Top 20 Insurance Resume Objective Examples you can use

If you are writing a resume or CV for an insurance position, your career objective statement can decide if the recruiter reads your resume or not.

When hiring for an insurance position, employers usually look for candidates that are persuasive and possess the talent to attract and sign up clients in volumes for their companies.

If you are that kind of person, then you need a compelling resume objective to help sell your qualities.

There is no point selling yourself short and you should avoid that by learning how to write a great objective statement for your insurance resume.

This post will teach just how to craft a powerful insurance resume objective statement that will make your resume irresistible to employers.

How to Write a Great Resume Objective for an Insurance Position

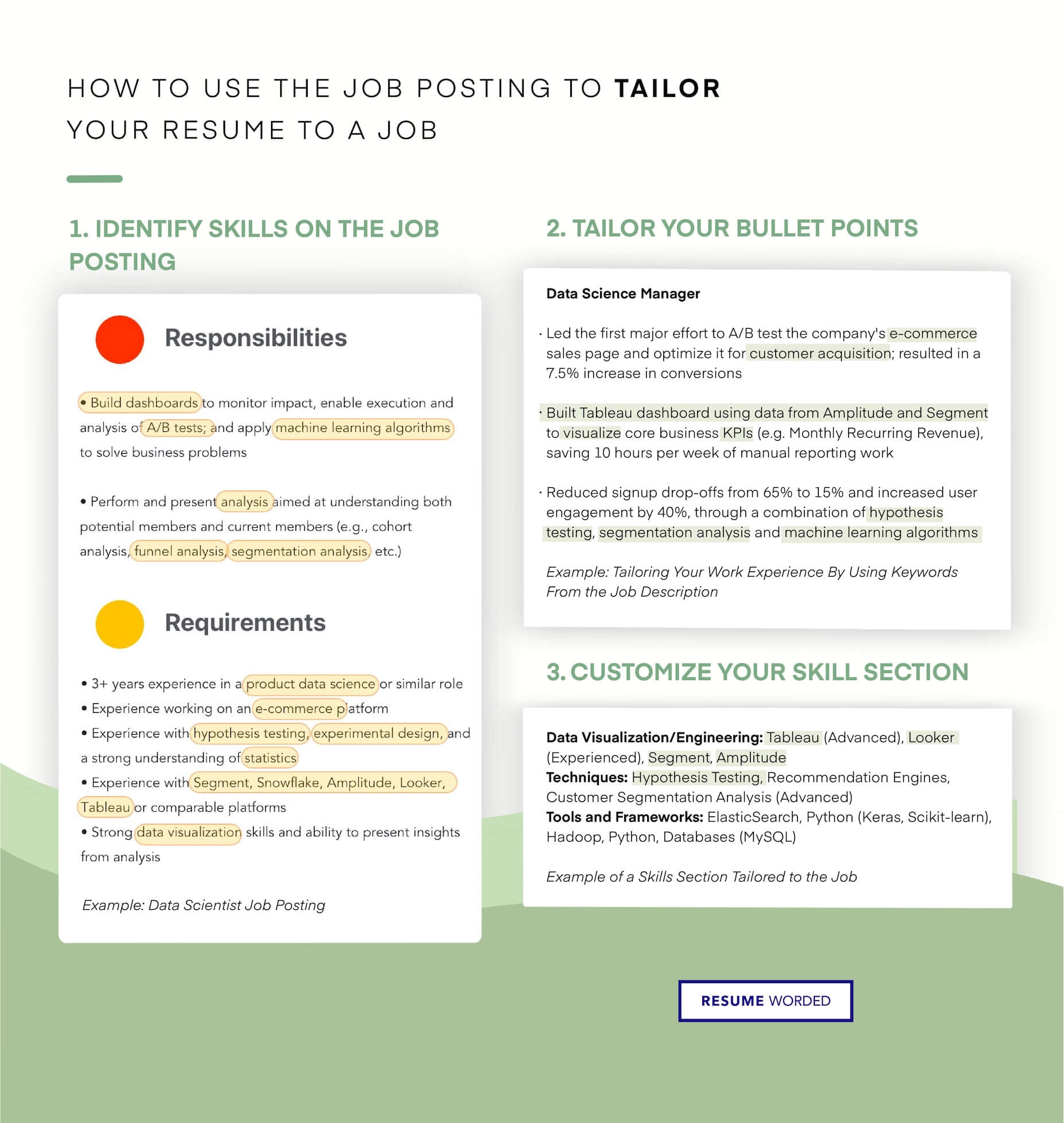

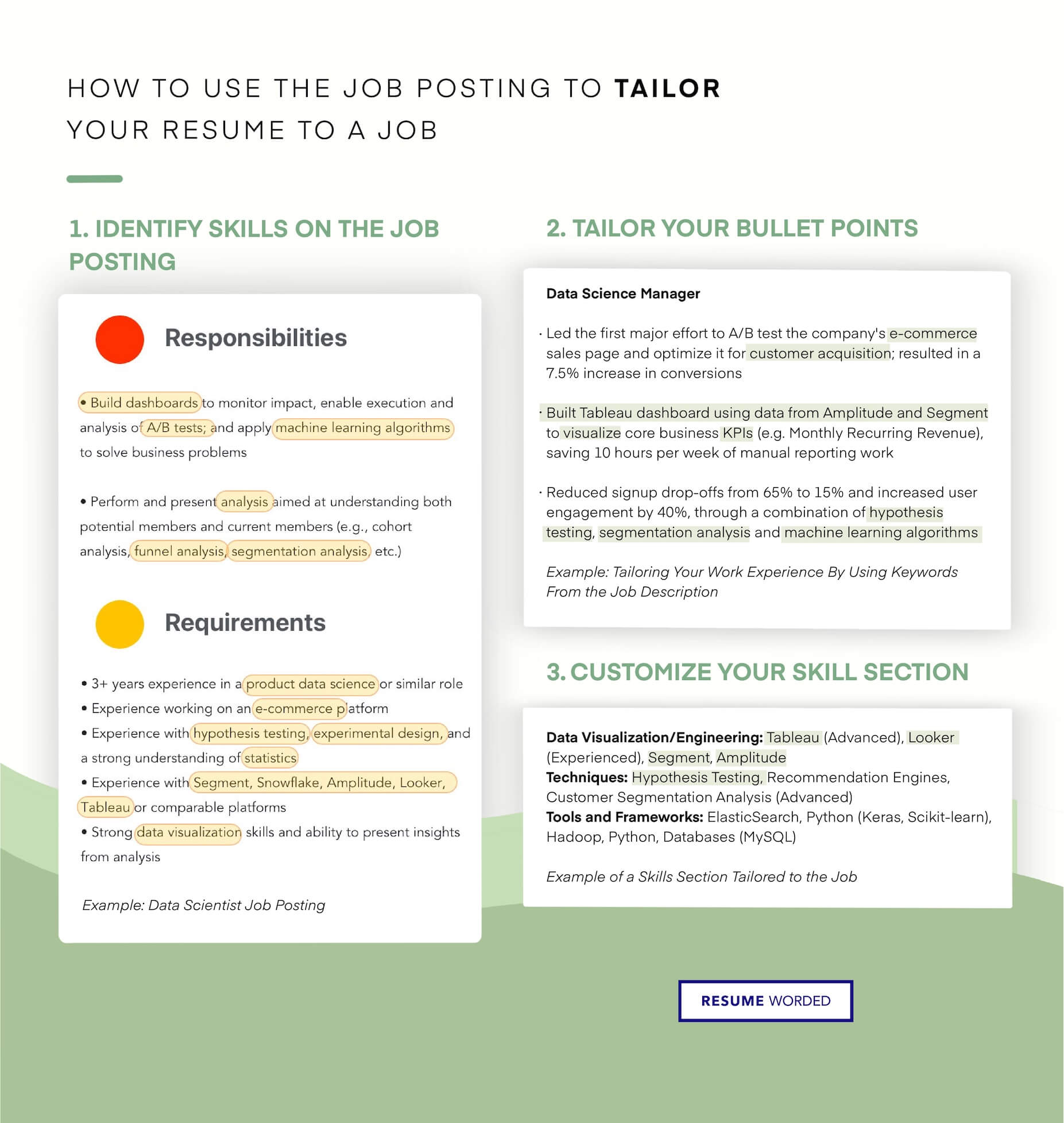

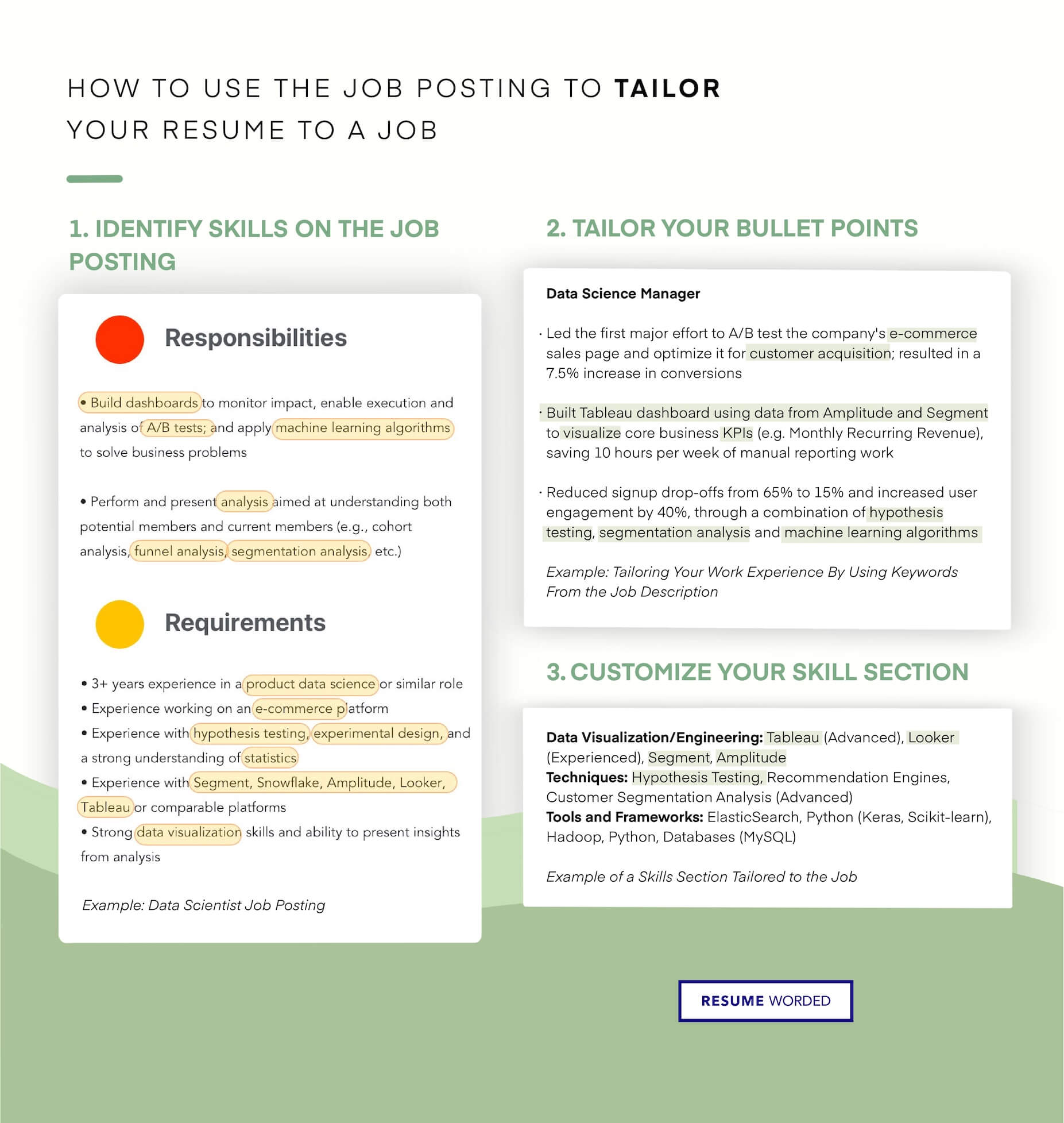

To write a winning resume objective for an insurance position, you need to learn what the job entails by checking the job advert, and study the job requirements and description.

You will have good knowledge of the duties and responsibilities that you will be expected to perform if hired for the insurance role, as well as the qualities, qualifications, experience, etc. that you need to have to succeed on the job.

Having this background information about the specific insurance job will help you to tailor your resume objective to match the major relevant competency, skills, qualities, experience, and personality that you possess and that are required for the job.

The insurance objective statement in your resume should assure the employer that you have what it takes to handle the responsibilities of the job effectively.

To improve your ability to write captivating resume objective statements for insurance positions, it’s important to study some good examples, see below:

Best 20 Insurance Resume Objective Examples you can apply

- Adaptable individual looking to gain an Insurance Service Representative position with Assura Group; coming with superior awareness of insurance principles as well as the capacity to skillfully handle insurance related matters.

- Progressive individual with polished relational and multitasking skills seeking to join a fast-paced organization as an Insurance Service Representative to afford the company solid administrative support.

- Hoping to secure an Entry-level Insurance Service Representative position with Steadfast Inc. Coming with exceptional talent to work well with clients to offer risk management packages.

- Seeking an Insurance Service Representative position with Long Life Company; bringing administrative and organizational skills to maintain insurance records, database, and bookkeeping system.

- Self-driven professional currently seeking an Insurance Agent with Dura Insurance Company where 7years of working experience in the insurance industry as well as management and strong communication skills will be utilized for the benefit the company.

- To obtain an Insurance Agent position with Global Sure Co., to assess personal and business needs and then recommend a solid protection package.

- Loyal and talented individual interested in an Insurance Agent position with Diamond Protection Corp, bringing along over 8years of experience as an insurance customer representative. Possess excellent logical ability to evaluate client’s present insurance policies and recommend changes if it will be more beneficial for the client.

- Smart and well organized individual keen on securing an Insurance Agent position in a progressive, customer-oriented environment to benefit the organization with exceptional administrative and multitasking skills to successfully manage diverse insurance issues.

- Bringing top performance as an Insurance Agent with ABC Global Insurance; coming with strong ability to learn fast, sound knowledge of insurance policies, and a track record for delivering quality service.

- Creative individual seeking an Insurance Agent role at Everest Assurance Co. Coming with 7+ years of experience in the insurance industry where workable marketing strategies were devised in addition to effectively promoting new products.

- To secure an Insurance Agent position in a fast-paced and challenging environment. Bringing above-usual passion to nurture warm prospects to a long term customer relationships for the company.

- Desiring an Insurance Agent position with a Top 5% Insurance Player. Bringing comprehensive knowledge of insurance fundamentals and talent to manage complex problems successfully using exceptional time management and organizational and skills.

- Seeking a full time Insurance Agent position with Zenith Assurance Co., coming with the talent to comprehensively examine a property to determine if it’s a good or bad insurance risk.

- Looking to build a long term career in the insurance industry beginning as an Insurance Agent in an ambitious organization, bringing solid analytical skills to evaluate and recommend suitable protection packages for different clients, as well as a natural persuasive ability to increase customer base for the company.

- Result-oriented individual with 5+ years in a marketing department. Looking to earn an Insurance Agent position where prospects can be converted to customers, and customer base grown to admirable numbers within a short time.

- Committed professional hoping to land a job as an Insurance Agent with Nanoth Insurance Co., bringing 5years of experience in the insurance industry which can be built upon to grow an efficient insurance unit.

- Smart individual; a fast learner with passion for the industry, seeks an entry level Insurance Agent position with GotBack Assurance Co. Bringing exceptional interpersonal and multitasking abilities as a foundation for meeting company’s goals.

- Result-oriented individual seeking an Insurance agent position with Sinai Group where excellent social skills and ability to distinguish several policies and bringing this information to clients, so they are well-informed in choosing their insurance policy will be utilized.

- Well organized individual desiring a professional Insurance Agent position with EverGreen Assurance that can benefit immensely from excellent management and client-focused skills.

- To earn an Insurance Agent position with Sun Insurance Company. Bringing 5 years experience in the industry and a track record for winning new clients and clientele.

To be able to gain the insurance job that you desire, you need to be able to communicate in your resume objective that you possess what the recruiter requires for anyone to access and succeed on the job.

This post provides valuable ideas and insurance resume objective samples you can learn with and apply in making a great objective statement for your resume.

Related Posts

This Site Uses Cookies

Privacy overview.

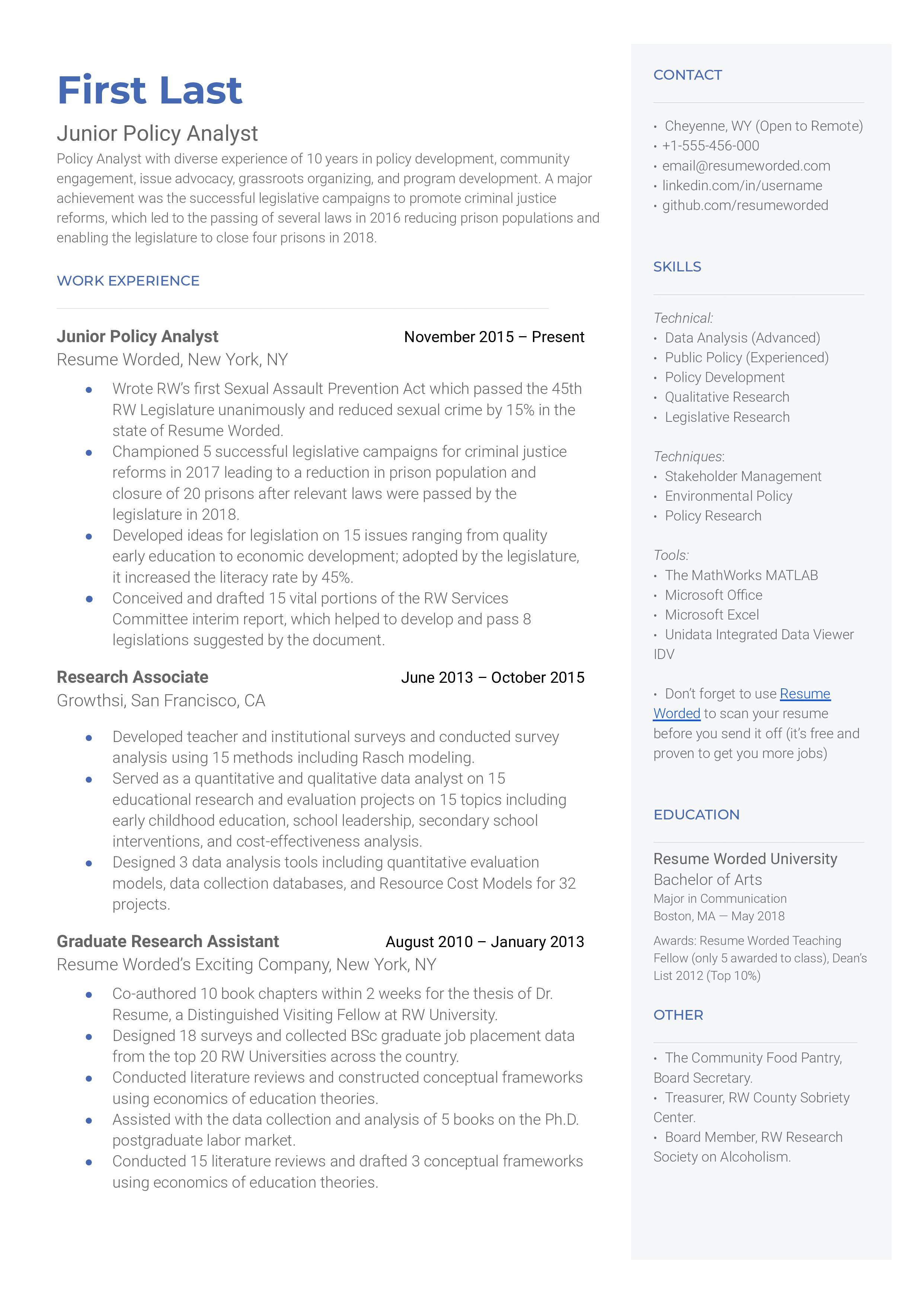

Resume Worded | Proven Resume Examples

- Resume Examples

- Other Resumes

9 Insurance Resume Examples - Here's What Works In 2024

Insurance gives you peace of mind and security against any unforeseen events in life. as a professional in the insurance industry, you need to provide your clients with beneficial insurance against harmful events, while at the same time protecting the insurance company against fraudulent claims and maximizing their bottom line. this guide will break down professional titles within the insurance industry, show you successful resume samples for each title, and give you tips to create your winning resume..

The insurance industry is a huge multifaceted industry with a multitude of career options. Each title has different responsibilities, required skills, and educational backgrounds. If you are an insurance sales representative, you might not even need a bachelor’s degree to get hired. In contrast, for more senior-level and associate positions, a bachelor’s degree and advanced degree or certification would be expected.

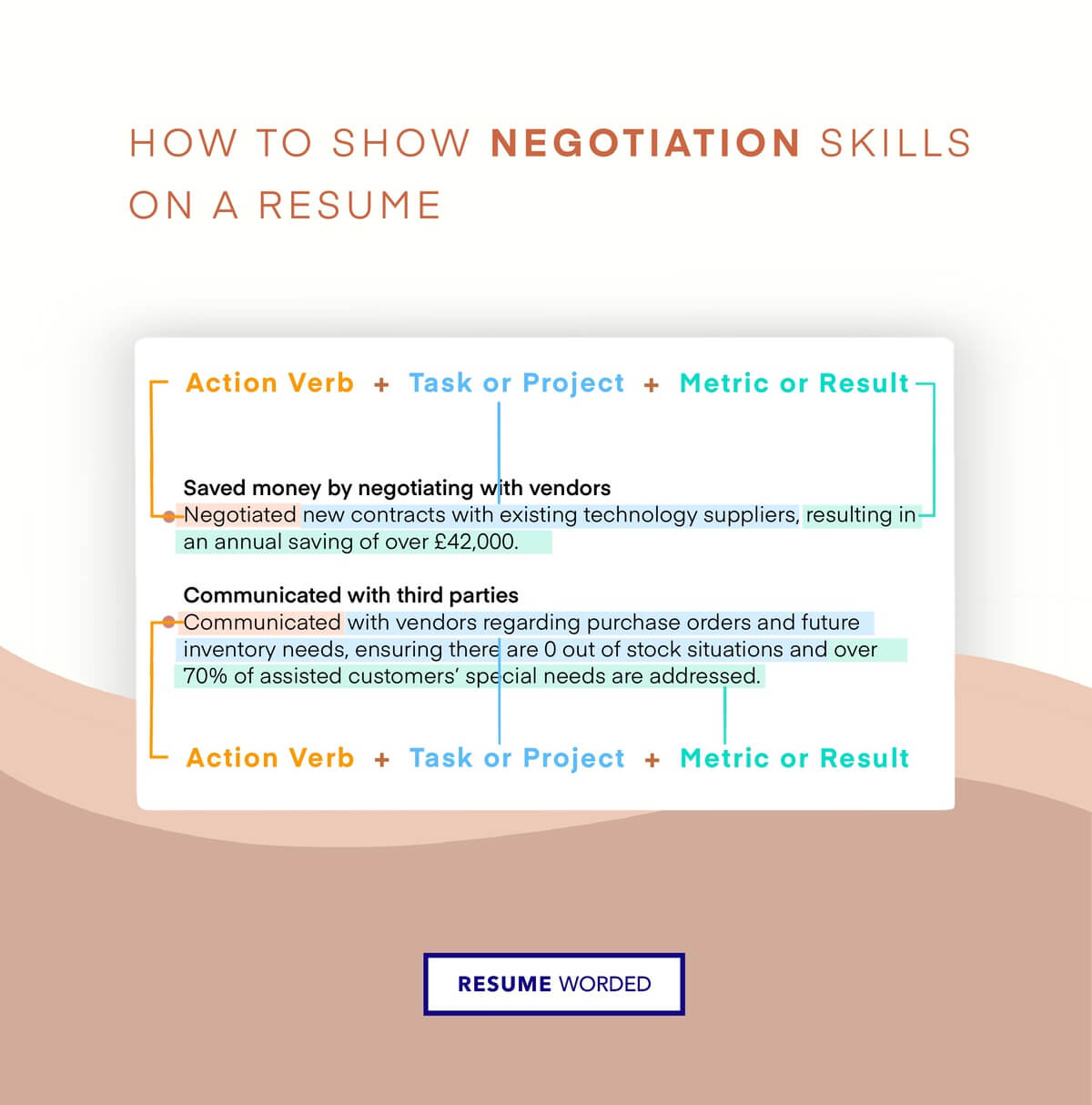

Some overarching requirements of professionals in the insurance industry include in-depth knowledge of the industry and the services offered, great analytical skills, and great financial and accounting skills. For a front-facing position, negotiation, marketing, and communication skills are key.

Here are some insurance industry career options with details of what recruiters are looking for when looking at your resume.

Insurance Resume Templates

Jump to a template:

- Insurance Agent

- Insurance Sales Agent

- Life Insurance Agent

- Insurance Investigator

- Insurance Case Manager

- Insurance Underwriter

- Health Insurance Agent

- Insurance Claims Manager

Jump to a resource:

- Keywords for Insurance Resumes

Insurance Resume Tips

- Action Verbs to Use

- Related Other Resumes

Get advice on each section of your resume:

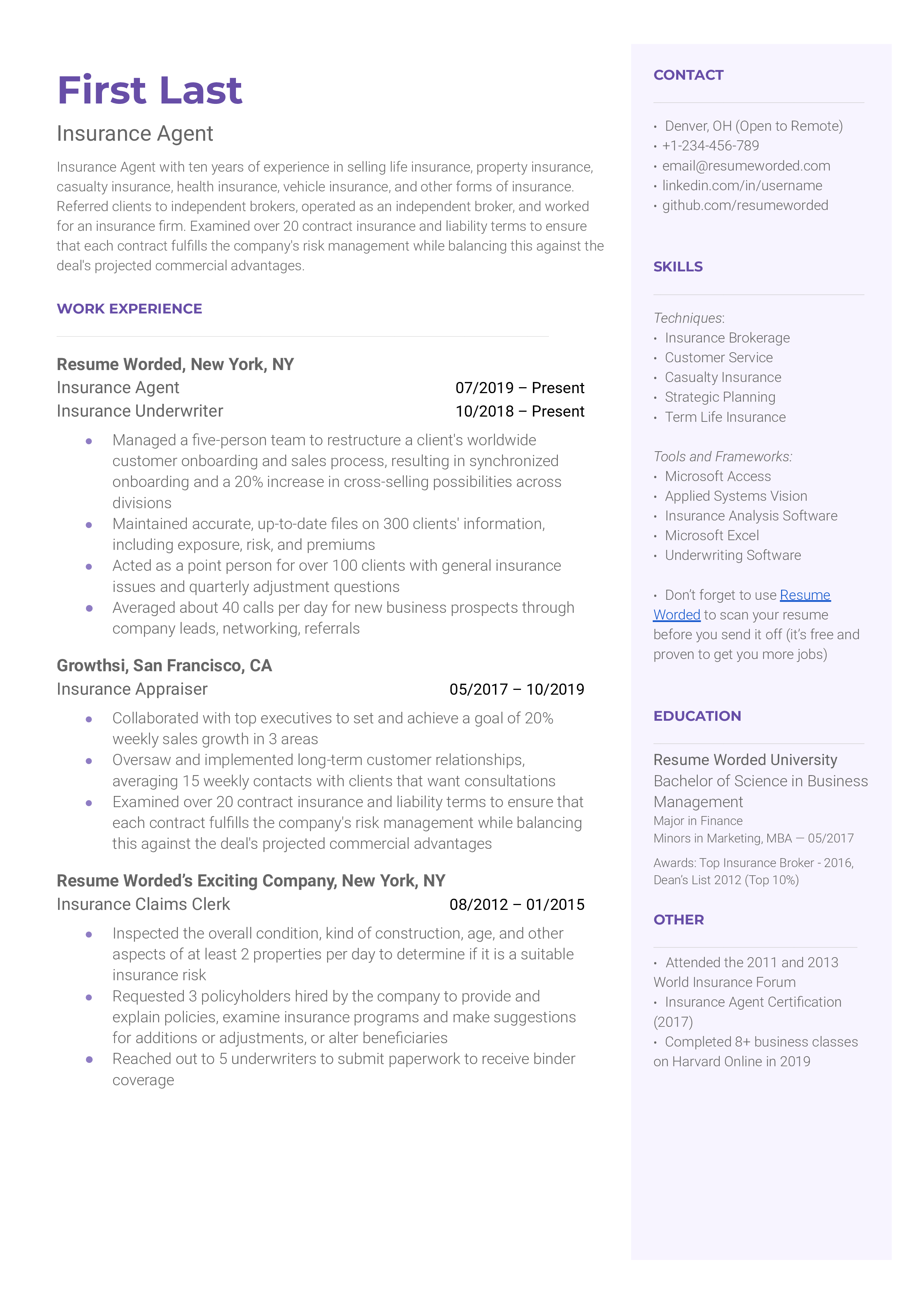

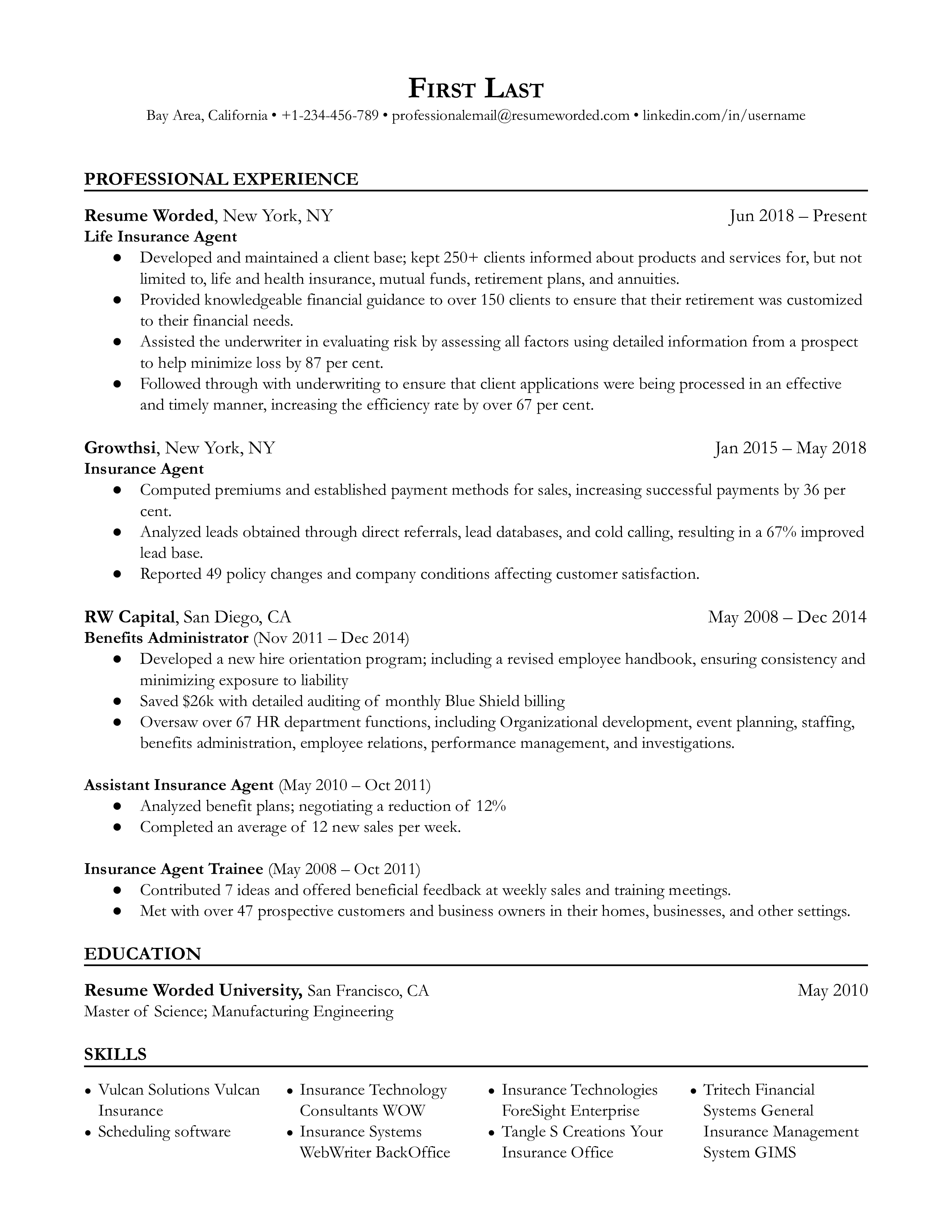

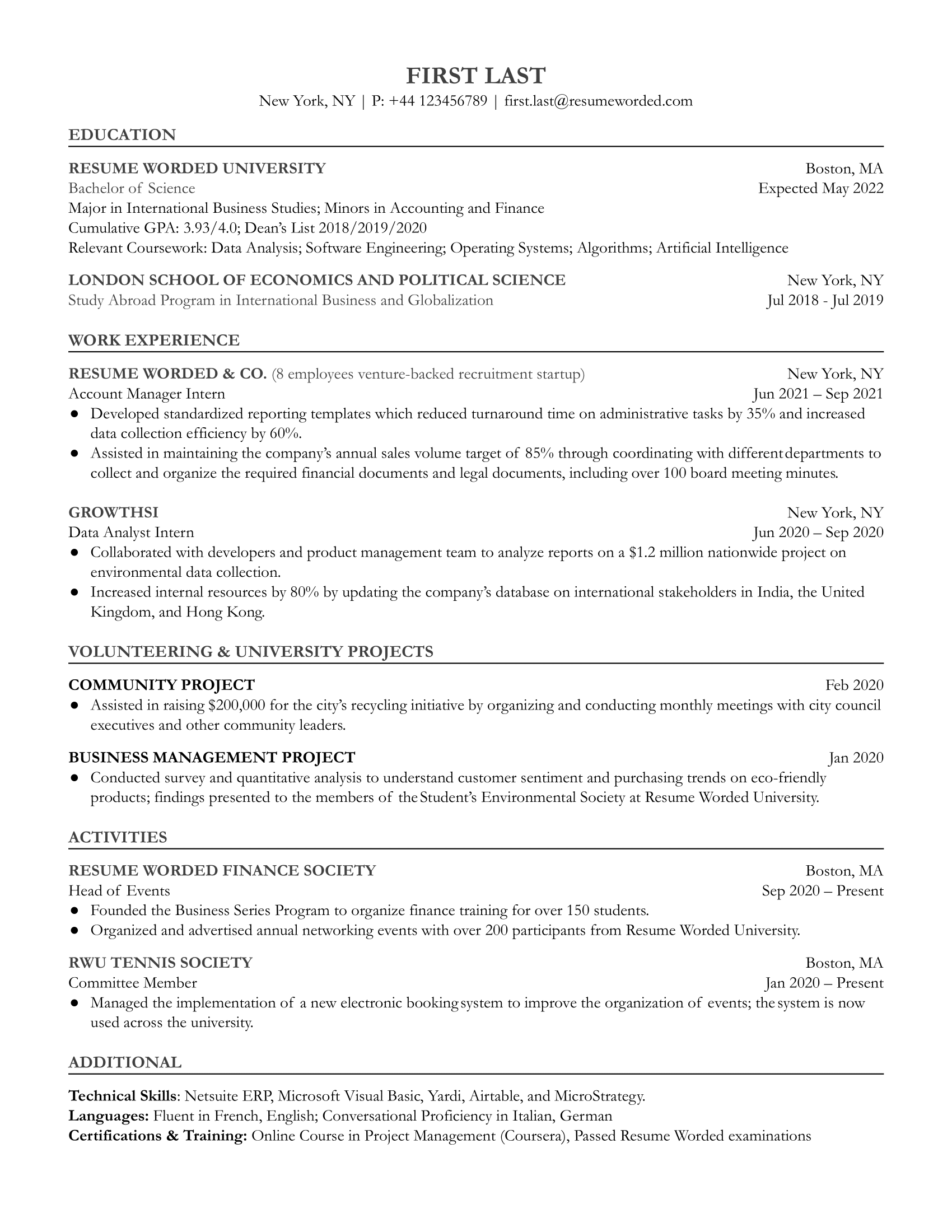

Template 1 of 9: Insurance Agent Resume Example

In the simplest terms, an insurance agent sells insurance policies. Because of the nature of your job, your sales, negotiation, and communication skills must be incredibly strong. You will also have to have an in-depth understanding of the insurance industry and, more specifically, of the different insurance policies you are offering to clients. You can work for an insurance company or act as an independent broker. Educationally, a bachelor's degree in finance or an insurance-related field would be highly beneficial but is not an absolute requirement. Depending on where you would like to work, however, you may need to be certified or licensed by the relevant governing body. If such certification is needed, ensure you list your relevant certifications in your resume.

We're just getting the template ready for you, just a second left.

Tips to help you write your Insurance Agent resume in 2024

quantify your sales success as an insurance agent..

What is your success rate in closing deals? On average, how many new clients did you bring your previous employers monthly? Whatever impressive figures you may have about your success as an insurance agent should be highlighted on your resume.

Include any experience of accolades in negotiating or communication.

If you are beginning your career in insurance as an insurance agent, you may not have a lot of directly relevant experience to add to your resume. In this situation, you can list any communication experience you have. So if you were on the debate team, or if you have a small business where you handle your sales, include that experience.

Skills you can include on your Insurance Agent resume

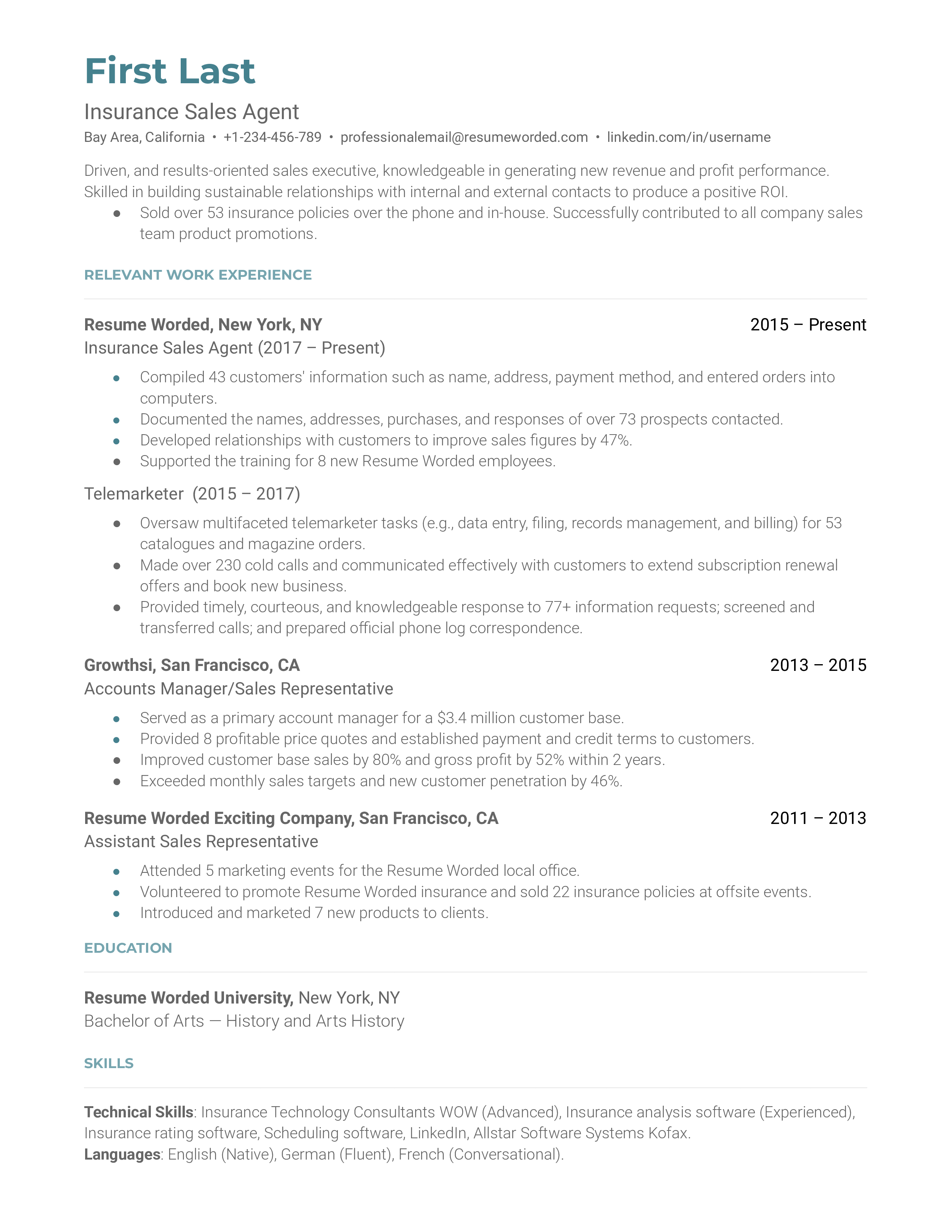

Template 2 of 9: insurance sales agent resume example.

An insurance sales agent’s job is to contact potential insurance customers and convince them to buy an insurance policy that suits their needs and budget. You may be meeting clients physically to discuss options, or virtually. This position includes a level of research as you source potential clients as well as admin tasks as you onboard new clients and get them registered with their policies. To do this job you should be outgoing and have strong intrapersonal and negotiation skills. In addition, you need to be persistent and resilient in the face of rejection. Recruiters will be looking to see your previous experience to get an idea of your level of success, so ensure your experience section highlights any and all success you have had in your career thus far. Here is an example of a successful insurance sales agent resume.

Tips to help you write your Insurance Sales Agent resume in 2024

indicate your specialization within insurance (e.g. life, health, or others)..

There are many types of insurance including life insurance, health insurance, travel insurance, motor insurance, etc. Each type of insurance has its specifications and requires a different approach to sales. If you are particularly skilled in one type of insurance, be sure to highlight that in your introduction section.

Use your network to meet people in the insurance industry.

The saying 'your network is your net worth' is particularly true in this profession. The more groups of people you have access to, the more potential clients you can reach. If you have access to a particularly relevant group of people, find a way to include that in your resume.

Skills you can include on your Insurance Sales Agent resume

Template 3 of 9: life insurance agent resume example.

Crafting a resume for a life insurance agent role isn't just about showcasing your sales acumen. The industry has been evolving lately with a stronger focus on customer relationships and digital marketing. So, in addition to sales, it’s vital to highlight your interpersonal skills and tech-savviness. Many firms are also increasingly looking for agents who can educate customers about complex insurance products effectively. Therefore, your ability to distill and communicate complex information clearly should shine through your resume.

Tips to help you write your Life Insurance Agent resume in 2024

display proficiency in digital tools.

You should highlight your proficiency in using digital tools like customer relationship management software, email automation, and social media platforms. These skills demonstrate your ability to adapt to the evolving insurance landscape and effectively engage with today's tech-savvy customers.

Showcase your education-focused selling approach

Potential employers value agents who can clearly explain complex insurance products to customers. So, emphasize instances where you've educated clients about their policy options and helped them make informed decisions. This approach demonstrates your commitment to customer satisfaction and ethical sales practices.

Skills you can include on your Life Insurance Agent resume

Template 4 of 9: life insurance agent resume example.

As the name suggests, life insurance agents sell life insurance. Like other agents, you can work for one insurance company or act as a broker and sell life insurance from multiple insurance companies. This is a particularly difficult profession with over 90% of agents leaving the profession within one year. Contributing to the difficulty in the profession is the fact that you will most likely not be officially employed but will probably be retained as a contractor. In addition, you will most likely be based on a commission basis which means you will only receive wages for completed deals. Add to that, the fact that life insurance unlike motor insurance, is not compulsory to have, and is not considered important by large sections of the population. On the positive side, this profession has low barriers to entry. You do not necessarily need much more than a high school diploma. What you must excel in is networking, sales, and negotiating. Ensure your resume stresses your success in these areas most of all. Take a look at this strong life insurance agent resume.

Use numbers, like your success rate as an agent.

To survive in this profession you have to make sales. To put yourself above the multitudes of other applicants, highlight your success rate if you have been particularly successful thus far. How much money did you bring in for your previous employer? How many sales on average did you make per month?

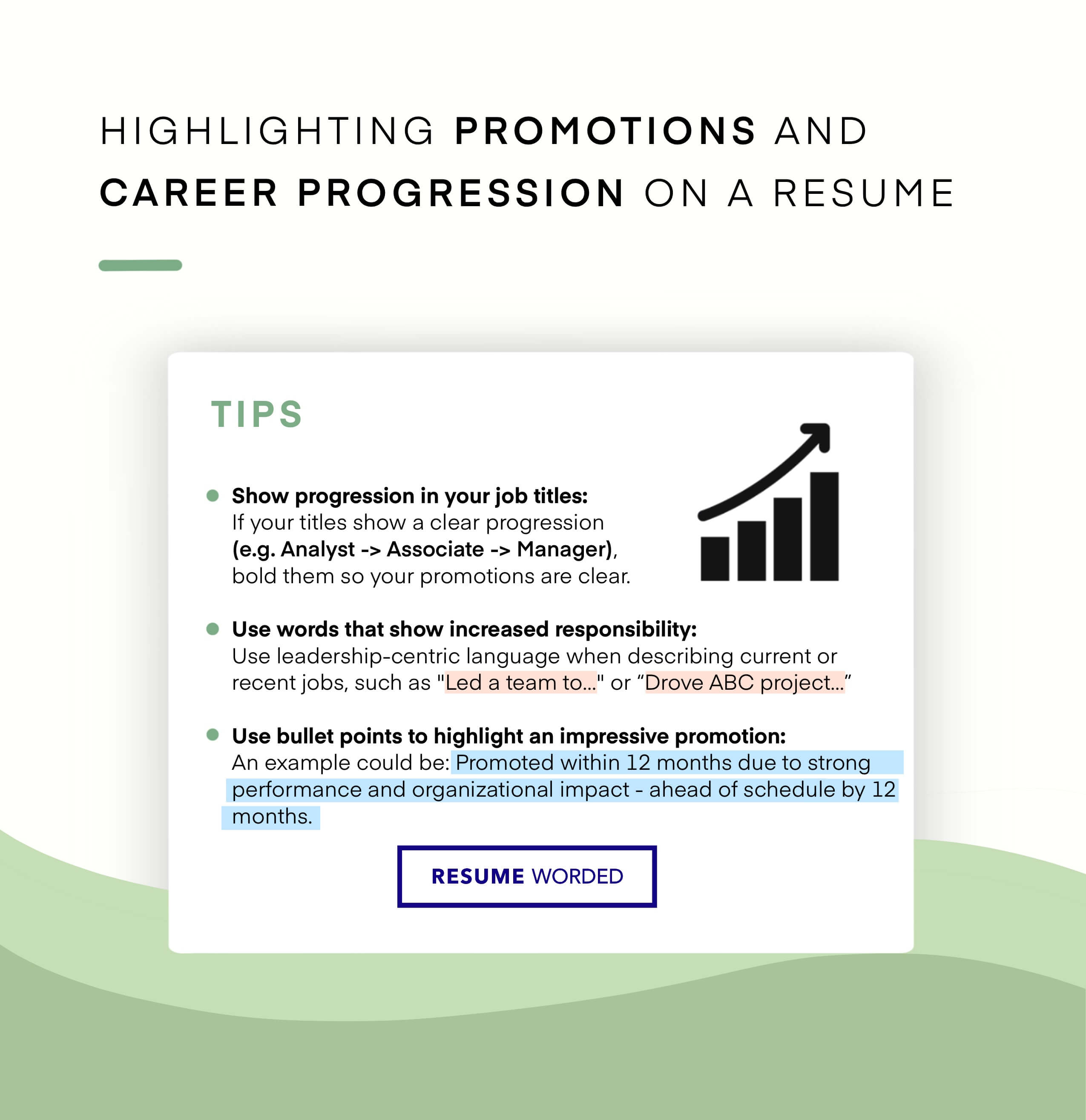

Show career progression in the insurance industry.

A potential employer would appreciate an applicant who can show that their career has grown in the industry. It shows dedication to the profession and affirms a wealth of knowledge and experience in the industry.

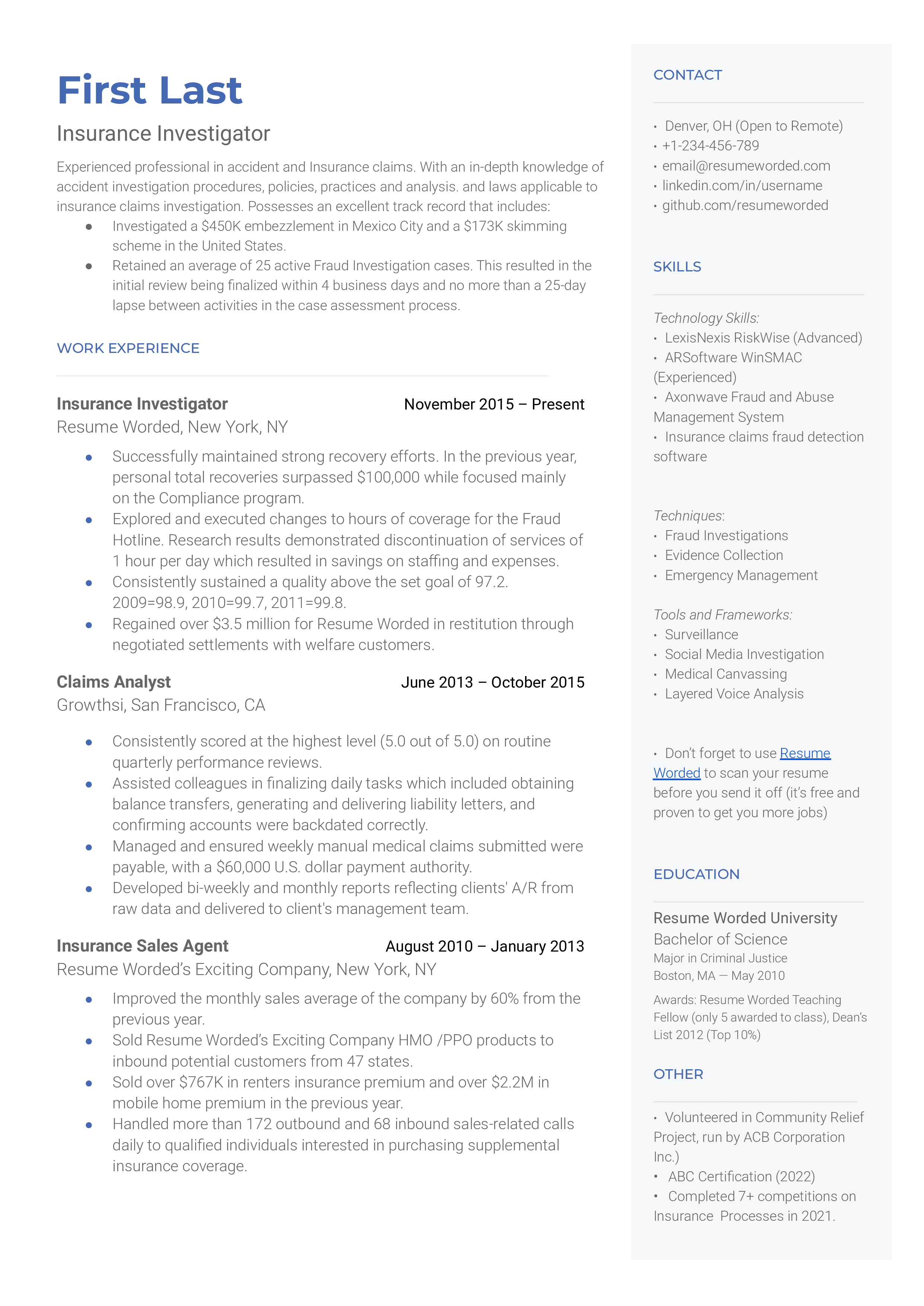

Template 5 of 9: Insurance Investigator Resume Example

Insurance investigators investigate claims that are suspected to be fraudulent. Like others in the insurance field, you can work in-house for one insurance company or as a sub-contractor for multiple insurance companies. Your investigations may range from following paper trails to physically surveilling claimants to prove fraud. While you do not need a bachelor’s degree, a potential employer would appreciate one. In addition, certain states or countries may require licensing or certification before you can begin in the profession so ensure you do your research and list your license on your resume.

Tips to help you write your Insurance Investigator resume in 2024

state your investigative specialty and use keywords related to your niche in your resume..

Are you particularly skilled at surveillance work or at following a financial paper trail? Make sure you list that in the introduction and show figures of your success in your experience section to back that up.

Include investigative positions outside the insurance industry.

Your ability to investigate is the core skill needed for this position. So if you used to be a private investigator or a claims examiner in any field, ensure that you include that experience in your resume. A lot of the skills from these positions will be transferable to the insurance investigator position.

Skills you can include on your Insurance Investigator resume

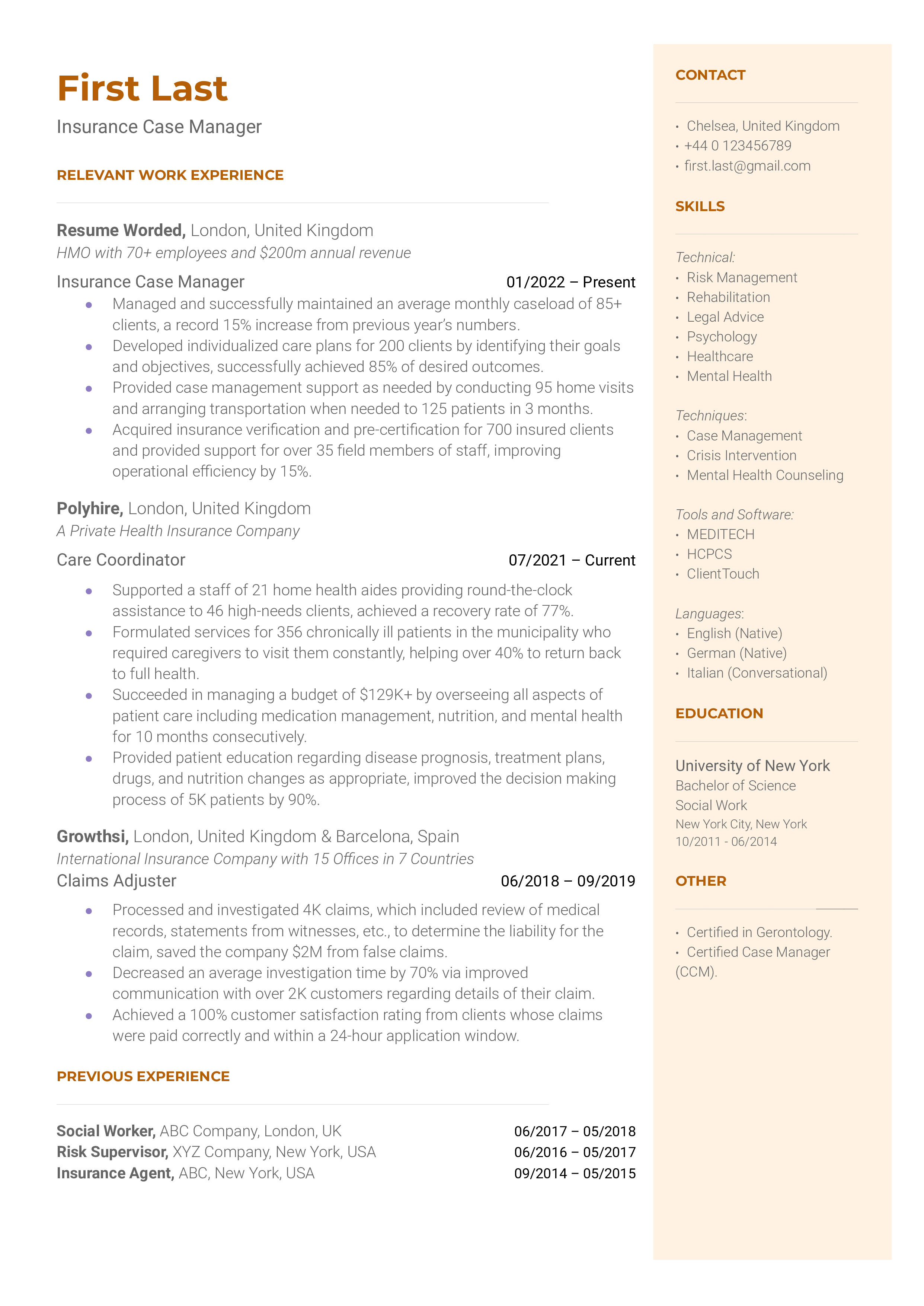

Template 6 of 9: insurance case manager resume example.

An insurance case manager takes care of the insurance company’s clients. They help clients decide on the most beneficial policies and ensure clients can benefit from their insurance policies. They also oversee any claims and cases. This is not usually an entry-level position as professionals in this position will usually have begun as insurance agents or advisors. Because there will be contact with clients, communication skills are very important as are problem-solving skills. Take a look at this strong insurance case manager resume.

Tips to help you write your Insurance Case Manager resume in 2024

include experience where you were in a support or carer position..

This position requires you to root for the company's clients and assist them where necessary. Because of this, any experience in a support position can be mentioned as the soft skills are transferable. This should especially be included if you do not have a lot of professional experience in the insurance industry.

Include your administrative skills.

It would be easy to craft your resume around your communication and negotiation skills. But a significant part of your job will include administrative work. This will include writing reports, processing claims and policy registrations, etc. Ensure that you include experience doing these tasks as well. To bolster your resume further, quantify the administrative workload that you can and have handled.

Skills you can include on your Insurance Case Manager resume

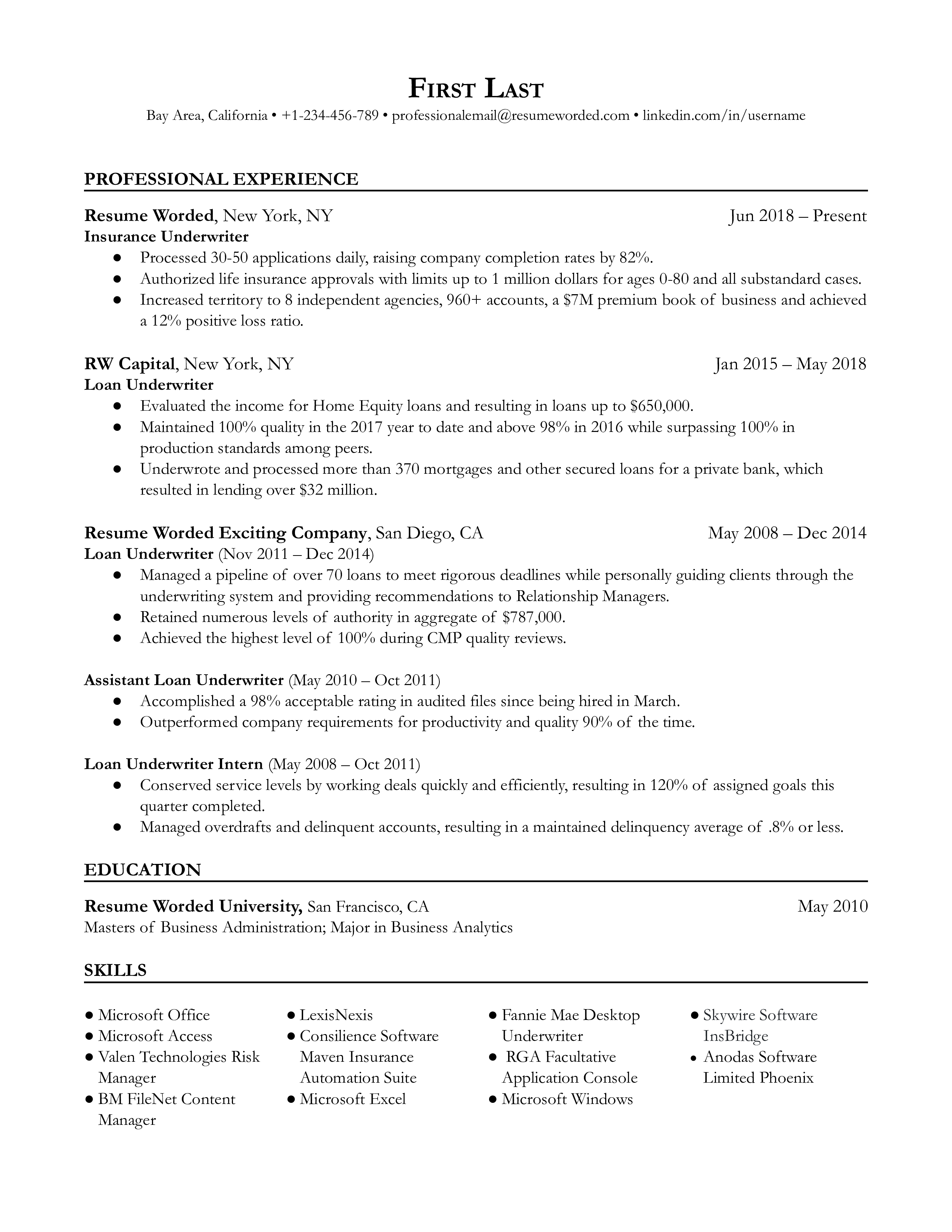

Template 7 of 9: insurance underwriter resume example.

An insurance underwriter analyzes the risk associated with insuring a potential client or their assets and then calculates an acceptable price determined by that risk. You will usually be the middle man between insurance agents eager to make sales and insurance companies who want to minimize risk at all costs. Unlike other professions in the insurance industry, you will probably work as an employee of an insurance company as opposed to working as a contractor on a commission basis. While there is software that you can use to establish risk, you will still need a very analytical mind to accomplish your tasks. You will also be expected to have a bachelor's degree - preferably in an analytical field. Your resume should highlight your experience with industry-standard technologies and software as well as your experience and educational background.

Tips to help you write your Insurance Underwriter resume in 2024

include recognition of your underwriting success..

It is sometimes hard to judge the quality of an applicant’s underwriting experience without seeing them in action on a case. To improve an employer’s confidence in your skills and success, include any recognition for you have gotten in your previous positions. So if you had high ratings, or won awards for your work, make sure you highlight that in your resume.

Keep an updated technical skills section.

This is a very technical job and technology is constantly evolving. Make sure you are using the latest risk calculating software at all times and ensure your list of technologies in your skill section is constantly up to date.

Skills you can include on your Insurance Underwriter resume

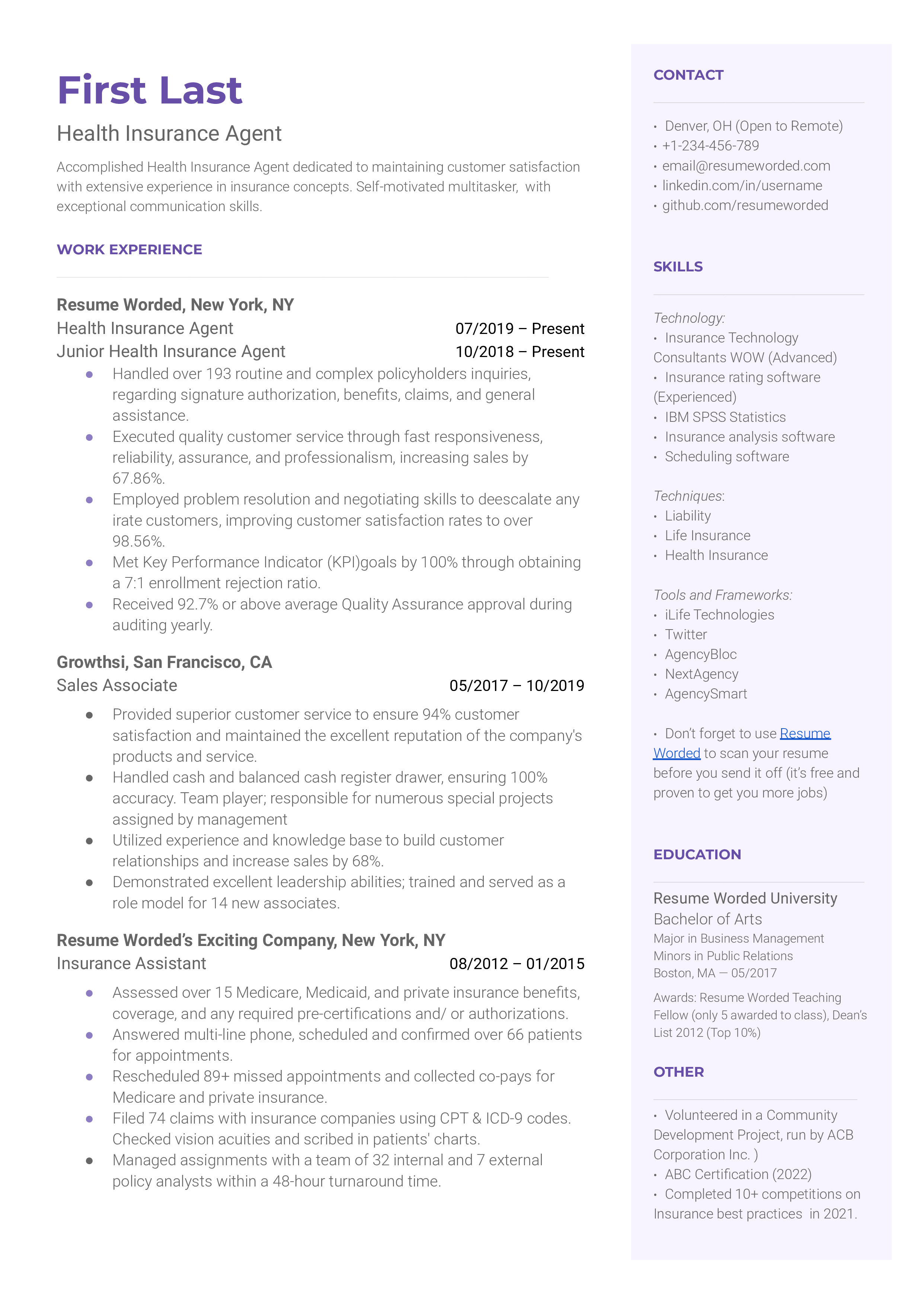

Template 8 of 9: health insurance agent resume example.

Health insurance agents sell health insurance. These agents, unlike health insurance brokers, will work for one insurance company as opposed to many and will work on a commission basis, so must be excellent salespeople to be able to make a living. Your tasks will include finding leads, approaching them, finding them the best cover possible, and convincing them to buy a cover. To thrive you will need soft skills like communication skills and perseverance. In most states and countries, you will need to be licensed to do their job so ensure you have researched to find out what licenses you require in your place of work.

Tips to help you write your Health Insurance Agent resume in 2024

be experienced using crms..

You will almost definitely be using some kind of a CRM to keep track of your leads and the status of your engagement with each lead. So become experienced with all the main CRM software and list all the CRMs you are comfortable with in the tools section of your resume.

Remember that you are obligated to get the best cover for your potential clients.

As a health insurance agent, you are obligated to offer and suggest the best cover possible for clients. So even as you try to get sales for your insurance company, remember that obligation to prevent getting into trouble and jeopardizing your job and career.

Skills you can include on your Health Insurance Agent resume

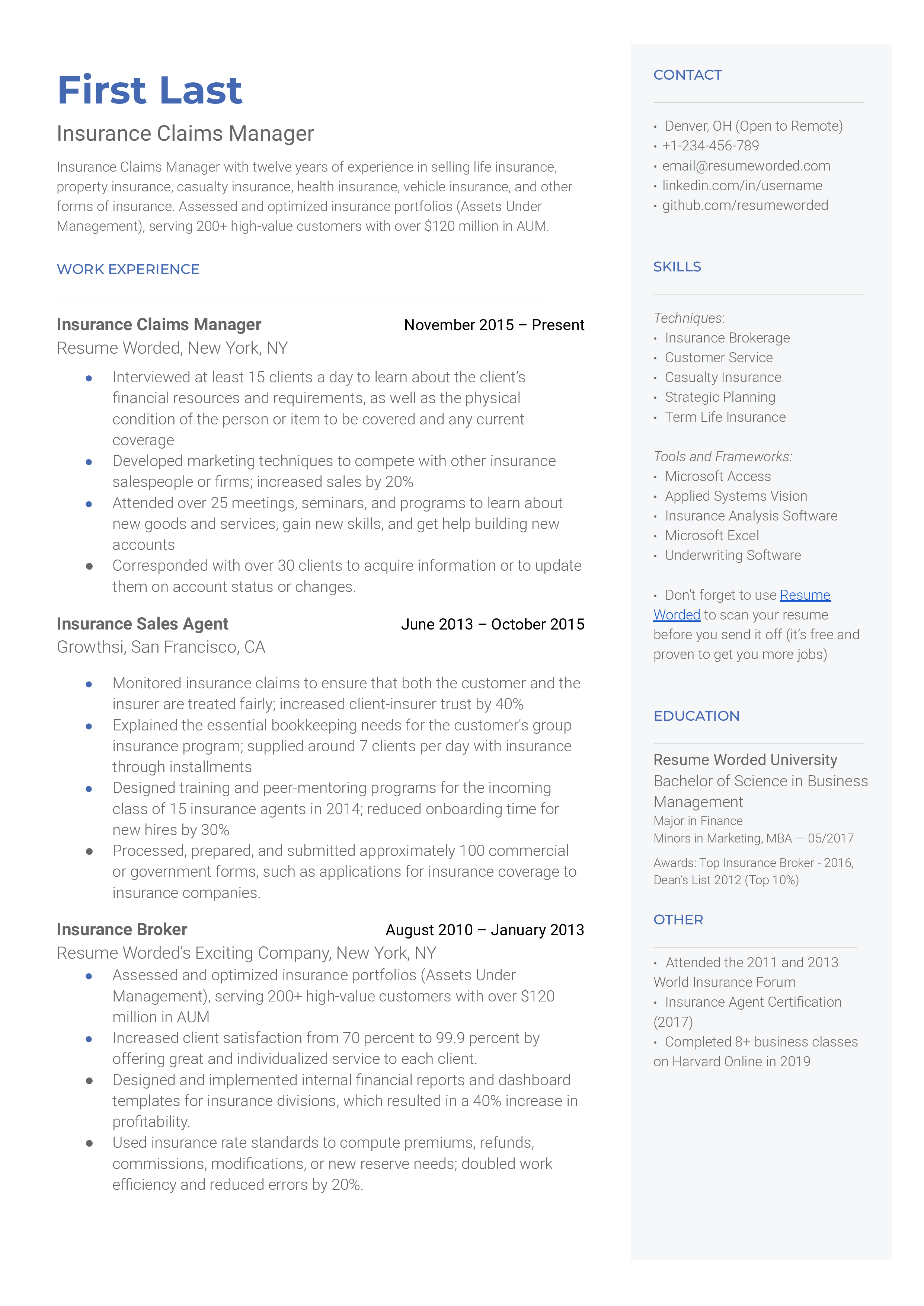

Template 9 of 9: insurance claims manager resume example.

Insurance claims managers will handle insurance claims as they are processed. Your tasks may include giving clients advice, investigating their claims, and ensuring their claims are processed to completion efficiently and fairly. You will have the added responsibility of managing a team in the claims department. You will be in charge of maximizing productivity and efficiency in processing claims. You will need to prove your ability to manage a team as well as your experience doing all tasks in the claims process. Most people in this position begin in an entry-level position (intern, broker, agent, etc.) and grow into this position. Once in this position, you may undergo further training to allow you to specialize within the insurance industry.

Tips to help you write your Insurance Claims Manager resume in 2024

highlight the success of your team under your leadership..

Show your competency as a manager of a team by listing your team’s successes. Quantify their increased efficiency and productivity. If your team has won any internal or external awards for their work, include that as well.

List your specializations in the insurance industry.

Are you particularly experienced in health insurance or life insurance? Ensure that you list the areas of insurance that you are particularly experienced with, in the introduction section.

Skills you can include on your Insurance Claims Manager resume

As a hiring manager who has recruited for insurance roles at companies like Geico, State Farm, and Allstate, I've seen firsthand what makes a resume stand out. The following tips will help you craft a strong resume that showcases your skills and experience in the insurance industry.

Highlight your insurance-specific skills

Employers want to see that you have the specific skills needed for the insurance role you're applying for. Make sure to highlight your relevant skills, such as:

- Knowledge of insurance products like auto, home, life, and health insurance

- Experience with underwriting, claims processing, or risk assessment

- Familiarity with insurance software like Applied Systems or Xactimate

For example, instead of simply listing 'insurance knowledge' as a skill, you could say:

- Extensive knowledge of auto, home, and life insurance products gained through 5+ years of experience in the industry

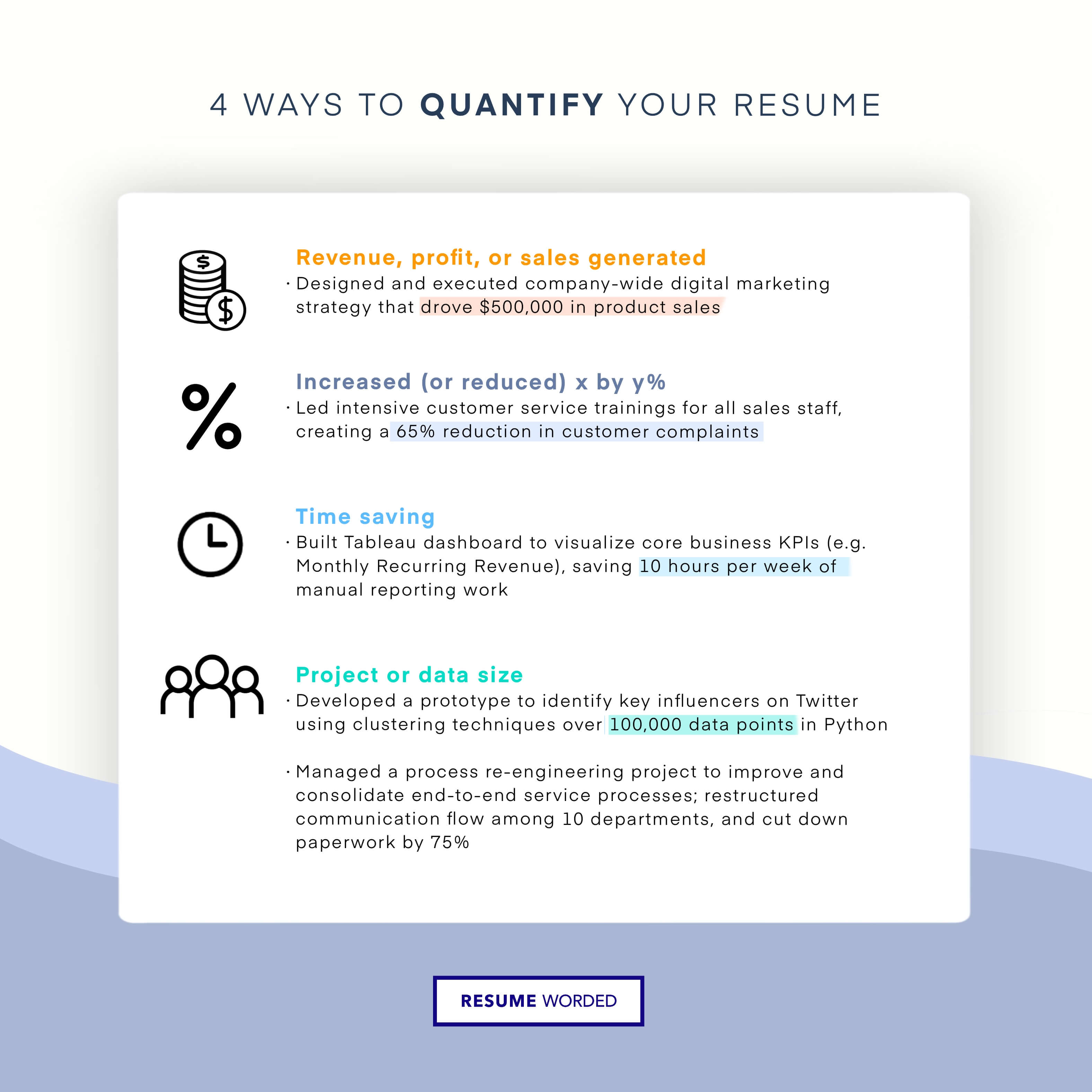

Quantify your accomplishments

Using numbers and metrics to quantify your achievements can make your resume more impactful. For instance:

- Processed insurance claims

This doesn't give the employer a clear idea of your capabilities. Instead, try:

- Processed an average of 50 insurance claims per week with a 98% accuracy rate

- Sold $500,000 worth of new insurance policies in 2022, exceeding quota by 20%

Quantifying your accomplishments gives employers a tangible sense of your skills and experience.

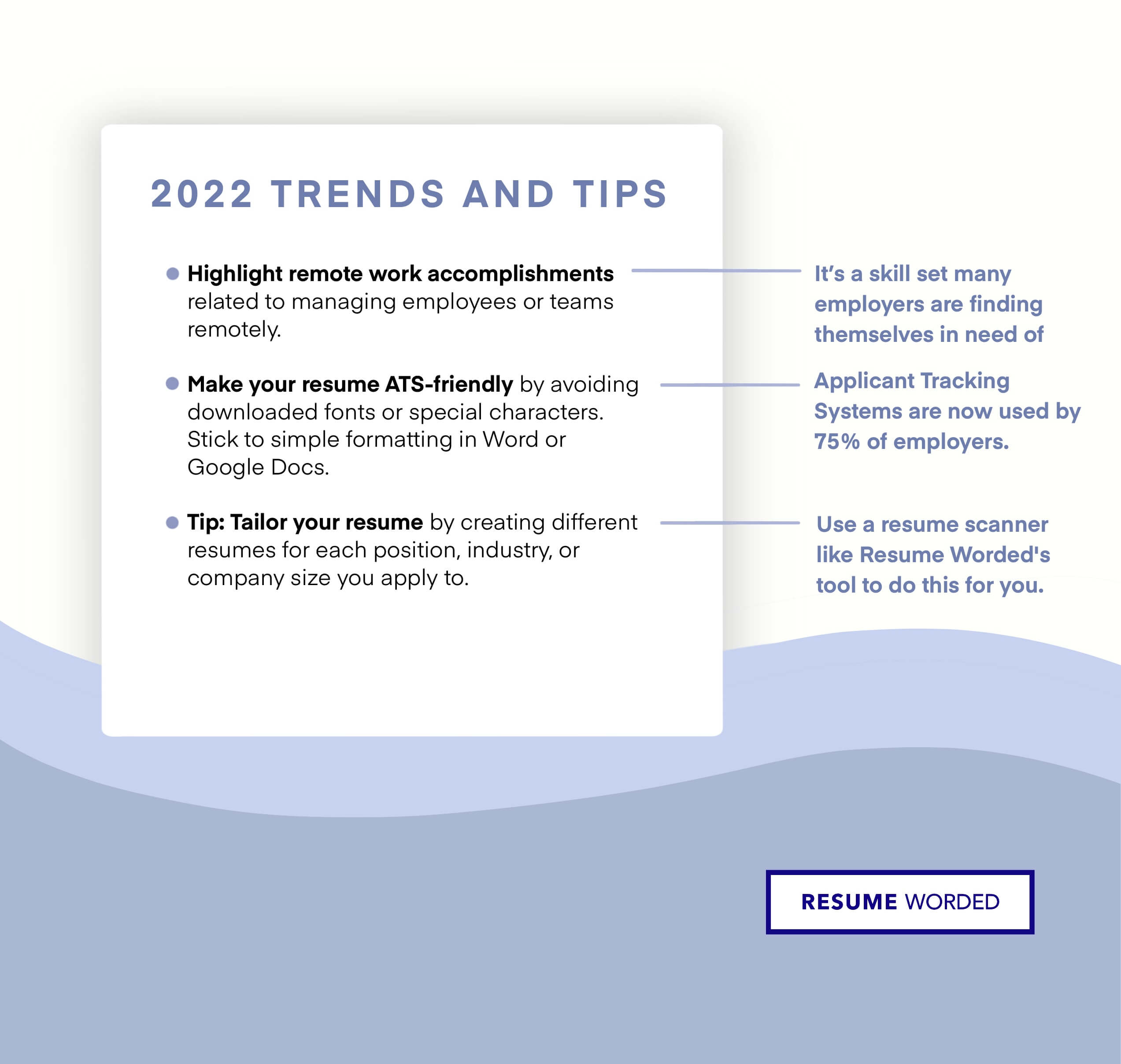

Tailor your resume to the specific role

Insurance is a broad field with many different types of roles, such as underwriter, claims adjuster, sales agent, and actuary. Make sure to tailor your resume to the specific role you're applying for.

For example, if you're applying for an underwriter position, emphasize your experience with risk assessment and policy analysis. If you're applying for a sales role, highlight your track record of meeting sales quotas and building client relationships.

Tailoring your resume shows employers that you understand the specific requirements of the role and have the relevant skills and experience.

Include relevant certifications and licenses

Many insurance roles require specific certifications or licenses. Make sure to include any relevant certifications you have, such as:

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Life Underwriter Training Council Fellow (LUTCF)

If you have a state-specific insurance license, make sure to include that as well. For example:

- Licensed Life and Health Insurance Agent in California

Demonstrate your customer service skills

Many insurance roles involve working directly with customers, so it's important to highlight your customer service skills on your resume. For example:

- Provided exceptional customer service to policyholders, answering questions and resolving issues in a timely manner

- Maintained a customer satisfaction rating of 95% or higher

If you have experience handling customer complaints or working in a call center environment, make sure to include that as well. Employers value candidates who can communicate effectively with customers and handle difficult situations with professionalism.

Show your industry involvement

Employers like to see candidates who are actively involved in the insurance industry. If you're a member of any industry associations or have attended industry conferences or events, make sure to include that on your resume.

For example:

- Member of the National Association of Insurance and Financial Advisors (NAIFA)

- Attended the Risk and Insurance Management Society (RIMS) Annual Conference in 2022

Showing your industry involvement demonstrates your passion for the field and your commitment to staying up-to-date with industry trends and best practices.

Writing Your Insurance Resume: Section By Section

header, 1. put your name front and center.

Your name should be the most prominent element in your header, positioned at the very top of your resume. Use a larger font size than the rest of your resume text to make it stand out.

Avoid nicknames or shortened versions of your name. Use your full name as it appears on your official documents, such as your driver's license or passport.

Johnny Smith, CPCU

John William Smith

2. Include your professional title

Below your name, add your professional title or the job title you're targeting. This helps recruiters quickly identify your area of expertise and career level.

Examples of effective professional titles for insurance resumes:

- Senior Claims Adjuster

- Life Insurance Sales Agent

- Risk Management Specialist

Avoid using generic titles or buzzwords that don't clearly convey your role or level.

- Insurance Guru

- Jack of All Trades

- Customer Service Ninja

3. Add key contact details

Include essential contact information so hiring managers can easily reach you:

- Phone number

- Professional email address

- LinkedIn profile URL

- City and state of residence

Avoid outdated contact details like fax numbers or full mailing addresses. Keep it simple and modern.

123 Main St, Apt 4B, Anytown, ST 12345 | 123-456-7890 | [email protected]

Anytown, ST | 123-456-7890 | [email protected] | linkedin.com/in/johnsmith

Summary

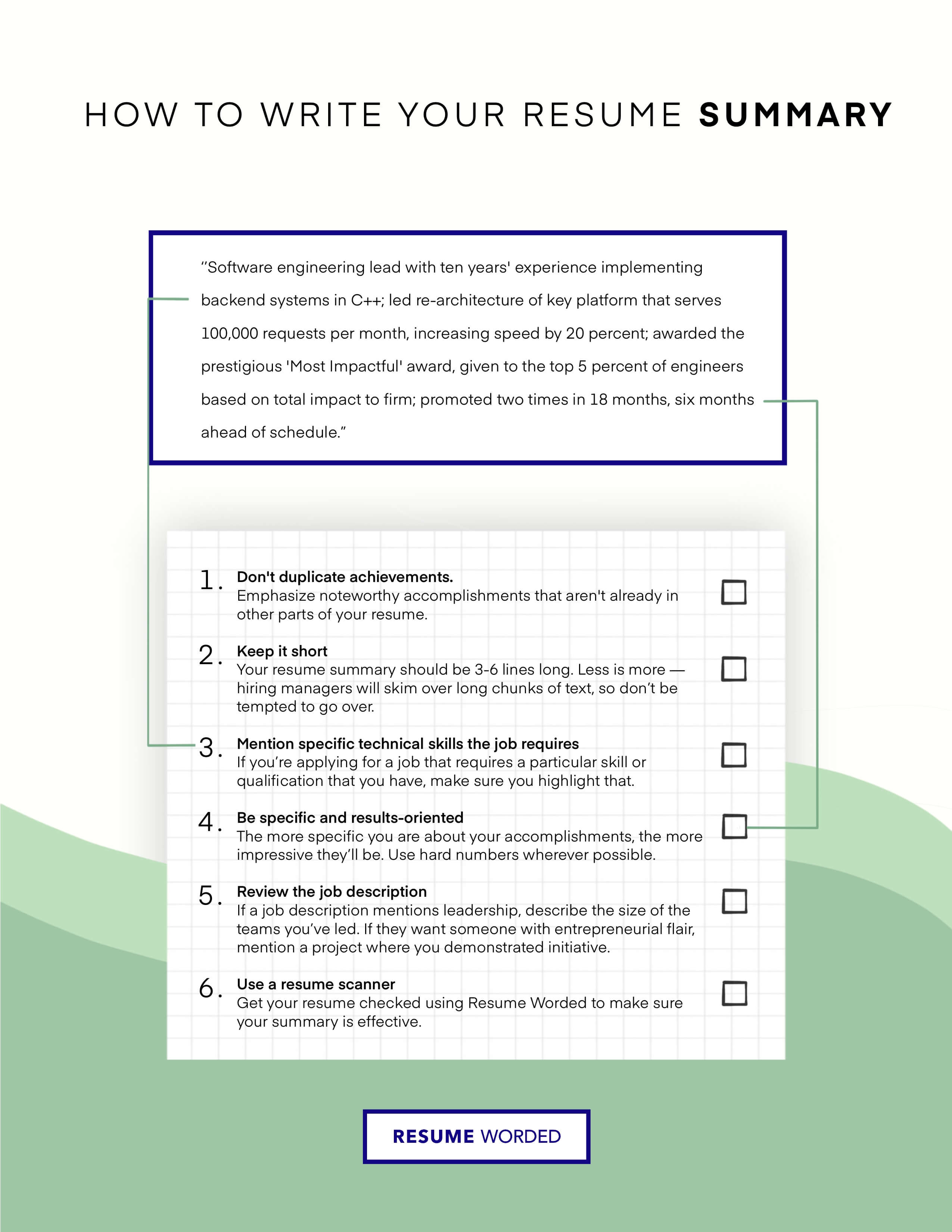

A resume summary for an insurance position is optional, but it can be a helpful way to provide context and highlight your most relevant qualifications. While an objective statement is outdated and should be avoided, a well-crafted summary can help you stand out to hiring managers and applicant tracking systems (ATS).

When writing your insurance resume summary, focus on showcasing your unique value proposition and the specific skills and experience that make you an ideal candidate for the role. Avoid repeating information that is already covered in other sections of your resume, and keep your summary concise and targeted.

To learn how to write an effective resume summary for your Insurance resume, or figure out if you need one, please read Insurance Resume Summary Examples , or Insurance Resume Objective Examples .

1. Highlight your insurance expertise and specializations

When crafting your insurance resume summary, it's essential to showcase your specific areas of expertise and the types of insurance you specialize in. This helps employers quickly understand your background and determine if you're a good fit for their open positions.

For example, instead of a generic summary like this:

Experienced insurance professional seeking a challenging role in the industry. Strong communication and problem-solving skills.

Try highlighting your specific areas of expertise:

Licensed property and casualty insurance specialist with 5+ years of experience in personal lines coverage. Skilled in risk assessment, policy interpretation, and customer service.

2. Quantify your achievements and impact

To make your insurance resume summary more impactful, include quantifiable achievements that demonstrate the value you've brought to previous employers. This helps hiring managers understand the scope of your responsibilities and the results you're capable of delivering.

- Experienced insurance claims adjuster with strong investigation and negotiation skills.

- Skilled underwriter with a keen eye for detail and risk assessment.

Instead, try incorporating specific numbers and metrics:

- Claims adjuster with a 98% customer satisfaction rate, handling an average of 50 complex claims per month.

- Underwriter who implemented a new risk assessment model, resulting in a 15% reduction in loss ratios for the commercial auto line of business.

3. Tailor your summary to the specific role

One of the most effective ways to grab the attention of hiring managers is to tailor your resume summary to the specific insurance role you're applying for. Review the job description carefully and identify the key skills, experience, and qualifications the employer is seeking.

For example, if you're applying for a health insurance sales position, your summary might look like this:

Dynamic health insurance sales professional with 7+ years of experience driving revenue growth and building strong client relationships. Proven track record of exceeding sales quotas by an average of 20% annually and maintaining a client retention rate of 95%.

In contrast, if you're seeking a role as a life insurance underwriter, your summary should focus on your risk assessment and analytical skills:

Detail-oriented life insurance underwriter with 4+ years of experience evaluating complex risk profiles. Skilled in analyzing medical records, financial data, and actuarial tables to make sound underwriting decisions. Collaborated with cross-functional teams to develop and implement new underwriting guidelines, resulting in a 10% improvement in risk selection.

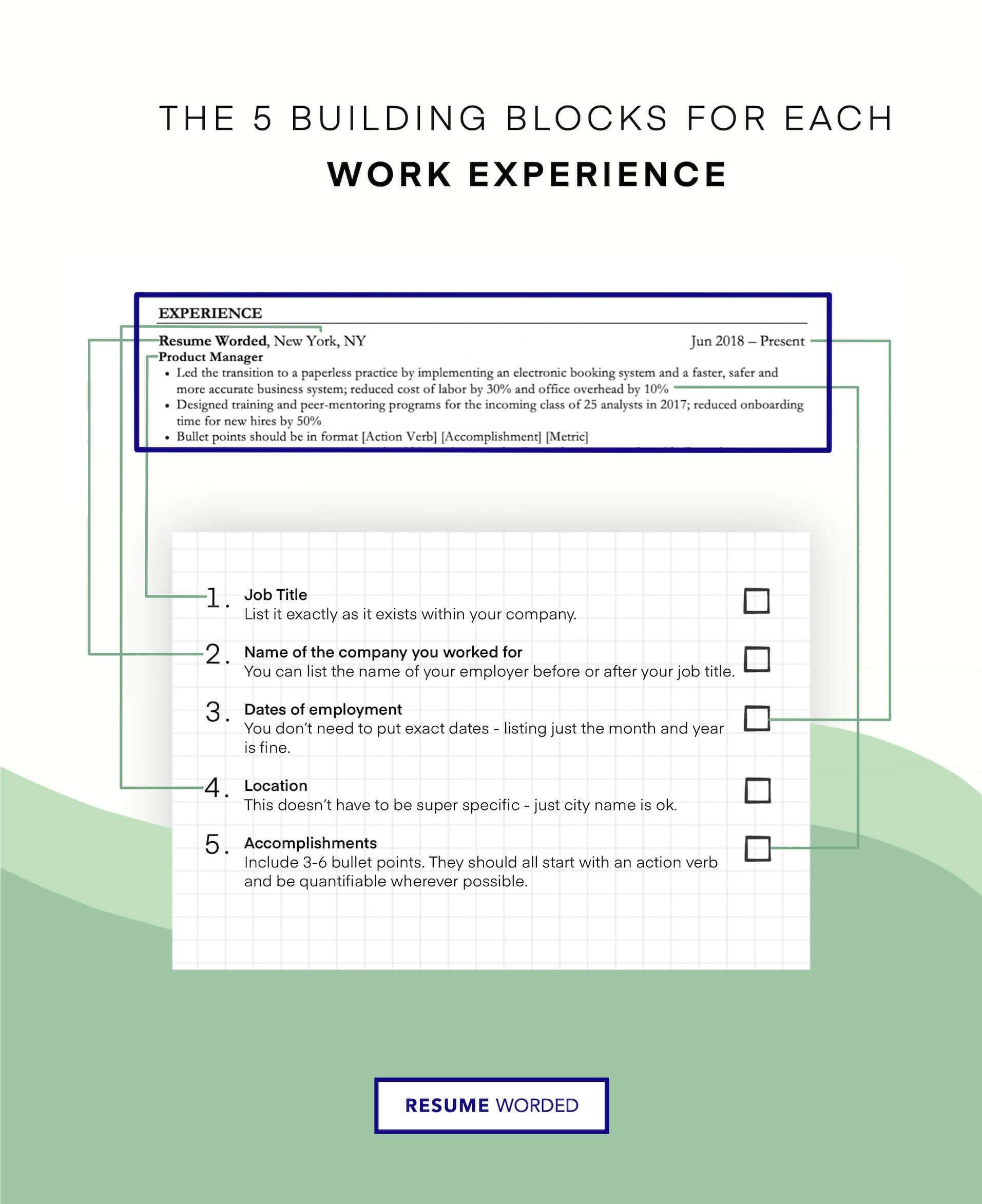

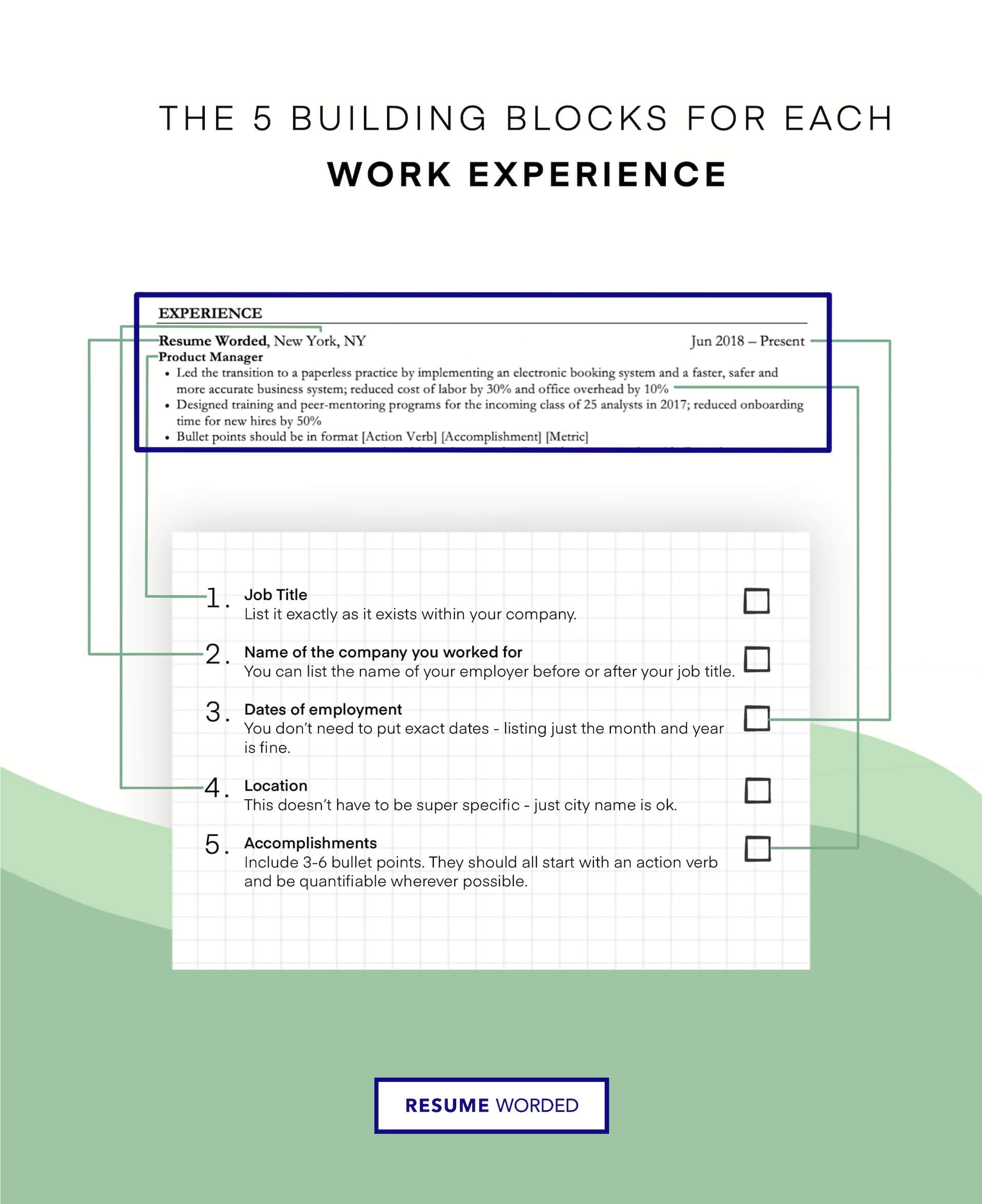

Experience

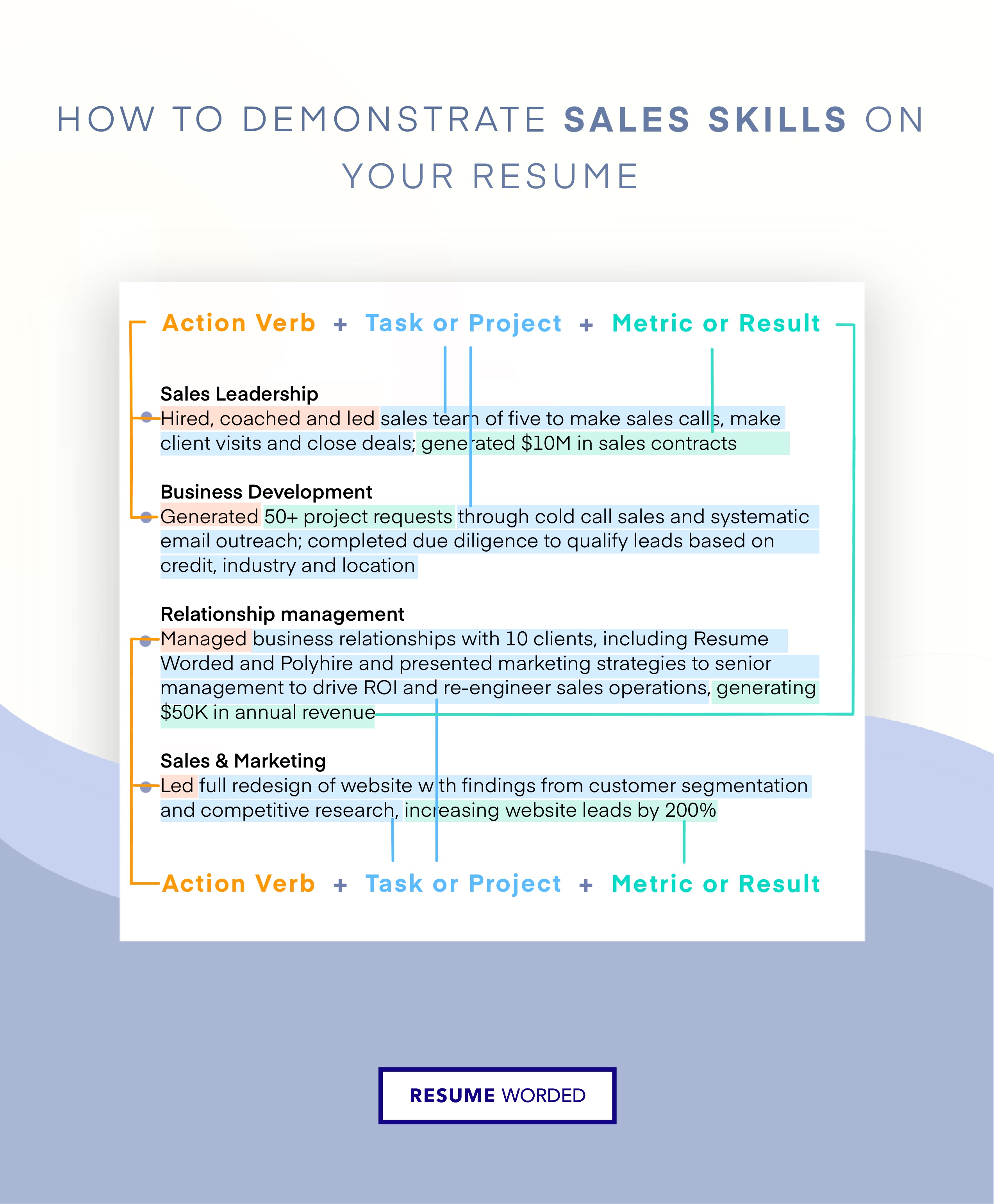

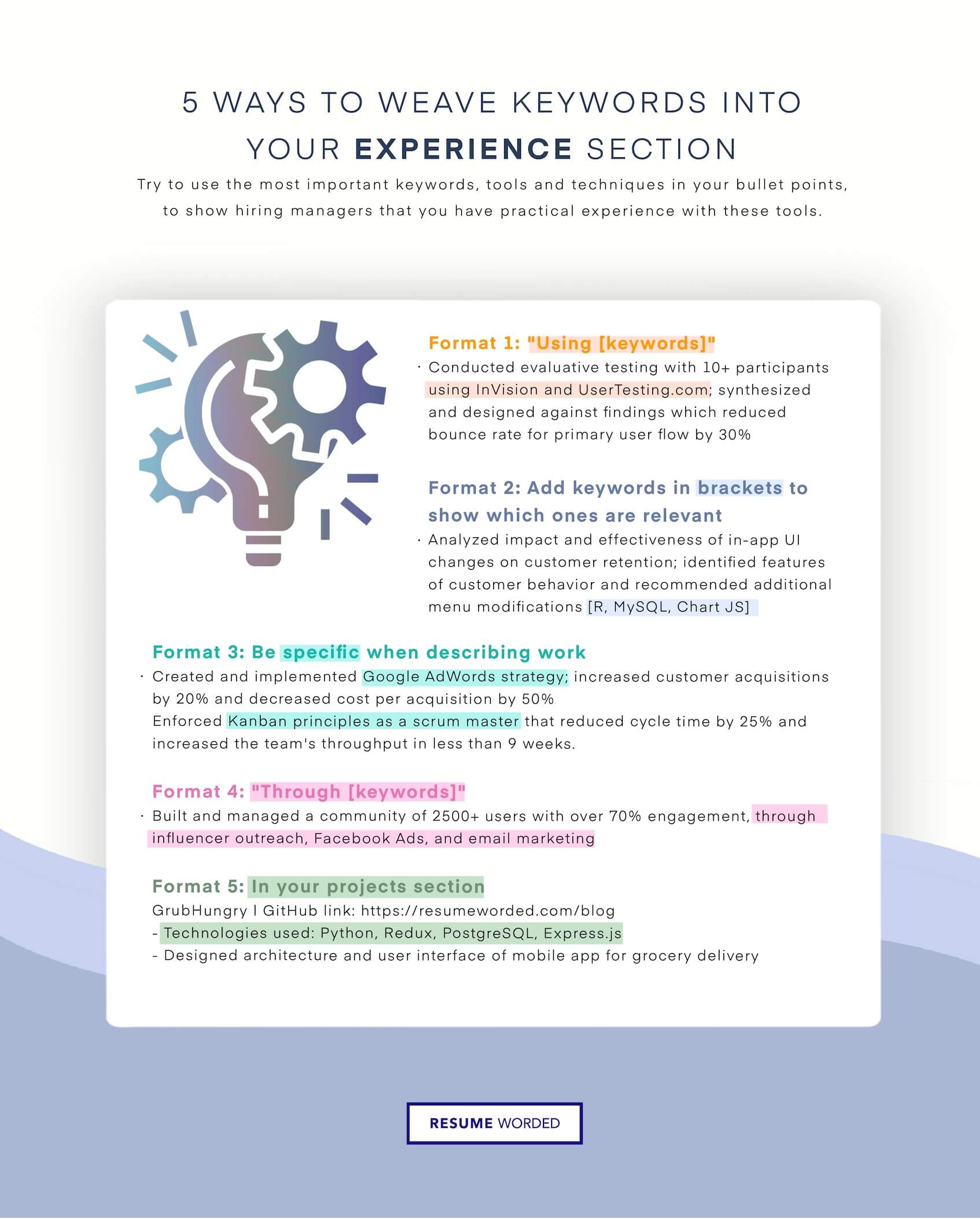

The work experience section is the heart of your resume. It's where you prove to employers that you have the skills and experience to excel in the role. Use the tips below to write a strong work experience section that will make you stand out from other candidates.

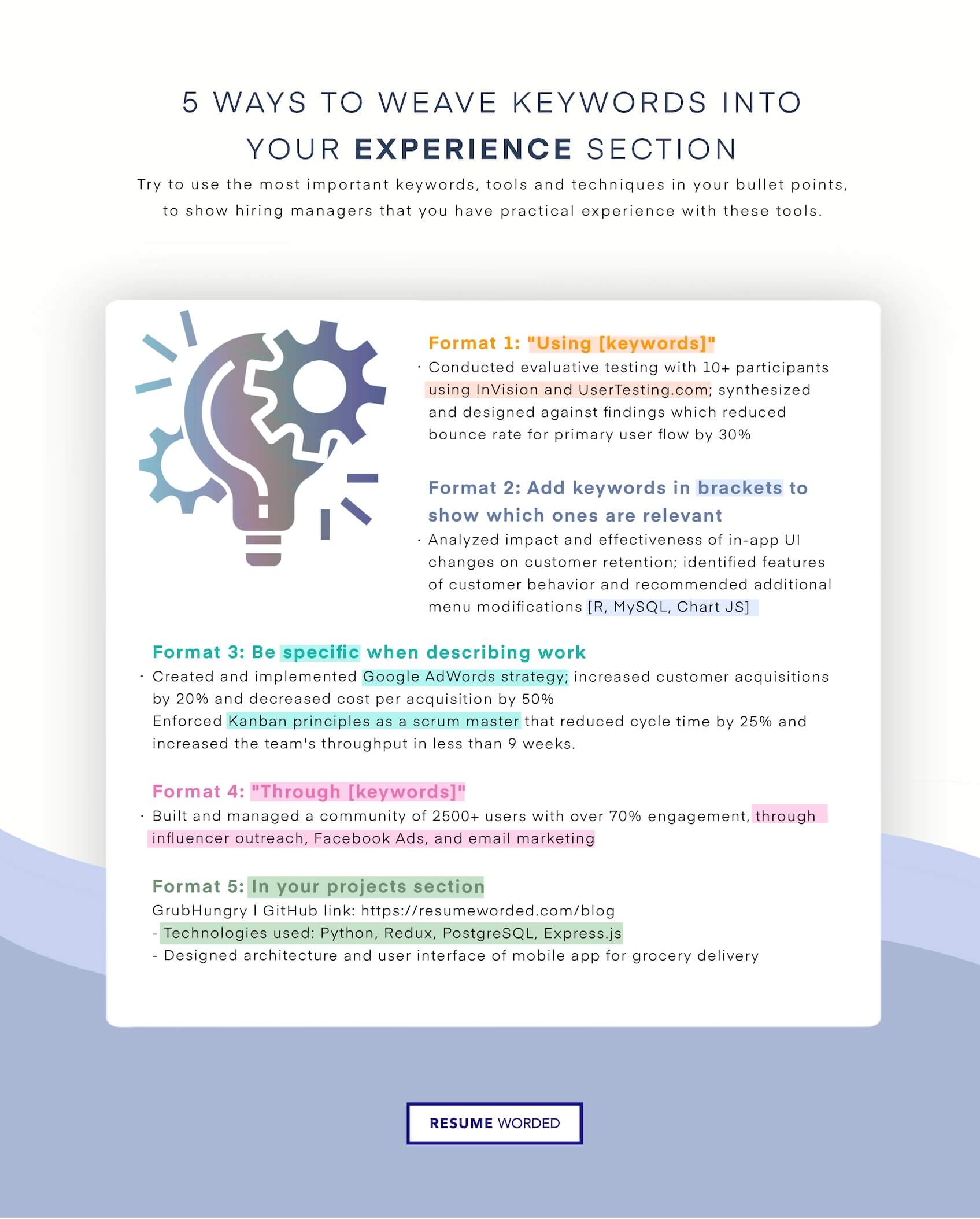

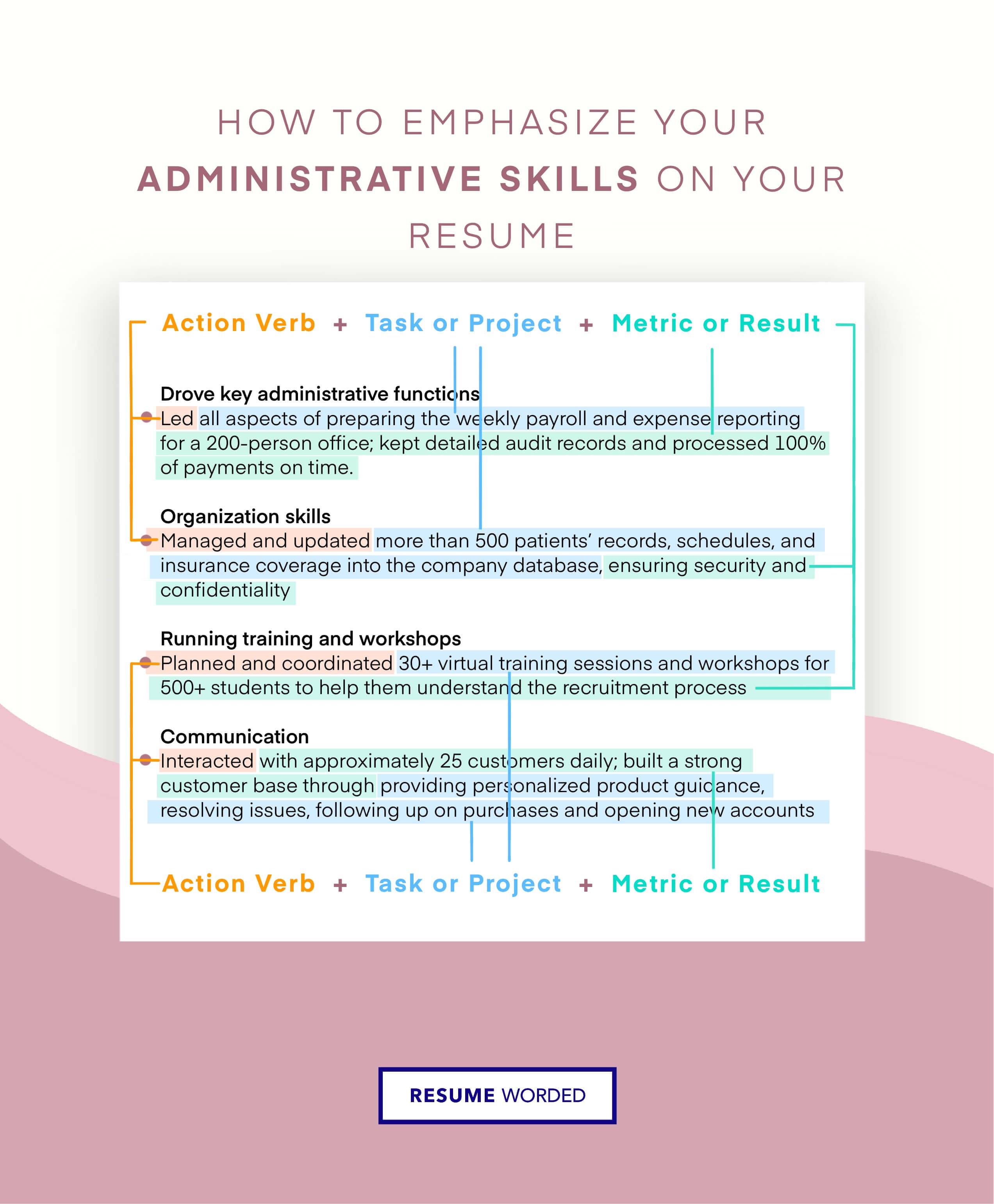

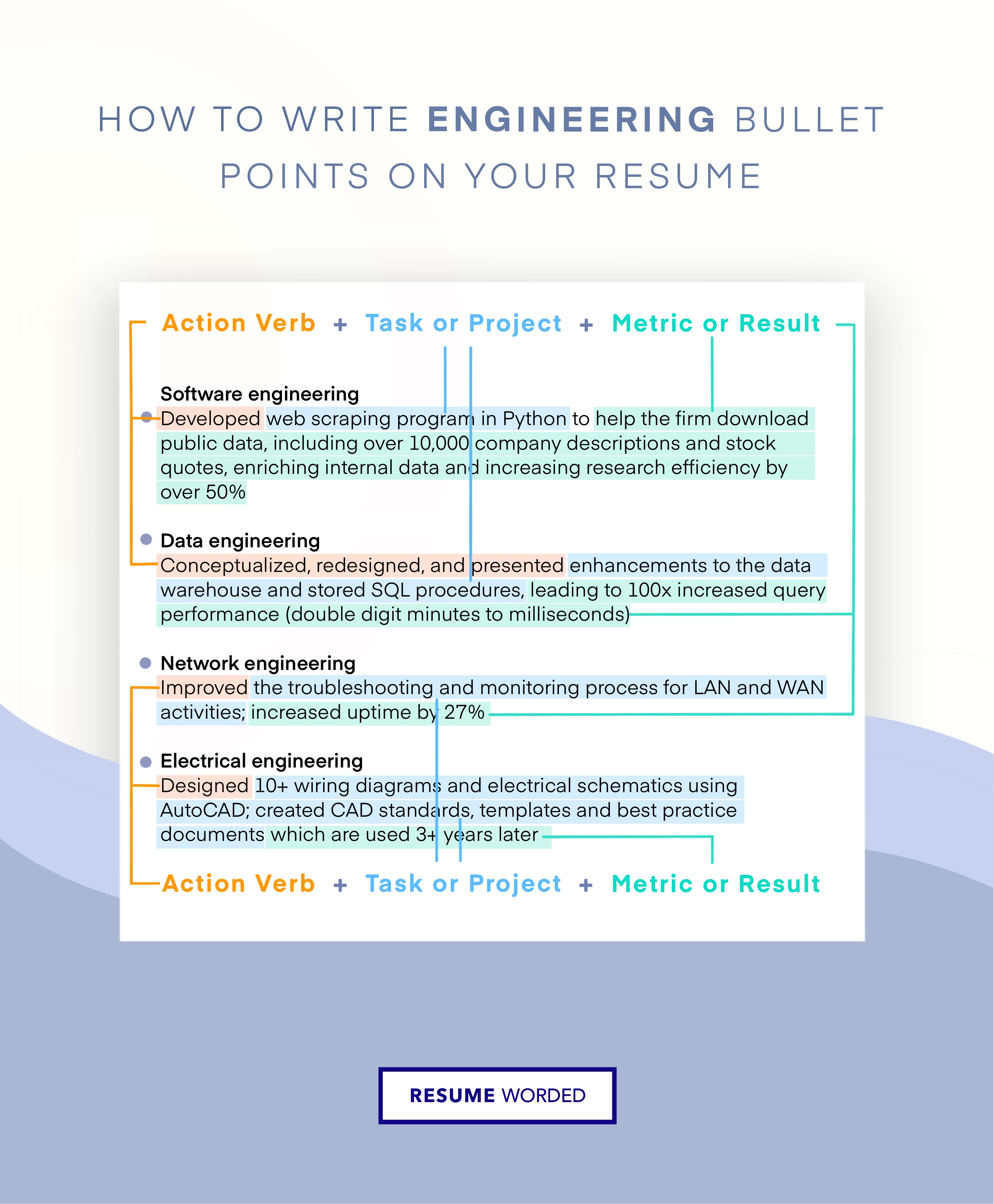

1. Highlight insurance-specific skills

When describing your work experience, focus on skills that are relevant to the insurance industry. This could include:

- Processing claims and managing customer inquiries

- Assessing risk and underwriting policies

- Collaborating with agents, brokers, and other insurance professionals

- Staying up-to-date with industry regulations and compliance requirements

For example, instead of a generic bullet point like "Processed customer requests", write something more specific like:

- Processed 50+ insurance claims per week, collaborating with adjusters and investigators to verify documentation and determine payouts

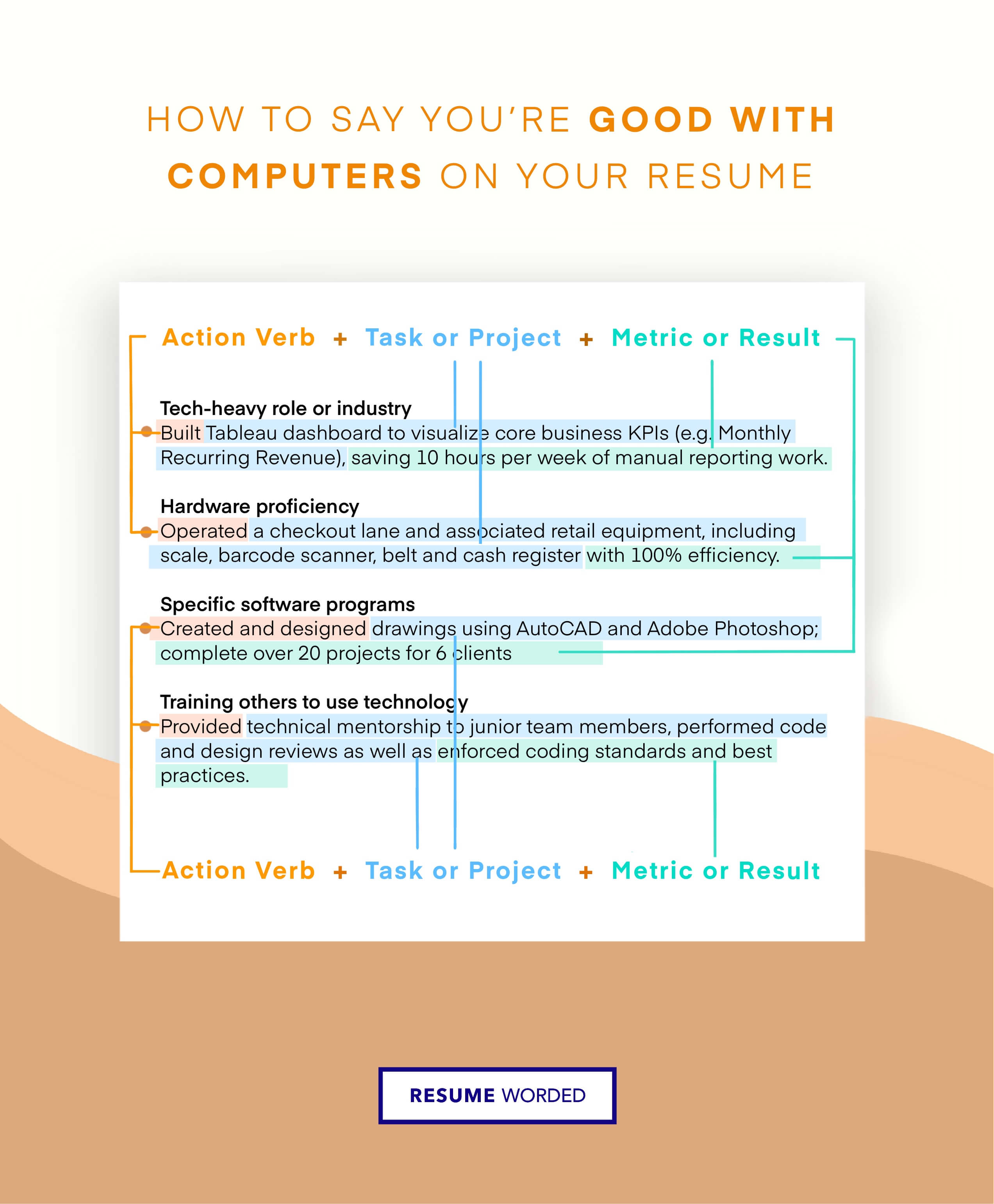

2. Quantify your impact with metrics

Numbers jump off the page and really showcase the impact you've made. Whenever possible, include metrics to quantify your achievements. Ask yourself:

- How many claims did you process per day/week/month?

- By what percentage did you increase customer retention or policy renewals?

- How much revenue did you generate through upselling or cross-selling?

- By what percentage did you reduce processing times or error rates?

Grew book of business by 25% year-over-year by nurturing relationships with 50+ independent brokers and agents

If you don't have access to hard numbers, estimates are fine too. The key is to provide concrete examples of how you added value.

3. Showcase your career progression

Hiring managers love to see candidates who have progressively taken on more responsibility. If you've been promoted or expanded your role, make sure that's clearly reflected in your work experience section.

One way to do this is by grouping multiple positions within the same company under one entry. For example:

ACME Insurance Senior Claims Adjuster (2019-Present) Claims Adjuster (2016-2019)

Avoid simply listing your responsibilities for each role. Instead, focus on new challenges you took on with each step up and the results you achieved.

4. Demonstrate industry knowledge

Show that you're well-versed in the latest trends and challenges facing the insurance industry. You can do this by:

- Highlighting experience with industry-specific software like Guidewire or Duck Creek

- Mentioning relevant certifications like CPCU or ARM

- Describing how you've adapted to regulatory changes like GDPR or CCPA

- Sharing examples of how you've innovated to meet evolving customer expectations

For instance:

- Implemented new claims management system based on Guidewire InsuranceSuite, reducing processing times by 30%

- Earned Chartered Property Casualty Underwriter (CPCU) designation, deepening knowledge of risk assessment and underwriting principles

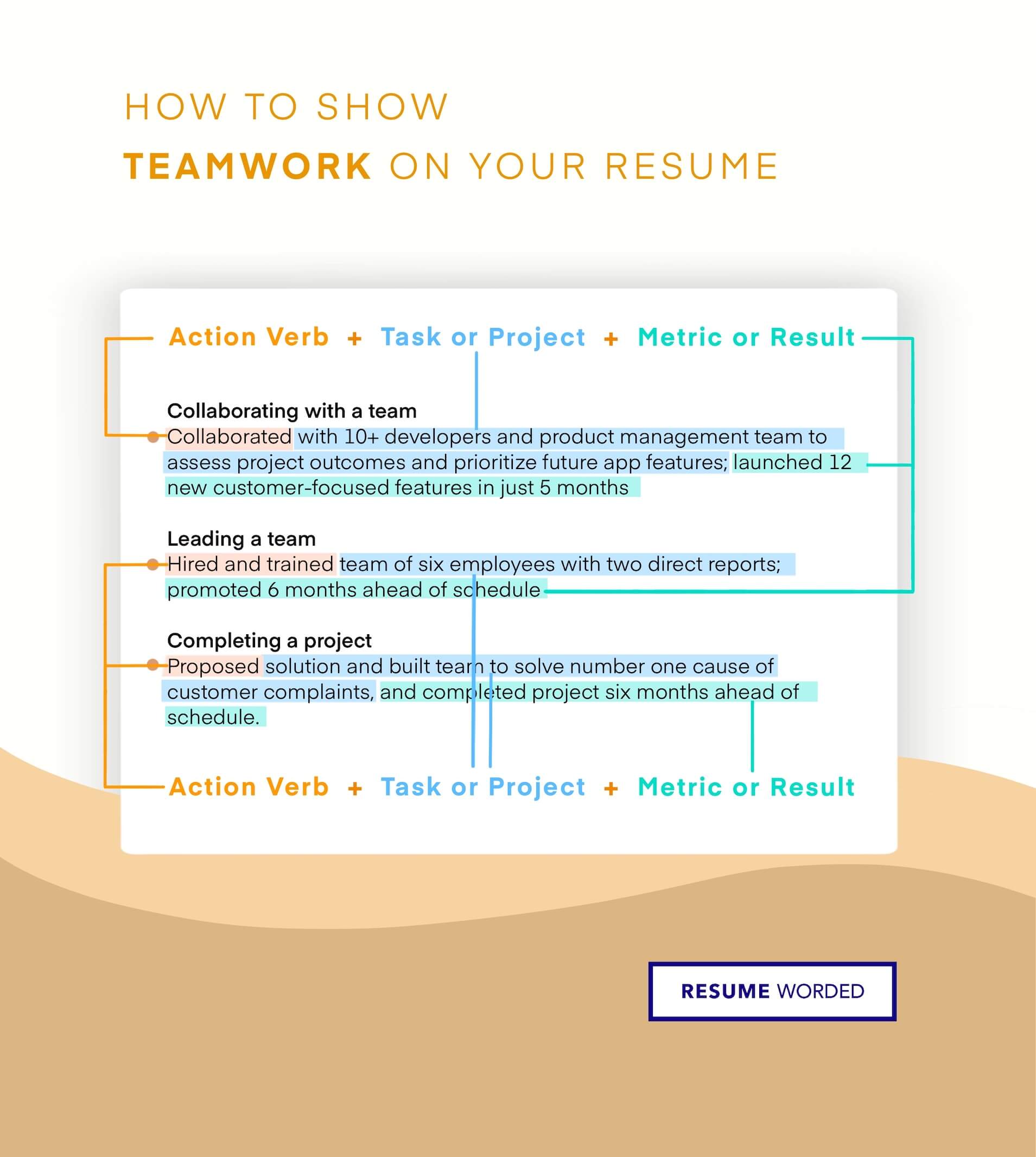

Action Verbs For Insurance Resumes

Strong action verbs help recruiters understand your role in specific tasks. Insurance professionals’ resumes should use action verbs that are relevant to the sale of policies and the processing of claims. Action verbs like "Authorized", "Contacted" or “Negotiated" are examples of strong action verbs for this profession.

- Investigated

- Interviewed

For a full list of effective resume action verbs, visit Resume Action Verbs .

Action Verbs for Insurance Resumes

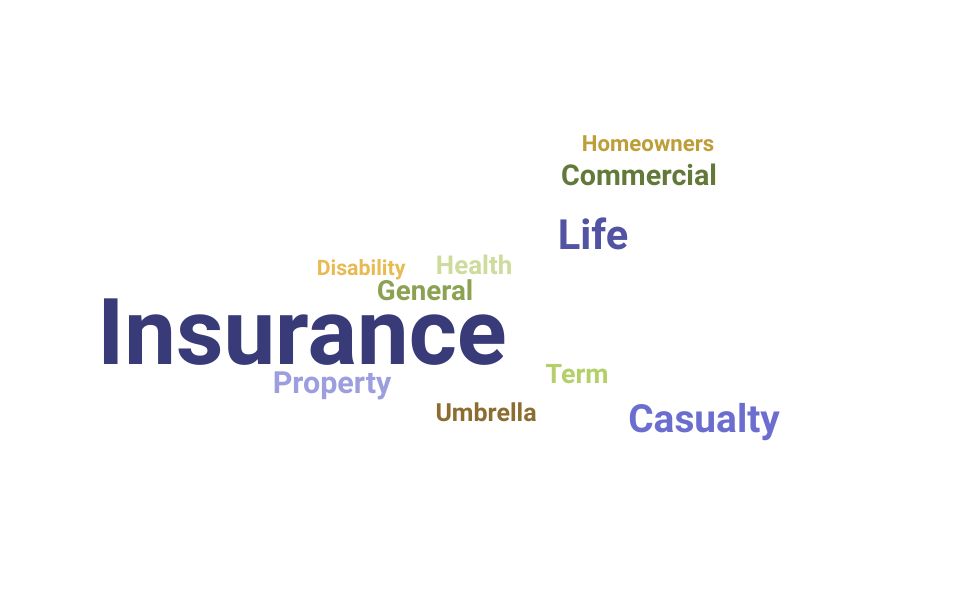

Skills for insurance resumes.

When you speak of skills for someone in insurance, you will want to list skills associated with selling insurance, and processing and investigating claims.

Here is a list of skills you would expect to see in an insurance professional’s resume. Add those that you are experienced with to your resume to impress recruiters.

- General Insurance

- Insurance Brokerage

- Life Insurance

- Customer Service

- Health Insurance

- Stockbroking

- Casualty Insurance

- Property & Casualty Insurance

- Business Strategy

- Commercial Insurance

- Strategic Planning

- Business Planning

- Risk Management

- Microsoft Access

- Term Life Insurance

- Umbrella Insurance

- Homeowners Insurance

- Disability Insurance

- Whole Life Insurance

- Underwriting

- Fixed Annuities

- Insurance Sales

- Retirement Planning

- Auto Insurance

Skills Word Cloud For Insurance Resumes

This word cloud highlights the important keywords that appear on Insurance job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more 'important' it is.

How to use these skills?

Other other resumes, account manager.

Policy Analyst

- Human Resources (HR) Resume Guide

- Recruiter Resume Guide

- Talent Acquisition Resume Guide

- Operations Manager Resume Guide

- Executive Assistant Resume Guide

- Social Worker Resume Guide

- Makeup Artist Resume Guide

- Journalism Resume Guide

- Supply Chain Planner Resume Guide

Insurance Resume Guide

- Demand Planning Manager Resume Guide

- Learning and Development Resume Guide

- Special Projects Resume Guide

- Consultant Resume Guide

- Change Management Resume Guide

- Process Specialist Resume Guide

- Non Profit Resume Guide

- Training and Development Resume Guide

- Sourcing Resume Guide

- Correctional Officer Resume Guide

- Production Planner Resume Guide

- Vice President of Operations Resume Guide

- Teacher Resume Guide

- Innovation Resume Guide

- Continuous Improvement Resume Guide

- Training Manager Resume Guide

- Digital Transformation Resume Guide

- Plant Manager Resume Guide

- Recruiting Coordinator Resume Guide

- Diversity and Inclusion Resume Guide

- Loss Prevention Resume Guide

- Business Owner Resume Guide

- Materials Management Resume Guide

- Operational Excellence Resume Guide

- Logistics Resume Guide

- Site Manager Resume Guide

- Orientation Leader Resume Guide

- Insurance Agent Resume Example

- Insurance Sales Agent Resume Example

- Life Insurance Agent Resume Example

- Insurance Investigator Resume Example

- Insurance Case Manager Resume Example

- Insurance Underwriter Resume Example

- Health Insurance Agent Resume Example

- Insurance Claims Manager Resume Example

- Tips for Insurance Resumes

- Skills and Keywords to Add

- All Resume Examples

- Insurance CV Examples

- Insurance Cover Letter

- Insurance Interview Guide

- Explore Alternative and Similar Careers

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 8 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 8 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Top 18 Insurance Agent Resume Objective Examples

Updated July 13, 2023 13 min read

A resume objective is a concise summary of your skills, experience, and qualifications that will be used to convince potential employers of your ability to fulfill the role of an insurance agent. When writing a resume objective for this position, it is important to emphasize your ability to provide quality customer service, understand complex insurance policies, and develop strong relationships with clients. Additionally, highlight any experiences you have working in the insurance industry and any certifications or licenses that are relevant to the job. Examples of effective resume objectives for an insurance agent position include: "Seeking a position as an Insurance Agent at ABC Company utilizing excellent customer service skills and knowledge of industry regulations," or "Experienced Insurance Agent looking for an opportunity to use my expertise in policy analysis and client relations at XYZ Company."

or download as PDF

Top 18 Insurance Agent Resume Objective Samples

- To secure a position as an Insurance Agent with ABC Company that allows me to utilize my knowledge of the insurance industry and customer service skills.

- To obtain a challenging position in the insurance industry that allows me to use my experience, knowledge, and creativity to help customers make informed decisions.

- Seeking an Insurance Agent role at XYZ Company where I can apply my expertise in customer service and sales to increase revenue.

- Looking for an opportunity to work as an Insurance Agent at ABC Company where I can contribute my strong communication skills and organizational abilities.

- To bring my extensive experience in the insurance industry and passion for helping people to a new role as an Insurance Agent at XYZ Company.

- Applying for the position of Insurance Agent at ABC Company with the goal of providing exceptional customer service while meeting sales targets.

- To leverage my background in insurance sales and customer service into a successful career as an Insurance Agent with XYZ Company.

- Seeking a position as an Insurance Agent with ABC Company that will allow me to use my problem-solving skills and attention to detail to provide excellent customer care.

- Aiming for a role as an Insurance Agent at XYZ Company where I can build relationships with clients while utilizing my knowledge of policy coverage options.

- To utilize my expertise in sales, communication, and customer service as an Insurance Agent at ABC Company.

- Looking for a job as an Insurance Agent at XYZ Company where I can apply my understanding of risk management principles and policies.

- Aiming to join ABC Company’s team of experienced professionals as an Insurance Agent by leveraging my ability to explain complex concepts clearly and concisely.

- Applying for the role of Insurance Agent at XYZ Company with the intention of using my interpersonal skills and knowledge of insurance products to meet client needs.

- Seeking employment as an Insurance Agent with ABC company that will allow me to combine my expertise in finance and marketing strategies while providing excellent service.

- Hoping to join XYZ company’s team of highly skilled professionals by filling the position of Insurance agent using strong communication, analytical, and problem-solving skills.

- To acquire a job as an insurance agent at ABC company where I can employ my professional experience in dealing with customers efficiently while ensuring maximum satisfaction levels are met consistently.

- Seeking a challenging yet rewarding role within the field of insurance through which I may be able to utilize both my technical knowledge & interpersonal skills effectively towards achieving success & growth goals set by XYZ company .

- Applying for the role of insurance agent within ABC company where I may be able to bring forth both prior experiences & creative ideas towards developing new business opportunities & delivering superior quality services .

How to Write an Insurance Agent Resume Objective

An insurance agent resume objective is an important part of any job application. It provides potential employers with a brief overview of your qualifications, experience and skills related to the role you are applying for. A well-crafted resume objective should be concise and to the point, highlighting the most important aspects of your candidacy.

The first step in writing a successful insurance agent resume objective is to identify your career goals and objectives. Are you looking for a position that allows you to provide excellent customer service? Do you have a passion for helping people understand their insurance needs? Whatever your goals may be, it’s important to make them clear in your objective statement. This will help potential employers better understand why you are the ideal candidate for the role.

Next, highlight key skills that make you qualified for the job. Insurance agents need strong communication and negotiation skills as well as knowledge of relevant laws and regulations. Include any relevant certifications or degrees that demonstrate your expertise in this field. Additionally, emphasize any experience working with customers or sales experience that could benefit an employer.

Finally, include information about what makes you stand out from other candidates. Maybe you have years of experience in the industry or have achieved top sales performance in previous roles. Whatever sets you apart from other applicants should be included in your resume objective so that employers can see why they should hire you over someone else.

With these tips in mind, crafting a strong resume objective should be relatively straightforward. By making sure it reflects your career goals and highlights relevant skills and experiences, an effective insurance agent resume objective can help get your foot in the door with potential employers while also giving them an idea of what kind of value you can bring to their organization.

Related : What does an Insurance Agent do?

Key Skills to Highlight in Your Insurance Agent Resume Objective

In crafting your insurance agent resume, it's crucial to emphasize certain skills in your objective statement that will catch the attention of potential employers. This section, titled 'Key Skills to Highlight in Your Insurance Agent Resume Objective', will provide a comprehensive guide on the essential abilities and competencies you should prominently feature. These skills not only demonstrate your proficiency in the field but also showcase your suitability for the role, thereby increasing your chances of standing out from other candidates.

1. Underwriting

Underwriting is a crucial skill for an insurance agent as it involves assessing risk and determining the cost of insurance policies. This skill is needed in a resume objective to show potential employers that the candidate has the ability to effectively evaluate and manage risk, which is essential in making sound decisions on policy approvals and pricing. It also demonstrates the candidate's analytical abilities and attention to detail, qualities that are highly valued in the insurance industry.

2. Risk assessment

An insurance agent needs the skill of risk assessment as they are responsible for evaluating the potential risks involved in insuring a client's property, health, or life. This skill is crucial in determining the appropriate insurance policies and coverage amounts to recommend to clients. It also helps in pricing premiums accurately and ensuring that the insurance company remains profitable while still providing adequate protection for clients. Including risk assessment in a resume objective shows potential employers that the candidate has the ability to make informed decisions and manage risk effectively, which are key aspects of success in the insurance industry.

3. Policy analysis

An insurance agent needs the skill of policy analysis to effectively understand, interpret, and explain complex insurance policies to clients. This skill is crucial in helping clients choose the right coverage for their needs and budget. It also aids in identifying any gaps or overlaps in coverage. Including this skill in a resume objective demonstrates an applicant's ability to provide excellent customer service and make informed decisions, which are key qualities employers look for in an insurance agent.

4. Claims management

An insurance agent needs to have claims management skills because they are responsible for guiding policyholders through the process of making a claim on their insurance. This includes understanding the terms and conditions of policies, evaluating the validity of claims, negotiating settlements, and ensuring timely and accurate payment. Including this skill in a resume objective demonstrates an ability to handle complex procedures and provide excellent customer service, which are crucial aspects of the role.

5. Customer service

An insurance agent often interacts directly with clients, answering queries, solving issues and providing information about different insurance policies. Excellent customer service skills are crucial to ensure client satisfaction, retention and to attract new customers. In a resume objective, highlighting this skill can show potential employers that the candidate is capable of delivering high-quality service, maintaining strong client relationships and contributing positively to the company's reputation.

6. Salesmanship

An insurance agent's primary role is to sell insurance policies to potential clients. Therefore, having strong salesmanship skills is crucial. This skill demonstrates the agent's ability to effectively communicate the benefits and features of various insurance policies, negotiate deals, and persuade customers to make purchases. It also shows their capability to meet sales targets and generate revenue for the company. Including this skill in a resume objective can highlight the candidate's proficiency in driving sales growth and their potential contribution to the company's success.

7. Negotiation

An insurance agent often deals with various clients, each with different needs and demands. Negotiation skills are essential to reach agreements that satisfy both the client and the insurance company. This skill also helps in resolving conflicts, closing deals, and maintaining strong relationships with clients. Including this skill in a resume objective demonstrates the ability to effectively manage client relationships and contribute positively to the company's customer service goals.

8. Time management

An insurance agent often has to juggle multiple tasks and clients at once. Time management skills are crucial to ensure that all work is completed in a timely manner, deadlines are met, and clients are served efficiently. This skill also reflects an agent's ability to prioritize tasks, handle pressure, and manage their workload effectively - all of which contribute to their overall productivity and success in the role. Including this skill in a resume objective can demonstrate an applicant's potential for managing responsibilities effectively.

9. Networking

In the insurance industry, building and maintaining a strong network of clients and potential clients is crucial for success. Networking skills indicate an ability to establish relationships, communicate effectively, and gain trust - all of which are key to selling insurance policies and growing a customer base. A resume objective that highlights networking skills can show potential employers that the candidate is capable of bringing in new business and fostering client loyalty.

10. CRM software

An Insurance Agent needs to have proficiency in CRM (Customer Relationship Management) software as it is crucial for managing interactions with current and potential clients. This skill is necessary for a resume objective because it shows the ability to organize, track, and manage client information effectively. It also indicates that the agent can use technology to improve customer service and increase sales, which are key objectives in the insurance industry.

In conclusion, the objective section of your insurance agent resume is a vital component that can significantly influence an employer's first impression of you. It's crucial to highlight key skills that align with the job requirements and demonstrate your ability to excel in the role. Remember, this section should not merely list your skills but also illustrate how they make you a valuable asset for the potential employer. Tailoring these skills to match each specific job application can greatly enhance your chances of landing an interview and ultimately securing the position.

Related : Insurance Agent Skills: Definition and Examples

Common Mistakes When Writing an Insurance Agent Resume Objective

When it comes to writing an insurance agent resume objective, there are many common mistakes that applicants make. It is important to understand the purpose of a resume objective and avoid making these mistakes in order to create an effective and professional document.

The first mistake is not including an objective statement at all. An insurance agent’s resume should include an objective statement that clearly outlines the applicant’s career goals and aspirations. Without this statement, employers may have difficulty determining the applicant’s qualifications and experience for the job.

Another common mistake is writing a vague or overly broad objective statement. The goal of a resume objective is to showcase the specific skills and qualities that make the applicant well-suited for a particular position. Generic statements such as “seeking a challenging role in insurance” provide little insight into why the applicant would be an ideal fit for the job.

In addition, many applicants write overly lengthy objectives that take up too much space on their resumes. While it can be tempting to include as much detail as possible, it is important to keep an objective concise yet impactful by focusing on key points that demonstrate your strengths and qualifications.

Finally, some applicants make the mistake of using generic language instead of industry-specific terms when writing their objectives. Insurance agents should use terminology that is commonly associated with their field in order to convey their knowledge and expertise more effectively.

By avoiding these common mistakes, insurance agents can create resumes with strong objectives that will help them stand out from other candidates and capture potential employers’ attention quickly and efficiently.

Related : Insurance Agent Resume Examples

A right resume objective for an insurance agent should focus on the skills and experience needed to effectively build relationships with clients, while a wrong resume objective may focus on the wrong skills or lack of experience.

Editorial staff

Brenna Goyette

Brenna is a certified professional resume writer, career expert, and the content manager of the ResumeCat team. She has a background in corporate recruiting and human resources and has been writing resumes for over 10 years. Brenna has experience in recruiting for tech, finance, and marketing roles and has a passion for helping people find their dream jobs. She creates expert resources to help job seekers write the best resumes and cover letters, land the job, and succeed in the workplace.

Similar articles

- Top 17 Insurance Sales Agent Resume Objective Examples

- Top 17 Health Insurance Agent Resume Objective Examples

- Top 17 Life Insurance Agent Resume Objective Examples

- Costco Insurance Agent Resume Examples

- Top 18 Insurance Assistant Resume Objective Examples

- Top 18 Insurance Consultant Resume Objective Examples

Insurance Manager CV example

So you want a Insurance Manager job, but you’re struggling to write a CV?

Use our Insurance Manager CV example and writing guide to learn exactly how you can create an effective CV and attract plenty of recruiters and employers.

Guide contents

Insurance Manager CV example

- Structuring and formatting your CV

- Writing your CV profile

- Detailing work experience

- Your education

- Skills required for your Insurance Manager CV

CV templates

This example CV demonstrates how to effectively structure and format your own Insurance Manager CV, so that it can be easily digested by busy employers, and quickly prove why you are the best candidate for the jobs you are applying to.

It also gives you a good idea of the type of skills, experience and qualifications that you need to be including and highlighting.

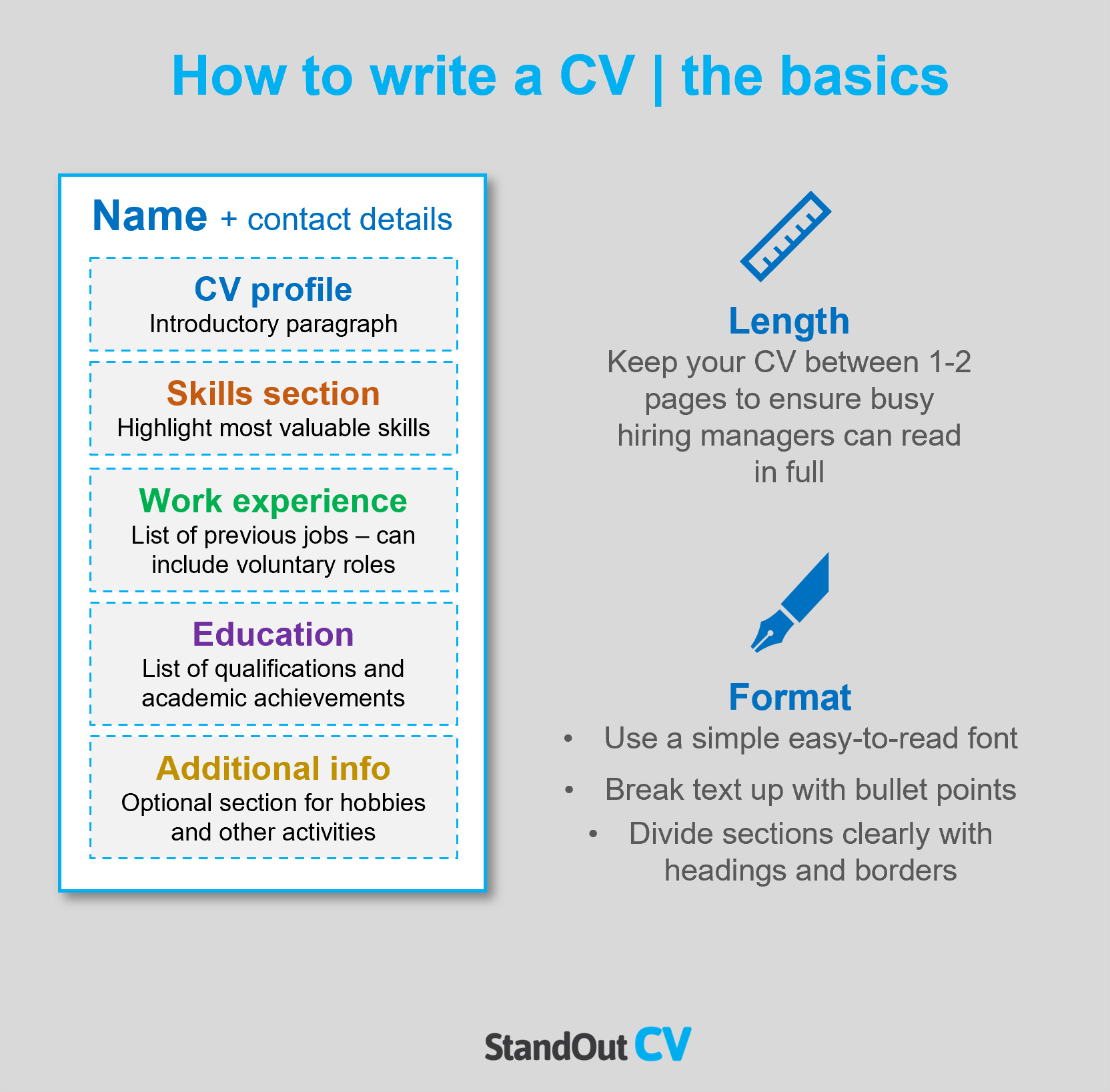

Insurance Manager CV structure and format

The format and structure of your CV is important because it will determine how easy it is for recruiters and employers to read your CV.

If they can find the information they need quickly, they’ll be happy; but if they struggle, your application could be overlooked.

A simple and logical structure will always create a better reading experience than a complex structure, and with a few simple formatting tricks, you’ll be good to go.

Formatting Tips

- Length: Two sides of A4 makes for the perfect CV length , though one page is okay for less experienced applicants. This forces you to make sure that every single sentence adds value to your CV and ensures you avoid waffle.

- Readability : To help busy recruiters scan through your CV, make sure your section headings stand out – bold or coloured text works well. Additionally, try to use bullet points wherever you can, as they’re far easier to skim through than huge paragraphs. Lastly, don’t be afraid of white space on your CV – a little breathing space is great for readability.

- Design: The saying ‘less is more’ couldn’t be more applicable to CVs. Readability is key, so avoid overly complicated designs and graphics. A subtle colour palette and easy-to-read font is all you need!

- Avoid photos: Recruiters can’t factor in appearance, gender or race into the recruitment process, so a profile photo is totally unnecessary. Additionally, company logos or images won’t add any value to your application, so you’re better off saving the space to showcase your experience instead.

Structuring your CV

Divide your CV into the following major sections when writing it:

- Name and contact details – Head your CV with your name and contact details, to let the reader know who you are and how to contact you.

- CV profile – A brief paragraph which summarises your skills and experience and highlights why you’re a good match for the role.

- Core skills list – A snappy, bullet-pointed list of your most relevant skills.

- Work experience – A structured list of your work experience in reverse chronological order.

- Education – A summary of any relevant qualifications or professional training you’ve completed.

- Hobbies and interests – An optional section, which should only be used if your hobbies are relevant to the jobs you’re applying to.

Now I’ll guide you through exactly what you should include in each CV section.

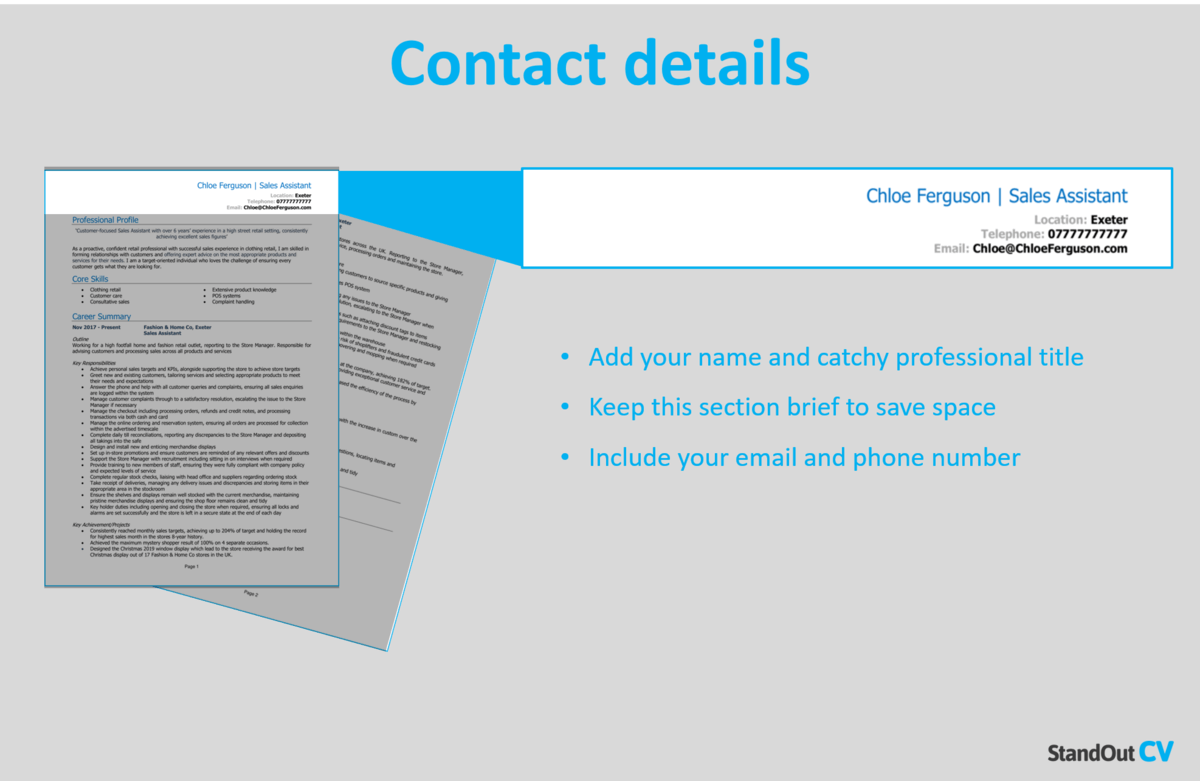

CV Contact Details

Start off your CV with a basic list of your contact details. Here’s what you should include:

- Mobile number

- Email address – It’s often helpful to make a new email address, specifically for your job applications.

- Location – Share your town or city; there’s no need for a full address.

- LinkedIn profile or portfolio URL – Make sure the information on them is coherent with your CV, and that they’re up-to-date

Quick tip: Delete excessive details, such as your date of birth or marital status. Recruiters don’t need to know this much about you, so it’s best to save the space for your other CV sections.

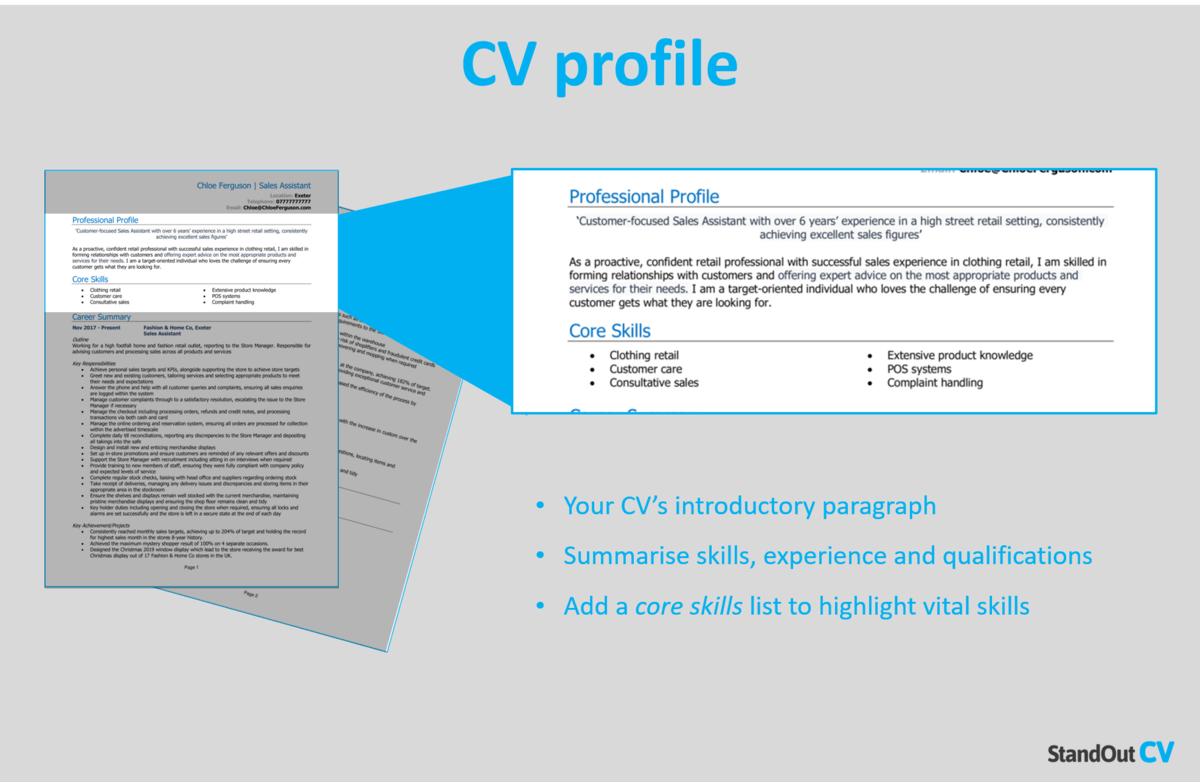

Insurance Manager CV Profile

Your CV profile (or personal statement , if you’re an entry-level applicant) provides a brief overview of your skills, abilities and suitability for a position.

It’s ideal for busy recruiters and hiring managers, who don’t want to waste time reading unsuitable applications.

Think of it as your personal sales pitch. You’ve got just a few lines to sell yourself and prove you’re a great match for the job – make it count!

Tips for creating an impactful CV profile:

- Keep it brief: Recruiters have piles of CVs to read through and limited time to dedicate to each, so it pays to showcase your abilities in as few words as possible. 3-4 lines is ideal.

- Tailor it: No matter how much time you put into your CV profile, it won’t impress if it’s irrelevant to the role you’re applying for. Before you start writing, make a list of the skills, knowledge and experience your target employer is looking for. Then, make sure to mention them in your CV profile and throughout the rest of your application.

- Don’t add an objective: If you want to discuss your career objectives, save them for your cover letter , rather than wasting valuable CV profile space.

- Avoid cliches: If your CV is riddled with clichès like “Dynamic thought-leader”, hit that delete button. Phrases like these are like a broken record to recruiters, who read them countless times per day. Hard facts, skills, knowledge and results are sure to yield far better results.

What to include in your Insurance Manager CV profile?

- Summary of experience: Start with a brief summary of your relevant experience so far. How many years experience do you have? What type of companies have you worked for? What industries/sectors have you worked in? What are your specialisms?

- Relevant skills: Employers need to know what skills you can bring to their organisation, and ideally they want to see skills that match their job vacancy. So, research your target roles thoroughly and add the most important Insurance Manager skills to your profile.

- Essential qualifications: If you have any qualifications which are highly relevant to Insurance Manager jobs, then highlight them in your profile so that employers do not miss them.

Quick tip: Your CV is your first impression on recruiters, so it’s vital to avoid spelling and grammar mistakes if you want to appear professional. Use our quick-and-easy CV Builder to add pre-written content that has been crafted by recruitment experts.

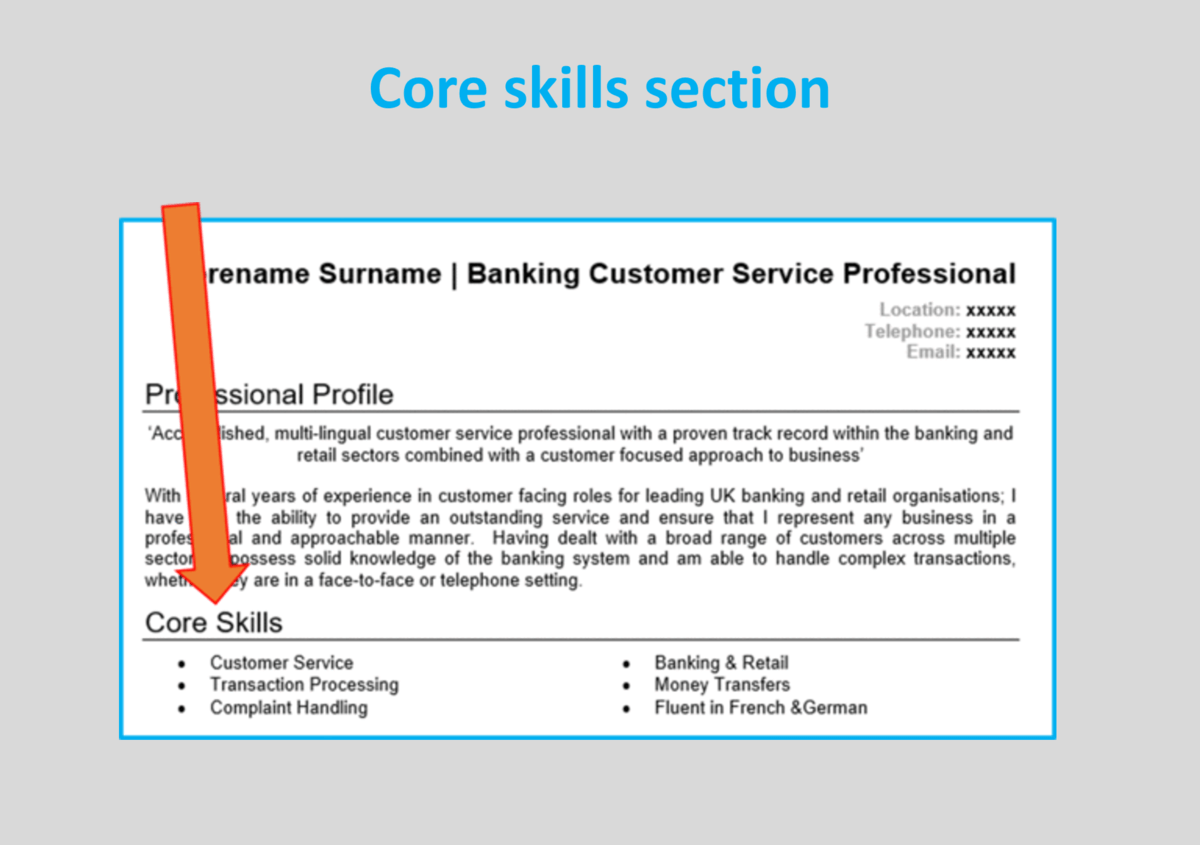

Core skills section

Next, you should create a bullet pointed list of your core skills , formatted into 2-3 columns.

Here, you should focus on including the most important skills or knowledge listed in the job advertisement.

This will instantly prove that you’re an ideal candidate, even if a recruiter only has time to briefly scan your CV.

Work experience/Career history

By this point, employers will be keen to know more detail about you career history.

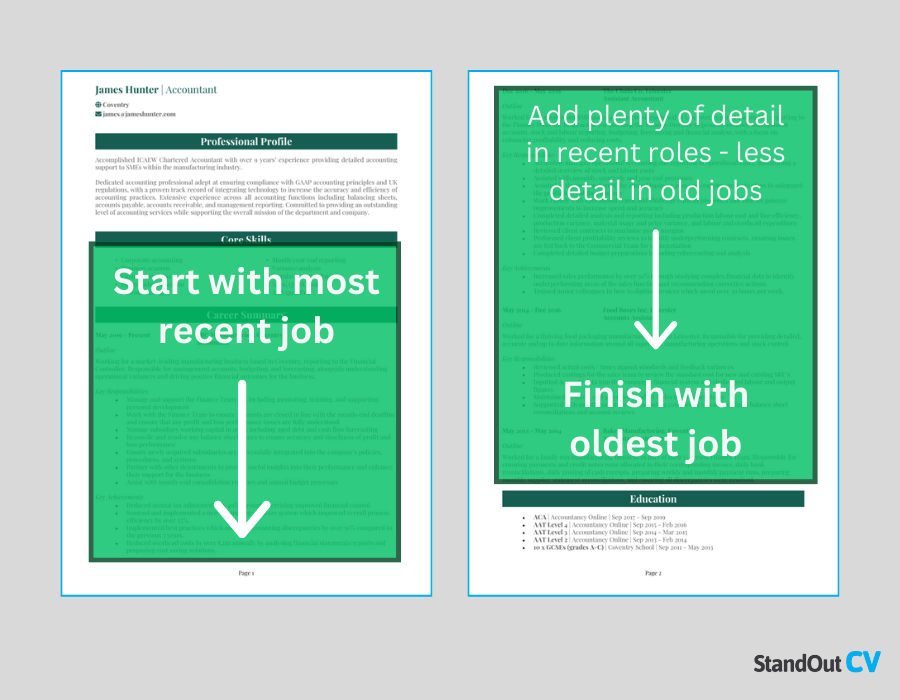

Starting with your most recent role and working backwards, create a snappy list of any relevant roles you’ve held.

This could be freelance, voluntary, part-time or temporary jobs too. Anything that’s relevant to your target role is well-worth listing!

Structuring your roles

Your work experience section will be long, so it’s important to structure it in a way which helps recruiters to quickly and easily find the information they need.

Use the 3-step structure, shown in the below example, below to achieve this.

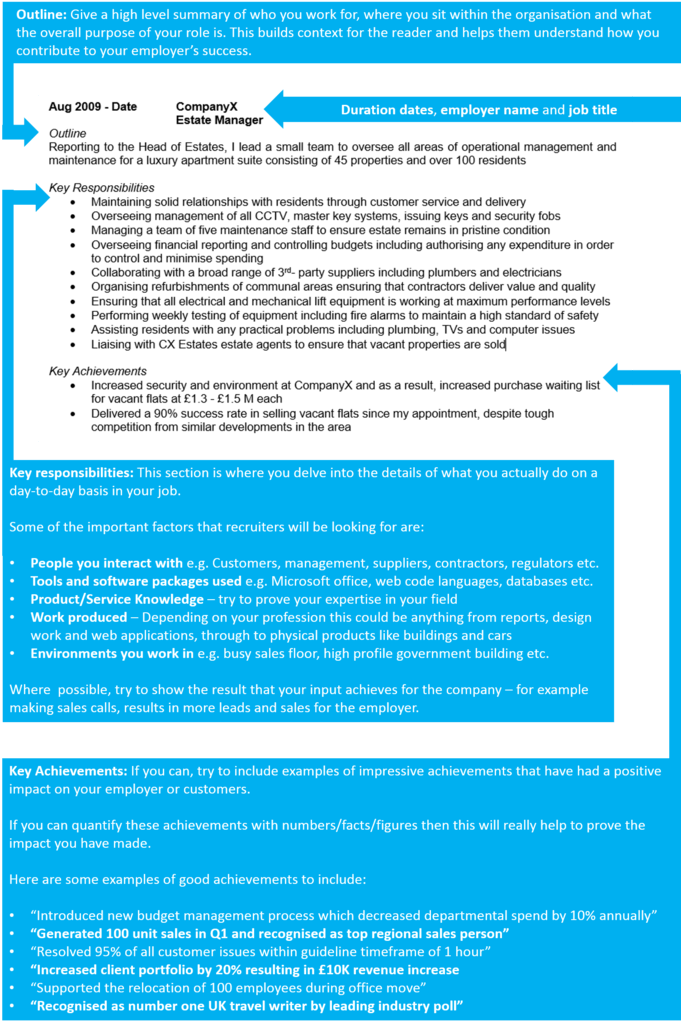

Start with a 1-2 sentence summary of your role as a whole, detailing what the goal of your position was, who you reported to or managed, and the type of organisation you worked for.

Key responsibilities

Using easy-to-read bullet points, note down your day-to-day responsibilities in the role.

Make sure to showcase how you used your hard sector skills and knowledge.

Key achievements

Lastly, add impact by highlight 1-3 key achievements that you made within the role.

Struggling to think of an achievement? If it had a positive impact on your company, it counts.

For example, you might increased company profits, improved processes, or something simpler, such as going above and beyond to solve a customer’s problem.

In your education section, make any degrees, qualifications or training which are relevant to Insurance Manager roles a focal point.

As well as mentioning the name of the organisation, qualification titles and dates of study, you should showcase any particularly relevant modules, assignments or projects.

Interests and hobbies

Although this is an optional section, it can be useful if your hobbies and interests will add further depth to your CV.

Interests which are related to the sector you are applying to, or which show transferable skills like leadership or teamwork, can worth listing.

On the other hand, generic hobbies like “going out with friends” won’t add any value to your application, so are best left off your CV.

Writing your Insurance Manager CV

An interview-winning CV for a Insurance Manager role, needs to be both visually pleasing and packed with targeted content.

Whilst it needs to detail your experience, accomplishments and relevant skills, it also needs to be as clear and easy to read as possible.

Remember to research the role and review the job ad before applying, so you’re able to match yourself up to the requirements.

If you follow these guidelines and keep motivated in your job search, you should land an interview in no time.

Best of luck with your next application!

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Insurance Resume Examples

Are you in the insurance sector and looking for a great resume to showcase your experience and skills? A well-crafted resume can help you stand out from the competition and increase your chances of securing a highly coveted insurance job. That’s why it’s important to put your best foot forward and make sure your resume reads as impressive as possible. To help you get started, we’ve put together a comprehensive guide, with resume examples, to make sure you make the right impression on your potential employer. In this guide you’ll find all the information you need to write a standout resume, including how to write a summary, highlight your skills and experience, format your resume, and more. So let’s get started!

Resume Examples by Job-Title

- Insurance Agent

- Insurance Broker

- Underwriter

- Claims Adjuster

- Claims Examiner

- Claims Investigator

- Risk Manager

- Insurance Sales Agent

- Customer Service Representative

- Insurance Appraiser

- Insurance Auto Damage Appraiser

- Insurance Fraud Investigator

- Insurance Account Manager

- Insurance Compliance Officer

- Insurance Analyst/Underwriting Analyst

- Insurance Product Manager

- Reinsurance Underwriter

- Insurance Medical Examiner

- Insurance Risk Surveyor

- Insurance Operations Manager

- Insurance Marketing Manager

- Insurance IT Analyst

- Insurance Actuarial Analyst

- Insurance Accountant

- Insurance Auditor

- Insurance Claims Manager

- Insurance Underwriting Manager

- Insurance Sales Manager

- Insurance Operations Analyst

- Insurance Compliance Analyst

- Insurance Data Analyst

- Insurance Marketing Coordinator

- Insurance Portfolio Manager

- Insurance Project Manager

- Insurance Business Analyst

- Insurance Credit Analyst

- Insurance Loss Control Specialist

- Insurance Benefits Administrator

- Insurance Policy Administrator

- Insurance Fraud Prevention Analyst

- Insurance Legal Counsel

- Insurance Human Resources Manager

- Insurance Training and Development Specialist

Insurance Resume Headline Examples

Creating a good headline for an insurance resume is an important step in the job search process. Your headline should accurately reflect your skills and experience, while also highlighting your unique qualifications. It should be short, concise, and easy to read.

Before you start writing your headline, make sure you have a clear idea of what you have to offer potential employers. You should have a good understanding of the job you are applying for and the company’s particular needs and goals. Once you have a good handle on what you can bring to the table, you can start crafting an effective headline.

When writing a headline for your insurance resume, focus on your most relevant experience and qualifications. Use powerful action verbs and strong keywords to show hiring managers just how qualified you are. Include key points such as years of experience, certifications, and special knowledge to give your headline extra impact.

It’s also important to avoid being too generic. Generic headlines can detract from the impact of your resume and make it seem less impressive. Instead, focus on emphasizing the most important parts of your resume, while still keeping the headline clear and concise.

Finally, make sure that your headline accurately reflects the nature of your insurance resume. By taking the time to create a unique, compelling headline, you will be giving yourself the best chance of standing out from the crowd. Here are some examples of insurance resume headlines to get you started:

- Experienced Insurance Professional with 10 Years of Industry Knowledge

- Certified Insurance Agent with a Proven Track Record of Success

- Skilled Underwriter Specializing in Risk Analysis and Management

- Reliable Financial Advisor with a Focus on Client Satisfaction and Growth

- Dedicated Insurance Broker with a Commitment to Quality Service

- Knowledgeable Claims Adjuster with a Focus on Claim Resolution and Client Relations

Insurance Resume Career Objective Examples

When it comes to crafting an effective insurance resume, it is essential to include a career objective statement. This statement can provide hiring managers with an insight into your professional goals, as well as give them an idea of how you will fit into their organization.

A good career objective should be focused and specific. For example, instead of writing a vague statement such as “seeking a career in insurance,” focus on something specific such as “seeking an entry-level position in the insurance industry where I can utilize my knowledge of insurance policies and regulations.” This statement provides potential employers with a clear idea of what you are looking for in a role and how you can become an asset to their organization.

When crafting a career objective statement for an insurance resume, it is important to keep it concise and to the point. Aim for a statement that is no more than two to three sentences long. This will ensure that the statement is easy to read and will not take up too much space on your resume.

In addition, your career objective should also be tailored to the job you are applying for. If you are applying for an entry-level position, emphasize your enthusiasm for the role and your desire to learn and grow with the company. If you are applying for a managerial role, focus on your experience and leadership skills.

By including a carefully crafted career objective statement on your insurance resume, you will be giving potential employers an insight into your professional goals, while also showing that you are a great fit for the role.

Insurance Resume Summary Statement Examples

Having a well-crafted summary statement on your insurance resume is essential when trying to land a job in the insurance industry. A summary statement serves as an introduction to potential employers and can be used to highlight your most notable skills and qualifications. It should be an attention-grabber that tells employers why you are the best person for the job.

When writing a summary statement for your insurance resume, make sure to include information about your experience and qualifications. Include the number of years of experience you have in the industry, as well as any specializations or certifications you have. If you have strong customer service or problem-solving skills, make sure to highlight those as well.

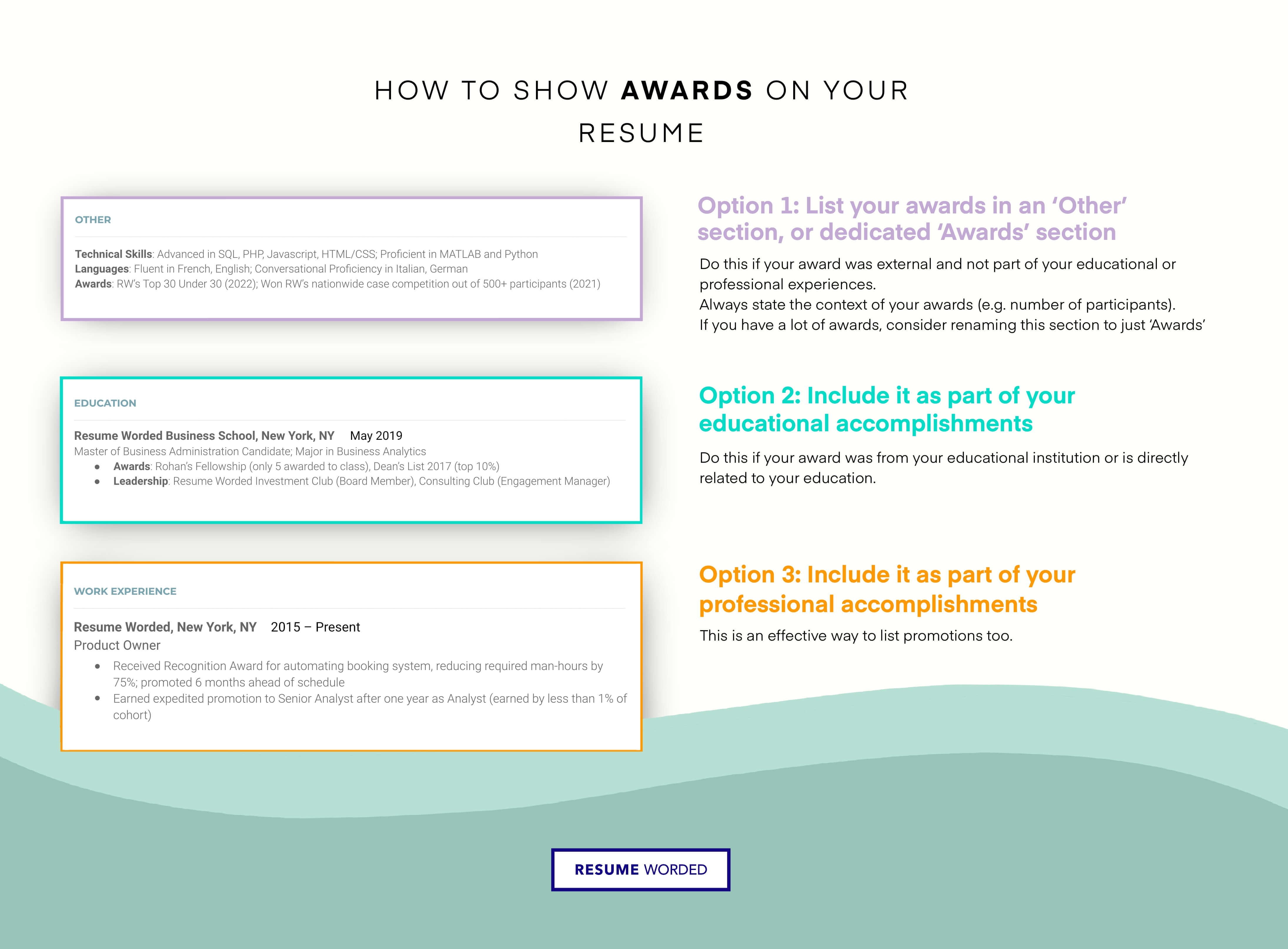

You should also include information about your accomplishments. Make sure to list any awards or recognition you have received in the industry, as well as any successful projects or campaigns you have worked on. This will demonstrate to employers that you are capable of taking on the challenges of the job.

Finally, make sure to include any other qualities that make you a great candidate for the job. Do you have excellent communication skills? Are you able to work well in a team setting? Are you tech-savvy? These are all things you can mention in your summary statement.

By crafting a strong and well-written summary statement, you can set yourself apart from other candidates and ensure that employers take notice of your resume.

How to write Experience Section in Insurance Resume

.The experience section of your insurance resume is the section where you can showcase the relevant jobs and positions you have held in the past. You should include the job title, name of the employer, and the dates that you worked there. You also need to give a brief description of the duties and responsibilities you had in each position, such as providing customer service, assessing risk, and managing policies. Showing that you have the experience needed to succeed in the insurance industry is important, and so you should be sure to highlight any accomplishments you achieved in each position. For example, if you helped lower claims by a certain percentage, be sure to include that information. Finally, when writing your experience section, make sure to use action words to give the employer a better understanding of your background.

Insurance Resume Writing Tips

When it comes to writing an effective insurance resume, there are a few essential tips to keep in mind. Firstly, it is important to tailor your resume to the specific job you are applying for. Different insurance roles require different skill sets, so make sure you highlight the strengths that best match the job description.

Secondly, it is essential to keep your resume brief and to the point. Make sure to include relevant industry experience and highlight your technical skills and qualifications. Focus on specific accomplishments and avoid writing long, detailed paragraphs.

Thirdly, make sure to include any certifications or licenses that you have obtained in the insurance field and list them prominently on your resume. This will demonstrate your commitment to professional development and show employers that you are knowledgeable and up to date on the latest industry trends.

Finally, don’t forget to include references. Make sure to include contact information for former employers, colleagues, and supervisors who can vouch for your work experience and skills. This will be a valuable asset when competing with other applicants.

By following the above tips, you will be able to create an effective and compelling insurance resume that stands out from the competition. Good luck!

Insurance Career Prospects in the Industry