Philippine Consulate General

The Republic of the Philippines

PHILIPPINE CONSULATE GENERAL

New york, usa.

REPORT OF MARRIAGE OF A FILIPINO ABROAD

The marriage between filipinos or between a filipino and a foreign national should be reported and registered with the philippine statistics authority (psa) through the philippine embassy/consulate general which has jurisdiction over the locality where the event took place..

ONLY marriages that took place in the following states can be registered or reported at the Philippine Consulate General in New York: (1) Connecticut, (2) Delaware, (3) Maine, (4) Massachusetts, (5) New Hampshire, (6) New Jersey, (7) New York, (8) Pennsylvania, (9) Rhode Island, and (10) Vermont.

For marriages that happened in other U.S. states, please click the Consulate Finder to find out which Philippine Embassy or Consulate can assist you, what the hours of operation are, and how to reach it.

Basic Requirements

Report of marriage form (notarized).

The wife should indicate her maiden surname as her last name. The husband and wife should accomplish and sign the four (4) ROM applications. The forms must be duly notarized by any US notary public. Guidelines on accomplishing the form can be found at the bottom of this page.

Marriage Contract or Certificate issued by US vital records

Submit one (1) original or one(1) Certified True Copy(CTC)/notarized as true copy, plus three(3) photocopies. The marriage contract or certificate must bear information on the number of marriages contracted by both parties . If the number of marriages does not appear on the marriage contract/certificate, please submit Marriage Record/License as an additional requirement.

Proof of Filipino Citizenship of Applicant/s at the time of marriage

Submit one (1) original or one(1) Certified True Copy(CTC)/notarized as true copy, plus three(3) photocopies. Samples of proof of Filipino citizenship are: US Naturalization Certificate, US Permanent Resident Card, Valid Visa or Work Permit; or Dual Citizenship papers (Identification Certificate and Approval Order)

Birth Certificates of Husband and Wife

Submit one (1) original or one(1) Certified True Copy(CTC)/notarized as true copy, plus three(3) photocopies. Foreign birth certificate of the alien spouse; PSA-issued birth certificate of the Filipino spouse

Valid Passports or IDs of Husband & Wife

Submit one (1) original or one(1) Certified True Copy(CTC)/notarized as true copy, plus three(3) photocopies. Valid passports or IDs of HUSBAND and WIFE who is filing the application.

Affidavit of Delayed Registration (Notarized)

Required if application is filed more than one (1) year after the marriage. Must be executed and signed by both parties and duly notarized by any US notary public. Submit four (4) original signed and notarized affidavit.

Additional Requirements (in case one or both parties have previous marriage)

If widow or widower:, psa death certificate.

Submit one (1) original or one(1) Certified True Copy(CTC)/notarized as true copy, plus three(3) photocopies.

If Annulled

Amended psa marriage certificate, with annotation of annulment, judicial decree of annulment, certificate of finality, if foreign spouse was previously married to another foreigner, foreign divorce decree, if the filipino citizen was previously married to a foreigner and a divorce was validly obtained abroad by the alien spouse, *foreign divorce decree duly recognized by the philippine court..

There is no divorce in the Philippines, but when a divorce is validly obtained abroad by an alien spouse from his or her Filipino spouse, the Filipino spouse shall have the capacity to remarry under Philippine law. However, the divorce obtained abroad must be passed upon judicially by a Philippine court, to prove its validity, before the Filipino spouse can remarry under Philippine law. The decision of the Philippine Court shall become the basis for the annotation on Philippine-issued Civil Registry documents. Please see below the guidelines on the Annotation of Foreign Divorce Decree with the Office of the Civil Registrar General in the Philippines.

The Consular Officer reserves the right to require additional documents from the informant or applicant.

Submit application via email

Send one copy each of the documentary requirements listed below to [email protected] for pre-assessment

The Consulate assesses the completeness of the emailed submission.

Mail the Report of Marriage (ROM) Application packet

Once emailed documents have been determined to be complete and in order by the Consular Officer, the informant mails to the Consulate the ROM Application packet (please see below the contents of the packet), taking note of the envelope’s tracking number. Address the mail to: Civil Registry Unit (Report of Marriage) Philippine Consulate General 556 Fifth Avenue, New York, NY 10036

Covering Letter

Include a covering letter (handwritten or typed), addressed to the Civil Registry Unit, indicating the consular service requested, name of person filing the application, including the person’s mobile number and email address.

Complete Documentary Requirements

Arrange documents in this order. Please refer below to the corresponding number of documents to be submitted.

Processing Fee: $25.00 (ROM); $25.00 (per Affidavit) Payment should be in the form of money order or cashier’s check payable to the Philippine Consulate General. Do not send cash by mail. Personal checks are not accepted.

Return Envelope

A self-addressed pre-paid stamped envelope, preferably USPS Priority Mail, with tracking number, must be included when sending the application. Do not use metered stamps or P.O. Box Return Address. Do not use Fedex. The Philippine Consulate General assumes no responsibility for any delay or loss in the mail, or while the documents are in the custody of the courier service. The applicant should note the tracking numbers of all envelopes used and submitted.

Ensure that all submitted requirements are correct and in order. Otherwise, incomplete submissions will not be processed and will be returned to the informant at their own expense.

Get PSA-authenticated Marriage Certificate Online

You may request PSA-authenticated copy of the ROM after 6 to 12 months from the date of reporting at www.psaserbilis.com.ph. To complete the online transaction, you will need the transmittal details (Reference Number, Despatch Number, Despatch Date and Transmittal Date) which can be obtained from the DFA Manila's Consular Records Division with email [email protected].

- (212) 764-1330 ext. 3825

- [email protected]

- Report of Marriage Form - New York

- Affidavit of Delayed Registration

- Affidavit of Citizenship Status

- Judicial Recognition of Foreign Divorce

- Guidelines in Accomplishing ROM

- Philippine Statistics Authority (PSA)

- PSA Serbilis

- Civil Registration Laws

- The Philippines

- The President

- The Government

- The Department of Foreign Affairs

- The Secretary of Foreign Affairs

- The Consul General

- The Consulate

- History of the Consulate General

- Consulate Directory

- Non-Working Holidays

- Consulate Finder

- Announcements and Advisories

- Press and Photo Releases

- Cultural & Community Events

- Consular Outreach

- Online Appointment

- Assistance-to-Nationals

- Civil Registration

- Dual Citizenship (RA 9225)

- Notarial Services

- Overseas Voting

- Travel Document

- Passport Tracker

- Schedule of Fees

- Citizen’s Charter

- Adopt a Child from the Philippines

- Foreign Donations to the Philippines

- Foreign Medical Missions to the Philippines

- GSIS Pensioners Abroad

- Importation of Motor Vehicles to the Philippines

- Importation of Personal Effects to the Philippines

- Importation of Pets and Plants to the Philippines

- J1 Visa Waiver

- National Bureau of Investigation (NBI) Clearance

- Philippine Centenarians

- Philippine Driver’s License Renewal

- PRC Registration of New Professionals

- Renunciation of Philippine Citizenship

- Restrictions in Bringing Medicine & Other Regulated Products to the Philippines

- Shipment of Human Remains to the Philippines

- Social Security System (SSS)

- Travel Tax Exemption

- Videoconference Hearing

- Sentro Rizal

- Promoting Philippine Culture

- Doing Business & Investing in the Philippines

- Traveling to the Philippines

- Fil-Am Community Directory

- Filipino Businesses

- Filipino International Students

- Request Message of the Consul General

- Procurements

Solemnization of Marriage

Consular Officers are authorized to solemnize marriages between two Filipinos of the states under the jurisdiction of the Embassy/Consulate General. Please check the Consulate Finder for the states covered by the Embassy/Consulates General in the U.S.

Applicants for solemnization of marriage between FILIPINO citizens can check and download this guide for more information and reference.

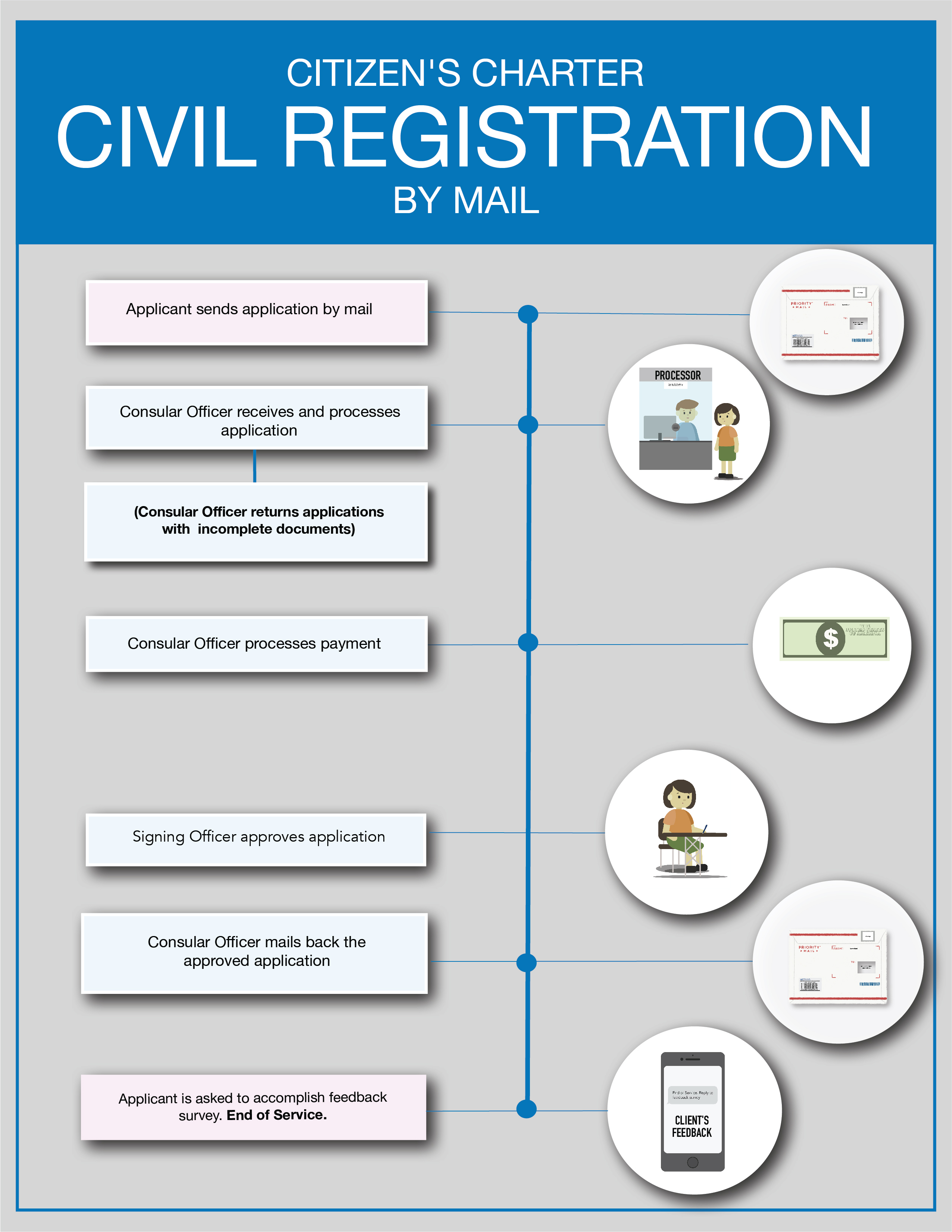

Report of Marriage: Application by Mail

The marriage of a Filipino should be reported to and registered with the Philippine Statistics Authority through the Embassy/Consulate General having jurisdiction over the locality where the event took place. Please check the Consulate Finder for the states /territories covered by the Embassy/Consulates General in the U.S.

Four (4) original copies of the duly accomplished Report of Marriage Contracted Abroad form , typed or printed legibly in black ink, and signed by both husband and wife. Wives should indicate their maiden name as her last name in the form. Forms must be completely filled out in black ink, signed, and notarized.

Covering letter (handwritten or typed), addressed to the Consular Section, indicating the specific service/ transaction requested. It is important to provide a telephone number and/or email address in case consular staff needs to contact the applicant.

Address : Philippine Embassy Civil Registration Unit 1617 Massachusetts Avenue NW Washington DC, 20036

Original or certified true copy of the Marriage Certificate and four (4) photocopies.

IMPORTANT NOTE : If the Marriage Certificate does not specify the civil status of the parties or the number of previous marriages at the time of marriage , applicant must also submit the original or certified true copy of a Marriage Record or any other Government-issued document specifying the civil status of the parties or the number of previous marriages, and three (3) photocopies.

Notarized copy of both spouses’ passport data page, and three (3) photocopies.

Original or notarized copy of proof that the spouse(s) was/were Filipino(s) at the time of marriage ( examples : green card, US visa, US naturalization certificate, notice of action, work permit, dual IC) and three (3) photocopies. If the spouse/s is/are former Filipino/s, please also submit a notarized copy of the foreign naturalization certificate and three (3) photocopies.

Original copy of the Philippine Statistics Authority (PSA) birth certificate/s of the Filipino spouse(s) and four (4) photocopies.

Helpful Links: psaserbilis.com

Notarized affidavit explaining the reasons for delayed registration if ROM is filed more than a year after marriage and three (3) photocopies.

Self-Addressed USPS Priority Mail Flat Rate/Priority Express Return Envelope (with $9.85 Stamp and Tracking Number )

Processing fee $25.00 Payable in money order made payable to “Embassy of the Philippines” (Cash, personal checks and credit cards are not accepted.)

For applicants residing in U.S. territories or other countries within the jurisdiction of the Philippine Embassy, applicants should enclose a treasurer’s, manager’s or certified check issued by a local bank that has a corresponding bank in the U.S, payable to the courier of choice, in U.S. dollars, to cover cost of mailing, and a corresponding self-addressed courier’s address label. Personal checks are not accepted.

The Consular Officer reserves the right to require additional documents from an applicant, to prove his/ her identity and/or citizenship, and ensure accurate and complete personal data entries, pursuant to the Philippine Passport Law (R.A. 8239) and the Foreign Service Act (R.A. 7157).

Citizen's Charter

Consular Processing: Monday to Friday, 9:00 AM – 4:00 PM

Report of marriage.

Reporting the Marriage of a Filipino national abroad is the recording of such vital event with the Philippine Statistics Authority (PSA) through the Consulate. The Consulate General only accepts Marriage Certificates issued by the following States: ILLINOIS, INDIANA, IOWA, KANSAS, MICHIGAN, MINNESOTA, MISSOURI, NEBRASKA, NORTH DAKOTA, OHIO, SOUTH DAKOTA AND WISCONSIN . Send the complete requirements only by mail. No walk-ins. Incomplete requirements will not be processed and will be returned to the sender. Additional requirements may be requested.

Downloadable Forms

Requirements, requirements and procedure.

- 1. Letter-request signed by the Party/ies. Please indicate your contact details (mobile no. and email address).

- 2. Four (4) originals of duly-accomplished REPORT OF MARRIAGE (ROM) forms (Please print annotated/filled out PDF form – not handwritten), signed by the party/ies and notarized by a local notary.

- 3. One (1) original and four (4) photocopies of the Marriage Certificate from the County Clerk’s office (original will be returned)

- 4. Four (4) photocopies of each both spouses' passports

- 5. Four (4) photocopies of a proof of Philippine citizenship of both/either spouse, as appropriate, at the time of the wedding , such as permanent residency, valid visa, work permit, dual citizenship certificate, or US Naturalization Certificate if they are now American citizens

- 6. Four (4) photocopies each of both spouses’ Birth Certificates

- 7. For dual citizens, four (4) photocopies of the Identification Certificate, if the wedding occurred prior to the re-acquisition of Philippine citizenship

- 8. Additional requirements in cases of divorce, annulment or death of a former spouse, and if ROM is filed more than a year after the wedding (Please see below)

Additional Requirements in cases of Divorce, Annulment or Death of a previous spouse

- 1. One (1) original and four (4) photocopies of the PSA-issued Annotated Marriage Contract (original will be returned)

- 1. For a Filipino spouse, one (1) original and four (4) photocopies of the authenticated Judicial Recognition of Divorce issued by a Philippine court and four (4) photocopies of the Marriage Certificate (original will be returned)

- 2. For a foreign spouse, four (4) photocopies of the divorce document and of the Marriage Certificate

- 1. Four (4) photocopies of both the Marriage Certificate (or PSA-issued Marriage Contract if married in the Philippines) and the Death Certificate (or PSA-issued Death Certificate if recorded in the Philippines) of the deceased spouse

Additional Requirement if filing more than a year after the wedding

- 1. One (1) original and three (3) photocopies of the Affidavit of Delayed Registration executed by the Informant (notarized by a local notary) explaining the reason/s for the delayed registration

404 Not found

404 Not found

- Remember me Not recommended on shared computers

Forgot your password?

Or sign in with one of these services

- Philippines

ROM verification

By FilAm24 March 22, 2019 in Philippines

- Register to Reply or Ask a Question

- Go to first unread post

9 posts in this topic

Recommended posts, filam24 74.

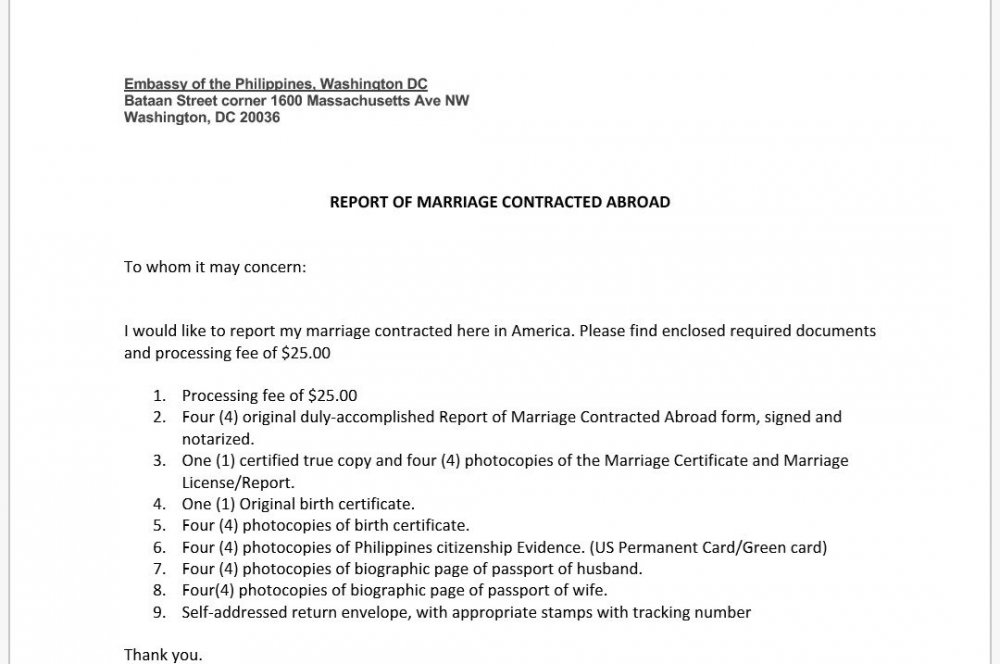

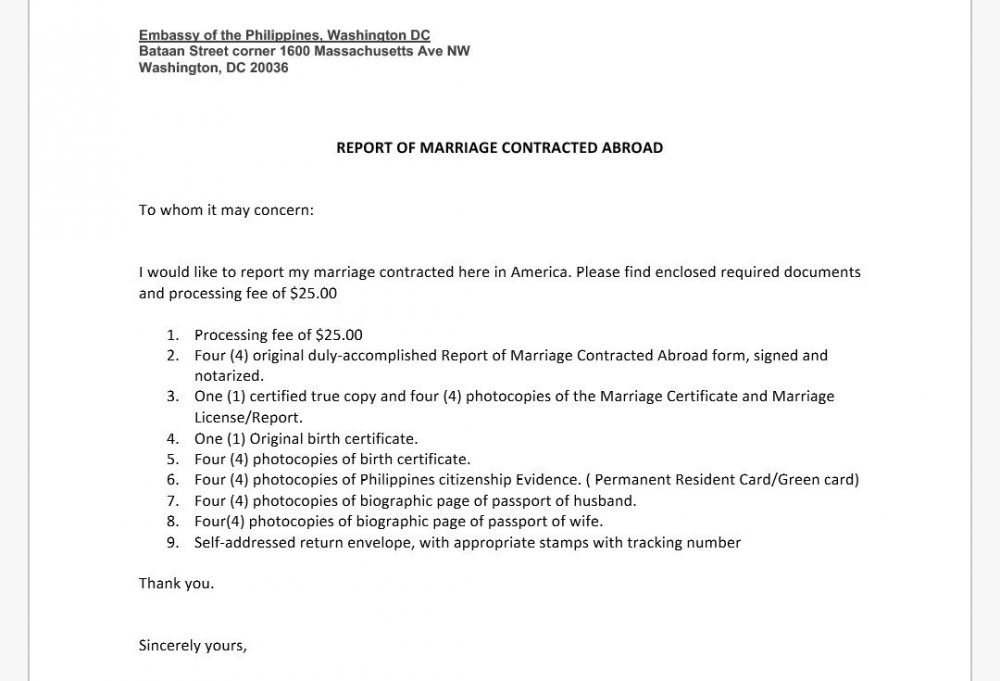

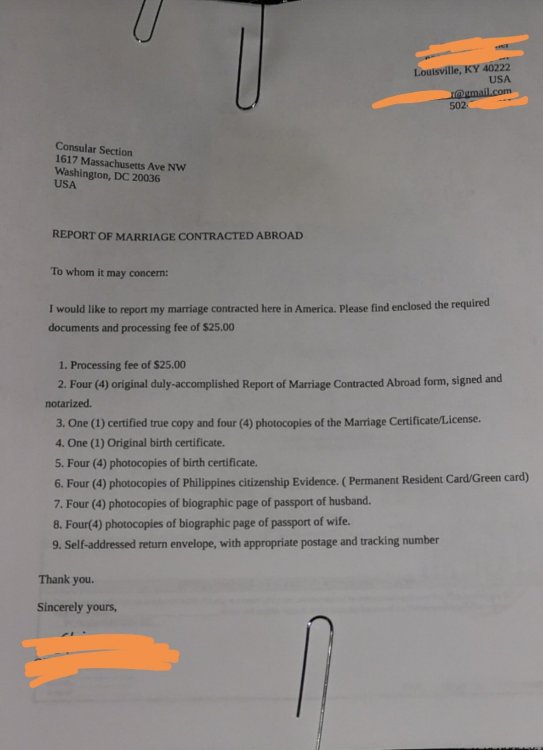

i will send my ROM next week and i need to verify from Filipino Men/women who previously report their Marriage. My state jurisdiction would be Washington DC and im not sure if i should put the Philippines Embassy address ( Embassy of the Philippines, Washington DC Bataan Street corner 1600 Massachusetts Ave NW Washington, DC 20036) OR the consular section (1617 Massachusetts Ave NW Washington, DC 20036). I assume it would be the Philippines Embassy address as it is not a consular matter anymore. right?

I made a sample of a cover letter if you guys dont mind to check it for me 😁 😁

Thank you so much!!

Link to comment

Share on other sites.

24 minutes ago, FilAm24 said: i will send my ROM next week and i need to verify from Filipino Men/women who previously report their Marriage. My state jurisdiction would be Washington DC and im not sure if i should put the Philippines Embassy address ( Embassy of the Philippines, Washington DC Bataan Street corner 1600 Massachusetts Ave NW Washington, DC 20036) OR the consular section (1617 Massachusetts Ave NW Washington, DC 20036). I assume it would be the Philippines Embassy address as it is not a consular matter anymore. right? I made a sample of a cover letter if you guys dont mind to check it for me 😁 😁 Thank you so much!!

Had to edit the number 6. lol

Hank_ 9,171

Per the website http://www.philippinesusa.info/

Embassy of the Philippines, Washington DC Bataan Street corner 1600 Massachusetts Ave NW Washington, DC 20036

"Chance Favors The Prepared Mind"

“LET’S GO BRANDON!”

8 minutes ago, Hank_ said: Per the website http://www.philippinesusa.info/ Embassy of the Philippines, Washington DC Bataan Street corner 1600 Massachusetts Ave NW Washington, DC 20036

That's what i assume too..

Thank you Hank

for other Filipino that might interested to check this thread who gonna report their marriage via mail..it is a bit confusing which address we might use and i read the requirements for ROM again and.. in the cover letter requirements it said:

- Covering letter (handwritten or typed), addressed to the CONSULAR SECTION, indicating service/transaction requested and telephone number or email address for contact details

so that means we should use the consular section address ↓↓

Consular Section 1617 Massachusetts Ave NW Washington, DC 20036

Thanks for the kindness of other Filipino who are willing to help lol

- 3 years later...

Talako 755

1 hour ago, MarkRobert said: These people need more help.

If they are still messing with this 3.5 years later, I would agree.

- Bob in Boston

Finally done.

- 9 months later...

Ane21 16

Such a headache, I thought I’m done after my naturalization, never thought that I’ll be needing tons of paperwork (again) just to report my marriage years later 😅 . My mistake, I also thought I can report our marriage and apply for dual citizenship at the same time.

- Aug 15 Chancy locked this topic

Chancy 6,232

*** Old thread from 2019 locked to further comment. Please start a new thread if you have questions about your own case. ***

- Existing user? Sign In

- Immigration Guides

- Immigration Wiki

- Example Immigration Forms

- Form Downloads

- K1 Fiancé Visa

- CR1 & IR1 Spousal Visa

- US Visa FAQs

Office Reviews & Info

- Consulate & USCIS Office Reviews

- US Port of Entry Reviews

- US Consulate Information

- Processing Times

- Immigration Timelines

- VJ Partners

- Ask a Lawyer

- All Activity

- Popular Topics

- Create New...

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Marriage and Family Therapist Cover Letter Sample

Get the job you've always wanted and learn practical tricks for your cover letter with this customizable Marriage and Family Therapist cover letter sample. Make a copy of this cover letter sample free of charge or try to redesign it using our powerful cover letter creator.

Related resume guides and samples

How to create a compelling dentist resume in 2022?

How to craft the ideal medical assistant resume

How to Write a Medical Doctor CV: What to Include Section by Section

Land a job in mental health therapy with this resume guide

How to write a job-winning nurse resume

How to build an effective pharmacy technician resume

Find your dream physical therapist job with this resume guide

A quick guide to writing your veterinarian resume

Marriage and Family Therapist Cover Letter Sample (Full Text Version)

Jeffrey Chang

Dear Hiring Manager,

As a licensed Marriage and Family Therapist with 7 years of clinical and private practice experience, I apply with enthusiasm for this opportunity.

In my current role at Willingdon Clinic in Sunnybank, I support active and former service personnel and their loved ones with a variety of military-related psychological and psychosocial problems. Mirroring your requirements, this involves intake screening/assessment, goal setting, service planning, risk assessment, crisis intervention, making psychosocial/psychiatric diagnostic inferences, and documenting clinical interactions. Prior to this, I worked across 4 Heathmont Healthcare outpatient clinics to support patients with mood disorders, harm reduction, and crisis management.

In addition to my experience, I hold a Master of Marriage and Family Therapy and a Bachelor of Psychology. I am currently registered with the State of California Board of Behavioral Sciences.

For me, being a Therapist isn’t a job – it’s a passion. My work plays an incredibly important role in the lives of couples, families, and individuals. I take pride in leveraging my therapeutic and clinical skills to support patients in working through obstacles that hinder their interactions with others.

I have enjoyed my time at Willingdon. My reason for leaving is solely based on my family’s decision to relocate. I am now seeking a stimulating full-time opportunity to make a similarly positive impact.

Please find attached my résumé for your consideration. Thank you very much for your time. I look forward to hearing from you regarding next steps.

Yours sincerely,

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Veterinary Medical Assistant Medical Doctor Nurse Pharmacy Technician Mental Health Therapist Physical Therapist Dentist

Related healthcare resume samples

Related mental health therapist cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

is here to help you!

Student years are the best time of one’s life. You are in the prime of your life and hopeful about the bright future ahead. This is the period that leaves the funniest photos, the sweetest memories, and gives you the most faithful friends. However, there is one thing that spoils all the fun – assignment writing. Have you ever struggled to write an essay or prepare a speech only to find that the deadline is getting closer, and the work is not ready yet? Are you desperate for someone to have your paper done? Ordering it online is a really convenient option, but you must be sure that the final product is worth the price. is one of the leading online writing centers that deliver only premium quality essays, term papers, and research papers.

Once you place an order and provide all the necessary instructions, as well as payment, one of our writers will start working on it. Be sure we won’t choose a person to do your paper at random. The writer assigned will hold an academic degree in the respective area of expertise, which makes it possible for him/her to find the relevant information, carry out exhaustive research, and develop a comprehensible and well-organized document. The final product will meet all your specifications regarding the content and formatting style. What is more, you will not have to proofread it for any grammatical or spelling errors, because our professionals have a really good command of the English language.

Customer Reviews

More From Forbes

Writing Cover Letters For A Career Change: Tips And Examples

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Embarking on a career change is a pivotal moment, fraught with uncertainty but brimming with potential. And especially in cases where your resume might not directly align with the job at hand, your cover letter becomes the narrative that connects the dots. A well-crafted cover can illuminate your strengths, align your past experiences with your future aspirations, and persuade potential employers to see the value you bring.

The Importance Of A Cover Letter In Career Changes

In career transitions, your cover letter is your storyteller. It explains the why and the how of your career change, showcasing your enthusiasm and demonstrating how your background equips you with unique perspectives and transferable skills. It addresses potential concerns about your career shift head-on, presenting your transition as an asset rather than a liability.

Tips For Writing A Career Change Cover Letter

1. Personalize Your Approach : Address the letter to a specific person whenever possible. Doing so demonstrates attention to detail and a genuine interest in the position. You want to show that you’re not conducting a generic job search, but that you’ve done your research. You’ve perused (not skimmed) the company website and you read that 20-page yearly report from the CEO. You’ve even read their blog and can quote freely from it. You’ve educated yourself.

2. Emphasize Transferable Skills : Highlight the skills and experiences from your previous roles that are relevant to the new position. Be specific and quantify achievements where possible.

3. Show Enthusiasm and Commitment : Employers want to know that you are genuinely interested in the new field. Express your passion for the career change and your eagerness to contribute.

One Of The Best Shows Ever Made Lands On Netflix Today For The Very First Time

Trump posts 175 million bond thanks to billionaire don hankey, apple just released a major upgrade for samsung galaxy watch 6, pixel watch.

4. Tailor Your Narrative : Connect your past experiences to the job you're applying for, demonstrating how your unique background can bring a fresh perspective to the role.

5. Address Potential Concerns : Be upfront about your career change, framing it as a positive decision guided by clear motivation and a strong understanding of the new field.

6. End with a Strong Call to Action : Conclude by expressing your desire to discuss your application further in an interview, showing proactivity and determination.

7. Use Strategic Language : Avoid clichéd adjectives. Opt for vivid, specific language that paints a clear picture of your capabilities and achievements.

Example: General Career Change Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the [Position] at [Company], transitioning from a career in [Current Industry] to [New Industry]. My experience in [Current Industry] has equipped me with valuable skills that I am eager to apply in [New Industry]. For instance, while working as [Previous Position], I developed a keen ability to [transferable skill], resulting in [specific achievement].

In [Current Industry], I honed my skills in [relevant skill] and demonstrated my ability to [relevant achievement], directly benefiting my team by [specific outcome]. I am particularly drawn to [New Industry] because [reason for interest], and I am enthusiastic about the opportunity to bring my [specific skill] and [another skill] to the [Position] at [Company].

[Your Name]

Tweaks For Various Career Stages

Whether you are making a change early in your career or transitioning later, your cover letter should reflect your rationale and excitement for this new path.

Example: Early Career Cover Letter

As someone at the early stages of my career, I am eager to leverage the foundational skills I gained in [Initial Field], such as [specific skill], in [New Field]. My recent role as [Previous Position] allowed me to develop [relevant skills or experiences], which align closely with the requirements of the [Position] at [Company].

Example: Late Career Cover Letter

Transitioning into [New Field] at this point in my career is a deliberate and enthusiastic choice, driven by my deep-seated interest in [aspect of New Field]. With extensive experience in [Previous Field], I bring a wealth of knowledge and a unique perspective that can contribute to innovative solutions and strategies at [Company].

Tweaks For White And Blue-Collar Roles

Transitioning between white and blue-collar roles offers a unique opportunity to highlight diverse skills and experiences.

Example: White To Blue Collar Cover Letter

I am eager to apply the strategic and managerial skills honed in my white-collar career to the hands-on, dynamic environment of [Blue Collar Field]. My experience in [White Collar Role], where I developed [specific skills], aligns well with the challenges and responsibilities of the [Blue Collar Position] at [Company].

Example: Blue To White Collar Cover Letter

Transitioning from [Blue Collar Field] to [White Collar Field], I bring practical, on-the-ground experience that can inform and enhance the strategic decisions in [White Collar Role]. My background in [Blue Collar Role], where I mastered [specific skills], equips me with a unique perspective beneficial for the [White Collar Position] at [Company].

Including A Career Change Statement On Your Resume/CV

While your cover letter is the ideal place to elaborate on your career change, your resume/CV should also reflect this transition. A brief career change statement, positioned at the beginning of your resume, can effectively set the context for your career narrative. This statement should succinctly convey your transition, emphasizing your commitment to the new field and highlighting any transferable skills or relevant experiences.

How To Craft A Career Change Statement For Your Resume

1. Objective Statement : Begin with a clear, concise objective that outlines your career goals and demonstrates your enthusiasm for your new field.

2. Summary of Qualifications : Follow your objective with a brief summary of your most relevant qualifications, focusing on skills and experiences that transition well into your new career.

3. Highlight Transferable Skills : Clearly identify and emphasize any skills from your previous career that are pertinent to your new path. This not only demonstrates your capability but also shows your proactive approach in aligning your skill set with the new role's requirements.

4. Tailor Your Experience : Adjust the descriptions of your past positions to highlight the responsibilities and achievements most relevant to your desired career path. Use quantifiable achievements to underscore your adaptability and impact.

5. Education and Training : If you have pursued any education or training relevant to your new field, highlight this prominently on your resume to illustrate your dedication and commitment to your career change.

Make Your Language Unique

To avoid sounding like everyone else, remember to use distinctive and precise adjectives in your cover letter and resume. For instance:

- Instead of "experienced," try "seasoned" or "accomplished," providing specific examples that demonstrate this experience, like spearheading a successful project or leading a team to exceed its targets.

- Replace "passionate" with "enthused" or "committed," detailing a project or initiative you pursued with zeal, which can resonate more authentically with hiring managers.

- Substitute "results-driven" with "outcome-focused," illustrating this with a particular scenario where your focus on results led to tangible success for your organization.

Your cover letter and resume are your advocates, narrating your professional journey and articulating why you are not just seeking a new job, but embarking on a new career with purpose and passion. By carefully crafting these documents to reflect your individual story, you position yourself as a memorable and compelling candidate, someone who stands out from the crowd.

- Editorial Standards

- Reprints & Permissions

- Manage communications

- Mutual Fund & 529 accounts

I invest on behalf of my clients.

I consult or invest on behalf of a financial institution.

I want to learn more about BlackRock.

Larry Fink’s 2024 Annual Chairman’s Letter to Investors

Time to rethink retirement.

When my mom passed away in 2012, my dad started to decline quickly, and my brother and I had to go through my parents’ bills and finances.

Both my mom and dad worked great jobs for 50 years, but they were never in the top tax bracket. My mom taught English at the local state college (Cal Northridge), and my dad owned a shoe store.

I don’t know exactly how much they made every year, but in today’s dollars, it was probably not more than $150,000 as a couple. So, my brother and I were surprised when we saw the size of our parents' retirement savings. It was an order of magnitude bigger than you’d expect for a couple making their income. And when we finished going over their estate, we learned why: My parents' investments.

My dad had always been an enthusiastic investor. He encouraged me to buy my first stock (the DuPont chemical company) as a teenager. My dad invested because he knew that whatever money he put in the bond or stock markets would likely grow faster than in the bank. And he was right.

I went back and did the math. If my parents had $1,000 to invest in 1960, and they put that money in the S&P 500, then by the time they’d reached retirement age in 1990, the $1,000 would be worth nearly $20,000. 1 That’s more than double what they would have earned if they’d just put the money in a bank account. My dad passed away a few months after my mom, in his late 80s. But both my parents could have lived beyond 100 and comfortably afforded it.

Why am I writing about my parents? Because going over their finances showed me something about my own career in finance. I had been working at BlackRock for almost 25 years by the time I lost my mom and dad, but the experience reminded me — in a new and very personal way — why my business partners and I founded BlackRock in the first place.

Obviously, we were ambitious entrepreneurs, and we wanted to build a big, successful company. But we also wanted to help people retire like my parents did. That’s why we started an asset manager — a company that helps people invest in the capital markets — because we believed participating in those markets was going to be crucial for people who wanted to retire comfortably and financially secure.

We also believed the capital markets would become a bigger and bigger part of the global economy. If more people could invest in the capital markets, it would create a virtuous economic cycle, fueling growth for companies and countries, which would, in turn, generate wealth for millions more people.

My parents lived their final years with dignity and financial freedom. Most people don’t have that chance. But they can. The same kinds of markets that helped my parents in their time can help others in our time. Indeed, I think the growth- and prosperity-generating power of the capital markets will remain a dominant economic trend through the rest of the 21 st Century.

This letter attempts to explain why.

I had been working at BlackRock for almost 25 years by the time I lost my mom and dad, but the experience reminded me — in a new and very personal way — why my business partners and I founded BlackRock in the first place.

A brief (and admittedly incomplete) history of U.S. capital markets

In finance, there are two basic ways to get or grow money.

One is the bank, which is what most people historically relied on. They deposited their savings to earn interest or took out loans to buy a home or expand their business. But over time a second avenue for financing arose, particularly in the U.S., with the growth of the capital markets: Publicly traded stocks, bonds, and other securities.

I saw this firsthand in the late 1970s and early 1980s when I played a role in the creation of the securitization market for mortgages.

Before the 1970s, most people secured financing for their homes the same way they did in the Christmas classic It’s a Wonderful Life — through the Building & Loan (B&L). Customers deposited their savings into the B&L, which was essentially a bank. Then that bank would turn around and lend out those savings in the form of mortgages.

In the movie — and in real life — everything works fine until people start lining up at the bank’s front door asking for their deposits back. As Jimmy Stewart explained in the film, the bank didn’t have their money. It was tied up in somebody else’s house.

After the Great Depression, B&Ls morphed into savings & loans (S&Ls), which had their own crisis in the 1980s. Approximately half of the outstanding home mortgages in the U.S. were held by S&Ls in 1980, and poor risk management and loose lending practices led to a raft of failures costing U.S. taxpayers more than $100 billion dollars. 2

But the S&L crisis didn’t cause the American economy lasting damage. Why? Because at the same time the S&Ls were collapsing another method of financing was getting stronger. The capital markets were providing an avenue to channel capital back to challenged real estate markets.

This was mortgage securitization.

Securitization allowed banks not just to make mortgages but to sell them. By selling mortgages, banks could better manage risk on their balance sheets and have capital to lend to home buyers, which is why the S&L crisis didn’t severely impact American homeownership.

Eventually, the excesses of mortgage securitization contributed to the crash in 2008, and unlike the S&L crisis, the Great Recession did harm home ownership in the U.S. The country still hasn’t fully recovered in that respect. But the broader underlying trend — the expansion of the capital markets — was still very helpful for the American economy.

In fact, it’s worth considering: Why did the U.S. rebound from 2008 faster than almost any other developed nation? 3

A big part of the answer is the country’s capital markets .

In Europe, where most assets were kept in banks, economies froze as banks were forced to shrink their balance sheets. Of course, U.S. banks had to tighten capital standards and pull back from lending as well. But because the U.S. had a more robust secondary pool of money – the capital markets — the nation was able to recover much more quickly.

Today public equities and bonds provide over 70% of financing for non-financial corporations in the U.S. – more than any other country in the world. In China, for example, the bank-to-capital market ratio is almost flipped. Chinese companies rely on bank loans for 65% of their financing. 4

In my opinion, this is the most important lesson in recent economic history: Countries aiming for prosperity don’t just need strong banking systems — they also need strong capital markets.

That lesson is now spreading around the world.

Replicating the success of America’s capital markets

Last year, I spent a lot of days on the road, logging visits to 17 different countries. I met with clients and employees. I also met with many policymakers and heads of state, and during those meetings, the most frequent conversation I had was about the capital markets.

More and more countries recognize the power of American capital markets and want to build their own.

Of course, many countries do have capital markets already. There are something like 80 stock exchanges around the world, everywhere from Kuala Lumpur to Johannesburg. 5 But most of these are rather small, with little investment. They’re not as robust as the markets in the U.S., and that’s what other nations are increasingly looking for.

In Saudi Arabia, for example, the government is interested in building a market for mortgage securitization, while Japan and India want to give people new places to put their savings. Today, in Japan, it’s mostly the bank. In India, it’s often in gold.

When I visited India in November, I met policymakers who lamented their fellow citizens’ fondness for gold. The commodity has underperformed the Indian stock market, proving a subpar investment for individual investors. Nor has investing in gold helped the country’s economy.

Compare investing in gold with, let’s say, investing in a new house. When you buy a home, that creates an economic multiplier effect because you need to furnish and repair the house. Maybe you have a family and fill the house with children. All that generates economic activity. Even when someone puts their money in a bank, there’s a multiplier effect because the bank can use that money to fund a mortgage. But gold? It just sits in a safe. It can be a good store of value, but gold doesn’t generate economic growth.

This is a small illustration — but a good one — of what countries want to accomplish with robust capital markets. (Or rather, of what they can’t accomplish without them.)

Despite the anti-capitalist strain in our modern politics, most world leaders still see the obvious: No other force can lift more people from poverty or improve quality of life quite like capitalism. No other economic model can help us achieve our highest hopes for financial freedom — whether we want it for ourselves or our country.

That’s why the capital markets will be key to addressing two of the mid-21 st Century’s biggest economic challenges.

- The first is providing people what my parents built over time — a secure, well-earned retirement. This is a much harder proposition than it was 30 years ago. And it’ll be a much harder proposition 30 years from now . People are living longer lives. They’ll need more money. The capital markets can provide it — so long as governments and companies help people invest.

- A second challenge is infrastructure. How are we going to build the massive amount the world needs? As countries decarbonize and digitize their economies, they’re supercharging demand for all sorts of infrastructure, from telecom networks to new ways to generate power. In fact, in my nearly 50 years in finance, I’ve never seen more demand for energy infrastructure. And that’s because many countries have twin aims: They want to transition to lower-carbon sources of power while also achieving energy security. The capital markets can help countries meet their energy goals, including decarbonization, in an affordable way.

[Retirement] is a much harder proposition than it was 30 years ago. And it’ll be a much harder proposition 30 years from now .

Asking the old age question: How do we afford longer lives?

Last year, Japan passed a demographic milestone. The country’s population has been aging since the early 1990s as the pool of working-age people has shrunk and the number of elderly has risen. But 2023 was the first time that 10% of their people exceeded 80 years old, 6 making Japan the “oldest country in the world” according to the United Nations. 7

This is part of the reason the Japanese government is making a push for retirement investment.

Most Japanese keep the bulk of their retirement savings in banks, earning a low interest rate. It wasn’t such a bad strategy when Japan was suffering from deflation, but now the country’s economy has turned around, with the NIKKEI surging past 40,000 for the first time this month (March 2024). 8

Most aspiring retirees are missing out on the upswing. The country didn’t have anything resembling a 401(k) program until 2001, but even then, the amount of income people could contribute was quite low. So a decade ago, the government launched the Nippon Individual Savings Accounts (NISA) to encourage people to invest even more in retirement. Now they’re trying to double NISA’s enrollment. The goal is 34 million Japanese investors before the end of the decade. 9 It will require the Japanese government to expand their capital markets, which historically had very little retail participation.

Japan isn’t alone in helping more of its citizens invest for retirement. BlackRock has a joint venture — Jio BlackRock — with Jio Financial Services, an affiliate of India’s Reliance Industries. Over the past 10 years, India has built a huge digital public infrastructure network that connects nearly one billion Indians to everything from healthcare to government payments via their smartphones. Jio BlackRock’s goal is to use the same infrastructure to deliver retirement investing (and more).

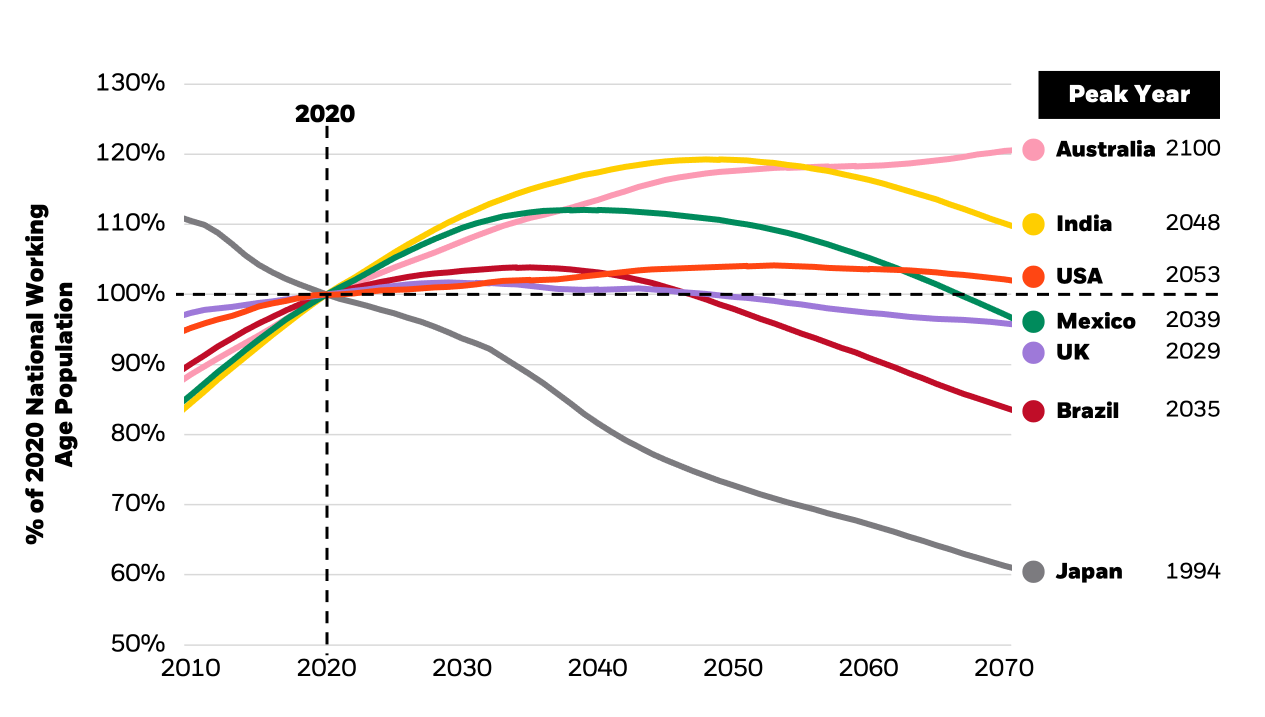

After all, India is aging, too. The whole world is, albeit at different speeds. Brazil will start seeing more people leave its workforce than enter it by 2035; Mexico will reach peak workforce by 2040; India sometime around 2050.

As populations age, building retirement savings has never been more urgent

Source: Working-age population (ages 15-64): UN “medium trend 10

By the mid-century mark, one-in-six people globally will be over the age of 65, up from one-in-11 in 2019. 11 To support them, governments are going to have to prioritize building out robust capital markets like the U.S. has.

But this isn’t to say the U.S. retirement system is perfect. I’m not sure anybody believes that. The retirement system in America needs modernizing, at the very least.

Rethinking retirement in the United States

This was particularly clear last year as the biotech industry pumped out a rush of new, life-extending drugs. Obesity, for example, can take more than 10 years off someone’s life expectancy, which is why some researchers think that new pharmaceuticals like Ozempic and Wegovy can be life-extending drugs, not just weight-loss drugs. 12 In fact, a recent study shows that semaglutide, the generic name for Ozempic, can give people with cardiovascular disease an extra two years of life where they don’t suffer a major condition like a heart attack. 13

We focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years.

These drugs are breakthroughs. But they underscore a frustrating irony: As a society, we focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years.

It wasn’t always this way. One reason my parents had a financially secure retirement was CalPERS, California’s state pension system. As a public university employee, my mom could enroll. But pension enrollment has been declining across the country since the 1980s. 14 Meanwhile the federal government has prioritized maintaining entitlement benefits for people my age (I’m 71) even though it might mean that Social Security will struggle to meet its full obligations when younger workers retire.

It’s no wonder younger generations, Millennials and Gen Z, are so economically anxious. They believe my generation — the Baby Boomers — have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.

Today in America, the retirement message that the government and companies tell their workers is effectively: “You’re on your own.” And before my generation fully disappears from positions of corporate and political leadership, we have an obligation to change that.

Maybe once a decade, the U.S. faces a problem so big and urgent that government and corporate leaders stop business as usual. They step out of their silos and sit around the same table to find a solution. I participated in something like this after 2008, when the government needed to find a way to unwind the toxic assets from the mortgage crisis. More recently, tech CEOs and the federal government came together to address the fragility of America’s semiconductor supply chain. We need to do something similar for the retirement crisis. America needs an organized, high-level effort to ensure that future generations can live out their final years with dignity.

What should that national effort do? I don’t have all the answers. But what I do have is some data and the beginnings of a few ideas from BlackRock’s work. Because our core business is retirement.

More than half the assets BlackRock manages are for retirement. 15 We help about 35 million Americans invest for life after work, 16 which amounts to about a quarter of the country’s workers. 17 Many are educators like my mom was. BlackRock helps manage pension assets for roughly half of U.S. public school teachers. 18 And this work — and our similar work around the globe — has given us some insight into how a national initiative to modernize retirement might begin.

We think the conversation starts by looking at the challenge through three different lenses.

- What’s the issue from the perspective of a current worker , someone who’s still trying to save for retirement?

- What about someone who has already retired? We have to look at the problem from the retiree’s point of view — an individual who has already saved enough to stop working but is worried the money will run out.

- But first it’s important to look at retirement in America like you’d look at a map of America — a high-level picture of the problem, the kind a national policymaker might look at. What’s the issue for the population as a whole? (It’s demographics.)

[Young people] believe my generation — the Baby Boomers — have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.

The demographics don’t lie

There’s a popular saying in economics: “You just can’t fight demographics.” And yet, when it comes to retirement, the U.S. is trying anyway.

In wealthy countries, most retirement systems have three pillars. One is what people invest personally (my dad putting his money in the stock market). Another is the plans provided by employers (my mom’s CalPERS pension). A third component is what we hear politicians mostly talking about – the government safety net. In the U.S., this is Social Security.

You’re probably familiar with the economics behind Social Security. During your working years, the government takes a portion of your income, then after you retire, it sends you a check every month. The idea actually originates from pre-World War I Germany, and these “old-age insurance” programs gradually became popular over the 20 th Century largely because the demographics made sense.

Think about someone who was 65 years old in 1952, the year I was born. If he hadn’t retired already, that person was probably getting ready to stop working.

But now think about that person’s former colleagues, all the people around his age who he’d entered the workforce with back in the 1910s. The data shows that in 1952, most of those people were not preparing for retirement because they’d already passed away .

This is how the Social Security program functioned: More than half the people who worked and paid into the system never lived to retire and be paid from the system. 19

Today, these demographics have completely unraveled, and this unraveling is obviously a wonderful thing. We should want more people to live more years. But we can’t overlook the massive impact on the country’s retirement system.

It’s not just that more people are retiring in America; it’s also that their retirements are increasing in length. Today, if you’re married and both you and your spouse are over the age of 65, there’s a 50/50 chance at least one of you will be receiving a Social Security check until you’re 90. 20

All this is putting the U.S. retirement system under immense strain. The Social Security Administration itself says that by 2034, it won’t be able to pay people their full benefits. 21

What’s the solution here? No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire.

Humanity has changed over the past 120 years. So must our conception of retirement.

One nation that’s rethought retirement is the Netherlands. In order to keep their state pension affordable, the Dutch decided more than 10 years ago to gradually raise the retirement age. It will now automatically adjust as the country’s life expectancy changes. 22

Obviously, implementing this policy elsewhere would be a massive political undertaking. But my point is that we should start having the conversation . When people are regularly living past 90, what should the average retirement age be?

Or rather than pushing back when people receive retirement benefits, perhaps there’s a more politically palatable idea: How do we encourage more people who wish to work longer with carrots rather than sticks? What if the government and the private sector treated 60-plus year-olds as late-career workers with much to offer rather than people who should retire?

One way Japan has managed its aging economy is by doing exactly this. They’ve found new ways to boost the labor force participation rate, a metric that has been declining in the U.S. since the early 2000s. 23 It’s worth asking: How can America stop (or at least, slow) that trend?

Again, I’m not pretending to have the answers. Despite BlackRock’s success helping millions retire, these questions are going to have to be posed to a broader range of investors, retirees, policymakers, and others. Over the next few months, BlackRock will be announcing a series of partnerships and initiatives to do just that, and I invite you to join us.

For workers, make investing (almost) automatic

When the U.S. Census Bureau released its regular survey of consumer finances in 2022, nearly half of Americans aged 55 to 65 reported not having a single dollar saved in personal retirement accounts. 24 Nothing in a pension. Zero in an IRA or 401(k).

Why? Well, the first barrier to retirement investing is affordability.

Four-in-10 Americans don’t have $400 to spare to cover an emergency like a car repair or hospital visit. 25 Who is going to invest money for a retirement 30 years away if they don’t have cash for today? No one. That’s why BlackRock’s foundation has worked with a group of nonprofits to set up an Emergency Savings Initiative. The program has helped mostly low-income Americans put away a total of $2 billion in new liquid savings. 26

Studies show that when people have emergency savings, they’re 70% more likely to invest for retirement. 27 But this is where workers run into another barrier: Investing is complex even if you can afford it.

No one is born a natural investor. It’s important to say that because sometimes in the financial services industry we imply the opposite. We make it seem like saving for retirement can be a simple task, something anyone can do with a bit of practice, like driving your car to work. Just grab your keys and hop in the driver’s seat. But financing retirement isn’t so intuitive. The better analogy is if someone dropped a bunch of engine and auto parts in your driveway and said, “Figure it out.”

At BlackRock, we’ve tried to make the investing process more intuitive by inventing simpler products like target date funds. They only require people to make one decision: What year do they expect to retire? Once people choose their “target date,” the fund automatically adjusts their portfolio, shifting from higher-return equities to less risky bonds as retirement approaches. 28

In 2023, BlackRock expanded the types of target date ETFs we offer so people can more easily buy them even if they don’t work for employers offering a retirement plan. There are 57 million people like this in America — farmers, gig workers, restaurant employees, independent contractors — who don’t have access to a defined contribution plan. 29 And while better investment products can help, there are limits to what something like a target date fund can do. Indeed, for most people, the data shows that the hardest part of retirement investing is just getting started.

Other nations make things simpler for their part-time and contract workers. In Australia, employers must contribute a portion of income for every worker between the ages of 18 and 70 into a retirement account, which then belongs to the employee. The Superannuation Guarantee was introduced in 1992 when the country seemed like it was on the path to a retirement crisis. Thirty-two years later, Australians likely have more retirement savings per capita than any other country. The nation has the world’s 54 th largest population, 30 but the 4 th largest retirement system. 31

Of course, every country is different, so every retirement system should be different. But Australia’s experience with Supers could be a good model for American policymakers to study and build on. Some already are. There are about 20 U.S. states — like Colorado and Virginia — that have instituted retirement systems to cover all workers like Australia does, even if they’re gig or part-time. 32

It’s a good thing that legislators are proposing different bills and states are becoming “laboratories of retirement.” More should consider it. The benefits could be enormous for individual retirees. These new programs could also help the U.S. ensure the long-term solvency of Social Security. That’s what Australia found — their Superannuation Guarantee relieved the financial tension in their country’s public pension program. 33

But what about workers who do have access to an employer retirement plan? They need support too.

Even among employees who have access to employer plans, 17% don’t enroll in them, and the hypothesis among retirement experts is this is not a conscious choice. People are just busy.

It sounds trivial, but even the hour or so it takes someone to look through their work email inbox for the correct link to their company’s retirement system, and then select the percentage of their income they want to contribute can be the unclearable hurdle. That’s why companies should make a conscious effort to look at what their default option is. Are people automatically enrolled in a plan or not? And how much are they auto-enrolled to contribute? Is it a minimum percentage of their income? Or the maximum?

In 2017, the University of Chicago economist Richard Thaler won the Nobel Prize, in part, for his pioneering work around “nudges” — small changes in policy that can have enormous impact in people’s financial lives. Auto-enrollment is one of them. Studies show that the simple step of making enrollment automatic increases retirement plan participation by nearly 50%. 34

As a nation, we should do everything we can to make retirement investing more automatic for workers. And there are already bright spots. Next year, a new federal law will kick in, requiring employers that set up new 401(k) plans to auto-enroll their new workers. Plus, there are hundreds of major companies (including BlackRock) that have already taken this step voluntarily.

But firms can do even more to improve their employee’s financial lives, such as providing some level of matching funds for retirement plans and offering more financial education on the tremendous long-term difference between contributing a small percentage of your income to retirement versus the maximum. I also think we should make it easier for workers to transfer their 401(k) savings when they switch jobs. There is a menu of options here, and we need to explore all of them.

For retirees, help them spend what they saved

In 2018, BlackRock commissioned a study of 1,150 American retirees. When we dug into the data, we found something unexpected — even paradoxical.

The survey showed that after nearly two decades of retirement, the average person still had 80% of their pre-retirement money saved. We’re talking about people who were probably between the ages of 75 and 95. If they had invested for retirement, they were likely sitting on more than enough money for the rest of their lives. And yet the data also showed that they were anxious about their finances. Only 32% reported feeling comfortable about spending what they saved. 35

This retirement paradox has a simple explanation: Even people who know how to save for retirement still don’t know how to spend for it.

In the U.S., this problem’s roots stretch back more than four decades when employers began switching from defined benefit plans — pensions — to defined contribution plans like 401(k)s.

In a lot of ways, pensions were much simpler than the 401(k). You had a job somewhere for 20 or 30 years. Then when you retired, your pension paid you a set amount — a defined benefit — every month.

When I entered the workforce in the 1970s, 38% of Americans had one of these defined benefit plans, but by 2008 the percentage had been cut almost in half. 36 Meanwhile, the fraction of Americans with defined contribution plans almost quadrupled. 37

This should have been a good thing. Beginning with the Baby Boomers, fewer and fewer workers spent their entire careers in one place, meaning they needed a retirement option that would follow them from job to job. In theory, 401(k)s did that. But in practice? Not really.

Anyone who’s switched jobs knows how unintuitive it is to transfer your retirement savings. In fact, studies show that about 40% of employees cash out their 401(k)s when they switch jobs, putting themselves back at the starting line for retirement savings. 38

The real drawback of defined contribution was that it removed most of the retirement responsibility from employers and put it squarely on the shoulders of the employees themselves. With pensions, companies had a very clear obligation to their workers. Their retirement money was a financial liability on the corporate balance sheet. Companies knew they’d have to write a check every month to each one of their retirees. But defined contribution plans ended that, forcing retirees to trade a steady stream of income for an impossible math problem.

Because most defined contribution accounts don’t come with instructions for how much you can take out every month, individual savers first must build up a nest-egg, then spend down at a rate that will last them the rest of their lives. But who really knows how long that will be?

Put simply, the shift from defined benefit to defined contribution has been, for most people, a shift from financial certainty to financial un certainty .

That’s why around the same time we saw the data that retirees were nervous about spending their savings, we started wondering: Was there something we can do about it? Could we develop an investment strategy that provided the flexibility of a 401(k) investment but also the potential for a predictable, paycheck-like income stream, similar to a pension?

It turns out, we could. That strategy is called LifePath Paycheck™, which will go live in April. As I write this, 14 retirement plan sponsors are planning to make LifePath Paycheck™ available to 500,000 employees. I believe it will one day be the most used investment strategy in defined contribution plans.

We’re talking about a revolution in retirement. And while it may happen in the U.S. first, eventually other countries will benefit from the innovation as well. At least, that is my hope. Because while retirement is mainly a saving challenge, the data is clear: It’s a spending one too.

Fear vs. hope

Before I conclude this section on retirement, I want to share a few words about one of the largest barriers to investing for the future. In my view, it’s not just affordability or complexity or the fact that people are too busy to enroll in their employer’s plan.

Arguably the biggest barrier to investing for retirement — or for anything — is fear.

In finance, we sometimes think of “fear” as a fuzzy, emotional concept — not as a hard economic data point. But that’s what it is. Fear is as important and actionable a metric as GDP. After all, investment (or lack thereof) is just a measure of fear because no one lets their money sit in a stock or a bond for 30 or 40 years if they’re afraid the future is going to be worse than the present. That’s when they put their money in a bank. Or underneath the mattress.

This is what happens in many countries. In China, where new surveys show consumer confidence has dropped to its lowest level in decades, household savings have reached their highest level on record — nearly $20 trillion — according to the central bank. 39 China has a savings rate of about 30%. Nearly a third of all money earned is socked away in cash in case it’s needed for harder times ahead. The U.S., by comparison, has a savings rate in the single digits. 40

America has rarely been a fearful country. Hope has been the nation’s greatest economic asset. People put their money in American markets for the same reason they invest in their homes and businesses — because they believe this country will be better tomorrow than it is today.

This big, hopeful America has been the one I’ve known my whole life, but over the past few years, especially as I’ve had more grandchildren, I’ve started to ask myself: Will they know this version of America, too?

As I was finishing this letter, The Wall Street Journal published an article that caught my attention. It was titled “The Rough Years that Turned Gen Z into America’s Most Disillusioned Voters,” and it included some eye-catching — and really disheartening — data.

The article showed that from the mid-1990s through most of the early 21 st Century, most young people — around 60% of high school seniors, to be specific — believed they’d earn a professional degree, would land a good job, and go on to be wealthier than their parents. They were optimistic. But since the pandemic, that optimism has fallen precipitously.

Compared with 20 years ago, the current cohort of young Americans is 50% more likely to question whether life has a purpose. Four-in-10 say it’s “hard to have hope for the world.” 41

I’ve been working in finance for almost 50 years. I’ve seen a lot of numbers. But no single data point has ever concerned me more than this one.

The lack of hope worries me as a CEO. It worries me as a grandfather. But most of all, it worries me as an American.

If future generations don’t feel hopeful about this country and their future in it, then the U.S. doesn’t only lose the force that makes people want to invest. America will lose what makes it America. Without hope, we risk becoming just another place where people look at the incentive structure before them and decide that the safe choice is the only choice. We risk becoming a country where people keep their money under the mattress and their dreams bottled up in their bedroom.

How do we get our hope back?

Whether we’re trying to solve retirement or any other problem, that is the first question we have to ask, although I readily admit that I do not have the solution. I look at the state of America — and the world — and I am as answerless as everyone else. There’s so much anger and division, and I often struggle to wrap my head around it.

What I do know is that any answer has to start by bringing young people into the fold. The same surveys that show their lack of hope also show their lack of confidence — far less than any previous generation — in every pillar of society: In politics, government, the media, and in corporations. Leaders of these institutions (I am one) should be empathetic to their concerns.

Young people have lost trust in older generations. The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.

Perhaps the best way to start building hope is by telling young people, “You may not feel very hopeful about your future. But we do. And we’re going to help you invest in it.”

Young people have lost trust in older generations. The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.

The new infrastructure blueprint: Steel, concrete, and public-private partnership

I started traveling to London in the 1980s, and back then, if you had a choice between the city’s two major international airports — Heathrow or Gatwick — you probably chose Heathrow. Gatwick was farther from the city. It was also in a comparative state of disrepair.

But things changed in 2009 when Gatwick was purchased by Global Infrastructure Partners (GIP). They increased runway capacity and instituted commonsense changes, like oversized luggage trays that cut security screening times by more than half.

“The thing about infrastructure businesses... is a lot of them tend not to focus on customer service,” GIP’s CEO Bayo Ogunlesi told the Financial Times . GIP wanted to make Gatwick different. In the process, they also turned the airport into a prime example of how infrastructure will be built and run in the 21 st Century — with private capital. 42

In the U.S., people tend to think of infrastructure as a government endeavor, something built with taxpayer funds. But because of one very big reason that I’ll dive into momentarily, that won’t be the primary way infrastructure is built in the mid-21 st Century. Rather than only tapping government treasuries to build bridges, power grids, and airports, the world will do what Gatwick did.

The future of infrastructure is public-private partnership.

Debt matters

The $1 trillion infrastructure sector is one of the fastest growing segments of the private markets, and there are some undeniable macroeconomic trends driving this growth. In developing countries, people are getting richer, boosting demand for everything from energy to transportation while in wealthy countries, governments need to both build new infrastructure and repair the old.

Even in the U.S., where the Biden Administration has signed generational infrastructure investments into law, there’s still $2 trillion worth of deferred maintenance. 43

How will we pay for all this infrastructure? The reason I believe it’ll have to be some combination of public and private dollars is that funding probably cannot come from the government alone. The debt is just too high.

From Italy to South Africa, many nations are suffering the highest debt burdens in their history. Public debt has tripled since the mid-1970s, reaching 92% of global GDP in 2022. 44 And in America, the situation is more urgent than I can ever remember. Since the start of the pandemic, the U.S. has issued roughly $11.1 trillion of new debt, and the amount is only part of the issue. 45 There’s also the interest rate the Treasury needs to pay on it.

Three years ago, the rate on a 10-year Treasury bill was under 1%. But as I write this, it’s over 4%, and that 3-percentage-point increase is very dangerous. Should the current rates hold, it amounts to an extra trillion dollars in interest payments over the next decade. 46

Why is this debt a problem now? Because historically, America has paid for old debt by issuing new debt in the form of Treasury securities. It’s a workable strategy so long as people want to buy those securities — but going forward, the U.S. cannot take for granted that investors will want to buy them in such volume or at the premium they currently do.

Today, around 30% of U.S. Treasury securities are held by foreign governments or investors. That percentage will likely go down as more countries build their own capital markets and invest domestically. 47

More leaders should pay attention to America’s snowballing debt. There’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded GDP and led to periods of austerity and stagnation. A high-debt America would also be one where it’s much harder to fight inflation since monetary policymakers could not raise rates without dramatically adding to an already unsustainable debt-servicing bill.

But is a debt crisis inevitable? No.

While fiscal discipline can help tame debt on the margins, it will be very difficult (both politically and mathematically) to raise taxes or cut spending at the level America would need to dramatically reduce the debt. But there is another way out beyond taxing or cutting, and that’s growth. If U.S. GDP grows at an average of 3% (in real, not nominal terms) over the next five years, that would keep the country’s debt-to-GDP ratio at 120% – high, but reasonable.

I should be clear: 3% growth is a very tall order, especially given the country’s aging workforce. It will require policymakers to shift their focus. We can’t see debt as a problem that can be solved only through taxing and spending cuts anymore. Instead, America’s debt efforts have to center around pro-growth policies , which include tapping the capital markets to build one of the best catalysts for growth: Infrastructure. Especially energy infrastructure.

Energy pragmatism

Roads. Bridges. Ports. Airports. Cell towers. The infrastructure sector contains multitudes, but the multitude where BlackRock sees arguably the greatest demand for new investment is energy infrastructure.

Why energy? Two things are happening in the sector at the same time.

The first is the “energy transition.” It’s a mega force, a major economic trend being driven by nations representing 90% of the world’s GDP. 48 With wind and solar power now cheaper in many places than fossil-fuel-generated electricity, these countries are increasingly installing renewables. 49 It’s also a major way to address climate change. This shift – or energy transition – has created a ripple effect in the markets, creating both risks and opportunities for investors, including BlackRock’s clients.

I started writing about the transition in 2020. Since then, the issue has become more contentious in the U.S. But outside the debate, much is still the same. People are still investing heavily in decarbonization. In Europe, for example, net-zero remains a top investment priority for most of BlackRock’s clients. 50 But now the demand for clean energy is being amplified by something else: A focus on energy security.

Governments have been pursuing energy security since the oil crisis of the 1970s, (and probably as far back as the early Industrial Revolution), so this is not a new trend. In fact, when I wrote my original 2020 letter about sustainability, I also wrote to our clients that countries would still need to produce oil and gas to meet their energy needs.

To be energy secure, I wrote, most parts of the globe would need “to rely on hydrocarbons for a number of years.” 51

I’m hearing more leaders talk about decarbonization and energy security together under the joint banner of what you might call “energy pragmatism.”