What type of loan are you looking for

Are you currently working with an apm loan advisor, who are you working with, when do you plan to buy, where is the property located, are you ready to apply, what is your current loan balance, what is the best way to reach you.

By entering your information and clicking “submit," you agree that American Pacific Mortgage may call/text you about your inquiry, which may involve use of automated means and prerecorded/artificial voices. You do not need to consent as a condition of buying any property, goods or services. Message/data rates may apply.

What is the estimated purchase price?

What type of refinance interests you, someone will be in contact with you shortly., what is your estimated down payment, what is your name, how is your credit.

Estimating your score will not harm your credit and will help us provide a range of available rates.

What is the best number to contact you?

What is your email, applying with is a breeze.

To begin, you will need to create a secure account. After you’ve created an account, you will enjoy:

- Secure loan application & document exchange

- Ability to pause and resume where you left off

- Updates on your application

- Capability to e-sign documents

- Easy access to resources

THE ART OF ORIGINATION

Complete guide to loan officer business planning.

At APM, we set aside time every year for strategic planning on how we’re going to succeed in the coming year, and we encourage all mortgage loan officers to do the same. The more intentional we are with what we want to accomplish, the more likely we are to achieve our goals.

In a rapidly changing industry, you need to outline your business objectives, set strategic goals, and review and reaffirm these plans every 90 days. That’s why we encourage our loan originators to set a 90-day plan each quarter that helps them achieve their long-term goals.

At APM, we’ve built a six-step process for mortgage loan officers to craft an effective business plan:

- Start with self-evaluation. Look back on the year and your performance both personally and professionally. We also recommend a scoring system around key areas of your business to help highlight areas of focus in the new year.

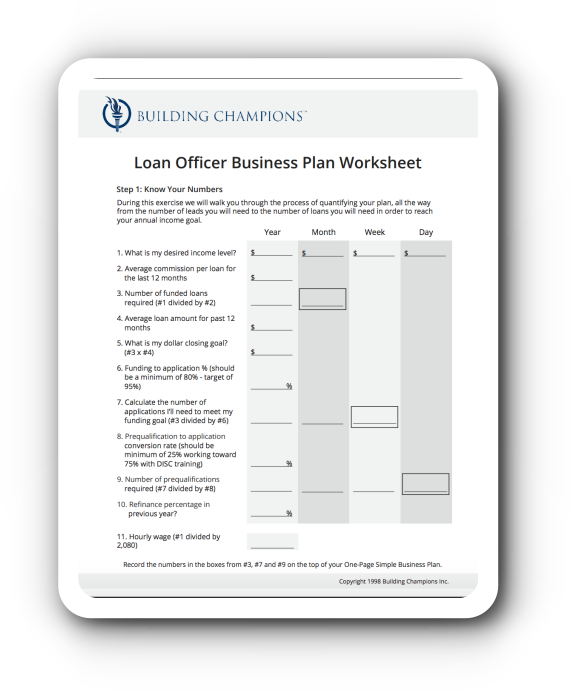

- Know your mortgage origination numbers.

- Look forward to the coming year and determine what you want to accomplish.

- Set your production goals for your business.

- Write down strategies and actions that will fuel your goals.

- Establish personal goals and strategies for balance.

Focusing on these six areas ensures that you’re covering every aspect of your work and personal life in your strategic planning, maximizing your chances for long-term success.

We’ve created a free guide that makes loan officer business planning simple and will help you evaluate your performance and set goals with action items to help achieve them.

Click here to download the APM Guide to Loan Officer Business Planning.

How to Structure Your Goals

Breaking your goal down into strategies with action items will help you achieve your overall goal. Here’s how to look at it:

- Goals: A goal is a business objective you seek to achieve by implementing the necessary strategies to get there. Goals define the destination, help you change your mindset to get to that destination, and create the need for tactics to get there.

- Strategies: Strategies are the stepping stones for achieving a goal. They’re the method or plan that will bring about the goal or the tactics that will get you from where you are to the end goal.

- Action items: These are the actions you need to take to implement your strategies. Mortgage loan officers should organize action items in the order of ideal execution.

Self-Evaluation

Before we dive into the specifics of loan officer business planning, it’s time to do an honest review of your performance over the past year. So consider what went well and what you need to tweak moving forward.

- What were your biggest business successes?

- What were some of your biggest challenges?

- What did you hope to accomplish but did not?

- Did you have a satisfying work-life balance throughout the year?

For more help, click here to download our comprehensive loan officer business planning guide .

Loan Officer Business Planning

First you’ll decide on your goals for each of the areas below for the new year. Then you’ll set one to three strategies for each of those goals every 90 days and identify the action items that will help you implement your strategies.

Strategies are simply things to keep doing, things to change, and things to start. By working your strategies with this discipline, it won’t feel so daunting to come up with something new every 90 days. Possibly it’s a small adjustment to an already-great strategy that will make all the difference.

Every 90 days, you’ll adjust as needed and plan your next 90 days. This allows you to make large goals but break down the things you need to do to achieve them without getting overwhelmed. It also builds in a specific time for you to review and reset course, which is important in the current market.

Here are the six areas to look at.

1. Strengthening referral partners (B2B)

How will you grow your relationship with strategic partners in the new year? It’s all about adding value, and here are a few of the strategies we recommend:

- Dedicate one day per week to connect with your top five real estate agents. Also reach out to two to three new real estate agents.

- Join a networking group to help build new referral partners and relationships in your community.

- Invest in lead acquisition to drive new business to yourself and your realtor referral partners.

2. Prospecting for new business (B2C)

When you’re looking for new clients, prospecting and marketing strategies are key to sourcing, transacting, and earning new business. Here are some ideas we recommend to our mortgage loan originators at APM:

- Try new marketing strategies to reach new clients. This might be adding a new social media platform, trying out geotargeted mail drops to renters, offering a free webinar on homeownership, or targeting people relocating to your area.

- Find a niche market, and create a campaign around it. This might be a specific type of home loan, a lending product with high demand and low competition, or marketing to a specific client type. Niching down can be a great strategy.

- Leverage video across all your marketing platforms.

3. Enhancing client experience

So much of what makes you successful as a loan officer isn’t the type of mortgage you offer. Instead, it’s the experience you provide the people who come to you for help with their loan options. At APM, we call this “Creating Experiences That Matter.”

That might translate into creating raving fans and referral partners for your business. Setting goals about the customer experience ensures that you never forget how important that is.

Here are some ways you could focus on your customer experience in the coming year:

- Each week, take the time to evaluate the experience you’re offering your loan applicants.

- Personalize the experience through designing memorable moments during the transaction. Determine how and where to connect, educate, and amaze.

- Use an interactive sales presentation to drive customer engagement and make the process of getting a home loan an empowering experience.

- Develop and implement a post-meeting follow-up plan for every new application. Ensure that you document the plan and that all team members adopt it.

There are a number of ways to improve your customers’ experience and make their transactions meaningful. The important thing is to make sure you’re tailoring the experience to what your specific customers want, and that won’t look the same for every loan officer.

4. Developing knowledge and skills

Loan officers can’t afford to take their eyes off professional development and mastering their craft. There are always additional things to learn, whether it’s new types of loans, mortgage officer regulatory guidelines, or a new sales technique.

In today’s high interest rate environment, your expertise is what will win you business. Here are a few action items you’ll want to have on your radar:

- Dedicate two hours per week to increase your knowledge and skill level to learn niche or new products for your business.

- Increase your knowledge of technology features and advancements for higher adoption and efficiency for yourself and your clients.

- Mentor with a top producing mortgage broker or business coach to learn the disciplines, practices, and tactics that bring success. Implement the learnings from these coaching sessions, and amend the strategies as needed.

5. Retaining clients and earning repeat business

Keeping the clients you already have is vital to loan officer business planning. Here are some action items in this area:

- How much business is sitting in your database right now waiting for you to reach out? If you don’t know, it’s time to focus some effort in this area.

- Ensure that all contacts in your database have accurate records and are signed up for automations, campaigns, and customer intelligence alerts.

- Schedule routine check-ins with past clients, something that is consistent and actionable.

- Spend time monthly reviewing contacts, content, and touchpoints and adjust as needed.

6. Personal development

It’s hard to do excellent work as a mortgage loan officer if you’re not also thriving in your personal life. That’s why one of our areas for loan officer business planning focuses on personal development. That includes setting strategic goals around several main areas of your life, including:

- Physical and mental health

- Learning and intellect

- Improving key relationships

- Financial security

- Personal aspirations

- Spirituality

There are no right or wrong answers when it comes to your personal goals. What matters is that you take the time to be intentional about what’s working and what’s not and how you can make positive changes in the coming year.

By focusing on these areas of loan officer business planning and business strategies, you’ll find that you accomplish more than you ever have before and feel better while doing it. For more help with your 2024 loan officer business plan, make sure to download our 2024 business planning book here !

Want more great content right in your inbox?

Recent posts.

EasyKnock’s programs are designed with the needs of our customers in mind.

Sell & Stay

Sell your house to us, stay in it as a renter, but keep the option to buy it back.

- MoveAbility

Convert your home equity to cash you can use to make a more competitive offer on your next house.

Everything you need to know about today’s real estate industry and financial climate, straight from the experts.

Tools for agents, brokerages, lenders, and more.

EASYKNOCK FOR

- Submit a Lead Become a Partner

- Customer Testimonials

Tools for agents, brokerages, lenders, and other partners.

- Become a Partner

- Submit a Lead

- Debt Management

- Home Equity Loan

- Sale-Leaseback

- Acquisition

- Aging in Place

- Assisted Living

- Bridge Loans

- Cash Out Refinance

- College Loans

- Consolidation

- Construction

- Contractors

- Coronavirus

- Credit Card

- Credit Score

- Customer Story

- Debt-to-Income

- Down Payment

- Financial Crisis

- Financial Goals

- Financial Planning

- financial program

- financial wellness

- First Time Home Buyer

- Forbearance

- Foreclosure

- Home Equity

- Home Equity Conversion Mortgage

- Home Equity Line of Credit

- Home Improvement

- House Flipping

- House Pricing

- Interest Rates

- Jarred Kessler

- Landscaping

- Late Payments

- Loan Officers

- Medical Bills

- Medical Expenses

- Natural Disaster

- newamericanfunding

- pressrelease

- Proof of Income

- Property Tax

- proptechbreakthrough

- Real Estate

- Real Estate Tax

- Refinancing

- Restrictions

- Reverse Mortgages

- Seasonality

- Second Home

- Second Mortgage

- Self-Employed

- Sell & Stay

- Small Business

- South Carolina

- Student Loans

- Testimonial

- Vacation Home

How to Create a Mortgage Loan Officer Business Plan

Are you a mortgage loan officer looking to create a business plan? We have the steps you need to take for success.

When people ask you how much loan officers make, do you have a hard time coming up with a succinct answer?

Don’t worry! It just means you know your business. There are probably as many total compensation numbers in mortgage lending as there are loan officers.

According to Payscale, the average mortgage loan officer earns about $47,500 per year in salary and $36,500 in bonuses and commissions. But the outlying data is what shows you just how varied compensation can be from person to person.

The same Payscale report shows that the base salary of a mortgage loan officer ranges from just above $29,100 to almost $84,000. And that’s not all – recent data shows that the top earners are bringing in more than $131,000 from commissions alone.

To get to that level, you have to know your industry. You have to understand what your customers want, of course, but first and foremost you need to know exactly how you’re going to build your business. And that means developing a solid business plan.

Creating a Mortgage Loan Officer Business Plan in Five Steps

Without a business plan, mortgage loan offices don’t know where they’re going or how they’re going to get there. In such a competitive industry, that’s like running a race with a blindfold on – no matter how fast you run, someone who can see is going to get to the finish line faster. Here’s how to give yourself that edge.

1. Analyze Your Market

You can’t know how to develop your mortgage loan officer business plan until you know what the market needs . Before you even start writing your business plan, take some time to research what’s going on in your market. For the area you serve, find out:

- The average value of homes

- Median household income

- Home purchase and sales trends

- Property valuation forecasts

- Homeownership rates

- Housing vacancies

This information will help you to understand who you’re serving and what they need. Your business plan will be different if your area has a median income of $50,000 than if your average buyer is earning six figures a year. Your sales goals may change if you learn that homeownership rates in your area are declining.

Once you have as much information as you can gather, you can start to develop actionable objectives.

2. State Your Business Objectives and Goals

The real estate market is notoriously uncertain. Pair that with an “it depends” business strategy and you’ll have a difficult time creating a mortgage loan officer business plan.

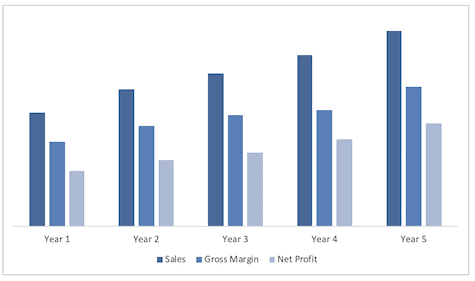

Look at the information you have and consider what’s realistic for your market. Where do you want your revenue levels to be in five years? In one year? Take a look at some examples of mortgage business plans to get an idea of the objectives that others in your field are pursuing .

Next, decide if you want to add any milestones or short-term goals. For example, if you plan to add a second office within five years, will you need to hit a certain revenue level by the three-year mark?

3. Develop a Marketing and Public Relations Strategy

Identify the tools that you’ll use to pursue your goals for your mortgage loan officer business plan. Make sure to diversify and take advantage of digital marketing strategies as well as good old-fashioned networking.

Schedule your blog posts, then go out to a Chamber of Commerce event. Buy ad space on a real estate website, but don’t forget to talk to your neighbors and find out who might be buying or selling.

It’s particularly important to keep your digital content up to date. Networking is networking in any age, but online trends change quickly. In 2019, for example :

- Infographics offer a 40 percent engagement rate

- Facebook Live videos have twice the engagement of non-live options

- The ROI of emailing relevant content is approximately $38 for every dollar spent

- Promoted social media ads are expected to generate $17 billion

Just make sure that you create time in your day to get those messages and posts out into the world!

4. Develop a Referral Network

Your networking strategy should involve fellow professionals as well as people in the community. Join professional organizations, like the National Association of Mortgage Brokers or the Mortgage Bankers Association .

A mortgage loan officer business plan should include making connections with people who aren’t directly involved in mortgage lending but who work with people who need loans. Reach out to local :

- Accountants

- Appraisers

- Real estate attorneys

- Listing agents

Make sure that your referral strategy includes organizations that you can send clients to as well as vice versa. For example, at some point, you will probably have a client that needs a second mortgage or home equity line of credit but doesn’t qualify. More than 20 percent of people seeking this kind of funding can’t get approved.

5. Keep Tracking Your Progress!

Your mortgage loan officer business plan objectives should be specific enough that you can track your progress as you go. The best way to do this is with key performance indicators , or KPIs, which are data-based metrics of a business’s momentum.

To help you evaluate the success of your business plans, your KPIs need to be:

- Based on numerical data

- Presented in the context of performance goals

- Relevant to current company processes

- Useable to drive change as necessary

KPIs that are particularly useful to loan officers include:

- Application conversion rate: the ratio of funded loans to applications in a certain time frame

- Average origination value per loan: revenue earned from each loan

- Cost per loan originated: how much you spend on average to secure each loan agreement

Key Takeaways

If you don’t know where you’re headed with your mortgage loan officer business plan, how will you know when you’re there? To know your destination as well as your path, you need a solid business plan with specific and actionable steps.

Talk to a financial advisor and start developing a plan today. You’ll thank yourself when you reach your first goal!

Ready to Make Your Equity Work For You?

Suggested Reading

How to Pay Off Debt Fast with Low Income: 12 Ways

What Is a Home Equity Sharing Agreement? Pros & Cons

Is Reverse Mortgage a Good Idea for Seniors?

What Can You Use a Home Equity Loan For?

Debt Resolution vs Debt Consolidation: Pros & Cons

Finding Flexibility for the Boxed-In Homeowner

Debt Forgiveness for Seniors: 10 Options

Where to Live Between Selling and Buying a House

What is a Real Estate Settlement?

Ribbon, now powered by EasyKnock, Expands RibbonCash to Florida, Making Homeownership More Achievable for Local Everyday Buyers

An Interview with Robert “Nev” Neville

How to Get Equity Out of Your Home Without Refinancing

An Interview with Jarred Kessler – Rehab Warriors Advisor

7 HELOC and Home Equity Loan Alternatives to Consider

An Interview with Shawn Tate

How to Qualify for a HELOC: A Step-by-Step Guide

Is HELOC Interest Tax Deductible? Find Out Now

Do You Need an Appraisal for a Home Equity Loan or HELOC?

This article is published for educational and informational purposes only. This article is not offered as advice and should not be relied on as such. This content is based on research and/or other relevant articles and contains trusted sources, but does not express the concerns of EasyKnock. Our goal at EasyKnock is to provide readers with up-to-date and objective resources on real estate and mortgage-related topics. Our content is written by experienced contributors in the finance and real-estate space and all articles undergo an in-depth review process. EasyKnock is not a debt collector, a collection agency, nor a credit counseling service company.

Mortgage Broker Business Plan Template

Written by Dave Lavinsky

Mortgage Broker Business Plan

You’ve come to the right place to create your Mortgage Broker business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Mortgage Broker companies.

Below is a template to help you create each section of your Mortgage Broker business plan.

Executive Summary

Business overview.

Davidson Mortgage, located in Tucson, Arizona, is a new mortgage brokerage specializing in residential mortgages. The company will operate in a professional setting, conveniently located next to several banks in the center of the shopping district. We offer a wide range of services to help our clients get a mortgage, including finding loan options, applying for the loans on the clients’ behalf, and completing all the paperwork. We strive to serve our clients with the utmost empathy to ensure they get the best mortgage for their situation.

Davidson Mortgage is headed by Harold Davidson. He is an MBA graduate from Arizona State University with 20 years of experience working in the finance industry. His passion is to help his clients qualify for their dream homes and provide them with a smooth process from start to finish.

Davidson Mortgage will focus on providing superior service to all of its clients to ensure they get the best mortgage possible. Our services include finding loan options, applying for loans on behalf of customers, and completing closing paperwork. Since customer service is our top priority, we will keep in touch with our clients after they have closed on the mortgage. Furthermore, Harold will create webinars, online courses, and other content to educate his clients and the local community on the mortgage lending process.

Customer Focus

Davidson Mortgage will primarily serve homebuyers interested in properties located in the Tucson, Arizona area. Tucson is a growing city with thousands of residents eager to purchase a new home. We expect our clientele to be equal parts first-time home buyers and existing homeowners.

Management Team

Davidson Mortgage is run by Harold Davidson. Harold has been a licensed mortgage broker for the past 20 years, working for several large firms. However, throughout his career, he desired to have a closer connection with his clients as well as have more flexibility to help them get their dream homes. He started this company in order to achieve those goals. In addition to his valuable experience, Harold also holds an MBA from Arizona State University.

Harold is joined by Bethany Peterson. She will serve as the company’s full-time assistant, who, among other things, will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

Success Factors

Davidson Mortgage is uniquely qualified to succeed due to the following reasons:

- Davidson Mortgage will fill a specific market niche in the growing community we are entering. In addition, we have surveyed local realtors and homebuyers and received extremely positive feedback saying that they would consider making use of our services when launched.

- Our location is in an economically vibrant area where new home sales are on the rise, and turnover in homes and rentals occurs often due to the upward mobility of residents.

- The management team has a track record of success in the mortgage brokerage business.

- The local area is currently underserved and has few independent mortgage brokers offering high customer service to homebuyers.

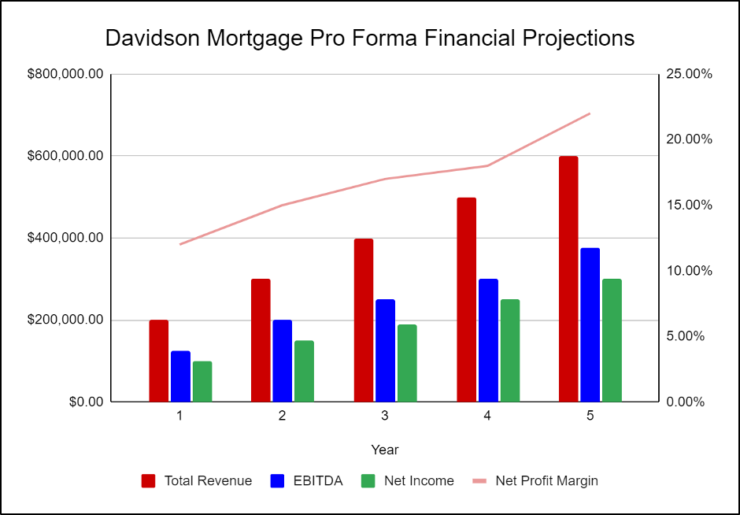

Financial Highlights

Davidson Mortgage is seeking a total funding of $250,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office design/build: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $100,00

- Marketing expenses: $50,000

- Working capital: $50,000

Company Overview

Who is davidson mortgage, davidson mortgage history.

After surveying the local customer base and finding a potential office, Harold Davidson incorporated Davidson Mortgage as an S-Corporation on 1/1/2023.

The business is currently being run out of Harold’s home office, but once the lease on Davidson Mortgage’s office location is finalized, all operations will be run from there.

Since incorporation, Davidson Mortgage has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

Davidson Mortgage Services

Industry analysis.

Despite the pandemic hurting several industries, the mortgage brokers industry still performed strong and is projected to continue to do so. Last year, U.S. mortgage brokerages brought in revenues of $11.7 billion and employed 47,000 people. There were just over 12,000 businesses in this market.

However, the mortgage broker industry is highly fragmented, with the top two companies accounting for just over 11% of industry revenue. Furthermore, mortgage interest rates are on the rise, as well as housing prices, preventing many people from buying houses and applying for mortgages. These two factors significantly stunt the industry at present.

Despite these challenges, the industry is still projected to increase moderately throughout the rest of the decade. Though larger firms may dominate revenue and clientele, studies and surveys show that clients don’t necessarily favor working with large firms. Providing excellent service and personal touches throughout the process can help small firms succeed in the industry.

Customer Analysis

Demographic profile of target market.

Davidson Mortgage will primarily serve the residents of Tucson, Arizona. The area we serve has a significant population of people who are searching for their first home, as well as families and individuals who need a new home.

The precise demographics for Tucson, Arizona are:

Customer Segmentation

Davidson Mortgage will primarily target the following customer segments:

- Existing homeowners

- First-time home buyers

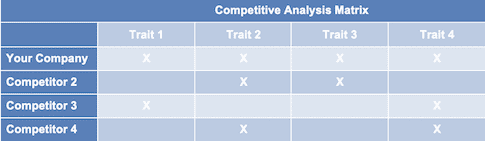

Competitive Analysis

Direct and indirect competitors.

Davidson Mortgage will face competition from other companies with similar business profiles. A description of each competitor company is below.

The Loan Store

Established in 2010, The Loan Store originates, finances, and sells mortgage and non-mortgage lending products throughout the United States. It offers a range of consumer credit products, such as home loan products, home equity loans, and unsecured personal loans, as well as home and personal loan servicing. The company claims to be one of the largest private, independent retail mortgage lenders in the U.S. Its current business channels include direct lending, affinity, branch retail, and servicing.

However, agents working with The Loan Store experience high turnover, resulting in little concern for maintaining ongoing relationships with clients. Also, the agents themselves are mixed in quality, ranging from part-time brokers with little experience or sales records to full-time brokers with long-term experience. There is no systematic company method for passing on knowledge from experienced to inexperienced brokers as all are competing with each other, to a certain extent, for commissions.

Direct Loan Connection

Founded in 2006, Direct Loan Connection (DLC) employs licensed mortgage professionals who have access to multiple lending institutions, including banks, credit unions, and trust companies. This access enables the company to offer a vast array of available mortgage products – ranging from first-time homebuyer programs to financing for the self-employed to financing for those with credit blemishes. In addition, to help homebuyers and homeowners, DLC offers commercial mortgages.

Though they are a local leader in the premium end of the market, they refuse to negotiate their broker’s fees and sometimes lose potential clients because of this. Davidson Mortgage’s fees will be far more reasonable.

Supreme Mortgage

Supreme Mortgage specializes in mortgage brokering and is committed to helping homebuyers, and homeowners get the best mortgage with the lowest interest rate. The brokerage works with more than 40 lenders who compete to provide mortgages and who pay Supreme Mortgage’s fee so that clients receive the service free of charge.

Some reviews of Supreme Mortgage point out the low-quality service offered by brokers, who have little training in customer service. Furthermore, Supreme Mortgage does not attempt to maintain long-term relationships with customers who will eventually purchase another home.

Competitive Advantage

Davidson Mortgage enjoys several advantages over its competitors. These advantages include:

- Location: Davidson Mortgage’s location is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Davidson Mortgage will have a full-time assistant to keep in contact with clients and answer their everyday questions. Harold Davidson realizes the importance of accessibility to his clients and will further keep in touch with his clients through monthly seminars on topics of interest.

- Management: Harold Davidson has been extremely successful working in the mortgage brokerage sector and will be able to use his previous experience to grant his clients detailed insight into the world of home loans. His unique qualifications will serve customers in a much more sophisticated manner than many of Davidson Mortgage’s competitors.

- Relationships: Having lived in the community for 25 years, Harold Davidson knows many of the local leaders, newspapers, and other influencers.

Marketing Plan

Davidson Mortgage will use several strategies to promote its name and develop its brand. By using an integrated marketing strategy, Davidson Mortgage will win clients and develop consistent revenue streams.

Brand & Value Proposition

The Davidson Mortgage brand will focus on the company’s unique value proposition:

- Client-focused residential mortgage brokerage services, where the company’s interests are aligned with the customer

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Davidson Mortgage is as follows:

Website/SEO

Davidson Mortgage will invest heavily in developing a professional website that displays all of the features and benefits of working with the mortgage broker. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Davidson Mortgage will invest heavily in a social media advertising campaign. Harold and Bethany will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Davidson Mortgage understands that the best promotion comes from satisfied customers. The company will work to partner with local realtors by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

By offering webinars and courses on topics of interest in the office or other locations, Harold Davidson will encourage residents in the community to become comfortable with the expertise and character of Davidson Mortgage. These webinars will generally be offered free of charge as general promotion and for direct networking.

Davidson Mortgage’s pricing will rely on the standard industry rates in order to be perceived as neither a luxury nor a discount broker. The standard rate for brokering a mortgage is 1-2% of the loan amount. By seeking quality clients and maintaining long-term relationships with them, Davidson Mortgage will fend off pressure to discount their rates, even in down markets.

Operations Plan

The following will be the operations plan for Davidson Mortgage.

Operation Functions:

- Harold Davidson is the founder and will operate as the President of the company. He will be in charge of all the general operations and executive functions within the company. Furthermore, until he hires additional staff, he will personally help all clients who agree to utilize the company’s services.

- Harold is assisted by his long-term assistant Bethany Peterson. She will serve as the company’s full-time assistant and will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

- As the business grows and Harold takes on more clients, he will hire other mortgage brokers to assist him.

Milestones:

The following are a series of steps that will lead to the company’s long-term success. Davidson Mortgage expects to achieve the following milestones in the next six months:

3/202X Finalize lease agreement

4/202X Design and build out Davidson Mortgage office

5/202X Hire and train initial staff

6/202X Kickoff of promotional campaign

7/202X Reach break-even

8/202X Reach 25 ongoing clients

Financial Plan

Key revenue & costs.

Davidson Mortgage’s revenues will come primarily from the commissions earned from residential mortgage sales.

The major cost drivers for the company will include employee salaries, lease payments, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual lease: $30,000

Financial Projections

Income statement, balance sheet, cash flow statement, mortgage broker business plan faqs, what is a mortgage broker business plan.

A mortgage broker business plan is a plan to start and/or grow your mortgage broker business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Mortgage Broker business plan using our Mortgage Broker Business Plan Template here .

What are the Main Types of Mortgage Broker Businesses?

There are a number of different kinds of mortgage broker businesses , some examples include: Retail Mortgage Broker, Business/Corporate Mortgage Broker, or Private Mortgage Brokers.

How Do You Get Funding for Your Mortgage Broker Business Plan?

Mortgage Broker businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Mortgage Broker Business?

Starting a mortgage broker business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Mortgage Broker Business Plan - The first step in starting a business is to create a detailed mortgage broker business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your mortgage broker business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your mortgage broker business is in compliance with local laws.

3. Register Your Mortgage Broker Business - Once you have chosen a legal structure, the next step is to register your mortgage broker business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your mortgage broker business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Mortgage Broker Equipment & Supplies - In order to start your mortgage broker business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your mortgage broker business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful mortgage broker business:

- How to Start a Mortgage Broker Business

Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Loan Officer Business Plan Guide

JUL.05, 2023

1. What are loan officers’ services?

Loan officers serve both home buyers and businesses. When evaluating clients’ eligibility for loans, they carefully assess their credit history and financial status. Additionally, they offer expert guidance in selecting mortgage products that cater to the unique needs of each client. Loan officers collaborate with lenders, streamlining the application process, negotiating terms, and facilitating closing.

2. Executive Summary

Why do you need a business plan for a loan officer business.

A business plan holds immense importance for the success of a Loan Officer business. A comprehensive guide on crafting a loan officer business plan acts as a roadmap leading to operational and financial success for the Loan Officer business. It should identify not only milestones but also the processes and strategies needed to achieve those goals.

The business plan should outline the company’s overall mission and objectives, its financials (including a budget and a pro forma income statement), market analysis, organizational structure, and customer acquisition strategies.

How to write an executive summary for a Loan officer business plan?

The executive summary of a loan officer business plan worksheet provides a comprehensive overview of the entire plan. The provided sentence lists various components of a summary, including the mission, goals, products and services, financial projections, and competitive analysis. It also mentions that the qualifications and experience of the loan officer are highlighted.

The executive summary should prioritize the loan officer’s objectives and strategies for acquiring and fulfilling client requests. It should outline how the loan officer plans to reach these goals effectively while explaining the specific techniques they will utilize.

The executive summary of the commercial loan officer business plan template should provide a concise overview of the products and services offered by the loan officer. Additionally, it should include anticipated financial projections and competitive analysis. This section aims to present an outline of available loans, associated fees, charges, and estimated total revenue for the loan officer’s business.

The executive summary should provide a concise overview of the loan officer’s qualifications and experience. This section briefly highlights the loan officer’s education, professional certifications, and pertinent industry expertise within lending.

3. Company Overview

History of loan officer company.

Loan Officer Company was founded in 2021 to become a top-tier mortgage loan provider. The company offers specialized mortgage loan services to its customers. These services are provided through a team of experienced and knowledgeable loan officers.

Moreover, our organization takes great pride in being a member of esteemed professional associations such as the National Association of Mortgage Professionals , the Mortgage Bankers Association of America, and the National Reverse Mortgage Lenders Association.

Our range of loan products encompasses conventional loans, government-backed loans, jumbo loans, and refinancing. Loan officers undergo ongoing training and must pass a stringent certification process to guarantee exceptional customer service quality.

The company’s main objective is to provide personalized creditworthy loans to every customer. Transparency and fairness are our core principles, ensuring that each customer receives the loan that suits their unique circumstances. Additionally, we prioritize clarity and understanding by guiding customers through the entire loan process from start to finish.

4. Services and pricing

- Conventional Loans: Fixed or adjustable rate mortgages as low as 3.875%, Low or no down payments, Flexible qualification criteria

- Government-Backed Loans: VA, FHA, and USDA loans with competitive rates and flexible qualifications

- Jumbo Loans: Loan limits up to $3.5 million with competitive rates and flexible qualifications

- Refinancing: Lower rates, cash-out options, and the ability to consolidate debt

- Mortgage Consultations: Comprehensive assessment of your financial situation and personalized advice

- Loan Packaging: Comprehensive loan packaging and presentation services to ensure competitive offers

- Loan Servicing: Professional loan servicing that includes payment processing, collections, and customer service

5. Customer Analysis

Customer segmentation.

The customer base for the loan officer business plan example can be segmented as follows:

- Homeowners: This segment comprises existing homeowners looking to obtain or refinance a mortgage loan. They are likely between the ages of 35-55 and have a higher net worth than the average consumer.

- First-time Home Buyers: This segment consists mostly of younger people who are first becoming homeowners. They may have lower credit scores or more limited finances and require more assistance in obtaining a mortgage loan.

- Real Estate Investors: This segment typically consists of experienced investors or business-minded individuals looking to purchase property as an income-generating tool.

- Small Business Owners: Small business owners may be interested in obtaining a commercial loan to purchase a building or expand their business operations.

- Homeowners with Equity: This segment comprises existing homeowners looking to access the built-up equity in their homes to finance a large purchase or investment.

6. SWOT Analysis

- The knowledgeable and experienced loan officer

- Access to data and analytics to better determine loanworthiness

- Established relationships with lenders

- Long-term relationships with customers

Weaknesses:

- Lack of resources, such as access to capital or the ability to hire new loan officers

- Lack of technology to efficiently process and monitor loan applications

Opportunities:

- Expansion into new geographic areas

- Leveraging new technology to increase efficiency and effectiveness in the loan process

- Establishing relationships with new lenders and financial service providers

- Increasing competition in the loan officer business

- Strained lending regulations that may limit loan products or terms

- Changing economic environment and interest rate markets that may inhibit borrower demand

7. Marketing Analysis

The Mortage Broker Business Plan industry is highly competitive, dominated by traditional banks and large financial institutions.

Competitors

The primary competitors of our Payday Loan officer services are other loan officers, mortgage brokers, banks, credit unions, mortgage lenders, and real estate agents. They offer services similar to our company, such as home loans, refinancing options, loan terms and conditions, etc.

Market trends

Recent market trends in the loan officer industry have seen an increase in demand and competition as the US housing market has continued to boom.

Competitive Advantage (USPs)

Our commitment lies in providing a comprehensive loan service, giving us a competitive edge. We dedicate ourselves to understanding the unique needs and financial goals of each client, allowing us to offer personalized loan advice and tailored solutions. Rather than settling for standard options, we go the extra mile to ensure our clients receive the absolute best choices available.

8. Marketing Plan

Create a commercial loan officer business plan marketing plan that includes a mix of promotional strategies and goals, an organizational structure for tracking and measuring effectiveness, and a budget.

Promotions Strategy

The promotional strategy for a loan officer business plan involves several activities, including direct mail advertising, personal contacts and referrals, print media, and social media.

- Direct Mail Advertising: Direct mailers are a great way to reach potential clients and remind existing clients of your services. When preparing a direct mailer, it is important to tailor the message and design to the target market.

- Print Media: Print media provides an effective way to showcase the qualifications of a loan officer and the services provided.

- Social Media: Social media presents a powerful opportunity for businesses to connect with potential clients.

9. Management Team

Organizational structure.

An organizational structure for a loan officer 1-year business plan includes the following components:

- Accounting and Financial Support Team

- Loan Processing Team

- Customer Service Team

- Loan Administration Team

- Compliance and Regulatory Team

- Sales and Marketing Team

10. Financial Plan

Startup costs.

Developing a loan officer Finance Business Plan requires an initial investment of capital. These costs may be broken down into the following categories:

- Technology and Equipment: $2,500

- Legal and Regulatory Fees: $2,500

- Insurance: $2,500

- Licensing: $1,000

- Office Expenses: $2,000

- Marketing and Advertising: $1,000

Total Startup Costs: $11,000

Financial Projections

Assuming a loan officer is loaned out at an average of $250 per hour yearly, the following financial projections may be made:

- Year 1: $60,000

- Year 2: $75,000

- Year 3: $90,000

- Year 1: $25,000

- Year 2: $30,000

- Year 3: $35,000

- Year 1: $35,000

- Year 2: $45,000

- Year 3: $55,000

Funding Ask

Initial funding for the loan officer business plan can be obtained through a variety of sources, including personal savings, friends and family, business loans, or venture capital. Depending on the sources, the owner may need to provide collateral or a personal guarantee.

11. Accelerate Your Loan Officer Business Goals with OGS Capital

Are you a Loan Officer looking to get ahead?

OGS Capital has the expertise to accelerate your business growth. Our team comprises experienced financial and marketing professionals with extensive knowledge in the mortgage and banking sector. They are dedicated to supporting Loan Officers, like yourself, in achieving their business goals.

The OGS Capital team of advisors possesses extensive experience and expertise in the realms of business strategy and management. They have collaborated with a diverse array of companies, ranging from fledgling startups to reputable Fortune 500 corporations.

Our strategy plans are customized to align with the unique goals and objectives of your loan office business. They provide valuable insights and guidance for effectively targeting niche markets and reaching your desired audience. By employing data-driven methods, our plans prioritize actionable insights for your marketing campaigns, optimize spending, and drive sales and revenue growth in a cost-efficient manner.

Whether you’re looking for an effective growth strategy or a comprehensive roadmap to success, the experienced consultants at OGS Capital are on hand to provide the knowledge and expertise to turn your vision into reality.

Are you looking for expert guidance on business growth? Reach out to OGS Capital today to obtain your personalized roadmap towards achieving your goals.

Q. What is the easiest way to finalize a loan officer business plan?

The easiest way to finalize a loan officer business plan is to utilize online resources or templates to customize it to meet your needs. Templates are typically available online for free or at nominal costs and often include sections like a mission statement, financial goals, target audience, risk assessment, and more. Additionally, consider seeking professional help from a financial advisor who can provide additional guidance and advice.

Q. Where can I download the loan officer business plan in PDF format?

You can download a Loan Officer Business Plan Template in PDF format from websites such as SCORE, HubSpot, OGS Capital, and BizPlanBuilder.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

Loan Officer Business Plan

The loan officer business is rewarding and an excellent career choice. They play a vital role in the economy by providing access to capital for businesses and individuals.

Thus, if you are planning to start a rewarding career in finance, then being a loan officer is a great option. But for all the rewards proper planning is necessary.

Need help writing a business plan for your loan officer business? You’re at the right place. Our loan officer business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Loan Officer Business Plan?

Writing a loan officer business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your business:

- This section may include the name of your loan officer business, its location, when it was founded, the type of loan officer business (E.g., mortgage loan officer, commercial loan officer, agriculture loan officer), etc.

Market opportunity:

Product and services:.

- For instance, you may include loan application assistance, and financial analysis as services and mention expert financial guidance, and customized financing solutions, as some of your USPs.

Marketing & sales strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business description:

- Mortgage loan officer

- Commercial loan officer

- SBA loan officer

- Consumer loan officer

- Agriculture loan officer

- Credit union loan officer

- Describe the legal structure of your loan officer company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission statement:

Business history:.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

Future goal:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

- For instance, SMEs, real estate investors, homebuyers, and mortgage borrowers can be the ideal market for a loan officer business.

Market size and growth potential:

Competitive analysis:, market trends:.

- For instance, digital services have a booming market; explain how you plan on dealing with this potential growth opportunity.

Regulatory environment:

Here are a few tips for writing the market analysis section of your loan officer business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the loan officer services your business will offer. This list may include services like

- Loan application assistance

- Financial assessment & analysis

- Loan product selection

- Loan documentation

- Loan refinancing or restructuring

- Loan portfolio management

- Loan closing and fund disbursement

- Personal loans & mortgages

Mention your specialized service:

Additional services:.

In short, this section of your loan officer plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique selling proposition (USP):

- For example, expert financial guidance, customized financing solutions, or thorough financial analysis, could be some of the great USPs for a professional loan officer company.

Pricing strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your loan officer business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your loan officer business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & training:

Operational process:, equipment and software:.

- Explain how these technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your loan officer business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founder/CEO:

Key managers:.

- It should include, key executives(e.g. COO, CMO.), senior management, and other department managers (e.g. operations manager, customer services manager, loan officer manager.) involved in the loan officer business operations, including their education, professional background, and any relevant experience in the industry.

Organizational structure:

Compensation plan:, advisors/consultants:.

- So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your loan officer services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more.These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your loan officer business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample loan officer business plan will provide an idea for writing a successful loan officer plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our loan officer business plan pdf .

Related Posts

Notary Business Plan

Paralegal Business Plan

Best Business Plan Template

10 Key Components of a Business Plan

Create a Quality Business Plan Presentation

ChatGPT Prompts to Write Business Plan

Frequently asked questions, why do you need a loan officer business plan.

A business plan is an essential tool for anyone looking to start or run a successful loan officer business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your loan officer company.

How to get funding for your loan officer business?

There are several ways to get funding for your loan officer business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your loan officer business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your loan officer business plan and outline your vision as you have in your mind.

What is the easiest way to write your loan officer business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any loan officer business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to Become a Successful Mortgage Loan Officer

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on January 28, 2024

Get Any Financial Question Answered

Table of contents, mortgage banking: what you need to know.

The mortgage banking business may be quite profitable. If you are considering working as a mortgage loan officer or have considered entering the field, it is essential to understand that it is not a nine-to-five job.

It will impact your personal life, family relationships, and leisure time.

Mortgage loan officers are expected to be available daily, even if they are not working. This means that they will end up taking problems home with them, thinking about them and how they can resolve issues.

No matter how hard you try, the problems will find you; it is not an easy job. Successful mortgage loan officers typically work very long hours, answer their phones on the weekends, and take their phones and laptop with them when they vacation.

Success in this line of work is based on hard effort, dedication, and devotion to one’s employment. When you are used to it, you will realize that the greater your earnings, the more stress you have to deal with.

Success comes with canceled deals, spinning your wheels on unfavorable transactions, denied loans, and difficult and demanding clients.

The ability to give outstanding client service, stay updated on shifting laws and regulations, and maintain unwavering attention toward achieving financial objectives is crucial for success.

Highly successful loan officers know how to manage their time, money, and effort to achieve their goals. Most loan officers make phone calls to clients after 8 pm each night.

It is not unusual for clients to be qualified at 8 in the morning, ten at night, or on a Sunday afternoon.

Being a successful loan officer requires long hours and little free time.

Having a flexible schedule goes hand-in-hand with earning a high income. You must be able to handle intense pressure, cutthroat competition, and unfeasible deadlines while managing difficult personalities.

If you think you can handle all that comes with the job, then being a mortgage loan officer may be your most lucrative career.

Mortgage loan officers are required to undertake a variety of tasks. They must contact their lead sources (sphere of influence) to discover new house loan prospects.

They must build and maintain a network of contacts that supply them with recurring recommendations for potential homebuyers.

Typically, these referral sources include real estate professionals, social media influencers, builders, attorneys, insurance agents, lenders, and other referrals from their sphere of influence.

The loan officer’s job is to collect prospective clients’ employment, income, debts, and credit history data to qualify them for a mortgage. Suppose the potential customer does not meet the qualifications for a mortgage.

In that case, it is the loan officer’s responsibility to guide what steps must be completed to qualify for a mortgage.

Counseling may involve basic education on borrowing, credit advice, explaining mortgage rules, or how a cosigner might help them qualify for a mortgage .

As a loan officer, you must comprehensively understand the product standards and regulatory restrictions to succeed.

In addition to these abilities, a loan officer must provide outstanding customer service by tracking the loan process and keeping all stakeholders up-to-date along the way, from application to payoff.

Collecting any paperwork needed to finish the mortgage as required by the loan conditions, processing, underwriting, or closing department is a part of this work. A high degree of client satisfaction depends on a thorough knowledge of the mortgage process.

A successful loan officer must handle ongoing transactions while understanding mortgage product standards and regulatory modifications well. Have questions for a mortgage loan officer? Click here .

Educational Certificate Requirements

Because of the mortgage crisis of 2007, there has been a lot of legislation. The Secure and Fair Enforcement Act of 2008, often known as the SAFE Act, was the first such legislation.

This legislation dictated that all mortgage loan officers must be licensed and complete annual continuing education courses. Annual continuing education consists of a total of eight hours each year.

This comprises three hours on federal law and regulations, two hours on ethics, two hours on standards training, and one hour on undefined mortgage origin training.

To obtain a license to originate mortgages, mortgage loan officials had to complete twenty-four hours of education, pass a comprehensive national exam, and do a background check.

Since 2008, Congress has passed a lot of legislation to regulate the mortgage banking industry, such as the Dodd-Frank Act and newly formed regulatory agencies like the Consumer Financial Protection Bureau (CFPB), which oversees and regulates and regulates all financial companies.

This legislation and the regulating body aim to safeguard consumers from unscrupulous lenders.

Although the measures imposed on financial institutions and mortgage lenders have eradicated most of the unsavory characteristics from the banking, lending, and investment industries, it has also been a major impediment to people obtaining mortgage loans.

Many individuals, such as self-employed persons, have been totally excluded as potential house buyers because of this legislation.

Over the last few years, there has been a lot of new legislation and regulation surrounding mortgages, resulting in significant changes to the industry.

To succeed as a loan officer, you must know how to navigate these rules and regulations while meeting customer expectations.

With so many restrictions in place, it is more important than ever that you can clearly explain the mortgage process to potential borrowers.

How to Choose the Right Employer and Environment

The company you work for will significantly influence your success and earnings. It is critical to thoroughly investigate a lender’s history, ability to deliver loans on time, product choice, and pricing before signing up with one.

It would also be beneficial to discover how much the top loan executives at the firm get paid; this will let you know your potential income limitations.

- Is the company reputable?

- How well do they keep to their loan timelines?

- What loan products do they specialize in?

- What is the loan officers’ average tenure at the company?

- What is the average income of successful loan officers in recent years?

Examine the Company’s Credibility

- Speak with your real estate, title, and mortgage professionals in the business.

- Is the firm well-regarded in the industry?

- Are they known for offering excellent customer service and closing loans promptly?

- Is the company easy for consumers to work with?

- What services or items do they provide?

- Do they offer competitive rates?

- What are the systems for processing, underwriting, and closing?

If it is a new firm, look into the owner and executives’ track records to learn more about their past accomplishments and failures.

Have you worked with any of the company’s employees in the past? Is there any way to determine how much financial backing the firm has?

Even though it is a start-up firm, it may have significant assets and be run by competent individuals. Try to gather as much information as possible before rejecting an opportunity when deciding on a new business.

Is the company familiar with your niche? Have you refined a specific mortgage program? Does your target audience know you as a specialized mortgage lender?

Ask for opinions if you are unsure which mortgage broker or lender to go with. If you know someone who already works with the company, they can tell you what they like and do not like about it.

- Do they seem content or unhappy?

- Do employees enjoy working at the company?

- Is it a welcoming and adaptable workplace?

- What job opportunity are you presented with (loan officer, branch manager, sales manager, or trainer)?

- Does this opportunity fit well with where you want to be in your career?

- Is there a chance for advancement?

- Is the pay worth the risk?

When considering taking on a new job, especially with a smaller or start-up firm, it is critical to do your homework and gather as much information as possible.

When weighing new employment possibilities, the risk, return, and experience value are all crucial elements to consider.

Guidelines for Product Knowledge

A loan officer’s success depends on sales ability and knowledge of loan products and guidelines. The more knowledgeable the loan officer is, the better they will be able to meet individual client’s needs by matching them with the right type of mortgage.

There are four main types of mortgage loans, each with different requirements regarding employment history, credit history, debt ratio , assets, and property standards.

Loan officers who understand these underwriting differences will be best equipped to determine which type of mortgage suits their clients.

There are four primary types of loans: conventional, Federal Housing Administration (FHA) , United States Department of Veterans Affairs (VA), and United States Department of Agriculture (USDA-RHS). Major differences between these loan types are described below.

Conventional Mortgage

Conventional loans are guaranteed by the government-sponsored entities Fannie Mae and Freddie Mac, which set maximum mortgage amounts, property standards, credit requirements, debt-to-income ratios, and down-payment minimums.

The current single-family conforming mortgage limit is $766,550. Conventional mortgages come in three forms: fixed, variable, and balloon. Mortgage-backed securities are frequently created from this loan type when bundled with other conventional loans.

FHA Mortgage

HUD manages FHA loans, which only require a 3.5% down payment as a gift from relatives or through eligible sources of aid. The credit qualifications for this type of loan are more straightforward to meet than most other loans.

Additionally, this loan has specific guidelines that do not exist with others and makes it accessible to those with past bankruptcies or foreclosures, income from renting property, child support /alimony payments, etc.

The largest amount you can get a mortgage for depends on the state and county you live in. FHA loans provide up to $498,257 for a single-family home in many areas.

In addition, FHA offers rehabilitation loans that give money for repairs or improvements that can be added to your mortgage.

VA Mortgage

The VA loan is backed by the United States Department of Veterans Affairs. This type of loan is only available to veterans or service personnel who want loans at favorable rates and terms with no down payment or mortgage insurance requirement.

The VA does not lend money directly to consumers; instead, it merely promises that if a veteran defaults, the lender will be reimbursed 25% of the mortgaged amount. In most areas, the maximum mortgage amount is usually $766,550.

With this loan type, underwriting standards are more relaxed than conventional loans—allowing for lower credit scores, only one debt ratio to be considered, and typically no reserves required from the borrower.

To qualify for a VA Loan, you must have served as active-duty personnel, reservist, or National Guard member with an honorable discharge. Senior surviving spouses may also be eligible if they meet specific conditions.

USDA/RHS Mortgage

The USDA provides a guarantee for rural housing loans. This loan requires no down payment and has a monthly maintenance fee comparable to private mortgage insurance. This loan is only accessible in specific rural regions.