- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

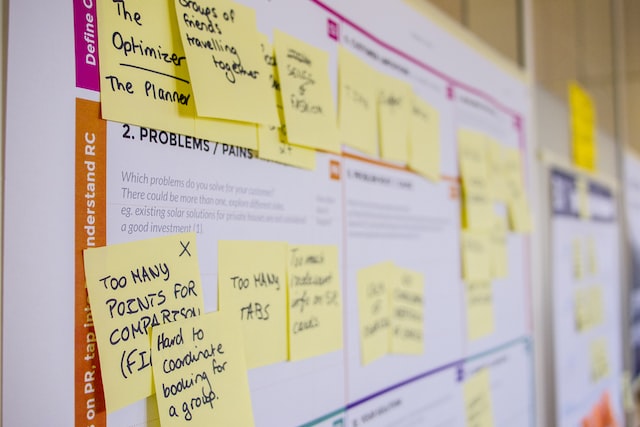

10 Feasibility study and business plan differences you should know

by Naiyer Jawaid | Nov 8, 2021 | Development , Real Estate | 5 comments

Feasibility study and business plan differences are subtle. In this post we will discuss 10 differences will help you to evaluate and differentiate between a feasibility study and a business plan.

Do you know what is a feasibility report? Do you know what is a business plan? Can you easily differentiate between a feasibility report and a business plan?

It’s easy! Just read out through the article and it will all be easy.

Let’s start by learning about a feasibility report:

A feasibility study is a formal document that assist in the identification and investigation of a proposed project. We can identify the project's weaknesses and strengths with the support of a feasibility study report, which saves us time and energy. We can determine whether the suggested idea will be lucrative and practicable in the future.

Before investing in a project, it is critical to determine if the project will be beneficial in the long run. The organization also needs to know how much the project will cost. Overall, a feasibility analysis indicates whether the firm should invest or continue with the project.

You should also like to read When to do feasibility study?

Now let us learn about business plan:

A business plan is a formal document that contains the goals/ objective of the business, the time in which the goal will be completed and the strategies that can be adopted to reach the specific goal.

A business plan is a necessary document for every new firm to have in place before it can begin operations. Writing a credible business plan is typically a requirement for banks and venture capital companies before contemplating granting funding to new enterprises.

It is not a smart idea to operate without a business strategy. In fact, very few businesses can survive for long without one. There are many more advantages to developing and keeping to a strong business plan, such as the ability to think through ideas without investing too much money and, eventually, losing money. Business plans are used by start-ups to get off the ground and attract outside investors.

A feasibility study is used to assess if a business or a concept is viable. After the business opportunity has been identified, the business strategy is produced. “A feasibility study is carried out with the goal of determining the workability and profitability of a company venture. A feasibility study is conducted before any money is committed in a new business endeavour to see whether it is worth the time, effort, and resources.

Similarities between a Feasibility study and a business plan

It's essential to analyse the similarities between a feasibility study and a business plan because they're both implemented altogether in same ways to help you build a lucrative company. The following are some of the similarities between the two documents:

Time: Both the reports are completed before the business begins and can be repeated afterwards to decide the next stages for new concepts.

Input: Both Feasibility report and the Business plan include input from a variety of people or departments with a variety of talents.

Format: Both report formats incorporate other documents that are gathered in order to create the report.

Components: Examining the target market, market circumstances, and financial expenses are some of the topics examined.

Use: Both may be displayed to potential investors and can assist the organization's management in making choices.

Organizations uses a business plan and a feasibility study as analytical and decision-making tools.

Although the three tools can be used in conjunction with one another in decision-making processes, they each have their own strengths and weaknesses, and they appear to target and address separate processes.

You might also like to read How to write a feasibility study report?

Now let us evaluate the difference between feasibility report and a business report-

- A feasibility study is conducted to determine the viability and profitability of a business endeavour. A feasibility study is conducted before any money is committed in a new business endeavour to see whether it is worth the time, effort, and resources.

A business plan, on the other hand, is created only when it has been determined that a business opportunity exists and that the endeavour is about to begin.

- A feasibility report is the first step and after that a business plan is made to be implemented, without feasibility report a business plan cannot be made.

- A feasibility study contains computations, research, and projected financial forecasts for a company possibility. A business plan, on the other hand, is mostly comprised of tactics and strategies to be applied to establish and expand the company.

- A feasibility study is concerned with the viability of a business concept, but a business plan is concerned with the development and sustainability of a company.

- A feasibility report informs the entrepreneur about the profit potential of a company concept or opportunity, whereas a business plan assists the entrepreneur in raising the necessary start-up cash from investors.

- Key components of a feasibility study and a business plan

- A business plan does not include the description of the sales methods used, such as distribution agreements, strategic alliances, and the amount of involvement with partners, as well as the payment terms, warranties, and other customer support.

But a feasibility report includes all the sales methods, strategies, alliances to payment and customer support.

- Feasibility report contains:

- Assists in cost estimation, describe the production site, required inputs, and sourcing region.

- Physical description of the factory, including machine, capacity, warehouse, and supply chain, is necessary.

- Indicate if the area used for production is rented or owned. This will have an impact on the financial forecast.

- Information regarding the manufacturer's capacity, order details, price, and so on, if manufacturing is outsourced. To aid in cost estimation, describe the production site, needed inputs, and sourcing location.

- A physical description of the factory, including machine, capacity, warehouse, and supply chain, is necessary.

But a business plan does not contain anything related to production and operations, but a business plan contains all the information related to management.

- A poorly written business plan – poor projections, strategies, analysis, business model, and environmental factors, among other things – can be easily adjusted during business operations, but this cannot be said of a feasibility study because an incorrect conclusion in a feasibility study can be costly — it could mean launching a venture with little chance of survival or approving a proposal that wastes the company's human and financial resources.

- A business plan presume that a company will prosper and lays out the procedures needed to get there. Those in charge of conducting a feasibility study should not have any predetermined notions regarding the likelihood of success. They must maintain as much objectivity as possible. They do research and allow the facts to lead to the study's conclusion. If the study concludes that the idea is viable, some of the findings, such as market size predictions, may be incorporated in the company's business plan.

You should also read What is land development feasibility study?

These 10 differences will help you to evaluate and differentiate between a feasibility study and a business plan.

Feasibility study may appear to be like the business plan in many respects. "A feasibility study may easily be transformed to a business plan” but it is crucial to remember that the feasibility study is completed prior to the endeavor. The business plan should be thought of in terms of growth and sustainability, whereas the feasibility study should be thought of in terms of concept viability.

This is all you need to know and understand about feasibility study and business plan.

Get ready to apply your knowledge in the real words with lots of success.

You might also like to explore below external contents on feasibility study :

- What Is a Feasibility Study? – Types & Benefits

- Best 8 Property Management Software

- FEASIBILITY STUDIES & BUSINESS PLANS

Hope you enjoyed this post on feasibility study , let me know what you think in the comment section below.

Are you someone involved with real estate feasibility?

We are excited to launch the next generation of real estate feasibility software to help you manage your development projects with ease.

Register now for a free trail license!

This is a very good piece of writing. When you have a concept for a company but want to be sure it’s a good idea, you do a feasibility study.

It was very helpful. Thank you so much!

Appropriately timed! A company’s future operations are laid out in great detail in the company’s business plan. Once you’ve done your feasibility study, you’ll know whether or not the proposal has merit. The next step is to lay out your goals, whether financial and otherwise, as well as the strategies you want to use to attain them and the organisational structure you envision.

Prior to the company opening, both are undertaken, and may be repeated again in the future to identify the next steps on new ideas that may arise.

Great Content.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Follow Us On

Latest Posts

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Goals and Objectives for Business Plan with Examples

NOV.05, 2023

Every business needs a clear vision of what it wants to achieve and how it plans to get there. A business plan is a document that outlines the goals and objectives of a business, as well as the strategies and actions to achieve them. A well-written business plan from business plan specialists can help a business attract investors, secure funding, and guide its growth.

Understanding Business Objectives

Business objectives are S pecific, M easurable, A chievable, R elevant, and T ime-bound (SMART) statements that describe what a business wants to accomplish in a given period. They are derived from the overall vision and mission of the business, and they support its strategic direction.

Business plan objectives can be categorized into different types, depending on their purpose and scope. Some common types of business objectives are:

- Financial objectives

- Operational objectives

- Marketing objectives

- Social objectives

For example, a sample of business goals and objectives for a business plan for a bakery could be:

- To increase its annual revenue by 20% in the next year.

- To reduce its production costs by 10% in the next six months.

- To launch a new product line of gluten-free cakes in the next quarter.

- To improve its customer satisfaction rating by 15% in the next month.

The Significance of Business Objectives

Business objectives are important for several reasons. They help to:

- Clarify and direct the company and stakeholders

- Align the company’s efforts and resources to a common goal

- Motivate and inspire employees to perform better

- Measure and evaluate the company’s progress and performance

- Communicate the company’s value and advantage to customers and the market

For example, by setting a revenue objective, a bakery can focus on increasing its sales and marketing efforts, monitor its sales data and customer feedback, motivate its staff to deliver quality products and service, communicate its unique selling points and benefits to its customers, and adjust its pricing and product mix according to market demand.

Advantages of Outlining Business Objectives

Outlining business objectives is a crucial step in creating a business plan. It serves as a roadmap for the company’s growth and development. Outlining business objectives has several advantages, such as:

- Clarifies the company’s vision, direction, scope, and boundaries

- Break down the company’s goals into smaller tasks and milestones

- Assigns roles and responsibilities and delegates tasks

- Establishes standards and criteria for success and performance

- Anticipates risks and challenges and devises contingency plans

For example, by outlining its business objective for increasing the average revenue per customer in its business plan, a bakery can:

- Attract investors with its viable business plan for investors

- Secure funding from banks or others with its realistic financial plan

- Partner with businesses or organizations that complement or enhance its products or services

- Choose the best marketing, pricing, product, staff, location, etc. for its target market and customers

Setting Goals and Objectives for a Business Plan

Setting goals and objectives for a business plan is not a one-time task. It requires careful planning, research, analysis, and evaluation. To set effective goals and objectives for a business plan, one should follow some best practices, such as:

OPTION 1: Use the SMART framework. A SMART goal or objective is clear, quantifiable, realistic, aligned with the company’s mission and vision, and has a deadline. SMART stands for:

- Specific – The goal or objective should be clear, concise, and well-defined.

- Measurable – The goal or objective should be quantifiable or verifiable.

- Achievable – The goal or objective should be realistic and attainable.

- Relevant – The goal or objective should be aligned with the company’s vision, mission, and values.

- Time-bound – The goal or objective should have a deadline or timeframe.

For example, using the SMART criteria, a bakery can refine its business objective for increasing the average revenue per customer as follows:

- Specific – Increase revenue with new products and services from $5 to $5.50.

- Measurable – Track customer revenue monthly with sales reports.

- Achievable – Research the market, develop new products and services, and train staff to upsell and cross-sell.

- Relevant – Improve customer satisfaction and loyalty, profitability and cash flow, and market competitiveness.

- Time-bound – Achieve this objective in six months, from January 1st to June 30th.

OPTION 2: Use the OKR framework. OKR stands for O bjectives and K ey R esults. An OKR is a goal-setting technique that links the company’s objectives with measurable outcomes. An objective is a qualitative statement of what the company wants to achieve. A key result is a quantitative metric that shows how the objective will be achieved.

OPTION 3: Use the SWOT analysis. SWOT stands for S trengths, W eaknesses, O pportunities, and T hreats. A SWOT analysis is a strategic tool that helps the company assess the internal and external factors that affect its goals and objectives.

- Strengths – Internal factors that give the company an advantage over others.

- Weaknesses – Internal factors that limit the company’s performance or growth.

- Opportunities – External factors that allow the company to improve or expand.

- Threats – External factors that pose a risk or challenge to the company.

For example, using these frameworks, a bakery might set the following goals and objectives for its SBA business plan :

Objective – To launch a new product line of gluten-free cakes in the next quarter.

Key Results:

- Research gluten-free cake market demand and preferences by month-end.

- Create and test 10 gluten-free cake recipes by next month-end.

- Make and sell 100 gluten-free cakes weekly online or in-store by quarter-end.

SWOT Analysis:

- Expertise and experience in baking and cake decorating.

- Loyal and satisfied customer base.

- Strong online presence and reputation.

Weaknesses:

- Limited production capacity and equipment.

- High production costs and low-profit margins.

- Lack of knowledge and skills in gluten-free baking.

Opportunities:

- Growing demand and awareness for gluten-free products.

- Competitive advantage and differentiation in the market.

- Potential partnerships and collaborations with health-conscious customers and organizations.

- Increasing competition from other bakeries and gluten-free brands.

- Changing customer tastes and preferences.

- Regulatory and legal issues related to gluten-free labeling and certification.

Examples of Business Goals and Objectives

To illustrate how to write business goals and objectives for a business plan, let’s use a hypothetical example of a bakery business called Sweet Treats. Sweet Treats is a small bakery specializing in custom-made cakes, cupcakes, cookies, and other baked goods for various occasions.

Here are some examples of possible startup business goals and objectives for Sweet Treats:

Earning and Preserving Profitability

Profitability is the ability of a company to generate more revenue than expenses. It indicates the financial health and performance of the company. Profitability is essential for a business to sustain its operations, grow its market share, and reward its stakeholders.

Some possible objectives for earning and preserving profitability for Sweet Treats are:

- To increase the gross profit margin by 5% in the next quarter by reducing the cost of goods sold

- To achieve a net income of $100,000 in the current fiscal year by increasing sales and reducing overhead costs

Ensuring Consistent Cash Flow

Cash flow is the amount of money that flows in and out of a company. A company needs to have enough cash to cover its operating expenses, pay its debts, invest in its growth, and reward its shareholders.

Some possible objectives for ensuring consistent cash flow for Sweet Treats are:

- Increase monthly operating cash inflow by 15% by the end of the year by improving the efficiency and productivity of the business processes

- Increase the cash flow from investing activities by selling or disposing of non-performing or obsolete assets

Creating and Maintaining Efficiency

Efficiency is the ratio of output to input. It measures how well a company uses its resources to produce its products or services. Efficiency can help a business improve its quality, productivity, customer satisfaction, and profitability.

Some possible objectives for creating and maintaining efficiency for Sweet Treats are:

- To reduce the production time by 10% in the next month by implementing lean manufacturing techniques

- To increase the customer service response rate by 20% in the next week by using chatbots or automated systems

Winning and Keeping Clients

Clients are the people or organizations that buy or use the products or services of a company. They are the source of revenue and growth for a company. Therefore, winning and keeping clients is vital to generating steady revenue, increasing customer loyalty, and enhancing word-of-mouth marketing.

Some possible objectives for winning and keeping clients for Sweet Treats are:

- To acquire 100 new clients in the next quarter by launching a referral program or a promotional campaign

- To retain 90% of existing clients in the current year by offering loyalty rewards or satisfaction guarantees

Building a Recognizable Brand

A brand is the name, logo, design, or other features distinguishing a company from its competitors. It represents the identity, reputation, and value proposition of a company. Building a recognizable brand is crucial for attracting and retaining clients and creating a loyal fan base.

Some possible objectives for building a recognizable brand for Sweet Treats are:

- To increase brand awareness by 50% in the next six months by creating and distributing engaging content on social media platforms

- To improve brand image by 30% in the next year by participating in social causes or sponsoring events that align with the company’s values

Expanding and Nurturing an Audience with Marketing

An audience is a group of people interested in or following a company’s products or services. They can be potential or existing clients, fans, influencers, or partners. Expanding and nurturing an audience with marketing is essential for increasing a company’s visibility, reach, and engagement.

Some possible objectives for expanding and nurturing an audience with marketing for Sweet Treats are:

- To grow the email list by 1,000 subscribers in the next month by offering a free ebook or a webinar

- To nurture leads by sending them relevant and valuable information through email newsletters or blog posts

Strategizing for Expansion

Expansion is the process of increasing a company’s size, scope, or scale. It can involve entering new markets, launching new products or services, opening new locations, or forming new alliances. Strategizing for expansion is important for diversifying revenue streams, reaching new audiences, and gaining competitive advantages.

Some possible objectives for strategizing for expansion for Sweet Treats are:

- To launch a new product or service line by developing and testing prototypes

- To open a new branch or franchise by securing funding and hiring staff

Template for Business Objectives

A template for writing business objectives is a format or structure that can be used as a guide or reference for creating your objectives. A template for writing business objectives can help you to ensure that your objectives are SMART, clear, concise, and consistent.

To use this template, fill in the blanks with your information. Here is an example of how you can use this template:

Example of Business Objectives

Our business is a _____________ (type of business) that provides _____________ (products or services) to _____________ (target market). Our vision is to _____________ (vision statement) and our mission is to _____________ (mission statement).

Our long-term business goals and objectives for the next _____________ (time period) are:

S pecific: We want to _____________ (specific goal) by _____________ (specific action).

M easurable: We will measure our progress by _____________ (quantifiable indicator).

A chievable: We have _____________ (resources, capabilities, constraints) that will enable us to achieve this goal.

R elevant: This goal supports our vision and mission by _____________ (benefit or impact).

T ime-bound: We will complete this goal by _____________ (deadline).

Repeat this process for each goal and objective for your business plan.

How to Monitor Your Business Objectives?

After setting goals and objectives for your business plan, you should check them regularly to see if you are achieving them. Monitoring your business objectives can help you to:

- Track your progress and performance

- Identify and overcome any challenges

- Adjust your actions and strategies as needed

Some of the tools and methods that you can use to monitor your business objectives are:

- Dashboards – Show key data and metrics for your objectives with tools like Google Data Studio, Databox, or DashThis.

- Reports – Get detailed information and analysis for your objectives with tools like Google Analytics, Google Search Console, or SEMrush.

- Feedback – Learn from your customers and their needs and expectations with tools like SurveyMonkey, Typeform, or Google Forms.

Strategies for Realizing Business Objectives

To achieve your business objectives, you need more than setting and monitoring them. You need strategies and actions that support them. Strategies are the general methods to reach your objectives. Actions are the specific steps to implement your strategies.

Different objectives require different strategies and actions. Some common types are:

- Marketing strategies

- Operational strategies

- Financial strategies

- Human resource strategies

- Growth strategies

To implement effective strategies and actions, consider these factors:

- Alignment – They should match your vision, mission, values, goals, and objectives

- Feasibility – They should be possible with your capabilities, resources, and constraints

- Suitability – They should fit the context and needs of your business

How OGSCapital Can Help You Achieve Your Business Objectives?

We at OGSCapital can help you with your business plan and related documents. We have over 15 years of experience writing high-quality business plans for various industries and regions. We have a team of business plan experts who can assist you with market research, financial analysis, strategy formulation, and presentation design. We can customize your business plan to suit your needs and objectives, whether you need funding, launching, expanding, or entering a new market. We can also help you with pitch decks, executive summaries, feasibility studies, and grant proposals. Contact us today for a free quote and start working on your business plan.

Frequently Asked Questions

What are the goals and objectives in business.

Goals and objectives in a business plan are the desired outcomes that a company works toward. To describe company goals and objectives for a business plan, start with your mission statement and then identify your strategic and operational objectives. To write company objectives, you must brainstorm, organize, prioritize, assign, track, and review them using the SMART framework and KPIs.

What are the examples of goals and objectives in a business plan?

Examples of goals and objectives in a business plan are: Goal: To increase revenue by 10% each year for the next five years. Objective: To launch a new product line and create a marketing campaign to reach new customers.

What are the 4 main objectives of a business?

The 4 main objectives of a business are economic, social, human, and organic. Economic objectives deal with financial performance, social objectives deal with social responsibility, human objectives deal with employee welfare, and organic objectives deal with business growth and development.

What are goals and objectives examples?

Setting goals and objectives for a business plan describes what a business or a team wants to achieve and how they will do it. For example: Goal: To provide excellent customer service. Objective: To increase customer satisfaction scores by 20% by the end of the quarter.

At OGSCapital, our business planning services offer expert guidance and support to create a realistic and actionable plan that aligns with your vision and mission. Get in touch to discuss further!

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Difference Between Feasibility Study and Business Plan

Many people don’t know that there is a difference between a business plan and a feasibility study.

Frequently, clients reach out seeking a feasibility study, but after an in-depth conversation, it becomes evident that what they truly require is a comprehensive business plan. In this article, I’ll clarify this common misconception and provide a clearer understanding of the distinction.

So let us start with the first one, which will give us a brief overview of what a business plan and a feasibility study is all about

Table of Contents

What is the Difference Between Feasibility Study and Business Plan

Business plans and feasibility studies are vital business tools for analysis and for making business decisions. However, a feasibility study is not the same thing as a business plan because a feasibility study gives a conclusion or recommendation that would be completed prior to developing the business plan.

Feasibility Study

A feasibility study is done to determine whether a proposed business has a high enough probability of success that it should be undertaken. A feasibility study is carried out first in order to know if the business will be viable before venturing into it. Before a company can invest in a business or launch a new product, a feasibility study is done to determine if there will be a return on investment.

According to Rochester.edu, a feasibility study can be defined as “a controlled process for identifying problems and opportunities, determining objectives, describing situations, defining successful outcomes, and assessing the range of costs and benefits associated with several alternatives for solving a problem.”

It can also be used to make decisions about whether to launch a new product for an existing company or enter a new market. Feasibility studies are sometimes termed cost-benefit analyses because the projected costs of the project are compared to the expected benefits to yield a conclusion.

For instance, imagine that you have been an instructor in a company that provides IT training and certifications in the USA and you want to come to Africa to impact the knowledge by starting a new business and even adding training like IT Certification Practice Test Dumps , but you are faced with the big question, “Would my business fly?”. Is there a market for my services?

In this situation, the best decision is to conduct a feasibility study to determine if those IT programmes have an established market. If they are a company that needs interns trained by your company.

Business plans are guidelines for carrying out actions that the company’s management has already determined to be feasible. So a business plan is like a roadmap for your business that outlines goals and details how you plan to achieve those goals.

Business plans map out the direction a company intends to take to reach its revenue and profit objectives in the future. They are a compilation of numerous decisions made by the management team about how the company should be run. A business plan is done after a feasibility study has been carried out. If the recommendation of the feasibility study is negative, then there will be no need to venture into the business. Then, if the feasibility study says the business will be feasible, a business plan is developed, which will then map out plans and strategies to adopt in order to achieve business goals, including revenue generation, market penetration, customer acquisition, marketing, and sales strategies, among others.

A business plan can be done for internal or external use. The internal use of a business plan is for the management and staff of the company, while the external use is for shareholders, investors, bank loans, and customers.

Main Purpose of a Business Plan and a Feasibility Study

In short, a feasibility study gives a conclusion or recommendations, while a business plan gives a roadmap.

The feasibility study helps determine whether an idea or business is a viable option. Therefore, a feasibility study is done first before investing a dime in the business. Before considering approaching investors, you must have done your research to know that the business is feasible before taking any decision. That is why a feasibility study gives a conclusion or recommendations.

A business plan will map out the roadmap and strategies to achieve your business goal because a business plan assumes a business is viable and presents the steps necessary to achieve success. If you are looking forward to approaching an investor or trying to get a bank loan, what you need is a business plan. Some investors might request for a feasibility study before the business plan

Outline of a Business Plan and a Feasibility Study

Below is the outline of a business plan:

- Executive Summary

- Business/Company Overview

- Products/Services

- Market/Industry Analysis

- Operation Plan

- Management/Personal plan

- Sales Forcast

- Financial Plan

- Appendices and Exhibits

A good outline for a feasibility study includes:

- Introduction

- Product or Service

- Market Environment

- Competition

- Business Model

- Market and Sales Strategy

- Production Operations Requirements

- Management and Personnel Requirements

- Regulations and Environmental Issues

- Critical Risk Factors

- Financial Predictions Including: Balance Sheet, Income Statement, Cash Flow Statement, Break Even Analysis, and Capital Requirements

Challenges of a Business Plan and a Feasibility Study

Looking at both the business plan and feasibility study, you will discover that both attempt to predict future outcomes using assumptions about what is likely to happen in the business and the business environment, which include government policies, the market, competition, and risk, among others. Any poorly done feasibility study can lead to a costly mistake. If a business is not viable and the recommendation says it will be viable, the end result will not be palatable. This will affect the business plan and the operation of the business adversely.

A poorly done business plan—poor projections, strategies, analysis, business model, and environmental factors, among others—can easily be adjusted in the course of running the business, but the same cannot be said of a feasibility study because, in a feasibility study, an incorrect conclusion can be costly—it could mean launching a venture that has very little chance of surviving or approving a project that wastes the company’s human and financial resources.

If you need a standard business plan, check out the list of Business Plan we have

Do you want us to develop a unique business plan for you, Check out our business plan service page

I would love to hear your thoughts. Kindly use the comment box below to leave your comment.

Thank you for reading this post, don't forget to subscribe!

Share this:

Are you interested in receiving the latest grant, funding, and business opportunities? Join our newsletter for free and stay updated! Click here to join our newsletter Join our community: Join our WhatsApp group Join our Telegram group Join our Facebook group

About The Author

5 thoughts on “Difference Between Feasibility Study and Business Plan”

This is beautiful. Thank you for sharing this informative article by shading more light on the two.

I’ve been planning to hire a feasibility analysis service, so I’ll have an idea, whether my candle business is feasible. I agree with you that this must be done first before approaching the investors. It is also true that an incorrect conclusion in the feasibility study could be costly.

It’s inevitable! It helps you to make the right decision.

My business plan is ready but I will like you to review it

Alright, You can reach out to me on 07031542324 or email me at [email protected]

Leave a Reply Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![study and business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![study and business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![study and business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Do You Need a Business Plan? Scientific Research Says Yes

Noah Parsons

13 min. read

Updated November 20, 2023

Should you spend some time developing a plan for your business, or just dive in and start, figuring things out as you go? There has been plenty of debate on this topic, but no one has pulled together the scientific evidence to determine if planning is worthwhile—until now .

With the help of my friend Jeff, from the University of Oregon, I’ve been looking at academic research on business planning—the actual science around planning and how it impacts both startups and existing businesses.

But, before we dive into the data, why do we even need to look at research on business planning? It seems like most advice on starting a business includes writing a business plan as a necessary step in the startup process. If so many people encourage you to write one, business plans must add value, right?

Well, over the past few years, there’s been a lot of controversy about the value of business plans. People look at certain companies that have been very successful but haven’t written business plans and conclude that planning is a waste of time.

After all, taking the time to plan is a bit of a trade-off. The time you spend planning could be time spent building your company. Why not just “get going” and learn as you build your company, instead of taking the time to formulate a strategy and understand your assumptions about how your business might grow?

Well, the research shows that it’s really not a “write a plan” or “don’t write a plan” conversation. What really matters is what kind of planning you do and how much time you spend doing it.

- Planning can help companies grow 30 percent faster

One study (1) published in 2010 aggregated research on the business growth of 11,046 companies and found that planning improved business performance . Interestingly, this same study found that planning benefited existing companies even more than it benefited startups.

But, this study still doesn’t answer the question it raises:

Why would planning help a business that has a few years of history more than one that is just starting up?

The answer most likely lies in the fact that existing businesses know a bit more about their customers and what their needs are than a new startup does. For an existing business, planning involves fewer guesses or assumptions that need to be proven, so the strategies they develop are based on more information.

Another study (2) found that companies that plan grow 30 percent faster than those that don’t plan. This study found that plenty of businesses can find success without planning, but that businesses with a plan grew faster and were more successful than those that didn’t plan.

To reinforce the connection between planning and fast growth, yet another study (3) found that fast-growing companies—companies that had over 92 percent growth in sales from one year to the next—usually have business plans. In fact, 71 percent of fast-growing companies have plans . They create budgets, set sales goals, and document their marketing and sales strategies. These companies don’t always call their plans “business plans” but instead often refer to things like strategic plans, growth plans, and operational plans. Regardless of the name, it’s all forward-looking planning.

Action: Carve out some time to set goals and build a plan for your business. More importantly, re-visit your plan as you grow and revise it as you learn more about your business and your customers.

Business planning is not an activity you undertake only when you’re getting your business up and running. It should be something you return to, time and time again, to revise and improve upon based on new knowledge.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The quality of the plan matters

But, it’s not as simple as it might appear. Just having a plan doesn’t guarantee faster growth. It’s the kind of plan you have and how you use it that really matters .

It turns out that startups, especially ones building highly innovative businesses, should create shorter, less detailed plans (4). That’s because these innovative startups are learning new things about their product and customers at a very fast pace and their strategies change more frequently. Simpler plans get updated more frequently and are more helpful to these companies because they can review their strategy at a glance.

Meanwhile, more established companies know a lot more about their products and customers and can craft more detailed strategies that are less likely to change as quickly. For these companies, more detailed planning is generally more helpful.

And it’s not just the size of the plan that matters. What you include in your plan is important as well.

The same study we talked about above—the one that found that businesses grow faster with a plan—also found that companies that did a good job defining their value proposition do even better than companies that have a hard time defining their customers’ needs.

These researchers also found that having a plan is less about accurately predicting the future, and more about setting regular goals, tracking your actual progress toward those goals and making changes to your business as you learn more about your customers. Silicon Valley businesses like to call the act of changing strategic direction “pivoting.” All it really means is that you need to stay nimble, keep your eyes open, and be willing to make changes in your business as you compare your actual results to your goals and gather additional feedback from your customers.

Action: Skip the 40-page business plan and instead focus on simpler planning that defines your goals and documents your customers’ needs. Adjust your plan frequently as you learn more about your business.

Being prepared matters when you’re seeking funding

Over and over again, you hear venture capitalists talk about how much the team matters in a funding decision. Beyond just the team, you also hear them talk about passion—how much the entrepreneur believes in the idea.

But, it turns out that there is something that trumps passion when VCs make their decisions. Research shows (5) that how well an entrepreneur is prepared is much more important than how much passion they have.

This doesn’t mean that VCs will ask for a business plan. In fact, they probably won’t ask for one.

What it means is that entrepreneurs need to have done some planning, in some form, so that they can be prepared to talk intelligently about their idea, their target market, their sales and marketing strategies, and so on.

So, the formal 40-page business plan document may not be useful when you’re pitching VCs. But, you’d better have done some planning, so that you can communicate verbally or through a pitch deck what would normally have been found in that written document.

And, not only will business planning help you be more prepared, it will actually improve your chances of getting funded. A study at the University of Oregon (6) found that businesses with a plan were far more likely to get funding than those that didn’t have a plan .

Action: Know your business inside and out. Document your strategy in an internal document, but skip all the time and effort creating a well-crafted business plan document.

When you start planning is important—the earlier the better

So, if business planning increases your likelihood of success, and in fact helps you grow faster, when should you start working on a business plan?

Research shows (7) that entrepreneurs who started the business planning process early were better at what the scientists call “establishing legitimacy.” That’s a fancy way of saying that these entrepreneurs used business planning to start the process of talking with potential customers, working with business partners, starting to look for funding, and gathering other information they needed to start their business.

Entrepreneurs that did a good job of using their business plan to “establish legitimacy” early were more likely to succeed and their businesses tended to last longer.

Not only that, starting the planning process before starting marketing efforts and before talking to customers reduces the likelihood that a business will fail ( 8).

That said, planning should never take the place of talking to customers. An ongoing planning process—one in which the plan is constantly revised as new information is gathered—requires that you talk to your potential customers so that you can learn more about what they need, what they are willing to pay, and how you can best reach them.

Action: Start the planning process early. Even if all you do is build out a simple elevator pitch to try your idea on for size, it will help you begin the conversation with potential customers and kick-start your business.

- Planning makes you more likely to start your business

If you’re like me, and like most entrepreneurs, you like to dream up new business ideas. You constantly think of new ways to improve existing businesses and solve new problems.

But, most of those dreams never become a reality. They live on as ideas in your head while other entrepreneurs see the same opportunity and find a way to make it happen.

It turns out that there’s a way to turn more of your ideas into a viable business. A study published in Small Business Economics found that entrepreneurs that take the time to create a plan for their business idea are 152 percent more likely to start their business ( 9). Not only that, those entrepreneurs with a plan are 129 percent more likely to push forward with their business beyond the initial startup phase and grow it. These findings are confirmed by another study that found that entrepreneurs with a plan are 260 percent more likely to start their businesses (10).

Interestingly, these same entrepreneurs who build plans are 271 percent more likely to close down a business . This seems counterintuitive to the stats above, but when you think about it a bit more, it makes a lot of sense.

Entrepreneurs with plans are tracking their performance on a regular basis. They know when things aren’t going to plan—when sales aren’t meeting projections and when marketing strategies are failing. They know when it’s time to walk away and try a different idea instead of riding the business into the ground, which could have disastrous results.

Action: If you really want to start a business, start committing your goals and strategy to paper. Even if it’s just a simple one-page business plan, that will help you get started faster. And, once you do start, track your performance so you know when to change direction and try something different.

You’re less likely to fail if you have a plan

Nothing can absolutely prevent your company from failing, but it turns out that having a plan can help reduce your risks.

Yet another study of 223 companies found that having a plan reduced the likelihood that a business would fail. Having a plan didn’t guarantee success, unfortunately. But, those companies with a plan had better chances of success than those that skipped the planning process.

Having a plan and updating it regularly means that you are tracking your performance and making adjustments as you go. If things aren’t working, you know it. And, if things are going well, you know what to do more of.

Action: Build a plan, but don’t just stick it in a drawer. Track your performance as you go so you can see if you’re reaching your goals. Your plan will help you discover what’s working so you can build your business.

- Your success depends on the type of planning you do

In the end, creating a business plan seems like common sense. You wouldn’t set out on a trip without a destination and a map, would you?

It’s great to see research back up these common-sense assumptions. The research also validates the idea that the value of business planning really depends on how you approach it.

It’s not a question of whether you should plan or not plan—it’s what kind of planning you do. The best planning is iterative; it’s kept alive and it adapts.

It’s not about predicting the future as if you’re a fortune teller at a carnival. Instead, it’s a tool that you use to refine and adapt your strategy as you go, continuing to understand your market as it changes and refining your business to the ever-changing needs of your customers.