What is an Anti-Assignment Clause?

When business owners are negotiating contracts to gear up for the sale of their business, they are rightly concerned with key questions such as the sale price for the business including assets such as how much the sale will cost them and what happens if something goes wrong. At the end of the contracts, there are usually several pages of type that usually look like boilerplate. Inside those clauses is usually something called an assignment clause, or more accurately, an anti-assignment clause.

It’s one of those clauses that everyone glosses over – after all, it’s just standard legal text, right?

For a business owner hoping to sell their business, an anti-assignment clause can dissuade potential buyers and play a crucial role in the selling price of a business. If this sounds familiar and you’re in the process of negotiating the merger or acquisition of your business, read on – we’ve put together a practical guide to anti-assignment clauses and what to look out for.

Looking for legal help? feel free to get in touch with our commercial lawyers for matters related to contracts.

What is an assignment clause?

The anti-assignment clause states that neither party can transfer or assign the agreement without the consent of the other party. On a basic level, that makes sense – after all, if you sign a contract with a specific party, you don’t expect to be entering into an agreement with a third party you didn’t intend to be.

However, when you sell your business, you will want to transfer ownership of those contracts to the buyer. If your contracts all contain an anti-assignment clause, they effectively restrict you from transferring ownership to the interested party. Now, you’re presented with a new challenge altogether – before you can focus on the sale of your business, you must first renegotiate the terms of your contracts with each party.

Language to look out for in anti-assignment clauses

If you’re thinking about selling your business or even have potential buyers interested, it’s better to know in advance if you’ve got anti-assignment clauses in your contracts. There are generally two types of anti-assignment clause to look out for. The first relates to the complete bar on assignment of rights and responsibilities and is typically worded in this way, or similar:

“Neither Party may assign, delegate, or transfer this agreement or any of its rights or obligations under this agreement.”

The second type prevents the transfer of rights or duties without prior written consent of the other party. This will read along the lines of:

“Neither this agreement nor any right, interest, or obligation herein may be assigned, transferred, or delegated to a third party without the prior written consent of the other party, and whose consent may be withheld for any reason.”

So, where the first prohibits assignment altogether, the second prohibits assignment unless permission is sought in advance. Some clauses may even explicitly state that a change of control such as a merger or acquisition is an assignment. The last thing you want is to cause a dispute by breaching the contract, but if you’ve already agreed to these terms, you’ll have to open a fresh set of negotiations with the contracting party before you sell the company.

Assignment clauses in M&A: what’s the problem?

Due diligence is the bread and butter of any merger or acquisition. Rather than a leap of faith, due diligence ensures the purchase of a business is a calculated decision with minimal risk to the buyer. Typically carried out by specialist lawyers, the process is designed to lift the hood on the target business to determine the valuation of assets and liabilities and identify any glaring issues that could leave the buyer open to risk.

During the due diligence process, the buyer will look through all of the major contracts the business has open, and specifically keep a close eye out for assignment clauses.

Despite the virtual environment that many businesses have been forced to operate in in 2020, most companies will have commercial leases for the premises from which they typically work. Almost all leases have an anti-assignment clause, and this is a perfect example of an instance that is often overlooked by commercial tenants when selling a business which includes a leasehold property. This transfer of ownership may well be prohibited under an anti-assignment clause so that prior to the sale of the business, you would be required to ask permission from your landlord. The issue here is that the landlord may well see this as the perfect opportunity to renegotiate and secure a better deal for themselves. What’s worse, if they don’t sign off on the transfer, you’ll have an obstruction on your hands that will stand in the way of the sale.

In any case, an unexpected anti-assignment clause usually winds up being a last-minute hitch in the sale, and it never comes at a good time. Whether it delays the sale or obstructs it altogether, overlooking an anti-assignment clause can cost you considerably in an M&A transaction.

What makes anti-assignment clauses enforceable?

Generally speaking, an anti-assignment clause will be enforced by the courts if it was agreed upon by both parties to the contract. Many contracts exclude or qualify the right to assignment – according to the courts, a clause that states that a party to a contract may not assign the benefit of that contract without the consent of the other party is legally effective and will extend to all rights and benefits arising under the contract.

Courts won’t always enforce assignments to which the counterparty did not give permission, even where there is no anti-assignment clause that specifies this provision.

How to negotiate anti-assignment clauses

The best practice for business owners is to be vigilant when negotiating new contracts and ensure that any anti-assignment clauses still allow for the transfer of ownership when they decide to sell the business.

Remember, even though the buyer is purchasing the assets of the business, this usually means that all of the contracts of the business go with it because the business remains intact. Therefore, the best way forward is to negotiate these clauses upfront from the outset of the relationship, so that when you do decide to sell your business, you automatically have permission to transfer the ownership without having to delay the sale by entering into fresh negotiations.

If your agreement does not permit assignments, it’s worth seeking the advice and support of a specialist lawyer who can help protect your interests through negotiation with your counterparty on this point. You may be able to include a provision that allows for assignment of your rights and obligations upon the prior written consent of the other party. Your lawyer will likely advise you to carve out a specific provision to prohibit the counterparty from unreasonably withholding or delaying consent or making it subject to unreasonable conditions – an issue which, if not provided for within the contract, can cause serious delay and disruption to the sale of your business. Further, it may be beneficial to add an extra element to the contract that makes exceptions to the clause for assignments between affiliates. If you’re planning to sell your business, this would be the right place to carve out an exception within the clause to the change of control via a merger or acquisition.

It’s important to bear in mind that anti-assignment clauses tend to be viewed narrowly by courts, and that there have been several instances whereby anti-assignment clauses have not been enforced since the clause itself did not explicitly state that the assignment of rights, duties or payment would render the contract void or invalid. So, if you’re in the process of negotiating an agreement and wish to protect your interests through the addition of an anti-assignment clause, it’s critical that you include the consequences of assignment within the clause itself and state that assignments would invalidate or be in breach of the contract.

If you do not wish for the counterparty to be able to transfer the legal obligation to perform their duties as stated in the contract to a third party, this must be explicitly stated in one of three ways:

- Specify the need for consent

There’s no need to be unreasonable – you can protect your interests while still giving the counterparty the space to re-negotiate should they wish to assign rights by including a clause that asks for consent.

- Provide an exemption to consent for affiliates, successors or new owners

Ask your lawyer to draft an exception into the clause that permits assignment to affiliates or successors to the counterparty, such as:

“Neither party may assign or delegate this agreement or its rights or obligations under this agreement without the prior written consent of the other party, except that no consent is required (a) for assignment to an entity in which the transferring party will own greater than 50 per cent of the shares or other interests; or (b) in connection with any sale, transfer, or disposition of all or substantially all of its business or assets; provided that no such assignment will relieve an assigning party of its obligations under this agreement. Any assignment or delegation that violates this provision shall be void.”

- Require reasonable consent

Just as you would not wish for consent to be held back from you unreasonably in the renegotiation of contract terms prior to a sale, your assignment clause should make clear that you will not unreasonably withhold or delay consent should the third party request permission to assign their legal obligations. This may read something like this:

“Neither party may assign or delegate this agreement or its rights or obligations under this agreement without the prior written consent of the other party, whose consent shall not be unreasonably withheld or delayed. Any assignment or delegation that violates this provision shall be void.”

Whatever the circumstances, we strongly recommend calling upon a contract law specialist, whether you’re undergoing due diligence in the run up to an M&A transaction, are considering selling your business or are negotiating new contracts with customers and suppliers. Our lawyers bring in-depth expertise in the area of anti-assignment clauses and will work closely with you to protect your interests and ensure no clauses in your contracts negatively impact the sale of your company.

For a free consultation, get in touch with our team through the contact form below or using our online chat service.

Join our Newsletter

- Book Consultation

Newsletter Sign-Up

Please enter your name and email to receive our latest newsletter.

Sign up to our newsletter

Please fill in the fields below to receive your free download.

English (UK) Portuguese (Brazil) Spanish (Spain) French (France) German Italian Polish Dutch Chinese (China)

Connect with us on LinkedIn

Global LinkedIn Page

Error: Contact form not found.

Arrange a Meeting

Schedule a 30 minute introductory consultation to discuss your legal requirements:

Select your Location Australia China Hong Kong India Indonesia Japan Malaysia New Zealand Pakistan Philippines Singapore South Korea Thailand Vietnam Austria Bahrain Belgium Bulgaria Cameroon Croatia Cyprus Czech Republic Denmark Egypt Finland France Germany Greece Hungary Iceland Iran Iraq Ireland Israel Italy Jersey Jordan Kenya Latvia Lebanon Lithuania Luxembourg Mozambique Netherlands Nigeria Norway Oman Poland Portugal Romania Saudi Arabia Serbia Slovakia Slovenia South Africa Spain Sweden Switzerland Tunisia Türkiye UAE Uganda United Kingdom Argentina Brazil Chile Colombia Costa Rica Mexico Peru Canada USA

Anti-Assignment Clause: Everything You Need To Know

An anti-assignment clause prevents either of the parties to a contract from assigning tasks to a third party without the consent of the non-assigning party. 3 min read updated on February 01, 2023

An anti-assignment clause prevents either of the parties to a contract from assigning tasks to a third party without the consent of the non-assigning party.

Anti-assignment clauses are of two types:

One that prohibits the assignment of work or service pursuant to the contract.

One that prohibits the assignment of payment under the contract.

The clause that prohibits the assignment of work or service is a valid clause, completely enforceable and does not bear much importance. However, the clause that prohibits the assignment of payment is a more complex clause that affects crucial buying and selling decisions.

Are Anti-Assignment Clauses That Prohibit Assigning Payments Enforceable?

As an anti-assignment clause prohibits the assignment of payment, it affects business and thus is unenforceable and ineffective under Section 9-406 of the Uniform Commercial Code. The code clearly states that clauses pertaining to "Discharge of Account Debtor, Notification of Assignment, Identification and Proof of Assignment, Restriction on Assignment of Account, Chattel Paper, Payment Intangibles and Promissory Notes" are ineffective and void.

What Should a Factor Do If a Client's Contract Contains an Anti-Assignment Clause?

Most factors prefer not to enter into an agreement with a client whose contract contains any anti-assignment clause to avoid hassle in the future. However, legal experts suggest that factors should ignore the anti-assignment clauses in the contract and proceed with business as usual along with providing a Notice of Assignment to the account debtor.

Even if the factor decides to proceed with the business decision with the said client, he should be aware that the account debtor may not want to engage in commercial activities with the factor, and may even create difficulties in dealings and collection. Though an anti-assignment clause does not deter the factor's decision to enter into a business arrangement with an account debtor or his ability to be paid given the issuance of a Notice of Assignment, it is for him to decide if the efforts are worth the business. However, to ensure a fool-proof commercial and business dealing, the factor can obtain a signed Estoppel Letter from the account debtor to avoid all future disputes.

What Are the Anti-assignment Provisions and Their Effect on Transaction Structures?

Most commercial contracts end with a clause, ”Neither this Agreement nor any of the rights, interests or obligations under the Agreement shall be assigned, in whole or in part, by operation of law or otherwise by either party without the prior written consent of the other party.” This is the anti-assignment clause that ensures the interest of both the parties and that none of the two parties transfer any rights to any other individual with our prior consent of the other main party.

Often, a contract assignment issue plays an important factor in merger and acquisition prospects as buyers want to acquire all customer and vendor contracts. However, if any of the contracts bound by the anti-assignment clause need the approval of the other party, it could lead to additional costs for the buyer, which may affect the decision. The general notion is that most contracts are assignable unless categorically included anti-assignment clauses .

What Is the Typical Anti-assignment Language to Look Out For?

There are numerous ways of including an anti-assignment provision in the contract. However, the AIA Standard Form of Agreement contains the following anti-assignment provision:

- The Party 1 and Party 2, respectively, bind themselves, their partners, successors, assigns, and legal representatives to the other party to this Agreement and to the partners, successors, assigns, and legal representatives of such other party with respect to all covenants of this Agreement. Neither Party 1 nor Party 2 shall assign this Agreement without the written consent of the other.

What Are the Recommendations for Parties Entering Into Construction Contracts?

Usually, when commercial agreements are drawn, parties tend to focus on the key business aspects but pay no heed to anti-assignment provisions. It is thus the main responsibility of a corporate lawyer to study, analyze, and dissect agreements to ensure the best for their clients.

- Check the miscellaneous sections of any agreement to rule out any anti-assignment clause in the contract.

- Read and understand the finer points of the anti-assignment clause in the contract, if any.

- Negotiate changes in the anti-assignment clause prior to signing the contract.

If you need help with an anti-assignment clause, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Assignment Law

- Legal Assignment

- Assignment Contract Law

- Assignment of Rights and Obligations Under a Contract

- Consent to Assignment

- What Is the Definition of Assigns

- Assignment Legal Definition

- Assignment Of Contracts

- Assignment of Rights Example

- What is an Assignment and Assumption Agreement

- Search Search Please fill out this field.

- Building Your Business

What Is an Anti-Assignment Clause?

Anti-Assignment Clauses Explained

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

- Definition and Example

How Anti-Assignment Clauses Work

- State Laws and Anti-Assignment Clauses

Extreme Media / Getty Images

An anti-assignment clause is a provision in an insurance policy that bars the policyholder from transferring their rights under the policy to another party. The clause prohibits the insured from authorizing someone else to file claims, make changes, or take other actions under the policy.

Many small businesses purchase insurance policies that contain an anti-assignment clause, which may affect their ability to conduct certain routine business transactions. For instance, if your property is damaged and you hire a contractor to make repairs, the clause may bar you from allowing the contractor to collect loss payments directly from your insurer. In addition, some restrictions found in anti-assignment clauses may be overridden by state laws. Below, we’ll explore further what an anti-assignment clause is and how it works.

Definition and Example of an Anti-Assignment Clause

An anti-assignment clause is language found in an insurance policy that forbids the policyholder from assigning their rights and interests under the policy to someone else without the insurer’s consent. The clause is usually found in the policy conditions section.

Alternate name : Assignment clause, Non-assignment clause

An example of an anti-assignment clause is wording contained in the standard Insurance Services Office (ISO) business owners policy (BOP) . You can find it in the Common Policy Conditions (Section III) under the heading “Transfer of Your Rights and Duties Under This Policy.” The clause states that your rights and duties under the policy may not be transferred without the insurer’s written consent. However, if you are an individual named on the policy and you die, your rights will be transferred to your legal representative.

An anti-assignment clause may not include the word “assignment” but instead refer to a transfer of rights under the policy.

Anti-assignment clauses prevent policyholders from transferring their rights under the policy to someone else without the insurer’s permission. The clauses are designed to protect insurers from unknown risks. Insurers evaluate insurance applicants carefully before they agree to provide coverage. They consider an applicant’s business experience, loss history, and other factors to gauge their susceptibility to claims. When an insurer issues a policy, the premium reflects the insurer’s assessment of the applicant’s risks. If the policyholder transfers their rights under the policy to another party, the insurer’s risk increases. This is because the insurer hasn’t had an opportunity to evaluate the new party’s risks.

The following example demonstrates how an anti-assignment clause in an insurance policy can affect a business.

Theresa is the owner of Tasty Tidbits, a pastry shop she operates out of a commercial building she owns. She has insured her business for liability and property under a business owners policy. Theresa decides to take a one-year sabbatical from her business and asks her friend Ted to manage Tasty Treats during her absence. Theresa signs a contract assigning her rights under Tasty Tidbits’ BOP to Ted.

If a loss occurs, Ted may have no right to file a claim or collect benefits under the policy on Tasty Treats’ behalf. The assignment is barred by the anti-assignment clause in the BOP.

Effect of State Laws on Anti-Assignment Clauses

Many states have enacted laws via a statute or court ruling that override anti-assignment clauses in insurance policies. These laws may invalidate all or a portion of a policy’s anti-assignment provision. While the laws vary, many bar pre-loss assignments but permit assignments made after a loss has occurred. Assignments made before any losses have occurred are prohibited because they increase the insurer’s risks. Post-loss assignments don’t increase the insurer’s risks, so they generally are permitted.

Some states prohibit any assignment of benefits made without the insurer’s consent, whether the assignment occurred before or after a loss.

Here's an example of how a state law can impact an anti-assignment clause in an insurance policy. Suppose that Theresa (in the previous scenario) has returned from her sabbatical and is again operating her business. Tasty Treats is located in a state that bars pre-loss assignments but allows assignments made after a loss has occurred.

Late one night, a fire breaks out in the pastry shop and a portion of the building is damaged. Theresa files a property damage claim under her BOP and hires Rapid Reconstruction, a construction company, to repair the building. At the contractor’s suggestion, Theresa assigns her rights to receive benefits for the claim under the BOP to Rapid Reconstruction. Because Theresa has assigned her rights after a loss has occurred, the assignment is permitted by law and should be accepted by Theresa’s insurer.

Key Takeaways

- Many policies purchased by small businesses contain an anti-assignment clause.

- An anti-assignment clause bars the policyholder from assigning their rights and interests under the policy to someone else without the insurer’s consent.

- Many states have a statute or court ruling that overrides anti-assignment clauses in insurance policies.

- State laws vary, but many prohibit pre-loss assignments yet permit assignments made after a loss has occurred.

Canopy Claims. " Business Owners Coverage Form ," Page 53.

Penn State Law Review. " If You Give a Shop a Claim: The Unsustainable Inequity of Pennsylvania’s Unbridled Post-Loss Assignments ."

Stahl, Davies, Sewell, Chavarria & Friend. " Buyers and Sellers Beware - Assignment of Hurricane Claims May Be Invalid in Texas ."

- What’s New on the Watch?

- COVID-19 Updates

- Private Equity Webinar Series

- Private Equity Finance

- Global PE Update

- Glenn West Musings

- Quarterly Private Funds Update

- Ancillary Agreements

- Co-investments

- Cybersecurity

- Going Privates

- Legal Developments

- Minority Investments

- Portfolio Company Matters

- Purchase Agreements

- R&W Insurance

- Secondaries

- Securities Laws

- Shareholder Agreements

- Specialist Areas

- Contributors

- Global Team

- Privacy Policy

Private Equity

Watch your inbox.

Get the latest views and developments in the private equity world from the Global Private Equity Watch team at Weil.

UNDERSTANDING THE ANTI-ASSIGNMENT CLAUSE IN CONTRACTS

Introduction.

Contracts, generally, are freely assignable i.e., either party can freely transfer one’s obligations or rights to a third party. This is what an assignment clause signifies. An assignment is a transfer of rights and liabilities that the third party must then discharge to the other party. But sometimes, some contracts include an Anti-assignment clause to obstruct or limit assignment. They prevent either party to contract to transfer contractual obligations and/or rights to a third party.

The early legal system was against assigning contract rights as it considered them highly personal and intelligible. Fear of litigation, fear of maintenance, and champerty are some of the other reasons that many commentators feel led to the development of a non-assignability clause. However, with the passage of time and the development of technology, the work-load increased mani-fold necessitating the assignment of some rights and liabilities to the third party; now assignment of rights has become a general trend and non-assignment has taken a backseat which especially needs to be drafted to forbid assignment.

An anti-assignment clause also referred to as a non-assignment clause is a boilerplate clause that either bar completely or partially either of the party to the contract from transferring their rights and obligations under the contract to a third party without due permission from the non-assigning party.

FORMS OF ANTI-ASSIGNMENT CLAUSE

A non-assignment clause in a contract can be presented to the oblige in varied forms depending on the nature of the contract and its terms and conditions.

It may take the following forms-

- Assignments of contract rights and liabilities may be completely prohibited, or;

- Assignments may be limited to entities within the same group as the assignor.

- The agreement may prohibit any transfers of the obligation without the approval of the obligor, which should not be unreasonably denied.

IMPORTANCE OF ANTI-ASSIGNMENT CLAUSE

A non-assignment clause limits the obligor’s contractual obligations to the obligee. The courts construe the clause in favor of the non-assigning party i.e., the obliger. Since the oblige afterward assigns its rights, the obliger then needs to also cooperate with the assignee i.e., a third-party or a stranger to the contract for the performance of the contract; therefore, the courts assume that only the party that can complain about the assignment is the non-assigning party.

SCOPE OF ANTI-ASSIGNMENT CLAUSE

Anti-assignment clauses in contracts have become a frequent practice because, without them, contracts are freely assignable. However, there are certain contracts where the assignment is excused by the statutes itself, however, the anti-assignment clause is still drafted into the contract for efficient enforcement. For example, Section 37 of the Indian Contract Act [1] prohibits the practice of “offering to perform” where it is against the lex-terrae. Such contracts could be of IPR where the nature of the contract is personal [2] or could be an employment agreement where an assignment without permission would lead to significant and unfavorable consequences for non-assigning parties. For all other contracts, anti-assignment clauses can be used with ease.

Examples of the use of the Anti-Assignment Clause

- In Franchise Agreement, this clause clearly outlines the extent of the permissibility of the assignment of the intellectual property of the franchise.

- In a Purchase and Sale Agreement, the purchaser may need to assign its rights and obligations to be able to obtain financing more easily. Certainly, the seller would need to keep some control over the financing parts of the transaction through a non-assignment clause to be on the safer side and protect himself against dealing with any strange entity.

- In Asset Acquisition Agreement , a purchaser only obtains those assets and liabilities of a target listed in the agreement. In the case of an asset acquisition. In the case of an asset acquisition, any agreement with an anti-assignment clause will be activated. [3]

- In the Stockholders’ Agreement, this clause will kick in (if included), the moment stockholder tries to transfer, assign, hypothecate, mortgage, or alienate any or all stocks in a corporation. This is the case where there is a complete ban on assignment, however the same can be assigned if however, there are exemptions to non-assignment by operation by law. [4]

- Almost in all Commercial Lease Agreements, there is an anti-assignment clause. The transfer of ownership may be forbidden by an anti-assignment clause, so before selling the business, you must seek permission from your proprietor; however, this permission should not be withheld against the interests of the lease.

However, the list is not exhaustive. There are still a lot of businesses where the anti-assignment clause is used including but not limited to joint-venture agreements, partnership agreements, limited liability company operating agreements, real estate contracts, bills of sale, Assignment, and transaction financing agreements, etc.

ENFORCEABILITY OF ANTI-ASSIGNMENT CLAUSE

This restrictive clause’s effect will be triggered the moment there is any breach of this clause. According to the traditional view, a contract is void if this restrictive clause is violated; however, the modern view holds that a breach of it will only result in a claim for damages; the contract is not ipso-facto void unless expressly stated in the contract. Along with this view, the court will consider the relevant law, the jurisdiction that governs the contract, and the language of the contract to enforce this clause.

MERITS OF ANTI-ASSIGNMENT CLAUSE

A contract with an anti-assignment clause thrives with the following advantages-

- The relationship between the assignor and the obligor is preserved, while the connection between the obligor and the assignee is either limited or eliminated.

- The obligor is safeguarded by this, as they may not want to be in a situation where they must mention a set-off defence against one party and a counterclaim against the other or become involved in a disagreement between the assignor and assignee under the contract of assignment. [5]

DEMERITS OF ANTI-ASSIGNMENT CLAUSE

The anti-Assignment clause also suffers from the following disadvantages-

- In cases where this clause is violated, it is extremely difficult to quantify and measure the damages.

- It can be a lengthy and exasperating process for businesses that are on the brink of bankruptcy, such as start-ups, to finalize the closure until they get the approval of all the commercial entities with whom they had a contract that included a non-assignment clause.

- In the event of a change in ownership, such as a merger or acquisition, a business may feel uneasy about the new owner of its partner company. To have a say in the selection of the other party’s owner, the business may include a clause in the agreement that mandates their approval before the change can occur, allowing them to indirectly manage the situation.

In conclusion, an anti-assignment clause is a provision in a contract that prohibits one party from transferring or assigning their rights or obligations under the contract to a third party without the other party’s consent. This clause is commonly used in contracts to protect the interests of the parties involved and to ensure that the original parties to the contract are the ones who will perform the obligations and receive the benefits. Anti-assignment clauses can be beneficial for both parties in a contract. For the party who is providing goods or services, it ensures that they are dealing with the same party throughout the duration of the contract, which can help to maintain consistency and quality. For the party who is receiving the goods or services, it can assure that they are dealing with a party that has the necessary expertise and resources to fulfill the obligations under the contract. However, there are also potential drawbacks to anti-assignment clauses. They can limit a party’s ability to transfer their rights or obligations under the contract, which can be problematic if the party needs to assign the contract due to unforeseen circumstances. Additionally, anti-assignment clauses can make it more difficult for a party to obtain financing or sell their business, as potential buyers or lenders may be hesitant to take on a contract with such a clause. Overall, the use of anti-assignment clauses in contracts should be carefully considered and tailored to the specific needs of the parties involved. It is important to strike a balance between protecting the interests of the parties and allowing for flexibility in the event of unforeseen circumstances.

Author(s) Name: Avee Singh Dalal (Dr B.R. Ambedkar National Law University, Sonipat)

References:

[1] The Indian Contract Act, 1872, Sec. 37, No. 9, Acts of Parliament, 1872 (India)

[2] Kapilaben v. Ashok Kumar Jayantilal Sheth, (2020) 20 SCC 648

[3] Aaron R Katz, A Guide to Understanding Anti-Assignment Clauses, GT ISRAEL LAW BLOG (Feb. 18, 2023, 5:15 PM), https://www.gtlaw-israelpractice.com/2016/02/04/a-guide-to-understanding-anti-assignment-clauses/ .

[4] The Law of Offices of STIMMEL, STIMMEL & ROESER, https://www.stimmel-law.com/en/articles/assignments-basic-law (last visited Feb. 18, 2023).

[5] Michael Bridge, The nature of assignment and non-assignment clauses, LSE RESEARCH ONLINE (2015), https://eprints.lse.ac.uk/61892/1/The_Nature.pdf .

Are Anti-Assignment Clauses Enforceable?

Written by: Brittainy Boessel

July 22, 2020

8 minute read

Contracts, in general, are freely assignable, which means that either party can transfer its contractual obligations or rights to a third party. But sometimes contracts include anti-assignment clauses to limit or prohibit assignment. Read on to discover the basics of assignment and anti-assignment clauses, what makes them unenforceable, and learn how to negotiate them.

What Is Assignment?

An assignment is like a transfer. If an agreement permits assignment, a party could assign — or transfer — its obligation to another party. The second party — the one to whom the contract was assigned — would then be required to provide the products or services.

Assignments don’t necessarily relieve liability for the party who transfers the agreement. Depending on the contract, the party who assigned its obligations may remain a guarantor of— or responsible for—the performance of the third party assigned the work. In other words, the party to the contract (the assignor) would be responsible for breaches committed by the party to which it assigned its performance (the assignee). To remove itself from the liability of the agreement, the assignor would need to seek a novation , which cancels the first contract and creates a new contract between the party that is the assignee and the original counterparty to the contract.

What is an Anti-Assignment Clause?

Anti-assignment clauses—also sometimes referred to as assignment clauses or non-assignment clauses—can appear in various forms. Essentially, they prevent one or both contracting parties from assigning some or all of their respective contractual obligations or rights to a third party.

Anti-Assignment Language to Look for in a Contract

When reading through your contract, you can typically find a separate paragraph entitled “Assignment,” “Non-assignment,” or “Anti-assignment.” Sometimes you’ll find the assignment language buried within a “Miscellaneous Provisions” section, which contains all the boilerplate language of a contract, such as severability and waiver provisions.

Contracts include two primary types of anti-assignment clauses. The first type categorically precludes all assignments of rights and duties. It usually reads something like this: “Neither Party may assign, delegate, or transfer this agreement or any of its rights or obligations under this agreement.”

The second type prohibits assignments unless the assigning party obtains the prior written consent of the other party. It usually reads something like this: “Neither this agreement nor any right, interest, or obligation herein may be assigned, transferred, or delegated to a third party without the prior written permission of the other party, and whose consent may be withheld for any reason.”

Some clauses may state that a change of control, such as a merger, consolidation, or acquisition, is considered an assignment. Read carefully , because you want to ensure that you won’t be in breach if you transfer the contract to an affiliate.

Additionally, check the termination section of your agreement. Some termination clauses may state that a non-assigning party may terminate the contract in the event of a non-permitted assignment. Or a termination clause may state that the agreement automatically terminates upon such a transfer.

Without an anti-assignment provision, contracts are generally assignable even absent the consent of the counterparty. The Uniform Commercial Code (UCC), a group of laws governing the sale of goods, prefers the free transferability of all types of property, including contracts.

Still, courts normally enforce anti-assignment clauses that are negotiated and agreed upon by both parties, depending on the applicable law, the jurisdiction governing the contract, and the language agreed upon in the contract. Be aware though that courts tend to narrowly interpret anti-assignment clauses. For instance, an anti-assignment clause may prohibit assignment but fail to state that an assignment in violation of the contract will be invalid. In this case, a party may be able to file a suit for breach of contract, but the court may not permit it to invalidate the assignment.

Even without a solid anti-assignment clause, there may still be an opportunity to prevent certain assignments. Courts may not enforce assignments to which the counterparty did not consent, even in the absence of a valid anti-assignment clause, especially if the contract is personal in nature. Some obligations can be performed equally well by a third party, such as a requirement to make payments. But a personal obligation involves a special relationship between parties or requires special levels of expertise, discretion, or reputation. For example, personal service contracts, including employment agreements, are personal enough in nature that they’re not transferable unless the non-transferring party consents.

In general, assignment is not enforceable when:

- The contract prohibits and voids assignment

As discussed above, contract provisions can prohibit and void an assignment.

- The assignment materially changes the contract

If the assignment would significantly impact the performance of the contract — for instance, if it greatly increases the risks or burden imposed on the other party — then a court would likely not enforce the assignment.

- The assignment violates the law

Certain laws prevent assignments. For example, some states legislate that an employee cannot assign its future wages to a third party.

- The assignment violates public policy

If the assignment would harm public policy interests, it will be void. For instance, victims may not assign their personal injury claims to third parties to discourage excessive litigation.

Negotiating Anti-Assignment Clauses

In certain situations, the inclusion of an anti-assignment clause may not be in a party’s best interests. If a party depends on a unique service provider or a specific person to perform, then it must make sure that that service provider or person can’t assign work to an unknown third party without its consent. For instance, if you pay a premium to hire a renowned jazz band to perform at your charity gala, you don’t want a local high school garage band to show up instead. In any situation involving unique services or providers, make sure you have the right to consent prior to any assignment under the agreement.

Another example of the importance of assignability is in mergers and acquisitions. When a company purchases another business, the acquired business’s existing customer base and supplier contracts make it more valuable . Consequently, if a party hopes to eventually sell its business, it would want the right to assign its existing contracts to the buyer. Otherwise, potential buyers may be scared off because of the time and money it will take to transfer the existing agreements. Plus, the existence of anti-assignment clauses may heavily impact the selling price. If it’s possible you may sell your business, ensure that you have the right to assign your contracts and that consent is not solely within the discretion of the counterparty.

If you want the right to assign the contract, but your agreement does not permit assignments, you’ll need to negotiate with your counterparty on this point. If the clause in your agreement prohibits all assignments, try to include a carve out by allowing assignment of your rights and obligations upon the prior written consent of the other party. Add that the counterparty shall not unreasonably withhold or delay consent. You may also want to carve out an exception to the anti-assignment clause by excluding assignments between affiliates or necessitated by change of control transactions, such as mergers or acquisitions.

Courts tend to construe anti-assignment and anti-delegation clauses narrowly. As mentioned, a number of courts have held that an anti-assignment clause does not remove the power of a party to assign the contract and invalidate the contract unless the provision explicitly states that such assignments will be invalid or void. Thus, if you want to make an assignment that violates your agreement, rather than creating an opportunity for a breach of contract case, explicitly state in your contract that such assignments are invalid or void.

If you don’t want the counterparty to be able to assign its rights or obligations, state your preference clearly in your agreement with one of these options.

- Require consent always

Include a clause such as, “Neither party may assign or delegate this agreement or its rights or obligations under this agreement without the prior written consent of the other party, and any assignment or delegation that violates this provision shall be void.”

- Don’t require consent for affiliates or successors

Include a clause such as, “Neither party may assign or delegate this agreement or its rights or obligations under this agreement without the prior written consent of the other party, except that no consent is required (a) for assignment to an entity in which the transferring party owns greater than 50 percent of the assets; or (b) in connection with any sale, transfer, or disposition of all or substantially all of its business or assets; provided that no such assignment will receive an assigning party of its obligations under this agreement. Any assignment or delegation that violates this provision shall be void.”

- Require consent to be given reasonably

Include a clause such as, “Neither party may assign or delegate this agreement or its rights or obligations under this agreement without the prior written consent of the other party, whose consent shall not be unreasonably withheld or delayed. Any assignment or delegation that violates this provision shall be void.”

Note that you will not be able to prevent assignments resulting from court orders or by operation of law, such as those ordered through a bankruptcy hearing.

When you enter a contractual relationship, make sure to clearly determine your rights and obligations, as well as those of the other party. If it may be important for your business to have the right to assign all or parts of the contract, negotiate for the removal of the anti-assignment clause, or request changes to it to provide sufficient flexibility for you to assign.

Learn how to tackle Due Diligence projects more efficiently and free up your (and your associates’) time more effectively!

This site uses cookies. By continuing to browse this site you are agreeing to our use of cookies. Learn more about what we do with these cookies in our privacy policy .

41 U.S. Code § 6305 - Prohibition on transfer of contract and certain allowable assignments

In subsection (a), the words “The party to whom the Federal Government gives a contract or order” are substituted for “the party to whom such contract or order is given” for clarity. The words “A purported transfer in violation of this subsection” are substituted for “any such transfer” because an actual transfer is precluded by this provision.

In subsection (b)(1), the words “amounts due from the Federal Government” are substituted for “moneys due or to become due from the United States or from any agency or department thereof” to eliminate unnecessary words. The words “may be assigned” are added to provide explicitly for authority that is necessarily implied by the source provision.

In subsection (b)(3), the words “in the case of any contract entered into after October 9, 1940 ” are omitted as obsolete.

In subsection (b)(5), the words “participating in such financing” are omitted as unnecessary.

In subsection (b)(8), the words “is not liable to make any refund to the Federal Government” are substituted for “no [liability] . . . shall create or impose any liability on the part of the assignee to make restitution, refund, or repayment to the United States of any amount heretofore since July 1, 1950 , or hereafter received under the assignment” to eliminate unnecessary words. The words “an assignor’s liability to the Federal Government” are substituted for “liability of any nature of the assignor to the United States or any department or agency thereof ” for clarity and to eliminate unnecessary words.

In subsection (b)(9)(A), the words “except any such contract under which full payment has been made” are omitted as unnecessary because subsection (b)(8) precludes refund where full payment has already been made. The words “payments made to an assignee under the contract” are substituted for “payments to be made to the assignee of any moneys due or to become due under such contract” to eliminate unnecessary words.

In subsection (b)(9)(B), the words “When a ‘no reduction or setoff ’ provision as described in subparagraph (A) is included in a contract” are substituted for “If a provision described in subsection (e) of this section or a provision to the same general effect has been at any time heretofore or is hereafter included or inserted in any such contract”, the words “payments to the assignee” are substituted for “payments to be made thereafter to an assignee of any moneys due or to become due”, and the words “an assignor’s liability” are substituted for “any liability of any nature of the assignor to the United States or any department or agency thereof ”, for clarity and to eliminate unnecessary words.

In subsection (b)(9)(C), the text of 40:15(g), which provided that nothing in 40:15 affected rights and obligations accrued before subsection (g) was added by the Act of May 15, 1951 (ch. 75, 65 Stat. 41 ), is omitted as obsolete.

Memorandum of President of the United States, Oct. 3, 1995 , 60 F.R. 52289 , provided:

Memorandum for the Heads of Executive Departments and Agencies

Section 2451 of the Federal Acquisition Streamlining Act of 1994 , Public Law 103–355 ([amending former] 41 U.S.C. 15 [see 41 U.S.C. 6305 ]) (“Act”), provides, in part, that “[a]ny contract of the Department of Defense , the General Services Administration , the Department of Energy or any other department or agency of the United States designated by the President, except [contracts where] . . . full payment has been made, may, upon a determination of need by the President, provide or be amended without consideration to provide that payments to be made to the assignee of any moneys due or to become due under [the] contract shall not be subject to reduction or set-off.”

By the authority vested in me as President by the Constitution and the laws of the United States of America, including section 301 of title 3 , United States Code, I hereby designate all other departments and agencies of the United States as subject to this provision. Furthermore, I hereby delegate to the Secretaries of Defense and Energy, the Administrator of General Services, and the heads of all other departments and agencies, the authority under section 2451 of the Act to make determinations of need for their respective agency’s contracts, subject to such further guidance as issued by the Office of Federal Procurement Policy.

The authority delegated by this memorandum may be further delegated within the departments and agencies.

This memorandum shall be published in the Federal Register.

- Follow us on Twitter

- Join us on LinkedIn

- Like us on Facebook

- Follow us on instagram

- Follow us on YouTube

Anti-Assignment Provisions and Assignments by ‘Operation of Law’: What Do I Have to Do? What Should I Do?

Introduction.

One of the key roles of legal due diligence in mergers and acquisitions (M&A) is to assist in the efficient and successful completion of any proposed M&A transaction. Due diligence is not merely a procedural formality but can serve as a proactive shield against unforeseen challenges and risks. One essential aspect of the legal due diligence process is reviewing third-party contracts to which the target entity is party, in order to better understand the scope of its commercial relationships and to anticipate any issues that may arise via the underlying contractual relationships as a result of completing the proposed M&A transaction.

A frequent reality in many M&A transactions is the requirement to obtain consents from third parties upon the “change of control” of the target entity and/or the transfer or assignment of a third-party contract to which the target is party. Notwithstanding the wording of such contracts, in many instances, the business team from the purchaser will often ask the question: “When is consent actually required?” While anti-assignment and change of control provisions are fairly ubiquitous in commercial contracts, the same cannot be said for when the requirement to obtain consent is actually triggered. The specifics of the proposed transaction’s structure will often dictate the purchaser’s next steps when deciding whether the sometimes-cumbersome process of obtaining consents with one or multiple third parties is actually needed.

This article examines what anti-assignment provisions are and how to approach them, depending on the situation at hand, including in the context of transactions where a change of control event may be triggered. This article also discusses how to interpret whether consent is required when faced with an anti-assignment provision which states that an assignment, including an assignment by operation of law , which requires consent from the non-assigning party.

Understanding Anti-Assignment Provisions

Generally, an anti-assignment provision prohibits the transfer or assignment of some or all of the assigning party’s rights and obligations under the contract in question to another person without the non-assigning party’s prior written consent. By way of example, a standard anti-assignment provision in a contract may read as follows:

Company ABC shall not assign or transfer this agreement, in whole or in part, without the prior written consent of Company XYZ.

In this case, Company ABC requires Company XYZ’s prior written consent to assign the contract. Seems simple enough. However, not all anti-assignment provisions are cut from the same cloth. For example, some anti-assignment provisions expand on the prohibition against general contractual assignment by including a prohibition against assignment by operation of law or otherwise . As is discussed in greater detail below, the nuanced meaning of this phrase can capture transactions that typically would not trigger a general anti-assignment provision and can also trigger the requirement to get consent from the non-assigning party for practical business reasons.

To explore this further, it is helpful to consider anti-assignment provisions in the two main structures of M&A transactions: (i) asset purchases and (ii) share purchases.

Context of M&A Transactions: Asset Purchases and Share Purchases

There are key differences between what triggers an anti-assignment provision in an asset purchase transaction versus a share purchase transaction.

i) Asset Purchases

An anti-assignment provision in a contract that forms part of the “purchased assets” in an asset deal will normally be triggered in an asset purchase transaction pursuant to which the purchaser acquires some or all of the assets of the target entity, including some or all of its contracts. Because the target entity is no longer the contracting party once the transaction ultimately closes (since it is assigning its rights and obligations under the contract to the purchaser), consent from the non-assigning party will be required to avoid any potential liability, recourse or termination of said contract as a result of the completion of the transaction.

ii) Share Purchases

Provisions which prohibit the assignment or transfer of a contract without the prior approval of the non-assigning party will not normally, under Canadian law, be captured in a share purchase transaction pursuant to which the purchaser acquires a portion or all of the shares of the target entity. In other words, no new entity is becoming party to that same contract. General anti-assignment provisions are not typically triggered by a share purchase because the contracts are not assigned or transferred to another entity and instead there is usually a “change of control” of the target entity. In such cases, the target entity remains the contracting party under the contract and the consent analysis will be premised on whether the contract requires consent of the third party for a “direct” or “indirect” change of control of the target entity and not the assignment of the contract.

Importantly, some anti-assignment provisions include prohibitions against change of control without prior written consent. For example, the provision might state the following:

Company ABC shall not assign or transfer this agreement, in whole or in part, without the prior written approval of Company XYZ. For the purposes of this agreement, any change of control of Company ABC resulting from an amalgamation, corporate reorganization, arrangement, business sale or asset shall be deemed an assignment or transfer.

In that case, a change of control as a result of a share purchase will be deemed an assignment or transfer, and prior written consent will be required.

A step in many share purchase transactions where the target is a Canadian corporation that often occurs on or soon after closing is the amalgamation of the purchasing entity and the target entity. So, what about anti-assignment provisions containing by operation of law language – do amalgamations trigger an assignment by operation of law? The short answer: It depends on the jurisdiction in which the anti-assignment provision is being scrutinized (typically, the governing law of the contract in question).

Assignments by Operation of Law

In Canada, the assignment of a contract as part of an asset sale, or the change of control of a party to a contract pursuant to a share sale – situations not normally effected via legal statute or court-ordered proceeding in M&A transactions – will not in and of itself effect an assignment of that contract by operation of law . [1]

Still, one must consider the implications of amalgamations, especially in the context of a proposed transaction when interpreting whether consent is required when an anti-assignment provision contains by operation of law language. Under Canadian law, where nuances often blur the lines within the jurisprudence, an amalgamation will not normally effect the assignment of a contract by operation of law . The same does not necessarily hold true for a Canadian amalgamation scrutinized under U.S. legal doctrines or interpreted by U.S. courts. [2]

Difference Between Mergers and Amalgamations

As noted above, after the closing of a share purchase transaction, the purchasing entity will often amalgamate with the target entity ( click here to read more about amalgamations generally). When two companies “merge” in the U.S., we understand that one corporation survives the merger and one ceases to exist which is why, under U.S. law, a merger can result in an assignment by operation of law . While the “merger” concept is commonly used in the U.S., Canadian corporations combine through a process called “amalgamation,” a situation where two corporations amalgamate and combine with neither corporation ceasing to exist. For all of our Canadian lawyer readers, you will remember the Supreme Court of Canada’s description of an amalgamation as “a river formed by the confluence of two streams, or the creation of a single rope through the intertwining of strands.” [3] Generally, each entity survives and shares the pre-existing rights and liabilities of the other, including contractual relationships, as one corporation. [4]

MTA Canada Royalty Corp. v. Compania Minera Pangea, S.A. de C.V.

As a practical note and for the reasons below, particularly in cross-border M&A transactions, it would be wise to consider seeking consent where a contract prohibits assignment by operation of law without the prior consent of the other contracting party when your proposed transaction contemplates an amalgamation.

In MTA Canada Royalty Corp. v. Compania Minera Pangea, S.A. de C.V. (a Superior Court of Delaware decision), the court interpreted a Canadian (British Columbia) amalgamation as an assignment by operation of law , irrespective of the fact that the amalgamation was effected via Canadian governing legislation. In essence, the Delaware court applied U.S. merger jurisprudence to a contract involving a Canadian amalgamation because the contract in question was governed by Delaware law. This is despite the fact that, generally, an amalgamation effected under Canadian common law jurisdictions would not constitute an assignment by operation of law if considered by a Canadian court. As previously mentioned, under Canadian law, unlike in Delaware, neither of the amalgamating entities cease to exist and, technically, there is no “surviving” entity as there would be with a U.S.-style merger. That being said, we bring this to your attention to show that it is possible that a U.S. court (if the applicable third-party contract is governed by U.S. law or other foreign laws) or other U.S. counterparties could interpret a Canadian amalgamation to effect an assignment by operation of law . In this case, as prior consent was not obtained as required by the anti-assignment provision of the contract in question, the Delaware court held that the parties to that agreement were bound by the anti-assignment provision’s express prohibition against all assignments without the other side’s consent. [5]

To avoid the same circumstances that resulted from the decision in MTA Canada Royalty Corp. , seeking consent where an anti-assignment provision includes a prohibition against assignment by operation of law without prior consent can be a practical and strategic option when considering transactions involving amalgamations. It is generally further recommended to do so in order to avoid any confusion for all contracting parties post-closing.

Practical Considerations

The consequences of violating anti-assignment provisions can vary. In some cases, the party attempting to complete the assignment is simply required to continue its obligations under the contract but, in others, assignment without prior consent constitutes default under the contract resulting in significant liability for the defaulting party, including potential termination of the contract. This is especially noteworthy for contracts with third parties that are essential to the target entity’s revenue and general business functions, as the purchaser would run the risk of losing key contractual relationships that contributed to the success of the target business. As such, identifying assignment provisions and considering whether they are triggered by a change of control and require consent is an important element when reviewing the contracts of a target entity and completing legal due diligence as part of an M&A transaction.

There can be a strategic and/or legal imperative to seek consent in many situations when confronted with contractual clauses that prohibit an assignment, either by operation of law or through other means, absent the explicit approval of the non-assigning party. However, the structure of the proposed transaction will often dictate whether consent is even required in the first place. Without considering this nuanced area of M&A transactions, purchasers not only potentially expose themselves to liability but also risk losing key contractual relationships that significantly drive the value of the transaction.

The Capital Markets Group at Aird & Berlis will continue to monitor developments in cross-border and domestic Canadian M&A transactions, including developments related to anti-assignment provisions and commercial contracts generally. Please contact a member of the group if you have questions or require assistance with any matter related to anti-assignment provisions and commercial contracts generally, or any of your cross-border or domestic M&A needs.

[1] An assignment by operation of law can be interpreted as an involuntary assignment required by legal statute or certain court-ordered proceedings. For instance, an assignment of a contract by operation of law may occur in, among other situations: (i) testamentary dispositions; (ii) court-ordered asset transfers in bankruptcy proceedings; or (iii) court-ordered asset transfers in divorce proceedings.

[2] MTA Canada Royalty Corp. v. Compania Minera Pangea, S.A. de C.V ., C. A. No. N19C-11-228 AML, 2020 WL 5554161 (Del. Super. Sept. 16, 2020) [ MTA Canada Royalty Corp. ].

[3] R. v. Black & Decker Manufacturing Co. , [1975] 1 S.C.R. 411.

[4] Certain Canadian jurisdictions, such as the Business Corporations Act (British Columbia), explicitly state that an amalgamation does not constitute an assignment by operation of law (subsection 282(2)).

[5] MTA Canada Royalty Corp .

With extensive experience in a broad range of corporate finance and commercial matters, Jeffrey offers clients a practical and business-minded approac...

Jeffrey K. Merk

- [email protected]

- T 416.865.7768

- C 416.722.7988

Liam is a driven and forward-thinking corporate lawyer, with a passion for helping public and private clients achieve their growth objectives.

Liam Tracey-Raymont

- [email protected]

- T 416.865.3964

Gary is a trusted legal business partner and is committed to building long-standing client relationships.

Gary Volman

- [email protected]

- T 647.426.2799

Christian advises clients on a range of capital markets transactions, bringing to bear a strong work ethic and problem-solving skills which make him a...

Christian Nianiaris

- [email protected]

- T 647.426.2810

Josh summered at the firm in 2021 and 2022. He recently graduated with Distinction from the University of Ottawa Faculty of Law, achieving Dean’...

Joshua Ward

- [email protected]

- T 416.863.1500

Related Areas of Expertise

- Capital Markets

- Mergers & Acquisitions

- International Transactions

Related publications

Budget 2024: capital gains inclusion rate to increase, first reading of bill 185 and the draft 2024 provincial planning statement, ontario releases a revised draft provincial planning statement.

A Fresh Take

Insights on M&A, litigation, and corporate governance in the US.

Delaware Court holds anti-assignment clause prevents enforcement of contract after merger

Get in touch.

On September 16, 2020, the Superior Court of Delaware issued an order with potential implications for companies contemplating acquisitions of businesses or assets. In MTA Can. Royalty Corp. v. Compania Minera Pangea , S.A. De C.V. , No. N19C-11-228 AML CCLD, 2020 Del. Super. LEXIS 2780 (Sept. 16, 2020), Judge Abigail M. LeGrow held that, following a merger,[1] the surviving company lacked standing to enforce a contract entered into by its predecessor (the non-surviving company in the merger) because the contract’s anti-assignment clause prohibited assignment “by operation of law”.

Companies considering acquisitions should carefully review their target’s contracts for anti-assignment clauses that prohibit assignment “by operation of law”, which Delaware courts interpret to include certain mergers. In addition, where a target’s key contracts contain anti-assignment clauses with such language, companies should carefully consider the preferred transaction structure. In a reverse triangular merger, the acquirer’s newly formed subsidiary is merged into the target, with the result being that the target survives and becomes the acquirer’s subsidiary. By contrast, in a forward triangular merger, the target does not “survive” and its rights are transferred to the existing subsidiary, which may implicate anti-assignment clauses. Reverse triangular mergers do not face the same issue because the target continues its corporate existence as a subsidiary of the acquirer.

Background of the contract and subsequent merger

In 2016, Compania Minera Pangea, S.A. de C.V. (“CMP”) purchased mineral rights in the El Gallo Mine from 1570926 Alberta Ltd. (“Alberta”). In exchange, CMP paid Alberta $5.25m in cash at closing and agreed to pay Alberta an additional $1m in 2018 subject to certain conditions. Of note, the agreement contained the following anti-assignment clause (the “Anti-Assignment Clause”):

Neither this Agreement nor any of the rights, interests or obligations under this Agreement may be assigned or delegated, in whole or in part, by operation of law or otherwise, by [Alberta] without the prior written consent of each other party, and any such assignment without such prior written consent shall be null and void. . . . [T]his Agreement will be binding upon, inure to the benefit of, and be enforceable by, the parties and their respective successors and assigns.

In July 2017, Alberta merged with Global Royalty Corp. (“Global”), a subsidiary of Metalla Royalty & Streaming Ltd., and Global was the surviving entity. Following that transaction, Global changed its name to MTA Canada Royalty Corp. (“MTA”). In November 2019, MTA brought a breach of contract claim against CMP based on CMP’s alleged failure to pay the $1m in consideration due in 2018.

Superior Court holds that anti-assignment clause extends to certain mergers

CMP argued that MTA lacked standing to enforce Alberta’s contract with CMP because, per the Anti-Assignment Clause, Alberta was required to obtain CMP’s written consent before assigning its rights to MTA. MTA argued that the Anti-Assignment Clause was meant to prevent third-party assignments, not “successor assignments” like Alberta’s merger. Id. at *11-12. To make this argument, it relied on a 1993 Chancery decision, in which then-Vice Chancellor Jacobs had held that, subject to certain conditions, anti-assignment clauses do not apply to mergers unless mergers are explicitly prohibited. Star Cellular Tel. Co. v. Baton Rouge CGSA ., 1993 Del. Ch. LEXIS 158, at *25 (July 30, 1993). According to MTA, because the last sentence of the Anti-Assignment Clause referred to “successors”, it was clearly not intended to extend to mergers.

The Superior Court disagreed. It explained that, as a result of the merger, Alberta had ceased to exist, so MTA could only enforce the contract if it showed that the Anti-Assignment Clause did not apply. MTA , at *6. It then held that the Anti-Assignment Clause clearly barred Alberta’s transfer of rights through a merger because the clause prevented assignment “by operation of law”, which Delaware case law had interpreted as referring to forward triangular mergers. Id. at *7-14. In light of what it regarded as a straightforward application of the Anti-Assignment Clause, the Superior Court did not engage in the Star Cellular analysis. The Superior Court found that the reference to “successors” in the Anti-Assignment Clause meant only that “valid successors” had the right to enforce the contract. Id. at *13.

Potentially at odds with Chancery precedent?

Of special relevance is the Superior Court’s treatment of existing Delaware case law on anti-assignment clauses and forward triangular mergers. Existing precedent from the Court of Chancery held that anti-assignment clauses containing both a prohibition on assignment “by operation of law” and a reference to “successors” were ambiguous. Under the Star Cellular test, this ambiguity was construed against the application of the anti-assignment clause.

Specifically, MTA appears at odds with the Chancery ruling in Tenneco Auto. Inc. v. El Paso Corp. , which also involved the impact of an anti-assignment clause following a forward triangular merger. C.A. No. 18810-NC, 2002 Del. Ch. LEXIS 26 (Mar. 20, 2002). The language of the anti-assignment clause in Tenneco was similar to that in MTA : both clauses prohibited assignment “by operation of law” while also referencing “successors”. In Tenneco , Vice Chancellor Noble found that those conflicting references made the anti-assignment clause ambiguous, meaning that, under the Star Cellular test, the successor company could enforce the contract. Id. at *7-10. The MTA Court did not explain why it reached the opposite result.

Similarly, in ClubCorp, Inc. v. Pinehurst, LLC , Vice Chancellor Parsons held that, following a forward triangular merger, an anti-assignment clause with language like that in Tenneco was ambiguous because the agreement both referenced “successors” and prohibited assignment “by operation of law”. No. 5120-VCP, 2011 Del. Ch. LEXIS 176, at *26-29 (Nov. 15, 2011). Again, the ambiguity militated in favor of finding that the anti-assignment clauses did not apply to the merger. MTA did not address Pinehurst.

Insights from MTA

MTA has several significant implications for practitioners. The first is a reminder to carefully review a target’s contracts for anti-assignment clauses. Such clauses in important contracts should be flagged and thoughtfully evaluated.

In addition, practitioners should remain aware that Delaware courts interpret the phrase “by operation of law” in assignment clauses to refer to mergers in which the target company does not survive. The presence of this language in anti-assignment clauses in a target’s important contracts (if those contracts are governed by Delaware law) should prompt a discussion about the appropriate transaction structure. For example, in MTA , the Court suggested that MTA would have had standing to enforce the contract with CMP if it had been merged through a reverse triangular merger rather than a forward triangular merger. The Superior Court cited a 2013 Chancery decision, Meso Scale Diagnostics, LLC v. Roche Diagnostics GmbH , in which Vice Chancellor Parsons found that “a reverse triangular merger does not constitute an assignment by operation of law”. 62 A.3d 62, 83 (Del. Ch. 2013).

If dealing with similar language in anti-assignment clauses in important agreements, practitioners should consider alternative transaction structures that would allow the target to retain its corporate existence. According to MTA , such alternatives should allow successor companies to enforce agreements without running afoul of anti-assignment clauses prohibiting “assignment by operation of law”.[2]

[1] The transaction was an amalgamation under Canadian law, which the parties and the Court agreed was the equivalent of a merger under Delaware law. The transaction structure was equivalent to a forward triangular merger.

[2] This may not be true in other jurisdictions. For example, under California law, a reverse triangular merger has been found to be a transfer of rights by operation of law . See SQL Sols. v. Oracle Corp. , 1991 U.S. Dist. LEXIS 21097, at *8-12 (N.D. Cal. Dec. 18, 1991).

Country Selector

Our regional experience.

- Netherlands

- Scandinavia

- Switzerland

- United Kingdom

- Latin America and the Caribbean

- United States

Asia-Pacific

- Southeast Asia

- South Korea

Middle East

- Saudi Arabia

International language sites

- Chinese | 汉语/漢語

- German | Deutsch

- Japanese | 日本語

A blog from the attorneys of Verrill

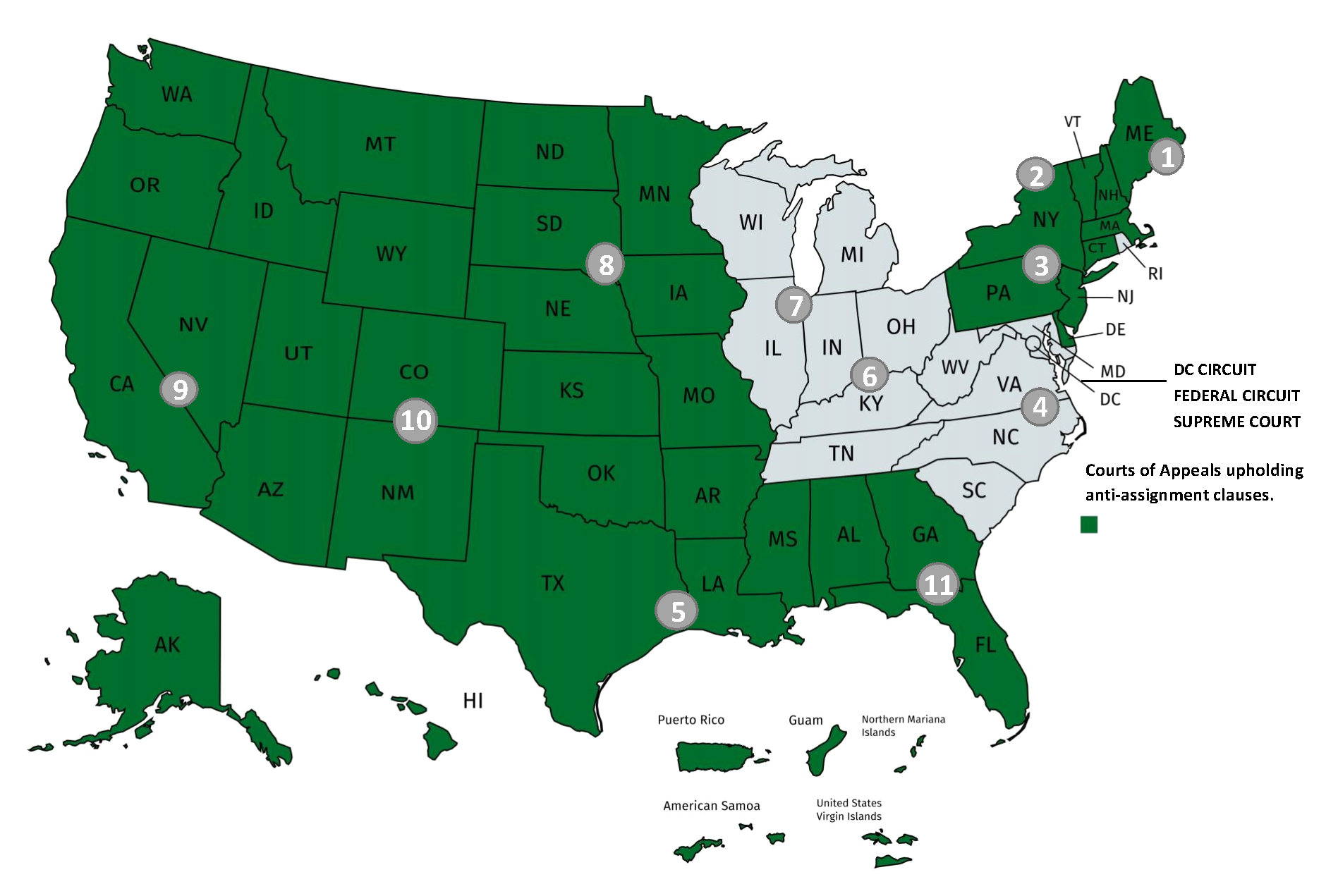

Near Unanimity Among the Circuits: Anti-Assignment Provisions are Enforceable

U.S. Courts of Appeals in all but four Circuits have now held that anti-assignment provisions in health insurance plans governed by ERISA are enforceable. In American Orthopaedic & Sports Medicine v. Independence Blue Cross Blue Shield , No. 17-1663, 2018 WL 2224394 (3d Cir. May 16, 2018) the Third Circuit joined the First, Second, Fifth, Ninth, Tenth, and Eleventh Circuit Courts of Appeals in holding that an anti-assignment provision effectively prevents a plan participant from assigning her right to sue for benefits under ERISA to a third party.

The provider in this case, American Orthopaedics, charged $58,400 to perform a shoulder surgery on an individual covered under an ERISA group health plan. The plan's insurers applied the plan's out-of-network limit to the provider's claim and reimbursed only $316 of the claim amount. The provider then pursued the internal administrative appeals process and simultaneously asked the participant to sign an assignment of benefits and limited power of attorney that would allow the provider to pursue a claim under Section 502(a)(1) of ERISA for payment of benefits under the plan. After the insurers denied the appeal, the provider filed suit and the insurers moved to dismiss citing an anti-assignment provision in the plan. The anti-assignment provision stated that right of the member to receive benefits under the plan was personal to the member and could not be assigned to any person, hospital or other entity.

Section 502(a) of ERISA provides that only a plan participant, beneficiary, fiduciary, or the Secretary of Labor have standing to bring a civil action under ERISA. This limitation is often referred to as a "statutory standing" requirement and the limitation seems straight forward enough. Nevertheless, several federal courts have held that a participant may assign the payment of insurance benefits and standing to sue under ERISA to a health care provider that has provided covered services to the participant. The rationale underlying these assignment decisions is that the ability to assign payment rights to a health care provider promotes access to health care by encouraging providers to treat patients without requiring payment in advance.

In recent years, health care providers - particularly out-of-network providers and collection agents purportedly acting on their behalf - have filed lawsuits pursuant to assignments from covered members that attempt to collect a larger share of their fees for service rendered to the member. In response to this increase in litigation, many plan sponsors have included the anti-assignment language in their plan documents in order to prevent participants and beneficiaries from assigning their rights under the plan to a health care provider or any other third party.

After concluding that the language of ERISA Section 502(a) did not conclusively preclude anti-assignment clauses, the Court in American Orthopaedics considered, but did not find persuasive, policy arguments advanced by both the insurers and the provider. Ultimately, the Court looked to the decisions of its sister circuits, which have held that an unambiguous provision in a private contract (in this case the plan document) must be enforced and followed suit. Accordingly, the Third Circuit joined the consensus opinion among several Circuits to hold that an anti-assignment clause in an ERISA health plan should, as a general matter, be enforceable. The Court also rejected the provider's argument that the insurers had waived their right to enforce the anti-assignment provision by failing to raise it as an affirmative defense during the administrative appeals process.

As illustrated above, following the American Orthopaedics decision, a majority of Federal Circuit Courts of Appeal have established strong authority that anti-assignment clauses in ERISA welfare benefit plans will be enforced. Even in the Fourth, Sixth, Seventh, and D.C. Circuits where there is no binding Court of Appeals decision, several District Courts have found that such provisions are enforceable. Accordingly, appropriately targeted anti-assignment provisions designed to limit provider litigation should be incorporated in most welfare benefit plans. The existence of such provisions provides the opportunity to end provider litigation at the motion to dismiss stage, often avoiding costly discovery and subsequent litigation activity.

If you would like additional information about incorporating anti-assignment language into your plan, or general protections against potentially expensive provider litigation, please contact a member of Verrill Dana's Employee Benefits and Executive Compensation group.

- Business Law

- Bankruptcy and Creditors' Rights

- Business Counseling

- Commercial Finance & Lending

- Corporate Governance & Board Advisory

- Emerging Companies

- Financial Services

- Mergers & Acquisitions

- Private Equity, Investment & Institutional Advisors

- Securities Offerings & Private Placements

- Tax & Nonprofit

- Construction

- White Collar Defense & Government Enforcement