- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Pagibig Financing

Pag-IBIG Fund, Housing Loans, Mortgage, Membership, Foreclosures, etc

How To Assume A Loan

by Pag-IBIG Financing Admin

Loan Assumption is one of the misunderstood concepts in real estate even among professionals like brokers and agents. A lot of them just don’t know how to go about it or can’t simply do it right.

While it’s true that a Pag-IBIG Housing Loan is assumable, it should be approached very carefully and with the help of a competent lawyer. Once you do it wrong, it could lead to a lot of problems, stressful situations and possibly loss of money.

If you are the one assuming the loan, for instance, one of the worst things that could happen is this: You religious pay the monthly obligation to the loan until such time that it is already fully paid. Suddenly you realize that Pag-IBIG doesn’t recognize you as the buyer and won’t transfer the title in your name. It’s like the original buyer is using “your money” to pay for his loan. How would you react if you are in this situation? Naturally, you would feel deceived. Sadly, a lot of people have been into this situation. And if you know someone who is into this, please do them a favour by sharing this article.

Here, we’ll show you two documents that you can use when assuming a loan and we also provide an sample of each.

The Assignment of Contract

This form is essentially used when one party (the original buyer) to a contract wants to assign his full interest in the contract to another party (the new buyer). In other words, nothing is changed in the contract except the fact that one party is being substituted by another.

When crafting this contract, it is important for the assignor (the party assigning the contract to another) and the assignee (the other party to whom the contract is being assigned) to agree and include an “indemnify and hold harmless” clause. Essentially, this means that the assignor releases full responsibility of the contract to the assignee.

Note: A copy of the original contract should be attached to this form and both parties (and their lawyers) should keep copies of this document.

Sample Form: Assignment of Contract

This assignment of contract is made on (date here) between (assignor name and address) and (assignee name and address).

For valuable consideration, the parties agree to the following terms and conditions:

(list your terms here)

Both parties have signed this assignment on the date specified at the beginning of the document.

(Assignor Name and Signature)

(Assignee Name and Signature)

Notice of Assignment of Contract

Sometimes a third party is involved and needs to be notified in writing when an agreement such as the one above is made. This should be the case when you assume a Pag-IBIG Housing Loan from someone else. The Notice of Assignment of Contract is a document meant for this purpose. On the part of the third party, they are now aware of the fact that a new party takes over the contract and should be the one responsible for all its benefits and obligations.

Sample Form: Notice of Assignment of Contract

Date : _____

To: (Home Development Mutual Fund)

RE : Assignment of Contact

Dear _________________:

This notice is in reference to the contract described in the attached document. (Please see the attachment.)

Please be advised that as of (date of assignment), all interest and rights under this contract which were formerly owned by (name and address of assignor) have been permanently assigned to (name and address of assignee).

Please be advised that all of the obligations and rights of the former party, the assignor, to this contact are now the responsibility of the new party to this contract.

(Name and signature of the Assignor)

Further Notes:

Always consult a competent lawyer when drafting documents of this kind. Don’t make the mistake of just relying on your broker to go about this. I’ve heard lots of stories and complaints from people who did this kind of transaction only to wind up with problems later on. Don’t be one of them.

Reader Interactions

July 1, 2012 at 2:52 pm

Hi, I would like to ask, is Contract of Assignment the same as Deed of Assignment and Transfer of Rights? Thanks and God Bless.

July 2, 2012 at 6:05 am

Yes, they are basically the same. That’s the way to do it.

July 18, 2012 at 3:14 am

I am planning to pay my housing loan in full . Where can I get its latest billing ?

July 22, 2012 at 1:39 am

Please request it from the branch where you got the loan.

July 19, 2012 at 9:15 am

Hello. Just wanna ask assuming that I as the assignor succesfully transferred the rights to the assignee, can I still avail of another housing loan from Pagibig?

September 26, 2012 at 6:31 am

Pag-IBIG only allows you to loan up to two times provided the first loan is fully paid. Please refer to this article:

https://www.pagibigfinancing.com/articles/2011/how-to-check-if-you-are-qualified-for-a-pag-ibig-housing-loan/

August 17, 2012 at 7:23 pm

is there a chance that a non-pag ibig member assume a loan?

September 26, 2012 at 6:28 am

This is only available to Pag-IBIG Members.

September 25, 2012 at 5:05 am

how do we know if i am the only interested party engaged in the said contract? Is Pag-ibig notified with the transaction??

September 26, 2012 at 6:30 am

It’s the signatories who are the parties interested with the transaction. If the other guy is not interested, he should not sign.

October 12, 2012 at 5:36 am

My parents is selling 1000 sq.m of the 4,000 sq.m lot which is currently mortgaged at the bank. pwede ko ba ito bilhin thru pag-ibig loan lot acquisition kahit partial lang? will the proceeds be used to pay off first to the bank and the excess be given to my parents? ano po bang maging collateral ng loan, ang 1K or ang whole 4K lot, or kelangan talagang ipasubdivide para ma separate ang 1K? Thanks.

December 13, 2012 at 3:27 am

Ask klang ho, ofw ho ako naisangla kasi yung house and lot nmin sa tao, pwide kbang gamitin ang pagibig ko n mbawi ang tittle nito,wla ho kasi akng ibng alam n pwidi eh.

October 24, 2012 at 7:51 am

I am selling my house that I have loaned through Pagibig. I have been paying the monthly due for more than 4 years now. A friend of mine wants to buy the house, where they will pay the amount that I already paid for the past 4 years. However, the would like to continue paying for the house via bank loan. Is it possible that the buyer can assume paying for the house via bank financing or they would need to continue paying for the pagibig loan. The reason why they want to pay for it via bank financing because the interest rates are lower, and the payment terms are shorter.

November 5, 2012 at 3:22 am

Yes, that’s possible. But it would be simpler and still cheaper if they use Pag-IBIG.

November 9, 2012 at 8:22 am

Thank you for the response.. In relation to my first question, let say I was able to transfer my Pag-Ibig housing loan to a certain bank.. Is it possible to have another person assume the bank loan? If it is possible, do you happen to know the procedure how to transfer it? Thanks..

November 2, 2012 at 12:12 pm

hello po! hingi po ako sana ng assistance s lupa n nkuha ko dito s antique, a portion of my land which was loan thru housing loan was intentionally/unintentionally occupied ng katabi kung lote almost 15 sqm mtrs po, naghintay po ako almost 5 months for them to vacate the area but they refused to do it, nagkasagutan n kmi ng tumitira s nasabing bahay, and they attempted me that if ever they loss tder temper something would happen to me…

November 5, 2012 at 3:20 am

Please ask the help of your Barangay Officials or the Police in your area.

November 3, 2012 at 5:22 pm

Hi po! I have a problem po. Kasi I bought the unit from a middleman. Nung nipakita ko po yung deed of sale sa developer, peke daw po. So I searched for the original owner kasi they are nowhere to be found na daw po. I found the wife of the contract owner po on Facebook and told them na ako na po yung new owner, blinock po ako. Now I am still paying the MA but I want to pay the loan in full na in about 6 years na po sana. Kaso di ko po maga guarantee na sakin mapupunta yung title kasi technically walang legal document na nagsasaad na akin na tong unit na to. Any suggestions po would greatly help.

November 5, 2012 at 3:19 am

The first thing you should do is stop paying for that one until you can prove the legality of the purchase. Use the help if a lawyer or your barangay officials.

November 4, 2012 at 12:37 pm

Dear sir/madam, I am O.F.W. employee I’m planning to apply Pagibig housing loan. Question: A) what the age limit? b) how many yrs i should pay my loan? c.) how much loanable amount? Age 56 yrs old Thank you and good day

November 5, 2012 at 3:11 am

Please check this link for the qualifications requirements. I think you are still qualified.

November 5, 2012 at 8:47 am

Question: Good day! i just want to ask if it is possible to tranfers may housing loan from a bank to pagibig housing loan…if possible what should i do? and what are the requirements and procdures should i make? thanks and more power…

November 7, 2012 at 1:54 am

Yes, that’s possible. Please coordinate with your bank for the documents you will be required to submit to the Pag-IBIG Fund.

November 11, 2012 at 2:59 pm

Hi! I’m an ofw.. ask ko lng po kung ano ung procedures pra makapagloan aq sa pag-IBIG para sa reconstruction ng house.. pwede k po bng ilakad mga papers dto sa sg?

December 4, 2012 at 5:29 am

You can start by preparing your documents while you are there, but you really have to apply here in the country at the branch which has the jurisdiction over the property you wanted to buy.

November 19, 2012 at 8:35 am

Hi..OFW din po ako. Pwede po ba ako magpa-represent sa brother ko in applying housing loan? Hindi po kasi ako makauwi ng Pinas para ayusin ang loan. If pwede ano po ba ang pwede kong isubmit..SPA? salamat po

December 4, 2012 at 5:06 am

Yes, you can do that. There is an SPA form at the office that you can use.

November 21, 2012 at 7:54 pm

Hi, got a housing loan for house construction (lot already owned by my father). I want my sister to assume the loan so I can make a new Pag-ibig loan for my own house. Two questions: (1) is this possible? meaning will i be allowed to make the second loan since the first would no longer be in my name? (2) since the loan was only for house construction, there is nothing that officially bears my name (except the loan, of course). so what should be put on the contract as being transferred? pls advise. and great &informative website. kudos!

December 4, 2012 at 5:35 am

I can’t give you an assessment based on the information you provided. A lot of things are still missing. My suggestion is for you to refer your case to the Pag-IBIG branch.

November 27, 2012 at 7:41 am

Good day..!Ask ko po tungkol dun sa property na nabili ko po sa townsville dasma, cvt.5yrs ago na pong di nababayaran.Ngayon,napagalaman k o po sa processing ninyo na pwede po pala i loan ang equity.i have paid for full equity as down payment and 1yr 8mnths ammortization.consider na po ba ito na makakuha ako ng 50%loan under maceda law.(24 monthly payment)Not even to loan the equity. Thank you! and need more information from you..!

December 4, 2012 at 5:48 am

I’m a little confused with your message. But you can consult the Pag-IBIG branch where you got the loan to ask for clarifications.

February 5, 2013 at 5:03 am

this is marilou.thanks for the advice.Now sabi nyo po to visit the Branch of pag ibig office to get the loan for clarification,Now.Where branch po ito pwede ako visit. sa Atrium po ba or sa Pag ibig office dito sa Justin building?Pwede po ba ito kontakin by mail? thanks and need your advice po..!

November 30, 2012 at 11:37 pm

hi! tanong ko lang po kung ano ang procedure if may iassume ako na loan. ito po yung scenario.. babayadan ko nlang sa kanila yung naihulog nila and ako nalang magtutuloy nung loan. Pero wala po akong cash to pay the full amount. ang plano ko po sana is magloan sa pag ibig ng buong amount kasama yung pambayad ko sa kanila at ituloy yung remaining yrs na huhulugan sa pag-ibig. pwede po kaya yun? parang ganito po kunwari ang total is 500k, 250k na nahulog nila. tapos un po ang ibabalik ko sa kanila yung remaining 250k ako maghuhulog sa pag ibig. pero since wala akong 250k onhand pwede ko po bang iloan sa pag ibig yung 500k den ibigay sa kanila yung 250k tapos hulugan na monthly yung reaming 250k? if pwede po panu ang process at anong documents ang kailangan?

maraming salamat po!

December 4, 2012 at 5:52 am

Please re-read the whole article above.

December 3, 2012 at 6:09 pm

Ask ko lang po kc mga 14months na akong di nakakapaghulog ng monthly ammortization ng bahay namin,pwede pba ipareconstruct un? Thanks..

December 4, 2012 at 5:54 am

You can try. Please visit the branch where you got the loan and inquire from there.

December 11, 2012 at 6:48 am

Ask ko lang po naka loan ang housing namin sa bank pwede ko ba Ito ilipat sa pag ibis and how…ty

December 13, 2012 at 2:59 am

Yes. Please consult with your banker on how to go about it.

December 12, 2012 at 2:03 pm

Hello po sa lahat dito. May problema po ako tungkol sa towhouse na kinuha ko noong 2011. bali po ganito yun story wala kasi akong pagIbig membership so bali hiniram ko Po sa Papa ko ang pagIbig nya para lang makuha ko yung Unit na nagustuhan ko.ngayon 1yr plus na Po ang nabayad kona sa pag-ibig loan pati Po yung downpayment bali 3yrs to Pay nabayaran ko na po yung bali 2yrs. And Last Year october ay napa extend ko na Po yung bahay except paint nalang ang wala talaga. I spend already 1.7M including sa downpayment nabayaran na silbi 200t Po yun lacking pa ako ng 97t for 2014 of March ang Finish ng payment nito. Tapos yung loan started nung lastyear sa july monthly payment ay 9370 Pesos.already paid end of this Year. At nitong nakaraang Mayo lang Po nagpa member ako ng pagIbig. ang tanong ko Po pwede kobang ma assume yung under the Name of my father itong Unit na ito? Kaylangan ko pa bang gagastos ng papers? Kasi ako naman Po talaga lahat ang nag Finance. Name lang talaga ang nahiram ko dito? Ano-ano Po ba ang dapat kong gawin para mapa sa’kin yung title ng House and Lot? Medyo nag worried kasi ako although his my father . Gusto ko sanang ma Secure ko yung bahay. Pwede Kaya ako makaassume nito na hindi pa kasi ako 2yrs membership ng pagIbig? Magkano din kaya ang magastos? May matatanggap pa din ba ng pera ang Papa ko through pagIbig? Kasi parang nahulog naibenta sa’kin?ano ano Kaya mga requirements ang ipapakita? At how Long it Takes the Processing? Kasi andito Po kasi ako sa ibang bansa at uuwi ako ngayon enero nxtyr 2013. Hindi Po Kaya mahirapan ako nito? Kylangan pabang magbabayad ng tax ang Papa ko? Eh hindi nman sya mag e-earn nito kasi Akin naman talaga yun? Ang Numero lang ng pagIbig nya lang nahiram dyan? Pls. Ineed Ur help sana masagot nyo Po before i will leave the Country at alam ko na ang dapat Kong gawin. 3weeks lang kasi stay kosa pinas 🙁 at kaylangan ko din ba ang abogado nito? Yan lang muna Po.. Salamat and best wishes! And merry xmasna rin sa inyo.

December 13, 2012 at 3:05 am

This one should be simpler since he is your father. Actually, this is like assuming the property from him and this is very acceptable to Pag-IBIG.

Please visit the Pag-IBIG branch where you got the loan for more details.

December 12, 2012 at 2:08 pm

Kong meron din Po kayo na pwedeng ibang ways na ma suggest how can i Secure my property pls. I Need Ur advise :)) hindi ko kasi alam ang mga ganito eh:( sana Po malaman ko soon anong dapat Kong gawin at anong dapat Kong dalhin na ipapakita na mga dokumento.. Salamat Po talaga

December 12, 2012 at 2:50 pm

magkano Kaya estimated magastos Po kong sa process lahat ng document? Kaylangan ba talaga pagIbig member Kong iassume ko ito? What Kaya ang Easy kong makompleto ko na ang bayad ng pagIbig pwede ko ba kaagad matransfer yun sa Name ko? Or kaylangan pang magpa change sa deed of seal ba tawag dun? Yung change ng property title? Malaki ba Kaya ang magasta? Sana Po matulungan nyo ako sa mga tanong ko salamat

December 17, 2012 at 7:21 pm

I have been waiting for the result of the house and lot in Batangas Lipa City Sabang STO. NIÑO VILLA DE LIPA II, what happened to the site? Mid-November, all of the houses are still listed. Now, what I can see is only one (1) property? http://www.pagibigfund.gov.ph/aa/aa.aspx

I am waiting for NOA for the phase 3 Block8 Lot37. I am ready to submit everything here on my end. I deposited 1000 on 2 October 2012 and until now no call or mail from the Branch. It is said from the seminar that it will just take 1 or maximum of 2 weeks for NOA. Please follow up.

+++ Contact details removed by admin ++

January 8, 2013 at 5:32 am

Tanong ko lang. Ano po ba ang mga dapat requirements kung mag assume nang house & lot at dapat hingiin na documents. Actually po na assume na nya ang property last 2004 at ipa assume na naman nya sa akin.

Ano po ba ang mga procedure na dapat kung gagawin?

Thanks. Philip Gaspar

January 29, 2013 at 3:30 am

Please read again the article written above this page.

January 22, 2013 at 9:57 pm

Tanong ko lng po, may balak po akong mag pagawa ng bahay, ofw po ako, may lupa n po ako. kung mag aaply po ako ngayon pra mag loan, gaano po kya ktagal para ma approvan mtagal kya? Kung halimbawa ho na sa 2013 n lng ako mag papagawa ng bahay, pwede po ba n mag aaply na ako ngayon ng loan? SALAMAT PO…….

January 29, 2013 at 3:33 am

The loan process could take from one week to several months, depending on the complexity of your application, the property you applying a loan for, and the availability of your documents.

January 30, 2013 at 5:54 pm

Hi po isa po aqng ofw d2 sa italy itatanong q lng po if pwedeng mg apply ng loan nagpagawa po kc aq ng bahay last year kaya po mgloloan sana aq para matubos po ung loan nmin sa banko..sana po may makuha po aqng sagot…balak q pong magloan ng 400k…salamat po

January 31, 2013 at 10:05 am

Wait q po reply nyo salamat…

February 20, 2013 at 7:31 pm

how many times can I assume the pag-ibig housing loan of other members?

March 20, 2013 at 7:52 am

Good afternoon po.

I have an active 30-year PAGIBIG housing loan. The unit is a subdivision house and lot, from a developer. I have been paying actively for more than 2-years already. Now, I am planning to have it assumed by a friend of mine (also a PAGIBIG member), he is interested. We seek advise from the branch office and they told us that since the loan has been paid for already more than 2 years, it will be needing a deed of sale already. According to them, after 2-years of payment, the developer will process the transfer of title into my name. However, until now for almost a year already, the developer has not yet processed the transfer of the title. What can I do about it? can PAGIBIG pressure also the developer to process it as soon as possible? Is their a chance or possibility that my friend can still assume the said contract even without it? I needed to dispatch the property as soon as possible because it is already more than a year that we were planning to transfer the contract under my friend’s name.

March 22, 2013 at 12:22 am

Please check also the status of title with your developer. They may have initiated the transfer process already.

March 22, 2013 at 5:20 am

I am regularly inquiring from them the status, but until now, they have not yet processed it. Actually, the owner developer is busy with his other activities, that is why they dont have time yet to process it… Is there anything possible to do so that I can start transacting iwth my friend interested to assume the contract of my housing loan?

March 25, 2013 at 11:58 am

hindi pa daw nila na-process…

March 26, 2013 at 4:03 am

ask ko lng po if on proces na ang loan ko?

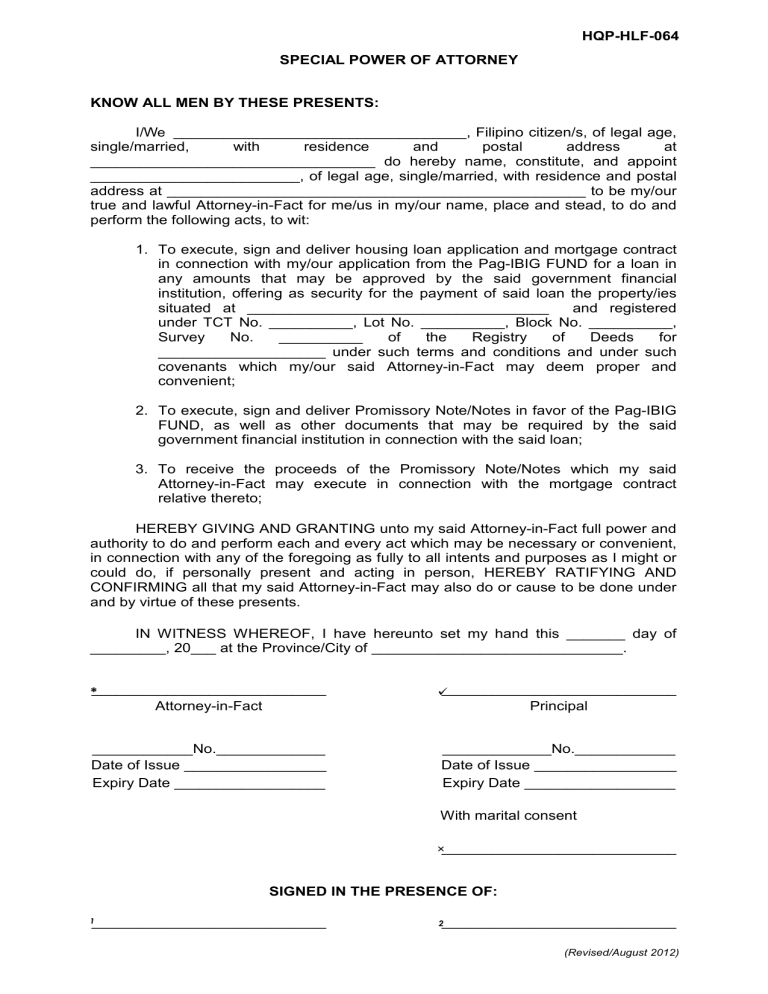

Pag-IBIG SPA HQP-HLF-064 - Type 1 (with marks)

Related documents

Study collections

Add this document to collection(s).

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

Philippine Government Forms All in One Location

Pag-IBIG HOUSING LOAN (For Direct or Retail Loan Application)

What this is for:, where to file:, how to file:.

a. Accomplish Preliminary Loan Counseling Questionnaire (PLCQ)

b. If eligible, accomplish Membership Status Verification Slip (MSVS) (HDMF H8-8)

c. Submit accomplished PLCQ and MSVS

2. Secure a Pag-IBIG Housing Loan Application form (HDMF H1-1) together with the checklist of requirements

3. Submit accomplished HDMF H1-1 form with complete requirements.

4. Secure Payment Order Form (POF)

5. Pay the initial processing fee of P1,000 and upgraded monthly contribution (if applicable)

6. Receive the Notice of Approval(NOA) and sign the loan documents

7. Proceed to the BIR and present the Deed of Absolute Sale (DOAS) executed by the owner of the property and the applicant for the computation of documentary stamps and capital gains tax, and proceed to authorized banks for the payment of documentary stamps and capital gains tax.

NOTE: Authorized bank shall issue a receipt as proof of payment which shall later be presented to the BIR. The BIR shall then issue to the member-borrower a Certificate Authorizing Registration.

8. Proceed to the Registry of Deeds (RD) for payment of transfer tax and registration fees relative to the transfer of title and annotation of mortgage

Present the following documents to the RD:-TCT/CCT/OCT in the name of the seller-Deed of Absolute Sale (DOA) between the owner of the property and applicant-PN with LMA-Certificate Authorizing Registration (issued by BIR)

9. Proceed to the Assessors Office for the assessment of property, and secure new tax declaration in the name of the member-borrower.

10. Secure Occupancy Permit from the Local Government Units (LGUs) Engineering Office. This is applicable to the following loan purposes: Purchase of New Residential Unit, Purchase of Lot and Construction of House (PLCH), and Construction of House (CH).

11. Submit the required documents

*Required Documents for submission upon loan approval:

1. Owners Duplicate Copy of the TCT/CCT/OCT in the name of the borrower with proper mortgage annotation in favor of the HDMF

2. Tax Declaration in the name of the borrower

3. Deed of Absolute Sale with R.D. stamp (for PLCH, DOAS shall cover lot only)

4. Promissory Note with Loan and Mortgage Agreement (PN with LMA) (HDMF H4-71) with original RD stamp

5. Certificate of Lot/House Acceptance (if not self-administered)

6. Certificate of Lot Acceptance (for lot purchase)

7. Updated Real Estate Tax Receipt

8. Certificate of House Acceptance and Completion (for house construction)

9. Disclosure Statement on Loan Transaction

10. Authority to Deduct Loan Amortization, if applicable

11. Occupancy Permit (upon loan take out)

12. Claim check

NOTE: The remaining processing fee of P2,000 shall be deducted from the loan proceeds.

13. Pay monthly amortization

NOTE: If payment of amortization is not thru salary deduction, the borrower must issue 12 post dated checks (PDCs) upon receipt of loan proceeds.

Other Documentary Requirements:

1. Housing Loan Application with ID photos of borrower (properly accomplished and duly notarized)

2. Income Tax Returns (ITRs) and BIR Form No. 2316 for the last two years immediately preceding date of loan application

3. Valid Certificate of Employment and Compensation (CEC) (for Pag-IBIG I & II)/ Employment Contract or Employers Certificate of Income duly certified by the employer (for POP members)(where applicable)

4. Latest Payslip(one-month)

5. Certified true copy of TCT/CCT/OCT by the Register of Deeds (latest title)

6. Location Plan and Vicinity Map

7. Photocopy of Updated Tax Declaration and Tax Receipt

8. Special Power of Attorney (for member/s abroad, SPA must be duly certified by the Philippine Embassy or Consulate in the country where the member is staying)

9. Medical Questionnaire and/or Full Medical Examination (For loans over P750,000 and for borrowers over 60 years old)

10. Proof of Billing Address

Copyright 2005-2018. Web and Software Development by EACOMM Corporation

Philippine Business Directory | Philippine Art and Antiquities

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Finance Basics

Assignment of Proceeds: Meaning, Pros and Cons, Example

Diane Costagliola is a researcher, librarian, instructor, and writer who has published articles on personal finance, home buying, and foreclosure.

:max_bytes(150000):strip_icc():format(webp)/_DianeCostagliola-8e8b0fa54fc946c282b909375b4184fe.jpg)

Investopedia / Jiaqi Zhou

What Is an Assignment of Proceeds?

An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third-party beneficiary . Assigning the proceeds from a letter of credit can be utilized in many types of scenarios, such as to pay suppliers or vendors in a business transaction or to settle other debts.

Key Takeaways

- An assignment of proceeds can be used to redirect funds from a line of credit to a third party.

- An assignment of proceeds must be approved by the financial institution that granted the line of credit following a request and fulfillment of any obligations by the original beneficiary.

- A benefit of this type of transaction is the ability to redirect only a portion of the proceeds, in which case both the original beneficiary and third party can access the same letter of credit.

- A drawback of this type of transaction is that the original beneficiary is still responsible for fulfilling all requirements under the letter of credit, even when the funds are redirected to the third party.

- This type of transaction is used in a number of circumstances, such as when paying suppliers or vendors, or when settling outstanding debts.

Understanding an Assignment of Proceeds

A letter of credit is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. The original beneficiary, the named party who is entitled to receive the proceeds from a letter of credit, may choose to have them delivered to a third party instead, through an "assignment of proceeds."

Due to the nature of international dealings, including factors such as distance, differing laws in each country, and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade.

In order to process an assignment of proceeds, the original beneficiary of the letter of credit must submit a request to the bank or other financial institution issuing the letter of credit requesting to assign the funds to a different individual or company. The assignment of proceeds will need to be approved by the financial institution once it is submitted, pending the fulfillment of any requirements set forth in the letter of credit.

If the original beneficiary does not meet the obligations outlined in the letter of credit, no assignment will take place. Once approved, the bank or other entity will release the money to the specified third party to be drawn upon at will.

Advantages and Disadvantages of an Assignment of Proceeds

The main benefit of an assignment of proceeds is that the original beneficiary has the ability to assign all or just a portion of the letter of credit to the third party. The original beneficiary will retain access to any portion of the proceeds not redirected to the third party. This allows both entities to make use of the same letter of credit when necessary.

This benefit must be weighed against the potential drawback of this type of transaction. When an assignment of proceeds takes place, the financial institution is not contracting directly with the third-party beneficiary. It is only acting as an agent in supplying the funds to the third party. The original beneficiary is still responsible for completing any and all requirements under the letter of credit.

Example of an Assignment of Proceeds

Assume XYZ Customer, in Brazil, is purchasing widgets from ABC Manufacturer, in the United States. In order to sign off on the deal, ABC Manufacturer requires that XYZ Customer obtains a letter of credit from a bank to mitigate the risk that XYZ may not pay ABC for the widgets once ABC has shipped them out of the country.

At this point, ABC Manufacturer is able to request that a portion of these funds be redirected to DEF Supplier, whom ABC still owes money for parts used in making the widgets. Even though a portion of the funds has been redirected to DEF Supplier, ABC Manufacturer still has to fulfill its obligations under the letter of credit, such as shipping out the widgets to XYZ.

:max_bytes(150000):strip_icc():format(webp)/what-are-different-types-letters-credit.asp-final-2f56c5a984a44a86817b362522bfe9e6.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Be a Member

Verify MID No.

Apply for MP2

Information:

I have read about the Data Privacy Statement as well as the Pag-IBIG Fund Privacy Policy and express my consent thereto. In the same manner, I hereby express my consent for Pag-IBIG Fund to collect, record, organize, update or modify, retrieve, consult, use, consolidate, block, erase or destruct my personal data as part of my information. I hereby affirm my right to: (a) be informed; (b) object to processing; (c) access; (d) rectify, suspend or withdraw my personal data; (e) damages; and (f) data portability pursuant to the provisions of the Act and its corresponding Implementing Rules and Regulations.

Copyright 2019 © Pag-IBIG Fund All Rights Reserved. || Terms and Conditions || Disclaimer || Privacy Statement

IMAGES

VIDEO

COMMENTS

HQP-HLF-124. V04. Revised Proforma Special Power of Attorney for Accomodation Mortgagor. HQP-HLF-275. V03. Conformity on New/Subsequent Housing Availment (For Borrower/Buyers tacked in a Housing Account. HQP-HLF-409.

Pag-IBIG Website (www.pagibigfund.gov.ph) or in any Pag-IBIG Branch/Person being represented 6. Notarized Special Power of Attorney (SPA) of other Family Members of the Legal Heir (1 original copy and 1 photocopy) Lawyer 7. Duly accomplished Housing Loan Application (HQP-HLF-068) (2 original copies) Pag-IBIG website (www.pagibigfund.gov.ph) or in

In case the developer is exempted from the payment of tax, no retention fee shall be deducted from the housing loan takeout proceeds up to the extent of the said exemption; provided, the developer shall furnish Pag-lBlG Fund with proof of Certificate of Tax Exemption issued by the BIR Commissioner.

ASSIGNMENT OF RETENTION PROCEEDS - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free.

Step #5. Sign Loan Documents. There are some and will be provided at the Pag-IBIG Fund office. Step #6: Visit the Bureau of Internal Revenue and Registry of Deeds. Pay for the documentary stamps and capital gains tax at the BIR. Have the Registry of Deeds put an annotation of mortgage on the Land Title. Step #7. Get Loan Proceeds.

This is part of our efforts to help you during these challenging times. As an added benefit, your restructured loan under the Special Housing Loan Restructuring program shall have an interest rate of only 6.375% per annum on a 3-year fixed pricing period. On the other hand, if your Pag-IBIG Housing Loan bears a subsidized interest rate, the ...

2. Income Tax Returns (ITRs) and BIR Form No. 2316 for the last two years immediately preceding date of loan application . 3. Valid Certificate of Employment and Compensation (CEC) (for Pag-IBIG I & II)/ Employment Contract or Employers Certificate of Income duly certified by the employer (for POP members)(where applicable) 4. Latest Payslip ...

pru_pcu_log_310 - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. cgjhf

Pag-IBIG Fund Circular No. 230 AMENDED GUIDELINES OF THE "ABOT-KAMAY PABAHAY" PROGRAM June 25, 2007 1. COVERAGE These guidelines shall apply to the following: 1.1 All accounts taken out ...

Notice of Assignment of Contract. Sometimes a third party is involved and needs to be notified in writing when an agreement such as the one above is made. This should be the case when you assume a Pag-IBIG Housing Loan from someone else. The Notice of Assignment of Contract is a document meant for this purpose.

SPECIAL POWER OF ATTORNEY. 1. To represent, receive/claim any documents from Pag-IBIG Fund particularly the Owner's Duplicate Certificate of Title and the Cancellation of Mortgage upon full payment of the said property covered by Transfer/Condominium Certificate of Title No. 2. To make, sign and execute, for and in my/our behalf, any ...

LOAN APPLICATION FORM Duly accomplished Housing Loan Application with your "1x1" ID photo • For Principal borrowers, please click here ... In the same manner, I hereby express my consent for Pag-IBIG Fund to collect, record, organize, update or modify, retrieve, consult, use, consolidate, block, erase or destruct my personal data as part of ...

1. To execute, sign and deliver housing loan application and mortgage contract. in connection with my/our application from the Pag-IBIG FUND for a loan in. any amounts that may be approved by the said government financial. institution, offering as security for the payment of said loan the property/ies.

DEED OF ASSIGNMENT OF RIGHTS WITH ASSUMPTION OF LIABILITY-PAG-IBIG-UY.docx - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world's largest social reading and publishing site. ...

1. Attend Loan Counseling. a. Accomplish Preliminary Loan Counseling Questionnaire (PLCQ) b. If eligible, accomplish Membership Status Verification Slip (MSVS) (HDMF H8-8) c. Submit accomplished PLCQ and MSVS. 2. Secure a Pag-IBIG Housing Loan Application form (HDMF H1-1) together with the checklist of requirements.

SUBJECT: GUIDELINES IMPLEMENTING THE PAG-IBIG FUND HOUSING LOAN RESTRUCTURING AND PENALTY CONDONATION PROGRAM Pursuant to Section 15 (e) of Republic Act No. 9679, of the HDMF Law of 2009, the Guidelines Implementing the Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation Program", are hereby issued: I. GENERAL PROVISIONS A. OBJECTIVE

The release of the retention fee shall be as follows. 1.1 The portion of the retention fee allotted for the Bureau of Internal Revenue expenses shall be released upon submission of: 1.1.1 Notarized Deed of Absolute Sale (DOAS); and 1.12 Updated Real Estate Property Tax CREPT). 1.2 The balance of the retention fee which pertains to the aggregate

For security reasons, you must log in to your Virtual Pag-IBIG Account to access your Pag-IBIG Fund savings and loan records. Continue. Enjoy Pag-IBIG Fund services anytime, anywhere with the Virtual Pag-IBIG! It's easy, it's convenient. It's your Lingkod Pag-IBIG 24/7. ... Downloadable Forms. Provident: Home Financing:

Pag-IBIG Branch NOTE: In all instances wherein photocopies are submitted, the original document must be presented for authentication. B. CHECK RELEASING REQUIREMENTS FOR BORROWER 1. Two (2) valid IDs of the Payee/s (1 photocopy each, back-to-back). Any of the following: - Passport Department of Foreign Affairs (DFA)

Assignment of proceeds occurs when a document transfers all or part of the proceeds from a letter of credit to a third party beneficiary . A letter of credit is often used to guarantee payment of ...

Notice of Assignment of Contract Pagibig.docx - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free.

Employers Approving Officer Change Information. HQP-PFF-381. V02. Application for Penalty Condonation for Financially Distressed Employers due to Covid-19 Pandemic. HQP-PFF-384. V01. Application for the New Penalty Condonation Program on Mandatory Monthly Savings (MS) Remittances.

Pag-IBIG Fund Website. FAQs. Contact Us. Log In. ×. For security reasons, you must log in to your Virtual Pag-IBIG Account to access your Pag-IBIG Fund savings and loan records. Continue. Be a Member. Register.