Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

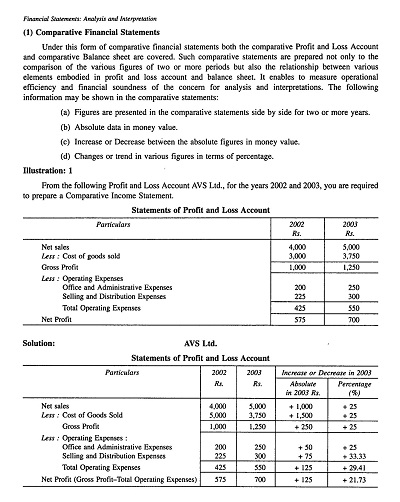

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

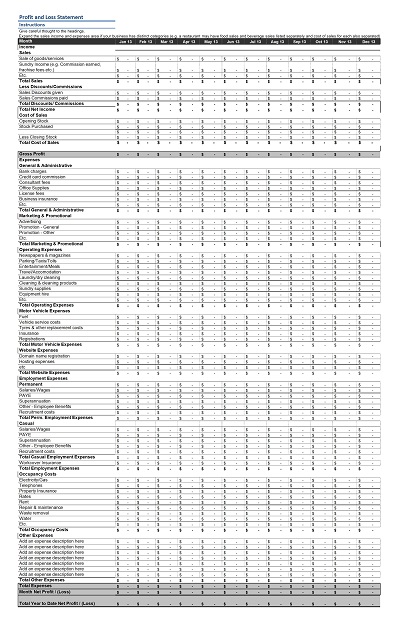

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

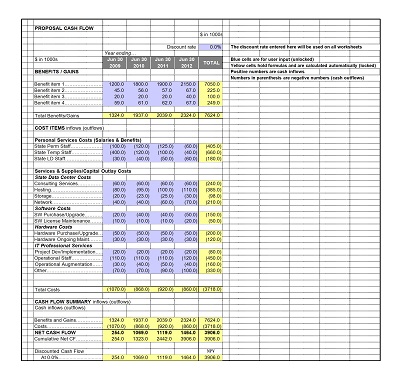

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

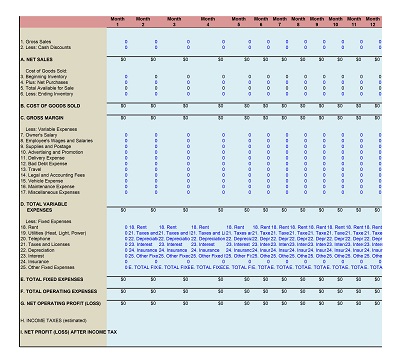

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

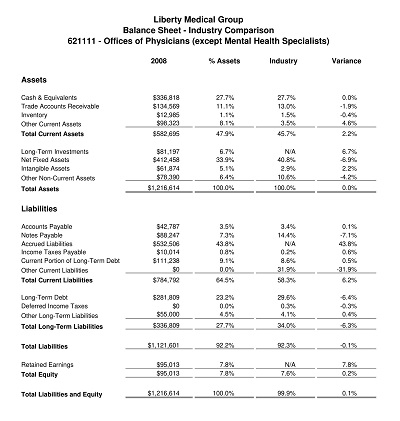

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

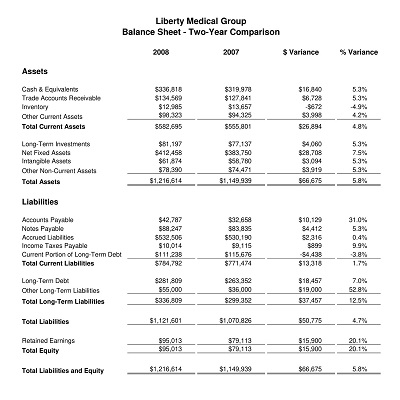

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

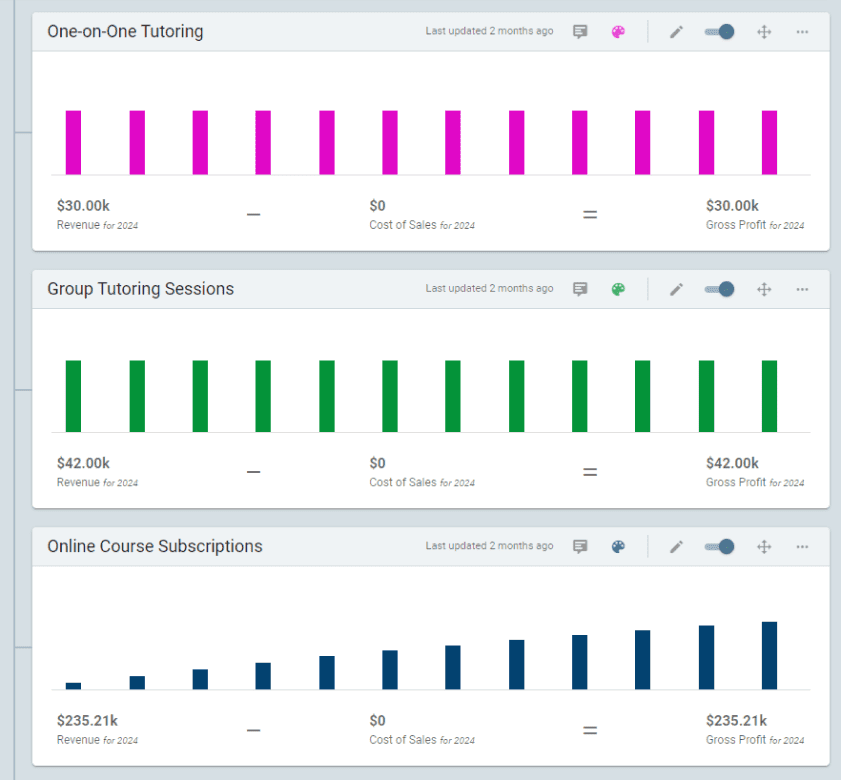

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

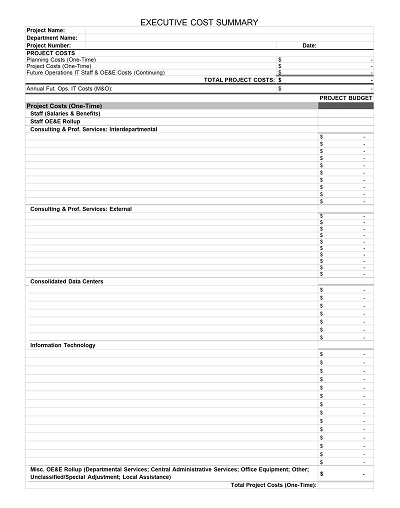

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

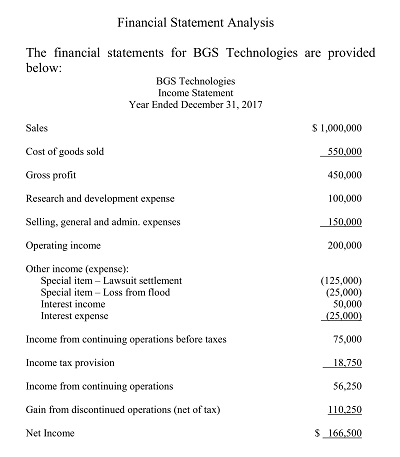

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Financial Templates for Your Business Plan

Income statement, balance sheet, cash flow, and more, use the financial statements template to prepare what you need for your business plan..

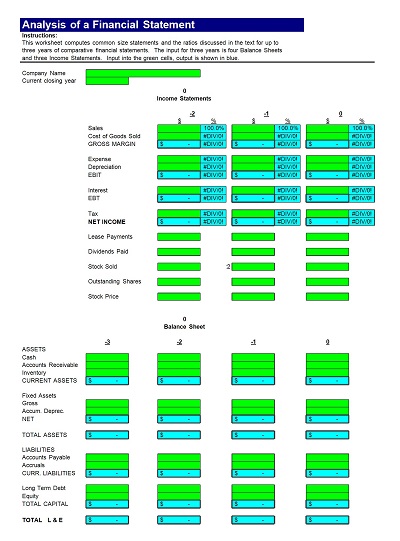

The financial statements template for each of the major financials will help you create exactly what you need for your business plan. The links in the left column will help you find exactly which financial statements template you need.

The financial projections of your business plan are very important to investors, lenders, and to you too of course! Yet, many new business owners struggle to understand how to create a pro-forma or projected income statement, statement of cash flow and balance sheet. That’s okay! In this section, you’ll learn what each of these financial statements is about, how they are different, and what they include. If you have some background in accounting or finance, the sections below will give you great guidance on what to include in your business plan and how to present it.

Included in this Section

- Income Statement

- Balance Sheet

- Sources and Uses of Funds

If you are a future business owner without any accounting background, you’ll learn the basics of each type of financial statement so that when you reach for outside help, you won’t be in the dark. Better still, by reading the information below, you’ll gain the confidence to discuss your financial statements with a lender, banker or investor. When making a loan or investment, bankers will want to know that you understand the basics of financial statements. The information, guidelines, examples and templates in the sections below will make sure that you do.

Click any section title in the left column for a detailed description and complete overview of what should be included, mistakes to avoid, and important considerations.

Your business plan needs to include a pro-forma balance sheet, income statement, and cash flow statement. The term “pro-forma” means projected or forecast. Most future business owners who do not have experience with financial statements seek outside help to complete this part of their plan. Whether you plan to prepare your own financials or get outside help, this section is intended to make sure that you know what to include and that you will be well prepared to discuss your financial statements with a banker or investor.

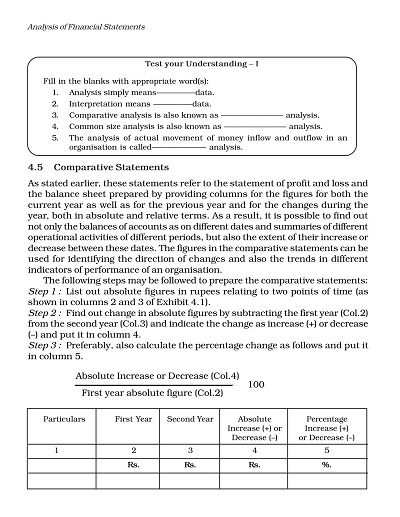

When working on how to prepare a balance sheet , income statement and statement of cash flow, plan to prepare quarterly projections for year 1, and yearly projections for years 2-3. Some investors or bankers will expect 5 year projections but that is not as common for startup businesses. If you’re new to financial statements, here is a brief definition of each type:

Income Statement: Also known as a profit and loss statement. Shows the company’s revenue, expenses, and profit or loss. Key formula: Total Revenue – Total Expenses = Profit or Loss. This is an important financial statement that you should learn to work with very carefully–it tells you how your business is doing each month. Our financial statements template for profit and loss will help you learn the key concepts.

Balance Sheet: This financial statement template will help you show the value of the company’s assets, liabilities and owner’s equity. Key equation: Assets = Liabilities + Owner’s Equity. Additionally, when creating your sample balance sheet , understand that this is the only financial statement that applies to a single point in time. It is a “snapshot” at a given point in time, unlike the other financial statements that show activity throughout a period of time. A small business balance sheet should include assets such as: cash, accounts receivable, and inventory.

Statement of Cash Flow: The statement of cash flow financial statement template maps inflows and outflows of cash. Sales and profit alone don’t tell the whole story. It’s important to know when money will come in and when money will be going out.

There are several key questions to be answered by this section of the plan. Lenders will want to know if the business will be able to repay the loan they are seeking. Investors will want to see if the longer-term growth trends represent a good investment for them. Both lenders and investors will want to see that the business is sufficiently capitalized so that it doesn’t run out of money, and how fast the business can reach break-even and become profitable.

Business Plan Outline for Financials:

- 3-Year Pro-Forma Income Statement

- Balance Sheet at the end of Years 1, 2 and 3

- 3-Year Pro-Forma Statement of Cash Flow

- Capitalization (Sources and Uses of Funds)

Important Considerations

Historical financial statements are different from those presented in a business plan. Historical financial statements report on a business’s actual financial performance and are used, in part, to prepare income taxes. They must take into account tax laws regarding depreciation, revenue recognition and other matters. While the financial statements for a business plan must be thorough, they are used for different purposes and require a different level of detail.

There are two overarching considerations for your pro-forma financial statements: First, they must match what you say in your business plan. Everything referenced in the text of the business plan must be included in the financial statements. For example, if the business plan says that there will be 15 people on the payroll at the end of the first year, the payroll section of the income statement must show the payroll expense for 15 people at month 12. If your marketing section says there will be an advertising blitz just prior to the holidays, then the marketing expense line of your income statement must reflect that. Everything must match up.

The second overarching consideration for your financial projections is, “How reasonable are your expectations?” Since nobody knows if your forecasts are accurate, you will need to emphasize how reasonable they are. Here are three examples of trouble signs from financial statements from business plans we have reviewed (critiques are shown in italics):

- A company was applying for a business loan from a bank. The income statement forecasted that the business would still be losing money in three years. It was not reasonable to expect a bank to lend money to this business when the financial statements projected they would not be able to repay the loan.

- A start-up was forecasting that their revenue would go from $0 to over $1 billion in 3 years, with an investment of just $250,000. This revenue forecast was not realistic. Not even Google grew that fast in its first three years.

- A business plan showed profit margins of 50% when the industry average for their type of business was 15%. The profit margins are not reasonable. An experienced lender or investor would recognize that this person either did not have a good handle on operations costs or pricing, or both.

For more information or the specific financial statements template you need, see the specific sections on the Balance Sheet , Income Statement or Cash Flow Statement . Or, for a different perspective, see the Wikipedia page on the financial statements template which you can find here .

Ready to complete your business plan in just 1 day?

Click GET STARTED to learn more about our fill-in-the-blank business plan template. We'll step you through all the details you need to develop a professional business plan in just one day!

Successfully used by thousands of people starting a business and writing a business plan. It will work for you too!

- Product Overview

- Create documents

- Sign documents securely

- Track & Monitor documents

- Collaborate

- Store & Organize

- Quote, Sell & Pay

- PandaDoc VS

- eSignatures

- All use cases

- Enterprise Scale

- Teams and Departments

- Individuals

- Customer stories

- Explore all content

- PandaDoc Q&A

- Help center

- Developer center

- HubSpot CRM

- All integrations

- Sales integrations

- CRM integrations

- Payment integrations

Business plan templates

From competitive analysis to financial projections, business plans give your new business a roadmap for success. Download one of our free business plan templates and take your company to the next level.

Big Data Startup Business Plan Template

Create a professional Big Data Startup business plan with our customizable Startup Business Plan Template.

Virtual Assistant Business Plan

Strategize your way to success with this customizable AI virtual assistant business plan template.

Virtual Reality (VR) Business Plan

Our free virtual reality (VR) business plan helps you customize your document and create a winning strategy to land investors.

Get unlimited eSignatures

Create, manage, and eSign documents for only $19 per month.

No credit card required

Laundromat Business Plan

Create your success roadmap with a laundromat business plan template, designed to arrange the essentials of the laundry business.

5-Year Business Plan Template

Empower your path to long-term success with our 5-year business plan template.

Car Wash Business Plan Template

Launch and grow your car wash business with our customizable plan template.

Airbnb Business Plan Template

Unlock your path to success with our Airbnb business plan template, made to guide you in structuring the fundamental aspects of your Airbnb business.

Clothing Line Business Plan

Use this free and customizable clothing line business plan to appeal to investors and set up your fashion brand.

Gym Business Plan Template

The Panda tips in this gym business plan template guide you through the process of researching and presenting information necessary to secure funding and partners for your business.

Handyman Business Plan Template

Start a new handyman business using a well-researched handyman business plan template to meet your goals faster.

Vending Machine Business Plan Template

If you’re starting a new vending machine business, a well-rounded vending machine business plan can improve your chances of success.

Bar Business Plan Template

Create your path to success with our bar business plan template, designed as a valuable tool to help entrepreneurs organize the bar business.

Massage Therapy Business Plan

This massage therapy business plan template helps you cover the basics of starting or expanding a massage business.

Bed and Breakfast Business Plan Template

Use a complete bed and breakfast business plan template to set up your business for growth and success.

Catering Business Plan

Chart your path to success with our catering business plan template designed to help entrepreneurs organize their catering business.

Event Venue Business Plan Template

Launch and grow your event venue with our customizable business plan template.

Event Planning Business Plan

Prepare your event planning business for success with our ready-to-fill and easily downloadable event planning business plan template.

Rental Property Business Plan

Develop a rental property business plan tailored to serve as a valuable resource for entrepreneurs to organize their rental business.

Coaching Business Plan Template

If you want to grow your new or existing coaching business, use our free coaching business plan template as a roadmap to success.

Lawn Care Business Plan

Use a comprehensive lawn care business plan template that includes guidance and all critical information.

T-shirt Business Plan Template

Craft a winning T-shirt business plan in a structured business format that attracts investors and funding.

Candle-Making Business Plan Template

Use a candle-making business plan template to get together all of the information you need to ensure that your candle business succeeds.

SBA Business Plan Template

Use our free and fully customizable SBA business plan template to get started when writing a successful proposal for an SBA loan.

Cleaning Business Plan Template

Discover a hassle-free way to document a roadmap for your cleaning business with this free business plan template.

Real Estate Business Plan Template

Start off your new real estate business on the right foot by using a real estate business plan template to ensure your goals, visions, and finances are sorted.

Trucking Business Plan Template

Empower your journey to success with our trucking business plan template, designed as a valuable tool to organize the essentials of your trucking business.

Food Truck Business Plan Template

Find a fully customizable, free food truck business plan template that helps you create an effective proposal for interested investors.

Simple Business Plan Template

This simple business plan template walks you through the stages of establishing a successful business or seeking funding.

Solar Farm Business Plan

Give your solar farm business the best start by creating a professional business plan to keep your company on the right track.

Ecommerce Business Plan Template

This Ecommerce Business Plan Template is tailored particularly to e-commerce companies, and all you require to do is add the elements related to your business.

Accounting Firm Business Plan

Use this Accounting Firm Business Plan to achieve your goals. Accounting firms are comparable to other industries and need the Business Plan to help their development.

Campground Business Plan Template

This PandaDoc Campground Business Plan Template has all the essential information to help you develop a successful business strategy.

Firewood Business Plan

This Firewood Business Plan Template perfectly outlines the company structure of a probable firewood venture. It highlights the budgets needed to start and manage the unique business.

Funeral Home Business Plan

A Funeral Home Business Plan covers detailed data on the courtesies offered by the company, market analysis, administration strategies, personnel procedures, budget and financing plans, and other applicable topics.

Community Center Business Plan

You can use this Community Center Business Plan Template, it is perfect for anyone desiring to open and run a society center. It gives the center’s owner an outline of areas that must be disseminated with the investors to earn an acquisition.

Gas Station Business Plan

Take the first step towards success in the fuel industry with our professionally crafted Gas Station Business Plan template.

Beauty Supply Store Business Plan

This Beauty Supply Store Business Plan Template covers all the appropriate sections needed to invest in a beauty supply store. The template will help you to raise money for your business.

Flower Shop Business Plan Template

The Flower Shop Business Plan Template is organized to help you achieve the awareness of various investors to invest in your company.

Electrical Contractor Business Plan

This Electrical Contractor Business Plan template include information about the services you offer, who your target consumers are, why they should prefer you over your opponents and how much capital you require to get started.

Car Dealership Business Plan

A Car Dealership Business Plan is a detailed plan that will help you take your business to the next level. Use this template to create your plan.

Farm Business Plan

Farm Business Plan gives an overview of the company, including corporation history, owner backgrounds, creations and more. Use this template to quickly develop your farm company plan.

Consultant Business Plan Template

An example of a document outlining your strategy for launching or expanding your consulting firm is a Consultant Business Plan Template. The essential elements include a summary of the company, team, sector, rivals, target audience, and an operations and marketing strategy.

Construction Company Business Plan

The objectives and tactics of a construction company are described in a business plan for a construction company. For the creation of your business plan, use this Construction Company Business Plan Template.

Fashion Business Plan Template

Structural and action plans for a fashion firm are laid out in the fashion business plan template.

Daycare Business Plan

The creation of a business strategy is the first step in starting a daycare. Use this Daycare Business Plan Template to describe your company’s objectives, as well as your target market, potential rivals, and your financing strategy.

Convenience Store Business Plan

Do you need a Convenience Store Business Plan Template? This plan includes all the details and information needed to secure funding for a convenience store.

Startup Business Plan Template

We offer you the steps and the tools to create a fantastic business plan. Attract investors with this sleek and free startup business plan template.

Business Plan Template

This business plan template is a great tool for your startup to customize to reflect your strong qualifications, experienced team, and marketable business idea.

What is a business plan?

A business plan is a document that helps small business owners determine the viability of their business idea. Combining market research and financial analysis, a professional business plan helps startup CEOs and potential investors determine if the company can compete in the target market.

Typically, a good business plan consists of the following:

- Executive summary

- Company description

- Mission statement

- Product and services

- Marketing plan

- Operations plan

- Management organization

- Financial plan

- Conclusion & appendix

Every section involved in a business plan is designed to help startup businesses reach their target market.

A business plan asks founders and entrepreneurs to detail their business strategy in a step-by-step process that makes sense from an operational perspective. This is essential if a startup is seeking a business loan or an investment from a venture capital firm.

However, even small businesses that are already economically viable can benefit from creating a business plan, since it encourages business owners and their management teams to examine their business model and reevaluate the best ways to reach their target customers.

Should I use a business plan template?

Yes. If you’ve never written one, a business plan can be challenging to write.

Creating a successful plan that you can use to grow your small business can require weeks of market analysis and financial preparation. You may spend time using Microsoft Excel or Powerpoint in order to create documentation which better supports our operational decisions.

However, almost every professional business plan is structured in the same way and most ask for the same information. Because of this, using a business plan template is advisable to save time, money, and effort.

Business plan templates for free

Rather than spending time trying to figure out how to write a business plan , use a free template as a guide to completion.

Business plan templates from PandaDoc can help you reach an effective go-to-market strategy even faster by asking you to provide all the relevant information you need when creating an effective business plan.

Grab a free template to get started!

Frequently asked questions

How many pages should my business plan be.

This depends on the kind of business plan you need to write and how you intend to use the plan that you create.

For example, a plan for a small business seeking potential investors or a business loan will need to provide income statements, cash flow statements, and a balance sheet (usually for a three-year or five-year forecast period).

These financial statements can be omitted if a small business owner isn’t seeking funding and is instead planning to use their business plan as a guiding document for themselves and their management team members.

Some business plans may only run a few pages. Fully-developed business plans can be as long as 50 pages. Much of this depends on the type of business, the operational strategy, and the level of detail that goes into developing the business plan.

Who needs a business plan?

Every business should have a business plan. This is an essential guidance document for any founder or CEO.

Good business plans help a company determine the viability of its place in the market and can help the business develop better strategies for differentiating itself from its competitors.

Business planning also forces business owners to evaluate their marketing strategy, the cost of customer acquisition and retention, and how they plan to grow their business over time.

What is the best business plan template?

Business plans come in all shapes and sizes. The best business plan template for your business is one that you understand and that matches the size and legal structure of your operation.

If you’re a sole proprietor, a business plan template designed for a big corporation probably doesn’t make sense. However, a business plan that helps you build an effective roadmap to grow your business while protecting your intellectual property is a good starting point.

PandaDoc offers specialized business plan templates for common industries along with tips to help you get started with business planning.

Should I hire someone to write my business plan for me?

No. You’ll find freelance writers and business strategy companies out there who are happy to write your business plan for a fee. These resources can guide you through the process, but you should write (or be heavily involved in) the creation of your business plan.

The reason for this is simple: You know the most about your business, and your business needs you to succeed.

A writer can work with you to make your business plan sound better to investors, and a consultant can help you fill in knowledge gaps — like how to conduct a SWOT analysis — and point out weaknesses in your plan. But, at the end of the day, you need to use the business plan to pitch investors and run your business.

Those ideas and guiding principles aren’t something you can outsource.

Should I use business planning software?

Software isn’t required when creating an effective business plan. Most business planning software is designed to help you navigate the outlining and writing process more effectively.

You don’t need software to write a professional business plan, but a solid template can help you get started. Download a free template from PandaDoc today and take your business to the next level.

Get started with PandaDoc today

Streamline your document workflow & close deals faster.

Get personalized 1:1 demo with our product specialist.

- Tailored to your needs

- Answers all your questions

- No commitment to buy

Schedule your free live demo

By submitting this form, I agree that the Terms of Service and Privacy Notice will govern the use of services I receive and personal data I provide respectively.

Business Plan Template for Financial Analysts

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

Creating a comprehensive business plan as a financial analyst can be a daunting task. You need a template that understands the unique needs of financial professionals and helps you analyze and project a company's financial performance with ease.

That's where ClickUp's Business Plan Template for Financial Analysts comes in! This template empowers financial analysts to:

- Outline a company's revenue streams, expenses, and profitability

- Project future financial performance and make informed recommendations

- Evaluate return on investment and assess the financial viability of business strategies

With ClickUp's Business Plan Template for Financial Analysts, you can streamline your analysis, make accurate projections, and confidently present your findings to help businesses thrive. Get started today and unlock the power of financial analysis!

Business Plan Template for Financial Analysts Benefits

Creating a business plan as a financial analyst can be a daunting task, but with the Business Plan Template for Financial Analysts, you can confidently outline your analysis and projections. Here are some benefits of using this template:

- Streamline your financial analysis process by having a structured framework to follow

- Present your findings and recommendations in a professional and organized manner

- Easily communicate financial projections, revenue forecasts, and expense estimates to stakeholders

- Save time and effort by leveraging pre-designed sections and templates tailored for financial analysis

- Make informed decisions and recommendations based on a comprehensive analysis of the company's financial performance.

Main Elements of Financial Analysts Business Plan Template

ClickUp's Business Plan Template for Financial Analysts provides the essential tools for financial professionals to create comprehensive and data-driven business plans.

Here are the key elements of this template:

- Custom Statuses: Track the progress of your business plan with statuses such as Complete, In Progress, Needs Revision, and To Do, ensuring that every task is accounted for and easily managed.

- Custom Fields: Utilize custom fields like Reference, Approved, and Section to add relevant information and categorize different aspects of your business plan, making it easy to find and analyze specific details.

- Custom Views: Access five different views tailored for financial analysts, including Topics, Status, Timeline, Business Plan, and Getting Started Guide, allowing you to focus on specific sections, track progress, visualize timelines, and follow a step-by-step guide to create a comprehensive plan.

- Data Analysis: Leverage ClickUp's powerful features such as Dashboards, Tables, and Integrations to analyze financial data, create charts and graphs, and integrate with external tools for in-depth financial analysis.

With ClickUp's Business Plan Template for Financial Analysts, you can streamline your financial analysis process, increase collaboration, and make well-informed decisions to drive the success of your organization.

How To Use Business Plan Template for Financial Analysts

If you're a financial analyst looking to create a business plan, the Business Plan Template in ClickUp can help streamline the process. Follow these steps to make the most out of this template:

1. Define your business idea and objectives

Start by clearly defining your business idea and objectives. What problem does your business solve? Who is your target audience? What are your short-term and long-term goals? Having a clear understanding of your business concept and objectives will lay the foundation for the rest of your business plan.

Use a Doc in ClickUp to write a detailed description of your business idea and objectives.

2. Conduct market research and analyze competitors

Next, conduct thorough market research to understand the current landscape and identify your target market. Analyze your competitors to gain insights into their strengths, weaknesses, and market positioning. This research will help you identify opportunities and potential challenges for your business.

Use the Table view in ClickUp to create a list of competitors and track their key metrics such as market share, revenue, and customer base.

3. Develop a financial forecast

As a financial analyst, one of the most critical aspects of your business plan will be the financial forecast. Use historical data, market trends, and industry benchmarks to create a comprehensive financial forecast that includes projected revenue, expenses, and cash flow. This will help you assess the financial feasibility of your business and make informed decisions.

Create custom fields in ClickUp to track financial metrics such as projected revenue, expenses, and profitability.

4. Outline your marketing and sales strategy

A well-defined marketing and sales strategy is essential for the success of any business. Outline your marketing channels, target audience, pricing strategy, and sales tactics. Identify the key marketing activities you will undertake to promote your business and attract customers.

Use tasks in ClickUp to create a detailed marketing and sales plan, assigning responsibilities and setting deadlines for each activity.

With the Business Plan Template in ClickUp, you can easily navigate the process of creating a comprehensive business plan for financial analysts. By following these steps, you'll be well on your way to developing a solid business plan that aligns with your objectives and sets you up for success.

Get Started with ClickUp’s Business Plan Template for Financial Analysts

Financial analysts can use the ClickUp Business Plan Template to efficiently create and manage comprehensive business plans for their clients or organizations.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a thorough business plan:

- Use the Topics View to organize your business plan by different sections, such as Executive Summary, Market Analysis, Financial Projections, etc.

- The Status View will help you track the progress of each section, with statuses like Complete, In Progress, Needs Revision, and To Do

- Utilize the Timeline View to set deadlines and visualize the overall timeline of your business plan

- The Business Plan View provides a comprehensive overview of all the sections and their statuses, allowing you to easily track progress and make updates

- Use the Getting Started Guide View to access helpful resources and instructions on how to effectively use the template

- Customize the template by adding custom fields like Reference, Approved, and Section to provide additional context and organization to your business plan

- Monitor and analyze the progress of your business plan using the various views and statuses to ensure accuracy and completeness.

- Business Plan Template for Mobile Designers

- Business Plan Template for Employee Retention

- Business Plan Template for Soldiers

- Business Plan Template for Kodak

- Business Plan Template for Vendor Selection

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Financial Business Plan Template

What is a Financial Business Plan?

A financial business plan outlines the financial goals of the business along with strategies to achieve those objectives. It includes a comprehensive financial analysis that includes current performance, areas of improvement, and financial risk reduction. It also includes a timeline for implementation of goals and strategies.

What's included in this Financial Business Plan template?

- 3 focus areas

- 6 objectives

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Financial Business Plan template for?

This Financial Business Plan template is designed to help financial analysts, business owners, and entrepreneurs create a comprehensive business plan that includes a financial analysis. It will provide you with the tools needed to make informed decisions and to keep track of your progress towards achieving your financial goals.

1. Define clear examples of your focus areas

A focus area is a broad topic that your business plan will address. Each focus area should have specific objectives and measurable targets (KPIs) that will help you track your progress towards achieving your goals. Examples of strategic focus areas that could fall under a Financial Business Plan could be: Analyze Financial Performance, Track and Monitor Business Growth, and Improve Customer Experience.

2. Think about the objectives that could fall under that focus area

Objectives are specific goals that are designed to help you achieve the broader focus area. Examples of some objectives for the focus area of Analyze Financial Performance could be: Increase Profitability, and Reduce Financial Risk.

3. Set measurable targets (KPIs) to tackle the objective

KPIs are measurable targets that can be used to evaluate the success of your objectives. These can be quantified, such as increasing profit margin from 2% to 5%, or reducing debt-to-equity ratio from 2.5 to 1.5. KPIs should be set with an initial value, a target value, and a unit of measurement.

4. Implement related projects to achieve the KPIs

Projects, or actions, are initiatives that you can undertake to achieve the KPIs that you have set. For example, analyzing customer data to identify opportunities to increase revenue, or automating processes to increase efficiency.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

Cascade Strategy Execution Platform allows you to track and monitor your performance against the established KPIs. This will help you to quickly identify areas of improvement and take corrective action to ensure that you reach your business goals faster.

Original text

Access our collection of user-friendly templates for business planning, finance, sales, marketing, and management, designed to assist you in developing strategies for either launching a new business venture or expanding an existing one.

You can use the templates below as a starting point to create your startup business plan or map out how you will expand your existing business. Then meet with a SCORE mentor to get expert business planning advice and feedback on your business plan.

If writing a full business plan seems overwhelming, start with a one-page Business Model Canvas. Developed by Founder and CEO of Strategyzer, Alexander Osterwalder, it can be used to easily document your business concept.

Download this template to fill out the nine squares focusing on the different building blocks of any business:

- Value Proposition

- Customer Segments

- Customer Relationships

- Key Activities

- Key Resources

- Key Partners

- Cost Structure

- Revenue Streams

For help completing the Business Model Canvas Template, contact a SCORE business mentor for guidance

From creating a startup budget to managing cash flow for a growing business, keeping tabs on your business’s finances is essential to success. The templates below will help you monitor and manage your business’s financial situation, create financial projections and seek financing to start or grow your business.

This interactive calculator allows you to provide inputs and see a full estimated repayment schedule to plan your capital needs and cash flow.

A 12-month profit and loss projection, also known as an income statement or statement of earnings, provides a detailed overview of your financial performance over a one-year period. This projection helps you anticipate future financial outcomes by estimating monthly income and expenses, which facilitates informed decision-making and strategic planning.

If you’re trying to get a loan from a bank, they may ask you for a personal financial statement. You can use this free, downloadable template to document your assets, liabilities and net worth.

A Personal Financial Statement is a

Marketing helps your business build brand awareness, attract customers and create customer loyalty. Use these templates to forecast sales, develop your marketing strategy and map out your marketing budget and plan.

How healthy is your business? Are you missing out on potential growth opportunities or ignoring areas of weakness? Do you need to hire employees to reach your goals? The following templates will help you assess the state of your business and accomplish important management tasks.

Whether you are starting your business or established and looking to grow, our Business Healthcheck Tool will provide practical information and guidance.

Learn how having a SCORE mentor can be a valuable asset for your business. A SCORE mentor can provide guidance and support in various areas of business, including finance, marketing, and strategy. They can help you navigate challenges and make important decisions based on their expertise and experience. By seeking out a SCORE mentor, you can gain the guidance and support you need to help grow your business and achieve success.

SCORE offers free business mentoring to anyone that wants to start, currently owns, or is planning to close or sell a small business. To initiate the process, input your zip code in the designated area below. Then, complete the mentoring request form on the following page, including as much information as possible about your business. This information is used to match you with a mentor in your area. After submitting the request, you will receive an email from your mentor to arrange your first mentoring session.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

Business Plan Financial Projections Template

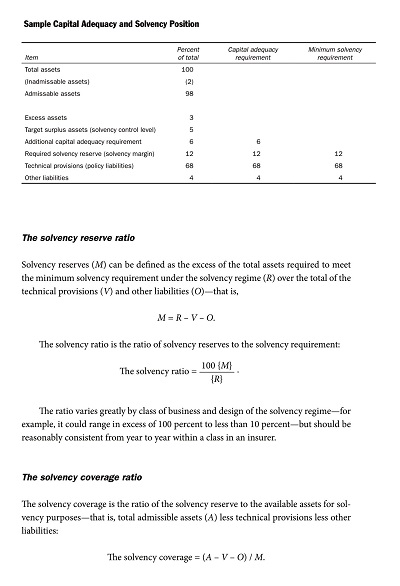

Identify financial requirements and objectives, draft projected income statement, detail projected balance sheet, calculate projected cash flow statement, apply appropriate financial ratios analysis.

- 1 Current Ratio

- 2 Gross Profit Margin

- 3 Return on Investment

- 4 Debt-to-Equity Ratio

- 5 Inventory Turnover

Adjust for inflation rate predictions

Consider the impact of business growth on financial projections, check cost assumptions for products and services, investigate potential risks and variables in the financial projection, approval: financial analyst for initial review.

- Draft projected income statement Will be submitted

- Detail projected balance sheet Will be submitted

- Calculate projected cash flow statement Will be submitted

- Apply appropriate financial ratios analysis Will be submitted

- Adjust for inflation rate predictions Will be submitted

- Consider the impact of business growth on financial projections Will be submitted

- Check cost assumptions for products and services Will be submitted

- Investigate potential risks and variables in the financial projection Will be submitted

Incorporate feedback and modify financial projections accordingly

Cross-check with industry standards and competitor analysis, analyse break-even point and profitability metrics, compile final draft of financial projections, approval: ceo review and validation of final draft.

- Incorporate feedback and modify financial projections accordingly Will be submitted

- Cross-check with industry standards and competitor analysis Will be submitted

- Analyse break-even point and profitability metrics Will be submitted

- Compile final draft of financial projections Will be submitted

Send financial projections for external auditing

Conduct scenario analysis for best-case, worst-case, and most likely outcomes, discuss and finalize plan with key stakeholders, approval: board of directors.

- Send financial projections for external auditing Will be submitted

- Conduct scenario analysis for best-case, worst-case, and most likely outcomes Will be submitted

- Discuss and finalize plan with key stakeholders Will be submitted

Implement financial projections into overall business plan

Take control of your workflows today., more templates like this.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

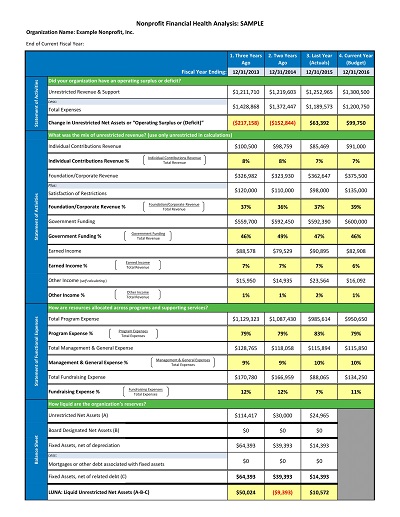

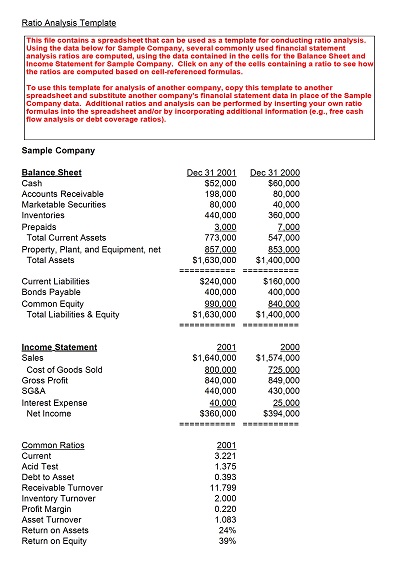

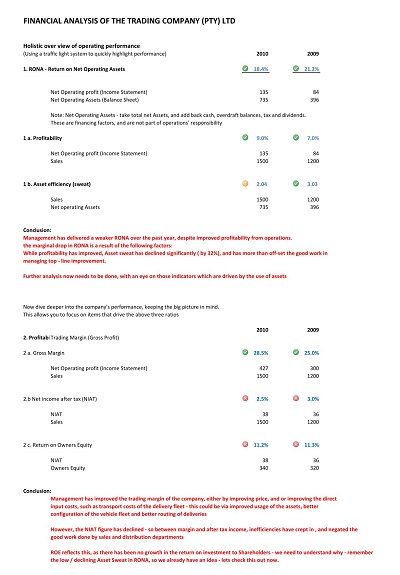

40+ Free Sample Financial Analysis Templates (MS Excel, PDF)

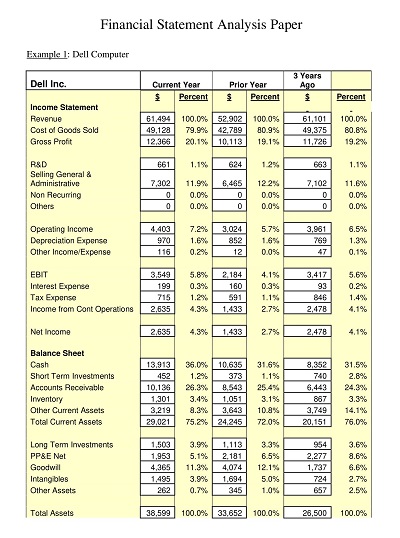

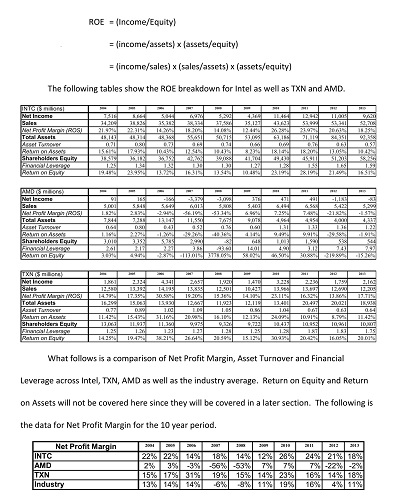

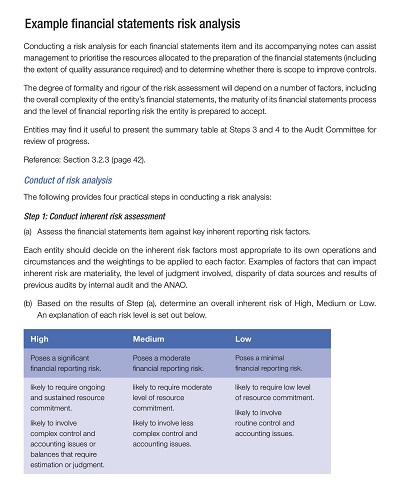

Financial analysis templates are effective tools for assessing the financial health of a business. By utilizing these templates, businesses can evaluate their financial statements and identify areas of strength and weakness. They systematically analyze key financial ratios, such as revenue growth and profitability, to support informed decision-making.

Table of Contents

Financial analysis templates are not only useful for company managers but also for investors looking to assess the potential value of a business. As a comprehensive tool, the financial analysis template can offer valuable insights into a company’s financial position, allowing business owners to make informed decisions based on facts and figures rather than guesswork.

Download Free Sample Financial Analysis Templates

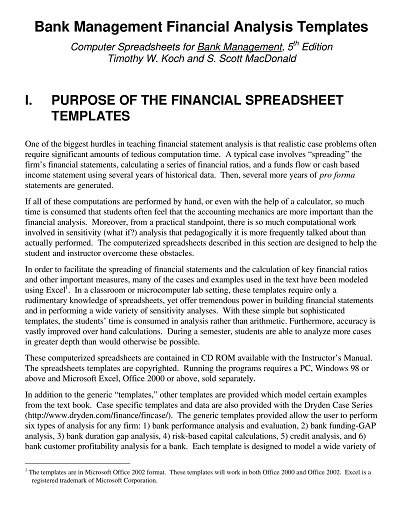

Bank Management Financial Analysis

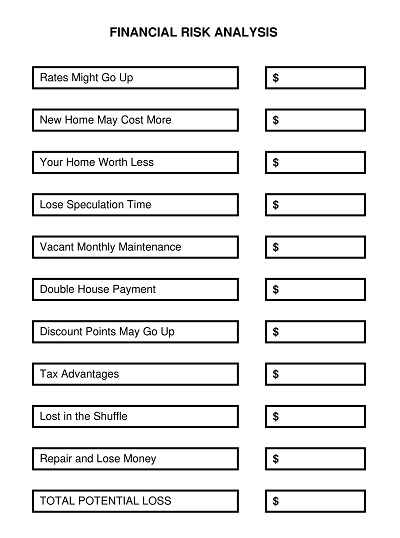

Blank Financial Risk Analysis Template

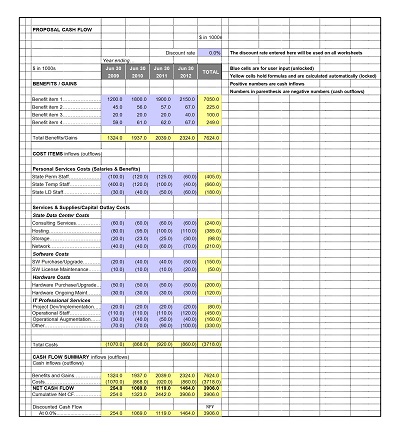

Business Case Financial Analysis Template

Business Financial Analysis Template

Company Financial Health Analysis

Company Financial History and Ratios

Company Financial Impact Statement Analysis

Company Ratio Analysis Template

Importance of financial analysis in business decision making.

Financial analysis is a critical component of business decision-making, as it provides insights into a company’s financial health and informs important strategic decisions. Whether it’s assessing cash flow, profit margins, or debt ratios, financial analysis helps to identify potential risks and opportunities for growth.

By analyzing financial data, businesses can determine the most effective ways to allocate resources, invest in new ventures, and make decisions that ultimately contribute to long-term success. Without a thorough understanding of financial analysis, companies risk making decisions based on incomplete or inaccurate data, which can have significant consequences. For this reason, financial analysis remains a crucial tool for businesses looking to make informed and effective decisions.

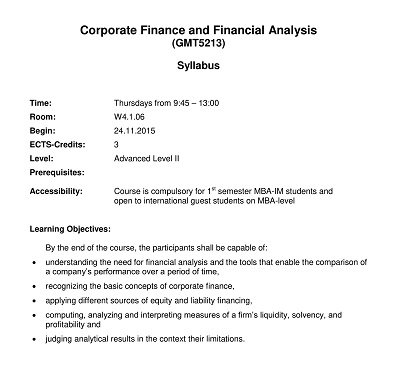

Corporate Finance and Financial Analysis

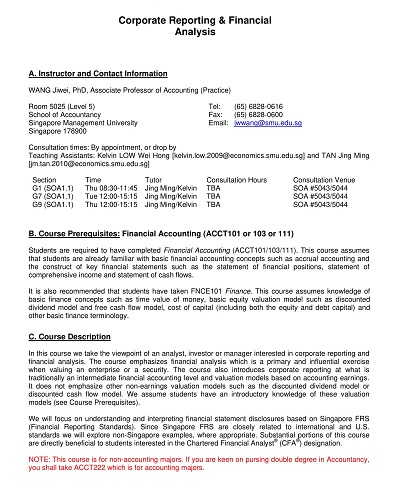

Corporate Reporting and Financial Analysis

Editable Company Financial Analysis

Financial Analysis for Trading Company

Financial Analysis Report Example

Financial Analysis Report Sample

Financial Analysis Template PDF

Financial Analysis Worksheet Template

Financial Corporation Analysis Template

Financial Income Statement Analysis

Key tools and techniques for effective financial analysis.

Understanding and utilizing key tools and techniques is critical for effective financial analysis. Whether you are an individual investor or a financial professional, the ability to analyze financial data can help you make informed decisions and achieve your financial goals. The most important tools and techniques include ratio, trend, and cash flow analysis. Ratio analysis allows you to compare financial data from different periods and companies, helping you to identify trends and potential areas of concern.

Trend analysis, on the other hand, allows you to identify patterns or trends in financial data over time and make predictions about future performance. Finally, understanding cash flow analysis can help you better understand a company’s cash flow situation and make more informed investment decisions. By mastering these key tools and techniques, you can become a more effective financial analyst and make informed investment decisions.

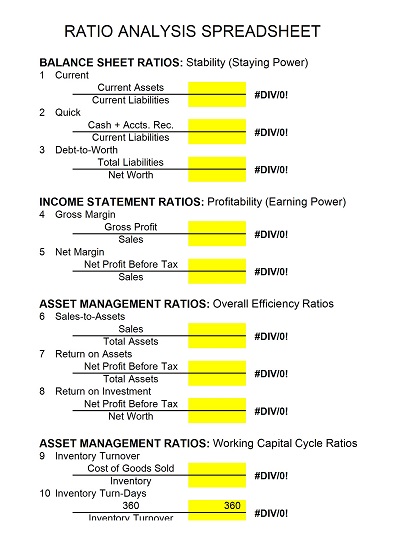

Financial Ratio Analysis Spreadsheet

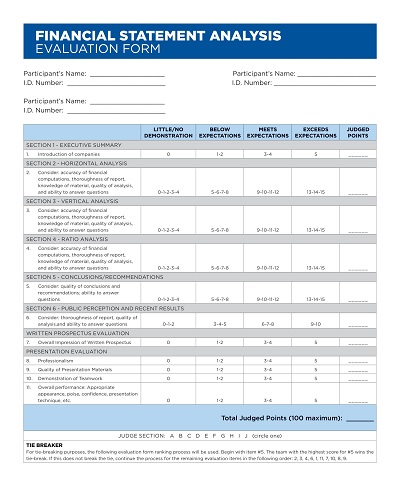

Financial Statement Analysis Evaluation Template

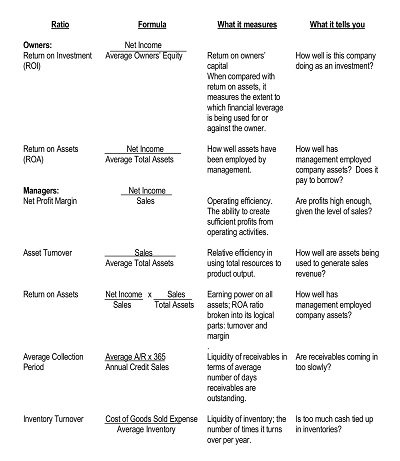

Financial Statement Analysis for Small Business

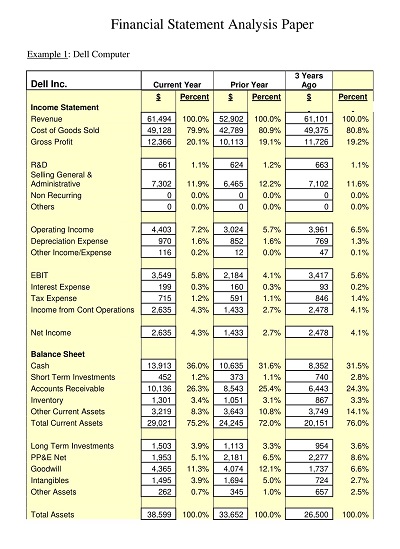

Financial Statement Analysis Paper

Financial Statement Analysis Sample

Financial Statement Analysis Template Excel

Financial Statement Risk Analysis

Insurance Company Financial Analysis

Sample Financial Analysis Template

Sample Financial Statement Analysis

Simple Business Case Financial Analysis

Simple Financial Statement Analysis

Financial analysis for strategic planning.

When it comes to strategic planning, financial analysis is an essential tool that helps organizations take a closer look at their financial position and make informed decisions about their future. With financial analysis, companies gain insights into their revenues, expenses, cash flow, and profitability, which enable them to create more effective strategies that align with their long-term goals.

Not only does financial analysis help organizations identify potential risks and opportunities and gives them a comprehensive view of their financial health, allowing them to make better decisions about resource allocation and investments. Financial analysis is a crucial component of strategic planning, enabling businesses to create sustainable growth and achieve their objectives while balancing their financial resources.

How to Create a Financial Analysis Template

A financial analysis template is a crucial tool in determining the financial health of a company. It plays a significant role in evaluating the management’s effectiveness, assessing the company’s profitability, and identifying potential financial risks. Creating a financial analysis template may seem challenging; however, a well-structured and organized document can help you make sound business decisions.

Determine the scope of your financial analysis template

Before creating a financial analysis template, determining your analysis’s scope is essential. What particular aspect of the company’s finances are you interested in measuring? You may focus on profitability, liquidity, solvency, or debt management. Determining the scope of your analysis ensures that your template’s content is sufficient and aligns with your objectives.

Select the financial statements for your analysis

The annual financial statements companies prepare include the income statement, balance sheet, and cash flow statement. These statements provide a comprehensive overview of the company’s financial health. Your financial analysis template should include these statements to ensure that you identify the company’s financial strengths and weaknesses. You can download these statements from the company’s website or request them from their finance department.

Analyze the financial statements

Once you have all the statements, it’s time to dive into the data. To conduct a thorough analysis, you may use financial ratios like profitability, liquidity, and solvency ratios. These ratios compare different financial metrics like revenues, costs, and assets to give you an idea of the company’s financial performance. Using ratios, you can identify relationships between different aspects of the company’s finances, allowing you to make informed decisions.

Use charts and graphs

Presenting data visually is an effective way to present the company’s financial performance. Charts and graphs represent data in a way that is easy to comprehend and interpret. You can use different graphs, depending on the data you want to represent. For example, you may use a line chart to show trends in revenue or a bar chart to illustrate the company’s debt levels. A well-designed chart or graph allows you to present your findings in a way that is easy to understand.

Add a commentary

A commentary summarizes your analysis and provides insights into the company’s finances. It should be well-written and concise while including all the critical points of your analysis. A good commentary should explain how the company performed relative to its competitors and the industry. It should also highlight the company’s strengths and weaknesses and provide recommendations for improvement.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.

Similar Posts

50 blank hold harmless agreement (free printable pdf).

A ‘hold harmless agreement’ is a contract between two parties that designates one party, the Indemnitor, as legally responsible for any damages or losses caused by the other party, the…

32+ Free Printable Work Checklist Templates (Word, PDF)

A work checklist simplifies tasks, reduces errors, and increases efficiency. Its beauty lies in its comfort and versatility. The Checklist can be used in many sectors, from business projects to…

30+ Printable Police Report Template [Fake Examples]

A police report template is used to make the process easier. This document is made when you file a report at a police station about an incident. A police report…

20+ Free Construction RFI Template Forms (Printable PDF)

In construction, RFI (Request for information) is used to gather the required information about products or services from different suppliers. It is a common process in business to collect information…

42+ Free Printable Silent Auction Bid Sheet Templates (PDF, Doc)

There is no need for an auctioneer in the silent auction; using mobile bidding software and bid sheets, participants will place their bids silently, unlike the conventional auction system. For…

45+ Employee Attendance Tracker Templates [Excel, PDF]

Employee attendance tracker is used to track employee presence, absence, leaves, tardiness, or more. The employee attendance tracker template provides information about who is absent or absent on certain dates….

Your email address is the only way we can be in touch. We usually send premium quality templates.

- All our Toolkits

- Corporate/Business Strategy and Strategic Planning Toolkit

- Operating Model and Organization Design Toolkit

- Digital Transformation Toolkit

- Program, Project and Change Management Toolkit

- Management Consulting Toolkit

- Human Resources & Talent Management Toolkit

- Mergers and Acquisitions Toolkit

- Post Merger Integration Toolkit

- Sales, Marketing & Communication Strategy Toolkit

- Business Plan and Entrepreneurship Toolkit

- Supply Chain Strategy Toolkit

- Lean 6 Sigma Toolkit

- Risk Management Toolkit

- Leadership Development Toolkit

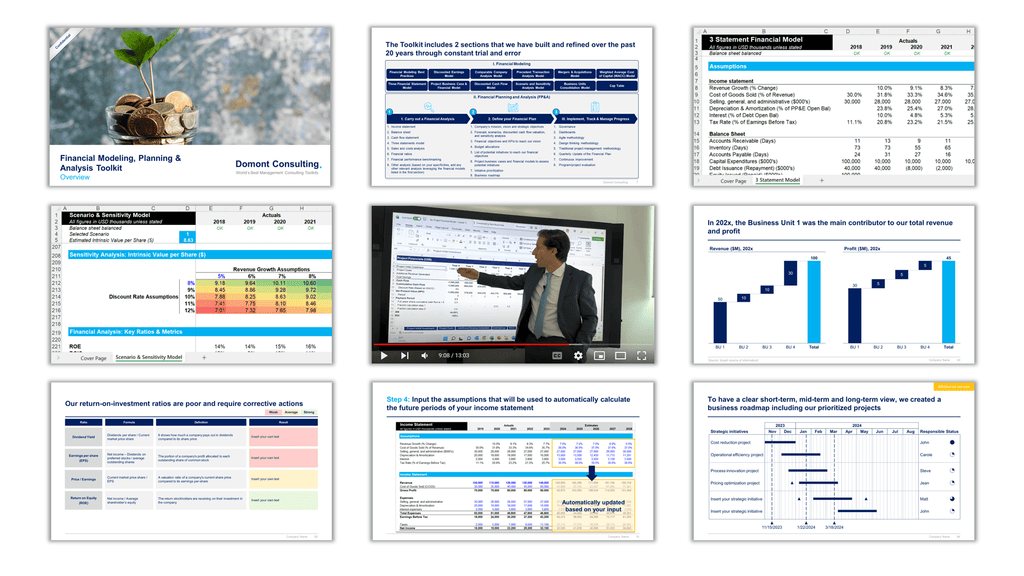

Financial Modeling, Planning & Analysis Toolkit

- Customer Experience Strategy & Design Thinking Toolkit

- Data Analytics Strategy Toolkit

- Warren Buffet Value Investing Strategy Toolkit

- Full Access

To instantly translate our Toolkits, our clients usually choose the world’s best AI translators in the world: Deepl Translator or Microsoft Translator.

- With Deepl Translator, you can easily and instantly translate an entire document in 30+ languages. All you need to do is go on their website https://www.deepl.com/translator, and drag and drop your Powerpoint or Word document. We indirectly pay for Deepl.com by providing you a US $50 discount, which you can use to purchase our Toolkits. This discount will cover the cost of Deepl.com. To get this US $50 discount, enter this discount code at checkout: DEEPL$50DISC.

- With Microsoft Translator, you can easily and instantly translate our Toolkits in all languages. Microsoft Translator is free and directly available within Powerpoint and Excel. It uses Neural Machine Translation (NMT), which is the new standard for high-quality AI-powered machine translations.

- Arabic, Levantine SM

- Bosnian (Latin)

- Cantonese (Traditional)

- Chinese Simplified

- Chinese Traditional

- Haitian Creole

- Portuguese (Brazil)

- Portuguese (Portugal)

- Queretaro Otomi

- Serbian (Cyrillic)

- Serbian (Latin)

- Yucatec Maya

This Toolkit was created by ex- JP Morgan Investment Bankers, and McKinsey & Deloitte Consultants, after more than 4,000 hours of work. It includes all the Frameworks, Best Practices & Templates required to build strong Financial Modeling, Planning & Analysis capabilities within your organization. Build a success story such as Apple and Google, who gained a competitive advantage by mastering Financial Modeling, Planning & Analysis.

Editable Toolkit to help you reuse our content: 400 Powerpoint slides | 60 Excel sheets | 30minutes of Video training

Number of users: rights: our toolkits and intellectual property (ip) are protected by copyright law. if multiple persons use our toolkit(s), please select a multi-user option. every user will have the right to download, store, copy, edit, print & use our toolkits for personal and professional presentations, on their professional and personal devices. which option to choose an independent consultant or a sole trader will usually select the option “1 user”. a team or a small business with less than 5 people using our toolkit(s) will usually select the option “5 users”. a team or a small business with less than 30 people using our toolkit(s) will usually select the option “30 users”. for more than 30 users, please contact us at [email protected] to get a quote. restrictions: the user is not allowed to publish our toolkits online, sell our toolkits or provide public access to our toolkits. " data-tipped-options="position: 'top',maxwidth: 800">, trusted by 200,000+ executives, consultants and entrepreneurs from small & large organizations.

This Toolkit includes frameworks, tools, templates, tutorials, real-life examples, best practices, and video training to help you:

- Build Financial Models with our ready-made Excel Models: (1) Financial Modeling Best Practices, (2) Three Financial Statement Model, (3) Project Business Case & Financial Model, (4) Discounted Cash Flow Model, (5) Scenario and Sensitivity Analysis Model, (6) Business Units Consolidation Model, (7) Discounted Earnings Model, (8) Comparable Company Analysis Model, (9) Precedent Transaction Analysis Model, (10) Mergers & Acquisitions Model, (11) Weighted Average Cost of Capital (WACC) Model, (12) Cap Table

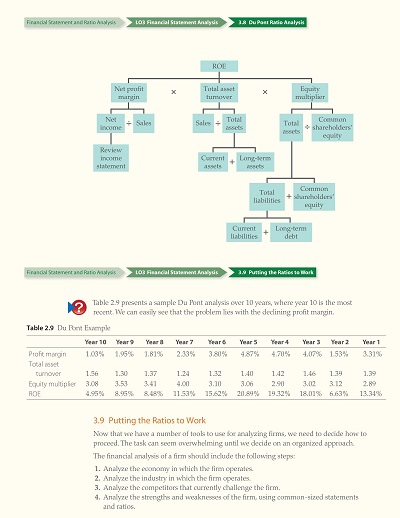

- Build strong Financial Planning and Analysis (FP&A) Capabilities with our 3-phase approach: (I) Carry out a Financial Analysis, (II) Define your Financial Plan, (III) Implement, Track & Manage Progress

- (I) Carry out a Financial Analysis: (1) Income Statement, (2) Balance Sheet, (3) Cash Flow Statement, (4) Three Statements Model, (5) Sales and Costs Analysis, (6) Financial Ratios, (7) Financial Performance Benchmarking, (8) Other Analysis

- (II) Define your Financial Plan: (1) Company’s Mission, Vision and Strategic Objectives, (2) Forecast, Scenarios, Discounted Cash Flow valuation, and Sensitivity Analysis, (3) Financial Objectives and KPIs to reach our Vision, (4) Budget Allocations, (5) List of Potential Initiatives to reach our Financial Objectives, (6) Project Business Cases and Financial Models to assess potential initiatives, (7) Initiative Prioritization, (8) Business Roadmap

- (IV) Implement, Track & Manage Progress: (1) Governance, (2) Dashboards, (3) Agile Methodology, (4) Design Thinking Methodology, (5) Traditional Project Management Methodology, (5) Quarterly Update of the Financial Plan, (6) Continuous Improvement, (7) Program/project evaluation

- Build a success story such as Apple and Google, who gained a competitive advantage by mastering Financial Modeling, Planning & Analysis

Benefits of our Management Consulting Toolkits

Improve the growth & efficiency of your organization by leveraging Management Consulting Toolkits created by ex-McKinsey, Deloitte & BCG Consultants.

Make a great investment for your career & organization. It cost us US$8M+ over the past 10 years to create all our Toolkits. Get them for a fraction of this cost.

Get a competitive advantage. It’s like hiring Management Consultants to create all the practical Frameworks, Tools & Templates you need.