- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Netflix’s Bold Disruptive Innovation

- Adam Richardson

Every now and then, the business world presents us with a lab experiment that we can observe in realtime. Netflix’s announcement that it is splitting off its DVD-by-mail business from its streaming business is just such an experiment. The DVD business will now go by the name Qwikster, and the streaming business will stay under […]

Every now and then, the business world presents us with a lab experiment that we can observe in realtime. Netflix’s announcement that it is splitting off its DVD-by-mail business from its streaming business is just such an experiment. The DVD business will now go by the name Qwikster, and the streaming business will stay under the Netflix brand. It is Clayton Christensen ‘s innovator’s dilemma incarnate, and Netflix is very publicly trying to solve it. Like its 60% price increase did earlier this year, this move is understandably causing consternation amongst some customers. It’s a bold move, one that will cost them in the near term, but Netflix I’m sure has done the calculus and is looking at the endgame 5-10 years out, not 5-10 months.

- Adam Richardson is a creative director at the global innovation firm frog design and the author of Innovation X: Why a Company’s Toughest Problems Are Its Greatest Advantage . His background combines experience in product development, product strategy, and customer research.

Partner Center

Brought to you by:

Netflix Inc.: The Disruptor Faces Disruption

By: Chris F. Kemerer, Brian Kimball Dunn

Netflix Inc. (Netflix) had surpassed Blockbuster, the previous movie rental leader, before making the successful transition to digital delivery of video content. But despite Netflix's success, in…

- Length: 12 page(s)

- Publication Date: Nov 27, 2017

- Discipline: Information Technology

- Product #: W17722-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Netflix Inc. (Netflix) had surpassed Blockbuster, the previous movie rental leader, before making the successful transition to digital delivery of video content. But despite Netflix's success, in 2017, numerous competitors, including both established, mainstream content producers and digital upstarts, were making it difficult for Netflix to recreate its earlier dominance. Critics pointed to Netflix's slowing acquisition of subscribers and accelerating debt levels. Netflix's chief executive officer was confronted with disruption from a variety of digital rivals. How should he respond? Should Netflix continue to try to be a content producer, competing with Hollywood's industry leaders? Should it form a partnership with other media companies to align everyone's incentives? Perhaps it could move into other media content areas outside of traditional entertainment. Further, there remained the question of how to treat its legacy DVD-by-mail business. As the incumbent firm, Netflix needed to respond to competitors and avoid a fate similar to that of Blockbuster.

Chris Kemerer is affiliated with University of Pittsburgh.

Learning Objectives

This case was written for undergraduate and post-graduate courses in information systems and technology strategy. It offers a vehicle for students to thoroughly explore Clayton Christensen's disruptive innovation concept. In particular, it offers the opportunity to see two disruption examples in one case. Through the case, students will understand both demand-side and supply-side disruption; analyze multi-objective management of a portfolio of both mature, cash-cow lines of business and emerging, less certain business delivery innovations; understand the economics of digital goods and platform businesses, including high-fixed-cost and low-marginal-cost production functions and the cross-side network effects inherent in platforms; and discuss new technology risk management, particularly with respect to rapidly changing and uncertain information technologies.

Nov 27, 2017

Discipline:

Information Technology

Ivey Publishing

W17722-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Netflix & Blockbuster – Case Study Of Disruptive Innovation

Written By:

Post Date – Update:

It’s rare for a week without me tuning into Netflix to watch something or at least browse its offerings to find my next binge-worthy series. I know I’m not alone in this habit; countless others probably engage in the same routine.

That’s why examining the Netflix and Blockbuster case study is so enlightening. It offers a riveting look at how disruptive innovation can permanently alter the digital landscape. One company survived and flourished, while the other faded into business irrelevance. As we delve into key learnings from this case study, we also discuss what contemporary companies can do to avoid meeting the same fate as Blockbuster.

Table of Contents

Understanding disruptive innovation, netflix’s early challenges, low-end footholds, new market footholds, blockbuster’s missed opportunities, the importance of transformation in business, 1. adapt or perish, 2. recognize low-end footholds, 3. embrace technology early, 4. customer-centric approach, 5. stay ahead through innovation, 6. use data intelligently, 7. anticipate future trends, 8. understand market signals, 9. transformation is continuous, listen to our podcast about streaming wars chronicles: the netflix & blockbuster case study of disruptive innovation below or by clicking here., 5 questions to ask when considering a solid wood furniture manufacturer, what is solid wood vs. engineered wood, hardwood solids furniture, what does the term mean, netflix & blockbuster: a case study in disruptive innovation.

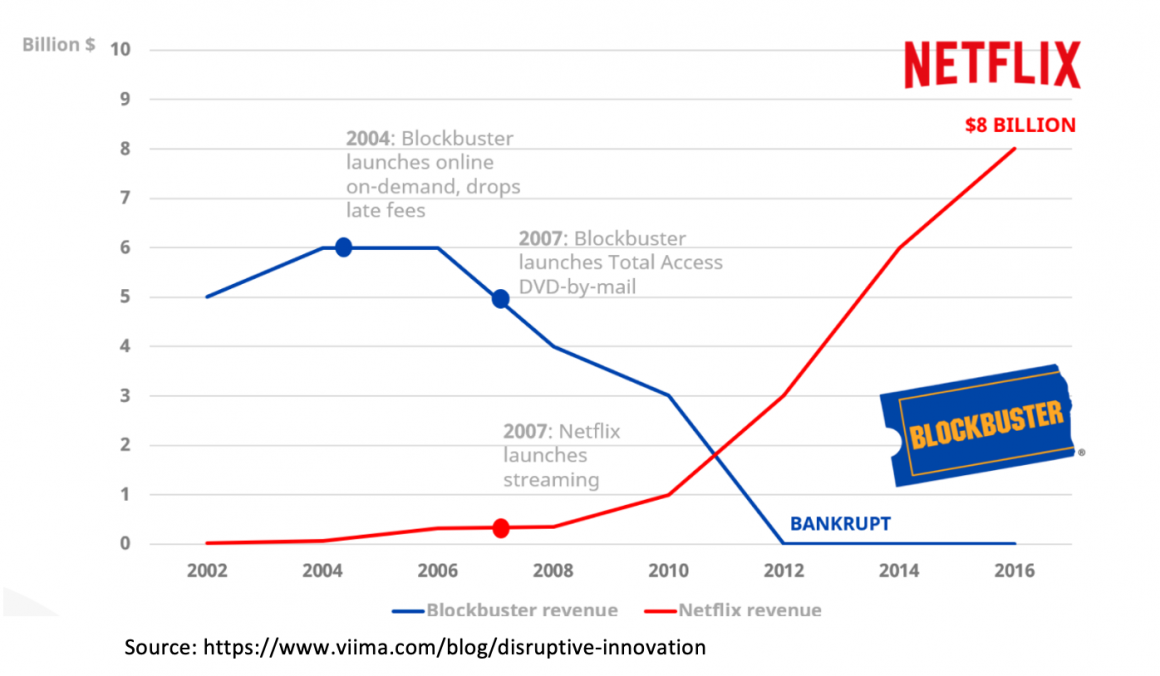

One of the most compelling case studies in disruptive innovation is the saga of Netflix and Blockbuster. This story provides valuable insights into how Netflix managed to upend the industry, positioning itself as a dominant force in today’s digital landscape.

Continue reading as we delve deeper into the disruptive journey of Netflix and Blockbuster.

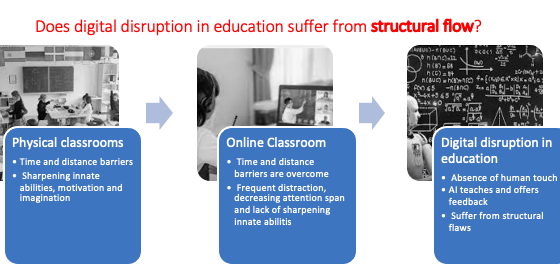

Digital disruption has been a game-changer in entrepreneurial strategies since the late 20th Century. Contrary to popular belief, disruptive innovation is not the same as mere creativity.

While creating a fuel-efficient engine might draw a new consumer base, the minor variations from standard engines do not categorize it as disruptive. True disruption focuses on targeting sectors that established companies overlook or revolutionizing an existing system.

This case study delves into how Netflix applied disruptive innovation to dethrone Blockbuster in the home entertainment industry.

Brief History Of Netflix

Understanding its history is crucial to grasp the scale of Netflix’s disruption fully. Netflix was founded in 1998 by Reed Hastings and Marc Randolph in Scott’s Valley, California, with an initial investment of $2.5 million from Hastings.

Opting to distribute DVDs rather than bulky and fragile VHS tapes, Netflix started with 30 employees and 925 available titles. Over time, the company introduced a monthly subscription model, eliminating the single rental system. It positioned itself as a consumer-friendly alternative to Blockbuster’s model, often including late fees and hidden charges.

Netflix wasn’t always the giant we know today. In 2000, the company even offered to sell itself to Blockbuster for $50 million—an offer that Blockbuster refused.

Following the dot-com bubble burst and the 9/11 attacks, Netflix was forced to lay off two-thirds of its staff. However, the proliferation of affordable DVD players and an IPO in 2002 helped the company regain its footing.

Disruptive Strategies Used By Netflix

Netflix employed various disruptive approaches to outmaneuver Blockbuster in the market. Continue reading to uncover two of these critical, innovative strategies.

Netflix initially targeted lower-end markets that Blockbuster ignored. It presented itself as a hassle-free alternative to Blockbuster by eliminating late fees. This allowed Netflix to grow its customer base steadily.

The company focused on improving service speed and video quality, gradually becoming a preferred choice over Blockbuster for many consumers.

Netflix further disrupted the industry by introducing DVDs and streaming services. Their easy-to-use online interface and innovative recommendation algorithm provided an experience Blockbuster couldn’t match.

They also invested in creating original content, widening their market appeal, and keeping audiences engaged.

Blockbuster’s business model worked well for a time, but their complacency in innovation left them vulnerable to disruption. They continued to rely on an aging model that included late fees and did not adapt quickly enough to new technologies.

When they finally attempted to catch up, it was too late, and they were already in decline.

While disruptive innovation is crucial for capturing market share, continual transformation is essential. Netflix’s willingness to adapt allowed it to evolve from a DVD rental service to a streaming giant.

Conversely, Blockbuster’s resistance to change led to its downfall. The case of Netflix vs. Blockbuster is a compelling example of how disruptive innovation can reshape industries and why companies must adapt to survive.

Lessons From The Netflix & Blockbuster Case Study On Disruptive Innovation

The evolution of Netflix and the decline of Blockbuster serve as an epic tale of disruptive innovation in the business landscape. This case study provides insights into strategic decision-making and offers lessons on how to deal with market transformation.

Here are ten key lessons companies can learn from this saga.

The inability of Blockbuster to adapt to emerging technologies and new consumer preferences, especially around the convenience of movie rentals, was a critical downfall. Companies must be agile and willing to adapt their business models to remain relevant.

Netflix capitalized on the aspects of the market that Blockbuster ignored, primarily around consumer annoyance with late fees. Companies should be cautious not to ignore market segments that might seem less profitable or secondary, as they may become entry points for disruptive competitors.

Netflix took a risk by betting on DVDs and online streaming. Companies should look towards emerging technologies as opportunities for future growth and be willing to invest early, even if the technology hasn’t yet reached mass adoption.

Netflix’s recommendation algorithm, easy-to-use interface, and concern for customer experience made them a consumer favorite. Companies should place the customer at the center of their business model and continually strive to improve the user experience.

Netflix invested in original content to differentiate itself further from Blockbuster and new competitors. Companies must continuously innovate and expand their offerings to keep customers engaged and deter potential entrants.

Netflix has been a pioneer in utilizing big data to understand customer behavior and preferences. Companies should leverage data analytics to make more informed decisions and to tailor their services/products to individual customer needs.

While Blockbuster remained committed to physical stores, Netflix anticipated the shift toward digital consumption. Forecasting and acting upon trends can differentiate between leading the market or becoming obsolete.

Blockbuster missed the signals when Netflix offered to sell itself for $50 million, and consumers began to show dissatisfaction with late fees. Recognizing and acting upon market signals, even subtle ones, can impact a company’s trajectory.

Even after establishing itself as a leader in streaming, Netflix continues to evolve and adapt. Understanding that transformation is an ongoing process rather than a one-time event is crucial for long-term success.

10. Learn From Failures

Both Netflix and Blockbuster had their share of mistakes. However, Netflix has shown an ability to learn from its failures, pivot, and recover. Companies should not only celebrate successes but also see failures as learning opportunities.

The tale of Netflix and Blockbuster is a masterclass in understanding disruptive innovation and market transformation mechanics. By recognizing early signs of disruption, staying adaptable, and being committed to continuous improvement and innovation, companies can remain competitive and relevant in their respective markets.

Find out more about how Mondoro can help you create, develop, and manufacture excellent home decor and home furniture products – don’t hesitate to contact me , Anita . Check out my email by clicking here , or become a part of our community and join our newsletter by clicking here .

Mondoro gives out a FREE Lookbook to anyone interested . You can receive a copy of our latest Lookbook by clicking here.

Listen to our Podcast called Global Trade Gal . You can find it on all major podcast platforms. Try out to listen to one of our podcasts by clicking here.

Subscribe to our Mondoro Company Limited YouTube Channel with great videos and information by clicking here.

Related Questions

One of the things we look at when we go into a new solid wood furniture manufacturer is in-house kiln wood drying. We also want to know if they understand how to join the wood properly and have the equipment. Also, if the manufacturer is in a hot and tropical climate if they have a dry room to help control the wood moisture levels. We like to work with factories that cut and shape all the wood and have in-house finishing facilities.

You can discover more by reading our blog 5 Questions To Ask When Considering A Solid Wood Furniture Manufacturer ; read more by clicking here.

Solid wood is cut down from the tree , cut into wood boards, and then used for manufacturing. On the other hand, engineered wood is considered manmade as it is usually manufactured with wood chips, wood shavings, and an adhesive. Today the manufacturing of engineered wood is extremely technical.

You can discover more by reading our blog All About Teak Wood And Outdod? by clicking here.

Hardwood solids can include non-solid woods such as engineered woods. Hardwood solids are used in furniture and other industries to classify what wood is used in a product. The terms usually do not classify what type of wood is used.

You can discover more by reading our blog Hardwood Solids Furniture, What Does The Term Mean? by clicking here .

- Latest Posts

- 5 Common Product Sourcing or Product Procurement Errors – January 18, 2024

- What Is Lacquer?Definition, History, And Modern Uses – November 19, 2023

- What Is Rubber Wood? Origin, Source, Processing – All About – November 18, 2023

Share Our Post On:

Anita Hummel

Do you have the world's best boss? Enter them to win two tickets to Sandals!

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Digital Disrupt: What We Can All Learn From the Netflix Model

Table of Contents

The past 20 years have been a fantastic journey in the world of technology, drastically changing the complexion of most businesses that survived the ride. For example, Netflix went from a modest DVD movie-rental subscription model to a digital media powerhouse that forever changed how we view entertainment.

Netflix’s ability to pivot, stay ahead of the competition, and set trends provides lessons for all businesses seeking success, growth and longevity in the digital age. We’ll take a closer look at Netflix’s journey, how it disrupted the media landscape, and what we can learn about digital transformation and innovation.

The evolution of Netflix

Netflix’s evolution is a modern tale of pivoting, staying ahead of the competition, and recognizing opportunities. Here’s a brief history of Netflix:

- Snail-mail DVD subscription service. Netflix started its snail-mail subscription service in 1999. Internet speed was slow, and there was nowhere near today’s digital infrastructure. Streaming technology as we now know it didn’t exist, and Netflix was about ordering your movies online and having them delivered to your mailbox.

- Almost an early exit. Most people felt Netflix’s DVD-rental business wasn’t a scalable model and would die on the vine. Netflix didn’t disagree; in 2000, the company sought a $50 million buyout from Blockbuster, but Blockbuster wasn’t interested.

- Fine-tuned business model. Netflix figured out how to fine-tune its distribution model for fast mail delivery. Still, users had to plan their entertainment at least two days ahead of time – for example, by ordering movies on a Wednesday to arrive for weekend viewing. Video stores like Blockbuster continued to prosper for last-minute needs.

- Pivot to streaming video. As technology improved, Netflix started providing streaming video for its ballooning customer base. Its customers enthusiastically welcomed the new model. Streaming video wasn’t a new idea, and competitors lurked on the sidelines. Still, Netflix’s ample, established customer base gave the company an advantage in this burgeoning arena. Blockbuster tried to follow Netflix into streaming, but it was too late for both Blockbuster and its movie-rental competitors.

- Content giant. With viewers enjoying more streaming entertainment, Netflix branched out into original content, creating award-winning movies and series. It has fierce competition from the likes of Hulu, HBO Max, Apple TV and many more services.

Netflix uses big data to learn subscribers’ viewing habits and behaviors to drive future production decisions and user experiences.

What can we learn from Netflix’s success?

Here are some lessons we can learn from Netflix’s continued success:

- Stay ahead of competitors. Netflix has been an innovator throughout its history. Being the innovator meant it was ahead of the competition at every step. Netflix revolutionized how people rented DVDs, innovated with viewer subscriptions, pivoted to online streaming, and turned itself into an award-winning content producer. Netflix is a household name and industry marker. Similarly, businesses should try to beat the competition by staying one step ahead in technology, service, operations and more.

- Set trends. Netflix introduced the concept of binge-watching, so consumers didn’t have to wait for a new episode of their favorite show each week. Binge-watching became an entertainment cornerstone, particularly during the pandemic. But setting trends means mixing things up, and Netflix is showing signs of new watch models. For example, with high-interest shows such as Stranger Things , Netflix is testing weekly releases. In your business, monitor technology trends and see how you can implement them to set new standards in your arena.

- Be opportunistic. Netflix took the leap into independent film production and distribution with hit shows such as Orange Is the New Black and The Umbrella Academy . Going from a streaming service to a filmmaker was a big step, but Netflix saw an opportunity to meet the demands of its target audience . Similarly, look for ways your business can seize opportunities and stay ahead of the competition.

- Focus on the consumer experience. Netflix makes the experience about the consumer. The navigation menu is intuitive and highly praised, and the system tracks what you watch so Netflix can recommend similar content. These elements help to improve the user experience and build customer loyalty . In your business, get customer feedback and insights to improve your systems and services.

- Expand wisely. When Netflix decided to go global, it didn’t just roll out the same platform of shows and movies to everyone; the company researched each country’s target audience to customize the user experience. Today, Netflix streams in more than 190 countries. In your business, scale carefully. Ensure you don’t grow your business too quickly , and research your customers’ needs.

Customer survey data is a great tool for staying ahead of the competition. Well-formulated surveys can help you identify consumer needs so you can innovate and lead.

What can we learn from Netflix’s growing pains?

Recent choppy waters indicate there may be additional digital media and business pivots ahead for Netflix.

In August 2022, Netflix lost more than 200,000 users – the first time it lost subscribers since 2011 – and its stock spiraled. Although those lost subscribers represented only 0.1% of Netflix’s customer base, the loss caused the company to assess content strategies in new ways.

For example, at the Cannes Lions advertising festival, Netflix co-CEO Ted Sarandos said the company plans to partner with Microsoft to test an ad-supported, lower-priced subscription level. It has also begun releasing some shows weekly or monthly instead of all at once – a departure from its “binge” reputation – and has started cracking down on rampant password sharing.

Netflix must also contend with other streaming platforms that produce excellent original content – an area where it once stood unchallenged.

As Netflix faces industry changes and pressure from the competition, it will likely strike a balance between continuing to do what made it successful and staying ahead of the competition by pivoting and identifying new trends. Netflix is sure to remain a streaming and original-content leader, but it also must continue to innovate.

Examples of industry disruptors like Netflix

Netflix isn’t the only digital disruptor. Here are some other major examples of innovation by industry leaders:

1. Apple’s iTunes changed digital content distribution.

iTunes was the first major system for providing widely distributed digital content, and the concept turned the music industry on its ear. An antiquated system of music production, distribution and sales gave way to the new method of paying for only what you wanted and accessing it immediately.

Industry resistance to the iTunes distribution model was fierce, but iTunes prevailed. Artists could even self-produce and release music without studios or physical music stores.

Today, iTunes has pivoted to become the Apple Music app, which lets you stream and download millions of songs and access your music library.

2. eBay’s auction marketplace was one of the first “killer apps.”

eBay was founded in 1995 as AuctionWeb and went public in 1998. It was, in fact, the first “killer app.” The online auction model quickly took hold and became a favorite of internet-savvy users.

Initially, traditional retailers weren’t concerned because eBay was considered a place where people sold their “junk.” However, eBay became an e-commerce player with PayPal digital payment integration and took on the features of more traditional online sellers, such as implementing a “Buy It Now” button to avoid auction haggling.

PayPal, once an eBay subsidiary, has done some digital disrupting of its own. The payment solution has grown to include PayPal business loans , and businesses can accept credit cards via PayPal .

3. Amazon started with books and became an e-commerce powerhouse.

Amazon’s book sales proved that the internet was a hugely scalable retail platform that didn’t require a massive real estate and workforce investment. Still, many retailers didn’t see the promise. The thought of shipping costs, packaging and returns gave them a headache, and adoption was slow.

However, Amazon began selling more than just books, and the concept exploded. At the same time, shippers such as UPS and FedEx saw the promise of this digital retail world.

Today, Amazon is the undisputed e-commerce leader, with offshoots such as Amazon Prime, Amazon Prime Video and its own digital devices. There are even Amazon business features to help small businesses.

What other industries are being disrupted?

Here’s a glance at some other industries undergoing digital disruption.

Keep an eye on innovation in your industry

Digital technology has been a massive disruptor in many industries, including retail, entertainment, communications and travel. Trying to track industry trends and predict their impact is complicated. However, seemingly unrelated or new innovations can damage your business or industry if you don’t take notice – and you can be sure someone will.

Sometimes, businesses have invested so much in infrastructure that it’s almost impossible to turn the ship, so getting an early start is crucial. Digital makes everything fast; it won’t take 30 years to scuttle an outdated business concept. No matter your industry, keep an eye on digital innovations and look toward the future.

Kimberlee Leonard contributed to the reporting and writing in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

The Power of Digitalization: The Netflix Story

- Conference paper

- First Online: 18 May 2020

- Cite this conference paper

- Manuel Au-Yong-Oliveira 20 , 21 ,

- Miguel Marinheiro 20 &

- João A. Costa Tavares 20

Part of the book series: Advances in Intelligent Systems and Computing ((AISC,volume 1161))

Included in the following conference series:

- World Conference on Information Systems and Technologies

4909 Accesses

2 Citations

8 Altmetric

The evolution of technology, and mainly the evolution of the Internet, has improved the way business is done. Nowadays, most services are offered through a website or through an app, as it is much more convenient and suitable for the customer. This business transformation made it possible to get a faster and cheaper service, and companies had to adapt to the change, in order to fulfill customers’ requirements. In this context, this paper relates to this digital transformation, focusing on a case study about Netflix, a former DVD rental company and currently an online streaming leader. We aimed to understand Netflix’s behavior alongside this digital wave. Thus, we performed a survey, which had 74 answers, mainly from Portugal, but also from Spain, Belgium, Italy, Turkey, Georgia and Malaysia. Of the people who answered the survey, 90.1% were stream consumers, but only 59.1% had premium TV channels. From those 90.1%, 58.3% also said that they watched streams between two and four times per week, but the majority of premium TV channel subscribers (63.8%) replied that they watch TV less than twice in a week. We see a trend in which the traditional TV industry is in decline and streaming as a service has increased in popularity. Consumer habits are changing, and people are getting used to the digitalization era. Netflix is also confirmed in our survey as the market leader of the entertainment distribution business, as stated in the literature, and the biggest strength of this platform is its content.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Leiner, B., Cerf, V., Clark, D., Kahn, R., Kleinrock, L., Lynch, D., Postel, J., Roberts, L.G., Wolff, S.: Brief History of the Internet—Internet Society (2009)

Google Scholar

Investopedia. https://www.investopedia.com/articles/personal-finance/121714/hulu-netflix-and-amazon-instant-video-comparison.asp . Accessed 03 Dec 2019

Littleton, C., Roettgers, J.: How Netflix Went From DVD Distributor to Media Giant (2018). https://variety.com/2018/digital/news/netflix-streaming-dvds-original-programming-1202910483/ . Accessed 31 Oct 2019

Business Insider. https://www.businessinsider.com/how-netflix-has-looked-over-the-years-2016-4#in-2010-streaming-begins-to-be-more-than-an-add-on-and-gets-prominent-real-estate-on-the-home-page-5 . Accessed 03 Dec 2019

Netflix. https://www.netflix.com/browse . Accessed 03 Dec 2019

Oomen, M.: Netflix: How a DVD rental company changed the way we spend our free time (2019). Business Models Inc. https://www.businessmodelsinc.com/exponential-business-model/netflix/ . Accessed 31 Oct 2019

Venkatraman, N.V.: Netflix: A Case of Transformation for the Digital Future (2017). https://medium.com/@nvenkatraman/netflix-a-case-of-transformation-for-the-digital-future-4ef612c8d8b . Accessed 31 Oct 2019

BMI - Business Models Inc. https://www.businessmodelsinc.com/exponential-business-model/netflix/ . Accessed 03 Dec 2019

Calia, R.C., Guerrini, F.M., Moura, G.L.: Innovation networks: from technological development to business model reconfiguration. Technovation 27 (8), 426–432 (2007)

Article Google Scholar

Ritter, T., Lund, C.: Digitization capability and the digitalization of business models in business-to-business firms: past, present, and future. Ind. Mark. Manag. (November), 1–11 (2019)

Hong, S.H.: The recent growth of the internet and changes in household-level demand for entertainment. Inf. Econ. Policy 19 (3–4), 304–318 (2007)

Evens, T.: Clash of TV platforms: how broadcasters and distributors build platform leadership. In: 25th European Regional Conference of the International Telecommunications Society (ITS), Brussels, Belgium, 22–25 June 2014. ECONSTOR (2014)

Aliloupour, N.P.: Impact of technology on the entertainment distribution market: the effects of Netflix and Hulu on cable revenue. Open access senior thesis. Bachelor of Arts. Claremont Graduate University (2015)

Johnson, C.M.: Cutting the cord: leveling the playing field for virtual cable companies. Law School Student Scholarship, Paper 497 (2014)

Pardo, A.: Digital hollywood: how internet and social media are changing the movie business. In: Friedrichsen, M., Muhl-Benninhaus, W. (eds.) Handbook of Social Media Management, pp. 329–348 (2013)

Bryman, A., Bell, E.: Business Research Methods, 4th edn. Oxford University Press, Oxford (2015)

Alvarez, E.: Netflix is taking a wait-and-see approach to virtual reality (2018). Engadget. https://www.engadget.com/2018/03/07/netflix-virtual-reality-not-a-priority/ . Accessed 31 Oct 2019

Nhan, J., Bowen, K., Bartula, A.: A comparison of a public and private university of the effects of low-cost streaming services and income on movie piracy. Technol. Soc. 60 , 101213 (2020)

Comissão Europeia - Portugal – A PAC no seu país. https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/by_country/documents/cap-in-your-country-pt_pt.pdf . Accessed 20 Jan 2020

Gonçalves, R., Oliveira, M.A.: Interacting with technology in an ever more complex world: designing for an all-inclusive society. In: Wagner, C.G. (ed.) Strategies and Technologies for a Sustainable Future, pp. 257–268. World Future Society, Boston (2010)

Fontoura, A., Fonseca, F., Piñuel, M.D.M., Canelas, M.J., Gonçalves, R., Au-Yong-Oliveira, M.: What is the effect of new technologies on people with ages between 45 and 75? In: Rocha, Á., et al. (eds.) New Knowledge in Information Systems and Technologies, WorldCist 2019, La Toja Island, Spain, 16–19 April. Advances in Intelligent Systems and Computing (Book of the AISC Series), vol. 932, pp. 402–414. Springer (2019)

Download references

Author information

Authors and affiliations.

Department of Economics, Management, Industrial Engineering and Tourism, University of Aveiro, 3810-193, Aveiro, Portugal

Manuel Au-Yong-Oliveira, Miguel Marinheiro & João A. Costa Tavares

GOVCOPP, Aveiro, Portugal

Manuel Au-Yong-Oliveira

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Manuel Au-Yong-Oliveira .

Editor information

Editors and affiliations.

Departamento de Engenharia Informática, Universidade de Coimbra, Coimbra, Portugal

Álvaro Rocha

College of Engineering, The Ohio State University, Columbus, OH, USA

Hojjat Adeli

FEUP, Universidade do Porto, Porto, Portugal

Luís Paulo Reis

DIMES, Università della Calabria, Arcavacata, Italy

Sandra Costanzo

Faculty of Electrical Engineering, University of Montenegro, Podgorica, Montenegro

Irena Orovic

Universidade Portucalense, Porto, Portugal

Fernando Moreira

Rights and permissions

Reprints and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper.

Au-Yong-Oliveira, M., Marinheiro, M., Costa Tavares, J.A. (2020). The Power of Digitalization: The Netflix Story. In: Rocha, Á., Adeli, H., Reis, L., Costanzo, S., Orovic, I., Moreira, F. (eds) Trends and Innovations in Information Systems and Technologies. WorldCIST 2020. Advances in Intelligent Systems and Computing, vol 1161. Springer, Cham. https://doi.org/10.1007/978-3-030-45697-9_57

Download citation

DOI : https://doi.org/10.1007/978-3-030-45697-9_57

Published : 18 May 2020

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-45696-2

Online ISBN : 978-3-030-45697-9

eBook Packages : Intelligent Technologies and Robotics Intelligent Technologies and Robotics (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Disruptive Innovation: A Case Study on How Netflix is Transforming the Living Room

Student thesis : Master thesis

Innovation has always been a crucial factor in business strategy across various market segments. In light of the digitalization revolution, the entertainment industry has been affected greatly, both in positive and negative ways. Long standing market incumbents such as Blockbuster have felt the disruptive shift of a new market player, Netflix. Its disruptively innovative strategy was simple enough to cater to small consumer segments, while rapidly gaining market traction. Eventually Netflix disrupted not only the market giant Blockbuster, but also consumers’ living rooms. Clayton M. Christiansen’s theory on disruptive innovation provides context and guidelines in better understanding the differences between sustaining innovation and disruptive innovation. Furthermore, it reflects over “The Innovators Dilemma” where, innovators must decide how to best invest their resources so as not to loose market share. This Thesis aims to better understand the effects of disruptive innovation within the entertainment content industry. The research utilizes a case study approach, using Netflix as the case company. Due to technological advancements the TV and entertainment content industry has drastically changed with new methods of consuming content, and new business models to disrupt the market. Having disrupted the market, Netflix remains a leading force among consumers. Moreover, in recent years, the competition within the market has radically increased. The project goes on to explore Netflix’s possible outcomes for future markets.

Documents & Links

File : application/pdf, 4.75 MB

Type : Text file

To read this content please select one of the options below:

Please note you do not have access to teaching notes, netflix: rise, fall and recovery.

Journal of Business Strategy

ISSN : 0275-6668

Article publication date: 27 November 2023

Netflix is the market leader in the streaming entertainment industry. In 2020 and 2021, Netflix’s subscriber numbers and revenue increased. During the first two quarters of 2022, Netflix lost millions of subscribers, revenue and profit declined and its share price and market capitalization deteriorated. The purpose of this study is to investigate how and why a company with such a strong track record as Netflix can experience this crisis and, most importantly, how it overcame the crisis and returned to growth.

Design/methodology/approach

This case study investigates Netflix’s rise, fall and recovery between 2020 and 2023 using qualitative research methods. It examines earnings calls, transcripts and letters to shareholders as well as the views of investment analysts, journalists and academics.

Netflix turned its fortunes around because its leaders faced the crisis head-on. They acknowledged that previous strategic decisions were no longer working, that no advertisements were on the platform and that there was no account sharing and they reversed these decisions. Netflix also realized that it needed to innovate, so it partnered with Microsoft to execute its go-to-market with advertising. It also launched games, made strategic acquisitions of gaming studios and developed its capabilities with new products.

Originality/value

This is a valuable case study. Investigating how a company as successful as Netflix can encounter a severe decline and how it changed its strategies and tactics to reverse the decline provides important lessons for other companies.

- SVOD (subscription video on demand) industry

de Zilwa, D.K. (2023), "Netflix: rise, fall and recovery", Journal of Business Strategy , Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JBS-08-2023-0177

Emerald Publishing Limited

Copyright © 2023, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

Another Netflix Disruption: A Transparent Board

How the company that overhauled the entertainment industry created a new model of corporate governance.

May 02, 2018

Netflix CEO Reed Hastings says board members won’t have the confidence to make tough calls unless they fully understand the company. | Reuters/Mike Blake

Netflix is known to tens of millions of consumers as the company that supplies them with a huge library of binge-worthy streaming videos and mail-order DVDs. But there’s a side to Netflix that consumers never see: The $133 billion company has developed a unique corporate governance structure that brings its board of directors much closer to management and arms them with a rich and accessible trove of operational information.

“At Netflix, there is sort of an open book — the managers basically share everything [with the board] that they see and use,” says David Larcker , a professor of accounting at Stanford Graduate School of Business.

As the elected representatives of shareholders, corporate directors are supposed to monitor management’s performance and conduct, weigh in on strategic decisions, and ensure a CEO succession plan is in place. All too often, though, directors lack the critical information and intimate knowledge of the company’s operations needed to make well-informed decisions, which Larcker calls “the information gap.”

Over the last five years, Netflix has done much to narrow that gap, Larcker and Brian Tayan , a researcher at the business school, conclude after a series of interviews with Netflix CEO Reed Hastings, his top executives, and most of the board of directors. Their findings are summarized in a paper published by the Stanford Closer Look Series: “Netflix Approach to Governance: Genuine Transparency with the Board.”

According to the researchers, directors at most companies generally meet only four to eight times a year in board and committee meetings, and the information they receive generally consists of dense PowerPoint presentations amid a thicket of hard-to-digest tables and graphs. What’s more, some CEOs maintain strict control over the content presented to the board, and often there’s little time at board meetings for directors to ask more than a question or two.

At Netflix, though, board members attend monthly and quarterly senior management meetings as observers. Communications to the board take the shape of approximately 30-page memos that are heavy on analysis and contain links to all relevant data on the company’s internal computer systems.

Being armed with the memo before the board meeting makes for “an intelligent and informed conversation,” according to one director.

Giving the board as much data as possible is essential, Hastings says. “The [board members aren’t] going to have the confidence to make hard decisions unless they really understand the market and the company.”

In one sense, having so much usable information makes the Netflix directors work harder. Typically, they spend twice as long preparing for board meetings as do directors at other companies. But because they’re so well informed, board meetings tend to be much shorter, says Tayan.

Quote At Netflix, there is sort of an open book — the managers basically share everything [with the board] that they see and use. Attribution David Larcker

The directors interviewed by Larcker and Tayan said they embrace the openness. Said one about attending management meetings: “It just gives you a far better understanding of the company. You get to know all of the operating players. You get a feel for the move, the cadence, how people think, how people contribute, how people interact with each other. And of course, you get an understanding of the issues of the day.”

The researchers interviewed seven of the company’s nine outside directors. To encourage openness, the directors were assured that their names would not be published. Tayan says that feedback about the governance structure was positive across all of the interviews.

Netflix has been enormously successful over the last five years. Revenues have nearly tripled, increasing to $11.69 billion from $4.4 billion at the end of 2013, while the market cap soared to $133 billion from $4.4 billion.

How much of that success can be attributed to the governance policy is difficult to discern, says Larcker. “The process has been in place for a few years, and the board and management really seem to like it. I suspect that the Netflix culture is the key driver of value, and the open board process supports the value creation process,” he says.

During the interviews with the company, the researchers pushed management to spell out the benefits of the open relationship with the board, says Tayan. While they couldn’t quantify the benefits, they did say that as a result of the open policies, the company is able to make decisions — and reverse mistakes — much faster.

For example, without the closer collaboration between the board and management, “we would have been much slower to invest so much money in content. There would have been more second-guessing if there wasn’t this completely open perspective,” said one director.

Are there downsides? “I suppose there is the possibility of leaking proprietary information that is discussed at management meetings, however this has never happened at Netflix,” Larcker says.

It’s hard to know how easily the policies that are working at Netflix could be replicated at other companies. For one thing, Netflix has an infrastructure that allows corporate data to be shared easily with the board and employees, says Tayan. Many companies do not have company-wide systems that enable data sharing.

“I think it would be hard to put this type of system in place at older and more mature organizations. Innovative organizations that want and need the insights from board members can clearly adapt this type of approach,” says Larker. “You need a CEO who wants a high level of discussion about strategy, etc., and is open to alternative points of view.”

Startups and smaller companies are likely the ideal candidates for a Netflix-style governance makeover. “In the end, the people and the culture have to want this type of information sharing, and this new information takes the governance discussion to a whole new level,” Larcker says.

For media inquiries, visit the Newsroom .

Explore More

Investigating the unsolved mysteries of boardrooms and c-suites, what executives are really saying when they dodge questions, executive bonuses might work better than you think, editor’s picks.

January 26, 2018 Learning From Uber’s Mistakes What fast-growing startups — and their boards — must understand about building culture.

Netflix Approach to Governance: Genuine Transparency with the Board David F. Larcker Brian Tayan

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

Netflix Inc.: The Disruptor Faces Disruption

- Technology & Operations / MBA EMBA Resources

Next Case Study Solutions

- Feeding America (B) Case Study Solution

- Burying the Hatchet for Catch-Up: Open Innovation among Industry Laggards in the Automotive Industry Case Study Solution

- Insights on Women's Labor Participation in Gulf Cooperation Council Countries Case Study Solution

- Bretton Woods and the Financial Crisis of 1971 (A) Case Study Solution

- Analytics for Sustainable Products: The Case of Sustainable Beef Case Study Solution

Previous Case Solutions

- Stanford Management Company in 2017: Venture Capital and Other Asset Allocation Case Study Solution

- The Role of a Municipality's Financial Health in a Firm's Siting Decision Case Study Solution

- Mission in Flux: Michigan National Guard in Liberia Case Study Solution

- Wild Chef Limited: Scaling Up a Cloud-Based Restaurant Case Study Solution

- Disruptive Technology as an Enabler of the Circular Economy: What Potential Does 3D Printing Hold? Case Study Solution

Predictive Analytics

April 13, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Netflix inc.: the disruptor faces disruption description.

Netflix Inc. (Netflix) had surpassed Blockbuster, the previous movie rental leader, before making the successful transition to digital delivery of video content. But despite Netflix's success, in 2017, numerous competitors, including both established, mainstream content producers and digital upstarts, were making it difficult for Netflix to recreate its earlier dominance. Critics pointed to Netflix's slowing acquisition of subscribers and accelerating debt levels. Netflix's chief executive officer was confronted with disruption from a variety of digital rivals. How should he respond? Should Netflix continue to try to be a content producer, competing with Hollywood's industry leaders? Should it form a partnership with other media companies to align everyone's incentives? Perhaps it could move into other media content areas outside of traditional entertainment. Further, there remained the question of how to treat its legacy DVD-by-mail business. As the incumbent firm, Netflix needed to respond to competitors and avoid a fate similar to that of Blockbuster. Chris Kemerer is affiliated with University of Pittsburgh.

Case Description Netflix Inc.: The Disruptor Faces Disruption

Strategic managment tools used in case study analysis of netflix inc.: the disruptor faces disruption, step 1. problem identification in netflix inc.: the disruptor faces disruption case study, step 2. external environment analysis - pestel / pest / step analysis of netflix inc.: the disruptor faces disruption case study, step 3. industry specific / porter five forces analysis of netflix inc.: the disruptor faces disruption case study, step 4. evaluating alternatives / swot analysis of netflix inc.: the disruptor faces disruption case study, step 5. porter value chain analysis / vrio / vrin analysis netflix inc.: the disruptor faces disruption case study, step 6. recommendations netflix inc.: the disruptor faces disruption case study, step 7. basis of recommendations for netflix inc.: the disruptor faces disruption case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Netflix Inc.: The Disruptor Faces Disruption

Netflix Inc.: The Disruptor Faces Disruption is a Harvard Business (HBR) Case Study on Technology & Operations , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Netflix Inc.: The Disruptor Faces Disruption is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Netflix Inc.: The Disruptor Faces Disruption case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Netflix Inc.: The Disruptor Faces Disruption will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Netflix Inc.: The Disruptor Faces Disruption case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Technology & Operations, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Netflix Inc.: The Disruptor Faces Disruption, is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Netflix Inc.: The Disruptor Faces Disruption case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Technology & Operations Solutions

In the Texas Business School, Netflix Inc.: The Disruptor Faces Disruption case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Netflix Inc.: The Disruptor Faces Disruption

Step 1 – Problem Identification of Netflix Inc.: The Disruptor Faces Disruption - Harvard Business School Case Study

The first step to solve HBR Netflix Inc.: The Disruptor Faces Disruption case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Netflix Netflix's is facing right now. Even though the problem statement is essentially – “Technology & Operations” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Netflix Netflix's, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Netflix Inc.: The Disruptor Faces Disruption. The external environment analysis of Netflix Inc.: The Disruptor Faces Disruption will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Netflix Inc.: The Disruptor Faces Disruption case study. PESTEL analysis of " Netflix Inc.: The Disruptor Faces Disruption" can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Netflix Inc.: The Disruptor Faces Disruption macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Netflix Inc.: The Disruptor Faces Disruption

To do comprehensive PESTEL analysis of case study – Netflix Inc.: The Disruptor Faces Disruption , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Netflix Inc.: The Disruptor Faces Disruption

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Netflix Inc.: The Disruptor Faces Disruption ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Netflix Netflix's is operating, firms are required to store customer data within the premises of the country. Netflix Netflix's needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Netflix Inc.: The Disruptor Faces Disruption has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Netflix Netflix's in case study Netflix Inc.: The Disruptor Faces Disruption" should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Netflix Netflix's in case study “ Netflix Inc.: The Disruptor Faces Disruption ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Netflix Netflix's in case study “ Netflix Inc.: The Disruptor Faces Disruption ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Netflix Inc.: The Disruptor Faces Disruption ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Netflix Netflix's can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Netflix Inc.: The Disruptor Faces Disruption case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.