- Search Search Please fill out this field.

What Is Equity Financing?

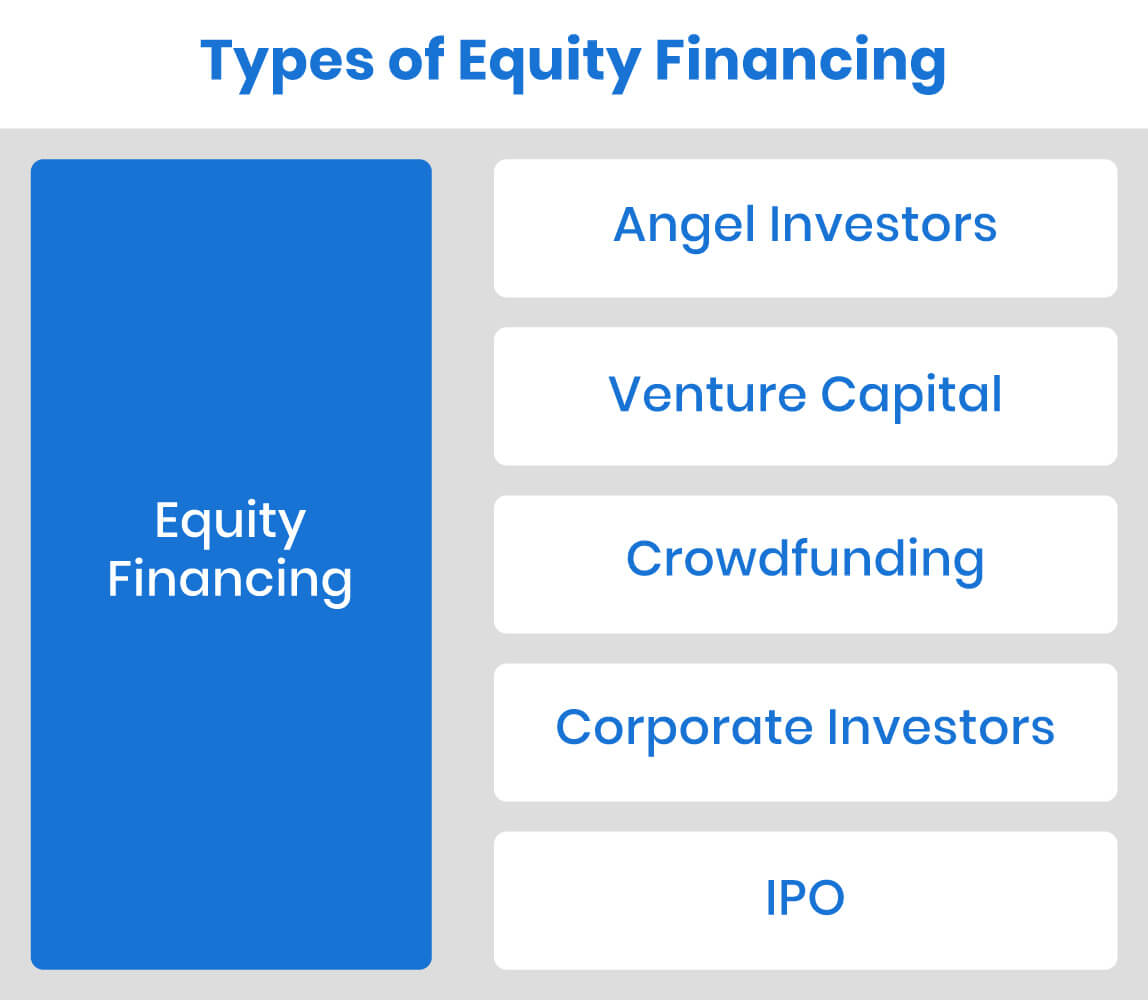

How equity financing works, types of equity financing.

- Equity vs. Debt Financing

Reasons to Choose Equity Financing

Pros and cons of equity financing, example of equity financing, special considerations.

- Equity Financing FAQs

The Bottom Line

- Small Business

- How to Start a Business

Equity Financing: What It Is, How It Works, Pros and Cons

:max_bytes(150000):strip_icc():format(webp)/AmyImage-AmyDrury-d6b6143c6d5c49a0add2201e25969457.jpg)

Equity financing is the process of raising capital through the sale of shares. Companies raise money because they might have a short-term need to pay bills or need funds for a long-term project that promotes growth. By selling shares, a business effectively sells ownership of its company in return for cash.

Equity financing comes from a variety of sources. For example, an entrepreneur's friends and family, professional investors, or an initial public offering (IPO) may provide needed capital.

An IPO is a process that private companies undergo to offer shares of their business to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors. Industry giants, such as Google and Meta (formerly Facebook), raised billions in capital through IPOs.

While the term equity financing refers to the financing of public companies listed on an exchange, the term also applies to private company financing.

Key Takeaways

- Equity financing is used when companies need cash.

- It is typical for businesses to use equity financing several times as they become mature companies.

- There are two methods of equity financing: the private placement of stock with investors and public stock offerings.

- Equity financing differs from debt financing: the first involves selling a portion of equity in a company, while the latter involves borrowing money .

- National and local governments closely monitor equity financing to ensure it's done according to regulations.

Equity financing involves the sale of common stock and other equity or quasi-equity instruments such as preferred stock, convertible preferred stock, and equity units that include common shares and warrants. This action can affect existing shareholders and impact the ability to reach new shareholders.

A startup that grows into a successful company will have several rounds of equity financing as it evolves. Since a startup typically attracts different types of investors at various stages of its evolution, it may use other equity instruments for its financing needs.

For example, angel investors and venture capitalists—generally the first investors in a startup—favor convertible preferred shares rather than common stock in exchange for funding new companies because the former have more significant upside potential and some downside protection.

Once a company has grown large enough to consider going public, it may consider selling common stock to institutional and retail investors.

Later, if the company needs additional capital, it may choose secondary equity financing options, such as a rights offering or an offering of equity units that includes warrants as a sweetener.

Equity financing is distinct from debt financing. With debt financing, a company assumes a loan and pays back the loan over time with interest. Equity financing involves selling ownership shares in return for funds.

Individual Investors

These are often friends, family members, and colleagues of business owners. Individual investors usually have less money to invest, so more are needed to reach financing goals. These investors may have no relevant industry experience, business skills, or guidance to contribute to a business.

Angel Investors

Often, these are wealthy individuals or groups interested in funding businesses they believe will provide attractive returns. Angel investors can invest substantial amounts and provide needed insight, connections, and advice due to their industry experience. Typically, angels invest in the early stage of a business's development.

Venture Capitalists

Venture capitalists are individuals or firms capable of making substantial investments in businesses that they view as having very high and rapid growth potential, competitive advantages, and solid prospects for success. They usually demand a noteworthy share of ownership in a business for their financial investment, resources, and connections. In fact, they may insist on significant involvement in managing a company's planning, operations, and daily activities to protect their investment. Venture capitalists typically get involved early and exit at the IPO stage, where they can reap enormous profits.

Initial Public Offerings

A more well-established business can raise funds through IPOs , selling company stock shares to the public. Due to the expense, time, and effort that IPOs require, this type of equity financing occurs in a later stage of development after the company has grown. Investors in IPOs expect less control than venture capitalists and angel investors.

Crowdfunding

Crowdfunding involves individual investors investing small amounts via an online platform (such as Kickstarter, Indiegogo, and Crowdfundr) to help a company reach particular financial goals. Such investors often share a common belief in the company's mission and goals.

Equity Financing vs. Debt Financing

Businesses typically have two options for financing when they want to raise capital for business needs: equity financing and debt financing . Debt financing involves borrowing money. Equity financing involves selling a portion of equity in the company. While there are distinct advantages to both types of financing, most companies use a combination of equity and debt financing.

No Ownership Issues With Debt

The most common form of debt financing is a loan. Unlike equity financing, which carries no repayment obligation , debt financing requires a company to pay back the money it receives, plus interest. However, an advantage of a loan (and debt financing, in general) is that it does not require a company to give up a portion of its ownership to shareholders.

With debt financing, the lender has no control over the business's operations. Once you pay back the loan, your relationship with the lender ends. Companies that elect to raise capital by selling stock to investors must share their profits and consult with these investors when they make decisions that impact the entire company.

Operational and Expense Differences

Debt financing can also restrict a company's operations, limiting its ability to take advantage of opportunities outside of its core business. In general, companies want a relatively low debt-to-equity ratio. Creditors look more favorably on such a metric and may allow additional debt financing in the future if a pressing need arises.

Finally, interest paid on loans is tax deductible as a business expense. Loan payments make forecasting for future expenses easy because the amount does not fluctuate.

Factors to Consider

When deciding whether to seek debt or equity financing, companies usually consider these three factors:

- What source of funding is most easily accessible for the company?

- What is the company's cash flow ?

- How important is it for principal owners to maintain complete control of the company?

If a company has given investors a percentage of their company through the sale of equity, the only way to remove them (and their stake in the business) is to repurchase their shares, a process called a buy-out. However, repurchasing the shares will likely cost more than you received when you issued them.

You're a Startup

Businesses in their early stages can be of particular interest to angel investors and venture capitalists. That's because of the high return potential they may see due to their experience and skills.

Established Lending Sources Ignore You

Equity financing is a solution when established financing methods aren't available due to the nature of the business. For example, traditional lenders such as banks often won't extend loans to companies they consider too significant a risk because of an owner's lack of business experience or an unproven business concept.

You Don't Want to Incur Debt

With equity financing, you don't add to your existing debt load and don't have a payment obligation. Investors assume the risk of investment loss.

You Get Guidance From Experts

Equity financing delivers more than money. Depending on the source of the funds, you may also receive and benefit from the valuable resources, guidance, skills, and experience of investors who want you to succeed.

Your Goal Is the Sale of Your Company

Equity financing can raise the substantial capital you may need to promote rapid and greater growth, making your company attractive to buyers and a sale possible.

While equity financing has benefits, there are some disadvantages to being funded this way.

No obligation to repay the money

No additional financial burden on the company

Large investors can provide a wealth of business expertise, resources, guidance, and contacts

You have to give investors an ownership percentage of your company

You have to share your profits with investors

You give up some control over your company

It may be more expensive than borrowing

Pros Explained

Equity financing results in no debt that must be repaid. It's also an option if your business can't obtain a loan. It's seen as a lower risk financing option because investors seek a return on their investment rather than the repayment of a loan. Plus, investors typically are more interested in helping you succeed than lenders are because the rewards can be substantial.

Equity financing offered by angel investors and venture capitalists can provide access to outstanding business expertise, insight, and advice. It can also provide you with new and vital business contacts and networks that may lead to additional funding.

Cons Explained

The stakes taken by investors providing equity financing can be significant, and thus, profits going to the business owners are reduced. Even small common stock investors get a share of the profits. Moreover, investors may want to be consulted whenever you plan to make decisions that will impact the company.

In exchange for the large amounts that angel investors and venture capitalists may invest, business owners must give over some percentage of ownership. That can translate to having less control over your own company.

The typically higher rate of return demanded by large investors can easily exceed that lenders charge. Also, shareholder dividends aren't tax deductible. Interest payments on loans are, with some exceptions.

Say that you've started a small tech company with your own capital of $1.5 million. At this stage, you have 100% ownership and control. Due to the industry that you're in and a fresh social media concept, your company attracts the interest of various investors, including angel investors and venture capitalists.

You're aware that you'll need additional funds to keep up a rapid pace of growth, so you decide to consider an outside investor. After meeting with a few and discussing your company's plans, goals, and financial needs with each, you decide to accept the $500,000 offered by an angel investor who you feel brings enough expertise to the table in addition to the funding. The amount is enough for this round of funding. Plus, you don't wish to relinquish a greater percentage of your company ownership by taking a larger amount.

Thus, the total invested in your company is now $2 million ($1.5 million + $500,000). The angel investor owns a 25% stake ($500,000/$2 million), and you maintain a 75% stake.

The equity-financing process is governed by rules imposed by a local or national securities authority in most jurisdictions. Such regulation is primarily designed to protect the investing public from unscrupulous operators who may raise funds from unsuspecting investors and disappear with the financing proceeds.

Equity financing is thus often accompanied by an offering memorandum or prospectus, which contains extensive information that should help the investor make an informed decision on the merits of the financing. The memorandum or prospectus will state the company's activities, give information on its officers and directors, discuss how the financing proceeds will be used, outline the risk factors, and have financial statements.

Investor appetite for equity financing depends significantly on the state of the financial markets in general and equity markets in particular. While a steady pace of equity financing indicates investor confidence, a torrent of financing may indicate excessive optimism and a looming market top.

For example, IPOs by dot-coms and technology companies reached record levels in the late 1990s, before the "tech wreck" that engulfed the Nasdaq from 2000 to 2002.

The pace of equity financing typically drops off sharply after a sustained market correction due to investor risk aversion during such periods.

How Does Equity Financing Work?

Equity financing involves selling a portion of a company's equity in return for capital. By selling shares, owners effectively sell ownership of their company in return for cash.

What Are the Different Types of Equity Financing?

Companies use two primary methods to obtain equity financing: the private placement of stock with investors or venture capital firms and public stock offerings. It is more common for young companies and startups to choose private placement because it is more straightforward.

Is Equity Financing Better Than Debt?

The most important benefit of equity financing is that the money does not need to be repaid. However, the cost of equity is often higher than the cost of debt.

Companies often require outside investment to maintain their operations and invest in future growth. Any smart business strategy will include a consideration of the balance of debt and equity financing that is the most cost-effective.

Equity financing can come from various sources. Regardless of the source, the greatest advantage of equity financing is that it carries no repayment obligation and provides extra capital that a company can use to expand its operations.

Google. " Form 10-K ."

Meta. " Facebook Annual Report 2012 ," Page 93.

Internal Revenue Service. " Publication 535 (2022), Business Expenses ."

Arvin Ghosh. " The IPO Phenomenon in the 1990s ."

Yahoo Finance. " NASDAQ Composite (^IXIC) ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-645973195-22e4ffc9e1bc4da39c90ca72cd940aa2.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is Equity Financing — and Is It Right for Your Business?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Equity financing trades a percentage of a business’s equity, or ownership, in exchange for funding. Equity financing can come from an individual investor, a firm or even groups of investors.

Unlike traditional debt financing, you don’t repay funding you receive from investors; rather, their investment is repaid by their ownership stake in the growing value of your company. Equity financing is a common type of financing for startup businesses — especially for pre-revenue startups that don’t qualify for traditional loans — and businesses that want to avoid taking out small-business loans .

Looking for tools to help grow your business?

Tell us where you're at in your business journey, and we'll direct you to the experience that fits.

on Nerdwallet's secure site

What is equity in business?

Business equity refers to the amount of ownership in a company or business, usually calculated as a percentage or by number of shares. For smaller private companies, equity is usually reserved for owners, investors and sometimes employees, while larger, publicly traded companies may also sell equity on the stock market.

Business equity is calculated by subtracting a business’s total liabilities from its total assets. For that reason, equity reflects a business’s value and indicates to shareholders the business’s overall financial stability.

» MORE: What is an equity injection?

How does equity financing work?

The process of getting equity financing will vary depending on the type of equity financing you’re looking for, your business and your investors. Generally, you can expect to follow these steps.

Gather documents

Before you start looking for investors, you’ll need documents like a business plan and financial reports , plus an idea of how much capital you need and what you will use it for. These are all things you’ll need to outline to a potential investor in your business pitch.

Find investors

If you don’t know investors or have potential investors in mind already, consider leveraging your personal or professional network to understand your options. You can also use online platforms to search for investors, or even check LinkedIn or attend local networking events.

Negotiate how much equity to give to your investors

Once you’ve found your investors, they may conduct their own business valuation, whereby they determine the potential value of your business to decide how much equity they want for their investment. Factors like business stage, amount of risk based on market trends and expected return based on financial projections will influence this negotiation. Angel investors may request 20-25% for example, while venture capitalists may want up to 40%.

Once you’ve negotiated a price, the cash you receive from investors may be used for product development, new hires, debt refinance or working capital.

Share profits

Once your business starts making money, your investors will be entitled to a portion of your profits depending on how much equity they have in your business. This percentage will be paid to your investors in dividends within a predetermined time frame. If your business fails to make money, original investments do not have to be repaid.

» MORE: Debt vs. equity financing

Pros and cons of equity financing

No repayment terms. Strictly speaking, you don’t “repay” an investor in your company the way you would a lender. Instead, the initial investment is repaid by the prospect of the future value and profits of your business. While loans can be a great way to fund your business, not having monthly or weekly payments can be very beneficial to startups or businesses that are focused on growth.

Access to advisors. Most investors have invested before, and have likely even run their own businesses, which can make them a good resource as you navigate the ups and downs of running your business. Plus, because they have money invested in your business, your investors will have a special interest in helping your business succeed.

Larger funding amounts. You may qualify for larger amounts of financing with equity investors than with debt financing, especially if you’re a startup business. In addition, if you end up needing more money along the way, an investor may provide additional injections.

Alternative qualification requirements. Rather than business revenue or personal credit, investors will typically look at things like your business idea’s potential and your character.

Loss of ownership. Any time you receive an equity investment, your percentage of ownership in the business will decrease, which can affect your share of any future profits and value.

Loss of control. When you hand over ownership, you may also be handing over some control of your business, which can become problematic if you and your investors don’t see eye to eye.

Usually for high-growth, high-potential businesses. Equity financing is usually tailored for fast-growing businesses with high growth potential, which means many small businesses won’t be the right fit for this type of financing.

Common types of equity financing

Angel investing.

Angel investors are high-net-worth individuals, most often accredited, who invest their own money in startups or early-stage operating businesses. It is possible to find angel investors through platforms like the Angel Capital Association or AngelList, but they can also be personal acquaintances or members of your professional network. Angel investors are a good option for business pitches or pre-revenue startups because they are often experienced individuals who can provide guidance in addition to funding.

Venture capital

Venture capital (VC) is a type of equity financing that’s similar to angel investing, but instead of wealthy individuals, VCs are usually investing on behalf of a venture capital firm. In general, VC can be a little more difficult to qualify for, and firms usually get involved after angel investors have already made initial investments. VC may be best fit for early-stage, high-growth businesses that have started operating already.

Equity crowdfunding

Equity crowdfunding is a form of equity financing that draws on groups of online investors, some accredited and some not, to fund businesses. Crowdfunding platforms allow potential investors to learn about businesses or business pitches through online profiles created by the business owners. Some may find less pressure in raising capital on crowdfunding platforms, which may make equity crowdfunding a good option for less experienced entrepreneurs or smaller businesses. However, online investing poses additional risk of fraud, so you want to be diligent about the platform you use. In addition, issuing more shares, however small, may dilute your ownership and increase costs more than using an angel investor or VC.

Alternatives to equity financing

Small-business loans. Small-business loans are a common type of debt financing, and a fair alternative to equity financing. Loans can be either term loans or lines of credit , and may come from banks, online lenders, credit unions or nonprofit lenders like community development financial institutions (CDFIs).

Small-business grants. If you want to avoid taking on debt and keep control of your business, and you don’t need a ton of funding, consider looking for small-business grants instead. Grants can be tricky to find and usually don’t fund in large amounts, but they can be worth it for funding that you don’t need to pay back.

Self-investing. Tapping into your own savings can be a way to maintain full ownership of your business and avoid paying any interest. However, you risk losing your savings if your business fails, so it’s best to seek the advice of a financial professional to determine whether this option is right for you.

Friends and family. If you have friends or family members you trust and who support you and your business, they may be willing to provide funding. Though this may feel less formal than receiving funding from a bank or other financial institution, you should still create a contract that details the terms of the business loan from your friends or family .

» MORE: How to fund your business idea

On a similar note...

- Finance and Accounting expand_more -->

- Customer Experience expand_more -->

- Business automation solutions expand_more -->

- Communities

- Find Talent

How Equity Financing Works: A Complete Guide For Beginners

Equity financing is raising capital for a business by selling ownership shares to investors. This means that individuals or entities invest money in a company in exchange for a percentage of ownership. Unlike loans, this form of financing does not incur debt or require regular repayments.

What Is Equity Financing for Startups and Businesses

Equity financing is especially crucial for startups and growing businesses. It provides an injection of capital that can be used for research and development, hiring skilled employees, marketing, and other essential operations. Additionally, equity investors often bring valuable industry expertise and networks, which can significantly contribute to the success of the business.

Equity Finance Example: Imagine a tech startup, XYZ Innovations, looking to develop groundbreaking software. They decide to seek equity financing, offering potential investors a share in the company in exchange for the capital needed to develop and market their product.

Understanding Equity Financing

Differentiating equity from debt is essential. Equity represents ownership in a company, whereas debt involves borrowing money that must be repaid with interest. Equity investors share in the company’s successes and challenges, and their returns are directly tied to the company’s performance.

Types of Equity

1. common stock.

Common stock represents basic ownership in a company. It typically grants voting rights, allowing shareholders to participate in key decisions.

2. Preferred Stock

Preferred stockholders have certain privileges over common shareholders. They often receive fixed dividends and have priority in case of liquidation.

3. Convertible Preferred Stock

This type of equity allows investors to convert their preferred shares into common shares at a later date, often at a predetermined conversion ratio.

4. Equity Shares in Limited Liability Companies (LLCs)

In LLCs, ownership units are called membership interests. These provide a share of the company’s profits and a say in its management.

Parties Involved

1. investors.

Investors provide the capital needed by the business in exchange for ownership shares. They can be individuals, venture capital firms, angel investors, or private equity groups.

2. Entrepreneurs/Founders

The entrepreneurs or founders are the individuals who establish and operate the business. They are the original owners and often retain a significant portion of equity.

Why Choose Equity Financing

1. no repayment obligations.

With equity financing, there is no obligation to make regular repayments, unlike loans. This allows the business to allocate funds towards growth and operations rather than servicing debt.

2. Access to Expertise and Networks

Equity investors often bring valuable industry knowledge, experience, and connections. This can open doors to new opportunities, partnerships, and markets that may have been inaccessible.

3. Shared Risk

Since equity investors become partial owners, they share in the business risks. If the company faces challenges or setbacks, they bear some losses alongside the founders.

Disadvantages

1. dilution of ownership.

As more equity is issued, the founders’ ownership stake in the company decreases. This is known as dilution. While it brings in much-needed capital, it also means relinquishing a degree of control over the business.

2. Loss of Control

Equity investors may have a say in major decisions, potentially impacting the founders’ ability to make unilateral choices about the company’s direction.

3. Sharing Profits

Profits are distributed among all shareholders, which means founders might not receive the full share of the company’s success.

The Equity Financing Process

Preparing for equity financing, 1. building a strong business plan.

Before seeking equity financing, it’s crucial to have a comprehensive business plan. This plan should outline the company’s mission, target market, competition analysis, financial projections, and growth strategy. A well-prepared business plan instills confidence in potential investors and serves as a roadmap for the business.

2. Valuing Your Company

Determining the value of your company is a critical step in equity financing. This valuation is typically based on revenue, profitability, market potential, and comparable company valuations. It’s essential to strike a balance between a fair valuation that attracts investors and one that doesn’t undervalue your company.

Finding Investors

1. angel investors.

Angel investors are typically affluent individuals who invest their capital into startups in exchange for equity. They often have industry experience and can provide valuable mentorship.

2. Venture Capitalists

Venture capitalists are professional investment firms that manage pooled funds from various investors. They actively seek out startups with high growth potential and provide capital, expertise, and guidance.

3. Private Equity Firms

Private equity firms invest in more established businesses and often take a more active role in management. They seek to enhance the company’s value and eventually exit with a profit.

Pitching to Investors

1. crafting a compelling pitch.

A pitch should concisely convey the business opportunity, the problem it solves, the market size, the competitive advantage, and the potential return on investment. It’s essential to be clear, concise, and persuasive.

2. Addressing Investor Concerns

Investors will have questions and concerns. It’s important to be prepared to address these, whether they pertain to market validation, scalability, competitive landscape, or financial projections.

Due Diligence

Before committing capital, investors conduct due diligence to thoroughly assess the company’s financials, market potential, team capabilities, and legal standing. This is critical to ensure the investment aligns with their risk tolerance and objectives.

Negotiating Terms

1. valuation.

Negotiating the valuation of the company is a pivotal aspect of equity financing. Both parties need to agree on a fair valuation that reflects the company’s current worth and future potential.

2. Equity Stake

The equity stake offered to investors determines their ownership share in the company. This can range from a small percentage for angel investors to a significant share for venture capital firms.

3. Investor Rights

Negotiating investor rights involves determining what privileges and protections the investors will have. This may include voting rights, information rights, and anti-dilution provisions.

Closing the Deal

Legal procedures, 1. drafting the term sheet.

A term sheet is a preliminary agreement outlining the key terms and conditions of the equity investment. It covers the investment amount, equity stake, investor rights, and specific provisions or milestones. This document serves as a basis for the final investment agreement.

2. Finalizing the Investment Agreement

The investment agreement is the legally binding document that formalizes the equity investment. It includes detailed terms, conditions, and protections for the company and the investors. Legal professionals are typically involved in drafting and reviewing this document.

Transferring Equity

Issuing shares to investors is the process of transferring equity ownership in exchange for the agreed-upon investment amount. This is when investors officially become shareholders of the company.

Post-Investment Phase

Reporting and communication.

After the investment, keeping investors informed about the company’s progress is essential. Regular reports and updates on financial performance, milestones achieved, and challenges faced help maintain transparency and trust.

Investor Relations

Building and maintaining positive relationships with investors is crucial. This involves not only providing updates but also seeking their input and feedback. Strong investor relations can lead to continued support and potential future investments.

Managing Equity

1. handling dilution.

Dilution occurs when new equity is issued, decreasing the ownership percentage of existing shareholders, including founders and early investors. Managing dilution effectively requires careful planning and communication.

2. Handling Exits or Buybacks

At some point, investors may seek an exit to realize their returns. This can happen through various mechanisms, such as selling their shares in a secondary market or the company going public (IPO). Alternatively, the company may buy back shares from investors under specific conditions.

Exit Strategies

Initial public offering (ipo).

An IPO is when a private company becomes publicly traded by offering its shares on a stock exchange. This provides an exit strategy for investors, including founders and early equity investors.

Acquisition

The acquisition involves selling the company to a larger entity. This can be a strategic move to leverage the acquiring company’s resources and reach.

Secondary Sale

In some cases, investors can sell their equity shares to other investors in secondary markets or through private sales. This provides liquidity without the company needing to go public or be acquired.

Understanding how equity financing works is essential for entrepreneurs and startups seeking to raise capital for their ventures. It offers a valuable alternative to traditional loans, providing access to funding while bringing in expertise and support from investors. However, weighing the advantages and disadvantages is crucial, considering factors like dilution of ownership and loss of control.

Equity financing involves careful planning, effective communication, and legal procedures. From preparing a strong business plan to negotiating terms with investors, each step is critical in securing the necessary funding.

After closing the deal, maintaining strong investor relations and effectively managing equity is key to long-term success. This includes reporting on progress, handling dilution, and addressing potential exits or buybacks.

Ultimately, clearly understanding the equity financing process empowers entrepreneurs to make informed decisions about their funding options and positions their businesses for growth and success.

Also Read: How Financial Forecasting Can Help Your Business Grow

The Ultimate Guide to Equity Financing

Table of contents

With stock markets trading close to record highs, now is a good time for companies to consider equity financing, even if they’re not publicly listed.

The average trading multiple on the S&P 500 is currently above 34, near the highest level it has been in a decade. All things being equal, that means that investors, on average, are overpaying for equity investments.

On the flip side, this represents a massive opportunity for companies looking to raise funds through equity financing.

Equity financing has many parallels to debt financing , although tends to bring more complications for the company raising funds in the long-term.

DealRoom regularly works with these companies, many of which are using equity to fund large M&A transactions. Our research indicates that of the 10 largest industry transactions (i.e. not involving private equity) in this decade, all involved some form of equity financing.

Hence, equity financing is of paramount importance to M&A. This is the DealRoom overview of the process.

What is Equity Financing?

Equity financing is the process through which capital is raised through the sale or exchange of shares. When capital is raised through the sale of shares, it implies that a third party acquires a pre-agreed amount of shares in the business in exchange for cash.

When there is an exchange of equity, as is the case with many M&A transactions, the third party accepts equity in the company in lieu of cash for their own company’s equity.

In both cases, the company is relinquishing some control in the company to the third party through the equity financing.

Types of Equity Financing

There are only two types of equity financing: Public and Private .

- Public equity financing: this includes initial public offerings, stock issues, and the sale of company held equity on the stock market. Publicly listed stock tends to be highly liquid, so even if it isn’t accepted as part payment in a transaction, the company could potentially sell equity that it holds to raise the required cash.

- Private equity financing: sometimes called a private placement, this is essentially the same as public equity financing with one major difference: the stock isn’t listed on a public exchange. That means that it is less liquid, but also faces less of the regulations that surround public equity listings.

Sources of Equity Financing

Having defined equity financing, the question then becomes:

‘Who would be interested in acquiring equity in my company?’

Even investors that claim to be industry agnostic often possess some restrictions about the kind of companies they invest in.

When these companies list the criteria that they’re looking for in investments on their websites, essentially what they’re doing is defining the criteria of the equity - as most will usually acquire part of the equity, rather than the whole business.

The following are the main sources of equity finance:

- Seed Capital Investors: Seed capital investors can range from incubation programs to private equity firms, and essentially refer to anybody that is willing to invest in a very early (often pre-revenue) stage company.

- Venture Capital Firms: Venture capital is early stage private equity. These investors usually seek high growth businesses, and accept higher risk in exchange for larger slices of equity. There is usually an experience imbalance (with the investors being more experienced in management than the company owners), so the equity investment will often have several stipulations around company management and strategy.

- Private Equity : Private equity has moved into the foreground in equity investing over the past two decades, with some estimates suggesting that industry will manage close to $6 trillion in assets by 2025 - 25% growth in just four years. The universe of private equity companies is now so large that, whatever your company’s size, there is likely to be a private equity company with the potential to provide equity financing.

- Crowdfunding : Crowdfunding received a major boost in 2012 with the passing of the JOBS Act, which aimed to encourage funding of small businesses in the United States by easing securities regulations. Now, companies can raise equity financing through a host of crowdfunding platforms, usually with a much broader base of investors (i.e., a crowd of investors) than more traditional forms of equity financing.

- Stock Market : As mentioned in the previous section, if your company has the relative luxury of being publicly listed, it can use its equity to raise financing on the public markets. Alternatively, if your company is private, if it meets certain criteria, it may be able to list on a public market through an IPO. Consider also a SPAC transaction (insert link), which have become widely popular in recent times.

Debt Financing vs. Equity Financing

When measuring whether your company should opt for debt or equity financing, there are a number of factors to consider.

As always, bear in mind that the comparisons made here are generalities and the specifics will depend on the prevailing market, your company, and the third parties involved in providing the finance.

This said, here are the main issues that you should consider when deciding which to choose for your company:

Debt financing means that your company has to repay cash according to the terms agreed at the time of its issuing. If your company is unable to generate the cash required for repayment, this can become burdensome very quickly.

By contrast, equity financing just means that the provider of funds receives a share of the company and its profits.

And while this may seem more attractive in the short-term, in the long-term, depending on how much equity (i.e. what share of your company) is issued, it can work out to be far more expensive than debt financing.

The bigger the funds required, the more terms and conditions will be attached. This is as true for debt financing as it is for equity financing.

On balance however, at least debt financing means that terms are only imposed for the duration of the loan being paid. With equity financing, the party that provided equity finance now holds a share of your company and by extension, some of the voting rights.

Depending on the terms agreed, they may even be able to influence your company’s strategy. All issues to ponder when considering the trade off between financing with debt or equity.

Note: While most articles of this kind take the narrative, ‘debt or equity’, we are keen to emphasize that your choice for financing doesn’t have to be one or the other.

There are hybrid options (i.e. combinations of the two) that may work out even better, particularly if you believe that your equity will be worth far more in the future.

Our recommendation is that you look at every option for financing available, including hybrid combinations of debt and equity.

Valuing Equity

If your company isn’t publicly listed, you will need to conduct a valuation of your company. This will allow you to arrive at an estimate for how much of its equity needs to be sold to obtain the required amount of funds.

In a previous article DealRoom looked at how to conduct a valuation of a private company and the challenges involved in doing so. There are several issues to consider with a valuation, including where the market is in its cycle.

Depending on what value the professionally conducted valuation provides for your business, it may be better to wait until your equity has a higher valuation before undertaking your company’s equity financing.

Useful resources:

How the approach to valuation frames success for diligence and integration, intangible asset valuation: methods from an industry pro, avoiding valuation surprises and accounting for m&a transactions, equity financing: advantages and disadvantages.

First, the advantages of equity financing:

- Private equity companies are sitting on record levels of ‘dry powder’ (i.e. capital waiting to be invested), so there’s never been a better time to seek equity financing.

- When markets are trading at historic highs, holders of equity have the potential to use equity to fund transactions that would otherwise require excessive amounts of cash.

- Equity financing tends to be a better option when interest rates are high, and debt financing becomes more expensive.

- If you raise equity financing with the right investment company, you may be able to benefit from their network and expertise.

- Raising equity financing with a high profile investment company (say, a blue chip private equity firm) is an excellent signalling mechanism for your company’s potential.

- Equity financing means none of the regular cash-sapping interest repayments that come with debt financing.

And the disadvantages of equity financing:

- The terms negotiated on your equity financing may hinder your company’s management from making growth-oriented decisions.

- In high-growth industries, or industries with uncertain futures, valuations can be challenging, opening the potential for undervaluing your company’s equity.

- The search for the right equity investor, combined with the time that it takes them to conduct due diligence on your company, can take several months.

- If relations sour with the equity investor after the equity financing, the investment may ultimately destroy value - negating the point of the investment in the first place.

- Dividing control of a company, particularly a private company, among several parties can make a sale of the company more challenging further down the road.

Using Equity Financing in M&A

As mentioned elsewhere in this article, all ten of the largest M&A transactions conducted this decade have involved some form of equity financing.

The biggest of these - the merger of S&P Global and IHS Markit in 2020 - was an all-equity affair, involving no cash or debt.

In the 9 or so months since the transaction, S&P Global’s share price has grown by over 25%, reflecting anecdotal evidence that it’s invariably a better idea to fund M&A transactions with equity when market valuations are looking frothy.

When considering whether to use equity financing for M&A, ask yourself honestly if you think your stock is a good buy at the current price. If the answer is ‘no’, it could provide you with a powerful weapon in an M&A transaction.

Equity Financing Due Diligence Checklist

1. capital-formation strategy.

- How much capital does the company really need, when does really need it, and whether there are alternative ways to obtain these resources?

- Do both parties have growth in company’s value once enter into an agreement?

- Is the deal structure going to 20% equity with 80% control or any other way? (or any other way)

- Is the chosen Capital Formation Strategy can mitigate risk or has downside protection?

- Obtain feedback on strengths and weaknesses from board members or other third parties.

- Comprehend the company's position against its public or private competitors by recognizing their public or private competitors.

- Asses the company's potential and how it fits into the investor's portfolio.

- Produce a tracking document/envieronment (to contact a lot of investors and process).

2. Preparing Confidential Info

- Make sure the business is on track with realistic and measurable goals, anticipating what is to come, reviewing the plan on a regular basis and revising if necessary.

- Brief history

- Mission and Vision Statement (why you are in this business)

- Discussion of your revenue and business model

- Overview of products and services

- Background of management team

- Key features of your market

- Summary of the company’s financial performance up to date

- How much money you need to raise and why?

- Organizational and management structure

- Operational and management policies

- Description of products and services (both current and anticipated)

- Overview of trends in the industry and marketplace in which the business compete (or plan to)

- Key strengths and weaknesses of the company

- Key products and services currently offered

- Proprietary features, strengths and weaknesses of each

- Anticipated products and services (how future product development and research will be affected by the financing you seek)

- The Role Your Business Plan Plays

- Prepapre a TOWS Analysis

- Strategies for reaching current and anticipated customers or clients

- Pricing policies and strategies

- Advertising and public-relations plans and strategic alliances

- Summary of financial performance for past three to five years

- Current financial condition (include recent Income Statements, Balance Sheets and Cashflows as attachments)

- Projected financial condition (present forecasts for three to five years)

- Discussion of working budgets and how capital will be allocated and used in accordance with these budgets will be extended.

3. Develop a Winning Pitch Deck

- Prepare a good summary than a lengthy discourse and piques the interest of potential investors.

- Problem - explains the market gap that needs to be filled in a way that people can relate to and investors can understand.

- Solution - needs to be concise, clear and scalable.

- Market - outline the past market, as well as future potential growth.

- Product or Services – in action

- Traction and Milestones - month over month growth of the business (e.g. revenue, metrics, etc).

- Team - describe the leadership’s team members.

- Competition – same-industry competitors

- Financials – 3- or 5-years performance and projections of the company

- Amount being raised - Instead of using specific amounts, consider using ranges of numbers.

4. Meetings and Immersion

- Present a brief and descriptive pitch deck

- Make a compelling narrative to share.

- Demonstrate your product or service's one-of-a-kind value.

- Present a solid and realistic data (with back ups)

- Describe your revenue strategy.

- Be prepared for any questions that may arise and be prepared to answer them in advance.

5. Creation of a Pro-Forma Cap Table

- Demonstrate the ownership and market value of the company both now and after a potential investment.

- Analyse the impact of investments, aftermath

- Identify the risks and rewards after a potential investment

To find a complete debt financing template visit our templates gallery and utilyze pre-built ready to use playbook. You can always customize it right inside the DealRoom to fit your needs.

The great thing about equity is that every company has it. The challenging part may be to convince investors that they want to give you money for it.

Equity financing brings a different set of considerations to debt financing, principally, understanding who you’re getting into business with.

ust as investors conduct due diligence on the companies that they invest in , those companies should conduct due diligence on the investors they’re giving part control of their company to.

Talk to DealRoom today about how our platform for M&A and services can help you through your equity financing process, and how we can improve the due diligence process of both sides of the transaction.

Related articles

Get your m&a process in order. use dealroom as a single source of truth and align your team..

Get weekly updates about M&A Science upcoming webinars, podcasts and events!

- en - english

- es - español

- > Business Finance

- > Article

Everything You Need To Know About Equity Financing

What Is Equity Financing?

How equity financing works, example of equity financing, pros and cons of equity financing, advantages:, no repayment stress, risk sharing with investors.

- businesses operating in volatile markets

- businesses embarking on ambitious projects.

Access To Expertise And Networks

Disadvantages, dilution of ownership, profit sharing, potential for conflict, types of equity financing, individual investors.

- family members

- professional acquaintances

Angel Investors

- convertible debt

- ownership equity

Venture Capital Firms

- larger amounts of investment

- rigorous management and strategic planning

Venture Capitalists

Venture capitalists (VCs) are professionals who manage funds invested in high-growth potential startups in exchange for equity. They are usually part of venture capital firms.

Initial Public Offerings (IPO)

Corporate investors.

- foster a partnership

- enter new markets

- access innovative technologies or products

Equity Crowdfunding

When to choose equity financing, if you’re a startup, if you can’t get funds from traditional lenders.

- stringent lending criteria

- high-risk business models

If You Don't Want To Be In Debt

If you'd like to receive expert guidance.

- strategic advice

- valuable industry contacts

If You Want To Sell Your Company In The Future

How to get equity financing, gather documentation.

- a business plan

- financial statements

- market analysis

- any other documents that showcase your business's potential

Find Investors

- networking events

- industry conferences

- online platforms

Negotiate How Much Equity To Give

Share profits and maintain transparent communication, alternatives to equity financing, debt financing, mezzanine financing, the benefits of equity financing over debt and mezzanine financing, vs debt financing, vs mezzanine financing, a loan could be a simpler, faster alternative, related articles.

When Were Credit Scores Invented? A Journey Through Financial History

Credit scores affect the financial health of both people and companies. Contrary to common belief, they are not a... Read More

Everything you need to know about DSCR: the debt service coverage ratio

The Debt-Service Coverage Ratio (DSCR) is a crucial indicator of financial health and stability. Understanding it can illuminate the... Read More

How Many Loans Can You Have?

When it comes to borrowing, knowing how many loans you can have and how much debt is too much... Read More

Payroll Loan Essentials: A Comprehensive Guide for Businesses

A payroll loan can serve as an essential lifeline when cash reserves are low, ensuring prompt payment to employees... Read More

Unveiling the Basics of Purchase Order Financing

Purchase order financing offers a funding solution for businesses to cover the costs of materials or products required to... Read More

Everything You Need To Know About Mezzanine Financing

Mezzanine financing is a key option for companies ready to grow but stuck between debt and equity. It blends... Read More

Prequalify in 5 minutes

Select your desired loan type.

- Business Credit

- Business Finance

- Entrepeneurship

- Business Managment

Latest Articles

The Best Money Saving Apps: 2024 Guide

Money-saving apps make managing your finances more effective and easy. They help you budget, save, and invest with just... Read More

What Is Financial Literacy? A Comprehensive Guide to The ABCs of Money

Financial literacy is a beacon of empowerment amidst economic uncertainty. This concept helps us understand the nuances of finances... Read More

The 3 Credit Bureaus: Their Reports And Credit Scores

Credit bureaus are responsible for managing the credit history of individuals and companies. This score is an important part... Read More

Compound Interest: A Guide to Long-Term Financial Growth

Did you know that compound interest can greatly affect a person’s long-term financial health for the better? This article... Read More

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Finance Articles

Equity Financing

A method of raising capital for a business by selling shares or ownership stakes to investors in exchange for funding

Previously a Portfolio Manager for MDH Investment Management, David has been with the firm for nearly a decade, serving as President since 2015. He has extensive experience in wealth management, investments and portfolio management .

David holds a BS from Miami University in Finance.

What Is Equity Financing?

How equity financing works.

- Types Of Equity Financing

- Reasons To Prefer Equity Financing

- When To Consider Equity Finance?

- What Do Investors Look For Before Investing In A Business?

- Disadvantages Of Equity Financing

- Equity Financing Vs. Debt Financing

Equity financing is a way for businesses to raise capital by selling a portion of their ownership. This process involves attracting investors who contribute cash in exchange for a share of the company. This approach is commonly used by companies to fulfill both short-term and long-term financial needs.

Equity refers to the amount of capital invested by the owner of a company. Hence it also includes the value of shareholders’ stake in the company, as shareholders are owners of a company.

If a business owner is unable to fund the company independently or needs a substantial amount of capital to expedite growth, seeking external funding through equity financing becomes a practical and efficient solution that also allows quick access to capital.

Along with a significant cash investment, equity financing provides the owner the expertise to take their company to the next level.

The success of equity financing is closely tied to the company's financial performance . If the business achieves its financial goals, shareholders receive a favorable return on their investment. Return on investment, a widely used metric, serves as a measure of the profitability of an investment, reflecting the gains made by shareholders through dividends or selling their shares at a higher price.

Key Takeaways

Equity financing involves selling ownership stakes in a business to raise capital, commonly used by companies for short and long-term financial needs.

Equity encompasses the capital invested by the owner and the value of shareholders' stakes, making it a crucial element in financing decisions.

Equity financing is advantageous for businesses needing substantial capital quickly, offering both funding and expertise to propel company growth.

Unlike debt financing, equity financing doesn't impose a repayment obligation, and shareholders benefit from returns based on the company's success.

Various sources, including crowdfunding, angel investors, venture capital, IPOs, and family/friends, contribute to equity financing, with investors seeking unique ideas, solid financials, and a well-prepared business plan.

Financing through equity can be done at various stages of the company’s growth, whether an esteemed and established company or a start-up. Likewise, capital can be raised at various stages through multiple rounds.

When you raise funds through equity, the investor gets a part of the company's ownership. So choosing the right investors will give the business an excellent boost to grow to its full potential.

Patience is of utmost importance, as raising funds through this process can be a tedious and complicated pathway. It requires a significant investment of time and money.

The founder has to negotiate the terms of the deal and compile all the required legal documents to facilitate the process. Sourcing and evaluating interested parties, pitching ideas, and onboarding investors make it a lengthy process.

To find the right investors for your business, asking yourself these questions might help:

- Do their goals and vision for the business align with yours?

- Do they represent the core values and brand image of your business well?

- Can they provide access to a bigger and more valuable network?

- Finally, how much do you want them to participate in the affairs of the business?

Types of Equity Financing

A few of the sources are:

1. Crowdfunding

Crowdfunding is the process of raising money from many people to fund a business with the help of the internet and social media. Individuals who firmly believe in the company's vision contribute to the fund.

Crowdfunding provides access to a diverse group of investors. Equity-based crowdfunding is gaining wide popularity as it allows companies to raise capital without giving any stake.

2. Angel investors

An angel investor usually assists start-ups in their initial stages when they cannot onboard other investors. They are individuals with high net worth who offer capital to small ventures in exchange for angel investor equity or convertible debt.

The network, finance, connections, and other perks that angel investors provide to these businesses help the company to accelerate its growth to newfound heights in the long term.

3. Venture capital

Venture capital is an attractive opportunity for new companies with a limited operating scale and hasn’t reached the stage where they can secure a bank loan. Venture capital is a form of private equity financing.

Venture capitalists get a significant amount of ownership of the companies in exchange for the high risk of investing in early-stage companies. As a result, venture capitalists get a bulkier stake in the company compared to angel investors.

4. Initial Public Offerings (IPOs)

In an IPO , shares of a company are sold to institutional investors and individuals to raise new equity capital. Investment banks underwrite these IPOs and also make arrangements for these shares to be listed on various stock exchanges.

Through this process, a privately held company is converted into a public company , enabling the funding of new capital and trading of existing shares with ease.

5. Family and friends

Offering a share in your business in exchange for finance to friends and family is a convenient way to raise funds as long as it does not strain your relationships with them.

Reasons to prefer Equity financing

Some of the reasons are:

1. Expertise and networking

Raising funds through equity finance gives access to networks with high-net-worth individuals. Their contacts, expertise, and other resources provide invaluable support to the company.

The assistance these angel investors or venture capitalists provide is crucial to the company's growth in its early stages.

2. Alternative funding source

Equity financing is a great way to raise funds in cases where companies do not qualify for a bank loan or raise funds through debt financing. Crowdfunding, IPOs, venture capitalists and angel investors become measures to raise funds.

3. Reduced burden

Unlike debt financing, it does not require the companies to pay timely interest. This is especially helpful to start-ups that do not make positive cash flows. The burden of making enough profits to pay interests is mitigated.

No loan is required in this process. Investors make plans for the long term; hence they do not expect returns on their investments immediately.

4. Creditworthiness issues

Start-ups not eligible for a bank loan due to their credit rating and history can raise funds through equity financing instead of debt. Creditworthiness is not an obstacle in equity financing.

5. Long-term vision

The investors who contribute their money to the business do not expect the start-up to give returns on their investments immediately. They believe in the vision of the company and plan for the long term.

The company is not burdened in its initial stages to make profits and provide a return on investment .

When to consider Equity finance?

Choosing the right way to raise funds for the business is crucial. The pros and cons are weighed and analyzed to determine which process works well for the business. Following are some factors one must consider while opting for equity finance:

a) How important is it for the owners to control the company with complete authority and ownership?

It requires the owners to sell a portion of the company's stake in exchange for funds. If complete ownership is not essential to the owners, they may opt for equity funds.

b) Cost of finance

The overall aim of any business is to minimize the cost of finance and maximize owners’ wealth as much as possible. However, the cost of finance has a significant impact on net income .

Hence it is important to understand the repercussions while choosing the source of funds. Each type of financing has its own set of pros and cons. It is vital to understand each of them and decide upon the source.

c) What is the most suitable source of funding for the company?

If you intend to fund your business through equity finance, you must understand that you need access to investors interested in buying the shares.

Contradictory to what most business owners believe, a pool of venture capitalists is not readily available to provide funds to businesses.

Networking with a wide range of individuals, presenting the business plan with finesse , and negotiating many terms and conditions; are just some tasks to be carried out to fund the business using equity.

Equity finance is feasible only for those business owners who can justify the lack of debt. For the rest, debt finance would be a more suitable option to finance.

d) Business capital structure

The gearing ratio is a metric used to measure financial risk. It expresses a company’s debt in terms of its equity. A high gearing ratio indicates the company may be unable to meet its obligations.

Debt seems attractive due to its low financing cost, but it still has a disadvantage of the interest to be paid. If excessive capital is borrowed and the company cannot pay principal and interest, it may have to liquidate.

The company's capital structure must be reviewed thoroughly before opting for a type of finance.

What do investors look for before investing in a business?

Once you’ve decided equity finance is the right decision for the business, you’ve to start pitching the business plan to potential investors. Then, consult a business attorney who will assist you with writing contracts for the investors.

It is essential to clearly define the rules that apply and the role of every party involved in the company’s growth. But what is it that investors look for before investing in a business?

Venture capitalists are in the business of putting money into promising businesses where they can make money. They want a return on their investment in the long run. You're almost there if you can demonstrate your business can make money!

1. An extraordinary idea

With the market saturated with thousands of identical products, investors look for innovative and lucrative ideas. Does your company solve a unique problem? How does it stand out?

Conveying how your product is unique will convince them to invest in your business.

2. Crunch the numbers

The investors want to see the hard data! You need to show your business has been putting out great numbers. The data from balance sheets, profit, and loss statements, and cash flow statements should be at your fingertips.

If your business is in the pre-revenue or net loss stage, you need to explain to them your vision for the business, what you plan to achieve a few years down the line, your business model, etc.

3. Concrete business plan

A solid business plan should represent a successful business. A business plan mainly contains the vision and mission of the company, methods of achieving them, and the time required to do so.

Other than these items, a good business plan should include the sales channels, the target market, marketing strategies, financial projections, and potential hurdles and action plans to deal with them.

Being well prepared to make a successful pitch is of utmost importance. The business plan must be carefully designed, and the pitch must be made in a compelling narrative. Showing your investors that you’re future-oriented will assure them, as it is their biggest concern.

Disadvantages of Equity Financing

As much as equity financing seems like the most feasible method to raise funds for a business, it still has some disadvantages that should be considered before deciding to finance through equity.

1. Loss of control

The major disadvantage of raising funds through equity is a dilution of ownership and loss of operational control. But on the other hand, the investors and shareholders get a share of the profit they deserve.

2. Absence of tax shields

The interest paid on debt is tax-deductible, whereas the dividends distributed to shareholders are not tax-deductible expenses. Thus there is no tax shield with equity financing.

The lack of any tax shield makes equity financing more costly than debt financing in the long term.

3. Differences of opinion

Equity brings in multiple partners or owners involved in decision-making. As a result, there will likely be differences in opinion, and conflicts may arise between the partners due to differences in perspectives, administration, and management.

Equity financing Vs. debt financing

Equity and debt are ways in which businesses raise funds. Deciding which method is the most suitable for your business depends mainly on the need for ownership control, risk appetite, and the business capital structure.

Some sources of debt financing include:

- Instalment purchases

On the contrary, equity financing sources include:

- Institutional investors

- Angel investors

- Venture capital firms

- Corporate investors.

With debt financing, making payments is required almost immediately. If not done at the right time, you may lose your collateral. In addition, the monthly payments may cause cash flow issues when the business does not have enough working capital .

Even with these cons, you get complete ownership and control over the business, unlike in the case of equity. In addition, debt interest payments are also tax-deductible, thereby decreasing the taxable income.

If the business is not at a profitable stage, it can be tricky to adopt debt financing. However, financing through equity could be riskier as the investors expect a huge share of profits in the long term.

Ownership control is sacrificed in equity financing to a huge extent. It may also be possible that the investors own more share control than the owner themselves.

Everything You Need To Understand Restructuring

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and authored by Sumedha Vasadi | LinkedIn

Reviewed and edited by Justin Prager-Shulga | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Capital Allocation Line (CAL) and Optimal Portfolio

- Corporate Finance Overview

- Mezzanine Financing

- Pecking Order Theory

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Home > Finance > Loans

What Is Equity Financing?

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Equity financing is when an investor agrees to supply a specified amount of their capital in exchange for equity in your business. The most common equity financiers include venture capitalists and angel investors. However, there are some significant differences between these investors that we’ll dive into later.

The key benefit of leveraging equity as a financing option is that there’s no debt—you’ll never make a single loan payment. Equity investors aren’t interested in loan payments as they are interested in becoming an integral part of your business and getting a return from a percentage of your sales profits.

By signing up I agree to the Terms of Use.

What influence do investors have over my business?

It’s crucial to understand the level of influence equity funders will have on your company. If you’re not interested in sharing your company with someone else, angel investors and venture capital firms may not be for you.

The exact level of influence an investor will legally have will depend on the amount of equity they get from the deal and its terms. There are a few different levels of ownership and influence you should know about:

- Majority ownership . This happens when an investor owns more than 50% of your shares. With majority ownership in your company, the investor essentially has complete control.

- Minority active . Your investor owns 20%–50% of the shares at this level. This does not give them total control over management decisions, but it does give them the right to influence your decisions. You’ll have to keep them in the loop and council over major decisions.

- Minority passive . Your investor has less than 20% of your equity shares at this level. Their small stake in your company gives them little to no influence over business decisions.

Another thing to consider is that there are venture capitalists and angel investors who will like your company, the way you run it, and the direction it’s heading in, and will happily let you make most of the business decisions despite their equity stake. You shouldn’t count on this, but it has been known to happen.

Almost all investors will expect a share of your profits as part of their equity deal. And they should be paid because they’re shouldering the bulk of the risk upfront.

The main benefit of an investor taking a profit percentage is you have to pay them only when you’re making money, keeping you out of debt.

How can equity financing benefit my business?

You shouldn’t count out the usefulness of bringing on an investor. The right investor or investment group may bring expertise and opportunity to your business to improve your cash flow and keep your business out of debt.

Often angel investors and venture capital groups are industry-leading professionals who have helped convert small businesses into major players. A lot of growth can come from having an expert mentor with a vested interest in the success of your company on your board of directors.

What should I look for in an investor?

The most important aspect of searching for an equity funding partner is finding someone whose vision and interests are a good fit for you and your company. You want to find an individual or group whose expertise and personality work well with you and your business.

Will my business attract investors?

If you feel pretty good about bringing on an investor to help run your business, you’re on the right track. The next question you’ll have to answer is whether your business will interest a venture capitalist or angel investor.

It’s crucial to figure this out because finding and securing equity funding can be a long and demanding process. You’ll be pitching your business over and over, so you should at least know whether you’ll be dead on arrival or have a fighting chance.

The first and most important thing any investor will look at is whether your business model is scalable . Equity investors want a quick and lucrative ride, so businesses without a lot of growth potential are completely out of the question.

What’s the difference between an angel investor and a venture capitalist?

There are some differences in the types of businesses venture capitalists will fund versus what angel investors will fund. You may be able to secure funding from one but not the other.

Angel investors are generally wealthy individuals interested in helping small businesses grow. The TV show, Shark Tank , is a reality TV representation of angel investors—individuals looking for companies that fit well into their networks and expertise.

Venture capitalists , on the other hand, are institutional investors from much larger conglomerates comprised of financial groups. These groups are interested in helping well-established, high-growth-potential businesses expand into large corporations. And these conglomerates often consist of financial firms, insurance companies, pension funds, and university endowments.