To read this content please select one of the options below:

Please note you do not have access to teaching notes, financial reporting quality during a crisis: a systematic review.

Journal of Accounting Literature

ISSN : 0737-4607

Article publication date: 18 October 2022

Issue publication date: 20 October 2022

This paper presents a systematic literature review, including content and bibliometric analyses, of the impact of a crisis on financial reporting quality. In addition, this review identifies emerging research themes and provides future directions.

Design/methodology/approach

The adopted systematic literature review approach finds 29 highly cited articles on the effect of a crisis on financial reporting quality, with an additional seven studies for analysis identified in a review of emerging literature.

This study consolidates prior research findings on financial reporting quality during a crisis under four major themes: (1) earnings quality and its determinants; (2) audit quality around a crisis; (3) conservatism, valuation effects and corporate governance; and (4) financial stability and regulations. Mixed and inconclusive findings are documented for most themes, suggesting that this literature is still in its infancy and that room exists for further theoretical refinement.

Practical implications

The study's findings potentially have important ramifications for managers, standard setters, government regulators and policymakers. By highlighting examples of changes in firms' reporting practices during a crisis, the study provides a context in which to understand the influence or potential influence of the current coronavirus (COVID-19) pandemic on firms' financial reporting practices.

Originality/value

To the best of the author's knowledge, this is the first study to systematically review and synthesise prior research findings on the quality of financial reporting during economic crises. The study identifies many unexplored research areas regarding crises, with possible direct implications for financial reporting practices. The impact of these issues needs to be carefully considered and understood, with the current coronavirus pandemic demonstrating that firms have the opportunity to compromise ethical aspects of their decisions as they experience pressure to maximise profits.

- Accounting quality

- Reporting quality

- Bibliographic analysis

Saha, A. (2022), "Financial reporting quality during a crisis: a systematic review", Journal of Accounting Literature , Vol. 44 No. 2/3, pp. 154-176. https://doi.org/10.1108/JAL-01-2022-0013

Emerald Publishing Limited

Copyright © 2022, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Financial reporting quality of financial institutions: Literature review

- Author & abstract

- Related works & more

Corrections

- Ahmed Mahdi Sahi

- Alaa Mahdi Sahi

- Alhamzah F. Abbas

- Saleh F. A. Khatib

Suggested Citation

Download full text from publisher.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Financial Reporting Quality: A Literature Review

2017, International Journal of Business Management and Commerce

The purpose of this paper is to review current articles and research papers with regard to influences on and measures of the quality of financial reporting. The paper also examines some findings and some gaps in the existing literature. The Design/Methodology/Approach: This paper reviews existing literature from some accounting journals, official accounting associations, and published papers from the period 2009 to 2015. Research Findings This research recognized some instances of insufficient information and some gaps in the existing literature. For example, the size of some study samples is not big enough to draw reasonable conclusions. Research limitations/Implications: It identifies some gaps in the current literature and calls for additional research. Further, the paper offers some object lessons, and exposes the reader to different aspects of financial reporting quality. NOTE: I am currently working for this copywriting company: http://sablecontent.com/. If you have any question about this upload or help with similar types of papers, feel free to reach out.

Related Papers

IAEME Publication

This study examined the adequacy of financial reports with the objective of determining if there exist significant differences in four proxies of financial reporting quality: earnings, conservatism; accruals and average financial reporting quality before and after the adoption of IFRS in Nigeria. Data were sourced from the published audited financial statements and accounts of firms quoted on the Nigeria Stock Exchange (NSE). Although there exist twelve (12) industrial classifications on the NSE only ten (10) sectors were purposively sampled for twelve (12) years (2006-2017). Due to the choice of variables adapted, the financial services industry was not withdrawn. Again, there are no firms recorded under the Utility sector. The study employed the parametric statistical pooled variance/ paired sample t-test model structured in a way to enhance a significant test between the pre-and post-IFRS periods. The study reveals that there are significant differences in the degree of accounting conservatism of quoted Nigerian firms after the adoption of IFRS in 2012. Further findings reveal that there are no significant differences in the degrees of earnings quality, accrual quality and the aggregate financial reporting quality of quoted Nigerian firms after the adoption of IFRS in 2012. Based on the findings from the study, recommendations include that firms should eliminate the incentives to carry out unethical practices which can only occur in the short term since in the long term the market penalizes those manipulative companies. Firms in Nigeria are enjoined to adopt complete accounting conservatism as this approach tends to reduce risks such as litigations.

Journal of Accounting and Financial Management

Hope Osayantin AIFUWA

The past corporate accounting scandals have left the accounting profession in doubts of its integrity and relevance. Against this backdrop, we investigated the impact of board characteristics on financial reporting quality of listed manufacturing firms. The study was driven by the positivist research philosophy and a deductive research approach using a multi- method quantitative research design. Descriptive and inferential statistics were employed to summarize the data and to draw inference on the population studied. The study used the Generalized Linear Model Regression in testing the hypotheses stated. We found out that board expertise was statistically significant and positively related to financial reporting quality at 5% level of significance, while board independence and board diversity was found to be insignificantly related to financial reporting quality at 5% level of significance. The study concluded that board characteristics partially affect financial reporting quality. Hence, we recommended that non-executive directors on the board should be reduced to cut excessive management cost.

raed kanakriyah

This study aims to understand the nature impact of earnings management practice on the quality of accounting information in Jordan.The study used the quantitative technique to gather the data by using a questionnaire to understand the users' attitudes about earnings management practice in Jordan and how this practice influences the quality of accounting information. To discover this issue, the researcher documented several criteria to identify the concept of "earning management'' and define the variables to measure it. The study states that all accounting information users believe that the earnings management practice is used by some companies in Jordan. They stated how the practice affects the quality of accounting information by detecting a significant effect of earnings management, which in turn has an impact on users' decisions, such as investors, financial analysts, and creditors. In addition, the study's outcome specified that earnings management has an important influence on accounting information quality. Most companies resort to using earnings management techniques to meet shareholders' wants, financial analysts' expectations for the company's performance, or management's desire to increase the net income which in turn increases the rewards they receive or to achieve their personal interests that resulted from agency problems. Finally, earnings management is considered a form of accounting manipulation practiced without breaching laws and standards.The consequences of the current study help users of financial reports, such as managers and investors, detect an effect of earning management on users' decision making.It is believed that there is no Jordanian study to date examining the impact of earnings management on the quality of accounting information. Therefore, this study significantly contributes to the limited literature on the exploitation of the earnings management concept to influence the quality of accounting information in developing countries.The difficulty with using a questionnaire in developing countries, such as Jordan, also there are a number of users who do not care about the results of the study Keywords: Earnings management, real activity manipulation, accrual manipulation, consequences of earnings management, quality of accounting information, reasons for earnings management applications.

Arshad Bhatti

Business & Economic Review , Arshad Bhatti

The existing literature concerning governance-value relationship is inconclusive as it assumes that the association is direct. A theoretical argument suggests that the effective corporate governance reduces the information asymmetry through better financial reporting quality. This serves as a tool to reduce this information risk. Following the argument, our study is an attempt to investigate the mediating role of earnings quality, a measure of financial reporting quality, in governance-value association. For estimation, we use a panel data of 214 non-financial listed firms in Pakistan for the period 2003-2014 and employ one-way random effect estimator for the SUR system, as suggested by Biørn (2004). Our findings show that the corporate governance effectively improves the earnings quality and value of the firm, which approves the monitoring role. Moreover, earnings quality contributes positively in maximizing the value of the firm and the results demonstrate that better earnings quality partially mediates the governance-value association. It is concluded that corporate governance not only improves the value of the firm directly, but also indirectly through the channel of earnings quality.

Asian Journal of research in Business, Economics and Management

Marziyeh Shariati

Abstract Ranking firms solely based on financial ratios does not capture managements' biased behavior in preparing financial information. The goal of this study is to introduce a model for firms' financial reporting quality. the aim of the study is ranking firms based on managements' biased (Opportunistic & Conservatism) behavior (i.e. Earnings management based on accruals, Real Earnings management, Earnings smoothing, Unconditional Conservatism, Conditional Conservatism) and investigating its' relation to information asymmetry. To this aim FAHP-Shannon Entropy-TOPSIS have been used. 13 scholars of accounting have answered the FAHP questionnaire and 23 firms in the Pharmaceutical industry of Tehran Stock Exchange Market have been studied for the years 1390- 1396 (138) observations. Regression analysis has been used to calculate biased criteria. The results indicate Earnings smoothing is the most biased behavior in relation to information asymmetry based on scholars' opinion and Shannon Entropy. The results show the least biased financial statements are the ones of Zagros, the most biased financial statements are the ones of Eksir Darou. However, TOPSIS scores of managements' behavior has no relation with information asymmetry.

Buhari Abubakar

One of the board of directors’ responsibilities is to monitor the quality of information disclosed in financial reports. The board’s structural and compositional characteristics can affect the quality of reported accounting information. The study therefore examined the impact of Board characteristics on Financial Reporting Quality of listed Consumer goods firms in Nigeria. Board characteristics was proxied by board size, board composition, board meetings and board equity. While control variables was proxied by firm size and firm age. The study covers the period of five years i.e. 2014 to 2018. Data for the study were extracted from the firm’s annual reports and accounts. Frances et al. (2005) model was used in extracting the discretionary accruals of the eight sampled firms out of the nine companies that served as the population of the study. A multiple regression was employed to test the model of the study using OLS regression technique. After running the OLS regression, a robustness test was conducted for validity of statistical inferences, the data was empirically tested. The results from the analysis revealed a positive significant relationship between board composition, board meetings and financial reporting quality of listed food products companies in Nigeria. Board size had a positive and insignificant relationship with financial reporting quality, while board equity is negatively but significantly related to financial reporting quality of consumer goods firms in Nigeria. The study concluded that, the higher number of independent (nonexecutive) directors on the board is an important monitoring and control device. In addition, the quality of financial report of consumer goods firms can be enhanced through frequent meetings by directors of the company for a given accounting year. The study therefore recommended that owners of these consumer goods firms should ensure greater number of outside directors on the board of directors.

Dr. Aminu Abdullahi

___________________________________________________________________ This paper conceptually review the various models employed by previous studies in the measurement of reporting quality following the adoption of International Financial Reporting Standards (IFRS) around the world. In the review, attention is paid to the nature, appropriateness and limitations of each of the models identified. It was found that, the methodologies used in studying the relationship and impact of IFRS on reporting quality are classified into qualitative, quantitative and firm-specific attributes models on one hand, and direct and indirect models on the other hand. Finally, the study calls on researchers to be wary, by selecting appropriate method that commensurates with the objectives of their studies, and their ability to adequately mitigate the limitation of the model highlighted in the review.

IJAR Indexing

Financial reporting quality (FRQ) refers to better information dissemination across different user groups. It remains a prevalent phenomenon for assessing organizations? performance and survival. Drawing on theoretical exigencies, this study tests the effects of political influence on FRQ using survey research approach and self-administered questionnaire. Data were gathered from 118 directors of finance representing local governments from four States at the north-west geopolitical zone of Nigeria. The regression estimate revealed a significant positive relation between political influence and FRQ. The study implication was discussed in the context of Nigeria.

RELATED PAPERS

Stuart Locke

EPRA International Journal of Multidisciplinary Research

Haseeb Ur Rahman

Hon Ahmed Babatunde

rahimah mohamed yunos

Ijaems Journal

International Journal of Management Science Research

Dr. Dagwom Dang

ASIAN JOURNAL OF BUSINESS AND ACCOUNTING (AJBA)

Research in Accounting Regulation

محمد عمر حمودي

Prof. Shehu Usman Hassan

Journal of Modern Accounting and Auditing David Publishing

Jerry D kwarbai

International Journal of Accounting and Financial Reporting

Deaa Sraheen

Grace O Ogundajo

Asia-Pacifc Management Accounting Journal

Mohammed Mahdi Obaid

Koon Boon Kee

SSRN Electronic Journal

Ying-Chou Lin

hassan abdulhadi

Global Journal of Computer Sciences: Theory and Research

International Journal of Economics and Business Administration

Mohammed Ibrahim

Working Papers

Johan R Christiaens

Mohammed Kasbar

Relationship between Modified Audit Opinion, Earnings Management and Auditor Size: evidence from Brazil

Roberto Tommasetti

Veronica Paz

thuy ngo dieu

Publishing India Group , hasan zalaghi

THINK INDIA (Quarterly Journal)

Shashank Jain

Ichsan Gaffar

Asian Journal of Accounting Research

Suneel Maheshwari , Veronica Paz

Advances in Accounting

ahsan habib

Advances in International Accounting

Md. Ahsan Habib

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Does automation improve financial reporting? Evidence from internal controls

- Published: 23 April 2024

Cite this article

- Musaib Ashraf ORCID: orcid.org/0000-0002-6935-2480 1

Automation—such as machine learning, robotic process automation, and artificial intelligence—is the next major technological leap in accounting and financial reporting, and I empirically study whether public firms’ use of automation technology improves their financial reporting, specifically focusing on the internal control environment. I document two critical inferences. First, I find evidence which suggests that automation improves financial reporting quality. Specifically, firms’ use of automation in the financial reporting process is associated with a reduction in internal control material weaknesses. This association is consistent in a levels analysis with firm and year fixed effects, in a changes analysis, and in a propensity score matched difference-in-differences analysis. Second, I find evidence which suggests that monitoring of the financial reporting process decreases after automation, likely because of a perception that automation reduces the need for monitoring vis-à-vis stronger internal controls. Specifically, automation is associated with higher external audit fees and audit committee meetings in the initial years after a firm implements automation but associated with lower external audit fees and audit committee meetings in subsequent years. I also find evidence which suggests that this decreased monitoring may be costly: when internal control failures do happen for firms with automation, the failures are more material, as proxied by stronger negative market reactions. In aggregate, my evidence provides nuanced insights regarding whether automation technology improves financial reporting.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Artificial intelligence and machine learning are relatively more sophisticated forms of automation in which the software has (at least some) built-in ability to make decisions, whereas robotic process automation is relatively less sophisticated where software repeats the tasks it is programmed to do but with no decision-making (Deloitte 2017 ).

The complexity also varies depending on the type of automation technology. For example, artificial intelligence and machine learning depend on models that must be trained on and learn from data, while robotic process automation is rules-based and completes repetitive tasks with little to no training or learning from data. Thus, the source of risk for artificial intelligence and machine learning stems from training on or learning from poor quality or unapplicable data whereas the source of risk for robotic process automation stems from being confined to pre-defined rules that are unable to adapt to potentially changing scenarios.

Concurrent work by Awyong et al. ( 2022 ) finds that firms’ digitalization improves financial reporting quality. However, like other manuscripts, Awyong et al. ( 2022 ) study the effect of job postings that require candidates to have digital skills, whereas I study the effect of implemented automation. Aside from being different empirical proxies, conceptually digitalization (which is related to information technology more generally) is a different construct than automation (which tends to focus on specifically on technologies like machine learning, artificial intelligence, and robotic process automation). Awyong et al. ( 2022 ) also do not document the same nuanced implications that I do (i.e., stronger overall financial reporting but decreased oversight).

According to SEC ( 2008 , p.19), “a company must disclose any change in its internal control over financial reporting that occurred during the fiscal quarter covered by the quarterly report, or the last fiscal quarter in the case of an annual report, that has materially affected, or is reasonably likely to materially affect, the company's internal control over financial reporting.”.

CALCBENCH is a data aggregator that extracts data directly from SEC filings (Hoitash and Hoitash 2018 ). CALCBENCH is similar to traditional data sources such as Compustat, except CALCBENCH extracts more than just financial statements from SEC filings. Specifically relevant to my research design, CALCBENCH gathers and allows textual analysis on the individual sections of 10-K and 10-Q filings – such as the Controls and Procedures section (Calcbench 2023 ).

Chen and Srinivasan ( 2023 ) search for seven types of words in their analyses: analytics-related, automation-related, artificial intelligence-related, big data-related, cloud-related, digitization-related, and machine learning-related (see their Appendix A). Given that my construct of interest is automation (which tends to focus specifically on things like machine learning, artificial intelligence, and robotic process automation) and not Chen and Srinivasan’s ( 2023 ) construct of digitalization (which is related to information technology more generally), I focus on their words that are related to automation, artificial intelligence, and machine learning.

It is possible that some firms introduce accounting automation that they do not discuss in the Controls and Procedures section. However, firms are required to disclose material changes to their financial reporting process in this section of 10-K and 10-Q filings (SEC 2008 ), filings that the CEO and CFO personally attest to the validity of. Consequently, any automation that a firm has introduced but has not disclosed in the Controls and Procedures section is likely to be not material. Empirically, this noise in my test variable should not bias toward statistical significance.

I employ a linear probability model, instead of a logistic regression, because of the incidental parameters problem that can arise from complex fixed effect structures in nonlinear models (Greene 2004 ) and because interactions can be difficult to interpret in nonlinear models (Ai and Norton 2003 ). Results are consistent in an analogous fixed effects logistic regression (see Table OA.2 in the online appendix).

My sample begins in 2009 because CALCBENCH coverage starts in 2008 and I require at least one prior period to calculate my test variable.

I calculate economic significance by re-estimating Eq. ( 1 ) in an analogous fixed effects logistic regression and then calculating the odds ratio for the coefficient on AUTOMATION (odds ratio = 0.3820) (see Table OA.2 in the online appendix).

TREAT equals one if firm i is part of the treatment group and zero if firm i is part of the control group. POST equals one if year t is after the year that firm i is treated (for treatment observations) or after the year that firm i ’s matched treatment firm is treated (for control observations) (zero otherwise).

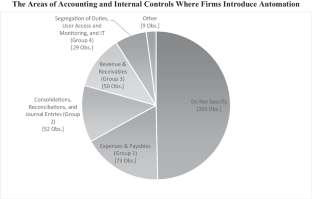

AUTOMATION_GROUP_1 equals one when AUTOMATION equals one but only for observations that introduced automation into the {expenses & payables} area of accounting; equals zero when AUTOMATION equals zero; and all other observations are discarded. AUTOMATION_GROUP_2 , AUTOMATION_GROUP_3 , and AUTOMATION_GROUP_4 are calculated similarly except for the {consolidations, reconciliations, and journal entries}, {revenue & receivables}, and {segregation of duties, user access and monitoring, and IT} areas of accounting, respectively. AUTOMATION_GROUP_1&2&3&4 equals one when either of AUTOMATION_GROUP_1 , AUTOMATION_GROUP_2 , AUTOMATION_GROUP_3 , or AUTOMATION_GROUP_4 equals one; equals zero when AUTOMATION equals zero; and all other observations are discarded.

MATERIAL_WEAKNESS_GROUP_1 equals one when MATERIAL_WEAKNESS equals one but only for observations that Audit Analytics categorizes as {code 29 [expense recording (payroll, SG&A) issues], code 14 [capitalization of expenditures issues], code 32 [inventory, vendor and cost of sales issues], code 27 [deferred, stock-based or executive comp issues], code 33 [liabilities, payables, reserves and accrual estimation failure issues], code 80 [pension and other post-retirement benefit issues], or code 41 [tax expense/benefit/deferral/other (FAS 109) issues]}; equals zero when MATERIAL_WEAKNESS equals zero; and all other observations are discarded. MATERIAL_WEAKNESS_GROUP_2 , MATERIAL_WEAKNESS_GROUP_3 , and MATERIAL_WEAKNESS_GROUP_4 are calculated similarly except for observations that Audit Analytics categorizes as {code 76 [journal entry control issues], code 24 [consolidation, (Fin46r/Off BS) & foreign currency translation issues], code 8 [intercompany/investment w/ subsidiary/affiliate issues], code 12 [untimely or inadequate account reconciliations], or code 38 [foreign, related party, affiliated and/or subsid issues]}, {code 39 [revenue recognition issues] or code 15 [accounts/loans receivable, investments & cash issues]}, and {code 42 [segregations of duties/design of controls issue] or code 22 [information technology, software, security & access issue]}, respectively. MATERIAL_WEAKNESS_GROUP_1&2&3&4 equals one when either of MATERIAL_WEAKNESS_GROUP_1 , MATERIAL_WEAKNESS_GROUP_2 , MATERIAL_WEAKNESS_GROUP_3 , or MATERIAL_WEAKNESS_GROUP_4 equals one; equals zero when MATERIAL_WEAKNESS equals zero; and all other observations are discarded.

The sample size varies between columns in Table 5 because in each column I exclude (i) observations that automated but did not specify the area of accounting that the automation was introduced in, (ii) observations that automated an area of accounting that is different than the focal area being studied, and (ii) observations that have a material weakness but in an area that is other than the focal accounting area being studied. In other words, the zeroes for each test variable are observations that did not introduce automation, and the zeroes for each dependent variable are observations that do not possess any material weaknesses.

I obtain data on audit committee meetings from Ashraf, Deore, and Krishnan ( 2024) , who programmatically extract data on audit committee meetings from firms’ proxy statement filings (firms are required to make such disclosures, see 17 CFR §229.407(b)). The sample size in Table 7 is relatively smaller than other analyses due to the fact that the audit committee meetings data is unstructured in proxy filings and therefore it is not possible to programmatically extract meetings data from every proxy filing. Observations with missing data on AC_MEETINGS are excluded from the analysis.

The ‘main effect’ of YEARS_SINCE_AUTOMATION is omitted from Table 6 and 7 due to collinearity: AUTOMATION*YEARS_SINCE_AUTOMATION and YEARS_SINCE_AUTOMATION are effectively the same variables and therefore both cannot be included in the same regression analysis.

RESTATEMENT_GROUP_1 equals one when RESTATEMENT equals one but only for observations that Audit Analytics categorizes as {code 7 [expense (payroll, SGA, other) recording issues], code 12 [liabilities, payables, reserves and accrual estimate failures], code 23 [capitalization of expenditures issues], code 20 [inventory, vendor and/or cost of sales issues], code 17 [deferred, stock-based and/or executive comp issues], code 48 [deferred, stock-based options backdating only], code 39 [deferred, stock-based SFAS 123 only], code 69 [pension and other post-retirement benefit issues], or code 18 [tax expense/benefit/deferral/other (FAS 109) issues]}; equals zero when RESTATEMENT equals zero; and all other observations are discarded. RESTATEMENT_GROUP_2 and RESTATEMENT_GROUP_3 are calculated similarly except for observations that Audit Analytics categorizes as {code 13 [consolidation issues incl Fin 46 variable interest & off-B/S], code 37 [consolidation, foreign currency/inflation issue], code 24 [intercompany, investment in subs./affiliate issues], code 43 [intercompany, only—accounting issues], code 11 [foreign, related party, affiliated, or subsidiary issues], or code 44 [foreign, subsidiary only issues]} and {code 6 [revenue recognition issues] or code 14 [accounts/loans receivable, investments & cash issues]}, respectively. RESTATEMENT_GROUP_1&2&3 equals one when either of RESTATEMENT_GROUP_1 , RESTATEMENT_GROUP_2 , or RESTATEMENT_GROUP_3 ; equals zero when RESTATEMENT equals zero; and all other observations are discarded. I do not conduct any analysis of AUTOMATION_GROUP_4 for restatements because there are no analogous restatement categories.

Following the advice of extant literature (e.g., Chan, Chen, Chen, and Yu 2012 ; Jha and Chen 2015 ; Ashraf et al. 2020 ), the control variables in Table 12 are based on DeFond and Zhang’s ( 2014 ) audit fees model.

Ai, C., and E.C. Norton. 2003. Interaction terms in logit and probit models. Economics Letters 80 (1): 123–129. https://doi.org/10.1016/S0165-1765(03)00032-6 .

Article Google Scholar

Altman, E. I. (1983). Corporate Financial Distress: A Complete Guide to Predicting, Avoiding, and Dealing with Bankruptcy (1st ed.). John Wiley and Sons.

American Institute of Certified Public Accountants (AICPA). (2020). Why CPAs should care about RPA. https://blog.aicpa.org/2020/08/why-cpas-should-care-about-rpa.html

Ashbaugh-Skaife, H., D.W. Collins, and W.R. Kinney. 2007. The discovery and reporting of internal control deficiencies prior to SOX-mandated audits. Journal of Accounting and Economics 44 (1–2): 166–192. https://doi.org/10.1016/j.jacceco.2006.10.001 .

Ashraf, M. 2022. The Role of Peer Events in Corporate Governance: Evidence from Data Breaches. The Accounting Review 97 (2): 1–24. https://doi.org/10.2308/TAR-2019-1033 .

Ashraf, M., P.N. Michas, and D. Russomanno. 2020. The Impact of Audit Committee Information Technology Expertise on the Reliability and Timeliness of Financial Reporting. The Accounting Review 95 (5): 23–56. https://doi.org/10.2308/accr-52622 .

Ashraf, M., Deore, A., and Krishnan, R. (2024). The Role of Identity in Corporate Governance: Evidence from Gender Differences in the Audit Committee Chair-Chief Financial Officer Dyad. Working Paper .

Association of Chartered Certified Accountants. (2015). The robots are coming? Implications for finance shared services. https://www.accaglobal.com/content/dam/ACCA_Global/Technical/fin/ea-robots-finance-shared-services-0909.pdf

Awyong, A., Cheng, Q., Deng, T., & Wang, R. (2022). Awyong et al. - 2022 - Digitalization, Accounting Jobs, and Financial Reporting Quality.pdf. Working Paper . https://abfer.org/component/edocman/main-annual-conference/digitalization-accounting-jobs-and-financial-reporting-quality?Itemid =

Badolato, P.G., D.C. Donelson, and M. Ege. 2014. Audit committee financial expertise and earnings management: The role of status. Journal of Accounting and Economics 58 (2–3): 208–230. https://doi.org/10.1016/j.jacceco.2014.08.006 .

BlackLine. (2017). BlackLine The Unified Cloud for Finance and Accounting Automation. https://www.blackline.com/

Blue Lance. (2012). Sarbanes-Oxley Control Transformation Through Automation. https://bluelance.com/wp-content/uploads/2015/02/SOX_ControlTransformation.pdf

Calcbench. (2023). Interactive Disclosures & Footnotes. https://www.calcbench.com/home/InteractiveDisclosures

Chan, L.H., K.C.W. Chen, T.-Y. Chen, and Y. Yu. 2012. The effects of firm-initiated clawback provisions on earnings quality and auditor behavior. Journal of Accounting and Economics 54 (2–3): 180–196. https://doi.org/10.1016/j.jacceco.2012.05.001 .

Chen, W., and S. Srinivasan. 2023. Going digital: Implications for firm value and performance. Review of Accounting Studies . https://doi.org/10.1007/s11142-023-09753-0 .

Choudhary, P., Ramadas, V., and Sigler, J. (2023). The Implications of IT Sophistication on Audit Effort and Effectiveness. Working Paper .

Commerford, B.P., S.A. Dennis, J.R. Joe, and J.W. Ulla. 2022. Man Versus Machine: Complex Estimates and Auditor Reliance on Artificial Intelligence. Journal of Accounting Research 60 (1): 171–201. https://doi.org/10.1111/1475-679X.12407 .

Cooper, L.A., D.K. Holderness, T.L. Sorensen, and D.A. Wood. 2019. Robotic Process Automation in Public Accounting. Accounting Horizons 33 (4): 15–35. https://doi.org/10.2308/acch-52466 .

Cooper, L.A., D.K. Holderness, T.L. Sorensen, and D.A. Wood. 2022. Perceptions of Robotic Process Automation in Big 4 Public Accounting Firms: Do Firm Leaders and Lower-Level Employees Agree? Journal of Emerging Technologies in Accounting 19 (1): 33–51. https://doi.org/10.2308/JETA-2020-085 .

Correia, S. (2015). Singletons, Cluster-Robust Standard Errors and Fixed Effects: A Bad Mix. Working Paper . http://scorreia.com/research/singletons.pdf

Dechow, P., W. Ge, and C. Schrand. 2010. Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50 (2–3): 344–401. https://doi.org/10.1016/j.jacceco.2010.09.001 .

DeFond, M., and J. Zhang. 2014. A review of archival auditing research. Journal of Accounting and Economics 58 (2–3): 275–326. https://doi.org/10.1016/j.jacceco.2014.09.002 .

Deloitte. (2015). Financial Reporting Automation. https://www2.deloitte.com/content/dam/Deloitte/ng/Documents/audit/Financial Reporting/ng-financial-reporting-automation-1.pdf

Deloitte. (2017). Automate this: The business leader’s guide to robotic process automation. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/process-and-operations/us-sdt-process-automation.pdf

Deloitte. (2018a). Internal Controls Over Financial Reporting Considerations for Developing and Implementing Bots. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/audit/us-audit-internal-controls-over-financial-reporting-considerations-for-developing-and-implementing-bots.pdf

Deloitte. (2018b). The Future of IT Internal Controls - Automation A Game Changer. https://www2.deloitte.com/content/dam/Deloitte/in/Documents/risk/in-risk-future-of-it-internal-controls-noexp.pdf

Dorantes, C., C. Li, G.F. Peters, and V.J. Richardson. 2013. The Effect of Enterprise Systems Implementation on the Firm Information Environment. Contemporary Accounting Research 30 (4): 1427–1461. https://doi.org/10.1111/1911-3846.12001 .

Doyle, J., W. Ge, and S. McVay. 2007. Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics 44 (1–2): 193–223. https://doi.org/10.1016/j.jacceco.2006.10.003 .

Ernst & Young (EY). (2020). 2020 SEC annual reports — Form 10-K. https://assets.ey.com/content/dam/ey-sites/ey-com/en_us/topics/assurance/accountinglink/ey-sec11376-201us-12-16-2020v2.pdf

Ernst & Young (EY). (2021). Finance leaders rethink roles and responsibilities as new operating reality sets in. https://www.ey.com/en_gl/news/2021/02/finance-leaders-rethink-roles-and-responsibilities-as-new-operating-reality-sets-in

Fedyk, A., J. Hodson, N. Khimich, and T. Fedyk. 2022. Is artificial intelligence improving the audit process? Review of Accounting Studies 27 (3): 938–985. https://doi.org/10.1007/s11142-022-09697-x .

Financial Accounting Standards Board (FASB). (1980). Statement of Financial Accounting Concepts No. 2. https://www.fasb.org/page/ShowPdf?path=con2.pdf&title=CON%202%20(AS%20ISSUED )

Gartner. (2020). 10 Trends for Finance to Navigate Now. https://www.gartner.com/smarterwithgartner/10-trends-for-finance-to-navigate-now

Greene, W. 2004. The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects. The Econometrics Journal 7 (1): 98–119.

Hoitash, R., and U. Hoitash. 2018. Measuring Accounting Reporting Complexity with XBRL. The Accounting Review 93 (1): 259–287. https://doi.org/10.2308/accr-51762 .

Jha, A., and Y. Chen. 2015. Audit Fees and Social Capital. The Accounting Review 90 (2): 611–639. https://doi.org/10.2308/accr-50878 .

Kim, I., and D.J. Skinner. 2012. Measuring securities litigation risk. Journal of Accounting and Economics 53 (1–2): 290–310. https://doi.org/10.1016/j.jacceco.2011.09.005 .

Kobelsky, K.W., V.J. Richardson, R.E. Smith, and R.W. Zmud. 2008. Determinants and Consequences of Firm Information Technology Budgets. The Accounting Review 83 (4): 957–995.

Lanza, R. B. (2007). Automate Your Internal Controls. Journal of Accountancy . https://www.journalofaccountancy.com/issues/2007/feb/automateyourinternalcontrols.html

Law, K., and Shen, M. (2022). How Does Artificial Intelligence Shape Audit Firms? Working Paper . https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3718343

Masli, A., G.F. Peters, V.J. Richardson, and J.M. Sanchez. 2010. Examining the Potential Benefits of Internal Control Monitoring Technology. The Accounting Review 85 (3): 1001–1034.

McCann, D. (2019). Finance Avoids RPA for Financial Reporting. https://www.cfo.com/financial-reporting-2/2019/10/finance-avoids-rpa-for-financial-reporting/

Plattfaut, R., and V. Borghoff. 2022. Robotic Process Automation: A Literature-Based Research Agenda. Journal of Information Systems 36 (2): 173–191. https://doi.org/10.2308/ISYS-2020-033 .

PricewaterhouseCoopers (PwC). (2019). Re-inventing Internal Controls in the Digital Age. https://www.pwc.com/sg/en/publications/assets/reinventing-internal-controls-in-the-digital-age-201904.pdf

PricewaterhouseCoopers (PwC). (2021). The future of finance: Leveraging automation to deliver undiscovered value. https://www.pwc.com/sg/en/risk-assurance/intelligent-automation-in-financial-reporting.html

Public Company Accounting Oversight Board (PCAOB). (2007). Auditing Standard No. 5 An Audit of Internal Control Over Financial Reporting. http://pcaobus.org/Rules/Rulemaking/Docket 021/2007–06–12_Release_No_2007–005A.pdf

Public Company Accounting Oversight Board (PCAOB). (2020). Data and Technology Research Project Update Spotlight. https://pcaob-assets.azureedge.net/pcaob-dev/docs/default-source/documents/data-technology-project-spotlight.pdf

Public Company Accounting Oversight Board (PCAOB). (2021). Changes in the Use of Data and Technology in the Conduct of Audits. https://pcaobus.org/oversight/standards/research-standard-setting-projects/changes-use-data-technology-conduct-audits

Roose, K. (2021). The Robots Are Coming for Phil in Accounting. The New York Times . https://www.nytimes.com/2021/03/06/business/the-robots-are-coming-for-phil-in-accounting.html

Schoenfeld, J. 2022. Cyber risk and voluntary Service Organization Control (SOC) audits. Review of Accounting Studies . https://doi.org/10.1007/s11142-022-09713-0 .

Securities and Exchange Commission (SEC). (2019). SEC Charges Four Public Companies With Longstanding ICFR Failures. https://www.sec.gov/news/press-release/2019-6

Securities and Exchange Commission (SEC). (2008). Final Rule: Management’s Report on Internal Control Over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports; Rel. No. 33–8238. https://www.sec.gov/rules/final/33-8238.htm

Shipman, J.E., Q.T. Swanquist, and R.L. Whited. 2017. Propensity Score Matching in Accounting Research. The Accounting Review 92 (1): 213–244. https://doi.org/10.2308/accr-51449 .

SolveXia. (2023). SolveXia for Accountants. https://www.solvexia.com/role/solvexia-for-accountants

Vic.ai. (2021). Automate your accounting to save time and money. https://www.vic.ai/

Wang, F. (2022). Accounting Automation: What Is It & Will It Replace Accountants. Tipalti . https://tipalti.com/accounting-automation/

Whitehouse, T. (2019). Automating Keep Controls in Step With Technology. The Wall Street Journal . https://deloitte.wsj.com/articles/automating-keep-controls-in-step-with-technology-01576529105

WNS. (2020). Use Automated Controls the Right Way to Mitigate Process Risks in F&A. https://www.wns.com/insights/articles/articledetail/18/use-automated-controls-the-right-way-to-mitigate-process-risks-in-fna

Download references

Acknowledgements

I thank Lakshmanan Shivakumar (editor), two anonymous reviewers, Preeti Choudhary, Ranjani Krishnan, Adi Masli, Vernon Richardson, Juan Manuel Sanchez, David Wood, and the workshop participants at University of Connecticut for their feedback. I also thank the Eli Broad College of Business at Michigan State University for funding that enabled this study. Any errors are my own.

Author information

Authors and affiliations.

Michigan State University, Business Complex 632 Bogue St Rm N270, East Lansing, MI, 48824, USA

Musaib Ashraf

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Musaib Ashraf .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Supplementary file1 (DOCX 68.2 KB)

See Table 14

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Ashraf, M. Does automation improve financial reporting? Evidence from internal controls. Rev Account Stud (2024). https://doi.org/10.1007/s11142-024-09822-y

Download citation

Accepted : 25 March 2024

Published : 23 April 2024

DOI : https://doi.org/10.1007/s11142-024-09822-y

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Robotic process automation

- Artificial intelligence

- Financial reporting

- Internal controls

- Information technology

JEL classification

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO

COMMENTS

223 James P Brawley Drive. Atlanta GA 30314 SW, USA. Abstract. The purpose of this paper is to review current articles and research papers with regard to influences on and. measures of the quality ...

Literature review. Corporate financial reporting refers to any deliberate release of financial information whether via informal or formal channels, voluntary or required, or in a qualitative or numerical form. ... The majority of studies on financial reporting quality have prioritized non-financial enterprises relative to financial firms (I. E ...

In addition, this review identifies emerging research themes and provides future directions.,The adopted systematic literature review approach finds 29 highly cited articles on the effect of a crisis on financial reporting quality, with an additional seven studies for analysis identified in a review of emerging literature.,This study ...

Business, Economics. Cogent Business & Management. Abstract The objective of this study is to examine and synthesize the existing literature on financial disclosure by financial institutions. It presents a systematic literature review of 204 studies on this topic published from 1990 to 2022. The studies were retrieved from Scopus database.

In addition, this review highlights the gaps in current literature including contradictory results, explores the potential data sources for empirical researchers, and offers guidance for investigating prospective areas for future studies. The study found monitoring attributes to be the key determinants of financial reporting quality.

Downloadable (with restrictions)! The objective of this study is to examine and synthesize the existing literature on financial disclosure by financial institutions. It presents a systematic literature review of 204 studies on this topic published from 1990 to 2022. The studies were retrieved from Scopus database. In addition, this review highlights the gaps in current literature including ...

2 Literature review and hypothesis development. ... Financial reporting quality has been defined as the extent to which the financial statements provide reliable and fair information about underlying economic performance and financial position (Tang et al., Citation 2016). Financial reporting quality is inherently difficult to measure because ...

Abstract. Accounting activities are shown in the financial reports of banks, while the relevant literature has found that creative accounting highly impacts the quality of financial reporting. However, previous studies indicated the limited impacts of creative accounting determinants on the quality of financial reporting, whereas the phenomenon ...

Prior literature defines financial reporting quality as the extent to which financial statements provide information that is useful to investors and creditors in their investment decisions (Schipper, 2003; Schipper & Vincent, 2003). This review summarizes the empirical evidence regarding the effectiveness of derivative regulation in achieving ...

and Quality of Financial Reporting in Emerging Markets: A Structured Literature Review Punita Dhansingh Rajpurohit1 and Parag Rajkumar Rijwani1 Abstract This article is a structured literature review (SLR) on the role of corporate governance (CG) in ensuring/improving the quality of financial reporting (FRQ)

This review contains: Section 1: Elements of Quality; Section 2: Influences of the Quality of Financial Reporting; Section 3: Approaches to Measure and Assess Accounting Quality; and Section 4: Gaps in Existing Literature and Suggestions for Future Research. 1. Elements of Quality According to IASB, the essential principle of assessing the ...

Doing literature review: Releasing the social science research imagination. SAGE Publications. ... Koh K., Rajgopal S., & Srinivasan S. (2013). Non-audit services and financial reporting quality: Evidence from 1978 to 1980. Review of Accounting Studies, 18(1), 1-33. Crossref. Google Scholar. Krishnan G. (2003). Does Big 6 auditor industry ...

The financial crisis of 2008 increased the call for standard setters and financial regulators to review the effectiveness of derivative regulation in improving financial reporting quality. Prior literature defines financial reporting quality as the extent to which financial statements provide information that is useful to investors and ...

We examine the relation between innovation and financial reporting quality (FRQ) and the implications of audit quality for this relation. We first document a negative relation between innovation and FRQ. This result is consistent with greater earnings management at higher innovation firms, likely because of the more opaque information environment that gives managers the opportunity to act ...

An issue that has long plagued the research on voluntary disclosure and financial reporting quality is the appropriate empirical measures for those constructs. Approaches used in the literature include survey rankings, researcher-constructed indices, measures from natural language processing technologies, and properties of the firm's reported ...

The quality of financial reporting determines, and depends upon, the value of accounting reporting. Across the world, the demand has gone out for providing a clear and full definition of financial ...

This article aims to review the literature on corporate governance (CG) in ensuring/improving the quality of financial reporting (FRQ) in emerging markets and identifying avenues for future research. FRQ results from the interaction between the quality of accounting standards and preparers' incentives to supply quality information ( Ball et ...

Creative accounting is considered to be a 21st-century phenomenon that has received increased attention after the worldwide economic crisis and budget deficits, particularly the prevention and detection of accounting manipulation. Creative accounting is a practice that influences financial indicators by using accounting knowledge and rules that do not explicitly violate accounting policies ...

The financial reporting quality was measured with three different proxies. Kothari et al. (Citation 2005) and Gul et al. (Citation 2013) estimated the discretionary accruals and audit aggressiveness, respectively. Companies that reported a profit to beat the earnings benchmark were marked. ... Based on the literature review, this is the ...

Abstract: The objective of this study is to examine and synthesize the existing literature on financial disclosure by financial institutions. It presents a systematic literature review of 204 ...

DOI: 10.3390/risks10040076 Corpus ID: 247948257; Creative Accounting Determinants and Financial Reporting Quality: Systematic Literature Review @article{Abed2022CreativeAD, title={Creative Accounting Determinants and Financial Reporting Quality: Systematic Literature Review}, author={Ibtihal A. Abed and Nazimah Hussin and Mostafa A. Ali and Hossam Haddad and Mr. IZUKWE Raymond and Elina F ...

The purpose of this research; it is examine the relationship between internal auditing and financial reporting quality. In this study, national and international studies investigating the relationship between internal auditing and financial reporting quality were examined in the literature. As a result of the study, it has been determined that it is a positive relationship between the audit ...

Firms are required to disclose material changes to internal control over financial reporting in the Controls and Procedures section of 10-K and 10-Q filings (usually Item 9a in 10-Ks and Item 4 in 10-Qs) (SEC 2008).This disclosure must be made every quarter, even though assessment of the effectiveness of internal control over financial reporting is on an annual basis, and the disclosure ...