Return on Investment

What do you think of this template.

Product details

Return on investment is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. Return on investment tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

To calculate Return on investment, the benefit or return of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

Current Value of Investment refers to the proceeds obtained from the sale of the investment of interest. Because Return on investment is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

Return on investment is a popular metric because of its versatility and simplicity. Essentially, Return on investment can be used as a rudimentary gauge of an investment’s profitability. This could be the Return on investment on a stock investment, the Return on investment a company expects on expanding a factory, or the Return on investment generated in a real estate transaction.

The calculation itself is not too complicated, and it is relatively easy to interpret for its wide range of applications. If an investment’s Return on investment is net positive, it is probably worthwhile. But if other opportunities with higher Return on investments are available, these signals can help investors eliminate or select the best options. Likewise, investors should avoid negative Return on investments, which imply a net loss.

What qualifies as a “good” Return on Investment will depend on factors such as the risk tolerance of the investor and the time required for the investment to generate a return. All else being equal, investors who are more risk-averse will likely accept lower Return on Investments in exchange for taking less risk. Likewise, investments that take longer to pay off will generally require a higher Return on Investment in order to be attractive to investors.

Be in the know of the return on your investment. The return on investment template is a PowerPoint template for visualizing the return on investment using charts and infographics.

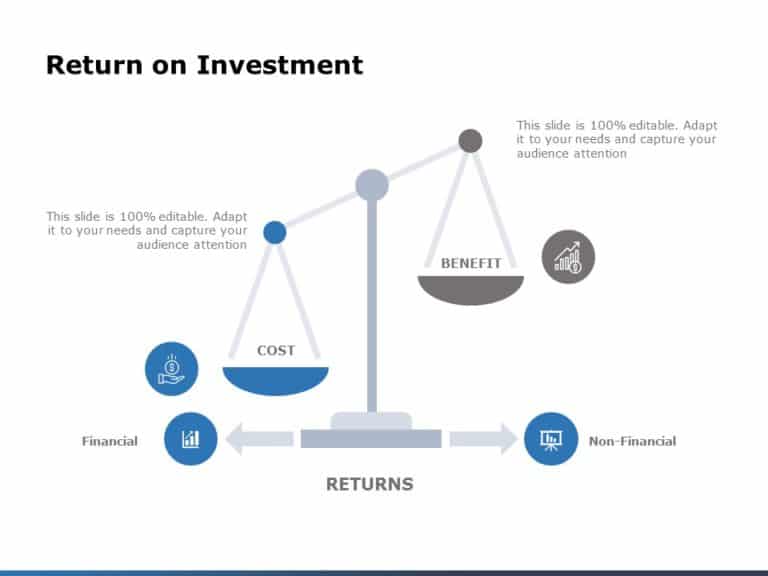

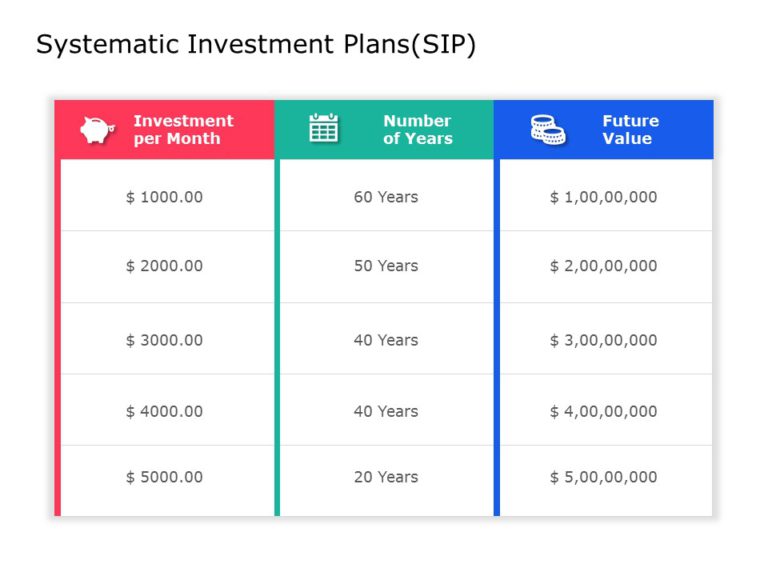

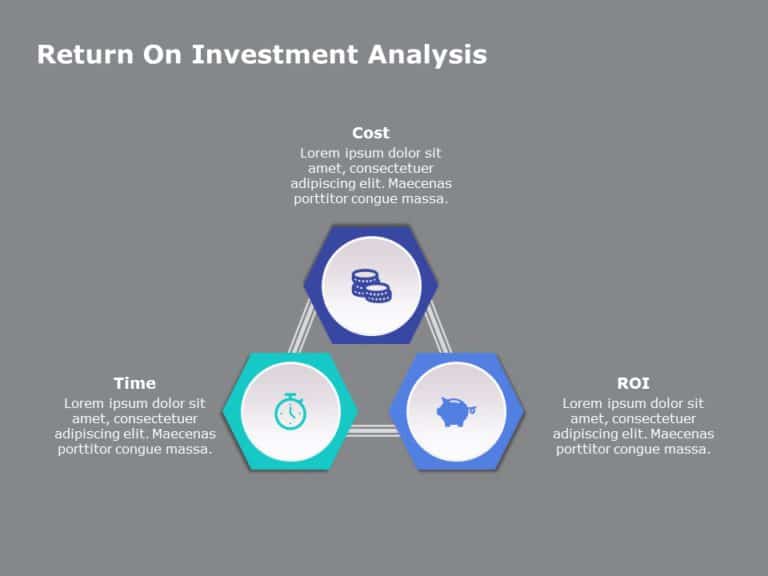

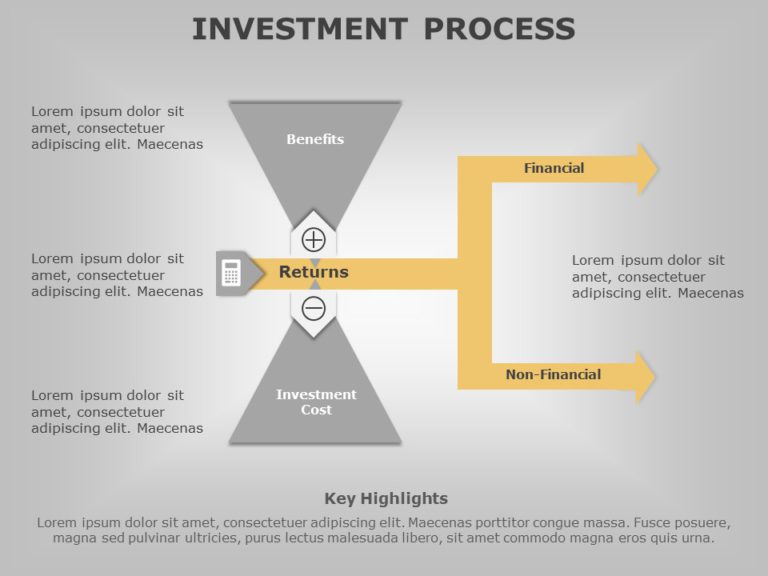

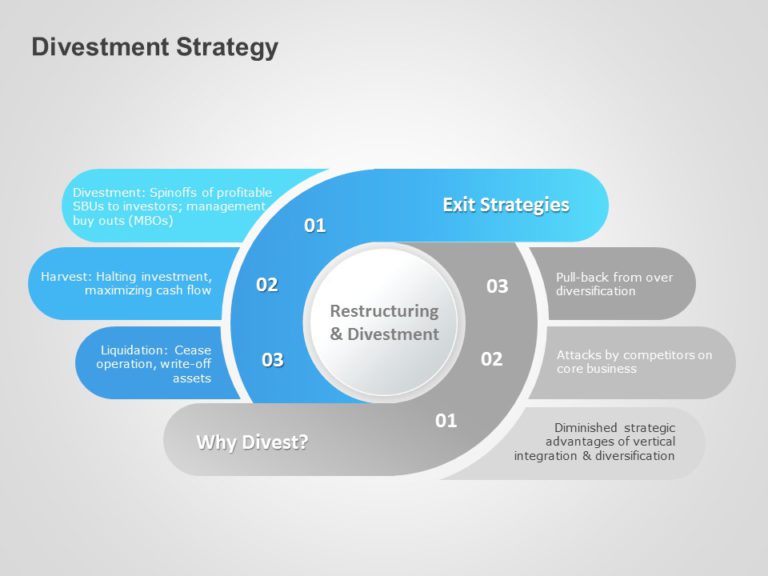

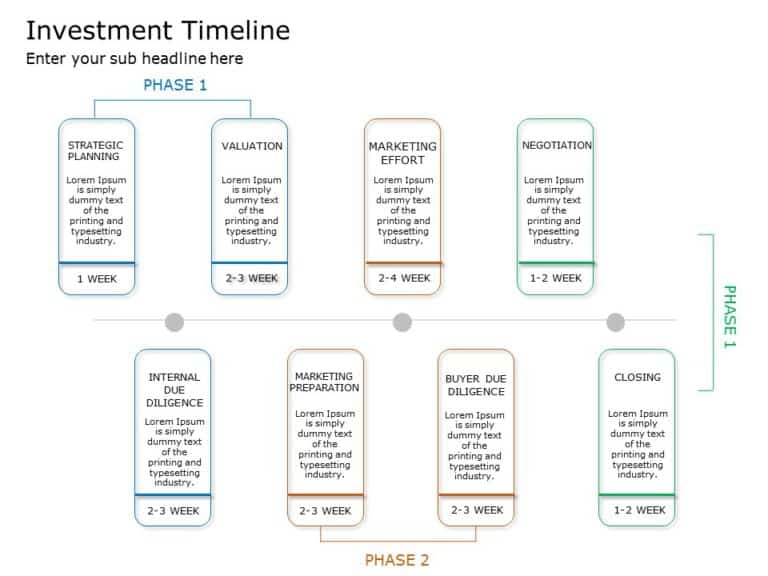

The ROI template contains 4 slides with impressive layout and graphics for engaging your audience. In the first slide, the weigh balance icon with cost and benefit weights on either side is a metaphor of cost-benefit analysis that is carried out before an investment is made. The opposite arrows let the audience know that both financial and non-financial costs and benefits are considered during the analysis. The table chart in the second slide allows the user to highlights RIO data and compare their costs and benefits. Subsequent slides allow the user to present the investment sum and the returns on the investment.

This template will be useful for startups when preparing to meet with potential investors. You can prepare information about the payback period of your startup and reaching the break-even point. Investment companies can also use this template when preparing an analysis of companies that can be invested in. You can prepare several slides for each company and on the last one make a comparative analysis of the payback of projects for each company.

Also, this template will be useful for heads of companies when preparing for a meeting with shareholders and providing them with a new strategy for the development of the company. Engineers can use the slides in this template to report on the need to retool old production lines and provide a timeline for project payback. Economists and financial analysts can also use this template in their day to day work.

The template is fully editable and customizable to meet user requirements. The ROI template is widely used in businesses before investment decisions are taken.

Related Products

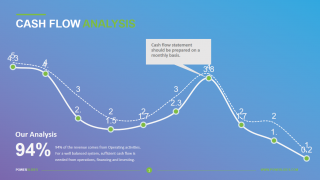

Cash Flow Analysis

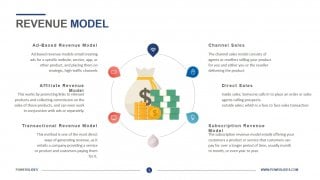

Revenue Model Template

Financial Performance

Quarterly Business Review

Incident Report

Economic Value Added

Business KPI Dashboards

Balance Sheet

Sales Goals

Financial Model

You dont have access, please change your membership plan., great you're all signed up..., verify your account.

PowerSlides.com will email you template files that you've chosen to dowload.

Please make sure you've provided a valid email address! Sometimes, our emails can end up in your Promotions/Spam folder.

Simply, verify your account by clicking on the link in your email.

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Return On Investment Powerpoint Presentation Slides

Explore our content ready topic-oriented Return On Investment PowerPoint Presentation Slides. The investment gains PowerPoint complete deck contains a set of ready to use slides such as financial and non-financial return analysis, ROI calculation, marketing return on Investment, ROI projection, etc. Demonstrate concepts of risk, sales, capital, return, finance, growth, progress, measure, investment , and success using this return on capital Presentation graphics. This content ready presentation is fully editable. Modify content as per your need. This is a powerful tool to attract the attention of your audience. Our professionally designed ROI presentation graphics speak visually. Furthermore, return on assets Presentation templates are intended to exhibit various subjects like return on equity, marketing plan, return on capital, return on marketing investment, the rate of profit, rate of return and many more. Keep in mind the purpose of your presentation and be prepared with the right content. Download capital investment analysis PowerPoint templates to measure business profitability.

These PPT Slides are compatible with Google Slides

Compatible With Google Slides

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

Want Changes to This PPT Slide? Check out our Presentation Design Services

Get Presentation Slides in WideScreen

Get This In WideScreen

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

- Add a user to your subscription for free

You must be logged in to download this presentation.

Do you want to remove this product from your favourites?

PowerPoint presentation slides

Presenting this set of slides with name - Return On Investment PowerPoint Presentation Slides. Download our professional PPT in both widescreen and standard screen. The PowerPoint Presentation comprising a total of 22 slides with extensively researched content and professional design. The PowerPoint presentation is a visual masterpiece with professional PPT templates, data-driven graphs, charts, and tables. This is fully editable so that you can make changes to colors, data, and fonts if you need to. The PPT slides are fully supported with Google Slides. It can be easily converted into JPG or PDF format

People who downloaded this PowerPoint presentation also viewed the following :

- Business Slides , Financials , Flat Designs , Strategic Planning Analysis , Visuals and Illustrations , Complete Decks , All Decks , Financial Services , Finance and Accounting

- Return on investment ,

- Investments Profitability ,

- Investments Gains ,

- Roi Calculation

Content of this Powerpoint Presentation

Slide 1 : This is an introductory slide to Return On Investment with imagery. Slide 2 : This is an Agenda slide. Present it cohesively here. Slide 3 : This is ROI slide showing COST, BENEFITS and RETURNS. It also shows two types of finances- Financial and Non-Financial. Slide 4 : This slide presents a graphical image showing return on investment in terms of years. Slide 5 : This slide shows ROI Calculation in a tabular form. Slide 6 : This slide shows the Marketing Return on Investment. Use it to showcase your projections etc. Slide 7 : This slide also shows Return on Investment Calculation with two divisions and stated. Slide 8 : This slide shows ROI with INVESTMENT, SALES, RISK, INTEREST CALCULATION, CAPITAL, RETURN, MEASURE, SUCCESS, PROGRESS. Slide 9 : This slide is titled Additional Slides which are to be used if required. You can also alter the slide content as per your requirement. Slide 10 : This slide represents Our Mission. State your mission and vision etc. Slide 11 : This slide presents a Column Chart for showcasing product/ company growth, comparison etc. Slide 12 : This slide presents a Bubble Chart for showcasing product/ company growth, comparison etc. Slide 13 : This is a Donut Pie Chart slide to present product/ entity comparison, specifications etc. Slide 14 : This is a Business Quotes slide to quote something you believe in. Slide 15 : This slide helps depict Our Team with text boxes. Slide 16 : This slide showcases About Our Company with- Valued Clients, Preferred By Many, Target Audiences as examples to state about. Slide 17 : This is a Comparison slide to compare male users and female users. Slide 18 : This slide showcases Post It notes to be displayed. Show events, important piece of information, events etc. here. Slide 19 : This slide covers the Timeline of various processes, you can use it as per your requirements. Slide 20 : This slide is a Venn diagram slide. Show information, specifications etc. here. Slide 21 : This is a Puzzle pieces image slide to show information, specifications etc. Slide 22 : This is a Thank You slide with Address, Email Address, and Contact Number.

Return On Investment Powerpoint Presentation Slides with all 22 slides:

Expand your journal with our Return On Investment Powerpoint Presentation Slides. Get good authors to contribute articles.

Ratings and Reviews

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

solar eclipse

25 templates

145 templates

biochemistry

37 templates

12 templates

sunday school

65 templates

education technology

181 templates

Return on Investment (ROI) Theme for Business

Return on investment (roi) theme for business presentation, premium google slides theme and powerpoint template.

Download the "Return on Investment (ROI) Theme for Business" presentation for PowerPoint or Google Slides. The world of business encompasses a lot of things! From reports to customer profiles, from brainstorming sessions to sales—there's always something to do or something to analyze. This customizable design, available for Google Slides and PowerPoint, is what you were looking for all this time. Use the slides to give your presentation a more professional approach and have everything under control.

Features of this template

- 100% editable and easy to modify

- Different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Google Slides and Microsoft PowerPoint

- Includes information about fonts, colors, and credits of the resources used

What are the benefits of having a Premium account?

What Premium plans do you have?

What can I do to have unlimited downloads?

Don’t want to attribute Slidesgo?

Gain access to over 22300 templates & presentations with premium from 1.67€/month.

Are you already Premium? Log in

Related posts on our blog

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

Register for free and start editing online

Home / 321+ Free Infographics PowerPoint Templates & Google Slides for Presentations / Free Google Slides ROI Infographic Template PowerPoint

Free Google Slides ROI Infographic Template PowerPoint

Google Slide,PowerPoint

100% Fully Customizable

Free to use

About the Template

The business world is constantly evolving, and when it comes to making money, you want to be assured that you are getting the most bang for your buck. That’s why creating a return-on-investment template is a great way to keep track of your profits and ensure that you are making the most money possible.

Also, the free templates library isn’t just specific to business or education, you can also find Medical infographic template .

Decision Making

Financial Management

Project Management

Free Money Heist Theme Google Slides & PowerPoint Template

Free Executive Summary Template PowerPoint & Google Slides

Free Business One Pager PowerPoint Template & Google Slides

Free Binance Pitch Deck PowerPoint Template & Google Slides

Free Artificial Intelligence PowerPoint Template & Google Slides

Are you looking for custom presentation template designs.

It is a long established fact that a reader will be distracted by the readable content of a page when or randomised words which don’t look even slightly believable

- All Resource

PPT Templates

Single slides.

- Pitch Deck 207 templates

- Animation 326 templates

- Vertical Report 316 templates

- Business 799 templates

- Finance 56 templates

- Construction 45 templates

- IT/Commerce 171 templates

- Medical 64 templates

- Education 45 templates

- Lifestyle 390 templates

- Pitch Decks 138 templates

- Business 539 templates

- Finance 20 templates

- Construction 75 templates

- IT/Commerce 73 templates

- Medical 27 templates

- Lifestyle 578 templates

- Pitch Decks 140 templates

- Business 469 templates

- Finance 19 templates

- Construction 64 templates

- IT/Commerce 72 templates

- Medical 29 templates

- Education 39 templates

- Lifestyle 490 templates

- Cover 266 templates

- Agenda 97 templates

- Overview 216 templates

- CEO 28 templates

- Our Team 142 templates

- Organization 48 templates

- History 38 templates

- Vision, Mission 109 templates

- Problem, Solution 193 templates

- Opportunity 154 templates

- Business Model 158 templates

- Product, Services 299 templates

- Technology 65 templates

- Market 155 templates

- Prices 56 templates

- Customers 55 templates

- Competitor 113 templates

- Business Process 151 templates

- Analysis 222 templates

- Strategy 120 templates

- Marketing, Sales 61 templates

- Profit, Loss 69 templates

- Financials 247 templates

- Timeline 122 templates

- Proposal 40 templates

- Contact Us 272 templates

- Break Slides 16 templates

- List 359 templates

- Process 351 templates

- Cycle 177 templates

- Hierarchy 98 templates

- Relationship 152 templates

- Matrix 86 templates

- Pyramid 67 templates

- Tables 145 templates

- Map 96 templates

- Puzzles 163 templates

- Graph 217 templates

- Infographics 436 templates

- SWOT 111 templates

- Icon 418 templates

- Theme Slides 138 templates

- Mockup 42 templates

- Column 315 templates

- Line 199 templates

- Pie 139 templates

- Bar 179 templates

- Area 130 templates

- X Y,Scatter 16 templates

- Stock 59 templates

- Surface 3 templates

- Doughnut 256 templates

- Bubble 65 templates

- Radar 83 templates

- Free PPT Templates 2,101 templates

- Free Keynote 2,017 templates

- Free Google Slides 2,098 templates

- Free Theme Slides 35 templates

- Free Diagram 126 templates

- Free Chart 49 templates

- New Updates

Slide Members Premium Membership Benefits

If you sign up for our premium membership, you can enjoy the better contents all year round.

- Unlimited Download

- Premium Templates

- Animation Slides

- 24/7 Support

- Business , Finance

Return on Investment (ROI) ppt template ppt

- Product ID : SM-20532

- Subject : Return on Investment

- Quantity : 30 slides

- Ratio : 16:9

- Format : MS Powerpoint

- Colors : orange blue

- Languages : EN

- Used Font : Montserrat, Calibri

- License : Personal and commercial use

- Rating : Premium

Slide Description

- Scalable vectorial PowerPoint shapes and PowerPoint icons

- Created by professionals

- Best investors pitch deck

- Premade color variation

- Professionally designed infographic templates

- Ready to use presentation slides on data analytics

Table of Contents

Membership Pricing

Premium member of Slide Members can have unlimited access to the 19,000+ advanced slide templates.

Basic (1 Day)

5 Downloads per Day

Basic (7 Days)

$ 10.99 /mo

All contents in Slide Members are available for commercial and personal use.

The contents that other members downloaded with this content

Best Project Presentation Modern PPT Templates

Quick and easy to customize Easy to change colors All images included Modern and clean design Data charts editable via Excel

Vietnamese Cuisine PowerPoint Format

Fully editable content (graphics and text) via PowerPoint - No Photoshop needed! Easy to change colors Free images and artwork Modern layouts based on master slides All elements are editable

State of the News Media PowerPoint

Quick and easy to customize Easy editable data driven charts (pie, bar, line) Premium & modern multipurpose Created by professionals Professional look presentation Professional business presentation

Working day - PPT Design Free

Modern, simple, and clean design Trend template Modern, attractive, and business-friendly colors Easy to change colors

Startup Creative Idea Business Presentation Examples

Modern, simple, and clean design Easy to edit and customize Vector icons 100% editable Data charts editable via Excel All elements are editable

Business Idea template design

Quick and easy to customize Easy to change colors Scalable vectorial PowerPoint shapes and PowerPoint icons Created with high quality slides Professional business presentation

Influencer Marketing Best PowerPoint Presentations

100% fully editable PowerPoint slides Easy to change colors Free images and artwork 16:9 aspect ratio All elements are editable

Background design Pitch Deck Marketing Presentation PPT

Easy to change colors Creative slides 100% vector objects & icons 16:9 aspect ratio Drag & drop image placeholders

Free Slides

Slide Members

All Rights Reserved 2024 © Copyright Slide Members

Information

- Privacy Policy

- Terms & Conditions

Recent Slides

- 19+ Recently Powerpoint Templates & Google slides Update

- 9+ New Powerpoint Templates & Google Slides Update

- 18+ New Templates Update (PPT templates & Google slides)

Showing Potential ROI in a Pitch Deck

May 11, 2023 / Blog

A successful pitch deck must demonstrate the potential ROI of investing in a company.

Potential investors look for ways to maximize their returns, and a strong ROI indicates a possible profitable investment. As such, demonstrating the potential ROI of investing in your company is crucial to capturing the attention and interest of potential investors.

Need a Presentation Designed? Click Here To View Our Amazing Portfolio

In this blog, let’s dive deeper into the specifics of showcasing potential ROI in a pitch deck.

What is ROI?

ROI stands for return on investment. It measures the potential profit or return investors can gain from an investment. To calculate it, divide the net profit by the initial investment and express the result as a percentage.

Importance of Demonstrating ROI in a Pitch Deck

Demonstrating potential ROI in a pitch deck is crucial for attracting investors and convincing them that investing in your company will yield a significant return.

Potential investors should see a clear path to profitability and a strong ROI, as it assures that their investment will be worthwhile. Moreover, showcasing possible ROI is an essential part of the decision-making process for investors. They evaluate multiple investment opportunities and need to weigh their options’ potential risks and rewards.

Ultimately, by demonstrating potential ROI in a pitch deck, entrepreneurs can set themselves apart from the competition and increase their chances of securing funding.

Ways to Show Potential ROI in a Pitch Deck

Here are some of the effective ways to show potential ROI in a pitch deck:

Highlight Past Successes

By showcasing past successes, entrepreneurs can demonstrate that their company has a track record of delivering results. Include successful campaigns, projects, or product launches.

Highlighting past successes can help investors see the potential for future success and feel more confident in their investments.

Market Analysis and Growth Projections

Entrepreneurs should conduct thorough market research to understand their industry’s potential for growth and profitability. They can use their gathered information to create growth projections and to demonstrate the potential ROI of investing in their business.

By providing evidence of the potential for future success, investors will be more likely to see the value in investing.

Competitive Advantage and Market Positioning

Entrepreneurs should clearly articulate their company’s competitive advantage and market positioning to demonstrate why their business is well-positioned for success.

Include unique intellectual property, a strong brand, or proprietary technology. By highlighting them, entrepreneurs can demonstrate the potential for a high ROI.

Case Studies and Testimonials

Using real-world examples and testimonials from satisfied customers or partners can be a powerful way to demonstrate the potential ROI of investing in a company.

Showcase concrete evidence of how the company has delivered value to others for investors to see the potential for similar success in the future.

Tips for Presenting ROI Effectively

When presenting potential ROI in a pitch deck, it’s essential to communicate the information clearly and compellingly.

Use Visuals

Incorporating visuals such as graphs, charts, and infographics can make the information about potential ROI more digestible and engaging.

Visuals can help illustrate complex data and present it in an easy-to-understand approach. When using visuals, it’s critical to ensure they are easy to read and visually appealing to avoid overwhelming investors with too much information.

Time the ROI Presentation Appropriately

When presenting potential ROI, entrepreneurs should carefully consider the timing of the presentation. Avoid presenting the information too early in the pitch, as doing so may overwhelm investors with too much information inappropriately.

On the other hand, presenting it too late may leave investors feeling uncertain about the potential return on their investment. Therefore, entrepreneurs should find a strategic point in the presentation to introduce the potential ROI.

Address Potential Risks and Challenges

Aside from ROI, investors want to understand the risks and challenges associated with the investment. Therefore, entrepreneurs should address potential risks and challenges head-on. Moreover, they should provide a clear plan for mitigating them.

Addressing risks and challenges can demonstrate they have considered all the potential challenges. It means they have a plan in place to overcome them.

Communicate the ROI Clearly

When presenting potential ROI, communicate the information clearly and concisely. Using simple language and avoiding jargon can ensure investors understand the potential for a return on their investment.

Also, you should be prepared to answer any questions that investors may have to clarify any confusing or complex presentation aspects.

Entrepreneurs can effectively communicate the potential for high ROI and increase their chances of securing funding for their businesses by following the steps outlined in this blog.

Popular Posts

Save your deck: methods to recover an unsaved powerpoint file.

Twitter: Lessons from Social Media

Oscar Speech Sounds A Lot Like…..

Olympians Can Teach Presenters a Thing or Two

Overcoming a Public Speaking Disaster: A Lesson from Michael Bay

The Similarities Between Presentations and Advertisments : Super Bowl Edition

Filter by Keywords

8 Dependable ROI Templates to Track Returns in Excel & ClickUp

Praburam Srinivasan

Growth Marketing Manager

February 13, 2024

ROI, or Return on Investment, is the go-to metric for tracking the profitability of anything done with a business motive. It’s all about finding how much a project earns relative to its cost, expressed as a percentage. Negative ROIs mean a venture is running at a loss.

Although ROI calculations are pretty basic, they hold immense weight in the corporate world. Decisions about pursuing or dropping projects ride on these numbers.

Sounds demanding? That’s why you need the right ROI templates to manage your company portfolio and optimize your capital allocation strategy.

We bring you a list of the most sophisticated ROI templates for managing sales and investments and making data-driven decisions to maximize your bottom line.

What is an ROI Template?

What makes a good roi template, 1. clickup roi commission sheet template, 2. clickup sales tracker template, 3. clickup sales pipeline template, 4. clickup real estate action plan template, 5. clickup sales kpi template, 6. marketing roi template by slideteam, 7. powerpoint roi tracking report template by slideteam, 8. excel roi template by 365financialanalyst.

Before we get to templates, let’s refresh our knowledge of ROIs from a mathematical standpoint. Return on investment essentially reveals the rate at which your investment in a project or activity has grown or shrunk. Here’s an ROI equation:

Return on Investment (ROI) = (Total Sales – Cost of Investment) ÷ Cost of Investment

The relevance of everything a business does boils down to returns, which is why you need a template to add structure to your net income method .

An ROI template is a financial review tool geared toward project managers and strategic leaders. It centralizes data from ongoing and proposed projects, giving you insights into:

- The most worthwhile projects

- Projects that should be scrapped due to negative/low ROIs

- Lucrative investment opportunities

- Projects blocking more funds (capital) than they should

- The overall financial health of the company

This template provides the framework for planning, calculating, and illustrating your ROI for internal stakeholders. It may come with extra features to set goals, outline ROI-boosting activities, track sales metrics, prioritize projects and tasks, or make predictions.

The type of ROI template you need depends on your goal, whether analyzing a single project, comparing several of them, or creating a company-wide portfolio. Still, for the template to be effective, it should have certain key characteristics , such as:

- Customizability : It should allow you to edit and customize different sections to calculate ROI and track the total cost. For example, many templates enable you to tailor goals using the OKR (objectives and key results) framework

- Visual appeal : You should be able to add elements like images, charts, and graphs to provide a visual representation of ROIs and facilitate comparison

- Clear structure : The best ROI templates have organized sections that let you absorb key information on a price sheet

- Versatility and scalability : While ROI templates typically don’t cater to a specific industry, they must adapt easily to represent different kinds and sizes of investments, expenses, projects, or income pools

- Collaboration options : It should support real-time review and brainstorming sessions with your strategy team

8 ROI Templates to Use in 2024

You’ll find more than a few ROI calculators on the internet, but the well runs pretty dry when it comes to analysis-friendly templates to determine the company’s cash flow.

Keeping diverse business goals in mind, we have cherry-picked eight of the most power-packed ROI templates to evaluate and compare projects and business processes. A large chunk of our templates are from ClickUp —they are completely free and work for most use cases. Options beyond ClickUp may come with a price tag.

Let’s dive in and set your business up for growth!

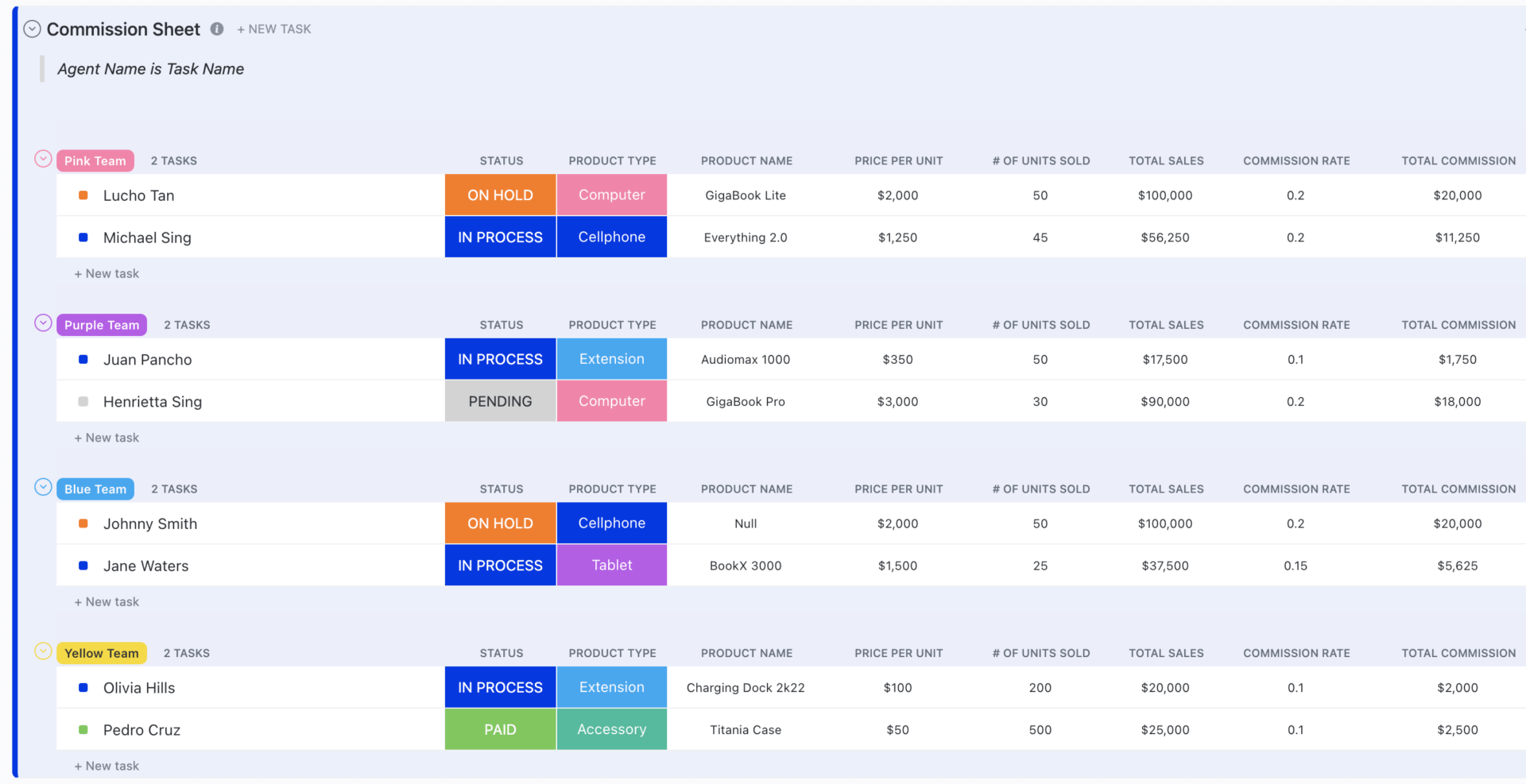

Our first pick is the ClickUp ROI Commission Sheet Template —ideal for reviewing sales team ROIs and the amount spent on commissions for each member!

This template helps you keep track of the commissions earned by different sales teams and individual members. It’s a one-stop tool to calculate commissions against the number of units sold.

To start using the template, it’s best to keep an ROI range in mind, say 25%–30%. You can feed simple to complicated commission structures to the template and ensure everyone is fairly compensated for the work put in. Adjust commission rates based on current market trends as long as your ROI doesn’t fall below the desired rate.

One of the most commendable features of the template is that your team members can have different commission rates based on their experience or performance .

Here are some practical things you can do with this template:

- ClickUp Goals to every salesperson and track their performance (keep targets realistic to avoid demotivating your team)

- Customize formulas for total commissions or ROI

- Set milestones and incentivize team members to reach them

- Provide feedback to your sales team on a monthly or quarterly basis

- Make budget forecasts based on the latest sales reports

Using the template couldn’t be simpler—just add the names of each salesperson along with relevant information like team classification and commission structure. Track the data through Commission per Team and Commissions per Area views.

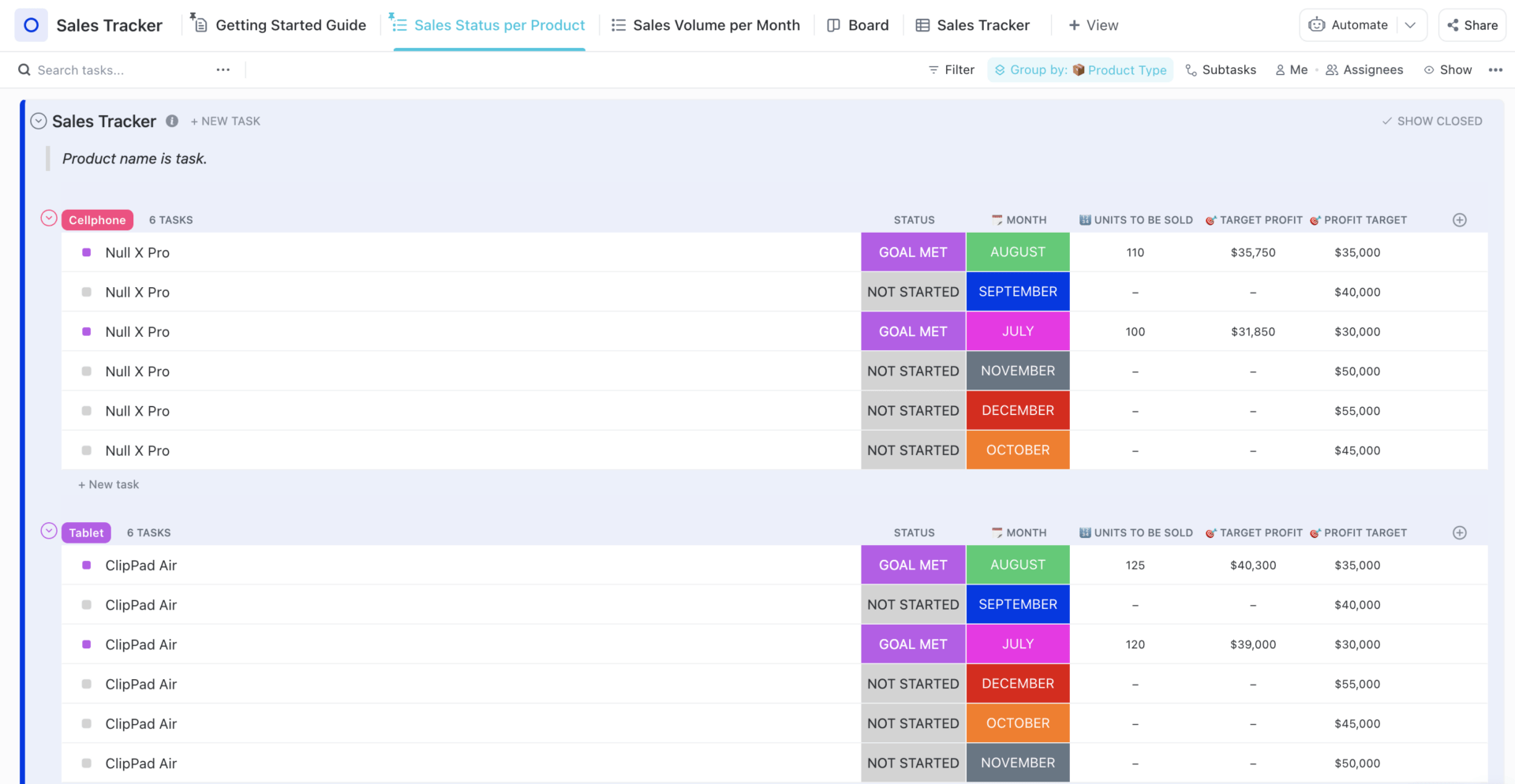

Constant changes in sales can make maintaining an average ROI challenging. Luckily, you have the ClickUp Sales Tracker Template to stabilize ROIs in the face of ever-evolving sales processes . This template comes with a chock-full of features to help you:

- Obtain accurate real-time information about all moving aspects of your sales workflow

- Tailor plans and write effective OKRs to meet targets

- Test different sales techniques

- Keep track of achieved and missed goals

If you want to use this template efficiently, all you need to do is feed the right data in the provided Custom Fields. Add info about virtually anything—from Product Type and Profit Target to Number of Returns .

Based on your team’s performance, you can calculate ROIs sorted by products or time periods. Play with the template views to get streamlined perspectives.

For example, the Sales Volume per Month View outlines the total sales for each month, helping you identify patterns and predict future sales. Or, you can use the Sales Volume per Product View and explore the ROI quality of your most popular products.

Keeping track of sales on your own can be a back-breaking task, especially if your company sells thousands of units every month. That’s hardly a problem with this template—it offers excellent features to collaborate with and delegate tasks to your teammates.

And thanks to ClickUp’s rich customization options , you can create a sales tracker that fits your company like a glove!

Keeping track of potential customers is a top priority for any business. But let’s be honest, taking care of leads, conversions, and customer journeys 24/7 is no picnic.

A trivial oversight can lead to losing credibility with customers, ultimately hurting your ROI. But thanks to ClickUp’s Sales Pipeline Template , you can watch your sales pipeline like a hawk day in and day out!

The template provides a host of savvy features to improve client management . Its multiple views and carefully-designed sections let you visualize your sales funnel from top to bottom—review, prioritize, and manage leads with a drag-and-drop interface.

This template is divided into two sections :

- Pipeline management

- Account management

Both parts provide in-depth insight into your sales processes.

To predict future sales and ROIs with high accuracy , we recommend breaking down your pipeline into smaller phases, such as Lead Qualification, Contact, Negotiation, and Closing. Assign tasks to members at each stage, establishing accountability in the process.

Account management is all about customer tracking, addressing feedback and service requests, and identifying areas for improvement. Add Custom Statuses and Last Contacted attributes to each customer to keep your CRM workflow consistent and productive!

Bummed about making manual changes to the template every day? Don’t worry! This template comes with three ClickUp Automations to update Lists and assignees on autopilot.

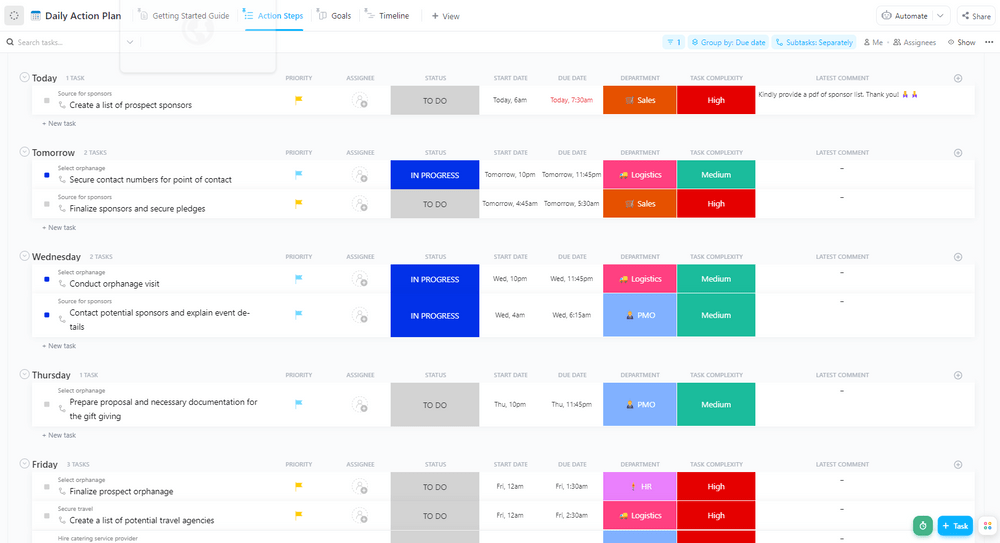

The ClickUp Real Estate Action Plan Template may be the only industry-specific option on our list, but trust us when we say it can help you make financial projections for any niche .

This template is designed to serve realtors and property managers . It lets you organize and prioritize tasks through daily action plans, helping you create a roadmap for your investment journey and compare properties using ROIs.

At its core, this template is about prospecting potential investment opportunities to increase your ROI. Its profitability-based comparison features make it a versatile ROI analysis tool for any project or portfolio .

Here’s how to use the template to measure the growth of your investments:

- Define measurable goals: Note your target profits and the key metrics for measuring success . You can use ClickUp Docs for record-keeping

- Identify your investments: Add uniform details about all your investment avenues to facilitate comparison. You can generate ROI projections for all or specific projects

- Make side-by-side ROI comparisons: Leverage ROI figures to select the project(s) worth investing in

It’s only a rough sketch, though, as dozens of processes stand between you and your desired ROI. But remember that this is an action plan template , so it will help you build a detailed plan for increasing your yield in the long run. 🤑

To understand and boost your ROI, you first need to analyze sales metrics from different angles. The ClickUp Sales KPI Template sets you up with a central hub for measuring your team’s performance and making plans for increasing revenue potential! 📈

The template presents sales KPIs across three sections :

- Weekly report

- Monthly report

- Revenue board per month (a Kanban-style display showcasing weekly sales for one month)

The template gives you 15 Custom Fields representing metrics like the number of sales, total sales revenue, upsell attempts, successful upsells, and number of quotes.

Want to investigate particular metrics? You can sort between fields using filters and generate focused reports with net profit figures for every week or month.

Besides helping you monitor your ROI, this template offers plenty of collaboration and customization tools . You can color-code sections, play with columns, and create unique layouts to promote at-a-glance views of relevant KPIs.

One of the fastest ways to ensure more people hear about your company is through marketing content and marketing campaigns, whether email, social media ads, flyers, or billboards. But would you be pouring money into marketing projects without calculating ROI?

A marketing-specific ROI template helps predict the success of your efforts by estimating the profitability of the relative spending. It’s used to budget or justify the marketing costs like ads, customer surveys, agency fees, and staff salaries.

Make use of the Marketing ROI Template by SlideTeam and create the perfect visual representation of your past or future campaigns for your stakeholders. This PowerPoint template comes with 100% editable slides, custom icons, and shapes.

While the default slides have predefined elements, it’s up to your marketing team to change them according to your audience and brand. You can customize the colors and fonts and add dialog boxes to make the presentation easy to grasp for first-time viewers.

This template is mostly useful for communicating your plans with your leadership or accounts teams in budget meetings.

Calculating ROIs is no big deal, but knowing how to present the data cohesively to a general audience is a tough job. In most cases, the biggest obstacle is communicating numbers to people with no background in finance or accounting.

The PowerPoint ROI Tracking Report Template by SlideTeam resolves this problem. Its simple table structure presents numerical basics without overwhelming your audience. You can list the cost of an investment and the generated revenue and connect them with the ROI value in a single window!

Representing profit numbers can be even more challenging if you’re showcasing more than one investment, which is often the case. But with this template, you’ll have more than enough room to outline multiple investments and create reports on how they compare.

One of the most significant benefits of this template is its user-friendliness . Since it’s a PowerPoint template, most users enjoy the sense of familiarity it provides.

Every element in the template is customizable—add or delete sections, change colors, or use icons and symbols to add character to your presentation!

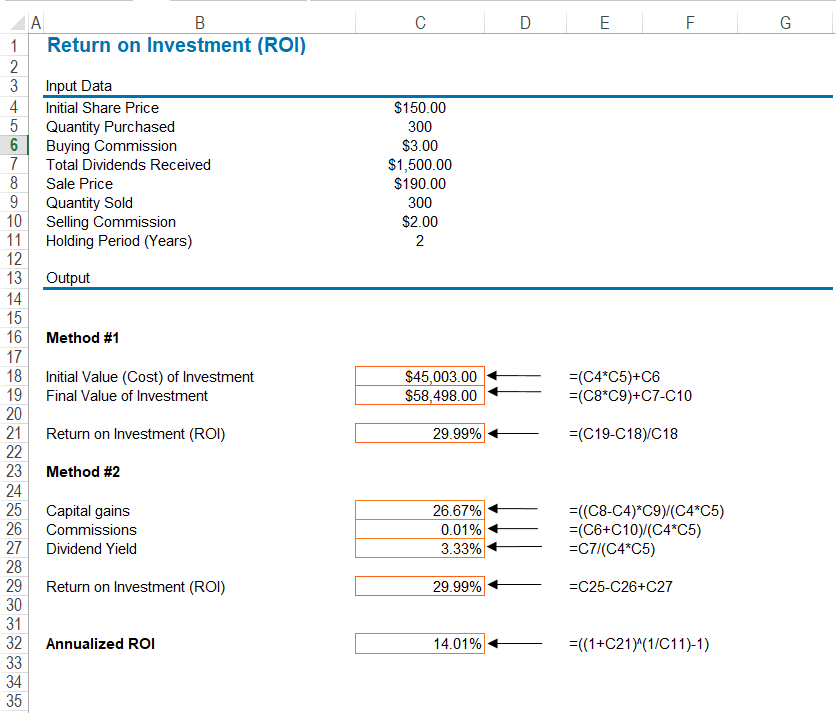

If all you need is an ROI calculator for super complicated investments or projects, the Excel ROI Template by 365FinancialAnalyst fits the bill.

This template is intricately designed for complex ROI calculations that depend on various variables, such as sales team commissions, taxes, and dividend yields. Committing to such labor-intensive, error-prone computations is not viable manually.

One small mistake could create a distorted picture of your company’s health. As a result, you could end up taking the wrong moves and hurting your business.

This free ROI Excel spreadsheet template is all about making calculations straightforward. It comes with defined formulas for extracting the correct return rate after factoring in all variables—all you have to do is enter the data in the required cells.

The template prioritizes functionality over aesthetics, so don’t expect customization or collaboration features.

Measure Your Company’s Profitability With ROI Templates

ROI templates are valuable tools for determining your company’s profitability. By utilizing these templates, you can easily and accurately track your investments, measure their returns, and ultimately make informed decisions about finances.

Remember, the key to boosting your company’s profitability lies in consistent monitoring and analyzing. ROI templates can serve as your guiding light in this process, helping you navigate the complex landscape of business finance.

Create a free ClickUp account and organize all your work in one place!

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

Home PowerPoint Templates Return on Investment

Return on Investment

ROI Slide Template for PowerPoint

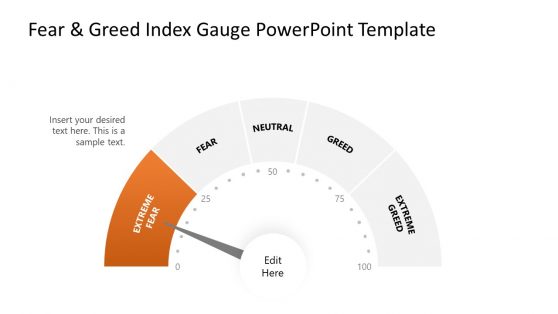

Fear & Greed Index Gauge PowerPoint Template

Beat the Market PowerPoint Template

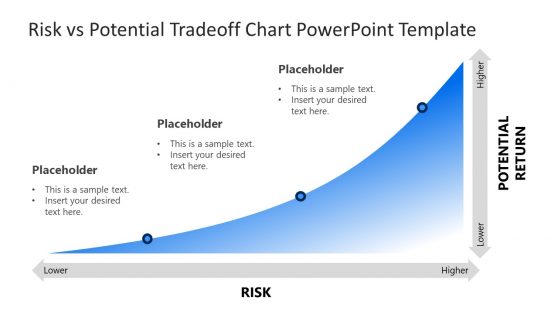

Risk vs Potential Tradeoff Chart PowerPoint Template

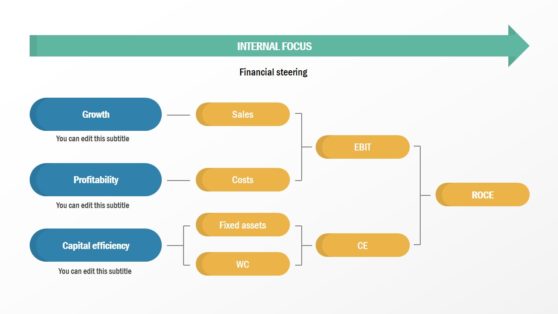

ROCE Analysis PowerPoint Diagram

Profit Word Cloud Picture for PowerPoint

Investment Word Cloud Picture for PowerPoint

Finance Word Cloud Picture for PowerPoint

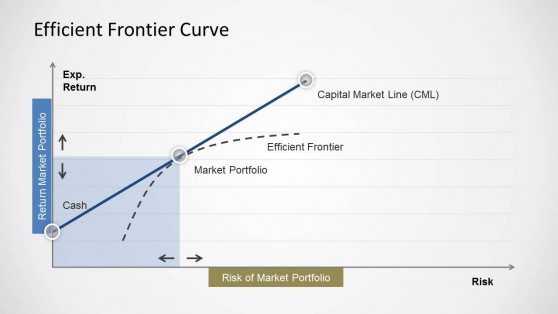

Simple Efficient Frontier Curve for PowerPoint

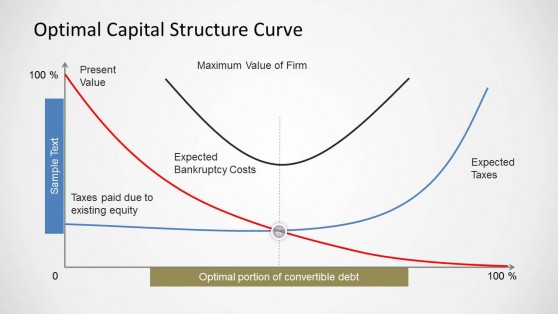

Optimal Capital Structure Curve for PowerPoint

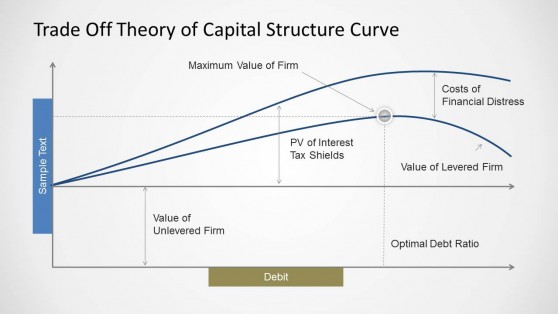

Trade Off Theory of Capital Structure Curve for PowerPoint

Download unlimited content, our annual unlimited plan let you download unlimited content from slidemodel. save hours of manual work and use awesome slide designs in your next presentation..

ROI Templates and Calculators For Many Disciplines

By Andy Marker | October 11, 2018

- Share on Facebook

- Share on LinkedIn

Link copied

In this guide, you will learn about the role of ROI, its formula, why you would use it, the four methods to easily calculate it, and additional methods to break down work. Download the essential Excel templates to perform a variety of ROI tasks, including content marketing metrics, website ROI analysis, healthcare quality initiative ROI, event ROI calculator, PLM ROI calculator, IT ROI, cost avoidance calculator, and TCO ROI.

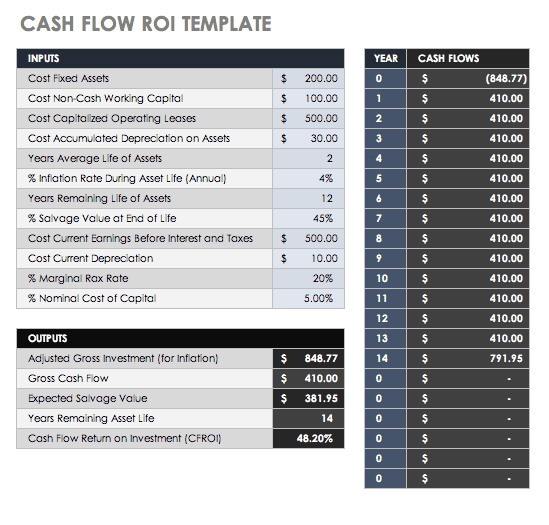

Cash Flow ROI and Template

Cash Flow ROI (CFROI) is a proxy for a company’s economic return. This return is compared to the interest rate charged to commercial banks from the Federal Reserve’s standard (the discount rate), to see if there is value-added potential. CFROI is the average economic return in a year on all of a company’s investments. Enter your variables in this template to determine your company’s CFROI.

Download Cash Flow ROI and Template - Excel

In this template, you will enter the following variables:

Cost Fixed Assets : These are assets not expected to be used up or converted into cash within a year. They can include property, plant, and equipment (PPE), and may be used to generate income.

Cost Non-cash Working Capital : The sum of inventory and receivables

Cost Capitalized Operating Leases : Posted as an asset on the balance sheet, this type of lease expenses the lease payments.

Cost Accumulated Depreciation on Assets : An asset account with a credit balance.

Years Average Life of Assets : The accumulated depreciation divided by the current depreciation expense.

Percent Inflation Rate During Asset Life (Annual) : The change in purchasing power.

Years Remaining Life of Assets : This is calculated based on when the asset went into service and the preferred depreciation method.

Percent Salvage Value at End of Life : The resale value at the end of the asset’s useful life.

Cost Current Earnings Before Interest and Taxes (EBIT) : All incomes and expenses, except interest and income tax expenses.

Cost Current Depreciation : The deduction that helps spread the cost over many years.

Percent Marginal Tax Rate : The tax percent of your income based on your tax bracket.

Percent Nominal Cost of Capital : The rate of return needed to persuade your company to make a given investment.

Below are the outputs from these inputs:

Adjusted gross investment (for inflation)

Gross cash flow

Expected salvage value

Years remaining asset life

Cash flow return on investment (CFROI)

Cash flows per investment year

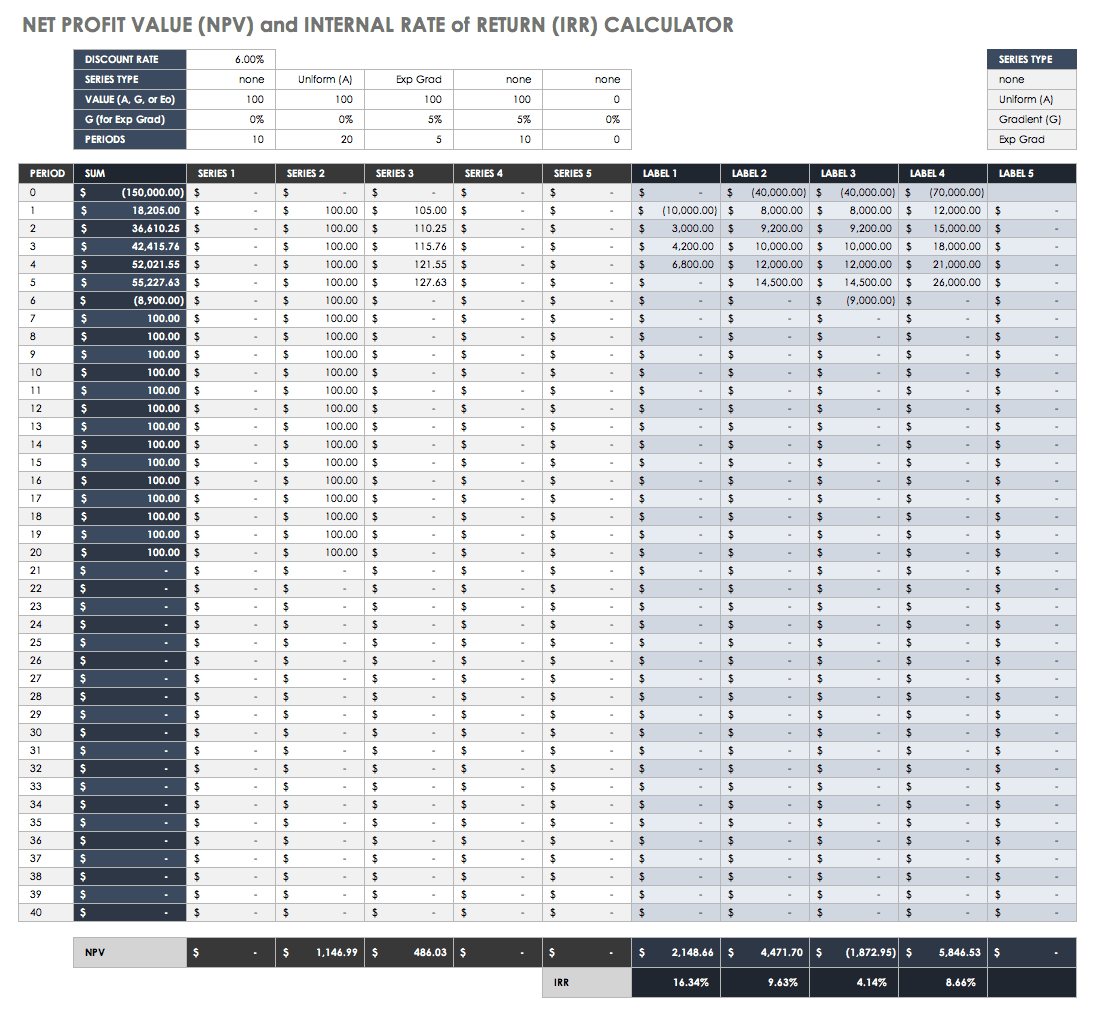

NPV and IRR Calculations and Template

Net present value (NPV) and internal rate of return (IRR) are metrics used to estimate ROI. NPV is the dollar difference between the present value of cash inflows and outflows over time. Companies use NPV as a tool to help them decide if an investment will provide long-term value, to compare different investment options, and to decide whether they should introduce a new product. IRR is the calculation that estimates the percent profitability of possible investments by taking the NPV equal to zero.

NPV looks at each cash flow separately, even when the discount rate is unknown. An NPV greater than zero makes a project financially worthwhile. IRR compares projects using one discount rate, predictable cash flows, equal risk, and a shorter time. IRR does not account for changes in the discount rate, which at times makes it a poor metric. Further, if there are a mix of positive and negative cash flows, IRR calculations are not effective. To calculate your company’s NPV and IRR, use this template.

Download NPV and IRR Calculations and Template - Excel

In this template, you will input the following:

Discount rate

Series payment type (None, Uniform, Gradient, or Exp Grad)

Value (A, G, or Eo)

G % for Exp Grad

The number of periods

For each period, the values

Below are the outputs for this template:

The sum for each period

The different series for each period

NPV for each series

NPV for each label

IRR for each label

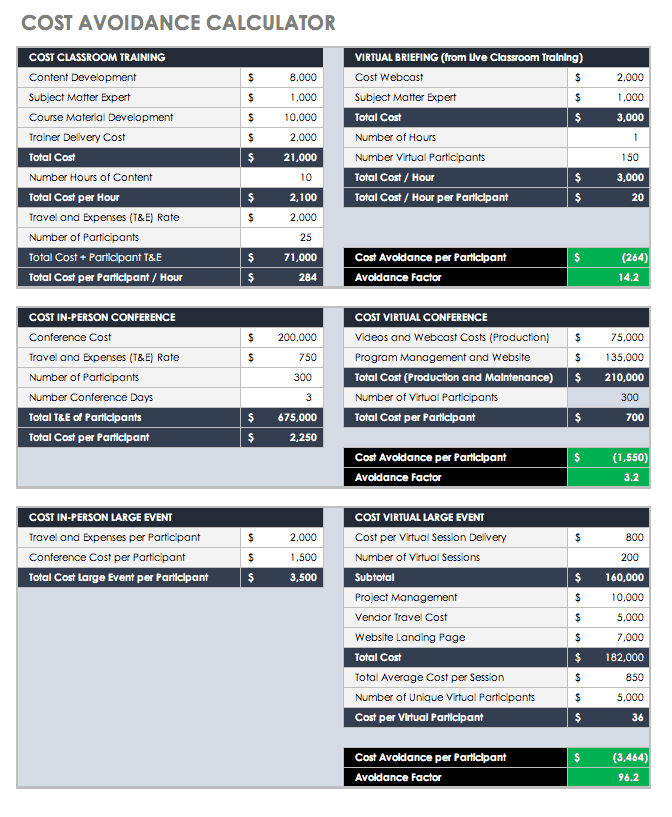

Cost Avoidance Calculator Template

Preparing for a conference or large event is a big commitment for a business. There are direct costs, such as airfare, registration, and accommodations, and indirect costs such as the hours of preparation. Cost avoidance includes actions or event-substitutions that reduce future costs, such as planning virtual conferences, trainings, or parts replacement before failure (and subsequent damage to other parts). Cost avoidance activities may incur higher immediate costs but save money — sometimes totaling extreme savings — over time. This is a different concept from cost savings , in which you actually save the money you plan on spending. Lower spending, investment, or debt levels is what saves money.

Use this template to calculate cost avoidance as ROI. This calculator has a variety of event scenarios, including training, conference, and an in-person event. These costs are compared to a virtual briefing, a virtual conference, and a virtual large event, respectively. With your input, you can calculate the costs per participant for each, the cost avoidance factor per participant, and the avoidance factor.

Download Cost Avoidance Calculator - Excel

Marketing ROI and Content Marketing Templates

Marketing is a huge expense for any business. Whether your company invests in a comprehensive program that rolls out print and television ads as well as a social media presence, or just has a Facebook page, you should know the worth of your content over time. Sirius Decisions stated in 2013 that 60 to 70 percent of content goes unused. The cost of creation itself involves the per hour cost of each person by the number of creation hours involved, plus any actual content expenses. Having the ROI for marketing content can help motivate your staff to use it.

The marketing ROI (MROI) is simply the revenue generated from your content minus the cost to produce your content. This is a simple calculation, but some professionals caution that marketing professionals should define how and what they have measured in order to signal to stakeholders whether they are defining short-term channel-specific ROI or informing for long-term budget or strategic decisions. In this marketing ROI template, you will find space for multiple marketing initiatives in order to compare their relative value.

Download Marketing ROI Template - Excel

To use this template, input the following:

Total initiative cost

Total circulation/audience

Response rate (percent of generated leads by the audience)

Conversion rate (percent of leads which will purchase)

Average revenue per sale

Average profit per sale

From these inputs, you will get these outputs:

Total costs of all initiatives

Total cost/audience for all initiatives

Average profit per sale for all initiatives

Number of leads generated

Number of sales

Total revenue uplift

Total profit uplift

ROI percent

Cost per lead

Cost per sale

Break even response rate

Break even conversion rate

Break even profit per sale

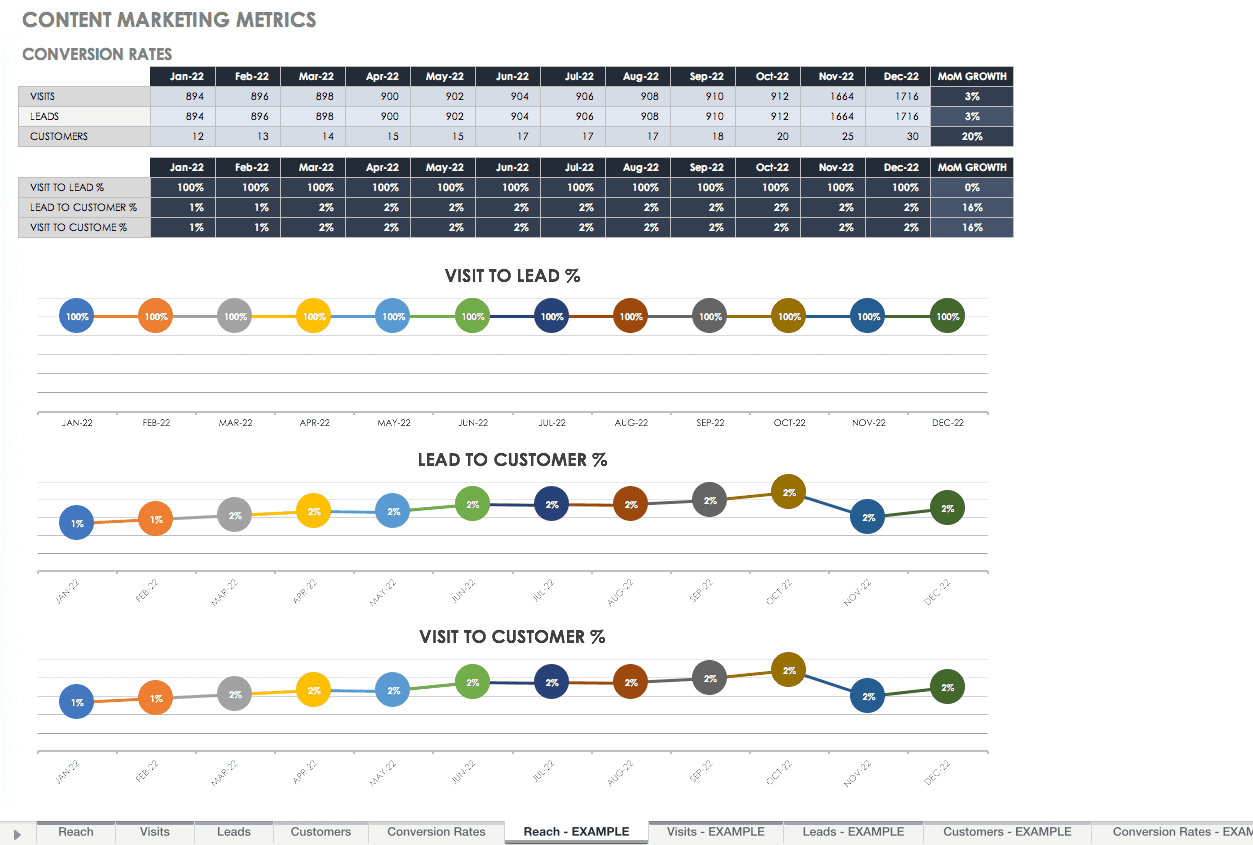

The demand for marketing measurement and reporting is rising with marketing costs. There are many metrics that should be reported to show the success of your marketing program. Many professionals are not comfortable communicating their impact on the bottom line metrics to get the support they need. The key metrics that every marketing person should be comfortable reporting include the following:

Total Reach : The number of people your company can reach across your different networks and platforms. Each is a potential client.

Reach by Channel : The number of people following or subscribed per channel.

Total Website Visits : The number of people who visited your website in a period of time. This metric shows how well your inbound marketing is directing people to your website, which is also tracked month over month (MoM).

Website Visits by Source : This metric reports where people are coming to your website from to determine how well specific campaigns are working.

Total Leads Generated : This metric shows the interest your campaign generates for the products or services. It is one of the strongest ROI indicators.

Leads Generated by Source : This metric shows the channels that produce the most leads, which allows you to focus on the most valuable sources.

Total Customers Driven by Marketing : This metric tracks which marketing campaigns are yielding the most customers.

Marketing Generated Customers by Source : Track the source of the customers acquired by each campaign.

Conversion Rates

Visit to Lead Conversion Rat e: This measures the percent of people whose website visit becomes a new lead for sales.

Lead to Customer Conversion Rate : This measures the percent of people moving from leads to customers. This metric helps determine if your campaigns are generating sales-ready leads.

Visit to Customer Conversion Rat e: This is the overall funnel: whether your traffic generated turns into customers.

Content Marketing Metrics Template

Use each of the above five categories to record metrics for reporting with this template. It provides a space for each metric and ready-made graphs to add to your marketing deck so you can present your success. Fill out the reach, visits, leads, and customers templates, and your conversion rates template will automatically fill from your data.

Download Content Marketing Metrics Template

Excel | Smartsheet

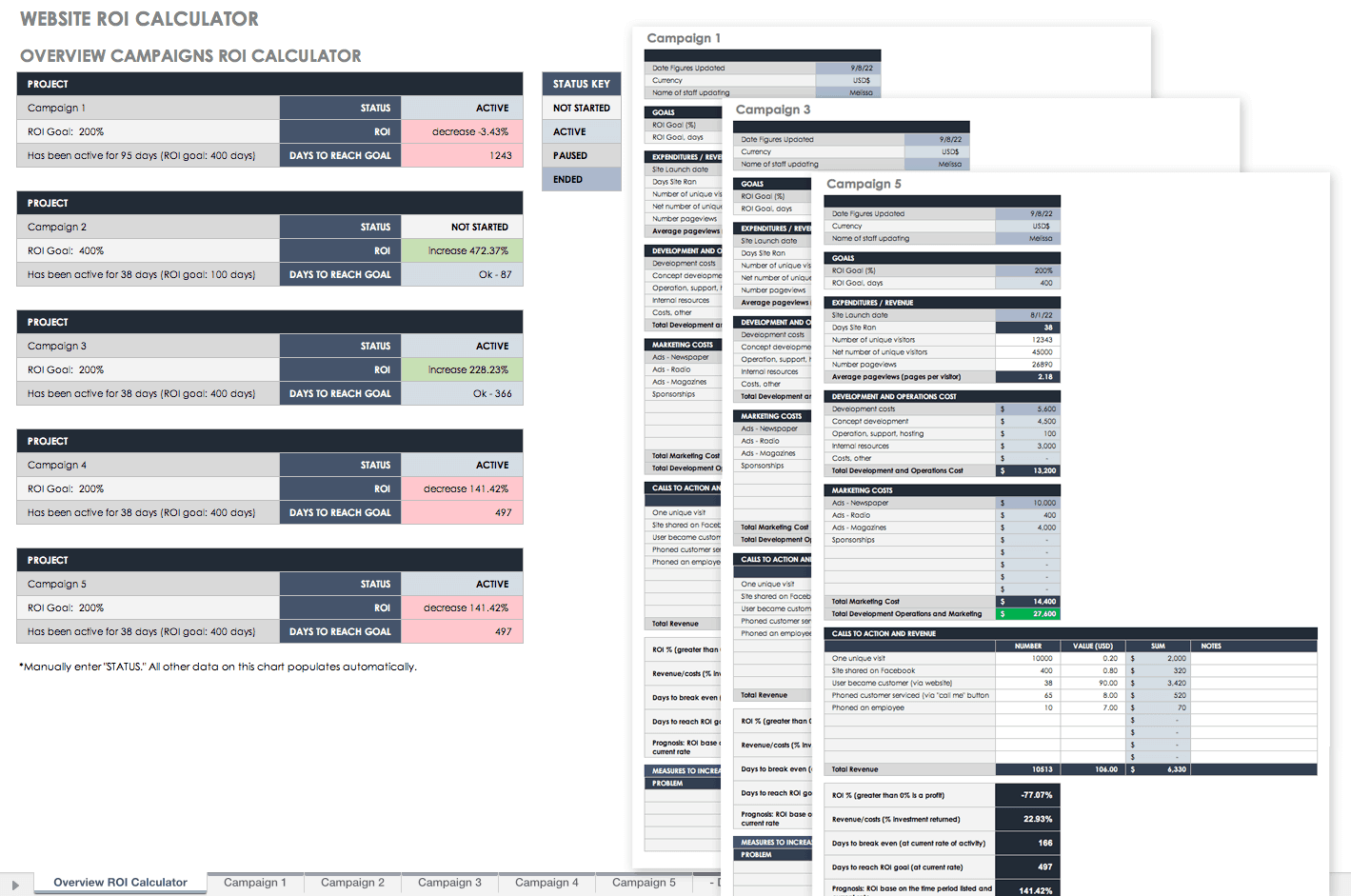

Website ROI Analyses and Template

Google Analytics 4 (GA4) can help you determine the financial value of your content so you can calculate ROI. Use GA4 to track the URLs from all your web materials, such as your website, Facebook, newsletters, and any other sources. You can track who comes to your site and the path they took to get there. For example, you can get a count of how many times someone accessed your site from a Facebook post, or how many times your content was downloaded from your site.

To set up Google Analytics 4, start by either signing in or creating an Analytics account. Set up your GA4 property, add a data stream and install your Google Analytics with Google Tag Manager. Here’s how to set up Google Analytics 4:

Create an Analytics account, unless you already have one.

Create a Google Analytics 4 Property:

Go to the Admin section of your Google Analytics 4 interface and then click Create Property .

Enter the name of your property, choose your company’s country, reporting time zone, and the main currency your business operates.

Press Next , and answer several questions.

Then select your business objectives.

Click Create .

Configure your first Data Stream:

In Admin , in the desired Property column, click Data Streams > Add stream .

Click iOS app , Android app , or Web . In this article we focus on the Web stream.

For the Web , enter the URL of your website (the protocol https is already selected) and enter the name of your website.

You have the option to enable or disable Enhanced Measurement feature. By default it is enabled, but you can disable it if you want.

Press the Create Stream button.

Install Google Analytics 4 with Google Tag Manager (GTM):

Install GTM on your site.

After that, go to GA4 > Admin > Data Streams , select your Web data stream, and copy the Measurement ID .

Go to your Google Tag Manager container > Tags > New and choose Google Analytics: GA4 Configuration .

In the Measurement ID field, enter the Measurement ID you copied in the GA4 interface.

In the Triggering section, select Initialization – All Pages .

Name the tag and save it.

Test the GA4 installation:

Click Preview in the top right corner of the GTM interface.

Once you enable the preview mode, you should see the new GA4 tag among the tags that fired. If your tag didn't fire, check your tag's trigger settings.

Publish your changes in GTM by clicking the Submit button in the top right corner and then completing all the other steps that the user interface asks you to do.

Website ROI Calculator Template

You can add Goals in your analytics page to determine how well your pages are performing. Import the information from your website or app into this website ROI calculator to determine the ROI for your web-based traffic. You’ll find a full website campaign overview in a roll-up sheet, which tells you which campaigns are the most successful so you can compare them.

Download Website ROI Calculator - Excel

In this calculator template, you will find spreadsheets for each of your campaigns. The inputs for each campaign are as follows:

Date figures updated

Name of staff updating

ROI goal (percent)

ROI goal (days)

Site launch date

Number of unique visitors

Net number of unique visitors

Number pageviews

Development costs

Concept development

Operation, support, hosting

Internal resources

Other costs

Marketing costs

Calls to action and revenue

From these inputs, the following are your outputs:

Days ste ran

Average pageviews (pages per visitor)

Total development and operations cost

Total marketing cost

Total development operations and marketing

Total revenue

ROI percent (greater than 0 percent is a profit)

Revenue/costs (percent investment returned)

Days to break even (at the current rate of activity)

Days to reach ROI goal (at current rate)

Prognosis: ROI based on the time period listed and the current rate

Another way to figure out the revenue from your web content is to look at your online sales. Each time you sell products on your website, you can use your digital content to push customers to your sales pages. Each time you post a blog article, there should be links your customers can follow to reach your products. From these page visits, look at the revenue earned over the period and the number of visits from your content.

There are other programs you can use to manage your social media and marketing content that you can purchase as well. Some of these plug into your existing software to make your reporting easier. It’s worth reviewing their features and ease of use for your company if your revenue is dependent on your social marketing content. Some of these apps include Hootsuite, Hubspot, Buzzsumo, and Quintly.

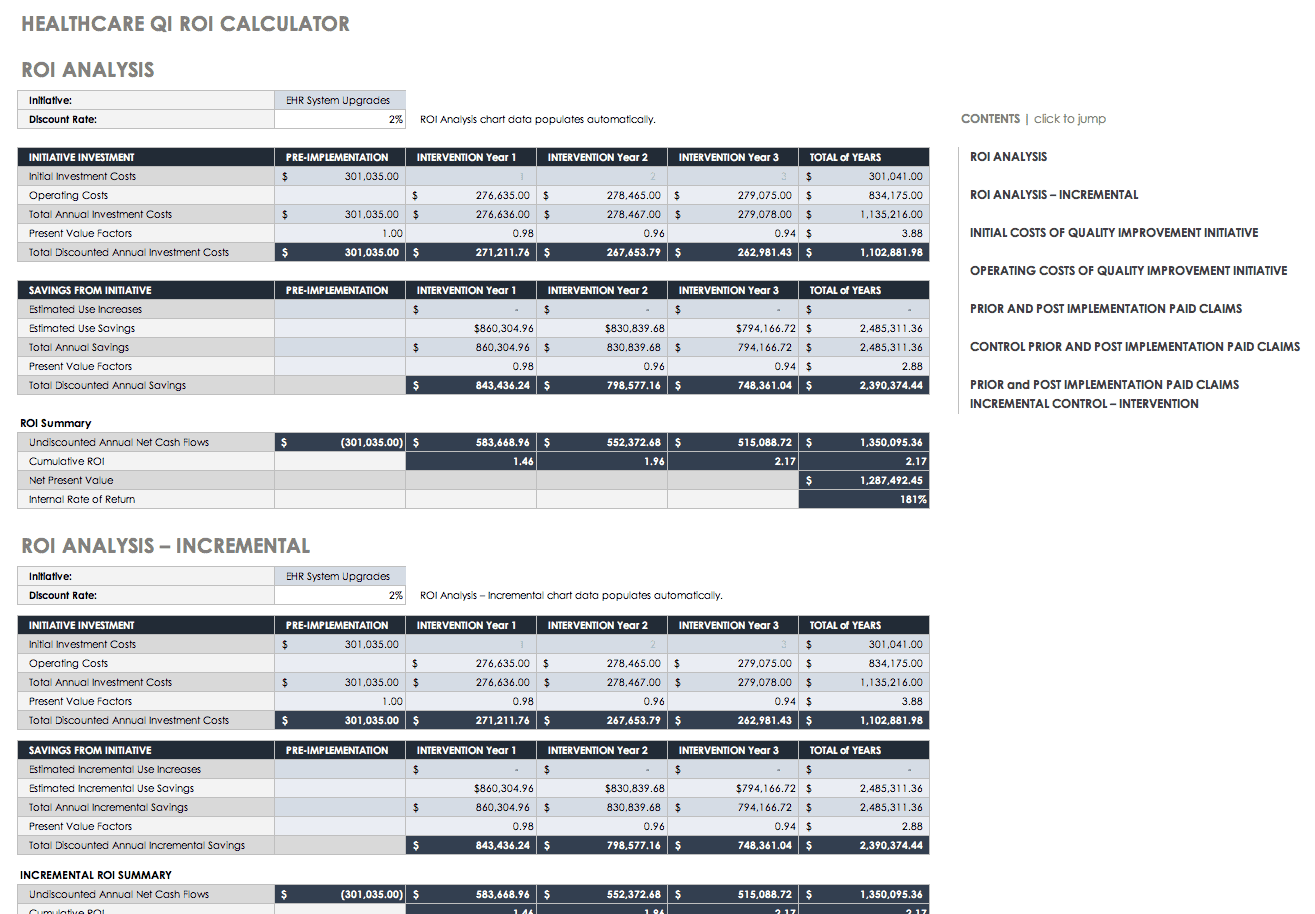

Healthcare Quality Initiative ROI Templates

With the cost of health care skyrocketing, state-sponsored and private health plans should be able to prove their ROI to measure the effect of their quality improvement initiatives. These seven worksheets can help you prove the ROI of your quality improvement initiative:

Initial Costs : In this template, the costs of the personnel involved in the initiative are laid out, as well as any additional costs such as supplies, contracted services, and equipment. The total costs of the initial investment are calculated. This is Year 1 costs.

Operating Costs : This spreadsheet template pulls data from your initial costs spreadsheet for Year 1 and allows you to add data for consecutive years of your initiative. You can add and adjust for additional staff and known costs, and then the worksheet calculates the total costs for each year.

Claims-Intervention : Data from claims is used to estimate savings per year. Inputs for this spreadsheet include the actual payments from each claim category and the estimated savings by claim category for each year, the monthly membership for the initiative, and the number of months in the year the initiative was operational.

Claims-Control : Data from a control group of claims (without the intervention) shows a difference in the intervention versus changes that are an artifact of other reasons. It is important to maintain a control group to show that improvements come from your initiative and not from other or natural progressions.

Claims-Incremental : This spreadsheet compiles data from your claims-control and claims-intervention spreadsheets to determine your savings, and whether these savings are relevant to your quality initiative.

ROI : This spreadsheet automatically compiles data from your other spreadsheets and calculates the total discounted annual investment costs, the total discounted annual savings, and the ROI summary, which includes undiscounted annual net cash flows, cumulative ROI, net present value, and internal rate of return.

ROI-Incremental : Like the ROI spreadsheet, this template calculates the savings and ROI summary, but for incremental data.

Download Healthcare Quality Initiative ROI Templates

Project ROI Templates

There are many projects that require you to calculate ROI. Some of these may be due to technology or software system changes that can get extremely expensive, so being able to report ROI to your stakeholders becomes critical.

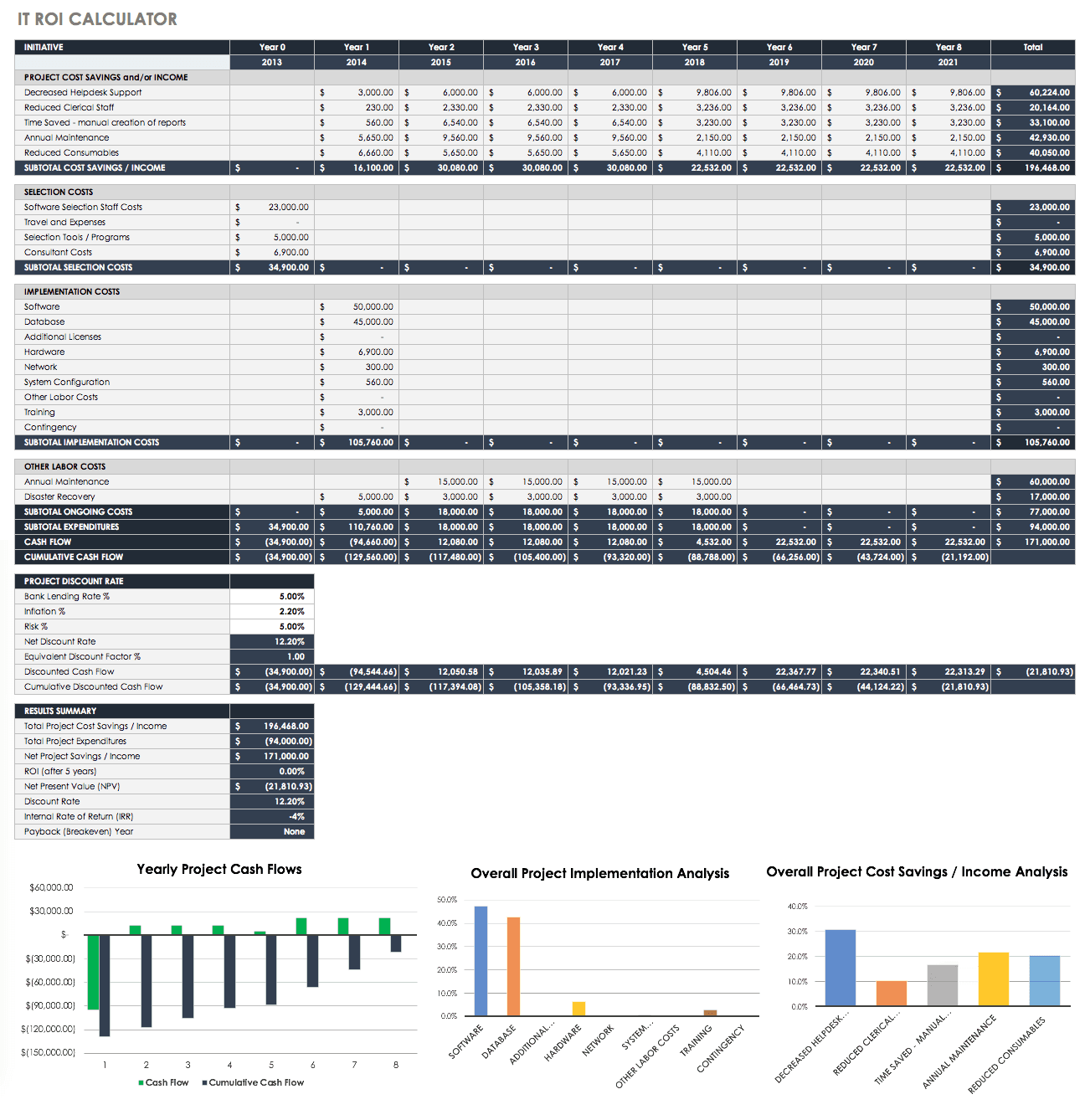

IT ROI Calculator Template

The following is an IT ROI calculator for any basic IT initiative or project. This calculator provides columns to include data for up to eight years, but you can add more years as columns. Inputs include the following:

Cost savings by year

Selection costs

Implementation costs

Ongoing costs

Project discount rates

The outputs from this include subtotals of each, cash flow, cumulative cash flow, and results. The results include the following:

Total project cost savings/income

Total project expenditures

Net project savings/income

ROI (after five years)

Net present value (NPV)

Internal rate of return (IRR)

Payback (breakeven) year

For ease of reporting, charts have been included that automatically show yearly project cash flows, overall project implementation analysis, and overall project cost savings/income analysis.

Download IT ROI Calculator

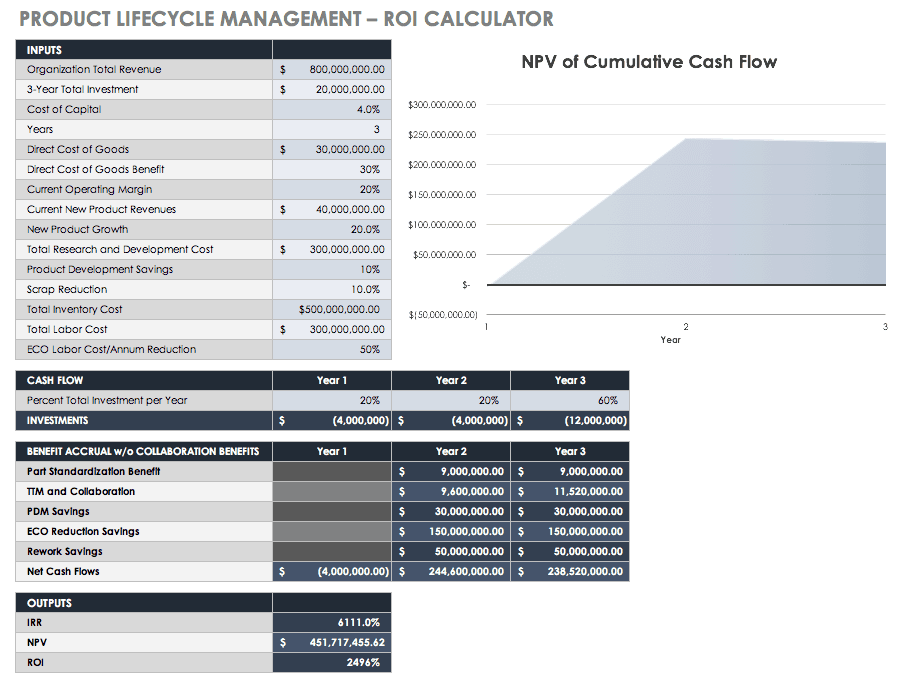

ROI Calculator for Product Lifecycle Management (PLM) Systems

Another software ROI calculator is for product lifecycle management (PLM) systems. Inputs for this calculator include the following:

Organization total revenue

Three-year total investment

Cost of capital

Direct cost of goods

Direct cost of goods benefit

Current operating margin

Current new product revenues

New product growth

Total research and development cost

Product development savings

Scrap reduction

Total inventory cost

Total labor cost

ECO labor cost/annum reduction

Percent total investment per year

Outputs from this calculator include the following:

Investment amounts

Part standardization benefit

TTM and collaboration

PDM savings

ECO reduction savings

Rework savings

Net cash flows

Use the diagram that visually shows the NPV of cumulative cash flow to update your stakeholders.

Download ROI Calculator for Product Lifecycle Management (PLM) Systems

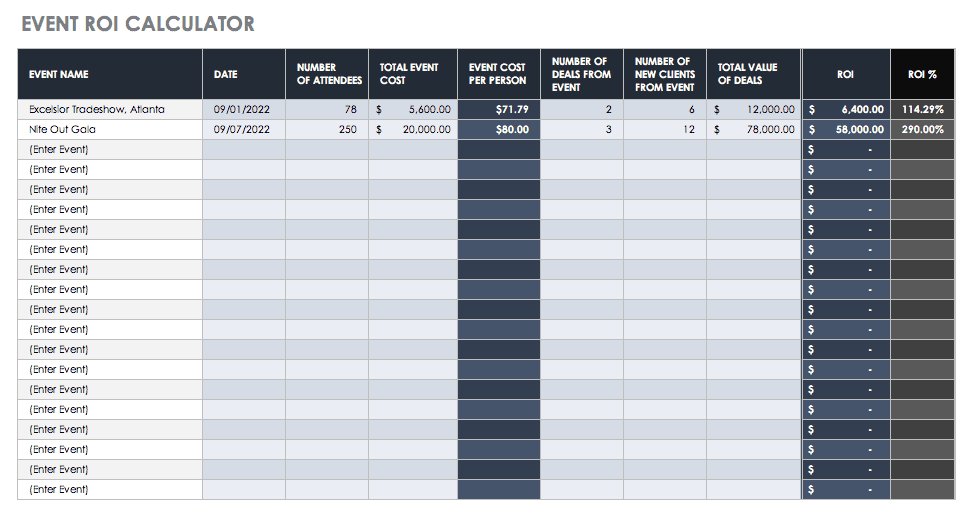

Business Case and Event ROI Template

Building a business case helps your team or company justify the funding in any proposal. This is the expected benefit from any undertaking, whether you are making a case for replacing old equipment or starting a fresh marketing program. Using ROI and other cash flow metrics are an excellent method to help you build your business case — especially in the case of technology investments where financial managers can identify expected costs and benefits to calculate ROI. For example, you may want to make a business case for an event your company is considering hosting. Based on the ROI of past events, you can give your company information on what level of event is relevant for their goals. For example, you can make a case for a large formal event rather than a small less-costly cocktail party if the ROIs are markedly different, and the large event generates more customers. Use this simple event ROI calculator template to discover what ROI your past events yielded by inputting the number of attendees, costs, and deal information. The outputs then give the event cost per person, the ROI, and the ROI percent.

Download Business Case and Event ROI Template - Excel

Justification and Total Cost of Ownership ROI Template

In the same vein as proving a business case, a business plan must have some type of economic justification to provide stakeholders with the knowledge that they are making sound policy and finance decisions. ROI is an appropriate choice, although it does not consider the intangible or fuzzy costs and the benefits that a cost-benefit analysis (CBA) might reveal. However, since those measures are fuzzy, they may not accurately represent the data anyway.

Total cost of ownership (TCO) helps assess costs across an enterprise for products or systems. Mainly used in IT, TCO generally includes not only the hardware and software, but the acquisition, management, support, expenses, training, and any other productivity losses to be expected during implementation. This calculation is made using data over a number of years, so you can present the TCO lifecycle. TCOs can be used to comprehensively justify new software purchases — especially since they are generally such expensive prospects. TCO is the negative data in an ROI equation that shows what you are spending.

Additionally, many professionals interested in TCO also want cost avoidance data, or the positive data in an ROI equation. For example, with both TCO and cost avoidance, you can calculate the ROI of replacing a software system that performs some function that saves you money.

Use this template for such a scenario, where the TCO of a software system (such as a virtual briefing platform) and the cost avoidance of a virtual briefing are combined to discover ROI. You can also use the template independently to determine either TCO or cost avoidance. In this template, you will find space to input your direct and indirect costs across several years. Inputs include costs for the following:

Implementation

Programmatic work

There is also space to enter cost avoidance data. The following are calculated from the input data:

Total cost of ownership/year

Total substitution cost avoidance

Total potential cost avoidance

Potential ROI

Potential ROI percent

Potential ROI/year

Download Justification and Total Cost of Ownership ROI- Template – Excel

Simple ROI Templates

An ROI analysis can vary in the levels of its complexity. Regardless of the amount of data, the basic ROI formula details three steps:

Estimate the Cost : Costs may be hard or soft, depending on the project or event planned. Hard costs are simple and are anything that comes with a receipt, such as travel costs, registration fees, and entertaining costs. Each of these can be a line item when you build or use an ROI calculator. Soft costs are more complex since they can include the number of hours spent on preparing, attending, and following-up after the event. This can also include the time spent corresponding, researching, and traveling. Multiply these “soft” hours by the employees’ hourly rate from their base pay to calculate the soft cost. Combine the hard and soft costs for a better representation of the cost estimate.

Estimate the Return : First, define your success metric. For a conference-type event, this may vary, but consider the type of event and your company’s function in the marketplace. Your team should help you define your success metrics. Defining success metrics is part art, part science. If the metrics are developed, they should align with your strategic plan and your key performance indicators (KPIs) .

Compute ROI : Calculate ROI by dividing the activity return by its cost. Below is another formula you may follow:

ROI = (Gain from investment – Cost of investment) / (Cost of investment)

Simple ROI Calculator Excel Template

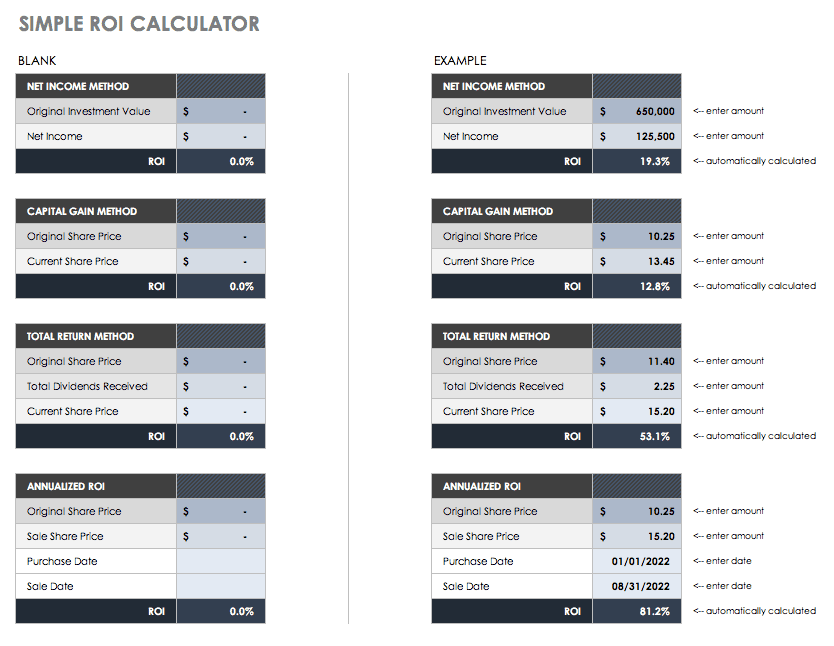

The attached simple ROI calculator is an Excel template. ROI may be calculated in Excel, but there is no specific formula for it — it simply displays inputs and outputs to help you come up with the final number. In this template, you will find four different methods to calculate ROI. But, you will always need to enter either your original investment value or share price.

Download Simple ROI Calculator Template

The four methods in the above template include net income method, capital gain method, total return method, and the annualized method: Net Income Method: Divide net profit by total assets. Enter your original investment value and its net income, which is what was earned less the taxes and deductions.

Capital Gain Method : Subtract your cost base from your capital proceeds. Enter your original share price and the current share price.

Total Return Method : The actual rate of return on an investment over a period of time, including capital gains, interest, and any dividends. Enter the original share price, your dividends, and the current share price.

Annualized Method: This is the geometric average amount earned every year over a given time. It is geometric to show compounding. Enter the original share price, the sale share price, when you purchased the share(s), and when you sold them.

What Is a Return on Investment (ROI)?

Companies use ROI to gauge the profits from any type of investment, whether time, money, or energy. Return on investment (ROI) is a performance measure that can be calculated in simple cases through a formula or in more complex cases via a template with multiple formulas. Calculations occur when you input what is spent versus what is earned. It can also be an investment view of a company’s cash flow via an action they took. In other words, the benefit of an investment is divided by the cost to see if it was worth making. ROI has many interpretations, depending on the business industry. For many businesses, ROI is simply the measurement of financial gain or loss relative to the costs such as deductions, fees, labor, or resources.

In project management, ROI helps businesses determine whether they want to invest in specific projects, and in the case of several projects, to decide between them. In the case of long-term projects, businesses must take into account inflation and future income to accurately calculate ROI. In the case of some quality projects, the ROI may be difficult to calculate because it’s hard to turn non-quantifiable data such as ideas and good feelings into monetary values. For example, spending money to put in a new breakroom may make your employees happier and feel more positive towards their environment. However, it’s difficult to calculate the revenue of a new break room.

ROI is used as a concept and a specific formula. As a concept, it can measure profitability or efficiency. People refer to ROI when discussing what they get back for their input. However, ROI is a true metric that can be calculated as a ratio or percentage. The basic formula to calculate ROI is:

ROI = Net Profit / Total Investment *100

You would use ROI for several reasons:

Provide Quantifiable Value : ROI provides leaders with information about a project’s worth, and can help garner their support by removing uncertainty and subjective benefits.

Build Stakeholder Support : When a project is up for decision (whether or not it gets approved), calculating the ROI gives stakeholders the information they need to either provide or deny their support.

Show Additional Benefits : Calculating ROI becomes a forcing function for staff to determine benefits they may not have considered at the start of a project.

Prioritize Projects : Many companies use ROI as a metric to rank their projects.

However, ROI modeling has some limitations. Some models do not adequately factor in accurate-enough costs and returns. Soft, or intangible, costs are difficult to assess. Another issue is that the costs and returns of a project may not match predictions. Finally, some ROI models may not give more than a financial measure of a project, giving stakeholders an inadequate measure of return or making the project’s actual return misunderstood.

There is more than one way to model ROI, and different analysts can model differently, possibly mischaracterizing the outcome. Therefore, stakeholders and business leaders should ask not only the ROI of a project but how it was modeled. The effects that a project has on more than just the business are sometimes left out. For example, social return on investment (SROI) is a modern metric that considers social, environmental, economic, and environmental outcomes in projects. SROI uses impact mapping, which is a strategic planning technique.

The ROI Formula

ROI is calculated by subtracting the project cost from the financial value. Financial value is what the project pays you back, but occasionally there is uncertainty in assigning monetary values to outcomes. To do so, break the values into known components and define them. These components usually include time, volume, and dollars for both the present and the project, such as this formula:

Financial value = TVD present – TVD project

V = volume, quantity of units

D = dollars/cost

Present = the current value

Project = the value of a successful project

One example of using this formula considers a project that decreases the production cycle by 20 percent. The team calculated that the production cost of their product was $5,000. The time to produce one unit was 10 hours, with a $90/hour wage and $41,00 worth of materials. For the production of 500 of these units, the product line cost was $2.5 million.

The project decreased the production cycle time by 20 percent, from 10 hours to eight hours, while keeping the remaining costs the same. The new production cost is $4,820 per unit and $2.41 million for the yearly product line. Therefore, using the formula above, the projects financial value is:

Financial value = $2,500,000 - $2,410,000 = $90,000 in annual savings

The project cost is the second component of the ROI formula. There are two main variables that compose project cost: work decomposition over time and cost of the work. The work decomposition over time breaks down the work or tasks into the most granular level possible, and in best practice by chronological order. In project management, this may also be known as the work breakdown structure (WBS). Here’s an example:

Insert Chart Here

For more information about WBS, see “ Getting Started with Work Breakdown Structures (WBS) .”

The costs of the required work need the practitioner to consider certain factors when they allot costs. Even these factors they can vary widely, they can include the following:

Any rentals/leases

Resources, such as workers

Hours to complete the work

Capital costs (hardware/software)

Once you have these costs defined, you can add them to your WBS, such as in the following example:

Some other methods of breaking down work include the following:

Gantt Charts : These are the WBS over time, and put your tasks into phases of work. To create your own, see “ How to Create a Gantt Chart in Excel .”

Process Maps or Process Flow Diagrams : These show the project work as workflow steps. This is a visual representation of your work. For more information on process maps, see “ Essential Guide to Business Process Mapping .”

These are all helpful tools to cost out your projects, but practitioners should also consider the following:

One-time Costs Versus Costs Over Time : Some equipment may be a one-time purchase or a rental over years. Include those costs over the period to get accurate ROI figures.

Consider What the Opportunity Cost May Be : When you have more than one project to compare, there may be savings you can attribute back to your company. Remember that the opportunity to perform the project may have value.

Estimate Liberally : Whenever there is a gray area for cost estimation, estimate higher. Cost overruns delay projects and erode confidence.

Once you have calculated all the financial values and project costs, the ROI formula is simple. Let’s assume in the following example that there is a one-time cost of $400,000 for our project to decrease the production time by 20 percent. In this example, Year 5 breaks even, and as the company goes forward, there is an appreciable saving:

ROI and Returns-Based Analysis

Another calculation that is important in a discussion of ROI is returns-based analysis . The financial industry performs style analyses when they are trying to determine the type of investment behavior either an investor or a money manager is using. Two distinct types of styles are holdings-based and returns-based. Returns-based is more widely used by financial professionals because monthly input data is readily available. The returns-based analysis compares three to five years of a portfolio’s monthly returns to the total returns of various style-based indexes. Inferences can be made about how closely the portfolio resembles the different indexes. In other words, a fund manager or investor professes that they will invest in a certain manner. A returns-based analysis is a model that shows if they have done so. Although not directly calculating ROI, a returns-based analysis can help determine whether your investment manager is worth their cost.

Make Better ROI Decisions, Faster with Charts in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Calculate the Return on Investment in PowerPoint

PowerPoint presentations have become a crucial tool in business communication. However, it is essential to determine the return on investment (ROI) of any tool you use in your business. Calculating ROI in PowerPoint is no different. This article will cover all you need to know about calculating ROI in PowerPoint, including why it is crucial, the basics of ROI calculation, factors to consider, step-by-step guides, tools and techniques for ROI calculation, common mistakes to avoid, real-life examples, presenting your results, data visualization, measuring intangible benefits, and leveraging your understanding of ROI for better business decisions.

Table of Contents

Why Calculating ROI in PowerPoint is Important for Your Business

Calculating ROI helps you determine whether an investment in a tool, such as PowerPoint, is worth the cost. You can use the ROI calculation to justify the cost of using PowerPoint for business presentations. Furthermore, it helps you make informed decisions about whether to continue using PowerPoint, improve your usage, or switch to an alternative tool.

Another reason why calculating ROI in PowerPoint is important for your business is that it helps you identify areas where you can improve your presentation skills. By analyzing the ROI of your PowerPoint presentations, you can determine which aspects of your presentations are most effective and which ones need improvement. This can help you tailor your presentations to better meet the needs of your audience and increase the overall effectiveness of your business communication.