Bank Teller Resume Examples [Updated for 2024]

As a bank teller, you’re a trusted individual that handles large sums of cash.

In fact, you’re the face of the bank!

You’ll be faced with many problems during your shifts, but perhaps you didn’t expect to face one so soon...

Your resume!

What does a good bank teller resume look like, anyway?

With so many people competing for the best bank teller positions, you can’t leave any questions unanswered.

But don’t worry, this guide has you covered!

- A job-winning bank teller resume example

- How to create a bank teller resume that hiring managers love

- Specific tips and tricks for the banking industry

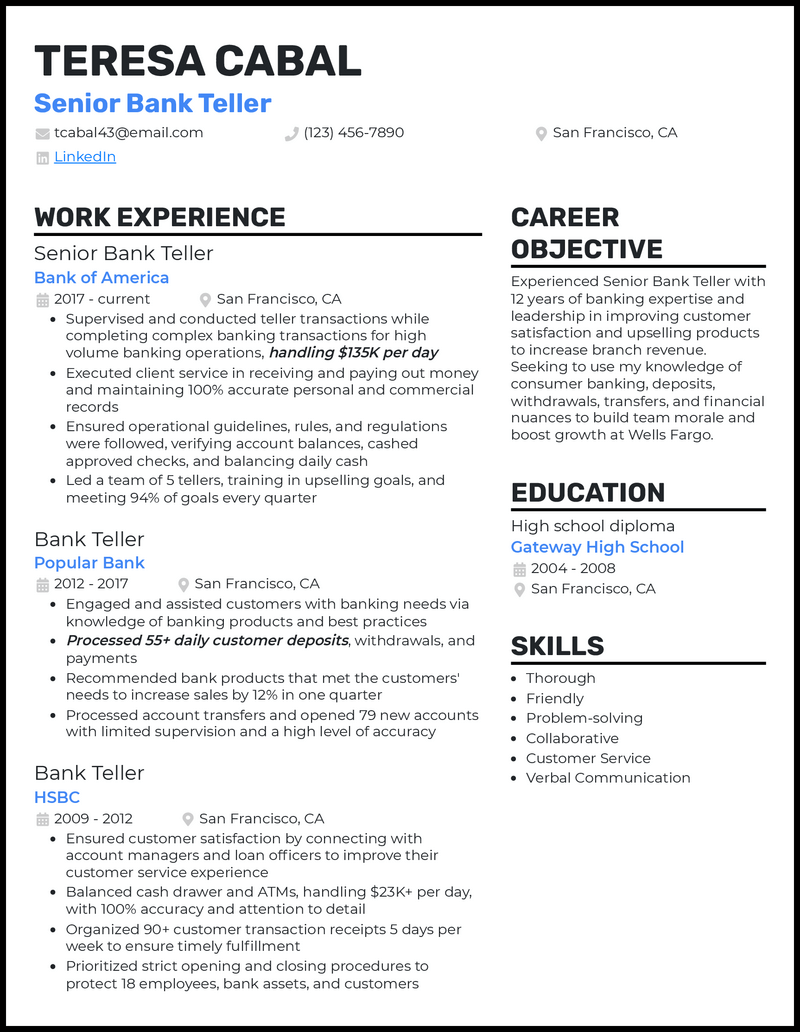

Here’s a bank teller resume example, built with our own resume builder :

Looking for a resume example for a different finance position? We've got more resume examples right here:

- Banking Resume

- Financial Analyst Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

Follow the steps below to create a bank teller resume of your own.

How to Format a Bank Teller Resume

Banking is always going to be a competitive segment of the job market.

However, you may be surprised at just how many apply for the position of bank teller.

Now, we aren’t telling you this to scare you.

Rather, that you must do everything in your power to make your resume stand out .

The first course of action is to choose the correct format.

You see, even those with the richest of bank teller experience won’t be able to impress a hiring manager that is struggling to read the content.

The “ reverse-chronological ” format is the most popular format for bank tellers, and it’s for good reason. It displays your most recent work experience first, and then works backwards through your history and skills.

You could also try the two following formats:

- Functional Resume - This format places a large emphasis on your skills, which makes it the best format for bank tellers that are highly-skilled, but have little in the way of bank teller work experience.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, which means it focuses on both your banking skills AND work experience.

- Try to keep your bank teller resume to one-page. Doing this will show the hiring manager that you present information is a precise way. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins - One-inch margins on all sides

- Font - Pick a font that stands out, but make it professional

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Line Spacing - Use only 1.0 or 1.15 line spacing

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As a bank teller, the recruiter wants to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Bank Teller Resume Template

Ever made a resume?

If so, there’s a good chance that Word was the program of choice.

There’s also a good chance that your resume wasn’t as well-formatted as it could be.

It’s no secret that Word is far from the best tool for the job.

For a professional bank teller resume that has a solid structure, you may want to use a resume template .

What to Include in a Bank Teller Resume

The main sections in a bank teller resume are:

- Contact Information

- Work Experience

For a bank teller resume that stands out from other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

Right, now let’s talk about each of the above sections, and explain how to write each of them.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a bank teller, you should know that not a single digit can be out of place.

And this is exactly the case with your contact information section. One small misspelling of your phone number can render your whole application useless.

For your contact information section, include:

- Title - This should be specific to the exact job you’re applying for, which is “Bank Teller”

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Emily Hembrow - Bank Teller. 101-358-6095. [email protected]

- Emily Hembrow - Banking Admin Angel. 101-358-6095. [email protected]

How to Write a Bank Teller Resume Summary or Objective

Now, you should be aware that making your resume stand out is the #1 goal .

But HOW can you do this?

There’s no use putting your best achievements right at bottom of the resume.

Nope – you need an opening paragraph that you can bank on!

These opening paragraphs are known as either a resume summary or objective .

Both are short, snappy paragraphs that sum up the main points of your resume. They are great for introducing your skills and experiences.

The difference between a summary and objective is that.

A resume summary is a paragraph that summarizes your most notable experiences and achievements. It is the best option for individuals who have multiple years of bank experience.

- Committed bank teller with five years of experience at YZX Bank, where I balanced ledgers, handled cashed, maintained accounts, and more. Maintained a 99.80% customer satisfaction rating during the total period of employment. Seeking a chance to leverage my interpersonal skills and banking knowledge to become a bank teller at Bank XYZ.

On the other hand, a resume objective should give a run-down of your professional goals and aspirations. It is ideal for entry-level bank teller candidates. Although you’re talking about your own goals, it is important to align these goals with the employer’s vision.

- Motivated finance student looking for a bank teller role at Bank XYZ. Two years of experience at a gym reception with heavy traffic. Excellent communication, organization, and problem solving skills. Enthusiastic to support your client-facing staff, where I can use my interpersonal skills to achieve the best quality of service.

So, which one is best for bank tellers?

Well, a summary is suited for bank tellers with work experience, whereas an objective is suited for those who are entering the field for the first time (student, graduate, or switching careers).

How to Make Your Bank Teller Work Experience Stand Out

There’s no easier way to impress the hiring manager than with a rich work experience.

Sure, talking about your education and banking knowledge is super important, but nothing proves your talents like a wealth of bank teller experience.

Follow this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

Bank Teller

01/2018 - 03/2020

- Voted “Teller of the Year” in 2018 and 2019

- Set-up a new database system that accurately secured all transactions

- Processed withdrawals, deposits, transfers, loan payments, and cashier’s checks for 50+ people every day]

To make your experience stand out, you should focus on your most impressive achievements , rather than your daily responsibilities.

Instead of saying:

“Data entry”

“Set-up a new database system that accurately secured all transactions”

So, what exactly are we suggesting here?

Simply put, the first statement isn’t impressive – at all!

On the other hand, the second statement goes into more detail and shows that you’re an excellent asset to the bank.

- Tailor your experience to the job advertisement. Simply look for any required skills that you can demonstrate in your work experience.

What if You Don’t Have Work Experience?

Maybe you’re a finance graduate who hasn’t worked before?

Or maybe you’re transitioning from a different banking position?

Whatever the situation, don’t threat.

You see, it doesn’t matter if you haven’t been a bank teller in the past, as you can still add relevant skills and experiences from previous jobs.

For example, if you’ve worked store manager, you can talk about any crossover skills and experiences. Just like a bank teller, you would have to be friendly, give advice to customers, and help with cashier duties.

For the students read this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Bank Teller Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these same words on nearly all bank teller resumes.

And since you need your bank teller resume stand out, we’d recommend using some of these action words instead:

- Conceptualized

- Spearheaded

How to List Your Education Correctly

The next section in any bank teller resume is the education section.

Now, there isn’t just one correct path to becoming a professional bank teller.

In fact, a high school diploma or GED certificate is usually all that’s required.

So whatever path you have taken, just include the following details:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Boston State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Risk Analysis, Financial Management, Bank Lending and the Legal Environment, Quantitative Methods for Banking, Finance and Economics, and more]

Now, you may have a few questions, so here are the most frequently asked questions:

- What if I haven’t finished studying?

No problem. Regardless of whether you’re still studying or not, you should still mention all of the years that you have studied to date

- Should I include my high school education?

Only if you don’t have any higher education. The bank manager will have little care for your high school education if you have a finance degree

- What is more important for a bank teller, education or experience?

If you’re an experienced bank teller, your work experience should come before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 15 Skills for a Bank Teller Resume

Being a professional bank teller requires having a certain set of skills.

And the hiring manager needs to see that you have them!

Now, you may be the most skilled bank teller in the world, but you need to make these skills clearly displayed on your resume.

You see, the manager can’t see your skills if you hide them away in a bank vault!

Here are some of the skills a hiring manager wants to see from a bank teller...

Hard Skills:

- Balancing Ledgers

- Mortgages and Loans

- Deposits and Withdrawals

- Investments

- Safety Deposit Boxes

- Cash Handling

- Risk Assessment

- Account Maintenance

- Foreign Currency Exchange

Soft Skills:

- Excellent Communicator

- Time Management

- Problem Solving

- Confident & Professional Manner

- Organization

- Although soft skills are important for a bank teller, they’re difficult to prove on your resume. As such, try not to go too overboard with the generic soft skills. You should also think of situations that you have used your soft skills, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have fantastic-looking resume that highlights your array of skills and experiences!

But wait...

Is your resume the absolute best it can be?

Remember, the #1 goal is for your resume to stand out .

And a carbon copy of your competitors resume is not going to do that.

The following sections will set you apart from the other bank teller candidates.

Awards & Certifications

Did you win any recognition awards at your previous work place?

Did you win a competition during your studies?

Have you completed any relevant courses on Coursera?

Whatever the recognition, be sure to add any awards and certifications to your resume.

Awards & Certificates

- “Economics of Money and Banking” - Coursera Certificate

- “Learning How to Learn” - Coursera Certificate

- “Teller of the Year” 2018 and 2019 - XYZ Bank]

Whether or not the bank teller requires knowledge of another language, being able to speak multiple languages is an impressive skill.

If you can speak any other language, even to a basic standard, feel free to add it to your resume, but only if you have space.

Order the languages by proficiency:

- Intermediate

Now, you’re likely wondering, “why does the hiring manager need to know about my book club meeting every Friday?”

Well, they don’t need to know, but it allows the hiring manager to learn more about you as a person.

And this is a good thing, as banks are looking for someone who they’ll get along with.

The best way to do this is by listing your hobbies and interests!

Especially if your hobby involves social interaction, as you’ll be working in a customer-facing role.

If you want some ideas of hobbies & interests to put on your resume , we have a guide for that!

Match Your Cover Letter with Your Resume

According to the U.S. BLS , bank teller jobs will decline by 12% between 2018 and 2028.

And this means there will be a constant increase in competition for the top jobs.

As such, you need to do everything in your power to stand out.

But HOW can you do this?

Well, by writing a convincing cover letter !

You see, a letter is perfect for communicating with more depth and personality.

Even better, you can show the bank’s hiring manager that want THIS position in THIS bank.

As with your resume, your cover letter should also have the correct structure.

Here’s how to do that:

And here’s what to put in each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website (or Behance / Dribble)

Hiring Manager’s Contact Information

Including full name, position, location, email

Opening Paragraph

It’s critical to hook the hiring manager with your opening paragraph, so it needs to be very powerful, otherwise they’re not going to read the rest of your resume. So, mention:

- The specific position you’re applying for – Bank Teller

- A short, punchy summary of your most notable experiences achievements

Once you’ve got the hiring manager hooked with your opener, you can go deeper into the rest of your work history and background. Some of the points you can mention here are:

- Why you want to work for this specific bank

- Anything you know about the bank’s culture

- What are your most notable and how do they relate to this job

- If you’ve worked in other banks or similar positions

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragrpah

- Thank the hiring manager for their time

- Finish with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “Sincerely” or “Best regards”.

Creating a job-winning cover letter can be a challenging craft. But don’t worry, you can rely on our how to write a cover letter for guidance.

Key Takeaways

You now have the knowledge and tools to create a job-winning bank teller resume.

Let’s quickly recap everything we’ve covered:

- Choose the correct format based on your specific circumstances. Prioritize a reverse-chronological format, and follow the best layout practices to keep everything clear and concise

- Use a resume summary or objective to hook the reader

- Talk about your most notable achievements, instead of your daily duties

- Match your bank teller resume with a convincing cover letter

Suggested reading:

- Guide to Green Careers - All You Need to Know

- Why Should We Hire You - 10+ Best Answers

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Bank Teller Resume: Guide, Free Templates, & Essential Skills

Handling a customer’s money and their accounts are your bread and butter as a Bank Teller. However, are you having trouble cashing in your resume with a hiring manager? We can help you complete your job application transaction thanks to our custom resume templates.

Bank Teller Resume Example MSWord® Make the right transaction and land an interview thanks to our Bank Teller Resume template in Word format

Whether you’re a high school graduate, a finance student wanting to break into the field, or an experienced teller on the hunt for something new, there’s one thing you’ll need every time: an impressive bank teller resume .

Many hiring managers— one in four , to be precise—spend less than 30 seconds reading a resume in the first round.

This ups the stakes for applicants to submit a detailed resume that pops! (The company must actually read your resume for you to get hired, after all.)

In this guide, we’ll help you build a successful resume, elaborate on what employers want, and offer our best bank teller resume examples for added inspiration.

You’ll learn how to write a resume suited for a bank teller position—one that stands out from the crowd and gets results.

Bank Teller Resume Sample

A good bank teller resume includes a few key specifics, but you can’t forget the basics. While all resumes must include the basics.

For example, always list your personal and contact information at the top of the resume .

Education, work experience, and skills sections are also mandatory features, but how you order them can depend on your preferred resume template design.

Don’t stress just yet. If you’re completely lost and unsure how to begin, this article is for you!

Let’s dive into a sample bank teller resume that will catch any employer’s eye!

[Daniel Barlow]

[Bank Teller]

[2426 NW 13th Ave, Amarillo, Texas 79107 | 806-220-0355 | [email protected]]

[Daniel Barlow] [Bank Teller] [2426 NW 13th Ave, Amarillo, Texas 79107 | 806-220-0355 | [email protected]]

Focused, detail-oriented professional with experience in providing exceptional customer service, administering transactions, and promoting financial offerings in the banking industry. Coordinated and attentive, capable of performing duties impeccably.

Bank Teller

Herring Bank | Amarillo, TX

July 2019 – March 2021

- Handled monetary transactions such as deposits, withdrawals, money transfers, and loan payments

- Handled and organized transaction records

- Assisted in opening and closing accounts, credits, loans, and mortgages

- Assisted clients with various inquiries concerning their account and the bank

Cashier Walmart | Amarillo, TX

February 2018 – May 2019

- Greeted customers and served as a face for the company

- Handled monetary transactions using a computerized operating system

- Dealt with customers’ questions and interacted with a diverse group

- Provided customer service.

High School Diploma

Amarillo High School, Amarillo, TX Graduation: 2017

- Attention to detail

- Reliability

- Customer service

- Mathematics and numeracy

- Finance rules and procedures

- Knowledge of bank standards and processes

Digital Skills

- Hyland Software OnBase

- Microsoft Word and Microsoft Excel

Certifications

Certified Bank Teller (CBT) Economics of Money and Banking Certificate, Coursera

English – Native

Spanish – Basic

Use the example above to inspire your own resume, changing the information to match your own skills and experience. Your final resume will also differ based on the format and structure you choose.

Contrary to what you might expect, the most eye-catching resumes are those with clean and simple structures. Choose a professional layout with legible fonts and clear headers .

For banking professionals, avoid going too big and flashy with your documents. The finance industry prioritizes organization, professionalism, and pragmatism. A tidy structure that hits all the main points will be the perfect base to build upon.

What’s the Best Bank Teller Resume Format?

The first step in creating a bank teller resume is determining the layout.

Do not overlook this step. Your resume layout is just as important as your content .

Every HR manager will have an opinion on format and structuring, but we know what they expect and what your competition submits.

Some might claim that a one-page resume is best, while others would rather see longer, more detailed docs.

The average resume contains up to 489 words. But when considering resume length, it’s best to make sure each and every phrase on your doc holds value. No fluff —short and sweet is best.

When it comes to resume structure, these are the most common and effective formats:

The Reverse-chronological Format

Under this format, you’ll list your career and previously held positions in reverse-chronological order, going from the most recent to the oldest.

The reverse-chronological format is best suited if your bank teller job resume includes lots of experiences and achievements.

It’s the most common format chosen —for good reason!

Your recent job holdings are usually most relevant to your current career path. If you’ve got several accomplishments and skills related to the industry, these resume formats can list your most relevant experiences throughout the doc and position you as a qualified candidate.

That said, the reverse-chronological format may not suit everyone, especially if you’re new to the professional industry with little previous experience.

The Functional Format

A functional resume format emphasizes skill rather than experience. This structure is great for those applying for a bank teller position without relevant work experience.

A functional resume is best for recent graduates, current students, or those switching to banking from a different field of work.

The Combination/Hybrid Format

A combination, or a hybrid resume format, combines the previous two formats. It focuses on skills and work experience .

It’s the least common of the three resume formats, but it can be a wise option if you’re changing career paths. Doubling down on how certain skills required in previous jobs are valuable to banking will help support a career transition.

And because it doesn’t follow a timely order, it’s also a better way to address gaps in your resume.

Remember, the best bank teller resume template is not one-size-fits-all. a reverse-chronological or functional resume is the safest option, but consider your total career history before committing to a format.

Above all, your resume format, layout, and overall style should complement your skills and work history.

How Do I Write a Resume Summary or Objective?

A resume summary should hook the reader and spark interest. Depending on your experience, you might opt for a career summary or an objective .

Bank Teller Resume Summary

An effective resume summary highlights your most notable achievements. It sets the stage for what the reviewer will find in the rest of the doc. Done right, a summary section can frame you as a highly desirable candidate while also including vital resume keywords specific to the industry.

Applicants with more than three years of experience in banking or other similar positions should choose a resume summary section. With extensive experience to pull from, you’ll have no trouble choosing the most relevant career highlights for your summary.

If you’re new to the field, don’t fret! There’s still a way to demand attention with a resume objective statement immediately.

Bank Teller Resume Objective

The career objective approach is ideal for a beginner’s entry-level bank teller resume. Students and entry-level candidates often leverage career objective statements to discuss what they want in their careers.

Simply give a run-down of your career goals and aspirations .

The objective must be pertinent to the job and the bank. Discuss what you hope to achieve and how your education (or skills) would be valuable to the company.

Summary Example

If you decide to open with a bank teller resume summary, you need a catchy way of presenting your past work. Here, you’ll simply frame your experience and tease the reader. Leave out the excess fat and cut to the chase.

Think about your greatest career moments and how they qualify you for the job.

If you’re struggling with where to start, here are some bank teller resume summary examples:

Committed and detail-oriented individual with 3 years of experience at a bank teller position. Accustomed to interacting with diverse sets of people, handling inquiries, as well as managing transactions, loans, documentation, and balancing cash drawers.

I am a friendly and sociable person with great people skills. I was in charge of the school newspaper in high school, where I handled money and various responsibilities.

How to Write an Entry-Level Objective

No experience? No problem! A bank teller’s entry-level objective is the perfect place to impress if you lack previous employment in banking!

Entry-level jobs are meant for newbie professionals, so don’t let your lack of experience deter you. Focus on why you want to work as a teller and how you will use your skills to learn and grow on the job.

Tailor your resume objective to each employer whenever possible . It requires more time to edit your docs for each job ad, making your application stand out. Tailored resumes perform better , and soft skills are just as important as hard skills.

Read the job description and pinpoint two to three job “requirements” you can tackle by leveraging your special experience.

Objective Examples

Good career objectives relate skills displayed in previous situations to the bank teller job and reference skills and abilities the company needs.

Let’s look at a bank teller resume objective example to help you write a stand out.

Finance graduate seeking to utilize my knowledge, interpersonal and organizational skills as a bank teller. Looking to be a part of a reputable team and contribute to the success and further growth of the bank.

How to Describe Your Bank Teller Experience

If you’re a bank teller with years worth of work history behind you, put that information front and center in a well-defined experience section.

No-experience candidates should focus on other aspects of their application, such as soft skills, leadership, and other related experiences that position them as hardworking and trustworthy.

A good banking teller resume should convey your past work concisely and signify how you would be an asset to the employer.

For each position, highlight how you assisted your previous employers. Write bullet points that highlight your achievements—don’t be modest.

Tips for Emphasizing Bank Teller Experience

One thing all eye-catching resumes have in common is their appropriate use of action verbs instead of cliche resume terms.

Avoid descriptors like “team player,” which is hard for a stranger to prove on paper. Other phrases like “responsible for” and “worked with” are overused and generic.

Replace tired words with words that signify action and competence. Try these words on for size.

- Spearheaded

Companies love employees who save them money. Try:

- Consolidated

To discuss performance-related achievements, use:

- Capitalized

Example Experience sections

Your experience will always serve as the meat of your resume. But each bullet point must tell a story.

Yes, you worked as a bank teller, but how did you go above and beyond in the role ? What did you do to perform your job successfully, and what changes did you implement to make the role better?

For example, did you keep customer satisfaction high? How?

Did you maintain a longer accuracy streak than your coworkers? Did you close or maintain the most accounts?

When writing your work experience, make sure to list the name of your employer and the dates worked. Then, follow it up with your qualifications and achievements .

Here is an example to consider:

Bank Teller Wells Fargo Bank | San Francisco, CA March 2017 – April 2020

- Organized and documented financial records

- Welcomed customers, answered queries and boosted overall customer satisfaction

- Processed credits, loans, and mortgages

Entry-Level Experience Section

While experience working in the same job position would be a plus for any candidate, it’s not always necessary. Bank teller is usually an entry-level position , and banks will train new employees.Here is a bank teller resume sample with no experience in the banking industry:

Assistant Manager McDonald’s | California City, CA July 2018 – September 2019

- Interacted with diverse customers

- Reconciled budget spending

- Served as a face for the company

- Provided customer service

Is Your Education Section Full of Discrepancies? Time to Fix That

All employers value high education and academic achievement. Recent graduates can also leverage education sections to prove value.

But you must display it correctly.

Bank Teller Resume Education Section

A college or university degree is great, but bank tellers only need a High School Diploma or GED Certificate .

Whatever your academic history, make sure to list the following details:

- High School or University

- Degree Type, Major

- Relevant courses, higher education only

- Years studied

- GPA, if high

- Achievements, awards, and honors

If you are a university graduate, there is no need to list your high school education .

If you are a current student, list your major, your e xpected graduation date, and other relevant courses or capstone projects.

For experienced tellers, your work experience should supersede your education, especially any university degree that’s not field-specific.

The Best Skills for Your Resume

An employer posts a job ad, they have a pretty clear picture of the skills and qualifications required to be successful. Study the job description to uncover the capabilities you’ll need to be a bank teller.

Ideally, you’ll need a mix of hard and soft skills.

Let’s go over the best bank teller resume skills to include.

Soft Skills

- Communication skills

- Interpersonal abilities

- Analytical thinking

- Flexibility

- Time management

- Problem solving

- Organization

Hard Skills

- Sales and service

- Processing transactions (deposits and withdrawals)

- Money handling

- Fraud detection

- Computer platforms and programs

- Language proficiencies

How to Add Other Sections for an Effective Resume

Bank teller resume will follow a certain structure across the board: contact information, employment history, and education.

To cater to your unique strengths, consider adding additional sections that highlight other aspects of your track record, such as awards, hobbies, professional development, or languages.

Awards and Certifications

Your resume is no place for modesty. Any formal recognition of success, such as employee of the year in prior workplaces, or additional training courses are a wise add.

A bank teller position doesn’t require you to posess additional certifications; however, accreditations are available.

Certificate commitments for the field vary widely and come from several accrediting institutions, whether the CBT (Certified Bank Teller) designation or certificate for completing desirable skill-related courses on sites like Coursera and Udemy.

Languages

Speaking more than one language is a huge leg up in any occupation, especially one like a bank teller.

You will deal with people regularly, both face-to-face and through internal communications.

If you’re bilingual, allocate space for the languages you know and your level of proficiency. Always include your native tongue first, and then list them by proficiency.

Interests and Hobbies

I t may seem strange to talk about leisurely activities on a resume. How does your love of football relate to banking transactions? Well, it doesn’t. But non-work-related interests showcase your individuality and remind reviewers that you’re human.

Without some unique features padding your standard resume wording, you’re just another face in the crowd—that is, until you’re a flag football club team captain with a knack for customer service.

If your hobbies allow you to use interpersonal and social skills—all the better!

Bank Teller Resume Sample “Other” Sections Example

- Employee of the Month – 7 times in 2 years

- English (Native)

- French (Proficient)

- Spanish (Intermediate)

- Chinese (Basic)

Hobbies and Interests

Key Takeaway

Bank teller resumes are straight and to-the-point. Take it slow and break down the main sections below using the advice in this article and our bank teller resume examples.

Your main sections must include :

- Personal Information

- Work Experience

If you need further help, our resume templates help make job applications even easier. With a few clicks, you’ll be well on your way to your next job. Good luck!

Free Resume Templates

Using resume templates that are proven to work will help you to move your career search forward. Start and customize as many resumes as you need with our free resume builder .

Thanks for using our free templates!

Enjoy ResumeGiants? We’d love it if you’d leave a review – it’d help others!

We hope we’ve helped you to move closer to your dream job. Have you found our resources helpful? If so, share your experiences with others – leave a review! (10 seconds max)

1 Bank Teller Resume Example to Land You a Role in 2023

Bank Tellers are great at providing excellent customer service and handling financial transactions with accuracy. As a Bank Teller, your resume should be just like your customer service - professional, reliable, and tailored to the needs of the employer. In this guide, we'll review X Bank Teller resume examples to help you craft a successful resume.

Resume Examples

Resume guidance.

- High Level Resume Tips

- Must-Have Information

- Why Resume Headlines & Titles are Important

- Writing an Exceptional Resume Summary

- How to Impress with Your Work Experience

- Top Skills & Keywords

- Go Above & Beyond with a Cover Letter

- Resume FAQs

- Related Resumes

Common Responsibilities Listed on Bank Teller Resumes:

- Greet customers and provide excellent customer service

- Process deposits, withdrawals, and other transactions

- Balance cash drawer and reconcile discrepancies

- Answer customer inquiries and provide information about bank services

- Cross-sell bank products and services

- Process loan payments and other payments

- Verify customer identification

- Process check orders and other banking forms

- Maintain customer records

- Assist with opening and closing procedures

- Follow bank security and compliance procedures

You can use the examples above as a starting point to help you brainstorm tasks, accomplishments for your work experience section.

Bank Teller Resume Example:

- Consistently exceeded monthly cross-selling goals by 25%, resulting in increased revenue for the bank.

- Implemented a new customer service training program for new hires, resulting in a 15% improvement in customer satisfaction scores.

- Identified and resolved discrepancies in cash drawer balancing procedures, resulting in a 20% reduction in errors and improved accuracy.

- Managed a high-volume branch, processing an average of 200 transactions per day with 100% accuracy.

- Developed and implemented a new loan payment processing system, resulting in a 30% reduction in processing time and improved customer satisfaction.

- Collaborated with the branch manager to implement new security procedures, resulting in a 50% reduction in security incidents.

- Consistently met or exceeded monthly transaction processing goals, averaging 95% accuracy.

- Developed and maintained strong customer relationships, resulting in a 20% increase in customer retention rates.

- Identified and resolved compliance issues, resulting in a 100% compliance rating during internal audits.

- Customer service

- Cross-selling

- Cash handling

- Attention to detail

- Transaction processing

- Problem-solving

- Compliance and regulatory knowledge

- Time management

- Communication

- Relationship building

- Security procedures

- Training and development

- Loan payment processing

- Adaptability to new technologies

High Level Resume Tips for Bank Tellers:

Must-have information for a bank teller resume:.

Here are the essential sections that should exist in an Bank Teller resume:

- Contact Information

- Resume Headline

- Resume Summary or Objective

- Work Experience & Achievements

- Skills & Competencies

Additionally, if you're eager to make an impression and gain an edge over other Bank Teller candidates, you may want to consider adding in these sections:

- Certifications/Training

Let's start with resume headlines.

Why Resume Headlines & Titles are Important for Bank Tellers:

Bank teller resume headline examples:, strong headlines.

- Highly Experienced Bank Teller with Proven Track Record of Success

- Ambitious Bank Teller Seeking to Make a Positive Impact

Why these are strong:

- These headlines effectively communicate the Bank Teller's experience and ambition, which are both qualities that hiring managers look for in a Bank Teller. The first headline highlights the Bank Teller's experience and the second headline emphasizes the Bank Teller's ambition and desire to make a positive impact.8

Weak Headlines

- Experienced Bank Teller

- Bank Teller with 5+ Years of Experience

Why these are weak:

- These headlines are too generic and do not provide any information about the Bank Teller's skills or qualifications. Additionally, the second headline does not accurately reflect the Bank Teller's experience level.

Writing an Exceptional Bank Teller Resume Summary:

Bank teller resume summary examples:, strong summaries.

- Detail-oriented Bank Teller with 5 years of experience in cash handling and customer service. Skilled in identifying fraudulent activity and resolving customer complaints, resulting in a 95% satisfaction rate. Proficient in using banking software and maintaining accurate records, ensuring compliance with industry regulations.

- Experienced Bank Teller with a strong focus on building customer relationships and providing exceptional service. Proficient in handling large volumes of cash and processing transactions accurately and efficiently. Skilled in cross-selling banking products and services, resulting in a 20% increase in customer retention.

- Results-driven Bank Teller with a proven track record of exceeding sales targets and delivering exceptional customer experiences. Skilled in identifying customer needs and recommending appropriate banking solutions, resulting in a 30% increase in revenue. Proficient in using banking software and adhering to industry regulations.

- These resume summaries are strong for Bank Tellers as they highlight the candidates' key skills, accomplishments, and industry-specific experience. The first summary emphasizes the candidate's attention to detail and ability to handle customer complaints and fraudulent activity. The second summary showcases the candidate's focus on building customer relationships and cross-selling banking products and services. Lastly, the third summary demonstrates the candidate's results-driven approach and success in exceeding sales targets and delivering exceptional customer experiences, making them highly appealing to potential employers.

Weak Summaries

- Bank Teller with experience in cash handling and customer service, seeking a new opportunity to grow and develop my skills in a fast-paced environment.

- Experienced Bank Teller with knowledge of banking procedures and regulations, looking for a challenging role in a reputable financial institution.

- Bank Teller with a focus on accuracy and attention to detail, committed to providing excellent customer service and ensuring the security of financial transactions.

- These resume summaries need improvement for Bank Tellers as they are too generic and lack specific details about the candidate's achievements or skills. The first summary only mentions cash handling and customer service, which are basic requirements for the job, but doesn't provide any information on the candidate's performance or accomplishments in these areas. The second summary mentions knowledge of banking procedures and regulations, but doesn't specify which ones or how the candidate has applied this knowledge in their previous roles. The third summary mentions accuracy and attention to detail, but doesn't provide any examples of how the candidate has demonstrated these qualities or how they have contributed to the success of their team or organization.

Resume Objective Examples for Bank Tellers:

Strong objectives.

- Detail-oriented and customer-focused Bank Teller with a strong work ethic and excellent communication skills, seeking an entry-level position to provide exceptional service and support to clients while contributing to the growth of a reputable financial institution.

- Recent finance graduate with a passion for numbers and a desire to learn, seeking a Bank Teller position to gain hands-on experience in the banking industry and utilize my analytical skills to assist clients with their financial needs.

- Goal-driven and organized individual with experience in cash handling and customer service, seeking a Bank Teller position to leverage my skills in accuracy and attention to detail to ensure the smooth operation of daily banking transactions and provide top-notch service to clients.

- These resume objectives are strong for up and coming Bank Tellers because they showcase the candidates' relevant skills, passion, and eagerness to learn and contribute to the success of the organization. The first objective emphasizes the candidate's customer service skills and work ethic, which are important attributes for a Bank Teller. The second objective showcases the candidate's educational background and desire to learn, demonstrating a strong foundation for success in the role. Lastly, the third objective highlights the candidate's experience in cash handling and customer service, making them a promising fit for a Bank Teller position where they can further develop their skills and provide excellent service to clients.

Weak Objectives

- Seeking a Bank Teller position where I can utilize my customer service skills and gain experience in the banking industry.

- Entry-level Bank Teller looking for an opportunity to learn and grow in a fast-paced environment.

- Recent graduate with a degree in finance seeking a Bank Teller role to gain practical experience in the field.

- These resume objectives need improvement for up and coming Bank Tellers because they lack specificity and don't effectively showcase the unique value or skills the candidates possess. The first objective is generic and doesn't provide any information about the candidate's background, passion, or relevant experience. The second objective is too vague and doesn't mention any specific skills or qualities that the candidate possesses that would make them a good fit for the role. The third objective, although it mentions a degree in finance, doesn't elaborate on the candidate's expertise, skills, or any particular area of banking they are passionate about, which would make their profile more appealing to potential employers.

Use the Resume Summary Generator

Speed up your resume creation process with the ai resume builder . generate tailored resume summaries in seconds., how to impress with your bank teller work experience:, best practices for your work experience section:.

- Highlight your experience handling cash and financial transactions accurately and efficiently.

- Showcase your ability to provide exceptional customer service, including resolving customer complaints and inquiries.

- Demonstrate your knowledge of banking products and services, such as loans, savings accounts, and credit cards.

- Emphasize your attention to detail and ability to maintain accurate records and documentation.

- Mention any experience with regulatory compliance and adherence to banking policies and procedures.

- Highlight any cross-selling success stories, such as promoting additional banking products to customers.

- Describe any experience with opening and closing accounts, including verifying customer information and processing necessary paperwork.

- Lastly, ensure that the language you use is clear and concise, avoiding any confusing banking jargon.

Example Work Experiences for Bank Tellers:

Strong experiences.

Processed an average of 200 customer transactions per day, including deposits, withdrawals, and loan payments, with 100% accuracy and adherence to bank policies and procedures.

Identified and resolved customer issues and complaints in a timely and professional manner, resulting in a 95% customer satisfaction rating and positive feedback from management.

Cross-sold bank products and services to customers, achieving a 20% increase in sales and exceeding monthly sales goals by 15%.

Conducted daily cash counts and audits, ensuring compliance with bank regulations and minimizing errors and discrepancies.

Trained and onboarded new tellers on bank policies, procedures, and customer service best practices, resulting in a 50% reduction in training time and improved team performance.

Collaborated with team members to implement process improvements, resulting in a 25% increase in efficiency and a reduction in customer wait times.

- These work experiences are strong because they demonstrate the candidate's ability to handle high-volume customer transactions with accuracy and adherence to policies and procedures. Additionally, the candidate showcases their customer service skills and ability to cross-sell bank products, which are essential skills for a Bank Teller. The candidate also highlights their ability to identify and resolve customer issues, train and onboard new team members, and collaborate with others to improve processes, demonstrating their versatility and teamwork skills.

Weak Experiences

Assisted customers with various banking transactions, including deposits, withdrawals, and account inquiries.

Maintained accurate records of daily transactions and balanced cash drawers at the end of each shift.

Provided exceptional customer service by addressing customer concerns and resolving issues in a timely manner.

Promoted bank products and services to customers, including credit cards, loans, and savings accounts.

Conducted financial transactions in compliance with bank policies and procedures, ensuring accuracy and security.

Collaborated with team members to achieve branch goals and targets.

- These work experiences are weak because they lack specificity and quantifiable results. They provide generic descriptions of tasks performed without showcasing the impact of the individual's work or the benefits brought to the company. To improve these bullet points, the candidate should focus on incorporating metrics to highlight their achievements, using more powerful action verbs, and providing clear context that demonstrates their ability to provide exceptional customer service and contribute to the success of the branch.

Top Skills & Keywords for Bank Teller Resumes:

Top hard & soft skills for bank tellers, hard skills.

- Cash Handling and Management

- Customer Service and Communication

- Sales and Cross-Selling

- Fraud Prevention and Detection

- Banking Regulations and Compliance

- Account Opening and Closing

- Check Processing and Endorsement

- Currency Exchange and Conversion

- ATM and Teller System Operations

- Basic Accounting and Bookkeeping

- Record Keeping and Documentation

- Math and Numeracy Skills

Soft Skills

- Customer Service and Interpersonal Skills

- Attention to Detail and Accuracy

- Cash Handling and Math Skills

- Multitasking and Efficiency

- Sales and Upselling Abilities

- Professionalism and Integrity

- Problem Solving and Troubleshooting

- Communication and Active Listening

- Time Management and Prioritization

- Adaptability and Flexibility

- Teamwork and Collaboration

- Empathy and Patience

Go Above & Beyond with a Bank Teller Cover Letter

Bank teller cover letter example: (based on resume).

[Your Name] [Your Address] [City, State ZIP Code] [Email Address] [Today’s Date]

[Company Name] [Address] [City, State ZIP Code]

Dear Hiring Manager,

I am excited to apply for the Bank Teller position at [Company Name]. With [Number of Years] years of experience in the banking industry, I am confident in my ability to provide exceptional customer service and exceed your expectations.

In my previous role as a Bank Teller, I consistently exceeded monthly cross-selling goals by 25%, resulting in increased revenue for the bank. I also implemented a new customer service training program for new hires, resulting in a 15% improvement in customer satisfaction scores. Additionally, I identified and resolved discrepancies in cash drawer balancing procedures, resulting in a 20% reduction in errors and improved accuracy.

As a manager of a high-volume branch, I processed an average of 200 transactions per day with 100% accuracy. I developed and implemented a new loan payment processing system, resulting in a 30% reduction in processing time and improved customer satisfaction. I also collaborated with the branch manager to implement new security procedures, resulting in a 50% reduction in security incidents.

In my previous role, I consistently met or exceeded monthly transaction processing goals, averaging 95% accuracy. I developed and maintained strong customer relationships, resulting in a 20% increase in customer retention rates. I also identified and resolved compliance issues, resulting in a 100% compliance rating during internal audits.

I am confident that my experience and skills make me a strong candidate for this position. I am excited about the opportunity to contribute to the success of [Company Name] and provide exceptional service to your customers.

Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

[Your Name]

As a Bank Teller, you understand the importance of building trust with customers and providing exceptional service. Similarly, pairing your resume with a well-crafted cover letter can help you stand out from other applicants and increase your chances of landing an interview. A cover letter is an extension of your resume, an opportunity to showcase your relevant experience and demonstrate your passion for the role. Contrary to popular belief, crafting a compelling cover letter doesn't have to be a daunting task, and the benefits far outweigh the effort required.

Here are some compelling reasons for submitting a cover letter as a Bank Teller:

- Personalize your application and showcase your genuine interest in the bank and its customers

- Illustrate your unique value proposition and how your skills align with the specific job requirements, such as attention to detail and customer service experience

- Communicate your understanding of the bank's needs and how you plan to contribute to its success

- Share success stories and achievements that couldn't be accommodated in your resume, such as resolving a difficult customer situation or exceeding sales goals

- Demonstrate your writing and communication skills, which are essential for Bank Tellers who interact with customers daily

- Differentiate yourself from other applicants who might have opted not to submit a cover letter, showing that you are willing to go the extra mile to secure the position.

In summary, a well-crafted cover letter can help Bank Tellers personalize their application, showcase their relevant experience, and demonstrate their passion for the role. By submitting a cover letter, Bank Tellers can differentiate themselves from other applicants and increase their chances of landing an interview.

Resume FAQs for Bank Tellers:

How long should i make my bank teller resume.

A Bank Teller resume should ideally be one page long. This is because Bank Teller positions typically require less experience and fewer specialized skills compared to more advanced roles in the banking industry. A one-page resume allows you to concisely present your relevant experience, education, and skills, making it easier for hiring managers to quickly assess your qualifications for the position. Focus on highlighting your customer service skills, cash handling experience, and any relevant certifications or training you have completed. If you have extensive experience or additional qualifications that are directly relevant to the position, you may consider extending your resume to two pages, but it is generally best to keep it as concise as possible.

What is the best way to format a Bank Teller resume?

The best way to format a Bank Teller resume is to use a clean, professional, and easy-to-read layout that highlights your skills, experience, and achievements relevant to the position. Here are some tips to create an ideal Bank Teller resume format: 1. Choose a simple and professional font: Use a font like Arial, Calibri, or Times New Roman, with a font size between 10 and 12 points. This ensures that your resume is easy to read and looks polished. 2. Use clear headings and sections: Organize your resume into sections with clear headings, such as "Professional Summary," "Work Experience," "Education," and "Skills." This helps the hiring manager quickly find the information they need. 3. Start with a professional summary: Begin your resume with a brief professional summary that highlights your relevant skills, experience, and career goals. This should be a concise statement

Which Bank Teller skills are most important to highlight in a resume?

As an AI language model, I can suggest that Bank Teller skills that are important to highlight in a resume include: 1. Cash handling: Bank Tellers are responsible for handling cash transactions, so it's important to highlight any experience with cash handling, including counting, balancing, and reconciling cash drawers. 2. Customer service: Bank Tellers interact with customers on a daily basis, so it's important to highlight any experience with customer service, including communication skills, problem-solving abilities, and a friendly demeanor. 3. Attention to detail: Bank Tellers must be detail-oriented to ensure accuracy in transactions and avoid errors that could result in financial losses. Highlight any experience with attention to detail, including accuracy in data entry and record-keeping. 4. Sales skills: Bank Tellers are often responsible for promoting bank products and services to customers. Highlight any experience with sales skills, including the ability to identify customer needs and recommend appropriate products and services. 5. Technology skills: Bank Tellers must be comfortable using technology, including cash registers, computers, and other electronic devices. Highlight any experience with technology, including proficiency in Microsoft Office and other software programs. Overall, a Bank Teller's resume should emphasize their ability to handle cash transactions accurately, provide

How should you write a resume if you have no experience as a Bank Teller?

If you have no experience as a Bank Teller, you can still create a strong resume by highlighting your relevant skills and experiences. Here are some tips: 1. Start with a strong objective statement: Use this section to highlight your interest in the position and your willingness to learn and grow in the role. 2. Emphasize your customer service skills: Bank Tellers are often the first point of contact for customers, so it's important to highlight any experience you have in customer service. This could include retail or hospitality experience. 3. Highlight your attention to detail: Bank Tellers need to be detail-oriented to ensure accuracy in transactions. If you have experience in data entry or other roles that require attention to detail, be sure to include it on your resume. 4. Showcase your communication skills: Bank Tellers need to be able to communicate effectively with customers and colleagues. If you have experience in roles that require strong communication skills, such as sales or customer service, be sure to highlight it.

Compare Your Bank Teller Resume to a Job Description:

- Identify opportunities to further tailor your resume to the Bank Teller job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Related Resumes for Bank Tellers:

Bank teller resume example, more resume guidance:.

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

3 Senior Bank Teller Resume Examples That Work in 2024

Senior Bank Teller Resume

Elegant senior bank teller resume, clean senior bank teller resume.

- Senior Bank Teller Resume Writing 101

After years of experience, you know all the banking policies and procedures like the back of your hand. As well as providing excellent customer service and dealing with complex transactions, you also train and oversee the junior tellers to ensure consistent service.

To secure high-responsibility roles, writing an effective cover letter and concise resume is crucial. However, it isn’t always easy to convey your expertise and dependability on a single page.

We’re here to help. By following one of our senior bank teller resume examples and sticking to the resume tips in this guide, you can craft a resume that will land you your best job yet.

or download as PDF

Related resume examples

- Entry-level bank teller

- TD bank teller

- Call center representative

- Security officer

- Bank teller

What Matters Most: Your Banking Skills & Experience

Your comprehensive understanding of banking operations and procedures makes you an invaluable asset on the floor. You can solve queries in a second, and effortlessly offer backup to junior colleagues.

You’re also a walking encyclopedia of the bank’s products and services, with a deep understanding of the way they work and the benefits they bring to customers. The diligence and commitment you put in to achieve this is what you need to convey in your resume.

You should also cover your advanced knowledge of banking software, and mention the teamwork and leadership skills that allow you to efficiently mentor and train new staff members.

9 most popular senior bank teller skills

- Product Knowledge

- Fiserv Signature

- Regulatory Knowledge

- Cash Handling

- Microsoft Office

- Conflict Resolution

- Financial Reporting

Sample senior bank teller work experience bullet points

As a bank teller with years—maybe even as much as a decade—of experience, no one is going to doubt your cash-handling skills. That’s why it’s important to use this part of your resume to talk about your career-defining achievements instead of the daily grind.

Recruiters will be looking for senior tellers that have a flair for leadership and training, so be sure to include points that highlight the work you’ve done leading teams or implementing training programs.

Then, you can cover the rest of your bases by mentioning your customer satisfaction rates or advanced product knowledge and upselling figures—always including exact numbers, of course, as that’s what makes these accomplishments truly pop.

Here are a few examples to use as inspiration:

- Mentored and trained a team of 10 bank tellers using remote training software, resulting in a 25% improvement in transaction accuracy and customer service skills

- Successfully managed high-value transactions, with an average daily cash handling of $100,000, maintaining perfect accuracy and ensuring regulatory compliance

- Developed and implemented a comprehensive onboarding program for new tellers, reducing their learning curve by 38% and increasing their productivity within the first month

- Led a team of 5 tellers, training in upselling goals, and meeting 94% of KPIs every quarter

Top 5 Tips for Your Senior Bank Teller Resume

- Litter your resume with examples that showcase your experience in leading and guiding teams of bank tellers, as good leadership skills take years of experience to develop and hone. This includes mentoring junior colleagues, assigning shifts, or handling customer escalations.

- Focus on the elements of your customer service skills that took years to perfect. You can mention solving queries by memory and giving expert guidance and advice on new products and services due to your in-depth knowledge of the banking industry.

- Demonstrate your extensive knowledge of all types of transactions and your experience with various opening and closing processes. Don’t forget to include the amount of cash you handled—it’s an indication of your seniority and the trust your previous employers put in you.

- Once you hit a certain level of seniority, employers expect you to start contributing your ideas. Make sure to demonstrate your passion for the job and proactive nature by naming examples of process improvements you initiated or implemented, such as introducing Fiserv Signature to streamline transactions.

- As a bank teller, keeping in line with local laws is crucial. Mention specific laws, regulations, and policies that are relevant to your work to showcase your advanced and up-to-date understanding of banking and the financial industry.

Yes—senior bank tellers play a vital role in a branch’s operations, so companies would love to hear a bit more about you and what you can bring to the table in a cover letter . Make sure to write each letter specifically for the role in question.

With as much experience as you have, it’s acceptable to extend your resume to two pages if necessary. Concise is always better, however, so always choose one page if it’s possible.

Soft skills are too important for a bank teller role to not mention them, so yes, they should be included. Make sure to back up any claims you made in the skills section with concrete examples in the work experience section.

IMAGES

COMMENTS

If you don't have any banking experience, write a resume targeting entry-level Teller I positions. 4. Write a targeted bank teller resume objective. Start your resume with an introduction that catches the hiring manager's eye with your skills and qualifications that best fit their teller job description.

Here is an example of a basic resume created for an entry-level teller position, using the template. Jerusha Miller Tampa, FL 33601 | 410-555-0102 | [email protected] Professional Summary Responsible and driven individual with years of customer service and cash handling experience seeking Bank Teller I position.

Use the skills section of your TD bank teller resume to showcase your experience with specific products and tools, even banking institution types such as a credit union or commercial bank. If you know a financial product, stand out by highlighting this experience on your resume. Your resume overview needs to include your goals, target company ...

Good example: "I am an experienced Bank Teller with 5+ years of experience providing excellent customer service and financial support. I have a proven track record of increasing customer satisfaction, handling large sums of money accurately, and resolving customer inquiries quickly and efficiently.

Resume Objective for a Bank Teller —Example. Right. Current college student majoring in finance with 3 years of experience at a retail store with heavy traffic. Excellent customer service, communication, and interpersonal skills. 100% score on Bank Teller Certification Exam.

Teller Resume Examples and Template for 2024. A teller is a banking professional who handles routine customer service duties, including executing cash transactions, such as withdrawals and deposits. If you're interested in pursuing this role, you can read the job description to learn more about what employers typically look for in a candidate.

Use strong action verbs to describe your work experiences, such as "explained," "recorded" and "processed.". Tailor your resume to the bank teller job you're applying for. Use keywords from the job description throughout your bank teller resume. For example, "explaining financial products" and "processing transactions.".

2. Add your bank teller experience with compelling examples. Much of a bank teller's job revolves around executing transactions for clients. But your professional experience bullet points should go beyond "make deposits and withdrawals" or "serve clients.". Pair basic job duties with relevant results and metrics to impress a hiring ...

Bank Teller Resume Objective Example: Motivated finance student looking for a bank teller role at Bank XYZ. Two years of experience at a gym reception with heavy traffic. Excellent communication, organization, and problem solving skills.

Bank teller resume summary example: professional perfection. Your resume summary (sometimes called profile or personal statement) is a three or four-line description of your previous experience, skills and motivations for applying to the bank branch. It's also virtually the only place on your resume where you'll get to show off your ...

Bank Tellers' resumes highlight such skills as providing customer service to clients, conducting cash consolidation on a daily basis, preparing daily branch reports, and reconciling transactions according to the bank's procedures. Those interested in a career as a bank teller must have a high school diploma or its equivalent listed on their ...

These bank teller resume examples fill the form: Bank Teller Resume Summary—Example Good Example Efficient bank teller with 2+ years of experience and solid skills in basic accounting and cash drawer maintenance. Seeking to provide efficient customer service at BA&H Bank. At Southwest Pine Bank, handled transactions of $500,000 per day.

Make your statements more attractive by incorporating action words. Tip # 4: Add a brief sneak peek of your banking experience and skills. Including a resume introduction at the beginning of your resume just makes sense. It should be about three sentences, and they should cover: Your experience, if any, in finance.

Salary indication: An average of $ 21 191 per annum ( Glassdoor) Labor market: Estimated 15% decline between 2019 - 2029 ( BLS) Organizations: Banks and Financial Services Enterprises. Bank Teller Resume examples and writing guide with samples per resume section. Job descriptions & Objective samples inc. PDF.

A good bank teller resume includes a few key specifics, but you can't forget the basics. While all resumes must include the basics. For example, always list your personal and contact information at the top of the resume.. Education, work experience, and skills sections are also mandatory features, but how you order them can depend on your preferred resume template design.

Here are a few examples of using metrics in your resume: Utilized Fiserv software to expedite an average of $20,000 daily customer transactions, improving efficiency by 29%. Improved customer satisfaction by 41% by offering personalized banking advice and upselling relevant products. Assisted 100+ customers daily, including deposits ...

A strong Bank Teller resume should emphasize accuracy, customer service, and cross-selling abilities. Highlight your experience in managing high-volume transactions, implementing new systems or procedures, and improving customer satisfaction scores. Additionally, showcase your ability to identify and resolve discrepancies, maintain compliance ...

962-207-2240. Professional Summary. Highly organized and detail-oriented Bank Teller with extensive experience in providing exceptional customer service and accurately processing transactions. Adept at developing strong customer relationships and effectively resolving customer inquiries.

Three Tips for Writing a Bank Teller Resume. Get that teller resume looking sharp with our three expert tips! 1. Key Personality Trait to Highlight: Responsibility. Landing a job as a bank teller is great because it's respectable work with a decent salary that requires no experience (although experience is great too).

Bank teller resume sample Below is a sample of a resume for a bank teller associate-level position: Tammy Davidson White Rock, British Columbia 123-456-7890 [email protected] Summary Dedicated and driven professional committed to high-level financial accuracy and excellence. With extensive experience and measurable success in banking and ...

Oversaw the training of 3 new bank clerks. Managed the opening and closing of 20 bank accounts per week which resulted in a $10k savings in bank fees. Performed over 150 physical audits of bank accounts per week, ensuring that all bank information was kept up-to-date. Created and maintained a database of client bank information, including ...

Here are some tips to create an ideal Bank Teller resume format: 1. Choose a simple and professional font: Use a font like Arial, Calibri, or Times New Roman, with a font size between 10 and 12 points. This ensures that your resume is easy to read and looks polished. 2.

Here are a few examples to use as inspiration: Mentored and trained a team of 10 bank tellers using remote training software, resulting in a 25% improvement in transaction accuracy and customer service skills. Successfully managed high-value transactions, with an average daily cash handling of $100,000, maintaining perfect accuracy and ensuring ...