- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Consumer Research: Examples, Process and Scope

What is Consumer Research?

Consumer research is a part of market research in which inclination, motivation and purchase behavior of the targeted customers are identified. Consumer research helps businesses or organizations understand customer psychology and create detailed purchasing behavior profiles.

It uses research techniques to provide systematic information about what customers need. Using this information brands can make changes in their products and services, making them more customer-centric thereby increasing customer satisfaction. This will in turn help to boost business.

LEARN ABOUT: Market research vs marketing research

An organization that has an in-depth understanding about the customer decision-making process, is most likely to design a product, put a certain price tag to it, establish distribution centers and promote a product based on consumer research insights such that it produces increased consumer interest and purchases.

For example, A consumer electronics company wants to understand, thought process of a consumer when purchasing an electronic device, which can help a company to launch new products, manage the supply of the stock, etc. Carrying out a Consumer electronics survey can be useful to understand the market demand, understand the flaws in their product and also find out research problems in the various processes that influence the purchase of their goods. A consumer electronics survey can be helpful to gather information about the shopping experiences of consumers when purchasing electronics. which can enable a company to make well-informed and wise decisions regarding their products and services.

LEARN ABOUT: Test Market Demand

Consumer Research Objectives

When a brand is developing a new product, consumer research is conducted to understand what consumers want or need in a product, what attributes are missing and what are they looking for? An efficient survey software really makes it easy for organizations to conduct efficient research.

Consumer research is conducted to improve brand equity. A brand needs to know what consumers think when buying a product or service offered by a brand. Every good business idea needs efficient consumer research for it to be successful. Consumer insights are essential to determine brand positioning among consumers.

Consumer research is conducted to boost sales. The objective of consumer research is to look into various territories of consumer psychology and understand their buying pattern, what kind of packaging they like and other similar attributes that help brands to sell their products and services better.

LEARN ABOUT: Brand health

Consumer Research Model

According to a study conducted, till a decade ago, researchers thought differently about the consumer psychology, where little or no emphasis was put on emotions, mood or the situation that could influence a customer’s buying decision.

Many believed marketing was applied economics. Consumers always took decisions based on statistics and math and evaluated goods and services rationally and then selected items from those brands that gave them the highest customer satisfaction at the lowest cost.

However, this is no longer the situation. Consumers are very well aware of brands and their competitors. A loyal customer is the one who would not only return to repeatedly purchase from a brand but also, recommend his/her family and friends to buy from the same brand even if the prices are slightly higher but provides an exceptional customer service for products purchased or services offered.

Here is where the Net Promoter Score (NPS) helps brands identify brand loyalty and customer satisfaction with their consumers. Net Promoter Score consumer survey uses a single question that is sent to customers to identify their brand loyalty and level of customer satisfaction. Response to this question is measured on a scale between 0-10 and based on this consumers can be identified as:

Detractors: Who have given a score between 0-6.

Passives: Who have given a score between 7-8.

Promoters: Who have given a score between 9-10.

Consumer market research is based on two types of research method:

1. Qualitative Consumer Research

Qualitative research is descriptive in nature, It’s a method that uses open-ended questions , to gain meaningful insights from respondents and heavily relies on the following market research methods:

Focus Groups: Focus groups as the name suggests is a small group of highly validated subject experts who come together to analyze a product or service. Focus group comprises of 6-10 respondents. A moderator is assigned to the focus group, who helps facilitate discussions among the members to draw meaningful insights

One-to-one Interview: This is a more conversational method, where the researcher asks open-ended questions to collect data from the respondents. This method heavily depends on the expertise of the researcher. How much the researcher is able to probe with relevant questions to get maximum insights. This is a time-consuming method and can take more than one attempt to gain the desired insights.

LEARN ABOUT: Qualitative Interview

Content/ Text Analysis: Text analysis is a qualitative research method where researchers analyze social life by decoding words and images from the documents available. Researchers analyze the context in which the images are used and draw conclusions from them. Social media is an example of text analysis. In the last decade or so, inferences are drawn based on consumer behavior on social media.

Learn More: How to conduct Qualitative Research

2.Quantitative Consumer Research

In the age of technology and information, meaningful data is more precious than platinum. Billion dollar companies have risen and fallen on how well they have been able to collect and analyze data, to draw validated insights.

Quantitative research is all about numbers and statistics. An evolved consumer who purchases regularly can vouch for how customer-centric businesses have become today. It’s all about customer satisfaction , to gain loyal customers. With just one questions companies are able to collect data, that has the power to make or break a company. Net Promoter Score question , “On a scale from 0-10 how likely are you to recommend our brand to your family or friends?”

How organic word-of-mouth is influencing consumer behavior and how they need to spend less on advertising and invest their time and resources to make sure they provide exceptional customer service.

LEARN ABOUT: Behavioral Targeting

Online surveys , questionnaires , and polls are the preferred data collection tools. Data that is obtained from consumers is then statistically, mathematically and numerically evaluated to understand consumer preference.

Learn more: How to carry out Quantitative Research

Consumer Research Process

The process of consumer research started as an extension of the process of market research . As the findings of market research is used to improve the decision-making capacity of an organization or business, similar is with consumer research.

LEARN ABOUT: Market research industry

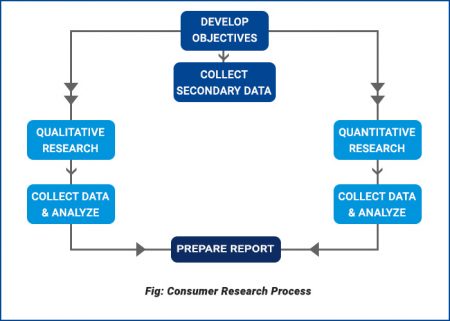

The consumer research process can be broken down into the following steps:

- Develop research objectives: The first step to the consumer research process is to clearly define the research objective, the purpose of research, why is the research being conducted, to understand what? A clear statement of purpose can help emphasize the purpose.

- Collect Secondary data: Collect secondary data first, it helps in understanding if research has been conducted earlier and if there are any pieces of evidence related to the subject matter that can be used by an organization to make informed decisions regarding consumers.

- Primary Research: In primary research organizations or businesses collect their own data or employ a third party to collect data on their behalf. This research makes use of various data collection methods ( qualitative and quantitative ) that helps researchers collect data first hand.

LEARN ABOUT: Best Data Collection Tools

- Collect and analyze data: Data is collected and analyzed and inference is drawn to understand consumer behavior and purchase pattern.

- Prepare report: Finally, a report is prepared for all the findings by analyzing data collected so that organizations are able to make informed decisions and think of all probabilities related to consumer behavior. By putting the study into practice, organizations can become customer-centric and manufacture products or render services that will help them achieve excellent customer satisfaction.

LEARN ABOUT: market research trends

After Consumer Research Process

Once you have been able to successfully carry out the consumer research process , investigate and break paradigms. What consumers need should be a part of market research design and should be carried out regularly. Consumer research provides more in-depth information about the needs, wants, expectations and behavior analytics of clients.

By identifying this information successfully, strategies that are used to attract consumers can be made better and businesses can make a profit by knowing what consumers want exactly. It is also important to understand and know thoroughly the buying behavior of consumers to know their attitude towards brands and products.

The identification of consumer needs, as well as their preferences, allows a business to adapt to new business and develop a detailed marketing plan that will surely work. The following pointers can help. Completing this process will help you:

- Attract more customers

- Set the best price for your products

- Create the right marketing message

- Increase the quantity that satisfies the demand of its clients

- Increase the frequency of visits to their clients

- Increase your sales

- Reduce costs

- Refine your approach to the customer service process .

LEARN ABOUT: Behavioral Research

Consumer Research Methods

Consumers are the reason for a business to run and flourish. Gathering enough information about consumers is never going to hurt any business, in fact, it will only add up to the information a business would need to associate with its consumers and manufacture products that will help their business refine and grow.

Following are consumer research methods that ensure you are in tandem with the consumers and understand their needs:

The studies of customer satisfaction

One can determine the degree of satisfaction of consumers in relation to the quality of products through:

- Informal methods such as conversations with staff about products and services according to the dashboards.

- Past and present questionnaires/ surveys that consumers might have filled that identify their needs.

T he investigation of the consumer decision process

It is very interesting to know the consumer’s needs, what motivates them to buy, and how is the decision-making process carried out, though:

- Deploying relevant surveys and receiving responses from a target intended audience .

Proof of concept

Businesses can test how well accepted their marketing ideas are by:

- The use of surveys to find out if current or potential consumer see your products as a rational and useful benefit.

- Conducting personal interviews or focus group sessions with clients to understand how they respond to marketing ideas.

Knowing your market position

You can find out how your current and potential consumers see your products, and how they compare it with your competitors by:

- Sales figures talk louder than any other aspect, once you get to know the comparison in the sales figures it is easy to understand your market position within the market segment.

- Attitudes of consumers while making a purchase also helps in understanding the market hold.

Branding tests and user experience

You can determine how your customers feel with their brands and product names by:

- The use of focus groups and surveys designed to assess emotional responses to your products and brands.

- The participation of researchers to study the performance of their brand in the market through existing and available brand measurement research.

Price changes

You can investigate how your customers accept or not the price changes by using formulas that measure the revenue – multiplying the number of items you sold, by the price of each item. These tests allow you to calculate if your total income increases or decreases after making the price changes by:

- Calculation of changes in the quantities of products demanded by their customers, together with changes in the price of the product.

- Measure the impact of the price on the demand of the product according to the needs of the client.

Social media monitoring

Another way to measure feedback and your customer service is by controlling your commitment to social media and feedback. Social networks (especially Facebook) are becoming a common element of the commercialization of many businesses and are increasingly used by their customers to provide information on customer needs, service experiences, share and file customer complaints . It can also be used to run surveys and test concepts. If handled well, it can be one of the most powerful research tools of the client management . I also recommend reading: How to conduct market research through social networks.

Customer Research Questions

Asking the right question is the most important part of conducting research. Moreover, if it’s consumer research, questions should be asked in a manner to gather maximum insights from consumers. Here are some consumer research questions for your next research:

- Who in your household takes purchasing decisions?

- Where do you go looking for ______________ (product)?

- How long does it take you to make a buying decision?

- How far are you willing to travel to buy ___________(product)?

- What features do you look for when you purchase ____________ (product)?

- What motivates you to buy_____________ (product)?

See more consumer research survey questions:

Customer satisfaction surveys

Voice of customer surveys

Product surveys

Service evaluation surveys

Mortgage Survey Questions

Importance of Consumer Research

Launching a product or offering new services can be quite an exciting time for a brand. However, there are a lot of aspects that need to be taken into consideration while a band has something new to offer to consumers.

LEARN ABOUT: User Experience Research

Here is where consumer research plays a pivotal role. The importance of consumer research cannot be emphasized more. Following points summarizes the importance of consumer research:

- To understand market readiness: However good a product or service may be, consumers have to be ready to accept it. Creating a product requires investments which in return expect ROI from product or service purchases. However, if a market is mature enough to accept this utility, it has a low chance of succeeding by tapping into market potential . Therefore, before launching a product or service, organizations need to conduct consumer research, to understand if people are ready to spend on the utility it provides.

- Identify target consumers: By conducting consumer research, brands and organizations can understand their target market based on geographic segmentation and know who exactly is interested in buying their products. According to the data or feedback received from the consumer, research brands can even customize their marketing and branding approach to better appeal to the specific consumer segment.

LEARN ABOUT: Marketing Insight

- Product/Service updates through feedback: Conducting consumer research, provides valuable feedback from consumers about the attributes and features of products and services. This feedback enables organizations to understand consumer perception and provide a more suitable solution based on actual market needs which helps them tweak their offering to perfection.

Explore more: 300 + FREE survey templates to use for your research

MORE LIKE THIS

21 Best Customer Advocacy Software for Customers in 2024

Apr 19, 2024

10 Quantitative Data Analysis Software for Every Data Scientist

Apr 18, 2024

11 Best Enterprise Feedback Management Software in 2024

17 Best Online Reputation Management Software in 2024

Apr 17, 2024

Consumer Values and Product Perception

- First Online: 17 March 2017

Cite this chapter

- Katrin Horn 4

2560 Accesses

1 Citations

This chapter explores the role consumer values play in the perception of product risks and benefits. While it is obvious that consumers interpret and assess risks and benefits differently, the reason for these differences can be attributed to various influences. Individual factors such as personality provide useful insight into preferences and allow clustering consumers with similar perceptions. However, they fail to acknowledge the impact of the surrounding environment on the consumer and hence on his interpretation. Here, the influence of values on product perception will be used to discuss the impact of culture on risk assessment. The concept of value is explored from two interlinked perspectives: first, consumer values represent a socio-cultural blueprint for consumer behavior, and are shaped by the cultural environment. Secondly, customer value as an assessment of benefit is derived from a consumption experience, in which consumers construct their interpretation of a product. The inclusion of culture as an influence in the development of consumer values and the subsequent assessment of the value of a product adds an important perspective to the understanding of how consumers interpret benefits and risks. Specifically, it offers a framework to explain differences in attitudes towards risk across cultures.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Arnould, E., & Thompson, C. (2005). Consumer culture theory (CCT): Twenty years of research. Journal of Consumer Research, 31 (4), 868–882.

Article Google Scholar

Berry, L., Carbone, L., & Haeckel, S. (2002). Managing the total customer experience. MIT Sloan Management Review, 43 (3), 85–89.

Google Scholar

Chiu, C., Wang, E., Fang, Y., & Huang, H. (2014). Understanding customers’ repeat purchase intentions in B2C e-commerce: The roles of utilitarian value, hedonic value and perceived risk. Information Systems Journal, 24 (1), 85–114.

Daghfous, N., Petrof, J., & Pons, F. (1999). Values and adoption of innovations: A cross-cultural study. Journal of Consumer Marketing, 16 (4), 314–331.

de Mooij, M., & Hofstede, G. (2011). Cross-cultural consumer behavior: A review of research findings. Journal of International Consumer Marketing, 23 (3/4), 181–192.

Fischer, R., & Poortinga, Y. (2012). Are cultural values the same as the values of individual? An examination of similarities in personal, social and cultural value structures. International Journal of Cross Cultural Management, 12 (2), 157–170.

Gatignon, H., Eliashberg, J., & Robertson, T. (1989). Modelling multinational diffusion patterns. Marketing Science , 8 (3), 231–247.

Geertz, C. (1973). The interpretation of cultures . New York: Basic Books.

Gilmore, J., & Pine, B. (2002). Customer experience places: The new offering frontier. Strategy & Leadership, 30 (4), 4–11.

Henry, W. (1976). Cultural values do correlate with consumer behavior. Journal of Marketing Research, 13 (2), 121–127.

Hofstede, G. (1980). Culture and organizations. International Studies of Management & Organization , 10 (4), 15–41.

Holbrook, M. (1996). Special session summary. Customer value—a framework for analysis and research. In K. Corfman & J. Lynch (Eds.), NA—Advances in Consumer Research (Vol. 23, Issue, 2, pp. 138–142).

Horn, S. (2005). Interkulturelle Kompetenz im Zugang zu japanischen Konsumenten: Eine empirische Untersuchung zur Einordn ung japanischer Akkulturationsstrategien im Zeichen globaler Consumscapes [Intercultural competence in accessing Japanese consumers: An empirical study on Japanese acculturation strategies in the context of global consumscapes]. Wiesbaden: Deutscher Universitäts-Verlag.

Kahle, L., & Kennedy, P. (1989). Using the list of values (LOV) to understand consumers. The Journal of Consumer Marketing, 6 (3), 5–12.

Kahle, L., Beatty, S., & Homer, P. (1986). Alternative measurement approaches to consumer values: The list of values (LOV) and values and life style (VALS). Journal of Consumer Research, 13 (3), 405–409.

Kamakura, W., & Novak, T. (1992). Value-system segmentation: Exploring the meaning of LOV. Journal of Consumer Research , 19 (1), 119–132.

Knafo, A., Roccas, S., & Sagiv, L. (2011). The value of values in cross-cultural research: A special issue in honor of Shalom Schwartz. Journal of Cross-Cultural Research, 42 (2), 178–185.

Kroeber, A., & Kluckhohn, C. (1952). Culture: A critical review of concepts and definitions. Papers. Peabody Museum of Archaeology & Ethnology, Harvard University. [Online]. [Accessed 03.06.2016]. Available from https://archive.org/details/papersofpeabodymvol47no1peab .

Lenartowicz, T., & Roth, K. (2004). The selection of key informants in IB Cross-cultural studies. Management International Review, 44 (1), 23–51.

Leroi-Werelds, S., Streukens, S., Brady, M. K., & Swinnen, G. (2014). Assessing the value of commonly used methods for measuring customer value: A multi-setting empirical study. Journal of the Academy of Marketing Science, 42 (4), 430–451.

Lewis, R., & Chambers, R. (2000). Marketing leadership in hospitality: Foundations and practices . New York: Wiley.

Maio, G., Pakizeh, A., Cheung, W., & Rees, K. (2009). Changing, priming, and acting on values: Effects via motivational relations in a circular model. Journal of Personality and Social Psychology, 97 (4), 699–715.

McCracken, G. (1986). Culture and consumption: A theoretical account of the structure and movement of the cultural meaning of goods. Journal of Consumer Research, 13 (1), 71–84.

Mitchell, V. (1999). Consumer Perceived Risk: Conceptualisations and models. European Journal of Marketing, 33 (1/2), 163–195.

Novak, T., & MacEvoy, B. (1990). On comparing alternative segmentation schemes: The list of values and values and life styles. Journal of Consumer Research, 17 (1), 105–109.

Rokeach, M. (1973). The nature of human values . New York: The Free Press.

Schein, E. (1996). Culture: The missing concept in organisation studies. Administrative Science Quarterly, 41 (2), 229–240.

Schwartz, S. (1992). Universals in the content and structure of values: Theory and empirical tests in 20 countries. In M. Zanna (Ed.), Advances in experimental psychology , 25 (1), 1–65. New York: Academic Press.

Schwartz, S., & Bilsky, W. (1987). Toward a universal psychological structure of human values. Journal of Personality and Social Psychology, 53 (3), 550–562.

Sheth, J., & Sethi, S. (1973). Theory of cross-cultural buyer-behavior. Faculty Working Paper. 115. College of Commerce and Business Administration, University of Illinois. [Online]. [Accessed 12.01.2016]. Available from https://www.ideals.illinois.edu/bitstream/handle/2142/27767/theoryofcrosscul115shet.pdf?sequence=1 .

Sojka, J., & Tansuhaj, P. (1995). Cross-cultural consumer research: A twenty-year review. Advances in Consumer Research, 22 , 461–461.

Solomon, M. (2009). Consumer behavior: Buying, having, and being . Upper Saddle River, NJ: Pearson Education International.

Steenkamp, J., Hofstede, F., & Wedel, M. (1999). A Cross-national investigation into the individual and national cultural antecendents of consumer innovativeness. Journal of Marketing, 63 (2), 55–69.

Triandis, H. (2007). Culture and psychology: A history of the study of their relationship. In S. Kitayama & D. Cohen (Eds.), Handbook of cultural psychology (pp. 59–76). New York: Guilford.

Zeithaml, V. A. (1988). Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. The Journal of Marketing, 52 , 2–22.

Download references

Author information

Authors and affiliations.

The Semiotic Alliance, London, UK

Katrin Horn

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Katrin Horn .

Editor information

Editors and affiliations.

Clinique du Nord, Port Louis, Mauritius

Gerard Emilien

Philip Morris Products S.A, Neuchâtel, Switzerland

Rolf Weitkunat

Frank Lüdicke

Rights and permissions

Reprints and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Horn, K. (2017). Consumer Values and Product Perception. In: Emilien, G., Weitkunat, R., Lüdicke, F. (eds) Consumer Perception of Product Risks and Benefits. Springer, Cham. https://doi.org/10.1007/978-3-319-50530-5_16

Download citation

DOI : https://doi.org/10.1007/978-3-319-50530-5_16

Published : 17 March 2017

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-50528-2

Online ISBN : 978-3-319-50530-5

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Research: Consumers Value Fate in Marketing Narratives

- Alexander G. Fulmer

The story of how a product was discovered can change the level of consumers’ interest.

Research shows that consumers prefer products where an element of them was found unintentionally, for example necklace made from gold from a previous unknown mine. Why? Learning about the unintentional discovery of a resource makes consumers think more about how the resource might never have been discovered, heightening their appreciation for the resource by increasing perceptions that the discovery was fated.

Imagine that you’re shopping for jewelry online, and the company’s brand biography webpage advertises that the gold mine from which it sources its material was discovered unintentionally when the company’s founder, a geologist, was on a hike. How would learning about the unintentional discovery of the gold mine influence your interest in shopping at the jewelry company?

- TR Taly Reich is an associate professor of Marketing at the Yale School of Management. Her research interests fall at the intersection of behavioral decision theory and social psychology. She has published articles in leading journals such as Nature, the Journal of Consumer Research and the Journal of Personality and Social Psychology.

- AF Alexander G. Fulmer is a Ph.D. Candidate in behavioral marketing at the Yale School of Management.

Partner Center

- Consumer Resource Center

- Our Approach

Events & News

What Does Value Mean To Your Consumer?

- April 17, 2024

Everything comes with a price, right? And if you’re out shopping, the price tag of your chosen item (and the cost of making it) is proof: the state of the economy is causing prices to be at an all-time high. But does the perceived value line up with the product value? What’s the price you’re willing to pay?

How are consumers coping with high prices and inflation? They’re trading off what they perceive as “value” to justify the price for the product.

- Should they buy your branded product, or go for the generic product?

- Do they buy in bulk, or go for the trial size?

- Do they splurge for the extra features, or stick to the original?

- Should they buy sustainable products with a purpose, or is it within their budget?

Where can they trade off, and what are they willing to give up?

These questions have become increasingly important to your consumers as they are looking for ways to spend their dollars more wisely. As a leader of your brand, you’re looking for ways to highlight the value of your products to win their purchase and repeat purchases.

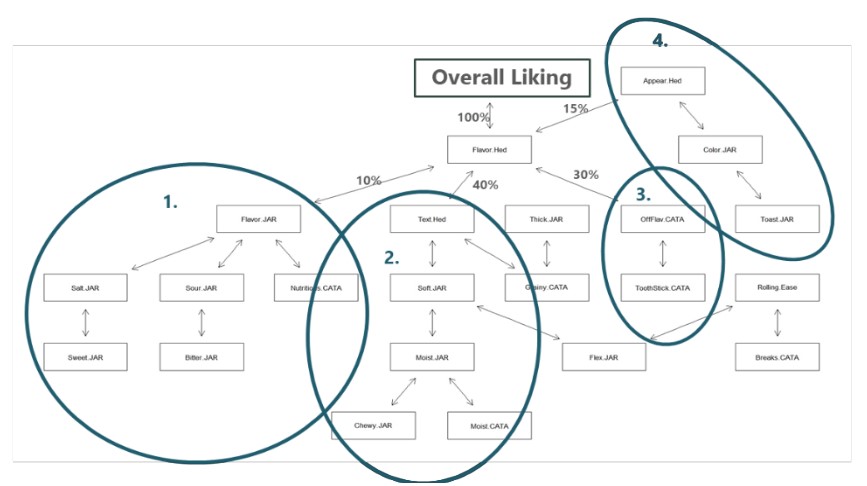

Knowing about the value trade-off dilemma from a consumer’s perspective, product developers are partnering with product testing and research companies like Curion to dig through and discover product blueprints to re-map value priorities that align with the needs of consumers.

This article dives into how we measure and test for value, and how those insights can closely connect your product and brand to your consumer in areas that matter most.

The Consumer Expectations of Value

When consumers search for a product, they have certain expectations behind the value of what that product can deliver for them. Think Apple Air Pods or hybrid electric vehicles. Consumer expectations about a product or a brand can affect how those consumers perceive their product experience – before they experience it.

Furthermore, these perceptions and expectations can shape our behaviors and product preferences that lead to purchase choices. After all, positive expectations paired with a positive experience from a product can lead to brand loyalty, word-of-mouth advertising, and repeat purchases.

According to an article in Journal of Services Marketing, “Perceived value refers to people’s evaluation after weighing the perceived benefits brought and the cost paid.”

Speaking as a consumer, our expectations should be aligned with the way we perceive the value of the product we’re buying.

The Value Equation

What does a Stanley tumbler, a Squishmallow, and a Tesla have in common? They are all successful products that carry status and a value that consumers are gladly willing to pay for.

In a perfect scenario, a successful product would be the equivalent of the right status, the right value, and the right price. However, no “perfect” scenario likely exists because consumers are often trading up or down to make the purchase.

Simply put, the Value Equation is a trade-off. It’s the balance between perceived benefits and costs. And it’s all in the eye of the consumer. For brands, it becomes important to understand your consumer to know what is meaningful and will deliver the best impact for your target consumer.

So this begs the question: What matters to consumers when it comes to value, and what are they willing to trade off in perceived benefits to result in a purchase?

Factors that influence perceived value

While it can be difficult to decipher, research companies like Curion can uncover the secrets behind what consumers truly value, going deep into psychological triggers.

As Harvard Business Review puts it, “Universal building blocks of value do exist, creating opportunities for companies to improve their performance in current markets or break into new ones.”

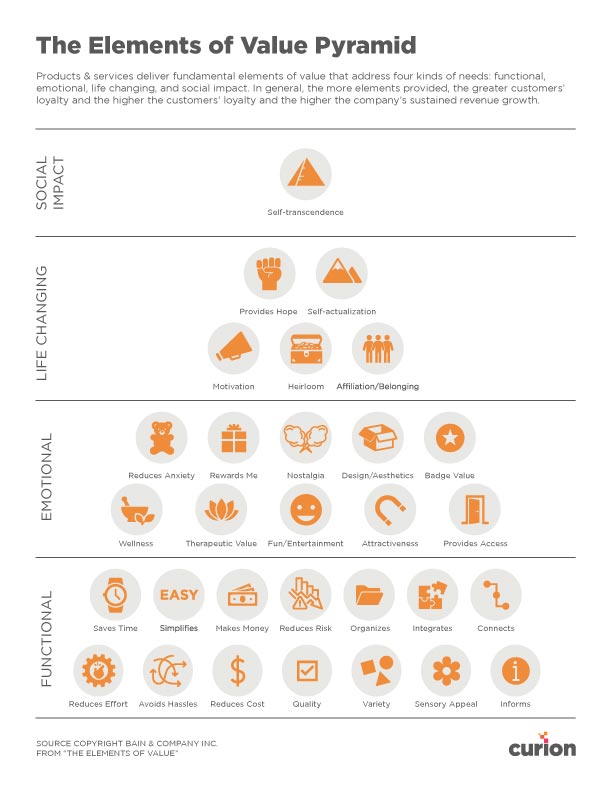

HBR uncovered 30 elements of value (“fundamental attributes in their most essential and discrete forms”) that fall into four kinds of needs: functional, emotional, life-changing, and social impact. While they cover inward and outward focused areas in our lives, the more elements a product or service can provide, the greater the brand/product loyalty which leads to higher revenue growth for companies.

Let’s trace this back to the psychologist Abraham Maslow’s Hierarchy of Needs. By identifying and mapping these value elements, the Hierarchy of Needs pyramid switches its focus on people as consumers, and highlights consumer behavior in relation to products.

Through a research study that tested 50 popular U.S. based companies, it was clear that some elements were identified to matter more than others. “Across all the industries we studied, perceived quality affects customer advocacy more than any other element.” With quality in the lead, other elements varied depending on the industry. For example, “sensory appeal” ranked second for food and beverage categories; grocery, discount, and apparel stores called out “variety” for their second highest score; while smartphones scored high in how they delivered value in the form of “reduces effort, saves time, connects, integrates, variety, fun/entertainment, provides access, and organizes.”

Even with quality ranked the highest, there’s still an ongoing debate between the tradeoff value of quality and price, leading consumers to wonder if it’s worth the money they’re spending. In some cases, a lower cost or generic alternative can deliver on the same experience and will draw more buyers if the value of a higher priced branded product isn’t noticed or acknowledged by consumers.

Strategic Testing for Value Perceptions

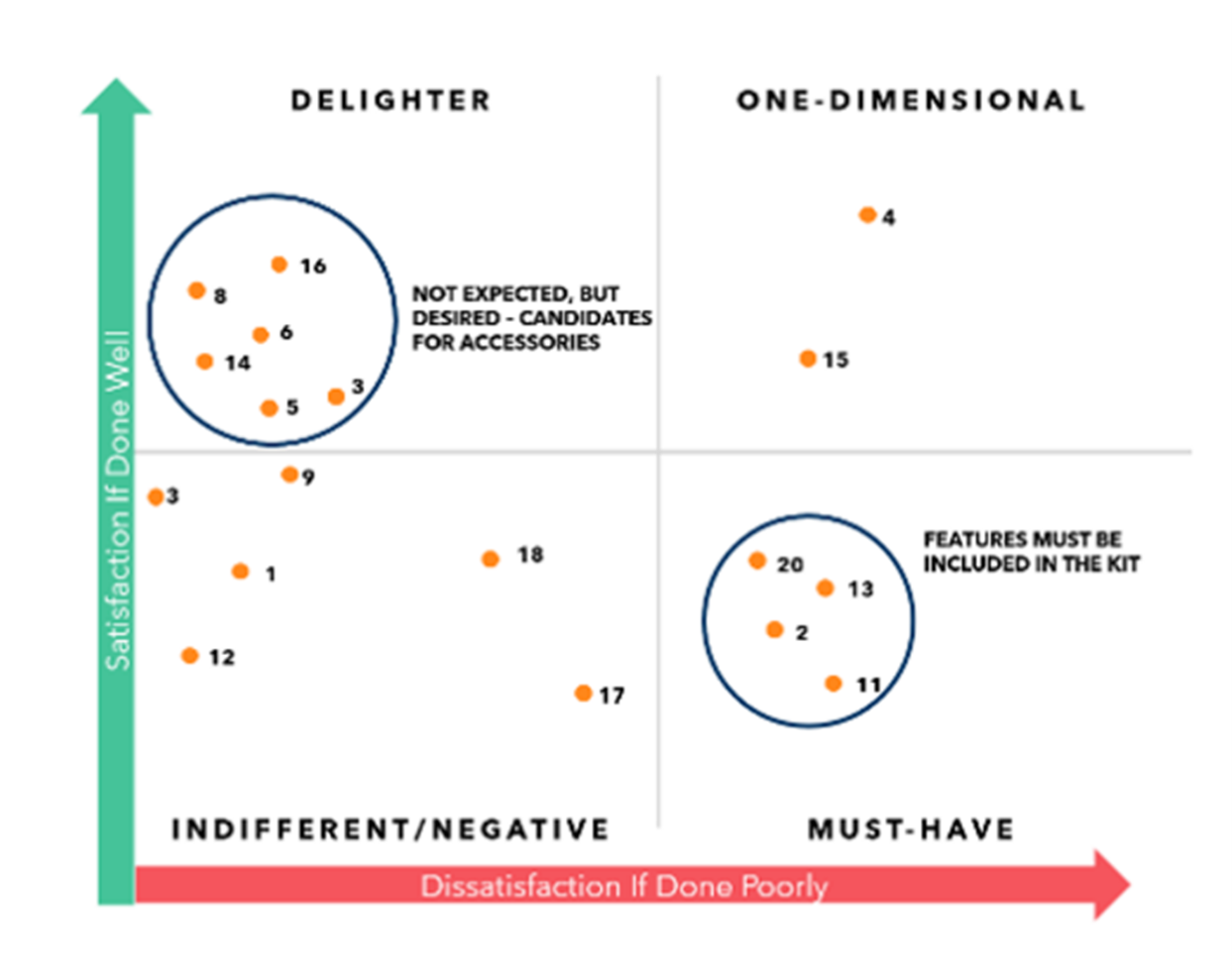

Curion’s mission is to connect brands to people, and we constantly help brands test their products to find perceived value for people by implementing Choice-Based Modeling through various Evaluative Statistical approaches. These advanced statistics can be built into regular product testing processes in-person and in-location or online like a Central Location Test (CLT) or a Home-Use Test (HUT) study to indicate which attributes are essential to consumer liking and how a product can achieve an even higher product preference.

Curion partnered with a luxury automotive company that pioneers product breakthroughs to fit their target consumer lifestyle. Through one of our studies, we tested over 40 features to learn which drove the highest interest in purchasing the client’s luxury outdoor product. Through Choice-Based modeling, a type of Conjoint testing, we were able to measure how a targeted group of consumers and brand users put value on the product and its features to reveal insights that lead to product preferences and purchase intent.

Brand loyalty is also a huge factor that plays into perceived value. When consumer segmentation is implemented into studies we’ve performed, we sifted through and uncovered what is considered valuable to different groups of consumers based on their demographics, lifestyles, interests, and much more. Focusing on certain segments and crossover elements across various segments can allow brands to identify areas of perceived value amongst their core target consumers. In many cases with segmentation, brand personas are generated to understand core segments and their level of brand loyalty.

Other methods also exist to uncover value perceptions in quantitative and qualitative research and testing methods. These include PROP studies, Alienation testing, Drivers of Liking, and Curion’s proprietary method called Fuel.

Learn more about our Fuel approach here.

Is your product built and designed for value?

In the end, the answers come down to each specific consumer value system. Do your consumers value status, functional benefits, brand name, sustainability, or something else entirely? It is crucial for brands and product developers to understand who their consumers are and know what resonates with them.

By conducting the right type of value research led by established, renowned, and well-known research companies like Curion, you and your fellow brand leaders will be reassured that your products are perceived as worth the price.

Let this serve as a future call to action for your brand and products to continually assess and realign your product value proposition with your consumer expectations. Rest assured, we’ve got your back to do the heavy lifting and ensure you that your products are built and designed for value.

About Curion:

Curion specializes in delivering impactful insights to the world’s top CPG companies, helping them develop winning, repeatedly purchased products. Curion’s deep data-driven product insights, sensory expertise, and state-of-the-art consumer centers enable them to uncover responses to critical client objectives. With over five decades of experience in the product testing industry, Curion is dedicated to guiding clients with their proprietary Product Experience and Performance (PXP™) platform, connecting brands to consumers at every step. An innovator in the industry, Curion recently developed a groundbreaking benchmarking product testing method, the Curion Score™, which has become a trusted and sought after tool within the industry. As one of the largest product and consumer insights companies in the U.S., Curion has built a reputation for excellence and trust among the world’s leading consumer brands. Curion’s commitment to innovation and expertise, coupled with a passion for delivering actionable insights, makes Curion a valuable partner for companies looking to develop and launch successful products.

- See All News and Articles

111 Deer Lake Road, Suite 120 Deerfield, IL 60015

- All Locations

- Privacy Policy

- Atlanta (Johns Creek)

- Atlanta (Sandy Springs)

- San Francisco

- 2024 Curion LLC. All rights reserved.

The rise of the inclusive consumer

The American consumer is undeniably becoming more inclusive. Responding to our survey 1 McKinsey Inclusive Consumer Survey, October 2021. in October 2021, two out of three Americans told us their social values now shape their shopping choices. And 45 percent—likely representing well over a hundred million shoppers 2 Extrapolated data: 45 percent of 270 million US residents over 18 years old would be about 120 million. —believe retailers should actively support Black-owned businesses and brands. This 45 percent represents the inclusive consumer.

About the authors

This article is a collaborative effort by Pamela Brown, Tiffany Burns , Tyler Harris, Charlotte Lucas, and Israe Zizaoui, representing views from McKinsey’s Retail Practice.

Large consumer and retail players from Nordstrom to Yelp are moving quickly to serve this group of influential customers. Indeed, while inclusive consumers tend to be younger, female, and more racially diverse, they include men and women across ethnic backgrounds, income levels, and age groups. Given this diverse and ubiquitous representation, the inclusive consumer holds the unique power to influence all demographic groups (Exhibit 1).

The inclusive consumer is more likely than other shoppers to buy Black-owned brands out of a desire to support diverse entrepreneurs on their growth journeys and small businesses in general (Exhibit 2). Like many other consumers today, they base their shopping choices less on traditional advertising and more on social media, friends’ recommendations, and the stories of those who founded the brands they admire. They are also more likely than other shoppers to care about sustainability and quality. 3 McKinsey Inclusive Consumer Survey, October 2021.

Where the inclusive consumer may be headed

Inclusive consumers are a large and influential population, and they want to spend more on Black-owned brands, which they know are underrepresented on store shelves. However, finding the brands and the products remains a barrier. Indeed, one in five inclusive consumers cited not finding the products they wanted as a reason for not buying from Black-owned brands. This plays out in the bigger picture of US retail spending as well. While about 14 percent of the US population identifies as Black, 4 “Quick facts,” United States Census Bureau, July 1, 2019. Black-owned brands rang up only about $83 billion in sales in 2020 5 Estimated with consumer-reported proportion of holiday shopping with Black-owned brands and National Retail Federation data on 2020 holiday spending of $790 billion. —less than 1.5 percent of $5.4 trillion 6 “Sales for U.S. retail trade sector over $5,411.0 billion,” United States Census Bureau, January 28, 2021. of retail spending. In our survey, about 21 percent of inclusive consumers said they had pledged to devote at least 15 percent of their retail spending to Black-owned brands in an effort to turn the tides. 7 McKinsey Inclusive Consumer Survey, October 2021.

Most retailers will need to make changes to meet the needs of inclusive consumers. Fewer than half of these shoppers say they know which products on retail shelves are from Black-owned brands, and a third don’t know where to go to purchase Black-owned brands. 8 McKinsey Inclusive Consumer Survey, October 2021. About 45 percent of the inclusive consumers we surveyed said they would value relevant labeling on store shelves and the ability to filter website results to find Black-owned brands. About a third would value additional sources of information, such as curated lists of products, a database of Black-owned brands, and recommendations from influencers.

Major retailers are now joining social influencers and other stakeholders to spread the word. Growing support for Black-owned brands is evident in social media and traditional media: a wide range of publications, from New York magazine and GQ to Harper’s Bazaar 9 “The 42 best gifts to shop from Black-owned businesses now and forever,” Harper’s Bazaar , November 17, 2021. and whowhatwear.com, published a curated holiday list of products from Black-owned brands in November 2021. In the same month, Oprah’s “favorite things” list 10 “Oprah’s favorite things 2021 list is here!,” Oprah Daily, November 23, 2021. focused on products from small businesses, many of which are owned by women and people of color.

How retailers could attract the inclusive consumer

In a marketplace being transformed by digitization, social change, and a global pandemic, leading retailers and brand managers know that they must keep meeting evolving consumer preferences to stay relevant. Major retailers are now reviewing how they work—from operations and merchandising to hiring and HR practices—and starting to move the needle. Retailers should consider actions in five main areas to bring the inclusive consumer through their doors and onto their websites.

Action 1: Reshape shelves. Retailers can first and foremost demonstrate a commitment to the inclusive consumer by evaluating and reimagining the brands on their shelves. Many are already taking strong action, reimagining their merchandising mix to make shelves and the brands that sit on them more representative. For example, more than 28 national retailers, including Gap, Macy’s, and Sephora, have signed the Fifteen Percent Pledge’s call for 15 percent of retail shelf space to be dedicated to Black-owned brands. Some of these retailers have doubled their assortments of Black-owned brands in just a year, opening their doors to almost 400 brands. 11 Elizabeth Segran, “In one year, the 15% Pledge got 385 Black-owned brands on the shelves of Macy’s, Gap, Sephora, and more,” Fast Company , July 7, 2021. In addition to introducing Black-owned brands, retailers could also review their planograms and product placement: for example, Ulta Beauty is intentional about placing Black-owned brands in prime locations in stores and creates dedicated efforts to increase Black-owned brands’ features in circular advertising and email marketing. 12 Liz Flora, “Camille Rose expands to Ulta Beauty as retailer makes Black-owned brand push,” Glossy, April 12, 2021.

Retailers can first and foremost demonstrate a commitment to the inclusive consumer by evaluating and reimagining the brands on their shelves.

Action 2: Switch up sourcing. Retailers, especially those who are vertically integrated, could also demonstrate commitment to the inclusive consumer by doubling down on diversity in their supply chain. For example, Best Buy has committed to spending at least $1.2 billion with businesses owned by members of the Black, Indigenous, and people of color (BIPOC) community and other diverse businesses by 2025. 13 “Best Buy commits to spending $1.2 billion with BIPOC and diverse businesses by 2025,” Business Wire, June 24, 2021. The commitment includes plans to increase all forms of spending with businesses from nearly every corner of the company—from how it brings goods and services to stores to where and how it advertises. Supplier diversity is not limited to retailers and can also be considered broadly by most brands and companies. For example, in 2020, the Coca-Cola Company committed to spending an additional $500 million over five years with Black-owned suppliers, more than doubling the company’s previous commitment. 14 “Coca-Cola Company commits $500 million in additional spending with Black-owned suppliers,” Coca-Cola Company, October 10, 2020. These actions show an increasing commitment to diversity across the supply chain, and these types of commitments will likely grow in future years as consumers begin calling for similar levels of diversity in the supply chain as they are calling for on shelves.

Action 3: Map it out. Inclusive consumers consistently say that not knowing which brands are Black-owned or where to shop for them are barriers to spending as much as they would like on brands from diverse founders. And wayfinding is their resounding answer. Retailers could help consumers identify Black-owned brands with clear labeling on shelves and websites, the ability to filter website search results, and curated lists of products, for example.

Sephora responded to these needs by creating a dedicated tab on its website to share Black-owned brands’ stories and products and by enhancing its online site, which features Black-owned brands on its browsing pane, provides a filter for shoppers looking for Black- and BIPOC-owned brands, and provides curated lists of recommended products, including a “Sephora Favorites” bundle in Black-owned beauty. 15 Kori Hale, “Sephora’s planning to double down on Black-owned brands,” Forbes , January 25, 2021. Google is also actively working on multiple initiatives to support Black-owned brands, including a tool that allows Black-owned businesses to identify themselves in maps, listings, and Google business-profile searches. 16 Keyword , “Standing with the Black community,” blog entry by Sundar Pichai, Google, June 3, 2020; “Supporting Black-owned businesses,” Google for Small Business, 2021. Additionally, Google has launched the ByBlack platform, which consists of both a national Black business directory (powered by the US Black Chambers) and a national certification as a Black-owned business (in partnership with American Express). This tool provides Black entrepreneurs access to a community with valuable business resources (including Google trainings) and a way to help reach new customers.

Action 4: Share the stories. Inclusive consumers care about what is on shelves, but they want more. They want to learn about founders’ stories, for example, and support the missions of small businesses. Further, our research shows that inclusive consumers are more likely than other shoppers to buy Black-owned brands based on recommendations from friends, and retailers that incorporate founder stories into marketing and digital placements are more likely than those that don’t to attract the inclusive consumer’s eye. Nordstrom, for example, introduced “Concept 012: Black_Space,” which includes a dedicated shop developed, designed, and curated by Black voices to amplify Black representation through in-store buildouts and merchandising. The concept is further supported with an online site experience that includes video content created by Black curators to represent their perspectives. 17 “New Concepts @Nordstrom launches Concept 012: Black_Space,” Nordstrom, February 22, 2021.

Action 5: Ditch the big-brand playbook. Introducing and cultivating smaller brands takes different capabilities and mindsets than retailers may be accustomed to when working with larger, more established brands. Unlike big brands, small brands come with more variability in experience and know-how, as well as growing pains as they enter the bigger retail stage. Retailers that are committed to fostering smaller brands will need to work differently, creating teams that understand how these brands operate. For example, those with experience working with small brands know that everyday requirements from retailers, such as buy sizes and inventory systems, can have large-scale repercussions on small brands with limited working capital or team capacity to meet these terms. A retailer that seeks to help smaller brands can boost the odds of success by adapting its playbook and its teams to suit their needs.

The time is now

In the years ahead, millions more consumers will likely join the ranks of inclusive consumers, rewarding businesses that pursue inclusion and avoiding those that don’t.

Businesses that meet the needs of inclusive consumers will likely do more than raise revenues and loyalty—they may also earn dividends in other areas of the business, including attracting and retaining talent. About 70 percent of the US-based employees we surveyed in August 2020 said their sense of purpose is largely defined by work, and nearly two-thirds said COVID-19 had caused them to reflect on their purpose in life, and nearly half were reconsidering the kind of work they do. (For more on this topic, please see Naina Dhingra, Andrew Samo, Bill Schaninger, and Matt Schrimper “ Help your employees find purpose—or watch them leave .”)

Whether employees or customers, the inclusive consumer is changing the imperative for retail. The evidence is overwhelming: the inclusive consumer is leading the pack, influencing consumers across demographics, and voting with their pocketbooks for retailers that support diverse entrepreneurs and their products. (For more on this topic, please see “ The Black unicorn: Changing the game for inclusivity in retail .”)

Pamela Brown is a partner in McKinsey’s New Jersey office, where Charlotte Lucas and Israe Zizaoui are consultants; Tiffany Burns is a partner in the Atlanta office; and Tyler Harris is an associate partner in the Washington, DC, office.

Explore a career with us

Related articles.

Help your employees find purpose—or watch them leave

The Black unicorn: Changing the game for inclusivity in retail

Reimagining marketing in the next normal

More From Forbes

How the 5-year total return helps measure value creation performance.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Figure 1: The Wealth of Nations by Adam Smith; Structure of Scientific Revolutions by Thomas Kuhn, ... [+] and Wisdom of Crowds by James Surowiecki

Tired of anecdotal accounts of management performance? Or cherry-picked management studies? Or self-serving claims by managers and consultants of successful turnarounds?

Then look no further than the 5-Year Total Return (5YTR). It helps measure aspects of a public firm’s performance. Examples of its usefulness were included in my last article . This article offers more on its function, strengths and limitations.

Thus, the 5YTR is not just another useful gadget. It can shed light on how the fastest growing firms today are being run very differently from average performing firms. “Management has been upended,” said Business School Professor of Leadership, Tammy Erickson recently at a Drucker Forum session . A management paradigm shift of the kind envisaged by Thomas Kuhn appears to be under way. In 2024, it’s not only time, as Peter Drucker suggested to “ look out the window and see what's visible—but not yet seen." We also need to change the way we think about and measure performance. The 5YTR can help solve the puzzle.

The Meaning Of The Long-Term Total Return

The 5-Year Total Return (5YTR) is a ratio calculated as follows:

Figure 2: Equation for 5-Year Total Return of a public company

In its numerical form, it is a percentage.

In its graphical form, the 5YTR shows how the stock market’s perception of the value of the stock has changed over the years.

Billionaire Mark Cuban Issues Post-Halving Bitcoin Warning Amid ‘Unprecedented’ Crypto Fee Price ‘Chaos’

Aew dynasty 2024 results winners and grades as swerve makes history, who is david pecker why he s testifying against trump in hush money trial.

Figure 2A: 5YTR of S&P500 vs Verizon, AT&T and T-Mobil US

A similar formula can calculate and picture the 10-year or 20-Year Total Return, if an even-longer-term perspective is desired.

The long-term total return (LTTR) of a public firm is composite measure of the stock market’s collective judgment that draws on:

· the perceived rate of value creation over the previous years,

· the efficiency of that value creation, and,

· a prediction as to the value that the firm will create in future.

The 5YTR is a gestalt generated by the active players in the stock market on a continuing basis over the previous 5 years. Although the 5YTR cannot be broken down into different components, separate indices are available to measure other dimensions of performance as needed.

How The Stock Market Serves As A ‘Societal Determinator’

The 5YTR is not just another opinion. In a capitalist economy, the stock market participants collectively assign a stable, rising, or falling, price to each public firm for the future. These price decisions are a set of societal decisions that largely determine whether a firm can acquire additional resources to do more, or alternatively, to suffer financial sanctions for perceived performance shortfalls.

The stock market thus functions as a “societal determinator” of public companies. Although investors may be pursuing their own self-interest and short-term gains, and stock prices can fluctuate wildly in the short-term, the collective actions of multiple “bullish” and “bearish” investors over time can result in relatively stable public valuations over time. The functioning of the 5YTR illustrates Adam Smith’s " invisible hand " in The Wealth of Nations: collective pursuit of self-interest can sometimes result in public welfare.

The 5YTR has obvious strengths and limitations.

The 5YTR’s Strengths

1. The Stock Market Draws On A Cornucopia Of Supporting Evidence: Public firms provide a vast array of audited financial, performance, and conversational data on a quarterly basis. Firms obviously seek to portray their activities in the best light, while analysts collectively seek to uncover hidden advantages or flaws. Civil and criminal penalties are applied for providing misinformation. Differing viewpoints, pro and con, are freely available.

2. The 5YTR Exemplifies ‘The Wisdom Of Crowds’: The 5YTR is a measure that reflects the collective judgment of investors, As James Surowiecki's argues in The Wisdom Of Crowds , groups are often smarter than the smartest individuals in them. The 5YTR has all the elements of useful crowd intelligence, including diversity of opinion, documentation of alternative viewpoints, independence of decision-makers, access to specialized and local knowledge, auditing of key input information, decentralization of judgments, an aggregating mechanism for collective decision-making, and a real interest in the outcome.

3. The 5YTR Captures Flow And Momentum, Not Just Snapshots: The graphical representation of the 5YTR helps uncover important performance trends. It looks beyond short-term ups and downs of the stock price. Seemingly abrupt declines or startling rises in value, or shifts in the economic context, can be seen in a clearer perspective.

4. The 5YTR Builds On ‘Exchange Value’ For Customers: : A key element in the valuing of stocks include earnings, hence sales, and ultimately the value that customers see in a firm’s products and services.. The 5YTR reflects in part the "exchange value” by which the customer’s subjective value becomes objective through the mechanism of willingness to pay. Customer perspectives can also be verified other methods, particularly sales data.

5. The 5YTR Enables Comparisons Between Firms Of All Sizes : it compares compare the performance of giants like Apple and Microsoft as well as tiny firms like Signet Jewelers or e.l.f. cosmetics .

6. The 5YTR Can Be Applied Globally: Thus “Blue Chip” European firms show the same split in performance as U.S. firms showed in my last article .

Figure 3: 60% of Blue Chip European firms perform below average

7 . The 5YTR Is Continuously Updated on tens of thousands of companies, their products and services and their customers.

8 . The 5YTR Is Widely Accepted. Although infrequently referred to in management or academic writing, the 5YTR is widely used in the financial world.

9 . The 5YTR Is Free And Easy To Use The information is available instantly and doesn’t require additional work. The information is available free of charge, at many sites including Finance Charts .

The 5YTR’s Limitations

The 5YTR’s main drawbacks as a measure include:

1. The 5YTR Is Necessary, But Not A Sufficient, Condition Of Success. It is useful summary as a starting point for analysis, not a final measure of success. Other dimensions need to be examined.

2. The 5YTR Prioritizes The Viewpoint Of Shareholders: It prioritizes viewpoint of investors and shareholders, ahead of employees and society. However as 58% of US households now own shares in the stock market and that percentage is steadily increasing, financial literacy is itself an issue of increasing public concern.

3. The 5YTR Covers Customer Value Indirectly Rather Than Explicitly : It is not a direct measure of customer value. It can be pursued separately by considering sales.

4. Big Players Have A Greater Say Than Small Players: Big players have more money at stake but often make more effort into making the best decision. If their judgements are wrong, they in turn suffer the consequences.

5. The Use Of The 5YTR May Facilitate Share Buybacks And Egregious Executive Compensation . Executive compensation is way out of line. $5 trillion in stock buybacks is a huge distortion in U.S. firms.

6. The 5YTR Doesn’t Eliminate Scams. Even though the 5YTR builds on a huge repository of audited data, cases of massive fraud like Enron or FTX do occur, but they are rare,

7. The 5YTR Follows A Period Of Aberrant Capitalism . The last half-century has been a period of aberrant capitalism . Nevertheless, the 5YTR can help navigate through those aberrations.

8. The 5YTR prioritizes growth: For some critics, growth is the problem, not the solution.

Alternatives To The 5YTR:

There are many alternatives to the 5YTR, none of them very satisfactory by themselves, including:

· Anecdotal accounts are essential supplements to data but cannot replace data.

· Indices such as sales revenues are closer to the customer viewpoint but don’t permit comparisons between firms of different sizes or measurement of the efficiency of delivering sales.

· Surveys such as the Net Promoter Score depend on who is surveyed, and why, as well as the survey’s underlying agenda.

· Rating agencies also depend on surveys and private ratings.

· Financial models like CF-ROIC depend on many internal assumptions as well as on business models that may now be obsolete.

Just as democracy is often said to be the worst form of governance except every other form that has been tried, so the 5YTR might be the worst single measure of performance of public firms, except for every other measure that has been tried.

The 5YTR is a fact of life. Use it—or ignore it—at your peril.

And read also:

The Management Paradigm Driving The World’s Most Valuable Firms

A Powerful Tool That Sees Behind The Financial Headlines

Most valuable US, European, & Japanese and other firms: # employees, market cap and 5YTR as of April ... [+] 7 2024

- Editorial Standards

- Reprints & Permissions

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Key findings about Americans and data privacy

Many Americans have endless digital tools at their fingertips. And each device, site or app collects, analyzes and uses personal data. What does this mean for Americans now that so much of their day-to-day life leaves a digital footprint?

Pew Research Center has a long record of studying Americans’ views of privacy and their personal data, as well as their online habits. This study sought to understand how people think about each of these things – and what, if anything, they do to manage their privacy online. ( Read the full report .)

This survey was conducted among 5,101 U.S. adults from May 15 to 21, 2023. Everyone who took part in the survey is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race and ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for this analysis , along with responses, and its methodology .

Here are nine takeaways from a new Pew Research Center report exploring these issues.

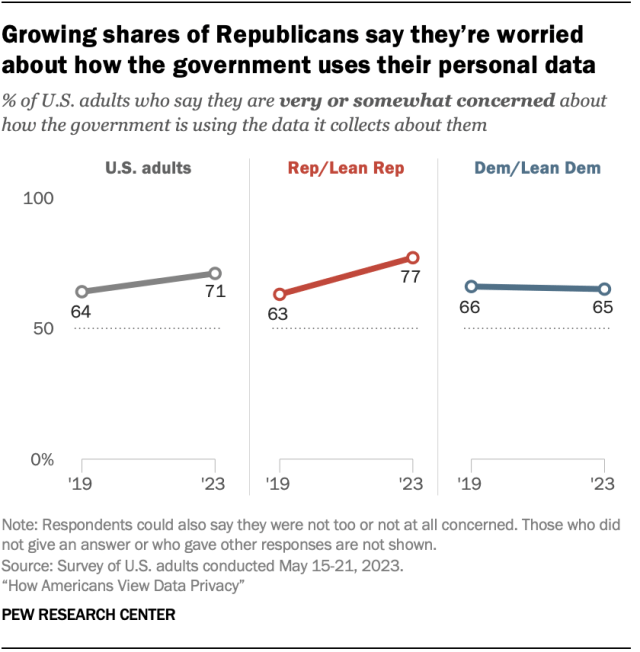

Americans, especially Republicans, are growing more concerned about how the government uses the data it collects about them. About seven-in-ten U.S. adults (71%) say they are very or somewhat concerned about this, up from 64% in 2019. Concern has grown among Republicans and those who lean Republican but has held steady among Democrats and Democratic leaners.

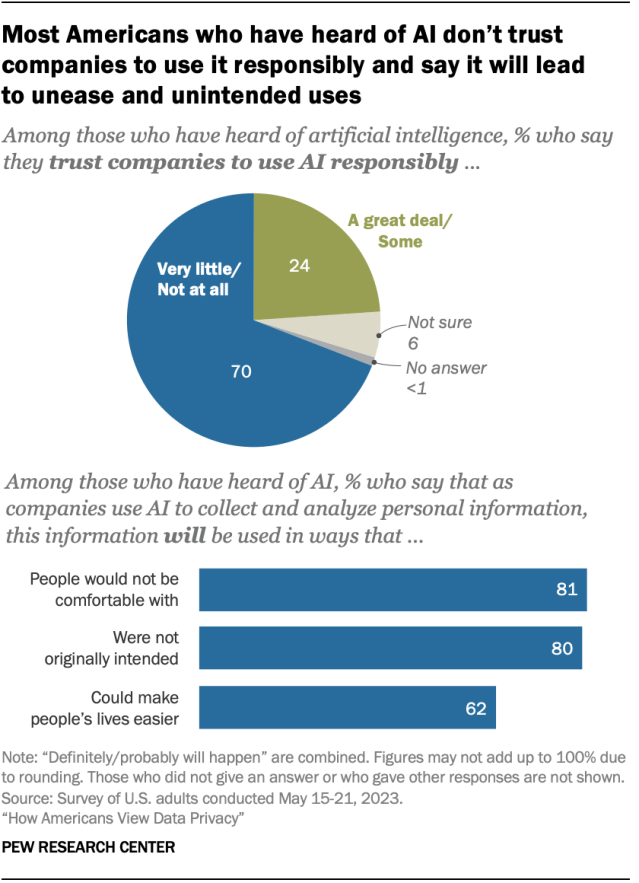

Many Americans have little trust in companies to use AI responsibly. Among those who have heard of artificial intelligence (AI):

- 70% say they have little to no trust in companies to make responsible decisions about how they use AI in their products.

- 81% say the information companies collect will be used in ways that people are not comfortable with

- 80% say it will be used in ways that were not originally intended.

Still, 62% of those who have heard of AI say companies using it to analyze personal details could make life easier.

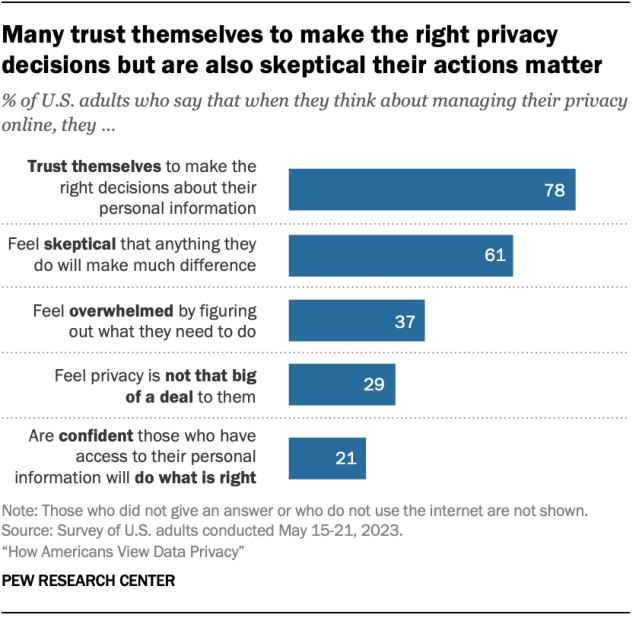

Many trust themselves to make the right decisions but are skeptical their actions matter. About eight-in-ten (78%) say they trust themselves to make the right decisions to protect their personal information.

But a majority (61%) are skeptical anything they do will make much difference. And only about one-in-five are confident that those with access to their personal information will treat it responsibly.

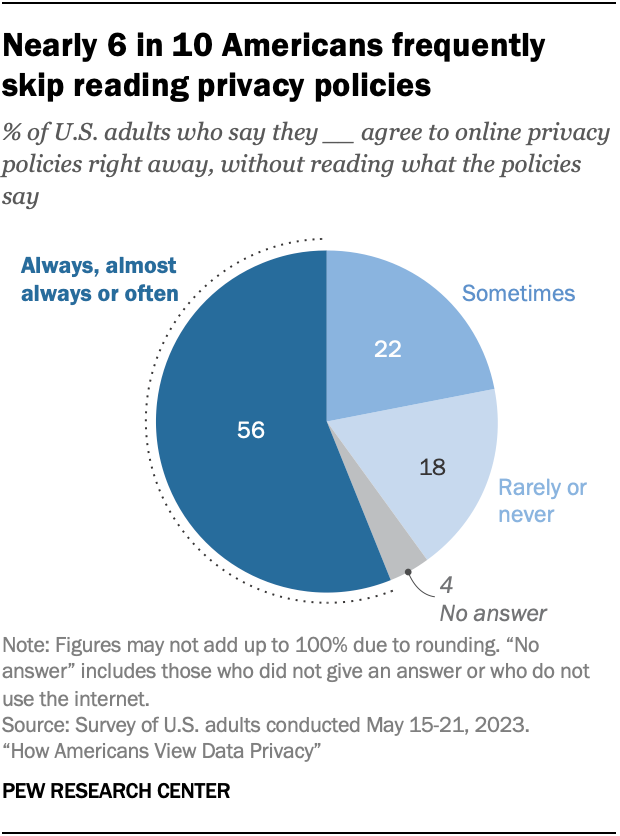

More than half of Americans (56%) say they always, almost always or often click “agree” without reading privacy policies. Another 22% say they do this sometimes and 18% rarely or never do this.

People are also largely skeptical that privacy policies do what they’re intended to do. About six-in-ten Americans (61%) think they’re ineffective at explaining how companies use people’s data.

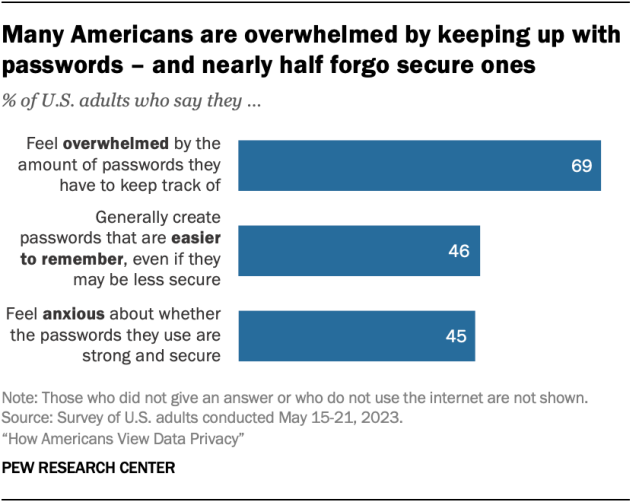

About seven-in-ten Americans are overwhelmed by the number of passwords they have to remember. And nearly half (45%) report feeling anxious about whether their passwords are strong and secure.

Despite these concerns, only half of adults say they typically choose passwords that are more secure, even if they are harder to remember. A slightly smaller share (46%) opts for passwords that are easier to remember, even if they are less secure.

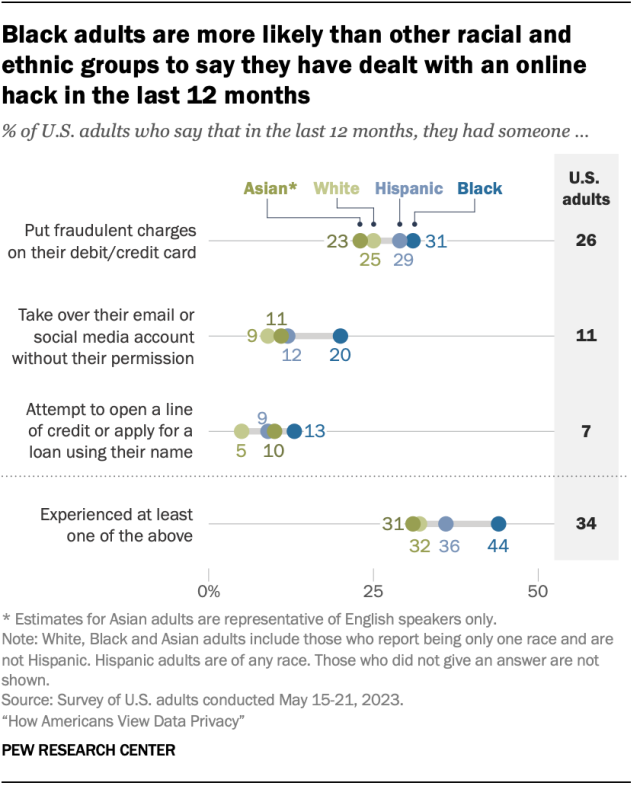

Some Americans have been targets of data breaches and hacking. In the past 12 months:

- Roughly a quarter of Americans (26%) say someone put fraudulent charges on their debit or credit card.

- A smaller share say they have had someone take over their email or social media account without their permission (11%).

- And 7% have had someone attempt to open a line of credit or apply for a loan using their name.

In total, 34% of Americans have experienced at least one of these issues in the past year. However, Black Americans are more likely than members of other racial and ethnic groups to have faced this.

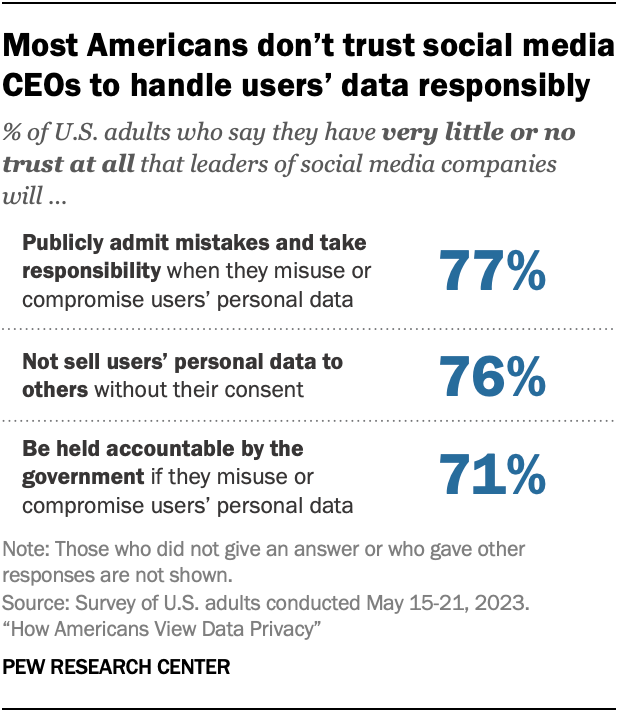

Americans have little faith that social media executives will protect user privacy. Some 77% of Americans have little or no trust in leaders of social media companies to publicly admit mistakes and take responsibility for data misuse.

They are no more optimistic about the government reining them in: 71% have little to no trust that tech leaders will be held accountable for their missteps.

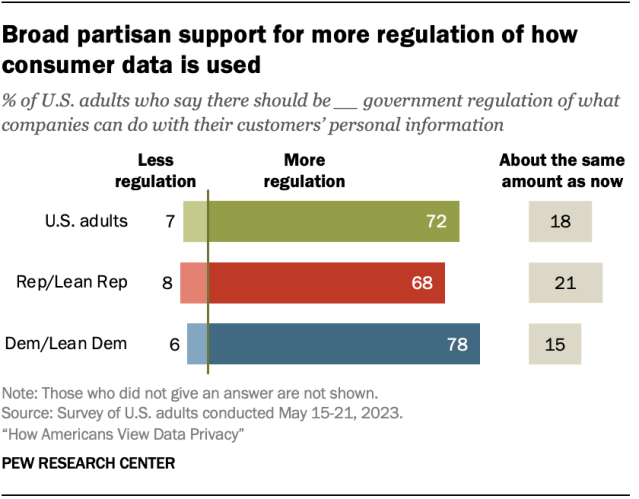

There is bipartisan support for more regulation to protect personal information. Some 78% of Democrats and 68% of Republicans think there should be more government regulation of what companies can do with customers’ personal information.

These findings are largely similar to our 2019 survey , which also showed strong support for increased regulation across parties.

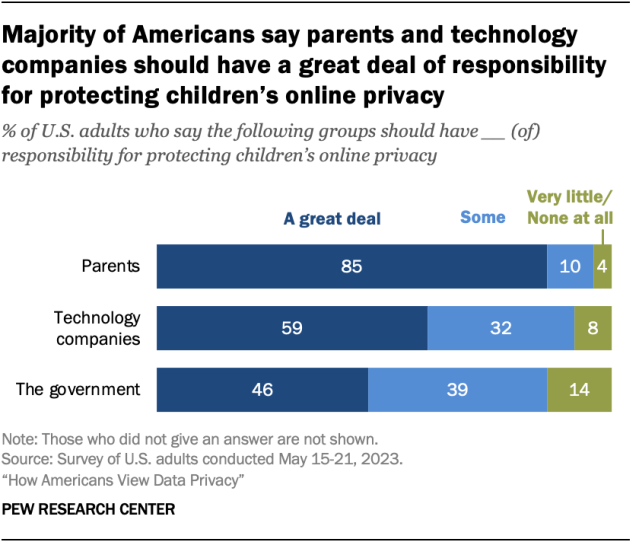

About nine-in-ten Americans (89%) are concerned about social media sites knowing personal information about children. Most Americans are also concerned about advertisers using data about children’s online activities to target ads to them (85%) and online games tracking children on the internet (84%).

When it comes to who should be responsible for protecting kids’ online privacy, a vast majority (85%) says parents should bear a great deal of the responsibility. Still, roughly six-in-ten say the same about technology companies, and just under half believe the government should have a great deal of responsibility.

Note: Here are the questions used for this analysis , along with responses, and its methodology .

- Artificial Intelligence

- Online Privacy & Security

- Privacy Rights

- Social Media

Many Americans think generative AI programs should credit the sources they rely on

Americans’ use of chatgpt is ticking up, but few trust its election information, q&a: how we used large language models to identify guests on popular podcasts, striking findings from 2023, what the data says about americans’ views of artificial intelligence, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY podcasts

EY webcasts

Operations leaders

Technology leaders

Marketing and growth leaders

Cybersecurity and privacy leaders

Risk leaders

EY Center for Board Matters

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

Artificial Intelligence (AI)

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

Supply chain and operations

EY Partner Ecosystem

Explore Services

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

MBA and advanced-degree students

Student and entry level programs

Contract workers

EY-Parthenon careers

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

Energy and resources

How data analytics can strengthen supply chain performance

13-Jul-2023 Ben Williams

How Takeda harnessed the power of the metaverse for positive human impact

26-Jun-2023 Edwina Fitzmaurice

Banking and Capital Markets

How cutting back infused higher quality in transaction monitoring

11-Jul-2023 Ron V. Giammarco

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

EY is now carbon negative

19-Sep-2022 Carmine Di Sibio

Our commitment to audit quality

13-Nov-2023 Julie A. Boland

No results have been found

Recent Searches

BEPS 2.0: as policies evolve, engagement is key

It remains to be seen whether the US will align its tax law with the OECD/G20’s global BEPS 2.0 rules. MNEs will feel the impact in 2024. Learn more.

How GenAI strategy can transform innovation

Companies considering or investing in a transformative GenAI strategy should tie generative artificial intelligence use cases to revenue, cost and expense. Learn more

Top five private equity trends for 2024

Read about the five key trends private equity firms will emphasize in 2024 as they create value

Select your location

close expand_more

Banking & Capital Markets

The bank of the future will integrate disruptive technologies with an ecosystem of partners to transform their business and achieve growth.

Disruption is creating opportunities and challenges for global banks. While the risk and regulatory protection agenda remains a major focus, banks must also address financial performance and heightened customer and investor expectations, as they reshape and optimize operational and business models to deliver sustainable returns. Innovation and business-led transformation will be critical for future growth. To remain competitive and relevant, every bank must embrace disruption and strategically build a better ecosystem — not a bigger bank.

Our worldwide team of industry-focused assurance, tax, transaction and consulting professionals integrates sector knowledge and technical experience. We work with clients to navigate digital innovation, new business models and ecosystem partnerships, helping banks become the nimble, responsive organizations that customers demand.

Five priorities for harnessing the power of GenAI in banking</p> "> Five priorities for harnessing the power of GenAI in banking

What to expect from global financial services in 2024 — Americas and EMEIA

In this webcast for Americas and EMEIA audiences, the EY Global Regulatory Network will discuss the direction of travel for regulators across key areas and how to prepare for what's coming.

Our latest thinking on Banking & Capital Markets

Can core platform modernization position a bank for future success?

Case study: how one regional bank used core platform modernization to build a strong foundation for future profitability.

The case for a modern transaction banking platform

The evolution of corporate treasury management needs presents an opportunity for corporate banks. Learn from an industry approach.

How to transition from a tactical to strategic adoption of ISO 20022

With ISO 20022 adoption lagging amid competing global deadlines, a successful migration may hinge on changing from a tactical to a strategic mindset.

How Gen Z’s preference for digital is changing the payments landscape

EY survey shows Gen Z embraces simple, seamless payment methods. Learn more.

How can financial institutions modernize their fair-lending practices?

FIs that disregard fair banking are lagging behind FIs that enhance compliance procedures, lending models and data analytics to become more compliant. Read more.

Digital identity opportunities in financial services

Exploring the policy and regulatory trends shaping digital identity and opportunities for financial services companies in a changing payment landscape.

Explore our Banking & Capital Markets case studies

Impacts of Central Clearing of US Treasuries and Repo

In this webcast, panelists will discuss key themes and high-level requirements of the US Treasury and repo central clearing rules.

Using AI to augment pricing intelligence for banks

How an AI-powered digital tool, Smart Advisor (SA), helped one bank deliver better client service while maximizing value creation.

How a global FinTech captured growth in the SME segment

A global Fintech captured growth in an opportunistic SME segment with a differentiated, holistic strategy. Learn more in this case study.

Using AI to improve a bank’s agent effectiveness

Leveraging the power of AI and machine learning, one bank mined sales agents’ calls for performance-boosting insights. Learn more in this case study.

After cloud migration, investment bank sees potential for big dividends

A leading investment bank sought to move vital assets to the clouds by building an experienced, cross-functional team. Find out how.

How digital transformation is redesigning trade finance

Banks that adopt an agile, design-based approach to digital transformation can boost the success of their trade finance functions.

How to transform product development to outperform the competition

EY Nexus is a cloud-based platform offering access to the most advanced technologies to launch new products, businesses and services.

How EY can help

Capital Markets Services

Know how our Capital Markets consulting team can help your business grow, manage costs and meet regulatory requirements.

Consumer banking and wealth services

EY consumer banking and wealth technology solutions are designed to drive operational excellence and profitable growth. Learn more.

Corporate, Commercial and SME Banking services

Our Corporate, Commercial and SME (CCSB) Banking services team can help your business navigate through rising market expectation. Learn more.

Cost transformation

EY cost transformation teams help banks to optimize profits and fund transformation. Find out more.

Consumer lending services

Our consumer lending team can help navigate the complexities of unique lending propositions. Find out how.

EY Nexus for Banking

A transformative solution that accelerates innovation, unlocks value in your ecosystem, and powers frictionless business. Learn more.

Finance transformation

We help clients transform finance functions to be a strategic business partner for the business via value creation and controllership activities.

EY Financial Crime solutions

Our skilled teams, operational efficiencies enabled by innovative technology and flexible global delivery service centers can help you manage financial crime risk in a cost-effective, sustainable way.

Financial services risk management

Discover how EY can help the banking & capital markets, insurance, wealth & asset management and private equity sectors tackle the challenges of risk management.

IBOR transition services

EY helps global institutions prepare for the imminent transition away from Interbank Offered Rates (IBORs) to Alternate Reference Rates (ARRs). We also play a leading role in supporting regulators, trade associations and others to increase awareness and education.

Open banking services

Our open banking professionals can help your business maintain a trusted and secure open banking ecosystem while managing its risks. Learn more.

Payment services

Our payments professionals can help your business enhance innovation, drive growth and improve performance. Find out more.

Third-party risk management services

Discover how EY's Third Party Risk Management team can enable your business to make better decisions about the third parties they choose to work with.

Direct to your inbox

Stay up to date with our Editor‘s picks newsletter.

The Banking & Capital Markets team

Enjoys traveling with family, and coaching his daughters’ basketball and soccer teams. Enjoys running and playing basketball and golf.

Lee Ann Lednik

People-focused leader committed to building trust and transparency amid increasing complexity. Passionate working mom of three. Aspiring photographer. Avid sports fan.

David Kadio-Morokro

Passionate about technology, innovation, and leading EY people to solve clients’ most challenging problems.

Heidi Boyle

Passionate about helping people thrive in the workplace and creating a sense of belonging for all. Writer. Musician. Cooking enthusiast.