What Is Joint Business Planning?

Joint Business Planning (JBP) helps Consumer Goods suppliers and retailers build winning relationships that benefit both parties and improve the commerce experience through clear insights into the other's needs and recognition of mutual interests.

Charles Redfield

Executive vice president and chief merchandising officer – sam’s club (walmart).

The symbiotic relationship between retailer and Consumer Packaged Goods (CPG) companies has, till now, been able to support steady growth based on demand alone. Now, as the Consumer Goods (CG) industry continues to shift away from organic expansion, the need to reach more customers and engage new audiences is more important than ever.

Let's dive in to some of the key shifts our customers are seeing in the retail environment:

Authentic challenger brands are continually entering the market. According to a recent survey carried out by McKinsey, 30-40% of consumers have been trying new brands and products during the pandemic. Of these consumers, 12% expect to continue to purchase the new brands after the pandemic. More competition = more difficulty obtaining or retaining market share.

Global supply chain stress has created a multitude of issues for companies seeking to keep costs down. Disruptions in labour markets have seen 15% of companies with insufficient labour for their facilities to keep up with increases in demand, leading to inflation re-emerging as a significant problem for the first time since the 1970s.

Changing consumer needs are not only encouraging the rise of new, healthier alternative brands but also instigating real legislative change. For example, in October 2022, HFSS (High in Fat, Salt & Sugar) regulations will see a crackdown on promotions for unhealthy food and drinks, which will have serious repercussions for both suppliers and retailers.

Evan Sheehan

Retail, wholesale & distribution leader - deloitte global.

These shifts have caused retailers to change the way they do business; the traditional playbook needs to be thrown out and rewritten. The diversification we have seen in channels, models and store formats means that retailers’ expectations for suppliers have changed. And, as increasing numbers of authentic challenger brands come to market, competition has never been higher.

For both retailers and suppliers, Key Account Management (KAM) needs to be revisited. A culture of test & learn in real time needs to be applied to contend with these new market entrants and, with “key accounts contribut[ing] between 40% to 80% of revenue for a branded supplier” in developed markets as indicated by this article by Bain & Company , the time to reinvent is now.

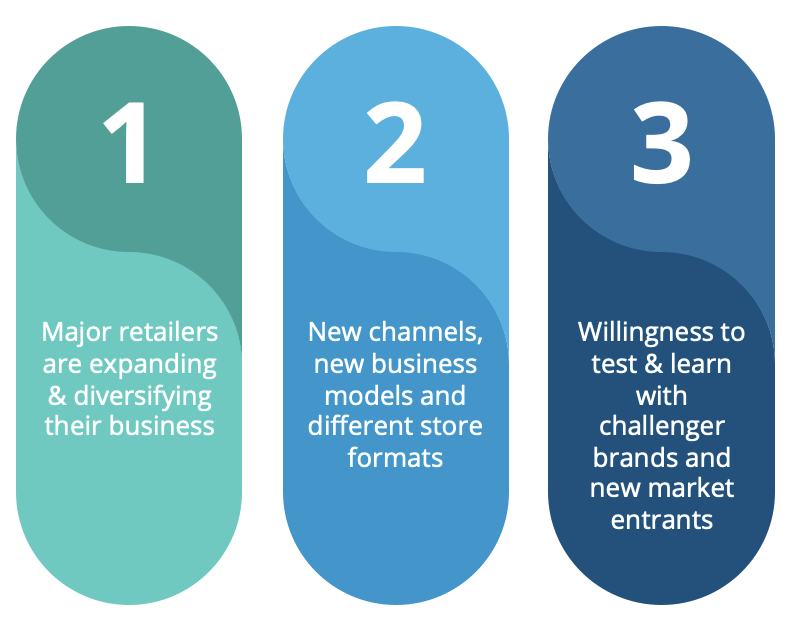

Major incentives for change can be distilled into these three points:

In the past, the CPG industry power dynamic has often favoured the supplier, but this is no longer the case. Only 3% of retailers are in an exclusive relationship with just one supplier in a given category, indicating the clout they hold to sway access to consumers is higher than ever before. With a number of Consumer Goods companies falling prey to a one-size-fits-all to their global business models, they have been losing valuable ground to more specialised, relevant competitors.

For CPG companies, visibility at point-of-sale for their products is vital. For retailers, getting the product in-store to sell is their business. Having retailers being ‘on-side’ and aligned is game-changing for suppliers.

But, as indicated in the name, Joint Business Plans need to be exactly that: Joint. If the manufacturers arrive at the table with a railroad agenda, offering little to no agency to the retailer, it will be too one-sided and off balanced. If retailers have unrealistic expectations, e.g broad assortments or 24-hour delivery, from certain suppliers, the equilibrium of the plan will be thrown off from the outset. This is where the value of insight-sharing cannot be understated; IGD asserts that both sides must 'be prepared to share information with each other' to achieve success.

Both CPG companies and retailers need to be able to influence the plan and offer respective insights to avoid creating a zero-sum atmosphere.

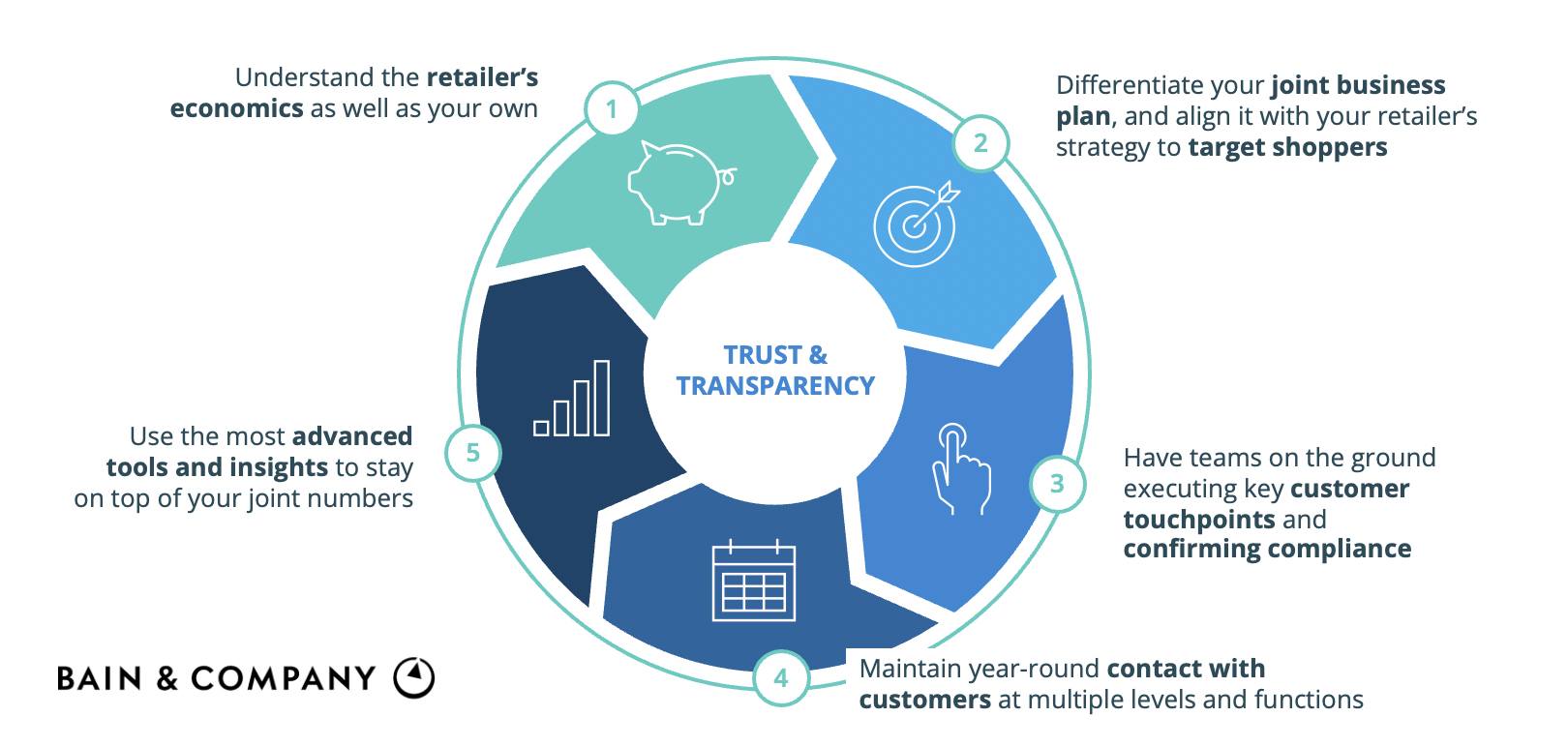

For companies collaborating on Joint Business Plans, certain proactive steps need to be taken to fit the plan to benefit both parties. Bain & Company have set out five key steps that they have seen Consumer Goods companies take to achieve 'more trustful and productive' relationships and provide significant value.

Entering into a business relationship, such as a JBP, with a full understanding of where a potential partner is in the market is pivotal to a successful collaboration. Being aware of any weaknesses provides the opportunity to address them before they become an issue and impact your business.

In turn, a complete understanding of your own business’ strengths and weaknesses before embarking on any external partnership is equally important. A Joint Business Plan can only be successful if it truly brings benefit to both the retailers and CPG companies; without this, joint commitment can’t be assured.

This demands the creation of an environment where retailers and CPG companies can offer total visibility into their data, thereby enabling creation of target audiences and consumer journeys. As indicated by an IGD Industry Survey , ‘Too often trust is the biggest barrier to putting any proposal into action’. Data transparency reduces the possibility of down-the-line surprises and potential derailing of the plan.

While keeping costs down may be advantageous, it is vital not to lose sight of the top priority; understanding the target customer segments.

Customer data extracted through the collaborative JBP can help maintain product stock levels, illustrate demand and identify trends in product distribution. Without this information, even a theoretically perfect Joint Business Plan will fail. Understanding who the customers are and what they are buying better enables CPG companies and retailers to produce and distribute - keeping the customer’s needs at the crux of their strategy.

It’s important to note that Joint Business plans are not one-size-fits-all; it may take more time to differentiate a plan to make it more tailored to a specific relationship, but the benefits can outweigh the expense.

Research by POI illustrates that 58% of CPG companies are struggling with retailer aligned compliance for store-level promotion execution. Clearly, there is a concerted need to ensure in-real time that assured promotions are being carried out, but 27% of CPG companies do not get any real-time insights into retailer compliance, forcing them to wait until the end of a cycle to make any significant changes.

While promotion compliance isn’t a new issue in the Consumer Goods industry, it can be a major roadblock to a JBP. With teams in the field, far more regular compliance checks can be performed and the information shared much wider, much faster.

The dialogue between each party needs to continue beyond initial negotiations and agreements. Regular meetings provide opportunities to correct mid-cycle issues, where the retailer and CPG company can align on real-time results and solutions.

Without clearly defined and tracked performance metrics, the success of the JBP is uncertain. Both parties need to agree on what data sources are going to be reviewed. Expectations must be laid out internally and externally, to establish what each side hopes to get out of the arrangement. This will prevent potential disappointment if or when unaired expectations aren’t met.

It is also important to have discussed and agreed upon the terms and investment in the JBP. Going into a project aware of the value that each business is adding to the other and being able to quantify the ROI is fundamental to a successful Joint Business Plan.

As shown in the recent Promotion Optimization Institute (POI) State of the Industry Report , 64% of manufacturers have challenges when looking for data from retailers. When data is such a foundational element to gainful retailer partnerships, it needs to be shared. The ideal is to involve teams from across the company including distribution, sales, finance and marketing. Siloed internal communication can negatively impact information sharing and lead to failure of a JBP.

CPG companies need to leverage real-time insights pulled from a range of commercial data sources that allow them to optimize strategies based on their business goals and current supply and promotion constraints. This maximises the value of every dollar invested in trade spend.

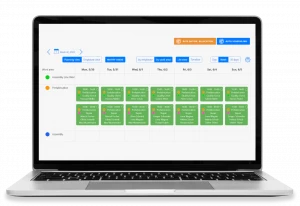

Closely aligned with the tenets of Bain's Key Account Management Commercial Excellence framework, Aforza drives Joint Business Planning with an end-to-end platform of core functionalities:

Account 360° View : Gain a complete view of an account's hierarchies and key relationships, as well as visibility into all engagement activity across channels.

Real-time Data & Insights on Account Performance: Get real-time insights, from a range of commercial data sources, across all aspects of your key account performance.

Integrated Trade Promotions: Optimize trade spend and target key customers by displaying a real-time view into promotion performance, inventory levels, sales order insights, budgets & funds, plans & objectives.

Retail Execution Checks from Field Sales Teams: Leverage your teams in the field to check key account compliance and take promotion-based order capture with penny-perfect pricing on mobile; online or offline .

Digital Asset Management : Ensuring all important business documents are centralised and accessible against the account, such as contracts and Joint Business Plans.

Check out this demo from Aforza's Chief Product Officer, Nick Eales, as he showcases how leading Consumer Goods companies are leveraging Aforza to create productive account collaborations that unlock revenue potential like never before:

With industry-leading innovations and capabilities, the Aforza cloud & mobile solution continues to help consumer goods companies sell more and grow faster. Take the first steps now and create productive account collaborations that unlock revenue potential like never before.

Joint Business Planning at WOW Tech

WOW Tech Group was founded in 2018 with the coming together of two industry leaders, Womanizer Group Management GmbH from Germany and Standard Innovation Corporation from Canada.

Their stated mission is to be the premier provider of pleasure products that enable people all over the world to increase the satisfaction of their personal and sexual well-being.

With Aforza, WOW Tech enabled Joint Business Planning by allowing Key Account Managers (KAMs) to easily set up and manage account plans and set sales targets across various KPIs.

Take a Tour

How to Create an Effective Joint Business Plan

For two businesses to form a joint venture, they need a plan that outlines the nature of the business coalition. A joint business plan defines the state of the companies involved, the purpose of the joint business and the partners’ responsibilities.

A joint business plan describes all the activities that these business ventures must carry out to achieve specific goals.

The relationship between the two parties and their goals must be clearly understood. After creating the business plan, it must go through a legal review to test its legitimacy. In your business planning, you work together in a collaborative relationship toward mutually agreed terms.

Business planning for joint ventures helps the parties leverage resources, reduce costs, combine expertise and/or enter foreign markets. A well-defined joint business plan is vital for any agreement and business strategy.

What is a joint business plan?

A joint business plan is a document that defines a merger between two or more companies. It describes the purpose and responsibilities of each partner in the incorporation. You may also see it as a collaborative process of planning where a supplier and retailer agree on both long- and short-term goals, including growth, finances and shared initiatives for profitability.

The purpose of a joint business plan is to design a win-win strategy for increasing consumer sales. This plan allows the partners to build a formidable relationship with retailers for mutual support and benefits. Having agreed upon goals, both parties share insights on a common vision for better support, customer growth, enhanced process and improved sales.

Business planning depends on interested parties sharing their plans with defined mutual growth opportunities. The partners can detail and share strategic planning, growth strategy, tactics and any area of competitive advantage.

The joint business plan is created once a partnership agreement is mutually beneficial and defined. Parties would draw up, approve and sign a formal contract before the execution of the plan. This is followed by a periodic review of joint scorecards based on necessary performance metrics to fine-tune strategies.

The joint business planning process comprises every possible logistic, including human resources planning and how to reach project milestones. Resource accountability is vital to building trust. Your best tool for transparent resource use and accountability is a resource planner .

If the employees of the venture will need to go to a different location, the venture will likely have difficulty planning their tasks and locations. TimeTrack Auto-Scheduling provides joint ventures with a transparent planning tool that reduces effort and enhances error-free shift planning.

TimeTrack Auto-Scheduling

Types of joint business plans

Standard plan.

This is often referred to as the working plan. It offers an overview of the company, outlines its goals, and details when and how entrepreneurs wish to achieve the goals. Such a plan helps secure funds, investments or loans. Within the plan, you could specify how you will use investor funds and their potential profits.

What-if plan

Sometimes things don’t go as planned in business. The what-if business plan defines the various roadblocks that a company might face as it strives to achieve its business objectives. The venture is largely at the whims of external factors, including the supply chain and stock market. You need to outline a predictable scenario to let business partners know how to recover their funds.

One-page plan

While a detailed plan is vital, there are instances where you will need to provide an abridged version of your plan. This one-page business plan outlines the summary of demand, solution, model, management team and action plan.

Start-up plan

A business plan for entrepreneurs, especially those in the early stages of their business planning, will need a start-up business plan. It is designed to give potential investors the bigger picture and outline how you want to achieve your goals. It often includes an executive summary, background, product and service descriptions, market analysis, costs and financial projections.

Expansion plan

This is a business plan that’s necessary when you need to scale your business and identify the necessary resources for its development. These could be financial investment, an additional workforce, new products or raw materials. This plan will detail the business background, needed resources and how they will contribute to growth and business expansion.

Operational plan

An operational business plan revolves around near-term goals , especially those you will work towards achieving within a year. It defines the activities your venture will focus on and emphasizes the role of the workforce and budgeting in achieving the operational goals. In most situations, the heads of departments are key participants in the operational plans because of the need for approval in achieving the goals.

Strategic business plan

This is different from the others because it focuses on how departments can work together. This venture plan is more comprehensive and requires senior-level approval before implementing goals. This plan answers the questions of how to achieve goals, what resources are needed and the execution plans for achieving the goals.

Joint business planning tips

Companies that benefit from a joint business plan

A joint venture exists mainly as a contract between new cooperating partners. In forming a joint venture, each of the business partners agrees to the assets they will bring to the table and how income and expenses will be shared.

While a joint venture is a corporation between two or more entities, each of the companies, be it an individual, company, corporation or group of individuals, still has its original legal status, though not all joint ventures result in a new business entity. These companies could be sole proprietorships or partnerships, limited partnerships, corporations, limited liability companies or non-profit organizations.

Examples of a joint business plan

Perhaps you have an online venture selling high-quality products at reasonable prices, while needing to increase brand strength. Such an example of a joint business plan outlines a company overview, executive summary, product and service offerings, marketing strategy, market analysis, budget and financial planning.

A joint business plan may be designed for ventures rendering menu services such as lattes, espresso, coffee, cappuccinos, and sandwiches. The business plan outlines an executive summary and studies your competition , target market, marketing plan, ownership structure and operational plan.

A joint venture could be designed around offering services such as shipping, faxing, postal and copying to residents to conduct research , create debate space and generate ideas. This example of a business plan will include an executive summary, a vision and mission statement, goals, objectives, and measures, organizational structure, marketing analysis and a financial plan.

Top strategies for effective joint business plan

In a joint business venture, there are risks which include rising complexity, cultural diversity, high failure rates and language diversity. The strategies detailed below will benefit the venture in navigating the challenges through effective joint business planning.

Strategic plan

Strategic global planning is an effective business practice for entering a new market. It helps to identify opportunities and threats. Before beginning strategic planning, be sure that a joint venture is the right action for you. Compare the strengths and weaknesses of the partners to confirm a good match. Your strategic plan should explain why you want to collaborate with that partner and what you hope to achieve, how to monitor trends and collect good data. Some of the reasons you may wish for a new joint partner may be to enter a new market, geographic expansion, financing, etc.

The right partner

The choice of partner is crucial, but what is more important is understanding the effectiveness of partners in delivering on their promises. Do your due diligence on your partner’s attitude toward collaboration, performance and level of commitment. What about sharing the same objectives?

Effective communication for a great relationship

After your investigation, if you deem the partner fit, find mutual ground. Communication is the key to a good relationship. Make sure your partner understands the foundation of the joint venture and agreement. Ensure they agree on human resources, financial contributions and goals. To consolidate the stability of your venture, be upfront, honest and transparent about your objectives.

Clarify how, what, and where

Be clear on the vision, strategic plans and scoreboard to ensure that everyone is energized and united about the goal. Define a common working pattern. This has to include conflict management, decision-making, collaboration, problem-solving and technology strategies. Focus on win-win solutions.

Track performance

Is everyone putting in the hours and making productive headway? One way to gauge this information is by time tracking. One of the challenges for companies whose employees work in shifts and in different locations is tracking attendance. TimeTrack Attendance Tracking helps companies monitor employees’ work hours and leave days, so that managers can stay up to date on potential delays.

TimeTrack Attendance Tracking

Once you have set out the goals and vision for the new venture, establish key performance indicators, the data you want to track and the process to measure those performance metrics. This involves creating a joint scorecard for each metric against trends and competition. The targets you set must guard against possible problems the partners might encounter.

Build trust

Your best joint business strategy is to build trust and create value, without which your partnership is bound to fail. Trust is the foundation of every partnership. It is an important factor in business planning. Without it, neither partner can succeed. How do you manage diverse cultures, interests and languages if the partners lack trust? Trust builds team strength and encourages creativity while promoting collaboration.

Good leadership

The cost of poor leadership is so high that you must not venture into joint partnership without assurance of good leadership. Focus on building good leadership and not just creating “bosses”. Leadership presents the biggest opportunities to change the performance narrative. Create a strong leadership team, from whom all employees can learn.

A joint business venture is not without its challenges. To ensure a successful collaboration, focus on a clear strategy, excellent communication, transparency and strong leadership.

I am a researcher, writer, and self-published author. Over the last 9 years, I have dedicated my time to delivering unique content to startups and non-governmental organizations and have covered several topics, including wellness, technology, and entrepreneurship. I am now passionate about how time efficiency affects productivity, business performance, and profitability.

You might also like

Ten Best Practices for Better Joint Business Planning

We recently led an alliance team through an alliance business planning session. Through that process we captured a number of best practices that lead to better business planning and ultimately better performing alliances. Here is what we learned:

- Develop the business plan with your partner. Successful alliances are win/win/win . Your partners’ strategic objectives, resources, commitment and creative insight are critical to the process and to a successful outcome for you, your partner, and your joint customers.

- Use the templates and checklists as stimuli for thought not a rigid formula. Your alliance is unique. The value creation thought process and business plan should reflect that.

- Build from the specific to the general. You may find that over several initiatives you have 80% commonality, but it is that 20% differential that makes for a successful joint offer. Specifics make an impact – generalizations put you to sleep.

- Articulate the differentiation in the solution clearly, unambiguously. Contrast with the competition…50% more scalable than .

- Individual value propositions should include specific descriptions of how value is created, so that a reader not in the alliance understands it. You will be describing the value of this alliance to executive management and other stakeholders.

- Include customer value and metrics .Hard metrics on customer value ie. “reduces deployment costs by 7%”, gives you a compelling reason to get in the door with customer decision makers and energizes the sales teams to engage collaboratively. Value props that impact customer business model are especially compelling i.e. increased competitive advantage for your customer. Focusing on your customer maintains common vision between partners.

- Keep focus on specifics: – “saving millions per drill head” is a more powerful vision than ‘saving costs’; “ saving up to $5M per well” even better! Same for alliance objectives, again, the best have very clear, numerically stated objectives for both partners and customer.

- For each metric establish a baseline “where you are today” and a goal “where you want to be in 6 mo, 1 yr”

- Identify risks and obstacles to success and include risk mitigation and contingency plans

- Evaluate your sales and marketing value props from the sales perspective. Are they strong enough to compel you sales teams to want to sell with a partner?

- Bonus Best Practice: Relationship strength is critical in an alliance. Measure it regularly via partner health checks and proactively manage the relationship.

Related Posts

Do you have a Recession Strategy for Alliances?

How Do You Know If Your Partner Ecosystem is Healthy?

Do you know why you need a Repeatable Delivery Model?

A better way to drive your business

Managing the availability of supply to meet volatile demand has never been easy. Even before the unprecedented challenges created by the COVID-19 pandemic and the war in Ukraine, synchronizing supply and demand was a perennial struggle for most businesses. In a survey of 54 senior executives, only about one in four believed that the processes of their companies balanced cross-functional trade-offs effectively or facilitated decision making to help the P&L of the full business.

That’s not because of a lack of effort. Most companies have made strides to strengthen their planning capabilities in recent years. Many have replaced their processes for sales and operations planning (S&OP) with the more sophisticated approach of integrated business planning (IBP), which shows great promise, a conclusion based on an in-depth view of the processes used by many leading companies around the world (see sidebar “Understanding IBP”). Assessments of more than 170 companies, collected over five years, provide insights into the value created by IBP implementations that work well—and the reasons many IBP implementations don’t.

Understanding IBP

Integrated business planning is a powerful process that could become central to how a company runs its business. It is one generation beyond sales and operations planning. Three essential differentiators add up to a unique business-steering capability:

- Full business scope. Beyond balancing sales and operations planning, integrated business planning (IBP) synchronizes all of a company’s mid- and long-term plans, including the management of revenues, product pipelines and portfolios, strategic projects and capital investments, inventory policies and deployment, procurement strategies, and joint capacity plans with external partners. It does this in all relevant parts of the organization, from the site level through regions and business units and often up to a corporate-level plan for the full business.

- Risk management, alongside strategy and performance reviews. Best-practice IBP uses scenario planning to drive decisions. In every stage of the process, there are varying degrees of confidence about how the future will play out—how much revenue is reasonably certain as a result of consistent consumption patterns, how much additional demand might emerge if certain events happen, and how much unusual or extreme occurrences might affect that additional demand. These layers are assessed against business targets, and options for mitigating actions and potential gap closures are evaluated and chosen.

- Real-time financials. To ensure consistency between volume-based planning and financial projections (that is, value-based planning), IBP promotes strong links between operational and financial planning. This helps to eliminate surprises that may otherwise become apparent only in quarterly or year-end reviews.

An effective IBP process consists of five essential building blocks: a business-backed design; high-quality process management, including inputs and outputs; accountability and performance management; the effective use of data, analytics, and technology; and specialized organizational roles and capabilities (Exhibit 1). Our research finds that mature IBP processes can significantly improve coordination and reduce the number of surprises. Compared with companies that lack a well-functioning IBP process, the average mature IBP practitioner realizes one or two additional percentage points in EBIT. Service levels are five to 20 percentage points higher. Freight costs and capital intensity are 10 to 15 percent lower—and customer delivery penalties and missed sales are 40 to 50 percent lower. IBP technology and process discipline can also make planners 10 to 20 percent more productive.

When IBP processes are set up correctly, they help companies to make and execute plans and to monitor, simulate, and adapt their strategic assumptions and choices to succeed in their markets. However, leaders must treat IBP not just as a planning-process upgrade but also as a company-wide business initiative (see sidebar “IBP in action” for a best-in-class example).

IBP in action

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function. Beyond S&OP, the sales function forecast demand in aggregate dollar value at the category level and over short time horizons. Finance did its own projections of the quarterly P&L, and data from day-by-day execution fed back into S&OP only at the start of a new monthly cycle.

The CEO endorsed a new way of running regional P&Ls and rolling up plans to the global level. The company designed its IBP process so that all regional general managers owned the regional IBP by sponsoring the integrated decision cycles (following a global design) and by ensuring functional ownership of the decision meetings. At the global level, the COO served as tiebreaker whenever decisions—such as procurement strategies for global commodities, investments in new facilities for global product launches, or the reconfiguration of a product’s supply chain—cut across regional interests.

To enable IBP to deliver its impact, the company conducted a structured process assessment to evaluate the maturity of all inputs into IBP. It then set out to redesign, in detail, its processes for planning demand and supply, inventory strategies, parametrization, and target setting, so that IBP would work with best-practice inputs. To encourage collaboration, leaders also started to redefine the performance management system so that it included clear accountability for not only the metrics that each function controlled but also shared metrics. Finally, digital dashboards were developed to track and monitor the realization of benefits for individual functions, regional leaders, and the global IBP team.

A critical component of the IBP rollout was creating a company-wide awareness of its benefits and the leaders’ expectations for the quality of managers’ contributions and decision-making discipline. To educate and show commitment from the CEO down, this information was rolled out in a campaign of town halls and media communications to all employees. The company also set up a formal capability-building program for the leaders and participants in the IBP decision cycle.

Rolled out in every region, the new training helps people learn how to run an effective IBP cycle, to recognize the signs of good process management, and to internalize decision authority, thresholds, and escalation paths. Within a few months, the new process, led by a confident and motivated leadership team, enabled closer company-wide collaboration during tumultuous market conditions. That offset price inflation for materials (which adversely affected peers) and maintained the company’s EBITDA performance.

Our research shows that these high-maturity IBP examples are in the minority. In practice, few companies use the IBP process to support effective decision making (Exhibit 2). For two-thirds of the organizations in our data set, IBP meetings are periodic business reviews rather than an integral part of the continuous cycle of decisions and adjustments needed to keep organizations aligned with their strategic and tactical goals. Some companies delegate IBP to junior staff. The frequency of meetings averages one a month. That can make these processes especially ineffective—lacking either the senior-level participation for making consequential strategic decisions or the frequency for timely operational reactions.

Finally, most companies struggle to turn their plans into effective actions: critical metrics and responsibilities are not aligned across functions, so it’s hard to steer the business in a collaborative way. Who is responsible for the accuracy of forecasts? What steps will be taken to improve it? How about adherence to the plan? Are functions incentivized to hold excess inventory? Less than 10 percent of all companies have a performance management system that encourages the right behavior across the organization.

By contrast, at the most effective organizations, IBP meetings are all about decisions and their impact on the P&L—an impact enabled by focused metrics and incentives for collaboration. Relevant inputs (data, insights, and decision scenarios) are diligently prepared and syndicated before meetings to help decision makers make the right choices quickly and effectively. These companies support IBP by managing their short-term planning decisions prescriptively, specifying thresholds to distinguish changes immediately integrated into existing plans from day-to-day noise. Within such boundaries, real-time daily decisions are made in accordance with the objectives of the entire business, not siloed frontline functions. This responsive execution is tightly linked with the IBP process, so that the fact base is always up-to-date for the next planning iteration.

A better plan for IBP

In our experience, integrated business planning can help a business succeed in a sustainable way if three conditions are met. First, the process must be designed for the P&L owner, not individual functions in the business. Second, processes are built for purpose, not from generic best-practice templates. Finally, the people involved in the process have the authority, skills, and confidence to make relevant, consequential decisions.

Design for the P&L owner

IBP gives leaders a systematic opportunity to unlock P&L performance by coordinating strategies and tactics across traditional business functions. This doesn’t mean that IBP won’t function as a business review process, but it is more effective when focused on decisions in the interest of the whole business. An IBP process designed to help P&L owners make effective decisions as they run the company creates requirements different from those of a process owned by individual functions, such as supply chain or manufacturing.

One fundamental requirement is senior-level participation from all stakeholder functions and business areas, so that decisions can be made in every meeting. The design of the IBP cycle, including preparatory work preceding decision-making meetings, should help leaders make general decisions or resolve minor issues outside of formal milestone meetings. It should also focus the attention of P&L leaders on the most important and pressing issues. These goals can be achieved with disciplined approaches to evaluating the impact of decisions and with financial thresholds that determine what is brought to the attention of the P&L leader.

The aggregated output of the IBP process would be a full, risk-evaluated business plan covering a midterm planning horizon. This plan then becomes the only accepted and executed plan across the organization. The objective isn’t a single hard number. It is an accepted, unified view of which new products will come online and when, and how they will affect the performance of the overall portfolio. The plan will also take into account the variabilities and uncertainties of the business: demand expectations, how the company will respond to supply constraints, and so on. Layered risks and opportunities and aligned actions across stakeholders indicate how to execute the plan.

Would you like to learn more about our Operations Practice ?

Trade-offs arising from risks and opportunities in realizing revenues, margins, or cost objectives are determined by the P&L owner at the level where those trade-offs arise—local for local, global for global. To make this possible, data visible in real time and support for decision making in meetings are essential. This approach works best in companies with strong data governance processes and tools, which increase confidence in the objectivity of the IBP process and support for implementing the resulting decisions. In addition, senior leaders can demonstrate their commitment to the value and the standards of IBP by participating in the process, sponsoring capability-building efforts for the teams that contribute inputs to the IBP, and owning decisions and outcomes.

Fit-for-purpose process design and frequency

To make IBP a value-adding capability, the business will probably need to redesign its planning processes from a clean sheet.

First, clean sheeting IBP means that it should be considered and designed from the decision maker’s perspective. What information does a P&L owner need to make a decision on a given topic? What possible scenarios should that leader consider, and what would be their monetary and nonmonetary impact? The IBP process can standardize this information—for example, by summarizing it in templates so that the responsible parties know, up front, which data, analytics, and impact information to provide.

Second, essential inputs into IBP determine its quality. These inputs include consistency in the way planners use data, methods, and systems to make accurate forecasts, manage constraints, simulate scenarios, and close the loop from planning to the production shopfloor by optimizing schedules, monitoring adherence, and using incentives to manufacture according to plan.

Determining the frequency of the IBP cycle, and its timely integration with tactical execution processes, would also be part of this redesign. Big items—such as capacity investments and divestments, new-product introductions, and line extensions—should be reviewed regularly. Monthly reviews are typical, but a quarterly cadence may also be appropriate in situations with less frequent changes. Weekly iterations then optimize the plan in response to confirmed orders, short-term capacity constraints, or other unpredictable events. The bidirectional link between planning and execution must be strong, and investments in technology may be required to better connect them, so that they use the same data repository and have continuous-feedback loops.

Authorize consequential decision making

Finally, every IBP process step needs autonomous decision making for the problems in its scope, as well as a clear path to escalate, if necessary. The design of the process must therefore include decision-type authority, decision thresholds, and escalation paths. Capability-building interventions should support teams to ensure disciplined and effective decision making—and that means enforcing participation discipline, as well. The failure of a few key stakeholders to prioritize participation can undermine the whole process.

Decision-making autonomy is also relevant for short-term planning and execution. Success in tactical execution depends on how early a problem is identified and how quickly and effectively it is resolved. A good execution framework includes, for example, a classification of possible events, along with resolution guidelines based on root cause methodology. It should also specify the thresholds, in scope and scale of impact, for operational decision making and the escalation path if those thresholds are met.

Transforming supply chains: Do you have the skills to accelerate your capabilities?

In addition to guidelines for decision making, the cross-functional team in charge of executing the plan needs autonomy to decide on a course of action for events outside the original plan, as well as the authority to see those actions implemented. Clear integration points between tactical execution and the IBP process protect the latter’s focus on midterm decision making and help tactical teams execute in response to immediate market needs.

An opportunity, but no ‘silver bullet’

With all the elements described above, IBP has a solid foundation to create value for a business. But IBP is no silver bullet. To achieve a top-performing supply chain combining timely and complete customer service with optimal cost and capital expenditures, companies also need mature planning and fulfillment processes using advanced systems and tools. That would include robust planning discipline and a collaboration culture covering all time horizons with appropriate processes while integrating commercial, planning, manufacturing, logistics, and sourcing organizations at all relevant levels.

As more companies implement advanced planning systems and nerve centers , the typical monthly IBP frequency might no longer be appropriate. Some companies may need to spend more time on short-term execution by increasing the frequency of planning and replanning. Others may be able to retain a quarterly IBP process, along with a robust autonomous-planning or exception engine. Already, advanced planning systems not only direct the valuable time of experts to the most critical demand and supply imbalances but also aggregate and disaggregate large volumes of data on the back end. These targeted reactions are part of a critical learning mechanism for the supply chain.

Over time, with root cause analyses and cross-functional collaboration on systemic fixes, the supply chain’s nerve center can get smarter at executing plans, separating noise from real issues, and proactively managing deviations. All this can eventually shorten IBP cycles, without the risk of overreacting to noise, and give P&L owners real-time transparency into how their decisions might affect performance.

P&L owners thinking about upgrading their S&OP or IBP processes can’t rely on textbook checklists. Instead, they can assume leadership of IBP and help their organizations turn strategies and plans into effective actions. To do so, they must sponsor IBP as a cross-functional driver of business decisions, fed by thoughtfully designed processes and aligned decision rights, as well as a performance management and capability-building system that encourages the right behavior and learning mechanisms across the organization. As integrated planning matures, supported by appropriate technology and maturing supply chain–management practices, it could shorten decision times and accelerate its impact on the business.

Elena Dumitrescu is a senior knowledge expert in McKinsey’s Toronto office, Matt Jochim is a partner in the London office, and Ali Sankur is a senior expert and associate partner in the Chicago office, where Ketan Shah is a partner.

Explore a career with us

Related articles.

To improve your supply chain, modernize your supply-chain IT

Supply-chain resilience: Is there a holy grail?

The Importance Of Joint Business Planning

- verdeassociates

- Thought Leadership

- Tags: accelerating growth , B2B , commercial processes , cooperation , joint business planning , process improvement

At Verde, we understand the impact of successful collaboration between B2B partners on business growth.

The key to success is creating a joint vision that is grounded in marketplace realities, coupled with flawless execution. To solidify this success and identify course-correction options, partners should develop progress measurement tools and processes. We want to share with you results of work to benchmark and improve Joint Business Planning (JBP) for the Electrical industry. (Spoiler: the process is not working as well as it should, but we know how to fix it). We will be rolling out new process between a major manufacturer and distributor later this fall. Stay tuned as we will share improvement results with you!

To find the full version of the article please visit the Electrical Trends website by clicking here.

Share this Post

Comments are closed.

- Buying & Merchandising

- Retail Marketing

- Category Leadership

- eCommerce Leadership

- Revenue Management

- Private Brands

- Foodservice

- Organization Design

- Merchandising Services

- Talent Development

- Joint Value Creation

- Retail Data & Insights

- Supply Chain

- Negotiation Skills

- Customer Development

- Data & Insights

- Commerce & Shopper Marketing

- TPG Overview

- Publications

- Corporate Strategy

- Functional Strategy

- Portfolio Optimization

- Omni-channel Strategy

- Assortment Optimization

- Retail Promotion Planning

- Retail Space Productivity

- Supplier Management

- Supplier Contribution Model

- Loyalty Program Design

- Category Marketing

- Digital Acceleration

- Customer Qualitative Research

- Customer Insight Activation

- Omni-channel Category Management

- Front End Excellence

- Department Transformation

- eCommerce Strategy Solutions

- Digital Category Management Solutions

- Digital Consumer Insights Solutions

- Online Grocery Solutions

- eCommerce Fulfillment

- eCommerce Training

- Strategic Pricing

- Promotion Effectiveness

- Brand Development

- Organization

- Operational Execution

- Full Plate Category Leadership

- Collaborative Planning

- Training & Development

- Supplier Segmentation

- Implementation

- Vision & Strategy

- Visual Merchandising

- Merchandising Execution

- Store & Space Planning

- Talent Assessment

- Competency Definitions

- Top Talent Development

- Performance Management

- Succession Planning

- Joint Business Planning

- Value Chain Optimization

- Curriculum Design

- Course Development

- Training Courses

- Understanding Customer Needs & Drivers

- Quantifying Enterprise Opportunities

- Uncovering Department & Category Opportunities

- Data-led Supplier Engagement

- Pinpointing eCommerce Opportunities

- Operationalizing Data, Tools, & Technology

- Inventory Management

- DC Productivity

- In-Bound Consolidation

- Freight Management

- Network Optimization

- Import/Export Transformation

- Business Unit Strategy

- Scenario Planning

- Creating Shared Value

- Strategic Planning Model

- Capability Assessment

- Turnkey Launch Programs

- Innovation Process Rewiring

- Strategy & Product Roadmap

- Category Navigator

- Brand Strategy & Development

- Consumer & Shopper Insights

- Shopper Marketing & Personalization

- Consumer Orchestration

- Pricing Optimization

- Integrated Commercial Business Planning

- Marketing Return on Investment

- Category/Brand Health Monitor

- Commercial Dashboard

- Capability Benchmarking

- Org Designer & Role Clarifier

- Marketing Academy

- Channel Strategy & Plans

- Customer Segmentation

- Customer Business Planning

- Understanding Shopper Needs & Drivers

- Uncovering Category Opportunities

- Defining Brand Opportunities

- Quantifying Omnichannel Retail Opportunities

- Insight Development

- Shopper Engagement

- Category Leadership Plan

- eCommerce Strategy

- Digital Retail Marketing

- Digital Category Leadership with Top Retailers

- eCommerce Supply Chain

- eCommerce Organization Transformation

- Procurement & Strategic Sourcing

- Incentive Based Pricing & Services

- Working Capital

- Manufacturing Productivity

- Sales & Operations Planning

- Revenue Management Strategy

- Customer Planning Discipline

- Revenue Management Discipline

- Revenue Management Analytics

- Full-Funnel Omni-Channel Media Planning

- Organizational Design & Development

- Digital Shelf & Media Plan Assessment & Audits

- Retailer Media, Commerce & Shopper Marketing Training

- Go-To-Market Strategy

- Operator Segmentation

- Trade Spend Effectiveness

- Marketing Training

- Category Management Training

- Sales Training

Course Description

This approach to Joint Business Planning (JBP) is rooted in an alignment process between the customer and seller (Manufacturer, Broker, Suppler, etc) that produces breakthrough business plans. The objective of JBP is to drive alignment of goals, strategies and action plans between the two collaborative partners.

Learning Objectives

- Customer Profile Development

- Situation Assessment & Opportunity Identification

- Alignment Process focused on Priorities

- Joint Business Plan Session including Scorecards and Strategies

- Joint Action Plan Development and Work Teams

- Instructor led

- Experiential

Target Audience

Any person from a Manufacturer, Retailer, Distributor or Agency, within the Consumer Product Goods industry, who seeks a more advanced understanding of Joint Business Planning. Typical participants include roles such as Category Managers, Buyers, Merchandisers, Customer Team leaders, Account Executives, Marketing Managers, Pricing & Promotion Managers, Finance Managers, Business Managers, Operations Managers, Retail or Sales Strategy Managers, Trade Marketers, Supply Chain Managers, Category Analysts, etc.

Supported Behaviors

Strategic Business Planning Analysis & Insights Trading Partner Development

Connect with us:

- Retail Consulting

- Manufacturer Consulting

- Privacy Policy

- Terms of Use

- © 2022 The Partnering Group, Inc

IMAGES

VIDEO

COMMENTS

A joint business plan (JBP) is the collaborative process of planning between a retailer and a supplier in which both companies agree on short-term and long-term objectives, financial goals, growth, and shared business initiatives for profitability. Joint business planning focuses on agreeing on common objectives and aligning on a single goal or ...

Joint business planning is a collaborative planning process in which the company and its supplier align on short- and long-term business objectives, agree on mutual targets, and jointly develop plans to achieve set objectives (exhibit). It brings a formal approach to collaboration with suppliers and helps to engage stakeholders from different ...

1. Stating the Blindingly Obvious - A Joint Business Plan is All About Trust. In Accenture's free report on joint business planning, they talk of a change in mindset for both parties to achieve 'Increased trust among parties'. And, of course, Accenture is right that trust is absolutely essential for a joint business plan to be effective.

With a joint venture business plan in place, both companies can align their messaging, target audience, and promotional activities for maximum impact. 2. Enhanced Communication and Coordination. Another significant benefit of a joint business plan is the improvement in communication and coordination among partners.

A Joint Business Plan can only be successful if it truly brings benefit to both the retailers and CPG companies; without this, joint commitment can't be assured. This demands the creation of an environment where retailers and CPG companies can offer total visibility into their data, thereby enabling creation of target audiences and consumer ...

A joint business plan is a document that defines a merger between two or more companies. It describes the purpose and responsibilities of each partner in the incorporation. You may also see it as a collaborative process of planning where a supplier and retailer agree on both long- and short-term goals, including growth, finances and shared initiatives for profitability.

Joint business planning, annual planning, buy and sell plans: over time the name given to joint business planning - or JBP - has evolved. However, the process for negotiating annual agreements that are collaborative, reflect mutual benefits and mitigate risk through alignment and contracting and assigning accountability is still an important process embraced by many businesses.

Summary. Use this template that includes a comprehensive set of tools to conduct joint business planning with key customers. Executive sales leaders responsible for account management can use the tools to identify and evaluate joint objectives, create a joint business plan and review progress against goals.

Collaboration is on many organization's strategic plans, with effective Joint Business Planning (JBP) being the outcome. Retailers' and Vendors' have the opportunity to determine mutual areas of interest and build their businesses in a collaborative way — namely by taking steps to improve Shopper satisfaction with a better experience.. However, effective Collaboration and JBP require ...

Joint Business Planning can be a process which builds mutual understanding, engages and motivates stakeholders, challenges current thinking, reveals new areas of opportunity, generates new ...

Joint Business Planning Process is industry certified and proven to drive positive results The Partnering Group Situation Assessment Retailers are re-designing their planning process yielding: • Fewer seats at the table - selective process to participate in Retailer JBP • Retailers need help understanding market (winners/losers) vs.

Develop the business plan with your partner. Successful alliances are win/win/win . Your partners' strategic objectives, resources, commitment and creative insight are critical to the process and to a successful outcome for you, your partner, and your joint customers. Use the templates and checklists as stimuli for thought not a rigid formula ...

Joint Business Planning is mission critical for today's consumer products retailers and suppliers. The consumer products and retailing industry is very competitive and companies are seeking advantage. Companies with a well-defined JBP process are able to formulate win-win plans and execute more effectively and efficiently by focusing their ...

Joint business planning Joint business planning is a collaborative planning process in which the company and its supplier align on short- and long-term business objectives, agree on mutual targets, and jointly develop plans to achieve set objectives (exhibit). It brings a formal approach to

That's because joint business planning, or JBP, means different things to different people. "The term is really loose," says Patrick Fitzmaurice, CEO and "head farmer" of Caterpillar Farm, an organizational change-activation consulting firm based in Atlanta. ... Disciplines involved in that planning process include shopper insights ...

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function.

Tags: accelerating growth, B2B, commercial processes, cooperation, joint business planning, process improvement; At Verde, we understand the impact of successful collaboration between B2B partners on business growth. The key to success is creating a joint vision that is grounded in marketplace realities, coupled with flawless execution.

Joint business planning is outliving its usefulness to both grocery retailers and vendors. What began as a strategic response to intensifying competition is transforming into a costly, complex, and cumbersome undertaking that's no longer delivering the desired results for either party. With growth prospects looking grim across the sector, it ...

Joint business planning (JBP) is a way for two or more companies to work together to achieve shared business goals. It's a collaborative process that involves identifying strengths and weaknesses, opportunities and threats, and jointly developing a plan to achieve success.

The Better Business Planning Process. The business plan process includes 6 steps as follows: Do Your Research. Strategize. Calculate Your Financial Forecast. Draft Your Plan. Revise & Proofread. Nail the Business Plan Presentation. We've provided more detail for each of these key business plan steps below.

Joint Business Planning is mission critical for today's consumer products retailers and suppliers. The consumer products and retailing industry is very competitive and companies are seeking advantage. ... JBP Process/Template/Tool Development: Using our Best Practice methodology, help develop the "Supplier Way" of JBP along with the ...

Joint Business Planning is designed to deliver a shared strategy focus, mutual accountability (via a joint scorecard), and a unified work plan. Participants will be led through a process based on a real-world simulation that will include Customer Profile Development; Situation Assessment & Opportunity Identification

a. This publication is the keystone document for joint planning. It provides the doctrinal foundation and fundament al principles that guide the Armed Forces of the United States in planning joint campaigns and operations. b. Joint planning is the process of identifying military ways and means (with