Trading Business Plan Template

Written by Dave Lavinsky

Trading Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their trading companies.

If you’re unfamiliar with creating a trading business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a trading business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start a trading company or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your trading business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Trading Companies

With regards to funding, the main sources of funding for a trading company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for trading companies.

Finish Your Business Plan Today!

How to write a business plan for a trading company.

If you want to start a trading business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your trading business plan.

Executive Summary

Your executive summary provides an introduction to your trading business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of trading company you are running and the status. For example, are you a startup, do you have a trading business that you would like to grow, or are you operating a chain of trading companies?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the trading industry.

- Discuss the type of trading business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail what type of trading business you are operating.

For example, you might specialize in one of the following types of trading businesses:

- Retail trading business: This type of business sells merchandise directly to consumers.

- Wholesale trading business: This type of business sells merchandise to other businesses.

- General merchandise trading business: This type of business sells a wide variety of products.

- Specialized trading business: This type of business sells one specific type of product.

In addition to explaining the type of trading business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of products sold, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the trading industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the trading industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the trading industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your trading business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of trading business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Trading Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other trading businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of retailers or wholesalers, re-sellers, and dropshippers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of trading business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a trading company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of trading company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you sell jewelry, clothing, or household goods?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your trading company. Document where your company is situated and mention how the site will impact your success. For example, is your trading business located in a busy retail district, a business district, a standalone facility, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your trading marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your trading business, including answering calls, scheduling shipments, ordering inventory, and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your trading business to a new city.

Management Team

To demonstrate your trading business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing trading businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a trading business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge per item or per pound and will you offer discounts for bulk orders? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your trading business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and traders don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a trading business:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility location lease or a list of your suppliers.

Writing a business plan for your trading business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the trading industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful trading business.

Trading Business Plan Template FAQs

What is the easiest way to complete my trading business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your trading business plan.

How Do You Start a Trading Business?

Starting a trading business is easy with these 14 steps:

- Choose the Name for Your Trading Business

- Create Your Trading Business Plan (use a trading business plan template or a forex trading plan template)

- Choose the Legal Structure for Your Trading Business

- Secure Startup Funding for Trading Business (If Needed)

- Secure a Location for Your Business

- Register Your Trading Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Trading Business

- Buy or Lease the Right Trading Business Equipment

- Develop Your Trading Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Trading Business

- Open for Business

What is a Trading Business?

There are several types of trading businesses:

- Retail trading business- sells merchandise directly to consumers

- Wholesale trading business- sells merchandise to other businesses

- General merchandise trading business- sells a wide variety of products

- Specialized trading business- sells one specific type of product

Don’t you wish there was a faster, easier way to finish your Trading business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

Trading Business Plan

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Trading Business Plan?

Writing a trading business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Mention your product range:.

Highlight the product range of your trading business you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of trading company you run and the name of it. You may specialize in one of the following trading businesses:

- Retail trading

- Wholesale trading

- Export-import

- Dropshipping

- Describe the legal structure of your trading company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established trading business, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your trading business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your products:

Mention the trading products your business will offer. This may include product categories, product range, product features, product sourcing, etc.

Describe each service:

Mention the trading services your business will offer. This may include:

- Logistics & shipping

- Warehousing & storage

- Distribution & fulfillment

Additional Services

In short, this section of your trading plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your trading business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your trading business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & machinery:.

Include the list of equipment and machinery required for trading, such as office equipment, warehouse equipment, transportation vehicles, packaging & testing equipment, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your trading business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your trading business, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your trading business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample trading business plan will provide an idea for writing a successful trading plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our trading business plan pdf .

Related Posts

Bookkeeping Business Plan

Notary Business Plan

How to write a Business Plan Cover Page

Write Business Plan Using ChatGPT

Business Plan Presentation Tips

Problem Statement in Business with Solution

Frequently asked questions, why do you need a trading business plan.

A business plan is an essential tool for anyone looking to start or run a successful trading business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your trading company.

How to get funding for your trading business?

There are several ways to get funding for your trading business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your trading business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your trading business plan and outline your vision as you have in your mind.

What is the easiest way to write your trading business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any trading business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Business Plan for Investors

Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Trading Business Plan

MAR.12, 2024

According to a report, 13% of day traders maintain consistent profitability over six months, and a mere 1% succeed over five years. This is primarily due to inadequate planning and undercapitalization. A well-crafted trading business plan can help you avoid these pitfalls, and this article will guide you.

In this article, you’ll learn:

- The current trends and growth forecasts in the stock trading industry

- A breakdown of the costs involved in starting a trading company

- The key components of a trading business plan (with a trading business plan example)

- Strategies for securing funding and overcoming the barriers to entry

By the end of this article, you’ll understand what it takes to create a business plan for an investment company , positioning your trading business for long-term success in this lucrative but highly competitive industry.

Pros and Cons of Trading Company

Let’s explore the pros and cons associated with running a trading company before diving into the specifics of a trading site business plan. Understanding them will help you make informed decisions:

- Potential for significant profits.

- Flexibility in terms of time and location.

- Opportunity for continuous learning and skill development.

- High risk due to market volatility.

- Emotional stress and psychological pressure.

- Requirement for constant vigilance and discipline.

Trading Industry Trends

Industry size and growth forecast.

According to a report , the global stock trading and investing applications market size was at around $37.27 billion in 2022 and projects to grow at a CAGR of 18.3% from 2023 to 2030 (Source: Grand View Research). The following factors drive this growth:

- Increasing internet penetration

- Rising disposable income

- Growing awareness of investment opportunities.

(Image Source: Grand View Research)

The Services

As per our private equity firm business plan , a stock trading business offers various services, including:

- Facilitating Trades on behalf of clients

- Algorithmic trading services to automatically execute trades

- Market Insights (research reports, market analysis, and economic forecasts)

- Technical and Fundamental Analysis (price charts, historical data, and company fundamentals)

- Investment Recommendations

- Seminars and Webinars

- Online Courses

- Demo Accounts

- Portfolio Diversification

- Stop-Loss Orders

- Hedging Strategies

- Direct Market Access (DMA)

- Global Market Access

- Trading Platforms

- Mobile Apps

- High-Frequency Trading (HFT)

- Legal and Compliance Services

- Educate clients about Risk Disclosure

How Much Does It Cost to Start a Trading Company

According to Starter Story, you can expect to spend an average of $12,272 for a stock trading business. Some key startup costs include:

How Much Can You Earn from a Trading Business?

Earnings in the trading business can vary significantly and depend heavily on:

- Trading strategy and approach

- Market conditions and volatility

- Risk management techniques

- Capital allocation and leverage

While specific income figures are difficult to predict due to these factors. However, here are some statistics showing the earning potential of a stock trading business:

- According to Investopedia, only around 5% to 20% of day traders consistently make money.

- According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year.

- 72% of day traders ended the year with financial losses, according to FINRA.

- Among proprietary traders, only 16% were profitable, with just 3% earning over $50,000. (Source: Quantified Strategies)

What Barriers to Entry Are There to Start a Trading Company

Barriers to entry into the stock trading business include:

- Regulatory Requirements: Obtaining necessary licenses and registrations from governing bodies like the SEC and FINRA is a complex and time-consuming process.

- Capital Requirements: Trading activities require significant capital to manage risks and leverage opportunities, which can be a substantial challenge for new or small firms.

- Technological Expertise: Developing or acquiring sophisticated trading platforms, algorithms, and data analysis tools is costly and requires specialized expertise.

- Market Knowledge and Experience: Gaining in-depth knowledge and practical experience in the complex and dynamic financial markets takes years of dedicated study.

- Competitive Landscape: Breaking into the highly competitive trading industry dominated by established firms and well-funded proprietary trading desks is challenging for new entrants.

You can overcome these barriers by developing unique strategies, leveraging innovative technologies, and offering competitive and specialized services to differentiate yourself in the market. Do check our financial advisor business plan to learn more.

Creating a Trading Business Plan

A well-researched stock trading business plan is crucial to start a trading business. A general trading company business plan is a comprehensive document that defines your goals, strategies, and the steps needed to achieve them. It helps you stay organized and focused and increases your chances of securing funding if you plan to seek investors or loans.

Steps to Write a Trading Business Plan

You can use a business plan template for a trading company or follow these steps to prepare a business plan for a personal trading business:

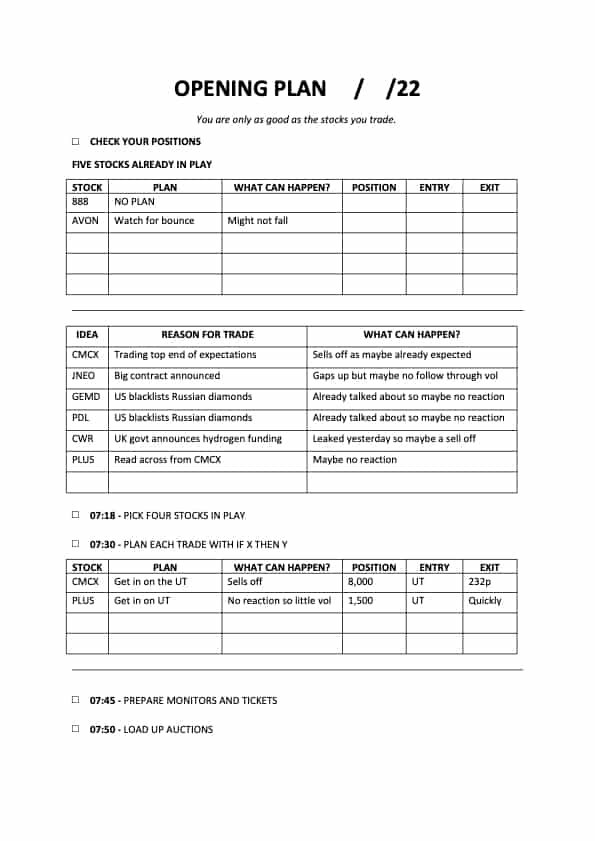

Step 1: Define Your Goals and Investment Objectives

Step 2: Conduct Market Research

Step 3: Develop Your Trading Strategy

Step 4: Establish Your Business Structure

Step 5: Develop a Financial Plan

Step 6: Outline Your Operational Procedures

Step 7: Create a Marketing and Growth Strategy

Step 8: Implement Risk Management

Step 9: Create an Exit Strategy

What to Include in Your Trading Business Plan

Executive summary, company overview.

- Market Analysis

- Trading Strategy and Risk Management

- Operations and Technology

- Financial Projections

- Management and Organization

- Appendices (e.g., research, charts, legal documents)

Here’s an online trading business plan sample of ABC Trading:

ABC Trading, a recently established stock trading firm, provides online trading services to individuals and institutional investors. Key highlights of our business include:

- Vision – Becoming a leading online trading platform with a wide range of trading products and services.

- Values – Our core focus is innovation, excellence, integrity, and customer satisfaction.

- Target market – Tech-savvy and risk-tolerant investors looking for alternative ways to invest their money and diversify their portfolios.

- Revenue model – Commissions and fees for each trade, as well as subscription fees for premium features and services.

- Financial goal – Break even in the second year of operation and generate a net profit of $1.2 million in the third year.

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

Company Name: ABC Trading

Founding Date: January 2024

Location: Delaware, USA

Registration: Limited Liability Company (LLC) in the state of New York

Regulated By: Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Our team comprises seasoned professionals with diverse finance, mathematics, computer science, and engineering backgrounds.

Marketing Plan

Marketing Strategy: We aim to leverage online channels, such as social media, blogs, podcasts, webinars, and email newsletters, to create awareness, generate leads, and convert prospects into customers.

Marketing Objectives:

- Reach 100,000 potential customers in the first year of operation

- Achieve a 10% conversion rate from leads to customers

- Retain 80% of customers in the first year and increase customer lifetime value by 20% in the second year

The customer profile of ABC Trading includes the following characteristics:

- Age: 25-65 years old

- Gender: Male and female

- Income: Above $100,000 per year

- Education: Bachelor’s degree or higher

- Occupation: Professionals, entrepreneurs, executives, or retirees

- Location: US or international

- Trading experience: Intermediate to advanced

- Trading goals: Income generation, capital appreciation, risk diversification, or portfolio optimization

- Trading preferences: Stocks, options, or both

- Trading style: Technical, trend following, or volatility trading

- Trading frequency: Daily, weekly, or monthly

- Trading risk: Low, medium, or high

Marketing Tactics:

- Create and distribute engaging and informative content on social media platforms

- Offer free trials, discounts, referrals, and loyalty programs

- Collect and analyze customer feedback and data to improve and personalize the customer experience

- Partner with influencers, experts, and media outlets in the trading and finance niche

Marketing Budget:

We will allocate $10,000 for our marketing campaign, which we will use for the following purposes:

Operations Plan

ABC Trading’s operations plan ensures the smooth and efficient functioning of the company’s platform and services and compliance with the relevant laws and regulations.

Operation Objectives:

- Maintain a 99% uptime and availability of the company’s platform and services

- Ensure the security and privacy of the company’s and customers’ data and funds

- Provide timely and professional customer support and service

Operation Tactics:

- Use cloud-based servers and services

- Implement encryption, authentication, and backup systems

- Hire and train qualified and experienced customer service representatives and technicians

- Monitor and update the company’s platform and services regularly

- Follow the best practices and standards of the industry and adhere to the applicable laws and regulations

Operation Standards:

- Test and verify the quality and reliability of the company’s platform and services before launching and after updating

- Document and report any issues, errors, or incidents that occur on the company’s platform or services

- Resolve any customer complaints or disputes in a timely and fair manner

- Maintain a record of the company’s operations activities and performance

Financial Plan

ABC Trading’s financial plan is to provide a realistic and detailed projection of the company’s income, expenses, and cash flow for the next three years, as well as the key financial indicators and assumptions that support the projection.

Financial Objectives:

- Achieve a positive cash flow in the second year of operation.

- Reach a break-even point in the second year of operation.

- Generate a net profit of $1.2 million in the third year of operation.

- Maintain a healthy financial ratio of current assets to current liabilities of at least 2:1.

Financial Assumptions:

- Launch its platform and services in the first quarter of 2024

- Acquire 10,000 customers in the first year, 20,000 customers in the second year, and 30,000 customers in the third year

- Average revenue per customer will be $50 per month, based on the average number and size of trades and the subscription fees

- Average operating expense per customer will be $10 per month, based on the average cost of salaries, rent, utilities, marketing, and legal fees

- Pay a 25% tax rate on its net income

- Reinvest 50% of its net income into the company’s growth and development

Projected Income Statement:

Projected Cash Flow Statement

Projected Balance Sheet

Fund a Trading Company

To successfully establish and operate a trading company, raising funds to finance daily operations and business expansion is crucial. There are different ways with their advantages and disadvantages:

1. Self-funding (Bootstrapping)

Self-funding, also known as bootstrapping, is when the founder or owner of the trading company uses their own personal savings, family business ideas , assets, or income to finance the business. This is the most common and simplest way to fund a trading company, especially in the early stages.

- Complete ownership and control

- Flexibility in decision-making

- Potential for higher long-term returns

- Limited access to capital

- Personal financial risk

- Slower growth potential

2. Debt Financing

Debt financing involves borrowing money from lenders, such as banks, credit unions, or microfinance institutions, to fund the trading company’s operations. The borrowed funds must be repaid with interest over a specified period.

- Retain ownership and control

- Potential tax benefits from interest deductions

- Disciplined approach due to repayment obligations

- Debt burden and interest payments

- Collateral requirements and personal guarantees

- Difficulty in securing financing for startups

3. Angel Investors

Angel investors are wealthy individuals who invest their own money into early-stage or high-potential trading companies in exchange for equity or convertible debt. Angel investors typically provide smaller funding than venture capitalists and offer mentorship, guidance, and access to their network.

- Access to capital and industry expertise

- Potential for additional mentorship and guidance

- Lower risk compared to traditional investors

- Dilution of ownership and control

- Potential for conflicting visions and expectations

- Limited resources compared to larger investors

4. Venture Capital (VC) Funding

Venture capital firms are professional investment firms that provide capital to high-growth startups in exchange for equity ownership. They typically invest large sums of money and are active in the company’s management and strategic direction.

- Access to substantial capital for growth

- Expertise and industry connections from the VC firm

- Validation and credibility for the business

- Significant dilution of ownership and control

- Intense pressure for rapid growth and return on investment

Depending on your business model, goals, and needs, you may also consider other options, such as grants, subsidies, partnerships, etc. Ensure to check for relevant documents, like the hedge fund private placement memorandum . The best way to fund your trading company is the one that suits your situation and preferences.

OGSCapital: Your Strategic Partner for Business Success

At OGSCapital, we specialize in professional business plans that empower startups, established companies, and visionary entrepreneurs. With over 15 years of experience, our seasoned team combines financial acumen, industry insights, and strategic thinking to craft comprehensive plans tailored to your unique vision. Whether you’re seeking funding, launching a new venture, or optimizing your existing business, we’ve got you covered.

If you have any further questions regarding how to write a business plan for your trading business, feel free to contact us. Our team at OGSCapital is here to support you on your entrepreneurial journey. You can also check our hedge fund business plan sample here.

Download Trading Business Plan Template in PDF

Frequently Asked Questions

What does a trading business include?

A trading business involves trading stocks and other financial instruments under a legal business structure. It includes:

- Market analysis

- Trading strategy

- Risk management

How does a trading company work?

A stock trading company facilitates the buying and selling of stocks (shares) on behalf of investors. These companies operate within stock exchanges, executing trades based on specific trading strategies.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

How To Start Your Trade Business

Table of Contents

Share this article.

Trade Business Mastery

Commercial Storage Insights

eCommerce and Warehousing

Georgia Warehousing

Illinois Warehousing

Starting a trade business can be an exciting and rewarding venture, brimming with the potential for personal growth and financial success. With the right approach, strategic planning, and dedication, it can evolve into a thriving and profitable enterprise.

This comprehensive guide is designed to steer you through the intricate process of launching your trade business, from the initial stage of selecting a niche that aligns with your interests and expertise, to effectively setting up your operations and making your mark in the market.

Whether you’re contemplating a career as an electrician, plumber, construction expert, or welder, this guide will provide you with the essential steps and insights to turn your entrepreneurial dreams into reality, ensuring a smooth transition from concept to successful business launch.

Choosing the Right Trade for You

Before diving into the business world, it’s crucial to select a trade that aligns with your skills and interests. While most blue-collar workers may already have a profession before considering opening their own business, there are also individuals interested in joining the blue-collar industry who aren’t sure where to start.

Are you hands-on and enjoy fixing things? Perhaps becoming an electrician or plumber might be your calling. If you prefer constructing and building, then a career in construction or welding might be more suitable. Consider market demand and potential profitability to ensure your chosen trade offers sustainable opportunities.

Here are the key steps to choosing a trade:

- Assessing your skills and interests

- Popular trade businesses: electrician, welder, construction, plumbing

- Market demand and potential profitability

After pinpointing the trade that best suits your skills and interests, or if you’re already seasoned in a trade, the exciting journey of launching your own business awaits.

A Step-by-Step Guide to Starting Your Trade Business

Embarking on your entrepreneurial journey in the trade industry begins with developing a solid plan. Crafting a comprehensive business plan that outlines your objectives, market analysis, and financial projections is crucial for laying the foundation of a successful trade business . Additionally, deciding on the legal structure of your business—be it a sole proprietorship, partnership, or LLC—will significantly impact your taxes, liability, and operational framework. It’s also essential to choose a name that not only reflects your brand’s identity but is also memorable and resonates with your target audience.

The initial steps to launching a blue-collar business include:

- Crafting a business plan : Detailing your objectives, market analysis, and financial projections.

- Deciding on the legal structure of your business : Options include sole proprietorship, partnership, LLC.

- Naming your business : Consider tips and factors that make your name stand out and be memorable.

With a foundational understanding of your business plan and a name for your company in place, we’re ready to dive into the detailed step-by-step guide on starting your trade business.

Getting the Required Licenses and Permits

Compliance with local laws and regulations is non-negotiable for your trade business. Before you can officially open your doors, you must navigate the maze of legal requirements, identifying and securing the necessary licenses and permits specific to your trade. This step is not just about meeting legal standards; it’s about laying a foundation for your business’s integrity and reliability. Additionally, investing in the right insurance coverage is essential to safeguard your enterprise against liability and unexpected challenges, thereby securing its long-term stability and growth.

To ensure your business operates within the legal framework, consider the following critical steps:

- Identifying necessary licenses for your trade : Research and understand the specific licenses required for your trade to avoid legal complications and ensure smooth operations.

- Process of obtaining permits and registrations : Familiarize yourself with the procedures for obtaining the necessary permits and registrations, which can vary greatly depending on your location and the nature of your trade.

- Importance of insurance for liability and protection : Obtain appropriate insurance to protect your business from potential liabilities and risks, ensuring peace of mind and a stable operational future.

Setting Up Your Workspace and Tools

The physical foundation of your trade business lies in an optimal workspace and the right toolkit. Whether you choose to work from a home office, lease a commercial space, or operate a mobile service, the effectiveness of your workspace directly influences your business efficiency and customer satisfaction. An essential part of this setup is equipping yourself with the right tools and technology that are fundamental to the services you offer. Moreover, effective inventory management and a reliable network of suppliers are crucial to ensure you always have the necessary materials and equipment on hand.

Consider the following aspects to optimize your workspace and toolset:

- Choosing a location : Decide on a workspace that best fits your business model, whether it’s a home office for administrative tasks, a leased space for operations, or a mobile setup for flexible service delivery.

- Essential tools and equipment for your trade : Invest in high-quality, reliable tools and equipment that will allow you to perform your work efficiently and professionally.

- Managing inventory and suppliers : Develop a systematic approach to inventory management and cultivate strong relationships with suppliers to ensure you have a steady supply of necessary materials and components.

A well-organized workspace and the right tools not only streamline your operations but also reflect your business’s professionalism and commitment to quality service.

Small Warehouse Space for Blue Collar Industries

Small warehouse spaces are incredibly beneficial for blue-collar businesses, offering the flexibility to scale operations, manage inventory efficiently, and reduce overhead costs associated with larger commercial spaces. These compact warehouses provide a practical solution for storing tools, materials, and equipment, while also allowing room for small-scale production or assembly activities. WareSpace stands out as a prime option in this sector, offering small warehouse spaces with 24/7 security , onsite management, and inclusive pricing, making it an ideal choice for businesses looking to optimize their operational efficiency and cost-effectiveness .

For more details on how WareSpace can benefit your business, book a tour today !

Financing Your Business

Securing adequate funding and managing your finances effectively are cornerstone elements in the blueprint of your trade business. Navigating through the myriad of financing options, from loans and grants to tapping into personal savings, is crucial to covering startup costs and fueling your business’s initial growth phase. An in-depth understanding of these financial avenues, along with meticulous budgeting, will pave the way for a stable and prosperous business journey.

To ensure financial readiness for your business venture, focus on these fundamental areas:

- Overview of funding options : Explore various financing routes such as bank loans, government grants, or personal savings to determine which option best aligns with your business needs and goals.

- Budgeting for startup costs : Develop a comprehensive budget that accounts for all initial expenses, from equipment purchases to marketing investments, ensuring you have a realistic financial roadmap to follow.

- Financial management basics : Establish strong financial management practices from the outset, including record-keeping, cash flow monitoring, and financial forecasting to maintain control over your business’s economic health.

A strategic approach to financing will not only kickstart your business but also sustain its growth and development.

Building Your Brand and Online Presence

In the digital age, cultivating a robust brand and establishing a compelling online presence is indispensable for your trade business’s market visibility and customer engagement. A distinctive logo, cohesive branding materials, and a professional website form the core of your brand identity, making a lasting impression on potential clients. Furthermore, active and strategic social media engagement is essential to connect with your audience, build relationships, and promote your services effectively.

To effectively build your brand and online presence, consider these critical steps:

- Creating a logo and branding materials : Design a logo and branding materials that reflect your business values and resonate with your target audience, fostering brand recognition and loyalty.

- Developing a professional website : Launch a website that is not only visually appealing but also user-friendly, informative, and optimized for search engines, serving as a digital storefront for your business.

- Utilizing social media for marketing and engagement : Develop a social media strategy that enhances your online visibility, engages with your audience, and promotes your services, leveraging the power of digital platforms to grow your business.

A well-crafted brand and dynamic online presence are vital to your business’s success, enabling you to stand out in the competitive trade industry and connect with customers both locally and globally.

Tour a small warehouse space TODAY!

See how a small warehouse space can transform your businesses.

Launching Your Business

The launch of your trade business is a pivotal moment that sets the tone for its future trajectory. Meticulous planning and strategic execution are paramount to ensure a smooth kickoff and to establish a solid foundation for sustained growth. Having a comprehensive checklist for launch day minimizes the risk of unforeseen issues, while robust launch strategies enhance your market entry impact. Additionally, building a strong network within the trade industry can open doors to valuable partnerships, client leads, and growth opportunities.

To guarantee a successful business launch, prioritize the following actions:

- Preparing for launch day : Compile a detailed checklist to cover all necessary preparations and contingencies, ensuring everything is in place for a smooth start.

- Effective strategies for a successful launch : Develop and implement launch strategies that highlight your unique selling propositions, engage your target audience, and generate buzz in the market.

- Networking and building relationships in the trade industry : Invest time in networking activities to forge connections with industry peers, suppliers, and potential clients, laying the groundwork for a robust business ecosystem.

Launching your business with clear objectives and a strategic approach will not only facilitate a successful debut but also drive long-term prosperity in the competitive landscape of the trade industry.

Managing Your Operations

Effective daily management is crucial for the success of your trade business, encompassing everything from workforce development to quality assurance and customer relations. Hiring the right talent is the first step, requiring robust recruitment strategies and comprehensive training programs to ensure employees not only meet the necessary skill levels but also align with the company’s values and work culture.

Beyond personnel, implementing stringent quality control measures is essential to maintain service standards and product quality, with regular monitoring, audits, and customer feedback playing key roles in continuous improvement.

Operational efficiency is another pillar of successful business management. Streamlining processes through workflow analysis and technology integration can significantly enhance productivity and reduce costs. Equally important is establishing effective customer service protocols to handle inquiries and complaints promptly and professionally, thereby fostering customer satisfaction and loyalty.

By addressing these critical aspects of business management, you can ensure smooth operations and create a strong foundation for sustained growth and profitability in your blue collar business.

Growing Your Trade Business

As your business matures, exploring growth opportunities will be key to continued success. Whether it’s expanding services, entering new markets, or enhancing marketing efforts, these strategies will help scale your business and increase profitability.

Starting your trade business is a journey filled with opportunities and challenges. By following these steps and continually adapting to the market, you can build a successful and sustainable business in the trade industry. Whether you’re an aspiring electrician, plumber, construction expert, or welder, the path to entrepreneurial success is within reach.

Blog Info: Author – Laura Johnson Category – Trade Business Mastery

Recent Articles

10 Ways to Optimize Shipping and Reduce Packaging Costs

Explore top tips to optimize shipping and packaging costs for SMEs. Learn about custom packaging, eco-friendly materials, and efficient logistics to save big.

The Role of Customer Service in Small Business Success

Discover how customer service drives small business success through personalized care, quick responses, and robust after-sales support.

More in Trade Business Mastery

Leveraging social media for small business growth, the importance of trade services in local economies, how to handle shipping delays and communicate with customers, join the thriving warespace community.

We’re about more than warehouses. Each WareSpace location is a community of energetic entrepreneurs, creating an excellent opportunity to network and build valuable alliances.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Businessing Magazine

Entrepreneuring Christina DeBusk January 22, 2018 8 min read

How to Create a Successful Skilled Trades Business

According to the Bureau of Labor Statistics’ (BLS) Occupational Outlook Handbook , not only are jobs in skilled trade industries—which include any business centered around electricians, carpenters, welders, bricklayers, plasterers, plumbers, masons, or any other skilled trade—growing, many are growing at an “as fast as average” or “much faster than average” rate.

Case in point: the average job growth rate for all industries from 2016 to 2026 is seven percent according to the BLS. Yet, carpenter occupations are expected to increase at a rate of eight percent during that 10-year timeframe. Electrician jobs are slightly higher at nine percent, and jobs in masonry and plumbing are even better yet, with 12 and 16 percent increases expected respectively.

This is great news for individuals who are considering establishing businesses within these categories of skilled trades. But just giving your company a name and setting up shop isn’t enough.

Ideally, you want to create a business that helps you pay your bills, save for retirement, and enjoy life a bit too. How do you do that? Here are three factors to consider.

Write a Business Plan

I know, I know. This is probably the last thing you want to do, but, as the U.S. Small Business Administration (SBA) says, “Your business plan is the foundation of your business.” It tells you where you are, where you want to go, and, perhaps most importantly, what you need to do to get there.

The SBA shares that there are two basic types of business plans: traditional and lean startup. The traditional plan is often preferred by individuals who are detail-focused and like to know exactly what steps they need to take.

This type of plan contains these eight sections:

- Executive Summary – a summary of your company and how it will be successful

- Company Description – a description of what problem or problems your business solves

- Market Analysis – an analysis of how you compare to other businesses within your market as well as industry-wide market trends

- Business Organization – the internal structure of your business and the hierarchy of its employees

- Products and Services – a list of the products and services you intend to sell and share how they will make your customers’ lives better, happier, easier, etc.

- Marketing and Sales –how you plan to market your goods and services to continue to increase your sales

- Funding – how much money you will need to start and grow your business, as well as which financial resources you intend to pursue

- Financial Projections – your business’s financial outlook for the next five years

If your business is “relatively simple” or you’re in a hurry to get it going, the SBA says that a lean startup business plan may be enough. This type of plan requires that you simply identify the key partnerships, activities, and resources needed to get your business going.

A lean plan also involves identifying who your customer base is and how they’ll interact with your business. It identifies your competitive advantage, states how you’ll handle initial and ongoing costs, and says what your revenue streams will look like.

Although both of these options can take a little bit of time to prepare, going through the process of creating a business plan helps you develop a clearer image of the company you want to create. It also forces you to look at it from many different viewpoints, making it easier to anticipate where your hardships will likely be and what you need to focus on to set yourself apart from your competitors.

Some small business owners tackle this planning task themselves, whereas others seek assistance from their employees, giving them a “wider view” of all of the issues that need to be addressed for greater levels of success. And if you’re really stuck, you may even consider hiring a professional writer to help you create a solid business plan. Because it is “the foundation of your business,” this could definitely be money that is well spent.

Create a Winning Hiring Strategy

Recent headlines indicate that this factor isn’t always easy. For instance, on December 4 th , 2017, CBS New York published a piece titled “ Nationwide Skilled Trade Shortage Creating Critical Need for Plumbers on Long Island .” Just a few months prior, on March 11 th of 2017, The Daily News in Memphis Tennessee reported a “ Shortage of Skilled Workers Creating a Crisis in Construction Industry .” Does this mean that, as a trades-based business owner, you’re going to struggle to find quality employees? One survey says yes.

In October of 2016, the ManpowerGroup revealed the results of their 2016/2017 U.S. Talent Shortage Survey , which included that 46 percent of the U.S.-based employers questioned said that they find it difficult to fill open positions. The absolute hardest ones to fill? Those related to skilled trades. Andrew Marshall, a business analyst, business expert and founder of the Biznovice.com , argues that in the end, the business plan should show how much money you need to start the project, when it will be self-sufficient, in what time it will be possible to return the invested funds and what profit can be expected.

Sadly, this isn’t new news. The ManpowerGroup goes on to explain that skilled trades have consistently held the top slot for hardest-to-fill jobs in the U.S. for seven consecutive years. Globally, it’s been number one five years in a row. What makes skilled trade workers so elusive that companies in this field are struggling to hire the number of people they need to fill their open positions?

Twenty-three percent of survey respondents indicated that the problem with finding enough trades workers was “a lack of available candidates.” Some expanded on this further by citing that lack of experience (18 percent) and lack of technical competencies (26 percent) were also to blame, as was the applicant wanting higher pay than they provided (16 percent).

In some cases (12 percent to be exact), it was the lack of soft skills that prevented the skilled trades business from finding suitable employees. Job search site Monster explains that soft skills are skills that are associated with communication, teamwork, adaptability, problem solving, critical observation, conflict resolution, and leadership—skills that don’t require a person’s handiwork, but are more centered around their ability to work well with others.

How do you overcome these hiring issues? ManpowerGroup says that many skilled trades businesses reported that they are implementing a variety of strategies to help them hire the best workers possible for their open positions. These include:

- Recruiting outside the talent pool (44 percent);

- Exploring alternative sourcing strategies (27 percent);

- Offering higher salary packages (22 percent) and/or more benefits (19 percent);

- Changing work models (17 percent); and

- Outsourcing the work (12 percent).

If you’re like I am, you’re looking at this list and thinking, “ Well, these are all great ideas, but most of them take money to implement (money that I really don’t have), so what am I supposed to do now? ” Fortunately, there are some agencies that can potentially help.

For instance, if your business is located within the State of Michigan, there’s something called the Skilled Trades Training Fund . This is a fund created to provide grants for business owners in these fields, to give them a hand financially when it comes to “training, developing and retaining current employees and individuals to be hired.”

From 2014 to 2017, this particular grant was awarded to 1,422 businesses, 712 of which have fewer than 100 employees on staff, qualifying them as small businesses. Furthermore, the average amount of the award was just under $34,000.

No matter where your business is located, check to see what types of financial resources are available in your area to potentially help offset these types of expenses. Research local, state, and national organizations and agencies to identify whether any of them provide grants or any other financial assistance that can help you create a top-notch staff.

Embrace Technology

When asked what changes have taken place within skilled trade industries within the last few years that can impact a company’s success, Chirag Ahuja, Head of Growth at Tradify —a company that offers software designed to help trades-based business owners schedule and manage jobs, quote projects, send invoices, and more—explains that “technology has had a massive impact on the trade industries in the last decade.”

Part of this arises from the way society as a whole has changed. “Customers are used to online shopping and instant service,” says Ahuja. “They want to see a quote the day they ask for it or they’ll have already found someone else. They want visibility and accountability.”

While some technology has made certain jobs or tasks no longer necessary, or obsolete, Ahuja shares that there is also a positive side to using this class of innovations within the trades. When trades professionals “adapt and embrace it, technology is improving business, enabling them to work faster and provide better results for clients,” says Ahuja.

Examples can be found across a variety of skilled trades, says Ahuja. For instance, locksmiths are using Amazon Key (a service that enables people to receive packages or let others into their homes without having to give them a key) and more and more builders are working with sustainable and recycled materials.

“One of our customers – a solar electrical company in Australia – uses drones to inspect solar panels from the air,” says Ahuja, “saving them hundreds of man hours.” That why Tradify takes an approach of “embracing technology to help them do their job better, build a reputation for producing high quality work, and – most of all – work hard to give their customers a professional, efficient service,” says Ahuja.

Currently, Tradify caters specifically to electricians, plumbers, and those with businesses within building, construction, and HVAC (heating, ventilation, and air conditioning). Regardless of what industry you’re in, it’s helpful to find technology created for your specific field, as it is more likely to have the features that you want, without a lot of the ones that you’d likely never use.

A Final Word on the Future of Skilled Trades

“No matter how advanced we get, we still need people who can unblock a toilet, install a light fitting, and build a house,” says Ahuja, adding that, “the more we live in a computer-driven world, the more prized those practical skills become.”

“Of course, some trades die out,” says Ahuja, as “there aren’t many coopers or blacksmiths left in the world. But new trades crop up.” Additionally, “because of the shortages and the fact that a university education doesn’t guarantee you a job any more, more and more schools and institutions are pushing the trades as a viable career choice for youth who have a practical mindset,” says Ahuja. “Trades are definitely here to stay.”

Christina DeBusk

Freelance writer, author, and small business consultant committed to helping entrepreneurs achieve higher levels of success.

Related Articles

Strategizing

Entrepreneuring

Interviews & Spotlights

Official Supporters

- How to start a trade business

Starting a trade business is an exciting opportunity to work for yourself and take complete control of the trade work you complete every day.

If you’re thinking about how to start a trade business and what you should do first, our guide will lead you through every step of the process and help you understand what you need to do and why.

Let’s get the basics out of the way first:

- What is a trade business?

The fact is that a modern trade business can be whatever you want it to be. It could be a one-person show, a small business with multiple types of tradesmen who work under you, or a specialist operation that bids on government contracts and uses highly skilled tradespeople to get the job done.

If you are starting a trade business and want to know what form one commonly takes, you’ll find that many trade businesses follow four main structures:

- Sole trader

- Partnership

- Family Trust

Types of tradesmen

To get a decent idea of what type of tradesman you could be, think about who you’d need to build a house:

Construction is a constant part of our lives, and so is the need for builders. Builders perform a vast range of tasks in their day-to-day work, and it’s a lot easier to research specific roles in the industry rather than read a list of them here. But for a brief synopsis, you’ll most likely see builders fall into either one or multiple of three industries:

- Residential

Electrician

Perhaps one of the most common types of tradies in business and for a good reason. Everything in our daily lives runs on electricity, and making sure that power goes where it needs to is the everyday life of an electrician. Skills in danger management and electrical engineering can make you one of the highest-paid types of tradesmen around, so definitely explore your options.

Plumbers specialise in everything related to pipes, fittings and water supply. Many consider plumbing a dirty job, but constant advances in the field of digital plumbing installation, maintenance and repair have moved plumbers away from the pipes and closer to a diagnostic computer in recent years.

Doors, floors, furniture and walls, if it involves cutting, shaping or installing, you’ll find a skilled carpenter at work. Take note of the fact that many carpenters work with various materials other than just wood.

Don’t let anyone tell you that bricklaying is an easy job. Building something made of hundreds of different pieces and making it run straight and true is an art, and the best bricklayers make it look easy.

Painting and decorating is a trade that’s always in demand. Homeowners look at the paint on the walls every day, and if they want those walls looking their best, they call a tradesman who can paint top to bottom with no mistakes.

If you aren’t afraid of heights, you’ll be at home as a roofer, the job which gives you more fresh air than any other type of tradesman. Laying roofing materials and waterproofing buildings is a roofing professional’s bread and butter work.

A good plasterer has an eye for detail and can create a perfectly finished wall with no blemishes. Painters rely on plasterers’ work to give them a smooth surface to paint over, and great plasterers can always demand top dollar for their work.

You can’t have a house without a great garden and outdoor living space to compliment it. Landscapers design and install just about everything related to outdoor activities infrastructure. Working as a landscaper could see you in an urban environment or the middle of nowhere; it’s just a matter of how you choose to specialise.

What makes a trades business successful?

Setting big goals

Success comes in many ways and at many different times in the trade industry, so let’s talk about big goals. When you ask a tradesman what helped them measure their ongoing success, they’ll often list off the large milestones they set for themselves as they grew their business.

Common goals include:

- Creating a profitable business structure

- Quality of life

- Continuous growth

- Getting off the tools

Measuring your success in between

Sometimes it can be hard to know if your trades business is a success at a glance, but there are lots of ways to dig deeper and check.

See how you’re doing by:

- Generating feedback and reviews

- Getting to know your financials better

- Seeing how you compare with industry developments and trade business profit averages

- Having a good night’s sleep – Seriously, if your trade business is running like clockwork, you should be resting easy, and if you aren’t, maybe there’s something you’ve been meaning to do but put off until now?

Two examples of successful trades business in Australia

New Plumbing Solutions (NPS)

With a 70 strong team and a great business model, New Plumbing Solutions is a fantastic example of a successful Australian trades business. Read more about them in this case study .

Online Air & Solar

No strangers to hard work, the 20+ team at Online Air & Solar have carved a niche as a successful Australian trades business working in domestic and commercial environments. Read more about them in this case study .