Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

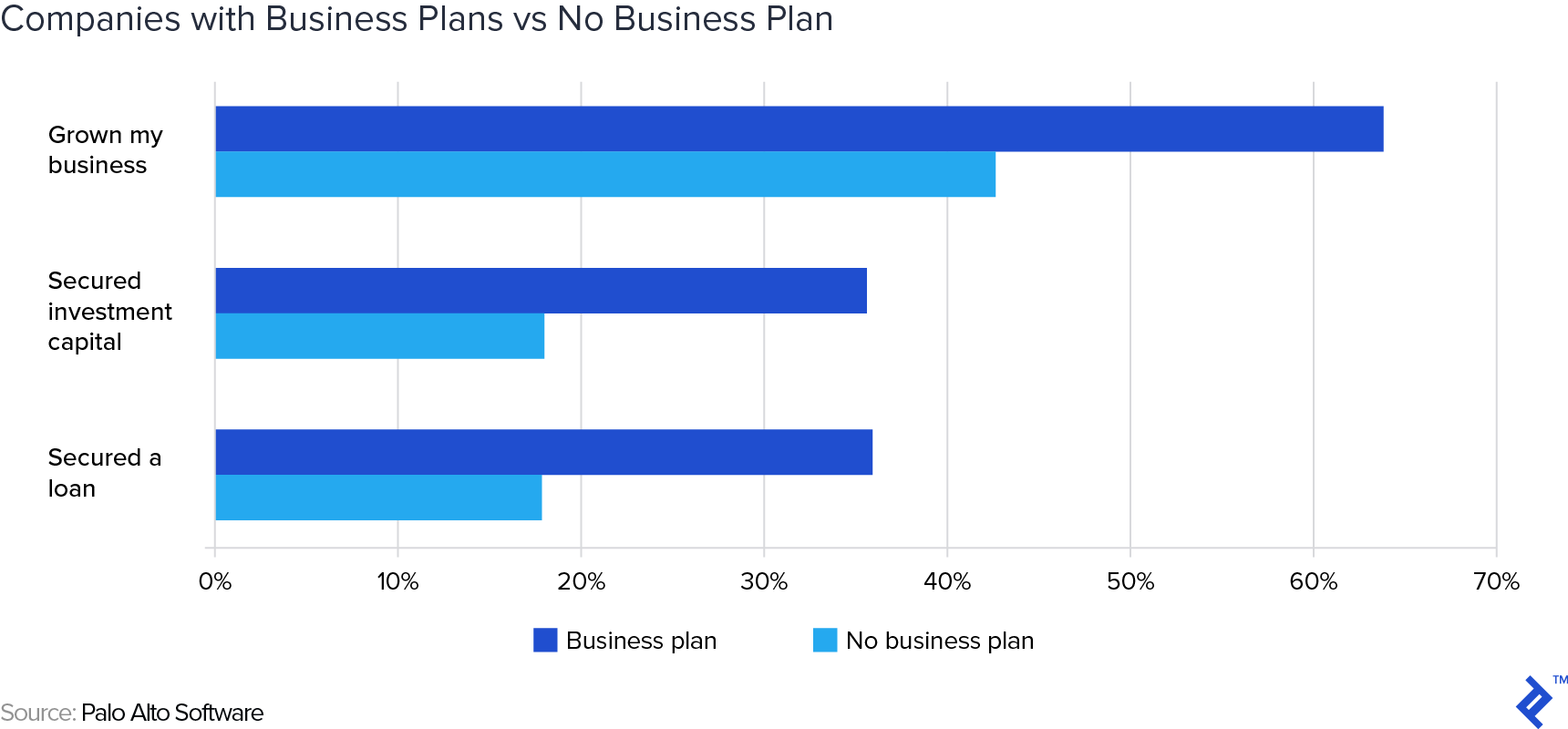

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

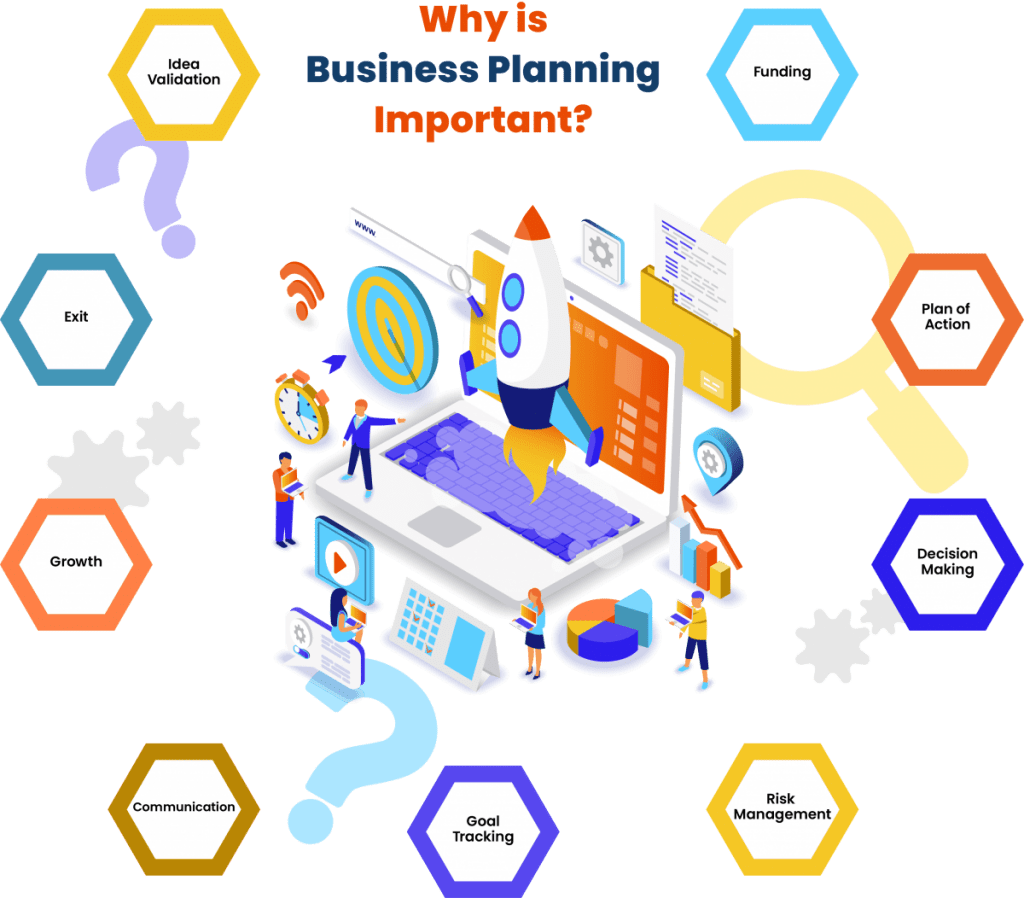

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.

To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business.

1. To help you with critical decisions

The primary importance of a business plan is that they help you make better decisions. Entrepreneurship is often an endless exercise in decision making and crisis management. Sitting down and considering all the ramifications of any given decision is a luxury that small businesses can’t always afford. That’s where a business plan comes in.

Building a business plan allows you to determine the answer to some of the most critical business decisions ahead of time.

Creating a robust business plan is a forcing function—you have to sit down and think about major components of your business before you get started, like your marketing strategy and what products you’ll sell. You answer many tough questions before they arise. And thinking deeply about your core strategies can also help you understand how those decisions will impact your broader strategy.

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

2. To iron out the kinks

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy.

3. To avoid the big mistakes

Only about half of small businesses are still around to celebrate their fifth birthday . While there are many reasons why small businesses fail, many of the most common are purposefully addressed in business plans.

According to data from CB Insights , some of the most common reasons businesses fail include:

- No market need : No one wants what you’re selling.

- Lack of capital : Cash flow issues or businesses simply run out of money.

- Inadequate team : This underscores the importance of hiring the right people to help you run your business.

- Stiff competition : It’s tough to generate a steady profit when you have a lot of competitors in your space.

- Pricing : Some entrepreneurs price their products or services too high or too low—both scenarios can be a recipe for disaster.

The exercise of creating a business plan can help you avoid these major mistakes. Whether it’s cash flow forecasts or a product-market fit analysis , every piece of a business plan can help spot some of those potentially critical mistakes before they arise. For example, don’t be afraid to scrap an idea you really loved if it turns out there’s no market need. Be honest with yourself!

Get a jumpstart on your business plan by creating your own cash flow projection .

4. To prove the viability of the business

Many businesses are created out of passion, and while passion can be a great motivator, it’s not a great proof point.

Planning out exactly how you’re going to turn that vision into a successful business is perhaps the most important step between concept and reality. Business plans can help you confirm that your grand idea makes sound business sense.

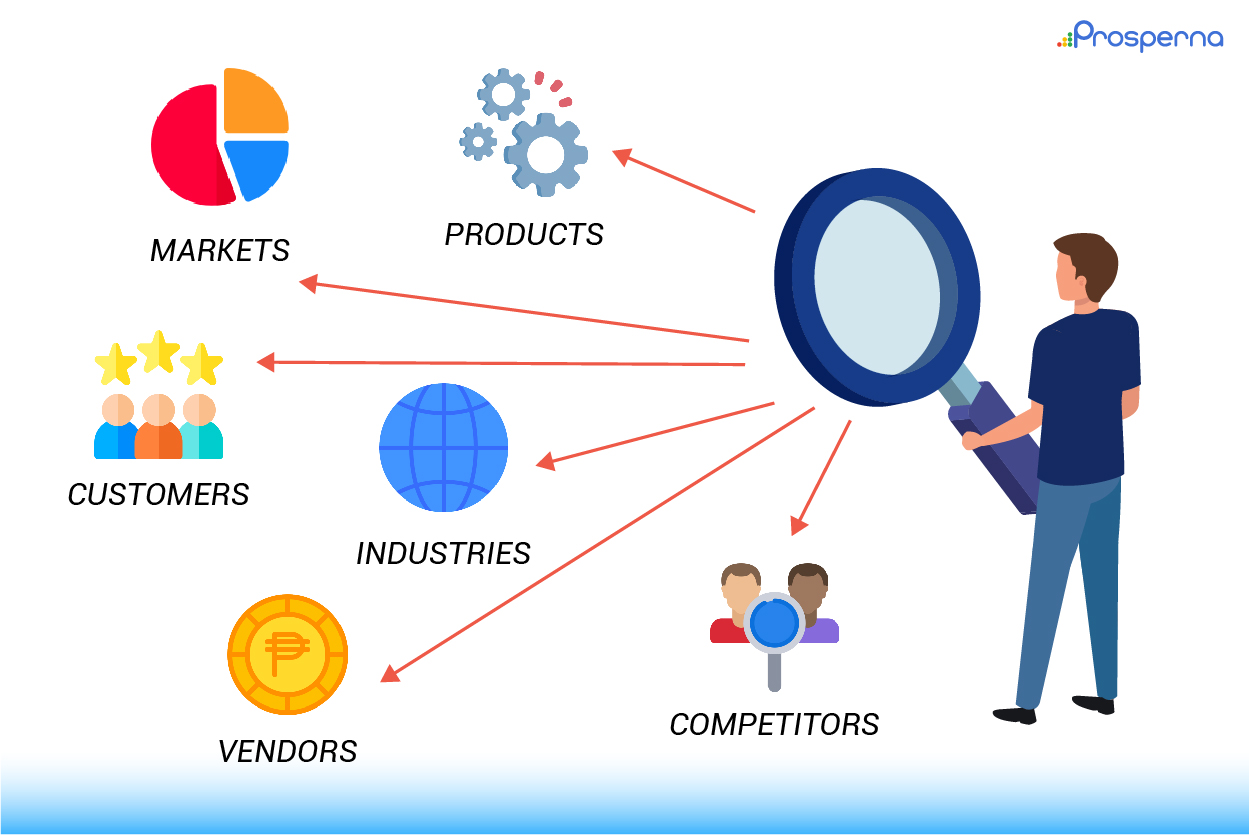

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Want to prove there’s a market gap? Here’s how you can get started with market research.

5. To set better objectives and benchmarks

Without a business plan, objectives often become arbitrary, without much rhyme or reason behind them. Having a business plan can help make those benchmarks more intentional and consequential. They can also help keep you accountable to your long-term vision and strategy, and gain insights into how your strategy is (or isn’t) coming together over time.

6. To communicate objectives and benchmarks

Whether you’re managing a team of 100 or a team of two, you can’t always be there to make every decision yourself. Think of the business plan like a substitute teacher, ready to answer questions any time there’s an absence. Let your staff know that when in doubt, they can always consult the business plan to understand the next steps in the event that they can’t get an answer from you directly.

Sharing your business plan with team members also helps ensure that all members are aligned with what you’re doing, why, and share the same understanding of long-term objectives.

7. To provide a guide for service providers

Small businesses typically employ contractors , freelancers, and other professionals to help them with tasks like accounting , marketing, legal assistance, and as consultants. Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, while ensuring everyone is on the same page.

8. To secure financing

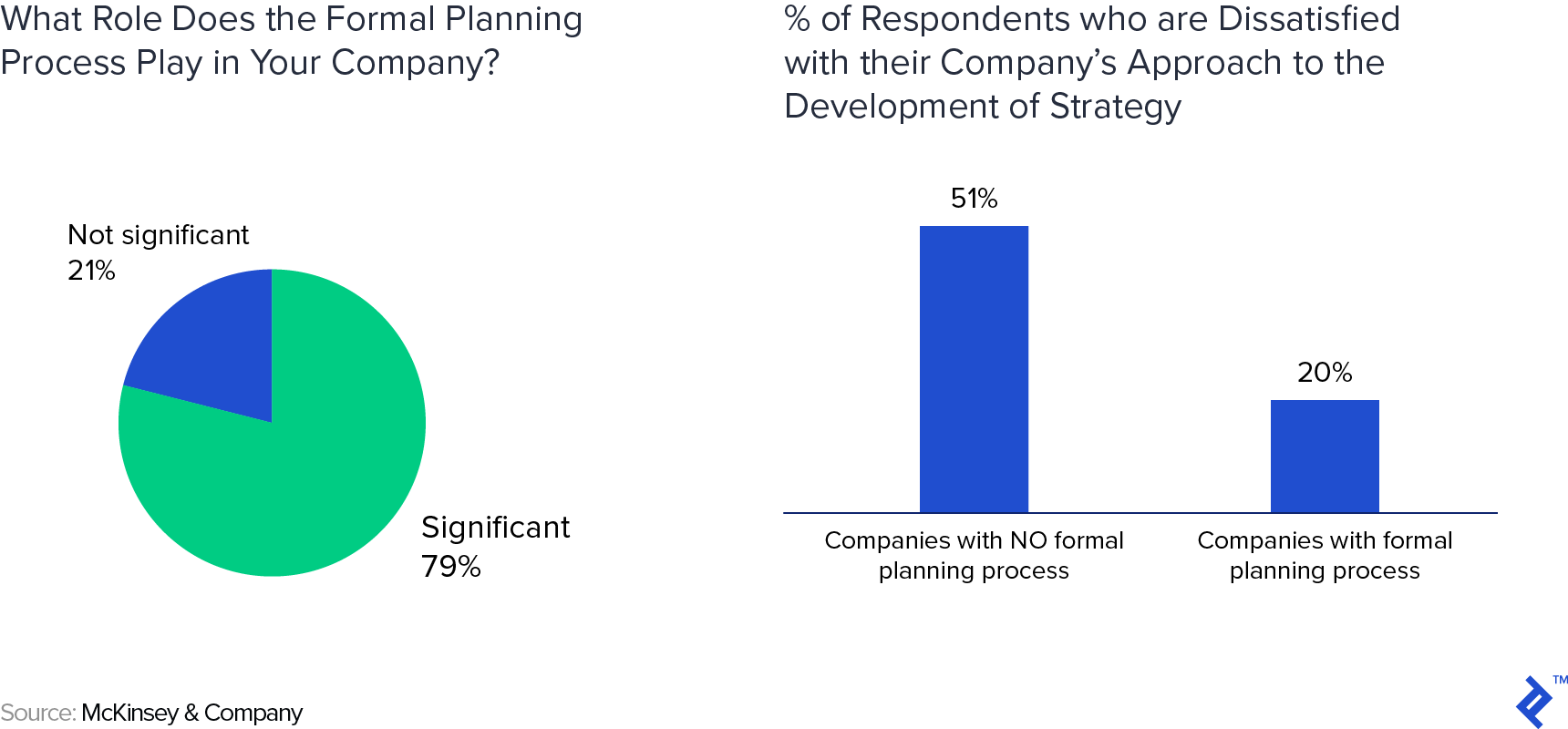

Did you know you’re 2.5x more likely to get funded if you have a business plan?If you’re planning on pitching to venture capitalists, borrowing from a bank, or are considering selling your company in the future, you’re likely going to need a business plan. After all, anyone that’s interested in putting money into your company is going to want to know it’s in good hands and that it’s viable in the long run. Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing.

Learn what you need to get a small business loan.

9. To better understand the broader landscape

No business is an island, and while you might have a strong handle on everything happening under your own roof, it’s equally important to understand the market terrain as well. Writing a business plan can go a long way in helping you better understand your competition and the market you’re operating in more broadly, illuminate consumer trends and preferences, potential disruptions and other insights that aren’t always plainly visible.

10. To reduce risk

Entrepreneurship is a risky business, but that risk becomes significantly more manageable once tested against a well-crafted business plan. Drawing up revenue and expense projections, devising logistics and operational plans, and understanding the market and competitive landscape can all help reduce the risk factor from an inherently precarious way to make a living. Having a business plan allows you to leave less up to chance, make better decisions, and enjoy the clearest possible view of the future of your company.

Understanding the importance of a business plan

Now that you have a solid grasp on the “why” behind business plans, you can confidently move forward with creating your own.

Remember that a business plan will grow and evolve along with your business, so it’s an important part of your whole journey—not just the beginning.

Related Posts

Now that you’ve read up on the purpose of a business plan, check out our guide to help you get started.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

Why Is a Business Plan Important? (+ How to Create One)

June 21st, 2022 | Small Business Resources

A business plan is not something you create just for the sake of creating it—it’s a key factor in your company’s success. According to a SCORE survey , the next biggest source of support for small business owners just starting out—behind their friends and family—is having a solid business plan in place.

Aside box: What is a business plan?

A business plan is a written document that outlines what your business objectives are and how you will go about achieving them. Refresh your business plan regularly to reflect with your evolving business objectives.

Business plans can be both internal and external documents. If you’re looking to secure funding from an investor or get a loan from a bank, they will certainly want to evaluate your business plan first.

Why is this plan so important? Because entrepreneurship without a business plan is like traveling without a roadmap. You might reach your destination eventually without it, but the journey will be tough, if not impossible.

Know the location of your destination and what roads you’ll need to travel, and you’ll significantly increase your chances of success.

12 reasons why having a business plan is important

The process of creating your business plan encourages you to take a deep dive into every aspect of your company—helping you spot flaws and take steps to improve.

Beyond highlighting weaknesses, a strong business plan positively shapes a company’s reputation. It shows investors, partners, and even potential hires that your business is working toward clear objectives and is on a reliable growth path.

1. It helps confirm the viability of your business idea

The research that goes into creating your business plan will help you gauge whether your idea is a viable one. You’ll learn the size of your potential market, who your competitors are, who your target customers are, and what problem you’re solving for them.

With this information, you can evaluate your chances of creating a profitable and sustainable business.

2. It helps you make financial projections

According to CB Insights , almost 40% of startups ran out of cash or failed to raise new capital. Business plans require you to evaluate your current financials and projects in detail, so you can steer clear of draining your bank account.

3. It helps you protect your business from common risks

Very few companies and individuals are willing to work in any capacity with businesses that don’t protect their partners with professional liability policies. To form your business plan, you’ll need to learn about the business risks your company faces and put together an insurance plan that helps mitigate them.

4. It helps you form partnerships

Regardless of the type of partners you have—contractors, freelancers, vendors, manufacturers—you need to establish trust. Partners want to know the specifics of your proposed cooperation before they commit.

Successful partnerships depend on well-defined roles and responsibilities and clearly specified incentives and key performance indicators (KPIs).

Business plans clearly define what cooperation and success look like for partnerships, so external parties feel comfortable working with your company.

5. It helps you hire and retain top talent

You can’t hire good people if they don’t believe your business is viable. A business plan shows top talent that your company has potential and is a good place to work.

A clear business plan is also helpful when you’re seeking hiring advice from more experienced peers. Approaching them with a business plan in hand makes that process easier as well.

“Merely telling a friend or potential business mentor you’re aiming to start with ten employees, for example, is not an exceptionally detailed statement,” said Admir Salcinovic, co-founder and marketing manager of PriceListo . “Showing a business plan that outlines the exact duties, salaries, and expectations you have for employees gives far more information for people to provide advice about.”

6. It provides you with competitor analysis

Market analysis is one of the cornerstones of a business plan. This process involves identifying and researching your main competitors and their business models. This data can provide insights into how you should position your business on the market in order to be competitive and carve out a market share for yourself.

7. It helps you understand customer pain points

Along with highlighting competitors, your market research helps you pin down the problem you’re solving for customers and how you plan on helping them. This research often involves surveying customers to understand their pain points.

8. It helps you assemble the right executive team

According to CB Insights , 15% of new businesses failed because the team they had in place wasn’t right. A strong and experienced leadership team can help navigate the many bumps in the road that new business experience, like structural and personal problem solving, risk assessment, and dips in team morale.

Business plans must include a detailed analysis of your management—who they are, and what they bring to the table to evaluate your leadership internally and externally. Startups also commonly dedicate a section of their business plans to the type of culture they are looking to build.

9. It makes you more attractive to lenders/investors

Real talk—most investors and banks won’t even talk to you if you don’t have a business plan. Harvard Business Review research from 2017 showed that writing a business plan increases the chances of your team receiving funding, noting that having a business plan “builds legitimacy and confidence among investors that the entrepreneur is serious.” “When I went to banks to ask for loans, every one of them asked for my business plan,” said Marina Vaamonde, owner and founder of off-market house marketplace HouseCashin . “If I didn’t have mine ready at the time, I would have wasted time during a crucial growth phase of my business when I needed employees.”

Investors and banks will use your business plan to understand your revenue model, cash flow, and, most importantly, how you plan on using funding.

“No matter how great your idea, angel investors won’t invest without a formal business plan,” said Calloway Cook, president of Illuminate Labs . “It doesn’t need to be 50-pages long, but they want to see that you’ve done the work to validate your concept, both informally with customer interviews and formally with market research.”

Cook, whose team was able to raise a pre-seed round of slightly over $100,000, also recommends including directly sourced customer data in your business plan to attract investors.

“Get feedback from real users. This is what sways the minds of investors,” said Cook. “Anyone can create a hypothetical profitable scenario using market size and demographic information, but if investors can see real people interested in your product or service, they’ll be more likely to invest.”

10. It helps you create a marketing strategy

To form a business plan, you’ll need to research on customer demographics and preferences. This data can inform and strengthen your marketing and branding strategies—helping you target your ideal customer.

New companies often have a limited budget to work with and need to adopt strategies that can spark greater growth and cost less than traditional marketing channels. The market research you’re doing for your business plan makes it a perfect starting point for developing these strategies.

11. It helps you set your pricing

The market analysis you perform while writing your business plan will inform how you set your pricing. Your competitor pricing models, your cost of goods sold , and your break-even point are some of the valuable data points you’ll need to acquire to start shaping your pricing model and your sales strategy.

12. It helps you establish the right KPIs

You can’t report on the progress of your business without first establishing what metrics are important to track.

Business plans show what metrics are important to track, given your financial projections, sales goals, marketing plans, and budgets. When you know which metrics to track, everyone in your organization can report on the progress of your business.

KPIs are not just financial goals. They can include trackable data like customer count, the quality of customer service (first response time, customer service satisfaction), and staff-related data like attendance, quality of work, retention, and satisfaction levels.

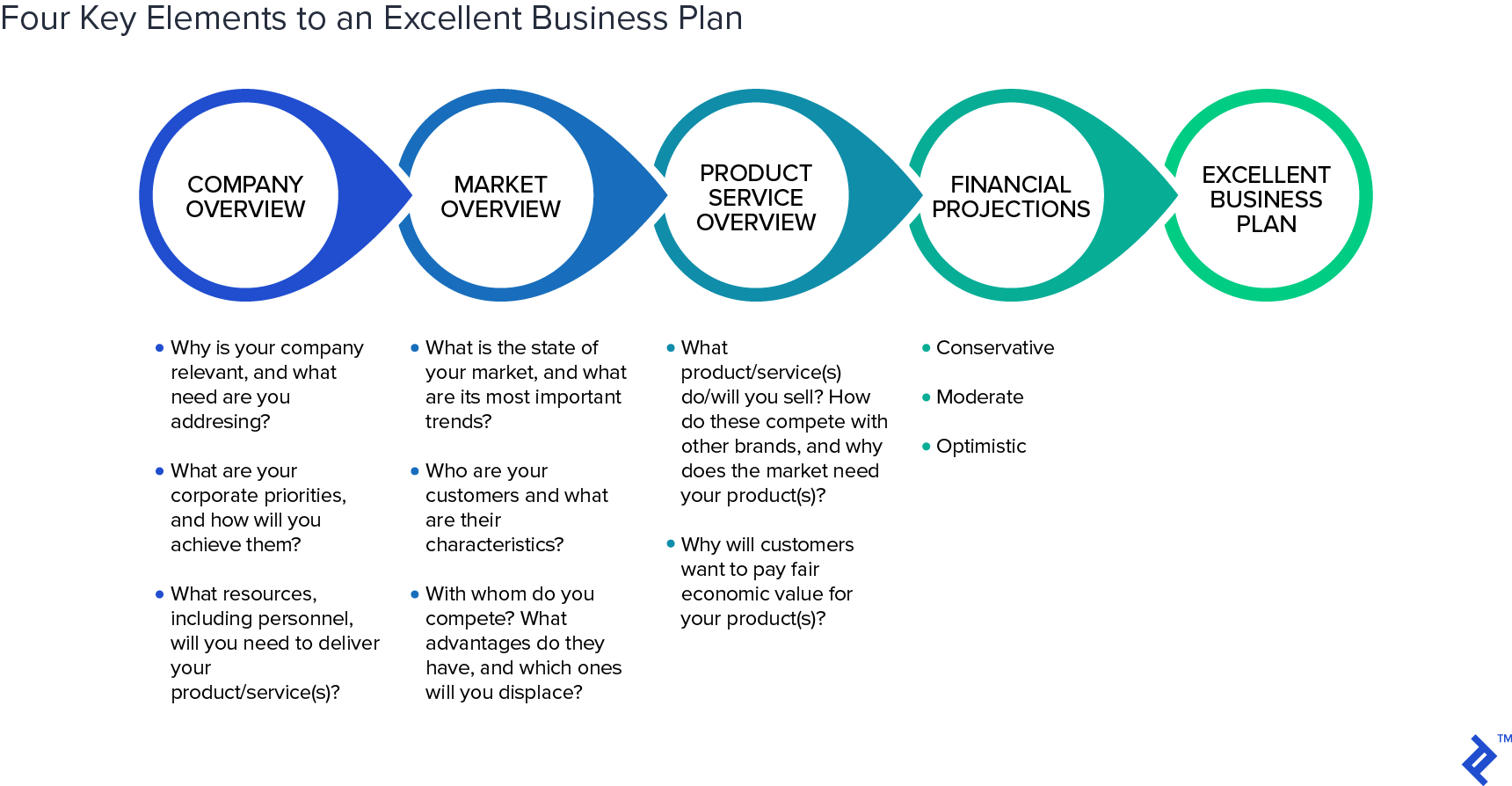

How to write a business plan: What are the core components?

To provide a big-picture view of vital company insights that gives both your team and third parties an easy way to gauge your financial health and projected growth, a good business plan must include the following components:

Executive summary

The executive summary serves as a high-level synopsis of your business plan—like the Cliff Notes for a book. It gives a general overview of the topics that your business plan will cover.

An executive summary should always be fairly brief. But when presenting your plan to third parties, it’s also important to write a summary that’s compelling enough to intrigue them and make them want to read on.

Even though this summary appears first in a business plan, we recommend writing this section last. That way, you’ll be familiar enough with all of the business plan’s main sections to be able to write a concise and accurate summary to kick it off.

Business summary

The business summary covers how the products and services your company offers serve the market. This section of your business plan should focus on your value proposition—defining what pain points you solve for your customers and how.

Explain what differentiates your brand from competitors by showing customer reviews and listing success stories and accomplishments. Readers of the business summary should come away from it convinced that your business is a viable one.

It’s also a good idea to wait until you’ve written the market analysis section before writing this section. Your business summary should consist of condensed takeaways sourced from market research.

Market analysis

This component of your business plan answers questions about the market in which your company is competing, such as:

- How big are your target market segments?

- Where does your business fit within these segments?

- Who are the main competitors?

- Who are your customers?

Performing market research is difficult work, especially for less experienced business owners. If you have the funds to do so, hiring a market research/competitive analysis agency to perform the analysis for you is definitely worth it.

The good news is that there are plenty of available resources for those who want to perform their own research, especially online, such as:

- U.S. census data tools : These tools and free industry research reports can help you determine your market size and gain insight into potential customer demographics data.

- Statista : One of the best research data websites, Statista covers hundreds of industries, constantly performing market research and providing hard business data. The website also uses graphs and charts to make their data more understandable for those who might be new to market research.

- Google Trends : Google Trends can help you understand what potential customers are most interested in, allowing you to see into the minds of consumers and audiences. The tool offers robust filter options to create detailed reports about what the trending stories and most searched terms are in a particular demographic.

If you’d rather find mentors and learn about your market through personal interactions, you can look to join local business organizations such as your local chamber of commerce , the National Federation of Independent Business (NFIB) , or Business Network International (BNI) .

Your market research helps you nail down your ideal customer segments. Uncover key customer demographics: where they live, how much money they make, how old they are, what their level of education is, what their buying habits look like, and more.

Market analysis will help you uncover who your direct competitors are, what their strengths and weakness are, and how your offer differs from theirs.

“Going in blind, without understanding who my competitors were, as well as their core strengths and weaknesses, would have decimated any chances of me establishing a worthwhile competitive strategy,” said Lisa Richards, CEO of the health website the Candida Diet . “Knowing who my competition was made it possible for me to develop a differentiation strategy that set me apart from them in terms of brand perception, allowing me to capture a large share of the market from the very beginning,” she added.

Marketing and sales plan

Along with identifying your target market, a business plan should outline how you plan on reaching this audience and selling your product or service to them.

This section of your business plan should detail your branding and marketing strategy. You should also cover any promotional strategies you plan to implement and a description of the current and future strategic partnerships you plan on installing. For example, if your business sells homemade soap, you could list the brick-and-mortar and online shops you plan on partnering with to increase the reach of your sales.

It should also include pricing strategy—the methodology and process behind how you plan on setting prices for your product or services. Set your prices too low, and you could struggle to turn a profit. Set the price too high, and customers could turn to your more affordable competition.

“After creating our initial business plan, we immediately saw how our business is not profitable enough given the current pricing ranges we have and the target market,” said Sherry Morgan, founder of animal content hub Petsolino . “After further investigation, we found out the holes in our initial plan. From there, we adjusted our pricing and selling strategies.”

The management-related part of your business plan should explain your company hierarchy and introduce your business’s leaders by providing information about their professional backgrounds, education, and achievements.

If you’ve received funding, be sure to highlight your investors, shareholders, and any professional advisors. If you have imminent hiring needs within management, detail them in this section.

Financial plan

The three statements that are integral to your financial plan section are your cash flow statement, income statement, and balance sheet. You should include a short explanation or analysis of all three in your business plan. Don’t hesitate to ask for expert help here, especially if you don’t currently have an in-house accountant.

This section of your business plan is particularly important if you’re looking to attract potential investors or you want to take out a business loan. If that’s the case, in addition to the three mandatory financial statements, you must also provide a detailed list of what you need the money for (marketing, equipment, labor expenses, insurance costs, rent, etc.).

As you grow, your financial plan will help you develop a model for tracking your income and expenses that will enable you to allocate your resources more effectively.

Revisit and revise your business plan regularly

Business plans are never set in stone. They must evolve and change as your business grows and reaches new milestones. Set a regular review schedule to revisit your business plan and tweak it when necessary.

“Creating and evaluating your business plan on a regular basis is a wonderful approach to identify weaknesses, gaps, and assumptions you’ve made to establish contingency plans,” said Matthew Paxton, founder and owner of gaming website Hypernia .

As you make adjustments, don’t hesitate to pick the brains of more experienced business people and mentors to gain different perspectives on areas of improvement for your business plan.

Share This Article

April 12th, 2022

March 31st, 2022

March 9th, 2022

June 26th, 2020

July 15th, 2020

This website uses cookies to improve your experience. By continuing to browse the site, you are agreeing to our use of cookies. Review our Privacy Policy for more details.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

The importance of business plan: 5 key reasons.

A key part of any business is its business plan. They can help define the goals of your business and help it reach success. A good business plan can also help you develop an adequate marketing strategy. There are a number of reasons all business owners need business plans, keep reading to learn more!

Here’s What We’ll Cover:

What Is a Business Plan?

5 reasons you need a well-written business plan, how do i make a business plan, key takeaways.

A business plan contains detailed information that can help determine its success. Some of this information can include the following:

- Market analysis

- Cash flow projection

- Competitive analysis

- Financial statements and financial projections

- An operating plan

A solid business plan is a good way to attract potential investors. It can also help you display to business partners that you have a successful business growing. In a competitive landscape, a formal business plan is your key to success.

Check out all of the biggest reasons you need a good business plan below.

1. To Secure Funding

Whether you’re seeking funding from a venture capitalist or a bank, you’ll need a business plan. Business plans are the foundation of a business. They tell the parties that you’re seeking funding from whether or not you’re worth investing in. If you need any sort of outside financing, you’ll need a good business plan to secure it.

2. Set and Communicate Goals

A business plan gives you a tangible way of reviewing your business goals. Business plans revolve around the present and the future. When you establish your goals and put them in writing, you’re more likely to reach them. A strong business plan includes these goals, and allows you to communicate them to investors and employees alike.

3. Prove Viability in the Market

While many businesses are born from passion, not many will last without an effective business plan. While a business concept may seem sound, things may change once the specifics are written down. Often, people who attempt to start a business without a plan will fail. This is because they don’t take into account all of the planning and funds needed to get a business off of the ground.

Market research is a large part of the business planning process. It lets you review your potential customers, as well as the competition, in your field. By understanding both you can set price points for products or services. Sometimes, it may not make sense to start a business based on the existing competition. Other times, market research can guide you to effective marketing strategies that others lack. To have a successful business, it has to be viable. A business plan will help you determine that.

4. They Help Owners Avoid Failure

Far too often, small businesses fail. Many times, this is due to the lack of a strong business plan. There are many reasons that small businesses fail, most of which can be avoided by developing a business plan. Some of them are listed below, which can be avoided by having a business plan:

- The market doesn’t need the business’s product or service

- The business didn’t take into account the amount of capital needed

- The market is oversaturated

- The prices set by the business are too high, pushing potential customers away

Any good business plan includes information to help business owners avoid these issues.

5. Business Plans Reduce Risk

Related to the last reason, business plans help reduce risk. A well-thought-out business plan helps reduce risky decisions. They help business owners make informed decisions based on the research they conduct. Any business owner can tell you that the most important part of their job is making critical decisions. A business plan that factors in all possible situations helps make those decisions.

Luckily, there are plenty of tools available to help you create a business plan. A simple search can lead you to helpful tools, like a business plan template . These are helpful, as they let you fill in the information as you go. Many of them provide basic instructions on how to create the business plan, as well.

If you plan on starting a business, you’ll need a business plan. They’re good for a vast number of things. Business plans help owners make informed decisions, as well as set goals and secure funding. Don’t put off putting together your business plan!

If you’re in the planning stages of your business, be sure to check out our resource hub . We have plenty of valuable resources and articles for you when you’re just getting started. Check it out today!

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

6 Reasons You Really Need to Write A Business Plan

Published: October 14, 2020

Starting a busine ss can be a daunting task, especially if you’re starting from square one.

It’s easy to feel stuck in the whirlwind of things you’ll need to do, like registering your company, building a team, advertising, the list goes on. Not to mention, a business idea with no foundation can make the process seem incredibly intimidating.

Thankfully, business plans are an antidote for the new business woes that many entrepreneurs feel. Some may shy away from the idea, as they are lengthy documents that require a significant amount of attention and care.

However, there’s a reason why those who take the time to write out a business plan are 16% more likely to be successful than those who don’t. In other words, business plans work.

What is a business plan, and why does it matter?

In brief, a business plan is a roadmap to success. It's a blueprint for entrepreneurs to follow that helps them outline, understand, and cohesively achieve their goals.

Writing a business plan involves defining critical aspects of your business, like brand messaging, conducting market research, and creating pricing strategies — all before starting the company.

A business plan can also increase your confidence. You’ll get a holistic view of your idea and understand whether it's worth pursuing.

So, why not take the time to create a blueprint that will make your job easier? Let’s take a look at six reasons why you should write a business plan before doing anything else.

Six Reasons You Really Need To Write a Business Plan

- Legitimize your business idea.

- Give your business a foundation for success.

- Obtain funding and investments.

- Hire the right people.

- Communicate your needs.

- It makes it easier to sell your business.

1. Legitimize your business idea.

Pursuing business ideas that stem from passions you’ve had for years can be exciting, but that doesn’t necessarily mean it’s a sound venture.

One of the first things a business plan requires you to do is research your target market. You’ll gain a nuanced understanding of industry trends and what your competitors have done, or not, to succeed. You may find that the idea you have when you start is not likely to be successful.

That may feel disheartening, but you can always modify your original idea to better fit market needs. The more you understand about the industry, your future competitors, and your prospective customers, the greater the likelihood of success. If you identify issues early on, you can develop strategies to deal with them rather than troubleshooting as they happen.

It’s better to know sooner rather than later if your business will be successful before investing time and money.

2. Give your business a foundation for success.

Let's say you’re looking to start a clean beauty company. There are thousands of directions you can go in, so just saying, “I’m starting a clean beauty company!” isn’t enough.

You need to know what specific products you want to make, and why you’re deciding to create them. The Pricing and Product Line style="color: #33475b;"> section of a business plan requires you to identify these elements, making it easier to plan for other components of your business strategy.

You’ll also use your initial market research to outline financial projections, goals, objectives, and operational needs. Identifying these factors ahead of time creates a strong foundation, as you’ll be making critical business decisions early on.

You can refer back to the goals you’ve set within your business plan to track your progress over time and prioritize areas that need extra attention.

All in all, every section of your business plan requires you to go in-depth into your future business strategy before even acting on any of those plans. Having a plan at the ready gives your business a solid foundation for growth.

When you start your company, and your product reaches the market, you’ll spend less time troubleshooting and more time focusing on your target audiences and generating revenue.

3. Obtain funding and investments.

Every new business needs capital to get off the ground. Although it would be nice, banks won’t finance loans just because you request one. They want to know what the money is for, where it’s going, and if you’ll eventually be able to pay it back.

If you want investors to be part of your financing plan, they’ll have questions about your business’ pricing strategies and revenue models. Investors can also back out if they feel like their money isn’t put to fair use. They’ll want something to refer back to track your progress over time and understand if you’re meeting the goals you told them you’d meet. They want to know if their investment was worthwhile.

The Financial Considerations section of a business plan will prompt you to estimate costs ahead of time and establish revenue objectives before applying for loans or speaking to investors.

You’ll secure and finalize your strategy in advance to avoid showing up unprepared for meetings with potential investors.

4. Hire the right people.

After you’ve completed your business plan and you have a clear view of your strategies, goals, and financial needs, there may be milestones you need to meet that require skills you don’t yet have. You may need to hire new people to fill in the gaps.

Having a strategic plan to share with prospective partners and employees can prove that they aren’t signing on to a sinking ship.

If your plans are summarized and feasible, they’ll understand why you want them on your team, and why they should agree to work with you.

5. Communicate your needs.

If you don’t understand how your business will run, it’ll be hard to communicate your business’s legitimacy to all involved parties.

Your plan will give you a well-rounded view of how your business will work, and make it easier for you to communicate this to others.

You may have already secured financing from banks and made deals with investors, but a business’ needs are always changing. While your business grows, you’ll likely need more financial support, more partners, or just expand your services and product offers. Using your business plan as a measure of how you’ve met your goals can make it easier to bring people onto your team at all stages of the process.

6. It makes it easier to sell your business.

A buyer won’t want to purchase a business that will run into the ground after signing the papers. They want a successful, established company.

A business plan that details milestones you can prove you’ve already met can be used to show prospective buyers how you’ve generated success within your market. You can use your accomplishments to negotiate higher price points aligned with your business’ value.

A Business Plan Is Essential

Ultimately, having a business plan can increase your confidence in your new venture. You’ll understand what your business needs to succeed, and outline the tactics you’ll use to achieve those goals.

Some people have a lifetime goal of turning their passions into successful business ventures, and a well-crafted business plan can make those dreams come true.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![the business plan is important because How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

What is a Business Plan? Definition, Tips, and Templates

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![the business plan is important because 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![the business plan is important because The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

What Is a Business Plan, and Why Is It Important?

If you’re planning to launch a business, the first thing you’ll need to do is develop a business plan. This can be a daunting task, especially if you’re launching your first business.

But with a few important things in mind, writing a business plan can become much easier–in this article, we’ll discuss what a business plan is, why you need one, the components that make up a comprehensive plan, and how you can use it to grow your business. Let’s begin!

What Is a Business Plan?

A business plan is a document that outlines your business goals, strategies, and activities. It’s often used to attract investors or secure loans from banks. Even if you’re not looking for outside funding, a business plan can still be a helpful tool. It can help you develop a road map for your business and keep you on track as you grow.

When it comes to developing a business plan, there is no one-size-fits-all approach. The length and structure of your plan will vary depending on the type of business you’re starting, the market you’re entering, your own goals and objectives, and the business plan writer you hire.

However, there are some key components that should be included in every business plan:

- The executive summary : This is a brief overview of your business plan. It should include your company’s mission statement, a description of your products or services, an overview of your market analysis, and your financial goals.

This is the most important part of your plan because it helps investors decide if they will continue reading your document, so be sure to learn how to write a good executive summary for your business plan .

- The company description : This section should provide more detail about your company, including its history, ownership structure, and location.

- The product or service : In this section, you should describe the products or services your company will offer. You’ll also want to discuss your target market, how you plan to sell your product or service, and who your competition is.

- The marketing strategy : Here, you’ll include details about how you plan to promote your business. This may include social media marketing efforts, public relations, advertising, and partnerships with other businesses.

- The financials : This is where you’ll include information about your business’ finances, including sales forecasts, cash flow statements, and profit and loss reports.

As you can see, a business plan is more than just numbers and words on paper–it consists of everything that you stand for as an entrepreneur, including important details about your company, your goals, and the strategies you’ll use to achieve those goals. Because of this, it’s important to make sure your business plan is as thorough as possible.

Why Is a Business Plan Important?

There are many benefits of developing a business plan, including:

- It helps you to clarify your goals and objectives.

- It can help you identify any potential challenges or risks you’ll face as you grow your business.

- It serves as a roadmap for your business, helping you stay on track as you develop new products, enter new markets, and hire more employees.

- It gives potential investors or lenders an idea of what your business is all about and how you plan to achieve your goals.

- It can help you stay organized and focused on your business, even when things get busy and hectic.

- It can help you determine whether your new product or service is viable and how to best position it in the market.

How to Use Your Business Plan to Grow Your Business

Once you’ve written your business plan, it’s important to put it into action and use it as a tool to help you grow your business. It should be a living document that grows and changes with your business–as you gain new insights or identify new opportunities, be sure to update your plan so it always reflects your current business goals.

Remember, your plan will serve as a map for you to navigate through the business world. If you start neglecting it because you’re making progress, your success will be short-lived and you’ll soon lose your way.

Additionally, if you’re looking for funding from investors or lenders, your business plan will be a key part of your pitch. Be sure to review your plan carefully before you meet with potential investors, as they’ll likely have questions about your business and your plans for growth, so be sure to have clear and detailed answers in mind.

How to Write an Executive Summary for a Business Plan

Advantages of Django Over ASP.NET

Related posts, what are the roles of support personnel, what is remote customer service, what does a customer support agent do, write a comment cancel reply.

Save my name & email for next time.

- How Guru Works

- Work Agreements

Type above and press Enter to search. Press Esc to cancel.

Does your business plan need a push?

Writting a business plan can be a springboard exercise for your business, and it's not as difficult as people think. All it takes is a bit of method, and some efficient tools. The good news our free articles and paid course have you covered!

Resources on Business Plan Writing :

An article of the Accelerated MBA written by:

Antoine Martin (Ph.D) | Business coach

Is this article relevant? Share it & help someone!

In this article:

Why is a business plan important to your business (it’s not what you think).

Writing a business plan is typically one of the most challenging exercises an entrepreneur has to face in their entrepreneurial life. Not so much because the exercise is challenging to handle – it isn’t that difficult if you know where to start. But because it stands in a grey area and requires much digging, thinking, planning, and writing that most entrepreneurs see as a hassle.

The exercise has a fundamental role in developing your business, though, so you should give it some attention. I’m saying ‘some’ attention here because if a business plan is an essential tool you should be using, it isn’t a finality. In fact, it tends to be a trap for entrepreneurs who focus on it so much that they lose track of what’s even more important: their business.

So, in this article, I will clarify a few points. First, why is a business plan important? For your business, of course. But also for you as the entrepreneur in charge, from a financial and message standpoint. And, well, when is a business plan a trap you should be avoiding.

Before we dig into the topic, though, please keep in mind two things!

One, this article is part of a very comprehensive series of blog posts on business plan writing available on Impactified . We’re trying to make your life easier with these, so give them a look!

Two – we have also designed our best-selling Business Plan Builder Module for those who want to stop losing their time and get the thing done, easy as 1, 2, 3.

The module includes:

- a complete business plan template

- two designer-made decks

- a working tool to get you started and tell you what to write (and how)

- the automated financial tables you’ve been dreaming of

- and over two hours of videos designed to take you by the hand!

So if writing a business plan is a topic for you, you have no excuse!

Having said this – let’s get back to our topic: Why is a business plan important to your business? Hint: it’s not what you think!

Why is a business plan important?

A business plan is one of those elements that keep coming up when you build a business and want to scale it. Bankers, potential investors, and potential partners ask for it from the earliest stages to open your bank account, put money on your account, or grant you a line of credit.

But is a business plan necessary to run a successful business? Not necessarily.

Some do everything instinctively and get results, that’s undeniable. Still, they remain a minority and, sooner or later, the absence of planning is the beginning of the end. More on this later…

In reality, the reason why people ask for a business plan is straightforward: while your business idea might be the best, it is usually a lot more evident to you than it is to whoever you are pitching to. Hence, formalizing your thoughts into an agreed and codified framework makes sense.

These potential partners ask for a business plan because a formalized version of your thoughts is the only way they have to grasp the core of what you have in mind. Plus, they also know that unless your idea has been formalized in some way, it simply cannot be clear for you either. And that’s an absolute red flag.

Like it or not, what usually happens is that entrepreneurs have an idea and go for it as fast as they can, to give it a try and see. However, they rarely have a clear ‘big picture’ of their business. Hence, topics like financial planning and cash flow prévision tend to be very foggy, not to say inexistent.

No goals. No target market. No go-to-market strategy. No marketing plans. No financial statements.

Tell me. How does that sound to you?

I know, right?