5 questions about Grab’s epic SPAC investor deck

As expected, Southeast Asian superapp Grab is going public via a SPAC.

The combination, which TechCrunch discussed over the weekend , will value Grab on an equity basis at $39.6 billion and will provide around $4.5 billion in cash, $4 billion of which will come in the form of a private investment in public equity, or PIPE. Altimeter Capital is putting up $750 million in the PIPE — fitting, as Grab is merging with one of Altimeter’s SPACs.

Ride-sharing is a profitable business for Grab, though the segment did take a pandemic-induced whacking.

Grab, which provides ride-hailing, payments and food delivery, will trade under the ticker symbol “GRAB” on Nasdaq when the deal closes. The announcement comes a day after Uber told its investors it was seeing recovery in certain transactions, including ride-hailing and delivery.

Uber also told the investing public that it’s still on track to reach adjusted EBITDA profitability in Q4 2021. The American ride-hailing giant did a surprising amount of work clearing brush for the Grab deal. Extra Crunch examined Uber’s ramp toward profitability yesterday .

This morning, let’s talk through several key points from Grab’s SPAC investor deck. We’ll discuss growth, segment profitability, aggregate costs and COVID-19, among other factors. You can read along in the presentation here .

How harshly did COVID-19 impact the business?

The impact on Grab’s operations from COVID-19 resembles what happened to Uber in that the company’s deliveries business had a stellar 2020, while its ride-hailing business did not.

From a high level, Grab’s gross merchandise volume (GMV) was essentially flat from 2019 to 2020, rising from $12.2 billion to $12.5 billion. However, the company did manage to greatly boost its adjusted net revenue over the same period, which rose from $1 billion to $1.6 billion.

Inside of the company’s business units, ups and downs were stark. After deliveries GMV grew from $600 million to $2.9 billion to $5.5 billion from 2018 to 2020; Grab’s rides business GMV grew from $4.6 billion to $5.7 billion in 2018 and 2019, only to tumble to $3.2 billion in 2020.

However, Grab’s overall business was more profitable in 2020 than 2019, seeing its post-combination EBITDA loss narrow from -$2.3 billion in 2019 to -$800 million in 2020.

In short, Grab’s transportation business was hit hard due to COVID, its delivery efforts soared, and the company grew while losing less money.

Which segments are profitable?

Grab has four businesses, of which two — ride-hailing and deliveries — account for the vast majority of its revenues. The company’s financial business generates comparatively modest revenues when stacked against its more established efforts.

Financial services brought in around $200 million in revenue during both 2019 and 2020. However, the segment’s EBITDA losses of $400 million in 2020 mattered. Grab’s deliveries business had a smaller $200 million 2020 EBITDA loss, and its rides business generated $300 million in 2020 EBITDA. (All figures in this section are post -InterCo, taking into account the impact of the transaction, which will eliminate the impacts of “intragroup transactions.”)

Grab’s “Enterprise & Others” segment generates effectively no revenues and has a negligible impact on profitability. It can be ignored.

In short, ride-sharing is a profitable business for Grab, though the segment did take a pandemic-induced whacking; deliveries form a rapidly growing segment at the company that has greatly improved in profitability terms — in 2020, it lost just 25% of its 2019 negative adjusted EBITDA. And Grab’s financial services business is a drag on its bottom line while not helping its top line much.

How close to breakeven is the company as a whole?

Not close at all. Considering its net income, Grab lost $2.7 billion in 2020. That was down from $4 billion in 2019, but up from its 2018 net loss of $2.5 billion.

The caveat is that quite a lot of the company’s recent net losses stem from costs sourced from redeemable convertible preferred stock, or RCPS. That expense, a form of interest, came to $1.1 billion in 2019 and $1.4 billion in 2020. Given that RCPS is, to our understanding, a non-cash cost, how much investors will mind the implied dilution in the company’s net losses and thus be willing to forgive some of their scale, is not clear.

Even discounting 100% of its RCPS expense, the company’s net loss was still greater than $1 billion last year.

What sort of growth does Grab anticipate?

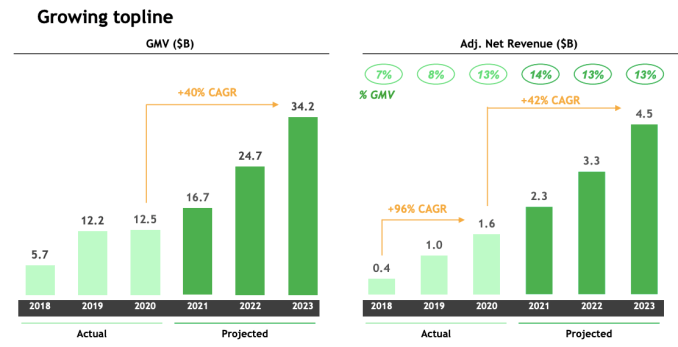

Here’s the chart:

Image Credits: Grab

You can see the COVID-19 impact on Grab’s GMV in the first chart. From here, the company expects total platform spend to grow rapidly. And that results in pretty strong net revenue growth.

Do note that the company does not expect its adjusted net revenue as a percentage of GMV to grow after 2021 — Grab actually anticipates adjusted net revenue to decline to 13% of GMV in 2022 after rising to 14% in 2021.

Still, the company expects a 40% compound annual growth rate (CAGR) in GMV from 2020 to 2023, and a 42% CAGR of adjusted net revenue over the same time period. That’s pretty good given the company’s scale, but a drastic slowdown from its pre-2021 growth pace of 96% CAGR.

What SPAC-ish shenanigans do we need to understand?

Oh boy. Well, let’s start with one of the numbers we just talked about: adjusted net revenue. What is that? Well net revenue is the company’s gross billings minus “Drivers and Merchants Base Incentives” and “Drivers and Merchants Excess Incentives.” Adjusted net revenue adds back in the second category of incentive.

Here’s how Grab defines the bucket:

Adjusted Net Revenue is a non-IFRS financial measure, which adjusts our net revenue by adding back excess incentives. Excess incentives occur when payments made to driver/merchant partners exceed Grab’s revenue received from such driver/merchant partners (excess incentives are calculated on a monthly basis for each country and not on a driver-by-driver basis).

So when Grab overpays someone, it doesn’t want that to count against its revenue. Sure. Cool. Judge that as you will, but reading this Grab deck, it is impossible to not get shades of the same joy that one beholds when trying to parse Uber’s earnings.

Finally, pay attention to the charts that show pre- InterCo data — the company’s performance before it was consolidated — and the tables that adjust for things that won’t stick around post-combination. The charts are often prettier than the tables. The charts, in essence, are what the company told itself before the deal. The tables, like the dataset featured on page 26 of the presentation, undercut some of Grab’s own hype.

Overall, this is a fun deal that will be exciting to see trade.

Ride-hailing’s profitability promise is in its final countdown

Grab to unveil world’s biggest SPAC merger, valued at nearly $40 bln - sources

- Medium Text

- Grab agrees merger with Altimeter Growth Corp

- Deal to provide Grab with about $4.5 bln in cash proceeds

- Investors agree bumper valuation for Grab

- Temasek, Fidelity, BlackRock are among new investors

- Deal set to close in next few months

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by Anshuman Daga; Editing by Muralikumar Anantharaman

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Anshuman Daga is a Singapore-based Asia Columnist for Breakingviews. He writes on investment banking, corporate activity and financial services, with a focus on Southeast Asia. Anshuman switched to financial commentary after 25 years with Reuters News including in London and Mumbai. During his 15 years in the Lion City, Anshuman has covered the emergence of Southeast Asia’s tech startups and Singapore’s growing status as a financial centre.

Business Chevron

Oil settles up on Middle East tensions, posts weekly loss

Oil rose around 1% on Friday on geopolitical tensions in the Middle East but posted a weekly loss on a bearish world oil demand growth forecast from the International Energy Agency (IEA) and worries about slower U.S. interest rate cuts.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Grab shares sink in historic Nasdaq debut as president touts the cross-selling opportunities of its super app strategy

After an initial jump on Thursday, shares of Grab slumped more than 20% in their Nasdaq trading debut after the ride-hailing and delivery app merged with U.S. blank-check firm Altimeter Growth Corp in a special purpose acquisition company—or SPAC—deal valued at $40 billion, the largest ever. The $4.5 billion Grab raised in the deal makes it the largest IPO by a Southeast Asian company in U.S. history.

The listing caps a rapid ascent for the startup that entrepreneurs Anthony Tan and Tan Hooi Ling launched as MyTeksi in Malaysia less than a decade ago. The pair, who are unrelated, founded the company with $25,000 that included prize money they’d won by entering their ride-hailing idea in Harvard Business School’s New Venture Competition in 2011.

Nine years and $12 billion in investments later, Singapore-based Grab now operates in nearly 470 cities across eight Southeast Asian markets, employs 700,000 drivers, and offers food delivery, payments and financial services—in addition to ride-hailing—to 187 million users.

Grab hopes its public debut will shine a “big spotlight” on the region and its market opportunities, says company president Ming Maa. Driven by its young, digitally-savvy and mobile-first populations, Southeast Asia is “on the cusp of a digital revolution,” says Maa.

But now that Grab is a public company, investors will be watching to see whether it can maintain its lofty goal of being an all-in-one-super app, wean its drivers and users off promotions, and—at some point—turn a profit. On Wednesday evening, Fortune spoke with Singapore-based Maa via video call about Grab’s business strategy and its plans ahead.

Fortune: Can you walk me through Grab’s plans to become profitable? Grab’s third quarter results last month showed losses of $988 million, despite steady growth in gross merchandise value (GMV), which ballooned to a record $4 billion in Q3. Market research firm Euromonitor said in a July report that a key weakness is Grab’s big spending on advertising, promotions and incentives, and that a challenge going forward is whether the company can make money and maintain customer loyalty without such discounts.

Maa: We don’t see profitability and growth as mutually exclusive. In Q3, we posted our third consecutive quarter of record GMV growth. We’ve also made very good strides on improving our economics. Our mobility segment has been positive since Q4 2019 and our margins are industry-leading [in that sector].

Our deliveries business—which is much younger at three years old—is already breaking even in a majority of our markets.

Our key is driving our super app strategy, which allows us to cross-sell new services when we roll them out, while maintaining discipline around our marketing costs. [It] also allows [Grab] drivers to earn more via [new] income opportunities [when ride-hailing is down] and helps us maintain discipline around [spending on] driver incentives. So the super app is really key to driving the new economics of our business.

Grab has several different business segments—which ones are your top priorities at the moment?

If you think about the long-term opportunities within Southeast Asia, [we’re] focused on three. The first is around continuing to deepen our delivery business. Whenever someone’s hungry, wants a restaurant meal, groceries to cook at home or potato chips for a snack on a Friday night, we want them to think of Grab first. So we’ll continue investing in deliveries.

The second is all around financial inclusion—continuing to drive affordability and accessibility of our financial services products. The way we do that is focusing on microinsurance, microlending and microsavings products that [are more] affordable [for the consumer in Southeast Asia]. The analogy I like to use is that in the U.S. you can buy a toothpaste that’s eight ounces; but in developing markets, they usually sell one ounce or two ounce toothpastes. We’re doing the same thing—creating bite-sized toothpastes for financial services.

The digital bank opportunity is very exciting. [Last year, the Monetary Authority of Singapore awarded Grab and telecommunications partner SingTel a license to set up a digital bank, which will launch next year]. Even in a developed country like Singapore, when you speak to consumers and SMEs on the ground, there’s a tremendous amount of underserved opportunities. Affordability, accessibility, and transparency is really key. And we want to make digital banking as easy as ordering a Grab ride.

Lastly, [we] continue to build infrastructure to support e-commerce, whether through our logistics network providing on-demand deliveries—we now operate the largest driver delivery network—or through our “buy now, pay later” services, which is very important in [this] region [since] credit card penetration is very low, at 10%. So for the remaining 90% of the population, this is the solution.

How will Grab fare against regional competitors? Indonesia’s GoTo—another Southeast Asian super app that formed this May when ride-hailing giant Gojek merged with e-commerce platform Tokopedia—is often cited as one of Grab’s most formidable regional competitor.

We’ve been blessed to have good competitors for the last nine years. Frankly, competition is good for consumers and the overall market. But we’re the only company that operates a regional super app. We got to where we are by focusing on tech investments. We invested quite a bit in our own mapping and routing. In some countries, there’s these little alleyways that aren’t on the maps. This helps us deliver items to people faster and more reliably than other companies. It’s also core to thinking about developing a shared driver fleet; what allows us to create the largest delivery network at the lowest cost. And the lowest cost delivery network is what drives long-term sustainability.

Can you share more about Grab’s plans in the year ahead? Will the company expand to more markets in Asia, or worldwide?

We are absolutely laser focused on Southeast Asia. It’s just day one of many long-term opportunities here. We want to drive the adoption and penetration of digital services here.

Has all the uncertainty surrounding the new Omicron COVID variant changed Grab’s strategy or outlook for the year ahead?

[In September], we did [write] down our forecasts for the year. But keep in mind that this was in a market environment where we had the Delta variant coming across Southeast Asia. We had a series of lockdowns [here]. Our revision was really out of an abundance of caution, rather than any weakness in the business itself.

It’s a bit too early to tell [about Omicron]. What’s changed in recent months is that we’ve seen vaccinations improve dramatically. We’ve seen most governments transition from a [zero-COVID] policy , which required strict lockdowns, to a policy of living with COVID as an endemic part of life. We’re starting to see cities open up, which is positive and will lead to a more constructive environment for the end of 2021 ,as well as leading into 2022.

This story has been updated to reflect Grab’s slump in later trading on Thursday.

Most Popular

- 0 minutes ago

$2.3 billion hedge fund manager on his move from New York to Florida: ‘I know of no business that has generated long term success by driving away its highest paying customers’

In-N-Out’s billionaire heiress says she stood in line for 2 hours to land a job at her own store when she was just a teenager to shake the ‘stigma of being the owner’s kid’ and ‘earn respect’

Billionaire and Virgin Group founder, Richard Branson’s wealth has tumbled by more than half since 2021 to $3bn as SPAC problems gave him ‘a big jolt from the side through COVID’

Donald Trump booted from prestigious list of billionaires after Truth Social parent’s swan dive

The Trump donor whom Biden can’t fire is running the U.S. Postal Service directly into the ground—just what everyone warned about when he was confirmed during the pandemic

Air Canada pilots land a Boeing 737 in Idaho after another in-flight emergency

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, digital standard + weekend, digital premium + weekend.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend newspaper delivered Saturday plus standard digital access

- FT Weekend Print edition

- FT Weekend Digital edition

- FT Weekend newspaper delivered Saturday plus complete digital access

- Everything in Preimum Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Nasdaq Welcomes Grab, the Largest Foreign SPAC Combination

On Thursday, @Nasdaq welcomed Southeast Asia’s leading super app @Grab, which went public via special purpose acquisition company (SPAC) Altimeter Growth Corp. (AGC), including $4.5 billion in fundraising for Grab and becoming the largest SPAC combination outside of the U.S.

O n Thursday, Nasdaq welcomed Southeast Asia’s leading super app Grab , which went public via special purpose acquisition company (SPAC) Altimeter Growth Corp. ( AGC ), including $4.5 billion in fundraising for Grab and becoming the largest SPAC combination outside of the U.S. Founded as a ride-hailing service, Grab has evolved into a cutting-edge technology company offering not just food delivery, but mobile payment and fintech, telemedicine, ride-sharing services, and more.

Grab, which has a $40 billion market cap, joins an extensive list of record-breaking listings this year on Nasdaq, including the largest initial public offering (IPO) , with Rivian ( RIVN ), and the largest direct listing with Coinbase ( COIN ).

Grab celebrated going public with a remote bell-ringing ceremony in Singapore, Nasdaq’s first in Southeast Asia. Grab CEO and Co-founder Anthony Tan hopes Grab will bring more attention to the Southeast Asian market, an area he believes is ripe for opportunity.

“We truly believe this is Southeast Asia’s time to shine, and we hope that our entrance into the global public market will help bring greater attention to the tremendous opportunity here in the region,” said Tan.

Grab’s journey to one of the most valued companies in all of Southeast Asia started with making the taxi service easier safer in Malaysia. Before Grab, Malaysia was notorious for unlicensed cabs overcharging for their rides. The app, first named MyTeksi, allowed commuters and tourists to digitally request a taxi instead of hailing one. Now, Grab operates in eight countries across Southeast Asia.

But even with its lofty accomplishments, Grab remains grounded in its mission to serve the Southeast Asian people and put the region on the map of global business.

“Our calling remains the same - to unlock greater opportunity for all Southeast Asians to participate in the digital economy,” said Tan.

This approach is key to Grab’s continued success. When COVID-19 quarantined most of the world, street vendors, which make up most of the food market in Southeast Asia, were effectively out of a job. In 2020, Grab brought 600,000 small businesses online with their app, bringing delicious food to the locals and keeping the street markets alive.

“Our evolution into a super app was guided by the everyday problems we wanted to solve for the people we care about,” said Tan.

Going forward, Grab will continue to create useful and innovative technology that serves Southeast Asian communities. Next year, it plans to launch a digital bank in Singapore and a mapping service.

Subscribe to Nasdaq+ for full access

Exclusive content, detailed data sets, and best-in-class trade insights to rewrite your portfolio for tomorrow.

Other Topics

Marketinsite.

Nasdaq’s Marketinsite offers actionable insights on a variety of market-moving topics. Learn from our thought leaders who are driving the capital markets of tomorrow.

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

- Sustainability

- Latest News

- News Reports

- Documentaries & Shows

- TV Schedule

- CNA938 Live

- Radio Schedule

- Singapore Parliament

- Mental Health

- Interactives

- Entertainment

- Style & Beauty

- Experiences

- Remarkable Living

- Send us a news tip

- Events & Partnerships

- Business Blueprint

- Health Matters

- The Asian Traveller

Trending Topics

Follow our news, recent searches.

Commentary commentary

Commentary: Why Grab is in such a rush to get listed

Advertisement.

commentary Commentary

CEO Anthony Tan is in a rush to build Grab into a super app and achieve profitability, and the company’s listings will help him do that without too much public scrutiny, say IMD Business School’s Howard Yu and Angelo Boutalikakis.

A man walks past a Grab office in Singapore. (File photo: Reuters/Edgar Su)

LAUSANNE: Grab battled Uber. It survived a merger fallout with Gojek. It coaxed tolerance out of regulators in a fragmented region of Southeast Asia.

Most recently, the Securities and Exchange Commission (SEC) has threatened to put a brake on the frantic SPAC (special purpose acquisition companies) activities. Despite all this, Grab managed to land a US$40 billion merger with the US-based Altimeter Capital.

“You need to be hyper paranoid and constantly thinking that the guy on your right is trying to murder you,” CEO Anthony Tan of Grab said in an interview with Financial Times in 2014.

READ: Commentary: Anthony Tan, the ‘unabashedly ambitious’ man behind Grab

His paranoia has been justified - Anthony is restless. His “workhorse” nature has been known since his days at Harvard Business School. He has been seen taking calls and reading case studies while running on a treadmill.

What he’s running against now is time. He needs Grab to become a super app before others. He needs to do so before Grab’s core business shows any signs of plateauing.

TOO MUCH MONEY IS CHASING TOO FEW GREAT IDEAS

The rise of SPACs is closely tied to one of the biggest wealth transfers of modern economic times. The purpose of a SPAC is to raise capital through an initial public offering (IPO).

Only later will a SPAC buy a start-up.

READ: Commentary: Grab’s blockbuster deal comes at questionable time for SPAC market

In this twisted arrangement, the start-up can effectively bypass all the compliance hurdles of a traditional IPO.

There’s no public scrutiny of financial disclosure and no formal filing of a detailed prospectus in the form of S-1. That’s why SPACs are referred to as blank cheque companies. They give whatever a start-up needs without asking too many questions.

For instance, through a regular IPO, Mr Tan would have faced lots of challenges in securing his 60.4 per cent voting rights that he has once the company is listed even though he only owns 2.2 per cent of ordinary shares.

The recent experiences of the founders of WeWork and Deliveroo show that investors can scupper such disproportionate control of power in an IPO.

During most of financial history, SPACs had been a minor play. After all, what respectable investors are going to put money in a shell company in the hope that it would one day successfully pick a high-flying unicorn? But the COVID-19 crisis changed all that.

Multi-trillion-dollar stimulus packages have flooded the market with liquidity never seen before. The record highs of Dow Jones and Nasdaq mean that the wealthy - family offices and hedge funds -have become obscenely wealthier.

READ: Commentary: Deliveroo’s IPO is a lesson to not underestimate investors

Meanwhile, the number of publicly listed companies has been dropping over the last three decades, dropping from 8,000 to just over 4,000 today. All that money needs to find new investment opportunities.

So, Altimeter Capital becomes the blank cheque company for Grab. And in this deal, Grab will receive a maximum of about US$4.5 billion in cash from the SPAC merger.

A BIG BUSINESS THAT MAKES NO MONEY

For Grab though, there may be other reasons why the SPAC route was preferred, to escape public scrutiny over financial disclosure compulsory under an IPO.

For venture capitalists or the financial market, no business model is more attractive than a platform - a marketplace that enables the exchange of goods or services and has purported “network effects”.

READ: Commentary: What’s behind Grab’s reported SPAC listing

This so-called network effect has been a common refrain among economists and academics to explain the spectacular growth of these businesses.

They argue the more people use a platform, the more inherently attractive it becomes, leading even more people to use it. And once a platform reaches a certain size, it becomes too dominant to unseat.

The problem is this argument ignores the profitability issue. In ride-sharing, it turns out that the mere presence of one additional competitor can lead to ruinous, undifferentiated competition.

Plus ride-sharing’s network effect is also limited within one location. For instance, if you are using Grab in Singapore, you don’t necessarily care about the service level in Manila.

This is unlike Facebook, which has a global network. It is also difficult for another company to give Airbnb, for example, a run for its money as that competitor needs to have a global reach and network that Airbnb has. For companies like Grab, competition can easily spring up locally.

Advertisers like P&G or Nike actually care a lot about the size of Facebook’s audience from London to Hong Kong and so companies like Grab who don’t have that global network lose out on large advertising money.

As a result of a more open playing field locally, ride-sharing can easily succumb to a price war. Discount coupons and driver incentives quickly eat into profit margins.

That’s how Grab, Gojek, Uber, and Lyft have lost money.

But Uber in Southeast Asia is no more. And so the bleeding on that front has stopped.

Yet here is exactly why Grab prefers the SPAC route. According to the details revealed in its investor presentation , Grab will have to shave off hundreds of millions of dollars each year, in order to reach profitability.

It only aims to get to positive EBITDA (earnings before interest, tax, depreciation and amortisation) in 2023.

READ: Commentary: What is the logic of AirAsia entering Singapore’s food delivery market?

Read: commentary: the gig economy – a surprise boost from the pandemic and in singapore, it’s not going anywhere.

How will it do that? Grab’s ride-hailing business – which achieved positive EBITDA just last year - shows the way.

Already, to save costs in 2020, it may have cut off more than S$600 million worth of incentives for drivers and merchants – a figure larger than the increase it earned in billings that year.

No surprises then if Grab slashes incentives further to achieve the targeted profitability in the next few years. Such information, if disclosed through an IPO prospectus, may have seen a public backlash, which could have affected its listing returns or share pricing.

The question is, can Grab still maintain market share in the currently loss-making food delivery business if it cuts incentives? Why wouldn’t Foodpanda, Deliveroo and others swoop in to scoop up the clientele? Why wouldn’t people simply switch when Foodpanda has full-time deliverers on shifts and therefore may be potentially more reliable?

Regardless, these shaky profitability concerns are also why Mr Tan must move Grab into online food delivery, which since last year is now the biggest contributor to the company’s revenue.

This brings us to Grab’s second listing in Singapore.

FINTECH IS WHERE THE MONEY LIES

Today, Grab is expanding into a “super app.” It offers everything from food and parcel delivery to hotels and airline bookings and access to financial and health services. But being a super app can’t promise profitability; only being in the financial sector does.

It’s a sector full of slow-moving incumbents - and one stuck with obscenely high margins. And most attractive of all, it’s an industry teeming with paperwork and manual processes that should have been automated through technologies decades ago.

And Singapore, being the financial hub, will be Grab’s toehold for its financial service ambition. It has already acquired a banking license together with Singtel.

READ: Commentary: Why a bumper crop of Southeast Asian tech unicorns look set to IPO this year

That’s also why Mr Tan is also considering a second listing in Singapore. He doesn’t need additional money, but a second listing will buy him goodwill from the Singapore Government.

Grab has already acquired a banking license together with Singtel in Singapore, which as a financial hub, will be Grab’s toehold for its financial service ambition. However, Grab will need ongoing accommodation from regulators to navigate any resistance from traditional banks.

Since the company has sufficient cash reserves, it would only raise a small amount on the SGX, but this very symbolic listing would mark a big win for the Singapore Exchange.

The deal will put SGX in the international spotlight to rival its bigger counterpart of Hong Kong.

Because in Asia, you “had to work with individual government stakeholders, people of power and influence, in the highest echelons,” said Anthony.

It’s never too early to buy public goodwill.

Howard Yu is the author of LEAP: How to Thrive in a World Where Everything Can Be Copied (PublicAffairs; June 2018), LEGO professor of management and innovation at the IMD Business School in Switzerland, and director of IMD’s signature Advanced Management Program. Angelo Boutalikakis is a research associate at Center for Future Readiness at IMD Business School in Switzerland and Singapore.

Related Topics

Also worth reading, this browser is no longer supported.

We know it's a hassle to switch browsers but we want your experience with CNA to be fast, secure and the best it can possibly be.

To continue, upgrade to a supported browser or, for the finest experience, download the mobile app.

Upgraded but still having issues? Contact us

404 Not found

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- SRX Property

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

Grab CEO confident Spac merger to close by year-end after delay

SINGAPORE (BLOOMBERG) - Grab Holdings chief executive Anthony Tan said he is confident the merger of the ride-hailing and food-delivery giant and a United States blank cheque company will be completed by year-end, following a delay caused by a review of its financials.

The Singapore-based start-up last week postponed the expected completion of the deal with Altimeter Growth Corp - set to be one of the largest-ever mergers with a special purpose acquisition company (Spac) - to the fourth quarter as it works on an audit of the past three years. When announcing the pact in April, Grab said in an investor presentation that its completion target was next month.

"We decided to be proactive," Mr Tan said in an interview with Bloomberg Television. "We wanted to set the bar in transparent financial reporting. It may have taken a little longer than we expected."

Grab, which operates across South-east Asia, is the latest company to be affected by intensifying scrutiny from US financial regulators on deals involving Spacs. After a frenzy of listings, the Spac market has been hit by a crackdown by the US Securities and Exchange Commission (SEC) as well as lawsuits from shareholders, falling stock prices and delays in planned listings.

The SEC's scrutiny on how accounting rules apply to a key element of blank cheque companies has prompted restatement filings. The regulator has said that Spacs may need to account for warrants - securities issued to early investors - as liabilities, rather than as equity.

Mr Tan, 39, declined to comment when asked if he expects any major restatements by Grab following the financial audit.

He did not rule out a secondary listing in Grab's home market of Singapore, saying that the company considers all options. But he said Grab is "laser-focused" on the Nasdaq listing via the Altimeter merger that values the combination at about US$40 billion (S$53 billion).

The CEO said Grab considered a traditional initial public offering, but opted for a deal with Mr Brad Gerstner's Altimeter after seeing the commitment by the Spac partner. Altimeter has committed to a three-year lock-up period.

"They put their money where their mouth is," he said.

Some analysts have questioned Grab's targeted valuation. Bloomberg Intelligence analyst Matthew Kanterman calculates that Grab's enterprise value-to-sales ratio is more than double those of ride-sharing peers Uber Technologies and Lyft, "giving it scant wiggle room for missteps".

When asked if the US$40 billion valuation may be too stretched, Mr Tan declined to give a direct answer.

"We are excited that Grab is an early one to represent South-east Asia on a global stage," he said.

Join ST's Telegram channel and get the latest breaking news delivered to you.

- Spac/blank-cheque company

Read 3 articles and stand to win rewards

Spin the wheel now

IMAGES

COMMENTS

Grab Investor Relations Overview Press Releases Events & Presentations. Stock Information . Stock Quote & Chart; ESG . Governance Documents; ... Grab 2023 Q4 Results Presentation. Grab 2023 Q3 Results Presentation. Grab 2023 Q2 Results Presentation. Grab 2023 Q1 Results Presentation.

As expected, Southeast Asian superapp Grab is via a SPAC. The combination, which , will value Grab on an equity basis at $39.6 billion and will provide around $4.5 billion in cash, $4 billion of ...

Prior to the SPAC deal, Grab had already raised more than $10 billion from a roster of heavyweight investors, including Japanese conglomerate SoftBank and Chinese ride-hailing firm Didi Chuxing ...

Grab Holdings, the largest ride-hailing and food delivery firm in Southeast Asia, clinched a merger on Tuesday with special-purpose acquisition company Altimeter Growth Corp (AGC.O) securing a ...

The proposal passed at a special shareholder meeting Tuesday, setting the stage for Grab to become a publicly traded company, according to a statement. Shareholder redemptions, or investors opting ...

BY Yvonne Lau. December 2, 2021, 8:03 AM PST. After an initial jump on Thursday, shares of Grab slumped more than 20% in their Nasdaq trading debut after the ride-hailing and delivery app merged ...

When announcing the pact in April, Grab said in an investor presentation its completion target was July. "We decided to be proactive," Tan said in an interview with Bloomberg Television.

Altimeter is very committed to the SPAC deal. According to the Grab Investor presentation dated April 2021 there will be a three-year lock-up on sponsor promote shares showing Altimeter's long ...

The Singaporean startup closed down nearly 21% Thursday as it began trading on New York's Nasdaq. Grab went public by merging with a special-purpose acquisition company, or SPAC. The deal — in ...

Shares opened at $13.06 on Thursday, up from the previous day's close of $11.01, when they were still trading as Altimeter Growth Corp, a special purpose acquisition company, or Spac. But they ...

Disclaimer 2 This Presentation has been prepared by Grab Holdings Inc. (the "Company") and Altimeter Growth Corporation (the "SPAC") in connection with a potential business combination involving the Company and the SPAC (the "Transaction") and is preliminary in nature and solely for information and discussion purposes and must not be relied upon for any other purpose.

Grab's agreement with a special purpose acquisition company (SPAC) backed by Altimeter Capital includes a $4 billion private investment in public equity (PIPE) from a group of Asian and global ...

Altimeter is very committed to the SPAC deal. According to the Grab Investor presentation dated April 2021 there will be a three-year lock-up on sponsor promote shares showing Altimeter's long ...

On Thursday, Nasdaq welcomed Southeast Asia's leading super app Grab, which went public via special purpose acquisition company (SPAC) Altimeter Growth Corp. (AGC), including $4.5 billion in ...

The deck begins with the details of Grab's SPAC merger deal, including the investment size, valuation, and investor, among others. It illustrates Altimeter's commitment to its long-term ...

Yet here is exactly why Grab prefers the SPAC route. According to the details revealed in its investor presentation , Grab will have to shave off hundreds of millions of dollars each year, in ...

Singapore-based Grab is merging with the specialist purpose collection your of Brad Gerstner's Altimeter Capital Management, leaving the Southeast Asian unicorn wertigkeit at nearly $40 billion and the first on go general through the SPAC boom. About $4 billion has being raised from investors including top U.S. firms BlackRock Inc ...

Disclaimer This Presentation has been prepared by Grab Holdings Inc. (the "Company") and Altimeter Growth Corporation (the "SPAC") in connection with a potential business combination involving the Company and the SPAC (the "Transaction") and is preliminary in nature and solely for information and discussion purposes and must not be relied upon for any other purpose.

Grab is the latest firm to be affected by intensifying scrutiny from US regulators on Spac deals. Read more at straitstimes.com. ... Grab said in an investor presentation that its completion ...

An analysis of the Grab Investor Presentation. Grab is merging with AGC and going public via SPAC. This is a high level discussion of the investor presentati...