Monopolistic Competition – definition, diagram and examples

Definition: Monopolistic competition is a market structure which combines elements of monopoly and competitive markets. Essentially a monopolistic competitive market is one with freedom of entry and exit, but firms can differentiate their products. Therefore, they have an inelastic demand curve and so they can set prices. However, because there is freedom of entry, supernormal profits will encourage more firms to enter the market leading to normal profits in the long term.

A monopolistic competitive industry has the following features:

- Many firms.

- Freedom of entry and exit.

- Firms produce differentiated products.

- Firms have price inelastic demand; they are price makers because the good is highly differentiated

- Firms make normal profits in the long run but could make supernormal profits in the short term

- Firms are allocatively and productively inefficient.

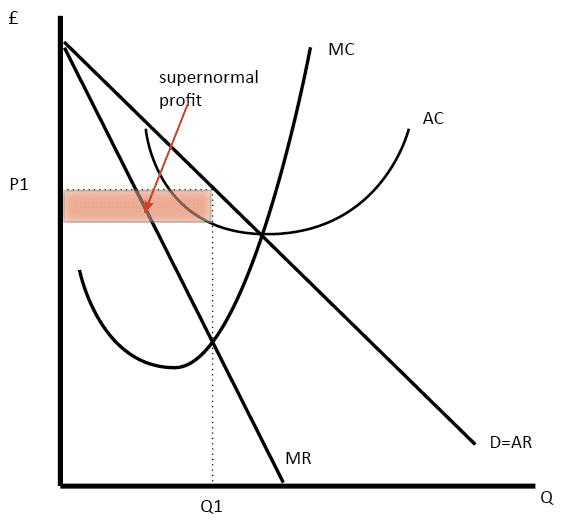

Diagram monopolistic competition short run

The firm maximises profit where MR=MC. This is at output Q1 and price P1, leading to supernormal profit

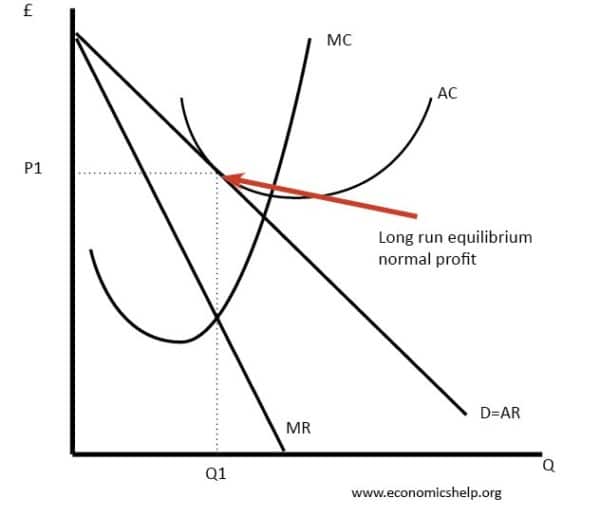

Monopolistic competition long run

In the long-run, supernormal profit encourages new firms to enter. This reduces demand for existing firms and leads to normal profit. I

Efficiency of firms in monopolistic competition

- Allocative inefficient. The above diagrams show a price set above marginal cost

- Productive inefficiency. The above diagram shows a firm not producing on the lowest point of AC curve

- Dynamic efficiency. This is possible as firms have profit to invest in research and development.

- X-efficiency. This is possible as the firm does face competitive pressures to cut cost and provide better products.

Examples of monopolistic competition

- Restaurants – restaurants compete on quality of food as much as price. Product differentiation is a key element of the business. There are relatively low barriers to entry in setting up a new restaurant.

- Hairdressers. A service which will give firms a reputation for the quality of their hair-cutting.

- Clothing. Designer label clothes are about the brand and product differentiation

- TV programmes – globalisation has increased the diversity of tv programmes from networks around the world. Consumers can choose between domestic channels but also imports from other countries and new services, such as Netflix.

Limitations of the model of monopolistic competition

- Some firms will be better at brand differentiation and therefore, in the real world, they will be able to make supernormal profit.

- New firms will not be seen as a close substitute.

- There is considerable overlap with oligopoly – except the model of monopolistic competition assumes no barriers to entry. In the real world, there are likely to be at least some barriers to entry

- If a firm has strong brand loyalty and product differentiation – this itself becomes a barrier to entry. A new firm can’t easily capture the brand loyalty.

- Many industries, we may describe as monopolistically competitive are very profitable, so the assumption of normal profits is too simplistic.

Key difference with monopoly

In monopolistic competition there are no barriers to entry. Therefore in long run, the market will be competitive, with firms making normal profit.

Key difference with perfect competition

In Monopolistic competition, firms do produce differentiated products, therefore, they are not price takers (perfectly elastic demand). They have inelastic demand.

New trade theory and monopolistic competition

New trade theory places importance on the model of monopolistic competition for explaining trends in trade patterns. New trade theory suggests that a key element of product development is the drive for product differentiation – creating strong brands and new features for products. Therefore, specialisation doesn’t need to be based on traditional theories of comparative advantage, but we can have countries both importing and exporting the same good. For example, we import Italian fashion labels and export British fashion labels. To consumers, the importance is the choice of goods.

Readers Question : if all firms in a monopolistic competitive industry were to merge would that firm produce as many different brands or just one brand?

Interesting question. I think it is an open-ended question with many different possibilities. One approach is to think how firms in different industries may behave if they did merge. Bearing in mind the model of monopolistic competition doesn’t always stand up to scrutiny too well in the real world.

If the firms merged together, there is no certainty how they would behave.

In some industries, it makes sense to have many differentiated brands creating an illusion of competition and providing a barrier to entry.

How many soap powders are there? About 35. But, most of these brands are owned by two companies, Unilever and Proctor and Gamble. Having brand proliferation means it is harder for a new firm to enter the market. This is because a new firm would have to compete against 30 established brands as opposed to 2. There is less chance of getting a good market share with so many brands. Therefore the new firm would have an incentive to keep different brands to deter competitors.

However, if you have merge different brands there may be economies of scale. You can devote more resources and investment to improving that particular product and maximising its efficiency. This might be appropriate for an industry like computer software or computers. There used to be many different brands of computers until the pc came to dominate.

Are the different brands catering to different sectors of the market. If you take the restaurant business, there is a big difference between Chinese and Indian. If 2 restaurants merge, they would be better off retaining distinct business. It would make no sense to have a restaurant which offered a mixture of Chinese/Indian – consumers would trust it less.

If you fear the arrival of a powerful company, it might be good to consolidate your brands. For example, there are many small search engines, but they would be better off combining forces to compete against the mighty Google.

43 thoughts on “Monopolistic Competition – definition, diagram and examples”

Was requesting for economic restrictions for monopolistic competition

All great actions and thoughts have a negligible beginning.

I work hard, I insist, I will succeed

Thanks a lot sir you explain easily the topic and this is very helpful for me

it was helpful kindly send some more important information to my gmail, will appreciate

why is not possible for monopoly to exist to a large extent in agriculture?

hello sir, Could you please tell me that which theme you uses ?

Explain the dertemination of the optimal price and output combination in a monopolistic competition.use the resulting equilibrium to illustrate the statement that ‘production inefficient is a necessary price to pay for product variety’ comment on this statement (25)

hi, how is a monopolistic competition different from monopoly? thanks

In monopolistic competition there are no barriers to entry. Theoretically, if firms have no barriers to entry or exit, there will be mass competition as everyone wants to get a piece of the super normal profit. If this happens, there will be decreased demand for a specific product or service, as theres more substitue goods. leading to firms in monopolistic competition acheiving normal profit in the long run. Whereas with monopolies, the low competition means they control supply, without the threat of competition offering more supply to boost market cap and sales, leading to them being able to keep demand constant and acheive supernormal profits in both the long and short run.

Monopoly cannot exist in large extent in agriculture because the Monopoly you are talking about is short run

I’m happy to have learnt something new

Comments are closed.

- Search Search Please fill out this field.

What Is Monopolistic Competition?

- How It Works

- Characteristics

- Pros and Cons

- Monopolistic Competition FAQs

The Bottom Line

Monopolistic competition: definition, how it works, pros and cons.

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Monopolistic competition exists when many companies offer competing products or services that are similar, but not perfect, substitutes.

The barriers to entry in a monopolistic competitive industry are low, and the decisions of any one firm do not directly affect its competitors. The competing companies differentiate themselves based on pricing and marketing decisions.

Key Takeaways

- Monopolistic competition occurs when many companies offer products that are similar but not identical.

- Firms in monopolistic competition differentiate their products through pricing and marketing strategies.

- Barriers to entry, or the costs or other obstacles that prevent new competitors from entering an industry, are low in monopolistic competition.

Investopedia / Joules Garcia

Understanding Monopolistic Competition

Monopolistic competition exists between a monopoly and perfect competition , combines elements of each, and includes companies with similar, but not identical, product offerings.

Restaurants, hair salons, household items, and clothing are examples of industries with monopolistic competition. Items like dish soap or hamburgers are sold, marketed, and priced by many competing companies.

Demand is highly elastic for goods and services of the competing companies and pricing is often a key strategy for these competitors. One company may opt to lower prices and sacrifice a higher profit margin , hoping for higher sales. Another may raise its price and use packaging or marketing that suggests better quality or sophistication.

Companies often use distinct marketing strategies and branding to distinguish their products. Because the products all serve the same purpose, the average consumer often does not know the precise differences between the various products, or how to determine what a fair price may be.

Characteristics of Monopolistic Competition

Low barriers to entry.

In monopolistic competition, one firm does not monopolize the market and multiple companies can enter the market and all can compete for a market share. Companies do not need to consider how their decisions influence competitors so each firm can operate without fear of raising competition.

Product Differentiation

Competing companies differentiate their similar products with distinct marketing strategies, brand names, and different quality levels.

Companies in monopolistic competition act as price makers and set prices for goods and services. Firms in monopolistic competition can raise or lower prices without inciting a price war, often found in oligopolies .

Demand Elasticity

Demand is highly elastic in monopolistic competition and very responsive to price changes. Consumers will change from one brand name to another for items like laundry detergent based solely on price increases.

Advantages and Disadvantages of Monopolistic Competition

Monopolistic competition provides both benefits and pitfalls for companies and consumers.

Few barriers to entry for new companies

Variety of choices for consumers

Company decision-making power for prices and marketing

Consistent quality of product for consumers

Many competitors limits access to economies of scale

Inefficient company spending on marketing, packaging and advertising

Too many choices for consumers means extra research for consumers

Misleading advertising or imperfect information for consumers

What Is the Difference Between Monopolistic Competition and Perfect Competition?

In perfect competition, the product offered by competitors is the same item. If one competitor increases its price, it will lose all of its market share to the other companies based on market supply and demand forces, where prices are not set by companies and sellers accept the pricing determined by market activity.

In monopolistic competition, supply and demand forces do not dictate pricing. Firms are selling similar, yet distinct products, so firms determine the pricing. Product differentiation is the key feature of monopolistic competition, where products are marketed by quality or brand. Demand is highly elastic, and any change in pricing can cause demand to shift from one competitor to another.

How Does Monopolistic Competition Function in the Short Term and Long Term?

Companies aim to produce a quantity where marginal revenue equals marginal cost to maximize profit or minimize losses. When existing firms are making a profit, new firms will enter the market. The demand curve and the marginal revenue curve shift and new firms stop entering when all firms are making zero profit in the long run. If existing firms are incurring a loss, some firms will exit the market. The firms stop exiting the market until all firms start making zero profit. The market is at equilibrium in the long run only when there is no further exit or entry in the market or when all firms make zero profit in the long run.

What Industry Is an Example of Monopolistic Competition?

Monopolistic competition is present in restaurants like Burger King and McDonald's. Both are fast food chains that target a similar market and offer similar products and services. These two companies are actively competing with one another, and seek to differentiate themselves through brand recognition, price, and by offering different food and drink packages.

What Is the Difference Between Monopolistic Competition and a Monopoly?

A monopoly is when a single company dominates an industry and can set prices for its product without fear of competition. Monopolies limit consumer choices and control production quantity and quality. Monopolistic competitive companies must compete with others, restricting their ability to substantially raise prices without affecting demand and providing a range of product choices for consumers. Monopolistic competition is more common than monopolies, which are discouraged in free-market nations.

Monopolistic competition exists when many companies offer competitive products or services that are similar, but not exact, substitutes. Hair salons and clothing are examples of industries with monopolistic competition. Pricing and marketing are key strategies for competing companies and often rely on branding or discount pricing strategies to increase market share.

- Antitrust Laws: What They Are, How They Work, Major Examples 1 of 24

- Understanding Antitrust Laws 2 of 24

- Federal Trade Commission (FTC): What It Is and What It Does 3 of 24

- Clayton Antitrust Act of 1914: History, Amendments, Significance 4 of 24

- Sherman Antitrust Act: Definition, History, and What It Does 5 of 24

- Robinson-Patman Act Definition and Criticisms 6 of 24

- How and Why Companies Become Monopolies 7 of 24

- Discriminating Monopoly: Definition, How It Works, and Example 8 of 24

- What Is Price Discrimination, and How Does It Work? 9 of 24

- Predatory Pricing: Definition, Example, and Why It's Used 10 of 24

- Bid Rigging: Examples and FAQs About the Illegal Practice 11 of 24

- Price Maker: Overview, Examples, Laws Governing and FAQ 12 of 24

- What Is a Cartel? Definition, Examples, and Legality 13 of 24

- Monopolistic Markets: Characteristics, History, and Effects 14 of 24

- Monopolistic Competition: Definition, How it Works, Pros and Cons 15 of 24

- What Are the Characteristics of a Monopolistic Market? 16 of 24

- Monopolistic Market vs. Perfect Competition: What's the Difference? 17 of 24

- What are Some Examples of Monopolistic Markets? 18 of 24

- A History of U.S. Monopolies 19 of 24

- What Are the Most Famous Monopolies? 20 of 24

- Monopoly vs. Oligopoly: What's the Difference? 21 of 24

- Oligopoly: Meaning and Characteristics in a Market 22 of 24

- Duopoly: Definition in Economics, Types, and Examples 23 of 24

- Oligopolies: Some Current Examples 24 of 24

:max_bytes(150000):strip_icc():format(webp)/Term-Definitions_monopoly-fa34a19571eb4168876f3a6947aa1a6f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

10.1 Monopolistic Competition

Learning objectives.

By the end of this section, you will be able to:

- Explain the significance of differentiated products

- Describe how a monopolistic competitor chooses price and quantity

- Discuss entry, exit, and efficiency as they pertain to monopolistic competition

- Analyze how advertising can impact monopolistic competition

Monopolistic competition involves many firms competing against each other, but selling products that are distinctive in some way. Examples include stores that sell different styles of clothing; restaurants or grocery stores that sell a variety of food; and even products like golf balls or beer that may be at least somewhat similar but differ in public perception because of advertising and brand names. There are over 600,000 restaurants in the United States. When products are distinctive, each firm has a mini-monopoly on its particular style or flavor or brand name. However, firms producing such products must also compete with other styles and flavors and brand names. The term “monopolistic competition” captures this mixture of mini-monopoly and tough competition, and the following Clear It Up feature introduces its derivation.

Clear It Up

Who invented the theory of imperfect competition.

Two economists independently but simultaneously developed the theory of imperfect competition in 1933. The first was Edward Chamberlin of Harvard University who published The Economics of Monopolistic Competition . The second was Joan Robinson of Cambridge University who published The Economics of Imperfect Competition . Robinson subsequently became interested in macroeconomics and she became a prominent Keynesian, and later a post-Keynesian economist. (See the Welcome to Economics! and The Keynesian Perspective chapters for more on Keynes.)

Differentiated Products

A firm can try to make its products different from those of its competitors in several ways: physical aspects of the product, location from which it sells the product, intangible aspects of the product, and perceptions of the product. We call products that are distinctive in one of these ways differentiated products .

Physical aspects of a product include all the phrases you hear in advertisements: unbreakable bottle, nonstick surface, freezer-to-microwave, non-shrink, extra spicy, newly redesigned for your comfort. A firm's location can also create a difference between producers. For example, a gas station located at a heavily traveled intersection can probably sell more gas, because more cars drive by that corner. A supplier to an automobile manufacturer may find that it is an advantage to locate close to the car factory.

Intangible aspects can differentiate a product, too. Some intangible aspects may be promises like a guarantee of satisfaction or money back, a reputation for high quality, services like free delivery, or offering a loan to purchase the product. Finally, product differentiation may occur in the minds of buyers. For example, many people could not tell the difference in taste between common varieties of ketchup or mayonnaise if they were blindfolded but, because of past habits and advertising, they have strong preferences for certain brands. Advertising can play a role in shaping these intangible preferences.

The concept of differentiated products is closely related to the degree of variety that is available. If everyone in the economy wore only blue jeans, ate only white bread, and drank only tap water, then the markets for clothing, food, and drink would be much closer to perfectly competitive. The variety of styles, flavors, locations, and characteristics creates product differentiation and monopolistic competition.

Perceived Demand for a Monopolistic Competitor

A monopolistically competitive firm perceives a demand for its goods that is an intermediate case between monopoly and competition. Figure 10.2 offers a reminder that the demand curve that a perfectly competitive firm faces is perfectly elastic or flat, because the perfectly competitive firm can sell any quantity it wishes at the prevailing market price . In contrast, the demand curve, as faced by a monopolist, is the market demand curve, since a monopolist is the only firm in the market, and hence is downward sloping.

The demand curve as a monopolistic competitor faces is not flat, but rather downward-sloping, which means that the monopolistic competitor can raise its price without losing all of its customers or lower the price and gain more customers. Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than that of a monopoly where there are no close substitutes. If a monopolist raises its price, some consumers will choose not to purchase its product—but they will then need to buy a completely different product. However, when a monopolistic competitor raises its price, some consumers will choose not to purchase the product at all, but others will choose to buy a similar product from another firm. If a monopolistic competitor raises its price, it will not lose as many customers as would a perfectly competitive firm, but it will lose more customers than would a monopoly that raised its prices.

At a glance, the demand curves that a monopoly and a monopolistic competitor face look similar—that is, they both slope down. However, the underlying economic meaning of these perceived demand curves is different, because a monopolist faces the market demand curve and a monopolistic competitor does not. Rather, a monopolistically competitive firm’s demand curve is but one of many firms that make up the “before” market demand curve. Are you following? If so, how would you categorize the market for golf balls? Take a swing, then see the following Clear It Up feature.

Are golf balls really differentiated products?

Monopolistic competition refers to an industry that has more than a few firms, each offering a product which, from the consumer’s perspective, is different from its competitors. The U.S. Golf Association runs a laboratory that tests 20,000 golf balls a year. There are strict rules for what makes a golf ball legal. A ball's weight cannot exceed 1.620 ounces and its diameter cannot be less than 1.680 inches (which is a weight of 45.93 grams and a diameter of 42.67 millimeters, in case you were wondering). The Association also tests the balls by hitting them at different speeds. For example, the distance test involves having a mechanical golfer hit the ball with a titanium driver and a swing speed of 120 miles per hour. As the testing center explains: “The USGA system then uses an array of sensors that accurately measure the flight of a golf ball during a short, indoor trajectory from a ball launcher. From this flight data, a computer calculates the lift and drag forces that are generated by the speed, spin, and dimple pattern of the ball. ... The distance limit is 317 yards.”

Over 1800 golf balls made by more than 100 companies meet the USGA standards. The balls do differ in various ways, such as the pattern of dimples on the ball, the types of plastic on the cover and in the cores, and other factors. Since all balls need to conform to the USGA tests, they are much more alike than different. In other words, golf ball manufacturers are monopolistically competitive.

However, retail sales of golf balls are about $500 million per year, which means that many large companies have a powerful incentive to persuade players that golf balls are highly differentiated and that it makes a huge difference which one you choose. Sure, Tiger Woods can tell the difference. For the average amateur golfer who plays a few times a summer—and who loses many golf balls to the woods and lake and needs to buy new ones—most golf balls are pretty much indistinguishable.

How a Monopolistic Competitor Chooses Price and Quantity

The monopolistically competitive firm decides on its profit-maximizing quantity and price in much the same way as a monopolist. A monopolistic competitor, like a monopolist, faces a downward-sloping demand curve, and so it will choose some combination of price and quantity along its perceived demand curve.

As an example of a profit-maximizing monopolistic competitor, consider the Authentic Chinese Pizza store, which serves pizza with cheese, sweet and sour sauce, and your choice of vegetables and meats. Although Authentic Chinese Pizza must compete against other pizza businesses and restaurants, it has a differentiated product. The firm’s perceived demand curve is downward sloping, as Figure 10.3 shows and the first two columns of Table 10.1 .

We can multiply the combinations of price and quantity at each point on the demand curve to calculate the total revenue that the firm would receive, which is in the third column of Table 10.1 . We calculate marginal revenue, in the fourth column, as the change in total revenue divided by the change in quantity. The final columns of Table 10.1 show total cost, marginal cost, and average cost. As always, we calculate marginal cost by dividing the change in total cost by the change in quantity, while we calculate average cost by dividing total cost by quantity. The following Work It Out feature shows how these firms calculate how much of their products to supply at what price.

Work It Out

How a monopolistic competitor determines how much to produce and at what price.

The process by which a monopolistic competitor chooses its profit-maximizing quantity and price resembles closely how a monopoly makes these decisions process. First, the firm selects the profit-maximizing quantity to produce. Then the firm decides what price to charge for that quantity.

Step 1. The monopolistic competitor determines its profit-maximizing level of output. In this case, the Authentic Chinese Pizza company will determine the profit-maximizing quantity to produce by considering its marginal revenues and marginal costs. Two scenarios are possible:

- If the firm is producing at a quantity of output where marginal revenue exceeds marginal cost, then the firm should keep expanding production, because each marginal unit is adding to profit by bringing in more revenue than its cost. In this way, the firm will produce up to the quantity where MR = MC.

- If the firm is producing at a quantity where marginal costs exceed marginal revenue, then each marginal unit is costing more than the revenue it brings in, and the firm will increase its profits by reducing the quantity of output until MR = MC.

In this example, MR and MC intersect at a quantity of 40, which is the profit-maximizing level of output for the firm.

Step 2. The monopolistic competitor decides what price to charge. When the firm has determined its profit-maximizing quantity of output, it can then look to its perceived demand curve to find out what it can charge for that quantity of output. On the graph, we show this process as a vertical line reaching up through the profit-maximizing quantity until it hits the firm’s perceived demand curve. For Authentic Chinese Pizza, it should charge a price of $16 per pizza for a quantity of 40.

Once the firm has chosen price and quantity, it’s in a position to calculate total revenue, total cost, and profit. At a quantity of 40, the price of $16 lies above the average cost curve, so the firm is making economic profits. From Table 10.1 we can see that, at an output of 40, the firm’s total revenue is $640 and its total cost is $580, so profits are $60. In Figure 10.3 , the firm’s total revenues are the rectangle with the quantity of 40 on the horizontal axis and the price of $16 on the vertical axis. The firm’s total costs are the light shaded rectangle with the same quantity of 40 on the horizontal axis but the average cost of $14.50 on the vertical axis. Profits are total revenues minus total costs, which is the shaded area above the average cost curve.

Although the process by which a monopolistic competitor makes decisions about quantity and price is similar to the way in which a monopolist makes such decisions, two differences are worth remembering. First, although both a monopolist and a monopolistic competitor face downward-sloping demand curves, the monopolist’s perceived demand curve is the market demand curve, while the perceived demand curve for a monopolistic competitor is based on the extent of its product differentiation and how many competitors it faces. Second, a monopolist is surrounded by barriers to entry and need not fear entry, but a monopolistic competitor who earns profits must expect the entry of firms with similar, but differentiated, products.

Monopolistic Competitors and Entry

If one monopolistic competitor earns positive economic profits, other firms will be tempted to enter the market. A gas station with a great location must worry that other gas stations might open across the street or down the road—and perhaps the new gas stations will sell coffee or have a carwash or some other attraction to lure customers. A successful restaurant with a unique barbecue sauce must be concerned that other restaurants will try to copy the sauce or offer their own unique recipes. A laundry detergent with a great reputation for quality must take note that other competitors may seek to build their own reputations.

The entry of other firms into the same general market (like gas, restaurants, or detergent) shifts the demand curve that a monopolistically competitive firm faces. As more firms enter the market, the quantity demanded at a given price for any particular firm will decline, and the firm’s perceived demand curve will shift to the left. As a firm’s perceived demand curve shifts to the left, its marginal revenue curve will shift to the left, too. The shift in marginal revenue will change the profit-maximizing quantity that the firm chooses to produce, since marginal revenue will then equal marginal cost at a lower quantity.

Figure 10.4 (a) shows a situation in which a monopolistic competitor was earning a profit with its original perceived demand curve (D 0 ). The intersection of the marginal revenue curve (MR 0 ) and marginal cost curve (MC) occurs at point S, corresponding to quantity Q 0 , which is associated on the demand curve at point T with price P 0 . The combination of price P 0 and quantity Q 0 lies above the average cost curve, which shows that the firm is earning positive economic profits.

Unlike a monopoly, with its high barriers to entry, a monopolistically competitive firm with positive economic profits will attract competition. When another competitor enters the market, the original firm’s perceived demand curve shifts to the left, from D 0 to D 1 , and the associated marginal revenue curve shifts from MR 0 to MR 1 . The new profit-maximizing output is Q 1 , because the intersection of the MR 1 and MC now occurs at point U. Moving vertically up from that quantity on the new demand curve, the optimal price is at P 1 .

As long as the firm is earning positive economic profits, new competitors will continue to enter the market, reducing the original firm’s demand and marginal revenue curves. The long-run equilibrium is in the figure at point Y, where the firm’s perceived demand curve touches the average cost curve. When price is equal to average cost, economic profits are zero. Thus, although a monopolistically competitive firm may earn positive economic profits in the short term, the process of new entry will drive down economic profits to zero in the long run. Remember that zero economic profit is not equivalent to zero accounting profit . A zero economic profit means the firm’s accounting profit is equal to what its resources could earn in their next best use. Figure 10.4 (b) shows the reverse situation, where a monopolistically competitive firm is originally losing money. The adjustment to long-run equilibrium is analogous to the previous example. The economic losses lead to firms exiting, which will result in increased demand for this particular firm, and consequently lower losses. Firms exit up to the point where there are no more losses in this market, for example when the demand curve touches the average cost curve, as in point Z.

Monopolistic competitors can make an economic profit or loss in the short run, but in the long run, entry and exit will drive these firms toward a zero economic profit outcome. However, the zero economic profit outcome in monopolistic competition looks different from the zero economic profit outcome in perfect competition in several ways relating both to efficiency and to variety in the market.

Monopolistic Competition and Efficiency

The long-term result of entry and exit in a perfectly competitive market is that all firms end up selling at the price level determined by the lowest point on the average cost curve. This outcome is why perfect competition displays productive efficiency : goods are produced at the lowest possible average cost. However, in monopolistic competition, the end result of entry and exit is that firms end up with a price that lies on the downward-sloping portion of the average cost curve, not at the very bottom of the AC curve. Thus, monopolistic competition will not be productively efficient.

In a perfectly competitive market, each firm produces at a quantity where price is set equal to marginal cost, both in the short and long run. This outcome is why perfect competition displays allocative efficiency: the social benefits of additional production, as measured by the marginal benefit, which is the same as the price, equal the marginal costs to society of that production. In a monopolistically competitive market, the rule for maximizing profit is to set MR = MC—and price is higher than marginal revenue, not equal to it because the demand curve is downward sloping. When P > MC, which is the outcome in a monopolistically competitive market, the benefits to society of providing additional quantity, as measured by the price that people are willing to pay, exceed the marginal costs to society of producing those units. A monopolistically competitive firm does not produce more, which means that society loses the net benefit of those extra units. This is the same argument we made about monopoly, but in this case the allocative inefficiency will be smaller. Thus, a monopolistically competitive industry will produce a lower quantity of a good and charge a higher price for it than would a perfectly competitive industry. See the following Clear It Up feature for more detail on the impact of demand shifts.

Why does a shift in perceived demand cause a shift in marginal revenue?

We use the combinations of price and quantity at each point on a firm’s perceived demand curve to calculate total revenue for each combination of price and quantity. We then use this information on total revenue to calculate marginal revenue, which is the change in total revenue divided by the change in quantity. A change in perceived demand will change total revenue at every quantity of output and in turn, the change in total revenue will shift marginal revenue at each quantity of output. Thus, when entry occurs in a monopolistically competitive industry, the perceived demand curve for each firm will shift to the left, because a smaller quantity will be demanded at any given price. Another way of interpreting this shift in demand is to notice that, for each quantity sold, the firm will charge a lower price. Consequently, the marginal revenue will be lower for each quantity sold—and the marginal revenue curve will shift to the left as well. Conversely, exit causes the perceived demand curve for a monopolistically competitive firm to shift to the right and the corresponding marginal revenue curve to shift right, too.

A monopolistically competitive industry does not display productive or allocative efficiency in either the short run, when firms are making economic profits and losses, nor in the long run, when firms are earning zero profits.

The Benefits of Variety and Product Differentiation

Even though monopolistic competition does not provide productive efficiency or allocative efficiency, it does have benefits of its own. Product differentiation is based on variety and innovation. Most people would prefer to live in an economy with many kinds of clothes, foods, and car styles; not in a world of perfect competition where everyone will always wear blue jeans and white shirts, eat only spaghetti with plain red sauce, and drive an identical model of car. Most people would prefer to live in an economy where firms are struggling to figure out ways of attracting customers by methods like friendlier service, free delivery, guarantees of quality, variations on existing products, and a better shopping experience.

Economists have struggled, with only partial success, to address the question of whether a market-oriented economy produces the optimal amount of variety. Critics of market-oriented economies argue that society does not really need dozens of different athletic shoes or breakfast cereals or automobiles. They argue that much of the cost of creating such a high degree of product differentiation, and then of advertising and marketing this differentiation, is socially wasteful—that is, most people would be just as happy with a smaller range of differentiated products produced and sold at a lower price. Defenders of a market-oriented economy respond that if people do not want to buy differentiated products or highly advertised brand names, no one is forcing them to do so. Moreover, they argue that consumers benefit substantially when firms seek short-term profits by providing differentiated products. This controversy may never be fully resolved, in part because deciding on the optimal amount of variety is very difficult, and in part because the two sides often place different values on what variety means for consumers. Read the following Clear It Up feature for a discussion on the role that advertising plays in monopolistic competition.

How does advertising impact monopolistic competition?

The U.S. economy spent about $180.12 billion on advertising in 2014, according to eMarketer.com. Roughly one third of this was television advertising, and another third was divided roughly equally between internet, newspapers, and radio. The remaining third was divided between direct mail, magazines, telephone directory yellow pages, and billboards. Mobile devices are increasing the opportunities for advertisers.

Advertising is all about explaining to people, or making people believe, that the products of one firm are differentiated from another firm's products. In the framework of monopolistic competition, there are two ways to conceive of how advertising works: either advertising causes a firm’s perceived demand curve to become more inelastic (that is, it causes the perceived demand curve to become steeper); or advertising causes demand for the firm’s product to increase (that is, it causes the firm’s perceived demand curve to shift to the right). In either case, a successful advertising campaign may allow a firm to sell either a greater quantity or to charge a higher price, or both, and thus increase its profits.

However, economists and business owners have also long suspected that much of the advertising may only offset other advertising. Economist A. C. Pigou wrote the following back in 1920 in his book, The Economics of Welfare :

It may happen that expenditures on advertisement made by competing monopolists [that is, what we now call monopolistic competitors] will simply neutralise one another, and leave the industrial position exactly as it would have been if neither had expended anything. For, clearly, if each of two rivals makes equal efforts to attract the favour of the public away from the other, the total result is the same as it would have been if neither had made any effort at all.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Authors: Steven A. Greenlaw, David Shapiro, Daniel MacDonald

- Publisher/website: OpenStax

- Book title: Principles of Economics 3e

- Publication date: Dec 14, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Section URL: https://openstax.org/books/principles-economics-3e/pages/10-1-monopolistic-competition

© Jan 23, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Chapter 10. Monopolistic Competition and Oligopoly

Introduction to Monopolistic Competition and Oligopoly

The Temptation to Defy the Law

Laundry detergent and bags of ice—products of industries that seem pretty mundane, maybe even boring. Hardly! Both have been the center of clandestine meetings and secret deals worthy of a spy novel. In France, between 1997 and 2004, the top four laundry detergent producers (Proctor & Gamble, Henkel, Unilever, and Colgate-Palmolive) controlled about 90 percent of the French soap market. Officials from the soap firms were meeting secretly, in out-of-the-way, small cafés around Paris. Their goals: Stamp out competition and set prices.

Around the same time, the top five Midwest ice makers (Home City Ice, Lang Ice, Tinley Ice, Sisler’s Dairy, and Products of Ohio) had similar goals in mind when they secretly agreed to divide up the bagged ice market.

If both groups could meet their goals, it would enable each to act as though they were a single firm—in essence, a monopoly—and enjoy monopoly-size profits. The problem? In many parts of the world, including the European Union and the United States, it is illegal for firms to divide up markets and set prices collaboratively.

These two cases provide examples of markets that are characterized neither as perfect competition nor monopoly. Instead, these firms are competing in market structures that lie between the extremes of monopoly and perfect competition. How do they behave? Why do they exist? We will revisit this case later, to find out what happened.

Chapter Objectives

In this chapter, you will learn about:

- Monopolistic Competition

Perfect competition and monopoly are at opposite ends of the competition spectrum. A perfectly competitive market has many firms selling identical products, who all act as price takers in the face of the competition. If you recall, price takers are firms that have no market power. They simply have to take the market price as given.

Monopoly arises when a single firm sells a product for which there are no close substitutes. Microsoft, for instance, has been considered a monopoly because of its domination of the operating systems market.

What about the vast majority of real world firms and organizations that fall between these extremes, firms that could be described as imperfectly competitive ? What determines their behavior? They have more influence over the price they charge than perfectly competitive firms, but not as much as a monopoly would. What will they do?

One type of imperfectly competitive market is called monopolistic competition . Monopolistically competitive markets feature a large number of competing firms, but the products that they sell are not identical. Consider, as an example, the Mall of America in Minnesota, the largest shopping mall in the United States. In 2010, the Mall of America had 24 stores that sold women’s “ready-to-wear” clothing (like Ann Taylor and Urban Outfitters), another 50 stores that sold clothing for both men and women (like Banana Republic, J. Crew, and Nordstrom’s), plus 14 more stores that sold women’s specialty clothing (like Motherhood Maternity and Victoria’s Secret). Most of the markets that consumers encounter at the retail level are monopolistically competitive.

The other type of imperfectly competitive market is oligopoly . Oligopolistic markets are those dominated by a small number of firms. Commercial aircraft provides a good example: Boeing and Airbus each produce slightly less than 50% of the large commercial aircraft in the world. Another example is the U.S. soft drink industry, which is dominated by Coca-Cola and Pepsi. Oligopolies are characterized by high barriers to entry with firms choosing output, pricing, and other decisions strategically based on the decisions of the other firms in the market. In this chapter, we first explore how monopolistically competitive firms will choose their profit-maximizing level of output. We will then discuss oligopolistic firms, which face two conflicting temptations: to collaborate as if they were a single monopoly, or to individually compete to gain profits by expanding output levels and cutting prices. Oligopolistic markets and firms can also take on elements of monopoly and of perfect competition.

Principles of Economics Copyright © 2016 by Rice University is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Essay on Monopolistic Competition

This term paper investigates the economic theory of monopolistic competition and its applicability to the modern business environment. In the study, monopolistic competition and its effects on a variety of industries—including technology, healthcare, and retail—are examined in three news items. The literature review contrasts and compares the writers’ viewpoints and provides significant facts, figures, and statistics to support the conclusions. The concerns discussed in the articles are examined using economic theory and concepts in the discussion section. The main findings and suggestions for decision-makers, companies, and consumers are outlined in the decision.

Monopolistic Competition

Monopolistic competition is a market structure where many firms compete by selling differentiated products. Each firm has some degree of market power, which allows them to charge higher prices than in a perfectly competitive market. Monopolistic competition can lead to product innovation but also lead to higher costs, reduced consumer welfare, and market inefficiencies. Hence, the need to examine the implications of monopolistic competition in various industries, including technology, healthcare, and retail.

Literature Review

Nick Dearden’s article “Breaking Corporate Monopolies: A Prerequisite for Democracy’s Survival” delves into the perils of corporate monopolies and their detrimental effects on democratic systems. The author posits that consolidating economic power among a select group of corporations and individuals harms democratic procedures and intensifies disparities in social and economic realms. Dearden illustrates the technology sector, wherein a few corporations, including Facebook, Google, and Amazon, hold a dominant position in the market and exercise significant control over extensive quantities of data and information. The author posits that the unregulated authority of these entities presents a potential hazard to personal privacy, freedom of expression, and democratic engagement and advocates for more robust antitrust policies to dismantle these monopolistic structures (Dearden, 2023). The article additionally examines the function of monopolies in sustaining environmental deterioration, labor exploitation, and the consolidation of wealth and authority. According to Dearden, addressing these concerns will necessitate a fundamental reorganization of the economy that prioritizes social justice, public goods, and democratic control (Dearden, 2023). Dearden’s article underscores the pressing necessity of mitigating the adverse effects of corporate monopolies on democratic processes and advocates for increased governmental intervention to foster competition and safeguard the public welfare.

According to the second article, “Pfizer and Moderna Hike Prices for COVID-19 Vaccines in EU Deals,” Pfizer and Moderna recently increased the cost of their COVID-19 vaccines. According to the article’s citations of industry experts, the pharmaceutical sector is characterized by monopolistic competition, with a few significant companies controlling the market for necessary medications and vaccines. According to the paper, the high pricing of COVID-19 vaccinations results from pharmaceutical companies’ monopolistic market position and a lack of industry competition. In particular, the COVID-19 pandemic is used to show the issue of monopolistic competition in the pharmaceutical sector. Data cited by the author demonstrates that Pfizer and Moderna increased the cost of their COVID-19 vaccines in recent agreements with the European Union, even though these vaccines were created with public monies and are crucial for containing the pandemic (Paolo et al., 2021). The article indicates that pharmaceutical companies’ market dominance, which has a substantial amount of control over the pricing of necessary medications and vaccinations, is partially to blame for the high prices of COVID-19 vaccines. According to the report, several variables contribute to this market power, such as the high costs of medication development and regulatory barriers to entry for new businesses. The article also mentions how, especially in poor nations, a lack of competition in the pharmaceutical sector can result in higher prices and restricted access to necessary medicines and vaccinations (Paolo et al., 2021). In order to encourage competition in the market, the article recommends that legislators increase financing for public research, lower regulatory barriers to entry for new businesses, and enact price restrictions on necessary medications and vaccines.

The article comprehensively analyzes the theory and empirical evidence pertaining to monopolistic competition. The article examines the genesis of the notion, its fundamental characteristics, and its ramifications for market results, including pricing, gains, and well-being. The article provides an overview of the empirical evidence about the incidence and ramifications of monopolistic competition in diverse sectors such as healthcare, technology, and retail. The article concludes that monopolistic competition can yield varying economic efficiency and welfare effects, contingent upon particular market conditions and policy interventions. The article thoroughly analyzes monopolistic competition and its impact on market results. The author emphasizes that monopolistic competition represents a market structure characterized by imperfect competition, wherein firms can differentiate their products and encounter demand curves that slope downwards (Leonhardt, 2018). The ability of firms to exercise market power and set prices above their marginal costs results in increased profitability. The author posits that monopolistic competition may engender heightened innovation and product diversity, conferring consumer advantages. This article reviews empirical evidence of monopolistic competition across industries. Retailers can differentiate their products by location and service quality. In the healthcare sector, healthcare providers such as hospitals and physicians may distinguish their offerings by emphasizing their quality and reputation. Companies can distinguish their offerings within the technology sector by incorporating unique features and compatibility measures. The article posits that the incidence of monopolistic competition within these sectors has the potential to result in augmented prices and profits. However, it may also prove advantageous for consumers by fostering more incredible innovation and a more comprehensive range of products (Leonhardt, 2018). The article additionally examines the function of policy interventions in overseeing monopolistic competition. According to the author, implementing antitrust policies and regulations can promote competition and deter market power exploitation by dominant entities. The author advises policymakers to exercise caution to avoid impeding innovation and product differentiation, as these factors can benefit consumers.

The three news items about monopolistic competition can be analyzed using various economic theories. Market power—the ability of enterprises to affect pricing, output, and other market outcomes—can be used first. Due to product differentiation and branding, monopolistic corporations have some market strength, yet they compete with other firms making comparable but not identical items. Market power can be enormous in industries with a few dominating enterprises, like electronics and pharmaceuticals, resulting in higher pricing, lesser output, and lower customer welfare. Second, market structure theory can compare perfect competition, monopolistic competition, oligopoly, and monopoly. Perfect competition has many tiny enterprises making identical items, no market power, and no entrance or exit restrictions. Monopolistic competition is characterized by several enterprises producing differentiated products, some barriers to entry and departure, and some market dominance. Oligopoly is characterized by a few dominating enterprises producing similar or identical items with high entry and exit barriers and market dominance. Finally, a monopoly is a single firm with market strength, a unique product, and high entry and exit obstacles. Third, we can assess monopolistic competition’s welfare effects using consumer surplus. Consumer surplus is the gap between consumers’ maximum price for a product and their actual price. In perfect competition, firms charge the marginal cost of production, and consumers gain from the competition, maximizing consumer surplus. Monopolistic competition reduces consumer surplus because companies overcharge over marginal cost, giving consumers fewer choices and inferior quality.

Dearden claims that concentrating wealth and power in a few significant businesses distorts market competition stifles innovation, reduces customer choice, and increases inequality. In economics, “monopoly power” occurs when one or more enterprises dominate the market and set pricing and output. The second paper discusses pharmaceutical market dominance and COVID-19 vaccine costs. The paper implies that Pfizer and Moderna can charge exorbitant prices and limit access to critical pharmaceuticals and vaccines due to a lack of competition and regulation (Paolo et al., 2021). Price limits, compulsory licensing, and other policies can make vital medications and vaccinations inexpensive, especially during public health emergencies. The third paper examines monopolistic competition and market outcomes theoretically and empirically. Depending on market conditions and regulatory interventions, monopolistic competition can boost economic efficiency and welfare. Research and development subsidies, consumer protection legislation, and regulatory monitoring can help policymakers balance product differentiation and innovation with limited competition and higher prices.

To sum it up, the three articles demonstrate that monopolistic competition is relevant in today’s economy: market concentration and lack of competition in technology, healthcare, and retail hurt consumers. According to theory and research, monopolistic competition can improve or harm welfare depending on market conditions and regulatory interventions. To improve financial results, policymakers, firms, and consumers should be aware of the effects of monopolistic competition and endeavor to promote competition, protect consumers, and regulate market dominance.

Dearden, N. (2023). Breaking corporate monopolies is the only way to save democracy. Open Democracy . https://www.opendemocracy.net/en/oureconomy/corporate-monopolies-are-threat-to-democracy-public-interest/

Leonhardt, D. (2018). The Monopolization of America. The New York Times . https://www.nytimes.com/2018/11/25/opinion/monopolies-in-the-us.html

Paolo, D., Kuchler, H., Khan, M. (2021). Pfizer and Moderna raise EU Covid vaccine prices. FINANCIAL TIMES . https://www.ft.com/content/d415a01e-d065-44a9-bad4-f9235aa04c1a

Cite This Work

To export a reference to this article please select a referencing style below:

Related Essays

A framework for an industry supported destination marketing information system, management information and hr data, navigating communication concepts in the digital age, case study on walt disney company, self-analysis paper, new technologies in the field of business, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

1.5 Monopolistic Competition, Oligopoly, and Monopoly

Learning objective.

- Describe monopolistic competition, oligopoly, and monopoly.

Economists have identified four types of competition— perfect competition , monopolistic competition , oligopoly , and monopoly . Perfect competition was discussed in the last section; we’ll cover the remaining three types of competition here.

Monopolistic Competition

In monopolistic competition , we still have many sellers (as we had under perfect competition). Now, however, they don’t sell identical products. Instead, they sell differentiated products—products that differ somewhat, or are perceived to differ, even though they serve a similar purpose. Products can be differentiated in a number of ways, including quality, style, convenience, location, and brand name. Some people prefer Coke over Pepsi, even though the two products are quite similar. But what if there was a substantial price difference between the two? In that case, buyers could be persuaded to switch from one to the other. Thus, if Coke has a big promotional sale at a supermarket chain, some Pepsi drinkers might switch (at least temporarily).

How is product differentiation accomplished? Sometimes, it’s simply geographical; you probably buy gasoline at the station closest to your home regardless of the brand. At other times, perceived differences between products are promoted by advertising designed to convince consumers that one product is different from another—and better than it. Regardless of customer loyalty to a product, however, if its price goes too high, the seller will lose business to a competitor. Under monopolistic competition, therefore, companies have only limited control over price.

Oligopoly means few sellers. In an oligopolistic market, each seller supplies a large portion of all the products sold in the marketplace. In addition, because the cost of starting a business in an oligopolistic industry is usually high, the number of firms entering it is low.

Companies in oligopolistic industries include such large-scale enterprises as automobile companies and airlines. As large firms supplying a sizable portion of a market, these companies have some control over the prices they charge. But there’s a catch: because products are fairly similar, when one company lowers prices, others are often forced to follow suit to remain competitive. You see this practice all the time in the airline industry: When American Airlines announces a fare decrease, Continental, United Airlines, and others do likewise. When one automaker offers a special deal, its competitors usually come up with similar promotions.

In terms of the number of sellers and degree of competition, monopolies lie at the opposite end of the spectrum from perfect competition. In perfect competition, there are many small companies, none of which can control prices; they simply accept the market price determined by supply and demand. In a monopoly , however, there’s only one seller in the market. The market could be a geographical area, such as a city or a regional area, and doesn’t necessarily have to be an entire country.

There are few monopolies in the United States because the government limits them. Most fall into one of two categories: natural and legal . Natural monopolies include public utilities, such as electricity and gas suppliers. Such enterprises require huge investments, and it would be inefficient to duplicate the products that they provide. They inhibit competition, but they’re legal because they’re important to society. In exchange for the right to conduct business without competition, they’re regulated. For instance, they can’t charge whatever prices they want, but they must adhere to government-controlled prices. As a rule, they’re required to serve all customers, even if doing so isn’t cost efficient.

A legal monopoly arises when a company receives a patent giving it exclusive use of an invented product or process. Patents are issued for a limited time, generally twenty years (United States Patent and Trademark Office, 2006). During this period, other companies can’t use the invented product or process without permission from the patent holder. Patents allow companies a certain period to recover the heavy costs of researching and developing products and technologies. A classic example of a company that enjoyed a patent-based legal monopoly is Polaroid, which for years held exclusive ownership of instant-film technology (Bellis, 2006). Polaroid priced the product high enough to recoup, over time, the high cost of bringing it to market. Without competition, in other words, it enjoyed a monopolistic position in regard to pricing.

Key Takeaways

- There are four types of competition in a free market system: perfect competition, monopolistic competition, oligopoly, and monopoly.

- Under monopolistic competition , many sellers offer differentiated products—products that differ slightly but serve similar purposes. By making consumers aware of product differences, sellers exert some control over price.

- In an oligopoly , a few sellers supply a sizable portion of products in the market. They exert some control over price, but because their products are similar, when one company lowers prices, the others follow.

- In a monopoly , there is only one seller in the market. The market could be a geographical area, such as a city or a regional area, and does not necessarily have to be an entire country. The single seller is able to control prices.

- Most monopolies fall into one of two categories: natural and legal .

- Natural monopolies include public utilities, such as electricity and gas suppliers. They inhibit competition, but they’re legal because they’re important to society.

- A legal monopoly arises when a company receives a patent giving it exclusive use of an invented product or process for a limited time, generally twenty years.

Identify the four types of competition, explain the differences among them, and provide two examples of each. (Use examples different from those given in the text.)

Bellis, M., “Inventors-Edwin Land-Polaroid Photography-Instant Photography/Patents,” April 15, 2006, http://inventors.about.com/library/inventors/blpolaroid.htm (accessed January 21, 2012).

United States Patent and Trademark Office, General Information Concerning Patents , April 15, 2006, http://www.uspto.gov/web/offices/pac/doc/general/index.html#laws (accessed January 21, 2012).

Exploring Business Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

Essay on Monopolistic Competition | Markets | Economics

In this essay we will discuss about:- 1. Meaning of Monopolistic Competition 2. Features of Monopolistic Competition 3. Price Output Determination 4. Selling Costs.

Essay on Monopolistic Competition

Essay # 1. meaning of monopolistic competition:.

Economists found that perfect competition and pure monopoly were unrealistic market situations. The actual market situations are somewhere between perfect competition and pure monopoly. The theory of Monopolistic Competition was first propounded and popularised by an American economist E. H. Chamberlin. Sometimes monopolist competition is termed as Imperfect Competition also.

Now let us understand the meaning of monopolistic competition. As Stonier and Hague put, “It means the large group or firms making very similar products. Here there is keen but not perfect competition between many firms making very similar products (products are not homogeneous as in perfect competition or remote substitutes as in monopoly, but they are differentiated)”.

ADVERTISEMENTS:

In the words of Dominick Salvatore, “Monopolistic competition refers to the market organisation in which there are many firms selling closely related but identical commodities.”

Thus monopolistic competition refers to the market situation in which many firms producing differentiated products (closely related but no identical products) compete with each other for the sale of their products.

So, monopolistic competition is a market situation with some elements of pure competition and some elements of pure monopoly. This explains the essential nature of monopolistic competition. It is competition between a large numbers of firms, each of them enjoying a measure of monopoly power. That is why; monopolistic competition is sometimes described as “Polypoly.”

Essay # 2. Features of Monopolistic Competition :

(i) Many Sellers:

There are large numbers of firms producing commodity in the market. Large number here implies that there are so many firms that the activities of one firm have no perceptible effect on the other firms in the industry. Each firm controls a very small or negligible share of the total output of the industry. The competitive element results from the fact that there are many firms in the market.

(ii) Freedom of Entry or Exit:

Every firm is free to enter into the industry and come out from the industry as and when it wishes.

(iii) Product Differentiation:

Product differentiation is the most important feature of a monopolistic competition market. Under monopolistic competition products of different firm are neither completely homogeneous as in perfect competition nor entirely distinct as in monopoly.

Here each firm produces a products that is somewhat different from the products of its competitors, but it is not entirely distinct, it is very close to the products of other firms. Products of two or more firms are not exact substitutes but also are not entirely different. They are each other’s close substitutes.

But each firm is known for its own product, which has some distinction. For its product, the firm is a monopolist. But because of close substitutes, it faces competition with other firms. In fact, absence of differentiation would mean pure competition and perfect differentiation would mean pure monopoly. Partial differentiation, therefore, defines the nature of monopolistic competition.

There might, for example, be a large number of competing firms producing different brands of soap, all similar but by no means identical products. Each soap would differ in physical composition from competing soaps; it would also have different packing, and as the advertisers-say, a different ‘brand image,’ from its competitors.

Thus, products may be differentiated in many ways, e.g. by changing in brand name, trademark, design, packing, colour, size, weight, measurement, etc. We are giving some examples of product differentiation below so that the term could be understood more clearly.

—Cycle-Atlas, Estern Star, Hind, Hero, A-One etc.

—Sewing Machines-Usha, Luxmi, Singer, etc.

—Cigarettes-Wills, Gold Flake, Bristol, Taj, etc.

—Soap-Lux, Rexona, Hamam, Jai, Lifebouy, Pears, etc.

—Tea-Brooke Bond, Lipton, Modies, Tata, etc.

We can find a number of examples of such differentiated products. Cross elasticity of demand between such commodities is very high.

(iv) Each Firm is a Monopolist for its Product:

Every firm has a monopoly over the production of its product i.e., no other firm can manufacture the product of this brand name. For instance no firm other that the Atlas Cycle Company can manufacture Atlas Cycle or no firm other than Hindustan Lever can manufacture Lux toilet soap.

(v) Consumer Exhibits Market Preference:

In this market situation a consumer exhibits market preference for a particular product in the market. For instance, some consumers prefer Brooke Bond tea while others prefer Lipton.

Those who prefer a particular product would like to purchase it at even somewhat higher price.

(vi) Selling Costs:

Selling costs have an important place in this market. Every firm seeks to modify consumers’ preferences through advertisements and salesmanship. This gives rise to what is called selling costs. Thus there is non-price competition among firms under monopolistic competition.

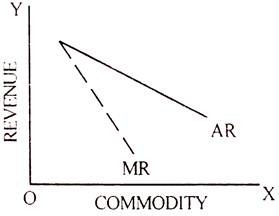

(vii) Independent Price Policy and Downward Sloping of AR-MR Curves:

A firm under monopolistic competition can have an independent price policy. It is price maker for its product. Hence the AR and MR curves facing a firm under monopolistic competition will be downward sloping similar to the monopoly.

But there is an important difference between the AR curves under monopoly and monopolistic competition. The AR curve under monopolistic competition is somewhat flatter than in the monopoly.

AR and MR curves of a firm under monopolistic competition are illustrated in the diagram:

StudyCorgi . (2022) 'Oligopoly and Monopolistic Competition'. 16 February.

1. StudyCorgi . "Oligopoly and Monopolistic Competition." February 16, 2022. https://studycorgi.com/oligopoly-and-monopolistic-competition/.

Bibliography

StudyCorgi . "Oligopoly and Monopolistic Competition." February 16, 2022. https://studycorgi.com/oligopoly-and-monopolistic-competition/.

StudyCorgi . 2022. "Oligopoly and Monopolistic Competition." February 16, 2022. https://studycorgi.com/oligopoly-and-monopolistic-competition/.

This paper, “Oligopoly and Monopolistic Competition”, was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.

Before publication, the StudyCorgi editorial team proofread and checked the paper to make sure it meets the highest standards in terms of grammar, punctuation, style, fact accuracy, copyright issues, and inclusive language. Last updated: February 16, 2022 .

If you are the author of this paper and no longer wish to have it published on StudyCorgi, request the removal . Please use the “ Donate your paper ” form to submit an essay.

68 Monopolistic Competition Essay Topic Ideas & Examples

🏆 best monopolistic competition topic ideas & essay examples, 📌 good research topics about monopolistic competition, 🔎 interesting topics to write about monopolistic competition.

- Role of Advertising in Monopolistic Competition and Oligopoly Advertising The goal of product differentiation and advertising in monopolistic competition is to make sure the the market is under control, and as a result, charge a higher price.

- Market Structures: Monopolistic Competition According to Mankiw, a monopolistic competition market structure is characterized by the presence of numerous small firms, each being relatively small in comparison to the overall market size. We will write a custom essay specifically for you by our professional experts 808 writers online Learn More

- Oligopoly Market and Monopolistic Competition The market price falls until the firms in the market start to make economic losses. In the long-run, the economic losses make the firms to exit the market.

- Monopolistic Competition of Smart Phones In the flurry of the responses that followed, there was concern whether the smart phone market was becoming monopolistic. This was a clear indication that the competition in the smart phone market was becoming monopolistic.

- Non-Price Competition in Monopoly and Oligopoly As such, it is overbearing that the digital company apply the unsurpassed strategies for the notebook in an effort of maximizing its revenue as well as enjoying pure monopoly.

- Monopolistic Competition as a Market Structure However, due to the fact that each of the firms has a slightly unique product compared to the rest of the firms, then each firm has a specific consumer and hence each of the firms […]

- Monopolistic Competition Practical Observation Regarding the design, Dove used the traditional for the company logo and color pallet with the additional images of the colorful-packaged chocolates included in the bag.

- Monopolistic Competition Aspects Products aimed at higher end consumers usually have a brighter and higher quality packaging and are placed on the shelves in the eye of the consumer.

- Price Control and Monopolistic Competition According to Charles Stein when the supply is limited and demand increases the prices rise and people are ready to pay more than these tickets really cost. There is a certain rule in the rise […]

- The Concept of Monopolistic Competition The operators are also free to set the prices of their products irrespective of the competitors’ moves or reaction as the competition is based on non-price related factors. This is simply because they are felt […]

- Monopolistic Competitive Firms This attracts new firms into the market in the long run given that the monopolistic market barriers to entry are low, firms have good knowledge of the market and there is an opportunity for the […]

- Monopoly Pricing Strategies in Case of Competition When it comes to a monopoly, the managers should offer a pricing strategy based on establishing the highest possible price that a company can propose with no engagement in price gouging.

- Night Club Monopoly Competition in the UK The operations in this model are that a recent monopoly will continue enjoying the supernormal profits in the short run. This occurs in the long run after the entry of a new similar but differentiated […]

- Microeconomics: Competition and Monopoly The following is a review of an example of an organisation in Maryland operating in a pure competition market and one in a pure monopoly market.

- Price Discrimination and Monopolistic Competition According to Varian, the competitive market is characterised by a large number of firms that deal identical products and this aspect limits a firm’s ability to exploit the consumers by selling the product at a […]

- Oligopolies and Monopolistic Competition The consumer segment is involved in selling its products while the industrial segment is involved in the production. It is however notable that the two companies that would be involved in the acquisition is McCormick […]

- Pure Competition vs. Monopolistic Competition Number of participants firms In a pure competitive market structure, the buyer does not have any effect on the price level of goods in the market.

- Monopolistic Competition It is important to understand the nature of competition and the competition that exists within the marketplace for the sake of businessmen and consumers.

- Tariff Reductions, Trade Patterns, and the Wage Gap in a Monopolistic Competition Model with Vertical Linkages

- Fiscal Policy, Distortionary Taxation, and Direct Crowding Out Under Monopolistic Competition

- Primary Inputs Supply, Government Size, and Welfare in the Presence of Monopolistic Competition

- Monopolistic Competition and International Trade: Reconsidering the Evidence

- Factor-Augmenting Technology Choice and Monopolistic Competition

- The Gains from Trade with Monopolistic Competition: Specification, Estimation, and Mis-Specification

- Monopolistic and Oligopolistic Competition: Theory and Examples

- Fiscal Stimulus and Endogenous Firm Entry in a Monopolistic Competition – Macroeconomic Model

- Auditing Internal Transfer Prices in Multinationals Under Monopolistic Competition

- Generalized Comparative Statics Under Monopolistic Competition: Anti-competitive Paradox, Immiserizing Growth, Catastrophes

- International Outsourcing Under Monopolistic Competition: Winners and Losers

- Economic Distributions and Primitive Distributions in Monopolistic Competition

- Preferences, Welfare, and Desirable Subsidies Under Monopolistic Competition

- The Generalized Gravity Equation, Monopolistic Competition, and the Factor-Proportions Theory in International Trade

- Market Structures: Monopoly, Monopsony, Oligopoly, Monopolistic Competition