinite sources of energy like wind. The Company intends to operate 4 turbines from its one acre land area that will produce approximately 1MW of electricity. This electricity will be then resold into the power grid. The third section of the business plan will further describe the services offered by the Wind Farm.

1.2 The Financing

Mr. Doe is seeking to raise $5,000,000 from an investor. The preliminary terms of this agreement call for an investor to receive a 45% ownership interest in the business coupled with a recurring stream of dividends starting in the first year of operations. The investor will also receive a seat on the board of directors.

1.3 Mission Statement

Management’s mission is to develop the Wind Farm into a profitable and ecologically friendly venture that will provide the Company and its owners with a steady stream of income from the sale of environmentally friendly energy productions services.

1.4 Mangement Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the alternative energy industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to aggressively solicit additional rounds of capital will concurrently reinvesting a significant portion of the Company’s after tax income into the acquisition of new wind powered turbines.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Wind Farm, Inc. The Company is registered as a corporation in the State of New York.

2.2 Required Funds

At this time, the Wind Farm requires $5,000,000 of investor funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

At this time, Mr. Doe is seeking to sell a 45% interest in the business in exchange for the capital sought in this business plan. The investor will also receive a seat on the board of directors as well as a recurring stream of dividends starting in the first year of operations.

2.4 Management Equity

John Doe owns 100% of the Wind Farm, Inc. Once the requisite capital is raised, he will retain a 55% ownership interest in the business.

2.5 Exit Strategy

If the business is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. Most likely, the Company will hire a qualified business broker to sell the business on behalf of the Wind Farm. Based on historical numbers, the business could fetch a sales premium of up to 4 to 6 times the previous year’s net earnings.

3.0 Products and Services

As mentioned in the executive summary, the Company is seeking to develop a 4 to 5 turbine wind power production facility that will produce 1 to 1.5 megawatts of zero emission electricity. The retail energy price of electricity is $.09-14 KWh, which is what residential customers pay on average within the United States. Wholesale pricing is lower than that based on the utilities expenses and profits. Management believes $.045 - $.06 per KWh is possible price that the Company can sell its energy to the local utilities and municipalities The expected cost of each turbine is $1,000,000. Despite this high cost, the Company will recognize tremendous revenues from the continued operation of these turbines on a 24 hour basis. Additionally, despite maintenance required on these turbines is minimal. Management will have a team of 8 to 12 employees that continually oversee the ongoing operation of the turbines on a daily basis. In the future, Management intends to expand its facility to accommodate up to 10 wind power producing turbines. The business may solicit additional rounds of capital or it may lease the turbines to generate a higher return on investment.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the alternative energy industry, the customer profile, and the competition that the business will face as it progresses through its business operations. The current geopolitical environment has led Management to believe that energy prices will continue to increase in the near future. The war in Iraq, faltering nuclear production talks with Iran, and general Middle Eastern instability has led many economists to believe that there is a fifteen to twenty percent risk premium now associated with the price of crude oil and related energy products. While these issues bring worry to the general economy, Management sees a significant opportunity to enter the market with a source of alternative energy. Many politicians and special interest groups have promoted the development of alterative energy solutions to combat the continually increasing energy prices in the United States. Additionally, the fast growth of Asian nations (namely India and China) has prompted further increases in the global demand for energy. This trend is expected to continue in perpetuity. Inflation is also concern for the Company. As the inflation rate decreases, the purchasing power parity of the American dollar decreases in relation to other currencies. This may pose a significant risk to the Company should rampant inflation, much like the inflation experienced in the late 1970s, occur again. In this event, the Company will enlist the services of a qualified derivatives focused investment bank to manage large scale currency transactions that would offset the risks normally associated with the distribution of energy products to foreign buyers. The primary risk of rapid inflation in the economy would contribute to a slow down in spending among consumers, but it would also effect the Company’s ability to borrow funds for the expansion of the number of wind turbines operated by the business.

4.2 Industry Analysis

There are approximately 316 companies that provide non-nuclear and non-fossil fuel power generation to the general public. Each year, these businesses aggregately provide more than $18 billion dollars of energy to the open market. The trend among these alternative energy sources is expected to grow significantly as the need for alternative fuels and power grows. Currently, the price of oil and other fossil fuels has skyrocketed to the point where many consumers are looking for alternative methods of power. Collectively, the industry employs more than 18,000 people. Aggregate payrolls exceed $4 billion dollars per year.

4.3 Customer Profile

For the Company’s wind electricity production capabilities, Management expects two core groups of purchasers: government agencies and electricity wholesalers. Among the first group, Management expects that agencies such as counties, state governments, and the US federal government will acquire large scale electricity delivery contracts from the Company with the intent to use the energy within their large scale applications. At the onset of operations, the Company will immediately begin developing relationships with local county governments as well as the state government for ongoing divestiture and purchase agreements. In this section of the analysis, you should describe the type of customer you are seeking to acquire. These traits include income size, type of business/occupation; how far away from your business is to your customer, and what the customer is looking for. In this section, you can also put demographic information about your target market including population size, income demographics, level of education, etc.

4.4 Competitive Analysis

Energy production is one of the most free markets in the economy. These markets operate on a global scale, and as such, it is difficult to determine the exact competitors that the Company will face as it progresses through its business operations. Any business that produces electricity is a potential competitor for the business. However, wind energy is becoming an increasingly popular method of producing electricity, and the Company’s primary competitive advantage will be its low cost operating infrastructure, its completely renewable input (wind), and the demand among consumers for cleaner alternatives to traditional oil, natural gas, coal, and nuclear energy power plants.

5.0 Marketing Plan

As the Wind Farm intends to sell its produced energy directly into the electrical grid, the marketing required by the business will be minimal. However, Management is committed to increasing the awareness of wind energy usage. Below is a brief overview of the ways that the Wind Farm will market its operations and alternative energy production.

5.1 Marketing Objectives

• Establish relationships with energy wholesalers and government agencies within the Company’s targeted market.

• Develop an online presence by developing a website and placing the Company’s name and contact information with online directories to further increase awareness of wind energy.

5.2 Marketing Strategies

Currently, there are a number of organizations, including the American Wind Association that are pushing initiatives, lobbying legislatures, and informing the general public about the benefits about alternative energy products. Management feels that it is important to invest in these public relations campaigns (even though they will not effect direct sales). Additionally, the increased awareness of wind electricity, its zero emissions, and ability to wean the United States off of foreign energy sources may prompt consumers and lawmakers to further expand the rebates, tax credits, and other incentive programs available for making wind produced electricity an economy viable energy product now and in the future. Approximately $10,000 to $20,000 per year will be spent to support these causes. Additionally, industry conventions, energy product trade shows, and other public relations campaigns will be enacted in order to promote the understanding of wind electricity to the general and business public.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page

6.0 Organizational Plan and Personnel Summary

6.1 Corporate Organization

6.2 Organizational Budget

6.3 Management Biographies

In this section of the business plan, you should write a two to four paragraph biography about your work experience, your education, and your skill set. For each owner or key employee, you should provide a brief biography in this section.

7.0 Financial Plan

7.1 Underlying Assumptions

• The Wind Farm will have an annual revenue growth rate of 5% per year.

• The Owner will solicit $5,000,000 of equity funds to develop the business.

• The Company will invest 25% of its after-tax profits back into the Company’s operating infrastructure.

7.2 Sensitivity Analysis

The Company’s revenues are moderately sensitive to changes in the general economy. Wind product electricity is comparatively priced with their petroleum/coal based counterparts, and in the event that prices decline, the Company may see a reduction in its revenues. However, the price of oil/coal is expected to continue to climb as reserves are limited and the price of oil has increased significantly over the last two years. Only in the event of a steep drop in the price of petrol based energy products does Management anticipate that the Company will have issues regarding top line income

7.3 Source of Funds

7.4 General Assumptions

7.5 Profit and Loss Statements

7.6 Cash Flow Analysis

7.7 Balance Sheet

7.8 General Assumptions

7.9 Business Ratios

Expanded Profit and Loss Statements

Expanded Cash Flow Analysis

U.S. identifies areas for offshore wind energy projects near California

The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here.

Reporting by Valerie Volcovici

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

Valerie Volcovici covers U.S. climate and energy policy from Washington, DC. She is focused on climate and environmental regulations at federal agencies and in Congress and how the energy transition is transforming the United States. Other areas of coverage include her award-winning reporting plastic pollution and the ins and outs of global climate diplomacy and United Nations climate negotiations.

Kobayashi factory searched over deaths possibly linked to supplements

Japanese health officials searched a Kobayashi Pharmaceutical factory on Saturday after the drugmaker reported five deaths possibly linked to dietary supplements using red yeast rice, an official said.

How To Create a Solar-Wind Energy Business Plan: Checklist

By henry sheykin, resources on hybrid solar-wind energy systems.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

Are you passionate about renewable energy and want to start your own business in the booming industry? Look no further than hybrid solar-wind energy systems! As the world increasingly focuses on sustainability and reducing carbon emissions, the demand for clean energy solutions is skyrocketing. In fact, according to the latest statistics, the global hybrid solar-wind energy market is projected to grow at a CAGR of 8.4% between 2021 and 2026. This presents an incredible opportunity for aspiring entrepreneurs to enter the market and make a positive impact on the planet while also generating profits.

In this blog post, we will provide you with a comprehensive nine-step checklist on how to write a business plan for hybrid solar-wind energy systems. By following these steps, you can ensure that your business is well-prepared and positioned for success in this rapidly growing industry.

So, let's dive right in! The first step is to identify market demand and potential customers. Understanding who your target audience is and the specific needs they have will help you tailor your services and marketing efforts. Researching and evaluating your competitors is also crucial in order to identify gaps in the market and differentiate your business.

Next, determining the funding required and exploring available financing options is essential. Developing a detailed financial plan will enable you to map out your start-up and ongoing costs, as well as project your revenue streams.

Conducting a feasibility analysis of the project will help you assess the viability and profitability of your business idea. This step involves evaluating factors such as the resource availability, technology requirements, and potential returns on investment.